This is “Cash Flows from Operating Activities: The Direct Method”, section 17.2 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

17.2 Cash Flows from Operating Activities: The Direct Method

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Identify the two methods available for reporting cash flows from operating activities.

- Indicate the method of reporting cash flows from operating activities that is preferred by FASB as well as the one that is most commonly used in practice.

- List the steps to be followed in determining cash flows from operating activities.

- List the income statement accounts that are removed entirely in computing cash flows from operating activities and explain this procedure when the direct method is applied.

- Identify common “connector accounts” that are used to convert accrual accounting figures to the change taking place in the cash balance as a result of these transactions.

- Compute the cash inflows and outflows resulting from common revenues and expenses such as sales, cost of goods sold, rent expense, salary expense, and the like.

The Handling of Noncash and Nonoperating Transactions by the Direct Method

Question: The net cash inflow or outflow generated by operating activities is especially significant information to any person looking at an organization’s financial health and future prospects. According to U.S. GAAP, that information can be presented within the statement of cash flows by either of two approaches: the direct methodA mechanical method of reporting the amount of cash flows that a company generates from its operating activities; it is preferred by FASB because the information is easier to understand but it is only rarely encountered in practice. or the indirect methodA mechanical method of reporting the amount of cash flows that a company generates from its operating activities; it is allowed by FASB (although the direct method is viewed as superior) but is used by a vast majority of businesses in the United States..

The numerical amount of the change in cash resulting from a company’s daily operations is not impacted by this reporting choice. The increase or decrease in cash is a fact that will not vary because of the manner of presentation. Both methods arrive at the same total. The informational value to decision makers, though, is potentially affected by the approach selected.

FASB has indicated a preference for the direct method. In contrast, reporting companies (by an extremely wide margin) continue to use the more traditional indirect method. Thus, both will be demonstrated here. The direct method is more logical and will be discussed first. How is information presented when the direct method is selected to disclose a company’s cash flows from operating activities?

Answer: The direct method starts with the entire income statement for the period. Then, each of the separately reported figures is converted into the amount of cash received or spent in carrying on this operating activity. “Sales,” for example, is turned into “cash collected from customers.” “Salary expense” and “rent expense” are recomputed as “cash paid to employees” and “cash paid to rent facilities.”

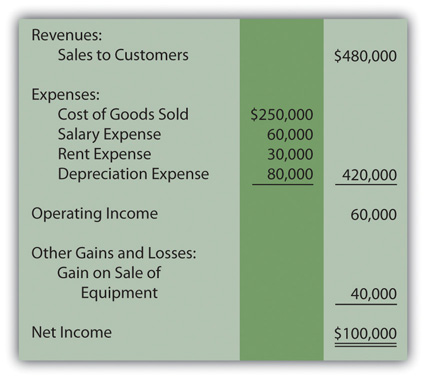

For illustration purposes, assume that Liberto Company prepared its income statement for the year ended December 31, Year One, as shown in Figure 17.4 "Liberto Company Income Statement Year Ended December 31, Year One". This statement has been kept rather simple so that the conversion to cash flows from operating activities is not unnecessarily complex. For example, income tax expense has been omitted.

Figure 17.4 Liberto Company Income Statement Year Ended December 31, Year One

The $100,000 net income figure reported here by Liberto is based on the application of U.S. GAAP. However, the amount of cash generated by the company’s operating activities might be considerably more or much less than that income figure. It is a different piece of information.

To transform a company’s income statement into its cash flows from operating activities, several distinct steps must be taken. These steps are basically the same regardless of whether the direct method or the indirect method is applied.

The first step is the complete elimination of any income statement account that does not involve cash. Although such balances are important in arriving at net income, they are not relevant to the cash generated and spent in connection with daily operations. By far the most obvious example is depreciation. This expense appears on virtually all income statements but has no direct impact on a company’s cash. In determining cash flows from operating activities, it is omitted because depreciation is neither a source nor use of cash. It is an allocation of a historical cost to expense over an asset’s useful life. To begin the calculation of the cash flows resulting from Liberto’s operating activities, the $80,000 depreciation expense must be removed.

The second step is the removal of any gains and losses that resulted from investing or financing activities. Although cash was likely involved in these transactions, this inflow or outflow is reported elsewhere in the statement of cash flows and not within the company’s operating activities. For example, Liberto’s $40,000 gain on the sale of equipment is germane to the reporting of investing activities, not operating activities. The cash received in this disposal is included on the statement of cash flows but as an investing activity.

Neither (a) noncash items such as depreciation nor (b) nonoperating gains and losses are included when an income statement is converted to the cash flows from operating activities.

Converting Accrual Accounts to Cash Flows—The Direct Method

Question: After all noncash and nonoperating balances are deleted, Liberto is left with four income statement accounts:

- Sales to customers—$480,000

- Cost of goods sold—$250,000

- Salary expense—$60,000

- Rent expense—$30,000

These balances all relate to operating activities. However, the numbers reflect the application of U.S. GAAP and accrual accounting rather than the amount of cash exchanged. The cash effects must be determined individually for these accounts. How are income statement figures such as sales or rent expense converted to the amount of cash received or expended?

Answer: The third step in the process of determining cash flows from operating activities is the individual conversion to cash of all remaining income statement accounts. For these balances, a difference usually exists between the time of recognition as specified by accrual accounting and the exchange of cash. A sale is made on Monday (revenue is recognized), but the money is not collected until Friday. An employee performs work on Monday (expense is recognized) but payment is not made until Friday.

These timing differences occur because accrual accounting is required by U.S. GAAP. Thus, many revenues and expenses are not recorded at the same time as the related cash transactions. In the interim, recognition of an asset or liability balance is necessary. Between the sale on Monday and the collection on Friday, the business reports an account receivable. This asset goes up when the sale is made and down when the cash is collected. Between the employee’s work on Monday and the payment on Friday, the business reports a salary payable. This liability goes up when the money is earned and down when the cash payment is made. In this textbook, these interim accounts (such as accounts receivable and salary payable) will be referred to as “connector accounts” because they connect the recording mandated by accrual accounting with the cash transaction.

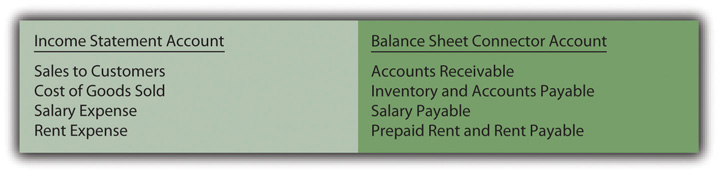

Each income statement account (other than the noncash and nonoperating numbers that have already been eliminated) has at least one asset or liability that is recorded between the time of accounting recognition and the exchange of cash. The changes in these connector accounts can be used to convert the individual income statement figures to their cash equivalents. Basically, the increase or decrease is removed to revert the reported number back to the amount of cash involved. As can be seen in Figure 17.5 "Common Connector Accounts for Liberto’s Four Income Statement Balances", connector accounts are mostly receivables, payables, and prepaid expenses.

Figure 17.5 Common Connector Accounts for Liberto’s Four Income Statement BalancesFor convenience, the allowance for doubtful accounts will not be included with accounts receivable. The possibility of bad debts makes the conversion to cash more complicated and is covered in upper-level accounting textbooks.

If a connector account is an asset and the balance goes up, the business has less cash (the receivable was not collected, for example). If a connector account is an asset and goes down, the business has more cash (such as when receivables from previous years are collected in the current period). Therefore, for a connector account that is an asset, an inverse relationship exists between the change in the balance during the year and the reporting entity’s cash balance.

- Increase in connector account that is an asset → Lower cash balance

- Decrease in connector account that is an asset → Higher cash balance

If a connector account is a liability and the balance goes up, the business has saved its cash and holds more (an expense has been incurred but not yet paid, for example). If a connector account is a liability and this balance falls, the business must have used its cash to reduce the debt and has less remaining. Consequently, a direct relationship exists between the change in a connector account that is a liability and the cash balance.

- Increase in connector account that is a liability → Higher cash balance

- Decrease in connector account that is a liability → Lower cash balance

Applying the Direct Method to Determine Cash Revenues and Expenses

Question: Liberto has one revenue and three expenses left on its income statement after removal of noncash and nonoperating items. To arrive at the net cash flows from operating activities, the cash inflow or outflow relating to each must be determined. Assume that the following changes took place during this year in the related balance sheet connector accounts:

- Accounts receivable: up $19,000

- Inventory: down $12,000

- Prepaid rent: up $4,000

- Accounts payable: up $9,000

- Salary payable: down $5,000

In applying the direct method to determine operating activity cash flows, how are the individual figures to be disclosed computed?

Answer:

- Sales to customers were reported on the income statement as $480,000. During that same period, accounts receivable increased by $19,000. Thus, less money was collected than the amount of the company’s credit sales. That is the cause for a rise in receivables. To reflect the collection of less cash, a reduction is needed. Consequently, the cash received from customers was only $461,000 ($480,000 less $19,000).

- Salary expense was reported as $60,000. During that time period, salary payable went down by $5,000. More cash must have been paid to cause this drop in the liability. The amount actually paid to employees was $65,000 ($60,000 plus $5,000).

- Rent expense was reported as $30,000. Prepaid rent increased by $4,000 from the first of the year to the end. This connector account is an asset. Because this asset increased, Liberto must have paid an extra amount for rent. Cash paid for rent was $34,000 ($30,000 plus $4,000).

-

Cost of goods sold has been left to last because it requires an extra step. The company first determines the quantity of inventory bought during this period. Only then can the cash payment made for those acquisitions be determined.

- Cost of goods sold is reported as $250,000. However, the balance held in inventory fell by $12,000. Thus, the company bought $12,000 less inventory than it sold. Fewer purchases cause a drop in inventory. The amount of inventory acquired during the period was only $238,000 ($250,000 less $12,000).

- Next, the cash paid for those purchases is calculated. As indicated, accounts payable went up $9,000. Liabilities increase because less money is paid. Although $238,000 of merchandise was acquired, only $229,000 in cash payments were made ($238,000 less $9,000).

After each of these four income statement accounts is converted to the amount of cash received or paid this period, the operating activity section of the statement of cash flows can be created by the direct method as shown in Figure 17.6 "Liberto Company Statement of Cash Flows for Year One, Operating Activities Reported by Direct Method".

Figure 17.6 Liberto Company Statement of Cash Flows for Year One, Operating Activities Reported by Direct Method

Liberto’s income statement reported net income of $100,000. However, the cash generated by operating activities during this same period was $133,000. The conversion from accrual accounting to operating cash inflows and outflows required three steps.

- All noncash revenues and expenses (depreciation, in this example) were removed. These accounts do not represent cash transactions.

- All nonoperating gains and losses (the gain on sale of equipment, in this example) were removed. These accounts reflect investing and financing activities and the resulting cash flows are reported in those sections of the statement of cash flows rather than within the operating activities.

- All remaining income statement accounts are adjusted to the amount of cash physically exchanged this period by applying the change in each related connector account. By this process, accrual accounting figures are converted to cash balances.

Test Yourself

Question:

The Giotto Company reported sales in its latest year of $800,000. Giotto held $170,000 in accounts receivable at the beginning of the period but only $144,000 at the end. Assume that all of these receivables are viewed as collectible so that no allowance is needed. What amount of cash did the company collect this period from its customers?

- $774,000

- $776,000

- $824,000

- $826,000

Answer:

The correct answer is choice d: $826,000.

Explanation:

During this year, the accounts receivable balance dropped by $26,000 ($170,000 to $144,000). Thus, more cash was collected than the amount of sales. Receivables decrease because cash is received. These additional receipts indicate that a total of $826,000 was collected from the Giotto’s customers ($800,000 plus $26,000).

Test Yourself

Question:

The Lessain Company reported salary expense of $345,000 on its income statement for the year ended December 31, Year One. At the beginning of that year, salary payable was shown as $31,000 but rose to $40,000 by December 31. In reporting the Lessain’s cash flows generated from operating activities, what amount should be shown as the cash paid to employees?

- $336,000

- $345,000

- $354,000

- $376,000

Answer:

The correct answer is choice a: $336,000.

Explanation:

Lessain’s salary payable went up by $9,000. Accrued liabilities rise because fewer payments are made than the expenses incurred. Although employees earned $345,000 during this year, only $336,000 was paid to them as salary ($345,000 less $9,000). It is this reduction in the cash payment that caused the salary payable account to increase by $9,000 during Year One.

Test Yourself

Question:

The TJ Corporation reported cost of goods sold for Year One of $564,000. During that same period, this company’s inventory balance rose by $22,000 while its accounts payable fell by $7,000. In creating a statement of cash flows using the direct method, what amount should be reported by the TJ Corporation as the cash spent to acquire inventory?

- $535,000

- $549,000

- $579,000

- $593,000

Answer:

The correct answer is choice d: $593,000.

Explanation:

Although cost of goods sold was reported as $564,000, the inventory on hand increased $22,000. More inventory was bought that year than sold. TJ acquired $586,000 in inventory during Year One ($564,000 sold plus the $22,000 increase). At the same time, accounts payable dropped. This decrease indicates that more in cash was paid than the amount bought. Spending an extra $7,000 caused the reduction. Thus, cash paid out this year to acquire inventory was $593,000 ($586,000 plus $7,000).

Test Yourself

Question:

Sales reported by a local shoe store are $470,000. Accounts receivable decreased by $27,000 this year while unearned revenues rose by $14,000. If the direct method is used to report cash flows from operating activities, how much should be shown as the store’s cash collected from its customers?

- $429,000

- $467,000

- $483,000

- $511,000

Answer:

The correct answer is choice d: $511,000.

Explanation:

A new connector account (unearned revenues) is included here. This balance represents cash received where revenue has not yet been earned. This increase indicates that $14,000 more in cash was collected from customers than the amount reported as revenue. Also, accounts receivable fell by $27,000. Receivables are reduced through collection. The shoe store must have received that much more cash than it earned. Cash received during this period is $511,000 ($470,000 plus $14,000 and $27,000).

Key Takeaway

An entity’s cash flows from operating activities can be derived and reported by either the direct method or the indirect method. FASB has expressed preference for the direct method but the indirect method has been adopted by virtually all businesses in the United States. The process always begins with the income for the period (the entire income statement is used when the direct method is applied). First noncash items (such as depreciation) and then nonoperating gains and losses are eliminated entirely because they are not related to operating activity cash flows. In the direct method, the remaining revenue and expense accounts are individually converted into cash figures. For each, the change in one or more related balance sheet connector accounts is used to adjust these accrual accounting numbers to their corresponding cash balances. Thus, income statement balances are returned to their underlying cash inflows and outflows for reporting purposes.