This is “Antitrust Policy and Business Regulation”, chapter 16 from the book Microeconomics Principles (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 16 Antitrust Policy and Business Regulation

Start Up: The Plastic War

The $2.5 trillion market for credit and debit cards received a major jolt in 2004 when the U.S. Supreme Court let stand a lower court ruling that Visa and MasterCard had violated the nation’s antitrust laws by prohibiting banks who issued Visa and/or MasterCard from issuing Discover or American Express cards. The court found that, rather than competing with each other, Visa and MasterCard had cooperated with each other by increasing their “intercharge fees,” the fees credit card companies charge to merchants who accept credit cards for payment, in lock-step. And, by locking Discover and American Express out of many markets, Visa and MasterCard were guilty of anti-competitive behavior.

The court’s ruling spelled major trouble for Visa and MasterCard. Under U.S. law, a competitor that has been damaged by the anticompetitive practices of dominant firms can recover triple the damages that actually occurred. Rivals Discover and American Express filed suits against Visa and MasterCard. In 2008, American Express reached an agreement with MasterCard for a settlement of $1.8 billion. That followed a 2007 settlement with Visa for $2.1 billion. Together, the two agreements represented the largest judgments in America’s antitrust history. Discover’s $6 billion suit was still pending in mid-2008.Eric Dash, “MasterCard Will Pay $1.8 Billion To a Rival,” New York Times, June 26, 2008, p. C4; and United States vs. Visa U.S.A., Inc., 344 F.3d 229 (2d. Circuit 2003). The government’s case against Visa and MasterCard illustrates one major theme of this chapter.

In this chapter we will examine some of the limits government imposes on the actions of private firms. The first part of the chapter considers the effort by the U.S. government to limit firms’ monopoly power and to encourage competition in the marketplace. The second part looks at those policies in the context of the global economy. We will also examine efforts to modify antitrust policy to make the U.S. economy more competitive internationally. In the third part of the chapter we will consider other types of business regulation, including those that seek to enhance worker and consumer safety, as well as deregulation efforts over the last 30 years.

16.1 Antitrust Laws and Their Interpretation

Learning Objectives

- Define antitrust policies and tell when and why they were introduced in the United States.

- Discuss highlights in the history of antitrust policies in the United States, focusing on major issues.

- Explain the guidelines the Justice Department uses in dealing with mergers.

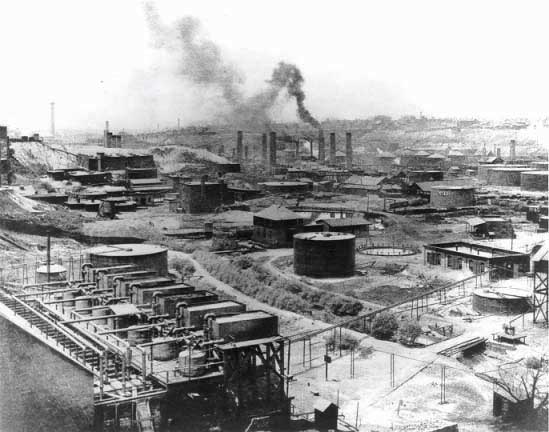

In the decades after the Civil War, giant corporations and cartels began to dominate railroads, oil, banking, meat packing, and a dozen other industries. These businesses were led by entrepreneurs who, rightly or wrongly, have come to be thought of as “robber barons” out to crush their competitors, monopolize their markets, and gouge their customers. The term “robber baron” was associated with such names as J.P. Morgan and Andrew Carnegie in the steel industry, Philip Armour and Gustavas and Edwin Swift in meat packing, James P. Duke in tobacco, and John D. Rockefeller in the oil industry. They gained their market power through cartels and other business agreements aimed at restricting competition. Some formed trusts, a combination of corporations designed to consolidate, coordinate, and control the operations and policies of several companies. It was in response to the rise of these cartels and giant firms that antitrust policy was created in the United States. Antitrust policyPolicy by which government attempts to prevent the acquisition and exercise of monopoly power and to encourage competition in the marketplace. refers to government attempts to prevent the acquisition and exercise of monopoly power and to encourage competition in the marketplace.

A Brief History of Antitrust Policy

The final third of the nineteenth century saw two major economic transitions. The first was industrialization—a period in which U.S. firms became far more capital intensive. The second was the emergence of huge firms able to dominate whole industries. In the oil industry, for example, Standard Oil of Ohio (after 1899, the Standard Oil Company of New Jersey) began acquiring smaller firms, eventually controlling 90% of U.S. oil-refining capacity. American Tobacco gained control of up to 90% of the market for most tobacco products, excluding cigars.

Public concern about the monopoly power of these giants led to a major shift in U.S. policy. What had been an economic environment in which the government rarely intervened in the affairs of private firms was gradually transformed into an environment in which government agencies took on a much more vigorous role. The first arena of intervention was antitrust policy, which authorized the federal government to challenge the monopoly power of firms head-on. The application of this policy, however, has followed a wandering and rocky road.

The Sherman Antitrust Act

The Sherman Antitrust Act of 1890 remains the cornerstone of U.S. antitrust policy. The Sherman Act outlawed contracts, combinations, and conspiracies in restraint of trade.

An important issue in the interpretation of the Sherman Act concerns which actions by firms are illegal per seActions taken by firms that are illegal in and of themselves without regard to the circumstances under which they occur., meaning illegal in and of itself without regard to the circumstances under which it occurs. Shoplifting, for example, is illegal per se; courts do not inquire whether shoplifters have a good reason for stealing something in determining whether their acts are illegal. One key question of interpretation is whether it is illegal per se to control a large share of a market. Another is whether a merger that is likely to produce substantial monopoly power is illegal per se.

Two landmark Supreme Court cases in 1911 in which the Sherman Act was effectively used to break up Standard Oil and American Tobacco enunciated the rule of reasonRule stating that whether or not a particular business practice is illegal depends on the circumstances surrounding the action., which holds that whether or not a particular business practice is illegal depends on the circumstances surrounding the action. In both cases, the companies held dominant market positions, but the Court made it clear that it was their specific “unreasonable” behaviors that the breakups were intended to punish. In determining what was illegal and what was not, emphasis was placed on the conduct, not the structure or size, of the firms.

In the next 10 years, the Court threw out antitrust suits brought by government prosecutors against Eastman Kodak, International Harvester, United Shoe Machinery, and United States Steel. The Court determined that none of them had used unreasonable means to achieve their dominant positions in the industry. Rather, they had successfully exploited economies of scale to reduce costs below competitors’ costs and had used reasonable means of competition to reap the rewards of efficiency.

The rule of reason suggests that “bigness” is no offense if it has been achieved through legitimate business practices. This precedent, however, was challenged in 1945 when the U.S. Court of Appeals ruled against the Aluminum Company of America (Alcoa). The court acknowledged that Alcoa had been able to capture over 90% of the aluminum industry through reasonable business practices. Nevertheless, the court held that by sheer size alone, Alcoa was in violation of the prohibition against monopoly.

In a landmark 1962 court case involving a proposed merger between United Shoe Machinery and the Brown Shoe Company, one of United’s competitors, the Supreme Court blocked the merger because the resulting firm would have been so efficient that it could have undersold all of its competitors. The Court recognized that lower shoe prices would have benefited consumers, but chose to protect competitors instead.

The Alcoa case and the Brown Shoe case, along with many other antitrust cases in the 1950s and 1960s, added confusion and uncertainty to the antitrust environment by appearing to reinvoke the doctrine of per se illegality. In the government’s case against Visa and MasterCard, the government argued successfully that the behavior of the two firms was a per se violation of the Sherman Act.

The Sherman Act also aimed, in part, to prevent price-fixingSituation in which two or more firms agree to set prices or to coordinate their pricing policies., in which two or more firms agree to set prices or to coordinate their pricing policies. For example, in the 1950s General Electric, Westinghouse, and several other manufacturers colluded to fix prices. They agreed to assign market segments in which one firm would sell at a lower price than the others. In 1961, the General Electric–Westinghouse agreement was declared illegal. The companies paid a multimillion-dollar fine, and their officers served brief jail sentences. In 2008, three manufactures of liquid crystal display panels—the flat screens used in televisions, cell phones, personal computers, and such—agreed to pay $585 million in fines for price fixing, with LG Display paying $400 million, Sharp Corporation paying $120 million, and Chunghwa Picture Tubes paying $65 million. The $400 million fine to LG is still less than the record single fine of $500 million paid in 1999 by F. Hoffman-LaRoche, the Swiss pharmaceutical company, in a case involving fixing prices of vitamin supplements.

Other Antitrust Legislation

Concerned about the continued growth of monopoly power, in 1914 Congress created the Federal Trade Commission (FTC), a five-member commission that, along with the antitrust division of the Justice Department, has the power to investigate firms that use illegal business practices.

In addition to establishing the FTC, Congress enacted new antitrust laws intended to strengthen the Sherman Act. The Clayton Act (1914) clarifies the illegal per se provision of the Sherman Act by prohibiting the purchase of a rival firm if the purchase would substantially decrease competition, and outlawing interlocking directorates, in which there are the same people sitting on the boards of directors of competing firms. More significantly, the act prohibits price discrimination that is designed to lessen competition or that tends to create a monopoly and exempts labor unions from antitrust laws.

The Sherman and Clayton acts, like other early antitrust legislation, were aimed at preventing mergers that reduce the number of firms in a single industry. The consolidation of two or more producers of the same good or service is called a horizontal mergerThe consolidation of two or more producers of the same good or service.. Such mergers increase concentration and, therefore, the likelihood of collusion among the remaining firms.

The Celler–Kefauver Act of 1950 extended the antitrust provisions of earlier legislation by blocking vertical mergersMergers between firms at different stages in the production and distribution of a product., which are mergers between firms at different stages in the production and distribution of a product if a reduction in competition will result. For example, the acquisition by Ford Motor Company of a firm that supplies it with steel would be a vertical merger.

U.S. Antitrust Policy Today

The “bigness is badness” doctrine dominated antitrust policy from 1945 to the 1970s. But the doctrine always had its critics. If a firm is more efficient than its competitors, why should it be punished? Critics of the antitrust laws point to the fact that of the 500 largest companies in the United States in 1950, over 100 no longer exist. New firms, including such giants as Walmart, Microsoft, and Federal Express, have taken their place. The critics argue that the emergence of these new firms is evidence of the dynamism and competitive nature of the modern corporate scene.

There is no evidence to suggest, for example, that the degree of concentration across all industries has increased over the past 25 years. Global competition and the use of the internet as a marketing tool have increased the competitiveness of a wide range of industries. Moreover, critics of antitrust policy argue that it is not necessary that an industry be perfectly competitive to achieve the benefits of competition. It need merely be contestableOpen to entry by potential rivals.—open to entry by potential rivals. A large firm may be able to prevent small firms from competing, but other equally large firms may enter the industry in pursuit of the high profits earned by the initial large firm. For example, Time Warner, primarily a competitor in the publishing and entertainment industries, has in recent years become a main competitor in the cable television market.

Currently, the Justice Department follows guidelines based on the Herfindahl–Hirschman Index (HHI). The HHI, introduced in an earlier chapter, is calculated by summing the squared percentage market shares of all firms in an industry, where the percentages are expressed as whole numbers (for example 30% would be expressed as 30). The higher the value of the index, the greater the degree of concentration. Possible values of the index range from 0 in the case of perfect competition to 10,000 ( ) in the case of a monopoly.

Current guidelines stipulate that any industry with an HHI under 1,000 is unconcentrated. Except in unusual circumstances, mergers of firms with a postmerger index under 1,000 will not be challenged. The Justice Department has said it would challenge proposed mergers with a postmerger HHI between 1,000 and 1,800 if the index increased by more than 100 points. Industries with an index greater than 1,800 are deemed highly concentrated, and the Justice Department has said it would seek to block mergers in these industries if the postmerger index would increase by 50 points or more. Table 16.1 "The Herfindahl-Hirschman Index and Antitrust Policy" summarizes the use of the HHI by the Justice Department.

Table 16.1 The Herfindahl-Hirschman Index and Antitrust Policy

| If the postmerger Herfindahl-Hirschman Index is found to be… | then the Justice Department will likely take the following action. |

|---|---|

| Unconcentrated (<1,000) | No challenge |

| Moderately concentrated (1,000–1,800) | Challenge if postmerger index changes by more than 100 points. |

| Highly concentrated (>1,800) | Challenge if postmerger index changes by more than 50 points. |

The Department of Justice (DOJ) and the Federal Trade Commission (FTC) have adopted the following guidelines for merger policy based on the Herfindahl-Hirschman Index.

U.S. Department of Justice and Federal Trade Commission, 1992 Horizontal Merger Guidelines, issued April 2, 1992, revised April 8, 1997.

One difficulty with the use of the HHI is that its value depends on the definition of the market. With a sufficiently narrow definition of the market, even a highly competitive market could have an HHI close to the value for a monopoly. The late George Stigler commented on the difficulty in a fanciful discussion of the definition of the relevant market for cameras:

“Consider the problem of defining a market within which the existence of competition or some form of monopoly is to be determined. The typical antitrust case is an almost impudent exercise in economic gerrymandering. The plaintiff sets the market, at a maximum, as one state in area and including only aperture-priority SLR cameras selling between $200 and $250. This might be called J-Shermanizing the market, after Senator John Sherman. The defendant will in turn insist that the market be world-wide, and include not only all cameras, but all portrait artists and all transportation media, since a visit is a substitute for a picture. This might also be called T-Shermanizing the market, after the Senator’s brother, General William Tecumseh Sherman. Depending on who convinces the judge, the concentration ratio will be awesome or trivial, with a large influence on the verdict.”G. J. Stigler, “The Economists and the Problem of Monopoly,” American Economic Review Papers and Proceedings 72:2 (May 1982): 8–9.

Of course, the definition of the relevant market is not a matter of arbitrarily defining the market as absurdly narrow or broad. There are economic tests to determine the range of goods or services that should be included in a particular market. Consider, for example, the market for refrigerators. Given the relatively low cost of shipping refrigerators, the relevant area might encompass all of North America, given the existence of the North American Free Trade Agreement (NAFTA), which establishes a tariff-free trade zone including Canada, the United States, and Mexico. What sorts of goods should be included? Presumably, any device that is powered by electricity or by natural gas and that keeps things cold would qualify. Certainly, a cool chest that requires ice that people take on picnics would not be included. The usual test is the cross price elasticity of demand. If it is high between any two goods, then those goods are candidates for inclusion in the market.

Should the entire world be the geographic region for the market for refrigerators? That is an empirical question. If the cross price elasticities for refrigerator brands worldwide are high, then one would conclude that the world is the relevant geographical definition of the market.

In the 1980s both the courts and the Justice Department held that bigness did not necessarily translate into badness, and corporate mergers proliferated. In the period 1982–1989 there were almost 200 mergers and acquisitions of firms whose value exceeded $1 billion. The total value of these companies was nearly half a trillion dollars.

Megamergers continued in the 1990s and into the 21st-century. In 2000, there were 212 mergers valued at $1 billion or more and in 2006 nearly that many. Since then, merger activity has decreased, in part due to turmoil in financial markets.Matt Krantz, “Merger Market Arrives At ’Good spot’; 2006 the Busiest Takeover Year Since End Of ’90s Bull,” USA Today, November 7, 2006, p. 3B; and Matt Krantz, “Big Day for Buyouts, But Tepid Pace Forecase To Continue; Credit Crunch and Other Economic Fears Take Toll,” USA Today, December 18, 2007, p. 1B.

Key Takeaways

- The government uses antitrust policies to maintain competitive markets in the economy.

- The Sherman Antitrust Act of 1890 and subsequent legislation defined illegal business practices, but these acts are subject to widely varying interpretations by government agencies and by the courts.

- Although price-fixing is illegal per se, most business practices that may lessen competition are interpreted under the rule of reason.

- The Justice Department and Federal Trade Commission use the Herfindahl-Hirschman Index to determine whether mergers should be challenged in particular industries.

Try It!

According to what basic principle did the U.S. Supreme Court find Eastman Kodak not guilty of violating antitrust laws? According to what basic principle did the Court block the merger of Brown Shoe Company and one of its competitors, United Shoe Machinery? Do you agree or disagree with the Court’s choices?

Case in Point: Does Antitrust Policy Help Consumers?

Figure 16.1

© 2010 Jupiterimages Corporation

The Department of Justice and the Federal Trade Commission spend a great deal of money enforcing U.S. antitrust laws. Firms defending themselves may spend even more.

The government’s first successful use of the Sherman Act came in its action against Standard Oil in 1911. The final decree broke Standard into 38 independent companies. Did the breakup make consumers better off?

In 1899, Standard controlled 88% of the market for refined oil products. But, by 1911, its share of the market had fallen to 64%. New discoveries of oil had sent gasoline prices down in the years before the ruling. After the ruling, gasoline prices began rising. It does not appear that the government’s first major victory in an antitrust case had a positive impact on consumers.

In general, antitrust cases charging monopolization take so long to be resolved that, by the time a decree is issued, market conditions are likely to have changed in a way that makes the entire effort seem somewhat frivolous. For example, the government charged IBM with monopolization in 1966. That case was finally dropped in 1982 when the market had changed so much that the original premise of the case was no longer valid. In 1998 the Department of Justice began a case against against Microsoft, accusing it of monopolizing the market for Internet browsers by bundling the browser with its operating system, Windows. A trial in 2000 ended with a judgment that Microsoft be split in two with one company having the operating system and another having applications. An appeals court overturned that decision a year later.

Actions against large firms such as Microsoft are politically popular. However, neither policy makers nor economists have been able to establish that they serve consumer interests.

We have seen that the Department of Justice and the Federal Trade Commission have a policy of preventing mergers in industries that are highly concentrated. But, mergers often benefit consumers by achieving reductions in cost. Perhaps the most surprising court ruling involving such a merger came in 1962 when the Supreme Court ruled that a merger in shoe manufacturing would achieve lower costs to consumers. The Court prevented the merger on grounds the new company would be able to charge a lower price than its rivals! Clearly, the Court chose to protect firms rather than to enhance consumer welfare.

What about actions against price-fixing? The Department of Justice investigates roughly 100 price-fixing cases each year. In many cases, these investigations result in indictments. Those cases would, if justified, result in lower prices for consumers. But, economist Michael F. Sproul, in an examination of 25 price-fixing cases for which adequate data were available, found that prices actually rose in the four years following most indictments.

Economists Robert W. Crandall and Clifford Winston have asked a very important question: Has all of this effort enhanced consumer welfare? They conclude that the Department of Justice and the Federal Trade Commission would best serve the economy by following a policy of benign neglect in cases of monopolization, proposed mergers, and efforts by firms to exploit technological gains by lowering price. The economists conclude that antitrust actions should be limited to the most blatant cases of price-fixing or mergers that would result in monopolies. In contrast, law professor Jonathan Baker argued in the same journal that such a minimalist approach could be harmful to consumer welfare. One argument he makes is that antitrust laws and their enforcement create a deterrence effect.

A recent paper by Orley Ashenfelter and Daniel Hosken analyzed the impact of five mergers in the consumer products industry that seemed to be most problematic for antitrust enforcement agencies. In four of the five cases prices rose following the mergers and in the fifth case the merger had little effect on price. While they do not conclude that this small study should be used to determine the appropriate level of government enforcement of antitrust policy, they state that those who advocate less intervention should note that the price effects were not negative, as they would have been if these mergers were producing cost decreases and passing them on to consumers. Those advocating more intervention should note that the price increases they observed after these mergers were not very large.

Sources: Orley Ashenfelter and Daniel Hosken, “The Effect of Mergers on Consumer Prices: Evidence from Five Selected Cases,” National Bureau of Economic Research Working Paper 13859, March 2008; James B. Baker, “The Case for Antitrust Enforcement,” Journal of Economic Perspectives, 17:4 (Fall 2003): 27–50; Robert W. Crandall and Clifford Winston, “Does Antitrust Policy Improve Consumer Welfare? Assessing the Evidence,” Journal of Economic Perspectives, 17:4 (Fall 2003): 3–26; Michael F. Sproul, “Antitrust and Prices,” Journal of Political Economy, 101 (August 1993): 741–54.

Answer to Try It! Problem

In the case of Eastman Kodak, the Supreme Court argued that the rule of reason be applied. Even though the company held a dominant position in the film industry, its conduct was deemed reasonable. In the proposed merger between United Shoe Machinery and Brown Shoe, the court clearly chose to protect the welfare of firms in the industry rather than the welfare of consumers.

16.2 Antitrust and Competitiveness in a Global Economy

Learning Objectives

- Define joint ventures and explain the evolution of U.S. antitrust policy towards them.

- Discuss other antitrust policy changes that relate to U.S. firms competing with foreign firms.

In the early 1980s, U.S. imports from foreign firms rose faster than U.S. exports. In 1986 the trade deficit reached a record level at that time. Antitrust laws played a relatively minor role in increasing the deficit, but business interests and politicians pressed for the relaxation of antitrust policy in order to make U.S. firms more competitive against multinational companies headquartered in other countries.

Antitrust enforcement was altered in the late 1980s so that horizontally competitive U.S. firms could cooperate in research and development (R&D) ventures aimed at innovation, cost-cutting technological advances, and new product development. In an antitrust context, joint venturesCooperative arrangements between two or more firms that otherwise would violate antitrust laws. refer to cooperative arrangements between two or more firms that otherwise would violate antitrust laws. Proponents of the change argued that foreign multinational firms were not subject to stringent antitrust restrictions and therefore had a competitive advantage over U.S. firms. The International Competition Policy Advisory Committee (ICPAC) was formed in the Department of Justice in 1997 in recognition of the dramatic increases in both international commerce and international anticompetitive activity. Composed of a panel of business, industrial relations, academic, economic, and legal experts, ICPAC is to provide advice and information to the department on international antitrust issues such as transnational cartels and international anticompetitive business practices.

Cooperative Ventures Abroad

Policymakers who revised U.S. antitrust restrictions on joint ventures pointed out that Japanese and European firms are encouraged to cooperate and to collude not only in basic R&D projects, but in production and marketing as well.

The evidence is difficult to interpret, but in Japan, for example, a substantial percentage of research projects are sponsored jointly by firms in the same market. Moreover, the evidence is fairly clear that Japan allows horizontal consolidations and mergers in moderately concentrated markets where antitrust policy would be applied in the United States. Mergers that create substantial monopoly power in Japan are not typically prosecuted by the government.

In Europe, the potential competitive threat to U.S. firms is twofold. First, as the European Union (EU) moved toward economic unification in 1992, it relaxed antitrust enforcement for mergers between firms in different nations, even though they would become a single transnational firm in the near future. In 1984, for example, the European Community (EC), the forerunner of the EU, adopted a regulation that provided blanket exemptions from antitrust provisions against collusion in R&D for firms whose total market share did not exceed 20%. This exemption included horizontal R&D and extended to production and distribution to the point of final sale. Moreover, firms that had a market share greater than 20% could apply for an exemption based on a case-by-case examination.

The U.S. government has relaxed antitrust restrictions in some cases in an effort to make domestic firms more competitive in global competition. For example, producers of semiconductors were allowed to form a research consortium, Sematech, in order to promote the U.S. semiconductor industry. This type of joint venture was formerly prohibited. Sematech has since created the International Sematech Manufacturing Initiative (ISMI), a wholly owned subsidiary dedicated to improve the productivity and cost performance of equipment and manufacturing operations well beyond a narrowly defined semiconductor industry. Its membership includes both domestic and foreign firms, and they collectively represent half of the world’s integrated circuit (semiconductor and microchip) production. In this case, we see the U.S. government is supporting cooperation among multinational and international firms ostensibly for product improvement. One suspects, however, that member firms gain a competitive advantage over non-member firms wherever in the world they are located.

Antitrust Policy and U.S. Competitiveness

In the 1980s Congress passed several laws that relaxed the antitrust prohibition against cooperation among U.S. firms, including the National Cooperative Research Act of 1984 (NCRA) and the Omnibus Trade and Competitiveness Act (OTCA).

The NCRA provided a simple registration procedure for joint ventures in R&D. The NCRA protects members of registered joint ventures from punitive antitrust penalties if the venture is later found to illegally reduce competition or otherwise act in restraint of trade. Between 1984 and 1990 over 200 research joint ventures were registered, substantially more than were formed over the same period within the EC.

Congress passed the OTCA in 1988. The OTCA made unfair methods of competition by foreign firms and importers punishable under the U.S. antitrust laws. It also changed the wording of existing laws concerning “dumping” (selling below cost) by foreign firms. In the past, a domestic firm that claimed injury from a foreign competitor had to prove that the foreign firm was “undercutting” the U.S. market prices. The OTCA changed this provision to the much less restrictive term “underselling” and specifically stated that the domestic firm did not have to prove predatory intent. This legislation opened the door for U.S. competitors to use antitrust laws to prevent competition from foreigners, quite the opposite of the laws’ original purpose. Dumping is discussed further in a later chapter.

In another policy shift, the Justice Department announced in 1988 that the rule of reason would replace per se illegality in analysis of joint ventures that would increase U.S. competitiveness. The Justice Department uses the domestic guidelines and the Herfindahl–Hirschman Index to determine whether a proposed joint venture would increase concentration and thereby lessen competition. In making that assessment, the Justice Department also looks at (1) whether the firms directly compete in other markets, (2) the possible impact on vertical markets, and (3) whether any offsetting efficiency benefits outweigh the anticompetitiveness of the joint venture. Although mergers between two firms in a moderately or highly concentrated industry are prohibited, joint ventures between them may be allowed.

The major antitrust issues to be resolved in the first decade of the twenty-first century go beyond joint R&D ventures. The World Trade Organization, the international organization created in 1995 to supervise world trade, has established a group to study issues relating to the interaction between trade and competition policy, including anticompetitive practices. Nations currently have quite different antitrust laws, as the Case in Point in this section illustrates. The United States has argued against any internationalization of antitrust issues that would reduce its ability to apply U.S. laws. On the other hand, the United States, via the 1994 International Antitrust Enforcement Assistance Act, is negotiating bilateral agreements that allow antitrust agencies in different countries to exchange information for use in antitrust enforcement. The issue of how to deal with anticompetitive practices on a worldwide basis remains unresolved, and this area of antitrust practice and policy will be closely watched and studied by economists.

Key Takeaways

- Increased imports in the last 25 years have led to a rethinking of American antitrust policy.

- One response by the U.S. to international competition is the encouragement of joint ventures.

- U.S. firms that have been “undersold” by foreign firms can charge those firms with “dumping.”

- The World Trade Organization is studying the interactions of trade, competition, and antitrust issues.

Try It!

Suppose that long-distance companies in the United States form a joint venture to explore alternative technologies in telephone services. Would such an effort suggest any danger of collusion? Would it be likely to be permitted?

Case in Point: The United States and the European Union—Worlds Apart

Figure 16.2

© 2010 Jupiterimages Corporation

The European Union’s initial reaction to the proposed merger of Boeing and McDonnell Douglas in 1997 was to threaten to impose tariffs on Boeing planes entering the continent if the deal went through. The issue brought the United States and its European partners to the brink of a trade war.

Then President Bill Clinton responded to the EU’s threat saying, “I’m concerned about what appears to be the reasons for the objection to the Boeing-McDonnell Douglas merger by the European Union, and we have some options ourselves when actions are taken in this regard.” The president seemed to be suggesting retaliatory trade sanctions, such as U.S. tariffs on European-made planes.

At the last minute, the EU allowed the merger on two conditions: that Boeing give up its exclusive supply deals and agreed to license to its competitors (meaning Airbus) McDonnell technology that had been developed with U.S. government support.

In the press, the incident was reported as an incipient trade war. Europe was trying to protect its own airline industry; the United States its own. According to New York University economist Eleanor Fox, though, the dispute stemmed not from countries trying to protect their own companies but from differing antitrust laws.

Ms. Fox argues that U.S. antitrust law is consumer oriented. The question for the Federal Trade Commission was whether the merger made consumers worse off by raising the price of jets to airlines. The FTC reasoned that McDonnell Douglas had no reasonable chance of making and selling new fleets on its own and thus did not constitute a competitive force in the marketplace. With McDonnell Douglas deemed competitively insignificant, the merger was permissible.

However, European Union antitrust laws consider not only consumers but also unfair competitive advantages of dominant firms. Because Boeing held 20-year exclusive contracts with three airlines that represent more than 10% of the market for airline manufacture, the merger magnified Boeing’s competitive advantage over other firms (primarily Airbus) that sell aircraft. The conditions that the EU impose thus made the merger subject to its antitrust laws.

The policy difference is fundamental. Americans argue that they seek to protect competition, while the EU protects competitors—even if consumers suffer as a result. The Economist, a British newsmagazine, reports American antitrust policy makers tend to rely on market forces to dampen monopoly power and argue that relying on regulation may tend to diminish innovation and, in the long run, competition. Europeans argue that regulation is necessary in order to ensure that all firms have a reasonable chance to compete.

The difference in the two approaches to antitrust is vividly illustrated in the treatment of Microsoft by the United States and by the European Union. While the United States initially attempted to prosecute Microsoft for violating the Sherman Act by bundling Internet Explorer with its Windows software, it has since permitted it. The European Union has come down very hard on Microsoft, fining it €1.4 billion ($2.2 billion) and ordering the firm to supply firms using Windows the complete documentation of the system. U.S. authorities argue that such restrictions make Microsoft a less innovative company and argue that the computer market is a highly competitive one as it is and that the imposition of a regulatory burden risks stifling the competition that exists.

Sources: Eleanor M. Fox, “Antitrust Regulation Across International Borders,” The Brookings Review, 16(1) (Winter 1998): 30–32; “Oceans Apart,” Economist, May 1, 2008, 387(8578): 78–79.

Answer to Try It! Problem

A joint venture between competing long-distance companies carries the danger that they may end up colluding. It is also possible that only some long-distance firms would be involved to the exclusion of other rival firms, as happened in the joint venture between General Motors and Toyota. On the other hand, the venture might be allowed in the U.S. under the notion that the firms might need to cooperate to face global competition. Another consideration is that technological change in this industry is occurring so rapidly that competitors can emerge from anywhere. Cable companies, internet providers, and cellular-phone companies all compete with regular telephone companies.

16.3 Regulation: Protecting People from the Market

Learning Objectives

- Compare the public interest and public choice theories of regulation.

- Discuss the costs and benefits of consumer protection laws.

- Discuss the pros and cons of the trend toward deregulation over the last quarter century.

Antitrust policies are primarily concerned with limiting the accumulation and use of market power. Government regulationGovernment power to control the choices of private firms or individuals. is used to control the choices of private firms or individuals. Regulation may constrain the freedom of firms to enter or exit markets, to establish prices, to determine product design and safety, and to make other business decisions. It may also limit the choices made by individuals.

In general terms, there are two types of regulatory agencies. One group attempts to protect consumers by limiting the possible abuse of market power by firms. The other attempts to influence business decisions that affect consumer and worker safety. Regulation is carried out by more than 50 federal agencies that interpret the applicable laws and apply them in the specific situations they find in real-world markets. Table 16.2 "Selected Federal Regulatory Agencies and Their Missions" lists some of the major federal regulatory agencies, many of which are duplicated at the state level.

Table 16.2 Selected Federal Regulatory Agencies and Their Missions

| Financial Markets | |

| Federal Reserve Board | Regulates banks and other financial institutions |

| Federal Deposit Insurance Corporation | Regulates and insures banks and other financial institutions |

| Securities and Exchange Commission | Regulates and requires full disclosure in the securities (stock) markets |

| Commodity Futures Trading Commission | Regulates trading in futures markets |

| Product Markets | |

| Department of Justice, Antitrust Division | Enforces antitrust laws |

| Federal Communications Commission | Regulates broadcasting and telephone industries |

| Federal Trade Commission | Focuses efforts on consumer protection, false advertising, and unfair trade practices |

| Federal Maritime Commission | Regulates international shipping |

| Surface Transportation Board | Regulates railroads, trucking, and noncontiguous domestic water transportation |

| Federal Energy Regulatory Commission | Regulates pipelines |

| Health and Safety | |

| Occupational Health and Safety Administration | Regulates health and safety in the workplace |

| National Highway Traffic Safety Administration | Regulates and sets standards for motor vehicles |

| Federal Aviation Administration | Regulates air and traffic aviation safety |

| Food and Drug Administration | Regulates food and drug producers; emphasis on purity, labeling, and product safety |

| Consumer Product Safety Commission | Regulates product design and labeling to reduce risk of consumer injury |

| Energy and the Environment | |

| Environmental Protection Agency | Sets standards for air, water, toxic waste, and noise pollution |

| Department of Energy | Sets national energy policy |

| Nuclear Regulatory Commission | Regulates nuclear power plants |

| Corps of Engineers | Sets policies on construction near rivers, harbors, and waterways |

| Labor Markets | |

| Equal Employment Opportunity Commission | Enforces antidiscrimination laws in the workplace |

| National Labor Relations Board | Enforces rules and regulations governing contract bargaining and labor relations between companies and unions |

Theories of Regulation

Competing explanations for why there is so much regulation range from theories that suggest regulation protects the public interest to those that argue regulation protects the producers or serves the interests of the regulators. The distinction corresponds to our discussion in the last chapter of the public interest versus the public choice understanding of government policy in general.

The Public Interest Theory of Regulation

The public interest theory of regulation holds that regulators seek to find market solutions that are economically efficient. It argues that the market power of firms in imperfectly competitive markets must be controlled. In the case of natural monopolies (discussed in an earlier chapter), regulation is viewed as necessary to lower prices and increase output. In the case of oligopolistic industries, regulation is often advocated to prevent cutthroat competition.

The public interest theory of regulation also holds that firms may have to be regulated in order to guarantee the availability of certain goods and services—such as electricity, medical facilities, and telephone service—that otherwise would not be profitable enough to induce unregulated firms to provide them in a given community. Firms providing such goods and services are often granted licenses and franchises that prevent competition. The regulatory authority allows the firm to set prices above average cost in the protected market in order to cover losses in the target community. In this way, the firms are allowed to earn, indeed are guaranteed, a reasonable rate of return overall.

Proponents of the public interest theory also justify regulation of firms by pointing to externalities, such as pollution, that are not taken into consideration when unregulated firms make their decisions. As we have seen, in the absence of property rights that force the firms to consider all of the costs and benefits of their decisions, the market may fail to allocate resources efficiently.

The Public Choice Theory of Regulation

The public interest theory of regulation assumes that regulations serve the interests of consumers by restricting the harmful actions of business firms. That assumption, however, is now widely challenged by advocates of the public choice theory of regulation, which rests on the premise that all individuals, including public servants, are driven by self-interest. They prefer the capture theory of regulationTheory stating that government regulations often end up serving the regulated firms rather than their customers., which holds that government regulations often end up serving the regulated firms rather than their customers.

Competing firms always have an incentive to collude or operate as a cartel. The public is protected from such collusion by a pervasive incentive for firms to cheat. Capture theory asserts that firms seek licensing and other regulatory provisions to prevent other firms from entering the market. Firms seek price regulation to prevent price competition. In this view, the regulators take over the role of policing cartel pricing schemes; individual firms in a cartel would be incapable of doing so themselves.

Because it is practically impossible for the regulatory authorities to have as much information as the firms they are regulating, and because these authorities often rely on information provided by those firms, the firms find ways to get the regulators to enforce regulations that protect profits. The regulators get “captured” by the very firms they are supposed to be regulating.

In addition to its use of the capture theory, the public choice theory of regulation argues that employees of regulatory agencies are not an exception to the rule that people are driven by self-interest. They maximize their own satisfaction, not the public interest. This insight suggests that regulatory agencies seek to expand their bureaucratic structure in order to serve the interests of the bureaucrats. As the people in control of providing government protection from the rigors of the market, bureaucrats respond favorably to lobbyists and special interests.

Public choice theory views the regulatory process as one in which various groups jockey to pursue their respective interests. Firms might exploit regulation to limit competition. Consumers might seek lower prices or changes in products. Regulators themselves might pursue their own interests in expanding their prestige or incomes. The abstract goal of economic efficiency is unlikely to serve the interest of any one group; public choice theory does not predict that efficiency will be a goal of the regulatory process. Regulation might improve on inefficient outcomes, but it might not.

Consumer Protection

Every day we come into contact with regulations designed to protect consumers from unsafe products, unscrupulous sellers, or our own carelessness. Seat belts are mandated in cars and airplanes; drivers must provide proof of liability insurance; deceptive advertising is illegal; firms cannot run “going out of business” sales forever; electrical and plumbing systems in new construction must be inspected and approved; packaged and prepared foods must carry certain information on their labels; cigarette packages must warn users of the dangers involved in smoking; gasoline stations must prevent gas spillage; used-car odometers must be certified as accurate. The list of regulations is seemingly endless.

There are often very good reasons behind consumer protection regulation, and many economists accept such regulation as a legitimate role and function of government agencies. But there are costs as well as benefits to consumer protection.

The Benefits of Consumer Protection

Consumer protection laws are generally based on one of two conceptual arguments. The first holds that consumers do not always know what is best for them. This is the view underlying government efforts to encourage the use of merit goods and discourage the use of demerit goods. The second suggests that consumers simply do not have sufficient information to make appropriate choices.

Laws prohibiting the use of certain products are generally based on the presumption that not all consumers make appropriate choices. Drugs such as cocaine and heroin are illegal for this reason. Children are barred from using products such as cigarettes and alcohol on grounds they are incapable of making choices in their own best interest.

Other regulations presume that consumers are rational but may not have adequate information to make choices. Rather than expect consumers to determine whether a particular prescription drug is safe and effective, for example, federal regulations require the Food and Drug Administration to make that determination for them.

The benefit of consumer protection occurs when consumers are prevented from making choices they would regret if they had more information. A consumer who purchases a drug that proves ineffective or possibly even dangerous will presumably stop using it. By preventing the purchase in the first place, the government may save the consumer the cost of learning that lesson.

One problem in assessing the benefits of consumer protection is that the laws themselves may induce behavioral changes that work for or against the intent of the legislation. For example, requirements for childproof medicine containers appear to have made people more careless with medicines. Requirements that mattresses be flame-resistant may make people more careless about smoking in bed. In some cases, then, the behavioral changes attributed to consumer protection laws may actually worsen the problem the laws seek to correct.

An early study on the impact of seat belts on driving behavior indicated that drivers drove more recklessly when using seat belts, presumably because the seat belts made them feel more secure.Sam Peltzman, “The Effects of Automobile Safety Regulations,” Journal of Political Economy 83 (August 1975): 677–725. A recent study, however, found that this was not the case and suggests that use of seat belts may make drivers more safety-conscious.Alma Cohen and Liran Einan, “The Effects of Mandatory Seat Belt Laws on Driving Behaviour and Traffic Fatalities,” Review of Economics and Statistics 85:4 (November 2003): 828–43.

In any event, these “unintended” behavioral changes can certainly affect the results achieved by these laws.

The Cost of Consumer Protection

Regulation aimed at protecting consumers can benefit them, but it can also impose costs. It adds to the cost of producing goods and services and thus boosts prices. It also restricts the freedom of choice of individuals, some of whom are willing to take more risks than others.

Those who demand, and are willing to pay the price for, high-quality, safe, warranted products can do so. But some argue that people who demand and prefer to pay (presumably) lower prices for lower-quality products that may have risks associated with their use should also be allowed to exercise this preference. By increasing the costs of goods, consumer protection laws may adversely affect the poor, who are forced to purchase higher-quality products; the rich would presumably buy higher-quality products in the first place.

To assess whether a particular piece of consumer protection is desirable requires a careful look at how it stacks up against the marginal decision rule. The approach of economists is to attempt to determine how the costs of a particular regulation compare to its benefits.

Economists W. Mark Crain and Thomas D. Hopkins estimated the cost of consumer protection regulation in 2001 and found that the total cost was $843 billion, or $7,700 per household in the United States.W. Mark Crain and Thomas D. Hopkins, “The Impact of Regulatory Costs on Small Firms,” Report for the Office of Advocacy, U.S. Small Business Administration, Washington, D.C., RFP No. SBAHQ-00-R-0027, October 2001, p. 1.

Deregulating the Economy

Concern that regulation might sometimes fail to serve the public interest prompted a push to deregulate some industries, beginning in the late 1970s. In 1978, for example, Congress passed the Airline Deregulation Act, which removed many of the regulations that had prevented competition in the airline industry. Safety regulations were not affected. The results of deregulation included a substantial reduction in airfares, the merger and consolidation of airlines, and the emergence of frequent flier plans and other marketing schemes designed to increase passenger miles. Not all the consequences of deregulation were applauded, however. Many airlines, unused to the demands of a competitive, unprotected, and unregulated environment, went bankrupt or were taken over by other airlines. Large airlines abandoned service to small and midsized cities, and although most of these routes were picked up by smaller regional airlines, some consumers complained about inadequate service. Nevertheless, the more competitive airline system today is probably an improvement over the highly regulated industry that existed in the 1970s. It is certainly cheaper. Table 16.3 "Improvement in Consumer Welfare from Deregulation" suggests that the improvements in consumer welfare from deregulation through the 1990s have been quite substantial across a broad spectrum of industries that have been deregulated.

Table 16.3 Improvement in Consumer Welfare from Deregulation

| Industry | Improvements |

|---|---|

| Airlines | Average fares are roughly 33% lower in real terms since deregulation, and service frequently has improved significantly. |

| Less-than-truckload trucking | Average rates per vehicle mile have declined at least 35% in real terms since deregulation, and service times have improved significantly. |

| Truckload trucking | Average rates per vehicle mile have declined by at least 75% in real terms since deregulation, and service times have improved significantly. |

| Railroads | Average rates per ton-mile have declined more than 50% in real terms since deregulation, and average transit time has fallen more than 20%. |

| Banking | Consumers have benefited from higher interest rates on deposits, from better opportunities to manage risk, and from more banking offices and automated teller machines. |

| Natural gas | Average prices for residential customers have declined at least 30% in real terms since deregulation, and average prices for commercial and industrial customers have declined more than 30%. In addition, service has been more reliable as shortages have been almost completely eliminated. |

Economist Clifford Winston found substantial benefits from deregulation in the five industries he studied—airlines, trucking, railroads, banking, and natural gas.

Source: Clifford Winston, “U.S. Industry Adjustment to Economic Deregulation,” Journal of Economic Perspectives 12(3) (Summer 1998): 89–110.

But there are forces working in the opposite direction as well. Many businesses continue to turn to the government for protection from competition. Public choice theory suggests that more, not less, regulation is often demanded by firms threatened with competition at home and abroad. More and more people seem to demand environmental protection, including clear air, clean water, and regulation of hazardous waste and toxic waste. Indeed, as incomes rise over time, there is evidence that the demand for safety rises. This market phenomenon began before the birth of regulatory agencies and can be seen in the decline in unintentional injury deaths over the course of the last hundred years.W. Kip Viscusi, “Safety at Any Price?” Regulation, Fall 2002: 54–63. And there is little reason to expect less demand for regulations in the areas of civil rights, handicapped rights, gay rights, medical care, and elderly care.

The basic test of rationality—that marginal benefits exceed marginal costs—should guide the formulation of regulations. While economists often disagree about which, if any, consumer protection regulations are warranted, they do tend to agree that market incentives ought to be used when appropriate and that the most cost-effective policies should be pursued.

Key Takeaways

- Federal, state, and local governments regulate the activities of firms and consumers.

- The public interest theory of regulation asserts that regulatory efforts act to move markets closer to their efficient solutions.

- The public choice theory of regulation argues that regulatory efforts serve private interests, not the public interest.

- Consumer protection efforts may sometimes be useful, but they tend to produce behavioral responses that often negate the effort at protection.

- Deregulation efforts through the 1990s generally produced large gains in consumer welfare, though demand for more regulation is rising in certain areas, especially finance.

Try It!

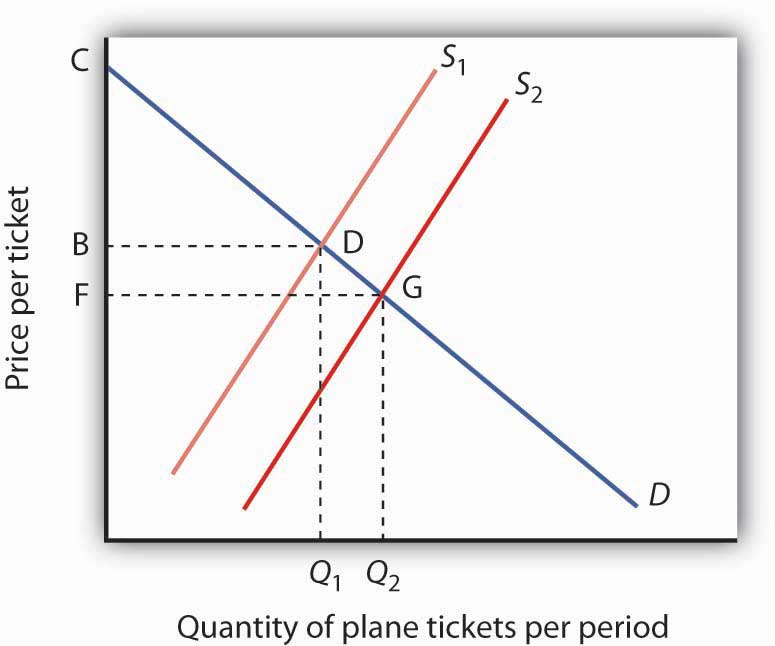

The deregulation of the airline industry has generally led to lower fares and increased quantities produced. Use the model of demand and supply to show this change. What has happened to consumer surplus in the market? (Hint: You may want to refer back to the earlier discussion of consumer surplus.)

Case in Point: Do Consumer Protection Laws Protect Consumers?

Figure 16.3

© 2010 Jupiterimages Corporation

Economist W. Kip Viscusi of the Harvard Law School has long advocated economic approaches to health and safety regulations. Economic approaches recognize 1) behavioral responses to technological regulations; 2) performance-oriented standards as opposed to command-and-control regulations; and 3) the opportunity cost of regulations. Below are some examples of how these economic approaches would improve health and safety policy.

Behavioral responses: Consider the requirement, imposed in 1972, that aspirin containers have childproof caps. That technological change seemed straightforward enough. But, according to Mr. Viscusi, the result has not been what regulators expected. Mr. Viscusi points out that childproof caps are more difficult to open. They thus increase the cost of closing the containers properly. An increase in the cost of any activity reduces the quantity demanded. So, childproof caps result in fewer properly closed aspirin containers.

Mr. Viscusi calls the response to childproof caps a “lulling effect.” Parents apparently think of containers as safer and are, as a result, less careful with them. Aspirin containers, as well as other drugs with childproof caps, tend to be left open. Mr. Viscusi says that the tragic result is a dramatic increase in the number of children poisoned each year. Hence, he urges government regulators to take behavioral responses into account when promulgating technological solutions. He also advocates well-articulated hazard warnings that give consumers information on which to make their own choices.

Performance-oriented standards: Once a health and safety problem has been identified, the economic approach would be to allow individuals or firms discretion in how to address the problem as opposed to mandating a precise solution. Flexibility allows a standard to be met in a less costly way and can have greater impact than command-and-control approaches. Mr. Viscusi cites empirical evidence that worker fatality rates would be about one-third higher were it not for the financial incentives firms derive from creating a safer workplace and thereby reducing the workers’ compensation premiums they pay. In contrast, empirical estimates of the impact of OSHA regulations, most of which are of the command-and-control type, range from nil to a five to six percent reduction in worker accidents that involve days lost from work.

Opportunity cost of regulations: Mr. Viscusi has estimated the cost per life saved on scores of regulations. Some health and safety standards have fairly low cost per life saved. For example, car seat belts and airplane cabin fire protection cost about $100,000 per life saved. Automobile side impact standards and the children’s sleepwear flammability ban, at about $1 million per life saved, are also fairly inexpensive. In contrast, the asbestos ban costs $131 million per life saved, regulations concerning municipal solid waste landfills cost about $23 billion per life saved, and regulations on Atrazine/alachlor in drinking water cost a whopping $100 billion per life saved. “A regulatory system based on sound economic principles would reallocate resources from the high-cost to the low-cost regulations. That would result in more lives saved at the same cost to society.”

Sources: W. Kip Viscusi, “Safety at Any Price?” Regulation, Fall 2002: 54–63; W. Kip Viscusi, “The Lulling Effect: The Impact of Protective Bottlecaps on Aspirin and Analgesic Poisonings,” American Economic Review 74(2) (1984): 324–27.

Answer to Try It! Problem

Deregulation of the airline industry led to sharply reduced fares and expanded output, suggesting that supply increased. That should significantly increase consumer surplus. Specifically, the supply curve shifted from S1 to S2. Consumer surplus is the difference between the total benefit received by consumers and total expenditures by consumers. Before deregulation, when the price was B and the quantity was Q1, the consumer surplus was BCD. The lower rates following deregulation reduced the price to consumers to, say, F, and increased the quantity to Q2 on the graph, thereby increasing consumer surplus to FCG.

Figure 16.4

16.4 Review and Practice

Summary

This chapter has shown that government intervention in markets takes the form of antitrust action to prevent the abuse of market power and regulations aimed at achieving socially desired objectives that are not or cannot be provided by an unregulated market system.

We saw that antitrust policy has evolved from a view that big business was bad business to an attempt to assess how the behavior of firms and the structure of markets affect social welfare and the public interest. The rule of reason rather than per se illegality guides most antitrust policy today, but because there is considerable debate concerning the appropriate role of government antitrust policy and regulation, application of the rule of reason in specific cases is uneven. Prosecution and enforcement of the nation’s antitrust laws has varied over time.

The rising role of a global economy in the last half of the twentieth century reduced the degree of market power held by domestic firms. Policymakers have reconsidered antitrust policy and what types of joint ventures and cooperation among competing firms should be allowed. U.S. antitrust policy has not been abandoned, but since the early 1980s it has been applied with greater consideration of its implications for the competitiveness of U.S. businesses against Asian, European, and other firms. Whether or not antitrust laws among nations will be made more compatible with each other is an issue for the future.

We saw that there are many different schools of thought concerning regulation. One group believes that regulation serves the public interest. Another believes that much current regulation protects regulated firms from competitive market forces and that the regulators are captured by the firms they are supposed to regulate. Yet another group points out that the regulators may do little more than serve their own interests, which include increasing the bureaucratic reach of their agencies.

Finally, the chapter looked at the complex issues surrounding consumer protection regulations. Consumer protection legislation has costs, borne by consumers and taxpayers. Economists are not in agreement concerning which, if any, consumer protection regulations are warranted. They do agree, however, that market incentives ought to be used when appropriate and that the most cost-effective policies should be pursued.

Concept Problems

- Apex Manufacturing charges Zenith Manufacturing with predatory pricing (that is, selling below cost). What do you think the antitrust authorities will want to consider before they determine whether to prosecute Zenith for unfair practices in restraint of trade?

- Some states require firms to close on Sunday. What types of firms support these laws? Why? What types of firms do not support these laws? Why?

- Individual taxis in New York, Chicago, and many other cities must have permits, but there are only a fixed number of permits. The permits are typically sold in the marketplace. Who benefits from such a regulation?

- What do you predict is the impact on workers’ wages of safety regulations in the workplace if the labor market is competitive?

- Many states require barbers and beauticians to be licensed. Using the public interest theory of regulation as a base, what, if any, arguments could you make to support such a regulation? Do you think consumers gain from such regulations? Why not just allow anyone to open up a barber shop or beauty salon?

- Suppose a landowner is required to refrain from developing his or her land in order to preserve the habitat of an endangered species. The restriction reduces the value of the land by 50%, to $1 million. Under present law, the landowner does not have to be compensated. Several proposals considered by Congress would require that this landowner be compensated. How does this affect the cost of the regulation?

- A study by the Federal Trade Commission compared the prices of legal services in cities that allowed advertising by lawyers to prices of those same services in cities that did not. It found that the prices of simple wills with trust provisions were 11% higher in cities that did not allow advertising than they were in cities that did.See Carolyn Cox and Susan Foster, “The Costs and Benefits of Occupational Regulation,” Federal Trade Commission, October 1990, p. 31. This, presumably, suggests the cost of such regulation. What might be the benefits? Do you think that such advertising should be restricted?

- Economist W. Kip Viscusi, whose work was cited in the Case in Point, and Gerald Cavallo studied the effects of federal regulations requiring cigarette lighter safety mechanisms.W. Kip Viscusi, “The Lulling Effect: The Impact of Protective Bottlecaps on Aspirin and Analgesic Poisonings,” American Economic Review 74(2) (1984): 324–27. Explain how this technological improvement might improve safety and how it might reduce safety.

- Explain how licensing requirements for providers of particular services result in higher prices for such services. Are such requirements justified? Why or why not?

- What is so bad about price-fixing? Why does the government prohibit it?

- In a 1956 antitrust case against DuPont, the Justice Department argued that the firm held a near monopoly in the cellophane market. DuPont argued that the definition of the market should be changed to include all wrapping paper. Why is this issue of market definition important? (DuPont’s position prevailed.)

- The Case in Point on the efficacy of antitrust enforcement painted a rather negative view of antitrust enforcement. Do you agree with this assessment? Why or why not?

- The Case in Point on Boeing and the European Union discussed a situation in which a foreign government, the European Union, attempted to exert authority over a relationship between two U.S. firms. How is this possible?

Numerical Problems

In 1986, Pepsi announced its intention to buy 7-Up, and Coca-Cola proposed buying Dr Pepper. The table below shows the market shares held by the soft-drink firms in 1986. Assume that the remaining 15% of the market is composed of 15 firms, each with a market share of 1%.

| Company | Market share (percent) |

|---|---|

| Coca-Cola | 39 |

| PepsiCo | 28 |

| Dr Pepper | 7 |

| 7-Up | 6 |

- Calculate the Herfindahl–Hirschman Index (HHI) for the industry as it was structured in 1986.

- Calculate the postmerger HHI if only PepsiCo had bought 7-Up.

- Calculate the postmerger HHI if only Coca-Cola had bought Dr Pepper.

- How would you expect the Justice Department to respond to each merger considered separately? To both?

(By the way, the proposed mergers were challenged, and neither was completed.)