This is “Summary and Exercises”, section 19.6 from the book The Legal Environment and Business Law: Master of Accountancy Edition (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

19.6 Summary and Exercises

Summary

As a general rule, one who signs a note as maker or a draft as drawer is personally liable unless he or she signs in a representative capacity and either the instrument or the signature shows that the signing has been made in a representative capacity. Various rules govern the permutations of signatures when an agent and a principal are involved.

The maker of a note and the acceptor of a draft have primary contract liability on the instruments. Secondarily liable are drawers and indorsers. Conditions precedent to secondary liability are presentment, dishonor, and notice of dishonor. Under the proper circumstances, any of these conditions may be waived or excused.

Presentment is a demand for payment made on the maker, acceptor, or drawee, or a demand for acceptance on the drawee. Presentment must be made (1) at the time specified in the instrument unless no time is specified, in which case it must be at the time specified for payment, or (2) within a reasonable time if a sight instrument.

Dishonor occurs when acceptance or payment is refused after presentment, at which time a holder has the right of recourse against secondary parties if he has given proper notice of dishonor.

A seller-transferor of any commercial paper gives five implied warranties, which become valuable to a holder seeking to collect in the event that there has been no indorsement or the indorsement has been qualified. These warranties are (1) good title, (2) genuine signatures, (3) no material alteration, (4) no defenses by other parties to the obligation to pay the transferor, and (5) no knowledge of insolvency of maker, acceptor, or drawer.

A holder on presentment makes certain warranties also: (1) entitled to enforce the instrument, (2) no knowledge that the maker’s or drawer’s signature is unauthorized, and (3) no material alteration.

Among the ways in which the parties may be discharged from their contract to honor the instrument are the following: (1) payment or satisfaction, (2) tender of payment, (3) cancellation and renunciation, (4) impairment of recourse or of collateral, (5) reacquisition, (6) fraudulent and material alteration, (7) certification, (8) acceptance varying a draft, and (9) unexcused delay in presentment or notice of dishonor.

Exercises

-

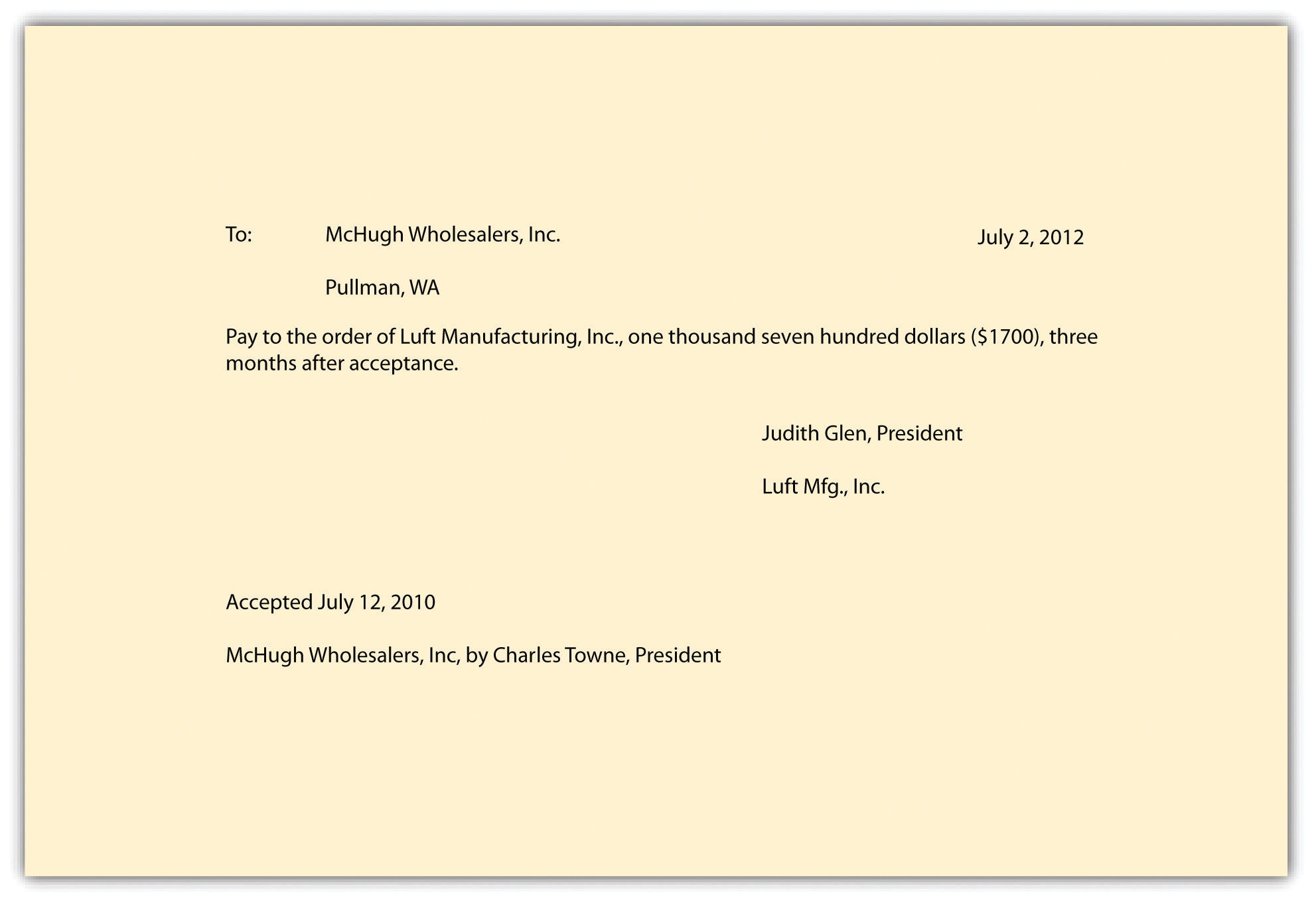

Howard Corporation has the following instrument, which it purchased in good faith and for value from Luft Manufacturing, Inc.

Figure 19.2

Judith Glen indorsed the instrument on the back in her capacity as president of Luft when it was transferred to Howard on July 15, 2012.

- Is this a note or a draft?

- What liability do McHugh and Luft have to Howard? Explain.

-

An otherwise valid negotiable bearer note is signed with the forged signature of Darby. Archer, who believed he knew Darby’s signature, bought the note in good faith from Harding, the forger. Archer transferred the note without indorsement to Barker, in partial payment of a debt. Barker then sold the note to Chase for 80 percent of its face amount and delivered it without indorsement. When Chase presented the note for payment at maturity, Darby refused to honor it, pleading forgery. Chase gave proper notice of dishonor to Barker and to Archer.

- Can Chase hold Barker liable? Explain.

- Can Chase hold Archer liable? Explain.

- Can Chase hold Harding liable? Explain.

- Marks stole one of Bloom’s checks, already signed by Bloom and made payable to Duval, drawn on United Trust Company. Marks forged Duval’s signature on the back of the check and cashed it at Check Cashing Company, which in turn deposited it with its bank, Town National. Town National proceeded to collect on the check from United. None of the parties was negligent. Who will bear the loss, assuming Marks cannot be found?

- Robb stole one of Markum’s blank checks, made it payable to himself, and forged Markum’s signature on it. The check was drawn on the Unity Trust Company. Robb cashed the check at the Friendly Check Cashing Company, which in turn deposited it with its bank, the Farmer’s National. Farmer’s National proceeded to collect on the check from Unity. The theft and forgery were quickly discovered by Markum, who promptly notified Unity. None of the parties mentioned was negligent. Who will bear the loss, assuming the amount cannot be recovered from Robb? Explain.

- Pat stole a check made out to the order of Marks, forged the name of Marks on the back, and made the instrument payable to herself. She then negotiated the check to Harrison for cash by signing her own name on the back of the instrument in Harrison’s presence. Harrison was unaware of any of the facts surrounding the theft or forged indorsement and presented the check for payment. Central County Bank, the drawee bank, paid it. Disregarding Pat, who will bear the loss? Explain.

- American Music Industries, Inc., owed Disneyland Records over $340,000. As evidence of the debt, Irv Schwartz, American’s president, issued ten promissory notes, signing them himself. There was no indication they were obligations of the corporation, American Music Industries, Inc., or that Irv Schwartz signed them in a representative capacity, but Mr. Schwartz asserted that Disneyland knew the notes were corporate obligations, not his personally. American paid four of the notes and then defaulted, and Disneyland sued him personally on the notes. He asserted he should be allowed to prove by parol evidence that he was not supposed to be liable. Is he personally liable? Explain.Schwartz v. Disneyland Vista Records, 383 So.2d 1117 (Fla. App. 1980).

- Alice Able hired Betty Baker as a bookkeeper for her seamstress shop. Baker’s duties included preparing checks for Able to sign and reconciling the monthly bank statements. Baker made out several checks to herself, leaving a large space to the left of the amount written, which Able noticed when she signed the checks. Baker took the signed checks, altered the amount by adding a zero to the right of the original amount, and cashed them at First Bank, the drawee. Able discovered the fraud, Baker was sent to prison, and Able sued First Bank, claiming it was liable for paying out on altered instruments. What is the result?

- Christina Reynolds borrowed $16,000 from First Bank to purchase a used Ford automobile. Bank took a note and a secured interest in the car (the car is collateral for the loan). It asked for further security, so Christina got her sister Juanita to sign the note as an accommodation maker. Four months later, Christina notified Bank that she wished to sell the Ford for $14,000 in order to get a four-wheel drive Jeep, and Bank released its security interest. When Christina failed to complete payment on the note for the Ford, Bank turned to Juanita. What, if anything, does Juanita owe?

Self-Test Questions

-

Drawers and indorsers have

- primary contract liability

- secondary liability

- no liability

- none of the above

-

Conditions(s) needed to establish secondary liability include

- presentment

- dishonor

- notice of dishonor

- all of the above

-

A demand for payment made on a maker, acceptor, or drawee is called

- protest

- notice

- presentment

- certification

-

An example of an implied warranty given by a seller of commercial paper includes a warranty

- of good title

- that there are no material alterations

- that signatures are genuine

- covering all of the above

-

Under UCC Article 3, discharge may result from

- cancellation

- impairment of collateral

- fraudulent alteration

- all of the above

Self-Test Answers

- b

- d

- c

- d

- d