This is “End-of-Chapter Exercises”, section 13.5 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

13.5 End-of-Chapter Exercises

Questions

- The Saint Louis Corporation is trying to determine whether a liability needs to be recognized in connection with an event that recently took place. What characteristics must be present before a liability has to be reported?

- The Topeka Company has a liability for $1.3 million. Company officials are trying to decide whether the debt should be shown as a current or noncurrent liability. How is that decision made?

- Why are most decision makers particularly concerned about the amount of current liabilities reported by a company?

- The Ames Company reports $300,000 in current assets and $100,000 in current liabilities. At the very end of the year, the company pays a $20,000 account payable. What was the current ratio before the payment? What was the current ratio after the payment?

- What are several examples of accrued liabilities? Why do they often require adjusting entries prior to the production of financial statements?

- How do companies account for gift cards that they sold?

- How do companies account for gift cards that are redeemed?

- How do companies account for gift cards that are unlikely to be redeemed?

- In financial reporting, what is a commitment, and how is it shown within a set of financial statements? Why is that reporting considered appropriate?

- The Atkinson Company has a contingent loss at December 31, Year One. It will not be completely settled for at least two years. Under what condition, should the company report a liability at the present time?

- Give three examples of possible contingencies that a company might have to report in its financial statements.

- The Salem Corporation has been sued for $2 million. Company lawyers believe that the chances of a loss are only reasonably possible. If a loss is incurred, the expected amount is $775,000. What does Salem report in connection with this contingency?

- The Oregon Company has been sued for $3 million. Company lawyers believe that a loss of $500,000 might result, but the chances of such a loss are really remote. How does Oregon report this contingent loss?

- The Randolph Corporation is being sued for $2 million. How does the reporting under U.S. GAAP differ from the reporting required under IFRS?

- The Remshaw Corporation has filed suit against a competitor for patent infringement. Company lawyers are confident of a positive outcome. They believe that an award of $1.2 million is probable. How does Remshaw report this contingent gain?

- A landscaping company sells live plants (such as azaleas) and promises to replace any plants that die within one year of purchase. At the end of the current fiscal year, how does the company determine the amount that must be reported as its liability?

- A company sells computers and promises to fix any problems that the customer encounters within two years of a purchase. When does the company recognize expense from this warranty program?

- A company sells computers and also sells an extended warranty that obligates the company to fix any problems that are encountered within two years from the purchase date. When does the company recognize expense from this warranty program?

- How is the age of accounts payable calculated?

True or False

- ____ A company has a liability, and company officials are not sure if it should be reported as a current liability or as a noncurrent liability. They are likely to prefer to report the balance as a current liability.

- ____ A current ratio of less than 1.0 to 1.0 means that a company has more current assets than current liabilities.

- ____ A company signs a contract on December 29, Year One, to buy 1,000 barrels of crude oil on January 24, Year Two, at $82 per barrel. The likelihood of this contingency is probable and, therefore, should be reported as a liability at the end of Year One.

- ____ Contingent liabilities should be reported on the balance sheet if they are both probable and can be reasonably estimated.

- ____ Because of conservatism, a contingent liability should be disclosed in a company’s financial statements even if the chance of loss is only remote.

- ____ Contingent gains should only be recorded if they are probable.

- ____ Liabilities for gift cards must remain on the balance sheet until they are redeemed, regardless of how long that takes.

- ____ If a gift card is redeemed, a liability is reduced for reporting purposes.

- ____ Restatement of previously issued financial statements will occur if a company attempts to mislead investors by understating liabilities.

- ____ A company has a contingent loss of $1 million. If a liability is reported using IFRS, the same monetary liability will also have to be reported according to U.S. GAAP.

- ____ A company has both embedded product warranties and extended product warranties. These warranties will be reported in the same way by this company.

- ____ A company gives customers an embedded warranty with each purchase. During the past several years, 4 percent of these products have been returned under the warranty program. Thus, the company should anticipate that 4 percent of the items sold this year will have to be fixed.

- ____ Company A takes twenty-two days to pay its accounts payable. Company Z takes thirty-one days to pay its accounts payable. Company A is a more financially healthy company than Company Z.

Multiple Choice

-

Which of the following is not a criterion that must be met for an item to be classified as a liability?

- A certain cash payment will occur in the future.

- A sacrifice will require the entity’s assets or services.

- There is a probable future sacrifice.

- There is a present obligation that results from a past transaction.

-

Watkins Inc. has the following assets at the end of Year One:

Cash $400 Inventory $730 Prepaid Rent $460 Equipment (net book value) $4,000 Watkins also has the following liabilities at the end of Year One:

Accounts Payable $560 Rent Payable $200 Note Payable, due on June 1, Year Four $3,500 At the end of Year One, what is Watkins’s current ratio?

- 1.14 to 1.0

- 1.31 to 1.0

- 1.49 to 1.0

- 2.09 to 1.0

-

Which of the following is the least likely to be an accrued liability?

- Accounts payable

- Interest payable

- Rent payable

- Salary payable

-

The Taylor Company sells music systems. Each music system costs the company $100 and will be sold to the public for $250. In Year One, the company sells 100 gift cards to customers for $250 each ($25,000 in total). These cards are valid for just one year, and company officials expect them to all be redeemed. In Year Two, only 96 of the cards are returned. What amount of net income does the company report for Year Two in connection with these cards?

- $15,000

- $15,400

- $15,500

- $15,800

-

Osgood sells music systems. Each system costs the company $100 and is sold for $250. During Year One, the company sells 1,000 of these systems ($250,000 in total). Each system comes with a free one-year warranty. The company expects 5 percent of the music systems to break and cost $40 each to fix. None break in Year One, but unfortunately, the systems were not well-manufactured, and 300 break in Year Two and cost $70 each to fix. What is the impact of this embedded warranty on Osgood’s reported net income for Year Two?

- Decrease of $15,000

- Decrease of $17,000

- Decrease of $19,000

- Decrease of $21,000

-

The James Corporation sells music systems. Each system costs the company $100 and is sold for $250. During Year One, the company sold 1,000 music systems ($250,000 in total). Every customer also paid $10 each ($10,000 in total) for a one-year warranty. The company expects 5 percent of the music systems to break and cost $40 each to fix. None break in Year One, but unfortunately, the systems were not well-manufactured, and 300 break in Year Two and cost $70 each to fix. What is the impact of this extended warranty on James’s reported net income for Year Two?

- Decrease of $10,000

- Decrease of $11,000

- Decrease of $18,000

- Decrease of $21,000

-

In Year One, Company A was allegedly damaged by Company Z and has filed suit for $300,000. At the end of Year One, Company A thinks it is probable that it will win $130,000 but reasonably possible that it will win $200,000. On that same day, Company Z thinks it is probable that it will lose $80,000 but reasonably possible that it will lose $180,000. On June 14, Year Two, the suit is settled when Company Z pays $97,000 in cash to Company A. Which of the following is true about the financial reporting for Year Two?

- Company A increases net income by $97,000; Company Z decreases net income by $17,000.

- Company A increases net income by $97,000; Company Z increases net income by $83,000.

- Company A decreases net income by $33,000; Company Z decreases net income by $17,000.

- Company A decreases net income by $33,000; Company Z increases net income by $83,000.

-

Stimpson Corporation buys cameras for $500 apiece and then sells each one for $1,200. During Year One, 9,000 units were sold. Each sale includes a one-year warranty. Stimpson estimates that 6 percent of the cameras will break (all during Year Two) and have to be fixed at an estimated cost of $190 each. In Year Two, no additional cameras are sold, but 590 cameras actually break but only cost $180 each to fix. What expense should Stimpson recognize for Year Two?

- $3,600

- $5,900

- $9,000

- $9,500

-

The Greene Company sells appliances along with an embedded warranty. In Year One, the company recognizes a warranty expense of $54,000. In Year Two, the company has an actual expense that is different than $54,000. Under what condition will the company restate the number reported for Year One?

- Under no condition.

- If the original estimate was discovered to be too low.

- If the original estimate was not made by company officials in good faith.

- If the original estimate was discovered to be too high.

-

The Knafo Company sells toaster ovens for $50 apiece. The company also planned to sell a one-year warranty with each purchase for $3. Company officials believe that 10 percent of all toaster ovens will break during Year Two and cost $7 each to fix. The company expects 40 percent of its customers to buy this extended warranty. At the last moment, company officials decide to give all customers a free one-year warranty to create customer loyalty. During Year One, the company sells 1,000 units. In Year Two, 11 percent of all toasters broke. Each repair cost $7. Because of the decision to give the warranty to all customers for free, the company will report a lower net income in Year One. How much lower will the net income figure be for Year One because of this decision?

- $298

- $400

- $700

- $1,200

-

Use the information in problem 10 again. Because of the decision to give the warranty to all customers for free, the company will report a lower liability at the end of Year One. How much lower will the liability be at the end of Year One because of this decision?

- $500

- $700

- $900

- $1,200

-

Use the information in problem 10 again. Because of the decision to give the warranty to all customers for free, the company will report a lower net income in Year Two. How much lower will the net income figure be in Year Two because of this decision?

- $320

- $468

- $648

- $962

-

On January 1, Year One, Purple Company sues Yellow Company for $6 million. At the end of Year One, both companies think that the probable outcome of this lawsuit is a settlement for $170,000. They also believe that a settlement of $290,000 is reasonably possible while a settlement of $540,000 is possible but remote. In Year Two, the lawsuit is settled with Purple winning exactly $120,000. Which of the following is correct about the reporting for Year Two?

- Purple recognizes a loss of $50,000; Yellow recognizes a gain (a recovery) of $50,000.

- Purple recognizes a gain of $120,000; Yellow recognizes a gain (a recovery) of $50,000.

- Purple recognizes a gain of $120,000; Yellow recognizes a loss of $120,000.

- Purple recognizes a loss of $50,000; Yellow recognizes a loss of $120,000.

-

Langston Corporation is being sued by a competitor for $1 million. At the end of the year, company officials believe that there is a 51 percent chance of a loss of $420,000 from this lawsuit. Which of the following statements is true?

- Under both U.S. GAAP and IFRS, a liability of $420,000 is recognized.

- Under U.S.GAAP (but not under IFRS), a liability of $420,000 is recognized.

- Under IFRS (but not under U.S. GAAP), a liability of $420,000 is recognized.

- Under both U.S. GAAP and IFRS, no liability is recognized at this time.

-

Maxout Company sells computers. Customers have the option to buy an extended warranty that covers their computer for two years. To get the extended warranty, the customer must pay $200. Maxout expects every computer will have to be fixed during the warranty period at a cost of $100. What journal entry will Maxout make at the time the computer is purchased, assuming the customer buys the extended warranty?

-

Figure 13.19

-

Figure 13.20

-

Figure 13.21

-

Figure 13.22

-

-

Sierra Inc. manufactures environmentally friendly appliances. It provides a four-year warranty as a standard part of each purchase. In Year One, Sierra sold 450,000 toasters. Past experience has shown that 4 percent of the toasters usually require repair at an average cost of $10 each. During Year One, Sierra actually spends $38,000 on repairs and during Year Two, Sierra spends another $65,000. What is the balance in the warranty liability account at the end of Year Two?

- $67,000

- $77,000

- $84,000

- $94,000

-

The following figures appear on LaGrange’s financial statements for the most recent fiscal year:

Cost of goods sold $1,960,000 Beginning inventory 238,000 Ending inventory 278,000 Accounts payable 182,000 What is the age of this company’s accounts payable?

- 33.2 days

- 33.9 days

- 34.7 days

- 35.3 days

Video Problems

Professor Joe Hoyle discusses the answers to these two problems at the links that are indicated. After formulating your answers, watch each video to see how Professor Hoyle answers these questions.

-

Your roommate is an English major. The roommate’s parents own a chain of ice cream shops located throughout Florida. One day, while returning a book at the library, your roommate poses this question: “My parents came up with this great idea. They started selling gift cards this year right before Christmas. A lot of our older customers bought bunches of these cards to give to their children and grandchildren as presents. This was one of my parent’s best ideas ever; the money really poured into each of the shops. However, when I asked my parents about their net income for the year, they said that these sales had not affected net income. That makes absolutely no sense. They sold thousands of gift cards for ice cream and got real money. How could their net income have not gone up through the roof?” How would you respond?

-

Your uncle and two friends started a small office supply store several years ago. The company has expanded and now has several large locations. Your uncle knows that you are taking a financial accounting class and asks you the following question: “We are about to start selling a new line of office equipment. We really want to get our customers to consider this merchandise. We have been thinking about giving a free two-year warranty with each purchase. That eliminates risk and makes people feel more comfortable about the purchase. However, one of the other owners wants to charge a small amount for this warranty just so that we can make a small profit. We still take away the risk, but we also increase our net income. The decision is important, so I want to understand: how will each of these two alternatives affect the way our company looks on its balance sheet and income statement?” How would you respond?

Problems

-

Knockoff Corporation sells a videogame unit known as the Gii. During the month of December, the following events occur. Prepare any necessary journal entries and adjusting entries that Knockoff should record.

- Knockoff purchased $300,000 of inventory on account.

- The company incurs salary expense of $45,000, although employees will not be paid until the beginning of January. The company also owes an additional $7,000 to the government for payroll taxes.

- Knockoff determines that it owes the IRS $120,000 in income taxes for this year.

- A retail customer places an advance order for Giis and pays Knockoff $23,000. The Giis will be shipped in January.

- Knockoff owes a local bank $4,000 in interest on a loan.

- Knockoff rents a warehouse of $3,000 per week. No payments were made for the last three weeks of the year.

-

OK Corporation sells gift cards in various denominations. The company likes to sell these cards because cash is collected immediately, but a certain percentage will never be redeemed for merchandise. On December 1, Year One, OK reported a balance in unearned revenue of $728,000 from the sale of gift cards.

- During December, OK sold an additional $578,000 in gift cards. Prepare this journal entry.

- During December, gift cards totaling $327,000 were redeemed to purchase inventory that had originally cost OK $190,000. Prepare these journal entries. Assume OK uses a perpetual inventory system.

- On December 31, OK’s accountant determines that 3 percent of the outstanding gift cards will never be redeemed because they have expired. Prepare a journal entry if necessary.

- What is the amount reported by OK on its December 31, Year One, balance sheet for unearned revenues?

-

In Year One, the Yankee Corporation allegedly damaged the Sox Corporation. The Sox Corporation sued the Yankee Corporation for $1 million. At the end of Year One, both companies believed that an eventual payment of $300,000 by Yankee was probable, but a payment of $480,000 was reasonably possible. The case moved through the court system rather slowly, and at the end of Year Two, both companies had come to believe that an eventual payment of $340,000 by Yankee was now probable, but a payment of $700,000 was reasonably possible. In Year Three, this lawsuit is settled for $275,000 in cash.

- Determine the income effect to be reported by each company for each of these three years.

- Discuss how the financial reporting might be different if these companies were reporting according to IFRS instead of U.S. GAAP.

-

Whalens Corporation buys large screen televisions for $500 each and sells them for $1,200 each. During Year One, 8,000 sets were bought and sold for cash. Whalens estimates that 1 percent of all sets will break during Year Two. Company officials believe they will cost $150 to fix. Whalens offers a one-year warranty for $40. A total of only 700 customers choose to buy the warranty. In Year Two, nine of the televisions under warranty break but cost only $140 to repair.

- At the end of Year One, what revenue and expense should Whalens report in connection with this warranty?

- At the end of Year Two, what revenue and expense should Whalens report in connection with this warranty?

-

The Haynesworth Corporation is sued for $10 million in Year One. At the end of Year One, company officials believe a loss is only remote. However, the case drags on so that by the end of Year Two, company officials believe it is reasonably possible that a loss of $2 million could be incurred. The case goes to trial during Year Three, and company officials now believe that a loss of $3 million is probable. The case ends on April 23, Year Four, when the Haynesworth Corporation agrees to pay $2.6 million in cash to settle all claims.

Indicate the amount of loss that will be reported by the Haynesworth Corporation in each of these four years.

-

On January 1, Year One, the Atlanta Company sues the Seattle Company for $100 million for patent infringement. The case is expected to take years to settle. For each of the following independent situations, indicate the financial reporting to be made by each company.

- Both companies believe that Atlanta will probably win this case. However, both feel that estimating the amount of this loss is virtually impossible.

- Both companies believe that Atlanta will probably win this case. Both feel that Atlanta will probably win approximately $9 million, but a win as high as $46 million is reasonably possible.

- Both companies believe that a loss by Seattle of $53 million is reasonably possible.

- Atlanta officials believe that their company will probably win $44 million whereas Seattle officials believe that their company will probably lose $8 million.

-

Ingalls Company is a jeweler located in a shopping mall in a midsize city in Ohio. During December of Year One, an unfortunate accident occurs. Mrs. Rita Yeargin trips over a giant, singing Rudolph set up by the mall management and goes sprawling into Ingalls’s store where she cracked her head on a display case. She spent several days in the hospital with a sprained ankle, severely bruised elbow, and a concussion. Prior to the end of the year, Mrs. Yeargin’s lawyer files papers to sue both the mall management company and Ingalls for $1,000,000. Ingalls’s insurance company informs the jeweler that the store policy does not cover accidents involving giant, singing Rudolphs. Ingalls’s attorney is unsure as to what a jury might do in this case because of the unusual nature of the event. He estimates that a loss of $800,000 is probable but that Ingalls will only be liable for 20 percent of that amount since the Rudolph actually belonged to the mall.

- Determine if Ingalls needs to record a journal entry on December 31, Year One, and if so, prepare that entry.

- Ingalls pays Mrs. Yeargin $97,000 on July 11, Year Two, to settle this claim. Make the journal entry for Ingalls at that time.

-

Sadler Corporation produces lawnmowers. The lawnmowers are sold with a free three-year warranty. During Year One, Sadler sold 20,000 lawnmowers for $10 million in cash. These lawnmowers cost $5,800,000. Sadler’s accountant estimates that 10 percent of the units will need to be repaired at some point over the next three years at an average cost of $37 per lawnmower.

- Make the journal entry to record the sale of the lawnmowers in Year One if a perpetual inventory system is used.

- Make the journal entry (if any is needed) to record the warranty.

- During Year Two, Sadler spends $24,000 to repair a number of these lawnmowers. Prepare the necessary journal entry.

- At the end of Year Two, Sadler’s accountant reevaluates the warranty. The accountant suspects that the actual warranty liability will be higher than her original estimate. She now believes that 12 percent of the original sales will eventually result in a repair (but still at $37 each). Make the necessary adjusting entry.

-

The Eyes Have It sells custom eyewear during Year One that come with an embedded warranty. If the glasses break during Year Two, they will be fixed for free. Customers may also purchase an extended warranty that covers Year Three. During Year One, the company sold 55,000 pairs of eyeglasses for $1,000,000. Customers who purchased 40,000 of those pairs also purchased the Year Three extended warranty. The extended warranty brought in additional cash of $200,000. The company expects that 6 percent of the glasses will break during Year Two, and another 8 percent will break during Year Three. Each repair will cost $20 to fix.

- Record the embedded warranty in Year One.

- Record the sale of the extended warranties in Year One.

- Assume that during Year Two the company spends $70,000 to repair glasses for these customers. Prepare the necessary journal entry.

- Assume that during Year Three the company spends another $102,000 to repair glasses that are covered under the extended warranty. Prepare the necessary journal entry.

-

During Year One, Company A and Company Z both sell 1,000 computers for $1,000 each in cash. Company A provides a one-year warranty to its customers for free. Company Z sells a one-year warranty to all of its customers for $50 each. Both companies expect 5 percent of the computers to break and cost $600 each to repair. In Year Two, both companies actually have 6 percent of these computers break. However, the required cost to fix each one was only $550.

- In financial reporting for Year One, which company will report the highest amount of net income? What will be the difference in the two reported amounts?

- In financial reporting for Year Two, which company will report the highest amount of net income? What will be the difference in the two reported amounts?

-

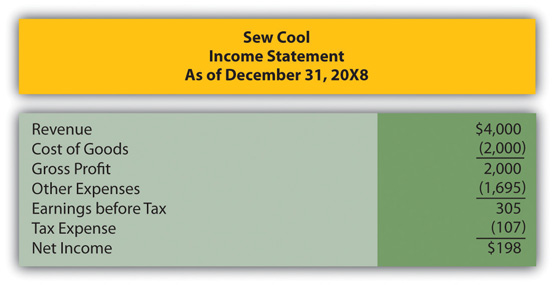

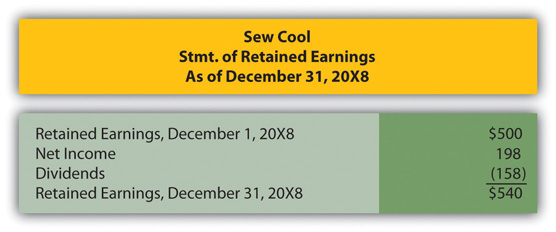

In several past chapters, we have met Heather Miller, who started her own business, Sew Cool. The following are the financial statements for December. To calculate age of accounts payable, assume that beginning inventory on 6/1/20X8, when Sew Cool started business, was zero. Also, assume that Sew Cool was only in business for 210 days.

Figure 13.23 Sew Cool Financial Statements

Figure 13.24

Figure 13.25

Based on the financial statements determine the following:

- Current ratio

- Age of accounts payable

Comprehensive Problem

This problem will carry through several chapters, building in difficulty. It allows students to continually practice skills and knowledge learned in previous chapters.

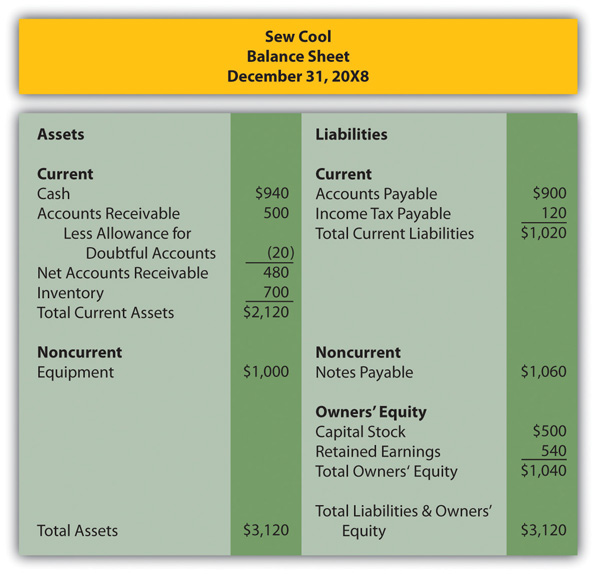

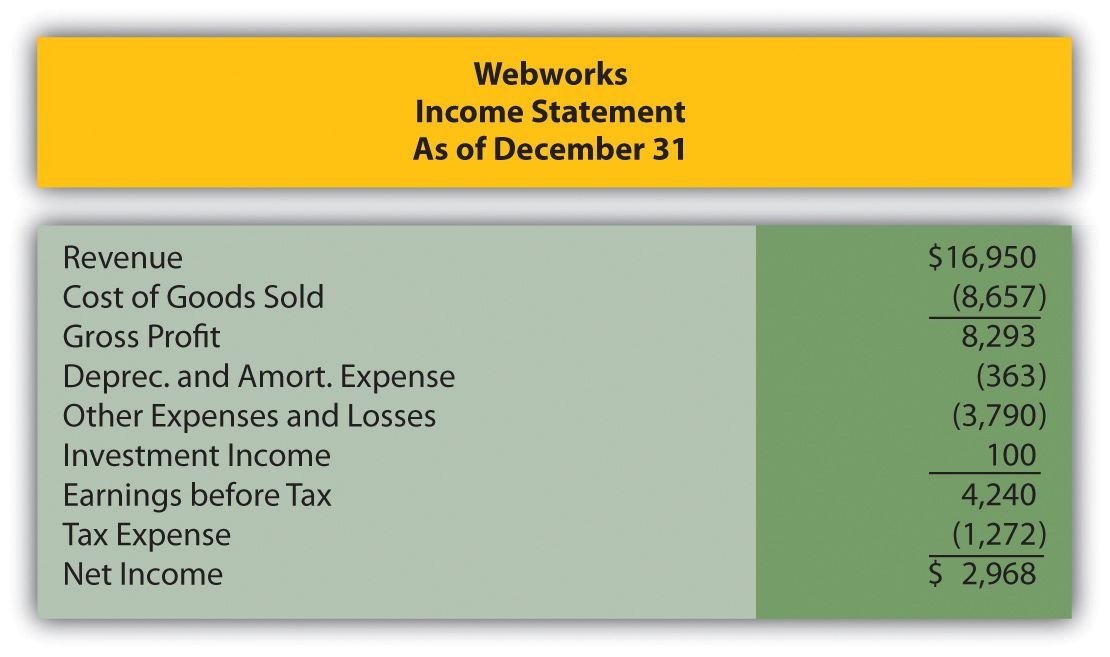

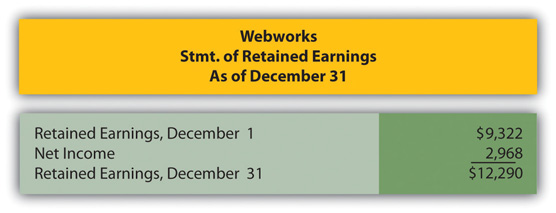

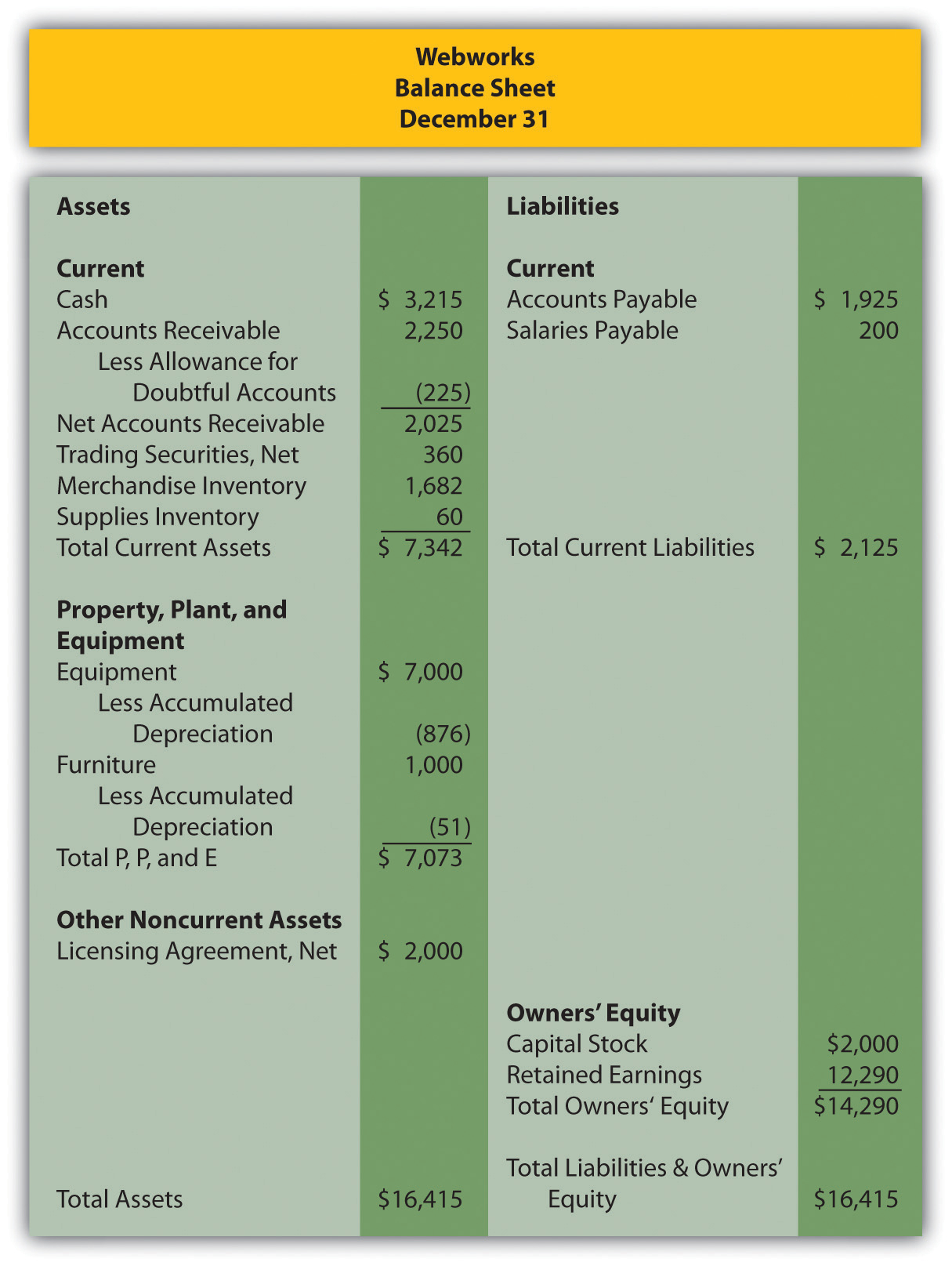

In Chapter 12 "In a Set of Financial Statements, What Information Is Conveyed about Equity Investments?", financial statements for December were prepared for Webworks. They are included here as a starting point for the required recording for January.

Figure 13.26 Webworks Financial Statements

Figure 13.27

Figure 13.28

The following events occur during January:

- Webworks starts and completes seven more sites and bills clients for $4,500.

- Webworks purchases supplies worth $100 on account.

- At the beginning of January, Webworks had fourteen keyboards costing $113 each and twenty flash drives that had been written down to $5 each in December due to obsolescence. Webworks uses periodic FIFO to cost its inventory.

- On account, Webworks purchases sixty-five keyboards for $117 each and ninety of the new flash drives for $20 each.

- Webworks pays Nancy Po (company employee) $775 for her work during the first three weeks of January.

- Webworks writes off an account receivable from October in the amount of $150 because collection appears unlikely.

- Webworks receives $450 in advance to design a Web site for a local salon. Work will not begin on the Web site until February.

- Webworks sells sixty keyboards for $9,000, all twenty of the old flash drives for $100 and eighty of the new flash drives for $2,400 cash.

- During January, Webworks receives notice that one of its former clients is not happy with the work performed. When Webworks refuses to refund the client’s money, the client decides to sue for what he paid plus damages for his “pain and suffering,” which comes to $5,000. An attorney friend of Leon Jackson’s (the owner of the business) mother believes that the suit is without merit and that Webworks probably will not have to pay anything.

- Webworks collects $5,000 in accounts receivable.

- During January, Webworks sells all of its stock in XYZ Company for $8 per share. Webworks had originally purchased sixty shares for $5 and they were selling for $6 per share on the last balance sheet date.

- Webworks pays $200 for advertising that will run over the next two months.

- Webworks pays off its salaries payable from December.

- Webworks purchased 175 shares of QRS Company for $10 per share. Webworks considers this an available-for-sale security.

- Webworks pays off $9,000 of its accounts payable.

- Webworks pays Leon Jackson a salary of $2,000.

- Webworks prepays $600 for rent for the months of January, February, and March.

- QRS Company pays Webworks a dividend of $30.

-

Webworks pays taxes of $1,000 in cash.

Required:

- Prepare journal entries for the previous events.

- Post the journal entries to T-accounts.

- Prepare an unadjusted trial balance for Webworks for January.

- Prepare adjusting entries for the following and post them to your T-accounts.

- Webworks owes Nancy Po $200 for her work during the last week of January.

- Leon’s parents let him know that Webworks owes $320 toward the electricity bill. Webworks will pay them in February.

- Webworks determines that it has $40 worth of supplies remaining at the end of January.

- Prepaid rent should be adjusted for January’s portion.

- Prepaid advertising should be adjusted for January’s portion.

- Webworks is continuing to accrue bad debts at 10 percent of accounts receivable.

- Webworks continues to depreciate its equipment over four years and its furniture over five years, using the straight-line method.

- The license agreement should be amortized over its one-year life.

- QRS Company is selling for $9 per share on January 31.

-

Record cost of goods sold.

- Prepare an adjusted trial balance.

- Prepare financial statements for January.

Research Assignment

Assume that you take a job as a summer employee for an investment advisory service. One of the partners for that firm is currently looking at the possibility of investing in Barnes & Noble. The partner is aware that Barnes & Noble sells a lot of gift cards. The partner is curious as to the size of the changes in that liability balance because the partner feels that increases and decreases will signal similar changes in revenue balances for the following year. The partner is also interested in knowing how much profit Barnes & Noble makes from breakage (gift cards that are never redeemed). The partner asks you to look at the 2011 financial statements for Barnes & Noble by following this path:

- Go to http://www.barnesandnoble.com.

- At the very bottom of this screen, click on “Investor Relations.”

- On the next screen, scroll to the bottom and click on “Annual Reports.”

- On the next screen, in the center, click on “2011 Annual Report” to download.

- Go to page 38 and read the paragraph under “Gift Cards.”

- What was the amount of gift card liability at the end of the previous year and at the end of the current year? What was the percentage change?

- What was the amount of net income reported for the most recent year as a result of breakage (gift cards that were not redeemed)?