This is “The Heckscher-Ohlin (Factor Proportions) Model”, chapter 5 from the book Policy and Theory of International Economics (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 5 The Heckscher-Ohlin (Factor Proportions) Model

The Heckscher-Ohlin (H-O; aka the factor proportions) model is one of the most important models of international trade. It expands upon the Ricardian model largely by introducing a second factor of production. In its two-by-two-by-two variant, meaning two goods, two factors, and two countries, it represents one of the simplest general equilibrium models that allows for interactions across factor markets, goods markets, and national markets simultaneously.

These interactions across markets are one of the important economics lessons displayed in the results of this model. With the H-O model, we learn how changes in supply or demand in one market can feed their way through the factor markets and, with trade, the national markets and influence both goods and factor markets at home and abroad. In other words, all markets are everywhere interconnected.

Among the important results are that international trade can improve economic efficiency but that trade will also cause a redistribution of income between different factors of production. In other words, some will gain from trade, some will lose, but the net effects are still likely to be positive.

The end of the chapter discusses the specific factor model, which represents a cross between the H-O model and the immobile factor model. The implications for income distribution and trade are highlighted.

5.1 Chapter Overview

Learning Objectives

- Learn the basic assumptions of the Heckscher-Ohlin (H-O) model, especially factor intensity within industries and factor abundancy within countries.

- Identify the four major theorems in the H-O model.

The factor proportions model was originally developed by two Swedish economists, Eli Heckscher and his student Bertil Ohlin, in the 1920s. Many elaborations of the model were provided by Paul Samuelson after the 1930s, and thus sometimes the model is referred to as the Heckscher-Ohlin-Samuelson (HOS) model. In the 1950s and 1960s, some noteworthy extensions to the model were made by Jaroslav Vanek, and so occasionally the model is called the Heckscher-Ohlin-Vanek model. Here we will simply call all versions of the model either the Heckscher-Ohlin (H-O) model, or simply the more generic “factor proportions model.”

The H-O model incorporates a number of realistic characteristics of production that are left out of the simple Ricardian model. Recall that in the simple Ricardian model only one factor of production, labor, is needed to produce goods and services. The productivity of labor is assumed to vary across countries, which implies a difference in technology between nations. It was the difference in technology that motivated advantageous international trade in the model.

The standard H-O model begins by expanding the number of factors of production from one to two. The model assumes that labor and capital are used in the production of two final goods. Here, capital refers to the physical machines and equipment that are used in production. Thus machine tools, conveyers, trucks, forklifts, computers, office buildings, office supplies, and much more are considered capital.

All productive capital must be owned by someone. In a capitalist economy, most of the physical capital is owned by individuals and businesses. In a socialist economy, productive capital would be owned by the government. In most economies today, the government owns some of the productive capital, but private citizens and businesses own most of the capital. Any person who owns common stock issued by a business has an ownership share in that company and is entitled to dividends or income based on the profitability of the company. As such, that person is a capitalist—that is, an owner of capital.

The H-O model assumes private ownership of capital. Use of capital in production will generate income for the owner. We will refer to that income as capital “rents.” Thus, whereas the worker earns “wages” for his or her efforts in production, the capital owner earns rents.

The assumption of two productive factors, capital and labor, allows for the introduction of another realistic feature in production: differing factor proportions both across and within industries. When one considers a range of industries in a country, it is easy to convince oneself that the proportion of capital to labor applied in production varies considerably. For example, steel production generally involves large amounts of expensive machines and equipment spread over perhaps hundreds of acres of land, but it also uses relatively few workers. (Note that relative here means relative to other industries.) In the tomato industry, in contrast, harvesting requires hundreds of migrant workers to hand-pick and collect each fruit from the vine. The amount of machinery used in this process is relatively small.

In the H-O model, we define the ratio of the quantity of capital to the quantity of labor used in a production process as the capital-labor ratioThe ratio of the quantity of capital to the quantity of labor used in a production process.. We imagine, and therefore assume, that different industries producing different goods have different capital-labor ratios. It is this ratio (or proportion) of one factor to another that gives the model its generic name: the factor proportions model.

In a model in which each country produces two goods, an assumption must be made as to which industry has the larger capital-labor ratio. Thus if the two goods that a country can produce are steel and clothing and if steel production uses more capital per unit of labor than is used in clothing production, we would say the steel production is capital intensiveAn industry is capital intensive relative to another industry if it has a higher capital-labor ratio in the production process. relative to clothing production. Also, if steel production is capital intensive, then it implies that clothing production must be labor intensiveAn industry is labor intensive relative to another industry if it has a higher labor-capital ratio in the production process. relative to steel.

Another realistic characteristic of the world is that countries have different quantities—that is, endowments—of capital and labor available for use in the production process. Thus some countries like the United States are well endowed with physical capital relative to their labor force. In contrast, many less-developed countries have much less physical capital but are well endowed with large labor forces. We use the ratio of the aggregate endowment of capital to the aggregate endowment of labor to define relative factor abundancy between countries. Thus if, for example, the United States has a larger ratio of aggregate capital per unit of labor than France’s ratio, we would say that the United States is capital abundant relative to France. By implication, France would have a larger ratio of aggregate labor per unit of capital and thus France would be labor abundant relative to the United States.

The H-O model assumes that the only differences between countries are these variations in the relative endowments of factors of production. It is ultimately shown that (1) trade will occur, (2) trade will be nationally advantageous, and (3) trade will have characterizable effects on prices, wages, and rents when the nations differ in their relative factor endowments and when different industries use factors in different proportions.

It is worth emphasizing here a fundamental distinction between the H-O model and the Ricardian model. Whereas the Ricardian model assumes that production technologies differ between countries, the H-O model assumes that production technologies are the same. The reason for the identical technology assumption in the H-O model is perhaps not so much because it is believed that technologies are really the same, although a case can be made for that. Instead, the assumption is useful in that it enables us to see precisely how differences in resource endowments are sufficient to cause trade and it shows what impacts will arise entirely due to these differences.

The Main Results of the H-O Model

There are four main theorems in the H-O model: the Heckscher-Ohlin (H-O) theorem, the Stolper-Samuelson theorem, the Rybczynski theorem, and the factor-price equalization theorem. The Stolper-Samuelson and Rybczynski theorems describe relationships between variables in the model, while the H-O and factor-price equalization theorems present some of the key results of the model. The application of these theorems also allows us to derive some other important implications of the model. Let us begin with the H-O theorem.

The Heckscher-Ohlin Theorem

The H-O theorem predicts the pattern of trade between countries based on the characteristics of the countries. The H-O theorem says that a capital-abundant country will export the capital-intensive good, while the labor-abundant country will export the labor-intensive good.

Here’s why. A country that is capital abundantA country is capital abundant relative to another country if it has a higher capital endowment per labor endowment than the other country. is one that is well endowed with capital relative to the other country. This gives the country a propensity for producing the good that uses relatively more capital in the production process—that is, the capital-intensive good. As a result, if these two countries were not trading initially—that is, they were in autarky—the price of the capital-intensive good in the capital-abundant country would be bid down (due to its extra supply) relative to the price of the good in the other country. Similarly, in the country that is labor abundantA country is labor abundant relative to another country if it has a higher labor endowment per capital endowment than the other country., the price of the labor-intensive good would be bid down relative to the price of that good in the capital-abundant country.

Once trade is allowed, profit-seeking firms will move their products to the markets that temporarily have the higher price. Thus the capital-abundant country will export the capital-intensive good since the price will be temporarily higher in the other country. Likewise, the labor-abundant country will export the labor-intensive good. Trade flows will rise until the prices of both goods are equalized in the two markets.

The H-O theorem demonstrates that differences in resource endowments as defined by national abundancies are one reason that international trade may occur.

The Stolper-Samuelson Theorem

The Stolper-Samuelson theoremA theorem that specifies how changes in output prices affect factor prices in the H-O model. It states that an increase in the price of a good will cause an increase in the price of the factor used intensively in that industry and a decrease in the price of the other factor. describes the relationship between changes in output prices (or prices of goods) and changes in factor prices such as wages and rents within the context of the H-O model. The theorem was originally developed to illuminate the issue of how tariffs would affect the incomes of workers and capitalists (i.e., the distribution of income) within a country. However, the theorem is just as useful when applied to trade liberalization.

The theorem states that if the price of the capital-intensive good rises (for whatever reason), then the price of capital—the factor used intensively in that industry—will rise, while the wage rate paid to labor will fall. Thus, if the price of steel were to rise and if steel were capital intensive, the rental rate on capital would rise, while the wage rate would fall. Similarly, if the price of the labor-intensive good were to rise, then the wage rate would rise, while the rental rate would fall.

The theorem was later generalized by Ronald Jones, who constructed a magnification effect for prices in the context of the H-O model. The magnification effect allows for analysis of any change in the prices of both goods and provides information about the magnitude of the effects on wages and rents. Most importantly, the magnification effect allows one to analyze the effects of price changes on real wages and real rents earned by workers and capital owners. This is instructive since real returns indicate the purchasing power of wages and rents after accounting for price changes and thus are a better measure of well-being than the wage rate or rental rate alone.

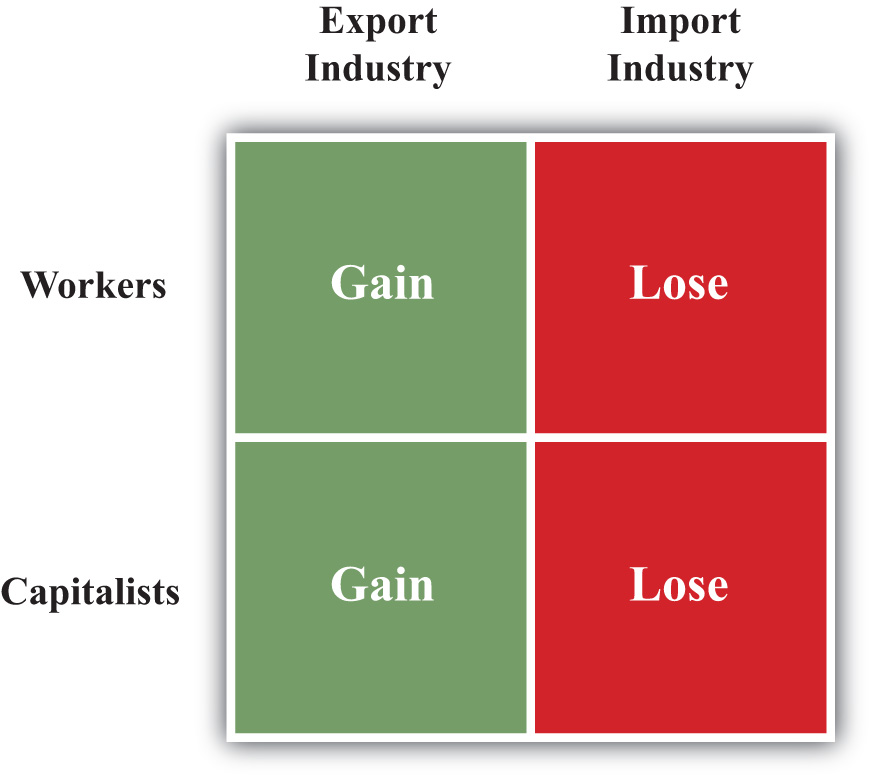

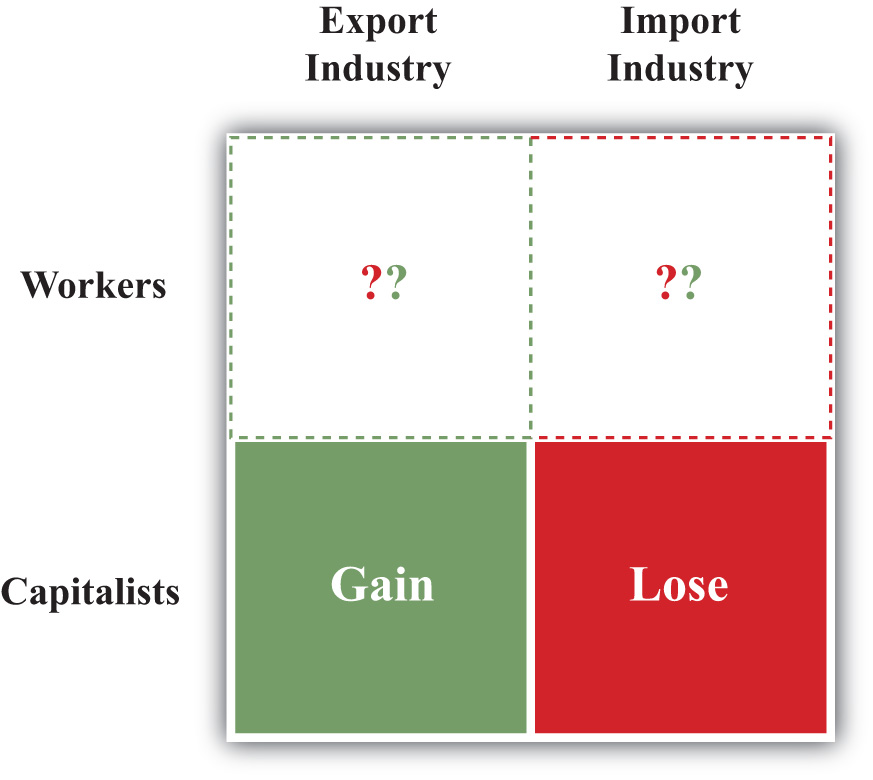

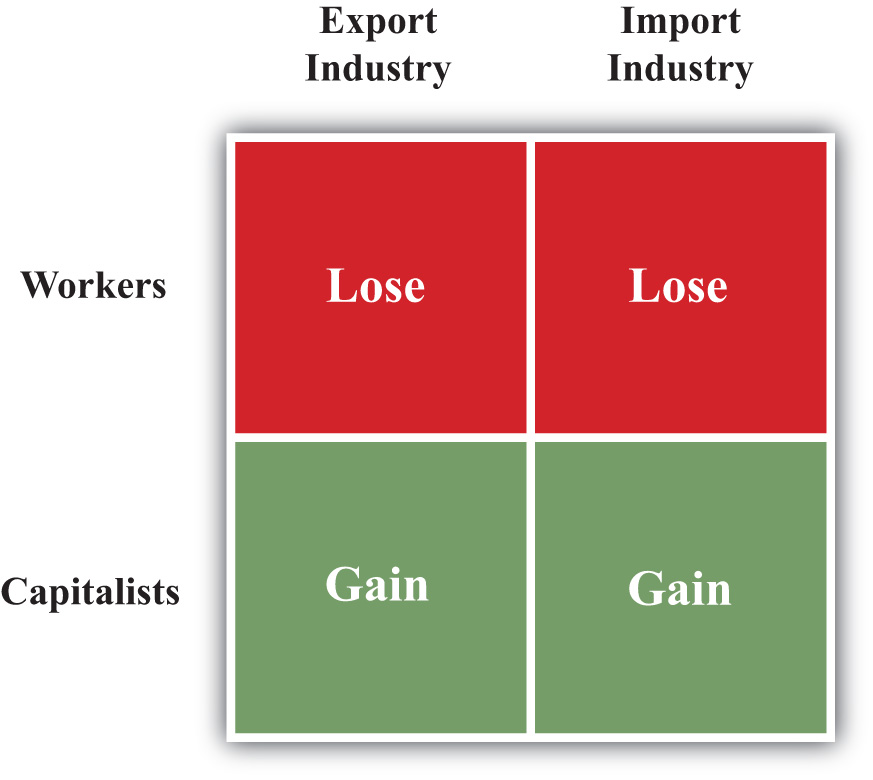

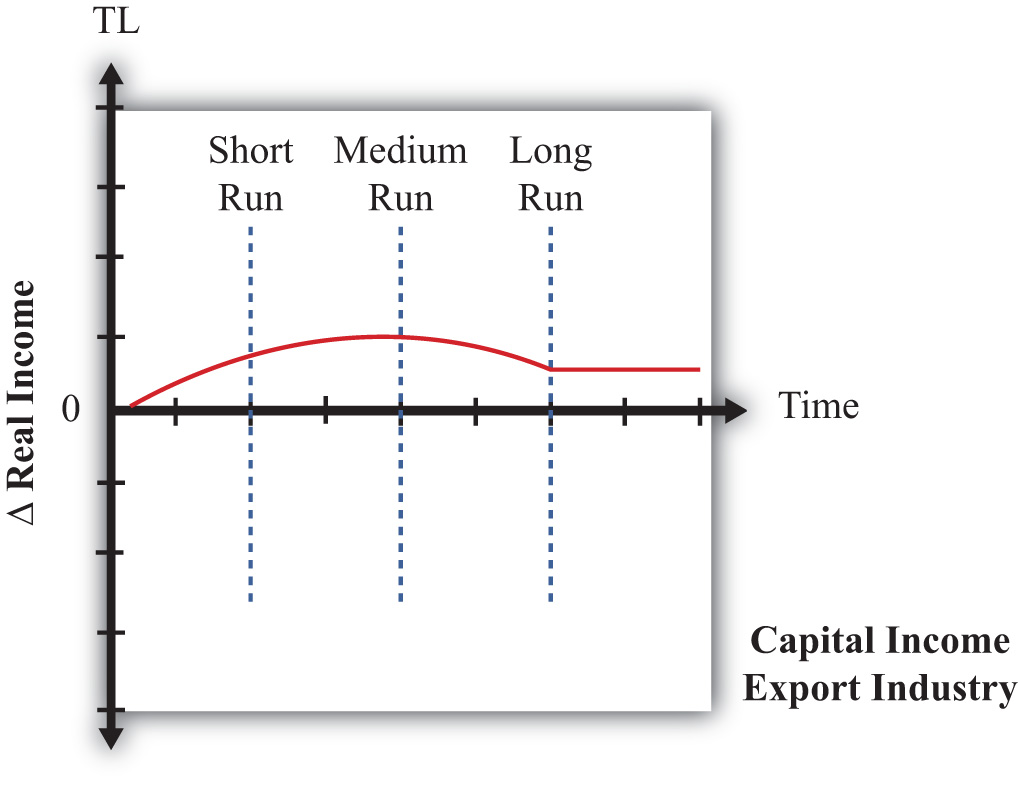

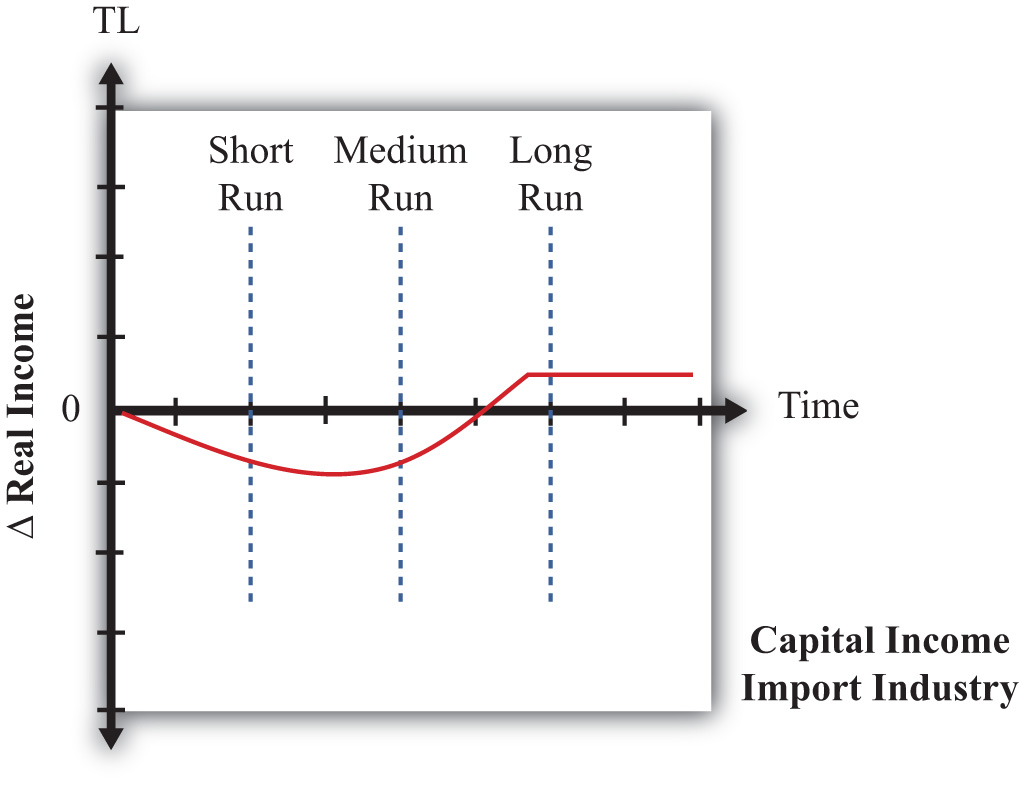

Since prices change in a country when trade liberalization occurs, the magnification effect can be applied to yield an interesting and important result. A movement to free trade will cause the real return of a country’s relatively abundant factor to rise, while the real return of the country’s relatively scarce factor will fall. Thus if the United States and France are two countries that move to free trade and if the United States is capital abundant (while France is labor abundant), then capital owners in the United States will experience an increase in the purchasing power of their rental income (i.e., they will gain), while workers will experience a decline in the purchasing power of their wage income (i.e., they will lose). Similarly, workers will gain in France, but capital owners will lose.

What’s more, the country’s abundant factor benefits regardless of the industry in which it is employed. Thus capital owners in the United States would benefit from trade even if their capital is used in the declining import-competing sector. Similarly, workers would lose in the United States even if they are employed in the expanding export sector.

The reasons for this result are somewhat complicated, but the gist can be given fairly easily. When a country moves to free trade, the price of its exported goods will rise, while the price of its imported goods will fall. The higher prices in the export industry will inspire profit-seeking firms to expand production. At the same time, the import-competing industry, suffering from falling prices, will want to reduce production to cut its losses. Thus capital and labor will be laid off in the import-competing sector but will be in demand in the expanding export sector. However, a problem arises in that the export sector is intensive in the country’s abundant factor—let’s say capital. This means that the export industry wants relatively more capital per worker than the ratio of factors that the import-competing industry is laying off. In the transition there will be an excess demand for capital, which will bid up its price, and an excess supply of labor, which will bid down its price. Hence, the capital owners in both industries experience an increase in their rents, while the workers in both industries experience a decline in their wages.

The Factor-Price Equalization Theorem

The factor-price equalization theorem says that when the prices of the output goods are equalized between countries, as when countries move to free trade, the prices of the factors (capital and labor) will also be equalized between countries. This implies that free trade will equalize the wages of workers and the rents earned on capital throughout the world.

The theorem derives from the assumptions of the model, the most critical of which are the assumptions that the two countries share the same production technology and that markets are perfectly competitive. In a perfectly competitive market, factors are paid on the basis of the value of their marginal productivity, which in turn depends on the output prices of the goods. Thus when prices differ between countries, so will their marginal productivities and hence so will their wages and rents. However, once goods’ prices are equalized, as they are in free trade, the value of marginal products is also equalized between countries and hence the countries must also share the same wage rates and rental rates.

Factor-price equalization formed the basis for some arguments often heard in the debates leading up to the approval of the North American Free Trade Agreement (NAFTA) between the United States, Canada, and Mexico. Opponents of NAFTA feared that free trade with Mexico would lower U.S. wages to the level in Mexico. Factor-price equalization is consistent with this fear, although a more likely outcome would be a reduction in U.S. wages coupled with an increase in Mexican wages.

Furthermore, we should note that factor-price equalization is unlikely to apply perfectly in the real world. The H-O model assumes that technology is the same between countries in order to focus on the effects of different factor endowments. If production technologies differ across countries, as we assumed in the Ricardian model, then factor prices would not equalize once goods’ prices equalize. As such, a better interpretation of the factor-price equalization theorem applied to real-world settings is that free trade should cause a tendency for factor prices to move together if some of the trade between countries is based on differences in factor endowments.

The Rybczynski Theorem

The Rybczynski theoremA theorem that specifies how changes in endowments affect production levels in the H-O model. It states that an increase in a country’s endowment of a factor will cause an increase in the output of the good that uses that factor intensively and a decrease in the output of the other good. demonstrates the relationship between changes in national factor endowments and changes in the outputs of the final goods within the context of the H-O model. Briefly stated, it says that an increase in a country’s endowment of a factor will cause an increase in output of the good that uses that factor intensively and a decrease in the output of the other good. In other words, if the United States experiences an increase in capital equipment, then that would cause an increase in output of the capital-intensive good (steel) and a decrease in the output of the labor-intensive good (clothing). The theorem is useful in addressing issues such as investment, population growth and hence labor force growth, immigration, and emigration, all within the context of the H-O model.

The theorem was also generalized by Ronald Jones, who constructed a magnification effect for quantities in the context of the H-O model. The magnification effect allows for analysis of any change in both endowments and provides information about the magnitude of the effects on the outputs of the two goods.

Aggregate Economic Efficiency

The H-O model demonstrates that when countries move to free trade, they will experience an increase in aggregate efficiency. The change in prices will cause a shift in production of both goods in both countries. Each country will produce more of its export good and less of its import good. Unlike the Ricardian model, however, neither country will necessarily specialize in production of its export good. Nevertheless, the production shifts will improve productive efficiency in each country. Also, due to the changes in prices, consumers, in the aggregate, will experience an improvement in consumption efficiency. In other words, national welfare will rise for both countries when they move to free trade.

However, this does not imply that everyone benefits. As the Stolper-Samuelson theorem shows, the model clearly demonstrates that some factor owners will experience an increase in their real incomes, while others will experience a decrease in their factor incomes. Trade will generate winners and losers. The increase in national welfare essentially means that the sum of the gains to the winners will exceed the sum of the losses to the losers. For this reason, economists often apply the compensation principle.

The compensation principle states that as long as the total benefits exceed the total losses in the movement to free trade, then it must be possible to redistribute income from the winners to the losers such that everyone has at least as much as they had before trade liberalization occurred.

Note that the “standard” H-O model refers to the case of two countries, two goods, and two factors of production. The H-O model has been extended to many countries, many goods, and many factors, but most of the exposition in this text, and by economists in general, is in reference to the standard case.

Key Takeaways

- The H-O model is a two-country, two-good, two-factor model that assumes production processes differ in their factor intensities, while countries differ in their factor abundancies.

- The Rybczynski theorem states there is a positive relationship between changes in a factor endowment and changes in the output of the product that uses that factor intensively.

- The Stolper-Samuelson theorem states there is a positive relationship between changes in a product’s price and changes in the payment made to the factor used intensively in that industry.

- The Heckscher-Ohlin theorem predicts the pattern of trade: it says that a capital-abundant (labor-abundant) country will export the capital-intensive (labor-intensive) good and import the labor-intensive (capital-intensive) good.

- The factor-price equalization theorem demonstrates that when product prices are equalized through trade, the factor prices (wages and rents) will be equalized as well.

Exercise

-

Jeopardy Questions. As in the popular television game show, you are given an answer to a question and you must respond with the question. For example, if the answer is “a tax on imports,” then the correct question is “What is a tariff?”

- The term used to describe the income earned on capital usage.

- The term used to describe the ratio of capital usage to labor usage in an industry.

- The term used to describe an industry that uses more capital per worker than another industry.

- This is by which industries differ from each other in the H-O model.

- This is by which countries differ between each other in the H-O model.

- The name given to the theorem in the H-O model that describes the pattern of trade.

- The name given to the theorem in the H-O model that describes the effects on wages and rents caused by a change in an output price.

- The name given to the theorem in the H-O model that describes the effects on the quantities of the outputs caused by a change in an endowment.

- The name given to the theorem in the H-O model that describes the relationship between factor prices across countries in free trade.

5.2 Heckscher-Ohlin Model Assumptions

Learning Objective

- Learn the main assumptions of a two-country, two-good, two-factor Heckscher-Ohlin (or factor proportions) model.

Perfect Competition

Perfect competition in all markets means that the following conditions are assumed to hold.

- Many firms produce output in each industry such that each firm is too small for its output decisions to affect the market price. This implies that when choosing output to maximize profit, each firm takes the price as given or exogenous.

- Firms choose output to maximize profit. The rule used by perfectly competitive firms is to choose the output level that equalizes the price (P) with the marginal cost (MC). That is, set P = MC.

- Output is homogeneous across all firms. This means that goods are identical in all their characteristics such that a consumer would find products from different firms indistinguishable. We could also say that goods from different firms are perfect substitutes for all consumers.

- There is free entry and exit of firms in response to profits. Positive profit sends a signal to the rest of the economy and new firms enter the industry. Negative profit (losses) leads existing firms to exit, one by one, out of the industry. As a result, in the long run economic profit is driven to zero in the industry.

- Information is perfect. For example, all firms have the necessary information to maximize profit and to identify the positive profit and negative profit industries.

Two Countries

The case of two countries is used to simplify the model analysis. Let one country be the United States, the other France. Note that anything related exclusively to France in the model will be marked with an asterisk.

Two Goods

Two goods are produced by both countries. We assume a barter economy. This means that there is no money used to make transactions. Instead, for trade to occur, goods must be traded for other goods. Thus we need at least two goods in the model. Let the two produced goods be clothing and steel.

Two Factors

Two factors of production, labor and capital, are used to produce clothing and steel. Both labor and capital are homogeneous. Thus there is only one type of labor and one type of capital. The laborers and capital equipment in different industries are exactly the same. We also assume that labor and capital are freely mobile across industries within the country but immobile across countries. Free mobility makes the Heckscher-Ohlin (H-O) model a long-run model.

Factor Constraints

The total amount of labor and capital used in production is limited to the endowment of the country.

The labor constraintA relationship showing that the sum of the labor used in all industries cannot exceed total labor endowment in the economy. is

LC + LS = L,where LC and LS are the quantities of labor used in clothing and steel production, respectively. L represents the labor endowmentThe total amount of labor resources available to work in an economy during some period of time. of the country. Full employment of labor implies the expression would hold with equality.

The capital constraintA relationship showing that the sum of the capital used in all industries cannot exceed total capital endowment in the economy. is

KC + KS = K,where KC and KS are the quantities of capital used in clothing and steel production, respectively. K represents the capital endowmentThe total amount of capital resources available to work in an economy during some period of time. of the country. Full employment of capital implies the expression would hold with equality.

Endowments

The only difference between countries assumed in the model is a difference in endowments of capital and labor.

Definition

A country is capital abundant relative to another country if it has more capital endowment per labor endowment than the other country. Thus in this model the United States is capital abundant relative to France if

where K is the capital endowment and L the labor endowment in the United States and K∗ is the capital endowment and L∗ the labor endowment in France.

Note that if the United States is capital abundant, then France is labor abundant since the above inequality can be rewritten to get

This means that France has more labor per unit of capital for use in production than the United States.

Demand

Factor owners are the consumers of the goods. The factor owners have a well-defined utility function in terms of the two goods. Consumers maximize utility to allocate income between the two goods.

In Chapter 5 "The Heckscher-Ohlin (Factor Proportions) Model", Section 5.9 "The Heckscher-Ohlin Theorem", we will assume that aggregate preferences can be represented by a homothetic utility function of the form U = CSCC, where CS is the amount of steel consumed and CC is the amount of clothing consumed.

General Equilibrium

The H-O model is a general equilibrium model. The income earned by the factors is used to purchase the two goods. The industries’ revenue in turn is used to pay for the factor services. The prices of outputs and factors in an equilibrium are those that equalize supply and demand in all markets simultaneously.

Heckscher-Ohlin Model Assumptions: Production

The production functions in Table 5.1 "Production of Clothing" and Table 5.2 "Production of Steel" represent industry production, not firm production. The industry consists of many small firms in light of the assumption of perfect competition.

Table 5.1 Production of Clothing

| United States | France |

|---|---|

| QC = f(LC, KC) | |

|

where QC = quantity of clothing produced in the United States, measured in racks LC = amount of labor applied to clothing production in the United States, measured in labor hours KC = amount of capital applied to clothing production in the United States, measured in capital hours f( ) = the clothing production function, which transforms labor and capital inputs into clothing output ∗All starred variables are defined in the same way but refer to the production process in France. |

|

Table 5.2 Production of Steel

| United States | France |

|---|---|

| QS = g(LS, KS) | |

|

where QS = quantity of steel produced in the United States, measured in tons LS = amount of labor applied to steel production in the United States, measured in labor hours KS = amount of capital applied to steel production in the United States, measured in capital hours g( ) = the steel production function, which transforms labor and capital inputs into steel output ∗All starred variables are defined in the same way but refer to the production process in France. |

|

Production functions are assumed to be identical across countries within an industry. Thus both the United States and France share the same production function f( ) for clothing and g( ) for steel. This means that the countries share the same technologies. Neither country has a technological advantage over the other. This is different from the Ricardian model, which assumed that technologies were different across countries.

A simple formulation of the production process is possible by defining the unit factor requirements.

Let

represent the unit labor requirement in clothing production. It is the number of labor hours needed to produce a rack of clothing.

Let

represent the unit capital requirement in clothing production. It is the number of capital hours needed to produce a rack of clothing.

Similarly,

is the unit labor requirement in steel production. It is the number of labor hours needed to produce a ton of steel.

And

is the unit capital requirement in steel production. It is the number of capital hours needed to produce a ton of steel.

By taking the ratios of the unit factor requirements in each industry, we can define a capital-labor (or labor-capital) ratio. These ratios, one for each industry, represent the proportions in which factors are used in the production process. They are also the basis for the model’s name.

First, is the capital-labor ratio in clothing production. It is the proportion in which capital and labor are used to produce clothing.

Similarly, is the capital-labor ratio in steel production. It is the proportion in which capital and labor are used to produce steel.

Definition

We say that steel production is capital intensive relative to clothing production if

This means steel production requires more capital per labor hour than is required in clothing production. Notice that if steel is capital intensive, clothing must be labor intensive.

Clothing production is labor intensive relative to steel production if

This means clothing production requires more labor per capital hour than steel production.

Remember

Factor intensity is a comparison of production processes across industries but within a country. Factor abundancy is a comparison of endowments across countries.

Heckscher-Ohlin Model Assumptions: Fixed versus Variable Proportions

Two different assumptions can be applied in an H-O model: fixed and variable proportions. A fixed proportions assumption means that the capital-labor ratio in each production process is fixed. A variable proportions assumption means that the capital-labor ratio can adjust to changes in the wage rate for labor and the rental rate for capital.

Fixed proportions are more simplistic and also less realistic assumptions. However, many of the primary results of the H-O model can be demonstrated within the context of fixed proportions. Thus the fixed proportions assumption is useful in deriving the fundamental theorems of the H-O model. The variable proportions assumption is more realistic but makes solving the model significantly more difficult analytically. To derive the theorems of the H-O model under variable proportions often requires the use of calculus.

Fixed Factor Proportions

In fixed factor proportions, aKC, aLC, aKS, and aLS are exogenous to the model and are fixed. Since the capital-output and labor-output ratios are fixed, the capital-labor ratios, and , are also fixed. Thus clothing production must use capital to labor in a particular proportion regardless of the quantity of clothing produced. The ratio of capital to labor used in steel production is also fixed but is assumed to be different from the proportion used in clothing production.

Variable Factor Proportions

Under variable proportions, the capital-labor ratio used in the production process is endogenous. The ratio will vary with changes in the factor prices. Thus if there were a large increase in wage rates paid to labor, producers would reduce their demand for labor and substitute relatively cheaper capital in the production process. This means aKC and aLC are variable rather than fixed. So as the wage and rental rates change, the capital output ratio and the labor output ratio are also going to change.

Key Takeaways

- The production process can be simply described by defining unit factor requirements in each industry.

- The capital-labor ratio in an industry is found by taking the ratio of the unit capital and unit labor requirements.

- Factor intensities are defined by comparing capital-labor ratios between industries.

- Factor abundancies are defined by comparing the capital-labor endowment ratios between countries.

- The simple variant of the H-O model assumes the factor proportions are fixed in each industry; a more complex, and realistic, variant assumes factor proportions can vary.

Exercise

-

Jeopardy Questions. As in the popular television game show, you are given an answer to a question and you must respond with the question. For example, if the answer is “a tax on imports,” then the correct question is “What is a tariff?”

- The term used to describe Argentina if Argentina has more land per unit of capital than Brazil.

- The term used to describe aluminum production when aluminum production requires more energy per unit of capital than steel production.

- The two key terms used in the Heckscher-Ohlin model; one to compare industries, the other to compare countries.

- The term describing the ratio of the unit capital requirement and the unit labor requirement in production of a good.

- The term used to describe when the capital-labor ratio in an industry varies with changes in market wages and rents.

- The assumption in the Heckscher-Ohlin model about unemployment of capital and labor.

5.3 The Production Possibility Frontier (Fixed Proportions)

Learning Objective

- Plot the labor and capital constraint to derive the production possibility frontier (PPF).

The production possibility frontier (PPF) can be derived in the case of fixed proportions by using the exogenous factor requirements to rewrite the labor and capital constraints. The labor constraint with full employment can be written as

aLCQC + aLSQS = L.The capital constraint with full employment becomes

aKCQC + aKSQS = K.Each of these constraints contains two endogenous variables: QC and QS. The remaining variables are exogenous.

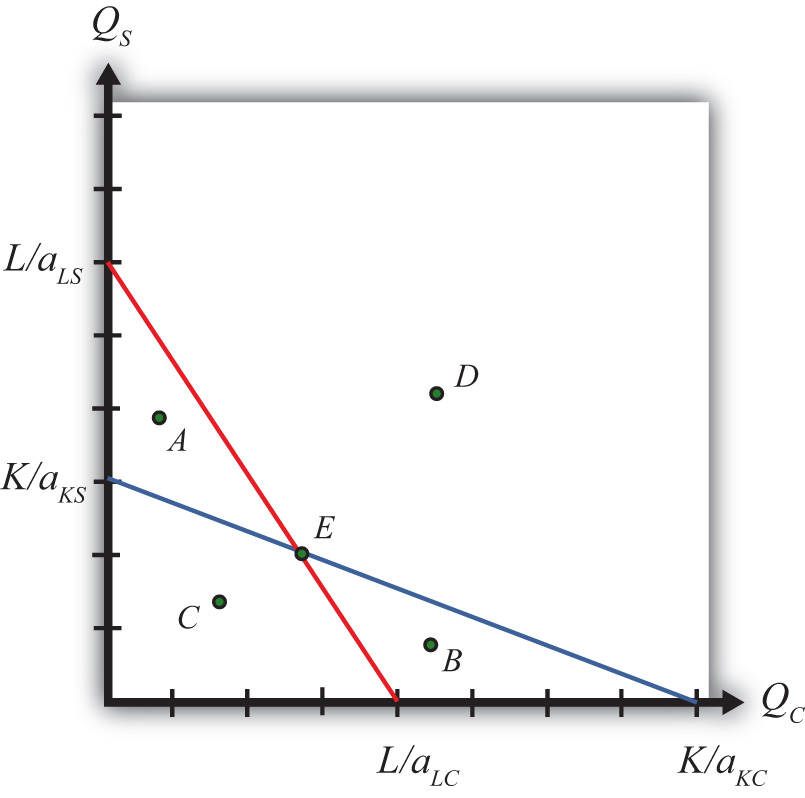

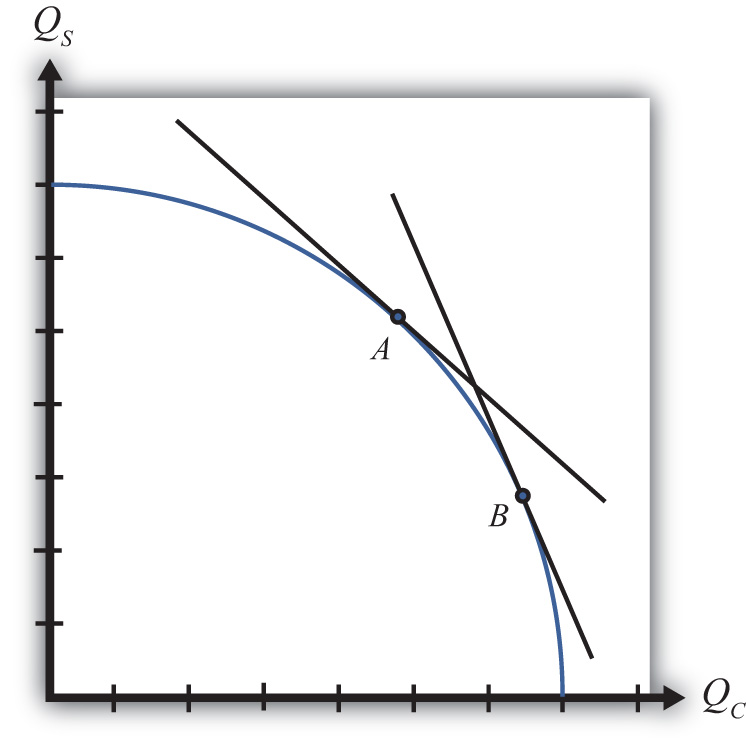

We graph the two constraints in Figure 5.1 "The Labor and Capital Constraints". The red line is the labor constraint. The endpoints and represent the maximum quantities of clothing and steel that could be produced if all the labor endowments were allocated to clothing and steel production, respectively. All points on the line represent combinations of clothing and steel outputs that could employ all the labor available in the economy. Points outside the constraint, such as B and D, are not feasible production points since there are insufficient labor resources. All points on or within the line, such as A, C, and E, are feasible. The slope of the labor constraint is .

Figure 5.1 The Labor and Capital Constraints

The blue line is the capital constraint. The endpoints and represent the maximum quantities of clothing and steel that could be produced if all the capital endowments were allocated to clothing and steel production, respectively. Points on the line represent combinations of clothing and steel production that would employ all the capital in the economy. Points outside the constraint, such as A and D, are not feasible production points since there are insufficient capital resources. Points on or within the line, such as B, C, and E, are feasible. The slope of the capital constraint is .

The PPF is the set of output combinations that generates full employment of resources—in this case, both labor and capital. Only one point, point E, can simultaneously generate full employment of both labor and capital. Thus point E is the PPF. The production possibility set is the set of all feasible output combinations. The PPS is the area bounded by the axes and the interior section of the labor and capital constraints. Thus at points like A, there is sufficient labor to make production feasible but insufficient capital; thus point A is not a feasible production point. Similarly, at point B there is sufficient capital but not enough labor. Points like C, however, which lie inside (or on) both factor constraints, do represent feasible production points.

Note that the labor constraint is drawn with a steeper slope than the capital constraint. This implies , which in turn implies (with cross multiplication) . This means that steel is assumed to be capital intensive and clothing production is assumed to be labor intensive. If the slope of the capital constraint had been steeper, then the factor intensities would have been reversed.

Key Takeaways

- The PPF in the fixed proportions Heckscher-Ohlin (H-O) model consists of the one point found at the intersection of the linear labor and capital constraints.

- Only those output combinations inside both factor constraint lines are feasible production points within the production possibility set.

- With clothing plotted on the horizontal axis, when the labor constraint is steeper than the capital constraint, clothing is labor intensive.

Exercise

-

Jeopardy Questions. As in the popular television game show, you are given an answer to a question and you must respond with the question. For example, if the answer is “a tax on imports,” then the correct question is “What is a tariff?”

- The description of the PPF in the case of fixed proportions in the Heckscher-Ohlin model.

- The equation for the capital constraint if the unit capital requirement in steel is ten hours per ton, the unit capital requirement in clothing is five hours per rack, and the capital endowment is ten thousand hours.

- The slope of the capital constraint given the information described in Exercise 1b. Include units.

- The equation for the labor constraint if the unit labor requirement in steel is one hour per ton, the unit labor requirement in clothing is three hours per rack, and the labor endowment is one thousand hours.

- The slope of the labor constraint given the information described in Exercise 1d. Include units.

- The capital labor ratio in clothing given the information described in Exercise 1b and Exercise 1d.

- The capital labor ratio in steel given the information described in Exercise 1b and Exercise 1d.

5.4 The Rybczynski Theorem

Learning Objective

- Use the PPF diagram to show how changes in factor endowments affect production levels at full employment.

The Relationship between Endowments and Outputs

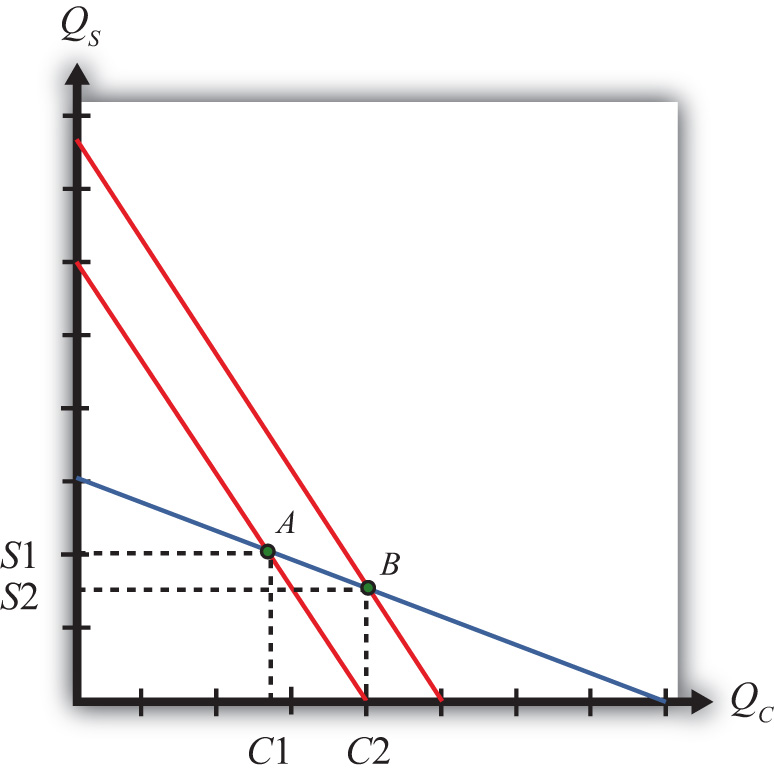

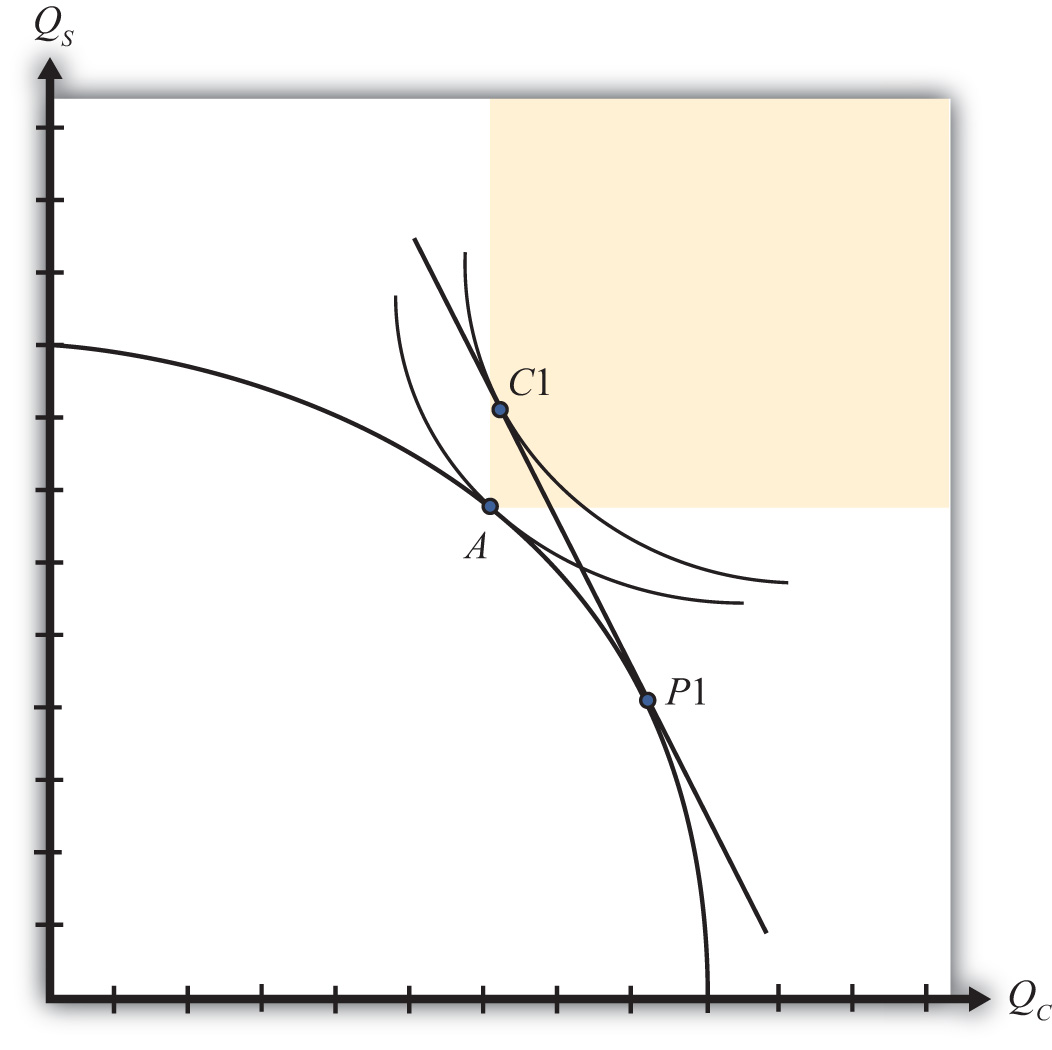

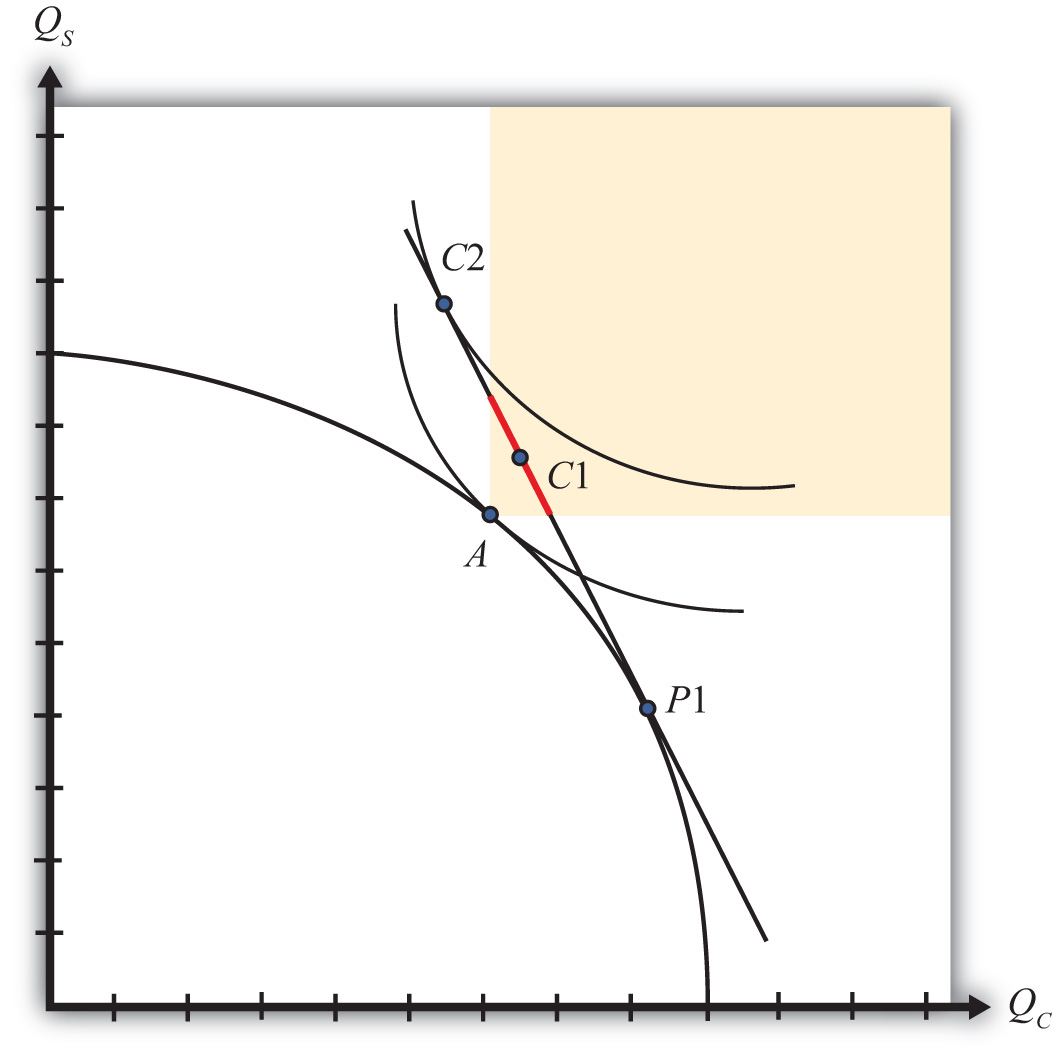

The Rybczynski theorem demonstrates how changes in an endowment affect the outputs of the goods when full employment is maintained. The theorem is useful in analyzing the effects of capital investment, immigration, and emigration within the context of a Heckscher-Ohlin (H-O) model. Consider Figure 5.2 "Graphical Depiction of Rybczynski Theorem", depicting a labor constraint in red (the steeper lower line) and a capital constraint in blue (the flatter line). Suppose production occurs initially on the PPF at point A.

Figure 5.2 Graphical Depiction of Rybczynski Theorem

Next, suppose there is an increase in the labor endowment. This will cause an outward parallel shift in the labor constraint. The PPF and thus production will shift to point B. Production of clothing, the labor-intensive good, will rise from C1 to C2. Production of steel, the capital-intensive good, will fall from S1 to S2.

If the endowment of capital rose, the capital constraint would shift out, causing an increase in steel production and a decrease in clothing production. Recall that since the labor constraint is steeper than the capital constraint, steel is capital intensive and clothing is labor intensive.

This means that, in general, an increase in a country’s endowment of a factor will cause an increase in output of the good that uses that factor intensively and a decrease in the output of the other good.

Key Takeaways

- The Rybczynski theorem shows there is a positive relationship between changes in a factor endowment and changes in the output of the product that uses that factor intensively.

- The Rybczynski theorem shows there is a negative relationship between changes in a factor endowment and changes in the output of the product that does not use that factor intensively.

Exercises

-

Jeopardy Questions. As in the popular television game show, you are given an answer to a question and you must respond with the question. For example, if the answer is “a tax on imports,” then the correct question is “What is a tariff?”

- Of increase, decrease, or stay the same, the effect on the output of the capital-intensive good caused by a decrease in the labor endowment in a two-factor H-O model.

- Of increase, decrease, or stay the same, the effect on the output of the labor-intensive good caused by a decrease in the labor endowment in a two-factor H-O model.

- Of increase, decrease, or stay the same, the effect on the output of the capital-intensive good caused by an increase in the capital endowment in a two-factor H-O model.

- Of increase, decrease, or stay the same, the effect on the output of the labor-intensive good caused by a decrease in the capital endowment in a two-factor H-O model.

- Consider an H-O economy in which there are two countries (United States and France), two goods (wine and cheese), and two factors (capital and labor). Suppose an increase in the labor force in the United States causes cheese production to increase. Which factor is used intensively in wine production? Which H-O theorem is applied to get this answer? Explain.

5.5 The Magnification Effect for Quantities

Learning Objective

- Learn how the magnification effect for quantities represents a generalization of the Rybczynski theorem by incorporating the relative magnitudes of the changes.

The magnification effect for quantities is a more general version of the Rybczynski theorem. It allows for changes in both endowments simultaneously and allows a comparison of the magnitudes of the changes in endowments and outputs.

The simplest way to derive the magnification effect is with a numerical example.

Suppose the exogenous variables of the model take the values in Table 5.3 "Numerical Values for Exogenous Variables" for one country.

Table 5.3 Numerical Values for Exogenous Variables

| aLC = 2 | aLS = 3 | L = 120 |

| aKC = 1 | aKS = 4 | K = 120 |

|

where L = labor endowment of the country K = capital endowment of the country aLC = unit labor requirement in clothing production aKC = unit capital requirement in clothing production aLS = unit labor requirement in steel production aKS = unit capital requirement in steel production |

||

With these numbers, , which means that steel production is capital intensive and clothing is labor intensive.

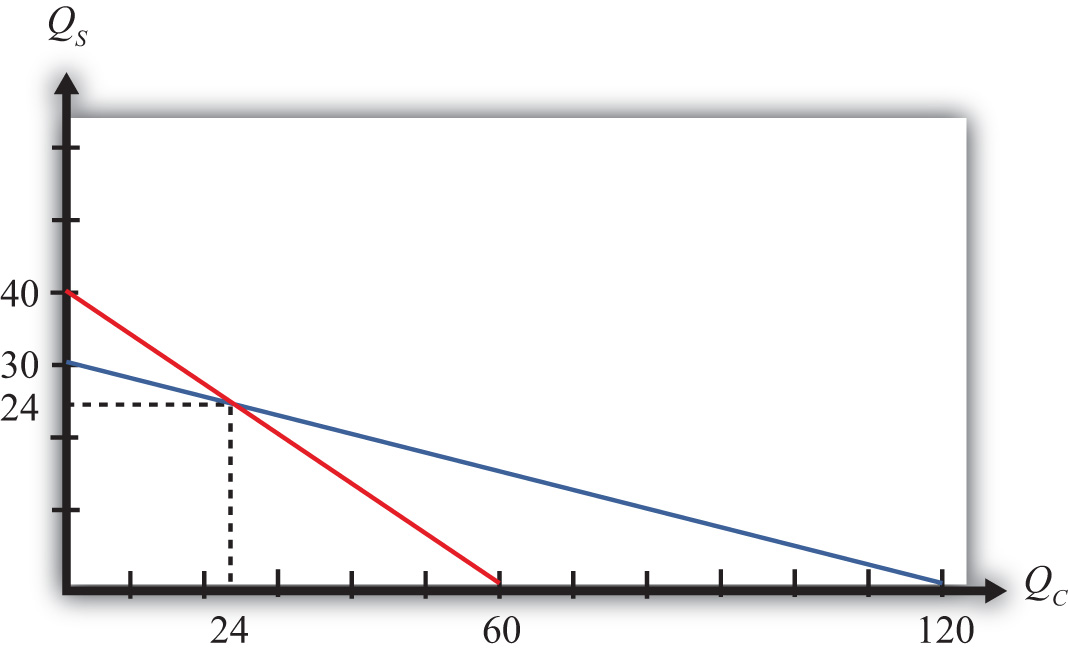

The following are the labor and capital constraints:

- Labor constraint: 2QC + 3QS = 120

- Capital constraint: QC + 4QS = 120

We graph these in Figure 5.3 "Numerical Labor and Capital Constraints". The steeper red line is the labor constraint and the flatter blue line is the capital constraint. The output quantities on the PPF can be found by solving the two constraint equations simultaneously.

Figure 5.3 Numerical Labor and Capital Constraints

A simple method to solve these equations follows.

First, multiply the second equation by (−2) to get

2QC + 3QS = 120and

−2QC − 8QS = −240.Adding these two equations vertically yields

0QC − 5QS = −120,which implies . Plugging this into the first equation above (any equation will do) yields 2QC + 3∗24 = 120. Simplifying, we get . Thus the solutions to the two equations are QC = 24 and QS = 24.

Next, suppose the capital endowment, K, increases to 150. This changes the capital constraint but leaves the labor constraint unchanged. The labor and capital constraints now are the following:

- Labor constraint: 2QC + 3QS = 120

- Capital constraint: QC + 4QS = 150

Follow the same procedure to solve for the outputs in the new full employment equilibrium.

First, multiply the second equation by (−2) to get

2QC + 3QS = 120and

−2QC − 8QS = −300.Adding these two equations vertically yields

0QC − 5QS = −180,which implies . Plugging this into the first equation above (any equation will do) yields 2QC + 3∗36 = 120. Simplifying, we get . Thus the new solutions are QC = 6 and QS = 36.

The Rybczynski theorem says that if the capital endowment rises, it will cause an increase in output of the capital-intensive good (in this case, steel) and a decrease in output of the labor-intensive good (clothing). In this numerical example, QS rises from 24 to 36 and QC falls from 24 to 6.

Percentage Changes in the Endowments and Outputs

The magnification effect for quantities ranks the percentage changes in endowments and the percentage changes in outputs. We’ll denote the percentage change by using a ^ above the variable (i.e., = percentage change in X).

Table 5.4 Calculating Percentage Changes in the Endowments and Outputs

| The capital stock rises by 25 percent. | |

| The quantity of steel rises by 50 percent. | |

| The quantity of clothing falls by 75 percent. | |

| The labor stock is unchanged. |

The rank order of the changes in Table 5.4 "Calculating Percentage Changes in the Endowments and Outputs" is the magnification effect for quantitiesA relationship in the H-O model that specifies the magnitude of output changes in response to changes in the factor endowments.:

The effect is initiated by changes in the endowments. If the endowments change by some percentage, ordered as above, then the quantity of the capital-intensive good (steel) will rise by a larger percentage than the capital stock change. The size of the effect is magnified relative to the cause.

The quantity of cloth (QC) changes by a smaller percentage than the smaller labor endowment change. Its effect is magnified downward.

Although this effect was derived only for the specific numerical values assumed in the example, it is possible to show, using more advanced methods, that the effect will arise for any endowment changes that are made. Thus if the labor endowment were to rise with no change in the capital endowment, the magnification effect would be

This implies that the quantity of the labor-intensive good (clothing) would rise by a greater percentage than the quantity of labor, while the quantity of steel would fall.

The magnification effect for quantities is a generalization of the Rybczynski theorem. The effect allows for changes in both endowments simultaneously and provides information about the magnitude of the effects. The Rybczynski theorem is one special case of the magnification effect that assumes one of the endowments is held fixed.

Although the magnification effect is shown here under the special assumption of fixed factor proportions and for a particular set of parameter values, the result is much more general. It is possible, using calculus, to show that the effect is valid under any set of parameter values and in a more general variable proportions model.

Key Takeaways

- The magnification effect for quantities shows that if the factor endowments change by particular percentages with one greater than the other, then the outputs will change by percentages that are larger than the larger endowment change and smaller than the smaller. It is in this sense that the output changes are magnified relative to the factor changes.

- If the percentage change of the capital endowment exceeds the percentage change of the labor endowment, for example, then output of the good that uses capital intensively will change by a greater percentage than capital changed, while the output of the good that uses labor intensively will change by less than labor changed.

Exercises

-

Consider a two-factor (capital and labor), two-good (beer and peanuts) H-O economy. Suppose beer is capital intensive. Let QB and QP represent the outputs of beer and peanuts, respectively.

- Write the magnification effect for quantities if the labor endowment increases and the capital endowment decreases

- Write the magnification effect for quantities if the capital endowment increases by 10 percent and the labor endowment increases by 5 percent.

- Write the magnification effect for quantities if the labor endowment decreases by 10 percent and the capital endowment decreases by 15 percent.

- Write the magnification effect for quantities if the capital endowment decreases while the labor endowment does not change.

-

Consider a country producing milk and cookies using labor and capital as inputs and described by a Heckscher-Ohlin model. The following table provides outputs for goods and factor endowments before and after a change in the endowments.

Table 5.5 Outputs and Endowments

Initial After Endowment Change Milk Output (QM) 100 gallons 110 gallons Cookie Output (QC) 100 pounds 80 pounds Labor Endowment (L) 4,000 hours 4,200 hours Capital Endowment (K) 1,000 hours 1,000 hours - Calculate and display the magnification effect for quantities in response to the endowment change.

- Which product is capital intensive?

- Which product is labor intensive?

-

Consider the following data in a Heckscher-Ohlin model with two goods (wine and cheese) and two factors (capital and labor).

aKC = 5 hours per pound (unit capital requirement in cheese)

aKW = 10 hours per gallon (unit capital requirement in wine)

aLC = 15 hours per pound (unit labor requirement in cheese)

aLW = 20 hours per gallon (unit labor requirement in wine)

L = 5,500 hours (labor endowment)

K = 2,500 hours (capital endowment)

- Solve for the equilibrium output levels of wine and cheese.

- Suppose the labor endowment falls by 100 hours to 5,400 hours. Solve for the new equilibrium output levels of wine and cheese.

- Calculate the percentage changes in the outputs and endowments and write the magnification effect for quantities.

- Identify which good is labor intensive and which is capital intensive.

5.6 The Stolper-Samuelson Theorem

Learning Objective

- Plot the zero-profit conditions to show how changes in product prices affect factor prices.

The Stolper-Samuelson theorem demonstrates how changes in output prices affect the prices of the factors when positive production and zero economic profit are maintained in each industry. It is useful in analyzing the effects on factor income either when countries move from autarky to free trade or when tariffs or other government regulations are imposed within the context of a Heckscher-Ohlin (H-O) model.

Due to the assumption of perfect competition in all markets, if production occurs in an industry, then economic profit is driven to zero. The zero-profit conditions in each industry imply

PS = aLS w + aKS rand

PC = aLC w + aKC r,where PS and PC are the prices of steel and clothing, respectively; w is the wage paid to labor, and r is the rental rate on capital. Note that is the dollar payment to workers per ton of steel produced, while is the dollar payment to capital owners per ton of steel produced. The right-hand-side sum then is the dollars paid to all factors per ton of steel produced. If the payments to factors for each ton produced equal the price per ton, then profit must be zero in the industry. The same logic is used to justify the zero-profit condition in the clothing industry.

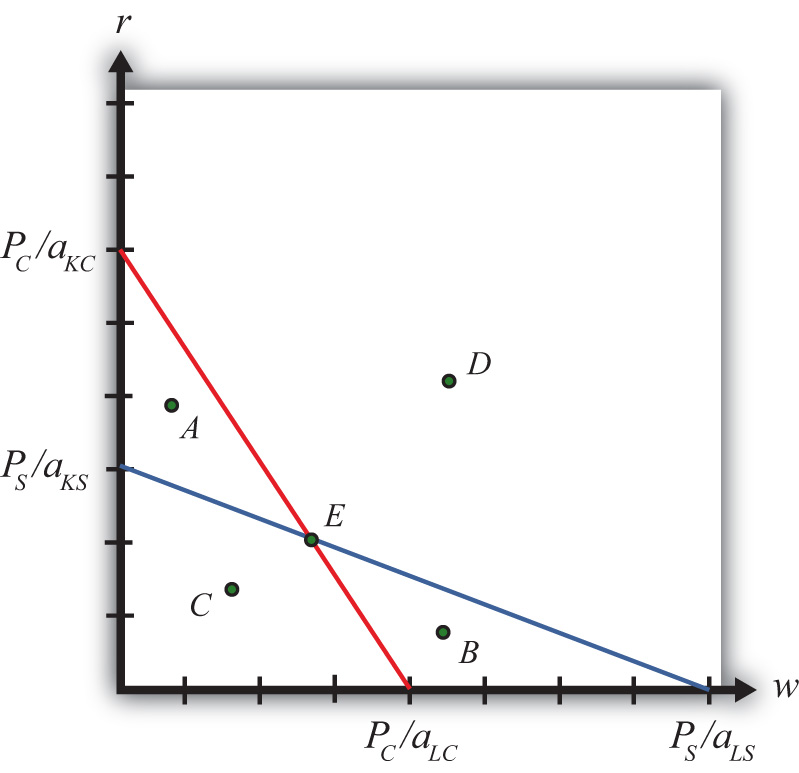

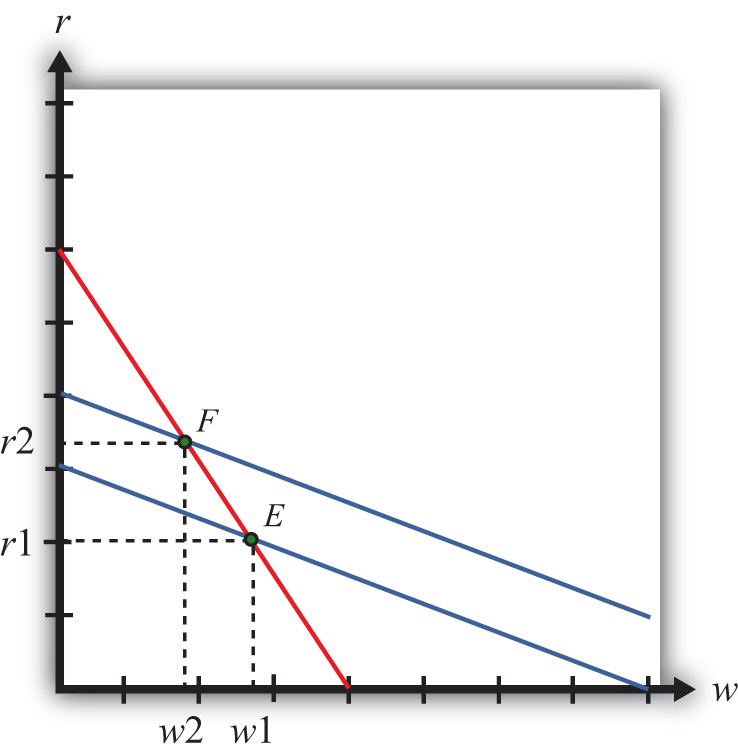

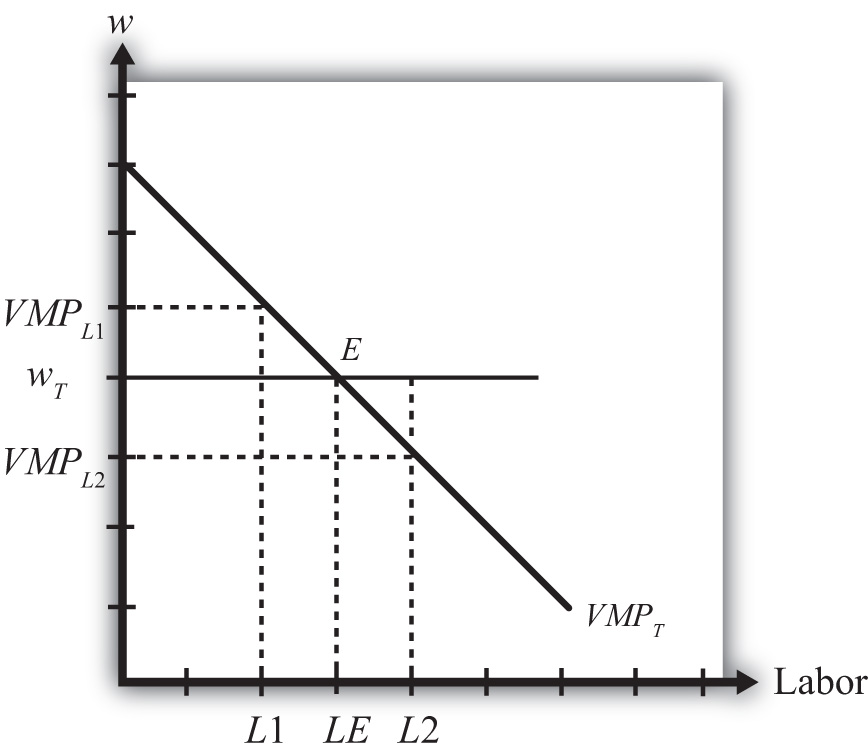

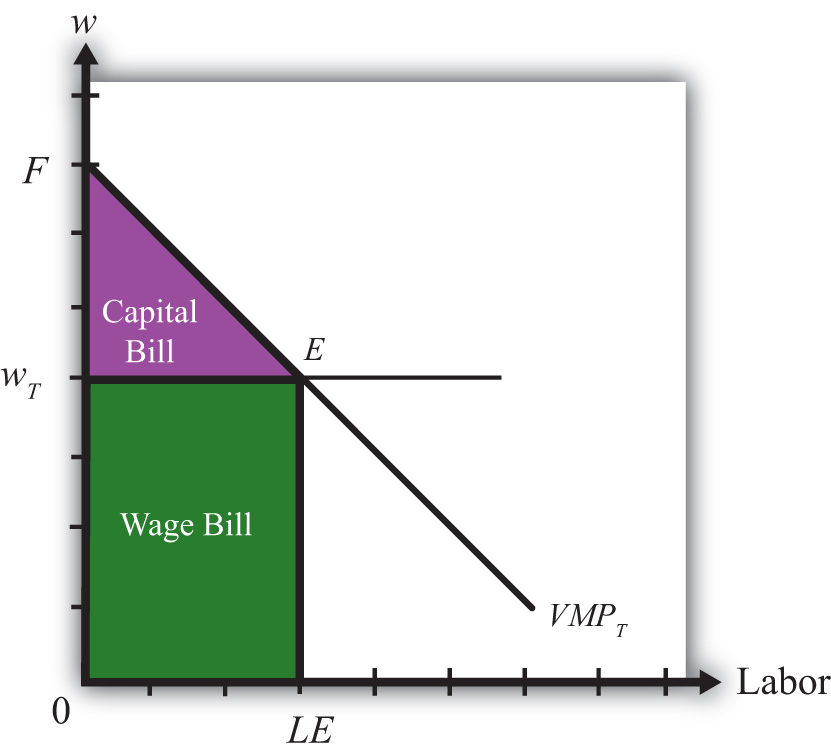

We imagine that firms treat prices exogenously since any one firm is too small to affect the price in its market. Because the factor output ratios are also fixed, wages and rentals remain as the two unknowns. In Figure 5.4 "Zero Profit Lines in Clothing and Steel", we plot the two zero-profit conditions in wage-rental space.

Figure 5.4 Zero Profit Lines in Clothing and Steel

The set of all wage and rental rates that will generate zero profit in the steel industry at the price PS is given by the flatter blue line. At wage and rental combinations above the line, as at points A and D, the per-unit cost of production would exceed the price, and profit would be negative. At wage-rental combinations below the line, as at points B and C, the per-unit cost of production would fall short of the price, and profit would be positive. Notice that the slope of the flatter blue line is .

Similarly, the set of all wage-rental rate combinations that will generate zero profit in the clothing industry at price PC is given by the steeper red line. All wage-rental combinations above the line, as at points B and D, generate negative profit, while wage-rental combinations below the line, as at A and C, generate positive profit. The slope of the steeper red line is .

The only wage-rental combination that can simultaneously support zero profit in both industries is found at the intersection of the two zero-profit lines—point E. This point represents the equilibrium wage and rental rates that would arise in an H-O model when the price of steel is PS and the price of clothing is PC.

Now, suppose there is an increase in the price of one of the goods. Say the price of steel, PS, rises. This could occur if a country moves from autarky to free trade or if a tariff is placed on imports of steel. The price increase will cause an outward parallel shift in the blue zero-profit line for steel, as shown in Figure 5.5 "Graphical Depiction of Stolper-Samuelson Theorem". The equilibrium point will shift from E to F, causing an increase in the equilibrium rental rate from r1 to r2 and a decrease in the equilibrium wage rate from w1 to w2. Only with a higher rental rate and a lower wage can zero profit be maintained in both industries at the new set of prices. Using the slopes of the zero-profit lines, we can show that , which means that clothing is labor intensive and steel is capital intensive. Thus, when the price of steel rises, the payment to the factor used intensively in steel production (capital) rises, while the payment to the other factor (labor) falls.

Figure 5.5 Graphical Depiction of Stolper-Samuelson Theorem

If the price of clothing had risen, the zero-profit line for clothing would have shifted right, causing an increase in the equilibrium wage rate and a decrease in the rental rate. Thus an increase in the price of clothing causes an increase in the payment to the factor used intensively in clothing production (labor) and a decrease in the payment to the other factor (capital).

This gives us the Stolper-Samuelson theorem: an increase in the price of a good will cause an increase in the price of the factor used intensively in that industry and a decrease in the price of the other factor.

Key Takeaways

- The Stolper-Samuelson theorem shows there is a positive relationship between changes in the price of an output and changes in the price of the factor used intensively in producing that product.

- The Stolper-Samuelson theorem shows there is a negative relationship between changes in the price of an output and changes in the price of the factor not used intensively in producing that product.

Exercises

- Consider an H-O economy in which there are two countries (United States and France), two goods (wine and cheese), and two factors (capital and labor). Suppose a decrease in the price of cheese causes a decrease in the wage rate in the U.S. economy. Which factor is used intensively in cheese production in France? Which H-O theorem is used to get this answer? Explain.

-

State what is true about profit in the steel and clothing industry at the wage-rental combination given by the following points in Figure 5.4 "Zero Profit Lines in Clothing and Steel" in the text.

- Point A

- Point B

- Point C

- Point D

- Point E

5.7 The Magnification Effect for Prices

Learning Objective

- Learn how the magnification effect for prices represents a generalization of the Stolper-Samuelson theorem by incorporating the relative magnitudes of the changes.

The magnification effect for prices is a more general version of the Stolper-Samuelson theorem. It allows for simultaneous changes in both output prices and compares the magnitudes of the changes in output and factor prices.

The simplest way to derive the magnification effect is with a numerical example.

Suppose the exogenous variables of the model take the values in Table 5.6 "Numerical Values for Exogenous Variables" for one country.

Table 5.6 Numerical Values for Exogenous Variables

| aLS = 3 | aKS = 4 | PS = 120 |

| aLC = 2 | aKC = 1 | PC = 40 |

|

where aLC = unit labor requirement in clothing production aLS = unit labor requirement in steel production aKC = unit capital requirement in clothing production aKS = unit capital requirement in steel production PS = the price of steel PC = the price of clothing |

||

With these numbers, , which means that steel production is capital intensive and clothing is labor intensive.

The following are the zero-profit conditions in the two industries:

- Zero-profit steel: 3w + 4r = 120

- Zero-profit clothing: 2w + r = 40

The equilibrium wage and rental rates can be found by solving the two constraint equations simultaneously.

A simple method to solve these equations follows.

First, multiply the second equation by (−4) to get

3w + 4r = 120and

−8w − 4r = −160.Adding these two equations vertically yields

−5w − 0r = −40,which implies . Plugging this into the first equation above (any equation will do) yields 3∗8 + 4r = 120. Simplifying, we get . Thus the initial equilibrium wage and rental rates are w = 8 and r = 24.

Next, suppose the price of clothing, PC, rises from $40 to $60 per rack. This changes the zero-profit condition in clothing production but leaves the zero-profit condition in steel unchanged. The zero-profit conditions now are the following:

- Zero-profit steel: 3w + 4r = 120

- Zero-profit clothing: 2w + r = 60

Follow the same procedure to solve for the equilibrium wage and rental rates.

First, multiply the second equation by (–4) to get

3w + 4r = 120and

−8w − 4r = −240.Adding these two equations vertically yields

−5w − 0r = −120,which implies . Plugging this into the first equation above (any equation will do) yields 3∗24 + 4r = 120. Simplifying, we get . Thus the new equilibrium wage and rental rates are w = 24 and r = 12.

The Stolper-Samuelson theorem says that if the price of clothing rises, it will cause an increase in the price paid to the factor used intensively in clothing production (in this case, the wage rate to labor) and a decrease in the price of the other factor (the rental rate on capital). In this numerical example, w rises from $8 to $24 per hour and r falls from $24 to $12 per hour.

Percentage Changes in the Goods and Factor Prices

The magnification effect for prices ranks the percentage changes in output prices and the percentage changes in factor prices. We’ll denote the percentage change by using a ^ above the variable (i.e., = percentage change in X).

Table 5.7 Calculating Percentage Changes in the Goods and Factor Prices

| The price of clothing rises by 50 percent. | |

| The wage rate rises by 200 percent. | |

| The rental rate falls by 50 percent. | |

| The price of steel is unchanged. | |

|

where w = the wage rate r = the rental rate |

|

The rank order of the changes in Table 5.7 "Calculating Percentage Changes in the Goods and Factor Prices" is the magnification effect for pricesA relationship in the H-O model that specifies the magnitude of factor price changes in response to changes in the output prices. It is used to identify the real wage and real rent effects of output price changes.:

The effect is initiated by changes in the output prices. These appear in the middle of the inequality. If output prices change by some percentage, ordered as above, then the wage rate paid to labor will rise by a larger percentage than the price of steel changes. The size of the effect is magnified relative to the cause.

The rental rate changes by a smaller percentage than the price of steel changes. Its effect is magnified downward.

Although this effect was derived only for the specific numerical values assumed in the example, it is possible to show, using more advanced methods, that the effect will arise for any output price changes that are made. Thus if the price of steel were to rise with no change in the price of clothing, the magnification effect would be

This implies that the rental rate would rise by a greater percentage than the price of steel, while the wage rate would fall.

The magnification effect for prices is a generalization of the Stolper-Samuelson theorem. The effect allows for changes in both output prices simultaneously and provides information about the magnitude of the effects. The Stolper-Samuelson theorem is a special case of the magnification effect in which one of the endowments is held fixed.

Although the magnification effect is shown here under the special assumption of fixed factor proportions and for a particular set of parameter values, the result is much more general. It is possible, using calculus, to show that the effect is valid under any set of parameter values and in a more general variable proportions model.

The magnification effect for prices can be used to determine the changes in real wages and real rents whenever prices change in the economy. These changes would occur as a country moves from autarky to free trade and when trade policies are implemented, removed, or modified.

Key Takeaways

- The magnification effect for prices shows that if the product prices change by particular percentages with one greater than the other, then the factor prices will change by percentages that are larger than the larger product price change and smaller than the smaller. It is in this sense that the factor price changes are magnified relative to the product price changes.

- If the percentage change in the price of the capital-intensive good exceeds the percentage change in the price of the labor-intensive good, for example, then the rental rate on capital will change by a greater percentage than the price of the capital-intensive good changed, while the wage will change by less than the price of the labor-intensive good.

Exercises

-

Consider a country producing milk and cookies using labor and capital as inputs and described by a Heckscher-Ohlin model. The following table provides prices for goods and factors before and after a tariff is eliminated on imports of cookies.

Table 5.8 Goods and Factor Prices

Initial ($) After Tariff Elimination ($) Price of Milk (PM) 5 6 Price of Cookies (PC) 10 8 Wage (w) 12 15 Rental rate (r) 20 15 - Calculate and display the magnification effect for prices in response to the tariff elimination.

- Which product is capital intensive?

- Which product is labor intensive?

-

Consider the following data in a Heckscher-Ohlin model with two goods (wine and cheese) and two factors (capital and labor).

aKC = 5 hours per pound (unit capital requirement in cheese)

aKW = 10 hours per gallon (unit capital requirement in wine)

aLC = 15 hours per pound (unit labor requirement in cheese)

aLW = 20 hours per gallon (unit labor requirement in wine)

PC = $80 (price of cheese)

PW = $110 (price of wine)

- Solve for the equilibrium wage and rental rate.

- Suppose the price of cheese falls from $80 to $75. Solve for the new equilibrium wage and rental rates.

- Calculate the percentage changes in the goods prices and factor prices and write the magnification effect for prices.

- Identify which good is labor intensive and which is capital intensive.

5.8 The Production Possibility Frontier (Variable Proportions)

Learning Objective

- Learn how the shift from a fixed proportions to a variable proportions model affects the presentation of the Heckscher-Ohlin (H-O) model.

The production possibility frontier can be derived in the case of variable proportions by using the same labor and capital constraints used in the case of fixed proportions, but with one important adjustment. Under variable proportions, the unit factor requirements are functions of the wage-rental ratio (w/r). This implies that the capital-labor ratios (which are the ratios of the unit factor requirements) in each industry are also functions of the wage-rental ratio. If there is a change in the equilibrium (for some reason) such that the wage-rental rate rises, then labor will become relatively more expensive compared to capital. Firms would respond to this change by reducing their demand for labor and raising their demand for capital. In other words, firms will substitute capital for labor and the capital-labor ratio will rise in each industry. This adjustment will allow the firm to maintain minimum production costs and thus the highest profit possible. This is the first important distinction between variable and fixed proportions.

The second important distinction is that variable proportions change the shape of the economy’s PPF. The labor constraint with full employment can be written as

where aLC and aLW are functions of (w/r).

The capital constraint with full employment becomes

where aKC and aKW are functions of (w/r).

Under variable proportions, the production possibility frontier takes the traditional bowed-out shape, as shown in Figure 5.6 "The PPF in the Variable Proportions H-O Model". All points on the PPF will maintain full employment of both labor and capital resources. The slope of a line tangent to the PPF (such as the line through point A) represents the quantity of steel that must be given up to produce another unit of clothing. As such, the slope of the PPF is the opportunity cost of producing clothing. Since the slope becomes steeper as more and more clothing is produced (as when moving production from point A to B), we say that there is increasing opportunity cost. This means that more steel must be given up to produce one more unit of clothing at point B than at point A in the figure. In contrast, in the Ricardian model the PPF was a straight line that indicated constant opportunity costs.

Figure 5.6 The PPF in the Variable Proportions H-O Model

The third important distinction of variable proportions is that the magnification effects, derived previously under a fixed proportions assumption, continue to work under variable proportions. To show this requires a fair amount of advanced math, but a student can rest assured that we can apply the magnification effect even in the more complex variable proportions version of the Heckscher-Ohlin (H-O) model.

Key Takeaways

- Variable proportions imply that the capital-labor ratios used in production are varied as wage and rental rates change in the economy.

- Variable proportions imply that the PPF becomes bowed out and continuous, consisting of many output combinations that can be produced with full employment of labor and capital.

- Variable proportions do not invalidate the Rybczynski theorem, the Stolper-Samuelson theorem, or the magnification effects for quantities and prices.

Exercise

-

Jeopardy Questions. As in the popular television game show, you are given an answer to a question and you must respond with the question. For example, if the answer is “a tax on imports,” then the correct question is “What is a tariff?”

- Interpretation given for the slope of the production possibility frontier in the case of variable proportions in the Heckscher-Ohlin model.

- In a variable proportion H-O model, the factor proportions in each industry vary with changes in these two other variables.

- Of increase, decrease, or stay the same, this is the effect on the capital-labor ratio in an industry when wages fall in a variable proportions H-O model.

- Of increase, decrease, or stay the same, this is the effect on the amount of capital used per worker in an industry when rental rates increase in a variable proportions H-O model.

- Of increase, decrease, or stay the same, this is the effect on the labor-capital ratio in an industry when wages fall in a variable proportions H-O model.

- Of increase, decrease, or stay the same, this is the effect on the capital-labor ratio in the cheese industry when wages increase in a variable proportions H-O model, if cheese is a labor-intensive industry.

- Of increase, decrease, or stay the same, this is the effect on the capital-labor ratio in the wine industry when wages increase in a variable proportions H-O model, if wine is a capital-intensive industry.

- Of increase, decrease, or stay the same, this is the effect on the capital-labor ratio in an industry when wages fall in a fixed proportions H-O model.

5.9 The Heckscher-Ohlin Theorem

Learning Objectives

- Learn the Heckscher-Ohlin theorem highlighting the determinants of the pattern of trade.

- Identify the effects of trade on prices and outputs using a PPF diagram.

The Heckscher-Ohlin (H-O) theoremA theorem that predicts the pattern of trade in the H-O model. It states that the capital-abundant country will export the capital-intensive good and the labor-abundant country will export the labor-intensive good. states that a country that is capital abundant will export the capital-intensive good. Likewise, the country that is labor abundant will export the labor-intensive good. Each country exports that good that it produces relatively better than the other country. In this model, a country’s advantage in production arises solely from its relative factor abundancy.

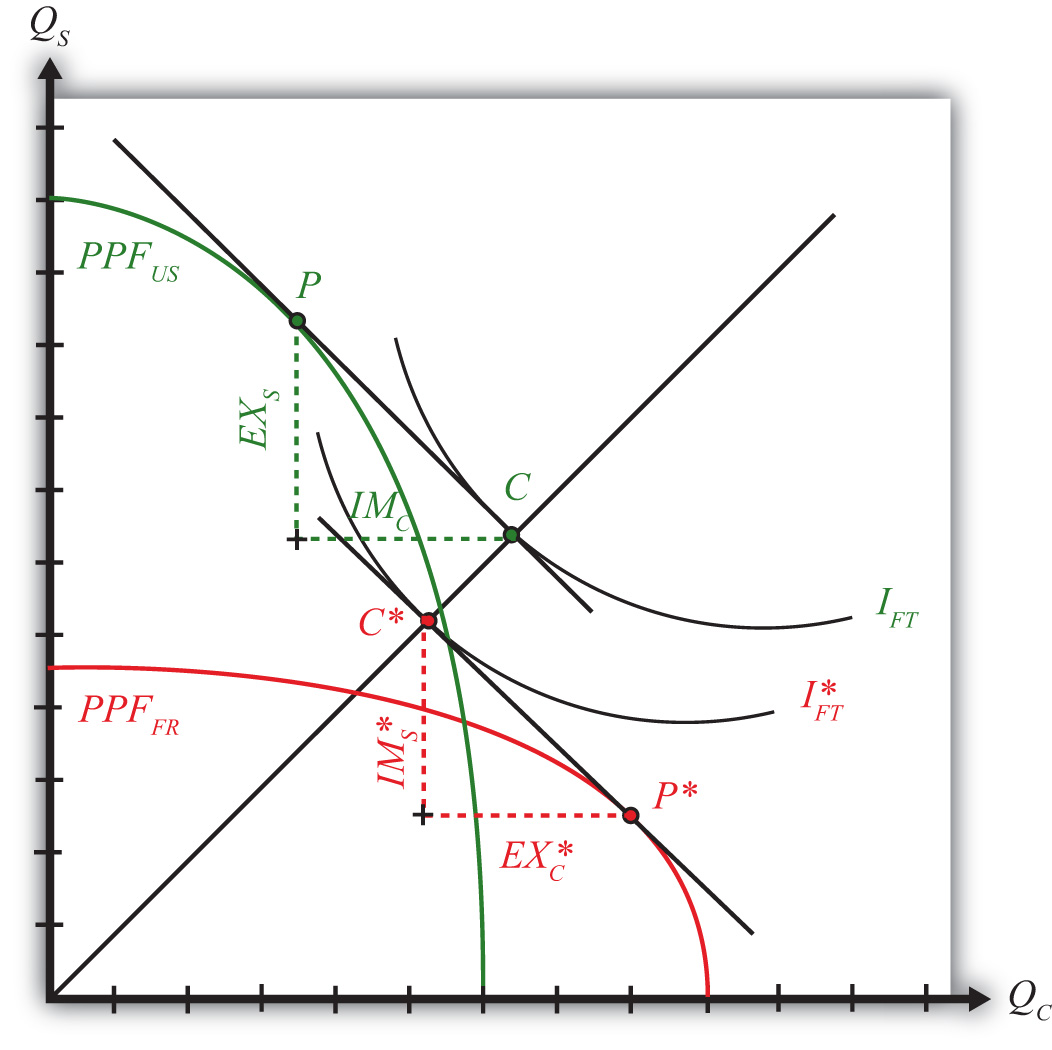

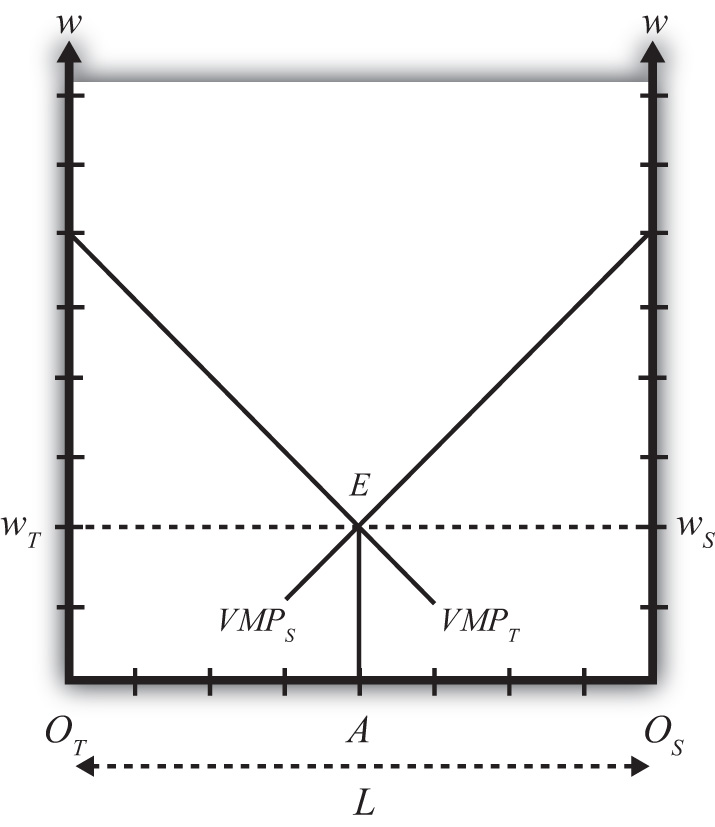

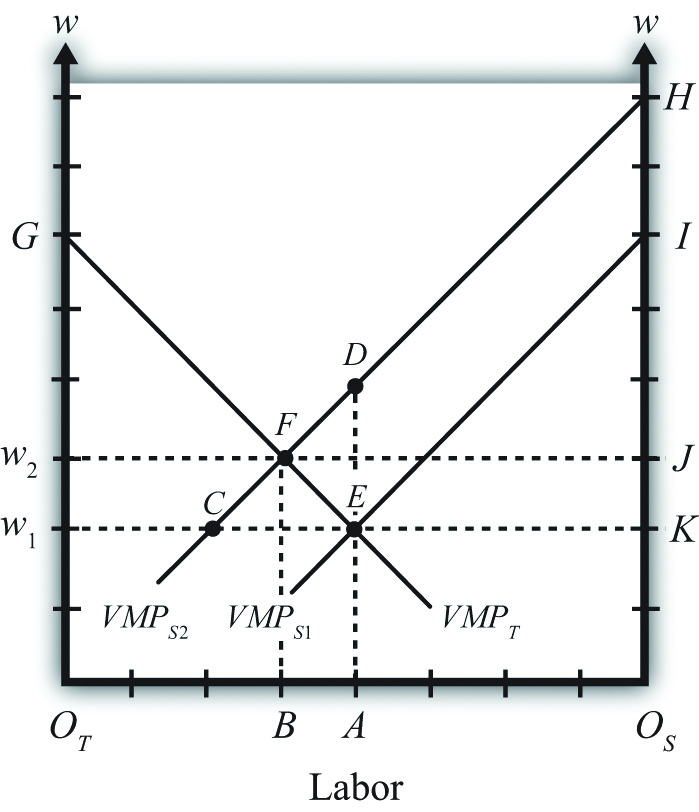

The H-O Theorem Graphical Depiction: Variable Proportions

The H-O model assumes that the two countries (United States and France) have identical technologies, meaning they have the same production functions available to produce steel and clothing. The model also assumes that the aggregate preferences are the same across countries. The only difference that exists between the two countries in the model is a difference in resource endowments. We assume that the United States has relatively more capital per worker in the aggregate than does France. This means that the United States is capital abundant compared to France. Similarly, France, by implication, has more workers per unit of capital in the aggregate and thus is labor abundant compared to the United States. We also assume that steel production is capital intensive and clothing production is labor intensive.

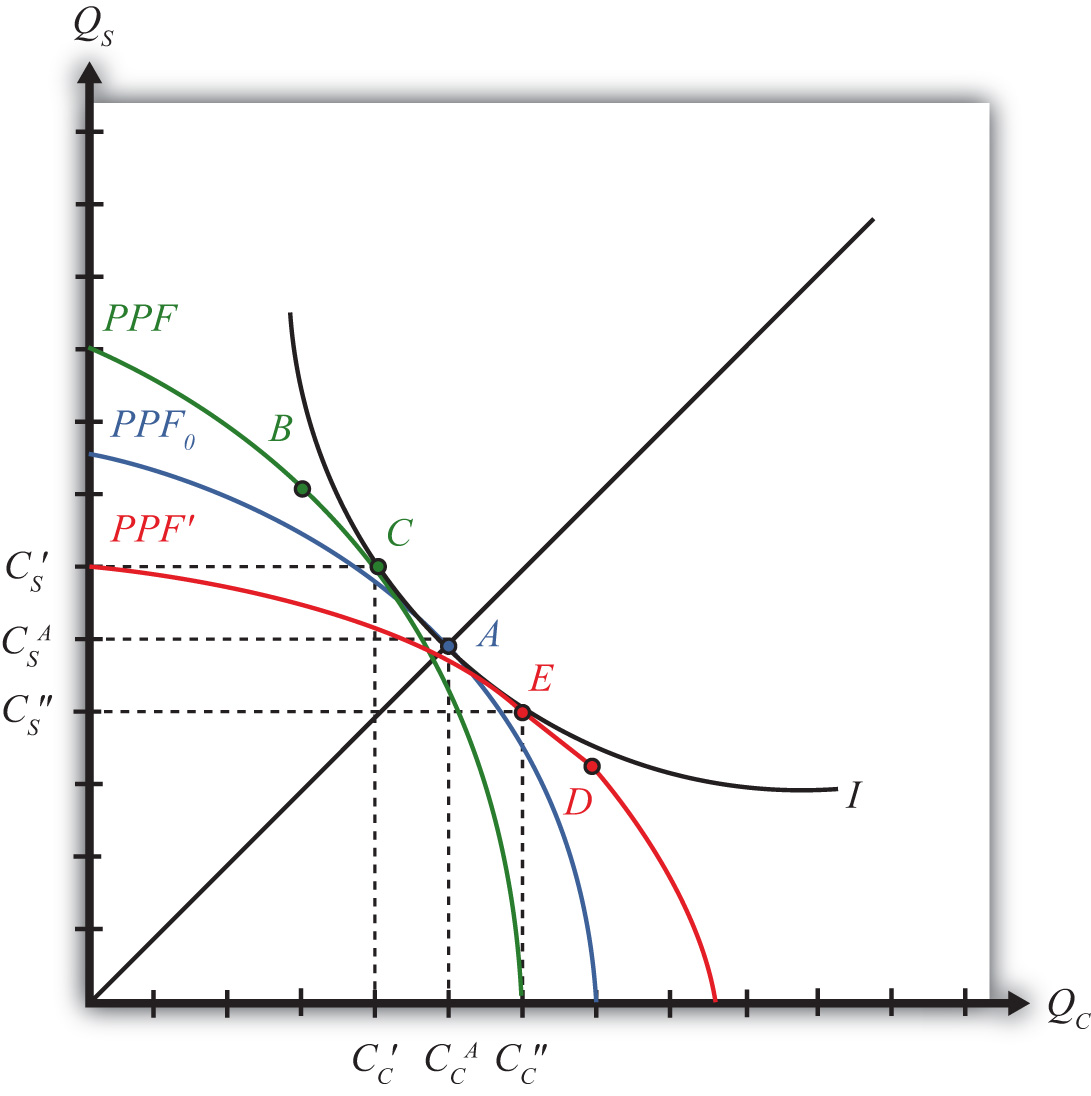

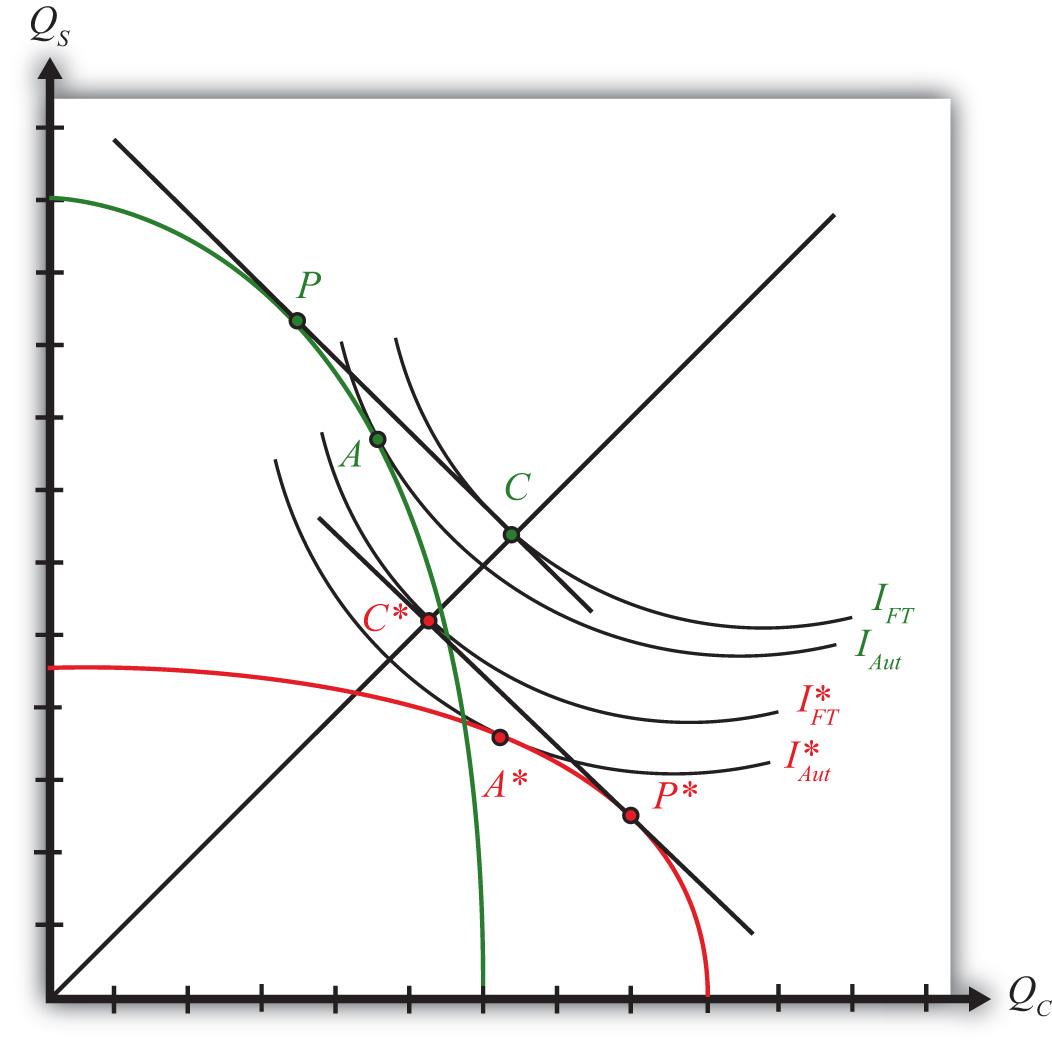

Figure 5.7 Endowment Differences and the PPF

The difference in resource endowments is sufficient to generate different PPFs in the two countries such that equilibrium price ratios would differ in autarky. To see why, imagine first that the two countries are identical in every respect. This means they would have the same PPF (depicted as the blue PPF0 in Figure 5.7 "Endowment Differences and the PPF"), the same set of aggregate indifference curves, and the same autarky equilibrium. Given the assumption about aggregate preferences—that is, U = CCCS—the indifference curve, I, will intersect the countries’ PPF at point A, where the absolute value of the slope of the tangent line (not drawn), PC/PS, is equal to the slope of the ray from the origin through point A. The slope is given by . In other words, the autarky price ratio in each country will be given by

Next, suppose that labor and capital are shifted between the two countries. Suppose labor is moved from the United States to France, while capital is moved from France to the United States. This will have two effects. First, the United States will now have more capital and less labor, and France will have more labor and less capital than it did initially. This implies that K/L> K∗/L∗, or that the United States is capital abundant and France is labor abundant. Second, the two countries’ PPFs will shift. To show how, we apply the Rybczynski theorem.

The United States experiences an increase in K and a decrease in L. Both changes will cause an increase in output of the good that uses capital intensively (i.e., steel) and a decrease in output of the other good (clothing). The Rybczynski theorem is derived assuming that output prices remain constant. Thus if prices did remain constant, production would shift from point A to B and the U.S. PPF would shift from the blue PPF0 to the green PPF in Figure 5.7 "Endowment Differences and the PPF".

Using the new PPF, we can deduce what the U.S. production point and price ratio would be in autarky given the increase in the capital stock and the decline in the labor stock. Consumption could not occur at point B because first, the slope of the PPF at B is the same as the slope at A because the Rybczynski theorem was used to identify it, and second, homothetic preferences imply that the indifference curve passing through B must have a steeper slope because it lies along a steeper ray from the origin.

Thus to find the autarky production point, we simply find the indifference curve that is tangent to the U.S. PPF. This occurs at point C on the new U.S. PPF along the original indifference curve, I. (Note that the PPF was conveniently shifted so that the same indifference curve could be used. Such an outcome is not necessary but does make the graph less cluttered.) The negative of the slope of the PPF at C is given by the ratio of quantities CS′/CC′. Since CS′/CC′ > CSA/CCA, it follows that the new U.S. price ratio will exceed the one prevailing before the capital and labor shift, that is, PC/PS > (PC/PS)0. In other words, the autarky price of clothing is higher in the United States after it experiences the inflow of capital and outflow of labor.

France experiences an increase in L and a decrease in K. These changes will cause an increase in output of the labor-intensive good (i.e., clothing) and a decrease in output of the capital-intensive good (steel). If the price were to remain constant, production would shift from point A to D in Figure 5.7 "Endowment Differences and the PPF", and the French PPF would shift from the blue PPF0 to the red PPF′.

Using the new PPF, we can deduce the French production point and price ratio in autarky given the increase in the capital stock and the decline in the labor stock. Consumption could not occur at point D since homothetic preferences imply that the indifference curve passing through D must have a flatter slope because it lies along a flatter ray from the origin. Thus to find the autarky production point, we simply find the indifference curve that is tangent to the French PPF. This occurs at point E on the red French PPF along the original indifference curve, I. (As before, the PPF was conveniently shifted so that the same indifference curve could be used.) The negative of the slope of the PPF at C is given by the ratio of quantities CS″/CC″. Since CS″/CC″ < CSA/CCA, it follows that the new French price ratio will be less than the one prevailing before the capital and labor shift—that is, PC∗/PS∗ < (PC/PS)0. This means that the autarky price of clothing is lower in France after it experiences the inflow of labor and outflow of capital.

All of the above implies that as one country becomes labor abundant and the other capital abundant, it causes a deviation in their autarky price ratios. The country with relatively more labor (France) is able to supply relatively more of the labor-intensive good (clothing), which in turn reduces the price of clothing in autarky relative to the price of steel. The United States, with relatively more capital, can now produce more of the capital-intensive good (steel), which lowers its price in autarky relative to clothing. These two effects together imply that

Any difference in autarky prices between the United States and France is sufficient to induce profit-seeking firms to trade. The higher price of clothing in the United States (in terms of steel) will induce firms in France to export clothing to the United States to take advantage of the higher price. The higher price of steel in France (in terms of clothing) will induce U.S. steel firms to export steel to France. Thus the United States, abundant in capital relative to France, exports steel, the capital-intensive good. France, abundant in labor relative to the United States, exports clothing, the labor-intensive good. This is the H-O theorem. Each country exports the good intensive in the country’s abundant factor.

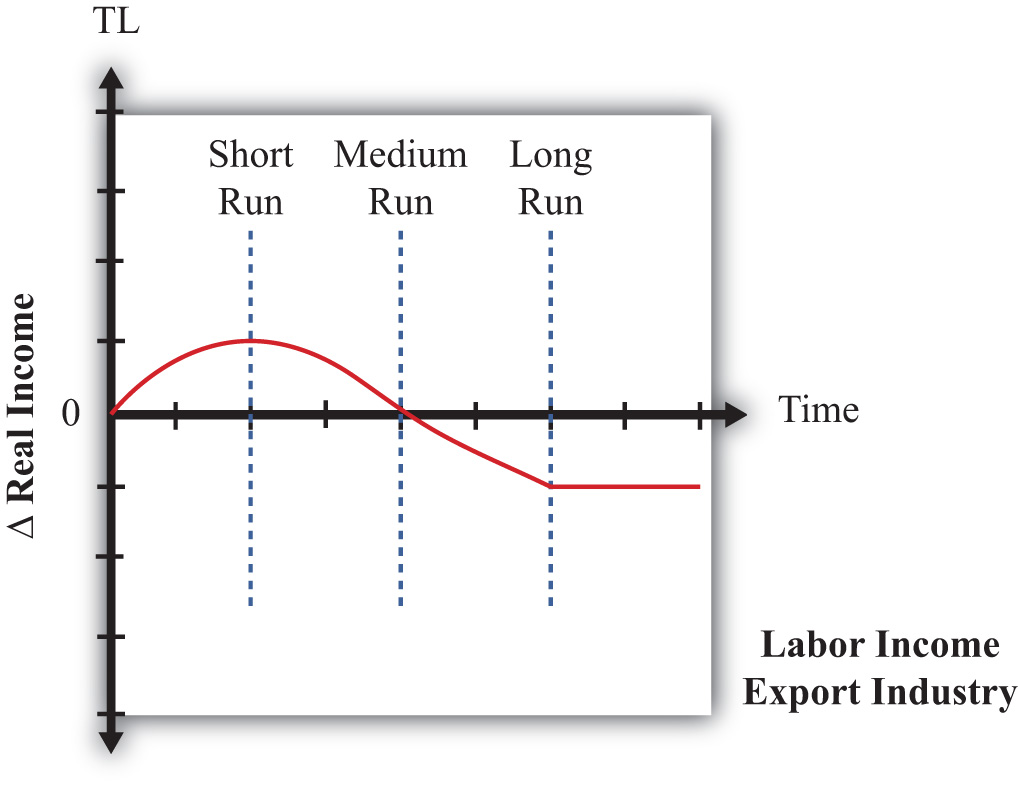

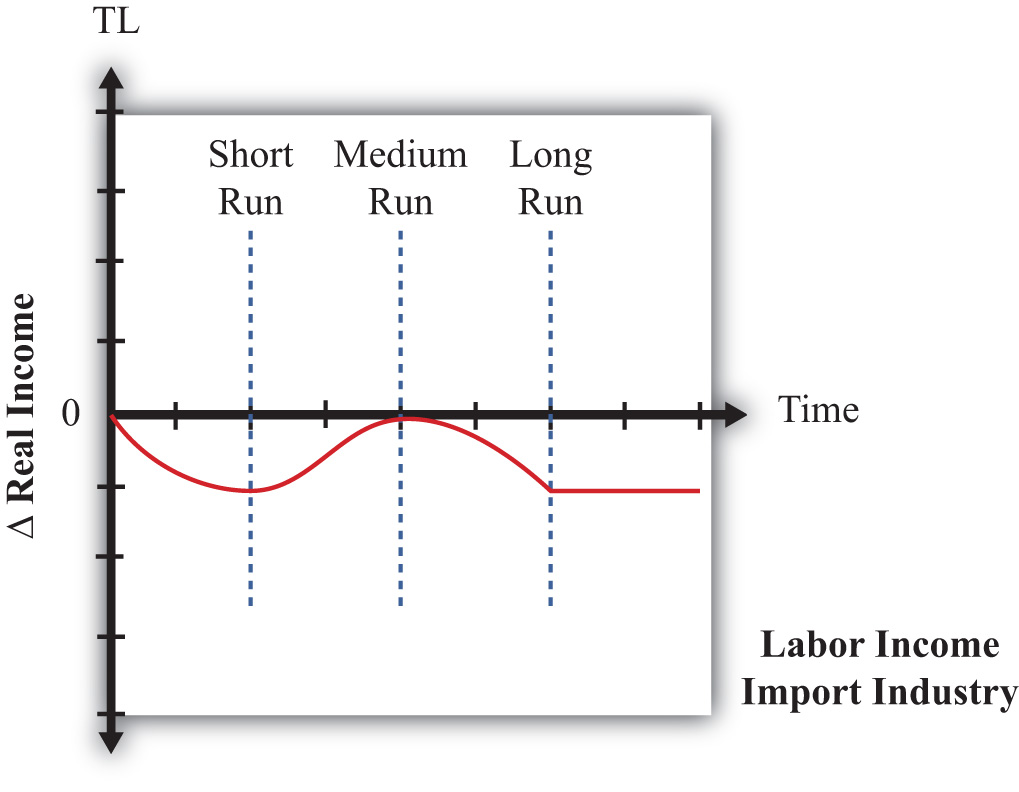

Key Takeaways