This is “End-of-Chapter Exercises”, section 15.5 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

15.5 End-of-Chapter Exercises

Questions

- The Ace Company buys a large piece of equipment, which it immediately leases to Zebra Corporation for five years. Which company is the lessor and which company is the lessee?

- In simplest terms, what is an operating lease? In simplest terms, what is a capital lease?

- On December 31, Year One, a company agrees to pay $100,000 per year for the next nine years to lease a large piece of machinery. The first payment is made when the contract is signed. If the contract qualifies as an operating lease, what appears on this company’s balance sheet at December 31, Year One?

- Use the information in question 3 to explain the term “off-balance sheet financing.”

- On December 31, Year One, a company agrees to pay a set amount each year for six years to lease a large truck for hauling purposes. The first payment is made when the contract is signed. If this contract qualifies as a capital lease, what appears on this company’s balance sheet at December 31, Year One?

- A five-year lease is signed. At the end of that time, the lessee can buy the leased asset for an amount of money that is viewed as a bargain. Why does this option make the contract a capital lease?

- A lease is signed for property that has an expected life of ten years. The lease is for only eight years. Why does the length of this lease require the parties to record it as a capital lease?

- How many of the four official criteria must be met to require capital lease accounting?

- A company believes that its incremental borrowing rate is 7 percent. What is meant by the term “incremental borrowing rate?”

- A company is negotiating to lease an asset for use in its business operations. Why will company officials attempt to structure the agreement as an operating lease rather than as a capital lease?

- On January 1, Year One, the Atkins Corporation signs a four-year lease with the first payment made immediately. If this contract is an operating lease, what type of expense or expenses will be recognized at the end of Year One?

- On January 1, Year One, the Carleton Company signs a five-year lease with the first payment made immediately. If this contract is a capital lease, what type of expense or expenses will be recognized at the end of Year One?

- A company leases a building for eighteen years and records it as a capital lease. Why does the handling of this lease illustrate the desire of accountants to report substance over form?

- The Marlento Company reports net income in Year One for financial reporting purposes of $983,000. However, when the company prepares its income tax return for Year One, taxable income is shown as only $536,000. In general, why are these two income totals different?

- What is meant by the term “temporary tax difference?”

- The Wyndsoki Corporation reports a gain of $3 million in Year One. For income tax purposes, the gain is not taxable until Year Four. Will company officials be happy with this delay? Why or why not?

- The Lendmor Corporation earns income of $1.2 million in Year One before income taxes. However, by careful planning, all of this income has been deferred for tax purposes until Year Four. Assume that the tax rate is 30 percent. What adjusting entry, if any, is made for income taxes at the end of Year One?

- The Astomori Corporation buys land for $300,000 in Year One and sells it for $400,000 in Year Two. The company collects half of this money in Year Three and the other half in Year Four. Assume that the tax rate is 30 percent. In what year is the income tax expense recognized on this gain? What journal entry or adjusting entry is used to record the income tax expense at the end of Year Two?

- Jane Buenti-Jones is hired by the Cleveland Corporation. She is thirty years old. The company promises to pay her medical insurance while she works for the company and also after she retires. What is the accounting problem that the company faces here?

- The Abraham Company informs all employees that their life insurance will be paid by the company each year after they retire. What must be done to determine the amounts to be reported on the company’s financial statements in the current year?

- What role does an actuary play in accounting for postretirement benefits?

- What impact can the reporting of postretirement benefits have on company employees?

- A financial analyst mentions that a certain company reports EBIT of $1.4 million. What does EBIT represent?

- The James Company reports liabilities of $3.5 million and stockholders’ equity of $2.0 million. Then, just before the end of the current year, the company pays off a long-term liability with $500,000 in cash. What was the impact of that payment on James Company’s debt-to-equity ratio?

- A company reports a number of figures on its income statement including rent expense of $600,000, interest expense of $500,000, and income tax expense of $400,000. The company’s net income was shown as $1.8 million. Compute the times interest earned ratio for this company.

True or False

- ____ A lessee that is reporting the effects of a capital lease will record depreciation expense on the leased property.

- ____ A capital lease is a common example of off-balance sheet financing.

- ____ A lessee negotiates the lease of a piece of equipment. The lessee will likely attempt to structure the lease as an operating lease.

- ____ A lease has been signed that meets only two of the four criteria for a capital lease. Thus, this transaction will be recorded as an operating lease.

- ____ Lessees usually prefer to record leases as operating leases rather than capital leases.

- ____ Depreciation and interest are both recorded by a lessee in connection with a capital lease, but not an operating lease.

- ____ A lease is signed on December 31, Year One, that calls for annual payments of $20,000. The present value of these payments is $73,000. The lease is an operating lease. On its December 31, Year One, balance sheet, the company will record a liability of $53,000.

- ____ A lease contract is for six years although the asset has an expected life of twelve years. The lessee can buy the asset at the end of six years for $14,000. The lease has to be recorded as a capital asset.

- ____ On January 1, Year One, a lease is signed that is a capital lease. The cash payments are $10,000 per year starting on January 1, Year One. The present value of the cash flows before the first payment is $65,860. If the incremental borrowing rate is 10 percent, the lessee recognizes interest of $6,586 for the first year.

- ____ A company’s Year One income statement reports net income of $348,000. The company’s taxable income for that same year will also be $348,000.

- ____ If a gain is earned in Year One but taxed in Year Three, the related expense is reported in Year One.

- ____ If a gain is earned in Year One but taxed in Year Three, a deferred tax liability is reported at the end of Year One.

- ____ The deferral of income tax payments is viewed as a strategy for increasing reported net income.

- ____ When using the installment sales method for tax purposes, gains are generally taxed when the sale is made.

- ____ Postretirement benefits are not expensed until they are paid.

- ____ The liability recorded for postretirement benefits reflects a factual number that is known by company officials.

- ____ Because Melody Stuart works for a company this year, an expense will be recorded in connection with benefits that she will receive after her retirement in 2020.

- ____ Companies work to reduce their debt-to-equity ratio because of the risk that this figure reflects.

- ____ The computation of times interest earned is found by dividing interest expense for the period by the total amount of noncurrent liabilities.

Multiple Choice

-

Wichita Corporation leases a large machine with a life of twenty years. Which of the following does not necessitate reporting this contract as a capital lease?

- The lease is only for sixteen years.

- At the end of the lease, Wichita can (but doesn’t have to) buy the machine at an amount significantly below expected fair value.

- At the end of twelve years, title to the machine goes to Wichita.

- Wichita will pay a smaller amount each year over a lease life of fourteen years.

-

Sizemore Corporation leases a building to use for the next twenty years. Which of the following is true about Sizemore’s reporting?

- If this contract is a capital lease, rent expense is recognized each period.

- If this contract is an operating lease, depreciation expense is recognized each period.

- If this contract is an operating lease, interest expense and rent expense are recognized each period.

- If this contract is a capital lease, depreciation expense and interest expense are recognized each period.

-

Albemarle Corporation leases a truck for six years and is trying to determine whether the contract qualifies as an operating lease or a capital lease. Which of the following is true?

- Albemarle will want the lease to be a capital lease because less interest is reported.

- Albemarle will want the lease to be a capital lease because less depreciation is reported.

- Albemarle will want the lease to be an operating lease because the reported liability will be lower.

- Albemarle will want the lease to be an operating lease because the reported asset balance will be larger.

-

Myers Company leases a boat on January 1, Year One. The lease does qualify as a capital lease. The lease covers four years, with payments of $20,000 annually, beginning on January 1, Year One. The expected life of the boat is six years. Myers annual incremental borrowing rate is 5 percent. The present value of an ordinary annuity for four years at a 5 percent rate is $3.54595. The present value of an annuity due for four years at a 5 percent rate is $3.72325. What amount of depreciation (rounded) should Myers recognize on the boat for Year One if Myers chooses to use the straight-line method?

- $12,411

- $13,616

- $17,730

- $18,616

-

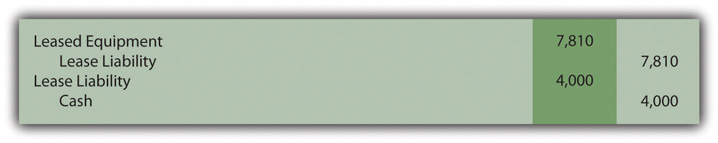

Charlotte Company leases a piece of equipment on February 1. The lease covers two years although the life of the equipment is four years. The contract contains no bargain purchase option, the equipment does not transfer to Charlotte at the end of the lease, and the payments do not approximate the fair value of the equipment. The annual payments are $4,000 due each February 1, starting with the current one. Charlotte’s incremental borrow rate is 5 percent. The present value of an annuity due of $1 at a 5 percent interest rate for two years is $1.95238. What journal entry or entries should Charlotte make on February 1?

-

Figure 15.14

-

Figure 15.15

-

Figure 15.16

-

Figure 15.17

-

-

On December 31, Year One, the Brangdon Corporation leases a truck to use in its operations. The truck has a life of ten years, although the lease is only for six years. Payments are $10,000 per year with the first payment made immediately. No interest payments are made but Brangsdon has an incremental borrowing rate of 9 percent. The present value of an annuity due at a 9 percent rate for six periods is $4.88965. The present value of an ordinary annuity at a 9 percent rate for six periods is $4.48592. If this is an operating lease, what figure is recorded initially as the capitalized cost of the truck?

- Zero

- $38,897

- $44,859

- $48,897

-

On December 31, Year One, the Sliyvoid Corporation leases a large machine for five years, its entire expected life. Depreciation is recorded using the straight-line method. Payments are $12,000 per year starting on December 31, Year One, and every December 31 thereafter. The incremental borrowing rate is 10 percent per year. The present value of an annuity due at a 10 percent rate for five periods is $4.16987. The present value of an ordinary annuity at a 10 percent rate for five periods is $3.79079. What is the net book value of the leased asset on December 31, Year Two?

- $30,431

- $36,392

- $37,875

- $40,030

-

Use the same information as in problem 7. Determine the interest expense to be recognized in Year Two.

- $3,349

- $3,804

- $4,549

- $5,004

-

Use the same information as in problem 7. Determine the lease liability to be reported on the company’s balance sheet at the end of Year Two.

- $24,838

- $29,842

- $38,038

- $43,042

-

On December 31, Year One, Company A leases a car for four years and pays $10,000 per year with the first payment made immediately. Company A believes the asset has a life of six years and records it as an operating lease. On December 31, Year One, Company B leases an identical car for four years and pays $10,000 per year with the first payment made immediately. Company B believes the asset has a life of five years and records it as a capital lease. The straight-line method of depreciation is used. Both companies have an annual incremental borrowing rate of 5 percent. The present value of an annuity due of $1 over four years at a 5 percent interest rate is $3.7232. Which of the following is true?

- Company B will report more expense in Year Two than Company A by $670.

- Company B will report more expense in Year Two than Company A by $1,120.

- Company A will report more expense in Year Two than Company B by $840.

- Company A will report more expense in Year Two than Company B by $1,250.

-

Potslitini Corporation has a large amount of income that is earned in Year One but will not be subject to income taxes until Year Three. Which of the following statements is true for financial reporting purposes?

- The income tax expense is reported when the income appears on the company’s income tax return.

- The income tax expense is reported when the tax money is physically paid to the government.

- The income tax expense is reported in Year One when the income is earned.

- The income tax expense can only be reported in this problem in Year Three.

-

Fargo Corporation earns revenue in Year One that will be reported on its Year One income statement but will not be reported on its tax return until Year Three. This revenue amounts to $800,000, and Fargo’s tax rate is 40 percent. Which of the following statements is true?

- Fargo should report a deferred tax liability of $800,000 at the end of Year One.

- Fargo should not recognize any deferred tax liability until Year Three.

- Fargo should report a deferred tax liability of $320,000 at the end of Year One.

- Fargo should recognize a deferred tax liability when the payment is eventually paid.

-

The Sinson Company buys land in Year One for $90,000 and then sells it in Year Two for $200,000. The company will collect this money in Year Four. For income tax purposes, Sinson will use the installment sales method. Sinson has a tax rate of 40 percent. Which of the following statements is true?

- Sinson records an income tax expense of $36,000 in Year Two.

- Sinson records an income tax expense of $80,000 in Year Four.

- Sinson records a deferred income tax liability of $44,000 at the end of Year Two.

- Sinson records a deferred income tax liability of $80,000 at the beginning of Year Four.

-

Which of the following is not a true statement about postretirement benefits?

- A company’s liability for postretirement benefits is quite difficult to estimate.

- An expense for an employee’s future postretirement benefits should be recognized during the period the employee helps generate revenue.

- The liability for postretirement benefits is reported at its present value.

- The liability reported for postretirement benefits represents the actual amount that will have to be paid.

-

At the start of Year One, the Arkansas Company promises all employees that it will pay their medical insurance after they retire. As a result, company officials realize that a liability will have to be reported. This promise is expected to cost the company a total cash amount of $3.3 million over the next 30 years. Who most likely determined this figure?

- An attorney.

- An insurance agent.

- An actuary.

- The head of the employee group.

-

Use the information in problem 15. What liability does Arkansas have to report at the end of Year One?

- $3.3 million

- $110,000

- The present value of $3.3 million

- Zero

-

On its latest balance sheet, the Sellers Corporation reports assets of $450,000 and liabilities of $200,000. What is Sellers’ debt-to-equity ratio?

- 0.44 to 1.00

- 0.80 to 1.00

- 1.25 to 1.00

- 2.25 to 1.00

-

The Xi Company is started at the beginning of Year One when its owners contribute $120,000 in cash. The company reports net income of $70,000 and pays cash dividends of $10,000 every year thereafter. At the end of Year Three, the company reports total assets of $900,000. On that date, what is the debt-to-equity ratio?

- 1.00 to 1.00

- 2.00 to 1.00

- 3.00 to 1.00

- 3.33 to 1.00

-

A company has a debt-to-equity ratio of 3.00 to 1.00. The company pays a cash dividend of $62,000. What is the impact on the debt-to-equity ratio?

- The debt-to-equity ratio will increase.

- The debt-to-equity ratio will decrease.

- The debt-to-equity ratio will not be affected.

- No determination of the impact on the debt-to-equity ratio can be made with the information provided.

-

Hyde Corporation has long-term liabilities, such as bonds, notes and leases, for which interest expense must be accrued. During Year One, Hyde reported net income of $65,000 after income taxes of $15,000 and interest expense of $10,000. Which of the following is Hyde’s times interest earned?

- 6.5 times

- 7.5 times

- 8.0 times

- 9.0 times

Video Problems

Professor Joe Hoyle discusses the answers to these two problems at the links that are indicated. After formulating your answers, watch each video to see how Professor Hoyle answers these questions.

-

Your roommate is an English major. The roommate’s parents own a chain of ice cream shops located throughout Florida. One day, while walking over to the computer lab your roommate poses this question: “My parents just signed a contract to lease a new shop in Tampa. It is in a great location so they are going to pay $120,000 each year to lease this facility for 10 years. That’s $1.2 million. However, they were telling me that they will not have to report this liability on their financial statements. That makes no sense to me. They have a contract that requires them to pay over $1 million in the future. How could they possibly not have to report that as a liability?” How would you respond?

-

Your uncle and two friends started a small office supply store several years ago. The company has grown and now has several large locations. Your uncle knows that you are taking a financial accounting class and asks you the following question: “We always want to make sure that our financial statements and our tax returns are done properly. Several years ago we bought some land and built a store on it. However, we didn’t use all the land, so this year we sold several extra acres. The land had really appreciated in value, and we made a very large gain. We made the sale this year, but the payments will not start for a couple of years. Our accountant tells us that we have to report the related income tax expense this year, but we don’t have to pay the government anything until we start getting the money. That doesn’t sound right. It seems to me that the expense and the payment should be at the same time. Can you explain what is going on here because I really don’t want to get into any trouble?” How would you respond?

Problems

-

On October 1, Year One, United Company leases an office space in a downtown building. This contract qualifies as an operating lease. United pays $30,000 in advance for rent every year. Record journal entries and adjusting entries for United for the following dates in connection with this property.

- October 1, Year One.

- December 31, Year One.

- September 30, Year Two.

-

Ralph Corporation agreed to lease a piece of equipment to Amy Company on January 1, Year One. The following information relates to this lease:

- The lease term is five years, at the end of which time the equipment will revert back to Ralph. The life of the equipment is expected to be six years.

- Payments of $90,000 will be due at the beginning of each year, with the first payment to be made at the signing of the lease.

-

Amy’s incremental borrowing rate is 8 percent. The present value of a single payment of $1 in five years at an annual interest rate of 8 percent is $0.68058. The present value of an ordinary annuity of $1 for five years at an annual interest rate of 8 percent is $3.99271. The present value of an annuity due of $1 for five years at an annual interest rate of 8 percent is $4.31213.

Prepare the following journal entries for Amy.

- Record the signing of the lease on January 1, Year One.

- Record the first payment on January 1, Year One.

- Record depreciation on the equipment on December 31, Year One.

- Record interest on the liability on December 31, Year One.

- Record the second payment on January 1, Year Two.

-

On January 1, Year One, Landon Corporation decides to lease a truck for $20,000 per year for three years. The annual incremental borrowing rate for Landon is 10 percent. The truck has a life of five years. Landon cannot buy or obtain title to the truck. The present value of an annuity due of $1 for three years at an annual interest rate of 10 percent is $2.73554. At the last moment, Landon changes the contract to four years instead of three. No other changes are made. The present value of an annuity due of $1 for four years at an annual interest rate of 10 percent is $3.48685.

- How did the change from three years to four years affect the expense to be reported by Landon in Year One?

- How did the change from three years to four years affect the expense to be reported by Landon in Year Two?

- After changing the contract to four years, what net book value will be shown for the leased truck at the end of Year One?

- After changing the contract to four years, what lease liability balance will be shown at the end of Year One?

-

On December 31, Year One, the Abertion Company decides to lease a piece of equipment rather than buy it. The lease is for 10 years. Payments are $22,000 each December 31 beginning on December 31, Year One. Abertion has an annual incremental borrowing rate of 9 percent. The present value of an annuity due of $1 at 9 percent for 10 periods is $6.99525.

- Assume this lease is an operating lease. What journal entries are made in Year One and Year Two?

- Assume this lease is an operating lease. What is shown on the company’s balance sheet at the end of Year Two?

- Assume this lease is a capital lease. What journal entries are made in Year One and Year Two?

- Assume this lease is a capital lease. What is shown on the company’s balance sheet at the end of Year Two?

-

The Addams Corporation is preparing to lease several large pieces of equipment. The president has asked the company’s accountant to respond to the following questions about lease accounting.

- How will Addams know if the lease is an operating lease or a capital lease?

- What is meant by off-balance sheet financing? How does off-balance sheet financing relate to the reporting of leases?

- Why is a discussion of substance over form often heard in connection with the financial reporting of a capital lease?

-

On January 1, Year One, Lori Inc. signed a five-year capital lease for the use of an asset. Payments are $5,000 on each January 1, beginning with Year One. Lori’s incremental borrowing rate is 6 percent. The present value of an annuity due of $1 at 6 percent for 5 periods is $4.46511.

- Determine Lori’s interest expense for Year One.

- Assume Lori’s reported earnings for Year One before interest and taxes are $18,224. Determine Lori’s times interest earned.

- Assume that on January 1, Year One, before signing this lease agreement, Lori reported assets of $500,000 and liabilities of $220,000. What impact did signing this contract have on the company’s debt-to-equity ratio?

-

At December 30, Year One, the Eighorn Corporation has net income (and taxable income) of $400,000. The company has an effective tax rate of 30 percent. Taxes have not yet been recorded. Then, on the last day of the year, the company sells land that it bought several years ago for $70,000. The sales price is $300,000. The money will be collected in Year Three. The company opts to use the installment sales method to report this transaction for tax purposes.

- What does the company now report as its net income for Year One?

- When is the liability for the income tax on the gain on the sale of the land reported? Why is this timing appropriate?

-

The Yellow Corporation reports a deferred income tax liability of $732,000 in its December 31, Year One, balance sheet.

- Why are differences created between a company’s reported net income and the taxable income figure shown on its income tax return?

- What is meant by the term “temporary tax difference”?

- In general, what is the meaning of a deferred income tax liability?

- In analyzing a company, liabilities are generally viewed as a negative. Why do company officials attempt to create deferred income tax liabilities?

-

The Greene Company has net income before income tax expense of $300,000 in Year One. However, because of differences between U.S. GAAP and the tax laws, only 60 percent of this income is taxed in Year One (to be paid on March 15, Year Two). Another 30 percent will be taxed in Year Two and the final 10 percent will be taxed in Year Nine. Assume the effective tax rate is 25 percent.

- What adjusting entry is recorded at the end of Year One?

- What amount of net income should be reported by Greene Company for Year One?

-

The Bleu Company reports a liability for “postretirement benefits” of $14 million on its December 31, Year One, balance sheet.

- Explain how this obligation was created.

- In determining this liability of $14 million, company officials worked their way through two steps. Describe those two steps.

- Some companies might argue that this liability should not be reported on a balance sheet. What argument would they use for this position?

-

Myrtle Inc. begins Year One with liabilities of $456,000 and stockholders’ equity of $320,000. On the first day of Year One, the following occur:

- Myrtle enters into an operating lease where it agrees to pay $50,000 per month for warehouse space. The contract is signed, and the first payment is made.

- Myrtle borrows $103,000 in cash from Community Bank.

- Several owners invest a total of $57,000 in cash into the company.

- Determine Myrtle’s debt-to-equity ratio before the above transactions occur.

- Determine Myrtle’s debt-to-equity ratio considering the effect of the above transactions.

-

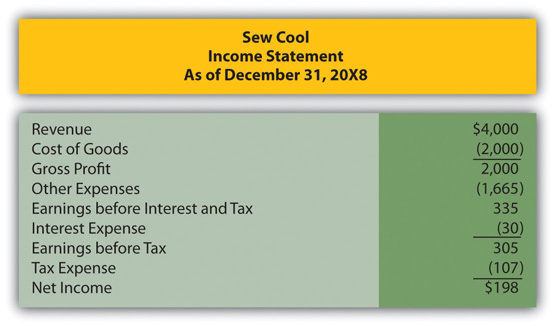

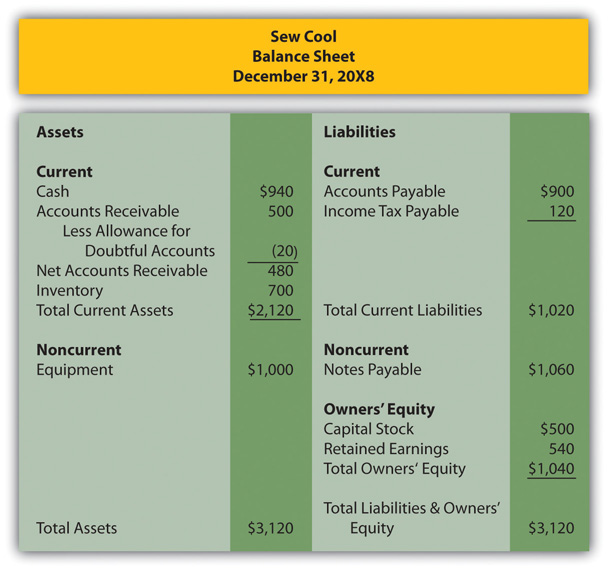

In several past chapters, we met Heather Miller, who started her own business, Sew Cool. The following are the financial statements for December.

Figure 15.18 Sew Cool Financial Statements

Figure 15.19

Figure 15.20

Based on the financial statements determine the following:

- Debt-to-equity ratio.

- Times interest earned.

Comprehensive Problem

This problem will carry through several chapters, building in difficulty. It allows students to continually practice skills and knowledge learned in previous chapters.

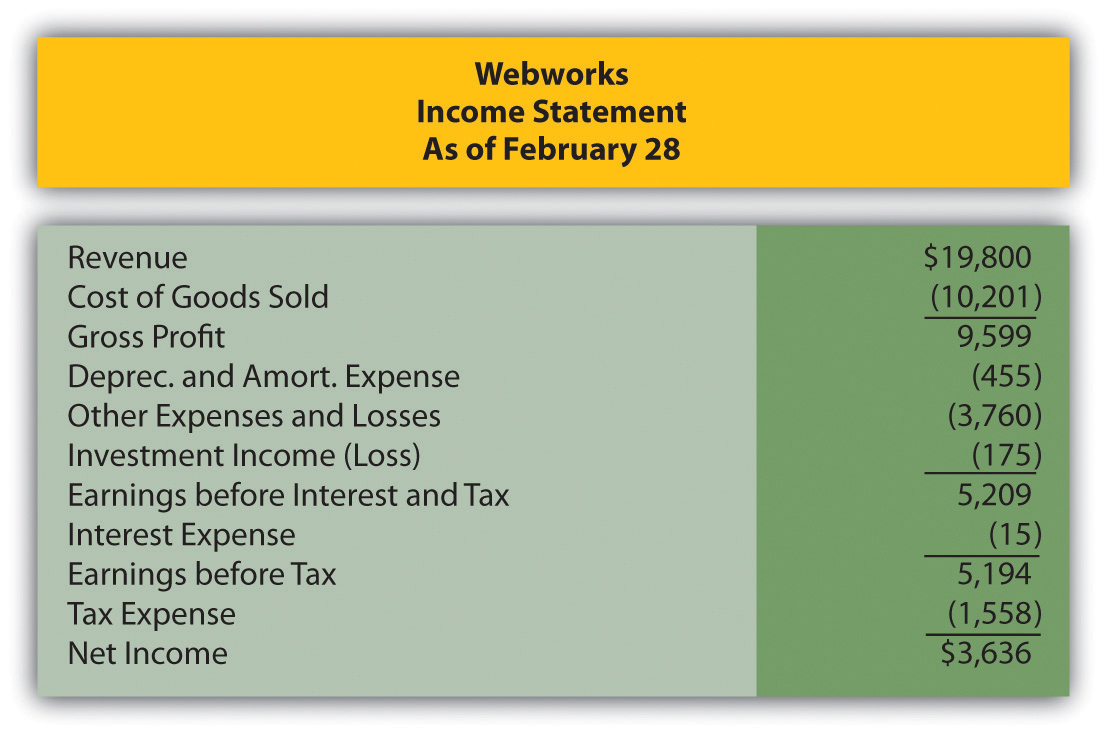

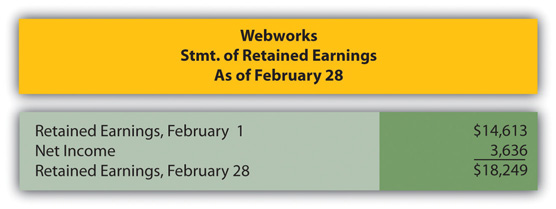

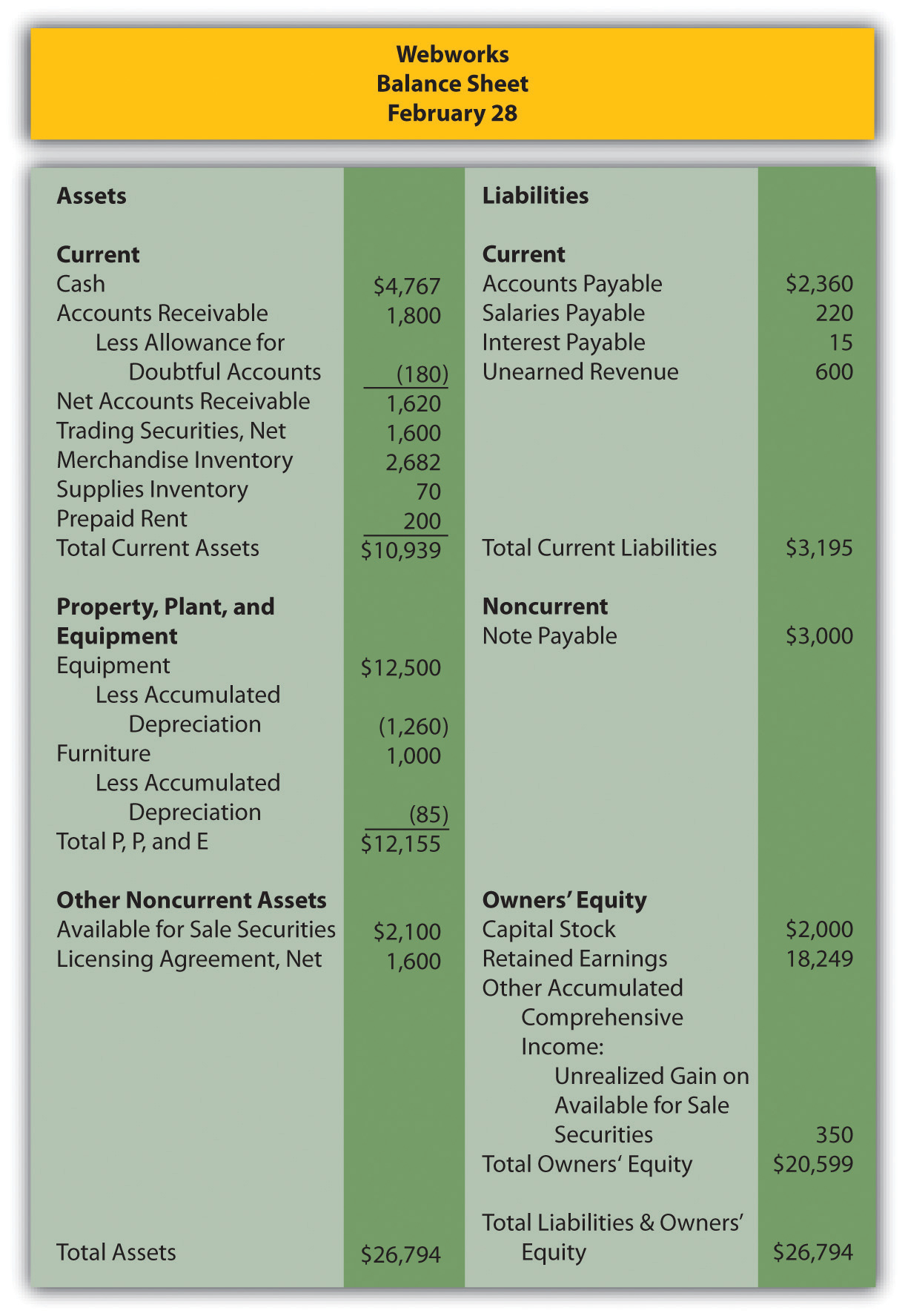

In Chapter 14 "In a Set of Financial Statements, What Information Is Conveyed about Noncurrent Liabilities Such as Bonds?", financial statements for February were prepared for Webworks, They are included here as a starting point for the required recording for March.

Figure 15.21 Webworks Financial Statements

Figure 15.22

Figure 15.23

The following events occur during March:

- Webworks starts and completes seven more sites and bills clients for $5,000.

- Webworks purchases supplies worth $110 on account.

- At the beginning of March, Webworks had nineteen keyboards costing $118 each and twenty flash drives costing $22 each. Webworks uses periodic FIFO to cost its inventory.

- On account, Webworks purchases eighty keyboards for $120 each and one hundred flash drives for $23 each.

- Webworks sells eighty-five keyboards for $12,750 and ninety-two of the flash drives for $2,760 cash.

- Webworks collects $5,000 in accounts receivable.

- Webworks pays off $12,000 of its accounts payable.

- Leon Jackson (the company’s owner) determines that some of his equipment is not being used and sells it. The equipment sold originally cost $2,000 and had accumulated depreciation of $297. Webworks sold the equipment for $1,650 cash.

- Webworks pays Nancy Po (company employee) $750 for her work during the first three weeks of March.

- Leon Jackson and Nancy Po are having trouble completing all their work now that the business has grown. Another assistant, Juan Marcon, is hired. Webworks pays Juan $550 for his help during the first three weeks of March.

- Webworks writes off an account receivable from December in the amount of $200 because collection appears unlikely.

- Webworks pays off its salaries payable from March.

- Webworks pays Leon Jackson a salary of $3,500.

- Webworks completes the design for the bakery but not the photographer for which it was paid in February. Only $300 of the unearned revenue should be reclassified to revenue.

- Webworks decides that more space is needed than that which is available in the home of Leon’s parents (much to his parents’ relief). His parents return the $200 he prepaid for March. Webworks signs a six-month lease in a nearby office building. Webworks will pay $500 at the beginning of each month, starting on March 1. The life of the building is forty years, and no bargain purchase option exists, nor do the payments come close to paying the market value of the space.

-

Webworks pays taxes of $580 in cash.

Required:

- Prepare journal entries for the previous events.

- Post the journal entries to T-accounts.

- Prepare an unadjusted trial balance for Webworks for March.

- Prepare adjusting entries for the following and post them to your T-accounts.

- Webworks owes Nancy $200 and Juan $150 for their work during the last week of March.

- Webworks receives an electric bill for $400. Webworks will pay the bill in April.

- Webworks determines that it has $50 worth of supplies remaining at the end of March.

- Webworks is continuing to accrue bad debts at 10 percent of accounts receivable.

- Webworks continues to depreciate its equipment over four years and its furniture over five years, using the straight-line method.

- The license agreement should be amortized over its one-year life.

- QRS Company is selling for $13 per share and RST Company is selling for $18 per share on March 31.

- Interest should be accrued for March.

-

Record cost of goods sold.

- Prepare an adjusted trial balance.

- Prepare financial statements for March.

Research Assignment

Assume that you take a job as a summer employee for an investment advisory service. One of the partners for that firm is currently looking at the possibility of investing in SuperValu Inc. The partner is aware that SuperValu uses a lot of stores and, therefore, probably has to lease many of those sites. The partner is curious as to whether these leases are mostly capital leases or operating leases. The partner asks you to look at the 2011 financial statements for SuperValu by following this path:

- Go to http://www.supervalu.com.

- At the top right side of this screen, click on “About Us.”

- On the right side of the next screen, click on “Investors.”

- On the right side of the next screen, click on “Annual Report and Proxy Statement.”

- On the next screen, click on “2011 Annual Report on 10K” to download.

- Scroll to page 36 and find the company’s balance sheet as of February 26, 2011. Look at the liability section of the balance sheet and see what information is reported about “capital lease obligations.”

- Scroll down to “Note 6 – Long-Term Debt” and “Note 7 – Leases.” They begin on page 47. Read through the information that is provided.

- As of the balance sheet date, what is the company reporting as its “capital lease obligations?”

- In the future, how much cash will the company have to pay on its operating leases?

- In the future, how much cash will the company have to pay on its capital lease obligations?