This is “Effect of an Increase in Government Demand on Real GNP”, section 8.10 from the book Policy and Theory of International Finance (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

8.10 Effect of an Increase in Government Demand on Real GNP

Learning Objective

- Learn how a change in government demand affects equilibrium GNP.

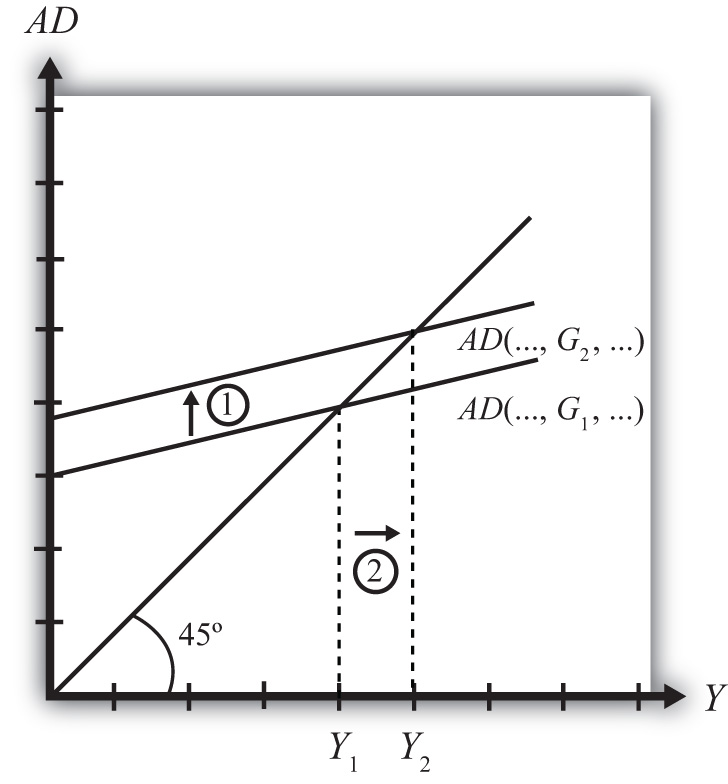

Suppose the economy is initially in equilibrium in the G&S market with government demand at level G1 and real GNP at Y1, shown in Figure 8.4 "Effect of an Increase in Government Demand in the G&S Market". The initial AD function is written as AD(…, G1, …) to signify the level of government demand and to denote that other variables affect AD and are at some initial and unspecified values.

Figure 8.4 Effect of an Increase in Government Demand in the G&S Market

Next, suppose the government raises demand for G&S from G1 to G2, ceteris paribus. The increase might arise because a new budget is passed by the legislature with new spending initiatives. The ceteris paribus assumption means that all other exogenous variables are assumed to remain fixed. Most importantly in this context, this means that the increase in government demand is not paid for with increases in taxes or decreases in transfer payments.

Since higher government demand raises aggregate demand, the AD function shifts up from AD(…, G1, …) to AD(…, G2, …) (step 1). The equilibrium GNP in turn rises to Y2 (step 2). Thus the increase in government demand causes an increase in real GNP.

The adjustment process follows the “GNP too low” story. When government demand increases, but before GNP rises to adjust, AD is greater than Y1. The excess demand for G&S depletes inventories, in this case for firms that supply the government, causing merchants to increase order size. This leads firms to increase output, thus raising GNP.

Key Takeaway

- In the G&S model, an increase (decrease) in government demand causes an increase (decrease) in real GNP.

Exercises

-

Jeopardy Questions. As in the popular television game show, you are given an answer to a question and you must respond with the question. For example, if the answer is “a tax on imports,” then the correct question is “What is a tariff?”

- Of increase, decrease, or stay the same, the effect on equilibrium real GNP from a decrease in government demand in the G&S model.

- Of increase, decrease, or stay the same, the effect on equilibrium real GNP caused by an increase in government demand in the G&S model.

- Of GNP too low or GNP too high, the equilibrium story that must be told following an increase in government demand in the G&S model.

- Of GNP too low or GNP too high, the equilibrium story that must be told following a decrease in government demand in the G&S model.

-

In the text, the effect of a change in government demand is analyzed. Use the G&S model (diagram) to individually assess the effect on equilibrium GNP caused by the following changes. Assume ceteris paribus.

- An increase in investment demand.

- An increase in transfer payments.

- An increase in tax revenues.

-

Consider an economy in equilibrium in the G&S market.

- Suppose investment demand decreases, ceteris paribus. What is the effect on equilibrium GNP?

- Now suppose investment demand decreases, but ceteris paribus does not apply because at the same time government demand rises. What is the effect on equilibrium GNP?

- In general, which of these two assumptions, ceteris paribus or no ceteris paribus, is more realistic? Explain why.

- If ceteris paribus is less realistic, why do economic models so frequently apply the assumption?