This is “The Structure of a Statement of Cash Flows”, section 17.1 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

17.1 The Structure of a Statement of Cash Flows

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Describe the purpose of a statement of cash flows.

- Define cash and cash equivalents.

- Identify the three categories disclosed within a statement of cash flows.

- Indicate the type of transactions that are reported as operating activities and provide common examples.

- Indicate the type of transactions that are reported as investing activities and provide common examples.

- Indicate the type of transactions that are reported as financing activities and provide common examples.

The Importance of a Statement of Cash Flows

Question: Thus far in this textbook, the balance sheet and income statement have been studied in comprehensive detail along with the computation of retained earnings. By this point, a student should be able to access a set of financial statements (on the Internet, for example) and understand much of the reported information. Terms such as “FIFO,” “accumulated depreciation,” “goodwill,” “common stock,” “bad debt expense,” and the like that might have sounded like a foreign language at first should now be understandable.

Examination of one last financial statement is necessary to complete the portrait presented of a reporting entity by financial accounting and the rules of U.S. GAAP. That is the statement of cash flows. This statement was introduced briefly in an earlier chapter but will be covered here in detail. Why is it needed by decision makers? What is the rationale for presenting a statement of cash flows?

Answer: Coverage of the statement of cash flows has been postponed until now because its construction is unique. For this one statement, the figures do not come directly from ending T-account balances found in a general ledger. Instead, the accounts and amounts are derived from the other financial statements. Thus, an understanding of those statements is a helpful prerequisite when considering the creation of a statement of cash flows.

The delay in examining the statement of cash flows should not be taken as an indication of its lack of significance. In fact, some decision makers view it as the most important of the financial statements. They are able to see how corporate officials managed to get and then make use of the ultimate asset: cash. The acquisition of other assets, the payment of debts, and the distribution of dividends inevitably leads back to a company’s ability to generate sufficient amounts of cash. Consequently, presentation of a statement of cash flows is required by U.S. GAAP for every period in which an income statement is reported.

To reiterate the importance of this information, Michael Dell, founder of Dell Inc., states in his book Direct from Dell: Strategies That Revolutionized an Industry (written with Catherine Fredman): “We were always focused on our profit and loss statement. But cash flow was not a regularly discussed topic. It was as if we were driving along, watching only the speedometer, when in fact we were running out of gas.”Michael Dell with Catherine Fredman, Direct from Dell: Strategies That Revolutionized an Industry (New York: HarperBusiness, 1999), 47.

The income statement and the statement of cash flows connect the balance sheets from the beginning of the year to the end. During that time, total reported net assets either increase or decrease as does the entity’s cash balance. The individual causes of those changes are explained by means of the income statement and the statement of cash flows.

The purpose of the statement of cash flows is virtually self-evident: It reports the cash receipts (cash inflows) and the cash disbursements (cash outflows) to explain the changes in cash that took place during the year. However, the physical structure of this statement is not self-evident. As illustrated previously, all cash flows are classified within three distinct categories. Coverage here is designed to demonstrate the logic of this classification system and the method by which the reported numbers are derived.

Cash and Cash Equivalents

Question: Because current assets are listed in order of liquidity, most businesses present “cash and cash equivalentsShort-term, highly liquid investments with original maturities of ninety days or fewer that can be readily converted into known amounts of cash.” as the first account on their balance sheets. For example, as of December 31, 2010, Ball Corporation reported holding cash and cash equivalents totaling $152.0 million. This same terminology is used on Ball’s statement of cash flows which explains the drop of $58.6 million in cash and cash equivalents that took place during 2010. What constitutes cash and what are cash equivalents?

Answer: Cash consists of coins, currencies, bank deposits (both checking accounts and savings accounts) and some negotiable instruments (money orders, checks, and bank drafts). Cash equivalents are short-term, highly liquid investments that are readily convertible into known amounts of cash. They are so near their maturity date that significant changes in value are unlikely. Only securities with original maturities of ninety days or fewer are classified as cash equivalents. Cash equivalents held by most companies include Treasury bills,A Treasury bill is a popular U.S. government security with a maturity date of one-year or less. commercial paper,The term “commercial paper” refers to securities issued by corporations to meet their short-term cash needs. and money market funds.

For the past few years, FASB has been considering the elimination of the cash equivalents category. If a change is made, such assets (other than cash) will likely appear on the balance sheet as temporary investments. As with all such debates, both pros and cons exist for making such an official change. For simplicity purposes, cash will be used in the examples presented throughout this chapter. However, until new authoritative rules are passed, accounting for cash equivalents is the same as that for cash.

Test Yourself

Question:

Which of the following assets is least likely to be considered a cash equivalent?

- Treasury bills

- Commercial paper

- Money market funds

- Corporate bonds

Answer:

The correct answer is choice d: Corporate bonds.

Explanation:

Treasury bills, commercial paper, and money market funds are all considered to be cash equivalents as long as they can be converted into cash and had an original maturity of ninety days or fewer. Most corporate bonds have maturity dates much longer than ninety days, often many years.

Cash Flows from Operating Activities

Question: For reporting purposes all cash flows are classified within one of three categories: operating activities, investing activities, and financing activities. What transactions are specifically identified as operating activities?

Answer: Operating activitiesA statement of cash flow category used to disclose cash receipts and disbursements arising from the primary activities of the reporting organization. generally involve producing and delivering goods and providing services to customers. These events are those that transpire on virtually a daily basis as a result of the organization’s primary function. For a business like Barnes & Noble, operating activities include the buying and selling of books (and other inventory items) as well as the multitude of other tasks required by that company’s retail function. As shown in Figure 17.1 "Typical Operating Activity Cash Inflows and Outflows", operating activities are those that are expected to take place regularly in the normal course of business.

Figure 17.1 Typical Operating Activity Cash Inflows and Outflows

The net number for the period (the inflows compared to the outflows) is presented as the cash flows generated from operating activities. This figure is viewed by many decision makers as a good measure of a company’s ability to prosper. Investors obviously prefer to see a positive number, one that increases from year to year. Some analysts believe that this figure is a better reflection of a company’s financial health than reported net income because the ultimate goal of a business is to generate cash.

For example, International Paper Company reported a net loss on its income statement for the year ended December 31, 2008, of $1.282 billion (considerably worse than any of the previous five years). However, its statement of cash flows for the same period reported a net cash inflow from operating activities of $2.669 million (considerably better than any of the previous five years). That is nearly a $4 billion difference. No one could blame a decision maker for being puzzled. Did the company do poorly that year or wonderfully well?

That is the problem with relying on only a few of the numbers in a set of financial statements without a closer and more complete inspection. What caused this company to lose over $1.2 billion dollars? How did the company manage to generate nearly $2.7 billion in cash from its operating activities? In-depth analysis of financial statements is never quick and easy. It requires patience and knowledge and the willingness to dig through all the available information.

Investing Activity Cash Flows

Question: On the statement of cash flows for the year ended August 31, 2011, Walgreen Co. reported that a net of over $1.5 billion in cash was spent in connection with a variety of investing activities. This company’s management obviously made decisions that required the use of considerable sums of money. Details about those expenditures should be of interest to virtually any party analyzing this company. What cash transactions are specifically identified as investing activities?

Answer: Investing activitiesA statement of cash flow category used to disclose cash receipts and disbursements arising from an asset transaction other than one relating to the primary activities of the reporting organization. encompass the acquisition and disposition of assets in transactions that are separate from the central activity of the reporting organization. In simple terms, these cash exchanges do not occur as part of daily operations.

- For a delicatessen, the purchase of bread, mustard, or onions is an operating activity, but the acquisition of a refrigerator or stove is an investing activity.

- For a pharmacy, the sale of aspirin or a decongestant is an operating activity, but the disposal of a delivery vehicle or cash register is an investing activity.

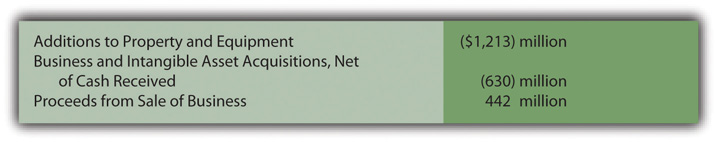

All of these cash transactions involve assets but, to be classified as an investing activity, they can only be tangentially related to the day-to-day operation of the business. For example, Figure 17.2 "The Three Biggest Investing Activity Cash Flows Identified on Walgreen’s Statement of Cash Flows for the Year Ended August 31, 2011" shows the three biggest investing activity cash flows reported by Walgreen.

Figure 17.2 The Three Biggest Investing Activity Cash Flows Identified on Walgreen’s Statement of Cash Flows for the Year Ended August 31, 2011

Healthy, growing companies normally expect cash flows from investing activities to be negative (a net outflow) as money is invested by management especially in new noncurrent assets. As can be seen in Figure 17.2 "The Three Biggest Investing Activity Cash Flows Identified on Walgreen’s Statement of Cash Flows for the Year Ended August 31, 2011", Walgreen Co. spent over $1.2 billion in cash during this one year to buy property and equipment. The company apparently had sufficient cash available to fund this significant expansion.

Financing Activity Cash Flows

Question: The third category of cash flows lists the amounts received and disbursed by a business through financing activities. For the year ended July 2, 2011, Sara Lee Corporation reported that its cash balance had been reduced by over $1.7 billion as a result of such financing activities. Again, that is a lot of money leaving the company. What transactions are specifically identified in a statement of cash flows as financing activities?

Answer: Financing activitiesA statement of cash flow category used to disclose cash receipts and disbursements arising from a liability or stockholders’ equity transaction other than one relating to the primary activities of the organization. are transactions separate from the central, day-to-day activities of an organization that involve either liabilities or shareholders’ equity accounts. Cash inflows from financing activities include issuing capital stock and incurring liabilities such as bonds or notes payable. Outflows are created by the distribution of dividends, the acquisition of treasury stock, the payment of noncurrent liabilities, and other similar cash transactions.

As can be seen in Figure 17.3 "The Three Biggest Financing Activity Cash Flows Identified on Sara Lee’s Statement of Cash Flows for the Year Ended July 2, 2011", Sara Lee’s three biggest changes in cash that resulted from financing activities were the repayments of other debt, purchases of common stock, and borrowing of other debt. Significant information about management’s decisions is readily apparent from an analysis of the cash flows from both investing and financing activities.

Figure 17.3 The Three Biggest Financing Activity Cash Flows Identified on Sara Lee’s Statement of Cash Flows for the Year Ended July 2, 2011

The net result reported for financing activities is frequently positive in some years and negative in others. When a company borrows money or sells capital stock, an overall positive inflow of cash is likely. In years when a large dividend is distributed or debt is settled, the net figure for financing activities is more likely to be negative.

Test Yourself

Question:

The Reardon Company paid salary to its employees totaling $527,000 during the current year. Into which category on a statement of cash flows will these payments be placed?

- Operating activities

- Investing activities

- Financing activities

- Capital activities

Answer:

The correct answer is choice a: Operating activities.

Explanation:

The payment of salary is a regular operating activity. The expenditure takes place as a direct result of the day-to-day operations of the business.

Test Yourself

Question:

The McGuire Company, located in Wilcox, Texas, issued 10,000 shares of its $3 par value common stock during this year for $9 in cash per share. Into which category on a statement of cash flows will this $90,000 capital contribution be placed?

- Operating activities

- Investing activities

- Financing activities

- Capital activities

Answer:

The correct answer is choice c: Financing activities.

Explanation:

This issuance of common (and preferred) stock is identified as a financing activity. It represents a change in a shareholders’ equity account. However, the cash inflow is not directly related to the daily operations of the business.

Test Yourself

Question:

The Staunton Corporation owns and operates several restaurants in eastern Iowa. Looking to expand operations, Staunton bought a piece of land recently for $500,000. The business paid $100,000 and a noncurrent note payable was signed for the remaining $400,000. How is this transaction reported on a statement of cash flows?

- Investing activity as an outflow of $100,000

- Investing activity as an outflow of $500,000

- Financing activity as an outflow of $100,000

- Financing activity as an outflow of $500,000

Answer:

The correct answer is choice a: Investing activity as an outflow of $100,000.

Explanation:

The purpose of the transaction is to acquire land. Land is an asset and this event did not take place as a normal part of Staunton’s daily operations. Thus, the transaction is an investing activity. Because $100,000 in cash was spent for this acquisition, the transaction is reported as an outflow of that amount. The $500,000 cost of the land and the $400,000 note payable will be recorded on the corporation’s balance sheet.

Disclosure of Noncash Transactions

Question: Significant investing and financing transactions can occur without any cash component. Land, for example, might be obtained by issuing common stock. Buildings are often bought through the signing of a long-term note payable with all cash payments deferred into the future. Is that information omitted entirely from the statement of cash flows? If no cash is received or expended, should a transaction be reported on a statement of cash flows?

Answer: All investing and financing transactions need to be reported in some manner because of the informational value. They represent choices made by the organization’s management. Even if no cash is involved, such events must still be disclosed in a separate schedule (often attached to the statement of cash flows) or explained in the notes to the financial statements. This information is valuable to the interested parties who want a complete picture of the investing and financing decisions that were made during the period.

For example, on the statement for Duke Energy Corporation for the year ended December 31, 2010, a significant noncash transaction was identified as “accrued capital expenditures” of $361 million. Although cash was not involved, inclusion of this information was still deemed to be important.

Stock dividends and stock splits, though, are omitted entirely in creating a statement of cash flows. As discussed previously, they are viewed as techniques to reduce the price of a corporation’s stock and are not decisions that impact the allocation of financial resources.

Key Takeaway

A statement of cash flows is required by U.S. GAAP whenever an income statement is presented. It explains all changes occurring in cash and cash equivalents during the reporting period. The various cash inflows and outflows are classified into one of three categories. Operating activities result from the primary or central function of the business. Investing activities are not part of normal operations and affect an asset (such as the cash acquisition of a truck or the sale of a patent). Financing activities are not part of normal operations and involve a liability or a stockholders’ equity account (borrowing money on a note, for example, or the reacquisition of treasury stock). Significant investing and financing activities that do not impact cash must still be disclosed because they reflect decisions made by management.