This is “Accounting for Investments in Trading Securities”, section 12.1 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

12.1 Accounting for Investments in Trading Securities

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Realize that the financial reporting of investments in the ownership shares of another company depends on the purpose of the acquisition.

- Explain the characteristics of investments that are classified as trading securities.

- Account for changes in the value of investments in trading securities and understand the rationale for this handling.

- Record dividends received from investments that are classified as trading securities.

- Determine the gain or loss to be recorded on the sale of a trading security.

The Reasons Why One Company Buys Ownership Shares of Another

Question: Businesses frequently acquire ownership shares (often referred to as equity or capital shares) of other companies. On September 30, 2011, Microsoft disclosed that it held “equity and other investments” reported at nearly $8.6 billion. Many such investments are only made to acquire a small percentage of the ownership. However, that is not always the case. In April, 2011, Johnson & Johnson announced the $21.3 billion purchase of Swiss medical device maker Synthes Inc. Whether a few shares are bought, or the entire company is bought, such investments offer many potential benefits. What are the most common reasons for one company to buy the ownership shares of another company?

Answer: Potentially, many benefits can accrue from obtaining shares of the capital stock issued by another business. Interestingly, the specific method of financial reporting depends on the owner’s purpose for holding such investments. Thus, the accounting process here is quite unique. The reporting of most assets (such as inventory and equipment) does not vary because of the rationale for making the purchase and then retaining the property. In contrast, the accounting process used to report the ownership of stock in another company falls within one of several methods based solely on the reason for the investment.

Companies frequently find that they are holding excess cash not needed at the moment for operating purposes. Such money can be temporarily invested to increase net income. Traditional savings accounts or money market funds offer only very low returns. Company officials often seek greater profit by using surplus money to buy the ownership shares of other organizations. The hope is that the market price of these shares will appreciate in value and/or dividends will be received before the cash is needed for operations. Such investments can be held for a few days (or even hours) or many years. Although earnings can improve through this strategy, the buyer does face additional risk. Share prices do not always go up. They can also decline in value, resulting in losses for the investor.

When equity shares are bought solely as a way to store cash and increase profits, the investor has no desire to influence or control the decisions of the other company. That is not the reason for the purchase; the ownership interest is much too small.

Investors, though, may also embrace a strategy of acquiring enough shares to gain some degree of influence over the other organization. Often, profitable synergies can be developed by having two companies connected in this way. For example, as of October 3, 2010, Starbucks Corporation held 39.9 percent of the outstanding stock of Starbucks Coffee Japan Ltd. Starbucks does not own a sufficient number of shares to controlAccording to U.S. GAAP, it exists when one company owns more than 50 percent of the outstanding common shares of another company so that the parent can direct all decision making; for external reporting purposes, the financial information of both companies must be consolidated to form a single set of financial statements. the operations of the Japanese company, but it certainly can apply significant influence if it so chooses.

Finally, as in the acquisition of Synthes by Johnson & Johnson, the investor may seek to obtain a controlling interest in the other company (in U.S. GAAP that is viewed as being over 50 percent of the outstanding capital stock). In many cases, the parent company chooses to buy 100 percent ownership of the other business to gain complete control. Such acquisitions are common as large companies attempt to (a) move into new industries or geographical areas, (b) become bigger players in their current markets, (c) gain access to valuable assets, or (d) eliminate competitors. Many smaller companies are started by entrepreneurs with the specific hope that success will attract acquisition interest from a larger organization. Often, significant fortunes are earned by the original owners as a result of the sale of their company to a bigger business.

Trading Securities

Question: As can be seen in the previous answer, several different reasons exist for buying capital stock. Applicable accounting rules can best be demonstrated by focusing on one of these types of investments at a time.

Assume that Valente Corporation is holding $25,000 in cash that it will not need for several weeks. This money is currently in a money market fund earning only a 1 percent annual rate of return. In hopes of generating a higher profit, the president of Valente has studied the financial statements of Bayless Corporation, a company with capital stock trading on the New York Stock Exchange for $25 per share. By November 30, Year One, the president has come to believe that Bayless stock will make a rather significant jump in market price in the near future. Consequently, Valente uses the $25,000 to acquire one thousand shares of stock in Bayless that will be held for only a few weeks or months. How does a company report an equity investment that is bought with the expectation that the shares will be sold shortly after the purchase is made?

Answer: If management intends to sell the equity shares of another company shortly after buying them, the purchase is classified on the balance sheet as an investment in trading securitiesClassification of investments in stocks and bonds when management’s intentions are to sell them quickly in the near term; they are reported as assets on the balance sheet at fair value with all changes in value affecting net income.. On the acquisition date, as shown in Figure 12.1 "Purchase of Ownership Shares Classified as Trading Securities", the asset is recorded by Valente at historical cost.

Figure 12.1 Purchase of Ownership Shares Classified as Trading Securities

As an owner, even if the shares are only held for a short time, Valente might receive a cash dividend from Bayless. Many companies distribute dividends to their stockholders periodically as a way of sharing a portion of any income that has been earned.

Assume that Bayless has been profitable and, as a result, a $0.20 per share cash dividend is declared by its board of directors and paid in December, Year One. Valente receives $200 of this dividend ($0.20 per share × 1,000 shares), which is reported as revenue on the owner’s Year One income statement. The journal entry is presented in Figure 12.2 "Receipt of Dividend from Investment in Stock".

Figure 12.2 Receipt of Dividend from Investment in Stock

Because of the short-term nature of this investment, Valente might sell these shares prior to the end of Year One. The purchase of Bayless stock was made anticipating a quick sale. Consequently, a gain is reported if more than $25,000 is received, whereas a loss results if the shares are sold for less than $25,000. Such gains and losses appear on the owner’s income statement when created by the sale of a trading security.

The Value of Trading Securities at Year’s End

Question: The accounting process for trading securities becomes more complicated if Valente continues to own this investment in Bayless at year end. Should equity shares held as a trading security be reported on the owner’s balance sheet at historical cost or current fair value? Which reporting provides the most helpful information to outside decision makers?

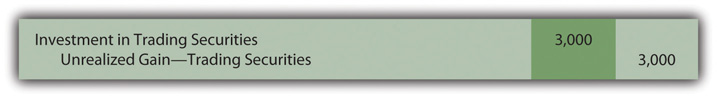

Answer: U.S. GAAP requires investments in trading securities to be reported on the owner’s balance sheet at fair value. Therefore, if the shares of Bayless are worth $28,000 at December 31, Year One, Valente must adjust the reported value from $25,000 to $28,000 by reporting a gain as shown in Figure 12.3 "Shares of Bayless (a Trading Security) Adjusted to Fair Value at End of Year One".

Figure 12.3 Shares of Bayless (a Trading Security) Adjusted to Fair Value at End of Year One

The gain here is labeled as unrealizedA gain or loss created by an increase or decrease in the value of an asset although not yet finalized by a sale. to indicate that the value of the asset has appreciated but no final sale has yet taken place. Therefore, the gain is not guaranteed; the value might go back down before the shares are sold. However, the $3,000 unrealized gain is reported on Valente’s Year One income statement so that net income is affected.

Test Yourself

Question:

James Attenborough is studying the financial statements published for the Hawthorne Roberts Corporation. This company owns shares in Microsoft and several other companies. Consequently, it reports an investment in trading securities account on its year-end balance sheet as an asset with a balance of $18,765. What does that figure represent?

- It is impossible to tell without reading the notes to the financial statements.

- The $18,765 was the historical cost of these shares.

- The $18,765 is the fair value of the shares on the balance sheet date.

- The $18,765 is the lower of the cost or market value of these shares at the end of the year.

Answer:

The correct answer is choice c: The $18,765 is the fair value of the shares on the balance sheet date.

Explanation:

Investments in trading securities are held for a relatively quick sale. They are always reported at fair value regardless of whether that figure is above or below the cost of acquisition. Fair value is easy to determine and the company knows that it can get that amount on the balance sheet date.

Reporting Trading Securities at Fair Value

Question: The reporting demonstrated above for an investment in a trading security raises a theoretical question that has long been debated in financial accounting. Is recognizing a gain in the value of a trading security (or a loss if the stock price has declined) on the owner’s income statement appropriate before an actual sale takes place? In this illustration, for example, a $3,000 gain is reported, but the value of these shares might suddenly plummet and eliminate that gain prior to a sale. The gain might never be received. In previous chapters, assets such as buildings and inventory were never adjusted to fair value unless impairment had taken place. Why is an investment in a trading security always reported at fair value regardless of whether that value is above or below historical cost?

Answer: Changes in the value of trading securities are recognized and the resulting gains or losses are included within current net income for several reasons:

- The Bayless shares sell on a stock exchange. Thus, the reported value of $28,000 can be objectively determined. It is not an estimated amount subject to manipulation as is the fair value of assets such as buildings and inventory.

- The stock can be sold immediately; Valente does not even have to find a buyer. The stock exchange provides a workable mechanism to create a sale whenever the owner wants to liquidate the investment. No question exists that these shares can be sold at any time. Once again, the same assertion cannot be made for assets such as buildings and inventory.

- As a trading security, a sale is anticipated in the near term. The owner does not plan to hold the stock for a long period of time. Further changes in value can certainly take place but are less likely to be severe. The shortness of time limits the chance of radical fluctuations in value after the balance sheet date.

For these reasons, U.S. GAAP requires that investments in trading securities be reported on the owner’s balance sheet at fair value ($28,000 in this example). Therefore, Valente will report both the dividend revenue of $200 and the unrealized gain of $3,000 on its Year One income statement.

If, instead, the fair value at year-end had been only $21,000, a $4,000 unrealized loss appears on Valente’s income statement to reflect the decline in value ($25,000 historical cost dropping to $21,000 fair value).

Test Yourself

Question:

During Year One, Hancock Corporation buys 2,000 shares of Waltz Inc. for $34 per share. Hancock appropriately records this acquisition as an investment in trading securities because it plans to make a sale in the near future. In December of Year One, Waltz pays a $1 per share cash dividend to its owners. On the last day of December, the stock is selling on a stock exchange for $39 per share. What is the impact of these events on the income reported by Hancock for Year One?

- No effect

- Increase of $2,000

- Increase of $10,000

- Increase of $12,000

Answer:

The correct answer is choice d: Increase of $12,000.

Explanation:

The dividend that is received ($2,000 or $1.00 per share × 2,000 shares) is reported as revenue by the recipient (Hancock). In addition, because these shares are classified as trading securities, the change in value this year also impacts net income. The price of the stock went up $5 per share ($39 less $34) so that Hancock reports a gain of $10,000 ($5 per share × 2,000 shares). Total increase in income reported by Hancock is $12,000 ($2,000 plus $10,000).

The Sale of a Trading Security

Question: In this ongoing illustration, Valente Corporation bought one thousand shares of Bayless Corporation which it planned to sell in a relatively short period of time. At the end of Year One, this trading security was adjusted from the historical cost of $25,000 to its fair value of $28,000. The $3,000 unrealized gain was reported within net income on the Year One income statement.

Assume that these shares are sold by Valente on February 3, Year Two, for $27,000 in cash. What financial reporting is appropriate when an investment in trading securities is sold in a subsequent period? What effect does this final transaction have on reported income?

Answer: Following the Year One adjustment, this investment is recorded in the general ledger at the fair value of $28,000 rather than historical cost. When eventually sold, any difference between the sales price and this carrying amount is recorded as a gain or a loss on the Year Two income statement.

Because the sales price of these shares ($27,000) is less than the balance now being reported ($28,000), recognition of a $1,000 loss is appropriate, as can be seen in Figure 12.4 "Sale of Shares of Bayless (a Trading Security) for $27,000 in Year Two". This loss reflects the drop in value of the shares that took place during Year Two.

Figure 12.4 Sale of Shares of Bayless (a Trading Security) for $27,000 in Year Two

This investment was originally bought for $25,000 and later sold for $27,000 so an overall gain of $2,000 was earned. For reporting purposes, this income effect is spread between the two years of ownership. A gain of $3,000 was recognized in Year One to reflect the appreciation in value during that period of time. Then, in Year Two, a loss of $1,000 is reported because the stock price fell by that amount prior to being sold.

Investments in trading securities are always shown on the owner’s balance sheet at fair value. The gains and losses reported in the income statement will parallel the movement in value that took place each period.

Test Yourself

Question:

Late in Year One, a company buys one share of a publicly traded company for $75. This investment is reported as a trading security because the owner plans to sell the stock in the near future. At the end of Year One, this share is only worth $62. However, early in Year Two, the stock price soars to $80 and the stock is sold. A $2 cash dividend is also received by the owner in January of Year Two. What is the reported income effect of this ownership?

- No change in income in Year One but a $5 increase in Year Two.

- No change in income in Year One but a $7 increase in Year Two.

- Net income is reduced $13 in Year One but an $18 increase in Year Two.

- Net income is reduced $13 in Year One but a $20 increase in Year Two.

Answer:

The correct answer is choice d: Net income is reduced $13 in Year One but a $20 increase in Year Two.

Explanation:

As a trading security, the $13 drop in value in Year One ($75 less $62) is reported as a loss on the owner’s income statement. Then, the $18 rise in value in Year Two ($80 less $62) increases net income. In addition, the $2 dividend increases the Year Two income reported by the owner bringing it up to $20.

Key Takeaway

Many companies acquire the equity shares of other companies as investments. The applicable accounting procedures depend on the purpose for the ownership. If the stock is only to be held for a short period of time, it is labeled a trading security. The investment is then adjusted to fair value whenever financial statements are to be produced. Any change in value creates a gain or loss that is reported within net income because fair value is objectively determined, the shares can be liquidated easily, and a quick sale is anticipated before a significant change in fair value is likely to occur. Dividends received by the owner are recorded as revenue. Whenever trading securities are sold, only the increase or decrease in value during the current year is reported within net income since earlier changes have already been reported in that manner.