This is “Accounting for Investments in Securities That Are Classified as Available-for-Sale”, section 12.2 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

12.2 Accounting for Investments in Securities That Are Classified as Available-for-Sale

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Identify the types of investments classified as available-for-sale.

- Record the receipt of dividends from an investment that is viewed as available-for-sale.

- Explain the financial reporting of changes in the fair value of investments in available-for-sale securities.

- Calculate the gain or loss to be reported when available-for-sale securities are eventually sold.

- Understand the need for reporting comprehensive income as well as net income.

- Explain the adjustment made to net income in order to arrive at comprehensive income.

Reporting Available-For-Sale Investments

Question: Not all investments in stock are bought for quick sale. Assume that Valente Corporation bought one thousand shares of Bayless Corporation for $25 each in Year One but does not anticipate selling this investment in the near term. Company officials intend to hold these shares for the foreseeable future until the money is clearly needed. Although the stock could be sold at any time, the president of Valente believes the investment might well be retained for years. During Year One, a $200 cash dividend is received from the Bayless shares. At the end of that period, the stock is selling for $28 per share. How does the decision to hold equity shares for an extended period of time impact the financial reporting process?

Answer: Valente does not anticipate a quick sale of its investment in Bayless. Because Valente’s intention is to retain these shares for an indefinite period, they will be classified on the company’s balance sheet as an investment in available-for-sale securitiesAccounting classification for investments in stocks and bonds when management’s intentions are to retain them for an indefinite period; they are reported on the balance sheet at fair value although unrealized gains and losses are included in stockholders’ equity and not within net income. rather than as trading securities. Despite the difference in the plan for holding these shares, they are—once again—recorded at historical cost when acquired, as shown in Figure 12.5 "Purchase of Ownership Shares Classified as Available-for-Sale Securities".

Figure 12.5 Purchase of Ownership Shares Classified as Available-for-Sale Securities

The receipt of the dividend is also reported in the same manner as before with the dividend revenue increasing Valente’s net income. No difference is created between the accounting for trading securities and accounting for available-for-sale securities as a result of a dividend.

Figure 12.6 Receipt of Dividend from Investment in Available-for-Sale Securities

The difference in reporting begins at the end of the year. U.S. GAAP requires available-for-sale investments to be included on the investor’s balance sheet at fair value (in the same manner as trading securities). As before, this adjustment to fair value creates an unrealized gain of $3,000, as is reflected in Figure 12.7 "Shares of Bayless (an Available-for-Sale Security) Are Adjusted to Fair Value at End of Year One". However, reported net income is not affected as it was with the investment in the trading security.

Figure 12.7 Shares of Bayless (an Available-for-Sale Security) Are Adjusted to Fair Value at End of Year One

Accumulated Other Comprehensive Income

Question: Based on the previous discussion, an immediate question is obvious: If the $3,000 unrealized gain shown in Figure 12.7 "Shares of Bayless (an Available-for-Sale Security) Are Adjusted to Fair Value at End of Year One" is not presented on the income statement, where is that amount reported by the owner? How are changes in the fair value of available-for-sale securities reported?

Answer: Because no sale is anticipated in the near term, the fair value of available-for-sale shares will possibly go up and down numerous times before being sold. Hence, the current gain is not viewed as “sure enough.” As a result of this uncertainty, a change in the owner’s reported net income is not considered appropriate.

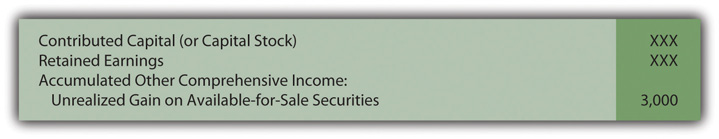

Instead, any unrealized gain (or loss) in the value of an investment that is classified as available-for-sale is reported within the stockholders’ equity section of the balance sheet. The figure is listed either just above or below the retained earnings account. A few other unrealized gains and losses are handled in this manner and are combined and reported as accumulated other comprehensive incomeA section of the stockholders’ equity of a balance sheet where unrealized gains and losses on available-for-sale securities (as well as a few other specified gains and losses) are shown rather than being presented on the reporting company’s income statement. as shown in Figure 12.8 "Stockholders’ Equity Including Accumulated Other Comprehensive Income".

Figure 12.8 Stockholders’ Equity Including Accumulated Other Comprehensive Income

Consequently, the primary difference in the financial accounting for trading securities and available-for-sale securities is in the placement of unrealized gains and losses from changes in value:

- Changes in the value of trading securities are reported in the income statement.

- Changes in the value of available-for-sale securities are shown in stockholders’ equity and not net income.

The described procedures were first created in 1993 and have been used since that time. Interestingly, in 2007, FASB passed a rule that allows companies to elect to report available-for-sale investments as trading securities. This option must be selected when the investment is purchased. Thus, if that election is made, the $3,000 unrealized gain is reported on the income statement despite the intention to hold the securities for an indefinite period. This is another example of accounting rules that are not as rigid as sometimes perceived.

Test Yourself

Question:

Company A buys shares of a well-known company in Year One for $130,000. Company officials plan to hold this investment for only a short period of time so that it is classified as a trading security. Coincidentally, Company B makes the same investment at the same time for the same cost. However, Company B officials expect to hold these shares indefinitely. Company B reports this investment as available-for-sale and does not elect to report it in the same manner as a trading security. Both companies continue to hold their investments at the end of the year when they are each worth $144,000. Which of the following is not true?

- Both companies will report their investment at $144,000.

- Net income will increase more for Company A than for Company B because of these investments.

- Company A reports other accumulated comprehensive income on the December 31, Year One, balance sheet of $14,000.

- Company B reports other accumulated comprehensive income on the December 31, Year One, balance sheet of $14,000.

Answer:

The correct answer is choice c: Company A reports other accumulated comprehensive income on the December 31, Year One, balance sheet of $14,000.

Explanation:

Both companies report the asset as $144,000, its fair value at the end of the year. Company A views these shares as trading securities so that the increase in value of $14,000 is reported as an unrealized gain in net income. However, Company B has classified the investment as available-for-sale. Thus, the $14,000 unrealized gain is not shown within net income but, rather, in stockholders’ equity as “other accumulated comprehensive income.”

The Sale of Available-For-Sale Securities

Question: Assume that Valente did not choose to report the available-for-sale investment as a trading security but rather by means of the traditional approach. Thus, the $3,000 unrealized gain created by the appreciation of value is reported within stockholders’ equity at the end of Year One. In Year Two, these shares are sold on the stock exchange for $27,000. What reporting is made at that time? How is the eventual sale of investments that are classified as available-for-sale securities reported?

Answer: When available-for-sale securities are sold, the difference between the original cost ($25,000) and the selling price ($27,000) appears as a realized gain (or loss) on the owner’s income statement. Because no change in net income was reported in the previous year, this entire amount has to be recognized at the date of sale. Having presented the unrealized gain within stockholders’ equity in Year One, the change in value only touches net income when sold.

However, mechanical complexities now exist. The investment has been adjusted to a $28,000 carrying amount, and a $3,000 unrealized gain still remains within stockholders’ equity. As a balance sheet account, this $3,000 figure is not closed out at the end of Year One. Therefore, when the investment is sold, both the $28,000 asset and the $3,000 unrealized gain must be removed. The net amount mirrors the $25,000 historical cost of these shares. By eliminating the previous gain in this manner, the asset is brought back to the original $25,000. Thus, as shown in Figure 12.9 "Sale of Available-for-Sale Security in Year Two", the appropriate realized gain of $2,000 is recognized. The shares were bought for $25,000 and sold for $27,000, and the previous unrealized gain is removed.

Figure 12.9 Sale of Available-for-Sale Security in Year Two

Test Yourself

Question:

Company A buys ownership shares of a well-known company for $68,000 in Year One and classifies the asset as an investment in trading securities. Company B also buys shares of this company on the same date for $68,000. However, the investment is reported by this owner as available-for-sale. Company B does not elect to report this investment in the same manner as a trading security. Both investments are worth $70,000 at the end of Year One. Both investments are sold in Year Two for $60,000. Which of the following is true?

- Company B reports a bigger gain on its income statement in Year One than does Company A.

- Company B reports a bigger loss on its income statement in Year Two than does Company A.

- Company A reports a bigger loss on its income statement in Year One than does Company B.

- Company A reports a bigger loss on its income statement in Year Two than does Company B.

Answer:

The correct answer is choice d: Company A reports a bigger loss on its income statement in Year Two than does Company B.

Explanation:

Company A reports a trading security; the $2,000 increase in value is an income statement gain in Year One. The $10,000 drop in value is an income statement loss in Year Two. Because Company B reports these shares as available-for-sale, no income effect is recognized in Year One. In Year Two, the $8,000 difference between cost and amount received is a loss on the income statement. The gain reported by Company A is larger in Year One but the loss reported by Company A is larger in Year Two.

The Reporting of Comprehensive Income

Question: In Year One, Valente’s investment in the shares of Bayless Corporation rose in value by $3,000. As discussed earlier, if those securities are classified as available-for-sale, the unrealized gain does not impact reported net income but, rather, stockholders’ equity. This handling is justified because a number of additional changes in value (both increases and decreases) are likely to take place prior to the eventual sale of the investment.

As a result, the net income figure reported by Valente seems a bit misleading. It does not include the increase in the reported worth of this asset. Are decision makers well-served by an income figure that omits certain gains and losses? Assume, for example, that Valente reports total net income for Year One of $80,000. This figure includes no part of the $3,000 unrealized gain. What reporting is necessary to help investors and creditors understand the impact on income of a change in value when investments are labeled as available-for-sale?

Answer: As noted, changes in the value of available-for-sale securities create unrealized gains or losses that appear in the stockholders’ equity section of the balance sheet but not in net income. The completeness of reported net income in such situations can be questioned.

To help decision makers better evaluate reporting companies with such unrealized items, a second income figure is presented that does include these gains or losses. The resulting balance, known as comprehensive incomeNet income plus any unrealized gains and less any unrealized losses that appear in stockholders’ equity rather than within net income., is shown within a company’s financial statements. In Figure 12.10 "Net Income Converted to Comprehensive Income", by adding in the $3,000 change in fair value, Valente’s net income figure is adjusted to the more complete total.

Figure 12.10 Net Income Converted to Comprehensive Income

Decision makers can choose to emphasize one figure (net income) or another (comprehensive income) in their analysis of a reporting company. More appropriately, they can view these two figures as simply different ways to portray the results of the current year and make use of both.

Comprehensive income includes all changes in stockholders’ equity other than (a) amounts contributed by stockholders and (b) dividend distributions made to stockholders. Unrealized gains and losses on available-for-sale securities are common but several other unrealized gains and losses are also included in moving from net income to comprehensive income.

Sometimes comprehensive income makes a company appear more successful, sometimes less so. For example, for the year ended December 31, 2010, Yahoo! Inc. reported its net income as $1.245 billion. However, the financial picture seems improved by disclosure of comprehensive income for the period of $1.367 billion. Conversely, The Dow Chemical Company reported net income for the same year of $2.321 billion but comprehensive income of only $1.803 billion.

Test Yourself

Question:

The Jelanizada Company reports revenue of $800,000 in Year One along with expenses of $700,000. In addition, the company bought shares of a publicly held company for $50,000 that was worth $70,000 by year’s end. This investment was reported as available-for-sale. Which of the following is true?

- Jelanizada should report net income for Year One of $80,000.

- Jelanizada should report net income for Year One of $120,000.

- Jelanizada should report comprehensive income for Year One of $100,000.

- Jelanizada should report comprehensive income for Year One of $120,000.

Answer:

The correct answer is choice d: Jelanizada should report comprehensive income for Year One of $120,000.

Explanation:

As an investment in an available-for-sale security, the $20,000 increase in value is reported as a gain in other accumulated comprehensive income in the stockholders’ equity section of the balance sheet. Net income is revenue minus expenses or $100,000 ($800,000 less $700,000). The gain, though, must then be included in arriving at a more inclusive comprehensive income figure of $120,000 (net income of $100,000 plus gain of $20,000).

Key Takeaway

Investments in equity securities are often held by the owner for an indefinite period of time. As such, the asset is classified as available-for-sale and shown at fair value each period. Any change in the reported amount is not included in net income but is rather listed within accumulated other comprehensive income in the stockholders’ equity section of the balance sheet. However, dividends that are received from the investment are reported as revenue and do impact the computation of net income. When eventually sold, the difference between the original cost of the securities and the proceeds received is reported as a gain or loss shown within net income. Because the periodic changes in value are not factored into the calculation of net income, they are included in the calculation of comprehensive income. Thus, both net income and comprehensive income are reported to decision makers to provide them with a better understanding of the impact of these unrealized gains and losses.