This is “Managing Financial Resources”, chapter 13 from the book An Introduction to Business (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 13 Managing Financial Resources

How to Keep from Going Under

How can you manage to combine a fantastic business idea, an efficient production system, a talented management team, and a creative marketing plan…and still go under? It’s not so hard if you don’t understand finance. Everyone in business—not finance specialists alone—needs to understand how the U.S. financial system operates and how financial decisions affect an organization. Businesspeople also need to know how securities markets work. In this chapter, we’ll discuss these three interrelated topics. Let’s start by taking a closer look at one of the key ingredients in any business enterprise—money.

13.1 The Functions of Money

Learning Objective

- Identify the functions of money and describe the three government measures of the money supply.

Finance is about money. So our first question is, what is money? If you happen to have one on you, take a look at a $5 bill. What you’ll see is a piece of paper with a picture of Abraham Lincoln on one side and the Lincoln Memorial on the other. Though this piece of paper—indeed, money itself—has no intrinsic value, it’s certainly in demand. Why? Because money serves three basic functions. MoneyAnything commonly accepted as a medium of exchange, measure of value, and store of value. is the following:

- A medium of exchange

- A measure of value

- A store of value

Figure 13.1

Money itself has no intrinsic value.

© 2010 Jupiterimages Corporation

To get a better idea of the role of money in a modern economy, let’s imagine a system in which there is no money. In this system, goods and services are bartered—traded directly for one another. Now, if you’re living and trading under such a system, for each barter exchange that you make, you’ll have to have something that another trader wants. For example, say you’re a farmer who needs help clearing his fields. Because you have plenty of food, you might enter into a barter transaction with a laborer who has time to clear fields but not enough food: he’ll clear your fields in return for three square meals a day.

This system will work as long as two people have exchangeable assets, but needless to say, it can be inefficient. If we identify the functions of money, we’ll see how it improves the exchange for all the parties in our hypothetical set of transactions.

Medium of Exchange

Money serves as a medium of exchange because people will accept it in exchange for goods and services. Because people can use money to buy the goods and services that they want, everyone’s willing to trade something for money. The laborer will take money for clearing your fields because he can use it to buy food. You’ll take money as payment for his food because you can use it not only to pay him but also to buy something else you need (perhaps seeds for planting crops).

For money to be used in this way, it must possess a few crucial properties:

- It must be divisible—easily divided into usable quantities or fractions. A $5 bill, for example, is equal to five $1 bills. If something costs $3, you don’t have to rip up a $5 bill; you can pay with three $1 bills.

- It must be portable—easy to carry; it can’t be too heavy or bulky.

- It must be durable. It must be strong enough to resist tearing and the print can’t wash off if it winds up in the washing machine.

- It must be difficult to counterfeit; it won’t have much value if people can make their own.

Measure of Value

Money simplifies exchanges because it serves as a measure of value. We state the price of a good or service in monetary units so that potential exchange partners know exactly how much value we want in return for it. This practice is a lot better than bartering because it’s much more precise than an ad hoc agreement that a day’s work in the field has the same value as three meals.

Store of Value

Money serves as a store of value. Because people are confident that money keeps its value over time, they’re willing to save it for future exchanges. Under a bartering arrangement, the laborer earned three meals a day in exchange for his work. But what if, on a given day, he skipped a meal? Could he “save” that meal for another day? Maybe, but if he were paid in money, he could decide whether to spend it on food each day or save some of it for the future. If he wanted to collect on his “unpaid” meal two or three days later, the farmer might not be able to “pay” it; unlike money, food could go bad.

The Money Supply

Now that we know what money does, let’s tackle another question: How much money is there? How would you go about “counting” all the money held by individuals, businesses, and government agencies in this country? You could start by counting the money that’s held to pay for things on a daily basis. This category includes cash (paper bills and coins) and funds held in demand depositsChecking accounts that pay given sums to “payees” when they demand them.—checking accounts, which pay given sums to “payees” when they demand them.

Then, you might count the money that’s being “saved” for future use. This category includes interest-bearing accounts, time deposits (such as certificates of deposit, which pay interest after a designated period of time), and money market mutual fundsAccounts that pay interest to investors who pool funds to make short-term loans to businesses and the government., which pay interest to investors who pool funds to make short-term loans to businesses and the government.

M-1 and M-2

Counting all this money would be a daunting task (in fact, it would be impossible). Fortunately, there’s an easier way—namely, by examining two measures that the government compiles for the purpose of tracking the money supply: M-1 and M-2.

- The narrowest measure, M-1Measure of the money supply that includes only the most liquid forms of money, such as cash and checking-account funds., includes the most liquid forms of money—the forms, such as cash and checking-accounts funds, that are spent immediately.

- M-2Measure of the money supply that includes everything in M-1 plus near-cash. includes everything in M-1 plus near-cash items invested for the short term—savings accounts, time deposits below $100,000, and money market mutual funds.

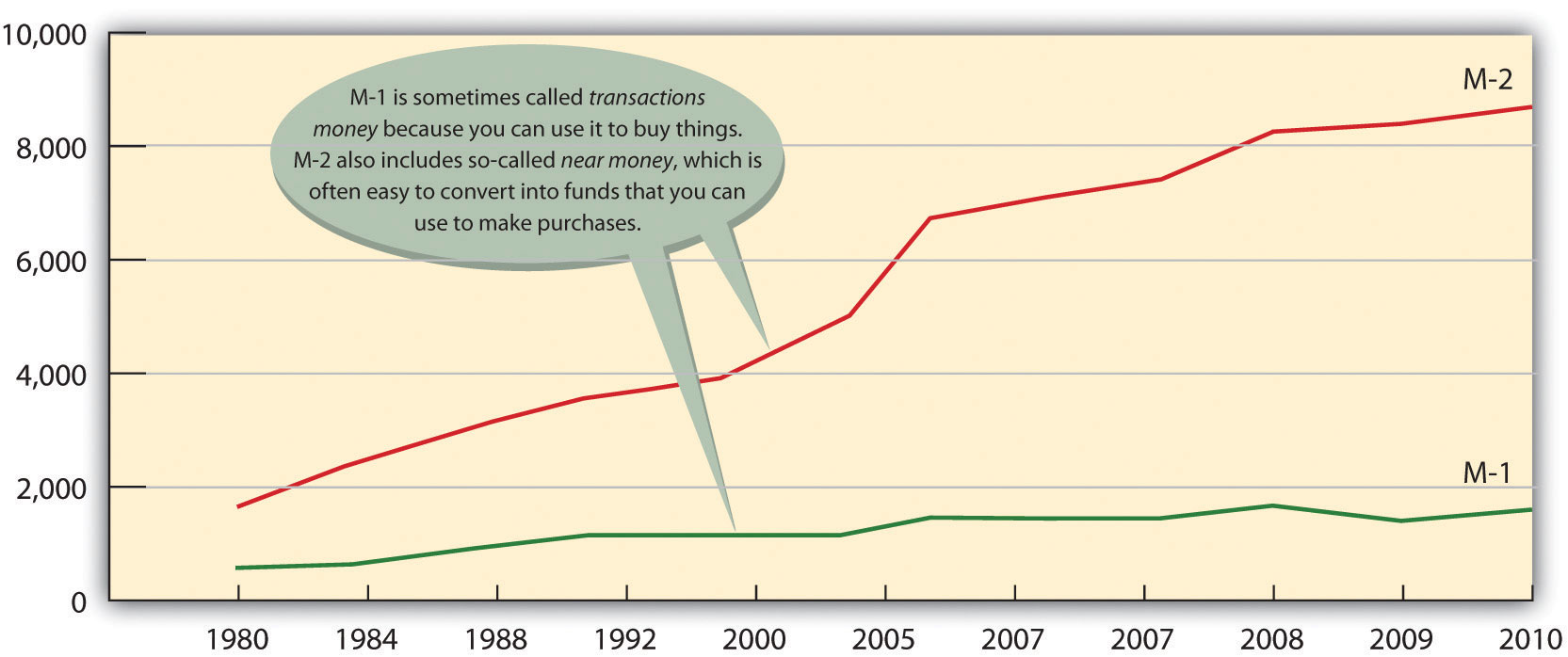

So what’s the bottom line? How much money is out there? To find the answer, you can go to the Federal Reserve Board Web site. The Federal Reserve reports that in September 2011, M-1 was about $2.1 trillion and M-2 was $9.6 trillion.Federal Reserve, “Money Stock Measures,” Federal Reserve Statistical Release, http://www.federalreserve.gov/releases/h6/current/ (accessed November 6, 2011). Figure 13.2 "The U.S. Money Supply, 1980–2010" shows the increase in the two money-supply measures since 1980.

Figure 13.2 The U.S. Money Supply, 1980–2010

If you’re thinking that these numbers are too big to make much sense, you’re not alone. One way to bring them into perspective is to figure out how much money you’d get if all the money in the United States were redistributed equally. According to the U.S. Census Population Clock,U.S. Census Bureau, “U.S. World Population Clocks,” U.S. Census Bureau, http://www.census.gov/main/www/popclock.html (accessed November 7, 2011). there are more than three hundred million people in the United States. Your share of M-1, therefore, would be about $6,700 and your share of M-2 would be about $31,000.

What, Exactly, Is “Plastic Money”?

Are credit cards a form of money? If not, why do we call them plastic money? Actually, when you buy something with a credit card, you’re not spending money. The principle of the credit card is buy-now-pay-later. In other words, when you use plastic, you’re taking out a loan that you intend to pay off when you get your bill. And the loan itself is not money. Why not? Basically because the credit card company can’t use the asset to buy anything. The loan is merely a promise of repayment. The asset doesn’t become money until the bill is paid (with interest). That’s why credit cards aren’t included in the calculation of M-1 and M-2.

Key Takeaways

-

Money serves three basic functions:

- Medium of exchange: because you can use it to buy the goods and services you want, everyone’s willing to trade things for money.

- Measure of value: it simplifies the exchange process because it’s a means of indicating how much something costs.

- Store of value: people are willing to hold onto it because they’re confident that it will keep its value over time.

- The government uses two measures to track the money supply: M-1 includes the most liquid forms of money, such as cash and checking-account funds. M-2 includes everything in M-1 plus near-cash items, such as savings accounts and time deposits below $100,000.

Exercise

(AACSB) Analysis

Instead of coins jingling in your pocket, how would you like to have a pocketful of cowrie shells? These smooth, shiny snail shells, which are abundant in the Indian Ocean, have been used for currency for more than four thousand years. At one point, they were the most widely used currency in the world. Search “cowrie shells” on Google and learn as much as you can about them. Then answer the following questions:

- How effectively did they serve as a medium of exchange in ancient times?

- What characteristics made them similar to today’s currencies?

- How effective would they be as a medium of exchange today?

13.2 Financial Institutions

Learning Objectives

- Distinguish among different types of financial institutions.

- Discuss the services that financial institutions provide and explain their role in expanding the money supply.

For financial transactions to happen, money must change hands. How do such exchanges occur? At any given point in time, some individuals, businesses, and government agencies have more money than they need for current activities; some have less than they need. Thus, we need a mechanism to match up savers (those with surplus money that they’re willing to lend out) with borrowers (those with deficits who want to borrow money). We could just let borrowers search out savers and negotiate loans, but the system would be both inefficient and risky. Even if you had a few extra dollars, would you lend money to a total stranger? If you needed money, would you want to walk around town looking for someone with a little to spare?

Depository and Nondepository Institutions

Now you know why we have financial institutions: they act as intermediaries between savers and borrowers and they direct the flow of funds between them. With funds deposited by savers in checking, savings, and money market accounts, they make loans to individual and commercial borrowers. In the next section, we’ll discuss the most common types of depository institutions (banks that accept deposits), including commercial banks, savings banks, and credit unions. We’ll also discuss several nondepository institutions (which provide financial services but don’t accept deposits), including finance companies, insurance companies, brokerage firms, and pension funds.

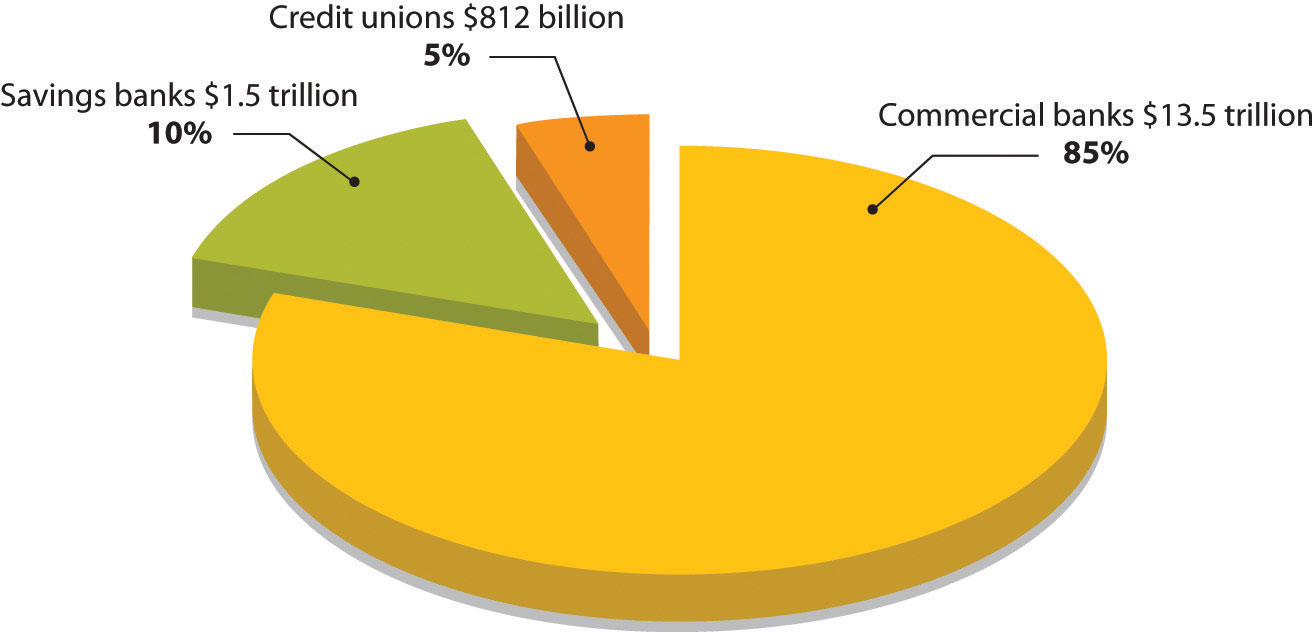

Commercial Banks

Commercial banksFinancial institution that generates profits by lending funds and providing customers with services, such as check processing. are the most common financial institutions in the United States, with total financial assets of about $13.5 trillion (85 percent of the total assets of the banking institutions).Insurance Information Institute, Financial Services Fact Book 2010, Banking: Commercial Banks, http://www.fsround.org/publications/pdfs/Financial_Services_Factbook_2010.pdf (accessed November 7, 2011). They generate profit not only by charging borrowers higher interest rates than they pay to savers but also by providing such services as check processing, trust- and retirement-account management, and electronic banking. The country’s 7,000 commercial banks range in size from very large (Bank of America, J.P. Morgan Chase) to very small (local community banks). Because of mergers and financial problems, the number of banks has declined significantly in recent years, but, by the same token, surviving banks have grown quite large. If you’ve been with one bank over the past ten years or so, you’ve probably seen the name change at least once or twice.

Savings Banks

Savings banksFinancial institution originally set up to provide mortgages and encourage saving, which now offers services similar to those of commercial banks. (also called thrift institutions and savings and loan associations, or S&Ls) were originally set up to encourage personal saving and provide mortgages to local home buyers. Today, however, they provide a range of services similar to those offered by commercial banks. Though not as dominant as commercial banks, they’re an important component of the industry, holding total financial assets of almost $1.5 trillion (10 percent of the total assets of the banking institutions).Insurance Information Institute, Financial Services Fact Book 2010, Banking: Commercial Banks, http://www.fsround.org/publications/pdfs/Financial_Services_Factbook_2010.pdf (accessed November 7, 2011). The largest S&L, Sovereign Bancorp, has close to 750 branches in nine Northeastern states.Todd Wallack, “Sovereign Making Hub its Home Base,” Boston.com, http://articles.boston.com/2011-08-16/business/29893051_1_sovereign-spokesman-sovereign-bank-deposits-and-branches (accessed November 7, 2011). Savings banks can be owned by their depositors (mutual ownership) or by shareholders (stock ownership).

Credit Unions

To bank at a credit unionFinancial institution that provides services to only its members (who are associated with a particular organization)., you must be linked to a particular group, such as employees of United Airlines, employees of the state of North Carolina, teachers in Pasadena, California, or current and former members of the U.S. Navy. Credit unions are owned by their members, who receive shares of their profits. They offer almost anything that a commercial bank or savings and loan does, including savings accounts, checking accounts, home and car loans, credit cards, and even some commercial loans.Pennsylvania Association of Community Bankers, “What’s the Difference?,” http://www.pacb.org/banks_and_banking/difference.html (accessed November 7, 2011). Collectively, they hold about $812 billion in financial assets (around 5 percent of the total assets of the financial institutions).

Figure 13.3 "Where Our Money Is Deposited" summarizes the distribution of assets among the nation’s depository institutions.

Figure 13.3 Where Our Money Is Deposited

Finance Companies

Finance companiesNondeposit financial institution that makes loans from funds acquired by selling securities or borrowing from commercial banks. are nondeposit institutions because they don’t accept deposits from individuals or provide traditional banking services, such as checking accounts. They do, however, make loans to individuals and businesses, using funds acquired by selling securities or borrowed from commercial banks. They hold about $1.9 trillion in assets.Insurance Information Institute, Financial Services Fact Book 2010, Banking: Commercial Banks, http://www.fsround.org/publications/pdfs/Financial_Services_Factbook_2010.pdf (accessed November 7, 2011). Those that lend money to businesses, such as General Electric Capital Corporation, are commercial finance companies, and those that make loans to individuals or issue credit cards, such a Citgroup, are consumer finance companies. Some, such as General Motors Acceptance Corporation, provide loans to both consumers (car buyers) and businesses (GM dealers).

Insurance Companies

Insurance companiesNondeposit institution that collects premiums from policyholders for protection against losses and invests these funds. sell protection against losses incurred by illness, disability, death, and property damage. To finance claims payments, they collect premiums from policyholders, which they invest in stocks, bonds, and other assets. They also use a portion of their funds to make loans to individuals, businesses, and government agencies.

Brokerage Firms

Companies like A.G. Edwards & Sons and T. Rowe Price, which buy and sell stocks, bonds, and other investments for clients, are brokerage firmsFinancial institution that buys and sells stocks, bonds, and other investments for clients. (also called securities investment dealers). A mutual fundFinancial institution that invests in securities, using money pooled from investors (who become part owners of the fund). invests money from a pool of investors in stocks, bonds, and other securities. Investors become part owners of the fund. Mutual funds reduce risk by diversifying investment: because assets are invested in dozens of companies in a variety of industries, poor performance by some firms is usually offset by good performance by others. Mutual funds may be stock funds, bond funds, and money market fundsFund invested in safe, highly liquid securities., which invest in safe, highly liquid securities. (Recall our definition of liquidity in Chapter 12 "The Role of Accounting in Business" as the speed with which an asset can be converted into cash.)

Finally, pension fundsFund set up to collect contributions from participating companies for the purpose of providing its members with retirement income., which manage contributions made by participating employees and employers and provide members with retirement income, are also nondeposit institutions.

Financial Services

You can appreciate the diversity of the services offered by commercial banks, savings banks, and credit unions by visiting their Web sites. For example, Wells Fargo promotes services to four categories of customers: individuals, small businesses, corporate and institutional clients, and affluent clients seeking “wealth management.” In addition to traditional checking and savings accounts, the bank offers automated teller machine (ATM) services, credit cards, and debit cards. It lends money for homes, cars, college, and other personal and business needs. It provides financial advice and sells securities and other financial products, including individual retirement account (IRA)Personal retirement account set up by an individual to save money tax free until retirement., by which investors can save money that’s tax free until they retire. Wells Fargo even offers life, auto, disability, and homeowners insurance. It also provides electronic banking for customers who want to check balances, transfer funds, and pay bills online.See Wells Fargo, https://www.wellsfargo.com/ (accessed November 7, 2011).

Bank Regulation

How would you react if you put your life savings in a bank and then, when you went to withdraw it, learned that the bank had failed—that your money no longer existed? This is exactly what happened to many people during the Great Depression. In response to the crisis, the federal government established the Federal Depository Insurance Corporation (FDIC)Government agency that regulates banks and insures deposits in its member banks up to $250,000. in 1933 to restore confidence in the banking system. The FDIC insures deposits in commercial banks and savings banks up to $250,000. So today if your bank failed, the government would give you back your money (up to $250,000). The money comes from fees charged member banks.

To decrease the likelihood of failure, various government agencies conduct periodic examinations to ensure that institutions are in compliance with regulations. Commercial banks are regulated by the FDIC, savings banks by the Office of Thrift Supervision, and credit unions by the National Credit Union Administration. As we’ll see later in the chapter, the Federal Reserve System also has a strong influence on the banking industry.

Crisis in the Financial Industry (and the Economy)

What follows is an interesting, but scary, story about the current financial crisis in the banking industry and its effect on the economy. In the years between 2001 and 2005, lenders made billions of dollars in subprime adjustable-rate mortgages (ARMs) to American home buyers. Subprime loans are made to home buyers who don’t qualify for market-set interest rates because of one or more risk factors—income level, employment status, credit history, ability to make only a very low down payment. In 2006 and 2007, however, housing prices started to go down. Many homeowners with subprime loans, including those with ARMs whose rates had gone up, were able neither to refinance (to lower their interest rates) nor to borrow against their homes. Many of these homeowners got behind in mortgage payments, and foreclosures became commonplace—1.3 million in 2007 alone.Justin Lahart, “Egg Cracks Differ in Housing, Finance Shells,” Wall Street Journal, http://online.wsj.com/article/SB119845906460548071.html?mod=googlenews_wsj (accessed November 7, 2011). By April 2008, 1 in every 519 American households had received a foreclosure notice.RealtyTrac Inc., “Foreclosure Activity Increases 4 Percent in April,” realtytrac.com, http://www.realtytrac.com/content/press-releases/ (accessed November 7, 2011). By August, 9.2 percent of the $12 trillion in U.S. mortgage loans was delinquent or in foreclosure.Mortgage Bankers Association, “Delinquencies and Foreclosures Increase in Latest MBA National Delinquency Survey,” September 5, 2008, http://www.mbaa.org/NewsandMedia/PressCenter/64769.htm (accessed November 11, 2011); Charles Duhigg, “Loan-Agency Woes Swell from a Trickle to a Torrent,” nytimes.com http://www.nytimes.com/2008/07/11/business/11ripple.html?ex=1373515200&en= 8ad220403fcfdf6e&ei=5124&partner=permalink&exprod=permalink (accessed November 11, 2011).

The repercussions? Banks and other institutions that made mortgage loans were the first sector of the financial industry to be hit. Largely because of mortgage-loan defaults, profits at more than 8,500 U.S. banks dropped from $35 billion in the fourth quarter of 2006 to $650 million in the corresponding quarter of 2007 (a decrease of 89 percent). Bank earnings for the year 2007 declined 31 percent and dropped another 46 percent in the first quarter of 2008.Federal Deposit Insurance Corporation, Quarterly Banking Profile (Fourth Quarter 2007), http://www.2.fdic.gov/qbp/2007dec/qbp.pdf (accessed September 25, 2008); FDIC, Quarterly Banking Profile (First Quarter 2008), at http://www.2.fdic.gov/qbp/2008mar/qbp.pdf (accessed September 25, 2008).

Losses in this sector were soon felt by two publicly traded government-sponsored organizations, the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac). Both of these institutions are authorized to make loans and provide loan guarantees to banks, mortgage companies, and other mortgage lenders; their function is to make sure that these lenders have enough money to lend to prospective home buyers. Between them, Fannie Mae and Freddie Mac backed approximately half of that $12 trillion in outstanding mortgage loans, and when the mortgage crisis hit, the stock prices of the two corporations began to drop steadily. In September 2008, amid fears that both organizations would run out of capital, the U.S. government took over their management.

Freddie Mac also had another function: to increase the supply of money available in the country for mortgage loans and new home purchases, Freddie Mac bought mortgages from banks, bundled these mortgages, and sold the bundles to investors (as mortgage-backed securities). The investors earned a return because they received cash from the monthly mortgage payments. The banks that originally sold the mortgages to Freddie Mac used the cash they got from the sale to make other loans. So investors earned a return, banks got a new influx of cash to make more loans, and individuals were able to get mortgages to buy the homes they wanted. This seemed like a good deal for everyone, so many major investment firms started doing the same thing: they bought individual subprime mortgages from original lenders (such as small banks), then pooled the mortgages and sold them to investors.

But then the bubble burst. When many home buyers couldn’t make their mortgage payments (and investors began to get less money and consequently their return on their investment went down), these mortgage-backed securities plummeted in value. Institutions that had invested in them—including investment banks—suffered significant losses.Shawn Tully, “Wall Street’s Money Machine Breaks Down,” Fortune, CNNMoney.com, November 12, 2007, http://money.cnn.com/magazines/fortune/fortune_archive/2007/11/26/101232838/index.htm (accessed November 7, 2011). In September 2008, one of these investment banks, Lehman Brothers, filed for bankruptcy protection; another, Merrill Lynch, agreed to sell itself for $50 billion. Next came American International Group (AIG), a giant insurance company that insured financial institutions against the risks they took in lending and investing money. As its policyholders buckled under the weight of defaulted loans and failed investments, AIG, too, was on the brink of bankruptcy, and when private efforts to bail it out failed, the U.S. government stepped in with a loan of $85 billion.See Greg Robb et al., “AIG Gets Fed Rescue in Form of $85 Billion Loan,” MarketWatch, September 16, 2008, http://www.marketwatch.com/story/aig-gets-fed-rescue-in-form-of-85-billion-loan (accessed November 7, 2011). The U.S. government also agreed to buy up risky mortgage-backed securities from teetering financial institutions at an estimated cost of “hundreds of billions.”Mortgage Bankers Association, “Delinquencies and Foreclosures Increase in Latest MBA National Delinquency Survey,” Press Release, September 5, 2008, http://www.mbaa.org/NewsandMedia/PressCenter/64769.htm (accessed November 7, 2011). And the banks started to fail—beginning with the country’s largest savings and loan, Washington Mutual, which had 2,600 locations throughout the country. The list of failed banks kept getting longer: by November of 2008, it had grown to nineteen.

The economic troubles that began in the banking industry as a result of the subprime crisis spread to the rest of the economy. Credit markets froze up and it became difficult for individuals and businesses to borrow money. Consumer confidence dropped, people stopped spending, businesses cut production, sales dropped, company profits fell, and many lost their jobs. It would be nice if this story had an ending (and even nicer if it was positive), but it might take us years before we know the ending. At this point in time, all we do know is that the economy is going through some very difficult times and no one is certain about the outcome. As we head into 2012, one in three Americans believe the United States is headed in the wrong direction. Our debt has been downgraded by Moody’s, a major credit rating agency. Unemployment seems stuck at around 9 percent, with the long-term unemployed making up the biggest portion of the jobless since records began in 1948. “As the superpower’s clout seems to ebb towards Asia, the world’s most consistently inventive and optimistic country has lost its mojo.”“America’s Missing Middle,” The Economist, November 2011, 15.

How Banks Expand the Money Supply

When you deposit money, your bank doesn’t set aside a special pile of cash with your name on it. It merely records the fact that you made a deposit and increases the balance in your account. Depending on the type of account, you can withdraw your share whenever you want, but until then, it’s added to all the other money held by the bank. Because the bank can be pretty sure that all its depositors won’t withdraw their money at the same time, it holds on to only a fraction of the money that it takes in—its reserves. It lends out the rest to individuals, businesses, and the government, earning interest income and expanding the money supply.

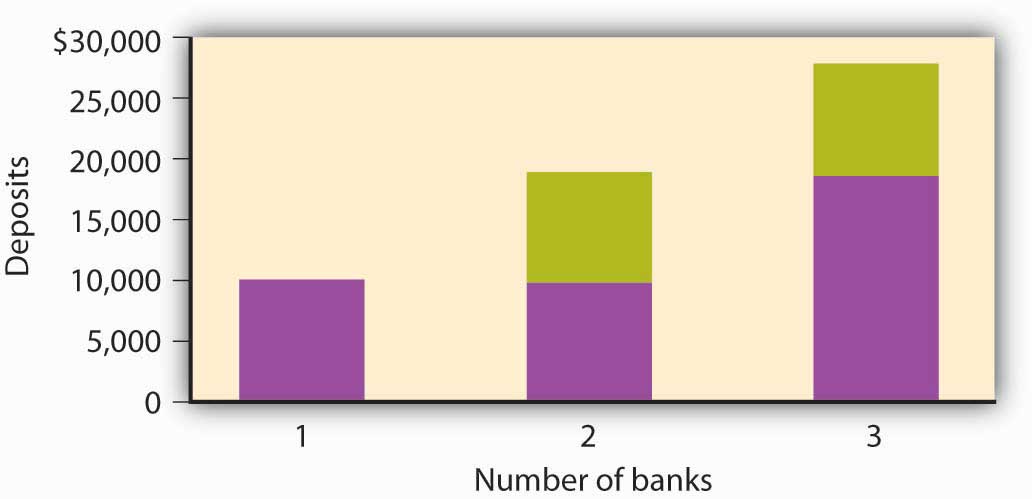

The Money Multiplier

Precisely how do banks expand the money supply? To find out, let’s pretend you win $10,000 at the blackjack tables of your local casino. You put your winnings into your savings account immediately. The bank will keep a fraction of your $10,000 in reserve; to keep matters simple, we’ll use 10 percent. The bank’s reserves, therefore, will increase by $1,000 ($10,000 × 0.10). It will then lend out the remaining $9,000. The borrowers (or the parties to whom they pay it out) will then deposit the $9,000 in their own banks. Like your bank, these banks will hold onto 10 percent of the money ($900) and lend out the remainder ($8,100). Now let’s go through the process one more time. The borrowers of the $8,100 (or, again, the parties to whom they pay it out) will put this amount into their banks, which will hold onto $810 and lend the remaining $7,290. As you can see in Figure 13.4 "The Effect of the Money Multiplier", total bank deposits would now be $27,100. Eventually, bank deposits would increase to $100,000, bank reserves to $10,000, and loans to $90,000. A shortcut for arriving at these numbers depends on the concept of the money multiplierThe amount by which an initial bank deposit will expand the money supply., which is determined using the following formula:

Money multiplier = 1/Reserve requirementIn our example, the money multiplier is 1/0.10 = 10. So your initial deposit of $10,000 expands into total deposits of $100,000 ($10,000 × 10), additional loans of $90,000 ($9,000 × 10), and increased bank reserves of $10,000 ($1,000 × 10). In reality, the multiplier will actually be less than 10. Why? Because some of the money loaned out will be held as currency and won’t make it back into the banks.

Figure 13.4 The Effect of the Money Multiplier

Key Takeaways

- Financial institutions serve as financial intermediaries between savers and borrowers and direct the flow of funds between the two groups.

- Those that accept deposits from customers—depository institutions—include commercial banks, savings banks, and credit unions; those that don’t—nondepository institutions—include finance companies, insurance companies, and brokerage firms.

- Financial institutions offer a wide range of services, including checking and savings accounts, ATM services, and credit and debit cards. They also sell securities and provide financial advice.

- A bank holds onto only a fraction of the money that it takes in—an amount called its reserves—and lends the rest out to individuals, businesses, and governments. In turn, borrowers put some of these funds back into the banking system, where they become available to other borrowers. The money multiplier effect ensures that the cycle expands the money supply.

Exercises

-

(AACSB) Analysis

Does the phrase “The First National Bank of Wal-Mart” strike a positive or negative chord? Wal-Mart isn’t a bank, but it does provide some financial services: it offers a no-fee Wal-Mart Discovery credit card with a 1 percent cash-back feature, cashes checks and sells money orders through an alliance with MoneyGram International, and houses bank branches in more than a thousand of its superstores. Through a partnering arrangement with SunTrust Banks, the retailer has also set up in-store bank operations at a number of outlets under the cobranded name of “Wal-Mart Money Center by SunTrust.” A few years ago, Wal-Mart made a bold attempt to buy several banks but dropped the idea when it encountered stiff opposition. Even so, some experts say that it’s not a matter of whether Wal-Mart will become a bank, but a matter of when. What’s your opinion? Should Wal-Mart be allowed to enter the financial-services industry and offer checking and savings accounts, mortgages, and personal and business loans? Who would benefit if Wal-Mart became a key player in the financial-services arena? Who would be harmed?

-

(AACSB) Analysis

Congratulations! You just won $10 million in the lottery. But instead of squandering your newfound wealth on luxury goods and a life of ease, you’ve decided to stay in town and be a financial friend to your neighbors, who are hardworking but never seem to have enough money to fix up their homes or buy decent cars. The best way, you decide, is to start a bank that will make home and car loans at attractive rates. On the day that you open your doors, the reserve requirement set by the Federal Reserve System is 10 percent. What’s the maximum amount of money you can lend to residents of the town? What if the Fed raises the reserve requirement to 12 percent? Then how much could you lend? In changing the reserve requirement from 10 percent to 12 percent, what’s the Fed trying to do—curb inflation or lessen the likelihood of a recession? Explain how the Fed’s action will contribute to this goal.

13.3 The Federal Reserve System

Learning Objective

- Identify the goals of the Federal Reserve System and explain how it uses monetary policy to control the money supply and influence interest rates.

Figure 13.5

The Federal Reserve Building in Washington, DC.

© 2010 Jupiterimages Corporation

Who decides how much banks should keep in reserve? The decision is made by the Federal Reserve SystemU.S. central banking system, which has three goals: price stability, sustainable economic growth, and full employment. (popularly known as “the Fed”), a central banking system established in 1913. Most large banks belong to the Federal Reserve System, which divides the country into twelve districts, each with a member-owned Federal Reserve Bank. The twelve banks are coordinated by a board of governors.

The Tools of the Fed

The Fed has three major goals:

- Price stability

- Sustainable economic growth

- Full employmentFederal Reserve System, “Monetary Policy Basics,” http://federalreserveeducation.org/about%2Dthe%2Dfed/structure%2Dand%2Dfunctions/monetary%2Dpolicy/ (accessed November 7, 2011).

Recall our definition of monetary policy in Chapter 1 "The Foundations of Business" as the efforts of the Federal Reserve System to regulate the nation’s money supply. We also defined price stability as conditions under which the prices for products remain fairly constant. Now, we can put the two concepts together: the Fed seeks to stabilize prices by regulating the money supply and interest rates. In turn, stable prices promote economic growth and full employment—at least in theory. To conduct monetary policy, the Fed relies on three tools: reserve requirements, the discount rate, and open market operations.

Reserve Requirements

Under what circumstances would the Fed want to change the reserve requirement for banks? The purpose of controlling the money supply is primarily to lessen the threat of inflation (a rise in the overall price level) or recession (an economic slowdown gauged by a decline in gross domestic product). Here’s how it works (again, in theory). If the Fed raises the reserve requirement (for example, from 10 percent to 11 percent), banks must set aside more money. Consequently, they have less to lend and so raise their interest rates. Under these conditions, it’s harder and more expensive for people to borrow money, and if they can’t borrow as much, they can’t spend as much, and if people don’t spend as much, prices don’t go up. Thus, the Fed has lessened the likelihood of inflation.

Conversely, when the Fed lowers the reserve requirement (for example, from 10 percent to 9 percent), banks need to set aside less money. Because they have more money to lend, they keep interest rates down. Borrowers find it easier and cheaper to get money for buying things, and the more consumers buy, the higher prices go. In this case, the Fed has reduced the likelihood of a recession.

A 1 percent change in the reserve requirement, whether up to 11 percent or down to 9 percent, may not seem like much, but remember our earlier discussion of the money multiplier: because of the money-multiplier effect, a small change in the reserve requirement has a dramatic effect on the money supply. (For the same reason, the Fed changes reserve requirements only rarely.)

The Discount Rate

To understand how the Fed uses the discount rate to control the money supply, let’s return to our earlier discussion of reserves. Recall that banks must keep a certain fraction of their deposits as reserves. The bank can hold these reserve funds or deposit them into a Federal Reserve Bank account. Recall, too, that the bank can lend out any funds that it doesn’t have to put on reserve. What happens if a bank’s reserves fall below the required level? The Fed steps in, permitting the bank to “borrow” reserve funds from the Federal Reserve Bank and add them to its reserve account at the Bank. There’s a catch: the bank must pay interest on the borrowed money. The rate of interest that the Fed charges member banks is called the discount rateRate of interest the Fed charges member banks when they borrow reserve funds.. By manipulating this rate, the Fed can make it appealing or unappealing to borrow funds. If the rate is high enough, banks will be reluctant to borrow. Because they don’t want to drain their reserves, they cut back on lending. The money supply, therefore, decreases. By contrast, when the discount rate is low, banks are more willing to borrow because they’re less concerned about draining their reserves. Holding fewer excess reserves, they lend out a higher percentage of their funds, thereby increasing the money supply.

Even more important is the carryover effect of a change in the discount rate to the overall level of interest rates.Robert Heilbroner and Lester Thurow, Economics Explained (New York: Simon & Schuster, 1998), 134. When the Fed adjusts the discount rate, it’s telling the financial community where it thinks the economy is headed—up or down. Wall Street, for example, generally reacts unfavorably to an increase in the discount rate. Why? Because the increase means that interest rates will probably rise, making future borrowing more expensive.

Open Market Operations

The Fed’s main tool for controlling the money supply and influencing interest rates is called open market operationsThe sale and purchase of U.S. government bonds by the Fed in the open market.: the sale and purchase of U.S. government bonds by the Fed in the open market. To understand how this process works, we first need to know a few facts:

- The Fed’s assets include a substantial dollar amount of government bonds.

- The Fed can buy or sell these bonds on the open market (consisting primarily of commercial banks).

- Because member banks use cash to buy these bonds, they decrease their reserve balances when they buy them.

- Because member banks receive cash from the sale of the bonds, they increase their reserve balances when they sell them.

- Banks must maintain a specified balance in reserves; if they dip below this balance, they have to make up the difference by borrowing money.

If the Fed wants to decrease the money supply, it can sell bonds, thereby reducing the reserves of the member banks that buy them. Because these banks would then have less money to lend, the money supply would decrease. If the Fed wants to increase the money supply, it will buy bonds, increasing the reserves of the banks that sell them. The money supply would increase because these banks would then have more money to lend.

The Federal Funds Rate

In conducting open market operations, the Fed is trying to do the same thing that it does in using its other tools—namely, to influence the money supply and, thereby, interest rates. But it also has something else in mind. To understand what that is, you need to know a few more things about banking. When a bank’s reserve falls below its required level, it may, as we’ve seen, borrow from the Fed (at the discount rate). But it can also borrow from other member banks that have excess reserves. The rate that banks pay when they borrow through this channel is called the federal funds rateThe interest rate that a Federal Reserve member bank pays when it borrows from other member banks to meet reserve requirements..Federal Reserve System, “Monetary Policy Basics,” http://federalreserveeducation.org/about%2Dthe%2Dfed/structure%2Dand%2Dfunctions/monetary%2Dpolicy/ (accessed November 7, 2011).

How does the federal funds rate affect the money supply? As we’ve seen, when the Fed sells bonds in the open market, the reserve balances of many member banks go down. To get their reserves back to the required level, they must borrow, whether from the Fed or from other member banks. When Bank 1 borrows from Bank 2, Bank 2’s supply of funds goes down; thus, it increases the interest rate that it charges. In short, the increased demand for funds drives up the federal funds rate.

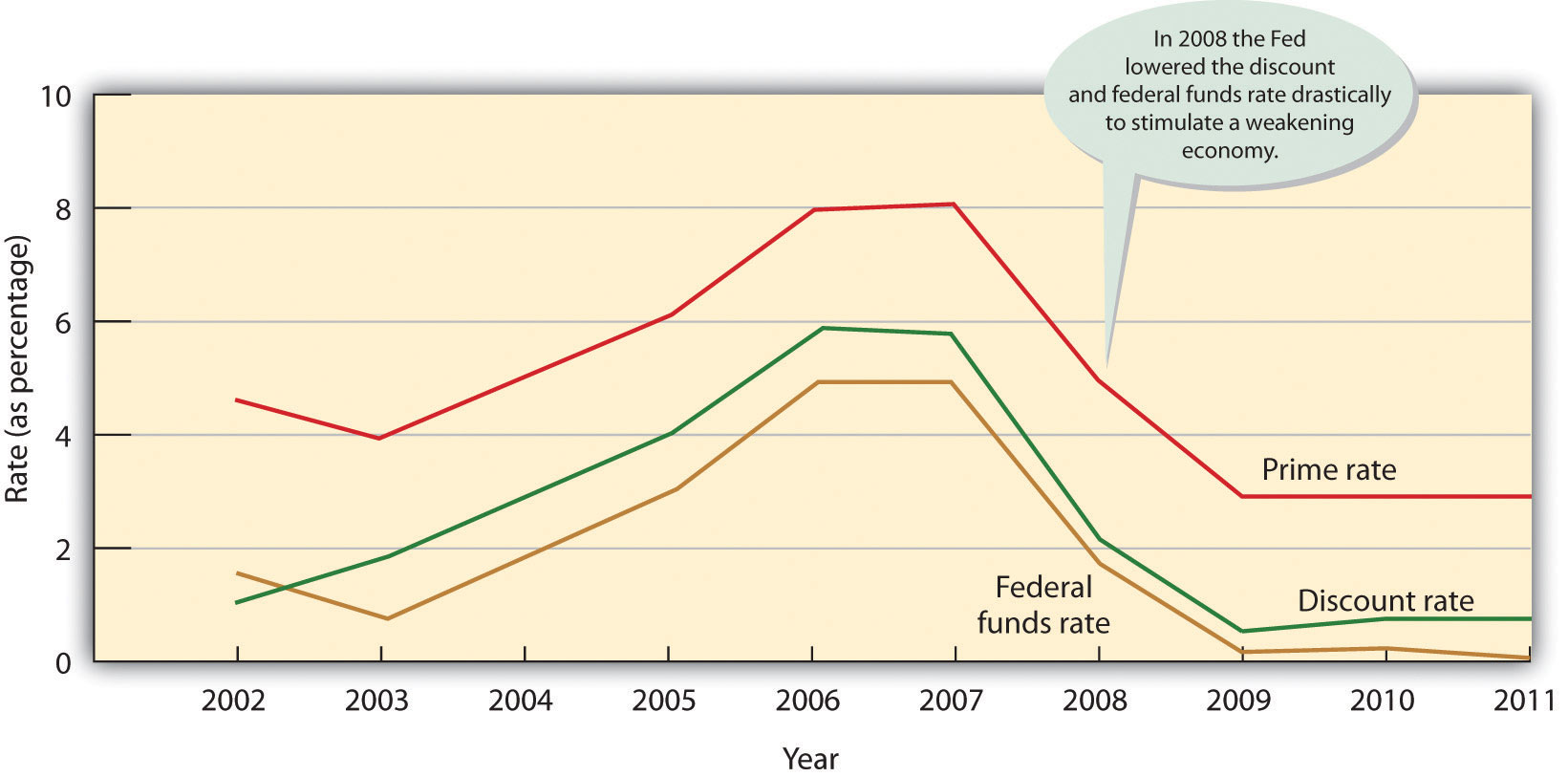

All this interbank borrowing affects you, the average citizen and consumer. When the federal funds rate goes up, banks must pay more for their money, and they’ll pass the cost along to their customers: banks all over the country will raise the interest rates charged on mortgages, car loans, and personal loans. Figure 13.6 "Key Interest Rates, 2002–2011" charts ten-year fluctuations in the discount rate, federal funds rate, and prime rateRate that banks charge their best customers.—the rate that banks charge their best customers. Because all three rates tend to move in the same direction, borrowers—individuals, as well as organizations—generally pay more to borrow money when banks have to pay more and less when banks have to pay less. Notice that the prime rate (which banks charge their customers) is higher than both the federal funds and discount rates (which banks must pay when they need to borrow). That’s why banks make profits when they make loans. Note, too, that the Fed lowered the discount rate and federal funds rate drastically in 2008 in an attempt to stimulate a weakening economy. Despite continued low rates through 2011, the economy is still very weak.

Figure 13.6 Key Interest Rates, 2002–2011

The Banker’s Bank and the Government’s Banker

The Fed performs another important function: it serves its member banks in much the same way as your bank serves you. When you get a check, you deposit it in your checking account, thereby increasing your balance. When you pay someone by check, the dollar amount of the check is charged to your account, and your balance goes down. The Fed works in much the same way, except that its customers are member banks. Just as your bank clears your check, the Fed clears the checks that pass through its member banks. The monumental task of clearing more than fifteen billion checks a year is complicated by the fact that there are twelve district banks. If someone in one district (for example, Boston) writes a check to a payee in another district (say, San Francisco), the check must be processed through both districts.Federal Reserve System, “Financial Services,” http://federalreserveeducation.org/about%2Dthe%2Dfed/structure%2Dand%2Dfunctions/financial%2Dservices/ (accessed November 7, 2011).

Prior to 2004, clearing checks took days because the checks themselves needed to be physically moved through the system. But thanks to the passage of Check 21 (a U.S. federal law), things now move much more quickly. Instead of physically transporting checks, banks are allowed to make an image of the front and back of a check and send the digital version of the original check, called a “substitute” check, through the system electronically.“Fact Sheet 30: Check 21: Paperless Banking,” Privacy Rights Clearinghouse, https://www.privacyrights.org/fs/fs30-check21.htm (accessed November 7, 2011). The good news is that Check 21 shortened the time it takes to clear a check, often down to one day. The bad news is that Check 21 shortened the time it takes to clear a check, which increases the risk that a check you write will bounce. So be careful: don’t write a check unless you have money in the bank to cover it.

In performing the following functions, the Fed is also the U.S. government’s banker:

- Holding the U.S. Treasury’s checking account

- Processing the paperwork involved in buying and selling government securities

- Collecting federal tax payments

- Lending money to the government by purchasing government bonds from the Treasury

The Fed also prints, stores, and distributes currency and destroys it when it’s damaged or worn out. Finally, the Fed, in conjunction with other governmental agencies, supervises and regulates financial institutions to ensure that they operate soundly and treat customers fairly and equitably.Federal Reserve System, “Banking Supervision,” http://federalreserveeducation.org/about%2Dthe%2Dfed/structure%2Dand%2Dfunctions/banking%2Dsupervision/ (accessed November 7, 2011).

Key Takeaways

- Most large banks are members of the central banking system called the Federal Reserve System (commonly known as “the Fed”).

- The Fed’s goals include price stability, sustainable economic growth, and full employment. It uses monetary policy to regulate the money supply and the level of interest rates.

-

To achieve these goals, the Fed has three tools:

- it can raise or lower reserve requirements—the percentage of its funds that banks must set aside and can’t lend out;

- it can raise or lower the discount rate—the rate of interest that the Fed charges member banks to borrow “reserve” funds;

- it can conduct open market operations—buying or selling government securities on the open market.

Exercise

(AACSB) Analysis

Answer this three-part question on the Federal Reserve:

- What is the Federal Reserve?

- What is the purpose of the Federal Reserve? What are its goals?

- How does the Federal Reserve affect the U.S. economy?

13.4 The Role of the Financial Manager

Learning Objectives

- Explain the ways in which a new business gets start-up cash.

- Identify approaches used by existing companies to finance operations and growth.

So far, we’ve focused our attention on the financial environment in which U.S. businesses operate. Now let’s focus on the role that finance plays within an organization. In Chapter 1 "The Foundations of Business", we defined finance as all the activities involved in planning for, obtaining, and managing a company’s funds. We also explained that a financial manager determines how much money the company needs, how and where it will get the necessary funds, and how and when it will repay the money that it has borrowed. The financial manager also decides what the company should do with its funds—what investments should be made in plant and equipment, how much should be spent on research and development, and how excess funds should be invested.

Financing a New Company

Because new businesses usually need to borrow money in order to get off the ground, good financial management is particularly important to start-ups. Let’s suppose that you’re about to start up a company that you intend to run from your dorm room. You thought of the idea while rummaging through a pile of previously worn clothes to find something that wasn’t about to get up and walk to the laundry all by itself. “Wouldn’t it be great,” you thought, “if there was an on-campus laundry service that would come and pick up my dirty clothes and bring them back to me washed and folded.” Because you were also in the habit of running out of cash at inopportune times, you were highly motivated to start some sort of money-making enterprise, and the laundry service seemed to fit the bill (even though washing and folding clothes wasn’t among your favorite activities—or skills).

Developing a Financial Plan

Because you didn’t want your business to be so small that it stayed under the radar of fellow students and potential customers, you knew that you’d need to raise funds to get started. So what are your cash needs? To answer this question, you need to draw up a financial planPlanning document that shows the amount of funds a company needs and details a strategy for getting those funds.—a document that performs two functions:

- Calculating the amount of funds that a company needs for a specified period

- Detailing a strategy for getting those funds

Estimating Sales

Fortunately, you can draw on your newly acquired accounting skills to prepare the first section—the one in which you’ll specify the amount of cash you need. You start by estimating your sales (or, in your case, revenue from laundering clothes) for your first year of operations. This is the most important estimate you’ll make: without a realistic sales estimate, you can’t accurately calculate equipment needs and other costs. To predict sales, you’ll need to estimate two figures:

- The number of loads of laundry that you’ll handle

- The price that you’ll charge per load

You calculate as follows: You estimate that 5 percent of the ten thousand students on campus will use the service. These five hundred students will have one large load of laundry for each of the thirty-five weeks that they’re on campus. Therefore, you’ll do 17,500 loads (500 × 35 = 17,500 loads). You decide to price each load at $10. At first, this seemed high, but when you consider that you’ll have to pick up, wash, dry, fold, and return large loads, it seems reasonable.

Perhaps more important, when you projected your costs—including salaries (for some student workers), rent, utilities, depreciation on equipment and a truck, supplies, maintenance, insurance, and advertising—you found that each load would cost $8, leaving a profit of $2 per load and earning you $35,000 for your first year (which is worth your time, though not enough to make you rich).

Figure 13.7

Determining a sound financial plan is the first step in starting a successful business. What would you be willing to pay to have someone else deal with your laundry?

© 2010 Jupiterimages Corporation

What things will you have to buy in order to get started? Using your estimate of sales, you’ve determined that you’d need the following:

- Five washers and five dryers

- A truck to pick up and deliver the clothes (a used truck will do for now)

- An inventory of laundry detergent and other supplies, such as laundry baskets

- Rental space in a nearby building (which will need some work to accommodate a laundry)

And, you’ll need cash—cash to carry you over while the business gets going and cash with which to pay your bills. Finally, you’d better have some extra money for contingencies—things you don’t expect, such as a machine overflowing and damaging the floor. You’re mildly surprised to find that your cash needs total $33,000. Your next task is to find out where you can get $33,000. In the next section, we’ll look at some options.

Getting the Money

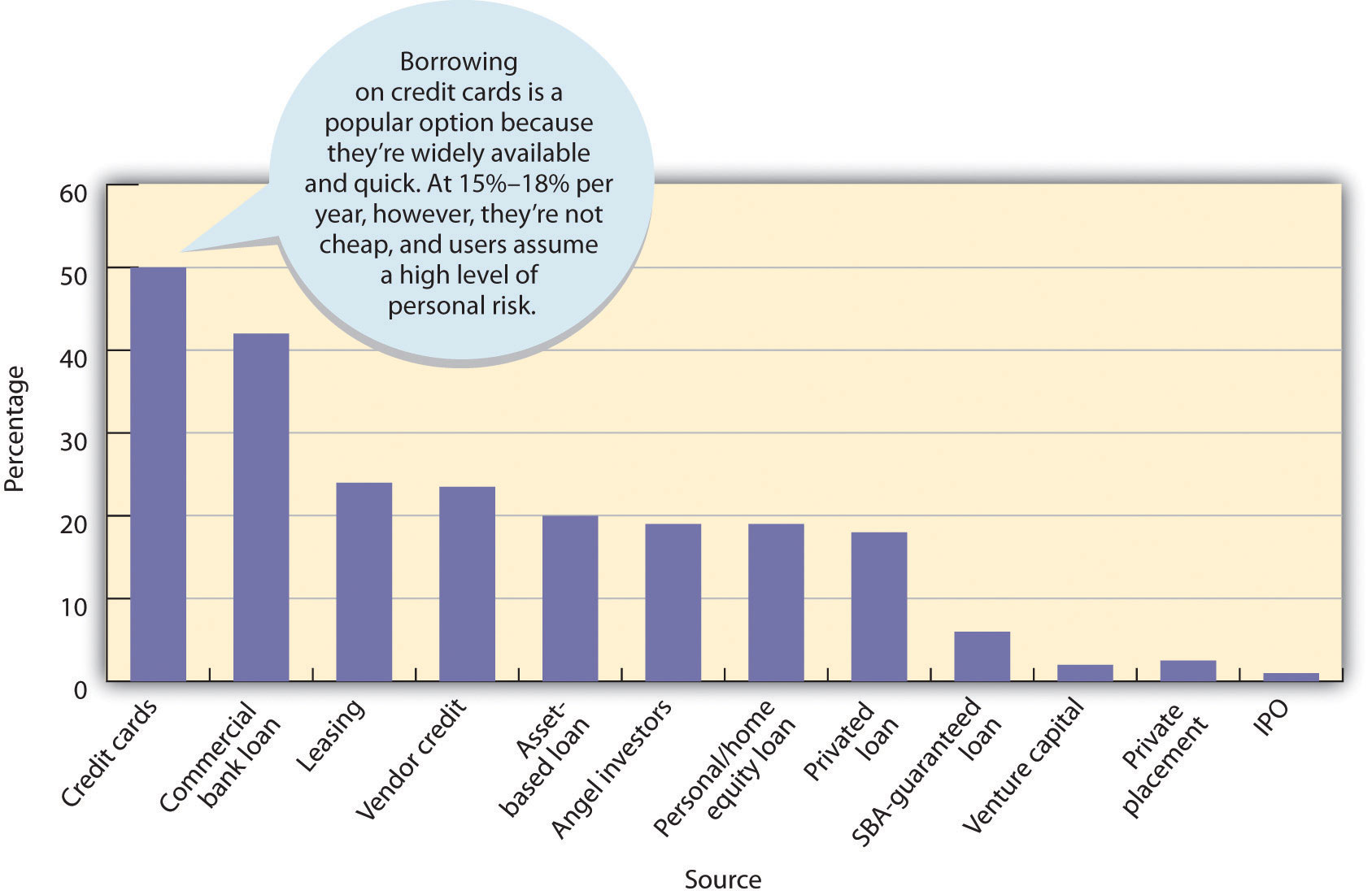

Figure 13.8 "Where Small Businesses Get Funding" summarizes the results of a survey in which owners of small and medium-size businesses were asked where they typically acquired their financing. To simplify matters, we’ll work on the principle that new businesses are generally financed with some combination of the following:

- Owners’ personal assets

- Loans from families and friends

- Bank loans (including those guaranteed by the Small Business Development Center)

Figure 13.8 Where Small Businesses Get Funding

Remember that during its start-up period, a business needs a lot of cash: it not only will incur substantial start-up costs, but may even suffer initial operational losses.

Personal Assets

Its owners are the most important source of funds for any new business. Figuring that owners with substantial investments will work harder to make the enterprise succeed, lenders expect owners to put up a substantial amount of the start-up money. Where does this money come from? Usually through personal savings, credit cards, home mortgages, or the sale of personal assets.

Loans from Family and Friends

For many entrepreneurs, the next stop is family and friends. If you have an idea with commercial potential, you might be able to get family members and friends either to invest in it (as part owners) or to lend you some money. Remember that family and friends are like any other creditors: they expect to be repaid, and they expect to earn interest. Even when you’re borrowing from family members or friends, you should draw up a formal loan agreement stating when the loan will be repaid and specifying the interest rate.

Bank Loans

The financing package for a start-up company will probably include bank loans. Banks, however, will lend you some start-up money only if they’re convinced that your idea is commercially feasible. They also prefer you to have some combination of talent and experience to run the company successfully. Bankers want to see a well-developed business plan, with detailed financial projections demonstrating your ability to repay loans. Financial institutions offer various types of loans with different payback periods. Most, however, have a few common characteristics.

Maturity

The period for which a bank loan is issued is called its maturityPeriod of time for which a bank loan is issued.. A short-term loanLoan issued with a maturity date of less than one year. is for less than a year, an intermediate loanLoan issued with a maturity date of one to five years. for one to five years, and a long-term loanLoan issued with a maturity date of five years or more. for five years or more. Banks can also issue lines of creditCommitment by a bank that allows a company to borrow up to a specified amount of money as the need arises. that allow you to borrow up to a specified amount as the need arises (it’s a lot like the limit on your credit card).

In taking out a loan, you want to match its term with its purpose. If, for example, you’re borrowing money to buy a truck that you plan to use for five years, you’d request a five-year loan. On the other hand, if you’re financing a piece of equipment that you’ll use for ten years, you’ll want a ten-year loan. For short-term needs, like buying inventory, you may request a one-year loan.

With any loan, however, you must consider the ability of the business to repay it. If you expect to lose money for the first year, you obviously won’t be able to repay a one-year loan on time. You’d be better off with intermediate or long-term financing. Finally, you need to consider amortizationSchedule by which you’ll reduce the balance of your debt.—the schedule by which you’ll reduce the balance of your debt. Will you be making periodic payments on both principal and interest over the life of the loan (for example, monthly or quarterly), or will the entire amount (including interest) be due at the end of the loan period?

Security

A bank won’t lend you money unless it thinks that your business can generate sufficient funds to pay it back. Often, however, the bank takes an added precaution by asking you for securityCollateral pledged to secure repayment of a loan.—business or personal assets, called collateralSpecific business or personal assets that a bank accepts as security for a loan., that you pledge in order to guarantee repayment. You may have to secure the loan with company assets, such as inventory or accounts receivable, or even with personal assets. (Likewise, if you’re an individual getting a car loan, the bank will accept the automobile as security.) In any case, the principle is pretty simple: if you don’t pay the loan when it’s due, the bank can take possession of the collateral, sell it, and keep the proceeds to cover the loan. If you don’t have to put up collateral, you’re getting an unsecured loanLoan given by a bank that doesn’t require the borrower to put up collateral., but because of the inherent risk entailed by new business ventures, banks don’t often make such loans.

Interest

InterestCost charged to use someone else’s money. is the cost of using someone else’s money. The rate of interest charged on a loan varies with several factors—the general level of interest rates, the size of the loan, the quality of the collateral, and the debt-paying ability of the borrower. For smaller, riskier loans, it can be as much as 6 to 8 percentage points above the prime rate—the rate that banks charge their most creditworthy borrowers. It’s currently around 3 percent per year.

Making the Financing Decision

Now that we’ve surveyed your options, let’s go back to the task of financing your laundry business. You’d like to put up a substantial amount of the money you need, but you can only come up with a measly $1,000 (which you had to borrow on your credit card). You were, however, able to convince your parents to lend you $10,000, which you’ve promised to pay back, with interest, in three years. (They were wavering until you pointed out that Fred DeLuca started SUBWAY as a way of supporting himself through college).

So you still need $22,000 ($33,000 minus the $11,000 from you and your parents). You talked with someone at the Small Business Development Center located on campus, but you’re not optimistic about getting them to guarantee a loan. Instead, you put together a sound business plan, including projected financial statements, and set off to your local banker. To your surprise, she agreed to a five-year loan at a reasonable interest rate. Unfortunately, she wanted the entire loan secured. Because you’re using some of the loan money to buy washers and dryers (for $15,000) and a truck (for $6,000), you can put up these as collateral. You have no accounts receivable or inventories, so you agreed to put up some personal assets—namely, the shares of Microsoft stock that you got as a high-school graduation present (now worth about $5,000).

Financing the Business During the Growth Stage

Flash-forward two and a half years: much to your delight, your laundry business took off. You had your projected five hundred customers within six months, and over the next few years, you expanded to four other colleges in the geographical area. Now you’re serving five colleges and some three thousand customers a week. Your management team has expanded, but you’re still in charge of the company’s finances. In the next sections, we’ll review the tasks involved in managing the finances of a high-growth business.

Managing Cash

Cash-flow managementProcess of monitoring cash inflows and outflows to ensure that the company has the right amount of funds on hand. means monitoring cash inflows and outflows to ensure that your company has sufficient—but not excessive—cash on hand to meet its obligations. When projected cash flows indicate a future shortage, you go to the bank for additional funds. When projections show that there’s going to be idle cash, you take action to invest it and earn a return for your company.

Managing Accounts Receivable

Because you bill your customers every week, you generate sizable accounts receivable—money that you’ll receive from customers to whom you’ve sold your service. You make substantial efforts to collect receivables on a timely basis and to keeping nonpayment to a minimum.

Managing Accounts Payable

Accounts payable are records of cash that you owe to the suppliers of products that you use. You generate them when you buy supplies with trade creditCredit given to a company by its suppliers.—credit given you by your suppliers. You’re careful to pay your bills on time, but not ahead of time (because it’s in your best interest to hold on to your cash as long as possible).

Budgeting

A budgetA document that itemizes the sources of income and expenditures for a future period (often a year). is a preliminary financial plan for a given time period, generally a year. At the end of the stated period, you compare actual and projected results and then you investigate any significant discrepancies. You prepare several types of budgets: projected financial statements, a cash budgetFinancial plan that projects cash inflows and outflows over a period of time. that projects cash flows, and a capital budgetBudget that shows anticipated expenditures for major equipment. that shows anticipated expenditures for major equipment.

Seeking Out Private Investors

So far, you’ve been able to finance your company’s growth through internally generated funds—profits retained in the business—along with a few bank loans. Your success, especially your expansion to other campuses, has confirmed your original belief that you’ve come up with a great business concept. You’re anxious to expand further, but to do that, you’ll need a substantial infusion of new cash. You’ve poured most of your profits back into the company, and your parents can’t lend you any more money. After giving the problem some thought, you realize that you have three options:

- Ask the bank for more money.

- Bring in additional owners who can invest in the company.

- Seek funds from a private investor.

Angels and Venture Capitalists

Eventually, you decide on the third option. First, however, you must decide what type of private investor you want—an “angel” or a venture capitalist. AngelsWealthy individual willing to invest in start-up ventures. are usually wealthy individuals willing to invest in start-up ventures they believe will succeed. They bet that a business will ultimately be very profitable and that they can sell their interest at a large profit. Venture capitalistsIndividual who pools funds from private and institutional sources and invests them in businesses with strong growth potential. pool funds from private and institutional sources (such as pension funds and insurance companies) and invest them in existing businesses with strong growth potential. They’re typically willing to invest larger sums but often want to cash out more quickly than angels.

There are drawbacks. Both types of private investors provide business expertise, as well as financing, and, in effect, both become partners in the enterprises that they finance. They accept only the most promising opportunities, and if they do decide to invest in your business, they’ll want something in return for their money—namely, a say in how you manage it.

When you approach private investors, you can be sure that your business plan will get a thorough going-over. Under your current business model, setting up a new laundry on another campus requires about $50,000. But you’re a little more ambitious, intending to increase the number of colleges that you serve from five to twenty-five. So you’ll need a cash inflow of $1 million. On weighing your alternatives and considering the size of the loan you need, you decide to approach a venture capitalist. Fortunately, because you prepared an excellent business plan and made a great presentation, your application was accepted. Your expansion begins.

Going Public

Fast-forward another five years. You’ve worked hard (and been lucky), and even finished your degree in finance. Moreover, your company has done amazingly well, with operations at more than five hundred colleges in the Northeast. You’ve financed continued strong growth with a combination of venture-capital funds and internally generated funds (that is, reinvested earnings).

Up to this point, you’ve operated as a privately held corporation with limited stock ownership (you and your parents are the sole shareholders). But because you expect your business to prosper even more and grow even bigger, you’re thinking about the possibility of selling stock to the public for the first time. The advantages are attractive: not only would you get a huge influx of cash, but because it would come from the sale of stock rather than from borrowing, it would also be interest free and you wouldn’t have to repay it. Again there are some drawbacks. For one thing, going public is quite costly—often exceeding $300,000—and time-consuming. Second, from this point on, your financial results would be public information. Finally, you’d be responsible to shareholders who will want to see the kind of short-term performance results that boosts stock prices.

After weighing the pros and cons, you decide to go ahead. The first step in the process of becoming a publicly traded corporation is called an initial public offering (IPO)Process of taking a privately held company public by selling stock to the public for the first time., and you’ll need the help of an investment banking firmFinancial institution that specializes in issuing securities.—a financial institution (such as Goldman Sachs or Morgan Stanley) that specializes in issuing securities. Your investment banker advises you that now’s a good time to go public and determines the best price at which to sell your stock. Then, you’ll need the approval of the Securities and Exchange Commission (SEC), the government agency that regulates securities markets.

Key Takeaways

- If a new business hopes to get funding, it should prepare a financial plan—a document that shows the amount of capital that it needs for a specified period, how and where it will get it, and how and when it will pay it back.

- Common sources of funding for new businesses include personal assets, loans from family and friends, and bank loans.

- Financial institutions offer business loans with different maturities. A short-term loan matures in less than a year, an intermediate loan in one to five years, and a long-term loan after five years or more.

- Banks also issue lines of credit that allow companies to borrow up to a specified amount as the need arises.

- Banks generally require security in the form of collateral, such as company or personal assets. If the borrower fails to pay the loan when it’s due, the bank can take possession of these assets.

- Existing companies that want to expand often seek funding from private investors. Angels are wealthy individuals who are willing to invest in ventures that they believe will succeed. Venture capitalists, though willing to invest larger sums of money, often want to cash out more quickly than angels. They generally invest in existing businesses with strong growth potential.

- Successful companies looking for additional capital might decide to go public, offering an initial sale of stock called an initial public offering (IPO).

Exercises

-

(AACSB) Analysis

The most important number in most financial plans is projected revenue. Why? For one thing, without a realistic estimate of your revenue, you can’t accurately calculate your costs. Say, for example, that you just bought a condominium in Hawaii, which you plan to rent out to vacationers. Because you live in snowy New England, however, you plan to use it yourself from December 15 to January 15. You’ve also promised your sister that she can have it for the month of July. Now, in Hawaii, condo rents peak during the winter and summer seasons—December 15 to April 15, and June 15 to August 31. They also vary from island to island, according to age and quality, number of rooms, and location (on the beach or away from it). The good news is that your relatively new two-bedroom condo is on a glistening beach in Maui. The bad news is that no one is fortunate enough to keep a condo rented for the entire time that it’s available. What information would you need to estimate your rental revenues for the year?

-

(AACSB) Analysis

You’re developing a financial plan for a retail business that you want to launch this summer. You’ve determined that you need $500,000, including $50,000 for a truck, $80,000 for furniture and equipment, and $100,000 for inventory. You’ll use the rest to cover start-up and operating costs during your first six months of operation. After considering the possible sources of funds available to you, create a table that shows how you’ll obtain the $500,000 you need. It should include all the following items:

- Sources of all funds

- Dollar amounts to be obtained through each source

- The maturity, annual interest rate, and security of any loan

The total of your sources must equal $500,000. Finally, write a brief report explaining the factors that you considered in arriving at your combination of sources.

-

(AACSB) Communication

For the past three years, you’ve operated a company that manufactures and sells customized surfboards. Sales are great, your employees work hard, and your customers are happy. In lots of ways, things couldn’t be better. There is, however, one stubborn cloud hanging over this otherwise sunny picture: you’re constantly short of cash. You’ve ruled out going to the bank because you’d probably be turned down, and you’re not big enough to go public. Perhaps the solution is private investors. To see whether this option makes sense, research the pros and cons of getting funding from a venture capitalist. Write a brief report explaining why you have, or haven’t, decided to seek private funding.

13.5 Understanding Securities Markets

Learning Objectives

- Show how the securities market operates and how it’s regulated.

- Understand how market performance is measured.

So, before long, you’re a publicly traded company. Fortunately, because your degree in finance comes with a better-than-average knowledge of financial markets, you’re familiar with the ways in which investors will evaluate your company. Investors will look at the overall quality of the company and ask some basic questions:

- How well is it managed?

- Is it in a growing industry? Is its market share increasing or decreasing?

- Does it have a good line of products? Is it coming out with innovative products?

- How is the company doing relative to its competitors?

- What is its future? What is the future of its industry?

Investors also analyze the company’s performance over time and ask more-specific questions:

- Are its sales growing?

- Is its income going up?

- Is its stock price rising or falling?

- Are earnings per share rising?

They’ll assess the company’s financial strength, asking another series of specific questions:

- Can it pay its bills on time?

- Does it have too much debt?

- Is it managing its productive assets (such as inventory) efficiently?

Primary and Secondary Markets and Stock Exchanges

Security markets serve two functions:

- They help companies to raise funds by making the initial sale of their stock to the public.

- They provide a place where investors can trade already issued stock.

When you went through your IPO, shares were issued through a primary marketMarket that deals in the sale of newly issued securities.—a market that deals in new financial assets. As we’ve seen, the sale was handled by an investment banking firm, which matched you, as a corporation with stock to sell, with investors who wanted to buy it.

Organized Exchanges

After a certain time elapsed, investors began buying and selling your stock on a secondary marketMarket in which investors buy previously issued securities from other investors.. The proceeds of sales on this market go to the investor who sells the stock, not to your company. The best-known of these markets is the New York Stock Exchange (NYSE)Best-known stock market where stocks of the largest, most prestigious corporations are traded.,The official name of the New York Stock Exchange is the “NYSE Euronext.” Its name was formed following its merger with the fully electronic stock exchange Euronext. The exchange tends to go by its old and very familiar name—the New York Stock Exchange. where the stocks of the largest, most prestigious corporations in the world are traded. Other exchanges, including the American Stock Exchange (AMEX)Stock market where shares of smaller companies are traded. and regional exchanges located in places like Chicago and Boston, trade the stock of smaller companies.

OTC Markets

Note that a “market” doesn’t have to be a physical location. In the over-the-counter (OTC) marketMarket in which securities are traded over computer networks and phones rather than on the trading floor of an exchange., securities are traded among dealers over computer networks or by phone rather than on the floor of an organized exchange. Though there are exceptions, stocks traded in the OTC market are generally those of smaller (and often riskier) companies. The best-known OTC electronic-exchange system is the NASDAQBest-known over-the-counter, electronic exchange system. (National Association of Securities Dealers Automated Quotation system). It’s home to almost five thousand corporations, many of them technology companies. Unlike other OTC markets, the NASDAQ lists a variety of companies, ranging from small start-ups to such giants as Google, Microsoft, and Intel.

Regulating Securities Markets: The SEC

Because it’s vital that investors have confidence in the securities markets, Congress created the Securities and Exchange Commission (SEC)Government agency that enforces securities laws. in 1934. The SEC is charged with enforcing securities laws designed to promote full public disclosure, protecting investors against misconduct in the securities markets, and maintaining the integrity of the securities markets.U.S. Securities and Exchange Commission, http://www.sec.gov (accessed November 8, 2011).

Before offering securities for sale, the issuer must register its intent to sell with the SEC. In addition, the issuer must provide prospective buyers with a prospectusWritten offer to sell securities that provides useful information to prospective buyers.—a written offer to sell securities that describes the business and operations of the issuer, lists its officers, provides financial information, discloses any pending litigation, and states the proposed use of funds from the sale.

The SEC also enforces laws against insider tradingPractice of buying or selling of securities using important information about the company before it’s made public.—the illegal buying or selling of its securities by a firm’s officers and directors or anyone else taking advantage of valuable information about the company before it’s made public. The intent of these laws is to prevent insiders from profiting at the expense of other investors.

Measuring Market Performance: Market Indexes

Throughout the day, you can monitor the general drift of the stock market by watching any major news network and following the band at the bottom of your TV. News channels and broadcasts generally feature a market recap in the evening. Even music-oriented radio stations break for a minute of news every now and then, including a quick review of the stock market. Almost all these reports refer to one or more of the market indexesMeasure for tracking stock prices. with which investors can track trends in stock price. Let’s look more closely at some of these indicators.

The Dow

By far the most widely reported market index is the Dow Jones Industrial Average (DJIA)Market index that reflects the total value of a “market basket” of thirty large U.S. companies., or “the Dow.” The Dow is the total value of a “market basket” of thirty large companies headquartered in the United States. They aren’t the thirty largest or best-performing companies, but rather a group selected by the senior staff members at the Wall Street Journal to represent a broad spectrum of the U.S. economy, as well as a variety of industries. The thirty selected stocks change over time, but the list usually consists of household names, such as AT&T, Coca-Cola, Disney, IBM, General Electric, and Wal-Mart.

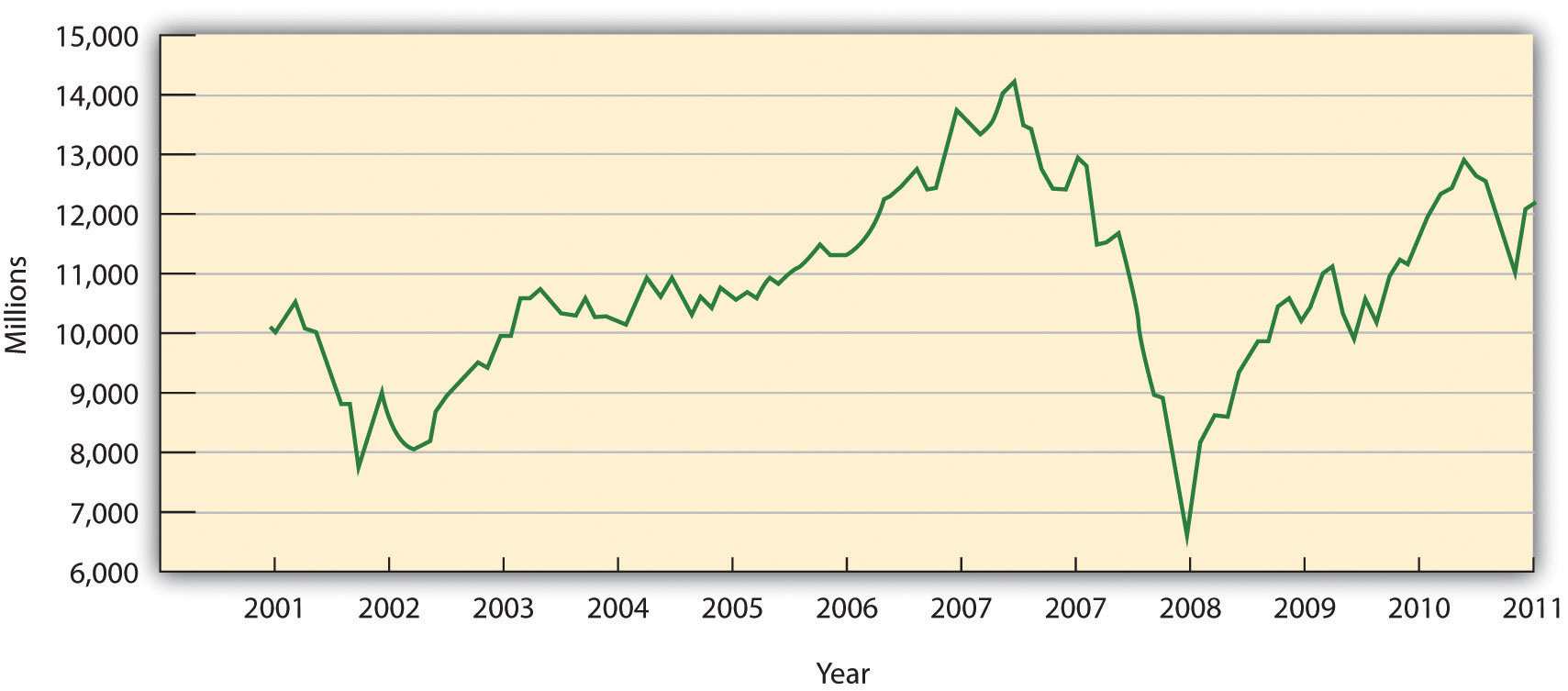

The graph in Figure 13.9 "DJIA for Ten-Year Period Ended November 2011" tracks the Dow for the ten-year period ended November 2011. The market measured by the Dow was on an upward swing from 2002 until it peaked in October 2007 at its all-time high of 14,200. At that point, it headed down until it reached a low point in March 2008 of 6,500 (a 54 percent drop from its all-time high). It has since crawled back up to 12,000, which is still 15 percent below its previous high. The path of the DOW during this ten-year period has been very volatile (subject to up and down movements in response to unstable worldwide economic and political situations).“History of the Dow Jones Industrial Average,” MD Leasing Corporation, http://www.mdleasing.com/djia.htm (accessed November 8, 2011).

Figure 13.9 DJIA for Ten-Year Period Ended November 2011

The NASDAQ Composite and the S&P 500

Also of interest is the performance of the NASDAQ Composite IndexMarket index of all stocks listed on the NASDAQ Stock Exchange., which includes many technology companies. Note in Figure 13.10 "NASDAQ for Ten-Year Period Ended November 2011" that the NASDAQ peaked in early 2000 at an index of over 5,000, but as investors began reevaluating the prospects of many technologies and technology companies, prices fell precipitously and the NASDAQ shed more than 80 percent of its value. It rebounded somewhat over the next seven years, only to be shot down again when difficult economic times in 2008 spelled trouble, and it declined by 45 percent. Another broad measure of stock performance is Standard & Poor’s Composite Index (S&P 500)Market index of the stocks of five hundred large U.S. companies., which lists the stocks of five hundred large U.S. companies. It followed the same pattern as the Dow and the NASDAQ Composite and declined by 37 percent in 2008.

Figure 13.10 NASDAQ for Ten-Year Period Ended November 2011

When the stock market is enjoying a period of large stock-price increases, we call it a bull marketPeriod of large stock-price increases.; when it’s declining or sluggish, we call it a bear marketPeriod of declining or sluggish stock prices.. The year 2008 was definitely a bear market.

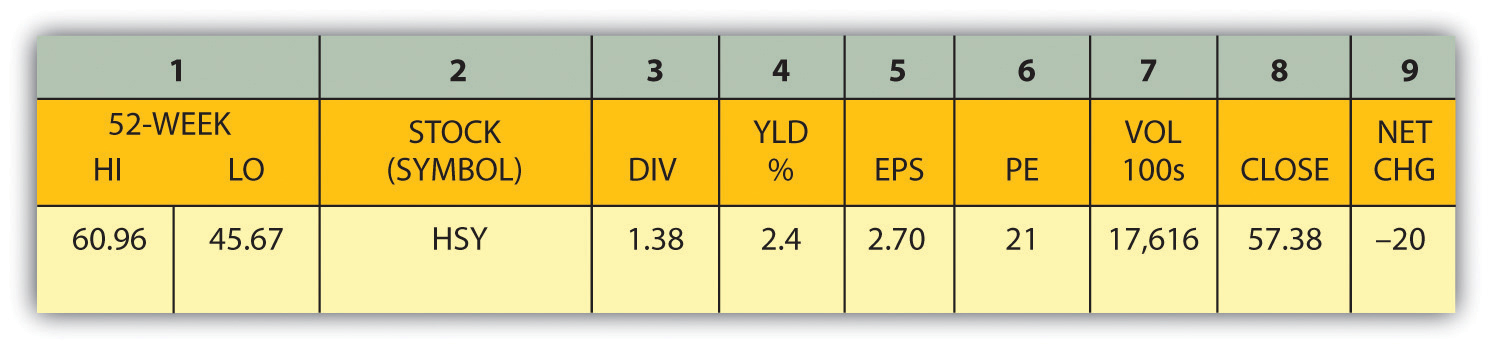

How to Read a Stock Listing

Businesspeople—both owners and managers—monitor their stock prices on a daily basis. They want the value of their stock to rise for both professional and personal reasons. Stock price, for example, is a sort of “report card” on the company’s progress, and it reflects the success of its managers in running the company. Many managers have a great deal of personal wealth tied directly to the fortunes of the companies for which they work.