This is “Legal Aspects of Banking”, chapter 17 from the book The Legal Environment and Advanced Business Law (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 17 Legal Aspects of Banking

Learning Objectives

After reading this chapter, you should understand the following:

- Banks’ relationships with their customers for payment or nonpayment of checks;

- Electronic funds transfers and how the Electronic Fund Transfer Act affects the bank-consumer relationship;

- What a wholesale funds transfer is and the scope of Article 4A;

- What letters of credit are and how they are used.

To this point we have examined the general law of commercial paper as found in Article 3 of the UCC. Commercial paper—notwithstanding waves of digital innovation—still passes through bank collection processes by the ton every day, and Article 3 applies to this flow. But there is also a separate article in the UCC, Article 4, “Bank Deposits and Collections.” In case of conflict with Article 3 rules, those of Article 4 govern.

A discussion of government regulation of the financial services industry is beyond the scope of this book. Our focus is narrower: the laws that govern the operations of the banking system with respect to its depositors and customers. Although histories of banking dwell on the relationship between banks and the national government, the banking law that governs the daily operation of checking accounts is state based—Article 4 of the UCC. The enormous increase in noncheck banking has given rise to the Electronic Fund Transfer Act, a federal law.

17.1 Banks and Their Customers

Learning Objectives

- Understand how checks move, both traditionally and electronically.

- Know how Article 4 governs the relationship between a bank and its customers.

The Traditional Bank Collection Process

The Traditional System in General

Once people mostly paid for things with cash: actual bills. That is obviously not very convenient or safe: a lost ten-dollar bill is almost certainly gone, and carrying around large quantities of cash is dangerous (probably only crooks do much of that). Today a person might go for weeks without reaching for a bill (except maybe to get change for coins to put in the parking meter). And while it is indisputable that electronic payment is replacing paper payment, the latter is still very significant. Here is an excerpt from a Federal Reserve Report on the issue:

In 2008, U.S. consumers had more payment instruments to choose from than ever before: four types of paper instruments—cash, check, money order, and travelers checks; three types of payment cards—debit, credit, and prepaid; and two electronic instruments—online banking bill payment (OBBP) and electronic bank account deductions (EBAD) using their bank account numbers. The average consumer had 5.1 of the nine instruments in 2008, and used 4.2 instruments in a typical month. Consumers made 52.9 percent of their monthly payments with a payment card. More consumers now have debit cards than credit cards (80.2 percent versus 78.3 percent), and consumers use debit cards more often than cash, credit cards, or checks individually. However, paper instruments are still popular and account for 36.5 percent of consumer payments. Most consumers have used newer electronic payments at some point, but these only account for 9.7 percent of consumer payments. Security and ease of use are the characteristics of payment instruments that consumers rate as most important.Kevin Foster, et al., The 2008 Survey of Consumer Payment Choice, Federal Reserve Bank of Boston, Public Policy Discussion Paper No. 09-10, p. 2 (April 2010), http://www.bos.frb.org/economic/ppdp/2009/ppdp0910.pdf.

Americans still wrote some thirty billion checks in 2006.Scott Schuh, Overview of the Survey of Consumer Payment Choice (SCPC) Program, Federal Reserve Bank of Boston, p. 5 (May 2010). http://www.bos.frb.org/economic/cprc/presentations/2010/Schuh050610.pdf. You can readily imagine how complex the bank collection process must be to cope with such a flood of paper. Every check written must eventually come back to the bank on which it is drawn, after first having been sent to the landlord, say, to pay rent, then to the landlord’s bank, and from there through a series of intermediate banks and collection centers.

Terminology

To trace the traditional check-collection process, it is necessary to understand the terminology used. The bank upon which a check is written is the payor bankThe bank upon which a check is drawn; the drawee. (the drawee bank). The depository bankThe bank into which a check is deposited by its payee. is the one the payee deposits the check into. Two terms are used to describe the various banks that may handle the check after it is written: collecting banks and intermediary banks. All banks that handle the check—except the payor bank—are collecting banksA bank that collects the amount of a check for its customer from the payor bank. (including the depository bank); intermediary banksA bank that handles checks, but not including payor and depository banks. are all the collecting banks except the payor and depository banks. A bank can take on more than one role: Roger in Seattle writes a check on his account at Seattle Bank and mails it to Julia in Los Angeles in payment for merchandise; Julia deposits it in her account at Bank of L.A. Bank of L.A. is a depository bank and a collecting bank. Any other bank through which the check travels (except the two banks already mentioned) is an intermediary bank.

Collection Process between Customers of the Same Bank

If the depository bank is also the payor bank (about 30% of all checks), the check is called an “on-us” item and UCC 4-215(e)(2) provides that—if the check is not dishonored—it is available by the payee “at the opening of the bank’s second banking day following receipt of the item.” Roger writes a check to Matthew, both of whom have accounts at Seattle Bank; Matthew deposits the check on Monday. On Wednesday the check is good for Matthew (he may have been given “provisional credit” before then, as discussed below, the bank could subtract the money from his account if Roger didn’t have enough to cover the check).

Collection Process between Customers of Different Banks

Roger in Seattle writes a check on Seattle Bank payable to Julia in L.A. Julia deposits it in her account at L.A. Bank, the depository bank. L.A. Bank must somehow present the check to Seattle Bank either directly or through intermediary banks. If the collecting banks (again, all of them except Seattle Bank) act before the midnight deadline following receipt, they have acted “seasonably” according to UCC 4-202. When the payor bank—Seattle Bank—gets the check it must pay it, unless the check is dishonored or returned (UCC 4-302).

Physical Movement of Checks

The physical movement of checks—such as it still occurs—is handled by three possible systems.

The Federal Reserve System’s regional branches process checks for banks holding accounts with them. The Feds charge for the service, and prior to 2004 it regularly included check collection, air transportation of checks to the Reserve Bank (hired out to private contractors) and ground transportation delivery of checks to paying banks. Reserve Banks handle about 27 percent of US checks, but the air service is decreasing with “Check 21,” a federal law discussed below, that allows electronic transmission of checks.

Correspondent banksThose banks that form a partnership to exchange checks among themselves, bypassing the Federal Reserve and its fees. are banks that have formed “partnerships” with other banks in order to exchange checks and payments directly, bypassing the Federal Reserve and its fees. Outside banks may go through a correspondent bank to exchange checks and payments with one of its partners.

Correspondent banks may also form a clearinghouse corporationAn office where banks exchange checks and drafts and settle accounts, owned by the member banks participating., in which members exchange checks and payments in bulk, instead of on a check-by-check basis, which can be inefficient considering that each bank might receive thousands of checks in a day. The clearinghouse banks save up the checks drawn on other members and exchange them on a daily basis. The net payments for these checks are often settled through Fedwire, a Federal Reserve Board electronic funds transfer (EFT) system that handles large-scale check settlement among US banks. Correspondent banks and clearinghouse corporations make up the private sector of check clearing, and together they handle about 43 percent of US checks.

The Electronic System: Check 21 Act

Rationale for the “Check Clearing for the 21st Century Act”

After the events of September 11, 2001, Congress felt with renewed urgency that banks needed to present and clear checks in a way not dependent upon the physical transportation of the paper instruments by air and ground, in case such transportation facilities were disrupted. The federal Check Clearing for the 21st Century Act (Public Law 108-100)—more commonly referred to as “Check 21 Act”—became effective in 2004.

Basic Idea of Check 21 Act

Check 21 Act provides the legal basis for the electronic transportation of check data. A bank scans the check. The data on the check is already encoded in electronically readable numbers and the data, now separated (“truncated”) from the paper instrument (which may be destroyed), is transmitted for processing. “The Act authorizes a new negotiable instrument, called a substitute checkA paper reproduction of an electronically copied check the image of which is transferred if requested, instead of the paper check., to replace the original check. A substitute check is a paper reproduction of the original check that is suitable for automated processing in the same manner as the original check. The Act permits banks to provide substitute checks in place of original checks to subsequent parties in the check processing stream.…Any financial institution in the check clearing process can truncate the original check and create a substitute check.United States Treasury, The Check Clearing for the 21st Century Act: Frequently Asked Questions, October 2004, http://www.justice.gov/ust/eo/private_trustee/library/chapter07/docs/check21/Check21FAQs-final.pdf. However, in the check collection process it is not required that the image be converted to a substitute check: the electronic image itself may suffice.

For example, suppose Roger in Seattle writes a check on Seattle Bank payable to Julia in L.A. and mails it to her. Julia deposits it in her account at L.A. Bank, the depository bank. L.A. Bank truncates the check (again, scans it and destroys the original) and transmits the data to Seattle Bank for presentation and payment. If for any reason Roger, or any appropriate party, wants a paper version, a substitute check will be created (see Figure 17.1 "Substitute Check Front and Back"). Most often, though, that is not necessary: Roger does not receive the actual cancelled checks he wrote in his monthly statement as he did formerly. He receives instead a statement listing paid checks he’s written and a picture of the check (not a substitute check) is available to him online through his bank’s website. Or he may receive his monthly statement itself electronically, with pictures of the checks he wrote available with a mouse click. Roger may also dispense with mailing the check to Julia entirely, as noted in the discussion of electronic funds transfers.

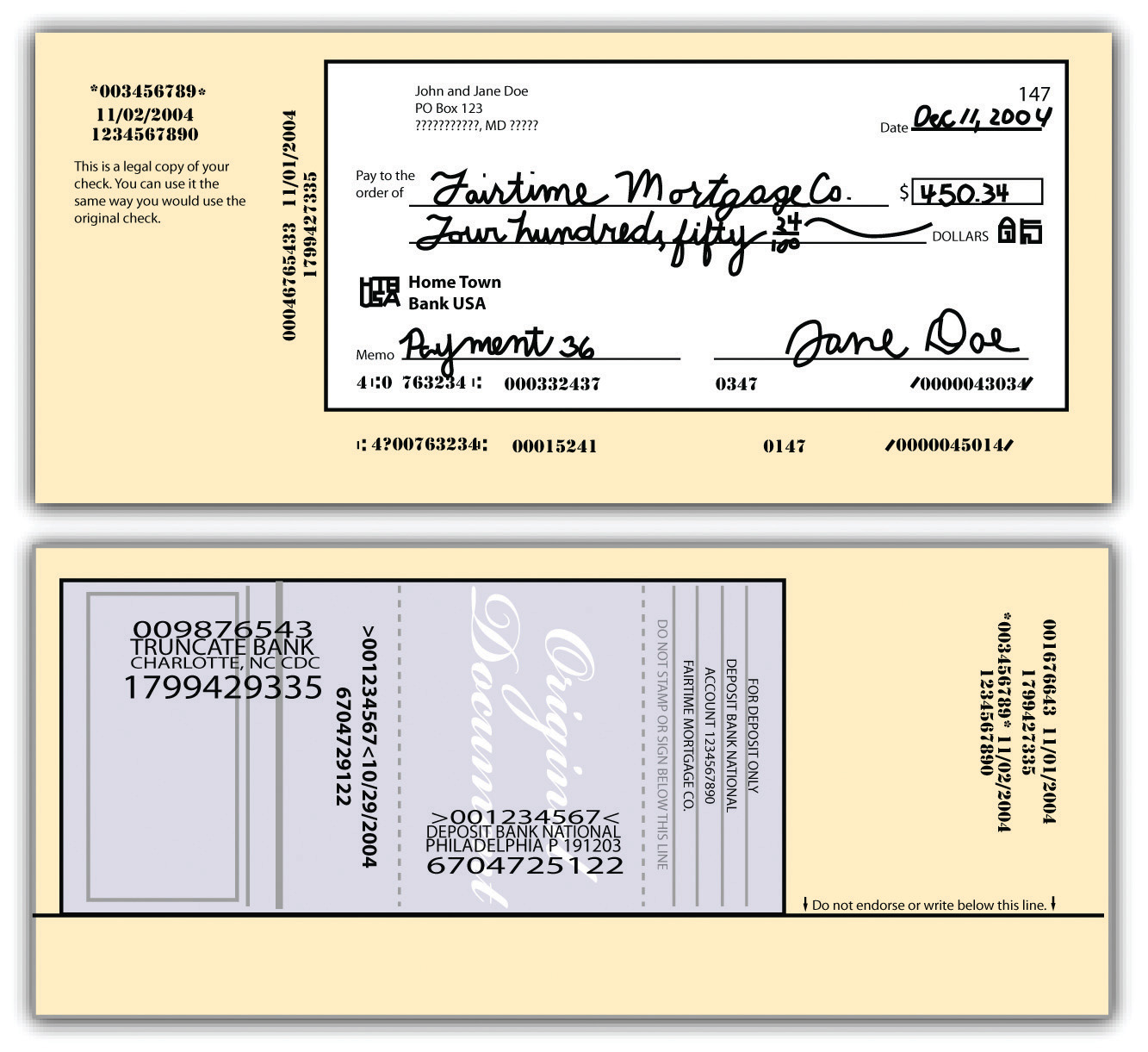

Figure 17.1 Substitute Check Front and Back

Front and back of a substitute check (not actual size).

Images from Federal Reserve Board: http://www.federalreserve.gov/pubs/check21/consumer_guide

Substitute checks are legal negotiable instruments. The act provides certain warranties to protect recipients of substitute checks that are intended to protect recipients against losses associated with the check substitution process. One of these warranties provides that “[a] bank that transfers, presents, or returns a substitute check…for which it receives consideration warrants…that…[t]he substitute check meets the requirements of legal equivalence” (12 CFR § 229.52(a)(1)). The Check 21 Act does not replace existing state laws regarding such instruments. The Uniform Commercial Code still applies, and we turn to it next.

Two notable consequences of the Check 21 Act are worth mentioning. The first is that a check may be presented to the payor bank for payment very quickly, perhaps in less than an hour: the customer’s “float” time is abbreviated. That means be sure you have enough money in your account to cover the checks that you write. The second consequence of Check 21 Act is that it is now possible for anybody—you at home or the merchant from whom you are buying something—to scan a check and deposit it instantly. “Remote deposit capture” allows users to transmit a scanned image of a check for posting and clearing using a web-connected computer and a check scanner. The user clicks to send the deposit to the desired existing bank account. Many merchants are using this system: that’s why if you write a check at the hardware store you may see it scanned and returned immediately to you. The digital data are transmitted, and the scanned image may be retrieved, if needed, as a “substitute check.”

UCC Article 4: Aspects of Bank Operations

Reason for Article 4

Over the years, the states had begun to enact different statutes to regulate the check collection process. Eighteen states adopted the American Bankers Association Bank Collection Code; many others enacted Deferred Posting statutes. Not surprisingly, a desire for uniformity was the principal reason for the adoption of UCC Article 4. Article 4 absorbed many of the rules of the American Bankers Association Code and of the principles of the Deferred Posting statutes, as well as court decisions and common customs not previously codified.

Banks Covered

Article 4 covers three types of banks: depository banks, payor banks, and collecting banks. These terms—already mentioned earlier—are defined in UCC Section 4-105. A depositary bank is the first bank to which an item is transferred for collection. Section 4-104 defines “item” as “an instrument or a promise or order to pay money handled by a bank for collection or payment[,]…not including a credit or debit card slip.” A payor bank is any bank that must pay a check because it is drawn on the bank or accepted there—the drawee bank (a depositary bank may also be a payor bank). A collecting bank is any bank except the payor bank that handles the item for collection.

Technical Rules

Detailed coverage of Parts 2 and 3 of Article 4, the substantive provisions, is beyond the scope of this book. However, Article 4 answers several specific questions that bank customers most frequently ask.

- What is the effect of a “pay any bank” indorsement? The moment these words are indorsed on a check, only a bank may acquire the rights of a holder. This restriction can be lifted whenever (a) the check has been returned to the customer initiating collection or (b) the bank specially indorses the check to a person who is not a bank (4-201).

- May a depositary bank supply a missing indorsement? It may supply any indorsement of the customer necessary to title unless the check contains words such as “payee’s indorsement required.” If the customer fails to indorse a check when depositing it in his account, the bank’s notation that the check was deposited by a customer or credited to his account takes effect as the customer’s indorsement. (Section 4-205(1)).

- Are any warranties given in the collection process? Yes. They are identical to those provided in Article 3, except that they apply only to customers and collecting banks (4-207(a)). The customer or collecting bank that transfers an item and receives a settlement or other consideration warrants (1) he is entitled to enforce the item; (2) all signatures are authorized authentic; (3) the item has not been altered; (4) the item is not subject to a defense or claim in recoupment; (5) he has no knowledge of insolvency proceedings regarding the maker or acceptor or in the case of an unaccepted draft, the drawer. These warranties cannot be disclaimed as to checks.

-

Does the bank have the right to a charge-back against a customer’s account, or refund? The answer turns on whether the settlement was provisional or final. A settlement is the proper crediting of the amount ordered to be paid by the instrument. Someone writes you a check for $1,000 drawn on First Bank, and you deposit it in Second Bank. Second Bank will make a “provisional settlement” with you—that is, it will provisionally credit your account with $1,000, and that settlement will be final when First Bank debits the check writer’s account and credits Second Bank with the funds. Under Section 4-212(1), as long as the settlement was still provisional, a collecting bank has the right to a “charge-back” or refund if the check “bounces” (is dishonored). However, if settlement was final, the bank cannot claim a refund.

What determines whether settlement is provisional or final? Section 4-213(1) spells out four events (whichever comes first) that will convert a payor bank’s provisional settlement into final settlement: When it (a) pays the item in cash; (b) settles without reserving a right to revoke and without having a right under statute, clearinghouse rule, or agreement with the customer; finishes posting the item to the appropriate account; or (d) makes provisional settlement and fails to revoke the settlement in the time and manner permitted by statute, clearinghouse rule, or agreement. All clearinghouses have rules permitting revocation of settlement within certain time periods. For example an item cleared before 10 a.m. may be returned and the settlement revoked before 2 p.m. From this section it should be apparent that a bank generally can prevent a settlement from becoming final if it chooses to do so.

Relationship with Customers

The relationship between a bank and its customers is governed by UCC Article 4. However, Section 4-103(1) permits the bank to vary its terms, except that no bank can disclaim responsibility for failing to act in good faith or to exercise ordinary care. Most disputes between bank and customer arise when the bank either pays or refuses to pay a check. Under several provisions of Article 4, the bank is entitled to pay, even though the payment may be adverse to the customer’s interest.

Common Issues Arising between Banks and Their Customers

Payment of Overdrafts

Suppose a customer writes a check for a sum greater than the amount in her account. May the bank pay the check and charge the customer’s account? Under Section 4-401(1), it may. Moreover, it may pay on an altered check and charge the customer’s account for the original tenor of the check, and if a check was completed it may pay the completed amount and charge the customer’s account, assuming the bank acted in good faith without knowledge that the completion was improper.

Payment of Stale Checks

Section 4-404 permits a bank to refuse to pay a check that was drawn more than six months before being presented. Banks ordinarily consider such checks to be “stale” and will refuse to pay them, but the same section gives them the option to pay if they choose. A corporate dividend check, for example, will be presumed to be good more than six months later. The only exception to this rule is for certified checks, which must be paid whenever presented, since the customer’s account was charged when the check was certified.

Payment of Deceased’s or Incompetent’s Checks

Suppose a customer dies or is adjudged to be incompetent. May the bank honor her checks? Section 4-405 permits banks to accept, pay, and collect an item as long as it has no notice of the death or declaration of incompetence, and has no reasonable opportunity to act on it. Even after notice of death, a bank has ten days to payor certify checks drawn on or prior to the date of death unless someone claiming an interest in the account orders it to refrain from doing so.

Stop Payment Orders

Section 4-403 expressly permits the customer to order the bank to “stop payment” on any check payable for her account, assuming the stop order arrives in enough time to reasonably permit the bank to act on it. An oral stop order is effective for fourteen days; a follow-up written confirmation within that time is effective for six months and can be renewed in writing. But if a stop order is not renewed, the bank will not be liable for paying the check, even one that is quite stale (e.g., Granite Equipment Leasing Corp. v. Hempstead Bank, 326 N.Y.S. 2d 881 (1971)).

Wrongful Dishonor

If a bank wrongfully dishonors an item, it is liable to the customer for all damages that are a direct consequence of (“proximately caused by”) the dishonor. The bank’s liability is limited to the damages actually proved; these may include damages for arrest and prosecution. See Section 17.4 "Cases" under “Bank’s Liability for Paying over Customer’s ‘Stop Payment’ Order” (Meade v. National Bank of Adams County).

Customers’ Duties

In order to hold a bank liable for paying out an altered check, the customer has certain duties under Section 4-406. Primarily, the customer must act promptly in examining her statement of account and must notify the bank if any check has been altered or her signature has been forged. If the customer fails to do so, she cannot recover from the bank for an altered signature or other term if the bank can show that it suffered a loss because of the customer’s slowness. Recovery may also be denied when there has been a series of forgeries and the customer did not notify the bank within two weeks after receiving the first forged item. See Section 17.4 "Cases" under “Customer’s Duty to Inspect Bank Statements” (the Planters Bank v. Rogers case).

These rules apply to a payment made with ordinary care by the bank. If the customer can show that the bank negligently paid the item, then the customer may recover from the bank, regardless of how dilatory the customer was in notifying the bank—with two exceptions: (1) from the time she first sees the statement and item, the customer has one year to tell the bank that her signature was unauthorized or that a term was altered, and (2) she has three years to report an unauthorized indorsement.

The Expedited Funds Availability Act

In General

In addition to UCC Article 4 (again, state law), the federal Expedited Funds Availability Act—also referred to as “Regulation CC” after the Federal Reserve regulation that implements it—addresses an aspect of the relationship between a bank and its customers. It was enacted in 1988 in response to complaints by consumer groups about long delays before customers were allowed access to funds represented by checks they had deposited. It has nothing to do with electronic transfers, although the increasing use of electronic transfers does speed up the system and make it easier for banks to comply with Regulation CC.

The Act’s Provisions

The act provides that when a customer deposits a cashier’s check, certified check, or a check written on an account in the same bank, the funds must be available by the next business day. Funds from other local checks (drawn on institutions within the same Federal Reserve region) must be available within two working days, while there is a maximum five-day wait for funds from out-of-town checks. In order for these time limits to be effective, the customer must endorse the check in a designated space on the back side. The FDIC sets out the law at its website: http://www.fdic.gov/regulations/laws/rules/6500-3210.html.

Key Takeaway

The bank collection process is the method by which checks written on one bank are transferred by the collecting bank to a clearing house. Traditionally this has been a process of physical transfer by air and ground transportation from the depository bank to various intermediary banks to the payor bank where the check is presented. Since 2004 the Check 21 Act has encouraged a trend away from the physical transportation of checks to the electronic transportation of the check’s data, which is truncated (stripped) from the paper instrument and transmitted. However, if a paper instrument is required, a “substitute check” will recreate it. The UCC’s Article 4 deals generally with aspects of the bank-customer relationship, including warranties on payment or collection of checks, payment of overdrafts, stop orders, and customers’ duties to detect irregularities. The Expedited Funds Availability Act is a federal law governing customer’s access to funds in their accounts from deposited checks.

Exercises

- Describe the traditional check-collection process from the drawing of the check to its presentation for payment to the drawee (payor) bank

- Describe how the Check 21 Act has changed the check-collection process.

- Why was Article 4 developed, and what is its scope of coverage?

17.2 Electronic Funds Transfers

Learning Objectives

- Understand why electronic fund transfers have become prevalent.

- Recognize some typical examples of EFTs.

- Know that the EFT Act of 1978 protects consumers, and recognize what some of those protections—and liabilities—are.

- Understand when financial institutions will be liable for violating the act, and some of the circumstances when the institutions will not be liable.

Background to Electronic Fund Transfers

In General

Drowning in the yearly flood of billions of checks, eager to eliminate the “float” that a bank customer gets by using her money between the time she writes a check and the time it clears, and recognizing that better customer service might be possible, financial institutions sought a way to computerize the check collection process. What has developed is electronic fund transfer (EFT), a system that has changed how customers interact with banks, credit unions, and other financial institutions. Paper checks have their advantages, but their use is decreasing in favor of EFT.

In simplest terms, EFT is a method of paying by substituting an electronic signal for checks. A “debit card,” inserted in the appropriate terminal, will authorize automatically the transfer of funds from your checking account, say, to the account of a store whose goods you are buying.

Types of EFT

You are of course familiar with some forms of EFT:

- The automated teller machine (ATM) permits you to electronically transfer funds between checking and savings accounts at your bank with a plastic ID card and a personal identification number (PIN), and to obtain cash from the machine.

- Telephone transfers or computerized transfers allow customers to access the bank’s computer system and direct it to pay bills owed to a third party or to transfer funds from one account to another.

- Point of sale terminals located in stores let customers instantly debit their bank accounts and credit the merchant’s account.

- Preauthorized payment plans permit direct electronic deposit of paychecks, Social Security checks, and dividend checks.

- Preauthorized withdrawals from customers’ bank accounts or credit card accounts allow paperless payment of insurance premiums, utility bills, automobile or mortgage payments, and property tax payments.

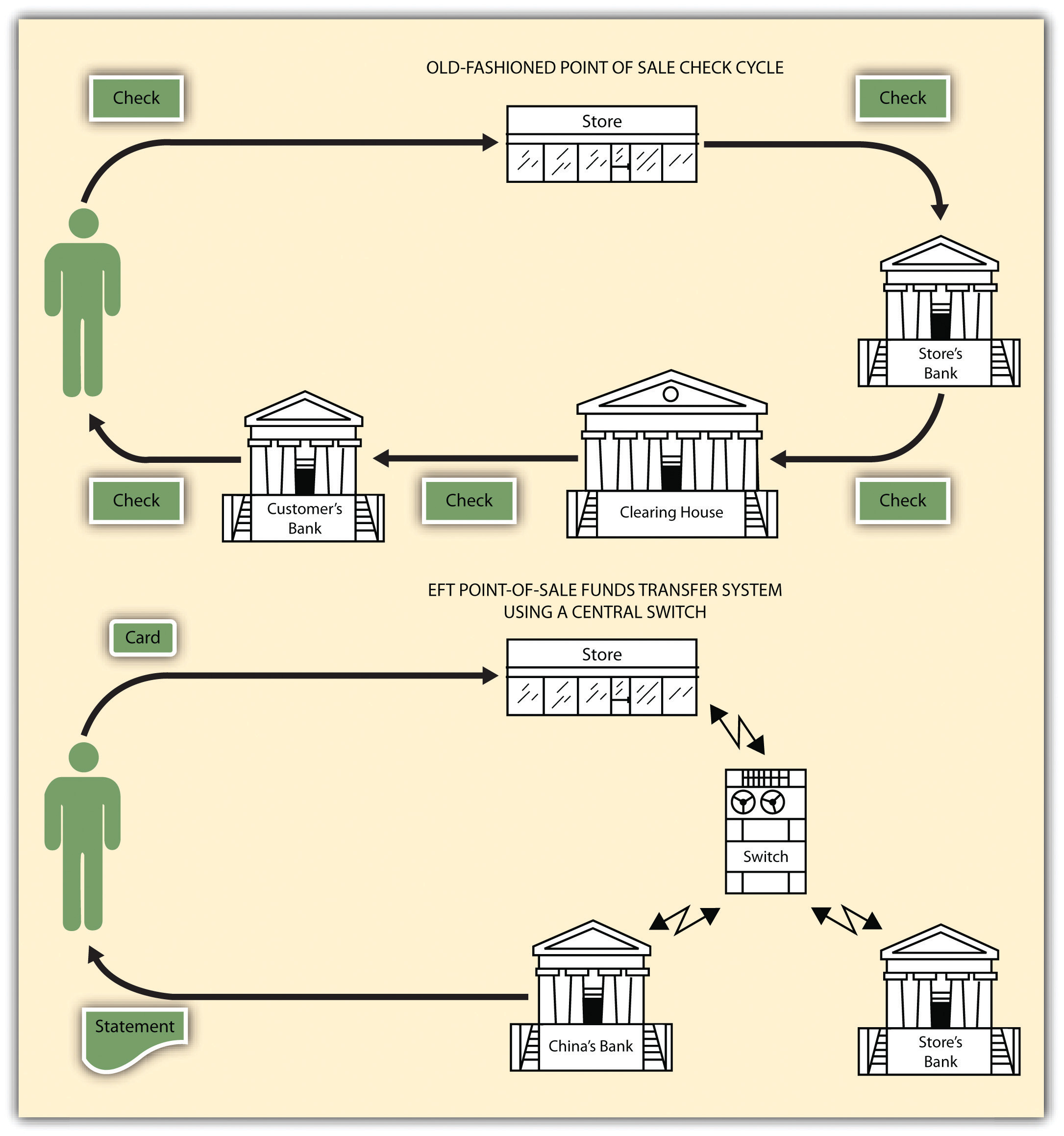

The “short circuit” that EFT permits in the check processing cycle is illustrated in Figure 17.2 "How EFT Replaces Checks".

Figure 17.2 How EFT Replaces Checks

Unlike the old-fashioned check collection process, EFT is virtually instantaneous: at one instant a customer has a sum of money in her account; in the next, after insertion of a plastic card in a machine or the transmission of a coded message by telephone or computer, an electronic signal automatically debits her bank checking account and posts the amount to the bank account of the store where she is making a purchase. No checks change hands; no paper is written on. It is quiet, odorless, smudge proof. But errors are harder to trace than when a paper trail exists, and when the system fails (“our computer is down”) the financial mess can be colossal. Obviously some sort of law is necessary to regulate EFT systems.

Electronic Fund Transfer Act of 1978

Purpose

Because EFT is a technology consisting of several discrete types of machines with differing purposes, its growth has not been guided by any single law or even set of laws. The most important law governing consumer transactions is the Electronic Fund Transfer Act of 1978Federal law that provides a basic framework establishing the rights, liabilities, and responsibilities of participants in electronic fund transfer systems.,FDIC, “Electronic Fund Transfer Act of 1978,” http://www.fdic.gov/regulations/laws/rules/6500-1350.html. whose purpose is “to provide a basic framework establishing the rights, liabilities, and responsibilities of participants in electronic fund transfer systems. The primary objective of [the statute], however, is the provision of individual consumer rights.” This federal statute has been implemented and supplemented by the Federal Reserve Board’s Regulation E, Comptroller of the Currency guidelines on EFT, and regulations of the Federal Home Loan Bank Board. (Wholesale transactions are governed by UCC Article 4A, which is discussed later in this chapter.)

The EFT Act of 1978 is primarily designed to disclose the terms and conditions of electronic funds transfers so the customer knows the rights, costs and liabilities associated with EFT, but it does not embrace every type of EFT system. Included are “point-of-sale transfers, automated teller machine transactions, direct deposits or withdrawal of funds, and transfers initiated by telephone or computer” (EFT Act Section 903(6)). Not included are such transactions as wire transfer services, automatic transfers between a customer’s different accounts at the same financial institution, and “payments made by check, draft, or similar paper instrument at electronic terminals” (Reg. E, Section 205.2(g)).

Consumer Protections Afforded by the Act

Four questions present themselves to the mildly wary consumer facing the advent of EFT systems: (1) What record will I have of my transaction? (2) How can I correct errors? (3) What recourse do I have if a thief steals from my account? (4) Can I be required to use EFT? The EFT Act, as implemented by Regulation E, answers these questions as follows.

- Proof of transaction. The electronic terminal itself must be equipped to provide a receipt of transfer, showing date, amount, account number, and certain other information. Perhaps more importantly, the bank or other financial institution must provide you with a monthly statement listing all electronic transfers to and from the account, including transactions made over the computer or telephone, and must show to whom payment has been made.

- Correcting errors. You must call or write the financial institution whenever you believe an error has been made in your statement. You have sixty days to do so. If you call, the financial institution may require you to send in written information within ten days. The financial institution has forty-five days to investigate and correct the error. If it takes longer than ten days, however, it must credit you with the amount in dispute so that you can use the funds while it is investigating. The financial institution must either correct the error promptly or explain why it believes no error was made. You are entitled to copies of documents relied on in the investigation.

- Recourse for loss or theft. If you notify the issuer of your EFT card within two business days after learning that your card (or code number) is missing or stolen, your liability is limited to $50. If you fail to notify the issuer in this time, your liability can go as high as $500. More daunting is the prospect of loss if you fail within sixty days to notify the financial institution of an unauthorized transfer noted on your statement: after sixty days of receipt, your liability is unlimited. In other words, a thief thereafter could withdraw all your funds and use up your line of credit and you would have no recourse against the financial institution for funds withdrawn after the sixtieth day, if you failed to notify it of the unauthorized transfer.

- Mandatory use of EFT. Your employer or a government agency can compel you to accept a salary payment or government benefit by electronic transfer. But no creditor can insist that you repay outstanding loans or pay off other extensions of credit electronically. The act prohibits a financial institution from sending you an EFT card “valid for use” unless you specifically request one or it is replacing or renewing an expired card. The act also requires the financial institution to provide you with specific information concerning your rights and responsibilities (including how to report losses and thefts, resolve errors, and stop payment of preauthorized transfers). A financial institution may send you a card that is “not valid for use” and that you alone have the power to validate if you choose to do so, after the institution has verified that you are the person for whom the card was intended.

Liability of the Financial Institution

The financial institution’s failure to make an electronic fund transfer, in accordance with the terms and conditions of an account, in the correct amount or in a timely manner when properly instructed to do so by the consumer makes it liable for all damages proximately caused to the consumer, except where

1) the consumer’s account has insufficient funds;

2) the funds are subject to legal process or other encumbrance restricting such transfer;

3) such transfer would exceed an established credit limit;

4) an electronic terminal has insufficient cash to complete the transaction; or

5) a circumstance beyond its control, where it exercised reasonable care to prevent such an occurrence, or exercised such diligence as the circumstances required.

Enforcement of the Act

A host of federal regulatory agencies oversees enforcement of the act. These include the Comptroller of the Currency (national banks), Federal Reserve District Bank (state member banks), Federal Deposit Insurance Corporation regional director (nonmember insured banks), Federal Home Loan Bank Board supervisory agent (members of the FHLB system and savings institutions insured by the Federal Savings & Loan Insurance Corporation), National Credit Union Administration (federal credit unions), Securities & Exchange Commission (brokers and dealers), and the Federal Trade Commission (retail and department stores) consumer finance companies, all nonbank debit card issuers, and certain other financial institutions. Additionally, consumers are empowered to sue (individually or as a class) for actual damages caused by any EFT system, plus penalties ranging from $100 to $1,000. Section 17.4 "Cases", under “Customer’s Duty to Inspect Bank Statements” (Commerce Bank v. Brown), discusses the bank’s liability under the act.

Key Takeaway

Eager to reduce paperwork for both themselves and for customers, and to speed up the check collection process, financial institutions have for thirty years been moving away from paper checks and toward electronic fund transfers. These EFTs are ubiquitous, including ATMs, point-of-sale systems, direct deposits and withdrawals and online banking of various kinds. Responding to the need for consumer protection, Congress adopted the Electronic Fund Transfers Act, effective in 1978. The act addresses many common concerns consumers have about using electronic fund transfer systems, sets out liability for financial institutions and customers, and provides an enforcement mechanism.

Exercises

- Why have EFTs become very common?

- What major issues are addressed by the EFTA?

- If you lose your credit card, what is your liability for unauthorized charges?

17.3 Wholesale Transactions and Letters of Credit

Learning Objectives

- Understand what a “wholesale transaction” is; recognize that UCC Article 4A governs such transactions, and recognize how the Article addresses three common issues.

- Know what a “letter of credit” (LC) is, the source of law regarding LCs, and how such instruments are used.

Wholesale Funds Transfers

Another way that money is transferred is by commercial fund transfers or wholesale funds transfersTransfers of large sums of money—tens of millions of dollars—between businesses or between businesses and financial institutions., which is by far the largest segment of the US payment system measured in amounts of money transferred. It is trillions of dollars a day. Wholesale transactions are the transfers of funds between businesses or financial institutions.

Background and Coverage

It was in the development of commercial “wholesale wire transfers” of money in the nineteeth and early twentieth centuries that businesses developed the processes enabling the creation of today’s consumer electronic funds transfers. Professor Jane Kaufman Winn described the development of uniform law governing commercial funds transfers:

Although funds transfers conducted over funds transfer facilities maintained by the Federal Reserve Banks were subject to the regulation of the Federal Reserve Board, many funds transfers took place over private systems, such as the Clearing House for Interbank Payment Systems (“CHIPS”). The entire wholesale funds transfer system was not governed by a clear body of law until U.C.C. Article 4A was promulgated in 1989 and adopted by the states shortly thereafter. The Article 4A drafting process resulted in many innovations, even though it drew heavily on the practices that had developed among banks and their customers during the 15 years before the drafting committee was established. While a consensus was not easy to achieve, the community of interests shared by both the banks and their customers permitted the drafting process to find workable compromises on many thorny issues.Jane Kaufman Winn, Clash of the Titans: Regulating the Competition between Established and Emerging Electronic Payment Systems, http://www.law.washington.edu/Directory/docs/Winn/Clash%20of%20the%20Titans.htm.

All states and US territories have adopted Article 4A. Consistent with other UCC provisions, the rights and obligations under Article 4A may be varied by agreement of the parties. Article 4A does not apply if any step of the transaction is governed by the Electronic Fund Transfer Act. Although the implication may be otherwise, the rules in Article 4A apply to any funds transfer, not just electronic ones (i.e., transfers by mail are covered, too). Certainly, however, electronic transfers are most common, and—as the Preface to Article 4A notes—a number of characteristics of them influenced the Code’s rules. These transactions are characterized by large amounts of money—multimillions of dollars; the parties are sophisticated businesses or financial institutions; funds transfers are completed in one day, they are highly efficient substitutes for paper delivery; they are usually low cost—a few dollars for the funds transfer charged by the sender’s bank.

Operation of Article 4A

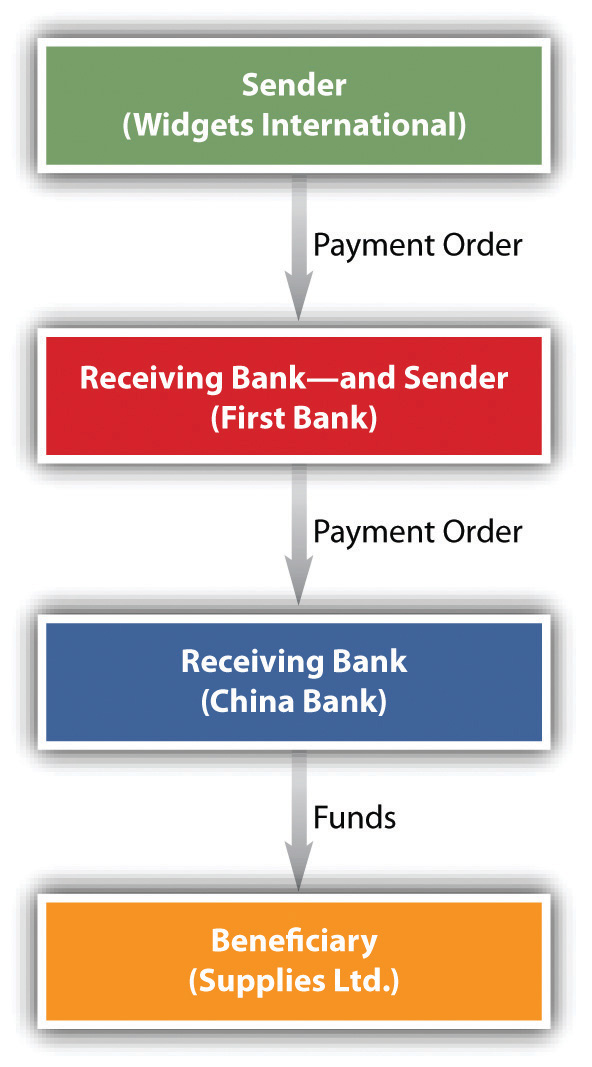

The UCC “Prefatory Note” to Article 4A observes that “the funds transfer that is covered by Article 4A is not a complex transaction.” To illustrate the operation of Article 4A, assume that Widgets International has an account with First Bank. In order to pay a supplier, Supplies Ltd., in China, Widgets instructs First Bank to pay $6 million to the account of Supplies Ltd. in China Bank. In the terminology of Article 4A, Widgets’ instruction to its bank is a “payment order.” Widgets is the “sender” of the payment order, First Bank is the “receiving bank,” and Supplies Ltd. is the “beneficiary” of the order.

When First Bank performs the purchase order by instructing China Bank to credit the account of Supplies Limited, First Bank becomes a sender of a payment order, China Bank becomes a receiving bank, and Supplies Ltd. is still the beneficiary. This transaction is depicted in Figure 17.3 "Funds Transfer". In some transactions there may also be one or more “intermediary banks” between First and Second Bank.

Figure 17.3 Funds Transfer

Frequently Occurring Legal Issues in Funds Transfers

Three legal issues that frequently arise in funds transfer litigation are addressed in Article 4A and might be mentioned here.

Responsibility for Unauthorized Payments

First, who is responsible for unauthorized payment orders? The usual practice is for banks and their customers to agree to security procedures for the verification of payment orders. If a bank establishes a commercially reasonable procedure, complies with that procedure, and acts in good faith and according to its agreement with the customer, the customer is bound by an unauthorized payment order. There is, however, an important exception to this rule. A customer will not be liable when the order is from a person unrelated to its business operations.

Error by Sender

Second, who is responsible when the sender makes a mistake—for instance, in instructing payment greater than what was intended? The general rule is that the sender is bound by its own error. But in cases where the error would have been discovered had the bank complied with its security procedure, the receiving bank is liable for the excess over the amount intended by the sender, although the bank is allowed to recover this amount from the beneficiary.

Bank Mistake in Transferring Funds

Third, what are the consequences when the bank makes a mistake in transferring funds? Suppose, for example, that Widgets (in the previous situation) instructed payment of $2 million but First Bank in turn instructed payment of $20 million. First Bank would be entitled to only $2 million from Widgets and would then attempt to recover the remaining $18 million from Supplies Ltd. If First Bank had instructed payment to the wrong beneficiary, Widgets would have no liability and the bank would be responsible for recovering the entire payment. Unless the parties agree otherwise, however, a bank that improperly executes a payment order is not liable for consequential damages.

Letters of Credit

Because international trade involves risks not usually encountered in domestic trade—government control of exports, imports, and currency; problems in verifying goods’ quality and quantity; disruptions caused by adverse weather, war; and so on—merchants have over the years devised means to minimize these risks, most notably the letter of credit (“LC”). Here are discussed the definition of letters of credit, the source of law governing them, how they work as payments for exports and as payments for imports.

Definition

A letter of creditA statement by a bank (or other financial institution) that it will pay a specified sum of money to specific persons if certain conditions are met. is a statement by a bank (or other financial institution) that it will pay a specified sum of money to specific persons if certain conditions are met. Or, to rephrase, it is a letter issued by a bank authorizing the bearer to draw a stated amount of money from the issuing bank (or its branches, or other associated banks or agencies). Originally, a letter of credit was quite literally that—a letter addressed by the buyer’s bank to the seller’s bank stating that the former could vouch for their good customer, the buyer, and that it would pay the seller in case of the buyer’s default. An LC is issued by a bank on behalf of its creditworthy customers, whose application for the credit has been approved by that bank.

Source of Law

Letters of credit are governed by both international and US domestic law.

International Law

Many countries (including the United States) have bodies of law governing letters of credit. Sophisticated traders will agree among themselves by which body of law they choose to be governed. They can agree to be bound by the UCC, or they may decide they prefer to be governed by the Uniform Customs and Practice for Commercial Documentary Credits (UCP), a private code devised by the Congress of the International Chamber of Commerce. Suppose the parties do not stipulate a body of law for the agreement, and the various bodies of law conflict, what then? Julius is in New York and Rochelle is in Paris; does French law or New York law govern? The answer will depend on the particulars of the dispute. An American court must determine under the applicable principles of the law of “conflicts of law” whether New York or French law applies.

Domestic Law

The principal body of law applicable to the letter of credit in the United States is Article 5 of the UCC. Section 5-103 declares that Article 5 “applies to letters of credit and to certain rights and obligations arising out of transactions involving letters of credit.” The Official Comment to 5-101 observes, “A letter of credit is an idiosyncratic form of undertaking that supports performance of an obligation incurred in a separate financial, mercantile, or other transaction or arrangement.” And—as is the case in other parts of the Code—parties may, within some limits, agree to “variation by agreement in order to respond to and accommodate developments in custom and usage that are not inconsistent with the essential definitions and mandates of the statute.” Although detailed consideration of Article 5 is beyond the scope of this book, a distinction between guarantees and letters of credit should be noted: Article 5 applies to the latter and not the former.

Letters of Credit as Payment for Exports

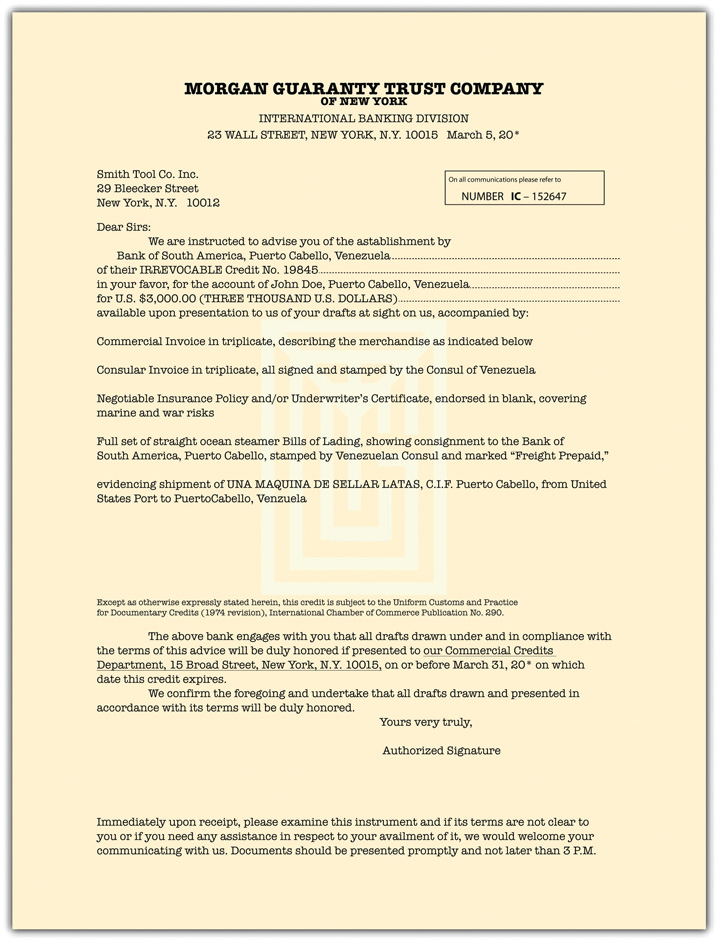

The following discussion presents how letters of credit work as payment for exports, and a sample letter of credit is presented at Figure 17.4 "A Letter of Credit".

Figure 17.4 A Letter of Credit

Julius desires to sell fine quality magic wands and other stage props to Rochelle’s Gallery in Paris. Rochelle agrees to pay by letter of credit—she will, in effect, get her bank to inform Julius that he will get paid if the goods are right. She does so by “opening” a letter of credit at her bank—the issuing bank—the Banque de Rue de Houdini where she has funds in her account, or good credit. She tells the bank the terms of sale, the nature and quantity of the goods, the amount to be paid, the documents she will require as proof of shipment, and an expiration date. Banque de Rue de Houdini then directs its correspondent bank in the United States, First Excelsior Bank, to inform Julius that the letter of credit has been opened: Rochelle is good for it. For Julius to have the strongest guarantee that he will be paid, Banque de Rou de Houdini can ask First Excelsior to confirm the letter of credit, thus binding both Banque de Rue de Houdini and Excelsior to pay according to the terms of the letter.

Once Julius is informed that the letter of credit has been issued and confirmed, he can proceed to ship the goods and draw a draft to present (along with the required documents such as commercial invoice, bill of lading, and insurance policy) to First Excelsior, which is bound to follow exactly its instructions from Banque de Rue de Houdini. Julius can present the draft and documents directly, through correspondent banks, or by a representative at the port from which he is shipping the goods. On presentation, First Excelsior may forward the documents to Banque de Rue de Houdini for approval and when First Excelsior is satisfied it will take the draft and pay Julius immediately on a sight draft or will stamp the draft “accepted” if it is a time draft (payable in thirty, sixty, or ninety days). Julius can discount an accepted time draft or hold it until it matures and cash it in for the full amount. First Excelsior will then forward the draft through international banking channels to Banque de Rue de Houdini to debit Rochelle’s account.

As Payment for Imports

US importers—buyers—also can use the letter of credit to pay for goods bought from abroad. The importer’s bank may require that the buyer put up collateral to guarantee it will be reimbursed for payment of the draft when it is presented by the seller’s agents. Since the letter of credit ordinarily will be irrevocable, the bank will be bound to pay the draft when presented (assuming the proper documents are attached), regardless of deficiencies ultimately found in the goods. The bank will hold the bill of lading and other documents and could hold up transfer of the goods until the importer pays, but that would saddle the bank with the burden of disposing of the goods if the importer failed to pay. If the importer’s credit rating is sufficient, the bank could issue a trust receipt. The goods are handed over to the importer before they are paid for, but the importer then becomes trustee of the goods for the bank and must hold the proceeds for the bank up to the amount owed

Key Takeaway

Wholesale funds transfers are a mechanism by which businesses and financial institutions can transmit large sums of money—millions of dollars—between each other, usually electronically, from and to their clients’ accounts. Article 4A of the UCC governs these transactions. A letter of credit is a promise by a buyer’s bank that upon presentation of the proper paperwork it will pay a specified sum to the identified seller. Letters of credit are governed by domestic and international law.

17.4 Cases

Bank’s Liability for Paying over Customer’s “Stop Payment” Order

Meade v. National Bank of Adams County

2002 WL 31379858 (Ohio App. 2002)

Kline, J.

The National Bank of Adams County appeals the Adams County Court’s judgment finding that it improperly paid a check written by Denton Meade, and that Meade incurred $3,800 in damages as a result of that improper payment.…

I.

Denton Meade maintained a checking account at the Bank. In 2001, Meade entered into an agreement with the Adams County Lumber Company to purchase a yard barn for $2,784 and paid half the cost as a deposit. On the date of delivery, Friday, March 9, 2001, Meade issued a check to the Lumber Company for the remaining amount he owed on the barn, $1,406.79.

Meade was not satisfied with the barn. Therefore, at 5:55 p.m. on March 9, 2001, Meade called the Bank to place a stop payment order on his check. Jacqueline Evans took the stop payment order from Meade. She received all the information and authorization needed to stop payment on the check at that time.

Bank employees are supposed to enter stop payments into the computer immediately after taking them. However, Evans did not immediately enter the stop payment order into the computer because it was 6:00 p.m. on Friday, and the Bank closes at 6:00 p.m. on Fridays. Furthermore, the Bank’s policy provides that any matters that are received after 2:00 p.m. on a Friday are treated as being received on the next business day, which was Monday, March 12, 2001 in this instance.

On the morning of Saturday, March 10, 2001, Greg Scott, an officer of the Lumber Company, presented the check in question for payment at the Bank. The Bank paid the check. On Monday, the Bank entered Meade’s stop payment into the computer and charged Meade a $15 stop payment fee. Upon realizing that it already paid the check, on Tuesday the Bank credited the $15 stop payment fee back to Meade’s account. On Thursday, the Bank deducted the amount of the check, $1,406.79, from Meade’s account.

In the meanwhile, Meade contacted Greg Scott at the Lumber Company regarding his dissatisfaction with the barn. Scott sent workers to repair the barn on Saturday, March 10 and on Monday, March 12. However, Meade still was not satisfied. In particular, he was unhappy with the runners supporting the barn. Although his order with the Lumber Company specifically provided for 4 x 6” runner boards, the Lumber Company used 2 x 6” boards. The Lumber Company “laminated” the two by six-inch boards to make them stronger. However, carpenter Dennis Baker inspected the boards and determined that the boards were not laminated properly.

Meade hired Baker to repair the barn. Baker charged Meade approximately three hundred dollars to make the necessary repairs. Baker testified that properly laminated two by six-inch boards are just as strong as four by six-inch boards.

Meade filed suit against the Bank in the trial court seeking $5,000 in damages. The Bank filed a motion for summary judgment, which the trial court denied. At the subsequent jury trial the court permitted Meade to testify, over the Bank’s objections, to the amount of his court costs, attorney fees, and deposition costs associated with this case. The Bank filed motions for directed verdict at the close of Meade’s case and at the close of evidence, which the trial court denied.

The jury returned a general verdict finding the Bank liable to Meade in the amount of $3,800. The Bank filed motions for a new trial and for judgment notwithstanding the verdict, which the trial court denied. The Bank now appeals, asserting the following five assignments of error.…

II.

In its first assignment of error, the Bank contends that the trial court erred in denying its motion for summary judgment. Specifically, the Bank asserts that Meade did not issue the stop payment order within a reasonable time for the Bank to act upon it, and therefore that the trial court should have granted summary judgment in favor of the Bank.

Summary judgment is appropriate only when it has been established: (1) that there is no genuine issue as to any material fact; (2) that the moving party is entitled to judgment as a matter of law; and (3) that reasonable minds can come to only one conclusion, and that conclusion is adverse to the nonmoving party. [Citation]

[UCC 4-403(A)] provides that a customer may stop payment on any item drawn on the customer’s account by issuing an order to the bank that describes the item with reasonable certainty and is received by the bank “at a time and in a manner that affords the bank a reasonable opportunity to act on it before any action by the bank with respect to the item.” What constitutes a reasonable time depends upon the facts of the case. See Chute v. Bank One of Akron, (1983) [Citation]

In Chute, Bank One alleged that its customer, Mr. Chute, did not give it a reasonable opportunity to act upon his stop payment order when he gave an oral stop payment at one Bank One branch office, and a different Bank One branch office paid the check the following day. In ruling that Bank One had a reasonable opportunity to act upon Mr. Chute’s order before it paid the check, the court considered the teller’s testimony that stop payment orders are entered onto the computer upon receipt, where they are virtually immediately accessible to all Bank One tellers.

In this case, as in Chute, Meade gave notice one day, and the Bank paid the check the following day. Additionally, in this case, the same branch that took the stop payment order also paid the check. Moreover, Evans testified that the Bank’s policy for stop payment orders is to enter them into the computer immediately, and that Meade’s stop payment order may have shown up on the computer on Saturday if she had entered it on Friday. Based on this information, and construing the facts in the light most favorable to Meade, reasonable minds could conclude that Meade provided the Bank with the stop payment order within time for the Bank to act upon the stop payment order. Accordingly, we overrule the Bank’s first assignment of error.

III.

In its second assignment of error, the Bank contends that the trial court erred in permitting Meade to testify regarding the amount he spent on court costs, attorney fees, and taking depositions. Meade contends that because he incurred these costs as a result of the Bank paying his check over a valid stop payment order, the costs are properly recoverable.

As a general rule, the costs and expenses of litigation, other than court costs, are not recoverable in an action for damages. [Citations]

In this case, the statute providing for damages, [UCC 4-403(c)], provides that a customer’s recoverable loss for a bank’s failure to honor a valid stop payment order “may include damages for dishonor of subsequent items * * *.” The statute does not provide for recouping attorney fees and costs. Meade did not allege that the Bank acted in bad faith or that he is entitled to punitive damages. Additionally, although Meade argues that the Bank caused him to lose his bargaining power with the Lumber Company, Meade did not present any evidence that he incurred attorney fees or costs by engaging in litigation with the Lumber Company.

Absent statutory authority or an allegation of bad faith, attorney fees are improper in a compensatory damage award.…Therefore, the trial court erred in permitting the jury to hear evidence regarding Meade’s expenditures for his attorney fees and costs. Accordingly, we sustain the Bank’s second assignment of error.…

IV.

In its third assignment of error, the Bank contends that the trial court erred when it overruled the Bank’s motion for a directed verdict. The Bank moved for a directed verdict both at the conclusion of Meade’s case and at the close of evidence.

The Bank first asserts that the record does not contain sufficient evidence to show that Meade issued a stop payment order that provided it with a reasonable opportunity to act as required by [the UCC]. Meade presented evidence that he gave the Bank his stop payment order prior to 6:00 p.m. on Friday, and that the Bank paid the check the following day.…We find that this constitutes sufficient evidence that Meade communicated the stop payment order to the Bank in time to allow the Bank a reasonable opportunity to act upon it.

The Bank also asserts that the record does not contain sufficient evidence that Meade incurred some loss resulting from its payment of the check. Pursuant to [UCC 4-403(c)] “[t]he burden of establishing the fact and amount of loss resulting from the payment of an item contrary to a stop payment order or order to close an account is on the customer.” Establishing the fact and amount of loss, “the customer must show some loss other than the mere debiting of the customer’s account.” [Citation]

…Baker testified that he charged Meade between two hundred-eighty and three hundred dollars to properly laminate the runners and support the barn. Based upon these facts, we find that the record contains sufficient evidence that Meade sustained some loss beyond the mere debiting of his account as a result of the Bank paying his check. Accordingly, we overrule the Bank’s third assignment of error.

V.

…In its final assignment of error, the Bank contends that the trial court erred in denying its motions for judgment notwithstanding the verdict and for a new trial.…

[U]nlike our consideration of the Bank’s motions for a directed verdict, in considering the Bank’s motion for judgment notwithstanding the verdict, we also must consider whether the amount of the jury’s award is supported by sufficient evidence. The Bank contends the jury’s general verdict, awarding Meade $3,800, is not supported by evidence in the record.

A bank customer seeking damages for the improper payment of a check over a valid stop payment order carries the burden of proving “the fact and amount of loss.” [UCC 4-403(C).] To protect banks and prevent unjust enrichment to customers, the mere debiting of the customer’s account does not constitute a loss. [Citation]

In this case, the Bank’s payment of Meade’s $1,406.79 check to the Lumber Company discharged Meade’s debt to the Lumber Company in the same amount. Therefore, the mere debiting of $1,406.79 from Meade’s account does not constitute a loss.

Meade presented evidence that he incurred $300 in repair costs to make the barn satisfactory. Meade also notes that he never got the four by six-inch runners he wanted. However, Meade’s carpenter, Baker, testified that since he properly laminated the two by six-inch runners, they are just as strong or stronger than the four by six-inch runners would have been.

Meade also presented evidence of his costs and fees. However, as we determined in our review of the Bank’s second assignment of error, only the court may award costs and fees, and therefore this evidence was improperly admitted. Thus, the evidence cannot support the damage award. Meade did not present any other evidence of loss incurred by the Bank’s payment of his check.…Therefore, we find that the trial court erred in declining to enter a judgment notwithstanding the verdict on the issue of damages. Upon remand, the trial court should grant in part the Bank’s motion for judgment notwithstanding the verdict as it relates to damages and consider the Bank’s motion for a new trial only on the issue of damages[.…] Accordingly, we sustain the Banks fourth and fifth assignments of error in part.

VI.

In conclusion, we find that the trial court did not err in denying the Bank’s motions for summary judgment and for directed verdict. However, we find that the trial court erred in permitting Meade to testify as to his court costs, attorney fees and deposition costs. Additionally, we find that the trial court erred in totally denying the Bank’s motion for judgment notwithstanding the verdict, as the amount of damages awarded by the jury is not supported by sufficient evidence in the record. Accordingly, we affirm the judgment of the trial court as to liability, but reverse the judgment of the trial court as to the issue of damages, and remand this cause for further proceedings consistent with this opinion.

Case Questions

- What did the bank do wrong here?

- Why did the court deny Meade damages for his attorneys’ fees?

- Why did the court conclude that the jury-awarded damages were not supported by evidence presented at trial? What damages did the evidence support?

Customer’s Duty to Inspect Bank Statements

Union Planters Bank, Nat. Ass’n v. Rogers

912 So.2d 116 (Miss. 2005)

Waller, J.

This appeal involves an issue of first impression in Mississippi—the interpretation of [Mississippi’s UCC 4-406], which imposes duties on banks and their customers insofar as forgeries are concerned.

Facts

Neal D. and Helen K. Rogers maintained four checking accounts with the Union Planters Bank in Greenville, Washington County, Mississippi.…The Rogers were both in their eighties when the events which gave rise to this lawsuit took place.Neal Rogers died prior to the institution of this lawsuit. Helen Rogers died after Union Planters filed this appeal. We have substituted Helen’s estate as appellee. After Neal became bedridden, Helen hired Jackie Reese to help her take care of Neal and to do chores and errands.

In September of 2000, Reese began writing checks on the Rogers’ four accounts and forged Helen’s name on the signature line. Some of the checks were made out to “cash,” some to “Helen K. Rogers,” and some to “Jackie Reese.” The following chart summarizes the forgeries to each account:

| Account Number | Beginning | Ending | Number of Checks | Amount of Checks |

|---|---|---|---|---|

| 54282309 | 11/27/2000 | 6/18/2001 | 46 | $16,635.00 |

| 0039289441 | 9/27/2000 | 1/25/2001 | 10 | $2,701.00 |

| 6100110922 | 11/29/2000 | 8/13/2001 | 29 | $9,297.00 |

| 6404000343 | 11/20/2000 | 8/16/2001 | 83 | $29,765.00 |

| Total | 168 | $58,398.00 |

Neal died in late May of 2001. Shortly thereafter, the Rogers’ son, Neal, Jr., began helping Helen with financial matters. Together they discovered that many bank statements were missing and that there was not as much money in the accounts as they had thought. In June of 2001, they contacted Union Planters and asked for copies of the missing bank statements. In September of 2001, Helen was advised by Union Planters to contact the police due to forgeries made on her accounts. More specific dates and facts leading up to the discovery of the forgeries are not found in the record.

Subsequently, criminal charges were brought against Reese. (The record does not reveal the disposition of the criminal proceedings against Reese.) In the meantime, Helen filed suit against Union Planters, alleging conversion (unlawful payment of forged checks) and negligence. After a trial, the jury awarded Helen $29,595 in damages, and the circuit court entered judgment accordingly. From this judgment, Union Planters appeals.

Discussion

…II. Whether Rogers’ Delay in Detecting the Forgeries Barred Suit against Union Planters.

The relationship between Rogers and Union Planters is governed by Article 4 of the Uniform Commercial Code. [UCC] 4-406(a) and (c) provide that a bank customer has a duty to discover and report “unauthorized signatures”; i.e., forgeries. [The section] reflects an underlying policy decision that furthers the UCC’s “objective of promoting certainty and predictability in commercial transactions.” The UCC facilitates financial transactions, benefiting both consumers and financial institutions, by allocating responsibility among the parties according to whomever is best able to prevent a loss. Because the customer is more familiar with his own signature, and should know whether or not he authorized a particular withdrawal or check, he can prevent further unauthorized activity better than a financial institution which may process thousands of transactions in a single day.…The customer’s duty to exercise this care is triggered when the bank satisfies its burden to provide sufficient information to the customer. As a result, if the bank provides sufficient information, the customer bears the loss when he fails to detect and notify the bank about unauthorized transactions. [Citation]

A. Union Planters’ Duty to Provide Information under 4-406(a).

The court admitted into evidence copies of all Union Planters statements sent to Rogers during the relevant time period. Enclosed with the bank statements were either the cancelled checks themselves or copies of the checks relating to the period of time of each statement. The evidence shows that all bank statements and cancelled checks were sent, via United States Mail, postage prepaid, to all customers at their “designated address” each month. Rogers introduced no evidence to the contrary. We therefore find that the bank fulfilled its duty of making the statements available to Rogers and that the remaining provisions of 4-406 are applicable to the case at bar.…

In defense of her failure to inspect the bank statements, Rogers claims that she never received the bank statements and cancelled checks. Even if this allegation is true,Since there was a series of forged checks, it is reasonable to assume that Reese intercepted the bank statements before Rogers could inspect them. However, Union Planters cannot be held liable for Reese’s fraudulent concealment. it does not excuse Rogers from failing to fulfill her duties under 4-406(a) & (c) because the statute clearly states a bank discharges its duty in providing the necessary information to a customer when it “sends…to a customer a statement of account showing payment of items.”…The word “receive” is absent. The customer’s duty to inspect and report does not arise when the statement is received, as Rogers claims; the customer’s duty to inspect and report arises when the bank sends the statement to the customer’s address. A reasonable person who has not received a monthly statement from the bank would promptly ask the bank for a copy of the statement. Here, Rogers claims that she did not receive numerous statements. We find that she failed to act reasonably when she failed to take any action to replace the missing statements.

B. Rogers’ Duty to Report the Forgeries under 4-406(d).

[Under UCC 4-406] a customer who has not promptly notified a bank of an irregularity may be precluded from bringing certain claims against the bank:

“(d) If the bank proves that the customer failed, with respect to an item, to comply with the duties imposed on the customer by subsection (c), the customer is precluded from asserting against the bank:

(1) The customer’s unauthorized signature…on the item,…

Also, when there is a series of forgeries, 406(d)(2) places additional duties on the customer, [who is precluded from asserting against the bank]:

(2) The customer’s unauthorized signature…by the same wrongdoer on any other item paid in good faith by the bank if the payment was made before the bank received notice from the customer of the unauthorized signature…and after the customer had been afforded a reasonable period of time, not exceeding thirty (30) days, in which to examine the item or statement of account and notify the bank.

Although there is no mention of a specific date, Rogers testified that she and her son began looking for the statements in late May or early June of 2001, after her husband had died.…When they discovered that statements were missing, they notified Union Planters in June of 2001 to replace the statements. At this time, no mention of possible forgery was made, even though Neal, Jr., thought that “something was wrong.” In fact, Neal, Jr., had felt that something was wrong as far back as December of 2000, but failed to do anything. Neal, Jr., testified that neither he nor his mother knew that Reese had been forging checks until September of 2001.Actually, it was Union Planters that notified Rogers that there had been forgeries, as opposed to Rogers’ discovering the forgeries herself.

Rogers is therefore precluded from making claims against Union Planters because (1) under 4-406(a), Union Planters provided the statements to Rogers, and (2) under 4-406(d)(2), Rogers failed to notify Union Planters of the forgeries within 30 days of the date she should have reasonably discovered the forgeries.…

Conclusion

The circuit court erred in denying Union Planters’ motion for JNOV because, under 4-406, Rogers is precluded from recovering amounts paid by Union Planters on any of the forged checks because she failed to timely detect and notify the bank of the unauthorized transactions and because she failed to show that Union Planters failed to use ordinary care in its processing of the forged checks. Therefore, we reverse the circuit court’s judgment and render judgment here that Rogers take nothing and that the complaint and this action are finally dismissed with prejudice. Reversed.

Case Questions

- If a bank pays out over a forged drawer’s signature one time, and the customer (drawer) reports the forgery to the bank within thirty days, why does the bank take the loss?

- Who forged the checks?

- Why did Mrs. Rogers think she should not be liable for the forgeries?

- In the end, who probably really suffered the loss here?

Customer’s Duty to Inspect Bank Statements

Commerce Bank of Delaware v. Brown

2007 WL 1207171 (Del. Com. Pl. 2007)

I. Procedural Posture

Plaintiff, Commerce Bank/Delaware North America (“Commerce”) initially filed a civil complaint against defendant Natasha J. Brown (“Brown”) on October 28, 2005. Commerce seeks judgment in the amount of $4.020.11 plus costs and interest and alleges that Brown maintained a checking account with Commerce and has been unjustly enriched by $4,020.11.…

The defendant, Brown…denied all allegations of the complaint. As an affirmative defense Brown claims the transaction for which plaintiff seeks to recover a money judgment were made by means of an ATM Machine using a debit card issued by the defendant. On January 16, 2005 Brown asserts that she became aware of the fraudulent transactions and timely informed the plaintiff of the facts on January 16, 2005. Brown asserts that she also requested Commerce in her answer to investigate the matter and to close her account. Based upon these facts, Brown asserts a maximum liability on her own part from $50.00 to $500.00 in accordance with the Electronic Fund Transfer Act (“EFTA”) 15 U.S.C. § 1693(g) and regulation (e), 12 CFR 205.6. [Commerce Bank withdrew its complaint at trial, leaving only the defendant’s counter-claim in issue.]

Defendant Brown asserts [that] defendant failed to investigate and violated EFTA and is therefore liable to the plaintiff for money damages citing [EFTA].

II. The Facts

Brown was the only witness called at trial. Brown is twenty-seven years old and has been employed by Wilmington Trust as an Administrative Assistant for the past three years. Brown previously opened a checking account with Commerce and was issued a debit/ATM card by Commerce which was in her possession in December 2004. Brown, on or about January 14, 2005 went to Commerce to charge a $5.00 debit to the card at her lunch-break was informed that there was a deficiency balance in the checking account. Brown went to the Talleyville branch of Commerce Bank and spoke with “Carla” who agreed to investigate these unauthorized charges, as well as honor her request to close the account. Defendant’s Exhibit No.: 1 is a Commerce Bank electronic filing and/or e-mail which details a visit by defendant on January 16, 2005 to report her card loss. The “Description of Claim” indicates as follows:

Customer came into speak with a CSR “Carla Bernard” on January 16, 2005 to report her card loss. At this time her account was only showing a negative $50.00 balance. She told Ms. Bernard that this was not her transaction and to please close this account. Ms. Bernard said that she would do this and that there would be an investigation on the unauthorized transactions. It was at this time also that she had Ms. Bernard change her address. In the meantime, several transactions posted to the account causing a balance of negative $3,948.11 and this amount has since been charged off on 1/27/05. Natasha Brown never received any notification of this until she received a letter from one of our collection agencies. She is now here to get this resolved.

On the back of defendant’s Exhibit No.: 1 were 26 separate unauthorized transactions at different mercantile establishments detailing debits with the pin number used on Brown’s debit card charged to Commerce Bank. The first charge was $501.75 on January 13, 2005.…Brown asserts at trial that she therefore timely gave notice to Commerce to investigate and requested Commerce to close the debit checking account on January 16, 2005.

At trial Brown also testified she “never heard” from Commerce again until she received a letter in December 2005 citing a $4,000.00 deficiency balance.…

On cross-examination Brown testified she received a PIN number from Commerce and “gave the PIN number to no other person.” In December 2004 she resided with Charles Williams, who is now her husband. Brown testified on cross-examination that she was the only person authorized as a PIN user and no one else knew of the card, ‘used the card,’ or was provided orally or in writing of the PIN number. Brown spoke with Carla Bernard at the Commerce Bank at the Talleyville branch. Although Brown did not initially fill out a formal report, she did visit Commerce on January 16, 2005 the Talleyville branch and changed her address with Carla. Brown does not recall the last time she ever received a statement from Commerce Bank on her checking account. Brown made no further purchases with the account and she was unaware of all the “incidents of unauthorized debit charges on her checking account” until she was actually sued by Commerce Bank in the Court of Common Pleas.

III. The Law

15 U.S.C. § 1693(g). Consumer Liability:

(a) Unauthorized electronic fund transfers; limit. A consumer shall be liable for any unauthorized electronic fund transfer.…In no event, however, shall a consumer’s liability for an unauthorized transfer exceed the lesser of—

(1) $ 50; or

(2) the amount of money or value of property or services obtained in such unauthorized electronic fund transfer prior to the time the financial institution is notified of, or otherwise becomes aware of, circumstances which lead to the reasonable belief that an unauthorized electronic fund transfer involving the consumer’s account has been or may be affected. Notice under this paragraph is sufficient when such steps have been taken as may be reasonably required in the ordinary course of business to provide the financial institution with the pertinent information, whether or not any particular officer, employee, or agent of the financial institution does in fact receive such information.

15 U.S.C. § 1693(m) Civil Liability:

(a) [A]ction for damages; amount of award.…[A]ny person who fails to comply with any provision of this title with respect to any consumer, except for an error resolved in accordance with section 908, is liable to such consumer in an amount equal to the sum of—

(1) any actual damage sustained by such consumer as a result of such failure;

(2) in the case of an individual action, an amount not less than $ 100 nor greater than $ 1,000; or…

(3) in the case of any successful action to enforce the foregoing liability, the costs of the action, together with a reasonable attorney’s fee as determined by the court.

12 C.F.R. § 205.6 Liability of consumer for unauthorized transfers.

(b) Limitations on amount of liability. A consumer’s liability for an unauthorized electronic fund transfer or a series of related unauthorized transfers shall be determined as follows:

(1) Timely notice given. If the consumer notifies the financial institution within two business days after learning of the loss or theft of the access device, the consumer’s liability shall not exceed the lesser of $ 50 or the amount of unauthorized transfers that occur before notice to the financial institution.

(2) Timely notice not given. If the consumer fails to notify the financial institution within two business days after learning of the loss or theft of the access device, the consumer’s liability shall not exceed the lesser of $ 500 or the sum of:

(i) $ 50 or the amount of unauthorized transfers that occur within the two business days, whichever is less; and