This is “Increasing the Net Assets of a Company”, section 3.3 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

3.3 Increasing the Net Assets of a Company

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Define “retained earnings” and explain its composition.

- Define “capital stock” and explain the meaning of its reported account balance.

- Explain the lack of financial impact that the exchange of ownership shares between investors has on a corporation.

The Meaning of Retained Earnings

Question: The second financial statement is known as the statement of retained earnings.As indicated earlier, many businesses actually report a broader statement of changes in stockholders’ equity. At this initial point in the coverage, focusing solely on retained earnings makes the learning process easier. The term retained earnings has not yet been introduced. What information does a retained earnings balance communicate to an outside decision maker? For example, on May 1, 2010, Barnes & Noble reported retained earnings of aproximately $681.1 million, one of the largest amounts found in the company’s financial statements. What does that figure tell decision makers about this bookstore chain?

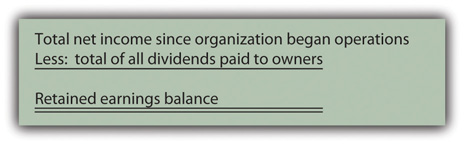

Answer: The retained earnings account (sometimes referred to as “reinvested earnings”) is one of the most misunderstood figures in all of financial reporting. As shown in Figure 3.2, this balance is the total amount of all net income earned by a business since it first began operations, less all dividends paid to stockholders during that same period of time. Retained earnings is a measure of the profits left in a business throughout its existence to create growth. For an organization like The Coca-Cola Company with a long history of profitability, much of its enormous expansion over the years has come from its own operations. That growth is reflected by the retained earnings balance, which is $49.2 billion for Coca-Cola as of December 31, 2010.

Figure 3.2

When a business earns income, it becomes larger because net assets have increased. Even if a portion of the profits is distributed to shareholders as a dividend, the company has grown in size as a result of its own operations. The retained earnings figure informs decision makers of the amount of that internally generated expansion. This reported balance answers the question: How much of the company’s net assets have been derived from operations during its life?

If a company reports an annual net income of $10,000 and then pays a $2,000 dividend to its owners each year, it is growing in size at the rate of $8,000 per year. After four years, for example, $32,000 ($8,000 × four years) of its net assets will have been generated by its own operating activities. That information is communicated through the retained earnings balance.

As of May 1, 2010, Barnes & Noble reported total assets of $3.7 billion and liabilities of $2.8 billion. Thus, the company had net assets of $900 million. Assets exceeded liabilities by that amount. Those additional assets did not appear by magic. They had to come from some source. One of the primary ways to increase the net assets of a business is through profitable operations. The balance for retained earnings shown by Barnes & Noble lets decision makers know that approximately $681 million of its net assets were generated by the total net income earned since the company’s inception, after all dividend distributions to shareholders were subtracted.

Test Yourself

Question:

On January 1, Year One, the Green River Company was started when owners contributed $100,000 cash to start operations. During the first year, the company earned a reported net income of $23,000 and paid a $2,000 dividend. During the second year, the company earned another $31,000 and paid a $5,000 dividend. What is reported on the company’s balance sheet as the total retained earnings at the end of Year Two?

- $47,000

- $54,000

- $147,000

- $154,000

Answer:

The correct answer is choice a: $47,000.

Explanation:

Retained earnings are a measure of a company’s growth in net assets because of its operations. Since its beginning, Green River made a total profit of $54,000 ($23,000 plus $31,000) and paid a total dividend of $7,000 ($2,000 plus $5,000). As a result, net assets rose by $47,000 ($54,000 less $7,000). This balance is reported as retained earnings. The increase from the money the owners put into the business is known as contributed capital (or capital stock), which is a separately reported figure.

The Reporting of Retained Earnings

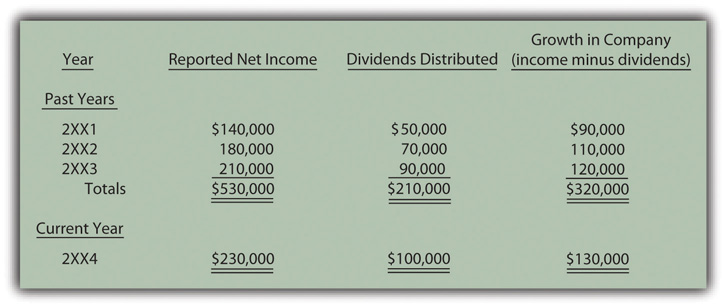

Question: In Figure 3.2, Davidson Groceries calculated its net income for 2XX4 as $230,000. Assume that this company began operations on January 1, 2XX1, and reported the balances shown in Figure 3.3 over the years:

Figure 3.3

How is the growth of this company’s net assets reported? What is the structure of the statement of retained earnings as it appears within a set of financial statements?

Answer: In the three prior years of its existence, Davidson Groceries’ net assets increased by $320,000 as a result of operating activities. As can be seen in Figure 3.3, the company generated total profit during this earlier period of $530,000 while distributing dividends to shareholders of $210,000, a net increase of $320,000. During the current year (2XX4), net assets continued to rise as Davidson Groceries made an additional profit (see also Figure 3.1 "Income Statement") of $230,000 but distributed another $100,000 in dividends. Thus, the net assets of Davidson Groceries increased in 2XX4 by $130,000 ($230,000 less $100,000) as a result of business operations. For all four years combined, net assets went up by $450,000 ($320,000 + $130,000), all net income for these years minus all dividends.

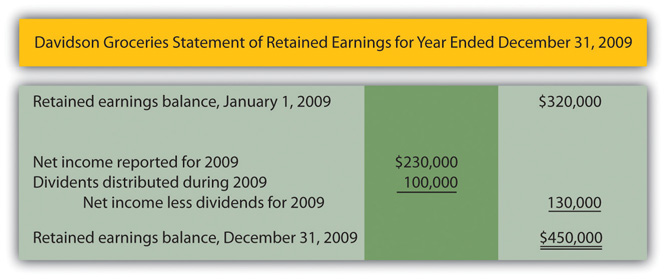

Figure 3.4 "Statement of Retained Earnings" shows the format by which this retained earnings information is conveyed to the decision makers who are evaluating Davidson Groceries. As can be seen here, this structure first presents the previous growth in net assets ($320,000) followed by the net income ($230,000) and dividends ($100,000) for just the current year.

Figure 3.4 Statement of Retained Earnings

Test Yourself

Question:

The London Corporation has just produced a set of financial statements at the end of its fifth year of operations. On its balance sheet, it shows assets of $700,000 and liabilities of $200,000. The retained earnings balance within stockholders’ equity is $100,000. Net income for the current year was reported as $90,000 with dividends of $50,000 distributed to the company’s owners. Which of the following statements is true?

- The company’s net income for the previous four years can be determined from this information.

- The company’s dividend payments for the previous four years can be determined from this information.

- The company’s retained earnings balance at the beginning of its fifth year was $10,000.

- Total income less dividends paid during the previous four years was $60,000.

Answer:

The correct answer is choice d: Total income less dividends paid during the previous four years was $60,000.

Explanation:

Retained earnings at the end of the fifth year was reported as $100,000. Of that, $40,000 is the growth in net assets during the current year from net income ($90,000) less dividends ($50,000). Retained earnings at the beginning of the year must have been $60,000 ($100,000 total less $40,000 increase). That represents the growth in net assets in all prior years from net income less dividends. The exact amount of income during this earlier period or the total dividends cannot be derived, only the net figure.

Assets Contributed to Gain Ownership Shares

Question: In the information provided, Barnes & Noble reported holding net assets of $900 million, but only $681 million of that amount was generated through operations as shown by the retained earnings balance. That raises an obvious question: How did Barnes & Noble get the rest of its net assets? Clearly, additional sources must have enabled the company to attain the $900 million reported total. Increases in net assets are not the result of magic or miracles. Other than through operations, how does a company derive net assets?

Answer: Beyond operations (as reflected by the retained earnings balance), a business accumulates net assets by receiving contributions from investors who become owners through the acquisition of capital stock.Other events can also impact the reported total of a company’s net assets. They will be discussed in other chapters. The two sources described here—capital stock and retained earnings—are shown by all corporations and are normally significantly large amounts. This is the other major method that an organization like Barnes & Noble uses to gather millions in net assets. In financial statements, the measure of this inflow is usually labeled something like capital stockOwnership (equity) shares of stock in a corporation that are issued to raise monetary financing for capital expenditures and operations., common stockA type of capital stock that is issued by every corporation; it provides rights to the owner that are specified by the laws of the state in which the organization is incorporated., or contributed capitalAmounts invested in a corporation by individuals or groups in order to attain ownership interests; balance indicates the amount of the corporation’s net assets that came directly from the owners.. Regardless of the exact title, the reported amount indicates the portion of the net assets that came into the business directly from stockholders who made the contribution to obtain an ownership interest.

The amount of a company’s net assets is the excess of its assets over its liabilities. For most businesses, two accounting balances indicate the primary sources of those net assets.

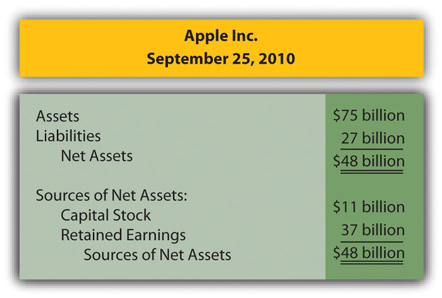

- Capital stock (or contributed capital). This is the amount invested in the business by individuals and groups in order to become owners. For example, as of September 25, 2010, Apple Inc. reported assets of $75 billion and liabilities of $27 billion. Thus, the company was holding $48 billion in net assets ($75 billion less $27 billion). How did Apple get that amount of net assets? That is a question that should interest virtually any investor or creditor analyzing this business. A reported capital stock balance of nearly $11 billion shows that this portion of the $48 billion came from owners contributing assets in order to purchase shares of the company’s stock directly from Apple.

- Retained earningsAccumulated total of the net income earned by an organization during its existence in excess of dividends distributed to the owners; indicates the amount of the net assets currently held that came from operations over the life of the organization.. This figure is the total net income earned by the organization over its life less amounts distributed as dividends to owners. On September 25, 2010, Apple Inc. reported a retained earnings balance of approximately $37 billion (see Figure 3.5 "Apple Inc."). A growth in net assets of that amount resulted from the operating activities since the day Apple first got started.

Figure 3.5 Apple Inc.

These numbers reconcile because the total amount of net assets ($48 billion) must have a source of the same amount ($48 billion).

The Trading of Shares of Capital Stock

Question: A corporation issues (sells) ownership shares to investors to raise money. The source of the resulting inflow of assets into the business is reflected in financial accounting by the reporting of a capital stock (or contributed capital) balance. Thus, over its life, Apple has received assets of $11 billion in exchange for shares of capital stock. Does a company receive money when its shares are sold each day on the New York Stock Exchange, NASDAQ (National Association of Securities Dealers Automated Quotations), or other stock exchanges?

Answer: No, purchases and sales on stock markets normally occur between two investors and not directly with the company. Only the initial issuance of the ownership shares to a stockholder creates the inflow of assets reported by a capital stock or contributed capital account.

To illustrate, assume that Investor A buys one thousand shares of capital stock shares directly from Business B for $179,000 in cash. This transaction increases the net assets of Business B by that amount. The source of the increase is communicated to decision makers by adding $179,000 to the capital stock balance reported by the company. Business B is bigger by $179,000, and the capital stock account provides information about that growth.

Subsequently, these shares may be exchanged between investors numerous times without any additional financial impact on Business B. For example, assume Investor A later sells the 1,000 shares to Investor Z for $200,000 using a stock market such as the New York Stock Exchange. Investor A earns a $21,000 gain ($200,000 received less $179,000 cost), and Investor Z has replaced Investor A as an owner of Business B. However, the financial condition of the company has not been affected by this new exchange. Business B did not receive anything. From its perspective, nothing happened except for a change in the identity of an owner. Thus, a corporation’s capital stock balance only measures the initial investment contributed directly to the business.

Key Takeaway

The source of a company’s net assets (assets minus liabilities) is of interest to outside decision makers. The reported retained earnings figure indicates the amount of these net assets that came from the operations of the company. This growth in size was internally generated. The reported retained earnings balance is all the net income earned since operations began less all dividend distributions. Net assets can also be derived from contributions made by parties seeking to become owners. The capital stock (or contributed capital) balance measures this source of net assets. There is no reported impact unless these assets go directly from the owners to the company. Hence, exchanges between investors using a stock exchange do not affect a business’s net assets or its financial reporting.