This is “Money”, chapter 3 from the book Finance, Banking, and Money (v. 1.1). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 3 Money

Chapter Objectives

By the end of this chapter, students should be able to:

- Define money.

- Describe the work or economic functions that money performs.

- Define barter and explain why it is economically inefficient.

- Explain why some forms of commodity money are better than others.

- Explain why representative money and credit money supplanted commodity money.

- Define the money supply and explain how and why it is measured.

3.1 Of Love, Money, and Transactional Efficiency

Learning Objective

- What is money and what economic functions does it perform?

Like love, money is ubiquitous, yet few of us feel that we have enough of either. As abstract concepts, money and love are both slippery, yet most of us believe that we know them when we see them. Despite those similarities, mixing money and love can be dangerous. The love of money is said to be one of the seven deadly sins; the money of love, despite its hoariness, is illegal in many jurisdictions in the United States and abroad.

Jest and wordplay aside, money is, perhaps, the most important invention of all time. Like the other major contenders for the title, indoor plumbing, internal combustion engines, computers, and other modern gadgets of too recent origin to consider; the wheel, which needs no introduction; the hearth, a pit for controlling fire; and the atlatl, a spear thrower similar in concept to a lacrosse stick, money is a force multiplier. In other words, it allows its users to complete much more work in a given amount of time than nonusers can possibly do, just as the wheel let porters move more stuff, the hearth helped cooks prepare more food, and the atlatl allowed hunters (warriors) to kill more prey (enemies).

What work does money do? It facilitates trade by making it easier to buy and sell goods compared to barter, the exchange of one nonmoney good for another. (If you’ve ever traded baseball cards, clothes, beers, phone numbers, homework assignments, or any other nonmoney goods, you’ve engaged in barter.) This is no minor matter because trade is the one thing that makes us human. As that great eighteenth-century Scottish economist Adam Smith (and others) pointed out, no other animal trades with nonrelatives of the same species. The inherent predisposition to trade may explain why humans have relatively large brains and relatively small digestive tracts. Trade certainly explains why humans have more material comforts by far than any other species on the planet. Each trade that is fairly consummated enriches both the buyer and the seller. The good feeling people get when they buy (sell) a good is what economists call consumer surplusIn a standard supply and demand graph, that area above the price line and below the demand curve. (producer surplus). By making trading relatively easy, money helps to make humanity happier. (Note that this is not the same as claiming that wealth makes people happy. Although sometimes used synonymously with wealth in everyday speech, money is actually a special form of wealth.)

Imagine what life would be like without money. Suppose you try to fill up your automobile’s gasoline tank, or take mass transit to school, or acquire any good, without using money (or credit, money’s close cousin). How would you do it? You would have to find something that the seller desired. That could take a long time and quite possibly forever. If you don’t believe me, go to any Craigslist posting,newyork.craigslist.org/about/sites where you will find listings like the one below. It’s a fun diversion, but what would this person think is a “fair” trade? A lava lamp and a Grateful Dead poster? Would she give you a ball of yarn in change?

Date: 2006-11-30, 2:37 PM EST

Hello Craigslisters,

I recently moved to NYC and I have no use for the six items pictured below. Starting from the upper left going clockwise, I have: a working desk lamp, a hardcover copy of the NY Times best-selling book The Historian, an unused leather-bound photo album, a giant bouncy-ball that lights up when it bounces, a pair of goofy sunglasses, and a hand-made tribal mask from Mexico.

Make me any offer for any or all of the items, and if it’s fair, we’ll trade.

Answer: Only if you have a lot of time to waste.

In the lingo of economists, by serving as a means or medium of exchange, money eliminates one of the major difficulties of barter, fulfilling this mutual or double coincidence of wants. And it does it quite well as it zips across the country and the entire globe.

Another serious difficulty with barter helps us to see the second major type of work that money does. Suppose that the gas station attendant or bus driver wanted chewing gum and you had some. Exchange may still not take place because a crucial question remains unanswered: how many sticks of gum is a gallon of gas or a bus trip worth? Ascertaining the answer turns out to be an insurmountable barrier in most instances. In a money economy, the number of prices equals the number of traded goods because each has a money price, the good’s cost in terms of the unit of account. In a barter economy, by contrast, the number of prices equals the number of pairs of goods. So, for example, an economy with just 1,000 goods (a very poor economy indeed) would require 499,500 different prices! Little wonder, then, that barter economies, when they exist, usually produce only ten or so tradable goods, which means about forty-five different prices, each good paired with nine others. By serving as a unit of account, a measuring rod of economic value, money makes price determination much easier.

The unit of account function of money is more abstract than its work as a medium of exchange and hence is less well understood, but that does not mean that it is less important. To be an effective force multiplier, money has to eliminate both of barter’s biggest deficiencies. In other words, it has to end the double coincidence of wants problem and reduce the number of prices, ideally to one per good. It does the former by acting as a medium of exchange, something that people acquire not for its own sake but to trade away to another person for something of use. The latter it does by serving as a unit of account, as a way of reckoning value. When functioning as a unit of account, money helps us to answer the question, How much is that worth? much like inches help us to answer, How long is that? or degrees Fahrenheit or Celsius help us to ascertain, What is the temperature of that? By helping us to reckon value, money allows us to easily and quickly compare the economic value of unlike things, to compare apples and oranges, both literally and figuratively.

Stop and Think Box

After the demise of the Soviet Union, inflation reigned supreme as the Russian ruble lost more and more of its value each day. Rubles remained a medium of exchange, but in many places in Russia, prices and debts began to be denominated in “bucks.” What were bucks and why did they arise?

Bucks were essentially U.S. dollars, and they were used as a unit of account and standard of deferred payment, as a way of reckoning value in a stable unit. Physical U.S. dollar-denominated assets, like Federal Reserve notes, were a medium of exchange, but also, in this context, they were a good store of value because they could purchase more rubles each passing day.

Money also works as a store of value and as a standard of deferred compensation. By store of value, economists mean that money can store purchasing power over time. Of course, many other assets—real estate, financial securities, precious metals and gems—perform precisely the same function. Storing value, therefore, is not exclusively a trait of money. By standard of deferred compensation, economists mean that money can be used to denominate a debt, an obligation to make a payment in the future.

To help you to see the different functions of money, consider the following transaction:

Customer: How much for a gallon of gasoline? (A)

Attendant: $2.99 (A)

Customer: Great, fill ’er up. (A)

Attendant: Will that be cash (E), check (E), debit (E), or credit (D)?

In the places labeled (A), money is working as a unit of account. The customer is trying to reckon the value of the gasoline, information that the attendant quickly encapsulates by quoting a money price. The customer just as quickly decides that she would rather have the gasoline than the money, or more precisely the other goods that the money could acquire, and requests the trade. The attendant responds by inquiring which medium of exchange (E) the customer wishes to use to pay for the good. Cash refers to physical currency, like Federal Reserve notesFiat paper money issued by America’s central bank, the Federal Reserve. or Treasury coins. Check refers to a paper order for the transfer of money from a bank account. Debit refers to an electronic order for a transfer from a bank account or a prepaid declining balance debit card. Credit entails the prearranged transfer of funds from the customer’s creditor, a bank or other lender, in exchange for a small service fee from the gas stationGas stations and other vendors sometimes charge higher prices for credit than for cash sales to compensate them for the transaction fee charged by the credit card companies. Most have given up such policies, however, due to competition for customers who found it convenient to charge purchases at a time before debit cards were widespread and many merchants refused to accept checks due to the high moral hazard. (Too many “bounced,” or were returned, unpaid, for insufficient funds in the customer’s account.) and the customer’s promise to repay the lender (and perhaps interest and a yearly fee). In the case of the credit transaction, money is working as a standard of deferred payment (D) because the customer promises to repay the lender the value of the gas at some point in the future. (We will speak of credit money below, but students should not allow the lingo to confuse them. Credit cards and other loans are not money per se but rather are ways of obtaining it. The distinction will become clearer as your course of study during the semester unfolds.)

Of course, conversations like the one above rarely occur today. Except in New Jersey and a few other places, people pump their own gas; stations post their prices on big signs for all to see; and in addition to dispensing the product, gas pumps handle credit and debit (and sometimes cash) purchases with ease. Money makes all that possible, saving humanity untold hours of waste over the trillions of exchanges completed each year.

Key Takeaways

- Barter entails the exchange of one good for another. It is inefficient because it requires satisfaction of the double coincidence of wants (party one must have what party two desires, and vice versa) and pricing problems (the number of prices of goods equals the number of possible pairs).

- Perhaps the most important invention of all time, money is anything that reduces the transaction costs of barter, anything that is commonly accepted as payment or in exchange.

- Money serves as a medium of exchange (physical means of payment), unit of account (measure of economic value), store of value (method of storing said value over time), and standard of deferred payment (basis upon which debts are repaid).

3.2 Better to Have Had Money and Lost It Than to Have Never Had Money at All

Learning Objective

- What usually happens when money is absent in an economy?

To further appreciate money’s importance, consider what happens when it is absent—universal distress, followed quickly by money’s reintroduction or reinvention! After World War I, for example, the German government created too much money too quickly. Hyperinflation, a very rapid rise in the prices of all goods, ensued. Prices increased so fast that workers insisted on being paid twice daily so they could run, not walk, to the nearest store to buy food before their hard-earned wages became worthless. Before the hyperinflation, it was said that you could buy a wheelbarrow full of food with a purse full of cash. During the hyperinflation, you needed a wheelbarrow full of cash to purchase a purse full of food. At the end of the debacle, you kept the wheelbarrow at home lest your most valuable asset, the wheelbarrow, be stolen! At the end of the crisis, the German economy was on a barter basis, but only briefly before currency reforms stopped the inflation and restored a money economy.

Stop and Think Box

During its most recent financial crisis, in 2001–2002, Argentina faced a severe shortage of its money, called pesos. Private firms responded by setting up giant flea markets where goods were priced and paid for using the firm’s notes, which in most instances were called creditós. The creditós could be used in subsequent flea markets run by the issuing firm but not in markets run by other firms. Creditós had very limited circulation outside the flea markets. As soon as the peso crisis passed, the firms stopped running flea markets and no longer honored the creditós they had issued. What happened in Argentina?

A new form of private credit money spontaneously arose to fill the vacuum created by the dearth of pesos. Although not as liquid or safe as pesos, creditós were far superior to barter. The end-game default can be interpreted as seigniorage, the profit the issuers of creditós exacted for providing money to local Argentine communities.

In prisons, prisoner-of-war camps, and other settings where money is unavailable, inmates quickly learn the inadequacies of barter firsthand and adopt the best available commodity as money—a medium of exchange; unit of account; a store of value; and even, to the limited extent that credit is available in such circumstances, a standard of deferred payment. Packs of cigarettes often emerge as the commodity moneyForms of money that have intrinsic value as a commodity. of choice. (Talk about one’s fortune going up in smoke!) There are good economic reasons for this preference. Although not perfect, cigarettes are a serviceable medium of exchange. First and foremost, sealed packs of cigarettes are easily authenticated because it would be extremely difficult to counterfeit or adulterate them, especially under prison conditions. Although they differ somewhat from brand to brand, they are also relatively uniform in quality. If you gave up a bar of soap for two packs, you could rest relatively well assured that you were not being cheated. Second, cigarette packs are divisible, into twenty individual cigarettes, or “loosies,” without giving up much of their ease of authentication. (A loosie is easier to adulterate than a sealed pack, say, by replacing the tobacco with sawdust, but is still not easy.) Divisibility is important because supply and demand might well dictate an equilibrium price that includes a fraction of a pack, just as it often leads to prices that are a fraction of a dollar ($), yen (¥), euro (€), or pound (£). Individual cigarettes are also somewhat divisible but only when filterless or when consumed. One might, for instance, sell a good blanket for four packs, two loosies, and five drags or puffs.

Cigarettes also have relatively high value-to-weight and value-to-bulk ratios. In other words, they are relatively valuable given their size and weight. That portability is, of course, important to their function as a medium of exchange. Although they eventually go stale and can be ruined if smashed or drenched in water, sealed cigarettes packs are durable enough to also serve as an intermediate term store of value. The elasticity of the supply of cigarette packs is volatile, however, because smokers find it difficult to quit smoking, no matter the price and the fact that the quantity of packs in circulation depends on shipments from the outside world. In modern prisons, this is less of a problem, but in prisoner-of-war (POW) camps, sudden gluts caused the prices of goods (noncigarettes) to soar (that is, the value of cigarettes plummeted), only to be followed by long periods of deflation (lower prices for noncigarettes) as the supply of cigarettes dried up and each cigarette gained in purchasing power.

Key Takeaways

- Where money is absent, an available commodity with the best combination of ease of authentication, uniformity, divisibility, durability, portability, and elasticity of supply may emerge as money.

- In other instances, as in Argentina, private credit money may emerge.

3.3 A Short History of Moolah

Learning Objective

- What characteristics does a good medium of exchange possess?

Much stranger commodities than cigarettes have served as money over the ages, and for the most part served well. As storied economist John Kenneth Galbraith once claimed, “More than most things, an understanding of money requires an appreciation of its history,” so a brief history lesson is in order here.www.johnkennethgalbraith.com/ As Figure 3.1 "Cowrie money from early China" suggests, various types of live animals, parts of dead animals, grains, metals, rocks, and shells have been money at one time and place or another. www.pbs.org/newshour/on2/money/timeline_ns4.html;http://www.ex.ac.uk/~RDavies/arian/amser/chrono.html

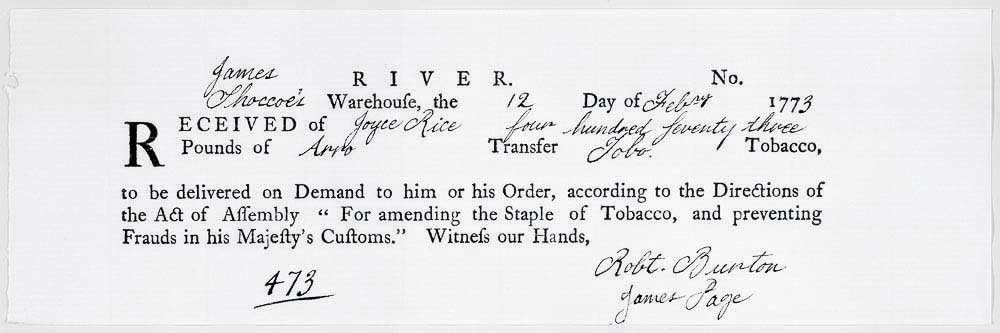

We generally find that, as with the case of prison inmates, early societies used available commodities that had the best combination of ease of authentication, uniformity, divisibility, durability, portability, and elasticity of supply. Hay (grassy livestock feed) rarely emerges as money because it is too easy to adulterate with weeds; its low value-to-bulk renders its portability very low due to the trouble and expense of transporting it; and until it is properly baled and stored, a rainstorm can ruin it. Tobacco, by contrast, has served as a commodity money because it is more uniform, durable, portable, and easily authenticated than hay. In colonial Virginia, tobacco was turned into a form of representative moneyIntrinsically value-less (or nearly so) tokens that represent commodities because they can be exchanged for commodities or converted into commodities at a fixed, predetermined rate. when trustworthy and knowledgeable inspectors attested to its quality, stored it in safe warehouses, and issued paper receipts for it. The receipts, shown in Figure 3.2 "Reproduction of eighteenth-century tobacco transfer note", rather than the tobacco itself, served as an extremely uniform, durable, divisible, portable, and easily authenticated medium of exchange.

Figure 3.2 Reproduction of eighteenth-century tobacco transfer note

Courtesy: The Colonial Williamsburg Foundation.

Diamonds, rubies, and other rare gems seldom become money because they are not uniform in quality and are difficult to authenticate. One needs expensive specialized training and equipment to value them properly. (See Figure 3.3 "Is it real?" for an example.) Gold, by contrast, has often served as money because, as an element (symbol = Au; atomic number = 79),www.webelements.com it is perfectly uniform in its pure form. It is also easily divisible; relatively highly portable for a commodity; and, though soft for a metal, quite durable. Gold can be adulterated by mixing it with cheaper metals. Even when coined, it can be clipped, sweated, or otherwise adulterated. Relatively easy ways of authenticating gold and other precious metals in their bullion (bar or brick) and coin forms exist, however.If you look through the Gunston Hall probate inventory database here: http://www.gunstonhall.org/probate/index.html, you’ll discover that a large percentage of households in Maryland and Virginia in the late eighteenth and early nineteenth centuries owned a set of money scales. People regularly weighed coins to authenticate them and determine their real value. Gold’s elasticity of supply, traditionally quite low due to its rarity, is its biggest shortcoming. Money must be scarce, meaning that free goods like air and water (where plentiful) will not work as money, but it need not be rare, and in fact, the best forms of money are not rare.

Figure 3.3 Is it real?

Answer: No, it’s a Cubic Zirconium, a fake diamond. Or is it???

© 2010 Jupiterimages Corporation

Many students have no problem seeing how commodities with use value, like food and cigarettes, or rarity value, like gold and silver, can be money. They often wonder, though, about the sanity of people who used common, useless items as money. Before congratulating themselves on their own rationality, however, they ought to peek into their wallets and purses, where they may discover, if they haven’t already used it on tuition, books, and entertainment, that they possess some greenish pieces of paper, called Federal Reserve notes, the use value of which is nearly nil.In the past, paper money that lost its value in exchange was used as wallpaper; thumb paper (to keep grimy young hands from dirtying textbooks, which in real terms were even more expensive in the distant past than at present, believe it or not); and tissue paper, for both the nose and the posterior! They were also used to tar and feather dogs and the occasional hated government official. True, those notes are fiat money. In other words, they appear to enjoy the advantage of legal tender status. The face of the notes makes clear that they are “legal tender for all debts, public and private.” That means that it is illegal to refuse them. That little note on the notes notwithstanding, it is clearDuring the American Revolution, Congress declared its paper money, Continental dollars, a legal tender. Despite the proclamation, Continentals soon lost almost all of their value, giving rise to the expression “Not worth a Continental.” Other examples of the failure of tender clauses abound. that people today accept Federal Reserve notes for the same reason that people in the past accepted clamshells, beads, or other low use-value items because they know that they can turn around and successfully exchange them for goods. In fact, many economists define money as anything commonly accepted in exchange. (So Ron Paul dollars are not money!)http://www.youtube.com/watch?v=qMhz_ki_B7o

Key Takeaways

- The best medium of exchange combines ease of authentication, uniformity, divisibility, durability, portability, and elasticity of supply.

- Gold is not necessarily the best type of money because its supply is relatively inelastic.

- Declaring a medium of exchange as legal tender may help that medium of exchange to circulate, but simply knowing that something is readily accepted in exchange can work just as well.

3.4 Commodity and Credit Monies

Learning Objective

- How do representative and credit monies compare to commodity monies?

Truth be told, the people who used lion teeth or rocks with holes in them as money might find moderns a bit off their rockers for using money created by the government. The reason is simple: commodity monies are self-equilibrating, but government fiat monies are not because they are sometimes subject more to the whims of politicians and bureaucrats than to the forces of supply and demand, as we will see in Chapter 13 "Central Bank Form and Function". Commodity money systems can self-equilibrate, or essentially run themselves, because commodities are scarce (but as noted above, not necessarily rare). In other words, the opportunity costs of their acquisition and production are greater than zero. That means that at some point people will find it just as profitable to produce nonmonetary goods as to produce money directly. At that point, money creation naturally ceases until more is needed.

Suppose, for example, that clams are money and that ten can be found in one hour, on average. Suppose too that people on average can also produce a bow in two hours, an arrow in one hour, and a dead rabbit in three hours. In that situation, an arrow would cost ten clams, a bow twenty clams, and a rabbit thirty clams because at those prices people would be indifferent whether they spent, say, six hours collecting clams (6 × 10 = 60), making arrows (6 × 10 = 60), making bows ([6/2 hours per bow] = 3 bows produced in 6 hours; 3 × 20 = 60), or hunting rabbits ([6/3] = 2; 2 × 30 = 60). If a big clambake takes clams out of (monetary) circulation by putting them in (bloodstream via the digestive tract) circulation, it will be more remunerative to harvest clams than to make bows or arrows or to fricassee rabbits until the supply of clams is restored, which should not be long. (In fact, if people expected the clambake, the adjustment might well be instantaneous. We’ll discuss the importance of expectations in Chapter 7 "Rational Expectations, Efficient Markets, and the Valuation of Corporate Equities" and Chapter 26 "Rational Expectations Redux: Monetary Policy Implications".)

Commodity money systems also automatically adjust to structural changes in the economy. If it suddenly became easier to find clams, say, twenty in an hour, everybody would harvest clams until the clam prices of arrows, bows, and rabbits doubled, restoring equilibrium. If clam production dropped to five an hour, prices would also drop by half because no one would harvest clams when they could earn twice as many clams in an hour producing arrows, bows, or rabbits. If clam production remained steady but it became easier to produce bows, the only thing that would change would be the price of bows relative to the prices of arrows and rabbits, and not the price level, or all prices. For example, if it was possible to produce bows in 1.5 hours instead of 2, the price of bows would drop to 15 clams (when 10 clams can be harvested in an hour).

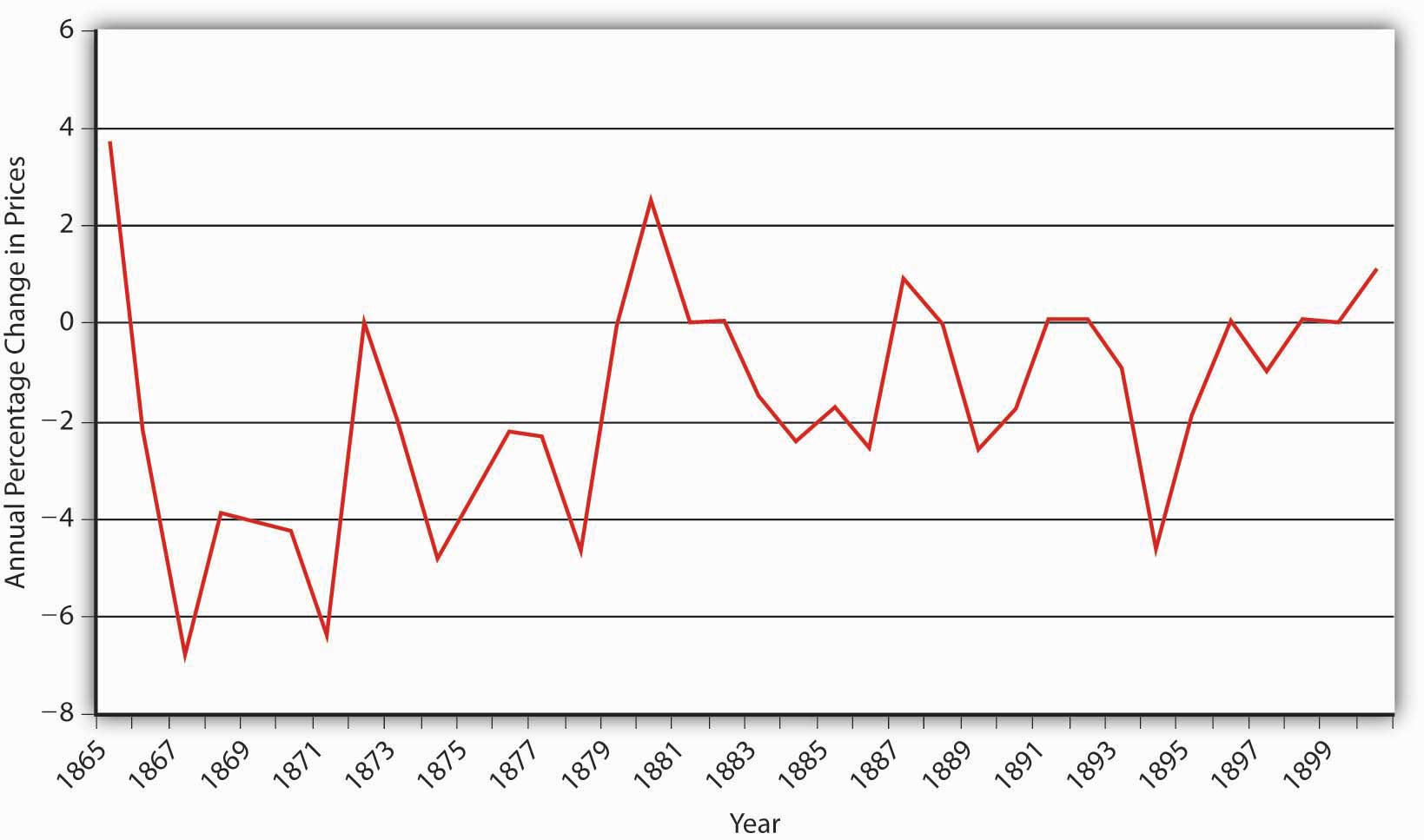

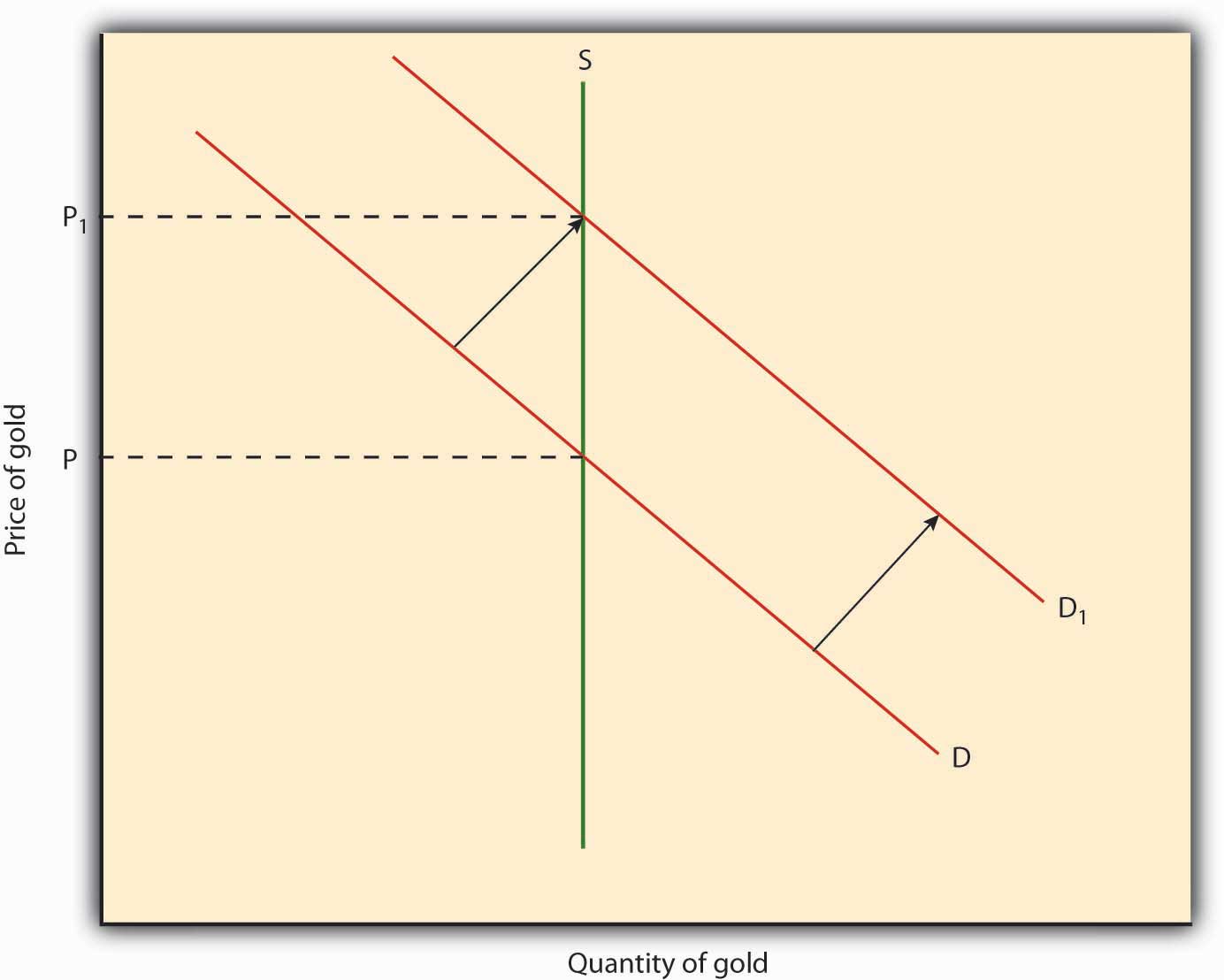

As noted above, gold is a very good commodity money in most respects. It fell from grace early in the twentieth century, however, primarily because of competition from superior types of exchange medium and the inelasticity of its supply. When gold became more abundant and output remained constant, the price level increased because there was more money chasing the same amount of goods and services. When the quantity of gold remained constant and output increased, the price level declined because there was no longer enough gold around to maintain the former prices, as in Figure 3.5 "A higher price for gold means a lower price for everything else". By making each ounce of gold more valuable, thus increasing one’s ability to purchase more goods and services than formerly, the decline in prices should have triggered an immediate increase in gold production, thereby rendering the deflation, or reduction of the price level, mild and transitory, as in our hypothetical clam case above. Due to the difficulty of finding new veins of gold, however, changes in the price level were often prolonged.This chart depicts changes in the price level in the United States between 1865 and 1900, when the country’s unit of account was defined in gold. Note that prices fell in most years. That deflation led to a series of political upheavals that resulted in the formation of the Populist Party and a prolonged struggle among Silverites, who desired to raise prices by monetizing silver; Greenbackers, who sought to raise prices through the issuance of fiat money; and Gold Bugs, who insisted on maintenance of the status quo. The Wonderful Wizard of Oz, a children’s book by Frank Baum made legendary by a movie version starring Judy Garland as protagonist Dorothy, is an allegory depicting the major political divisions of the era. Oz is of course the abbreviation for ounce; the yellow brick road refers to the gold standard; the Emerald City symbolizes Greenbacks; and in the book, Dorothy’s slippers were silver, not ruby, as they were depicted in the movie.

Figure 3.4 Changes in the U.S. price level, 1865–1900

Figure 3.5 A higher price for gold means a lower price for everything else

The end of gold’s reign was, in a sense, overdue. Gold’s monetary life had been extended by the invention and widespread use of fiduciary, or credit, money, including banknotes and deposits, because such money essentially rendered the gold supply more elastic. By the late seventeenth century, goldsmiths, skilled artisans who made gold watches and other auric goods, began to safeguard gold for their customers and to issue a form of representative money by issuing receipts to depositors. Like tobacco receipts, the gold receipts could be returned to the issuing goldsmith for gold. People often preferred to hold the receipts rather than the gold itself because they were even more portable and easily authenticated than the metal. So the receipts began to circulate as a medium of exchange. Credit money was born when the goldsmiths, now proto-bankers, discovered that due to the public’s strong preference for the receipts, they could issue notes to a greater value than the gold they had on physical deposit.

By the eighteenth century, banks in Great Britain, the United States, and a few other places increased the elasticity of the supply of gold by engaging in just such fractional reserve banking. Consider the following bank balance sheetA financial statement showing the sum or stock of an economic entity’s assets (things owned) and liabilities (things owed). Assets should equal liabilities, including equity (aka capital or net worth).:

| Assets: | |

| Gold | 200 |

| Public securities | 100 |

| Loans | 600 |

| Office and real estate | 100 |

| Liabilities: | |

| Notes | 400 |

| Deposits | 500 |

| Equity | 100 |

Because most people preferred to hold notes and deposits instead of gold, the bank could hold only a small reserve of gold to pay to holders of its demand liabilities (notes and deposits) and earn seigniorage, or the profit from the issuance of money, on the rest.Seigniorage can be earned in several ways. One way is to earn interest on assets acquired with liabilities that pay no interest or, more generally, on the positive spread between return on assets and the cost of monetary liabilities. The Federal Reserve, for example, pays no interest on its notes or deposits but earns interest on the Treasury securities and other assets that it buys with its notes and deposits. Another way to earn seigniorage is to mint coins that have a higher face or nominal value than production cost. Debasing the coinage, or extracting seigniorage by increasing the nominal value of a given sum of gold or silver, was highly profitable and therefore a favorite sport of kings. Here only 200 (dollars or pounds or whatever) of gold did the work of 900 (the sum of notes and deposits). Bankers essentially made gold less rare and also gained some control over its elasticity via the reserve ratio (reserves/monetary liabilities or 200/900), which was relatively unregulated by government at that time. Bankers could change the ratio as they saw fit, sometimes decreasing and sometimes increasing it, thereby changing the money supply, or the total quantity of money in the economy.

Stop and Think Box

In Ithaca, New York, and hundreds of other communities worldwide, consortia of businesses issue zero-interest bearer paper notes. The notes are denominated in local units (Hours in Ithaca; Greenbacks, Berkshares, and other names elsewhere)http://en.wikipedia.org/wiki/Local_currency#Modern_local_currencies and are designed to circulate as cash, like Federal Reserve notes. In the United States, the issuer must redeem the notes for dollars (unit of account) upon demand at a fixed conversion rate. Each Ithaca Hour, for example, is equal to 10 USD. The community notes are not a legal tender, have no intrinsic value, and generally circulate in an extremely limited geographical area. The issuers often use Marxist rhetoric, claiming that holding the notes will help the local economy by keeping money invested locally. (For more details, browse http://www.ithacahours.com/). What is really going on in Ithaca and the other community money centers?

The issuers of the notes are interested in earning seigniorage, or profits from the issuance of money. They act like fractional reserve bankers, issuing Hours in exchange for dollars, which they put out to interest. They don’t earn much, though, because most people are smart enough to realize their credit money is less liquid and more risky than other forms of credit money, like bank deposits, and much higher risk than fiat money, like Federal Reserve Notes. In fact, there is no good reason to hold such notes unless one believes (“buys into”) the dubious Marxist rhetoric that often accompanies them.

Since its invention, credit money has been extremely successful because it is an almost perfect medium of exchange. Take, for example, bank deposits. Essentially just an accounting entry crediting so much money (unit of account) to a person or organization, deposits are easily authenticated, perfectly uniform, divisible to fractions of a penny, highly portable via written or electronic orders, and extremely durable. Moreover, their supply is highly elastic because they can be created and destroyed at will. The usefulness of deposits is further extended by varying their characteristics to meet different risk, return, liquidity, and maturity preferences. The most common and familiar type of deposit, called a checking, transaction, or demand deposit account, pays no or relatively low interest, but funds can be withdrawn at any time via teller during banking hours, via ATM 24/7, or with a debit card or check. Other deposits, called time or savings deposits or certificates of deposit, pay relatively high interest but either cannot be withdrawn at all before a prespecified date or can be withdrawn only if the depositor suffers a penalty that wipes out much of the interest earned. Between those two extremes have emerged a variety of hybrids, like automatic transfer from savings (ATS)An account that automatically moves funds from your savings account if your checking account is depleted. (Of course, such an account doesn’t help if you don’t have any money in your savings account either.), and sweep accountsAn account that automatically moves funds from your savings account if your checking account is depleted. (Of course, such an account doesn’t help if you don’t have any money in your savings account either.), and money market mutual fundsMMMFs are mutual funds that invest in short-term, or money market, instruments. Fund owners earn the going market interest rates, minus management fees, and can draw upon their shares by check but at a cost higher than that of most bank checking accounts.. Most forms of electronic or e-money, like sQuidcards,http://www.squidcard.com/corporate/emoney.html are just new forms of credit money.

The biggest problem with credit money is that the issuer may default. Many banking regulations, as we will see in Chapter 11 "The Economics of Financial Regulation", attempt to minimize that risk. Other issuers of credit money are not so closely regulated, however, and hence constitute serious credit risksThe probability of not being paid a sum due. for holders of their liabilities.

Key Takeaways

- Representative money and credit money are more efficient than commodity money because they are superior media of exchange and units of account. Their quality is more uniform and easily ascertained, they have low weight-to-value ratios, they are more divisible and their divisibility is more flexible, and their supply is more elastic.

- However, the supply of representative and credit monies generally does not self-equilibrate the way the supply of a commodity money does.

3.5 Measuring Money

Learning Objective

- What is the money supply and how is it measured?

Due in part to the profusion of different types of credit money, measuring the money supply today is no easy task. The Fed, or Federal Reserve System, America’s monetary authority and central bank, has therefore developed a number of monetary aggregates, or different measures of the money supply. The monetary base (MB or M0, the narrowest aggregate) is the unweighted total of Federal Reserve notes and Treasury coins in circulation, plus bank reserves (deposits with the Federal Reserve). M1 adds to M0 travelers’ checks and demand deposits. (Banks other than the Fed no longer issue notes. If they did, they would be considered components of M1.) A broader aggregate, M2, includes M1 as well as time/savings deposits and retail money market mutual fund shares. A yet broader aggregate, M3, includes M2 as well as institutional time deposits, money market mutual fund shares, repurchase agreements, and Eurodollars, but its publication was discontinued by the Fed in 2006.

The Fed continues to estimate the other three measures because their movements are not highly correlated and the appropriate monetary aggregate varies over time and question. As we will see, the money supply helps to determine important macroeconomic variables like inflation, unemployment, and interest rates. Accurately measuring the money supply is so important that monetary economists still search for better ways of doing it. One approach, called divisia after its French inventor, François Divisia (1925), weighs credit instruments by their liquidity, or in other words, their degree of money-ness, or ease of use as a medium of exchange. The Federal Reserve Bank of Saint Louis tracks the U.S. money supply using various divisia formulas.research.stlouisfed.org/msi/

Each Friday, the Wall Street Journal publishes the M1 and M2 monetary aggregates in its “Federal Reserve Data” column. The data is also available on the Federal Reserve’s Web site: http://www.federalreserve.gov/releases/h6/. Students are cautioned, however, that the published data are mere estimates; the Fed often revises the figures by as much as 2 or 3 percent. Other countries’ central banks also report their monetary aggregates. Links to the Web sites of other central banks can be found here: http://www.bis.org/cbanks.htm.

Key Takeaways

- The money supply is the stock of all money in an economy.

- It is measured in a variety of ways to aid in the conduct of monetary policy and in macroeconomic forecasting.

3.6 Suggested Reading

Bernstein, Peter. A Primer on Money, Banking, and Gold. Hoboken, NJ: John Wiley and Sons, 2008.

Davies, Glyn. A History of Money: From Ancient Times to the Present Day. Cardiff: University of Wales Press, 2002.

Eagleton, Catherine, Jonathan Williams, Joe Cribb, Elizabeth Errington,. Money: A History. Richmond Hill, Ontario, Canada: Firefly Books, 2007.