This is “Reporting Postretirement Benefits”, section 15.4 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

15.4 Reporting Postretirement Benefits

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Define the term “postretirement benefits.”

- Explain the accounting problems associated with the recognition of accrued postretirement benefits.

- List the steps that are followed to determine a company’s reported obligation for postretirement benefits.

- Identify the role of the actuary in accounting for postretirement benefits.

- Calculate a company’s debt-to-equity ratio and explain its meaning.

- Calculate the times interest earned ratio and explain its meaning.

Liability for Postretirement Benefits

Question: According to the information provided at the beginning of this chapter, Alcoa reported a $2.6 billion liability at the end of 2010 for accrued postretirement benefits. What constitutes a postretirement benefit?

Answer: In a note to the 2010 financial statements, Alcoa explains part of this liability as follows:

“Alcoa also maintains health care and life insurance benefit plans covering eligible U.S. retired employees and certain retirees from foreign locations. Generally, the medical plans pay a percentage of medical expenses, reduced by deductibles and other coverages. These plans are generally unfunded, except for certain benefits funded through a trust. Life benefits are generally provided by insurance contracts. Alcoa retains the right, subject to existing agreements, to change or eliminate these benefits.”

Postretirement benefits cover a broad array of promises that companies make to their employees to boost morale and keep them from seeking other jobs. According to this note disclosure, Alcoa provides two of the most common: health care insurance and life insurance. Based on stipulations as to eligibility, Alcoa helps its employees by paying a portion of these insurance costs even after they have retired. Alcoa apparently continues to provide these payments as a reward for years of employee service.

Determining a Liability for Postretirement Benefits

Question: Assume that one of the employees for the Michigan Company is currently thirty-four years old and is entitled to certain postretirement benefits starting at the age of sixty-five. The company has promised to continue paying health care and life insurance premiums for all retirees as long as they live.Health care and life insurance benefits paid by an employer while an employee is still working do not pose an accounting issue. The costs are known and can be expensed as incurred. These expenses are matched with the revenues being generated by the employees at the current time. For this employee, no postretirement benefits will be paid for the next thirty-one years (65 less 34). After that, an unknown payment amount will begin and continue for an unknown period of time. In one of the opening chapters of this book, the challenge presented to accountants as a result of future uncertainty was discussed. Probably no better example of uncertainty can be found than postretirement benefits. Payments may continue for decades and neither their amount nor their duration is more than a guess.

The employee is helping the company generate revenues currently so that, as always, the related expense should be recognized now according to the matching principle. Although this obligation might not be paid for many years, both the expense and related liability are recorded when the person is actually working for the company and earning these benefits.

How is the amount of this liability possibly determined? An employee might retire at sixty-five and then die at sixty-six or live to be ninety-nine. Plus, estimating the cost of insurance (especially medical insurance) over several decades into the future seems to be a virtually impossible challenge. The skyrocketing cost of health care is difficult to anticipate months in advance, let alone decades. The dollar amount of the company’s obligation for these future costs appears to be a nebulous figure at best. In this textbook, previous liabilities have been contractual or at least subject to a reasonable estimation prior to recognition. How is the liability calculated that will be reported by a company for the postretirement benefits promised to its employees?

Answer: As shown by the Alcoa example, postretirement benefits are estimated and reported according to U.S. GAAP while employees work. Because of the length of time involved and the large number of variables (some of which, such as future health care costs, are quite volatile), a precise determination of this liability is impossible. In fact, this liability might be the most uncertain number found on any set of financial statements. Apparently, reporting a dollar amount for postretirement benefits, despite its inexactness, is more helpful than omitting the expense and liability entirely. However, decision makers need to understand that these reported balances are no more than approximations.

The actual computation and reporting of postretirement benefits is more complicated than can be covered adequately in an introductory financial accounting textbook. An overview of the basic steps, though, is useful in helping decision makers understand the information that is provided.

To arrive at the liability to be reported for postretirement benefits that are earned now but only paid after retirement, the Michigan Company takes two primary steps. First, an actuaryAn individual who mathematically computes the likelihood of future events. calculates an estimation of the cash amounts that will eventually have to be paid as a result of the terms promised to employees. “An actuary is a business professional who analyzes the financial consequences of risk. Actuaries use mathematics, statistics, and financial theory to study uncertain future events, especially those of concern to insurance and pension programs.”http://www.math.purdue.edu/academic/actuary/what.php?p=what. In simpler terms, an actuary is a mathematical expert who computes the likelihood of future events.

To make a reasonable guess at the amount of postretirement benefits, the actuary has to make a number of difficult estimations such as the average length of time employees will live and the future costs of health care and life insurance (and any other benefits provided to retirees). For example, an actuary’s calculations might indicate that these costs will average $10,000 per year for the twenty years that an employee is expected to live following retirement.

The future payments to be made by the company are estimated by an actuary, but they are projected decades into the future. Thus, as the second step in this process, the present value of these amounts is calculated to derive the figure to be reported currently on the balance sheet. Once again, as in previous chapters, interest for this period of time is determined mathematically and removed to leave just the principal of the obligation as of the balance sheet date. That is the amount reported by the employer within noncurrent liabilities.

| Determining Accrued Postretirement Benefits |

|---|

| Step One: Estimate Future Payments |

| Step Two: Calculate Present Value of Estimated Future Payments |

Test Yourself

Question:

The Johnson Corporation hires 100 employees in Year One. At that time, the organization makes a promise to each of its employees. If they will work for Johnson for twenty years, the company will pay for the college education of all their children. At that time, none of the employees has a child who will start college until after the next six years. Which of the following statements is true?

- The company should report an expense and a liability at the end of Year One.

- The company should start reporting an expense and a liability after six years.

- The company should start reporting an expense in Year One but no liability.

- The company will never report this promise as an expense and a liability.

Answer:

The correct answer is choice a: The company should report an expense and a liability at the end of Year One.

Explanation:

Johnson Corporation has begun to incur an expected cost in connection with future benefits for its employees. The related expense should be recognized beginning in Year One because these employees are working to generate revenues. An actuary can estimate the eventual cost of this promise based on the amount of work performed to date. A present value computation will then be made to determine the amount of this expense and liability that are applicable to the first year.

The Consequences of Having to Report a Liability

Question: Alcoa recognizes an accrued postretirement benefit liability on its balance sheet of $2.6 billion. This number is the present value of the estimated amounts that the company will have to pay starting when each employee retires. Except for the inherent level of uncertainty, this accounting seems reasonable. At one time decades ago, companies were not required to recognize this obligation. The liability was ignored and costs were simply expensed as paid. Only after advanced computer technology and sophisticated mathematical formulas became available was the reporting of this liability mandated. What is the impact of reporting postretirement benefits if the numbers can only be approximated?

Answer: Organizations typically prefer not to report balances that appear to weaken the portrait of their economic health and vitality. However, better decisions are made by all parties when relevant information is readily available. Transparency is a primary goal of financial accounting. Arguments can be made that some part of the problems that many businesses currently face are the result of promises that were made over past decades where the eventual costs were not properly understood.

As the result of the evolution of U.S. GAAP, decision makers (both inside and outside the company) can now better see the costs associated with postretirement benefits. Not surprisingly, once disclosed, some companies opted to cut back on the amounts promised to retirees. The note disclosure quoted previously for Alcoa goes on further to say, “All U.S. salaried and certain hourly employees hired after January 1, 2002 are not eligible for postretirement health care benefits. All U.S. salaried and certain hourly employees that retire on or after April 1, 2008 are not eligible for postretirement life insurance benefits” (emphasis added).

For the employees directly impacted, these decisions may have been understandably alarming. However, by forcing the company to recognize this liability, U.S. GAAP has helped draw attention to the costs of making such promises.

Test Yourself

Question:

On its most recent balance sheet, the Randle Company reports a noncurrent liability of $30 million as an accrued postretirement benefit obligation. Which of the following statements is least likely to be true?

- The amount to be paid will be more than $30 million.

- The company will have the $30 million in cash payments scheduled out at set times.

- The $30 million figure is a culmination of a number of difficult estimations.

- This liability could extend into the future for several decades.

Answer:

The correct answer is choice b: The company will have the $30 million in cash payments scheduled out at set times.

Explanation:

Postretirement benefits are amounts that a company will pay years into the future, often based on the life expectancy of retirees. After amounts are determined based on several estimates, cash payments are reduced to present value for reporting purposes. Because of the length of time involved, present value is often much less than the anticipated cash payments. Determination of the exact amount and timing of payments is subject to many variables that are not yet known such as life expectancy.

Vital Signs Studied in Connection with Liabilities

Question: In previous chapters, various vital signs have been examined—numbers, ratios, and the like—that assist decision makers in evaluating an entity’s financial condition and future prospects. In connection with liabilities, do specific vital signs exist that are frequently relied on to help assess the economic health of a business or other organization?

Answer: One vital sign that is often studied by decision makers is the debt-to-equity ratioA measure of a company’s use of debt for financing purposes; it is computed by dividing total liabilities by total stockholders’ equity.. This figure is simply the total liabilities reported by a company divided by total stockholders’ equity. The resulting number indicates whether most of a company’s assets have come from borrowing and other debt or from its own operations and owners. A high debt-to-equity ratio indicates that a company is highly leveraged. As discussed previously, that raises the level of risk but also increases the possible profits earned by stockholders. Relying on debt financing makes a company more vulnerable to bankruptcy and other financial problems but also provides owners with the chance for higher financial rewards.

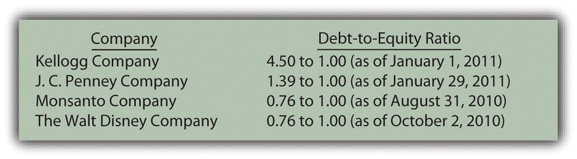

Recent debt-to-equity ratios presented in Figure 15.12 "Recent Debt-to-Equity Ratios for Several Prominent Companies" for several prominent companies show a wide range of results. No single financing strategy is evident here. The debt-to-equity ratio indicates a company’s policy toward debt, but other factors are involved. For example, in some industries, debt levels tend to be higher than in others. Also, individual responses to the recent economic recession might have impacted some companies more than others.

Figure 15.12 Recent Debt-to-Equity Ratios for Several Prominent Companies

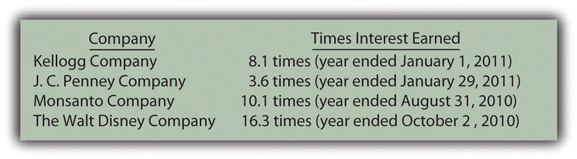

Another method to evaluate the potential problem posed by a company’s debts is to compute the times interest earned (TIE)A measure of a company’s ability to meet obligations as they come due; it is computed by taking EBIT (earnings before interest and taxes) and dividing that number by interest expense for the period. ratio. Normally, debt only becomes a risk if interest cannot be paid when due. This calculation helps measure how easily a company has been able to meet its interest obligations through current operations.

Times interest earned begins with the company’s net income before both interest expense and income taxes are removed (a number commonly referred to as “EBIT” or “earnings before interest and taxes”). Interest expense for the period is then divided into this income figure. For example, if EBIT is $500,000 and interest expense is $100,000, the reporting company earned enough during the year to cover the required interest obligations five times.

Figure 15.13 Recent Times Interest Earned for Several Prominent Companies

Test Yourself

Question:

The owners of a company contribute $100,000 to acquire its capital stock. Another $200,000 is borrowed from a bank. In its first year, the company earns a reported net income of $50,000. If the company then pays a cash dividend of $10,000, what is the impact of this distribution on the debt-to-equity ratio?

- There is no effect on the debt-to-equity ratio.

- It goes up. It was 1.33 to 1.00 and now is 1.43 to 1.00.

- It goes down. It was 1.33 to 1.00 and now is 1.25 to 1.00.

- It goes down. It was 1.43 to 1.00 and now is 1.33 to 1.00.

Answer:

The correct answer is choice b: It goes up. It was 1.33 to 1.00 and now is 1.43 to 1.00.

Explanation:

The company has one debt of $200,000. Before the dividend, stockholders’ equity is $150,000 ($100,000 in contributed capital and $50,000 in retained earnings). The debt-to-equity ratio is $200,000/$150,000 or 1.33 to 1.00. The dividend reduces retained earnings (this portion of net income is distributed to stockholders rather than leaving the assets in the business) to $40,000. Stockholders’ equity has dropped to $140,000. The debt-to-equity ratio is $200,000/$140,000 or 1.43 to 1.00.

Key Takeaway

Businesses and other organizations often promise benefits (such as health care and life insurance) to eligible employees to cover the years after they reach retirement age. Determining the liability balance to be reported at the current time poses a significant challenge for accountants because eventual payment amounts are so uncertain. An actuary uses historical data, computer programs, and statistical models to estimate these amounts. The present value of the projected cash payments is then calculated and recognized by the company as a noncurrent liability. The size of this debt can be quite large but the numbers are no more than approximations. Decision makers often analyze the level of a company’s debt by computing the debt-to-equity ratio and the times interest earned ratio. Both of these calculations help decision makers evaluate the risk and possible advantage of the current degree of debt financing.

Talking with a Real Investing Pro (Continued)

Following is a continuation of our interview with Kevin G. Burns.

Question: Lease arrangements are quite common in today’s business environment. For a capital lease, the present value of the future payments is reported by the lessee as a liability. In contrast, for an operating lease, only the amount currently due is included on the balance sheet as a liability. The reporting of such off-balance sheet financing has been criticized because businesses often go out of their way to create operating leases to minimize the total shown for their debts. However, information about these operating leases must be clearly disclosed in the notes to the financial statements. Are you concerned when you see a company with a lot of off-balance sheet financing? Would you prefer a system where companies had to report more of their debts from leasing arrangements? Do you believe off-balance sheet financing is a problem for the users of financial accounting information?

Kevin Burns: I hate off balance sheet financing. It is trickery in my opinion. As usual, I prefer full or even too much disclosure. A lease is a liability. It should be categorized as such. It is really quite simple—show the liability. Having information in the notes helps but liabilities should be reported on the balance sheet for all to see easily. Anything that reduces transparency is bad for the accounting industry and the people relying on reported financial information.

Obviously, I prefer for companies to have less debt. But, there are exceptions. I own a stake in a company that has a large building that has had a significant appreciation in value. Because they use that building, they cannot take advantage of that increase in value. I suggested to the management that they sell the building to get all of that money and then lease the building back so they could still use it. They would have to report the liability for the lease, but they get their money in a usable form right now, and they can remain in the building.

Video Clip

(click to see video)Professor Joe Hoyle talks about the five most important points in Chapter 15 "In a Set of Financial Statements, What Information Is Conveyed about Other Noncurrent Liabilities?".