This is “National Income and the Balance of Payments Accounts”, chapter 13 from the book Policy and Theory of International Economics (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 13 National Income and the Balance of Payments Accounts

The most important macroeconomic variable tracked by economists and the media is the gross domestic product (GDP). Whether it ought to be so important is another matter that is discussed in this chapter. But before that evaluation can occur, the GDP must be defined and interpreted. This chapter presents the national income identity, which defines the GDP. It also presents several other important national accounts, including the balance of payments, the twin-deficit identity, and the international investment position. These are the variables of prime concern in an international finance course.

13.1 National Income and Product Accounts

Learning Objectives

- Define GDP and understand how it is used as a measure of economic well-being.

- Recognize the limitations of GDP as a measure of well-being.

Many of the key aggregate variables used to describe an economy are presented in a country’s National Income and Product Accounts (NIPA). National income represents the total amount of money that factors of production earn during the course of a year. This mainly includes payments of wages, rents, profits, and interest to workers and owners of capital and property. The national product refers to the value of output produced by an economy during the course of a year. National product, also called national output, represents the market value of all goods and services produced by firms in a country.

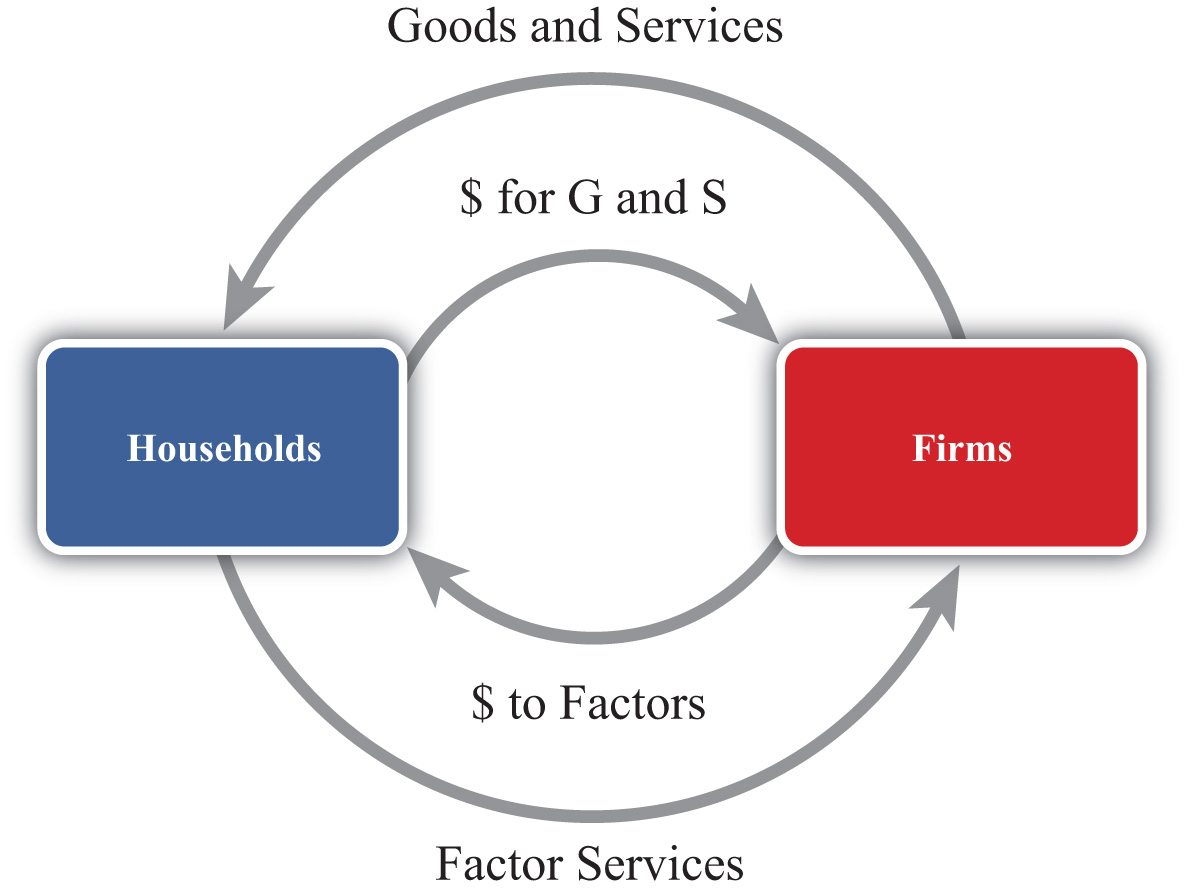

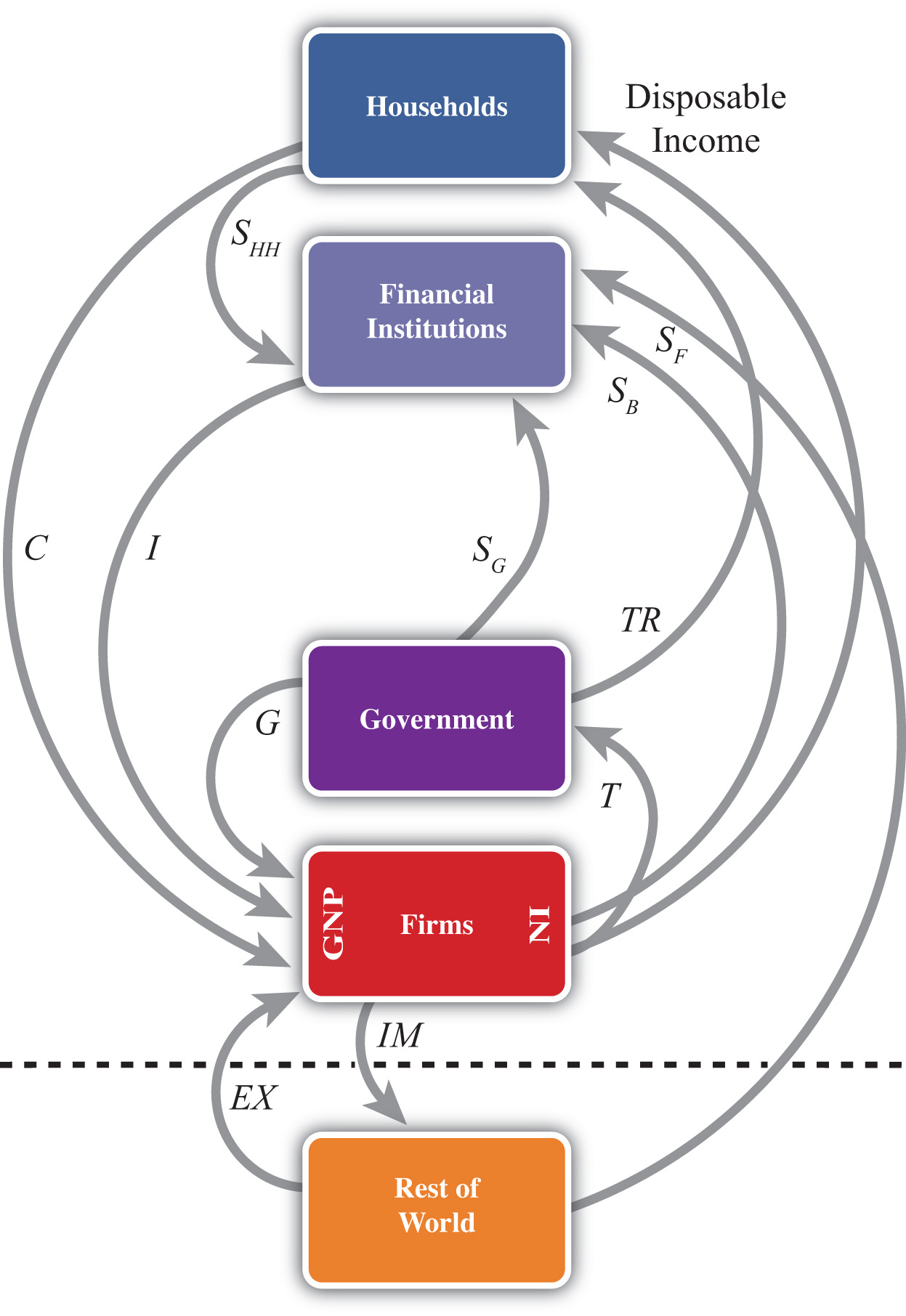

Because of the circular flow of money in exchange for goods and services in an economy, the value of aggregate output (the national product) should equal the value of aggregate income (national income). Consider the adjoining circular flow diagram, Figure 13.1 "A Circular Flow Diagram", describing a very simple economy. The economy is composed of two distinct groups: households and firms. Firms produce all the final goods and services in the economy using factor services (labor and capital) supplied by the households. The households, in turn, purchase the goods and services supplied by the firms. Thus goods and services move between the two groups in the counterclockwise direction. Exchanges are facilitated with the use of money for payments. Thus when firms sell goods and services, the households give the money to the firms in exchange. When the households supply labor and capital to firms, the firms give money to the households in exchange. Thus money flows between the two groups in a clockwise direction.

Figure 13.1 A Circular Flow Diagram

National product measures the monetary flow along the top part of the diagram—that is, the monetary value of goods and services produced by firms in the economy. National income measures the monetary flow along the bottom part of the diagram—that is, the monetary value of all factor services used in the production process. As long as there are no monetary leakages from the system, national income will equal national product.

The national product is commonly referred to as gross domestic product (GDP)Measures the total value of all goods and services produced by a country during a year.. GDP is defined as the value of all final goods and services produced within the borders of a country during some period of time, usually a year. A few things are worth emphasizing about this definition.

First, GDP is measured in terms of the monetary (or dollar) value at which the items exchange in the market. Second, it measures only final goods and services as opposed to intermediate goods. Thus wheat sold by a farmer to a flour mill will not be directly included as part of GDP since the value of the wheat will be included in the value of the flour that the mill sells to the bakery. The value of the flour will in turn be included in the value of the bread sold to the grocery store. Finally, the value of the bread will be included in the price charged by the grocery when the product is finally purchased by the consumer. Only the final bread sale should be included in GDP or else the intermediate values would overstate total production in the economy. Finally, GDP must be distinguished from another common measure of national output, gross national product (GNP)A measure of national income that includes all production by citizens that occurs anywhere in the world. It is measured using the current account balance for exports and imports..

Briefly, GDP measures all production within the borders of the country regardless of who owns the factors used in the production process. GNP measures all production achieved by domestic factors of production regardless of where that production takes place. For example, if a U.S. resident owns a factory in Malaysia and earns profits on the operation of that factory, then those profits would be counted as production by a U.S. factory owner and thus would be included in the U.S. GNP. However, since that production took place beyond U.S. borders, it would not be counted as the U.S. GDP. Alternatively, if a Dutch resident owns a factory in the United States, then the fraction of that production that accrues to the Dutch owner would be counted as part of the U.S. GDP since the production took place in the United States. It would not be counted as part of the U.S. GNP, however, since the production was done by a foreign factor owner.

GDP is probably the most widely reported and closely monitored aggregate statistic. GDP is a measure of the size of an economy. It tells us the total amount of “stuff” the economy produces. Since most of us, as individuals, prefer to have more stuff rather than less, it is straightforward to extend this to the national economy to argue that the higher the GDP, the better off the nation. For this simple reason, statisticians track the growth rate of GDP. Rapid GDP growth is a sign of growing prosperity and economic strength. Falling GDP indicates a recession, and if GDP falls significantly, we call it an economic depression.

For a variety of reasons, GDP should be used only as a rough indicator of the prosperity or welfare of a nation. Indeed, many people contend that GDP is an inadequate measure of national prosperity. Below is a list of some of the reasons why GDP falls short as an indicator of national welfare.

- GDP only measures the amount of goods and services produced during the year. It does not measure the value of goods and services left over from previous years. For example, used cars, two-year-old computers, old furniture, old houses, and so on are all useful and provide welfare to individuals for years after they are produced. Yet the value of these items is only included in GDP in the year in which they are produced. National wealth, on the other hand, measures the value of all goods, services, and assets available in an economy at a point in time and is perhaps a better measure of national economic well-being than GDP.

- GDP, by itself, fails to recognize the size of the population that it must support. If we want to use GDP to provide a rough estimate of the average standard of living among individuals in the economy, then we ought to divide GDP by the population to get per capita GDP. This is often the way in which cross-country comparisons are made.

- GDP gives no account of how the goods and services produced by the economy are distributed among members of the economy. One might prefer a lower GDP with a more equitable distribution to a higher GDP in which a small percentage of the population receives most of the product.

- Measured GDP growth may overstate the growth of the standard of living since price level increases (inflation) would raise measured GDP. Thus even if the economy produces exactly the same amount of goods and services as the year before and prices of those goods rise, then GDP will rise as well. For this reason, real GDP is typically used to measure the growth rate of GDP. Real GDP divides nominal (or measured) GDP by the price level and is designed to eliminate some of the inflationary effects.

- Sometimes, economies with high GDPs may also produce a large amount of negative production externalities. Pollution is one such negative externality. Thus one might prefer to have a lower GDP and less pollution than a higher GDP with more pollution. Some groups also argue that rapid GDP growth may involve severe depletion of natural resources, which may be unsustainable in the long run.

- GDP often rises in the aftermath of natural disasters. Shortly after the Kobe earthquake in Japan in the 1990s, economists predicted that Japan’s GDP would probably rise more rapidly. This is mostly because of the surge of construction activities required to rebuild the damaged buildings. This illustrates why GDP growth may not be indicative of a healthy economy in some circumstances.

- GDP measures the value of production in the economy rather than consumption, which is more important for economic well-being. As will be shown later, national production and consumption are equal when a country’s trade balance is zero; however, if a country has a trade deficit, then its national consumption will exceed its production. Ideally, because consumption is pleasurable while production often is not, we should use the measure of national consumption to measure economic well-being rather than GDP.

Key Takeaways

- GDP is defined as the value of all final goods and services produced within the borders of a country during some period of time, usually a year.

-

The following are several important weaknesses of GDP as a measure of economic well-being:

- GDP measures income, not wealth, and wealth is a better measure of economic well-being.

- GDP does not account for income distribution effects that may be important to economic well-being.

- GDP measures “bads” like pollution as well as “goods.”

- GDP measures production, not consumption, and consumption is more important to economic well-being.

Exercises

-

Jeopardy Questions. As in the popular television game show, you are given an answer to a question and you must respond with the question. For example, if the answer is “a tax on imports,” then the correct question is “What is a tariff?”

- The term for the measure of national output occurring within the nation’s borders.

- The term for the measure of national output that includes all production by domestic factors regardless of location.

- Of income or wealth, this term better describes the gross domestic product (GDP).

- Of income or wealth, this term better describes the gross national product (GNP).

- The term used to describe the measure of GDP that takes account of price level changes or inflationary effects over time.

- The term used to describe the measure of GDP that allows better income comparisons between countries that have different population sizes.

- Many people argue that GDP is an inadequate measure of a nation’s economic well-being. List five reasons why this may be so.

-

GDP is used widely as an indicator of the success and economic well-being of the people of a nation. However, for many reasons it is not the perfect indicator. Briefly comment on the following statements related to this issue:

- Domestic spending is a better indicator of standard of living than GDP.

- National wealth is a better indicator of standard of living than GDP.

13.2 National Income or Product Identity

Learning Objectives

- Identify the components of GDP defined in the national income identity.

- Understand why imports are subtracted in the national income identity.

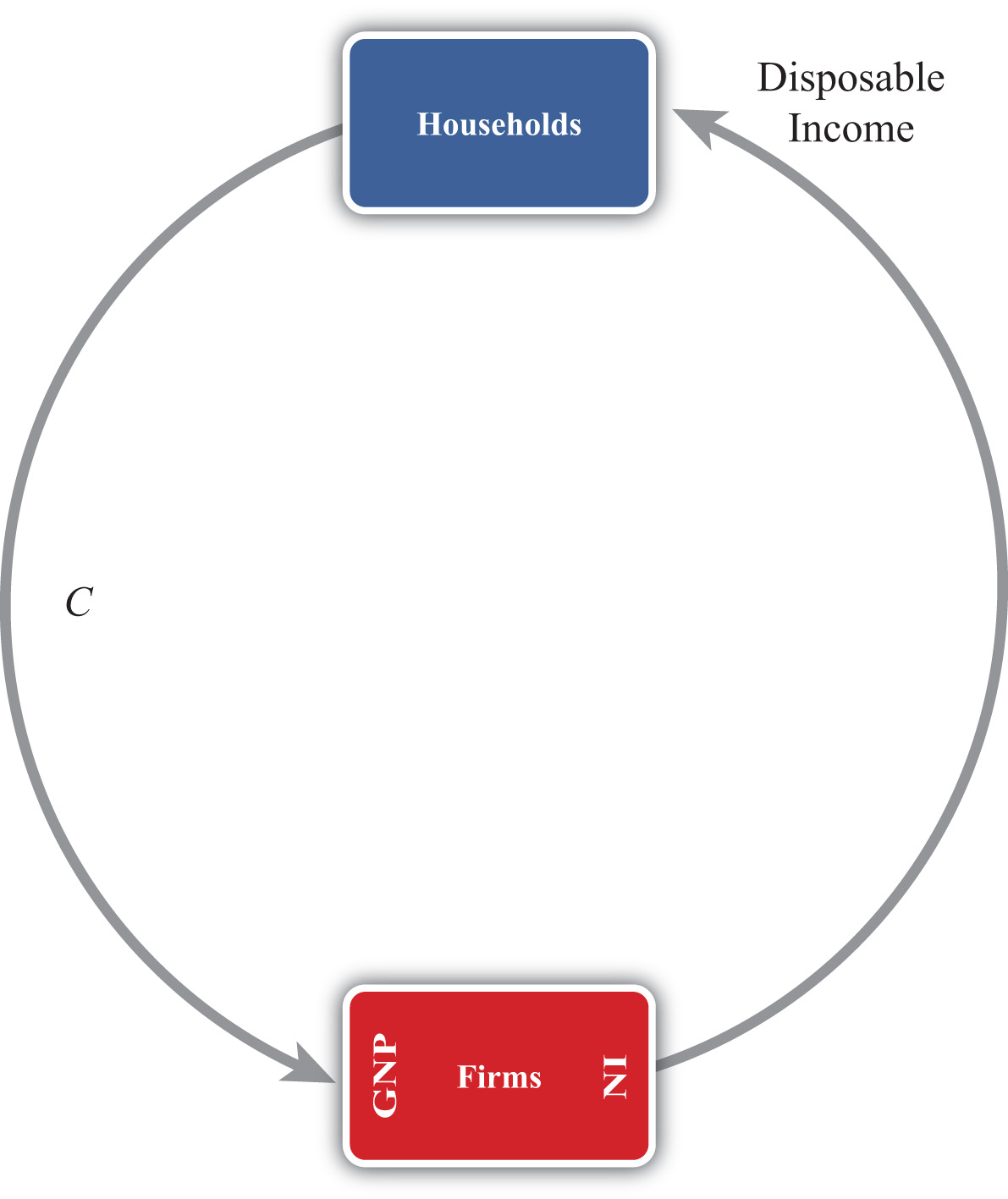

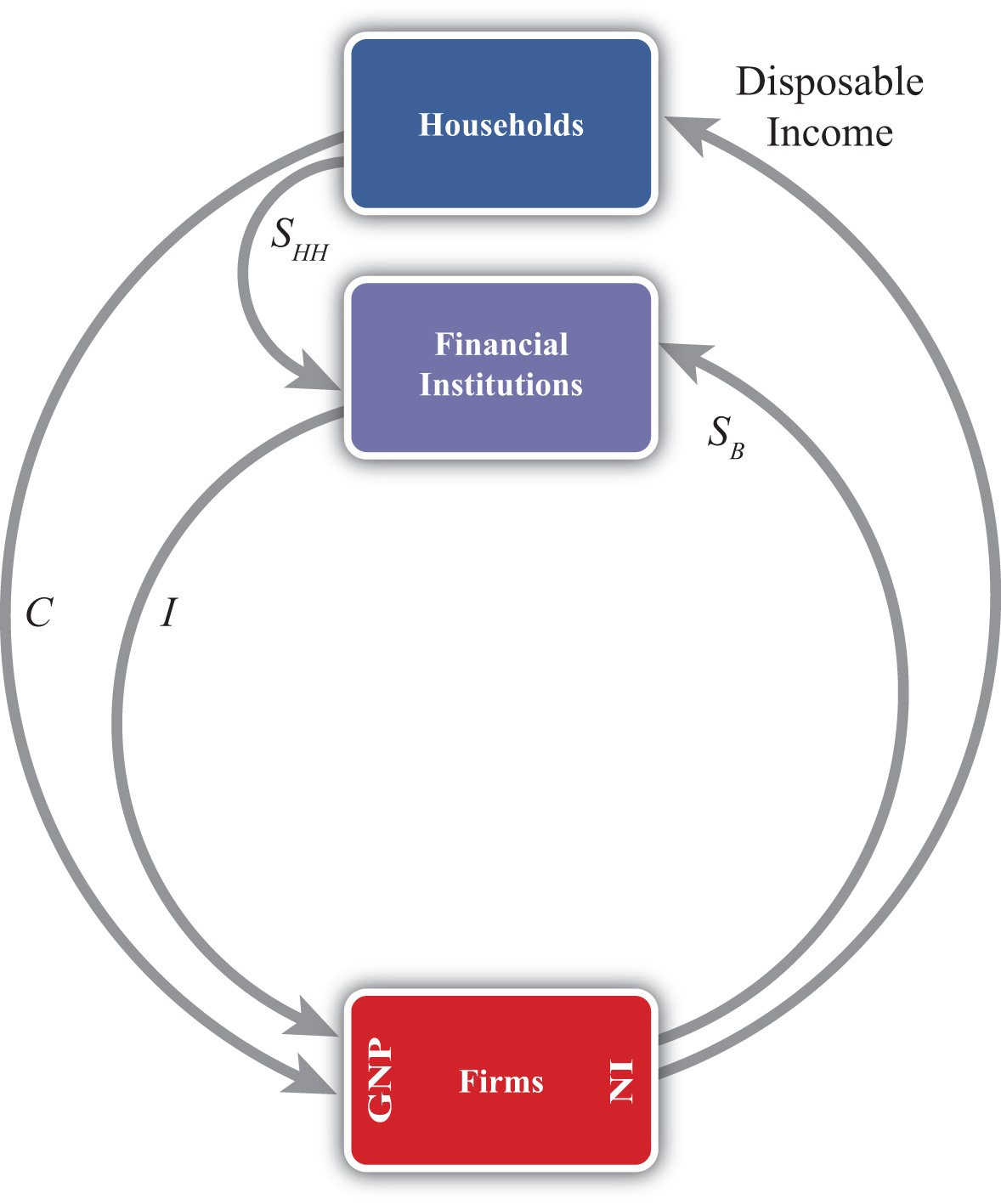

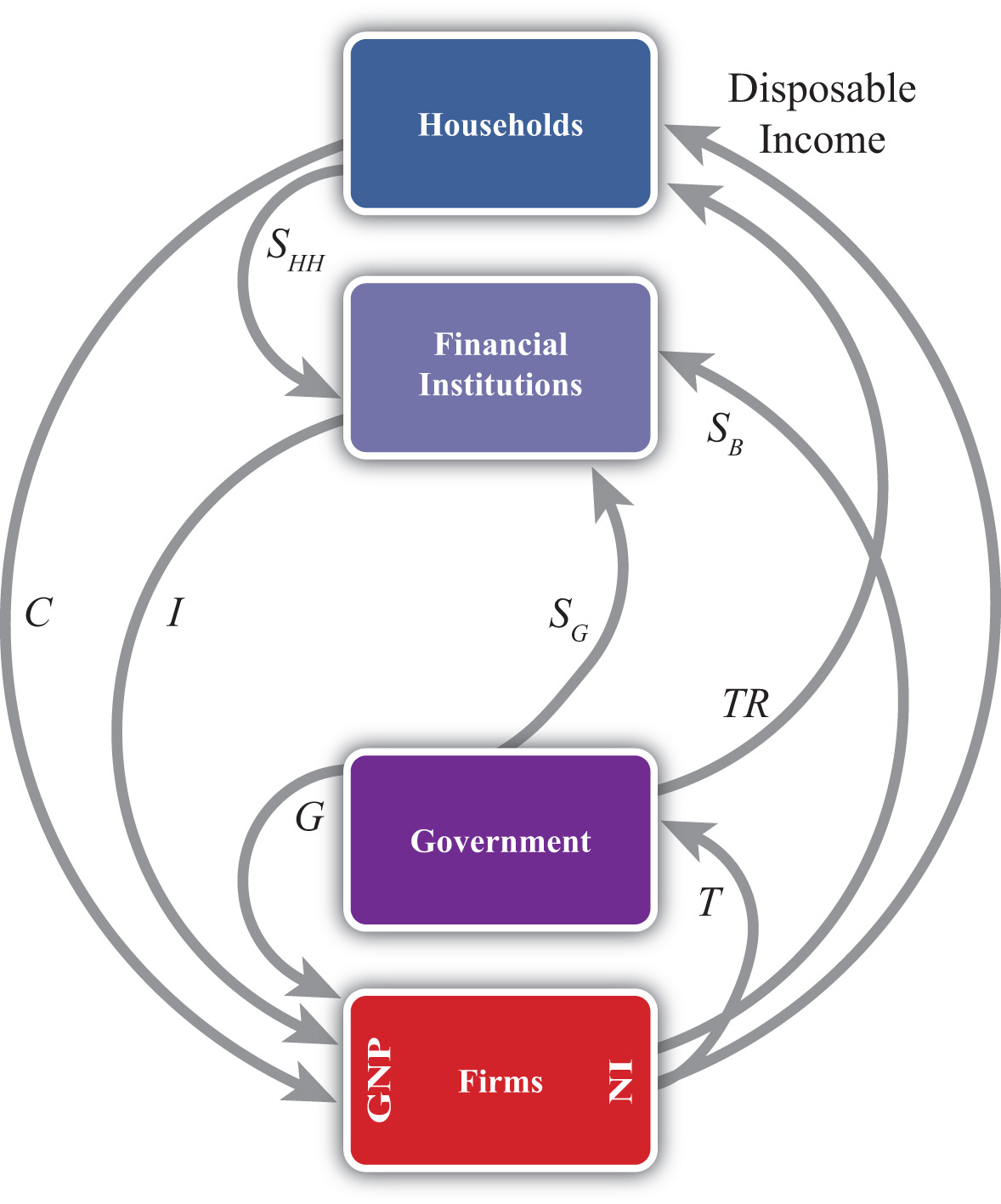

The national income or product identity describes the way in which the gross domestic product (GDP) is measured, as the sum of expenditures in various broad spending categories. The identity, shown below, says that GDP is the sum of personal consumption expenditures (C), private investment expenditures (I), government consumption expenditures (G), and expenditures on exports (EX) minus expenditures on imports (IM):

GDP = C + I + G + EX − IM.Personal consumption expenditures (C), or “consumption” for short, include goods and services purchased by domestic residents. These are further subdivided into durable goods, commodities that can be stored and that have an average life of at least three years; nondurable goods, all other commodities that can be stored; and services, commodities that cannot be stored and are consumed at the place and time of purchase. Consumption also includes foreign goods and services purchased by domestic households.

Private domestic investment (I), or “investment” for short, includes expenditures by businesses on fixed investment and any changes in business inventories. Fixed investment, both residential and nonresidential, consists of expenditures on commodities that will be used in a production process for more than one year. It covers all investment by private businesses and by nonprofit institutions, regardless of whether the investment is owned by domestic residents or not. Nonresidential investment includes new construction, business purchases of new machinery, equipment, furniture, and vehicles from other domestic firms and from the rest of the world. Residential investment consists of private structures, improvements to existing units, and mobile homes. Note that this term does not include financial investments made by individuals or businesses. For example, one purchase of stock as an “investment” is not counted here.

Government expenditures include purchases of goods, services, and structures from domestic firms and from the rest of the world by federal, state, and local government. This category includes compensation paid to government employees, tuition payments for higher education, and charges for medical care. Transfer payments, such as social insurance payments, government medical insurance payments, subsidies, and government aid are not included as a part of government expenditures.

Exports consist of goods and services that are sold to nonresidents.

Imports include goods and services purchased from the rest of the world.

The difference between exports and imports (EX − IM) is often referred to as net exports. Receipts and payments of factor income and transfer payments to the rest of the world (net) are excluded from net exports. Including these terms changes the trade balance definition and reclassifies national output as growth national product (GNP).

The Role of Imports in the National Income Identity

It is important to emphasize why imports are subtracted in the national income identity because it can lead to serious misinterpretations. First, one might infer (incorrectly) from the identity that imports are subtracted because they represent a cost to the economy. This argument often arises because of the typical political emphasis on jobs or employment. Thus higher imports imply that goods that might have been produced at home are now being produced abroad. This could represent an opportunity cost to the economy and justify subtracting imports in the identity. However, this argument is wrong.

The second misinterpretation that sometimes arises is to use the identity to suggest a relationship between imports and GDP growth. Thus it is common for economists to report that GDP grew at a slower than expected rate last quarter because imports rose faster than expected. The identity suggests this relationship because, obviously, if imports rise, GDP falls. However, this interpretation is also wrong.

The actual reason why imports are subtracted in the national income identity is because imports appear in the identity as hidden elements in consumption, investment, government, and exports. Thus imports must be subtracted to assure that only domestically produced goods are being counted. Consider the following details.

When consumption expenditures, investment expenditures, government expenditures, and exports are measured, they are measured without accounting for where the purchased goods were actually made. Thus consumption expenditures (C) measures domestic expenditures on both domestically produced and foreign-produced goods. For example, if a U.S. resident buys a television imported from Korea, that purchase would be included in domestic consumption expenditures. Likewise, if a business purchases a microscope made in Germany, that purchase would be included in domestic investment. When the government buys foreign goods abroad to provide supplies for its foreign embassies, those purchases are included in government expenditures. Finally, if an intermediate product is imported, used to produce another good, and then exported, the value of the original imports will be included in the value of domestic exports.

This suggests that we could rewrite the national income identity in the following way:

GDP = (CD + CF) + (ID + IF) + (GD + GF) + (EXD + EXF) − IM,where CD represents consumption expenditures on domestically produced goods, CF represents consumption expenditures on foreign-produced goods, ID represents investment expenditures on domestically produced goods, IF represents investment expenditures on foreign-produced goods, GD represents government expenditures on domestically produced goods, GF represents government expenditures on foreign-produced goods, EXD represents export expenditures on domestically produced goods, and EXF represents export expenditures on previously imported intermediate goods. Finally, we note that all imported goods are used in consumption, investment, or government or are ultimately exported, thus

IM = CF + IF + GF + EXF.Plugging this expression into the identity above yields

GDP = CD + ID + GD + EXDand indicates that GDP does not depend on imports at all.

The reason imports are subtracted in the standard national income identity is because they have already been included as part of consumption, investment, government spending, and exports. If imports were not subtracted, GDP would be overstated. Because of the way the variables are measured, the national income identity is written such that imports are added and then subtracted again.

This exercise should also clarify why the previously described misinterpretations were indeed wrong. Since imports do not affect the value of GDP in the first place, they cannot represent an opportunity cost, nor do they directly or necessarily influence the size of GDP growth.

Key Takeaways

- GDP can be decomposed into consumption expenditures, investment expenditures, government expenditures, and exports of goods and services minus imports of goods and services.

- Investment in GDP identity measures physical investment, not financial investment.

- Government includes all levels of government and only expenditures on goods and services. Transfer payments are not included in the government term in the national income identity.

- Imports are subtracted in the national income identity because imported items are already measured as a part of consumption, investment and government expenditures, and as a component of exports. This means that imports have no direct impact on the level of GDP. The national income identity does not imply that rising imports cause falling GDP.

Exercises

-

Jeopardy Questions. As in the popular television game show, you are given an answer to a question and you must respond with the question. For example, if the answer is “a tax on imports,” then the correct question is “What is a tariff?”

- A measure of the value of all capital equipment and services purchased during a year.

- The term for the goods and services sold to residents of foreign countries.

- The component of GDP that includes household purchases of durable goods, nondurable goods, and services.

- The component of GDP that includes purchases by businesses for physical capital equipment used in the production process.

- The government spending in the GDP identity does not count these types of government expenditures.

- Of true or false, imported goods and services are counted once in the C, I, G, or EX terms of the GDP identity.

-

The national income identity says that gross domestic product is given by consumption expenditures, plus investment expenditures, plus government expenditures, plus exports, minus imports. In short, this is written as GDP = C + I + G + EX − IM.

Consider each of the following expenditures below. Indicate in which category or categories (C, I, G, EX, or IM) the item would be accounted for in the United States.

Product Category a. German resident purchase of a U.S.-made tennis racket b. U.S. firm purchase of a U.S.-made office copy machine c. Salaries to U.S. troops in Iraq d. School spending by county government e. U.S. household purchase of imported clothing - What is the gross domestic product in a country whose goods and services balance is a $300 billion deficit, consumption is $900 billion, investment is $300 billion, and government spending is $500 billion?

-

Below are the economic data for the fictional country of Sandia. Write out the national income identity. Verify whether Sandia’s data satisfy the identity.

Table 13.1 Sandia’s Economic Data (Billions of Dollars)

Gross Domestic Product 400 Imports of Goods and Services 140 Investment Spending 20 Private Saving 30 Exports of Goods and Services 100 Government Transfers 40 Government Tax Revenues 140 Government Spending 140 Consumption Spending 280

13.3 U.S. National Income Statistics (2007–2008)

Learning Objective

- Learn the recent values for U.S. GDP and the relative shares of its major components.

To have a solid understanding of the international economy, it is useful to know the absolute and relative sizes of some key macroeconomic variables like the gross domestic product (GDP). For example, it is worthwhile to know that the U.S. economy is the largest in the world because its annual GDP is about $14 trillion, not $14 million or $14 billion. It can also be useful to know about how much of an economy’s output each year is consumed, invested, or purchased by the government. Although knowing that the U.S. government expenditures in 2008 were about $2.9 trillion is not so important, knowing that government expenditures made up about 20 percent of GDP can be useful to know.

Table 13.2 "U.S. Gross Domestic Product (in Billions of Dollars)" contains U.S. statistics for the national income and product accounts for the years 2007 and 2008. The table provides the numerical breakdown of GDP not only into its broad components (C, I, G, etc.) but also into their major subcategories. For example, consumption expenditures are broken into three main subcategories: durable goods, nondurable goods, and services. The left-hand column indicates which value corresponds to the variables used in the identity.

Table 13.2 U.S. Gross Domestic Product (in Billions of Dollars)

| 2007 | 2008 | 2008 (Percentage of GDP) | ||

|---|---|---|---|---|

| GDP | Gross domestic product | 13,807.5 | 14,280.7 | 100.0 |

| C | Personal consumption expenditures | 9,710.2 | 10,058.5 | 70.4 |

| Durable goods | 1,082.8 | 1,022.8 | 7.2 | |

| Nondurable goods | 2,833.0 | 2,966.9 | 20.8 | |

| Services | 5,794.4 | 6,068.9 | 42.5 | |

| I | Gross private domestic investment | 2,134.0 | 2,004.1 | 14.0 |

| Nonresidential | 1,503.8 | 1,556.2 | 10.9 | |

| Structures | 480.3 | 556.3 | 3.9 | |

| Equipment and software | 1,023.5 | 999.9 | 7.0 | |

| Residential | 630.2 | 487.8 | 3.4 | |

| Change in business inventories | −3.6 | −39.9 | −0.0 | |

| G | Government consumption expenditures and gross investment | 2,674.8 | 2,883.2 | 20.2 |

| Federal | 979.3 | 1,071.2 | 7.5 | |

| National defense | 662.2 | 734.3 | 5.1 | |

| Nondefense | 317.1 | 336.9 | 2.4 | |

| State and local | 1,695.5 | 1,812.1 | 12.6 | |

| EX | Exports | 1,662.4 | 1,867.8 | 13.1 |

| Goods | 1,149.2 | 1,289.6 | 9.0 | |

| Services | 513.2 | 578.2 | 4.0 | |

| IM | Imports | 2,370.2 | 2,533.0 | 17.7 |

| Goods | 1,985.2 | 2,117.0 | 14.8 | |

| Services | 385.1 | 415.9 | 2.9 |

Source: Bureau of Economic Analysis, National Economic Accounts, Gross Domestic Product (GDP), at http://www.bea.gov/national/nipaweb/Index.asp.

There are a number of important things to recognize and remember about these numbers.

First, it is useful to know that U.S. GDP in 2008 was just over $14 trillion (or $14,000 billion). This is measured in 2008 prices and is referred to as nominal GDP. This number is useful to recall, first because it can be used in to judge relative country sizes if you happen to come across another country’s GDP figure. The number will also be useful in comparison with U.S. GDP in the future. Thus if in 2020 you read that U.S. GDP is $20 trillion, you’ll be able to recall that back in 2008 it was just $14 trillion. Also, note that between 2007 and 2008, the United States added over $600 billion to GDP.

The next thing to note about the numbers is that consumption expenditures are the largest component of U.S. GDP, making up about 70 percent of output in 2008. That percentage is relatively constant over time, even as the economy moves between recessions and boom times (although it is up slightly from 68 percent in 1997). Notice also that services is the largest subcategory in consumption. This category includes health care, insurance, transportation, entertainment, and so on.

Gross private domestic investment, “investment” for short, accounted for just 14 percent of GDP in 2008. This figure is down from almost 17 percent just two years before and is reflective of the slide into the economic recession. As GDP began to fall at the end of 2008, prospects for future business opportunities also turned sour, and so investment spending also fell. As the recession continued into 2009, we can expect that number to fall even further the next year.

The investment component of GDP is often the target of considerable concern in the United States. Investment represents how much the country is adding to the capital stock. Since capital is an input into production, in general the more capital equipment available, the greater will be the national output. Thus investment spending is viewed as an indicator of future GDP growth. Perhaps the higher is investment, the faster the economy will grow in the future.

One concern about the U.S. investment level is that, as a percentage of GDP, it is lower than in many countries in Europe, especially in China and other Asian economies. In many European countries, it is above 20 percent of GDP. The investment figure is closer to 30 percent in Japan and over 35 percent in China. There was a fear among some observers, especially in the 1980s and early 1990s, that lower U.S. investment relative to the rest of the world would ultimately lead to slower growth. That this projection has not been borne out should indicate that higher investment is not sufficient by itself to assure higher growth.

Government expenditures on goods and services in the United States amounted to 20 percent of GDP in 2008. Due to the recession and the large government stimulus package in 2009, we can expect this number will rise considerably next year. Recall that this figure includes state, local, and federal spending but excludes transfer payments. When transfer payments are included, government spending plus transfers as a percentage of GDP exceeds 30 percent in the United States.

Two things are worth noting. First, the state and local spending is almost twice the level of federal spending. Second, most of the federal spending is on defense-related goods and services.

Exports in the United States accounted for 13 percent of GDP in 2008 (up from 10 percent in 2003) and are closing in on the $2 trillion level. Imports into the United States are at $2.5 trillion, amounting to almost 18 percent of GDP. In terms of the dollar value of trade, the United States is the largest importer and exporter of goods and services in the world. However, relative to many other countries, the United States trades less as a percentage of GDP.

Key Takeaways

- U.S. GDP stands at just over $14 trillion per year in 2008.

- U.S. consumption is about 70 percent of GDP; investment, 14 percent; government expenditures, 20 percent; exports, 13 percent; and imports, about 18 percent.

Exercise

-

Jeopardy Questions. As in the popular television game show, you are given an answer to a question and you must respond with the question. For example, if the answer is “a tax on imports,” then the correct question is “What is a tariff?”

- The approximate share of U.S. consumption as a share of U.S. GDP in 2008.

- The approximate share of U.S. investment as a share of U.S. GDP in 2008.

- The approximate share of U.S. government spending as a share of U.S. GDP in 2008.

- The approximate share of U.S. exports of goods and services as a share of U.S. GDP in 2008.

- The approximate share of U.S. imports of goods and services as a share of U.S. GDP in 2008.

- This main category represents the largest share of GDP spending in the U.S. economy.

13.4 Balance of Payments Accounts: Definitions

Learning Objectives

- Learn the variety of ways exports and imports are classified in the balance of payments accounts.

- Understand the distinction between GDP and GNP.

The balance of payments accounts is a record of all international transactions that are undertaken between residents of one country and residents of other countries during the year. The accounts are divided into several subaccounts, the most important being the current accountA record of all international transactions for goods and services, income payments and receipts, and unilateral transfers. and the financial accountA record of all international transactions for assets.. The current account is often further subdivided into the merchandise trade account and the service account. These are each briefly defined in Table 13.3 "Balance of Payments Accounts Summary".

Table 13.3 Balance of Payments Accounts Summary

| Current Account | Record of all international transactions for goods and services, income payments and receipts, and unilateral transfers. The current account is used in the national income identity for GNP. |

| Merchandise Trade AccountA record of all international transactions for goods only. | Record of all international transactions for goods only. Goods include physical items like autos, steel, food, clothes, appliances, furniture, etc. |

| Services AccountA record of all international transactions for services only. | Record of all international transactions for services only. Services include transportation, insurance, hotel, restaurant, legal, consulting, etc. |

| Goods and Services AccountA record of all international transactions for goods and services only. | Record of all international transactions for goods and services only. The goods and services account is used in the national income identity for GDP. |

| Financial Account | Record of all international transactions for assets. Assets include bonds, Treasury bills, bank deposits, stocks, currency, real estate, etc. |

The balance on each of these accounts is found by taking the difference between exports and imports.

Current Account

The current account (CA) balance is defined as CA = EXG,S,IPR,UT − IMG,S,IPR,UT where the G,S,IPR,UT superscript is meant to include exports and imports of goods (G), services (S), income payments and receipts (IPR), and unilateral transfers (UT). If CA > 0, then exports of goods and services exceed imports and the country has a current account surplus. If CA < 0, then imports exceed exports and the country has a current account deficit.

Income payments represent the money earned (i.e., income) by foreign residents on their investments in the United States. For example, if a British company owns an office building in the United States and brings back to the United Kingdom a share of the profit earned there as a part of its income, then this is classified as an income payment on the current account of the balance of payments.

Income receipts represent the money earned by domestic residents on their investments abroad. For example, if a U.S. company owns an assembly plant in Costa Rica and brings back to the United States a share of the profit earned there as a part of its income, then this is classified as an income receipt on the current account of the balance of payments.

It may be helpful to think of income payments and receipts as payments for entrepreneurial services. For example, a British company running an office building is providing the management services and taking the risks associated with operating the property. In exchange for these services, the company is entitled to a stream of the profit that is earned. Thus income payments are classified as an import, the import of a service. Similarly, the U.S. company operating the assembly plant in Costa Rica is also providing entrepreneurial services for which it receives income. Since in this case the United States is exporting a service, income receipts are classified as a U.S. export.

Unilateral transfers represent payments that are made or received that do not have an offsetting product flow in the opposite direction. Normally, when a good is exported, for example, the good is exchanged for currency such that the value of the good and the value of the currency are equal. Thus there is an outflow and an inflow of equal value. An accountant would record both sides of this transaction, as will be seen in the next section. However, with a unilateral transfer, money flows out, but nothing comes back in exchange or vice versa. The primary examples of unilateral transfers are remittances and foreign aid. Remittances occur when a person in one country transfers money to a relative in another country and receives nothing in return. Foreign aid also involves a transfer, expecting nothing in return.

Merchandise Trade Balance

The merchandise trade balance (or goods balance) can be defined as GB = EXG − IMG, where we record only the export and import of merchandise goods. If GB > 0, the country would have a (merchandise) trade surplus. If GB < 0, the country has a trade deficit.

Services Balance

The service balance can be defined as SB = EXS − IMS, where we record only the export and import of services. If SB > 0, the country has a service surplus. If SB < 0, the country has a service deficit.

Goods and Services Balance

The goods and services balance (or goods balance) can be defined as GSB = EXG&S − IMG&S, where we record the export and import of both merchandise goods and services. If GSB > 0, the country would have a goods and services (G&S) surplus. If GB < 0, the country has a G&S deficit. Note that sometimes people will refer to the difference EXG&S − IMG&S as net exports. Often when this term is used the person is referencing the goods and services balance.

Here it is important to point out that when you hear a reference to a country’s trade balance, it could mean the merchandise trade balance, or it could mean the goods and services balance, or it could even mean the current account balance.

Occasionally, one will hear trade deficit figures reported in the U.S. press followed by a comment that the deficit figures refer to the “broad” measure of trade between countries. In this case, the numbers reported refer to the current account deficit rather than the merchandise trade deficit. This usage is developing for a couple of reasons. First of all, at one time, around thirty years ago or more, there was very little international trade in services. At that time, it was common to report the merchandise trade balance since that accounted for most of the international trade. In the past decade or so, service trade has been growing much more rapidly than goods trade and it is now becoming a significant component of international trade. In the United States, service trade exceeds 30 percent of total trade. Thus a more complete record of a country’s international trade is found in its current account balance rather than its merchandise trade account.

But there is a problem with reporting and calling it the current account deficit because most people don’t know what the current account is. There is a greater chance that people will recognize the trade deficit (although most could probably not define it either) than will recognize the current account deficit. Thus the alternative of choice among commentators is to call the current account deficit a trade deficit and then define it briefly as a “broad” measure of trade.

A simple solution would be to call the current account balance the “trade balance” since it is a record of all trade in goods and services and to call the merchandise trade balance the “merchandise goods balance,” or the “goods balance” for short. I will ascribe to this convention throughout this text in the hope that it might catch on.

GDP versus GNP

There are two well-known measures of the national income of a country: GDP and GNP. Both represent the total value of output in a country during a year, only measured in slightly different ways. It is worthwhile to understand the distinction between the two and what adjustments must be made to measure one or the other.

Conceptually, the gross domestic product (GDP) represents the value of all goods and services produced within the borders of the country. The gross national product (GNP) represents the value of all goods and services produced by domestic factors of production.

Thus production in the United States by a foreign-owned company is counted as a part of U.S. GDP since the productive activity took place within the U.S. borders, even though the income earned from that activity does not go to a U.S. citizen. Similarly, production by a U.S. company abroad will generate income for U.S. citizens, but that production does not count as a part of GDP since the productive activity generating that income occurred abroad. This production will count as a part of GNP though since the income goes to a U.S. citizen.

The way GDP versus GNP is measured is by including different items in the export and import terms. As noted above, GDP includes only exports and imports of goods and services, implying also that GDP excludes income payments and receipts and unilateral transfers. When these latter items are included in the national income identity and the current account balance is used for EX − IM, the national income variable becomes the GNP. Thus the GNP measure includes income payments and receipts and unilateral transfers. In so doing, GNP counts as additions to national income the profit made by U.S. citizens on its foreign operations (income receipts are added to GNP) and subtracts the profit made by foreign companies earning money on operations in the U.S. (income payments are subtracted).

To clarify, the national income identities for GDP and GNP are as follows:

GDP = C + I + G + EXG&S − IMG&Sand

GNP = C + I + G + EXG,S,IPR,UT − IMG,S,IPR,UT.Financial Account Balance

Finally, the financial account balance can be defined as KA = EXA − IMA, where EXA and IMA refer to the export and import of assets, respectively. If KA > 0, then the country is exporting more assets than it is importing and it has a financial account surplus. If KA < 0, then the country has a financial account deficit.

The financial account records all international trade in assets. Assets represent all forms of ownership claims in things that have value. They include bonds, Treasury bills, stocks, mutual funds, bank deposits, real estate, currency, and other types of financial instruments. Perhaps a clearer way to describe exports of assets is to say that domestic assets are sold to foreigners, whereas imports of assets mean foreign assets that are purchased by domestic residents.

It is useful to differentiate between two different types of assets. First, some assets represent IOUs (i.e., I owe you). In the case of bonds, savings accounts, Treasury bills, and so on, the purchaser of the asset agrees to give money to the seller of the asset in return for an interest payment plus the return of the principal at some time in the future. These asset purchases represent borrowing and lending. When the U.S. government sells a Treasury bill (T-bill), for example, it is borrowing money from the purchaser of the T-bill and agrees to pay back the principal and interest in the future. The Treasury bill certificate, held by the purchaser of the asset, is an IOU, a promissory note to repay principal plus interest at a predetermined time in the future.

The second type of asset represents ownership shares in a business or property, which is held in the expectation that it will realize a positive rate of return in the future. Assets, such as common stock, give the purchaser an ownership share in a corporation and entitle the owner to a stream of dividend payments in the future if the company is profitable. The future sale of the stock may also generate a capital gain if the future sales price is higher than the purchase price. Similarly, real estate purchases—say, of an office building—entitle the owner to the future stream of rental payments by the tenants in the building. Owner-occupied real estate, although it does not generate a stream of rental payments, does generate a stream of housing services for the occupant-owners. In either case, if real estate is sold later at a higher price, a capital gain on the investment will accrue.

An important distinction exists between assets classified as IOUs and assets consisting of ownership shares in a business or property. First of all, IOUs involve a contractual obligation to repay principal plus interest according to the terms of the contract or agreement. Failure to do so is referred to as a default on the part of the borrower and is likely to result in legal action to force repayment. Thus international asset purchases categorized as IOUs represent international borrowing and lending.

Ownership shares, on the other hand, carry no such obligation for repayment of the original investment and no guarantee that the asset will generate a positive rate of return. The risk is borne entirely by the purchaser of the asset. If the business is profitable, if numerous tenants can be found, or if real estate values rise over time, then the purchaser of the asset will make money. If the business is unprofitable, office space cannot be leased, or real estate values fall, then the purchaser will lose money. In the case of international transactions for ownership shares, there is no resulting international obligation for repayment.

Key Takeaways

- The trade balance may describe a variety of different ways to account for the difference between exports and imports.

- The current account is the broadest measure of trade flows between countries encompassing goods, services, income payments and receipts, and unilateral transfers.

- The merchandise trade balance is a more narrow measure of trade between countries encompassing only traded goods.

- Net exports often refer to the balance on goods and services alone.

- GDP is a measure of national income that includes all production that occurs within the borders of a country. It is measured by using the goods and services balance for exports and imports.

- GNP is a measure of national income that includes all production by U.S. citizens that occurs anywhere in the world. It is measured by using the current account balance for exports and imports.

- The financial account balance measures all exports and imports of assets, which means foreign purchases of domestic assets and domestic purchases of foreign assets.

Exercise

-

Jeopardy Questions. As in the popular television game show, you are given an answer to a question and you must respond with the question. For example, if the answer is “a tax on imports,” then the correct question is “What is a tariff?”

- A record of all international transactions for goods and services.

- A record of all international transactions for assets.

- The name of the balance of payments account that records transactions for goods.

- The term used to describe the profit earned by domestic residents on their foreign business operations.

- The term used to describe the profit earned by foreign residents on their domestic business operations.

- The term used to describe remittances because they do not have a corresponding product flow to offset the money export or import.

- Of net importer or net exporter of services, this describes a country that has more income payments than income receipts.

- This measure of national output includes only the imports and exports of goods and services in its trade balance.

- This measure of national output includes income payments and receipts in its trade balance.

13.5 Recording Transactions on the Balance of Payments

Learning Objectives

- Learn how individual transactions between a foreign and domestic resident are recorded on the balance of payments accounts.

- Learn the interrelationship between a country’s current account balance and its financial account balance and how to interpret current account deficits and surpluses in terms of the associated financial flows.

In this section, we demonstrate how international transactions are recorded on the balance of payment accounts. The balance of payments accounts can be presented in ledger form with two columns. One column is used to record credit entries. The second column is used to record debit entries.

Almost every transaction involves an exchange between two individuals of two items believed to be of equal value.An exception is the case of unilateral transfers. These transfers include pension payments to domestic citizens living abroad, foreign aid, remittances, and other types of currency transfers that do not include an item on the reverse side being traded. Thus if one person exchanges $20 for a baseball bat with another person, then the two items of equal value are the $20 of currency and the baseball bat. The debit and credit columns in the ledger are used to record each side of every transaction. This means that every transaction must result in a credit and debit entry of equal value.

By convention, every credit entry has a “+” placed before it, while every debit entry has a “−” placed before it. The plus on the credit side generally means that money is being received in exchange for that item, while the minus on the debit side indicates a monetary payment for that item. This interpretation in the balance of payments accounts can be misleading, however, since in many international transactions, as when currencies are exchanged, money is involved on both sides of the transaction. There are two simple rules of thumb to help classify entries on the balance of payments:

- Any time an item (good, service, or asset) is exported from a country, the value of that item is recorded as a credit entry on the balance of payments.

- Any time an item is imported into a country, the value of that item is recorded as a debit entry on the balance of payments.

In the following examples, we will consider entries on the U.S. balance of payments accounts. Since it is a U.S. account, the values of all entries are denominated in U.S. dollars. Note that each transaction between a U.S. resident and a foreign resident would result in an entry on both the domestic and the foreign balance of payments accounts, but we will look at only one country’s accounts.

Finally, we will classify entries in the balance of payments accounts into one of the two major subaccounts, the current account or the financial account. Any time an item in a transaction is a good or a service, the value of that item will be recorded in the current account. Any time an item in a transaction is an asset, the value of that item will be recorded in the financial account.

Note that in June 1999, what was previously called the “capital account” was renamed the “financial account” in the U.S. balance of payments. A capital account stills exists but now includes only exchanges in nonproduced, nonfinancial assets. This category is very small, including such items as debt forgiveness and transfers by migrants. However, for some time, it will be common for individuals to use the term “capital account” to refer to the present “financial account.” So be warned.

A Simple Exchange Story

Consider two individuals, one a resident of the United States, the other a resident of Japan. We will follow them through a series of hypothetical transactions and look at how each of these transactions would be recorded on the balance of payments. The exercise will provide insight into the relationship between the current account and the financial account and give us a mechanism for interpreting trade deficits and surpluses.

Step 1: We begin by assuming that each individual wishes to purchase something in the other country. The U.S. resident wants to buy something in Japan and thus needs Japanese currency (yen) to make the purchase. The Japanese resident wants to buy something in the United States and thus needs U.S. currency (dollars) to make the purchase. Therefore, the first step in the story must involve an exchange of currencies.

So let’s suppose the U.S. resident exchanges $1,000 for ¥112,000 on the foreign exchange market at a spot exchange rate of 112 ¥/$. The transaction can be recorded by noting the following:

- The transaction involves an exchange of currency for currency. Since currency is an asset, both sides of the transaction are recorded on the financial account.

- The currency exported is $1,000 in U.S. currency. Hence, we have made a credit entry in the financial account in the table below. What matters is not whether the item leaves the country, but that the ownership changes from a U.S. resident to a foreign resident.

- The currency imported into the country is the ¥112,000. We record this as a debit entry on the financial account and value it at the current exchange value, which is $1,000 as noted in the table.

| Step 1 | U.S. Balance of Payments ($) | |

|---|---|---|

| Credits (+) | Debits (−) | |

| Current Account | 0 | |

| Financial Account | +1,000 ($ currency) | −1,000 (¥ currency) |

Step 2: Next, let’s assume that the U.S. resident uses his ¥112,000 to purchase a camera from a store in Japan and then brings it back to the United States. Since the transaction is between the U.S. resident and the Japanese store owner, it is an international transaction and must be recorded on the balance of payments. The item exported in this case is the Japanese currency. We’ll assume that there has been no change in the exchange rate and thus the currency is still valued at $1,000. This is recorded as a credit entry on the financial account and labeled “¥ currency” in the table below. The item being imported into the United States is a camera. Since a camera is a merchandise good and is valued at ¥112,000 = $1,000, the import is recorded as a debit entry on the current account in the table below.

| Step 2 | U.S. Balance of Payments ($) | |

|---|---|---|

| Credits (+) | Debits (−) | |

| Current Account | 0 | |

| Financial Account | +1,000 (¥ currency) | 0 |

Step 3a: Next, let’s assume that the Japanese resident uses his $1,000 to purchase a computer from a store in the United States and then brings it back to Japan. The computer, valued at $1,000, is being exported out of the United States and is considered a merchandise good. Therefore, a credit entry of $1,000 is made in the following table on the current account and labeled as “computer.” The other side of the transaction is the $1,000 of U.S. currency being given to the U.S. store owner by the Japanese resident. Since the currency, worth $1,000, is being imported and is an asset, a $1,000 debit entry is made in the table on the financial account and labeled “$ currency.”

| Step 3a | U.S. Balance of Payments ($) | |

|---|---|---|

| Credits (+) | Debits (−) | |

| Current Account | +1,000 (computer) | |

| Financial Account | 0 | −1,000 ($ currency) |

Summary Statistics (after Steps 1, 2, and 3a)

We can construct summary statistics for the entries that have occurred so far by summing the debit and credit entries in each account and eliminating double entries. In the following table, we show all the transactions that have been recorded. The sum of credits in the current account is the $1,000 computer. The sum of debits in the current account is the $1,000 camera. On the financial account there are two credit entries of $1,000, one representing U.S. currency and the other representing Japanese currency. There are two identical entries on the debit side. Since there is a U.S. currency debit and credit entry of equal value, this means that the net flow of currency is zero. The dollars that left the country came back in subsequent transactions. The same is true for Japanese currency. When reporting the summary statistics, the dollar and yen currency financial account entries would cancel, leaving a net export of assets equal to zero and the net inflow of assets equal to zero as well.

| Summary 1, 2, 3a | U.S. Balance of Payments ($) | |

|---|---|---|

| Credits (+) | Debits (−) | |

| Current Account | +1,000 (computer) | |

| Financial Account | +1,000 ($ currency), +1,000 (¥ currency) | −1,000 ($ currency), −1,000 (¥ currency) |

After cancellations, then, the summary balance of payments statistics would look as in the following table.

| Summary 1, 2, 3a | U.S. Balance of Payments ($) | |

|---|---|---|

| Credits (+) | Debits (−) | |

| Current Account | +1,000 (computer) | |

| Financial Account | 0 | 0 |

The current account balance is found by summing the credit and debit entries representing exports and imports, respectively. This corresponds to the difference between exports and imports of goods and services. In this example, the current account (or trade) balance is CA = $1,000 − $1,000 = 0. This means the trade account is balanced—exports equal imports.

The financial account balance is also found by summing the credit and debit entries. Since both entries are zero, the financial account balance is also zero.

Step 3b: Step 3b is meant to substitute for step 3a. In this case, we imagine that the Japanese resident decided to do something other than purchase a computer with the previously acquired $1,000. Instead, let’s suppose that the Japanese resident decides to save his money by investing in a U.S. savings bond. In this case, $1,000 is paid to the U.S. government in return for a U.S. savings bond certificate (an IOU) that specifies the terms of the agreement (i.e., the period of the loan, interest rate, etc.). The transaction is recorded on the financial account as a credit entry of $1,000 representing the savings bond that is exported from the country and a debit entry of $1,000 of U.S. currency that is imported back into the country.

| Step 3b | U.S. Balance of Payments ($) | |

|---|---|---|

| Credits (+) | Debits (−) | |

| Current Account | 0 | |

| Financial Account | +1,000 (U.S. savings bond) | −1,000 ($ currency) |

Summary Statistics (after Steps 1, 2, and 3b)

We can construct summary statistics assuming that steps 1, 2, and 3b have taken place. This is shown in the following table. The sum of credits in the current account in this case is zero since there are no exports of goods or services. The sum of debits in the current account is the $1,000 camera.

On the financial account, there are three credit entries of $1,000: one representing U.S. currency, the other representing Japanese currency, and the third representing the U.S. savings bond. There are two $1,000 entries on the debit side: one representing U.S. currency and the other representing Japanese currency. Again, the dollar and yen currency financial account entries would cancel, leaving only a net export of assets equal to the $1,000 savings bond. The net inflow of assets is equal to zero.

| Summary 1, 2, 3b | U.S. Balance of Payments ($) | |

|---|---|---|

| Credits (+) | Debits (−) | |

| Current Account | 0 | |

| Financial Account |

+1,000 ($ currency), +1,000 (¥ currency), +1,000 (U.S. savings bond) |

−1,000 ($ currency), −1,000 (¥ currency) |

After cancellations, the summary balance of payments statistics would look like the following table.

| Summary 1, 2, 3b | U.S. Balance of Payments ($) | |

|---|---|---|

| Credits (+) | Debits (−) | |

| Current Account | 0 | |

| Financial Account | +1,000 (U.S. savings bond) | 0 |

The current account balance is found by summing the credit and debit entries representing exports and imports, respectively. This corresponds to the difference between exports and imports of goods and services. In this example, the current account (or trade) balance is CA = $0 − $1,000 = −$1,000. This means there is a trade deficit of $1,000. Imports of goods and services exceed exports of goods and services.

The financial account balance is also found by summing the credit and debit entries. In this example, the financial account balance is KA = $1,000 − $0 = +$1,000. This means the financial account has a surplus of $1,000. Exports of assets exceed imports of assets.

Important Lessons from the Exchange Story

The exercise above teaches a number of important lessons. The first lesson follows from the summary statistics, suggesting that the following relationship must hold true:

current account balance + financial account balance = 0.In the first set of summary statistics (1, 2, 3a), both the current account and the financial account had a balance of zero. In the second example (1, 2, 3b), the current account had a deficit of $1,000 while the financial account had a surplus of $1,000.

This implies that anytime a country has a current account deficit, it must have a financial account surplus of equal value. When a country has a current account surplus, it must have a financial account deficit of equal value. And when a country has balanced trade (a balanced current account), then it must have balance on its financial account.

It is worth emphasizing that this relationship is not an economic theory. An economic theory could be right or it could be wrong. This relationship is an accounting identity. (That’s why an identity symbol rather than an equal sign is typically used in the formula above.) An accounting identity is true by definition.

Of course, the identity is valid only if we use the true (or actual) current account and financial account balances. What countries report as their trade statistics are only the measured values for these trade balances, not necessarily the true values.

Statisticians and accountants attempt to measure international transactions as accurately as possible. Their objective is to record the true values or to measure trade and financial flows as accurately as possible. However, a quick look at any country’s balance of payments statistics reveals that the balance on the current account plus the balance on the financial account rarely, if ever, sums to zero. The reason is not that the identity is wrong but rather that not all the international transactions on the balance of payments are accounted for properly. Measurement errors are common.

These errors are reported in a line in the balance of payments labeled “statistical discrepancy.” The statistical discrepancy represents the amount that must be added or subtracted to force the measured current account balance and the measured financial account balance to zero. In other words, in terms of the measured balances on the balance of payments accounts, the following relationship will hold:

current account balance + financial account balance + statistical discrepancy = 0.The second lesson from this example is that imbalances (deficits and surpluses) on the balance of payments accounts arise as a result of a series of mutually voluntary transactions in which equally valued items are traded for each other. This is an important point because it is often incorrectly interpreted that a trade deficit implies that unfair trade is taking place. After all, the logic goes, when imports exceed exports, foreigners are not buying as many of our goods as we are buying of theirs. That’s unequal exchange and that’s unfair.

The story and logic are partially correct but incomplete. The logic of the argument focuses exclusively on trade in goods and services but ignores trade in assets. Thus it is true that when imports of goods exceed exports, we are buying more foreign goods and services than foreigners are buying of ours. However, at the same time, a current account deficit implies a financial account surplus. A financial account surplus, in turn, means that foreigners are buying more of our assets than we are buying of theirs. Thus when there is unequal exchange on the trade account, there must be equally opposite unequal exchange on the financial account. In the aggregate, imbalances on a current account, a trade account, or a financial account do not represent unequal exchanges between countries.

Key Takeaways

- Every transaction between a domestic and foreign resident can be recorded as a debit and credit entry of equal value on the balance of payments accounts.

- All components of transactions that involve assets, including currency flows, are recorded on the financial account; all other items are recorded on the current account.

- All trade deficits on a country’s current account implies an equally sized financial account surplus, while all trade surpluses implies an equally sized financial account deficit.

- In the aggregate, imbalances on a current account, a trade account, or a financial account do not represent unequal exchanges, or inequities, between countries.

Exercises

-

Jeopardy Questions. As in the popular television game show, you are given an answer to a question and you must respond with the question. For example, if the answer is “a tax on imports,” then the correct question is “What is a tariff?”

- The balance on a country’s financial account when its current account has a deficit of $80 billion.

- A country’s financial account balance when its trade balance is −$60 billion, its service balance is +$25 billion, and its unilateral transfer and income account has a surplus of +$10 billion.

- The international transactions for shares of stock in corporations (in excess of 10 percent of the company’s value) or for real estate.

- Of credit or debit, this is how exports are recorded on the balance of payments.

- Of current account or financial account, this is where an export of a clock will be recorded.

- Of current account or financial account, this is where an import of currency from your aunt in Paraguay will be recorded.

-

Use the information below from the 1997 U.S. national income accounts to calculate the following. (Assume the balance on income and unilateral transfers was zero.)

- Current account balance: __________

- Merchandise trade balance: __________

- Service balance: __________

- Net income payments and receipts: __________

- Goods and services balance: __________

Table 13.4 U.S. National Income Statistics, 1997 (Billions of Dollars)

| Gross Domestic Product | 8,080 |

| Exports of Goods and Services | 934 |

| Merchandise Exports | 678 |

| Income Receipts | 257 |

| Imports of Goods and Services | 1,043 |

| Merchandise Imports | 877 |

| Income Payments | 244 |

| Net Unilateral Transfers | −45 |

13.6 U.S. Balance of Payments Statistics (2008)

Learning Objective

- Learn the recent values for U.S. balance of payments statistics and the ways transactions are classified on both the current account and the financial account.

One of the most informative ways to learn about a country’s balance of payments statistics is to take a careful look at them for a particular year. We will do that here for the U.S. balance of payments (U.S. BoP) statistics for 2008. Below we present an abbreviated version of the U.S. BoP statistics.

The line numbers refer to the line item on the complete Bureau of Economic Analysis (BEA) report. All debit entries have a minus sign, and all credit entries have a plus sign. A brief description of each line item is provided below where all values are rounded downward for easy reference with the table. To see the entries for every line or for more recent statistics, see the U.S. Department of Commerce, Bureau of Economic Analysis Web site, located at http://www.bea.gov.

Table 13.5 U.S. Balance of Payments, 2008 (Millions of Dollars Seasonally Adjusted)

| Line Number | Category | Value (credits [+], debits [−]) |

|---|---|---|

| Current Account | ||

| 1 | Exports of goods, services, and income receipts | +2,591,233 |

| 3 | Goods | +1,276,994 |

| 4 | Services | +549,602 |

| 13 | Income receipts on U.S. assets abroad | +761,593 |

| 14 | Direct investment receipts | +370,747 |

| 15 | Other private receipts | +385,940 |

| 16 | U.S. government receipts | +4,906 |

| 18 | Imports of goods, services, and income | −3,168,938 |

| 20 | Goods | −2,117,245 |

| 21 | Services | −405,287 |

| 30 | Income payments on foreign assets in the United States | −636,043 |

| 31 | Direct investment payments | −120,862 |

| 32 | Other private payments | −349,871 |

| 33 | U.S. government payments | −165,310 |

| 35 | Unilateral transfers, net | −128,363 |

| Capital Account | ||

| 39 | Capital account transactions, net | +953 |

| Financial Account | ||

| 40 | U.S. assets abroad (increase/financial outflow [−]) | −106 |

| 41 | U.S. official reserve assets | −4,848 |

| 46 | U.S. government assets | −529,615 |

| 50 | U.S. private assets | +534,357 |

| 51 | Direct investment | −332,012 |

| 52 | Foreign securities | +60,761 |

| 53 | U.S. claims reported by U.S. nonbanks | +372,229 |

| 54 | U.S. claims reported by U.S. banks | +433,379 |

| 55 | Foreign assets in the United States (increase/financial inflow [+]) | +534,071 |

| 56 | Foreign official assets in the United States | +487,021 |

| 63 | Other foreign assets in the United States, net | +47,050 |

| 64 | Direct investment | +319,737 |

| 65 | U.S. Treasury securities | +196,619 |

| 66 | U.S. securities other than T-bills | −126,737 |

| 67 | U.S. currency | +29,187 |

| 68 | U.S. liabilities reported by U.S. nonbanks | −45,167 |

| 69 | U.S. liabilities reported by U.S. banks | −326,589 |

| 71 | Statistical discrepancy (sum of above with sign reversed) | +200,055 |

Below we provide a brief description of each line item that appears on this abbreviated balance of payments record.

Current Account

Line 1, $2.59 trillion, shows the value of all U.S. exports of goods, services, and income. This value is equal to the sum of lines 3, 4, and 13.

Line 3, $1.27 trillion, shows exports of merchandise goods. This includes any physical items that leave the country.

Line 4, $549 billion, shows exports of services to foreigners. This category includes travel services, passenger fares, royalties, license fees, insurance legal services, and other private services.

Line 13, $761 billion, shows income receipts on U.S. assets abroad. This represents profits and interest earned by U.S. residents on investments in other countries. In a sense, these are payments for services rendered where the services include entrepreneurial services in the case of foreign-operated factories, or monetary services in the case of interest and dividend payments on foreign securities. This line is included in a measure of gross national product (GNP) since this income is accruing to U.S. factors of production. However, the line is excluded from a measure of gross domestic product (GDP) since production did not take place within the borders of the country. Income receipts are divided into four subcategories: direct investment receipts, other private receipts, U.S. government receipts, and compensation of employees.

Line 14, $370 billion, shows direct investment receipts. This represents profit earned by U.S. companies on foreign direct investment (FDI), where FDI is defined as a greater than 10 percent ownership share in a foreign company. Note that this is not new investments but rather the profit and dividends earned on previous investments.

Line 15, $385 billion, shows other private receipts. This category includes interest and profit earned by individuals, businesses, investment companies, mutual funds, pension plans, and so on. In effect, all private investment income that accrues on investments worth less than 10 percent of a company would be included here.

Line 16, $4.9 billion, shows U.S. government income receipts. This refers to interest and other income earned by government investments abroad. Notice that this item is very small compared to the other two income categories.

Line 18, $3.1 trillion, records imports of goods, services, and income. This value is equal to the sum of lines 20, 21, and 29.

Line 20, $2.1 trillion, shows imports of merchandise goods. Notice that goods imports make up about two-thirds of total imports.

Line 21, $405 billion, shows imports of services such as travel services, passenger fares, insurance, and so on.

Line 30, $636 billion, shows income payments on foreign assets in the United States. This corresponds to income earned by foreigners who operate companies in the United States or income earned on other U.S.-based assets held by foreigners. This entry is further divided into four components: direct investment payments, other private payments, U.S. government payments, and compensation of employees.

Line 31, $120 billion, records direct investment payments to foreigners in the United States. This represents profit earned on foreign direct investment by foreign residents’ companies, where FDI is defined as a greater than 10 percent ownership share in a U.S. company. Note that this is not new investments but rather the profit and dividends earned on previous investments.

Line 32, $349 billion, reports other private payments. This category includes interest and profit earned by individuals, businesses, investment companies, mutual funds, pension plans, and so on. In effect, all private investment income that accrues on investments worth less than 10 percent of a company would be included here.

Line 33, $165 billion, records payments made by the U.S. government to foreigners. This item represents mostly interest payments on U.S. Treasury bills owned by foreigners.

Line 35, $128 billion, records net unilateral transfers. These transfers refer to government grants to foreign nations, government pension payments, and private remittances to family and friends abroad. A debit entry here means that the net transfers are outbound, that is, more transfers are made from the U.S. to individuals abroad than are made in the reverse direction.

Capital Account

Line 39, $953 million, represents net capital account transactions.

Financial Account

Line 40, $106 million, shows the value of purchases of foreign assets by U.S. residents, hence it is referred to as a capital outflow. The line is the sum of U.S. official reserve assets (line 41), U.S. government assets (line 46), and U.S. private assets (line 50).

Line 41, $4.8 billion, represents net U.S. official reserve transactions. Any purchases or sales of foreign currency in a foreign exchange intervention by the central bank would be recorded here. Since the item is a debit entry, it means that the U.S. central bank made net purchases of foreign assets (currencies) in 2008.

It is worth noting that this line is more important for a country maintaining a fixed exchange rate. To maintain a credible fixed exchange rate, central banks must periodically participate in the foreign exchange market. This line measures the extent of that participation and is sometimes referred to as the “balance of payments” in a fixed exchange rate system.

Line 46, $529 billion, represents net purchases of assets by the U.S. government, though not by the Federal Reserve.

Line 50, $534 billion, shows private purchases of foreign assets by U.S. residents. It is the primary component of total U.S. assets abroad. The item is composed of direct investment (line 51), foreign securities (line 52), U.S. claims reported by U.S. nonbanks (line 53), and U.S. claims reported by U.S. banks (line 54).

Line 51, $332 billion, shows direct investment by U.S. residents abroad. It would include purchases of factories, stocks, and so on by U.S. businesses and affiliates in foreign countries as long as there is a controlling interest in excess of 10 percent voting share.

Line 52, $60 billion, shows net purchases of foreign stocks and bonds by U.S. individuals and businesses when there is no controlling interest in the foreign company. Most purchases by U.S. mutual funds, pension funds, and insurance companies would be classified here.

Line 53, $372 billion, shows U.S. resident purchases of foreign assets reported by nonbanks.

Line 54, $433 billion, reports U.S. resident purchases of foreign assets reported by U.S. banks. This may include items like foreign currency denominated demand deposits held by U.S. businesses and individuals in U.S. banks.

Line 55, $534 billion, shows the sum total of foreign assets in the United States. This item refers to all purchases of U.S. assets by foreign residents, thus, it is listed as a capital inflow. This line is composed of the sum of foreign official assets in the United States (line 56), and other foreign assets in the United States (line 63).

Line 56, $487 billion, refers to purchases of U.S. assets by foreign governments or foreign central banks.

Line 63, $47 billion, refers to all other foreign assets purchases of U.S. assets and is the main component of capital inflows. It is composed of direct investment (line 64), U.S. Treasury securities (line 65), U.S. securities other than T-bills (line 66), U.S. currency (line 67), U.S. liabilities reported by U.S. nonbanks (line 68), and U.S. liabilities reported by U.S. banks (line 69).

Line 64, $319 billion, refers to purchases of U.S. factories and stocks when there is a greater than 10 percent ownership share.

Line 65, $196 billion, shows total purchases of U.S. Treasury bills by foreigners. This corresponds to foreign loans to the U.S. government.

Line 66, $126 billion, shows non-U.S. Treasury bill and nondirect investment purchases of stocks and bonds by foreigners.

Line 67, $29 billion, a debit entry, represents U.S. currency that has been repatriated (net). Typically, this flow is a credit indicating an outflow of U.S. currency. Because of the expectation that the U.S. dollar will remain stable in value, it is often held by residents in inflationary countries to prevent the deterioration of purchasing power. It is estimated that over $270 billion of U.S. currency circulates abroad and is used in exchange for foreign goods and services or simply held to store value. The value on line 67 represents only the amount that flowed back in 2007.

Line 68, $45 billion, shows deposits and purchases of U.S. assets by foreigners reported by U.S. nonbanks.

Line 69, $326 billion, reports deposits and purchases of U.S. assets by foreigners reported by U.S. banks. Thus if a foreign resident opens a checking account in a U.S. bank denominated in U.S. dollars, that value would be recorded here.

Line 71, $200 billion, represents the statistical discrepancy. It is the sum of all the above items with the sign reversed. It is included to satisfy the accounting requirement that all debit entries be balanced by credit entries of equal value. Thus when the statistical discrepancy is included, the balance on the complete balance of payments is zero.

Summary Balances on the U.S. Balance of Payments (2008)

Table 13.6 "Balances on the U.S. Balance of Payments, 2008 (Millions of Dollars Seasonally Adjusted) (Credits [+], Debits [−])" reports a number of noteworthy balance of payments “balances” for 2008. In effect these subaccount balances allow us to identify net inflows or outflows of specific categories of goods, services, income, and assets.

Table 13.6 Balances on the U.S. Balance of Payments, 2008 (Millions of Dollars Seasonally Adjusted) (Credits [+], Debits [−])

| Lines 1 + 18 + 35 | Current account balance | −706, 068 |

| Lines 3 + 20 | Trade (goods) balance | −840, 251 |

| Lines 4 + 21 | Services balance | +144, 315 |

| Lines 2 + 19 | Goods and services balance | −695, 936 |

| Lines 12 + 29 | Investment income balance | +118, 231 |

| Lines 40 + 55 | Financial account balance | +533, 965 |

| Line 71 | Statistical discrepancy | +200,055 |

The sum of lines 1, 18, and 35 (i.e., exports of goods, services, and income; imports of goods, services, and income; and unilateral transfers [maintaining signs]) represents the current account (CA) balance. In 2008 in the United States, the CA balance was −706 billion dollars where the minus sign indicates a deficit. Thus the United States recorded a current account deficit of $706 billion. Note that the current account balance is often reported as the “trade balance using a broad measure of international trade.”

Because unilateral transfers are relatively small and because investment income can be interpreted as payments for a service, it is common to say that a current account deficit means that imports of goods and services exceed exports of goods and services.