This is “In a Set of Financial Statements, What Information Is Conveyed about Intangible Assets?”, chapter 11 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 11 In a Set of Financial Statements, What Information Is Conveyed about Intangible Assets?

Video Clip

(click to see video)In this video, Professor Joe Hoyle introduces the essential points covered in Chapter 11 "In a Set of Financial Statements, What Information Is Conveyed about Intangible Assets?".

11.1 Identifying and Accounting for Intangible Assets

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- List the characteristics of intangible assets and provide several common examples.

- Understand that intangible assets are becoming more important to businesses and, hence, are gaining increased attention in financial accounting.

- Record the acquisition of an intangible asset.

- Describe the amortization process for intangible assets.

- Explain the accounting used to report an intangible asset that has increased in value since acquisition.

The Rise in the Importance of Intangible Assets

Question: Not so many years ago, the balance sheets of most large companies disclosed significant amounts of property and equipment but considerably smaller figures for intangible assetsAn asset lacking physical substance that is expected to help generate revenues for more than one year; common examples are patents, copyrights, and trademarks.. Businesses were often referred to as “bricks and mortar” operations because much of their money was invested in buildings and the long-lived tangible assets that were housed in those buildings.

Today, the basic nature of many corporate operations has changed dramatically. As of June 30, 2011, Microsoft Corporation reported a total of $13.3 billion for its “goodwill” and “intangible assets, net” versus only $8.2 billion in “property and equipment, net of accumulated depreciation.” For Yahoo! Inc., the difference is similarly striking. On December 31, 2010, Yahoo! disclosed $3.9 billion of “goodwill” and “intangible assets, net” but a mere $1.7 billion in “property and equipment, net.”

The rise in the number, value, and importance of intangible assets might well be the biggest change experienced in the reporting of businesses over the last ten to twenty years. The sudden growth of Internet and technology companies like Microsoft and Yahoo! has focused attention on the significance of ideas and innovation (rather than bricks and mortar) for achieving profits.

Financial accounting rules must evolve as the nature of business moves forward over time. Not surprisingly, considerable debate has taken place recently concerning the methods by which intangible assets are reported in a set of financial statements. A relatively minor topic in the past has gained a genuine level of importance in today’s accounting conversations. Should an idea or an invention be reported in the same manner as a building or a machine? For financial accounting, that is a very important question. As a starting point for this discussion, the basic nature of an intangible asset needs to be understood. What is an intangible asset and what are common examples?

Answer: As the title implies, an intangible asset is one that lacks physical substance. It cannot be touched but is expected to provide future benefits for longer than one year. More specifically, it will assist the reporting company in generating revenues in the future. Except for a few slight variations, intangible assets are reported in the same manner as a building or equipment. For example, historical cost serves as the basis for reporting. If the intangible has a finite life, the depreciation process (although the term amortizationA mechanically derived pattern allocating the cost of an intangible asset to expense over the shorter of the legal life or estimated useful life; it is the equivalent of depreciation but relates to intangible assets. is normally applied in reporting intangibles) reclassifies this cost from asset to expense over that estimated period.

U.S GAAP provides structure for the reporting process by placing all intangibles into six major categories:

- Artistic-related (such as copyrightsAn intangible asset that provides the owner with the right to use literary, dramatic, musical, artistic, and certain other intellectual works.)

- Technology-related (patents)

- Marketing-related (trademarks)

- Customer-related (a database of customer information)

- Contract-related (franchises)

- Goodwill

In all of these categories (except for goodwill, which will be explained later in this chapter), the intangible asset is actually an established right of usage. As an example, according to the Web site for the United States Copyright Office, a copyright provides its owner with the right to use “literary, dramatic, musical, artistic, and certain other intellectual works.” Similarly, the United States Patent and Trademark Office Web site explains that “a patent for an invention is the grant of a property right to the inventor.” Thus, most intangible assets represent a legal right that helps the owner to generate revenues.

Test Yourself

Question:

The Weddington Company reports a number of assets on its balance sheet. Which of the following should not be included as an intangible asset?

- Copyright

- Account receivable

- Patent

- Franchise

Answer:

The correct answer is choice b: Account receivable.

Explanation:

An intangible asset is one with no physical substance that provides a company with future benefit, usually a legal or contractual right, that helps to generate revenues for a period of over one year. Accounts receivable are not usually outstanding for that length of time and do not assist in the generation of future revenues. They help bring in cash that was earned in the past. Copyrights, patents, and franchises are rights that can be owned or controlled and are used to produce revenues.

The Acquisition of an Intangible

Question: Intangible assets are accounted for in a manner that is similar to property and equipment. To illustrate, assume that an automobile company is creating a series of television commercials for one of its new models. On January 1, Year One, the company pays $1 million cash to a famous musical group for the right to use a well-known song. The band holds the legal copyright on this piece of music and agrees to share that right with the automobile company so that the song can be played in one or more commercials. What accounting is made by a company that acquires an intangible asset such as a copyright?

Answer: The buyer of an intangible asset prepares a journal entry that is basically identical to the acquisition of inventory, land, or a machine. As with all those other assets, the intangible is recorded initially at historical cost.

Figure 11.1 January 1, Year One—Acquisition of Right to Use Copyrighted Song

Many intangible assets have defined legal lives. For example, copyrights last for seventy years beyond the creator’s life. Acquired intangibles (such as the copyright for this song) often have lives legally limited by contractual agreement. However, the true useful life of most intangibles is generally only a small number of years. Few intangibles manage to help a company generate revenues for decades. Amortization of the cost to expense should extend over the shorter of the asset’s useful life or its legal life.

Assume that this piece of music is expected to be included by the automobile company in its television commercials for the next four years. After that, a different advertising campaign will likely be started. If the straight-line method is applied (which is normal for intangible assets), annual amortization of this copyright is $250,000 ($1 million cost/4 year life).

Figure 11.2 December 31, Year One—First Year Amortization of Copyright Cost

At the end of the first year, the copyright appears on the automobile company’s balance sheet as $750,000, the remainder of its historical cost. As can be seen in Figure 11.2 "December 31, Year One—First Year Amortization of Copyright Cost", the credit in this adjusting entry is a direct decrease in the asset account. Although establishing a separate contra account (such as accumulated amortization) is permitted, most companies simply reduce the intangible asset balance because the utility is literally shrinking. Depreciation of a building or equipment does not mean that the asset is getting smaller. A four-story building remains a four-story building throughout its life. Reducing the building account directly is not a reflection of reality. In contrast, the right to use this song does get smaller over time. The automobile company went from holding a copyright to play this music in its commercials for an expected four years to a copyright that will likely only be used for three more years. A direct reduction of the cost is more appropriate.

Intangible Assets and Fair Value

Question: In this example, the automobile company acquired the right to use this music for $1 million. That was historical cost, the figure to be reported for intangible assets on the company’s balance sheet. The number was objectively determined and the accounting straightforward. However, the artist who originally created the music (or his or her recording company) still holds the original copyright. As indicated by the sale, the rights to this music are extremely valuable. How does the creator report an intangible asset such as a copyright? Should the copyright to this piece of music now be reported by the artist at its proven value of $1 million?

Answer: Depending on the specific terms of the contract, the creator often continues to possess the copyright and maintains that asset on its own balance sheet. In many cases, the original artist only conveys permission to a buyer to use this music (or other intellectual work) for specific purposes or a set period of time. However, the copyright is not adjusted on the creator’s books to this $1 million value; rather, it remains at historical cost less any amortization to date. That is the reporting basis for intangible assets according to U.S. GAAP in the same way as for land, buildings, and equipment. The figure shown on the balance sheet is not increased to reflect a rise in fair value.

The reported amount shown for copyrights and other similar intangibles contains all normal and necessary costs such as attorney fees and money spent for legal filings made with appropriate authorities. Subsequently, such intangible assets sometimes become the subject of lawsuits if other parties assert claims to the same ideas and creations. The cost of a successful defense is also capitalized and then amortized over the shorter of the remaining legal life or estimated useful life of the asset. If the defense proves unsuccessful, the remaining asset balance is written off as a loss.

Test Yourself

Question:

John Doe successfully creates an invention and, on January 1, Year One, receives a patent that gives him the exclusive rights to that invention for twenty years. One year later, John Doe sells all of his rights to the patent to Nahquan Corporation for $3 million. Nahquan pays another $400,000 to a legal firm to help ensure that the right is properly transferred. Nahquan hopes to use the patent for five years and then sell it for $200,000. On December 31, Year Two, another company offers to pay Nahquan $4 million for this intangible asset but that amount is rejected as being too low. On its balance sheet at that time, what balance is reported by Nahquan for the patent?

- $2,560,000

- $2,760,000

- $3,040,000

- $3,221,053

Answer:

The correct answer is choice b: $2,760,000.

Explanation:

The capitalized cost of this asset is $3.4 million—the normal and necessary amount to acquire the patent so that it can be used to generate revenues. Annual amortization is $640,000 ([$3.4 million less $200,000 residual value] divided by five-year life). After one year, reported value is $2,760,000 ($3.4 million less $640,000). The $4 million offer does not affect the balance since it was not accepted. Amortized historical cost is the basis for financial reporting unless the value is impaired.

Talking With an Independent Auditor about International Financial Reporting Standards

Following is a continuation of our interview with Robert A. Vallejo, partner with the accounting firm PricewaterhouseCoopers.

Question: Under U.S. GAAP, intangible assets with a finite life are reported at historical cost less any accumulated amortization recognized to date. Except in impairment cases, fair value is ignored completely. How are intangible assets reported when IFRS standards are applied?

Robert Vallejo: Unless a company chooses to revalue its intangible assets regularly (an option that is available under IFRS but that is rarely chosen because the process must then be done every reporting period), the accounting under U.S. GAAP and IFRS is basically the same. After initial recognition under IFRS, intangible assets are carried at cost less accumulated amortization (as well as any impairment losses). If an active market is available, similar intangible assets can then be adjusted to fair value but, again, that value must be updated each reporting period. Per IAS 38, Intangible Assets, the method of amortization that is used should reflect the pattern in which the asset’s future economic benefits are expected to be realized by the entity. If that pattern cannot be determined reliably, the straight-line method of amortization must be used.

Key Takeaway

The financial reporting of intangible assets has grown in significance in recent years because of the prevalence and success of businesses in industries such as technology and electronics. For the most part, intangible assets provide the owner with a legal right to use an idea, invention, artistic creation, or the like. Copyrights, patents, and trademarks are common examples. An intangible is recorded initially at historical cost. Most of these assets have a finite life, so the cost is then amortized to expense over the shorter of the legal life or estimated useful life. Consequently, intangible assets appear on the owner’s balance sheet at net book value. Amortization is usually reflected as a direct reduction in the asset balance rather than indirectly through a separate contra account. Other than this difference, accounting for intangibles resembles that used with property and equipment so that, for example, increases in value are not reported.

11.2 Balance Sheet Reporting of Intangible Assets

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Explain the theoretical rationale for using historical cost as the basis for reporting intangible assets as well as long-lived assets such as equipment.

- Understand that using historical cost as the accounting basis means that a company’s intangible assets can actually be worth much more than is shown on the balance sheet.

- Recognize that intangible assets with large monetary balances can result from acquisition either individually or through the purchase of an entire company that holds valuable intangible assets.

- Describe the method of recording intangible assets when the company that owns them is acquired by another company.

Reporting Historical Cost for Intangible Assets Rather Than Fair Value

Question: Much was made in earlier chapters about the importance of painting a portrait that fairly presents the financial health and future prospects of an organization. Many companies develop copyrights and other intangible assets that have incredible value but little or no actual cost.

Trademarks provide an excellent example. The golden arches that represent McDonald’s must be worth many millions, but the original design cost was probably not significant and has likely been amortized entirely to expense by now. Could the balance sheet of McDonald’s possibly be considered fairly presented if the value of its primary trademark is omitted?

Many other companies, such as Walt Disney, UPS, Google, Apple, Coca-Cola, and Nike, rely on trademarks to help create awareness and brand loyalty around the world. Are a company’s reported assets not understated if the value of a trademark is ignored despite serving as a recognizable symbol to millions of potential customers? With property and equipment, this concern is not as pronounced because those assets tend to have significant costs whether bought or constructed. Internally developed trademarks and other intangibles often have little actual cost despite the possibility of gaining immense value.

Answer: Figures reported for intangible assets such as trademarks may indeed be vastly understated on a company’s balance sheet when compared to fair values. Decision makers who rely on financial statements need to understand what they are seeing. U.S. GAAP requires that companies follow the historical cost principle in reporting many assets. A few exceptions do exist, and several are examined at various points in this textbook. For example, historical cost may have to be abandoned when applying the lower-of-cost-or-market rule to inventory. The same is true when testing property and equipment for possible impairment losses. Those departures from historical cost were justified because the asset had lost value and financial accounting tends to be conservative. Reporting an asset at a balance in excess of its historical cost basis is much less common.

In financial accounting, what is the rationale for the prevalence of historical cost, which some might say was an obsession? As discussed in earlier chapters, cost can be reliably and objectively determined. It does not fluctuate from day to day throughout the year. It is based on an agreed-upon exchange price and reflects a resource allocation judgment made by management. Cost is not a guess, so it is less open to manipulation. Although fair value may appear to be more relevant, various parties might arrive at significantly different estimates of worth. What is the true value of the golden arches to McDonald’s as a trademark? Is it $100 million or $10 billion? Six appraisals from six experts could suggest six largely different amounts.

Plus, if the asset is not going to be sold, is the fair value of much relevance at the current time?

Cost remains the basis for reporting many assets in financial accounting, though the use of fair value has gained considerable momentum. It is not that one way is right and one way is wrong. Instead, decision makers need to understand that historical cost is the generally accepted accounting principle normally used to report long-lived assets such as intangibles. The use of historical cost does have obvious flaws, primarily that it fails to report any appreciation in value no matter how significant. Unfortunately, any alternative number that can be put forth as a replacement also has its own set of problems. At the present time, authoritative accounting literature holds that historical cost is the appropriate basis for reporting intangibles.

Even though fair value accounting seems quite appealing to many decision makers, accountants have proceeded slowly because of potential concerns. For example, the 2001 collapse of Enron Corporation was the most widely discussed accounting scandal to occur in recent decades. Many of Enron’s reporting problems began when the company got special permission (due to the unusual nature of its business) to report a number of assets at fair value (a process referred to as “mark to market”).Unique accounting rules have long existed in certain industries to address unusual circumstances. College accounting textbooks such as this one tend to focus on general rules rather than delve into the specifics of accounting as it applies to a particular industry. Because fair value was not easy to determine for many of those assets, Enron officials were able to manipulate reported figures to make the company appear especially strong and profitable.For a complete coverage of the history and ramifications of the Enron scandal, both the movie and the book The Smartest Guys in the Room are quite informative and fascinating. Investors then flocked to the company only to lose billions when Enron eventually filed for bankruptcy. A troubling incident of this magnitude makes accountants less eager to embrace the reporting of fair value except in circumstances where very legitimate amounts can be determined. For intangible assets as well as property and equipment, fair value is rarely so objective that the possibility of manipulation can be eliminated.

Test Yourself

Question:

The Consetti Company acquires a patent for $932,000 to be used in its daily operations. However, the value of this patent rises dramatically so that three years later, it is worth $3.2 million. Which of the following is not a reason that this fair value is ignored when the asset is reported on the Consetti’s balance sheet?

- Investors are not interested in the fair value of the patent or other intangible assets.

- Fair value can change often so that any one figure is not necessarily relevant for a long period of time.

- Different fair values might be estimated by different people.

- Noncurrent assets are acquired to help generate revenues and not for resale purposes.

Answer:

The correct answer is choice a: Investors are not interested in the fair value of the patent or other intangible assets.

Explanation:

Investors are likely to be interested in the fair value of all company assets because that information helps to assess the worth of the company and, hence, the possible sales price of its stock. However, accounting rules shy away from use of fair value for property and equipment as well as intangible assets. That value is no more than a guess and it can swing radically over time. Plus, if the asset is not for sale, fair value is not particularly relevant to the operations of the company.

Acquiring a Company to Gain Control of Its Intangibles

Question: Although a historical cost basis is used for intangible assets rather than fair value, Microsoft Corporation still reports $13.3 billion as “goodwill and intangible assets, net” while Yahoo! indicates similar balance sheet accounts totaling $3.9 billion. Even the size of these numbers is not particularly unusual for intangible assets in today’s economic environment. As of June 30, 2011, for example, the balance sheet for Procter & Gamble listed goodwill of $57.6 billion and trademarks and other intangible assets, net of $32.6 billion. If historical cost is often insignificant, how do companies manage to report such immense monetary amounts for their intangible assets?

Answer: Two possible reasons exist for a company’s intangible asset figures to grow to incredible size. First, instead of being internally developed, assets such as copyrights and patents are often acquired from outside owners. Reported asset balances then represent the historical costs of these purchases which were based on fair value at the time of the transaction. Large payments may be necessary to acquire such rights if their value has already been firmly established.

Second, Microsoft, Yahoo!, and Procter & Gamble could have bought one or more entire companies so that title to a multitude of assets (including a possible plethora of intangibles) was obtained in a single transaction. In fact, such acquisitions often occur specifically because one company wants to gain valuable intangibles owned by another. In February 2008, Microsoft offered over $44 billion in hopes of purchasing Yahoo! for exactly that reason. Yahoo! certainly did not hold property and equipment worth $44 billion. Microsoft was primarily interested in acquiring a wide variety of intangibles owned by Yahoo! Although this proposed takeover was never completed, the sheer size of the bid demonstrates the staggering value of the intangible assets that companies often possess today.

If a company buys a single intangible asset directly from its owner, the financial reporting follows the pattern previously described. Whether the asset is a trademark, franchise, copyright, patent, or the like, it is reported at the amount paid. That cost is then amortized over the shorter of its estimated useful life or legal life. Intangible assets that do not have finite lives are not amortized and will be discussed later in this chapter.

Reporting the assigned cost of intangible assets acquired when one company (often referred to as “the parent”) buys another company (“the subsidiary”) is a complex issue discussed in more detail in Chapter 12 "In a Set of Financial Statements, What Information Is Conveyed about Equity Investments?". In simple terms, the subsidiary’s assets (inventory, land, buildings, equipment and the like) are valued and recorded at that amount by the parent as the new owner. The subsidiary’s assets and liabilities are consolidated with those of the parent. In this process, each intangible asset held by the subsidiary that meets certain requirements is identified and recorded by the parent at its fair value. The assumption is that a portion of the price conveyed to purchase the subsidiary is being paid to obtain these intangible assets.

To illustrate, assume Big Company pays $10 million in cash to buy all the capital stock of Little Company. Consolidated financial statements will now be necessary. Little owns three intangibles (perhaps a copyright, patent, and trademark) that are each worth $1 million. Little also holds land worth $7 million but has no liabilities. Little’s previous net book value for these assets is not relevant to Big, the new owner.

Following the takeover of Little, Big reports each of the intangibles on its balance sheet at its cost of $1 million (and the land at $7 million). The acquisition price is assumed to be the historical cost paid by Big to obtain these assets. A parent that buys many subsidiaries will frequently report large intangible asset balances as a result. When Big purchases Little Company, it is really gaining control of all these assets and records the transaction as shown in Figure 11.3 "Big Company Buys Little Company, Which Holds Assets with These Values".

Figure 11.3 Big Company Buys Little Company, Which Holds Assets with These Values

Test Yourself

Question:

The Tiny Company creates a logo for a product line and gets a copyright on it. The entire cost is $40,000, and the logo is expected to have a useful life of ten years. One year later, Gigantic Company buys all the ownership stock of Tiny Company. At that point in time, the logo has gained national prominence and is thought to be worth $400,000. If Gigantic prepares a consolidated balance sheet immediately after acquiring Tiny, what is reported for this logo?

- $36,000

- $400,000

- $436,000

- $440,000

Answer:

The correct answer is choice b: $400,000.

Explanation:

Because Gigantic bought Tiny, the assumption is made that a portion of the price that was paid for Tiny was made to acquire the logo at its fair value. Thus, to Gigantic, the historic cost of this asset is $400,000. The cost to Tiny is no longer relevant. The $400,000 will then be amortized to expense over the remaining life of the intangible.

Key Takeaway

Many intangible assets (such as trademarks and copyrights) are shown on the balance sheet of their creator at a value significantly below actual worth. They are reported at historical cost less all amortization since the date of acquisition. Development cost can be relatively low in comparison to the eventual worth of the right. However, because of conservatism, the amount reported for these assets is not raised to fair value. Such numbers are subjective and open to sudden fluctuations. Furthermore, if an intangible asset is not held for sale, fair value is of questionable relevance to current operations. Companies, though, often pay large amounts either to buy intangibles or entire companies that hold valuable intangibles. In accounting for a parent’s acquisition of a subsidiary, the amount paid is assigned to the identifiable assets of the subsidiary (both tangible and intangible) based on fair value at that date.

11.3 Recognizing Intangible Assets Owned by a Subsidiary

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Understand that only subsidiary intangible assets that meet either of two specific criteria are recognized separately by a parent following an acquisition.

- Explain the meaning of the asset goodwill.

- Compute and record the amount to be reported as goodwill on a consolidated balance sheet when a parent acquires another company as a subsidiary.

- Understand that amounts attributed to goodwill are not amortized to expense but rather are checked periodically for impairment of value.

Criteria for Recognizing Intangible Assets

Question: Most major businesses report some amount of intangible assets. These can be developed internally, bought individually, or obtained as part of the purchase of an entire company. Larger amounts usually come from the acquisition of a subsidiary by a parent. The accountant faces the challenge of determining which costs to capitalize and which costs to expense. Because of their very nature, identifying intangible assets is more difficult than identifying tangible assets. A computer is obviously an asset, but is a list of client names inside of that computer also an asset?

For example, when one company buys another, the subsidiary is often holding rights to numerous intangibles. As mentioned previously, company acquisitions often take place to gain those rights. The parent then places the assets that qualify on its balance sheet at fair value to show that a portion of the amount paid for the subsidiary was the equivalent of an acquisition price for these items. That is a major reason why companies such as Microsoft and Procter & Gamble report billions of dollars in intangibles. They have probably gained ownership of many of these assets by acquiring entire companies.

However, according to U.S. GAAP, certain requirements have to be met before intangibles are recognized as assets. What criteria must be satisfied for a company to record an intangible as an asset? A business could very well spend millions of dollars for scores of intangibles: patents, copyrights, databases, smart employees, loyal customers, logos, and the like. Which of these intangibles should actually be recognized on a balance sheet as an asset?

Answer: The rules for reporting intangible assets are best demonstrated through the acquisition of a subsidiary by a parent because large amounts are often spent for numerous items that might qualify as assets. In establishing rules for consolidated financial statements, FASB has stated that a parent company must identify all intangible assets held by a subsidiary on the date of acquisition. The fair value of each of these intangibles is recorded by the parent as an asset but only if contractual or other legal rights have been gained or the intangible can be separated and sold. This authoritative guideline serves as a minimum standard for recognition of intangible assets:

- Contractual or other legal rights have been gained or

- The intangible can be separated from the subsidiary and sold

Patents, copyrights, trademarks, and franchises clearly meet the first of these criteria. Legal rights are held for patents, copyrights, and trademarks while contractual rights allow the owner to operate franchises. By acquiring the subsidiary, the parent now controls these same rights and should record them on the consolidated balance sheet at fair value.

Other intangibles that can be separated from the subsidiary and sold should also be consolidated at fair value. For example, an acquired company might have a database containing extensive information about its customers. After purchasing the subsidiary, this information could be separated from that company and sold. Thus, on the date the subsidiary is purchased, the parent recognizes this database as an intangible asset at fair value to reflect the portion of the acquisition price paid to obtain it.

Test Yourself

Question:

Tree Company buys all the ownership stock of Leaf Company. Leaf holds one intangible worth $10,000, but it is not separately consolidated by Tree after the purchase. What is the most likely reason that this intangible was not included by the new parent?

- Leaf owned the intangible rather than Tree.

- The intangible did not have a finite life and, therefore, could not be viewed as an asset.

- Leaf must sell the intangible directly to Tree before it can be reported by the parent.

- Leaf did not have contractual or legal rights to the intangible and it could not be separated from the company and sold.

Answer:

The correct answer is choice d: Leaf did not have contractual or legal rights to the intangible and it could not be separated from the company and sold.

Explanation:

To be recognized as an intangible asset after a corporate takeover, FASB has set guidelines. Either the company must have contractual or legal rights in the intangible asset or it must be an item that could be separated from Leaf and sold. Without meeting one of these criteria, it is uncertain as to whether the subsidiary actually possesses something that will have value to the consolidated company.

Recognition of Goodwill

Question: When one company buys another, payment amounts will likely be negotiated to compensate the seller for intangibles where contractual or legal rights are held or where the asset can be separated and then sold. Thus, parent companies who buy subsidiaries (especially in industries such as technology) will likely recognize significant intangible asset balances on a subsequently consolidated balance sheet.

However, some intangibles have significant value but fail to meet either of these two criteria. Customer loyalty, for example, is vitally important to the future profitability of a business, but neither contractual nor legal rights are present and loyalty cannot be separated from a company and sold. Hence, customer loyalty is not reported as an intangible asset regardless of its worth. Much the same can be said for brilliant and creative employees. A value exists but neither rule for recognition is met.

During negotiations, the owners of a company that is being acquired will argue for a higher price if attributes such as these are in place because they provide increased profitability in the future. The amount paid to obtain a subsidiary can be impacted although these intangibles do not meet the criteria for separate reporting as assets. How is this additional acquisition cost reported by the parent in producing consolidated financial statements?

To illustrate, assume Giant Corporation pays $16 million to acquire Tiny Corporation. The subsidiary owns property and equipment worth $4 million. It also holds patents worth $6 million, a database worth $2 million, and copyrights worth $3 million. The total value of these four assets is only $15 million. For convenience, assume Tiny has no liabilities. Assume that Giant agrees to pay the extra $1 million because the subsidiary has customer loyalty valued at $600,000 and a talented workforce worth $400,000. How is this additional $1 million reported on consolidated financial statements after the takeover? What recording is appropriate when a parent buys a subsidiary and pays an extra amount because valuable intangibles are present that do not meet the criteria for separate reporting?

Answer: Every subsidiary intangible (such as patents, copyrights, and databases) that meets either of the official criteria is consolidated by the parent as an asset at fair value. Any excess price paid over the total fair value of these recorded assets (the extra $1 million in this example) is also reported as an asset. It has a definite cost and an expected future value. The term that has long been used to report an amount paid to acquire a company that exceeded all the identified and recorded assets is goodwillThe price paid by one company to acquire another that is in excess of the fair value of net identifiable assets and liabilities; this cost is often associated with intangibles that do not meet the criteria for accounting recognition, such as employee expertise and customer loyalty.. Some amount of goodwill is recognized as a result of virtually all corporate acquisitions. In this example, it specifically reflects the value of the customer loyalty and the quality of the subsidiary’s workforce.

If Giant pays $16 million for the stock of Tiny when its reportable assets have a value of only $15 million, the entry shown in Figure 11.4 "Giant Company Buys Tiny Company—$1 Million Paid in Excess of Fair Value of Identifiable Assets" is made by Giant to consolidate the two companies. The additional payment of $1 million is labeled as goodwill, which will then be reported along with the other intangible assets.

Figure 11.4 Giant Company Buys Tiny Company—$1 Million Paid in Excess of Fair Value of Identifiable Assets

Excess Payment for a Subsidiary Not Identified with an Intangible

Question: In the previous illustration, Giant (the parent) paid an extra $1 million for specified intangibles. However, the subsidiary’s customer loyalty and talented workforce could not be recognized separately as assets because they met neither of the required criteria. Instead, a goodwill balance was created.

Will the reporting be any different if the parent simply paid this amount as a result of intense negotiations? Assume, for example, that Giant agreed to pay the additional $1 million to obtain Tiny solely because that company’s owners refused to sell for less. That often happens in the business world. Giant believed that the $16 million price was still a good investment even though it required $1 million more than the value of the identified assets (tangible and intangible). If a parent pays an additional amount to purchase a subsidiary without a specific rationale, is this cost still recorded as goodwill?

Answer: The acquisition of one company by another can require months of bargaining between the parties. One company wants to collect as much as possible; the other wants to pay as little as possible. Compromise is frequently necessary to arrive at a figure that both parties are willing to accept. In most cases, the parent has to pay more than the sum of the value of all individual assets to entice the owners of the other company to sell.

Sometimes, as in the initial example, the reason for the added payment is apparent (customer loyalty and talented workforce). More likely, the increased amount is simply necessary in order to make the deal happen. Whenever an extra cost must be expended to gain control of a subsidiary, it is labeled by the parent as an asset known as goodwill. The rationale does not impact the accounting. Any additional acquisition price that was required to obtain a subsidiary appears in the parent’s balance sheet as goodwill and is shown as an intangible asset.

Test Yourself

Question:

Lance Company has three assets. The first is land with a cost of $700,000 and a fair value of $1 million. The second is a building with a net book value of $2 million but a fair value of $3 million. Finally, the company has a trademark that has no reported value (it has been fully depreciated) but is worth $400,000. The Empire Company offers $4.4 million for all the ownership shares of Lance. Lance owners counter with a price of $5.1 million. After nine days of negotiations, Empire pays $4.7 million to acquire Lance Company. When the financial statements of the two companies are consolidated, what amount will be reported as goodwill?

- Zero

- $300,000

- $700,000

- $2 million

Answer:

The correct answer is choice b: $300,000.

Explanation:

On consolidated statements after the takeover, Empire reports the land, building, and trademark at their fair values, which total $4.4 million. However, Empire paid an additional $300,000 ($4.7 million less $4.4 million) to convince the owners of Lance to sell. This payment is reported as the intangible asset goodwill. In this situation, it is not attributed to any specific value such as employee loyalty. It is the amount in excess of the individual fair values that the parent had to pay.

Accounting for Goodwill Over Time

Question: Buildings, equipment, patents, databases, and the like are all assets. They have reported costs that will be assigned to expense over an expected life as they help generate revenues. Goodwill is a different type of asset. It represents either (a) a subsidiary attribute (such as customer loyalty) that is too nebulous to be recognized specifically as an asset or (b) an extra payment made by the parent to acquire the subsidiary as a result of the negotiation process. What happens to a cost identified as the asset goodwill after the date a subsidiary is acquired?

How do Microsoft, Yahoo!, or Procter & Gamble account for their large goodwill balances over time? Is this asset like land that simply continues to be reported at historical cost potentially forever or, possibly, like equipment that is depreciated systematically over some anticipated useful life?

Answer: Because goodwill is the one asset on a balance sheet that is not tied to an identifiable benefit, no attempt is ever made to determine an anticipated life. Consequently, the assigned cost is not amortized to expense. A goodwill balance can remain unchanged on a consolidated balance sheet for decades after a subsidiary is purchased. However, the reported figure is reduced immediately if its value is ever judged to be impaired. Attributes such as customer loyalty or a talented workforce might continue in place for years or disappear completely in a short period of time. If goodwill is merely a premium paid to acquire a subsidiary, the justification for that excess amount could vanish because of poor management decisions or environmental factors. The value of all assets is tentative but probably none is more so than goodwill.

Although a cost recorded as goodwill is not amortized over time, its ongoing worth is not assumed. Instead, a test to check for any loss of that value is performed periodically. This verification process is more complex than can be covered in an introductory course. The result, though, is important to understand. In the event that the goodwill associated with a subsidiary is ever found to be worth less than its reported balance, an impairment loss is recorded. Although not identical, the accounting is similar in some ways to the impairment test for land, buildings, and equipment demonstrated previously.

In 2000, Time Warner and America Online (AOL) merged. Because of the perceived benefit of combining these two companies, a huge premium was paid and reported as goodwill on the consolidated balance sheet. A mere two years later, it was obvious that the anticipated synergies from this transaction had not developed as expected. In simple terms, too much money had been paid by the owners to create the merger. The value of the combined companies had not managed to achieve overly optimistic projections. Consequently, goodwill was reduced in 2002 by nearly $100 billion. A loss of that amount was reported by the consolidated company. The goodwill account was not amortized to expense, but the impairment of its value had to be recognized.

Test Yourself

Question:

Giant Company buys all the outstanding stock of Small Company on January 1, Year One. Subsequently, on the consolidated balance sheet as of December 31, Year Five, Giant and Consolidated Subsidiary reported a goodwill balance of $300,000. Which of the following is most likely to be true?

- $300,000 is the value of Small on this date in excess of the value of its assets minus its liabilities.

- $300,000 is the excess amount paid by Giant to acquire Small unless the value of that figure has become impaired since the purchase.

- $300,000 is the excess amount paid by Giant to acquire Small less any amortization since January 1, Year One.

- $300,000 is the fair value of the goodwill on December 31, Year Five.

Answer:

The correct answer is choice b: $300,000 is the excess amount paid by Giant to acquire Small unless the value of that figure has become impaired since the purchase.

Explanation:

Goodwill is initially recorded as the excess amount paid over the value of the identifiable assets and liabilities when a subsidiary is acquired. This figure stays unchanged because it is not subject to amortization unless the value is ever judged to have been impaired. If so, the recorded amount is reduced to recognize this loss of value.

Key Takeaway

When a parent acquires another company, all intangibles held by that subsidiary must be identified and consolidated at fair value if either of two criteria is met. Reporting these assets is necessary if legal or contractual rights are held or the intangible can be separated from the subsidiary and sold. Additional amounts are often included in the acquisition price of a subsidiary to compensate for intangibles (such as customer loyalty) that do not meet either of these criteria. An extra payment may also be necessary simply to entice the owner to sell. In either situation, this additional cost is reported as goodwill, an intangible asset that then appears on the consolidated balance sheet. Goodwill does not have an expected useful life. Consequently, the amount assigned to this intangible asset is not amortized to expense over time. Instead, the reported balance is checked periodically for impairment with a loss recognized if the value ever declines.

11.4 Accounting for Research and Development

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Define the terms “research” and “development.”

- Explain the problem that uncertainty creates for accountants in reporting research and development costs.

- Understand the required method of reporting research and development costs according to U.S. GAAP.

- Discuss the advantages of reporting research and development costs in the manner required by U.S. GAAP.

- Recognize that many companies report asset totals that are vastly understated as a result of the authoritative handling of research and development costs.

Reporting Research and Development Costs

Question: Many companies create internally developed intangibles such as copyrights and trademarks. One common intangible of this type is a patent, the right to make use of an invention. The creation and nurturing of an idea so that it can eventually earn a patent and be offerred for sale often takes years. The monetary amounts spent in this way to arrive at new marketable products are often enormous. The risk of failure is always present.

Such expenditures are essential to the future success of a great many companies. In 2010 alone, Intel reported spending $6.6 billion on researchThe attempt to find new knowledge with the hope that the results will eventually be useful in creating new products or services or significant improvements in existing products or services; these costs are expensed as incurred according to U.S. GAAP. and developmentThe translation of new knowledge into actual products or services or into significant improvements in existing products or services; these costs are expensed as incurred according to U.S. GAAP. in hopes of discovering new products to patent and sell. During the same one-year period, Bristol-Myers Squibb incurred costs of $3.6 billion on research and development. Those are clearly not inconsequential amounts. What is meant by the term “research”? What is meant by the term “development”? If a company such as Intel or Bristol-Myers Squibb spends billions on research and development each year, what accounting is appropriate? Should an asset or expense be recognized or possibly some combination? The outcome is uncertain, but the money was spent under the assumption that future economic benefits would be derived.

For example, assume that a technological company or a pharmaceutical company spends $1 million in Year One to do research on Future Product A. The company then spends another $1 million during the same period on development costs for Future Product A. At the end of this year, officials believe that a patent is 80 percent likely for Future Product A. If the patent is received, sales can be made.

Also during that time, the company spends another $1 million in research and $1 million in development in connection with Future Product B. However, at year’s end, the same officials are less optimistic about these results. They believe that only a 30 percent chance exists that this second product will ever receive a patent so that it can be used to generate revenues. According to U.S. GAAP, what reporting is appropriate for the cost of these two projects?

Answer: Definitions are easy to recite.

- Research is any attempt made to find new knowledge with the hope that those results will eventually be useful in creating new products or services or significant improvements in existing products or services.

- Development is the natural next step. It is the translation of that new knowledge into actual products or services or into significant improvements in existing products or services.

In simple terms, research is the effort expended to create new ideas; development is the process of turning those new ideas into saleable products.

However, the reporting of research and development costs poses incredibly difficult challenges for the accountant. As can be seen with Intel and Bristol-Myers Squibb, the quantity of these expenditures is often massive because of the essential role that new ideas and products play in the future success of many organizations. Unfortunately, significant uncertainty is inherent in virtually all such endeavors. The probability that any research and development cost will eventually lead to a successful product can be impossible to determine for years. Furthermore, any estimation of the outcome of such work is open to manipulation. Often the only piece of information that is known with certainty is the amount that has been spent.

Thus, except for some relatively minor exceptions, all research and development costs are expensed as incurred according to U.S. GAAP. The probability for success is not viewed as relevant to this reporting. Standardization is very apparent. All companies provide the same information in the same manner. The total cost incurred each period for research and development appears on the income statement as an expense regardless of the chance for success.

Consequently, the accounting for Future Product A and Future Product B is identical. Although one is 80 percent likely to be successful whereas the other is only 30 percent likely, all research and development costs for both are expensed as incurred. No asset is reported despite the possibility of future benefits. The rigidity of this rule comes from the inherent uncertainty as to whether revenues will ever be generated and, if so, for how long. Rather than trying to anticipate success, the conservatism found in financial accounting simply expenses all such costs as incurred. The percentages associated with the likelihood of receiving a patent and generating future revenues are ignored.

Two major advantages are provided by this approach. First, the amount spent by a company on research and development each period is easy to determine and then compare with previous years and with other similar businesses. Most decision makers are interested in the amount invested in the search for new ideas and products and that information is readily apparent. Second, the possibility for manipulation is virtually eliminated. No distinction is drawn between a likely success and a probable failure. No reporting advantage is achieved by maneuvering the estimation of a profitable outcome.

Test Yourself

Question:

On its income statement for the current year, the Acme Corporation reported an expense for research and development of $236 million. What information is conveyed by this balance?

- It is an amortization expense associated with patents, copyrights, and other intangible assets.

- It is the amount spent on projects that failed during the year.

- It is the amount spent on all research and development activities during the year.

- It is the amount spent on all projects during the year that did not become at least 50 percent likely of achieving status as an asset.

Answer:

The correct answer is choice c: It is the amount spent on all research and development activities during the year.

Explanation:

All research and development costs are expensed as incurred. No asset balances are recognized. In that way, the amount invested by a company each year in connection with this vital activity is evident to decision makers.

Research and Development Costs and the Impact on the Balance Sheet

Question: Billions of dollars are spent each year on research and development in hopes of creating new products that could be sold in the future. Company officials would never risk this money unless they believed that a reasonable chance existed for recouping such huge investments. However, whether success is 100 percent likely or only 2 percent, no assets are reported on the balance sheet for these costs. That is U.S. GAAP.

Because all amounts spent on research and development are expensed automatically, are the assets reported by companies in industries such as technology and pharmaceuticals not omitting many of their most valuable future benefits? If a company spends $5 billion to develop a new drug or electronic device that becomes worth $11 billion, does the reporting of no asset make sense? Does that approach provide a fair portrait of the company?

Answer: Even a student in an introductory accounting course can quickly recognize the problems created by a rule requiring that all research and development costs be expensed as incurred. Companies in technology, pharmaceutical, and many other industries must exclude items of significant value from their balance sheets by following U.S. GAAP. While this approach is conservative, consistent, and allows for comparability, the rationale is confusing. The balance sheet hardly paints a fair portrait of the assets being held. Expensing research and development costs also violates the matching principle. These expenditures are made in the hopes of generating future revenues but the expense is recorded immediately before any revenues have been earned.

Capitalizing these costs so that they are reported as assets is logical but measuring the value of future benefits is extremely challenging. Without authoritative guidance, the extreme uncertainty of such projects would leave the accountant in a precarious position. The temptation would be to tailor the reporting to make the company look as good as possible. U.S. GAAP “solves” the problem by eliminating the need for any judgment by the accountant. All costs are expensed. No rule could be simpler to apply.

Consequently, any decision maker evaluating a company that invests heavily in research and development needs to recognize that the assets appearing on the balance sheet are incomplete. Such companies spend money to create future benefits that are not being reported. The wisdom of that approach has long been debated but it is the rule under U.S. GAAP. Difficult estimates are not needed and the possibility of manipulation is avoided.

Talking with an Independent Auditor about International Financial Reporting Standards

Following is a continuation of our interview with Robert A. Vallejo, partner with the accounting firm PricewaterhouseCoopers.

Question: Virtually without exception, U.S. GAAP requires that all research and development expenditures must be expensed as incurred. This requirement has existed for over thirty years. Does IFRS handle research and development costs in the same manner?

Robert Vallejo: This is one of the best examples of differences between IFRS and U.S. GAAP. If specified criteria are met, IFRS requires the capitalization of development costs. These guidelines help determine when a project moves from the research stage into the development stage. However, once the development stage commences, the costs are capitalized and amortized over the anticipated useful life. When companies first adopt IFRS, this change will require some effort, particularly if development costs are significant. Changing to IFRS will have a substantial impact on reported net income. This issue will need to be considered early in a conversion to IFRS, as recasting prior period information taking into account the capitalization of development costs will be difficult.

The difference between U.S. GAAP and IFRS is not a question of right or wrong but rather an example of differing yet valid viewpoints. U.S. GAAP prefers not to address the uncertainty inherent in research and development programs but rather to focus on comparability of amounts spent (between years and between companies). IFRS, on the other hand, takes a view that the expenses should be matched with the benefits to be obtained in future periods.

Key Takeaway

Research and development costs include all amounts spent to create new ideas and then turn them into products that can be sold to generate revenue. Because success in these endeavors is highly uncertain, accounting has long faced the challenge of determining whether such costs should be capitalized or expensed. U.S. GAAP requires that all research and development costs (with a few minor exceptions) be expensed as incurred. This official standard does prevent manipulation and provides decision makers with the monetary amount spent by management each year for this essential function. However, this method of accounting means that companies (especially in certain industries) often fail to show some of their most important assets on their balance sheets. Despite the obvious value of these assets, the cost is expensed entirely.

11.5 Acquiring an Asset with Future Cash Payments

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Realize that if payments to acquire an asset are delayed into the future, part of the total cash amount is attributed to the purchase of the asset with the rest deemed to be interest.

- Recognize that a reasonable rate of interest on a long-term debt can be stated explicitly in the contract and paid when due so that no present value computation is needed.

- Record the acquisition of an intangible asset based on a present value computation whenever payments are made over a period of years and no explicit interest is included in those payments.

- Define the term “compounding.”

- Compute interest to be recognized each period when a long-term debt was recorded using a present value computation.

- Differentiate between an annuity due and an ordinary annuity.

Purchases Made with Future Cash Payments

Question: A company buys a patent from an inventor on January 1, Year One, for $1 million to be paid immediately. The accounting here is straightforward; the patent is recognized as an intangible asset and reported at the historical cost of $1 million. Accounting rules are clear on the handling of such acquisitions.

Assume, instead, that the company offers to pay this $1 million but not until five years have passed. The seller agrees to that proposal. The purchase is made now, but payment is delayed. Is the $1 million still being paid solely for the patent? Does the entire $1 million reflect the historical cost of this intangible? What reporting is appropriate if an asset such as a patent, building, or land is bought but payment will not take place for several years? In such cases, how is historical cost determined?

Answer: More than forty years ago, the accounting body that was viewed as authoritative at the time ruled that when cash is paid for a purchaseSimilar rules apply when an asset is sold and the money is to be collected over a period of future years. For convenience, the illustrations in this chapter will focus solely on cash payments made in an acquisition. over an extended period of time, two distinct reasons for the payments always exist.The Accounting Principles Board (APB) was the primary group in charge of creating U.S. GAAP from 1962 until 1973 when it was replaced by the Financial Accounting Standards Board (FASB). During those years, the APB produced thirty-one opinions. Its Opinion 21, “Interest of Receivables and Payables” was issued in August 1971 and established the rules described here. Within the new Accounting Standards Codification, information on the reporting of interest can be found at FASB ASC 835-30.

- The first is obviously the acquisition of the property such as the patent in this example.

- The second is interestThe charge for using money over time, often associated with long-term loans; even if not specifically mentioned in the debt agreement, financial accounting rules require it to be computed and reported based on a reasonable rate.. Interest is the charge for the use of money over time.

This rule assumes that no reasonable seller would allow cash payments to be spread over several years without some interest charge being factored into the negotiated amounts. In other words, interest (the charge for the use of the money over time) is included whether it can be seen or not. The accounting demonstrated here is the result of that assertion.

In many purchases where payments are made over time, interest payments are explicitly included. For example, the contract to buy this patent could have required payment of the $1 million after five years plus interest at a 7 percent rate to be paid each year. With those terms, the accounting process is not complicated. The $1 million is the historical cost of the patent while the annual $70,000 payments ($1 million × 7 percent) are recorded each year by the buyer as interest expense. The two amounts are clearly differentiated based on the terms of the agreement.

A theoretical problem arises if interest is not identified in the contract. In the current illustration, assume that the company agrees to make a single $1 million payment in five years with no mention of interest. According to U.S. GAAP, interest is still present and must be recognized because the conveyance of cash has been delayed. This means that only part of the $1 million is actually paid for the patent with the rest serving as interest. Authoritative accounting rules hold that an interest charge is always present when payment is put off into the future. Payment has been deferred for five years; some part of that amount serves to compensate the seller for having to wait to receive the money.

However, the specific allocation of the $1 million between patent and interest is not readily apparent. To calculate the interest included within the price, an introduction to present valueThe amount associated with cash flows after all future interest—computed at a reasonable rate—has been mathematically removed; this figure is the principal of those future cash flows. computations is necessary.

In simple terms, the present value of future cash flows is the amount left after all future interest is removed (hence the term “present value”). The present value is the portion within the $1 million that is being paid for the patent. The remainder will be recognized as interest expense over the five-year period until payment is made.

To determine the present value of future cash flows, a reasonable interest rate is needed. Then, the amount of interest for these five years can be mathematically calculated and removed. An appropriate interest rate is often viewed as the one the buyer would be charged if the money were borrowed from a local bank.

Assume here that 10 percent is a reasonable annual interest rate. Fortunately, present value conversion factors have already been mechanically computed. They can serve to remove the future amount of interest so that only the present value (the amount paid for the patent) is left. The formula to determine the present value of $1 at a designated point in the future is $1 divided by (1 + i) raised to the nth power with “n” being the number of periods and “i” the appropriate interest rate. In this case, because payment is due in five years, the present value $1 is $1/(1.10)5, or 0.62092. This factor can then be multiplied by the actual cash payment to determine its present value.

In an Excel spreadsheet, the present value of $1 at 10 percent for five years is derived by entering the following formula into one of the cells: =PV(.10,5,0,1). Thus, the present value of $1,000,000 is found in Excel by entering =PV(.10,5,0,1000000).

Regardless of the method being applied, if $1 is paid in five years for an asset and a reasonable rate of interest is 10 percent per year, then the $0.62 (rounded) present value is the portion being paid for the asset with the remaining $0.38 representing interest for those years. The present value computation mathematically determines the interest and then removes it to leave the cost of the asset.

Predetermined present value tables are available as well as calculators and computer spreadsheets that make this computation relatively easy. Present value tables can be found at the end of this book as well as through Internet links provided at appropriate spots throughout the chapters.

On a table created to provide the present value of a single amount of $1, the factor is found by looking under the specific interest rate column (10 percent) at the line for the number of applicable time periods (five).

Present Value of Single Amount of $1

http://www.principlesofaccounting.com/ART/fv.pv.tables/pvof1.htm

The present value today of paying $1 million in five years assuming a 10 percent annual interest rate is $1 million times 0.62092 or $620,920. This is the cost before any future interest is accrued over time. Mathematically, the interest for these five years has been computed and removed to arrive at this figure. The remainder of the payment ($379,080) will be reported as interest expense by the buyer over the subsequent five years using a 10 percent annual rate. The total ($620,920 for the patent plus $379,080 in interest) equals the $1 million payment.

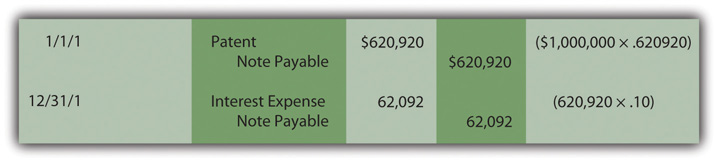

The journal entries for Year One are shown in Figure 11.5 "Present Value—Acquisition of Patent with Future Payment of Cash and Recognition of Year One Interest". On January 1, the patent and the liability are reported at present value. No time has passed so no interest is recognized. However, at the end of that first year, interest expense of $62,092 should be reported. That amount is 10 percent of the liability’s principal balance for that year ($620,920).The effective rate method of computing interest is demonstrated here. The principal balance is multiplied by the reasonable interest rate to get the amount of interest to be recorded each period. The effective rate method is the preferred approach according to U.S. GAAP. In Chapter 14 "In a Set of Financial Statements, What Information Is Conveyed about Noncurrent Liabilities Such as Bonds?", an alternative method known as the straight-line method is also demonstrated. It is also allowed by U.S. GAAP if the differences are not viewed as material.

Figure 11.5 Present Value—Acquisition of Patent with Future Payment of Cash and Recognition of Year One Interest

Notice in the December 31 entry that no interest is paid on that date. Payment of this additional charge actually occurs in five years when $1 million is paid and not just $620,920. Because interest was recognized in Year One but not paid, the amount of the liability (the principal) has grown. Increasing a debt to reflect the accrual of interest is referred to as “compounding.” Whenever interest is recognized but not paid, it is compounded which means that it is added to the principal of the liability.

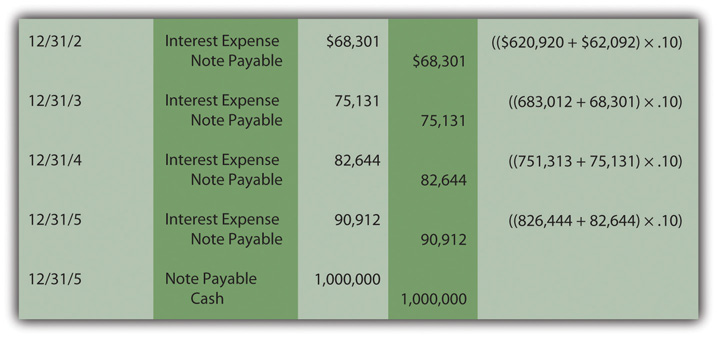

In the second year, the expense to be recognized is higher because the principal has increased from $620,920 to $683,012 ($620,920 plus $62,092) as a result of compounding the Year One interest. The ongoing compounding raises the principal each year so that the interest expense also increases as can be seen in the series of entries in Figure 11.6 "Present Value—Recognition and Compounding of Interest".

Figure 11.6 Present Value—Recognition and Compounding of InterestIf the computations and entries are all correct, the liability balance will grow to $1 million at the end of five years. In the present value computation, the interest was removed at a 10 percent annual rate and then put back into the liability each year through compounding at the same rate. Because figures are rounded in these computations, the final interest journal entry may have to be adjusted by a few dollars to arrive at the $1 million total.

These journal entries show that three goals are achieved by this reporting process.

- The patent is recorded at its historical cost of $620,920, the total amount to be paid less a reasonable interest rate for the five year delay until payment is made.

- The compounding process adds the interest back into the liability that was removed in determining the present value so that the reported balance returns to $1 million as of the due date.

- Interest expense of $379,080 is recognized over the five-year period ($62,092 + $68,301 + $75,131 + $82,644 + $90,912). Although interest was not mentioned in the contract, U.S. GAAP requires it to be computed and reported over these five years.

Test Yourself

Question:

Osgood Company buys an intangible asset on January 1, Year One, for $300,000. The company will make this payment at the end of Year Three. In the interim, interest payments of $27,000 will be made each year based on a reasonable rate. On January 1, Year One, what amount is reported for the intangible and the liability?

- $300,000

- The present value of $300,000

- The present value of $327,000

- The present value of $381,000

Answer:

The correct answer is choice a: $300,000.

Explanation:

A reasonable interest rate is being paid, so although payment to acquire the intangible has been delayed for three years, there is no reason to compute the present value of the cash flows. Present value is only used when a reasonable interest is not explicitly stated and paid. The $300,000 amount is the principal amount and the $27,000 annual payments are the interest.

Test Yourself

Question:

Weisz Company buys an intangible asset on January 1, Year One, for $300,000 to be paid in exactly three years. No additional amounts are mentioned in the contract although a reasonable interest rate is 8 percent per year. The present value of $1 at an 8 percent rate to be paid at the end of a three-year period is $0.79383. What does the company report on the date of acquisition?

- Asset of $238,149 and liability of $238,149

- Asset of $300,000 and liability of $238,149

- Asset of $238,149 and liability of $300,000

- Asset of $300,000 and liability of $300,000

Answer:

The correct answer is choice a: Asset of $238,149 and liability of $238,149.

Explanation:

Because a reasonable interest rate is not being paid, the initial acquisition (both the cost of the asset and the principal of the liability) is recorded at the present value of the future cash flows ($238,149 or $300,000 × 0.79383). Present value computes the interest for three years at an 8 percent rate and then removes it to leave the amount paid, here, for the intangible asset.

Test Yourself

Question:

Tylo Company buys an intangible asset on January 1, Year One, for a single $400,000 payment in exactly four years with no additional cash being paid in the interim. A reasonable interest rate is 10 percent per year. The present value of $1 at a 10 percent rate to be paid at the end of a four-year period is $0.68301. How does the annual recognition of interest over those four years impact the recorded amount of the intangible asset?

- It has no effect.

- It increases the reported asset by $6,830.10 per year.

- It increases the reported asset by $27,320.40 per year.

- It increases the reported asset by $40,000.00 per year.

Answer:

The correct answer is choice a: It has no effect.

Explanation:

Interest will be recognized each year based on the reasonable rate of 10 percent. However, that impacts the liability balance and has no impact on the asset. The asset is recorded initially at present value and that cost is then amortized to expense over the useful life of the asset (unless the asset does not have a finite life). The interest is recorded each year as an expense and compounded to increase the liability.

Test Yourself

Question:

Guthrie Company buys an intangible asset on January 1, Year One, for a single $500,000 payment in exactly five years with no additional cash being paid in the interim. A reasonable interest rate is 10 percent per year. The present value of $1 at a 10 percent rate to be paid at the end of a five-year period is $0.62092. What interest is recognized in each of the first two years?

- Zero in Year One and Zero in Year Two

- $31,046 in Year One and $31,046 in Year Two

- $31,046 in Year One and $34,150.60 in Year Two

- $50,000 in Year One and $50,000 in Year Two

Answer:

The correct answer is choice c: $31,046 in Year One and $34,150.60 in Year Two.

Explanation:

Because a reasonable interest rate is not paid, the liability for this $500,000 payment is recorded initially at its present value of $310,460 ($500,000 × 0.62092). Interest for the first year is 10 percent of this principal or $31,046 ($310,460 × 10 percent). No interest is paid at that time so this entire amount is compounded raising the principal to $341,506 ($310,460 plus $31,046). Interest expense for the second year is $34,150.60 based on the reasonable 10 percent annual rate.

Test Yourself

Question:

Laettner Company buys an intangible asset on January 1, Year One, for $200,000 to be paid in exactly five years with no additional cash being paid in the interim. A reasonable interest rate is 10 percent per year. The present value of $1 at 10 percent rate to be paid at the end of a five-year period is $0.62092. What does Laettner Company report on its December 31, Year Two balance sheet for this liability?

- $124,184.00

- $136,602.40

- $150,262.64

- $200,000.00

Answer:

The correct answer is choice c: $150,262.64.

Explanation:

Because reasonable interest is not paid, the liability is recorded at present value ($200,000 × 0.62092 or $124,184). After one year, interest of $12,418.40 ($124,184 × 10 percent) is recognized. It is not paid but compounded raising the principal to $136,602.40 ($124,184.00 plus $12,418.40). After the second year, interest is again computed. It is $13,660.24 ($136,602.40 × 10 percent). It is compounded raising the principal to $150,262.64 ($136,602.40 plus $13,660.24).

The Present Value of Cash Flows Paid as an Annuity

Question: Does the application of present value change substantially if cash is paid each year rather than as a lump sum at the end of the term? What reporting is appropriate if an intangible asset is purchased by making a down payment today followed by a series of equal payments in the future?

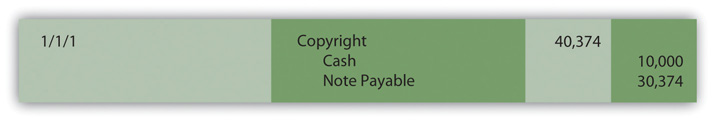

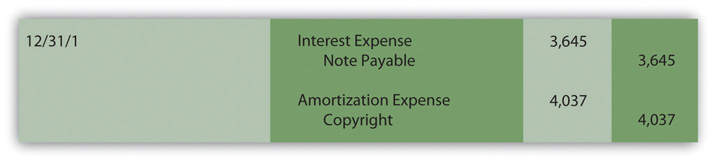

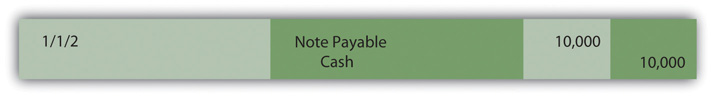

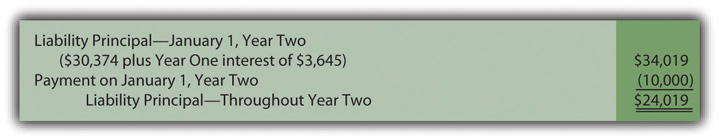

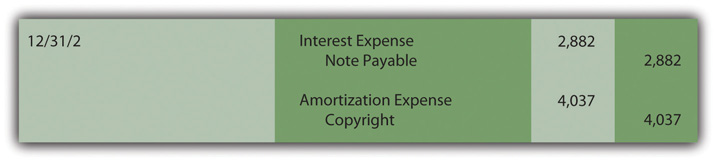

To illustrate, assume a company acquires a copyright from an artist by paying $10,000 on January 1, Year One, and agreeing to pay an additional $10,000 at the beginning of each subsequent year until January 1, Year Five. The total cash amount is $50,000. As with the previous example, no separate interest is paid so that a present value computation is required. What is the historical cost to be reported for this intangible asset and what interest should be recorded on the liability over these future years?

Answer: Cash is conveyed over an extended period of time in this purchase. However, a reasonable rate of interest is not being explicitly paid to compensate for the delay in payments. Once again, accounting believes that interest exists within the cash amounts. A present value computation is necessary to pull out the appropriate amount of interest and leave just the cost of the newly acquired asset. As before, the present value of the payments is the cash paid after all future interest is mathematically removed. The idea behind the process has not changed. Here, though, cash is not conveyed as a single amount but rather as an annuityA series of equal payments made at equal time intervals.—an equal amount paid at equal time intervals. An annuity can be either of the following:

- An ordinary annuityAn annuity with payments made at the end of each period; it is also referred to as an annuity in arrears. with payments made at the end of each period

- An annuity dueAn annuity with payments made at the beginning of each period; it is also referred to as an annuity in advance. with payments starting immediately at the beginning of each period