This is “The Actual Estimation of Uncollectible Accounts”, section 7.4 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

7.4 The Actual Estimation of Uncollectible Accounts

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Estimate and record bad debts when the percentage of sales method is applied.

- Estimate and record bad debts when the percentage of receivables method is applied.

- Explain the reason that bad debt expense and the allowance for doubtful accounts normally report different figures.

- Understand the reason for maintaining a subsidiary ledger.

Two Methods for Estimating Uncollectible Accounts

Question: The final step in reporting receivables for Year Two is the estimation of the bad accounts incurred during this period. This calculation enables the preparation of the year-end adjusting entry. According to the ledger balances in Figure 7.7 "End of Year Two—Sales, Receivables, and Bad Debt Balances", sales on credit for the year were $400,000, remaining accounts receivable amount to $160,000, and a $3,000 debit sits in the allowance for doubtful accounts. No recording has yet been made for the Year Two bad debt expense. How does the accountant arrive at the estimation of uncollectible accounts each year?

Answer: Much of financial accounting is quite standardized. However, estimations can be made by any method that is considered logical. After all, it is an estimate. Over the decades, two different approaches have come to predominate when predicting the amount of uncollectible receivables. As long as company officials obtain sufficient evidence to support the reported numbers, either way can be applied.

Percentage of sales methodAn income statement approach for estimating uncollectible accounts that computes bad debt expense by multiplying sales (or just credit sales) by the percentage that are not expected to be collected.. This approach computes the current period expense by anticipating the percentage of sales (or credit sales) that will eventually fail to be collected. The percentage of sales method is sometimes referred to as an income statement approach because the only number being estimated (bad debt expense) appears on the income statement.

Percentage of receivables methodA balance sheet approach for estimating uncollectible accounts that computes the allowance for doubtful accounts by multiplying ending accounts receivable by the percentage that are not expected to be collected.. Here, the proper balance for the allowance for doubtful accounts is determined based on the percentage of ending accounts receivable that are presumed to be uncollectible. This method is identified as a balance sheet approach because the only figure being estimated (the allowance for doubtful accounts) is found on the balance sheet. A common variation applied by many companies is the aging methodA variation of the percentage of receivables method where all receivables are first classified by age; the total of each category is then multiplied by an appropriate percentage and summed to determine the allowance balance to be reported., which first classifies all receivable balances by age and then multiplies each of those individual totals by a different percentage. Normally, a higher rate is used for accounts that are older because they are considered more likely to become uncollectible.

Applying the Percentage of Sales Method

Question: Assume that this company chooses to use the percentage of sales method. All available evidence is studied by officials who come to believe that 8 percent of the credit sales made during Year Two will prove to be worthless. In applying the percentage of sales method, what adjusting entry is made at the end of the year so that financial statements can be prepared and fairly presented?

Answer: According to the ledger account in Figure 7.7 "End of Year Two—Sales, Receivables, and Bad Debt Balances", sales of $400,000 were made during Year Two. If uncollectible accounts are expected to be 8 percent of that amount, the expense for the period is $32,000 ($400,000 × 8 percent). Bad debt expense (the figure being estimated) must be raised from its present zero balance to $32,000. Bad debt expense must be reported as $32,000 when the process is completed.

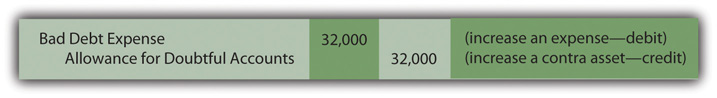

Figure 7.8 Adjusting Entry for Year Two—Uncollectible Accounts Estimated as a Percentage of Sales

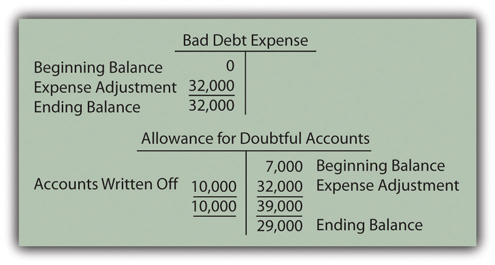

The adjustment in Figure 7.8 "Adjusting Entry for Year Two—Uncollectible Accounts Estimated as a Percentage of Sales" does increase the expense to the $32,000 figure, the proper percentage of the sales figure. However, prior to adjustment, the allowance account held a residual $3,000 debit balance ($7,000 Year One estimation less $10,000 accounts written off). As can be seen in Figure 7.9 "Resulting T-Accounts, Based on Percentage of Sales Method", the $32,000 recorded expense for Year Two results in only a $29,000 balance for the allowance for doubtful accounts.

Figure 7.9 Resulting T-Accounts, Based on Percentage of Sales Method

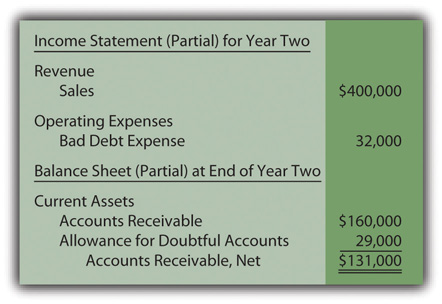

After this adjustment, the figures appearing in the financial statements for Year Two are shown in Figure 7.10 "Uncollectible Accounts Estimated Based on 8 Percent of Sales".

Figure 7.10 Uncollectible Accounts Estimated Based on 8 Percent of Sales

Test Yourself

Question:

The Travers Corporation starts operations in Year One and makes credit sales of $300,000 per year while collecting cash of only $200,000 per year. During each year, $15,000 in accounts are judged to be uncollectible. The company estimates that 8 percent of its credit sales will eventually prove to be worthless. What is reported as the allowance for doubtful accounts on the company’s balance sheet at the end of Year Two?

- $15,000

- $18,000

- $24,000

- $30,000

Answer:

The correct answer is choice b: $18,000.

Explanation:

At the end of Year One, the allowance account will show a $15,000 debit for the accounts written off and a 24,000 credit for the estimated bad debt expense ($300,000 × 8 percent) for a reported total of $9,000. During Year Two, another $15,000 debit is recorded because of the accounts written off and a second $24,000 credit is recorded to recognize the current year’s expense. The allowance balance is now $18,000 ($9,000 − $15,000 + $24,000).

The Difference Between Bad Debt Expense and the Allowance for Doubtful Accounts

Question: Figure 7.10 "Uncollectible Accounts Estimated Based on 8 Percent of Sales" presents the financial statement figures for this company for Year Two. How can bad debt expense be reported on the income statement as $32,000, whereas the allowance for doubtful accounts on the balance sheet shows only $29,000? Should those two numbers not be identical in every set of financial statements?

Answer: The difference in these two accounts is caused by the failure of previous estimations to be accurate. In Year One, bad debt expense for this company was reported as $7,000 but accounts with balances totaling $10,000 actually proved to be uncollectible in Year Two. That caused an additional $3,000 reduction in the allowance as can be seen in Figure 7.7 "End of Year Two—Sales, Receivables, and Bad Debt Balances". This amount carries through and causes the allowance for doubtful account to be $3,000 lower at the end of Year Two. The reported expense is the estimated amount ($32,000), but the allowance ($29,000) is $3,000 less because of the difference in the actual and expected amounts for Year One.

Students are often concerned because these two reported numbers differ. However, both are merely estimates. The actual amount of worthless accounts is quite likely to be a number entirely different from either $29,000 or $32,000. Therefore, the lingering impact of the $3,000 Year One underestimation should not be an issue as long as company officials believe that neither of the two reported balances is materially misstated.

Applying the Percentage of Receivables Method

Question: The percentage of receivables method handles the calculation of bad debts a bit differently. Assume that the Year Two adjusting entry has not yet been made so that bad debt expense remains at zero and the allowance for doubtful accounts still holds a $3,000 debit balance as shown in Figure 7.7 "End of Year Two—Sales, Receivables, and Bad Debt Balances". Also assume that the company has now chosen to use the percentage of receivables method rather than the percentage of sales method. Officials have looked at all available evidence and come to the conclusion that 15 percent of ending accounts receivable ($160,000 × 15 percent or $24,000) are likely to prove uncollectible. How does application of the percentage of receivables method affect the recording of doubtful accounts?

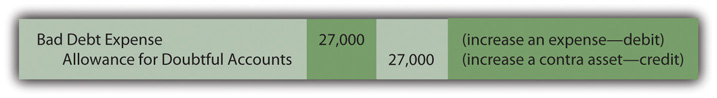

Answer: The percentage of receivables method (or the aging method if that variation is used) views the estimated figure of $24,000 as the proper total for the allowance for doubtful accounts. Thus, the accountant must turn the $3,000 debit balance residing in that contra asset account into the proper $24,000 credit. That change can only be accomplished by recognizing an expense of $27,000 as shown in Figure 7.11 "Adjusting Entry for Year Two—Uncollectible Accounts Estimated as a Percentage of Receivables". Under the percentage of receivables method, after the adjustment has been recorded, the allowance balance will equal the estimate ($24,000). The bad debt expense is not computed directly; it is the amount needed to arrive at this allowance figure.

Figure 7.11 Adjusting Entry for Year Two—Uncollectible Accounts Estimated as a Percentage of Receivables

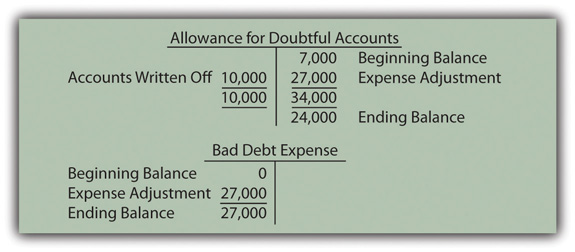

As shown in Figure 7.12 "Resulting T-Accounts, Based on Percentage of Receivables Method", this entry successfully changes the allowance from a $3,000 debit balance to the desired $24,000 credit. Because bad debt expense had a zero balance prior to this entry, it now reports the $27,000 amount needed to establish the proper allowance.

Figure 7.12 Resulting T-Accounts, Based on Percentage of Receivables Method

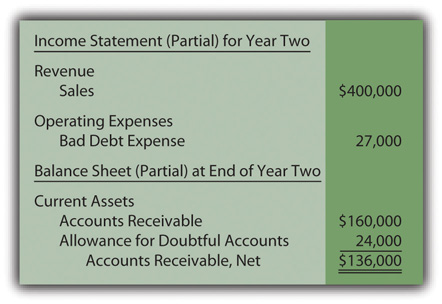

After this adjusting entry has been posted, the balances appearing in Figure 7.13 "Uncollectible Accounts Estimated Based on 15 Percent of Receivables" appear in the financial statements for Year Two.

Figure 7.13 Uncollectible Accounts Estimated Based on 15 Percent of Receivables

Once again, the reported expense ($27,000) is $3,000 higher than the allowance ($24,000). As before, the difference is the result of the estimation being too low in the prior year. The additional write-offs led to this lower balance in the allowance T-account.

Either approach can be used as long as adequate support is gathered for the numbers reported. They are just two alternatives to arrive at an estimate. However, financial accounting does stress the importance of consistency to help make numbers comparable from year to year. Once a method is selected, it normally must continue to be applied in all subsequent periods.

- Under the percentage of sales method, the expense account is aligned with the volume of sales.

- In applying the percentage of receivables method, the uncollectible portion of ending receivables is determined and reported as the allowance for doubtful accounts.

Regardless of the approach, both bad debt expense and the allowance for doubtful accounts are simply the result of estimating the final outcome of an uncertain event—the collection of accounts receivable.

Test Yourself

Question:

The Yarrow Corporation starts operations in Year One and makes credit sales of $400,000 per year while collecting cash of only $300,000 per year. During each year, $12,000 in accounts are judged to be uncollectible. The company estimates that 10 percent of its ending accounts receivable each year will eventually prove to be worthless. What is reported as bad debt expense on the company’s income statement for Year Two?

- $17,600

- $20,800

- $28,800

- $32,000

Answer:

The correct answer is choice b: $20,800.

Explanation:

In Year One, accounts receivable total $88,000 ($400,000 sales less $300,000 collections and $12,000 accounts written off). The allowance is $8,800 or 10 percent of the total. In Year Two, receivables rise to $176,000 ($88,000 plus $400,000 less $300,000 and $12,000). The allowance holds a debit of $3,200 ($8,800 beginning balance less $12,000 in write-offs). The allowance needs to be $17,600 (10 percent). To turn the $3,200 debit into a $17,600 credit, an expense of $20,800 is recognized.

The Purpose of a Subsidiary Ledger

Question: A company such as Dell Inc. must have thousands or even hundreds of thousands of separate receivables. The accounts receivable T-account in the ledger maintains the total of all amounts owed to a company but does not indicate the balance due from each individual customer. How does an accounting system monitor all the specific receivable amounts? Those balances must be essential information for any organization for billing and collection purposes.

Answer: As indicated, a ledger account only reflects a single total at the present time. In many cases, as with accounts receivable, the composition of that balance is also essential information. For those T-accounts, the accounting system can be expanded to include a subsidiary ledgerA group of individual accounts whose sum agrees with (and, therefore, explains) a general ledger account balance. to maintain data about the various individual components making up the account total.

In the previous illustration, the company reports $160,000 as the total of its accounts receivable at the end of Year Two. A separate subsidiary ledger should also be in place to monitor the amounts owed by each customer (Mr. A, Ms. B, and so on). The general ledger figure is used whenever financial statements are to be produced. The subsidiary ledger allows the company to access individual balances so that appropriate action can be taken when collection is received or if specific receivables grow too large or become overdue.

When a subsidiary ledger is maintained, the accounting system can be programmed so that each entry into the general ledger T-account requires an immediate parallel increase or decrease to the appropriate individual account. Thus, a $75 sale on credit to Mr. A raises the accounts receivable T-account total by that amount while also increasing the balance listed specifically for Mr. A in the subsidiary ledger.

Subsidiary ledgers can be established in connection with any general ledger account where the availability of component information is helpful. Other than accounts receivable, subsidiary ledgers are commonly set up for inventory, equipment, and accounts payable. As might be imagined, large enterprises maintain additional records for virtually every T-account, whereas small companies are likely to limit use to accounts receivable and—possibly—a few other significant balances.

Before computer systems became common, manually keeping the total of thousands of individual accounts in a subsidiary ledger in agreement with the corresponding general ledger T-account balance was an arduous task. Mechanical errors (mathematical problems as well as debit and credit mistakes) tended to abound. However, current electronic systems are typically designed so that the totals reconcile automatically.

Key Takeaway

Each year, an estimation of uncollectible accounts must be made as a preliminary step in the preparation of financial statements. Some companies use the percentage of sales method, which calculates the reported expense, an amount that is also added to the allowance for doubtful accounts. Other companies use the percentage of receivable method (or a variation known as the aging method). It determines the ending balance for the allowance. Bad debt expense is the amount required to adjust the allowance balance to this ending total. Both methods provide no more than an approximation of net realizable value based on the validity of the numerical percentages that are applied. Because actual and expected uncollectible amounts will differ, the expense and the allowance almost always report different balances. Regardless of the method employed, virtually all companies maintain a subsidiary ledger to provide the individual balances that comprise the total found in the general ledger T-account.