This is “Recognition of Deferred Income Taxes”, section 15.3 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

15.3 Recognition of Deferred Income Taxes

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Understand that the recognition of revenues and expenses under U.S. GAAP differs at many critical points from the taxation rules established by the Internal Revenue Code.

- Explain the desire by corporate officials to defer the payment of income taxes.

- Determine the timing for the reporting of a deferred income tax liability and explain the connection of this process to the matching principle.

- Calculate taxable income as well as the related deferred income tax liability when the installment sales method is used.

The Reporting of Deferred Tax Liabilities

Question: At the beginning of this chapter, mention was made that Southwest Airlines reported deferred income taxes at the end of 2010 as a noncurrent liability of $2.5 billion. Such an account balance is not unusual. The Dow Chemical Company listed a similar debt of almost $1.3 billion on its December 31, 2010, balance sheet while Marathon Oil Corporation showed approximately $3.6 billion. What information is conveyed by these huge account balances? How is a deferred income tax liability created?

Answer: The reporting of deferred income tax liabilitiesA balance sheet account indicating that the current payment of an income tax amount has been delayed until a future date; companies often seek to create this deferral so that tax dollars can be used in the interim to increase net income. is, indeed, quite prevalent. One recent survey found that approximately 70 percent of businesses included a deferred tax balance within their noncurrent liabilities.Matthew Calderisi, senior editor, Accounting Trends & Techniques, 63rd edition (New York: American Institute of Certified Public Accountants, 2009), 279. Decision makers need to have a basic understanding of any account that is so commonly encountered in a set of financial statements.

In the earlier discussion of LIFO, the disparity between financial accounting principles and income tax rules was described. In the United States, financial information is presented based on the requirements of U.S. GAAP (created by FASB) whereas income tax reporting is determined according to the Internal Revenue Code (written by Congress). At many places, these two sets of guidelines converge. If a grocery store sells a can of tuna fish for $6 in cash, the revenue is $6 on both the reported financial statements and the income tax return. However, at a number of critical junctures, the recognized amounts can be quite different.

Where legal, companies frequently exploit these differences for their own benefit by delaying tax payments. The deferral of income taxes is usually considered a wise business strategy because the organization is able to use its cash for a longer period of time and, hence, generate additional revenues. When paid, the money is gone, but until then, it can be used to raise net income. For example, if an entity earns a 10 percent return on assets and manages to defer a tax payment of $700 million for one year, the increased profit is $70 million ($700 million × 10 percent).

Businesses commonly attempt to reduce their current taxable income by moving reported gains and revenue into the future. That is one prevalent method for deferring tax payments. Southwest, Dow Chemical, and Marathon likely used this approach to create a portion of the deferred tax liabilities they are reporting. Revenue or a gain might be recognized this year for financial reporting purposes although deferred until an upcoming time period for tax purposes. Consequently, the payment of tax on this income is pushed into that future year. As long as the tax laws are obeyed, such deferral is legal.

Taxable income is reduced in the current period (revenue is moved out) but increased at a later time (the revenue is moved back into taxable income). Because a larger tax will have to be paid in the subsequent period, a deferred income tax liability is created. To illustrate, assume that a business reports revenue of $10,000 on its Year One income statement. Because of tax rules and regulations, assume that this amount will not be subject to income taxation until Year Six. The $10,000 is referred to as a temporary tax differenceA revenue or expense reported for both financial accounting and income tax purposes but in two different time periods; leads to the recognition of deferred income taxes.. It is reported for both financial accounting and tax purposes but in two different time periods.

If the effective tax rate for this business is 40 percent, it reports a $4,000 ($10,000 × 40 percent) deferred income tax liability on its December 31, Year One, balance sheet. The revenue was earned in Year One, so the related expense and liability are also recorded in Year One. This amount will be paid to the government but not until Year Six when the revenue becomes taxable. The revenue is recognized now according to U.S. GAAP but in a later year for income tax purposes. Although, net income is higher in the current year than taxable income, taxable income will be higher in the future by $10,000. Most important, payment of the $4,000 income tax is delayed until Year Six.

Simply put, a deferred income tax liabilityMany companies also report deferred income tax assets that arise because of other differences in U.S. GAAP and the Internal Revenue Code. For example, Southwest Airlines included a deferred income tax asset of $214 million on its December 31, 2010, balance sheet. Accounting for such assets is especially complex and will not be covered in this textbook. Some portion of this asset balance, although certainly not all, is likely to be the equivalent of a prepaid income tax where Southwest was required to make payments by the tax laws in advance of recognition according to U.S. GAAP. is created when an event occurs now that will lead to a higher amount of income tax payment in the future.

Test Yourself

Question:

A company earns $60,000 late in Year One. The tax rate is 25 percent so the tax payment on this income will be $15,000. Because of a specific rule in the Internal Revenue Code, this $60,000 is not taxable until Year Two. Thus, the $15,000 will be paid on March 15, Year Three when the company files its Year Two income tax return. Which of the following statements is true?

- The liability is first recognized in Year One even though payment is not made until Year Three.

- The liability is first recognized in Year Two even though payment is not made until Year Three.

- The liability is not recognized until Year Three when the tax return is filed.

- There is not enough information presented here to determine when the liability should first be recognized.

Answer:

The correct answer is choice a: The liability is first recognized in Year One even though payment is not made until Year Three.

Explanation:

The income is recognized in Year One so the related income tax expense should be recognized in that same period to conform to the matching principle. Because recognition of the income has been delayed for tax purposes, a deferred income tax liability is also reported in Year One to disclose the future payment. The income was earned in Year One according to U.S. GAAP so the related liability must be reported then as well.

The Installment Sales Method and Deferred Income Taxes

Question: Assume that the Hill Company buys an asset (land, for example) for $150,000. Later, this asset is sold for $250,000 during Year One. The earning process is substantially complete at that point. Hill reports a gain on its Year One income statement of $100,000 ($250,000 less $150,000). Because of the terms of the sales contract, this money will not be collected from the buyer until Year Five. The buyer is financially strong and should be able to pay at the required times. Hill’s effective tax rate for this transaction is 30 percent.

Officials for Hill are pleased to recognize the $100,000 gain on this sale in Year One because it makes the company looks better. However, they prefer to wait as long as possible to pay the income tax especially since no cash has yet been collected. How can the recognition of income for tax purposes be delayed, thereby creating the need to report a deferred income tax liability?

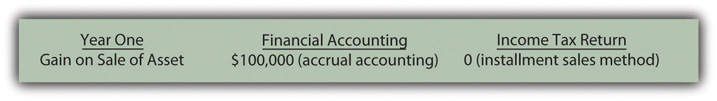

Answer: According to U.S. GAAP, this $100,000 gain is recognized on Hill Company’s income statement in Year One based on accrual accounting. The earning process is substantially complete and the amount to be collected can be reasonably estimated. However, if certain conditions are met, income tax laws permit taxpayers to report such gains using the installment sales method.The installment sales method can also be used for financial reporting purposes but only under very limited circumstances. In simple terms, the installment sales method allows a seller to delay reporting a gain for tax purposes until cash is collected. In this illustration, no cash is received in Year One, so no taxable income is reported. The tax will be paid in Year Five when Hill collects the cash. Thus, as shown in Figure 15.10 "Year One—Comparison of Financial Reporting and Tax Reporting", the income is reported now on the financial statements but not until Year Five for tax purposes.

Figure 15.10 Year One—Comparison of Financial Reporting and Tax Reporting

The eventual tax to be paid on the gain will be $30,000 ($100,000 × 30 percent). How is this $30,000 reported in Year One if payment to the government is not required until Year Five?

- First, because of the matching principle, the income tax expense of $30,000 must be recorded in Year One. The $100,000 gain is reported on the income statement in that year; therefore, any related expense is recognized in the same period. That is the basic premise of the matching principle.

- Second, the $100,000 gain creates a temporary difference. The amount will become taxable when the cash is collected in Year Five. At that time, a tax payment of $30,000 is required. Accountants have long debated whether this liability is created when the income is earned (Year One) or when the payment is to be made (Year Five). Legally, the company does not owe any money to the government until the Year Five income tax return is filed. However, reporting guidance provided by U.S. GAAP holds that recognition of the gain in Year One is the event that creates the probable future sacrifice. Thus, the liability is recognized immediately; a deferred income tax liability must be reported.

Consequently, the adjusting entry shown in Figure 15.11 "December 31, Year One—Recognition of Deferred Income Tax on Gain" is prepared at the end of Year One so that both the expense and the liability are properly reported.

Figure 15.11 December 31, Year One—Recognition of Deferred Income Tax on Gain

In Year Five, when the cash is received from the sale, Hill will report the $100,000 gain on its income tax return. The resulting $30,000 payment to the government eliminates the deferred income tax liability. However, as shown in Figure 15.11 "December 31, Year One—Recognition of Deferred Income Tax on Gain", the income tax expense was reported back in Year One when the original sale was recognized for financial reporting purposes.

Test Yourself

Question:

A local business buys property for $80,000 and later sells it for $200,000. Payments will be collected equally over this year and the following three. The profit is recognized immediately for financial reporting purposes. For tax purposes, assume that this transaction qualified for use of the installment sales method. The business’s effective tax rate is 20 percent. What amount of deferred income tax liability should this entity recognize as of December 31, Year One?

- Zero

- $18,000

- $24,000

- $30,000

Answer:

The correct answer is choice b: $18,000.

Explanation:

The company makes a profit of $120,000 ($200,000-$80,000). Using the installment sales method, the gain is taxed when cash is collected. Because 25 percent of the cash is collected in the first year, $30,000 of that profit (25 percent × $120,000) is recognized immediately for tax purposes. Only the remaining $90,000 ($120,000 less $30,000) is deferred until later years for tax purposes. At a rate of 20 percent, the deferred tax liability is $18,000 ($90,000 × 20 percent).

Key Takeaway

U.S. GAAP and the Internal Revenue Code are created by separate groups with different goals in mind. Consequently, many differences exist as to amounts and timing of income recognition. The management of a business will try to use these differences to postpone payment of income taxes so that the money can remain in use and generate additional profits. Although payment is not made immediately, the matching principle requires the income tax expense to be reported in the same time period as the related revenue. If payment is delayed, a deferred income tax liability is created that remains in the financial records until the income becomes taxable. One of the most common methods for deferring income tax payments is application of the installment sales method. For financial reporting purposes, any gain is recorded immediately as is the related income tax expense. However, according to tax laws, recognition of the profit can be delayed until cash is collected. In the interim, a deferred tax liability is reported to alert decision makers to the eventual payment that will be required.