This is “Operation: Relations among Partners”, section 14.1 from the book The Legal Environment and Business Law: Executive MBA Edition (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

14.1 Operation: Relations among Partners

Learning Objectives

- Recognize the duties partners owe each other: duties of service, loyalty, care, obedience, information, and accounting.

- Identify the rights that partners have, including the rights to distributions of money, to management, to choice of copartners, to property of the partnership, to assign partnership interest, and to enforce duties and rights.

Most of the rules discussed in this section apply unless otherwise agreed, and they are really intended for the small firm.“The basic mission of RUPA is to serve the small firm. Large partnerships can fend for themselves by drafting partnership agreements that suit their special needs.” Donald J. Weidner, “RUPA and Fiduciary Duty: The Texture of Relationship,” Law and Contemporary Problems 58, no. 2 (1995): 81, 83. The Uniform Partnership Act (UPA) and the Revised Uniform Partnership Act (RUPA) do not dictate what the relations among partners must be; the acts supply rules in the event that the partners have not done so for themselves. In this area, it is especially important for the partners to elaborate their agreement in writing. If the partners should happen to continue their business beyond the term fixed for it in their agreement, the terms of the agreement continue to apply.

Duties Partners Owe Each Other

Among the duties partners owe each other, six may be called out here: (1) the duty to serve, (2) the duty of loyalty, (3) the duty of care, (4) the duty of obedience, (5) the duty to inform copartners, and (6) the duty to account to the partnership. These are all very similar to the duty owed by an agent to the principal, as partnership law is based on agency concepts.Revised Uniform Partnership Act, Section 404, Comment 3: “Indeed, the law of partnership reflects the broader law of principal and agent, under which every agent is a fiduciary.”

Duty to Serve

Unless otherwise agreed, expressly or impliedly, a partner is expected to work for the firm. The partnership, after all, is a profit-making co-venture, and it would not do for one to loaf about and still expect to get paid. For example, suppose Joan takes her two-week vacation from the horse-stable partnership she operates with Sarah and Sandra. Then she does not return for four months because she has gone horseback riding in the Southwest. She might end up having to pay if the partnership hired a substitute to do her work.

Duty of Loyalty

In general, this requires partners to put the firm’s interests ahead of their own. Partners are fiduciaries as to each other and as to the partnership, and as such, they owe a fiduciary dutyThe highest duty of good faith and trust, imposed on partners as to each other and the firm. to each other and the partnership. Judge Benjamin Cardozo, in an often-quoted phrase, called the fiduciary duty “something stricter than the morals of the market place. Not honesty alone, but the punctilio of an honor the most sensitive, is then the standard of behavior.”Meinhard v. Salmon, 164 N.E. 545 (N.Y. 1928). Breach of the fiduciary duty gives rise to a claim for compensatory, consequential, and incidental damages; recoupment of compensation; and—rarely—punitive damages. See Section 14.4.1 "Breach of Partnership Fiduciary Duty", Gilroy v. Conway, for an example of breach of fiduciary duty.

Application of the Fiduciary Standard to Partnership Law

Under UPA, all partners are fiduciaries of each other—they are all principals and agents of each other—though the word fiduciary was not used except in the heading to Section 21. The section reads, “Every partner must account to the partnership for any benefit, and hold as trustee for it any profits derived by him without the consent of the other partners from any transaction connected with the formation, conduct, or liquidation of the partnership or from any use by him of its property.”

Section 404 of RUPA specifically provides that a partner has a fiduciary duty to the partnership and other partners. It imposes the fiduciary standard on the duty of loyalty in three circumstances:

(1) to account to the partnership and hold as trustee for it any property, profit, or benefit derived by the partner in the conduct and winding up of the partnership business or derived from a use by the partner of partnership property, including the appropriation of a partnership opportunity;

(2) to refrain from dealing with the partnership in the conduct or winding up of the partnership business as or on behalf of a party having an interest adverse to the partnership; and

(3) to refrain from competing with the partnership in the conduct of the partnership business before the dissolution of the partnership.

Limits on the Reach of the Fiduciary Duty

This sets out a fairly limited scope for application of the fiduciary standard, which is reasonable because partners do not delegate open-ended control to their copartners. Further, there are some specific limits on how far the fiduciary duty reaches (which means parties are held to the lower standard of “good faith”). Here are two examples. First, RUPA—unlike UPA—does not extend to the formation of the partnership; Comment 2 to RUPA Section 404 says that would be inappropriate because then the parties are “really dealing at arm’s length.” Second, fiduciary duty doesn’t apply to a dissociated partner (one who leaves the firm—discussed in Section 14 "Dissociation") who can immediately begin competing without the others’ consent; and it doesn’t apply if a partner violates the standard “merely because the partner’s conduct furthers the partner’s own interest.”RUPA, Section 503(b)(2); RUPA, Section 404 (e). Moreover, the partnership agreement may eliminate the duty of loyalty so long as that is not “manifestly unreasonable.”RUPA, Section 103(2)(c).

Activities Affected by the Duty of Loyalty

The duty of loyalty means, again, that partners must put the firm’s interest above their own. Thus it is held that a partner

- may not compete with the partnership,

- may not make a secret profit while doing partnership business,

- must maintain the confidentiality of partnership information.

This is certainly not a comprehensive list, and courts will determine on a case-by-case basis whether the duty of loyalty has been breached.

Duty of Care

Stemming from its roots in agency law, partnership law also imposes a duty of care on partners. Partners are to faithfully serve to the best of their ability. Section 404 of RUPA imposes the fiduciary standard on the duty of care, but rather confusingly: how does the “punctilio of an honor the most sensitive”—as Judge Cardozo described that standard—apply when under RUPA Section 404(c) the “the duty of care…is limited to refraining from engaging in grossly negligent or reckless conduct, intentional misconduct, or a knowing violation of law”? Recognize that a person can attend to business both loyally and negligently. For example, Alice Able, a partner in a law firm who is not very familiar with the firm’s computerized bookkeeping system, attempts to trace a missing check and in so doing erases a month’s worth of records. She has not breached her duty of care: maybe she was negligent, but not grossly negligent under RUPA Section 404(c). The partnership agreement may reduce the duty of care so long as it is not “unreasonably reduce[d]”; it may increase the standard too.RUPA, Section 103(2)(d); RUPA, Section 103.

Duty of Obedience

The partnership is a contractual relationship among the partners; they are all agents and principals of each other. Expressly or impliedly that means no partner can disobey the partnership agreement or fail to follow any properly made partnership decision. This includes the duty to act within the authority expressly or impliedly given in the partnership agreement, and a partner is responsible to the other partners for damages or losses arising from unauthorized activities.

Duty to Inform Copartners

As in the agency relationship, a partner is expected to inform copartners of notices and matters coming to her attention that would be of interest to the partnership.

Duty to Account

The partnership—and necessarily the partners—have a duty to allow copartners and their agents access to the partnership’s books and records and to provide “any information concerning the partnership’s business and affairs reasonably required for the proper exercise of the partner’s rights and duties under the partnership agreement [or this Act].”UPA, Sections 19 and 20; RUPA, Section 403. The fiduciary standard is imposed upon the duty to account for “it any property, profit, or benefit derived by [a] partner,” as noted in RUPA Section 404.RUPA, Section 404(1).

The Rights That Partners Have in a Partnership

Necessarily, for every duty owed there is a correlative right. So, for example, if a partner has a duty to account, the other partners and the partnership have a right to an accounting. Beyond that, partners have recognized rights affecting the operation of the partnership.

Here we may call out the following salient rights: (1) to distributions of money, (2) to management, (3) to choose copartners, (4) to property of the partnership, (5) to assign partnership interest, and (6) to enforce duties and rights.

Rights to Distributions

The purpose of a partnership is ultimately to distribute “money or other property from a partnership to a partner in the partner’s capacity.”RUPA, Section 101(3). There are, however, various types of money distributions, including profits (and losses), indemnification, capital, and compensation.

Right to Profits (and Losses)

Profits and losses may be shared according to any formula on which the partners agree. For example, the partnership agreement may provide that two senior partners are entitled to 35 percent each of the profit from the year and the two junior partners are entitled to 15 percent each. The next year the percentages will be adjusted based on such things as number of new clients garnered, number of billable hours, or amount of income generated. Eventually, the senior partners might retire and each be entitled to 2 percent of the firm’s income, and the previous junior partners become senior, with new junior partners admitted.

If no provision is stated, then under RUPA Section 401(b), “each partner is entitled to an equal share of the partnership profits and is chargeable with a share of the partnership losses in proportion to the partner’s share of the profits.” Section 18(a) of the Uniform Partnership Act is to the same effect. The right to share in the profits is the reason people want to “make partner”: a partner will reap the benefits of other partners’ successes (and pay for their failures too). A person working for the firm who is not a partner is an associate and usually only gets only a salary.

Right to Indemnification

A partner who incurs liabilities in the normal course of business or to preserve its business or property is entitled to indemnification (UPA Section 18(b), RUPA Section 401(c)). The liability is a loan owing to the partner by the firm.

Right to Return of Capital Contribution

When a partner joins a partnership, she is expected to make a capital contribution to the firm; this may be deducted from her share of the distributed profit and banked by the firm in its capital account. The law provides that “the partnership must reimburse a partner for an advance of funds beyond the amount of the partner’s agreed capital contribution, thereby treating the advance as a loan.”UPA, Section 18(c); RUPA, Section 401(d). A partner may get a return of capital under UPA after creditors are paid off if the business is wound down and terminated.UPA, Section 40(b); RUPA, Section 807(b).

Right to Compensation

Section 401(d) of RUPA provides that “a partner is not entitled to remuneration for services performed for the partnership, except for reasonable compensation for services rendered in winding up the business of the partnership”; UPA Section 18(f) is to the same effect. A partner gets his money from the firm by sharing the profits, not by a salary or wages.

Right to Management

All partners are entitled to share equally in the management and conduct of the business, unless the partnership agreement provides otherwise.UPA, Section 18(e); RUPA, Section 401(f). The partnership agreement could be structured to delegate more decision-making power to one class of partners (senior partners) than to others (junior partners), or it may give more voting weight to certain individuals. For example, perhaps those with the most experience will, for the first four years after a new partner is admitted, have more voting weight than the new partner.

Right to Choose Partners

A business partnership is often analogized to a marriage partnership. In both there is a relationship of trust and confidence between (or among) the parties; in both the poor judgment, negligence, or dishonesty of one can create liabilities on the other(s). In a good marriage or good partnership, the partners are friends, whatever else the legal relationship imposes. Thus no one is compelled to accept a partner against his or her will. Section 401(i) of RUPA provides, “A person may become a partner only with the consent of all of the partners.” UPA Section 18(g) is to the same effect; the doctrine is called delectus personaeThe theory that a new partner can only be admitted to a firm with the unanimous consent of all.. The freedom to select new partners, however, is not absolute. In 1984, the Supreme Court held that Title VII of the Civil Rights Act of 1964—which prohibits discrimination in employment based on race, religion, national origin, or sex—applies to partnerships.Hishon v. King & Spalding, 467 U.S. 69 (1984).

Right to Property of the Partnership

Partners are the owners of the partnership, which might not include any physical property; that is, one partner could contribute the building, furnishings, and equipment and rent those to the partnership (or those could count as her partnership capital contribution and become the partnership’s). But partnership property consists of all property originally advanced or contributed to the partnership or subsequently acquired by purchase or contribution. Unless a contrary intention can be shown, property acquired with partnership funds is partnership property, not an individual partner’s: “Property acquired by a partnership is property of the partnership and not of the partners individually.”RUPA, Section 203; UPA, Sections 8(1) and 25.

Rights in Specific Partnership Property: UPA Approach

Suppose that Able, who contributed the building and grounds on which the partnership business is conducted, suddenly dies. Who is entitled to her share of the specific property, such as inventory, the building, and the money in the cash register—her husband and children, or the other partners, Baker and Carr? Section 25(1) of UPA declares that the partners hold the partnership property as tenants in partnershipUnder UPA, how partnership property is held by the partners: jointly.. As spelled out in Section 25(2), the specific property interest of a tenant in partnership vests in the surviving partners, not in the heirs. But the heirs are entitled to the deceased partner’s interest in the partnership itself, so that while Baker and Carr may use the partnership property for the benefit of the partnership without consulting Able’s heirs, they must account to her heirs for her proper share of the partnership’s profits.

Rights in Specific Property: RUPA Approach

Section 501 of RUPA provides, “A partner is not a co-owner of partnership property and has no interest in partnership property which can be transferred, either voluntarily or involuntarily.” Partnership property is owned by the entity; UPA’s concept of tenants in partnership is abolished in favor of adoption of the entity theory. The result, however, is not different.

Right to Assign Partnership Interest

One of the hallmarks of the capitalistic system is that people should be able to dispose of their property interests more or less as they see fit. Partnership interests may be assigned to some extent.

Voluntary Assignment

At common law, assignment of a partner’s interest in the business—for example, as a mortgage in return for a loan—would result in a legal dissolution of the partnership. Thus in the absence of UPA, which changed the law, Baker’s decision to mortgage his interest in the car dealership in return for a $20,000 loan from his bank would mean that the three—Able, Baker, and Carr—were no longer partners. Section 27 of UPA declares that assignment of an interest in the partnership neither dissolves the partnership nor entitles the assignee “to interfere in the management or administration of the partnership business or affairs, or to require any information or account of partnership transactions, or to inspect the partnership books.” The assignment merely entitles the assignee to receive whatever profits the assignor would have received—this is the assignor’s transferable interest.UPA, Section 26. Under UPA, this interest is assignable.UPA, Section 27.

Under RUPA, the same distinction is made between a partner’s interest in the partnership and a partner’s transferable interest. The Official Comment to Section 101 reads as follows: “‘Partnership interest’ or ‘partner’s interest in the partnership’ is defined to mean all of a partner’s interests in the partnership, including the partner’s transferable interest and all management and other rights. A partner’s ‘transferable interest’ is a more limited concept and means only his share of the profits and losses and right to receive distributions, that is, the partner’s economic interests.”RUPA, Official Comment to Section 101.

This transferable interest is assignable under RUPA 503 (unless the partners agree to restrict transfers, Section 103(a)). It does not, by itself, cause the dissolution of the partnership; it does not entitle the transferee to access to firm information, to participate in running the firm, or to inspect or copy the books. The transferee is entitled to whatever distributions the transferor partner would have been entitled to, including, upon dissolution of the firm, the net amounts the transferor would have received had there been no assignment.

RUPA Section 101(b)(3) confers standing on a transferee to seek a judicial dissolution and winding up of the partnership business as provided in Section 801(6), thus continuing the rule of UPA Section 32(2). But under RUPA 601(4)(ii), the other partners may by unanimous vote expel a partner who has made “a transfer of all or substantially all of that partner’s transferable interest in the partnership, other than a transfer for security purposes [as for a loan].” Upon a creditor foreclosure of the security interest, though, the partner may be expelled.

Involuntary Assignment

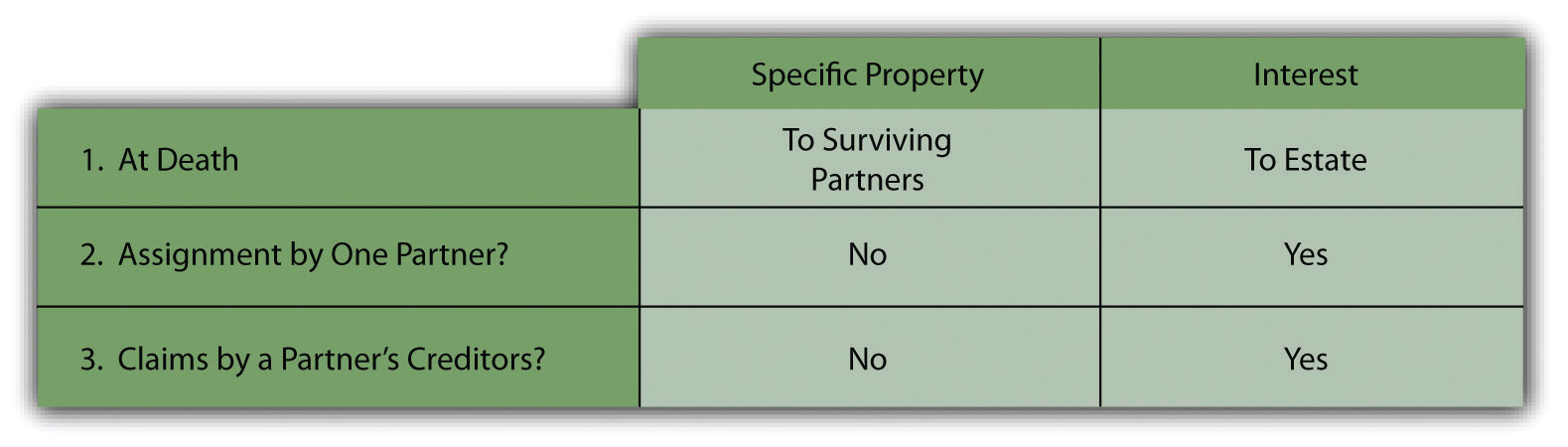

It may be a misnomer to describe an involuntary assignment as a “right”; it might better be thought of as a consequence of the right to own property. In any event, if a partner is sued in his personal capacity and a judgment is rendered against him, the question arises: may the judgment creditor seize partnership property? Section 28 of UPA and RUPA Section 504 permit a judgment creditor to obtain a charging orderA court order directing a partnership to pay a partner’s judgment creditor the distribution that the partner would normally receive., which charges the partner’s interest in the partnership with obligation to satisfy the judgment. The court may appoint a receiver to ensure that partnership proceeds are paid to the judgment creditor. But the creditor is not entitled to specific partnership property. The partner may always pay off the debt and redeem his interest in the partnership. If the partner does not pay off the debt, the holder of the charging order may acquire legal ownership of the partner’s interest. That confers upon the judgment creditor an important power: he may, if the partnership is one at will, dissolve the partnership and claim the partner’s share of the assets. For that reason, the copartners might wish to redeem the interest—pay off the creditor—in order to preserve the partnership. As with the voluntary assignment, the assignee of an involuntary assignment does not become a partner. See Figure 14.1 "Property Rights".

Figure 14.1 Property Rights

Right to Enforce Partnership Rights

The rights and duties imposed by partnership law are, of course, valueless unless they can be enforced. Partners and partnerships have mechanisms under the law to enforce them.

Right to Information and Inspection of Books

We noted in Section 14.1.1 "Duties Partners Owe Each Other" of this chapter that partners have a duty to account; the corollary right is the right to access books and records, which is usually very important in determining partnership rights. Section 403(b) of RUPA provides, “A partnership shall provide partners and their agents and attorneys access to its books and records. It shall provide former partners and their agents and attorneys access to books and records pertaining to the period during which they were partners. The right of access provides the opportunity to inspect and copy books and records during ordinary business hours. A partnership may impose a reasonable charge, covering the costs of labor and material, for copies of documents furnished.”RUPA Section 403(b).

Section 19 of UPA is basically in accord. This means that without demand—and for any purpose—the partnership must provide any information concerning its business and affairs reasonably required for the proper exercise of the partner’s rights and duties under the partnership agreement or the act; and on demand, it must provide any other information concerning the partnership’s business and affairs, unless the demand is unreasonable or improper.RUPA, Section 403(c)(1); RUPA, Section 403(c)(2). Generally, the partnership agreement cannot deny the right to inspection.

The duty to account mentioned in Section 14.1.1 "Duties Partners Owe Each Other" of this chapter normally means that the partners and the partnership should keep reasonable records so everyone can tell what is going on. A formal accounting under UPA is different.

Under UPA Section 22, any partner is entitled to a formal account (or accounting) of the partnership affairs under the following conditions:

- If he is wrongfully excluded from the partnership business or possession of its property by his copartners;

- If the right exists under the terms of any agreement;

- If a partner profits in violation of his fiduciary duty (as per UPA 22); and

- Whenever it is otherwise just and reasonable.

At common law, partners could not obtain an accounting except in the event of dissolution. But from an early date, equity courts would appoint a referee, auditor, or special master to investigate the books of a business when one of the partners had grounds to complain, and UPA broadened considerably the right to an accounting. The court has plenary power to investigate all facets of the business, evaluate claims, declare legal rights among the parties, and order money judgments against any partner in the wrong.

Under RUPA Section 405, this “accounting” business is somewhat modified. Reflecting the entity theory, the partnership can sue a partner for wrongdoing, which is not allowed under UPA. Moreover, to quote from the Official Comment, RUPA “provides that, during the term of the partnership, partners may maintain a variety of legal or equitable actions, including an action for an accounting, as well as a final action for an accounting upon dissolution and winding up. It reflects a new policy choice that partners should have access to the courts during the term of the partnership to resolve claims against the partnership and the other partners, leaving broad judicial discretion to fashion appropriate remedies[, and] an accounting is not a prerequisite to the availability of the other remedies a partner may have against the partnership or the other partners.”RUPA Official Comment 2, Section 405(b).

Key Takeaway

Partners have important duties in a partnership, including (1) the duty to serve—that is, to devote herself to the work of the partnership; (2) the duty of loyalty, which is informed by the fiduciary standard: the obligation to act always in the best interest of the partnership and not in one’s own best interest; (3) the duty of care—that is, to act as a reasonably prudent partner would; (4) the duty of obedience not to breach any aspect of the agreement or act without authority; (5) the duty to inform copartners; and (6) the duty to account to the partnership.

Partners also have rights. These include the rights (1) to distributions of money, including profits (and losses), indemnification, and return of capital contribution (but not a right to compensation); (2) to management; (3) to choose copartners; (4) to property of the partnership, and no partner has any rights to specific property; (5) to assign (voluntarily or involuntarily) the partnership interest; and (6) to enforce duties and rights by suits in law or equity. (Under RUPA, a formal accounting is not first required.)

Exercises

- What is the “fiduciary duty,” and why is it imposed on some partners’ actions with the partnership?

- Distinguish between ownership of partnership property under UPA as opposed to under RUPA.

- Carlos obtained a judgment against Pauline, a partner in a partnership, for negligently crashing her car into Carlos’s while she was not in the scope of partnership business. Carlos wants to satisfy the judgment from her employer. How can Carlos do that?

- What is the difference between the duty to account and a formal partnership accounting?

- What does it mean to say a partnership interest has been involuntarily assigned?