This is “Trade Policies with Market Imperfections and Distortions”, chapter 9 from the book Policy and Theory of International Economics (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 9 Trade Policies with Market Imperfections and Distortions

Most models showing the advantages of international trade and the costs associated with protection assume that the world is perfectly competitive. The problem is that for a variety of reasons markets are usually not perfectly competitive, at least not completely so. Economists use the term “market imperfections” to describe situations that deviate from perfect competition. And when such deviations occur, interesting things happen.

For example, it is valid to say that in a world with market imperfections, free trade may not be the best policy to maximize national welfare; instead, some type of trade protection may be better. This chapter illustrates a series of examples with models that incorporate market imperfections to demonstrate this result. However, application of another theory in economics, the theory of the second best, and some other issues are shown to mitigate this result. In other words, even though trade policies can be used to raise a nation’s welfare, there may be a better way to achieve a superior result.

9.1 Chapter Overview

Learning Objectives

- Understand that the presence of market imperfections or distortions in a trade model changes the potential outcomes of trade policies.

- Learn the basic terminology used in discussing the theory of the second best.

Most of the models previously discussed incorporate a very standard economic assumption: namely, that markets are perfectly competitive. This was true in the Ricardian model, the Heckscher-Ohlin model, the specific factor model, and all the partial equilibrium analyses of trade and domestic policies using supply and demand curves in specific markets. The only deviation from perfect competition was in the discussion of economies-of-scale models and monopolistic competition. This is important because almost all the results concerning the effects of trade and trade policies presume that markets are perfectly competitive. But what if they’re not?

Many critics of the economic conclusions about trade argue that the assumptions of perfect competition are unrealistic and that as a result standard trade theory misses some of the important impacts of trade found in the real world. There is much truth to this. By default, perfect competition models include many assumptions that are unrealistic. However, in defense, that is the nature of model building. Simplification is necessary to make the models tractable and solvable. If we were to try to create a model that included many or most of the complexities that we can imagine are present in real-world markets, we would no doubt quickly be overwhelmed with the model’s intractability and might find it impossible to even identify an equilibrium solution. Indeed, in the real world, being in “equilibrium” might even be a rare occurrence.

Criticisms of economic theory along these lines, however, fail to recognize that economic analysis includes many attempts to incorporate market realities. Although it remains difficult to include many complexities simultaneously, it is possible to study them in a piecemeal way: one at a time.

The all-encompassing terms economists use to describe these complexities are market imperfections, or market failures, and market distortions. These cases are worthy of study because it is clear that markets rarely satisfy all the assumptions made under perfect competition. These cases offer compelling arguments for protection, including the infant industry argument, the optimal tariff argument, strategic trade policy arguments, and arguments concerning national security.

Market imperfections or market distortionsAny situation that deviates from the explicit or implicit assumptions of perfect competition., generally, are any deviations from the assumptions of perfect competition. These include monopoly and oligopoly markets, production with increasing returns to scale, markets that do not clear, negative and positive externalities in production and consumption, and the presence of public goods.

When imperfections or distortions are present in a trade model, it is usually possible to identify a trade policy that can raise aggregate economic efficiency. In this chapter many cases are demonstrated in which trade policies improve national welfare. These welfare-improving policies, although detrimental to national welfare when used in a perfectly competitive setting, act to correct the imperfections or distortions present in the market. As long as the welfare impact of the correction exceeds the standard welfare loss associated with the trade policy, the policy will raise welfare.

Trade policies with market imperfections and distortions represent applications of the theory of the second bestDescribes the class of models that consider policy implications in the presence of market imperfections and distortions., formalized by Richard G. Lipsey and Kelvin Lancaster.See R. G. Lipsey and K. Lancaster, “The General Theory of the Second Best,” Review of Economic Studies 24 (1956): 11–32. When imperfections or distortions are present in an international trade model, we describe the resulting equilibrium as second best. In this case, the standard policy prescriptions to maximize national welfare in a first-best or nondistorted economy will no longer hold true. Also, the implementation of what would be a detrimental policy in a first-best world can become a beneficial policy when implemented within a second-best world. For example, tariffs applied by a small country in the presence of domestic distortions can sometimes raise national welfare.

In 1971, Jagdish Bhagwati presented a general theory of distortions in trade situations.See J. N. Bhagwati, “The Generalized Theory of Distortions and Welfare,” in Trade, Balance of Payments and Growth, ed. J. N. Bhagwati, R. W. Jones, R. A. Mundell, and J. Vanek (Amsterdam: North-Holland Publishing Co., 1971). He characterized many of the distortions that can occur and considered which policies could be used to correct each distortion and raise national welfare. He considered not only trade policies but also domestic tax or subsidy policies. He showed that for most distortions, a trade policy is inferior (in terms of the extent to which it can raise national welfare) to other purely domestic policies. The most appropriate or first-best policyThe policy that raises welfare to the highest level possible; with market imperfections or distortions present, the policy that most directly corrects the distortion or imperfection., in general, would be the policy that most directly corrects the distortion or imperfection present in the market. This chapter provides numerous examples of policy rankings and applications of this general rule.

In one case, a trade policy does prove to be first best. This is the case of a large import or export country in international markets. In this case, the first-best policy is the optimal tariff or the optimal export tax.

Thus the results of this section are somewhat schizophrenic. On the one hand, these models offer some of the most compelling arguments supporting protection. For example, one can easily use these models to justify protection when national defense is a concern, when unemployment may arise in a market, when trade causes environmental degradation, or when there are infant industries in a country. On the other hand, in almost all of these cases, a trade policy is not the most effective policy tool available to correct the problems caused by the distortion or imperfection.

Finally, when more complex markets are considered, as when there are multiple distortions or imperfections present simultaneously, our ability to identify welfare-improving policies rapidly diminishes. The theory of the second best states that correcting one distortion in the presence of many may not improve welfare even if the policy makes perfect sense within the partial equilibrium framework containing the one distortion. The reason is that correcting one distortion may have unintentional (and probably immeasurable) impacts in other sectors due to the presence of other distortions. For example, suppose a trade policy is implemented to correct an environmental problem. One might be able to measure the welfare costs of the trade policy and the environmental benefits that would accrue to society and conclude that the benefits exceed the costs. However, the trade policy will have an impact on prices and resource allocation, potentially spreading across numerous sectors. Suppose one other sector, adversely affected, generates positive spillover effects that act to raise well-being for some groups. Then it is conceivable that the loss of the positive spillover effects would more than outweigh the net benefit accruing to society due to the environmental improvement. This means that the well-intentioned and reasonably measured environmental trade policy could result in an unintentional welfare loss for the nation. The more complex is the economy and the more distortions and imperfections that are present, the more likely it is that we simply cannot know what the national effects of trade policies will be.

Key Takeaways

- In the presence of market imperfections or distortions, free trade may no longer be the best policy, even for a small open economy.

- Although trade policies can sometimes generate national welfare improvements, trade policies are often second-best policies, meaning that there are other nontrade policies that are superior (called first-best policies).

- The first-best policy is the policy that targets and corrects the market imperfection as directly as possible.

Exercise

-

Jeopardy Questions. As in the popular television game show, you are given an answer to a question and you must respond with the question. For example, if the answer is “a tax on imports,” then the correct question is “What is a tariff?”

- The term describing any assumption that represents a deviation from the standard assumptions of perfect competition.

- The term describing a policy that most directly corrects the market imperfection or distortion in a market.

- The name of the theory describing the class of models that consider policy implications in the presence of market imperfections and distortions.

9.2 Imperfections and Distortions Defined

Learning Objectives

- Identify the various types of market imperfections and distortions.

- Recognize that market imperfections and distortions are widespread in real-world markets.

Market imperfections and distortions, generally, are any deviations from the assumptions of perfect competition. Many of the assumptions in a perfectly competitive model are implicit rather than explicit—that is, they are not always stated.

Below are descriptions of many different types of imperfections and distortions. Perfect competition models assume the absence of these items.

Monopoly, Duopoly, and Oligopoly

Perhaps the most straightforward deviation from perfect competition occurs when there are a relatively small number of firms operating in an industry. At the extreme, one firm produces for the entire market, in which case the firm is referred to as a monopoly. A monopoly has the ability to affect both its output and the price that prevails on the market. A duopoly consists of two firms operating in a market. An oligopoly represents more than two firms in a market but less than the many, many firms assumed in a perfectly competitive market. The key distinction between an oligopoly and perfect competition is that oligopoly firms have some degree of influence over the price that prevails in the market.

Another key feature of these imperfectly competitive markets is that the firms within them make positive economic profits. The profits, however, are not sufficient to encourage entry of new firms into the market. In other words, free entry in response to profit is not possible. The typical method of justifying this is by assuming that there are relatively high fixed costs. High fixed costs, in turn, imply increasing returns to scale. Thus most monopoly and oligopoly models assume some form of imperfect competition.

Large Countries in International Trade

Surprisingly, “large” importing countries and “large” exporting countries have a market imperfection present. This imperfection is more easily understood if we use the synonymous terms for “largeness,” monopsony and monopoly power. Large importing countries are said to have “monopsony power in tradeAnother term to describe a large importing country—that is, a country whose policy actions can affect international prices.,” while large exporting countries are said to have “monopoly power in tradeAnother term to describe a large exporting country—that is, a country whose policy actions can affect international prices..” Let’s first consider monopoly power.

When a large exporting country implements a trade policy, it will affect the world market price for the good. That is the fundamental implication of largeness. For example, if a country imposes an export tax, the world market price will rise because the exporter will supply less. An export tax set optimally will cause an increase in national welfare due to the presence of a positive terms of trade effect. This effect is analogous to that of a monopolist operating in its own market. A monopolist can raise its profit (i.e., its firm’s welfare) by restricting supply to the market and raising the price it charges its consumers. In much the same way, a large exporting country can restrict its supply to international markets with an export tax, force the international price up, and create benefits for itself with the terms of trade gain. The term monopoly “power” is used because the country is not a pure monopoly in international markets. There may be other countries exporting the product as well. Nonetheless, because its exports are a sufficiently large share of the world market, the country can use its trade policy in a way that mimics the effects caused by a pure monopoly, albeit to a lesser degree. Hence the country is not a monopolist in the world market but has “monopoly power” instead.

Similarly, when a country is a large importer of a good, we say that it has “monopsony power.” A monopsony represents a case in which there is a single buyer in a market where there are many sellers. A monopsony raises its own welfare or utility by restricting its demand for the product and thereby forcing the sellers to lower their price. By buying fewer units at a lower price, the monopsony becomes better off. In much the same way, when a large importing country places a tariff on imports, the country’s demand for that product on world markets falls, which in turn lowers the world market price. An import tariff set optimally will raise national welfare due to the positive terms of trade effect. The effects in these two situations are analogous. We say that the country has monopsony “power” because the country may not be the only importer of the product in international markets, yet because of its large size, it has “power” like a pure monopsony.

Externalities

ExternalitiesEconomic actions that have effects external to the market in which the action is taken. are economic actions that have effects external to the market in which the action is taken. Externalities can arise from production processes (production externalities) or from consumption activities (consumption externalities). The external effects can be beneficial to others (positive externalities) or detrimental to others (negative externalities). Typically, because the external effects impact someone other than the producer or consumers, the producer and the consumers do not take the effects into account when they make their production or consumption decisions. We shall consider each type in turn.

Positive Production Externalities

Positive production externalities occur when production has a beneficial effect in other markets in the economy. Most examples of positive production externalities incorporate some type of learning effect.

For example, manufacturing production is sometimes considered to have positive spillover effects, especially for countries that are not highly industrialized. By working in a factory, the production workers and managers all learn what it takes to operate the factory successfully. These skills develop and grow over time, a process sometimes referred to as learning by doing. The skills acquired by the workers, however, are likely to spill over to others in the rest of the economy. Why? Because workers will talk about their experiences with other family members and friends. Factory managers may teach others their skills at local vocational schools. Some workers will leave to take jobs at other factories, carrying with them the skills that they acquired at the first factory. In essence, learning spillovers are analogous to infectious diseases. Workers who acquire skills in one factory in turn will infect other workers they come into contact with and will spread the skill disease through the economy.

A similar story is told concerning research and development (R&D). When a firm does R&D, its researchers learn valuable things about production that in turn are transmitted through the rest of the economy and have positive impacts on other products or production processes.

Negative Production Externalities

Negative production externalities occur when production has a detrimental effect in other markets in the economy. The negative effects could be felt by other firms or by consumers. The most common example of negative production externalities involves pollution or other environmental effects.

When a factory emits smoke into the air, the pollution will reduce the well-being of all the individuals who must breathe the polluted air. The polluted air will also likely require more frequent cleaning by businesses and households, raising the cost incurred by them.

Water pollution would have similar effects. A polluted river cannot be used for recreational swimming or at least reduces swimmers’ pleasures as the pollution rises. The pollution can also eliminate species of flora and fauna and change the entire ecosystem.

Positive Consumption Externalities

Positive consumption externalities occur when consumption has a beneficial effect in other markets in the economy. Most examples of positive consumption externalities involve some type of aesthetic effect.

Thus when homeowners landscape their properties and plant beautiful gardens, it benefits not only themselves but also neighbors and passersby. In fact, an aesthetically pleasant neighborhood where yards are neatly kept and homes are well maintained would generally raise the property values of all houses in the neighborhood.

One could also argue that a healthy lifestyle has positive external effects on others by reducing societal costs. A healthier person would reduce the likelihood of expensive medical treatment and lower the cost of insurance premiums or the liability of the government in state-funded health care programs.

Negative Consumption Externalities

Negative production externalities occur when consumption has a detrimental effect in other markets in the economy. Most examples of negative consumption externalities involve some type of dangerous behavior.

Thus a mountain climber in a national park runs the risk of ending up in a precarious situation. Sometimes climbers become stranded due to storms or avalanches. This usually leads to expensive rescue efforts, the cost of which is generally borne by the government and hence the taxpayers.

A drunk driver places other drivers at increased risk. In the worst outcome, the drunk driver causes the death of another. A smoker may also put others at risk if secondhand smoke causes negative health effects. At the minimum, cigarette smoke surely bothers nonsmokers when smoking occurs in public enclosed areas.

Public Goods

Public goodsGoods that are nonrival (the consumption or use of a good by one consumer does not diminish the usefulness of the good to another) and nonexcludable (once the good is provided, it is exceedingly costly to exclude nonpaying customers from using it). have two defining characteristics: nonrivalry and nonexcludability. NonrivalryA situation in which consumption or use of a good by one consumer does not diminish the usefulness of the good to another. means that the consumption or use of a good by one consumer does not diminish the usefulness of the good to another. NonexcludabilityA situation in which once the good is provided, it is exceedingly costly to exclude nonpaying customers from using it. means that once the good is provided, it is exceedingly costly to exclude nonpaying customers from using it. The main problem posed by public goods is the difficulty of getting people to pay for them in a free market.

The classic example of a public good is a lighthouse perched on a rocky shoreline. The lighthouse sends a beacon of light outward for miles, warning every passing ship of the danger nearby. Since two ships passing are equally warned of the risk, the lighthouse is nonrival. Since it would be impossible to provide the lighthouse services only to those passing ships that paid for the service, the lighthouse is nonexcludable.

The other classic example of a public good is national security or national defense. The armed services provide security benefits to everyone who lives within the borders of a country. Also, once provided, it is difficult to exclude nonpayers.

Information has public good characteristics as well. Indeed, this is one reason for the slow start of electronic information services on the World Wide Web. Once information is placed on a Web site, it can be accessed and used by millions of consumers almost simultaneously. Thus it is nonrival. Also, it can be difficult, although not impossible, to exclude nonpaying customers from accessing the services.

Nonclearing Markets

A standard assumption in general equilibrium models is that markets always clear—that is, supply equals demand at the equilibrium. In actuality, however, markets do not always clear. When markets do not clear, for whatever reason, the market is distorted.

The most obvious case of a nonclearing market occurs when there is unemployment in the labor market. Unemployment could arise if there is price stickiness in the downward direction, as when firms are reluctant to lower their wages in the face of restricted demand. Alternatively, unemployment may arise because of costly adjustment when some industries expand while others contract. As described in the immobile factor model, many factors would not immediately find alternative employment after being laid off from a contracting industry. In the interim, the factors must search for alternative opportunities, may need to relocate to another geographical location, or may need to be retrained. During this phase, the factors remain unemployed.

Imperfect Information

One key assumption often made in perfectly competitive models is that agents have perfect information. If some of the participants in the economy do not have full and complete information in order to make decisions, then the market is distorted.

For example, suppose entrepreneurs did not know that firms in an industry were making positive economic profits. Without this information, new firms would not open to force economic profit to zero in the industry. As such, imperfect information can create a distortion in the market.

Policy-Imposed Distortions

Another type of distortion occurs when government policies are set in markets that are perfectly competitive and exhibit no other distortions or imperfections. These were labeled policy-imposed distortions by Jagdish Bhagwati since they do not arise naturally but rather via legislation.

Thus suppose the government of a small country sets a trade policy, such as a tariff on imports. In this case, the equilibrium that arises with the tariff in place is a distorted equilibrium.

Key Takeaways

- An implicit assumption of perfect competition models is that there are no market imperfections or distortions in place.

- Among some of the most common market imperfections are monopolies, oligopolies, large countries in trade, externalities, public goods, nonclearing markets, imperfect information, and government tax and subsidy policies.

- Externality effects can arise from production or consumption activities.

- Externalities can be positive or negative in their effects.

Exercise

-

Jeopardy Questions. As in the popular television game show, you are given an answer to a question and you must respond with the question. For example, if the answer is “a tax on imports,” then the correct question is “What is a tariff?”

- The term used to describe the favorable effect that a production activity can have in another market.

- The term used to describe the detrimental effect that a consumption activity can have on another person.

- The two characteristics that identify “public goods.”

- The term used to describe the type of distortion that occurs when governments implement taxes, subsidies, or regulations in otherwise perfectly competitive markets.

- The type of power a large importing country is said to have.

- The type of power a large exporting country is said to have.

9.3 The Theory of the Second Best

Learning Objectives

- Understand the key features of the theory of the second best.

- Distinguish between first-best and second-best equilibria.

- Distinguish between first-best and second-best policies.

The theory of the second best was formalized by Richard Lipsey and Kelvin Lancaster in 1956. The primary focus of the theory is what happens when the optimum conditions are not satisfied in an economic model. Lipsey and Lancaster’s results have important implications for the understanding of not only trade policies but also many other government policies.

In this section, we will provide an overview of the main results and indicate some of the implications for trade policy analysis. We will then consider various applications of the theory to international trade policy issues.

First of all, one must note that economic models consist of exercises in which a set of assumptions is used to deduce a series of logical conclusions. The solution of a model is referred to as an equilibrium. An equilibrium is typically described by explaining the conditions or relationships that must be satisfied in order for the equilibrium to be realized. These are called the equilibrium conditions. In economic models, these conditions arise from the maximizing behavior of producers and consumers. Thus the solution is also called an optimum.

For example, a standard perfectly competitive model includes the following equilibrium conditions: (1) the output price is equal to the marginal cost for each firm in an industry, (2) the ratio of prices between any two goods is equal to each consumer’s marginal rate of substitution between the two goods, (3) the long-run profit of each firm is equal to zero, and (4) supply of all goods is equal to demand for all goods. In a general equilibrium model with many consumers, firms, industries, and markets, there will be numerous equilibrium conditions that must be satisfied simultaneously.

Lipsey and Lancaster’s analysis asks the following simple question: What happens to the other optimal equilibrium conditions when one of the conditions cannot be satisfied for some reason? For example, what happens if one of the markets does not clear—that is, supply does not equal demand in that one market? Would it still be appropriate for the firms to set the price equal to the marginal cost? Should consumers continue to set each price ratio equal to their marginal rate of substitution? Or would it be better if firms and consumers deviated from these conditions? Lipsey and Lancaster show that, generally, when one optimal equilibrium condition is not satisfied, for whatever reason, all the other equilibrium conditions will change. Thus if one market does not clear, it would no longer be optimal for firms to set the price equal to the marginal cost or for consumers to set the price ratio equal to the marginal rate of substitution.

First-Best versus Second-Best Equilibria

Consider a small perfectly competitive open economy that has no market imperfections or distortions, no externalities in production or consumption, and no public goods. This is an economy in which all resources are privately owned, the participants maximize their own well-being, firms maximize profit, and consumers maximize utility—always in the presence of perfect information. Markets always clear and there are no adjustment costs or unemployment of resources.

The optimal government policy in this case is laissez-faire. With respect to trade policies, the optimal policy is free trade. Any type of tax or subsidy implemented by the government under these circumstances can only reduce economic efficiency and national welfare. Thus with a laissez-faire policy, the resulting equilibrium would be called first best. It is useful to think of this market condition as economic nirvana since there is no conceivable way of increasing economic efficiency at a first-best equilibriumA market equilibrium that arises in the absence of any market imperfections or distortions; in other words, under the standard assumptions of perfect competition..

Of course, the real world is unlikely to be so perfectly characterized. Instead, markets will likely have numerous distortions and imperfections. Some production and consumption activities have externality effects. Some goods have public good characteristics. Some markets have a small number of firms, each of which has some control over the price that prevails and makes positive economic profit. Governments invariably set taxes on consumption, profit, property and assets, and so on. Finally, information is rarely perfectly and costlessly available.

Now imagine again a small, open, perfectly competitive economy with no market imperfections or distortions. Suppose we introduce one distortion or imperfection into such an economy. The resulting equilibrium will now be less efficient from a national perspective than when the distortion was not present. In other words, the introduction of one distortion would reduce the optimal level of national welfare.

In terms of Lipsey and Lancaster’s analysis, the introduction of the distortion into the system would sever one or more of the equilibrium conditions that must be satisfied to obtain economic nirvana. For example, suppose the imperfection that is introduced is the presence of a monopolistic firm in an industry. In this case, the firm’s profit-maximizing equilibrium condition would be to set its price greater than the marginal cost rather than equal to the marginal cost as would be done by a profit-maximizing perfectly competitive firm. Since the economic optimum obtained in these circumstances would be less efficient than in economic nirvana, we would call this equilibrium a second-best equilibriumA market equilibrium that arises in the presence of one or more market imperfections or distortions.. Second-best equilibria arise whenever all the equilibrium conditions satisfying economic nirvana cannot occur simultaneously. In general, second-best equilibria arise whenever there are market imperfections or distortions present.

Welfare-Improving Policies in a Second-Best World

An economic rationale for government intervention in the private market arises whenever there are uncorrected market imperfections or distortions. In these circumstances, the economy is characterized by a second-best rather than a first-best equilibrium. In the best of cases, the government policy can correct the distortions completely and the economy would revert back to the state under economic nirvana. If the distortion is not corrected completely, then at least the new equilibrium conditions, altered by the presence of the distortion, can all be satisfied. In either case, an appropriate government policy can act to correct or reduce the detrimental effects of the market imperfection or distortion, raise economic efficiency, and improve national welfare.

It is for this reason that many types of trade policies can be shown to improve national welfare. Trade policies, chosen appropriate to the market circumstances, act to correct the imperfections or distortions. This remains true even though the trade policies themselves would act to reduce economic efficiency if applied starting from a state of economic nirvana. What happens is that the policy corrects the distortion or imperfection and thus raises national welfare by more than the loss in welfare arising from the application of the policy.

Many different types of policies can be applied, even for the same distortion or imperfection. Governments can apply taxes, subsidies, or quantitative restrictions. They can apply these to production, to consumption, or to factor usage. Sometimes they even apply two or more of these policies simultaneously in the same market. Trade policies, like tariffs or export taxes, are designed to directly affect the flow of goods and services between countries. Domestic policies, like production subsidies or consumption taxes, are directed at a particular activity that occurs within the country but is not targeted directly at trade flows.

One prominent area of trade policy research focuses on identifying the optimal policy to be used in a particular second-best equilibrium situation. Invariably, this research has considered multiple policy options in any one situation and has attempted to rank order the potential policies in terms of their efficiency-enhancing capabilities. As with the ranking of equilibria described above, the ranking of policy options is also typically characterized using the first-best and second-best labels.

Thus the ideal or optimal policy choice in the presence of a particular market distortion or imperfection is referred to as a first-best policy. The first-best policy will raise national welfare, or enhance aggregate economic efficiency, to the greatest extent possible in a particular situation.

Many other policies can often be applied, some of which would improve welfare. If any such policy raises welfare to a lesser degree than a first-best policy, then it would be called a second-best policyA policy whose best effect is inferior to another policy.. If there are many policy options that are inferior to the first-best policy, then it is common to refer to them all as second-best policies. Only if one can definitively rank three or more policy options would one ever refer to a third-best or fourth-best policy. Since these rankings are often difficult, third-best (and so on) policies are not commonly denoted.

Trade Policies in a Second-Best World

In a 1971 paper, Jagdish Bhagwati provided a framework for understanding the welfare implications of trade policies in the presence of market distortions.See J. N. Bhagwati, “The Generalized Theory of Distortions and Welfare,” in Trade, Balance of Payments and Growth, ed. J. N. Bhagwati, R. W. Jones, R. A. Mundell, and J. Vanek (Amsterdam: North-Holland Publishing Co., 1971). This framework applied the theory of the second best to much of the welfare analysis that had been done in international trade theory up until that point. Bhagwati demonstrated the result that trade policies can improve national welfare if they occur in the presence of a market distortion and if they act to correct the detrimental effects caused by the distortion. However, Bhagwati also showed that in almost all circumstances a trade policy will be a second-best rather than a first-best policy choice. The first-best policy would likely be a purely domestic policy targeted directly at the distortion in the market. One exception to this rule occurs when a country is “large” in international markets and thus can affect international prices with its domestic policies. In this case, as was shown with optimal tariffs, quotas, voluntary export restraints (VERs), and export taxes, a trade policy is the first-best policy.

Since Bhagwati’s paper, international trade policy analysis has advanced to include market imperfections such as monopolies, duopolies, and oligopolies. In many of these cases, it has been shown that appropriately chosen trade policies can improve national welfare. The reason trade policies can improve welfare, of course, is that the presence of the market imperfection means that the economy begins at a second-best equilibrium. The trade policy, if properly targeted, can reduce the negative aggregate effects caused by the imperfection and thus raise national welfare.

Summary of the Theory of the Second Best

In summary, the theory of the second best provides the theoretical underpinning to explain many of the reasons that trade policy can be shown to be welfare enhancing for an economy. In most (if not all) of the cases in which a trade policy is shown to improve national welfare, the economy begins at an equilibrium that can be characterized as second best. Second-best equilibria arise whenever the market has distortions or imperfections present. In these cases, it is relatively straightforward to conceive of a trade policy that corrects the distortion or imperfection sufficiently to outweigh the detrimental effects of the policy itself. In other words, whenever market imperfections or distortions are present, it is always theoretically or conceptually possible to design a trade policy that would improve national welfare. As such, the theory of the second best provides a rationale for many different types of protection in an economy.

The main criticism suggested by the theory is that rarely is a trade policy the first-best policy choice to correct a market imperfection or distortion. Instead, a trade policy is second best. The first-best policy, generally, would be a purely domestic policy targeted directly at the market imperfection or distortion.

In the remaining sections of this chapter, we use the theory of the second best to explain many of the justifications commonly given for protection or for government intervention with some form of trade policy. In each case, we also discuss the likely first-best policies.

Key Takeaways

- A first-best equilibrium occurs in a perfectly competitive market when no imperfections or distortions are present.

- A second-best equilibrium arises whenever a market includes one or more imperfections or distortions.

- A first-best policy is that policy that can improve national welfare to the greatest extent when beginning in a second-best equilibrium.

- A second-best policy is one whose best national welfare effect is inferior to a first-best policy when beginning in a second-best equilibrium.

- As a general rule of thumb, beginning in a second-best equilibrium, the first-best policy will be a policy that attacks the market imperfection or distortion as directly as possible.

- As a general rule of thumb, domestic policies are usually first-best policies, whereas trade policies are usually second-best policies.

- One exception to the previous rule of thumb is that a trade policy is the first-best policy choice to correct the imperfection of a large country in international markets.

Exercise

-

Jeopardy Questions. As in the popular television game show, you are given an answer to a question and you must respond with the question. For example, if the answer is “a tax on imports,” then the correct question is “What is a tariff?”

- The term used to describe an equilibrium that arises in the presence of market imperfections and distortions.

- The term used to describe a policy action that can raise economic efficiency to the greatest extent possible.

- The names of the economists who first formalized the theory of the second best.

- The term used to describe an equilibrium that arises in the absence of market imperfections and distortions.

- The term used to describe a policy action whose best effect is inferior to another policy option.

9.4 Unemployment and Trade Policy

Learning Objectives

- Understand that unemployment of workers in a labor market is a type of market imperfection since supply of labor does not equal demand.

- Recognize that a trade policy can be used to correct for an unemployment imperfection.

- Learn the first-best and second-best policy options to correct for an unemployment imperfection in an import market.

Consider a small perfectly competitive economy. Suppose this economy has a market imperfection in the form of relatively immobile factors of production across industries. We will imagine that the labor force develops sector-specific skills as the time of employment in an industry increases. Thus if a worker works in an industry—say, the textile industry—for a long period of time, her productivity in textile production rises relative to nontextile workers who might begin employment in the textile industry. Similarly, other workers become more productive in their own industries relative to a textile worker who might begin employment in another industry.

These assumptions imply that although workers might be free to move across sectors of the economy, they might not be easily or costlessly transferred. Workers in one industry, accustomed to being paid a wage proportional to their productivity, might be unwilling to accept a lower wage in another industry even though the lower wage would reflect their productivity in that industry. A worker’s reluctance to transfer could lead to a long search time between jobs as the worker continues to look for an acceptable job at an acceptable wage.

During the search period, a variety of adjustment costs would be incurred by the unemployed worker and by the government. The worker would suffer the anxiety of searching for another job. His or her family would have to adjust to a reduced income, and previous savings accounts would be depleted. At the worst, assets such as cars or homes may be lost. The government would compensate for some of the reduced income by providing unemployment compensation. This compensation would be paid out of tax revenues and thus represents a cost to others in the economy.

In some instances, the productivity of transferred workers could be raised by incurring training costs. These costs might be borne by the individual worker, as when the individual enrolls in a vocational training school. The costs might also be borne by an employer who hires initially low-productivity workers but trains them to raise their skills and productivity in the new industry.

In any case, the economy is assumed to have an unemployment imperfection that arises whenever resources must be transferred across industries. In every other respect, assume the economy is a small open economy with perfectly competitive markets and no other distortions or imperfections.

In the standard case of a small perfectly competitive economy, the optimal trade policy is free trade. Any tariff or quota on imports, although beneficial to the import-competing industry, will reduce aggregate efficiency—that is, the aggregate losses will exceed the aggregate benefits.

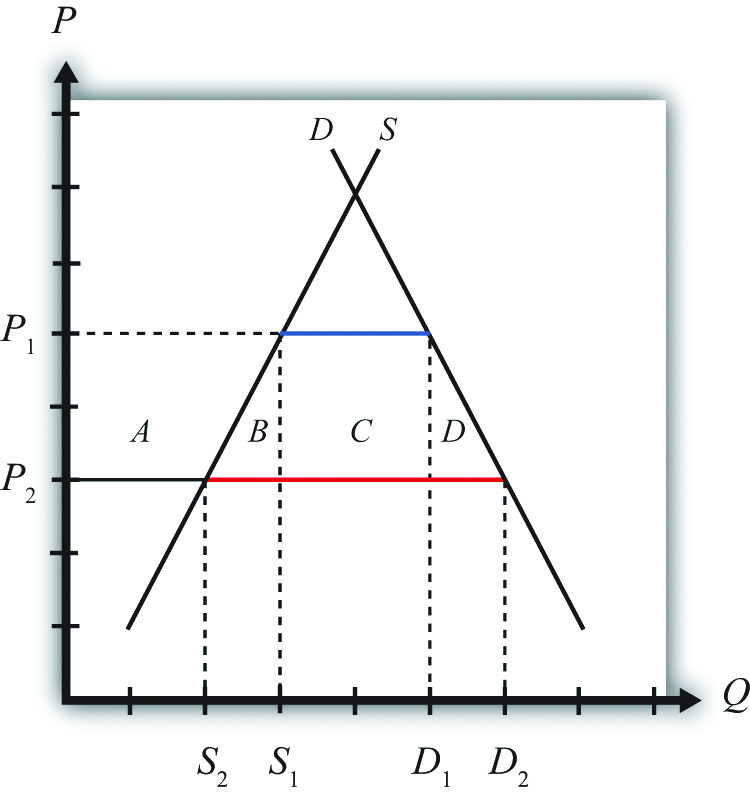

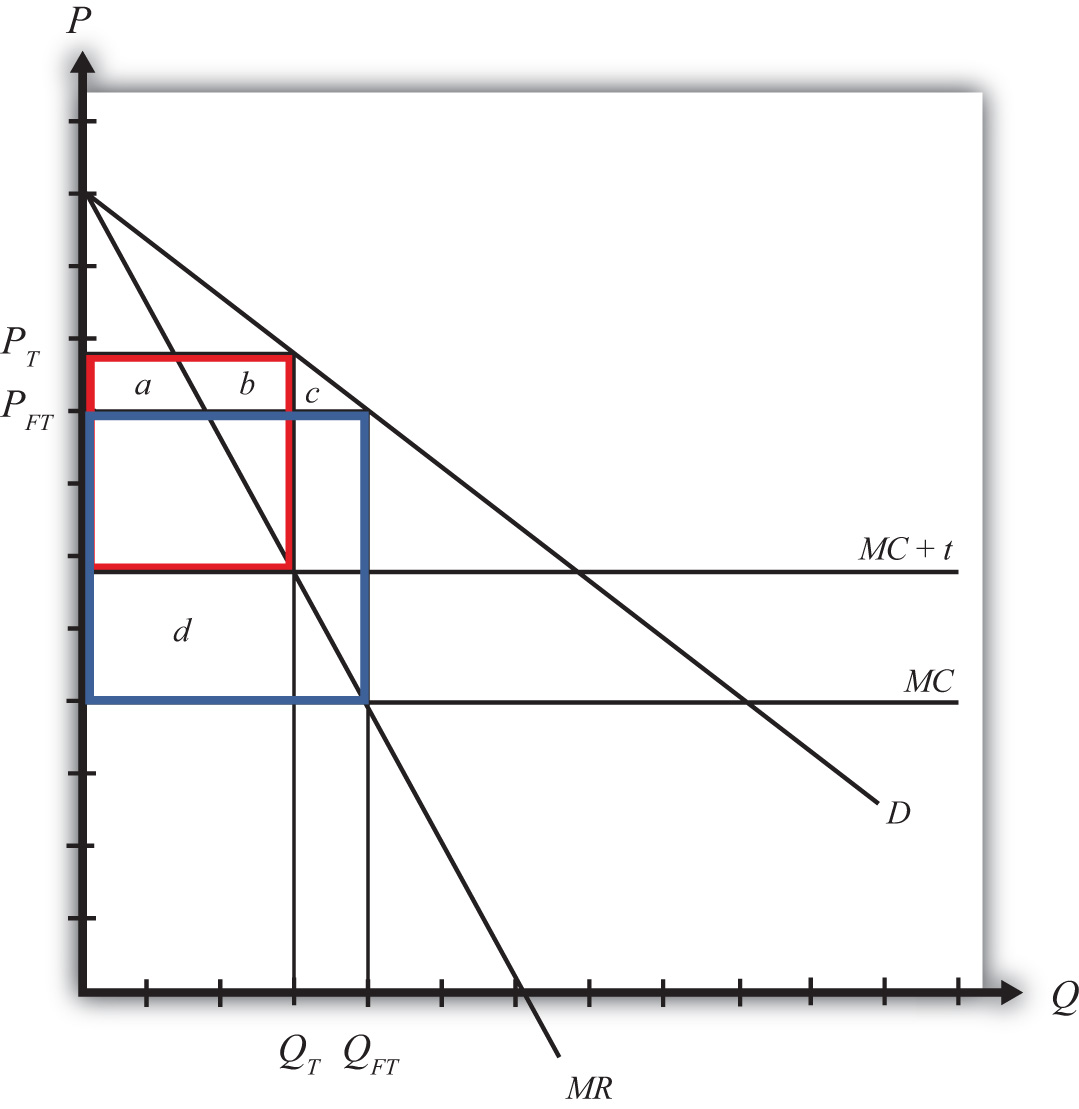

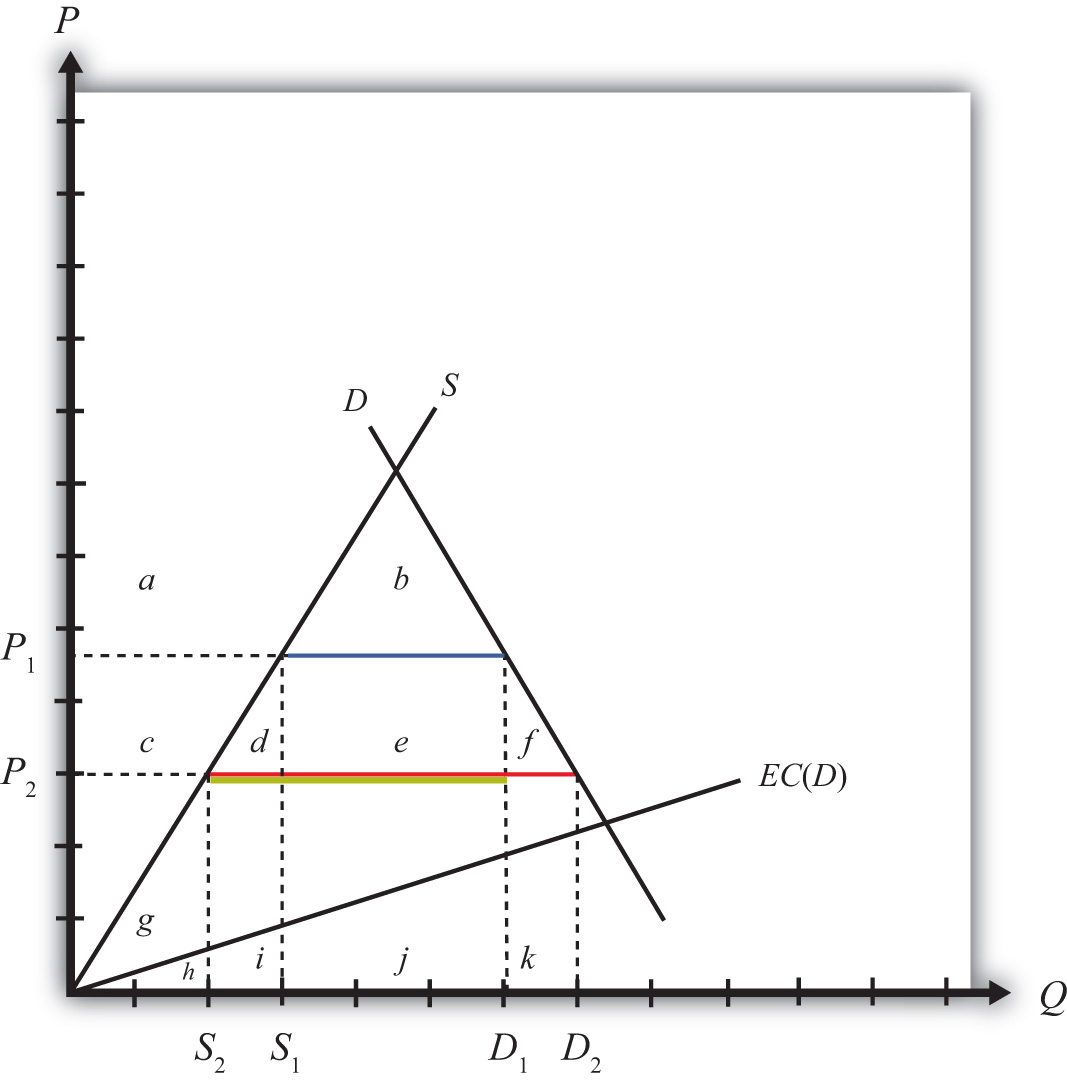

Imagine, however, that the economy initially has full employment of labor but that it has the unemployment imperfection described above. Suppose that initially the free trade price of textiles is given by P1 in Figure 9.1 "Unemployment in a Small Country Import Market". At that price, demand is given by D1, supply by S1, and imports by D1 − S1 (the blue line segment).

Figure 9.1 Unemployment in a Small Country Import Market

Suppose that international market conditions suddenly change such that a surge of imports begins in the textile industry.

The surge can be represented by a reduction in the world price of the imported good from P1 to P2. This would occur if there is an increase in total world supply of textiles of sufficient size to reduce the world price of the good. Since this importing country is assumed to be small, it must take the world price as given.

Domestic import-competing textile firms, to maintain profitability, would adjust to the lower free trade price by reducing output; supply would fall from S1 to S2. The lower price would stimulate demand for the product, which would rise to D2. Thus imports would rise to D2 − S2 (the red line segment). The welfare effects of the lower world price are shown in Table 9.1 "Welfare Effects of a Lower Free Trade Price".

Table 9.1 Welfare Effects of a Lower Free Trade Price

| Importing Country | |

|---|---|

| Consumer Surplus | + (A + B + C + D) |

| Producer Surplus | − A |

| Unemployment Cost | − F |

| National Welfare | (B + C + D) − F |

Consumers benefit from the lower free trade price. Producers lose in terms of a reduction in producer surplus. However, the unemployment imperfection implies that there is an additional cost that is hidden in this analysis. For domestic firms to reduce output requires them to reduce variable costs of production, which will include layoffs of workers. This means that the adjustment to the new free trade equilibrium will cause unemployment and its associated costs. We’ll represent these unemployment or adjustment costs by the variable F. Note that these costs do not appear in Figure 9.1 "Unemployment in a Small Country Import Market".

The national welfare effects of the import surge depend on how high the unemployment costs (F) are compared to the aggregate benefits (B + C + D). Thus the national welfare effect could be positive or negative.

Effects of an Import Tariff

It is possible to eliminate the costs of unemployment by applying a tariff on imports of textiles. Suppose in response to the sudden drop in the free trade price, the government responds by implementing a tariff equal to P1 − P2. In this case, the domestic price would rise by the amount of the tariff. Instead of facing the new world price P2, the domestic country will face the original price P1. The tariff would eliminate the unemployment in the industry by keeping the domestic price at the original level. Domestic supply would remain at S1 and employment would also remain at its original level.

However, implementing the tariff will also impose other costs on the economy. Table 9.2 "Welfare Effects of an Import Tariff" provides a summary of the direction and magnitude of the welfare effects to producers, consumers, and the government in the importing country. These effects are calculated relative to the economic situation after the surge of imports occurs. The aggregate national welfare effects are also shown.

Table 9.2 Welfare Effects of an Import Tariff

| Importing Country | |

|---|---|

| Consumer Surplus | − (A + B + C + D) |

| Producer Surplus | + A |

| Govt. Revenue | + C |

| Unemployment Cost | + F |

| National Welfare | F − (B + D) |

Tariff effects on the importing country’s consumers. Consumers of the product in the importing country suffer a reduction in well-being as a result of the tariff. The increase in the domestic price of both imported goods and the domestic substitutes reduces the amount of consumer surplus in the market. Refer to Table 9.2 "Welfare Effects of an Import Tariff" and Figure 9.1 "Unemployment in a Small Country Import Market" to see how the magnitude of the change in consumer surplus is represented.

Tariff effects on the importing country’s producers. Producers in the importing country experience an increase in well-being as a result of the tariff. The increase in the price of their product on the domestic market increases producer surplus in the industry. Refer to Table 9.2 "Welfare Effects of an Import Tariff" and Figure 9.1 "Unemployment in a Small Country Import Market" to see how the magnitude of the change in producer surplus is represented.

Tariff effects on the importing country’s government. The government receives tariff revenue as a result of the tariff. Who benefits from the revenue depends on how the government spends it. Typically, the revenue is simply included as part of the general funds collected by the government from various sources. In this case, it is impossible to identify precisely who benefits. However, these funds help support many government spending programs that presumably either help most people in the country, as is the case with public goods, or target certain worthy groups. Thus someone within the country is the likely recipient of these benefits. Refer to Table 9.2 "Welfare Effects of an Import Tariff" and Figure 9.1 "Unemployment in a Small Country Import Market" to see how the magnitude of the tariff revenue is represented.

Unemployment Costs

The tariff eliminates the unemployment or adjustment costs that would have been incurred in the absence of protection. Hence welfare rises by the amount F.

The aggregate welfare effect for the importing country is found by summing the gains and losses to consumers, producers, the government, and the potentially unemployed workers. The net effect consists of three components: a positive effect on workers who are saved from the negative effects of unemployment (F), a negative production distortion (B), and a negative consumption distortion (D).

Whether the country benefits from protection in the presence of an unemployment imperfection depends on how the cost of unemployment compares with the standard aggregate welfare cost of protection. If the aggregate costs of unemployment (F) that would arise in the absence of a tariff exceed the deadweight costs of the tariff (i.e., B + D), then national welfare would rise when the tariff is implemented. The tariff would eliminate the adjustment costs of unemployment while imposing other lower costs on consumers who would lose the benefit of lower prices.

With a more completely specified model, one could determine the optimal level of protection in these circumstances. It is not necessarily true that the optimal tariff will be the tariff that maintains the price at the original level. Instead, the optimal tariff will be achieved when the marginal cost of raising it further is just equal to the marginal benefit of the reduction in unemployment costs. This may be lower than the level set in the example above.

Objections to Protection

Of course, it is also conceivable that the aggregate costs of the tariff (B + D) exceed the aggregate adjustment costs (F) incurred by those who would become unemployed. In this case, the optimal tariff would remain zero and it would be best for the country to allow the adjustment to proceed. Thus the mere presence of unemployment is not sufficient evidence to justify the use of protection.

Also, even if protection is beneficial in the aggregate, it is important to remember that protection generates a redistribution of income. A tariff will force consumers to pay higher prices than they would have to pay in free trade. The extra costs to consumers are essentially being transferred to the firms and workers in the import-competing industry and to the government in the form of tariff revenue.

Finally, one could object to protection by noting that the benefit of protection—that is, eliminating unemployment—represents the permanent avoidance of temporary costs. If free trade were maintained in the face of the import surge, unemployment and its associated costs would be incurred, but these costs are likely to be temporary. Eventually workers will find alternative employment opportunities in other industries and the adjustment costs will dissipate. However, the benefits of free trade in the form of lower prices for consumers would be permanent benefits. Lower prices would presumably prevail period after period into the future. This means that even if the one-period benefits of eliminating unemployment exceed the one-period costs of protection, this may not hold if evaluated over multiple periods.

First-Best versus Second-Best Policies

Another objection to the use of a tariff to eliminate the cost of unemployment is that a tariff will be a second-best policy to correct the unemployment imperfection. The first-best policy would be a policy targeted more directly at the source of the market imperfection—in this case, the unemployment. Many such policies would be superior to a tariff. One easy-to-analyze policy is a production subsidy. A production subsidy means that the government would make payments, say, per unit of output produced by the domestic firms.

Begin with the same surge of imports described in Figure 9.1 "Unemployment in a Small Country Import Market" in the import market and with the same welfare costs and benefits. This time, however, suppose that the government offers a production subsidy sufficient to raise output in the domestic industry back to the original level. Recall that a production subsidy will raise the producer’s price by the amount of the subsidy for a small country and will maintain the consumer price at its original level. A specific production subsidy “s” set equal to the difference P1 − P2 would cause the producer price to rise to P1 while the consumer price would remain at P2. The higher producer price will induce domestic firms to raise their supply back to the original level of S1, but the constant consumer price will keep domestic demand at D2.

Table 9.3 "Welfare Effects of a Production Subsidy" provides a summary of the direction and magnitude of the welfare effects to producers, consumers, and the government in the importing country as a result of the production subsidy. These effects are calculated relative to the economic situation after the surge of imports occurs. The aggregate national welfare effects are also shown.

Table 9.3 Welfare Effects of a Production Subsidy

| Importing Country | |

|---|---|

| Consumer Surplus | 0 |

| Producer Surplus | + A |

| Govt. Revenue | − (A + B) |

| Unemployment Cost | + F |

| National Welfare | F − B |

Production subsidy effects on the importing country’s consumers. Consumers of the product in the importing country are unaffected by the subsidy since there is no change in the domestic price of the good.

Production subsidy effects on the importing country’s producers. Producers in the importing country experience an increase in well-being as a result of the tariff. Although they receive the same free trade price in the market as before, they now also receive the per-unit subsidy payment from the government. That means that their surplus is measured off of the original supply curve. Refer to Table 9.3 "Welfare Effects of a Production Subsidy" and Figure 9.1 "Unemployment in a Small Country Import Market" to see how the magnitude of the change in producer surplus is represented.

Production subsidy effects on the importing country’s government. The government must pay the per-unit production subsidy. The per-unit subsidy rate is given as the price difference (P1 − P2), while the quantity of domestic production is given by S1. The product of these two terms gives the value of the subsidy payments made by the government. Who loses from the subsidy payments depends on where the tax revenue is collected. Generally, it is impossible to identify precisely which taxpayers lose. Refer to Table 9.3 "Welfare Effects of a Production Subsidy" and Figure 9.1 "Unemployment in a Small Country Import Market" to see how the magnitude of the subsidy payments is represented.

Unemployment Costs

The subsidy eliminates the unemployment or adjustment costs that would have been incurred in the absence of the subsidy. Hence welfare rises by the amount F.

The aggregate welfare effect for the importing country is found by summing the gains and losses to consumers, producers, the government, and the potentially unemployed workers. The net effect consists of two components: a positive effect on workers who are saved from the negative effects of unemployment (F) and a negative production distortion (B).

Whether the country benefits from a production subsidy in the presence of an unemployment imperfection depends on how the cost of unemployment compares with the standard aggregate welfare cost of protection. If the aggregate costs of unemployment (F) that would arise in the absence of a tariff exceed the production efficiency losses of the subsidy (i.e., B), then national welfare would rise when the production subsidy is implemented. The production subsidy would eliminate the adjustment costs of unemployment but would cost the taxpayer extra money to finance the subsidy.

However, the key difference is the comparison of the production subsidy with the import tariff. Both policy actions could generate an improvement in national welfare, but the production subsidy would raise national welfare by more than the import tariff. In Figure 9.1 "Unemployment in a Small Country Import Market", it can be seen that F − B > F − B − D. For this reason, we might refer to the production subsidy as a first-best policy, while the import tariff is second best.

The production subsidy is superior because it corrects the imperfection more directly. By targeting production, the production subsidy creates a production distortion (B) but eliminates an unemployment imperfection. The tariff, on the other hand, creates a production and consumption distortion (B + D) to eliminate the same unemployment imperfection. Generally, it is preferable to introduce as few other distortions as possible in designing a policy to correct another.

This example shows how a production subsidy is superior to a tariff. However, in the case of an unemployment imperfection, there are likely to be policies superior to the production subsidy. It would seem that some policies would target the imperfection even more directly.

For example, the government could use a labor employment subsidy if the primary problem were the potential unemployment of labor. In this case, the government would make a payment to firms for each worker hired. If set at the correct level, the subsidy could eliminate the negative effects caused by unemployment. However, since firms would remain free to substitute labor for other inputs, industry production levels might not be the same as with a production subsidy. Firms’ freedom to adjust output could further reduce the cost of the additional distortion.

A labor employment subsidy, however, would not solve the problem of long-term adjustment. As mentioned, the cost associated with unemployment is likely to be temporary, while the cost of eliminating the unemployment with a subsidy would require a permanent taxpayer cost. Thus an even more superior policy would probably be one that is targeted even more directly at the source of the problem. Recall that the problem is in the adjustment process. Superior policies might be those that facilitate the adjustment of labor resources across industries.

In a sense, this is the purpose behind policies like trade adjustment assistance (TAA). TAA was originally implemented in the 1962 U.S. Trade Act. It provides for the extension of unemployment compensation, loans, and grants for technical retraining and other types of support programs for workers who are displaced as a result of trade liberalization. If TAA is designed and implemented in a cost-efficient manner, it could be first among the contenders for a first-best policy to correct an unemployment imperfection.

Key Takeaways

- An import tariff that reduces unemployment costs sufficiently can raise national welfare, even for a small importing country.

- An import tariff is a second-best policy to correct for an unemployment imperfection after an import surge.

- A production subsidy is superior to an import tariff as a policy to correct for an unemployment imperfection after an import surge.

- A production subsidy might be classified as first best in this situation, except that even more targeted policies, like worker retraining, could be superior.

- In the presence of an unemployment imperfection after an import surge, a domestic policy is first best, while the best trade policy is second best.

Exercises

-

Consider the following imperfect market situations in the table below. From the following list of policy options, identify all types of trade policies and all types of domestic policies that could potentially raise national welfare in the presence of each imperfection. Consider only the partial equilibrium effects of each policy.

Options: An import tariff, an import quota, a voluntary export restraint (VER), an export tax, an export subsidy, a production tax, a production subsidy, a consumption tax, and a consumption subsidy.

Table 9.4 Welfare Improving Policies

Trade Policy Domestic Policy 1. Unemployment in a small import-competing industry suffering from a surge of imports 2. A small country in which an export decline causes unemployment -

Consider the policy actions listed along the top row of the table below. In the empty boxes, use the following notation to indicate the effect of each policy on the variables listed in the first column. Use a partial equilibrium model to determine the answers and assume that the shapes of the supply and demand curves are “normal.” Assume that none of the policies begin with, or result in, prohibitive policies. Use the following notation:

+ the variable increases

– the variable decreases

0 the variable does not change

A the variable change is ambiguous (i.e., it may rise, it may fall)

Table 9.5 Effects of Policies to Alleviate Unemployment

Import Tariff by a Small Country with Unemployment Production Subsidy by a Small Country with Unemployment Domestic Consumer Price Domestic Producer Price Domestic Industry Employment Unemployment Welfare Effect Domestic Consumer Welfare Domestic Producer Welfare Domestic Government Revenue Domestic National Welfare

9.5 The Infant Industry Argument and Dynamic Comparative Advantage

Learning Objectives

- Learn that the infant industry argument presumes a market imperfection—the presence of a positive production externality.

- Recognize that a trade policy can be used to correct for an infant industry production externality imperfection.

- Learn the first-best and second-best policy options to correct for an infant industry production externality imperfection.

- Learn the practical implementation problems that can arise when governments attempt to apply infant industry protection.

One of the most notable arguments for protection is known as the infant industryAn industry, most often in a developing country, that cannot compete in international markets in free trade but that, if given time to learn and develop, could be world-class efficient. argument. The argument claims that protection is warranted for small new firms, especially in less-developed countries. New firms have little chance of competing head-to-head with the established firms located in the developed countries. Developed country firms have been in business longer and over time have been able to improve their efficiency in production. They have better information and knowledge about the production process, about market characteristics, about their own labor market, and so on. As a result, they are able to offer their product at a lower price in international markets and still remain profitable.

A firm producing a similar product in a less-developed country (LDC), on the other hand, would not have the same production technology available to it. Its workers and management would lack the experience and knowledge of its developed country rivals and thus would most likely produce the product less efficiently. If forced to compete directly with the firms in the developed countries, the LDC firms would be unable to produce profitably and thus could not remain in business.

Protection of these LDC firms, perhaps in the form of an import tariff, would raise the domestic price of the product and reduce imports from the rest of the world. If prices are raised sufficiently, the domestic firms would be able to cover their higher production costs and remain in business. Over time, these LDC firms would gain production and management experience that would lower their production costs. Essentially, the firms would follow the same path that the developed country firms had followed to realize their own production efficiency improvements. Protection, then, allows an infant industry time to “grow up.”

Furthermore, since the LDC firms would improve their productive efficiency over time, the protective tariffs could be gradually reduced until eventually, when the tariffs are eliminated, they would compete on an equal footing with the developed country firms.

Many people have argued that this was precisely the industrial development strategy that was pursued by countries like the United States and Germany during their rapid industrial development before the turn of the twentieth century. Both the United States and Germany had high tariffs during their industrial revolution periods. These tariffs helped protect fledgling industries from competition with more-efficient firms in Britain and may have been the necessary requirement to stimulate economic growth.

One counterargument to this theory is that by protecting infant industries, countries are not allocating resources in the short run on the basis of comparative advantage. The Ricardian and Heckscher-Ohlin models of trade show that resources will be allocated most efficiently if countries produce goods whose before-trade prices are lower than those in the rest of the world. This implies that the United States and Germany should have simply imported the cheaper industrial goods from Britain and shifted their own resources to other goods in which they had a comparative advantage if they wished to maximize economic efficiency.

The reason for the discrepancy in policy prescriptions can easily be seen by noting the difference between static comparative advantage and dynamic comparative advantage. The traditional Ricardian theory of comparative advantage identifies the most efficient allocation of resources at one point in time. In this sense, it is a static theory. The policy prescription is based on a snapshot in time.

On the other hand, the infant industry argument is based on a dynamic theory of comparative advantage. In this theory, one asks what is best for a country (i.e., what is most efficient) in the long run. The most efficient long-run strategy may well be different from what is best initially. Here’s why.

The problem faced by many LDCs is that their static comparative advantage goods, in most instances, happen to be agricultural commodities and natural resources. Reliance on production of these two types of goods can be problematic for LDCs. First of all, the prices of agricultural commodities and natural resources have historically been extremely volatile. In some years prices are very high, and in other years the prices are very low. If a country allocates many of its resources to production of goods with volatile prices, then the gross domestic product (GDP) will fluctuate along with the prices. Some years will be very good, and others will be very bad. Although a wealthier country may be able to smooth income by effectively using insurance programs, a poor country might face severe problems, perhaps as severe as famine, in years when the prices of their comparative advantage goods are depressed.

In addition, many people argue that the management and organizational skills necessary to produce agricultural goods and natural resources are not the same as the skills and knowledge needed to build an industrial economy. If true, then concentrating production in one’s static comparative advantage goods would prevent the development of an industrial economy. Thus one of the reasons for protecting an infant industry is to stimulate the learning effects that will improve productive efficiency. Furthermore, these learning effects might spill over into the rest of the economy as managers and workers open new businesses or move to other industries in the economy. To the extent that there are positive spillovers or externalities in production, firms are unlikely to take account of these in their original decisions. Thus, if left alone, firms might produce too little of these types of goods and economic development would proceed less rapidly, if at all.

The solution suggested by the infant industry argument is to protect the domestic industries from foreign competition in order to generate positive learning and spillover effects. Protection would stimulate domestic production and encourage more of these positive effects. As efficiency improves and other industries develop, economic growth is stimulated. Thus by protecting infant industries a government might facilitate more rapid economic growth and a much faster improvement in the country’s standard of living relative to specialization in the country’s static comparative advantage goods.

An Analytical Example

Consider the market for a manufactured good such as textiles in a small, less-developed country.

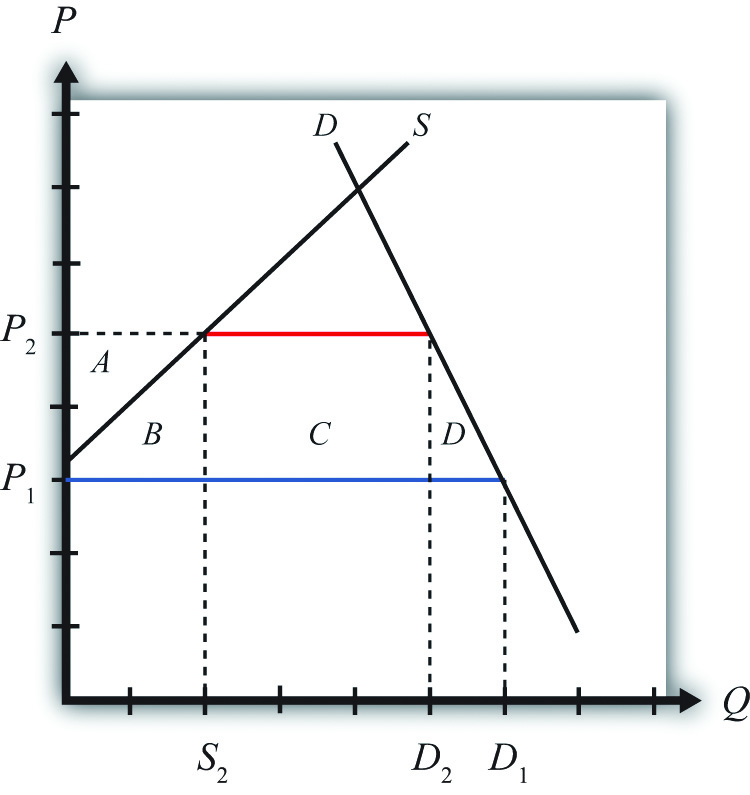

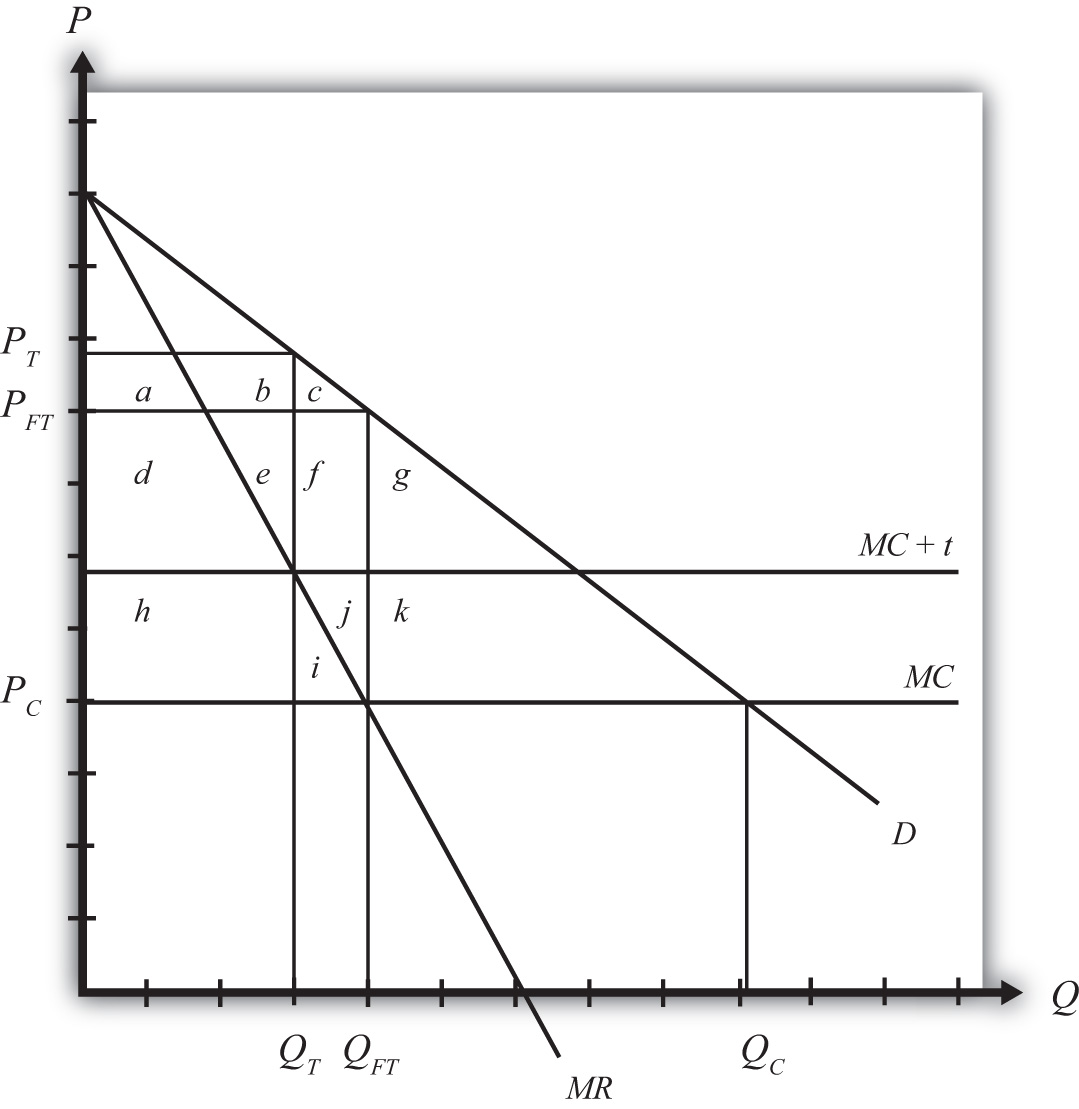

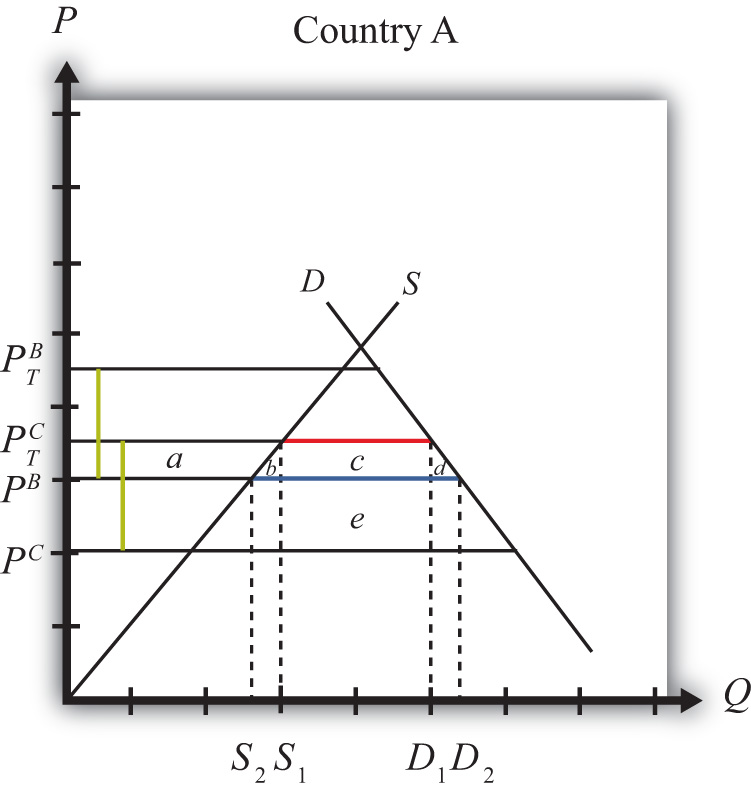

Suppose that the supply and demand curves in the country are as shown in Figure 9.2 "An Infant Industry in a Small Importing Country". Suppose initially free trade prevails and the world price of the good is P1. At that price, consumers would demand D1, but the domestic supply curve is too high to warrant any production. This is the case, then, where domestic producers simply could not produce the product cheaply enough to compete with firms in the rest of the world. Thus the free trade level of imports would be given by the blue line segment, which is equal to domestic demand, D1.

Figure 9.2 An Infant Industry in a Small Importing Country

Suppose that the infant industry argument is used to justify protection for this currently nonexistent domestic industry. Let a specific tariff be implemented that raises the domestic price to P2. In this case, the tariff would equal the difference between P2 and P1—that is, t = P2 − P1. Notice that the increase in domestic price is sufficient to stimulate domestic production of S2. Demand would fall to D2 and imports would fall to D2 − S2 (the red line segment).

The static (i.e., one-period) welfare effects of the import tariff are shown in Table 9.6 "Static Welfare Effects of a Tariff".

Table 9.6 Static Welfare Effects of a Tariff

| Importing Country | |

|---|---|

| Consumer Surplus | − (A + B + C + D) |

| Producer Surplus | + A |

| Govt. Revenue | + C |

| National Welfare | − B − D |

Consumers of textiles are harmed because of the higher domestic price of the good. Producers gain in terms of producer surplus. In addition, employment is created in an industry that did not even exist before the tariff. Finally, the government earns tariff revenue, which benefits some other segment of the population.

The net national welfare effect of the import tariff is negative. Although some segments of the population benefit, two deadweight losses to the economy remain. Area B represents a production efficiency loss, while area D represents a consumption efficiency loss.

Dynamic Effects of Infant Industry Protection

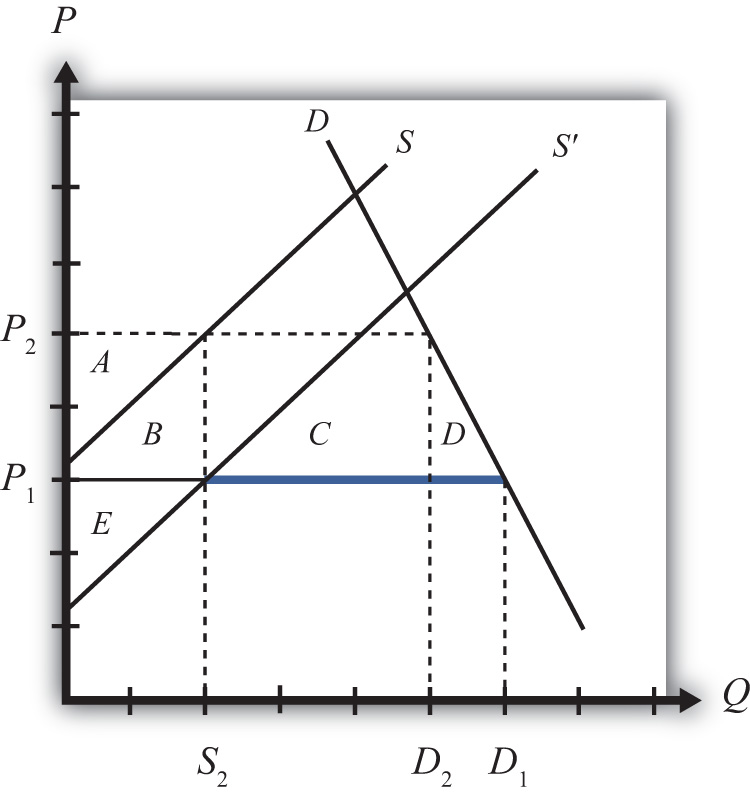

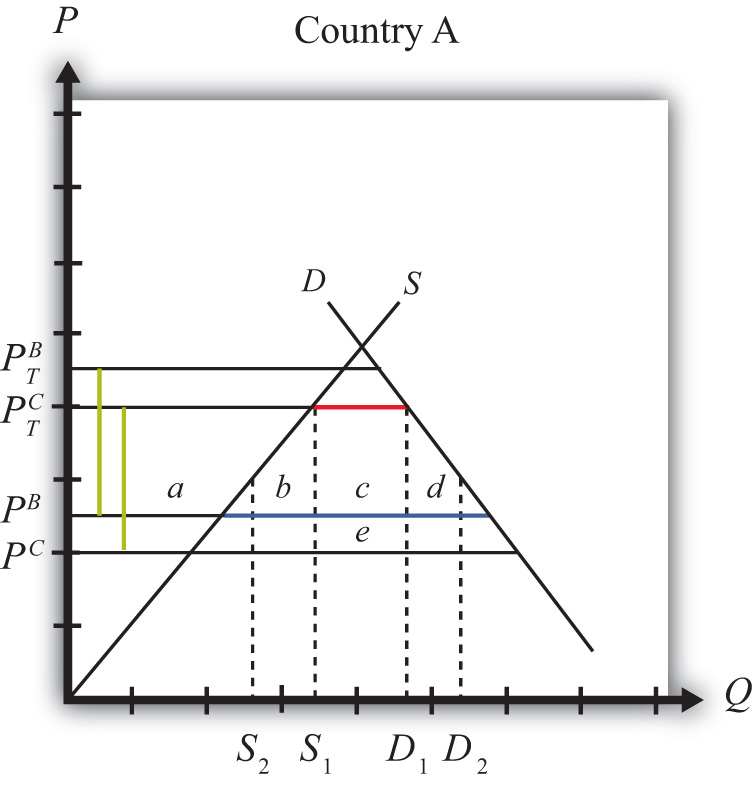

Now suppose that the infant industry argument is valid and that by stimulating domestic production with a temporary import tariff, the domestic industry improves its own productive efficiency. We can represent this as a downward shift in the domestic industry supply curve. In actuality, this shift would probably occur gradually over time as the learning effects are incorporated in the production process. For analytical simplicity, we will assume that the effect occurs as follows. First, imagine that the domestic industry enjoys one period of protection in the form of a tariff. In the second period, we will assume that the tariff is removed entirely but that the industry experiences an instantaneous improvement in efficiency such that it can maintain production at its period one level but at the original free trade price. This efficiency improvement is shown as a supply curve shift from S to S′ in Figure 9.3 "Efficiency Improvement in a Small Importing Country".

Figure 9.3 Efficiency Improvement in a Small Importing Country

This means that in the second period, free trade again prevails. The domestic price returns to the free trade price of P1, while domestic demand rises to D1. Because of the efficiency improvement, domestic supply in free trade is given by S2 and the level of imports is D1 − S2 (the blue segment).

The static (one-period) welfare effects of the tariff removal and efficiency improvement are summarized in Table 9.7 "Static Welfare Effects of Tariff Removal and Efficiency Improvement". Note that these effects are calculated relative to the original equilibrium before the original tariff was implemented. We do this because we want to identify the welfare effects in each period relative to what would have occurred had the infant industry protection not been provided.

Table 9.7 Static Welfare Effects of Tariff Removal and Efficiency Improvement

| Importing Country | |

|---|---|

| Consumer Surplus | 0 |

| Producer Surplus | + E |

| Govt. Revenue | 0 |

| National Welfare | + E |

Consumers again face the same free trade price that they would have faced if no protection had been offered. Thus they experience no loss or gain. Producers, however, face a new supply curve that generates a producer surplus of + E at the original free trade price. The government tariff is removed, so the government receives no tariff revenue. The net national welfare effect for the second period then is simply the gain in producer surplus.

The overall welfare impact over the two periods relative to no infant industry protection over two periods is simply the sum of each period’s welfare effects. This corresponds to the sum of areas (+ E − B − D), which could be positive or negative. If the second-period producer surplus gain exceeds the first-period deadweight losses, then the protection has a positive two-period effect on national welfare.

But wait. Presumably the efficiency improvement in the domestic industry would remain, if not improve, in all subsequent periods as well. Thus it is not complete to consider the effects only over two periods. Instead, and for simplicity again, suppose that the new supply curve prevails in all subsequent periods. In this case, the true dynamic national welfare effects would consist of area E multiplied by the number of future periods we wish to consider minus the one-period deadweight losses. Thus even if the costs of the tariff are not made up in the second period, they may well be made up eventually at some point in the future. This would make it even more likely that the temporary protection would be beneficial in the long run.

If, in addition to the direct efficiency effects within the industry, there are spillover efficiency effects on other industries within the domestic economy, then the likelihood that temporary protection is beneficial is enhanced even further. In other words, over time, workers and managers from the protected industries may establish firms or take jobs in other sectors of the economy. Since they will bring their newly learned skills with them, it will cause an improvement in productive efficiency in those sectors as well. In this way, the supply of many manufacturing industries will be increased, allowing these sectors to compete more easily with firms in the rest of the world. Industrialization and GDP growth then is stimulated by the initial protection of domestic industries.

In summary, we have shown the possibility that protection of an infant industry may be beneficial for an economy. At the heart of the argument is the assumption that production experience generates efficiency improvements either directly in the protected industry or indirectly in other industries as a learning spillover ensues. The infant industry argument relies on a dynamic view of the world rather than the static description used in classical trade models. Although protection may be detrimental to national welfare in the short run, it is conceivable that the positive dynamic long-run effects will more than outweigh the short-run (or static) effects.

The Economic Argument against Infant Industry Protection

The main economic argument against infant industry protection is that protection is likely to be a second-best policy choice rather than a first-best policy choice. The key element of the infant industry argument is the presence of a positive dynamic production externality. It is assumed that production experience causes learning, which improves future productive efficiency. Alternatively, it is assumed that these learning effects spill over into other industries and improve those industries’ future productive efficiencies as well.

The theory of the second best states that in the presence of a market distortion, such as a production externality, it is possible to conceive of a trade policy that can improve national welfare. However, in this case, the trade policy—namely, the import tariff—is not the first-best policy because it does not attack the distortion most directly. In this case, the more-efficient policy is a production subsidy targeted at the industries that generate the positive learning effects.

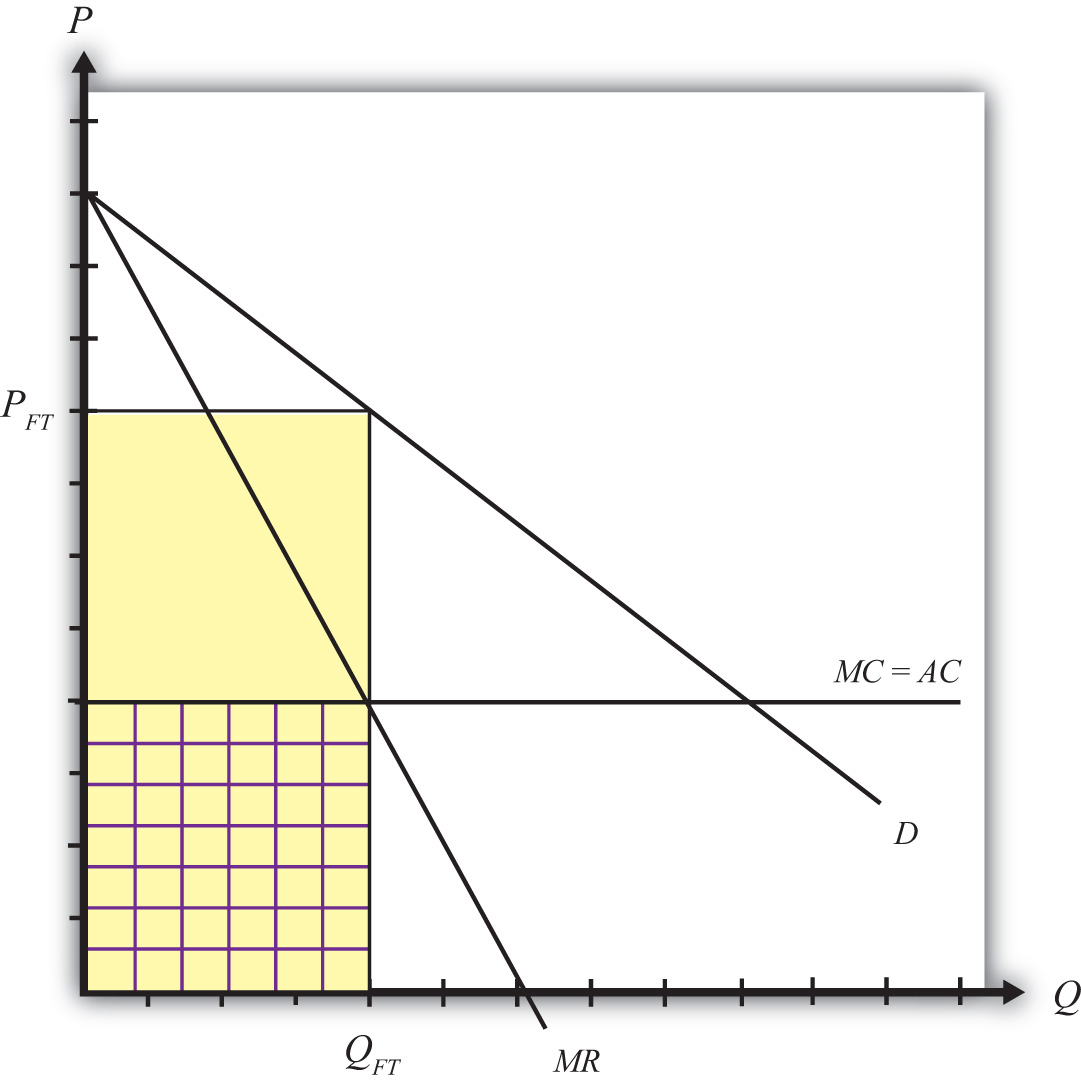

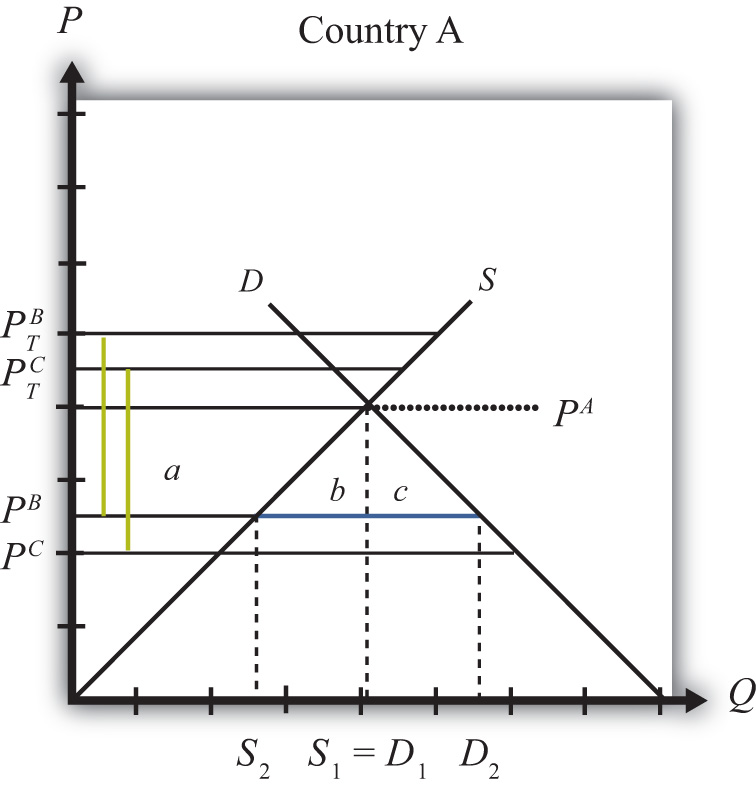

To demonstrate this result, consider the following analytical example. We will use the same supply and demand conditions as depicted in Figure 9.3 "Efficiency Improvement in a Small Importing Country". The domestic supply and demand curves are given by D and S, respectively. The initial free trade world price of the good is P1. At that price, consumers would demand D1, but the domestic supply curve is too high to warrant any production. Thus the level of imports is given by D1.