This is “Greenhouse Gases (GHGs) and the US Dairy Industry”, section 10.3 from the book Sustainable Business Cases (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

10.3 Greenhouse Gases (GHGs) and the US Dairy Industry

Learning Objectives

- Understand the social, political, and economic impact of climate change and global warming on the US dairy industry, specifically in Maine.

- Understand the role of industry associations and collaborative networks in addressing industry and company environmental challenges.

- Learn about carbon footprint mapping and life cycle analysis (LCA).

Industrial growth, deforestation, and increased consumption has exacerbated global warming and changes to the climate and will continue to do so. Gases that trap heat in the atmosphere are often called greenhouse gases (GHG). Of the total GHG emitted annually in the United States, two areas in which Oakhurst have an impact—transportation fuels and agricultural byproducts—emit 14 percent and 12.5 percent of the total, respectively.“Annual Greenhouse Gas Emissions by Sector,” accessed January 31, 2011, http://greenlifestyleideas.com/270/the-forgotten-greenhouse-gas-emissions.

There is mounting evidence, as reviewed in Chapter 2 "The Science of Sustainability", that heavy concentrations of GHGs have raised the earth’s temperatures from 1.2 to 1.4 degrees in the last hundred years. Also of concern is the fact that eight of the warmest years on record occurred between 1998 and 2010.“Climate Change,” U.S. Environmental Protection Agency, accessed January 31, 2011, http://www.epa.gov/climatechange/basicinfo.html. Rising temperatures have already had adverse effects on climate, agriculture, and people. People and animals are affected by climate change through extreme periods of heat and cold, storms, climate sensitive diseases, and prolonged and increased levels of smog. Scientists considering the potential impacts of climate change in the northeastern United States have identified heat waves and prolonged drought as two significant threats to the dairy industry, as heat-stressed cows generally produce less milk.Clean Air–Cool Planet, Taking All the Right Steps: A Maine Dairy Reduces Its Carbon Footprint, http://www.cleanair-coolplanet.org/information/pdf/Oakhurst%20Dairy%20Case%20Study%2001272009.pdf.

The previously stated factors provided strong incentive for Oakhurst to try to reduce its GHG emissions, or carbon footprint. Acting on this concern would be in the interest of the dairy industry in Maine and beyond and society more broadly and was also consistent with the company’s values in caring about the communities it served and operated in.

GHG Emissions Challenge in the US Dairy Industry

In December 2010, the Innovation Center for US Dairy published its first US Dairy Industry Sustainability Commitment Report. The report was a collaborative effort of leaders and experts in and outside the industry who joined together to “identify and deploy sustainability innovations that make good business sense.” The report documented that the United States was the largest dairy producer in the world, producing annually 189.9 billion pounds of milk and that milk was the fourth highest dollar value agricultural product in the United States (at 8 percent of total receipts). It also identified that the dairy industry contributed 2 percent of the total US GHG emissions. Working with the Sustainability Center at the University of Arkansas, the Innovation Center conducted the dairy industry’s first national GHG life cycle analysis (LCA)A technique to assess each and every impact associated with all the stages of a process from cradle to grave (i.e., from raw materials through materials processing, manufacture, distribution, use, repair and maintenance, and disposal or recycling). LCAs can help avoid a narrow outlook on environmental, social, and economic concerns. This is achieved by compiling an inventory of relevant energy, material inputs, and environmental releases; evaluating the potential impacts associated with identified inputs and releases; and interpreting the results to help you make a more informed decision., or carbon footprintA carbon footprint is “the total set of greenhouse gases (GHG) emissions caused by an organization, event, or product.” For simplicity of reporting, it is often expressed in terms of the amount of carbon dioxide, or other equivalent GHGs, emitted. study, of fluid milk.Innovation Center for US Dairy, U.S. Dairy Sustainability Commitment Progress Report: Sustaining the Dairy Industry for Future Generations, accessed January 9, 2011, http://www.usdairy.com/Sustainability/Pages/Home.aspx.

Figure 10.2 Cows

© Thinkstock

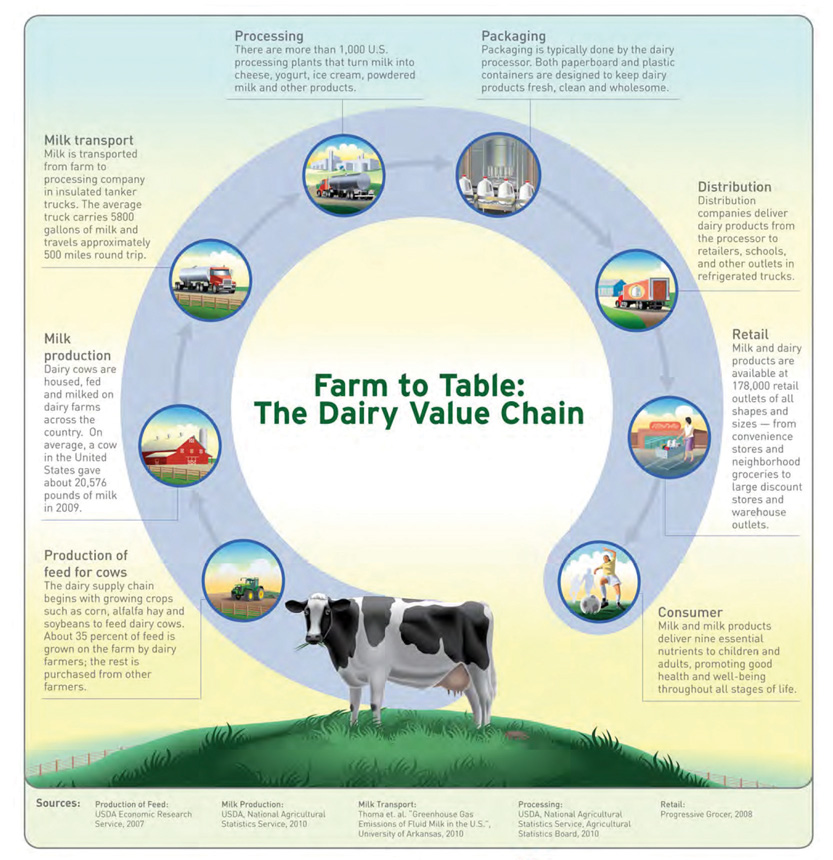

Formed in 2007, the Innovation Center represented an industry-wide commitment to identify best practices for lowering carbon emissions throughout the supply chainA supply chain is a system of organizations, people, technology, activities, information, and resources involved in moving a product or service from supplier to customer. Supply chain activities transform natural resources and raw materials and components into a finished product that is delivered to the end customer. In sophisticated supply chain systems, used products may reenter the supply chain at any point where residual value is recyclable. Supply chains link value chains.. More than five hundred dairy stakeholders including environmentalists, academics, and scientists worked on the report. The study found that “the carbon footprint of a gallon of milk, from farm to table, is 17.6 pounds of carbon dioxide equivalents (CO2e) per gallon of milk consumed.”Innovation Center for US Dairy, U.S. Dairy Sustainability Commitment Progress Report: Sustaining the Dairy Industry for Future Generations, accessed January 9, 2011, http://www.usdairy.com/Sustainability/Pages/Home.aspx. Carbon emissions by supply chain participant are depicted in Figure 10.3 "From Farm to Table: Percentage of GHG Emissions from One Gallon of Milk" and Figure 10.4. Figure 10.5 "GHG Emissions Sources and Opportunities" summarizes GHG emissions by participants and some of the opportunities for carbon reduction. By far, the largest single source of heat-trapping gases linked to global warming from milk production are farm emissions, which contribute roughly ten pounds of CO2e per gallon of milk. And 85 percent of those emissions come from one source—cows.

Figure 10.3 From Farm to Table: Percentage of GHG Emissions from One Gallon of Milk

Source: Innovation Center for US Dairy, U.S. Dairy Sustainability Commitment Progress Report: Sustaining the Dairy Industry for Future Generations, accessed January 9, 2011, http://www.usdairy.com/Public%20Communication%20Tools/USDairy_Sustainability_Report_12-2010%20(4).pdf.

Figure 10.4

Source: Innovation Center for US Dairy, U.S. Dairy Sustainability Commitment Progress Report: Sustaining the Dairy Industry for Future Generations, accessed January 9, 2011, http://www.usdairy.com/Public%20Communication%20Tools/USDairy_Sustainability_Report_12-2010%20(4).pdf.

Figure 10.5 GHG Emissions Sources and Opportunities

Source: Innovation Center for US Dairy, U.S. Dairy Sustainability Commitment Progress Report: Sustaining the Dairy Industry for Future Generations, accessed January 9, 2011, http://www.usdairy.com/Public%20Communication%20Tools/USDairy_Sustainability_Report_12-2010%20(4).pdf.

Dairy Industry Competitive Dynamics

The global demand for food is expected to double by 2050.Innovation Center for US Dairy, U.S. Dairy Sustainability Commitment Progress Report: Sustaining the Dairy Industry for Future Generations, accessed January 9, 2011, http://www.usdairy.com/Sustainability/Pages/Home.aspx. This growth will provide opportunities and challenges for the US dairy industry. The challenges for the industry include bringing milk to the consumer at competitive prices in a sustainable way when dairy prices are subject to economic cycles, changing weather patterns, and changing industry competitive dynamics.

Although the minimum wholesale price paid to farmers by milk processors is set by a complicated, government formula, milk prices constantly change across the full value chainInterlinked value-adding activities that convert inputs into outputs, which, in turn, add to the bottom line and help create competitive advantage. A value chain typically consists of (1) inbound distribution or logistics, (2) manufacturing operations, (3) outbound distribution or logistics, (4) marketing and selling, and (5) after-sales service. These activities are supported by (6) purchasing or procurement, (7) research and development, (8) human resource development, and (9) and corporate infrastructure. from raw milk to processed milk to milk at the grocery store. Among the factors affecting the cost to produce a pound of milk are feed cost, cow productivity (pounds produced per cow, per day), animal nutrition, genetics, and proper farm maintenance and housing of animals. For example, an increase in feed cost without a corresponding increase in cow milk productivity will squeeze farmer profits. It is not unusual to have milk production costs above the farmer’s selling price. According to Mark Stephenson, director of dairy policy analysis at the University of Wisconsin, when total milk production costs are above the wholesale price, farmers are forced to take one of a few actions.Sara Schoenborn, “Stephenson Hopeful, Realistic about 2011 Dairy Outlook,” AG Weekly, January 27, 2011, accessed January 20, 2011, http://www.agriview.com/news/dairy/stephenson-hopeful-realistic-about-dairy-outlook/article_fc01890d-cfda-5b25-a196-50ab45dbdaa1.html. These actions include the use of genetic engineering (putting human growth hormonesGrowth hormone (GH) is a protein-based polypeptide hormone. It stimulates growth and cell reproduction and regeneration in humans and other animals. in cow feed), investments in better cow management, culling out inferior cows, or going out of business.

Stephenson noted that weather and temperature abnormalities across the globe have dramatically affected not only the quality of feed but also the feed prices. In an industry presentation, he noted that recent changes in the La Niña pattern in the Pacific Ocean had affected weather around the globe and consequently feed prices and milk production. These changing weather patterns had raised feed prices, especially corn prices, in Australia, Indonesia, and New Zealand. Stephenson concluded that businesses in the US dairy industry are going to have to rethink their business models in an increasingly volatile industry.Sara Schoenborn, “Stephenson Hopeful, Realistic about 2011 Dairy Outlook,” AG Weekly, January 27, 2011, accessed January 20, 2011, http://www.agriview.com/news/dairy/stephenson-hopeful-realistic-about-dairy-outlook/article_fc01890d-cfda-5b25-a196-50ab45dbdaa1.html.

While a very small overall global contributor to GHG emissions worldwide, Oakhurst has successfully addressed its emissions in ways that have been beneficial to the company’s profitability and reputation. This has been accomplished by installing solar panels, retrofitting the company’s truck fleet, and using advanced rerouting software for its delivery trucks. With these efforts and others, Oakhurst has lowered its annual carbon emissions by more than one thousand metric tons and lowered its operating costs, primarily fuel costs, significantly. In periods of rising and highly volatile oil prices, fuel cost savings have been significant for Oakhurst. At the same time, its actions have reaffirmed the company’s commitment to the environment and to consumers in Maine and beyond, which has been beneficial to its standing among consumers, particularly those who cared about the environment.

The large majority of milk consumers are most concerned about price, not carbon footprints. Reflective of this, Walmart and other large milk retailers are increasingly demanding lower pricing for the milk they get from Oakhurst and other milk processors. According to the Wall Street Journal, cutthroat tactics “are making a mess of the dairy aisle.”John Jannarone, “Heard on the Street: Grocers Still Milking Dean Foods,” Wall Street Journal, February 2, 2011, http://online.wsj.com/article/SB10001424052748703445904576118502653780560.html?KEYWORDS=jannarone. The article reported that “grocery stores continue to use deep discounts to attract cash-strapped shoppers, sometimes selling milk at a loss.”John Jannarone, “Heard on the Street: Grocers Still Milking Dean Foods,” Wall Street Journal, February 2, 2011, http://online.wsj.com/article/SB10001424052748703445904576118502653780560.html?KEYWORDS=jannarone. These practices and pressure from the retailers have forced milk processors to take drastic action in lowering the cost they pay for their supplies. Even Dean Foods, the largest milk processor in the United States, has struggled to pass on price cuts to their raw products suppliers, and this has resulted in significant financial pressure on the milk processors. The recent sharp increase in milk costs has caused dramatic drops in Dean’s profits and stock price. Analysts were predicting further drops in Dean’s earning in 2011, which could violate the company’s leverage covenant with its banks and force the company into bankruptcy.John Jannarone, “Heard on the Street: Grocers Still Milking Dean Foods,” Wall Street Journal, February 2, 2011, http://online.wsj.com/article/SB10001424052748703445904576118502653780560.html?KEYWORDS=jannarone.

Figure 10.6 Dean’s Milk Truck

Source: Flickr, http://www.flickr.com/photos/45521369@N02/6825467774/.

According to the Wall Street Journal, “Even if milk prices stabilize, however, grocers are unlikely to relax their aggressive pricing strategy. With unemployment elevated, consumers are highly sensitive to price. That has crushed profits at grocer SuperValu, which charges higher prices for a basket of goods than rivals Kroger and Safeway. SuperValu’s shares have performed even worse than Dean’s since the market trough in 2009.”John Jannarone, “Heard on the Street: Grocers Still Milking Dean Foods,” Wall Street Journal, February 2, 2011, http://online.wsj.com/article/SB10001424052748703445904576118502653780560.html?KEYWORDS=jannarone.

One controversial strategy to increase productivity and cut costs per gallon of milk is the use of the human growth hormone rBST in cow feed. While the US Food and Drug Administration approved the use of rBST in cow feed in 1993, the controversy was far from resolved. Some scientific studies have shown that milk produced this way is safe and has the same amount of proteins, fats, and nutrients as non-hormone-fed cows.Recombinant bovine somatotropin (rBST) is a synthetic version of the bovine somatotropin (BST) hormone found in cattle. The use of rBST has met with some controversy from a variety of fronts, including the animal rights movement and some commercial dairy farmers. As a result, dairies that produce milk products without the use of rBST have begun indicating this on their labels. Though rBST has been banned in several countries, the Environmental Protection Agency in the United States has determined it to be safe to consume. See “What Does rBST Free Mean?,” wiseGEEK, accessed March 3, 2011, http://www.wisegeek.com/what-does-rbst-free-mean. Other studies contradict these findings.

Oakhurst took a firm stand against the use of the hormone rBST in cow feed. In 1997, Stanley Bennett asked its farmers to sign an affidavit pledging not to use human growth hormone. In return they received financial incentives, and shortly after, Oakhurst began marketing its milk as free of the human hormone rBST. In 2003, Monsanto, the largest manufacturer of rBST, sued Oakhurst claiming that Oakhurst’s labels deceived consumers by marketing a perception that one milk product is safer or of higher quality than other milk. At the time of the suit, Monsanto’s worldwide sales revenue from rBST was $4.7 billion. Stanley Bennett countered that Oakhurst made no claim on the science involved with growth hormones.Drew Kaplan, “Monsanto Sues Oakhurst Dairy over Advertising,” Health Freedom Alliance, June 18, 2010, accessed February 11, 2011, http://healthfreedoms.org/2010/06/18/monsanto-sues-oakhurst-dairy-over-advertising. He stated, “We’re in the business of marketing milk, not Monsanto’s drugs.” After an intense legal battle, Oakhurst settled the suit. Bill Bennett recalled, “Although the fight with Monsanto was expensive, Stanley Bennett didn’t waver. Stanley was very proud of our stand with Monsanto. We thought it was very important to be able to tell our consumers what was not in our milk.”John Jannarone, “Heard on the Street: Grocers Still Milking Dean Foods,” Wall Street Journal, February 2, 2011, http://online.wsj.com/article/SB10001424052748703445904576118502653780560.html?KEYWORDS=jannarone.

Key Takeaways

- Climate change and global warming can have significant impact on industry economics, including factor costs, prices, and profitability.

- Reducing an industry’s carbon footprint requires action by a host of stakeholders, including industry associations, companies, government agencies, nonprofits, educators, scientists, activists, and individuals.

- The nature of competition in the dairy industry, and all industries, is constantly changing and driven by social, economic, technical, and environmental factors.

- Addressing an industry’s environmental and economic challenges often requires cooperation by industry players, governmental agencies, researchers, and community agencies.

Exercises

- Go to the US Dairy Industry’s website, http://www.usdairy.com/Pages/Home.aspx, and read the 2010 Dairy Industry Sustainability Commitment Report. Why is the industry so committed to lowering greenhouse gas (GHG) emissions, especially given that only 2 percent of total US GHG emissions are due to dairy industry participants?

- Is Oakhurst justified in paying farmers for not feeding their cows with human growth hormones?

- Do you know your own carbon footprint? Go to the Nature Conservatory website at http://www.nature.org/initiatives/climatechange/calculator and calculate your carbon footprint. Why is it important to know your carbon footprint?

- See the sidebar “The State of Maine Dairy Industry.” How would you characterize the economic health of Maine’s Dairy Industry? Why have other states looked to Maine as an innovative leader in the dairy industry? What else might be done to help save Maine’s dairy farms?