This is “Competing in International Markets”, chapter 7 from the book Strategic Management: Evaluation and Execution (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 7 Competing in International Markets

Learning Objectives

After reading this chapter, you should be able to understand and articulate answers to the following questions:

- What are the main benefits and risks of competing in international markets?

- What is the “diamond model,” and how does it help explain why some firms compete better in international markets than others?

- What are the various global strategies that firms can adopt?

- What forms of involvement are available to firms that seek to compete in international markets?

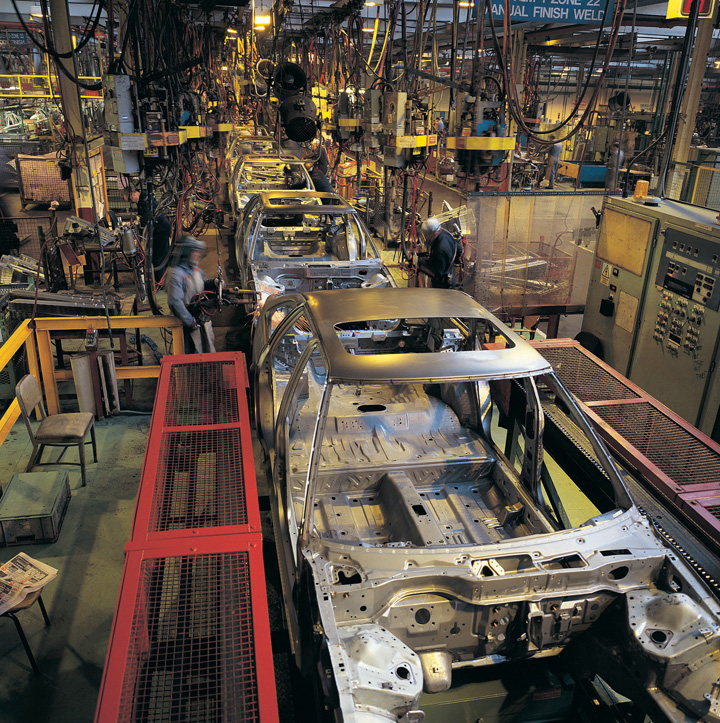

Kia Picks Up Speed

Kia is enjoying accelerated growth within the global automobile industry.

© Thinkstock

On June 2, 2011, South Korean automaker Kia announced plans for a major expansion of its American production facility. Capacity at Kia Motors Manufacturing Georgia Inc. (KMMG) was slated to expand 20 percent from 300,000 to 360,000 vehicles per year. In addition to the crossover utility vehicle Sorento, the plant would begin making a sedan named the Optima in September 2011. The expansion of the plant was estimated to cost $100 million and was expected to create 1,000 new jobs.http://www.kmmgusa.com/2011/06/kia-motors-manufacturing-georgia- begins-expansion-projects-to-support-increased-volume-beginning -in-2012/

This ambitious growth was made possible by Kia’s superb performance in the US market. KMMG had started building vehicles less than two years earlier after being constructed for a cost of $1 billion. In 2010, yearly sales in the United States climbed above 350,000 vehicles. Kia’s overall share of the US market increased in 2010 for the sixteenth consecutive year. In May 2011, Kia sold more than 48,000 cars and trucks in United States, an increase of more than 53 percent from May 2010 sales levels. The Optima led the way with a whopping 210 percent increase in sales.

Kia was not the only beneficiary of its success. KMMG’s location of West Point, Georgia, had been economically devastated when its homegrown textile company, WestPoint Home, shut down its local factories to take advantage of lower labor prices overseas. Following a fierce competition with towns in Mississippi, Kentucky, and other states, West Point was selected in 2006 as the site of Kia’s first US manufacturing facility. To win the plant, state and local authorities offered Kia more than $400 million worth of incentives, including tax breaks, free land, and infrastructure creation.

Georgia’s return on this investment included two thousand new jobs at the plant as well as hundreds of jobs at suppliers that set up shop to support KMMG. The neighboring state of Alabama benefited from KMMG’s success too. As of June 2011, nearly sixty companies spread across twenty-three Alabama counties supplied parts or services to KMMG.Kent, D. 2011, June 19. Kia production in Georgia helping companies across Alabama. al.com. Retrieved from http://blog.al.com/businessnews/2011/06/kia_production_in_georgia_help.html

The name “Kia” means to arise or come up out of Asia.Frequently asked questions. Kia website. Retrieved from http://www.kia.com/#/faq/ This name is very appropriate; Kia rose from humble beginnings as a maker of bicycle parts in 1944 to become a global player in the automobile industry. As of 2011, Kia was producing more than 2.1 million vehicles per year in eight countries. Kias were sold in 172 countries. Kia employed more than 44,000 people and enjoyed annual revenues in excess of $20 billion. Fellow South Korean automaker Hyundai owned just over 33 percent of Kia, and the two firms strengthened each other through collaboration. When taking all of these facts into consideration, Kia’s slogan—The Power to Surprise—had to make its rivals wonder what surprises the Korean upstart might have in store for them next.

Workers in Georgia build Sorentos for South Korea–based Kia.

Image courtesy of IFCAR, http://upload.wikimedia.org/wikipedia/commons/9/98/2011_Kia_Sorento_LX_2_--_02-13-2010.jpg.

7.1 Advantages and Disadvantages of Competing in International Markets

Learning Objectives

- Understand the potential benefits of competing in international markets.

- Understand the risks faced when competing in international markets.

As Kia’s experience illustrates, international business is a huge segment of the world’s economic activity. Amazingly, current projections suggest that, within a few years, the total dollar value of trade across national borders will be greater than the total dollar value of trade within all of the world’s countries combined. One driver of the rapid growth of internal business over the past two decades has been the opening up of large economies such as China and Russia that had been mostly closed off to outside investors.

Figure 7.1 Why Compete in New Markets?

© Thinkstock

The United States enjoys the world’s largest economy. As an illustration of the power of the American economy, consider that, as of early 2011, the economy of just one state—California—would be the eighth largest in the world if it were a country, ranking between Italy and Brazil.Stateside substitutes. 2011, January 2011. The Economist. Retrieved from http://www.economist.com/blogs/dailychart/2011/01/comparing_us_states_ countries The size of the US economy has led American commerce to be very much intertwined with international markets. In fact, it is fair to say that every business is affected by international markets to some degree. Tiny businesses such as individual convenience stores and clothing boutiques sell products that are imported from abroad. Meanwhile, corporate goliaths such as General Motors (GM), Coca-Cola, and Microsoft conduct a great volume of business overseas.

Access to New Customers

Perhaps the most obvious reason to compete in international markets is gaining access to new customers. Although the United States enjoys the largest economy in the world, it accounts for only about 5 percent of the world’s population. Selling goods and services to the other 95 percent of people on the planet can be very appealing, especially for companies whose industry within their home market are saturated (Figure 7.1 "Why Compete in New Markets?").

Few companies have a stronger “All-American” identity than McDonald’s. Yet McDonald’s is increasingly reliant on sales outside the United States. In 2006, the United States accounted for 34 percent of McDonald’s revenue, while Europe accounted for 32 percent and 14 percent was generated across Asia, the Middle East, and Africa. By 2011, Europe was McDonald’s biggest source of revenue (40 percent), the US share had fallen to 32 percent, and the collective contribution of Asia, the Middle East, and Africa had jumped to 23 percent. With less than one-third of its sales being generated in its home country, McDonald’s is truly a global powerhouse.

Levi’s jeans are appreciated by customers worldwide, as shown by this balloon featured at the Putrajaya International Hot Air Balloon Fiesta.

Image courtesy of Kevin Poh, http://www.flickr.com/photos/kevinpoh/4446228896.

China and India are increasingly attractive markets to US firms. The countries are the two most populous in the world. Both nations have growing middle classes, which means that more and more people are able to purchase goods and services that are not merely necessities of life. This trend has created tremendous opportunities for some firms. In the first half of 2010, for example, GM sold more vehicles in China than it sold in the United States (1.2 million vs. 1.08 million). This gap seemed likely to expand; in the first half of 2010, GM’s sales in China increased nearly 50 percent relative to 2009 levels, while sales in the United States rose 15 percent.Isidore, C. 2010. July 2. GM’s Chinese sales top US. CNNMoney. Retrieved from http://money.cnn.com/2010/07/02/news/companies/gm_china/index.htm

Lowering Costs

Many firms that compete in international markets hope to gain cost advantages. If a firm can increase it sales volume by entering a new country, for example, it may attain economies of scale that lower its production costs. Going international also has implications for dealing with suppliers. The growth that overseas expansion creates leads many businesses to purchase supplies in greater numbers. This can provide a firm with stronger leverage when negotiating prices with its suppliers.

OffshoringThe relocation of a business activity to another country. has become a popular yet controversial means for trying to reduce costs. Offshoring involves relocating a business activity to another country. Many American companies have closed down operations at home in favor of creating new operations in countries such as China and India that offer cheaper labor. While offshoring can reduce a firm’s costs of doing business, the job losses in the firm’s home country can devastate local communities. For example, West Point, Georgia, lost approximately 16,000 jobs in the 1990s and 2000s as local textile factories were shut down in favor of offshoring.Copeland, L. 2010, March 25. Kia breathes life into old Georgia textile mill town. USA Today. Retrieved from http://www.usatoday.com/news/nation/2010-03-24-boomtown_N.htm Fortunately for the town, Kia’s decision to locate its first US factory in West Point has improved the economy in the past few years. In another example, Fortune Brands saved $45 million a year by relocating several factories to Mexico, but the employee count in just one of the affected US plants dropped from 1,160 to 350.

A growing number of US companies are finding that offshoring is not providing the benefits they had expected. This has led to a new phenomenon known as reshoringThe relocation to a firm’s home country of business activity that had been sent overseas., whereby jobs that had been sent overseas are returning home. In some cases, the quality provided by workers overseas is not good enough. Carbonite, a seller of computer backup services, found that its call center in Boston was providing much strong customer satisfaction than its call center in India. The Boston operation’s higher rating was attained even though it handled the more challenging customer complaints. As a result, Carbonite plans to shift 250 call center jobs back to the United States by the end of 2012.

Concerns about customer service are leading some American firms to shift their call centers back to the United States.

© Thinkstock

In other cases, the expected cost savings have not materialized. NCR had been making ATMs and self-service checkout systems in China, Hungary, and Brazil. These machines can weigh more than a ton, and NCR found that shipping them from overseas plants back to the United States was extremely expensive. NCR hired 500 workers to start making the ATMs and checkout systems at a plant in Columbus, Georgia. NCR’s plans call for 370 more jobs to be added at the plant by 2014. Similarly, General Electric announced plans to hire approximately 1,300 workers in Louisville, Kentucky, starting in the fall of 2011. These workers will make water heaters and refrigerators that had been produced overseas.Isidore, C. 2011, June 17. Made in USA: Overseas jobs come home. CNNMoney. Retrieved from http://money.cnn.com/2011/06/17/news/economy/made_in_usa/index.htm

Diversification of Business Risk

A familiar cliché warns “don’t put all of your eggs in one basket.” Applied to business, this cliché suggests that it is dangerous for a firm to operate in only one country. Business riskThe potential that a business operation might fail. refers to the potential that an operation might fail. If a firm is completely dependent on one country, negative events in that country could ruin the firm. Just like spreading one’s eggs into multiple baskets reduces the chances that all eggs will be broken, business risk is reduced when a firm is involved in multiple countries.

Firms can reduce business risk by competing in a variety of international markets. For example, the ampm convenience store chain has locations in the United States, Mexico, Brazil, and Japan.

Image courtesy of MASA, http://upload.wikimedia.org/wikipedia/commons/d/db/Ampm.JPG.

Consider, for example, natural disasters such as the earthquakes and tsunami that hit Japan in 2011. If Japanese automakers such as Toyota, Nissan, and Honda sold cars only in their home country, the financial consequences could have been grave. Because these firms operate in many countries, however, they were protected from being ruined by events in Japan. In other words, these firms diversified their business risk by not being overly dependent on their Japanese operations.

American cigarette companies such as Philip Morris and R. J. Reynolds are challenged by trends within the United States and Europe. Tobacco use in these areas is declining as more laws are passed that ban smoking in public areas and in restaurants. In response, cigarette makers are attempting to increase their operations within countries where smoking remains popular to remain profitable over time.

In 2006, for example, Philip Morris spent $5.2 billion to purchase a controlling interest in Indonesian cigarette maker Sampoerna. This was the biggest acquisition ever in Indonesia by a foreign company. Tapping into Indonesia’s population of approximately 230 million people was attractive to Philip Morris in part because nearly two-thirds of men are smokers, and smoking among women is on the rise. As of 2007, Indonesia was the fifth-largest tobacco market in the world, trailing only China, the United States, Russia, and Japan. To appeal to local preferences for cigarettes flavored with cloves, Philip Morris introduced a variety of its signature Marlboro brand called Marlboro Mix 9 that includes cloves in its formulation.T2M. 2007, July 3. Clove-flavored Marlboro now in Indonesia [Web blog post]. Retrieved from http://www.the-two-malcontents.com/2007/07/clove-flavored-marlboro- now-in-indonesia

Trends in the decline of cigarette use in the United States and Europe may snuff out profits enjoyed by brands such as Marlboro.

Image courtesy of Autodesigner, http://en.wikipedia.org/wiki/File:Marlboroultralights.JPG.

Figure 7.2 Entering New Markets: Worth the Risk?

Image courtesy of The Fayj, http://www.flickr.com/photos/fayjo/333325967/

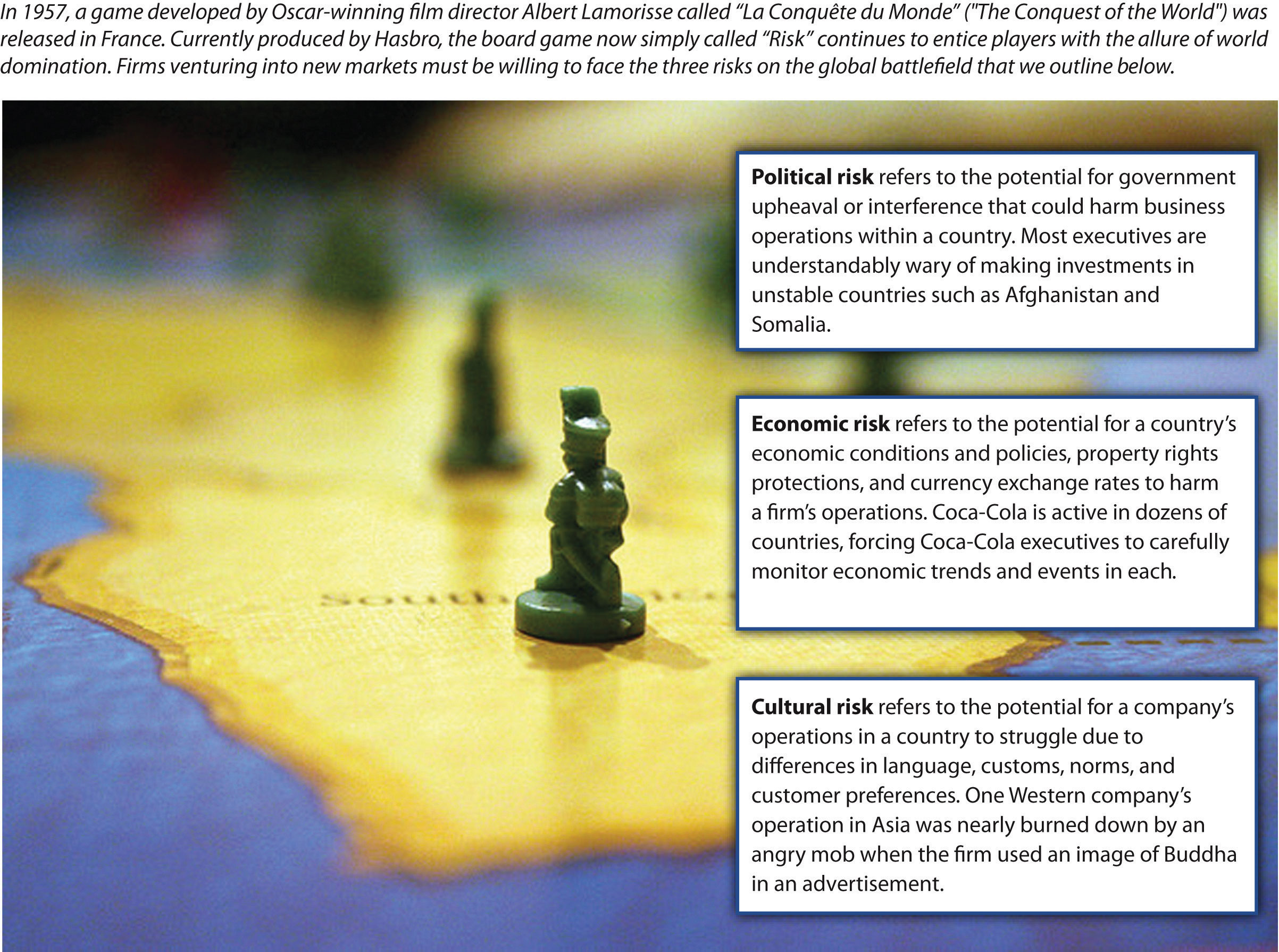

Political Risk

Although competing in international markets offers important potential benefits, such as access to new customers, the opportunity to lower costs, and the diversification of business risk, going overseas also poses daunting challenges. Political riskThe potential for government upheaval or interference with business to harm an operation within a country. refers to the potential for government upheaval or interference with business to harm an operation within a country (Figure 7.2 "Entering New Markets: Worth the Risk?"). For example, the term “Arab Spring” has been used to refer to a series of uprisings in 2011 within countries such as Tunisia, Egypt, Libya, Bahrain, Syria, and Yemen. Unstable governments associated with such demonstrations and uprisings make it difficult for firms to plan for the future. Over time, a government could become increasingly hostile to foreign businesses by imposing new taxes and new regulations. In extreme cases, a firm’s assets in a country are seized by the national government. This process is called nationalizationThe seizure of privately owned business operations by a national government.. In recent years, for example, Venezuela has nationalized foreign-controlled operations in the oil, cement, steel, and glass industries.

Countries with the highest levels of political risk tend to be those such as Somalia, Sudan, and Afghanistan whose governments are so unstable that few foreign companies are willing to enter them. High levels of political risk are also present, however, in several of the world’s important emerging economies, including India, the Philippines, Russia, and Indonesia. This creates a dilemma for firms in that these risky settings also offer enormous growth opportunities. Firms can choose to concentrate their efforts in countries such as Canada, Australia, South Korea, and Japan that have very low levels of political risk, but opportunities in such settings are often more modest.Kostigen, T. 2011, February 25. Beware: The world’s riskiest countries. Market Watch. Wall Street Journal. Retrieved from http://www.marketwatch.com/story/beware-the -worlds-riskiest-countries-2011-02-25

Cuban leader Fidel Castro nationalized the assets of thousands of US companies after overthrowing the previous government.

© Thinkstock

Economic Risk

Economic riskThe potential for a country’s economic conditions and policies, property rights protections, and currency exchange rates to harm an operation. refers to the potential for a country’s economic conditions and policies, property rights protections, and currency exchange rates to harm a firm’s operations within a country. Executives who lead companies that do business in many different countries have to take stock of these various dimensions and try to anticipate how the dimensions will affect their companies. Because economies are unpredictable, economic risk presents executives with tremendous challenges.

Consider, for example, Kia’s operations in Europe. In May 2009, Kia reported increased sales in ten European countries relative to May 2008. The firm enjoyed a 62 percent year-to-year increase in Slovakia, 58 percent in Austria, 50 percent in Gibraltar, 49 percent in Sweden, 43 percent in Poland, 24 percent in Germany, 21 percent in the United Kingdom, 13 percent in the Czech Republic, 6 percent in Belgium, and 3 percent in Italy.Kia sales climb strongly in 10 countries in May [Press release]. Kia website. Retrieved from http://www.kia-press.com/press/corporate/20090605-kia%20sales%20 climb%20strongly%20in%2010%20countries.aspx As Kia’s executives planned for the future, they needed to wonder how economic conditions would influence Kia’s future performance in Europe. If inflation and interest rates were to increase in a particular country, this would make it more difficult for consumers to purchase new Kias. If currency exchange rates were to change such that the euro became weaker relative to the South Korean won, this would make a Kia more expensive for European buyers.

Economic risk involves many complex and daunting elements.

© Thinkstock

Cultural Risk

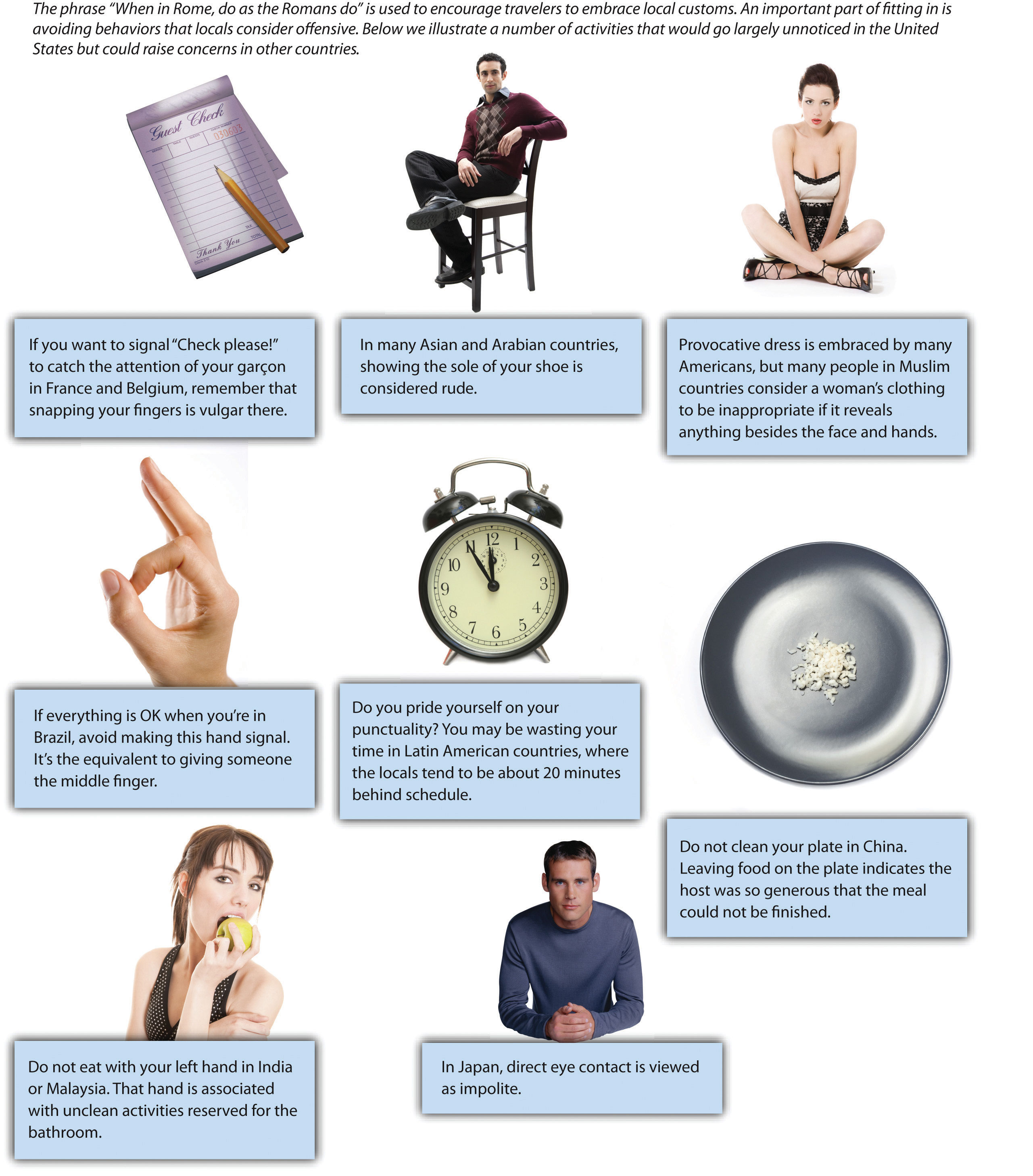

Figure 7.3 Cultural Risk: When in Rome

© Thinkstock

Cultural riskThe potential for a company’s operations in a country to struggle because of differences in language, customs, norms, and customer preferences. refers to the potential for a company’s operations in a country to struggle because of differences in language, customs, norms, and customer preferences (Figure 7.3 "Cultural Risk: When in Rome"). The history of business is full of colorful examples of cultural differences undermining companies. For example, a laundry detergent company was surprised by its poor sales in the Middle East. Executives believed that their product was being skillfully promoted using print advertisements that showed dirty clothing on the left, a box of detergent in the middle, and clean clothing on the right.

A simple and effective message, right? Not exactly. Unlike English and other Western languages, the languages used in the Middle East, such as Hebrew and Arabic, involve reading from right to left. To consumers, the implication of the detergent ads was that the product could be used to take clean clothes and make the dirty. Not surprisingly, few boxes of the detergent were sold before this cultural blunder was discovered.

A refrigerator manufacturer experienced poor sales in the Middle East because of another cultural difference. The firm used a photo of an open refrigerator in its prints ads to demonstrate the large amount of storage offered by the appliance. Unfortunately, the photo prominently featured pork, a type of meat that is not eaten by the Jews and Muslims who make up most of the area’s population.Ricks, D. A. 1993. Blunders in international business. Cambridge, MA: Blackwell. To get a sense of consumers’ reactions, imagine if you saw a refrigerator ad that showed meat from a horse or a dog. You would likely be disgusted. In some parts of world, however, horse and dog meat are accepted parts of diets. Firms must take cultural differences such as these into account when competing in international markets.

This photo would not help sell refrigerators in the Middle East because it includes pork, a meat that is taboo in that part of the world.

© Thinkstock

Cultural differences can cause problems even when the cultures involved are very similar and share the same language. RecycleBank is an American firm that specializes in creating programs that reward people for recycling, similar to airlines’ frequent-flyer programs. In 2009, RecycleBank expanded its operations into the United Kingdom. Executives at RecycleBank became offended when the British press referred to RecycleBank’s rewards program as a “scheme.” Their concern was unwarranted, however. The word scheme implies sneakiness when used in the United States, but a scheme simply means a service in the United Kingdom.Maltby, E. 2010, January 19. Expanding abroad? Avoid cultural gaffes. Wall Street Journal. Retrieved from http://online.wsj.com/article/SB100014240527487036 57604575005511903147960.html Differences in the meaning of English words between the United States and the United Kingdom are also vexing to American men named Randy, who wonder why Brits giggle at the mention of their name (Figure 7.4 "Watch Your Language").

Figure 7.4 Watch Your Language

Images courtesy of Joya Wu, http://www.flickr.com/photos/airencn/2770897336/ (top left); Bull-Doser, http://commons.wikimedia.org/wiki/File:Chevrolet_Nova_SS.jpg (bottom right); other images © Thinkstock.

Key Takeaway

- Competing in international markets involves important opportunities and daunting threats. The opportunities include access to new customers, lowering costs, and diversification of business risk. The threats include political risk, economic risk, and cultural risk.

Exercises

- Is offshoring ethical or unethical? Why?

- Do you expect reshoring to become more popular in the years ahead? Why or why not?

- Have you ever seen an advertisement that was culturally offensive? Why do you think that companies are sometimes slow to realize that their ads will offend people?

7.2 Drivers of Success and Failure When Competing in International Markets

Learning Objectives

- Explain the elements of the “diamond model.”

- Understand how the model helps to explain success and failure in international markets.

The title of a book written by newspaper columnist Thomas Friedman attracted a great deal of attention when the book was released in 2005. In The World Is Flat: A Brief History of the 21st Century, Friedman argued that technological advances and increased interconnectedness is leveling the competitive playing field between developed and emerging countries. This means that companies exist in a “flat world” because economies across the globe are converging on a single integrated global system.Friedman, T. L. 2005. The world is flat: A brief history of the 21st century. New York, NY: Farrar, Straus and Giroux. For executives, a key implication is that a firm’s being based in a particular country is ceasing to be an advantage or disadvantage.

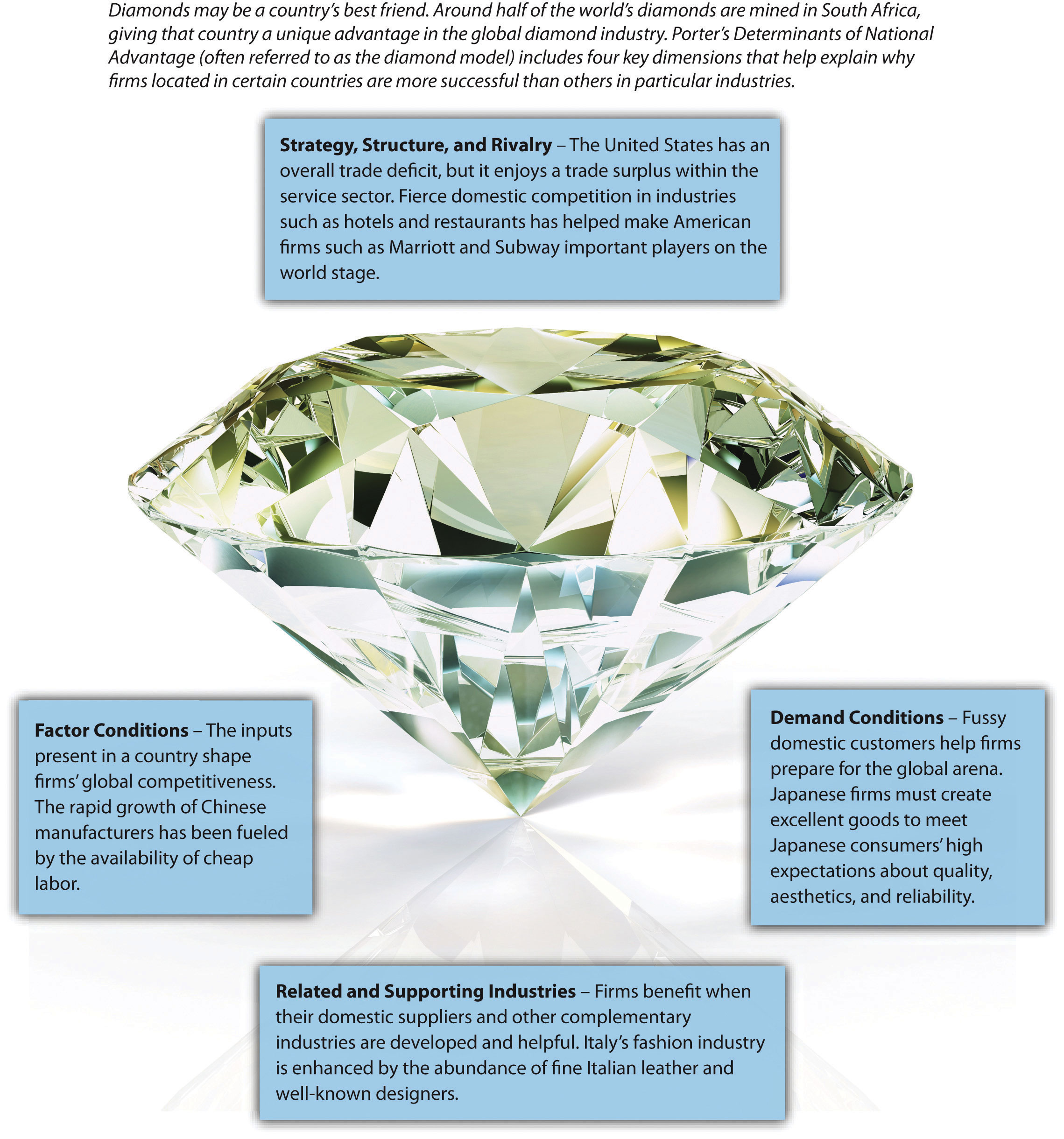

While Friedman’s notion of business becoming a flat world is flashy and attention grabbing, it does not match reality. Research studies conducted since 2005 have found that some firms enjoy advantages based on their country of origin while others suffer disadvantages. A powerful framework for understanding how likely it is that firms based in a particular country will be successful when competing in international markets was provided by Professor Michael Porter of the Harvard Business School.Porter, M. E. 1990. The competitive advantage of nations, New York, NY: Free Press. The framework is formally known as “the determinants of national advantage,” but it is often referred to more simply as “the diamond model” because of its shape (Figure 7.5 "Diamond Model of National Advantage").

Figure 7.5 Diamond Model of National Advantage

© Thinkstock

According to the model, the ability of the firms in an industry whose origin is in a particular country (e.g., South Korean automakers or Italian shoemakers) to be successful in the international arena is shaped by four factors: (1) their home country’s demand conditions, (2) their home country’s factor conditions, (3) related and supporting industries within their home country, and (4) strategy, structure, and rivalry among their domestic competitors.

Demand Conditions

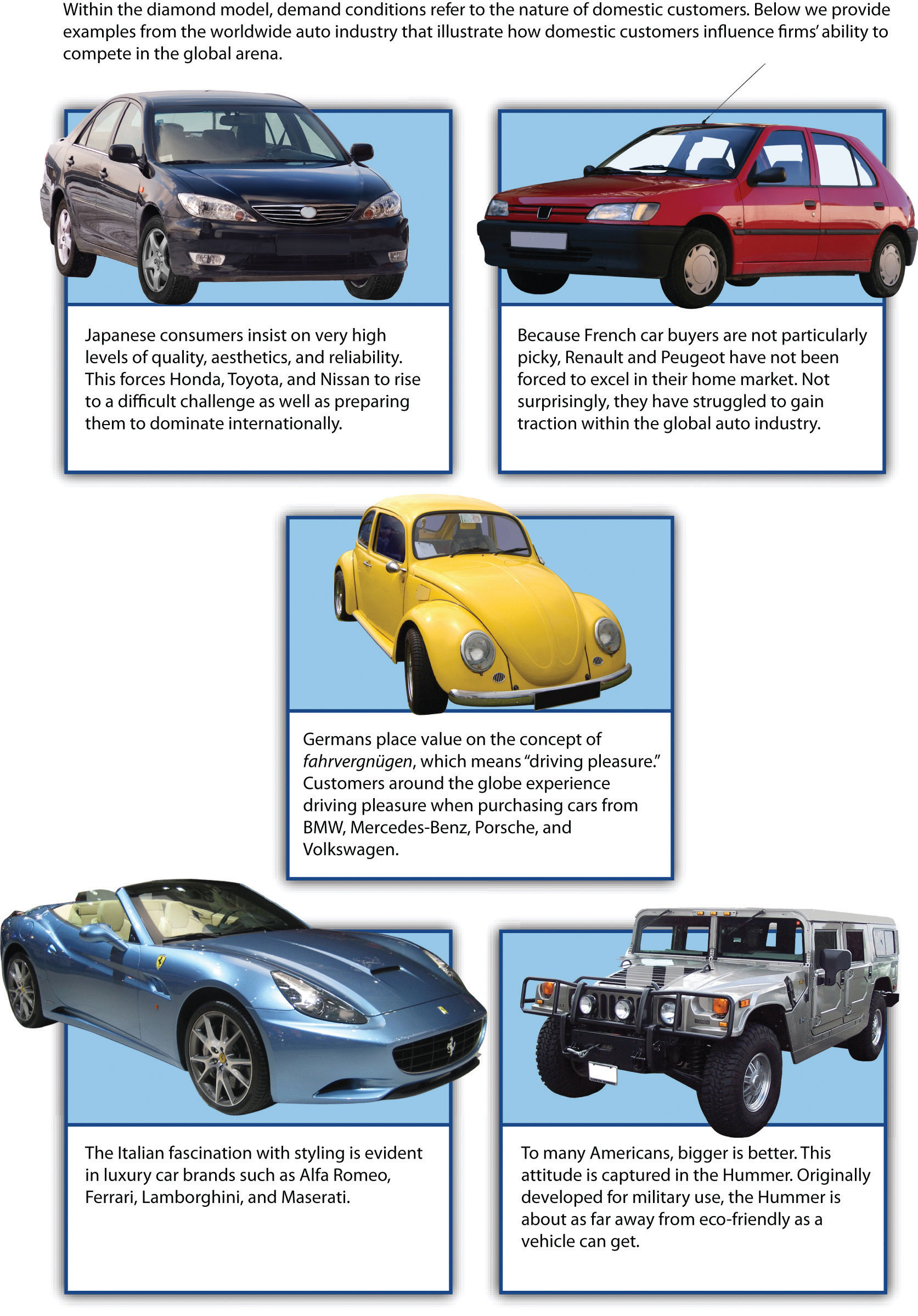

Within the diamond model, demand conditionsThe nature of domestic customers, especially whether they have high expectations of the goods and services that they buy. refer to the nature of domestic customers (Figure 7.6 "Demand Conditions"). It is tempting to believe that firms benefit when their domestic customers are perfectly willing to purchase inferior products. This would be a faulty belief! Instead, firms benefit when their domestic customers have high expectations.

Japanese consumers are known for insisting on very high levels of quality, aesthetics, and reliability. Japanese automakers such as Honda, Toyota, and Nissan reap rewards from this situation. These firms have to work hard to satisfy their domestic buyers. Living up to lofty quality standards at home prepares these firms to offer high-quality products when competing in international markets. In contrast, French car buyers do not stand out as particularly fussy. It is probably not a coincidence that French automakers Renault and Peugeot have struggled to gain traction within the global auto industry.

Figure 7.6 Demand Conditions

Images courtesy of Kaotic.nite, http://commons.wikimedia.org/wiki/File:Ferrari_California1.jpg (bottom left); other images © Thinkstock.

Demand conditions also help to explain why German automakers such as Porsche, Mercedes-Benz, and BMW create excellent luxury and high-performance vehicles. German consumers value superb engineering. While a car is simply a means of transportation in some cultures, Germans place value on the concept of fahrvergnügen, which means “driving pleasure.” Meanwhile, demand for fast cars is high in Germany because the country has built nearly eight thousand miles of superhighways known as autobahns. No speed limits for cars are enforced on more than half of the eight thousand miles. Many Germans enjoy driving at 150 miles per hour or more, and German automakers must build cars capable of safely reaching and maintaining such speeds. When these companies compete in the international arena, the engineering and performance of their vehicles stand out.

Japanese firms must deliver very high quality to meet the expectations of Japanese consumers.

© Thinkstock

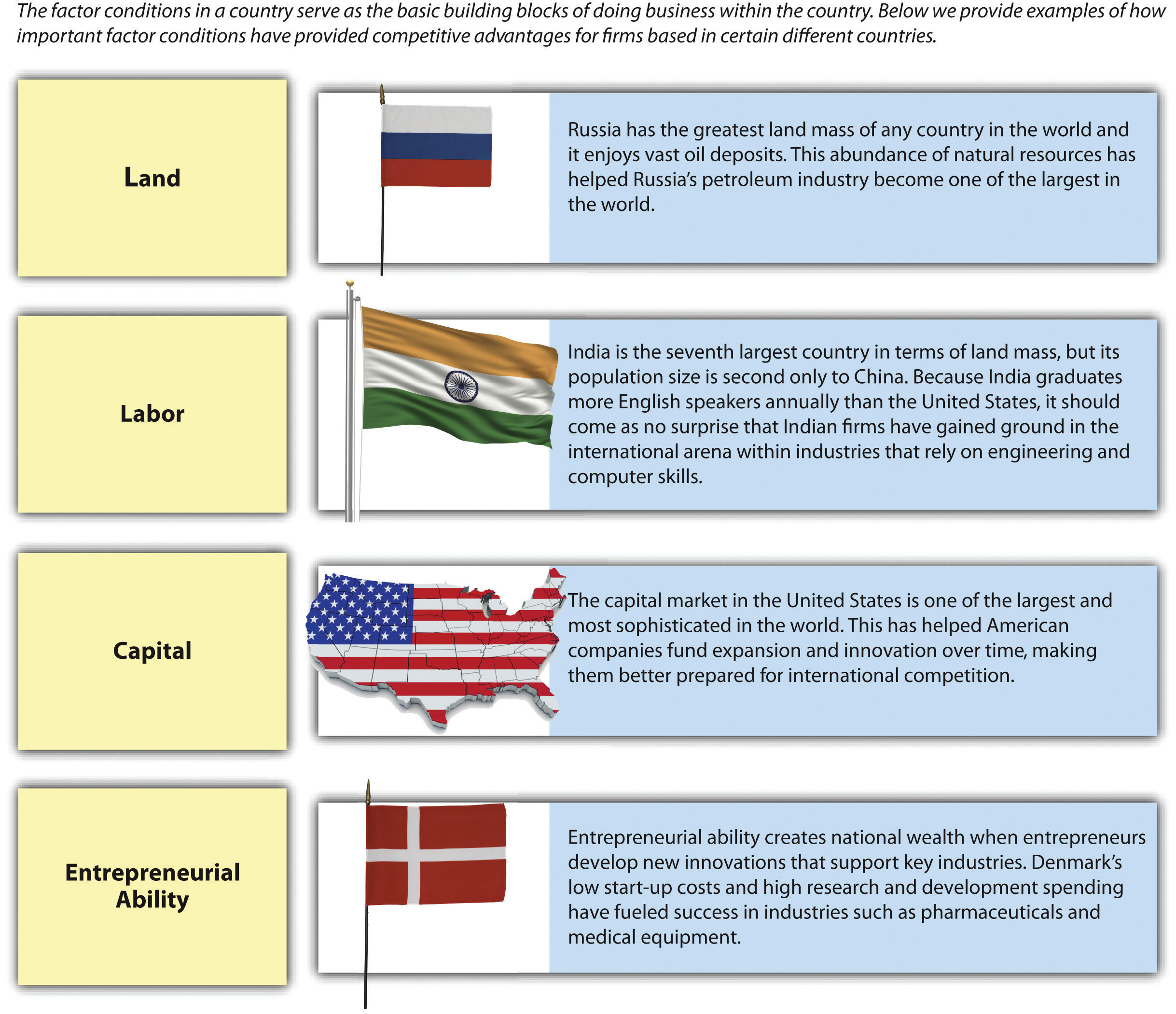

Factor Conditions

Factor conditionsThe nature of raw material and other inputs that firms need to create goods and services. refer to the nature of raw material and other inputs that firms need to create goods and services (Figure 7.7 "Factor Conditions"). Examples include land, labor, capital markets, and infrastructure. Firms benefit when they have good access to factor conditions and face challenges when they do not. Companies based in the United States, for example, are able to draw on plentiful natural resources, a skilled labor force, highly developed transportation systems, and sophisticated capital markets to be successful. The dramatic growth of Chinese manufacturers in recent years has been fueled in part by the availability of cheap labor.

Figure 7.7 Factor Conditions

© Thinkstock

In some cases, overcoming disadvantages in factor conditions leads companies to develop unique skills. Japan is a relatively small island nation with little room to spare. This situation has led Japanese firms to be pioneers in the efficient use of warehouse space through systems such as just-in-time inventory management (JIT)A production system that conserves space and lowers costs by requiring inputs to arrive at the moment they are needed.. Rather than storing large amounts of parts and material, JIT management conserves space—and lowers costs—by requiring inputs to a production process to arrive at the moment they are needed. Their use of JIT management has given Japanese manufacturers an advantage when they compete in international markets.

American furniture makers benefit from the abundance of high-quality lumber in the United States.

© Thinkstock

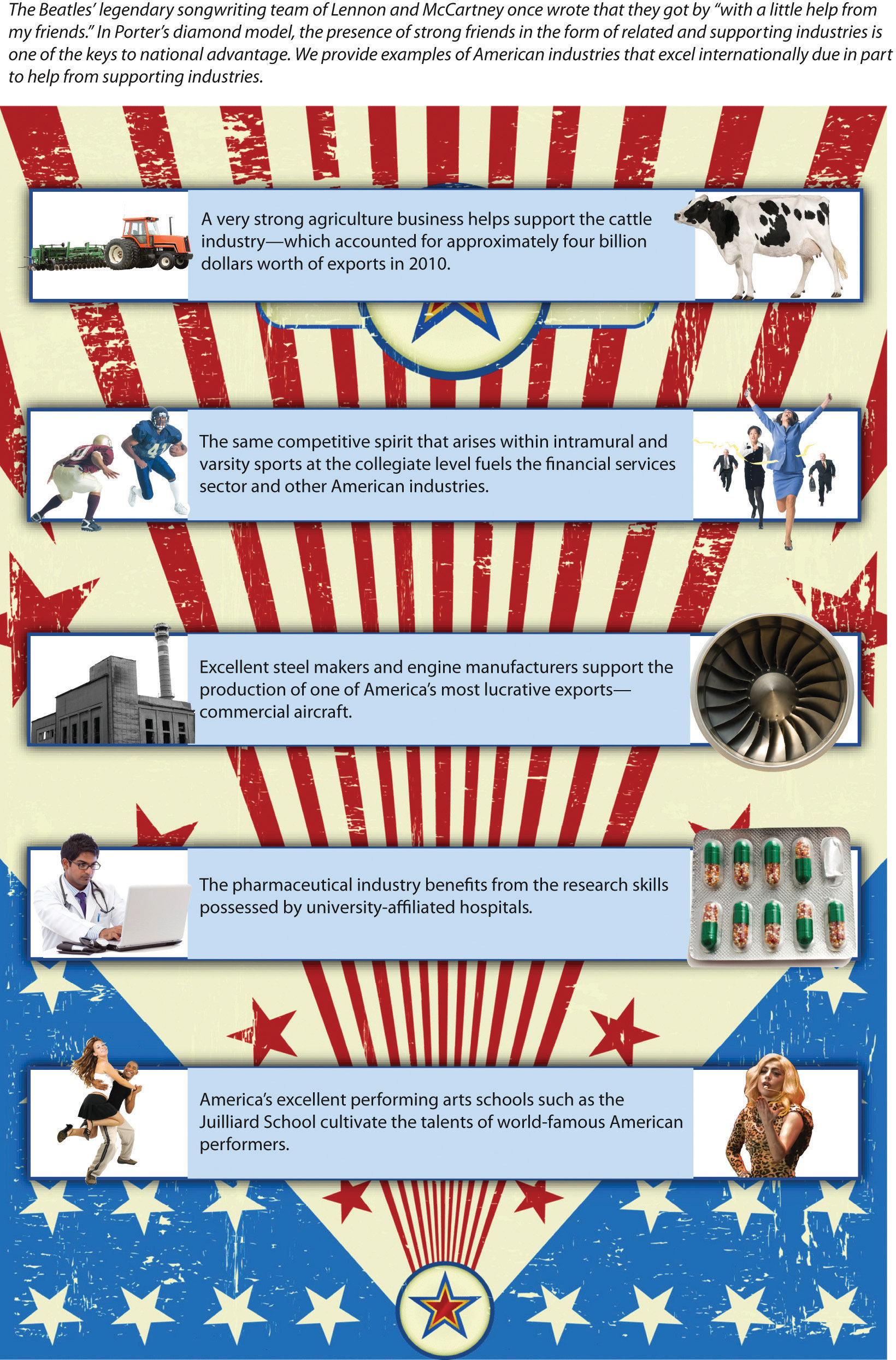

Related and Supporting Industries

Figure 7.8 Related and Supporting Industries

Images courtesy of John Robert Charlton, http://en.wikipedia.org/wiki/File:The_Monster_Ball_-_Poker_Face_revamped2-tweak.jpg (bottom right); other images © Thinkstock.

Could Italian shoemakers create some of the world’s best shoes if Italian leather makers were not among the world’s best? Possibly, but it would be much more difficult. The concept of related and supporting industriesThe extent to which firms’ domestic suppliers and other complementary industries are developed and helpful. refers to the extent to which firms’ domestic suppliers and other complementary industries are developed and helpful (Figure 7.8 "Related and Supporting Industries"). Italian shoemakers such as Salvatore Ferragamo, Prada, Gucci, and Versace benefit from the availability of top-quality leather within their home country. If these shoemakers needed to rely on imported leather, they would lose flexibility and speed.

Fine Italian shoes, such as those found at the famous Via Montenapoleone in Milan, are usually made of fine Italian leather.

Image courtesy of Warburg, http://en.wikipedia.org/wiki/File:Milan_Montenapoleone_16.JPG.

The auto industry is a setting where related and supporting industries are very important. Electronics are key components of modern vehicles. South Korean automakers Kia and Hyundai can leverage the excellent electronics provided by South Korean firms Samsung and LG. Similarly, Honda, Nissan, and Toyota are able to draw on the skills of Sony and other Japanese electronics firms. Unfortunately, for French automakers Renault and Peugeot, no French electronics firms are standouts in the international arena. This situation makes it difficult for Renault and Peugeot to integrate electronics into their vehicles as effectively as their South Korean and Japanese rivals.

In extreme cases, the poor condition of related and supporting industries can undermine an operation. Otabo LLC, a small custom shoe company, was forced to shut down its Florida factory in 2008. Otabo struggled to find technicians that had the skills needed to fix its shoemaking machines. Meanwhile, there are very few suppliers of shoelaces, soles, eyelets, and other components in the United States because about 99 percent of the shoes purchased in the United States are imported, mostly from China. The few available suppliers were unwilling to create the small batches of customized materials that Otabo wanted. In the end, the American factory simply could not get access to many of the supplies needed to create shoes.Aeppel, T. 2008, March 3. US shoe factory finds supplies are Achilles’ heel. Wall Street Journal. Retrieved from http://online.wsj.com/article/SB120450124543206313.html Production was shifted to China, where all the needed supplies can be found easily and cheaply.

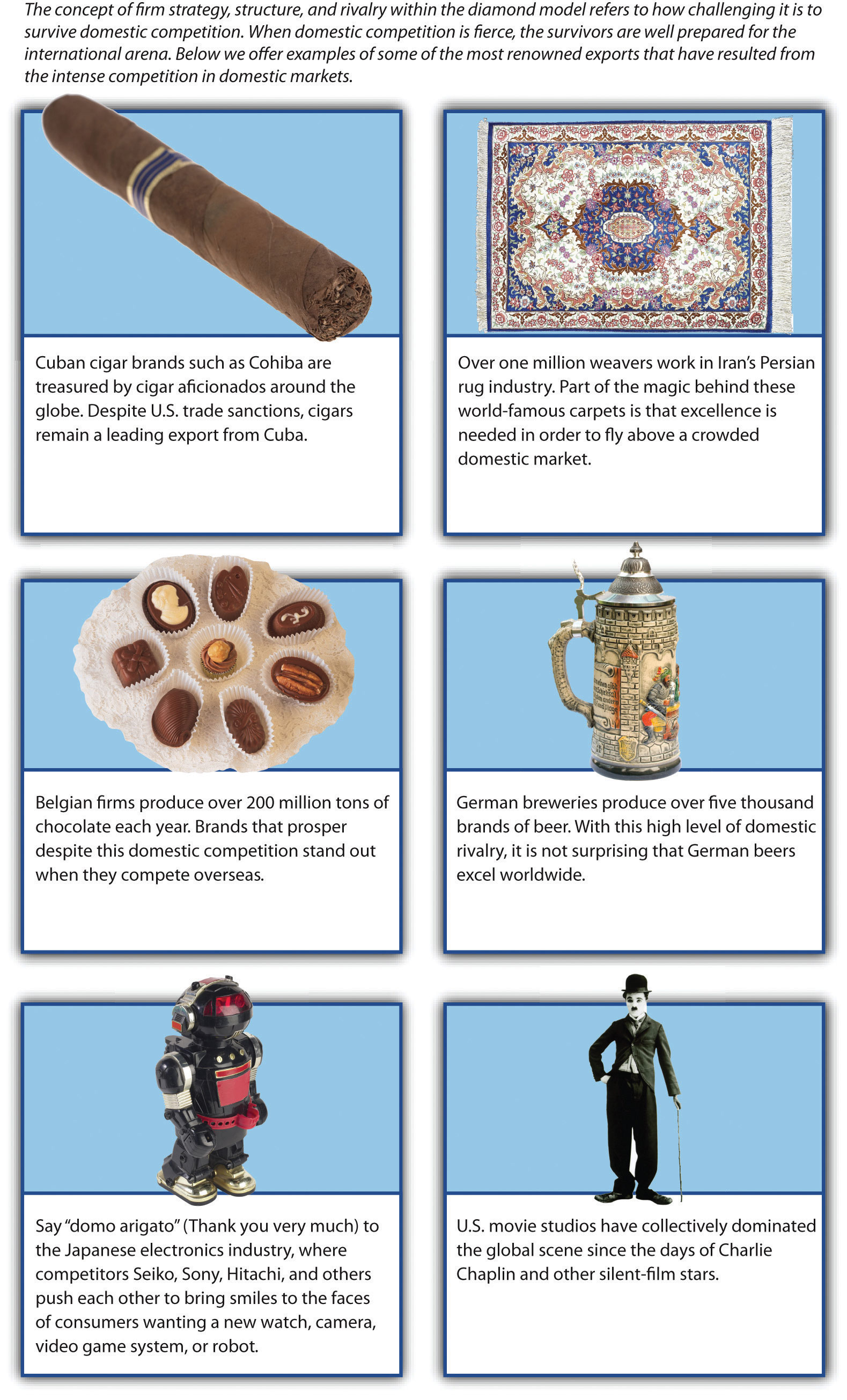

Firm Strategy, Structure, and Rivalry

Figure 7.9 Strategy, Structure, and Rivalry

Images courtesy of Wikipedia (bottom right); other images © Thinkstock.

The concept of firm strategy, structure, and rivalryHow challenging it is for firms to survive domestic competition. refers to how challenging it is to survive domestic competition (Figure 7.9 "Strategy, Structure, and Rivalry"). The Olympics offer a good analogy for illustrating the positive aspects of very challenging domestic situations. If the competition to make a national team in gymnastics is fierce, the gymnasts who make the team will have been pushed to stretch their abilities and performance. In contrast, gymnasts who faced few contenders in their quest to make a national team will not have been tested with the same level of intensity. When the two types meet at the Olympics, the gymnasts who overcame huge hurdles to make their national teams are likely to have an edge over athletes from countries with few skilled gymnasts.

Companies that have survived intense rivalry within their home markets are likely to have developed strategies and structures that will facilitate their success when they compete in international markets. Hyundai and Kia had to keep pace with each other within the South Korean market before expanding overseas. The leading Japanese automakers—Honda, Nissan, and Toyota—have had to compete not only with one another but also with smaller yet still potent domestic firms such as Isuzu, Mazda, Mitsubishi, Subaru, and Suzuki. In both examples, the need to navigate potent domestic rivals has helped firms later become fearsome international players.

Succeeding despite difficult domestic competition prepares firms to expand their kingdoms into international markets.

Image courtesy of Chrisloader, http://en.wikipedia.org/wiki/File:Leicester_Square_Burger_King.jpg.

If, in contrast, domestic competition is fairly light, a company may enjoy admirable profits within its home market. However, the lack of being pushed by rivals will likely mean that the firm struggles to reach its potential in creativity and innovation. This undermines the firm’s ability to compete overseas and makes it vulnerable to foreign entry into its home market. Because neither Renault nor Peugeot has been a remarkable innovator historically, these French automakers have enjoyed fairly gentle domestic competition. Once the auto industry became a global competition, however, these firms found themselves trailing their Asian rivals.

Key Takeaway

- The likelihood that a firm will succeed when it competes in international markets is shaped by four aspects of its domestic market: (1) demand conditions; (2) factor conditions; (3) related and supporting industries; and (4) strategy, structure, and rivalry among its domestic competitors.

Exercises

- Which of the four elements of the diamond model do you believe has the strongest influence on a firm’s fate when it competes in international markets?

- Automakers in China and India have yet to compete on the world stage. Based on the diamond model, would these firms be likely to succeed or fail within the global auto industry?

7.3 Types of International Strategies

Learning Objectives

- Understand what a multidomestic strategy involves and be able to offer an example.

- Understand what a global strategy involves and be able to offer an example.

- Understand what a transnational strategy involves and be able to offer an example.

A firm that has operations in more than one country is known as a multinational corporation (MNC)A firm that has operations in more than one country.. The largest MNCs are major players within the international arena. Walmart’s annual worldwide sales, for example, are larger than the dollar value of the entire economies of Austria, Norway, and Saudi Arabia. Although Walmart tends to be viewed as an American retailer, the firm earns more than one-quarter of its revenues outside the United States. Walmart owns significant numbers of stores in Mexico (1,730 as of mid-2011), Central America (549), Brazil (479), Japan (414), the United Kingdom (385), Canada (325), Chile (279), and Argentina (63). Walmart also participates in joint ventures in China (328 stores) and India (5).Standard & Poor’s stock report on Walmart. Even more modestly sized MNCs are still very powerful. If Kia were a country, its current sales level of approximately $21 billion would place it in the top 100 among the more than 180 nations in the world.

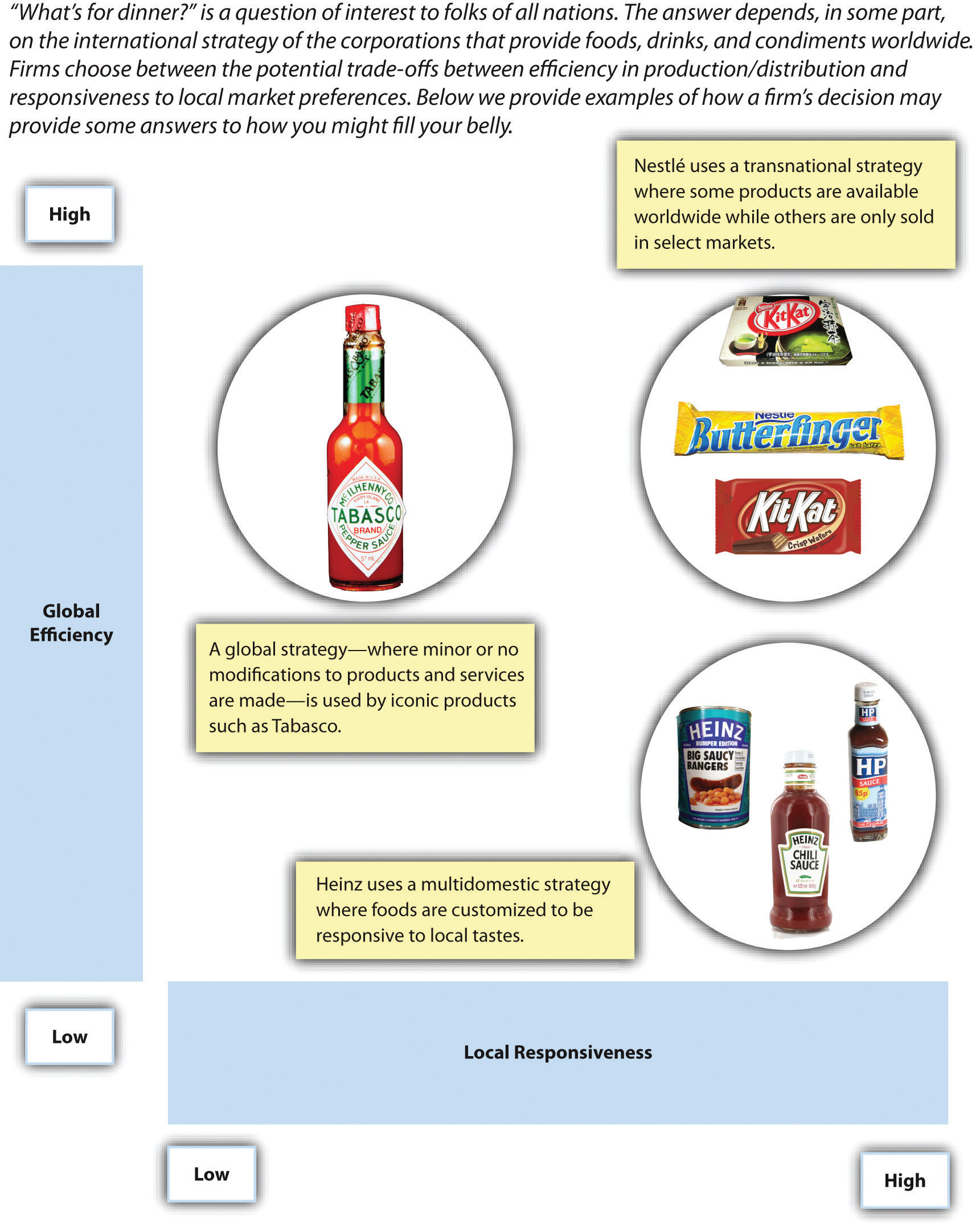

Multinationals such as Kia and Walmart must choose an international strategy to guide their efforts in various countries. There are three main international strategies available: (1) multidomestic, (2) global, and (3) transnational (Figure 7.10 "International Strategy"). Each strategy involves a different approach to trying to build efficiency across nations and trying to be responsiveness to variation in customer preferences and market conditions across nations.

Multidomestic Strategy

A firm using a multidomestic strategyTo sacrifice efficiency in favor of responsiveness to varying preferences across countries. sacrifices efficiency in favor of emphasizing responsiveness to local requirements within each of its markets. Rather than trying to force all of its American-made shows on viewers around the globe, MTV customizes the programming that is shown on its channels within dozens of countries, including New Zealand, Portugal, Pakistan, and India. Similarly, food company H. J. Heinz adapts its products to match local preferences. Because some Indians will not eat garlic and onion, for example, Heinz offers them a version of its signature ketchup that does not include these two ingredients.

Figure 7.10 International Strategy

Images courtesy of kenny-lex, http://www.flickr.com/photos/kenny_lex/3059058350/ (top left); Pete, http://www.flickr.com/photos/comedynose/3542592243/ (bottom right); Ged Carroll, http://www.flickr.com/photos/renaissancechambara/4241378353/ (top left); Creative Tools, http://www.flickr.com/photos/creative_tools/4293407348/ (bottom right); Windell Oskay, http://www.flickr.com/photos/oskay/4578993380/ (bottom right); Andrew Maiman, http://www.flickr.com/photos/amaiman/5550834826/ (top right); Bodo, http://www.flickr.com/photos/64448029@N05/5901416357/ (top right).

Baked beans flavored with curry? This H. J. Heinz product is very popular in the United Kingdom.

Image courtesy of Gordon Joly, http://upload.wikimedia.org/wikipedia/commons/f/f4/Curry_Beanz.jpg.

Global Strategy

A firm using a global strategyTo sacrifice responsiveness to local preferences in favor of efficiency. sacrifices responsiveness to local requirements within each of its markets in favor of emphasizing efficiency. This strategy is the complete opposite of a multidomestic strategy. Some minor modifications to products and services may be made in various markets, but a global strategy stresses the need to gain economies of scale by offering essentially the same products or services in each market.

Microsoft, for example, offers the same software programs around the world but adjusts the programs to match local languages. Similarly, consumer goods maker Procter & Gamble attempts to gain efficiency by creating global brands whenever possible. Global strategies also can be very effective for firms whose product or service is largely hidden from the customer’s view, such as silicon chip maker Intel. For such firms, variance in local preferences is not very important.

Transnational Strategy

A firm using a transnational strategyInvolves balancing the desire for efficiency with the need to varying preferences across countries. seeks a middle ground between a multidomestic strategy and a global strategy. Such a firm tries to balance the desire for efficiency with the need to adjust to local preferences within various countries. For example, large fast-food chains such as McDonald’s and Kentucky Fried Chicken (KFC) rely on the same brand names and the same core menu items around the world. These firms make some concessions to local tastes too. In France, for example, wine can be purchased at McDonald’s. This approach makes sense for McDonald’s because wine is a central element of French diets.

Key Takeaway

- Multinational corporations choose from among three basic international strategies: (1) multidomestic, (2) global, and (3) transnational. These strategies vary in their emphasis on achieving efficiency around the world and responding to local needs.

Exercises

- Which of the three international strategies is Kia using? Is this the best strategy for Kia to be using?

- Identify examples of companies using each of the three international strategies other than those described above. Which company do you think is best positioned to compete in international markets?

7.4 Options for Competing in International Markets

Learning Objectives

- Understand the various options for entering an international market.

- Be able to provide an example of a firm using each option.

Figure 7.11 Market Entry Options

Images courtesy of The Brandery, http://www.flickr.com/photos/thebrandery/5375176557/, http://www.flickr.com/photos/thebrandery/5375776224/ (fourth); other images © Thinkstock.

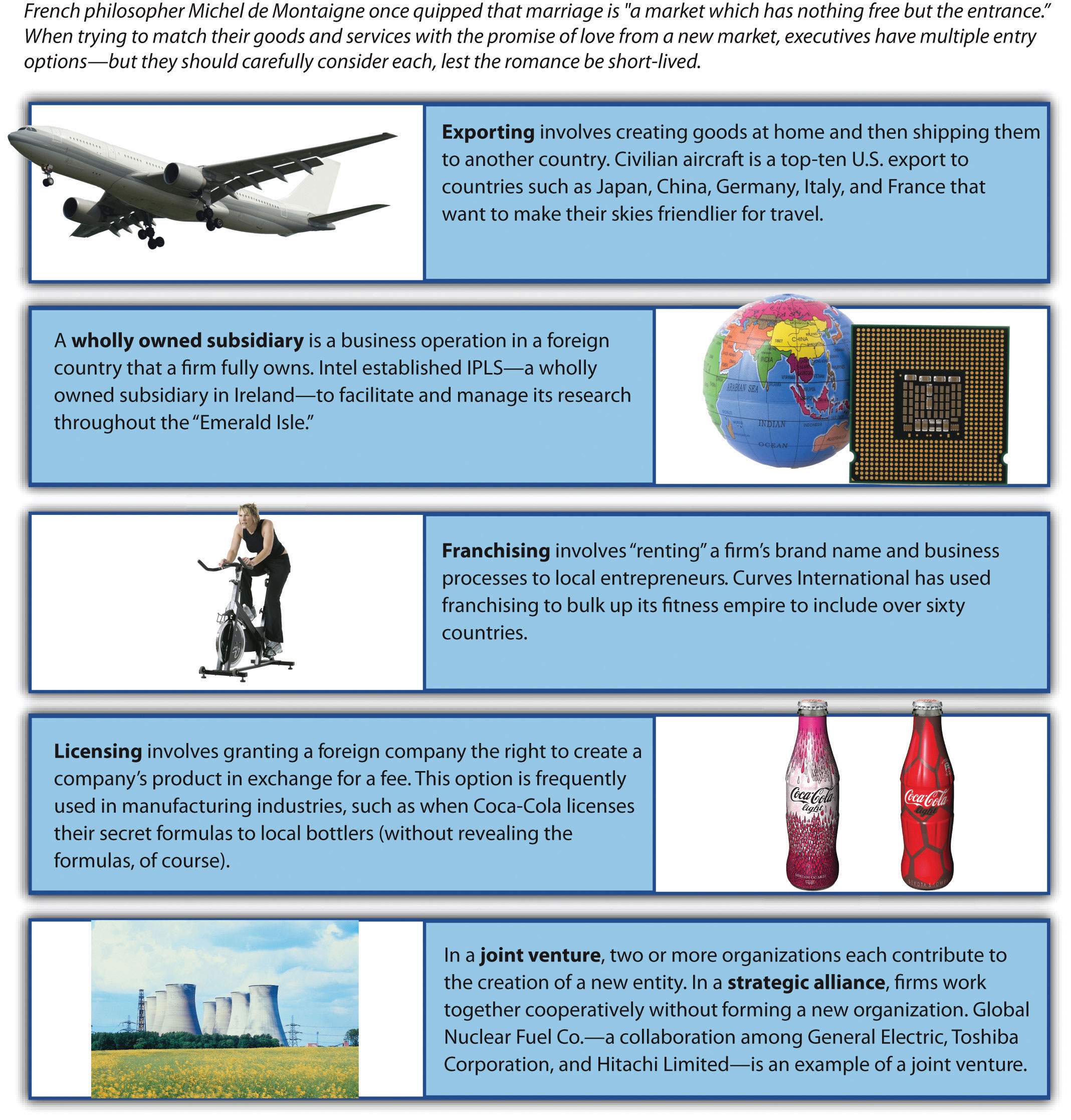

When the executives in charge of a firm decide to enter a new country, they must decide how to enter the country. There are five basic options available: (1) exporting, (2) creating a wholly owned subsidiary, (3) franchising, (4) licensing, and (5) creating a joint venture or strategic alliance (Figure 7.11 "Market Entry Options"). These options vary in terms of how much control a firm has over its operation, how much risk is involved, and what share of the operation’s profits the firm gets to keep.

Exporting

ExportingCreating goods within a firm’s home country and then shipping them to another country where they are sold to customers by a local firm. involves creating goods within a firm’s home country and then shipping them to another country. Once the goods reach foreign shores, the exporter’s role is over. A local firm then sells the goods to local customers. Many firms that expand overseas start out as exporters because exporting offers a low-cost method to find out whether a firm’s products are appealing to customers in other lands. Some Asian automakers, for example, first entered the US market though exporting. Small firms may rely on exporting because it is a low-cost option.

Exporting often relies on huge cargo ships, such as this one docked in Cyprus.

© Thinkstock

Once a firm’s products are found to be viable in a particular country, exporting often becomes undesirable. A firm that exports its goods loses control of them once they are turned over to a local firm for sale locally. This local distributor may treat customers poorly and thereby damage the firm’s brand. Also, an exporter only makes money when it sells its goods to a local firm, not when end users buy the goods. Executives may want their firm rather than a local distributor to enjoy the profits that are made when products are sold to individual customers.

Creating a Wholly Owned Subsidiary

A wholly owned subsidiaryA business operation in a foreign country that a firm fully owns. is a business operation in a foreign country that a firm fully owns. A firm can develop a wholly owned subsidiary through a greenfield ventureA foreign operation that a firm creates entirely by itself., meaning that the firm creates the entire operation itself. Another possibility is purchasing an existing operation from a local company or another foreign operator.

Regardless of whether a firm builds a wholly owned subsidiary “from scratch” or acquires an existing operation, having a wholly owned subsidiary can be attractive because the firm maintains complete control over the operation and gets to keep all of the profits that the operation makes. A wholly owned subsidiary can be quite risky, however, because the firm must pay all of the expenses required to set it up and operate it. Kia, for example, spent $1 billion to build its US factory. Many firms are reluctant to spend such sums in more volatile countries because they fear that they may never recoup their investments.

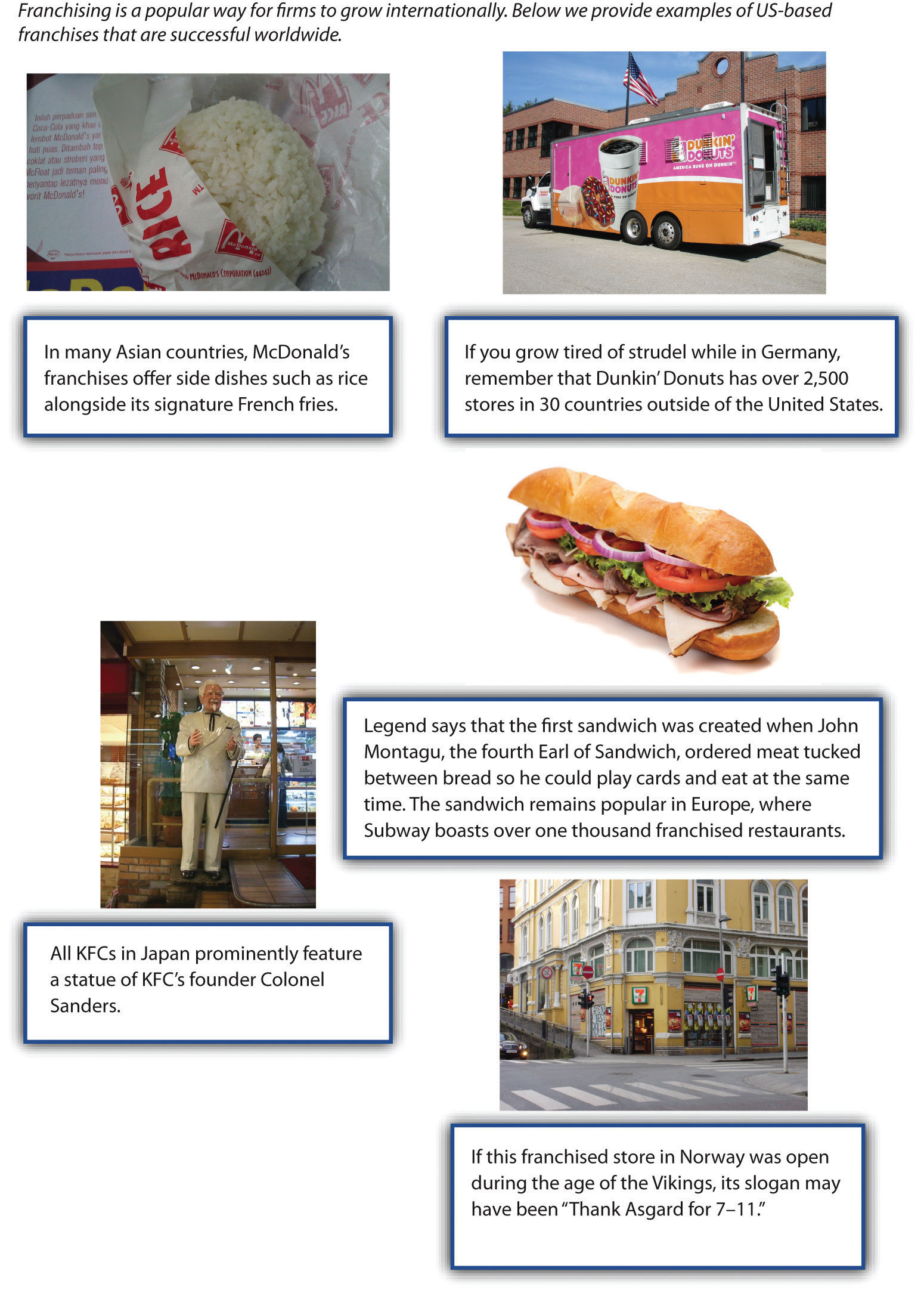

Franchising

Figure 7.12 Franchising: A Leading American Export

Images courtesy of Enrique Cornejo, http://en.wikipedia.org/wiki/File:7_eleven_Bergen_Nygardsgaten.JPG (bottom right); Lonnie, http://www.flickr.com/photos/hanataro/689530713/ (bottom left); Abdul Rahman, http://www.flickr.com/photos/yunir/5287015064/ (top left); Tianliu, http://commons.wikimedia.org/wiki/File:DunkinDonutsTruck.JPG (top right); other images © Thinkstock.

FranchisingAn organization (called a franchisor) grants the right to use its brand name, products, and processes to other organizations (known as franchisees) in exchange for an up-front payment (a franchise fee) and a percentage of franchisees’ revenues (a royalty fee). has been used by many firms that compete in service industries to develop a worldwide presence (Figure 7.12 "Franchising: A Leading American Export"). Subway, The UPS Store, and Hilton Hotels are just a few of the firms that have done so. Franchising involves an organization (called a franchisor) granting the right to use its brand name, products, and processes to other organizations (known as franchisees) in exchange for an up-front payment (a franchise fee) and a percentage of franchisees’ revenues (a royalty fee).

Franchising is an attractive way to enter foreign markets because it requires little financial investment by the franchisor. Indeed, local franchisees must pay the vast majority of the expenses associated with getting their businesses up and running. On the downside, the decision to franchise means that a firm will get to enjoy only a small portion of the profits made under its brand name. Also, local franchisees may behave in ways that the franchisor does not approve. For example, Kentucky Fried Chicken (KFC) was angered by some of its franchisees in Asia when they started selling fish dishes without KFC’s approval. It is often difficult to fix such problems because laws in many countries are stacked in favor of local businesses. Last, franchises are only successful if franchisees are provided with a simple and effective business model. Executives thus need to avoid expanding internationally through franchising until their formula has been perfected.

Firms should own a thoroughly proven business model before franchising in other countries.

Reproduced with permission from Ketchen, D. J., Short, J. C., Combs, J. G., & Terrell, W. 2011. Tales of Garcón: The Franchise Players. Irvington, NY: Flat World Knowledge.

Licensing

While franchising is an option within service industries, licensingOne organization grants another the right to create its product, often using patented technology, in exchange for a fee. is most frequently used in manufacturing industries. Licensing involves granting a foreign company the right to create a company’s product within a foreign country in exchange for a fee. These relationships often center on patented technology. A firm that grants a license avoids absorbing a lot of costs, but its profits are limited to the fees that it collects from the local firm. The firm also loses some control over how its technology is used.

A historical example involving licensing illustrates how rapidly events can change within the international arena. By the time Japan surrendered to the United States and its Allies in 1945, World War II had crippled the country’s industrial infrastructure. In response to this problem, Japanese firms imported a great deal of technology, especially from American firms. When the Korean War broke out in the early 1950s, the American military relied on Jeeps made in Japan using licensed technology. In just a few years, a mortal enemy had become a valuable ally.

Strategy at the Movies

Gung Ho

Can American workers survive under Japanese management? Although this sounds like the premise for a bad reality TV show, the question was a legitimate consideration for General Motors (GM) and Toyota in the early 1980s. GM was struggling at the time to compete with the inexpensive, reliable, and fuel-efficient cars produced by Japanese firms. Meanwhile, Toyota was worried that the US government would limit the number of foreign cars that could be imported. To address these issues, these companies worked together to reopen a defunct GM plant in Fremont, California, in 1984 that would manufacture both companies’ automobiles in one facility. The plant had been the worst performer in the GM system; however, under Toyota’s management, the New United Motor Manufacturing Incorporated (NUMMI) plant became the best factory associated with GM—using the same workers as before! Despite NUMMI’s eventual success, the joint production plant experienced significant growing pains stemming from the cultural differences between Japanese managers and American workers.

The NUMMI story inspired the 1986 movie Gung Ho in which a closed automobile manufacturing plant in Hadleyville, Pennsylvania, was reopened by Japanese car company Assan Motors. While Assan Motors and the workers of Hadleyville were both excited about the venture, neither was prepared for the differences between the two cultures. For example, Japanese workers feel personally ashamed when they make a mistake. When manager Oishi Kazihiro failed to meet production targets, he was punished with “ribbons of shame” and forced to apologize to his employees for letting them down. In contrast, American workers were presented in the film as likely to reject management authority, prone to fighting at work, and not opposed to taking shortcuts.

When Assan Motors’ executives attempted to institute morning calisthenics and insisted that employees work late without overtime pay, the American workers challenged these policies and eventually walked off the production line. Assan Motors’ near failure was the result of differences in cultural norms and values. Gung Ho illustrates the value of understanding and bridging cultural differences to facilitate successful cross-cultural collaboration, value that was realized in real life by NUMMI.

© Thinkstock

Joint Ventures and Strategic Alliances

Within each market entry option described earlier, a firm either maintains strong control of operations (wholly owned subsidiary) or it turns most control over to a local firm (exporting, franchising, and licensing). In some cases, however, executives find it beneficial to work closely with one or more local partners in a joint venture or a strategic alliance. In a joint venture, two or more organizations each contribute to the creation of a new entity. In a strategic alliance, firms work together cooperatively, but no new organization is formed. In both cases, the firm and its local partner or partners share decision-making authority, control of the operation, and any profits that the relationship creates.

Joint ventures and strategic alliances are especially attractive when a firm believes that working closely with locals will provide it important knowledge about local conditions, facilitate acceptance of their involvement by government officials, or both. In the late 1980s, China was a difficult market for American businesses to enter. Executives at KFC saw China as an attractive country because chicken is a key element of Chinese diets. After considering the various options for entering China with its first restaurant, KFC decided to create a joint venture with three local organizations. KFC owned 51 percent of the venture; having more than half of the operation was advantageous in case disagreements arose. A Chinese bank owned 25 percent, the local tourist bureau owned 14 percent, and the final 10 percent was owned by a local chicken producer that would supply the restaurant with its signature food item.

Having these three local partners helped KFC navigate the cumbersome regulatory process that was in place and allowed the American firm to withstand the scrutiny of wary Chinese officials. Despite these advantages, it still took more than a year for the store to be built and approved. Once open in 1987, however, KFC was an instant success in China. As China’s economy gradually became more and more open, KFC was a major beneficiary. By the end of 1997, KFC operated 191 restaurants in 50 Chinese cities. By the start of 2011, there were approximately 3,200 KFCs spread across 850 Chinese cites. Roughly 90 percent of these restaurants are wholly owned subsidiaries of KFC—a stark indication of how much doing business in China has changed over the past twenty-five years.

As of early 2011, KFC was opening a new store in China every eighteen hours on average.

Image courtesy of Wikimedia, http://upload.wikimedia.org/wikipedia/commons/f/fb/Kfc_of_china.jpg.

Key Takeaway

- When entering a new country, executives can choose exporting, creating a wholly owned subsidiary, franchising, licensing, and creating a joint venture or strategic alliance. The key issues of how much control a firm has over its operation, how much risk is involved, and what share of the operation’s profits the firm gets to keep all vary across these options.

Exercises

- Do you believe that KFC would have been so successful in China today if executives had tried to make their first store a wholly owned subsidiary? Why or why not?

- The typical joint venture only lasts a few years. Why might joint ventures dissolve so quickly?

7.5 Conclusion

This chapter explains competition in international markets. Executives must consider the benefits and risks of competing internationally when making decisions about whether to expand overseas. Executives also need to determine the likelihood that their firms will succeed when they compete in international markets by examining demand conditions, factor conditions, related and supporting industries, and strategy, structure, and rivalry among its domestic competitors. When a firm does venture overseas, a decision must be made about whether its international strategy will be multidomestic, global, or transnational. Finally, when leading a firm to enter a new market, executives can choose to manage the operation via exporting, creating a wholly owned subsidiary, franchising, licensing, and creating a joint venture or strategic alliance.

Exercises

- Divide your class into four or eight groups, depending on the size of the class. Each group should select a different industry. Find examples of each international strategy for your industry. Discuss which strategy seems to be the most successful in your selected industry.

- This chapter discussed Kia and other automakers. If you were assigned to turn around a struggling automaker such as General Motors or Chrysler, what actions would you take to revive the company’s prospects within the global auto industry?