This is “The Marketing Plan”, chapter 16 from the book Marketing Principles (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 16 The Marketing Plan

The average tenure of a chief marketing officer (CMO) can be measured in months—about twenty-six months or less, in fact.Hallie Mummert, “Sitting Chickens,” Target Marketing 31, no. 4 (April 2008): 11. Why? Because marketing is one of those areas in a company in which performance is obvious. If sales go up, the CMO can be lured away by a larger company or promoted.

Indeed, successful marketing experience can be a ticket to the top. The experience of Paul Polman, a former marketing director at Procter & Gamble (P&G), illustrates as much. Polman parlayed his success at P&G into a division president’s position at Nestlé. Two years later, he became the CEO (chief executive officer) of Unilever.David Benady, “Working with the Enemy,” Marketing Week, September 11, 2008, 18.

However, if sales go down, CMOs can find themselves fired. Oftentimes nonmarketing executives have unrealistic expectations of their marketing departments and what they can accomplish.Quotes in this paragraph are from Kate Maddox, “Bottom-Line Pressure Forcing CMO Turnover,” B2B 92, no. 17 (December 10, 2007): 3–4. “Sometimes CEOs don’t know what they really want, and in some cases CMOs don’t really understand what the CEOs want,” says Keith Pigues, a former CMO for Cemex, the world’s largest cement company. “As a result, it’s not surprising that there is a misalignment of expectations, and that has certainly led to the short duration of the tenure of CMOs.”

Moreover, many CMOs are under pressure to set rosy sales forecasts in order to satisfy not only their executive teams but also investors and Wall Street analysts. “The core underpinning challenge is being able to demonstrate you’re adding value to the bottom line,” explains Jim Murphy, former CMO of the consulting firm Accenture. The problem is that when CMOs overpromise and underdeliver, they set themselves up for a fall.

Much as firms must set their customers’ expectations, CMOs must set their organization’s marketing expectations. Marketing plans help them do that. A well-designed marketing plan should communicate realistic expectations to a firm’s CEO and other stakeholders. Another function of the marketing planA document that is designed to communicate the marketing strategy for an offering. The purpose of the plan is to influence executives, suppliers, distributors, and other important stakeholders of the firm so they will invest money, time, and effort to ensure the plan is a success. is to communicate to everyone in the organization who has what marketing-related responsibilities and how they should execute those responsibilities.

Audio Clip

Katie Scallan-Sarantakes

http://app.wistia.com/embed/medias/cd405f66d4Katie Scallan-Sarantakes develops and executes marketing plans for the Gulf States region of Toyota. Her path to this position is not unusual. Listen as she describes what she did to prepare herself for a position running a regional marketing office of a major global automaker.

16.1 Marketing Planning Roles

Learning Objective

- Identify the people responsible for creating marketing plans in organizations.

Who, within an organization, is responsible for creating its marketing plans? From our discussion above, you might think the responsibility lies with the organization’s chief marketing officer (CMO). The reality is that a team of marketing specialists is likely to be involved. Sometimes multiple teams are involved. Many companies create marketing plans at the divisional level. For example, Rockwell International has so many different business areas that each does its own strategic planning. The division responsible for military avionics, for instance, creates its own marketing plans and strategies separately from the division that serves the telecommunications industry. Each division has its own CMO.

Figure 16.1

Rockwell International’s many divisions serve a diverse set of industries, from military avionics and communications to consumer and business telecommunications. That’s why Rockwell develops marketing plans at the division level (business-unit level).

© 2010 Jupiterimages Corporation

Some of the team members specialize in certain areas. For example, the copier company Xerox has a team that specializes in competitive analysis. The team includes an engineer who can take competitors’ products apart to see how they were manufactured, as well as a systems analyst who tests them for their performance. Also on the team is a marketing analyst who examines the competition’s financial and marketing performance.

Some marketing-analyst positions are entry-level positions. You might be able to land one of these jobs straight out of college. Other positions are more senior and require experience, usually in sales or another area of marketing. Marketing analysts, who are constantly updating marketing information, are likely to be permanent members of the CMO’s staff.

In some consumer-goods companies with many brands (such as P&G and SC Johnson), product—or brand—managers serve on their firm’s marketing planning teams on an as-needed basis. These individuals are not permanent members of the team but participate only to the extent that their brands are involved. Many other members of the firm will also participate on marketing planning teams as needed. For example, a marketing researcher is likely to be part of such a team when it needs data for the planning process.

Key Takeaway

The CMO of a business unit is likely to be responsible for the creation of its marketing plan. However, the CMO is generally assisted by marketing professionals and other staff members, who often work on marketing planning teams as needed. Marketing analysts, however, are permanent members of the CMO’s staff.

Review Questions

- Who is involved in the creation of a marketing plan?

- In addition to marketing analysts, what other members of an organization help create marketing plans?

16.2 Functions of the Marketing Plan

Learning Objectives

- Understand the functions of a marketing plan.

- Write a marketing plan.

In Chapter 1 "What Is Marketing?", we introduced the marketing plan and its components. Recall that a marketing plan should do the following:

- Identify customers’ needs.

- Evaluate whether the organization can meet those needs in some way that allows for profitable exchanges with customers to occur.

-

Develop a mission statement, strategy, and organization centered on those needs.

- Create offerings that are the result of meticulous market research.

- Form operations and supply chains that advance the successful delivery of those offerings.

- Pursue advertising, promotional, and public relations campaigns that lead to continued successful exchanges between the company and its customers.

- Engage in meaningful communications with customers on a regular basis.

The Marketing Plan’s Outline

The actual marketing plan you create will be written primarily for executives, who will use the forecasts in your plan to make budgeting decisions. These people will make budgeting decisions not only for your marketing activities but also for the firm’s manufacturing, ordering, and production departments, and other functions based on your plan.

In addition to executives, many other people will use the plan. Your firm’s sales force will use the marketing plan to determine its sales strategies and how many salespeople are needed. The entire marketing staff will rely on the plan to determine the direction and nature of their activities. The advertising agency you hire to create your promotional campaigns will use the plan to guide its creative team. Figure 16.2 "Marketing Plan Outline" shows a complete outline of a marketing plan (you may also want to go to http://www.morebusiness.com/templates_worksheets/bplans/printpre.brc for an example). Next, we will discuss the elements in detail so you will know how to prepare a marketing plan.

Figure 16.2 Marketing Plan Outline

The Executive Summary

A marketing plan starts with an executive summary. An executive summary should provide all the information your company’s executives need to make a decision without reading the rest of the plan. The summary should include a brief description of the market, the product to be offered, the strategy behind the plan, and the budget. Any other important information, such as how your competitors and channel partners will respond to the actions your firm takes, should also be summarized. Because most executives will be reading the plan to make budgeting decisions, the budgeting information you include in the summary is very important. If the executives want more detail, they can refer to the “budget” section, which appears later in the plan. The executive summary should be less than one page long; ideally, it should be about a half page long. Most marketing plan writers find it easier to write a plan’s summary last, even though it appears first in the plan. A summary is hard to write when you don’t know the whole plan, so waiting until the plan is complete makes writing the executive summary easier.

The Business Challenge

In the “business challenge” section of the plan, the planner describes the offering and provides a brief rationale for why the company should invest in it. In other words, why is the offering needed? How does it fit in with what the company is already doing and further its overall business goals? In addition, the company’s mission statement should be referenced. How does the offering and marketing plan further the company’s mission?

Figure 16.3

Your marketing plan has to convince busy executives and other stakeholders that your idea is worth investing in.

© 2010 Jupiterimages Corporation

Remember that a marketing plan is intended to be a persuasive document. You are trying not only to influence executives to invest in your idea but also to convince other people in your organization to buy into the plan. You are also trying to tell a compelling story that will make people outside your organization—for example, the director of the advertising agency you work with, or a potential supplier or channel partner—invest money, time, and effort into making your plan a success. Therefore, as you write the plan you should constantly be answering the question, “Why should I invest in this plan?” Put your answers in the business challenge section of the plan.

The Market

The market section of the plan should describe your customers and competitors, any other organizations with which you will collaborate, and the state of the market. We suggest that you always start the section by describing the customers who will purchase the offering. Why? Because customers are central to all marketing plans. After that, discuss your competitors, the climate, and your company in the order you believe readers will find most persuasive. In other words, discuss the factor you believe is most convincing first, followed by the second-most convincing factor, and so on.

Customers

Figure 16.4

Progresso Soups may divide their market into several groups. This family photo might actually represent three different markets: a person who eats lunch at his or her desk at work and needs something quick and filling; a retired but active couple that wants something hot and nourishing; and a busy young family looking for easy meals to prepare.

© 2010 Jupiterimages Corporation

Who does your market consist of? What makes these people decide to buy the products they do, and how do they fulfill their personal value equations? What is their buying process like? Which of their needs does your offering meet?

Break the market into customer segments and describe each segment completely, answering those questions for each segment. When you write your plan, begin with the most important segment first and work your way to the least important segment. Include in your discussion the market share and sales goals for each segment.

For example, Progresso Soups’ primary market segments might include the following:

- Families in colder regions

- People who need a good lunch but have to eat at their desks

- Busy young singles

- Older, perhaps retired, empty-nesters

These segments would be based on research that Progresso has completed showing that these are the groups that eat the most soup.

Your discussion of each segment should also include how to reach the customers within it, what they expect or need in terms of support (both presales and postsales support), and other information that helps readers understand how each segment is different from the others. After reading the section, a person should have a good grasp of how the segments differ yet understand how the needs of each are satisfied by the total offering.

Audio Clip

Katie Scallan-Sarantakes

http://app.wistia.com/embed/medias/4e5cbb5411A marketing plan has to account for many factors: customers, competitors, and more. Listen as Katie Scallan-Sarantakes describes how she had to consider these factors when creating marketing plans for Toyota.

Company Analysis

Include the results of your analysis of your company’s strengths and weaknesses in this section. How is the company perceived by the customers you described earlier? Why is the company uniquely capable of capitalizing on the opportunity outlined in the plan? How sustainable is the competitive advantage you are seeking to achieve?

You will also need to identify any functional areas in which your company might need to invest for the plan to succeed. For example, money might be needed for new production or distribution facilities and to hire new marketing or sales employees and train existing ones.

One tool that is useful for framing these questions is the SWOT analysisAn acronym for strengths, weaknesses, opportunities, and threats, the SWOT analysis is a tool that frames the situational analysis.. SWOT stands for strengths, weaknesses, opportunities, and threats. Strengths and weaknesses are internal, meaning they are conditions of the company. Either these conditions are positive (strengths) or negative (weaknesses). Opportunities and threats are external to the company, and could be due to potential or actual actions taken by competitors, suppliers, or customers. Opportunities and threats could also be a function of government action or changes in technology and other factors.

When working with executives, some consultants have noted the difficulty executives have in separating opportunities from strengths, weaknesses from threats. Statements such as “We have an opportunity to leverage our strong product features” indicate such confusion. An opportunity lies in the market, not in a strength. Opportunities and threats are external; strengths and weaknesses are internal. Assuming demand (an external characteristic) for a strength (an internal characteristic) is a common marketing mistake. Sound marketing research is therefore needed to assess opportunity.

Other factors that make for better SWOT analysis are these:

- Honest. A good SWOT analysis is honest. A better way to describe those “strong” product features mentioned earlier would be to say “strong reputation among product designers,” unless consumer acceptance has already been documented.

- Broad. The analysis has to be broad enough to capture trends. A small retail chain would have to look beyond its regional operating area in order to understand larger trends that may impact the stores.

- Long term. Consider multiple time frames. A SWOT analysis that only looks at the immediate future (or the immediate past) is likely to miss important trends. Engineers at Mars (makers of Skittles, M&Ms, and Snickers) visit trade shows in many fields, not just candy, so that they can identify trends in manufacturing that may take a decade to reach the candy industry. In this way, they can shorten the cycle and take advantage of such trends early when needed.

- Multiple perspectives. SWOT analyses are essentially based on someone’s perception. Therefore, a good SWOT should consider the perspective of all areas of the firm. Involve people from shipping, sales, production, and perhaps even from suppliers and channel members.

The SWOT analysis for a company, or for any organization, is both internal and external in focus. Some of the external areas for focus are collaborators (suppliers, distributors, and others), competitors, and the business climate.

Collaborators

Along with company strengths and weaknesses, identify any actual or potential partners needed to pull the plan off. Note that collaborators are more than just a list of suppliers and distributors. Collaborators are those organizations, either upstream or downstream in the value chain, you need to partner with to cocreate value.

For example, AT&T collaborated with Apple to develop the iPhone. AT&T is downstream in the value chain, providing the needed cell service and additional features that made the iPhone so revolutionary. At the same time, however, AT&T was a part of the development of the iPhone and the attendant marketing strategy; the partnership began well before the iPhone was launched.

Competitors

Your marketing plan, if it is any good at all, is likely to spark retaliation from one or more competitors. For example, Teradata and Unica operate in the same market. Both sell data-warehousing products to companies. Teradata primarily focuses on the information technology departments that support the data warehouse, whereas Unica focuses on the marketing departments that actually use the data warehouse. Nonetheless, Teradata is well aware of Unica’s marketing strategy and is taking steps to combat it by broadening its own market to include data-warehousing users in marketing departments. One step was to teach their salespeople what marketing managers do and how they would use a data warehouse as part of their job so that when these salespeople are talking to marketing managers, they can know what they’re talking about.

Teradata marketing planners also have to be aware of potential competitors. What if IBM or HP decided to enter the market? Who is most likely to enter the market, what would their offering look like, and how can we make it harder for them to want to enter the market? If your company captures their market before they can enter, then they may choose to go elsewhere.

Identify your competitors and be honest about both their strengths and weaknesses in your marketing. Remember that other people, and perhaps other organizations, will be using your plan to create their own plans. If they are to be successful, they have to know what competition they face. Include, too, in this section of the plan how quickly you expect your competitors to retaliate and what the nature of that retaliation will be. Will they lower their prices, create similar offerings, add services to drive up the value of their products, spend more on advertising, or a combination of these tactics?

A complete competitive analysis not only anticipates how the competition will react; it also includes an analysis of the competition’s financial resources. Do your competitors have money to invest in a competitive offering? Are they growing by acquiring other companies? Are they growing by adding new locations or new sales staff? Or are they growing simply because they are effective? Maybe they are not growing at all. To answer these questions, you will need to carefully review your competitors’ financial statements and all information publicly available about them. This can include an executive quoted in an article about a company’s growth for a particular product or an analyst’s projection for future sales within a specific market.

Business Climate

You may have already addressed some of the factors in the business environment that are creating the opportunity for your offering. For example, when you discussed customers, you perhaps noted a new technology they are beginning to use.

A complete coverage of the climate would include the following (the PEST analysis):

- Political climate

- Economic climate

- Social and cultural environment

- Technological environment

A scan of the political climate should include any new government regulations as well as legislation. For example, will changes in the tax laws make for more or less disposable income among our customers? Will the tightening of government regulations affect how salespeople can call on doctors, for example, hindering your marketing opportunity? Will federal policies that affect exchange rates or tariffs make global competitors stronger or weaker? For example, the government introduced the Cash for Clunkers program to encourage people to buy new cars. Within only a few weeks, 250,000 new cars were sold through the program and it ran out of money. Auto dealers were caught unprepared and many actually ran out of popular vehicles.

The economic climate is also important to consider. While 2008 saw tremendous swings in gas prices, other factors such as the subprime lending crisis and decline of the housing market affected everything from the price of corn to the sales of movie tickets. Such volatility is unusual, but it is important nonetheless to know what the economy is doing.

Figure 16.5

The housing crisis was caused by a failure in the subprime lending market, an economic condition that affected many other businesses.

© 2010 Jupiterimages Corporation

The social and cultural environment is also important to watch. Marketers, for example, may note the rise in the Hispanic population as a market segment, but it is also important to recognize the influence of the Hispanic culture. Understanding the Hispanic culture is important in reaching this market segment with the right marketing mix. In creating marketing campaigns for something such as a financial product, it’s very important to understand the history that Hispanics have had with financial institutions in their home countries. Understanding that culturally Hispanics might not trust financial institutions and developing campaigns that generate positive word of mouth, such as refer-a-friend and influencer tactics, can be explosive once the wall has been torn down.

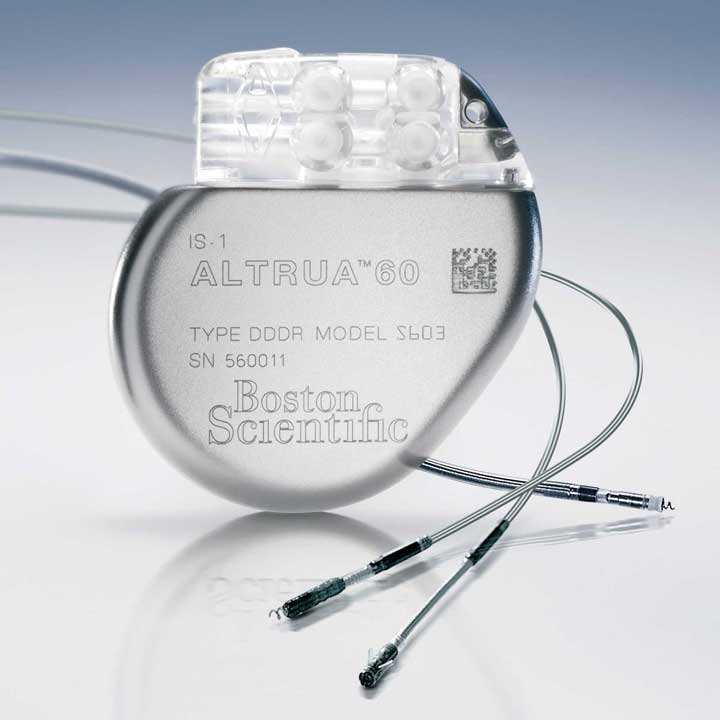

Finally, the technological environment should be considered. Technology is the application of science to solve problems. It encompasses more than just information (computer) technology. For example, when Ted Schulte (profiled in Chapter 13 "Professional Selling") discusses a pacemaker with a cardiac surgeon, Ted is describing the latest technology available. The new technology could be related to the battery used to power the pacemaker, the materials used in the leads (the wires that connect the pacemaker to the body), or even the material that encases the pacemaker. Understanding the technological environment can provide you with a greater understanding of a product’s life cycle and the direction the market is taking when it comes to newer technologies.

Figure 16.6

Technology encompasses more than just information technology. Produced by Guidant Technologies, this pacemaker utilizes information technology to record heart-function data a doctor can read later. But the product might also utilize other new technologies, such as a new battery, materials used to connect the pacemaker to the heart, and the casing for the pacemaker, all of which affect its performance.

Source: Guidant Technologies, used with permission.

Many of the environmental factors we mentioned impact other factors. For example, technological changes are altering the social and cultural environment. Instead of writing letters to one another, families and friends use e-mail and social networking sites to communicate and maintain relationships. Online communication has affected any number of businesses, including the greeting card business and the U.S. Postal Service, which recently announced it was closing many facilities.

Likewise, the economic environment influences the political environment and vice versa. The huge bailout of the banks by the government is an example of how the economic environment affects the political environment. The laws passed as a result of the bank bailout, which include more-restrictive lending practices, are affecting banks, businesses, and consumers. Any looming changes in the business climate such as this need to be included in your marketing plan.

The Strategy

The next section of the plan details the strategy your organization will use to develop, market, and sell the offering. This section is your opportunity to create a compelling argument as to what you intend to do and why others should invest in the strategy. Your reader will be asking, “Why should we adopt this strategy?” To answer that question, you may need to include a brief discussion of the strategic alternatives that were considered and discarded. When readers complete the section, they should conclude that the strategy you proposed is the best one available.

The Offering

Provide detail on the features and benefits of the offering, including pricing options, in this section. For example, in some instances, your organization might plan for several variations of the offering, each with different pricing options. The different options should be discussed in detail, along with the market segments expected to respond to each option. Some marketing professionals like to specify the sales goals for each option in this section, along with the associated costs and gross profit margins for each. Other planners prefer to wait until the budget section of the plan to provide that information.

The plan for the offering should also include the plan for introducing offerings that will follow the initial launch. For example, when should Progresso introduce new soup flavors? Should there be seasonal flavors? Should there be smaller sizes and larger sizes, and should they be introduced all at the same time or in stages?

Part of an offering is the service support consumers need to extract the offering’s full value. The support might include presales support as well as postsales support. For example, Teradata has a team of finance specialists who can help customers document the return on investment they would get from purchasing and implementing a Teradata data warehouse. This presales support helps potential buyers make a stronger business case for buying Teradata’s products with executives who control their companies’ budgets.

Postsales support can include technical support. In B2B (business-to-business) environments, sellers frequently offer to train their customers’ employees to use products as part of their postsales support. Before you launch an offering, you need to be sure your firm’s support services are in place. That means training service personnel, creating the appropriate communication channels for customers to air their technical concerns, and other processes.

Figure 16.7

Prior to launching a new offering, the presales and postsales support personnel for it have to be trained and the appropriate work processes created so that the right level of support is provided. These call-center technicians had to first learn the offering’s technical processes before it could be launched.

© 2010 Jupiterimages Corporation

The Communication Plan

How will the offering be launched? Will it be like Dow Corning’s launch of a new silicon acrylate copolymer, a product used to add color to cosmetics? That product was announced at the In-Cosmetics trade show in Barcelona. Or will you invite customers, media, and analysts from around the globe to your company’s offices for the launch, as SAS did with its SAS 9 software product?

In addition to the announcement of the new product, the communication plan has to specify how ongoing customer communications will be conducted. The mechanisms used to gather customer feedback as well as how the offering will be promoted to customers need to be spelled out. For example, will you create an online community like Laura Carros did with the JCPenney Ambrielle line?

The discussion of the communication plan can be fairly broad. You can put additional details in a separate planning document that outlines the product’s advertising strategies, event strategies (such as trade shows and special events like customer golf tournaments that will be used to promote the product), and sales strategies.

Distribution

This section should answer questions about where and how the offering will be sold. Who will sell it? Who will ship it? Who will service and support it? In addition, the distribution section should specify the inventories that need to be maintained in order to meet customer expectations for fast delivery and where those inventories should be kept.

Budget

The budget section is more than just a discussion of the money needed to launch the new offering. A complete budget section will cover all the resources, such as new personnel, new equipment, new locations, and so forth, for the launch to be a success. Of course, these resources have costs associated with them. In some instances, the budget might require that existing resources be redeployed and a case made for doing so.

The first portion of the budget will likely cover the investment required for the launch. The plan might point out that additional funds need to be allocated to the offering to make it ready for the market. For example, perhaps additional beta testing or product development over and above what the firm normally commits to new products is needed. Certainly, marketing funds will be needed to launch the offering and pay for any special events, advertising, promotional materials, and so forth. Funds might also be needed to cover the costs of training salespeople and service personnel and potentially hiring new staff members. For example, Teradata introduced a new offering that was aimed at an entirely new market. The new market was so different that it required a new sales force. Details for the sales force, such as how many salespeople, sales managers, and support personnel will be needed, would go in this section.

The budget section should include the costs associated with maintaining the amount of inventory of the product to meet customers’ needs. The costs to provide customers with support services should also be estimated and budgeted. Some products will be returned, some services will be rejected by the consumer, and other problems will occur. The budget should include projections and allowances for these occurrences.

The budget section is also the place to forecast the product’s sales and profits. Even though the plan likely mentioned the sales goals set for each market segment, the budget section is where the details go. For example, the cost for advertising, trade shows, special events, and salespeople should be spelled out. The projections should also include timelines. The sales costs for one month might be estimated, as well as two months, six months, and so forth, as Figure 16.8 "A Marketing Plan Timeline Illustrating Market Potential, Sales, and Costs" shows.

Note that Figure 16.8 "A Marketing Plan Timeline Illustrating Market Potential, Sales, and Costs" shows that the product’s costs are high early on and then decrease before leveling out. That cost line assumes there is a heavy upfront investment to launch the offering, which is usually true for new products. The sales of the offering should grow as it gathers momentum in the market. However, the market potential stays the same, assuming that the potential number of customers stays the same. That might not always be the case, though. If we were targeting mothers of babies, for example, the market potential might vary based on the projected seasonality in birth rates because more babies tend to be born in some months than others.

Figure 16.8 A Marketing Plan Timeline Illustrating Market Potential, Sales, and Costs

Conclusion

In the conclusion, repeat the highlights. Summarize the target market, the offer, and the communication plan. Your conclusion should remind the reader of all the reasons why your plan is the best choice.

Of course, the written plan is itself a marketing tool. You want it to convince someone to invest in your ideas, so you want to write it down on paper in a compelling way. Figure 16.9 "Tips for Writing an Effective Marketing Plan" offers some tips for effectively doing so. Also, keep in mind that a marketing plan is created at a single point in time. The market, though, is dynamic. A good marketing plan includes how the organization should respond to various scenarios if the market changes. In addition, the plan should include “triggers” detailing what should happen under the scenarios. For example, it might specify that when a certain percentage of market share is reached, then the price of the product will be reduced (or increased). Or the plan might specify the minimum amount of the product that must be sold by a certain point in time—say, six months after the product is launched—and what should happen if the mark isn’t reached. Also, it should once again be noted that the marketing plan is a communication device. For that reason, the outline of a marketing plan may look somewhat different from the order in which the tasks in the outline are actually completed.

Figure 16.9 Tips for Writing an Effective Marketing Plan

Key Takeaway

A marketing plan’s executive summary should include a brief summary of the market, the product to be offered, the strategy behind the plan, and the budget, as well as any other important information. In this section of the plan, the planner describes the offering and a brief rationale for why the company should invest in it. The market section of the plan should describe a firm’s customers, competitors, any other organizations with which it will collaborate, and the climate of the market. The strategy section details the tactics the organization will use to develop, market, and sell the offering. When readers complete the strategy section, they should conclude that the proposed strategy is the best one available.

The budget section of the marketing plan covers all the resources, such as new personnel, new equipment, new locations, and so forth, needed to successfully launch the product, as well as details about the product’s costs and sales forecasts.

Review Questions

- What is a marketing plan and how is it used?

- Which section of the marketing plan is most important? Why? The least important?

- What is the purpose of scenario planning?

16.3 Forecasting

Learning Objectives

- List steps in the forecasting process.

- Identify types of forecasting methods and their advantages and disadvantages.

- Discuss the methods used to improve the accuracy of forecasts.

Creating marketing strategy is not a single event, nor is the implementation of marketing strategy something only the marketing department has to worry about. When the strategy is implemented, the rest of the company must be poised to deal with the consequences. As we have explained, an important component is the sales forecast, which is the estimate of how much the company will actually sell. The rest of the company must then be geared up (or down) to meet that demand. In this section, we explore forecasting in more detail, as there are many choices a marketing executive can make in developing a forecast.

Accuracy is important when it comes to forecasts. If executives overestimate the demand for a product, the company could end up spending money on manufacturing, distribution, and servicing activities it won’t need. The software developer Data Impact recently overestimated the demand for one of its new products. Because the sales of the product didn’t meet projections, Data Impact lacked the cash available to pay its vendors, utility providers, and others. Employees had to be terminated in many areas of the firm to trim costs.

Underestimating demand can be just as devastating. When a company introduces a new product, it launches marketing and sales campaigns to create demand for it. But if the company isn’t ready to deliver the amount of the product the market demands, then other competitors can steal sales the firm might otherwise have captured. Sony’s inability to deliver the e-Reader in sufficient numbers made Amazon’s Kindle more readily accepted in the market; other features then gave the Kindle an advantage that Sony is finding difficult to overcome.

The marketing leader of a firm has to do more than just forecast the company’s sales. The process can be complex, because how much the company can sell will depend on many factors such as how much the product will cost, how competitors will react, and so forth—in fact, much of what you have already read about in preparing a marketing strategy. Each of these factors has to be taken into account in order to determine how much the company is likely to sell. As factors change, the forecast has to change as well. Thus, a sales forecast is actually a composite of a number of estimates and has to be dynamic as those other estimates change.

A common first step is to determine market potentialTotal industry-wide sales expected in a particular product category for the time period of interest., or total industry-wide sales expected in a particular product category for the time period of interest. (The time period of interest might be the coming year, quarter, month, or some other time period.) Some marketing research companies, such as Nielsen, Gartner, and others, estimate the market potential for various products and then sell that research to companies that produce those products.

Once the marketing executive has an idea of the market potential, the company’s sales potential can be estimated. A firm’s sales potentialThe maximum total revenue a company hopes to generate from a product or the number of units of it the company can hope to sell. is the maximum total revenue it hopes to generate from a product or the number of units of it the company can hope to sell. The sales potential for the product is typically represented as a percentage of its market potential and equivalent to the company’s estimated maximum market share for the time period. As you can see in Figure 16.8 "A Marketing Plan Timeline Illustrating Market Potential, Sales, and Costs", companies sell less than potential because not everyone will make a decision to buy their product: some will put off a decision; others will buy a competitor’s product; still others might make do with a substitute product. In your budget, you’ll want to forecast the revenues earned from the product against the market potential, as well as against the product’s costs.

Forecasting Methods

Forecasts, at their basic level, are simply someone’s guess as to what will happen. Each estimate, though, is the product of a process. Several such processes are available to marketing executives, and the final forecast is likely to be a blend of results from more than one process. These processes are judgment techniques and surveys, time series techniques, spending correlates and other models, and market tests.

Judgment and Survey Techniques

At some level, every forecast is ultimately someone’s judgment. Some techniques, though, rely more on people’s opinions or estimates and are called judgment techniquesForecasting methods that rely on someone’s estimate(s).. Judgment techniques can include customer (or channel member or supplier) surveys, executive or expert opinions, surveys of customers’ (or channel members’) intentions or estimates, and estimates by salespeople.

Customer and Channel Surveys

In some markets, particularly in business-to-business markets, research companies ask customers how much they plan to spend in the coming year on certain products. Have you ever filled out a survey asking if you intend to buy a car or refrigerator in the coming year? Chances are your answers were part of someone’s forecast. Similarly, surveys are done for products sold through distributors. Companies then buy the surveys from the research companies or do their own surveys to use as a starting point for their forecasting. Surveys are better at estimating market potential than sales potential, however, because potential buyers are far more likely to know they will buy something—they just don’t know which brand or model. Surveys can also be relatively costly, particularly when they are commissioned for only one company.

Sales Force Composite

A sales force compositeAn estimate of future sales based on the sum of estimates from all of the company’s salespeople. is a forecast based on estimates of sales in a given time period gathered from all of a firm’s salespeople. Salespeople have a pretty good idea about how much can be sold in the coming period of time (especially if they have bonuses riding on those sales). They’ve been calling on their customers and know when buying decisions will be made.

Estimating the sales for new products or new promotions and pricing strategies will be harder for salespeople to estimate until they have had some experience selling those products after they have been introduced, promoted, or repriced. Further, management may not want salespeople to know about new products or promotions until these are announced to the general public, so this method is not useful in situations involving new products or promotions. Another limitation reflects salespeople’s natural optimism. Salespeople tend to be optimistic about what they think they can sell and may overestimate future sales. Conversely, if the company uses these estimates to set quotas, salespeople are likely to reduce their estimates to make it easier to achieve quota.

Salespeople are more accurate in their near-term sales estimates, as their customers are not likely to share plans too far into the future. Consequently, most companies use sales force composites for shorter-range forecasts in order to more accurately predict their production and inventory requirements. Konica-Minolta, an office equipment manufacturer, has recently placed a heavy emphasis on improving the accuracy of its sales force composites because the cost of being wrong is too great. Underestimated forecasts result in some customers having to wait too long for deliveries for products, and they may turn to competitors who can deliver faster. By contrast, overestimated forecasts result in higher inventory costs.

Executive Opinion

Executive opinionA forecasting method in which an executive or group of executives provides a best estimate of what will be sold or what will happen. is exactly what the name implies: the best-guess estimates of a company’s executives. Each executive submits an estimate of the company’s sales, which are then averaged to form the overall sales forecast. The advantages of executive opinions are that they are low cost and fast and have the effect of making executives committed to achieving them. An executive-opinion-based forecast can be a good starting point. However, there are disadvantages to the method, so it should not be used alone. These disadvantages are similar to those of the sales force composites. If the executives’ forecast becomes a quota upon which their bonuses are estimated, they will have an incentive to underestimate the forecast so they can meet their targets. Organizational factors also come into play. A junior executive, for example, is not likely to forecast low sales for a product that his or her CEO is pushing, even if low sales are likely to occur.

Expert Opinion

Expert opinionA forecasting method in which the forecast is based on an objective third-party expert’s best estimate of what will happen in the market and how that will influence sales. is similar to executive opinion except that the expert is usually someone outside the company. Like executive opinion, expert opinion is a tool best used in conjunction with more quantitative methods. As a sole method of forecasting, however, expert opinions are often very inaccurate. Just consider how preseason college football rankings compare with the final standings. The football experts’ predictions are usually not very accurate.

Time Series Techniques

Time series techniques examine sales patterns in the past in order to predict sales in the future. For example, with a trend analysisA group of forecasting methods that base the future period of sales (or another variable) on the rate of change for previous periods of time., the marketing executive identifies the rate at which a company’s sales have grown in the past and uses that rate to estimate future sales. For example, if sales have grown 3 percent per year over the past five years, trend analysis would assume a similar 3 percent growth rate next year.

A simple form of analysis such as this can be useful if a market is stable. The problem is that many markets are not stable. A rapid change in any one of a market’s dynamics is likely to result in wide swings in growth rates. Just think about auto sales before, during, and after the government’s Cash for Clunkers program. What sold the previous month could not account for the effects of the program. Consequently, if an executive were to have estimated auto sales based on the rate of change for the previous period, the estimate would have been way off.

Figure 16.10

The federal government’s Cash for Clunkers program resulted in a significant short-term increase in new car sales and filled junkyards with thousands of clunkers!

Source: Wikimedia Commons.

The Cash for Clunkers program was an unusual situation; many products may have wide variations in demand for other reasons. Trend analysis can still be useful in these situations but adjustments have to be made to account for the swings in rates of change. Two common adjustments are the moving averageA trend analysis type of forecasting method that estimates sales (or other variable) based on an average rate of change over a group of previous periods of time; the rate changes (moves) as the oldest period is dropped off and the most recent period added in., whereby the rate of change for the past few periods is averaged, and exponential smoothingA method of trend analysis forecasting that weights more recent periods of time more heavily than more distant periods of time., a type of moving average that puts more emphasis on the most recent period.

Correlates and Other Models

A number of more sophisticated models can be useful in forecasting sales. One fairly common method is a correlational analysisA form of trend analysis that estimates sales based on the trends of other variables., which is a form of trend analysis that estimates sales based on the trends of other variables. For example, furniture-company executives know that new housing starts (the number of new houses that are begun to be built in a period) predict furniture sales in the near future because new houses tend to get filled up with new furniture. Such a correlate is considered a leading indicatorA correlate that occurs before the variable being forecasted (e.g., permits to build new houses is a leading indicator of building material sales because permits are issued before the materials are purchased)., because it leads, or precedes, sales. The Conference Board publishes an Index of Leading Indicators, which is a single number that represents a composite of commonly used leading indicators. Some of these leading indicators are housing starts, wholesale orders, orders for durable goods (items like refrigerators, air conditioning systems, and other long-lasting consumer products), and even consumer sentiment, or how consumers think the economy is doing.

Response Models

Some companies create sophisticated statistical models called response modelsSophisticated statistical models used in forecasting that are based on how customers have responded in the past to marketing strategies., which are based on how customers have responded in the past to marketing strategies. JCPenney, for example, takes previous sales data and combines it with customer data gathered from the retailer’s Web site. The models help JCPenney see how many customers are price sensitive and only buy products when they are on sale and how many customers are likely to respond to certain offers. The retailer can then estimate the sales for products by market segment based on the offers and promotions directed at those segments.

Market Tests

A market testThe test launch of a product’s complete marketing plan to ensure that it reaches buyers, gets positive reactions, and generates sales of the product. is an experiment in which the company launches a new offering in a limited market in order to gain real-world knowledge of how the market will react to the product. Since there isn’t any historical data on how the product has done, response models and time-series techniques are not effective. A market test provides some measure of sales in response to the marketing plan, so in that regard, it is like a response model, just based on limited data. The demand for the product can then be extrapolated to the full market. However, remember that market tests are visible to your competitors, and they can undertake actions, such as drastic price cuts, to skew your results.

Figure 16.11

HEB uses Waco, Texas, as a test market, combining data from its loyalty program with sales data to see who buys what and at what price.

Source: Wikimedia Commons.

The grocery chain HEB uses Waco, Texas, as a test site. HEB has a loyalty program that enables it to collect lots of data on its customers. When HEB wants to test market a new product, the firm does it in Waco, where individual customer data can be combined with sales data. Testing in Waco tells HEB who is likely to buy the product and at what price, information that makes extrapolating to their larger market more accurate.

Building Better Forecasts

At best, a forecast is a scientific estimate, but really, a forecast is still just a sophisticated guess. Still, there are steps that can enhance the likelihood of success. The first step is to commit to accuracy. At Konica-Minolta, regional vice presidents are rewarded for being accurate and punished for being wrong about their forecasts, no matter what the direction of them is. As we mentioned earlier, underestimating is considered by Konica-Minolta leadership to be just as bad as overestimating sales.

We’ve also mentioned how salespeople and managers will lower estimates if the estimates are used to set quotas. Using forecasts properly is another factor that can improve forecasting accuracy. But there are other ways to make forecasts more accurate. These begin with picking the right methods for your business.

Pick the Right Method(s) for Your Business and Your Decision

Some products have very short selling cycles; others take a long time to produce and sell. What is appropriate for a fast-moving consumer good like toothpaste is not appropriate for a durable good like a refrigerator. A response model might work for Crest toothpaste in the short term, but longer-term forecasts might require a sophisticated time-series technique. By contrast, Whirlpool might find, for example, that channel surveys are better predictors of refrigerator sales over the long term.

Use Multiple Methods

Since forecasts are estimates, the more estimates generated from various methods, the better. For example, combining expert opinions with a trend analysis could help you understand not only what is happening but also why. Every forecast results in decisions, such as the decision to hire more people, add manufacturing capacity, order supplies, and so forth. In addition, practice makes perfect, as they say. The more forecasts you have to make and resulting decisions you have to live with, the better you will get at forecasting.

Use Many Variables

Forecasting for smaller business units first can result in greater accuracy. For example, JCPenney may estimate sales by region first, and then roll that information up into a national sales forecast. By forecasting locally, more variables can be considered, and with more variables comes more information, which should help the accuracy of the company’s overall sales forecast. Similarly, JCPenney may estimate sales by market segment, such as women over age fifty. Again, forecasting in a smaller segment or business unit can then enable the company to compare such forecasts to forecasts by product line and gain greater accuracy overall.

Use Scenario-Based Forecasts

One forecast is not enough. Consider what will happen if conditions change. For example, how might your forecast change if your competitors react strongly to your strategy? How might it change if they don’t react at all? Or if the government changes a policy that makes your product tax free? All of these factors will influence sales, so the smart executive considers multiple scenarios. While the executive may not expect the government to make something tax free, scenarios can be created that consider favorable government regulation, stable regulation, and negative regulation, just as one can consider light competitive reaction, moderate reaction, or strong reaction.

Track Actual Results and Adjust

As time goes on, forecasts that have been made should be adjusted to reflect reality. For example, Katie Scallan-Sarantakes may have to do an annual forecast for Scion sales, but as each month goes by, she has hard sales data with which to adjust future forecasts. Further, she knows how strongly competition has reacted and can adjust her estimates accordingly. So, even though she may have an annual forecast, the forecast changes regularly based on how well the company is doing.

Key Takeaway

A forecast is an educated guess, or estimate, of sales in the future. Accuracy is important because so many other decisions a firm must make depend on the forecasts. When a company forecasts sales, it has to consider market potential and sales potential. Many methods of forecasting exist, including expert opinion, channel and customer surveys, sales force composites, time series data, and test markets.

Better forecasts can be obtained by using multiple methods, forecasting for various scenarios, and tracking actual data (including sales) and adjusting future forecasts accordingly.

Review Questions

- Which forecasting method would be most accurate for forecasting sales of hair-care products in the next year? How would your answer change if you were forecasting for the next month? For home appliances?

- What is the role of expert opinion in all forecasts?

- How can forecasting accuracy be improved?

16.4 Ongoing Marketing Planning and Evaluation

Learning Objectives

- Apply marketing planning processes to ongoing business settings.

- Identify the role of the marketing audit.

Our discussion so far might lead you to believe that a marketing plan is created only when a new offering is being launched. In reality, marketing plans are created frequently—sometimes on an annual basis, or when a new CMO is hired, when market dynamics change drastically and quickly, or just whenever a company’s CEO wants one. Moreover, as we indicated, a marketing plan should be something of a “living” document; it should contain triggers that result in a company reevaluating its strategies should different scenarios occur.

Some of those scenarios can occur immediately. For example, when a product is launched, the market reacts. Journalists begin to cover the phenomenon, competitors respond, and regulators may take note. What then should happen if the sales goals for the product are substantially exceeded? Should its price be raised or lowered? Should follow-on offerings be launched sooner? What if a competitor launches a similar offering a week later? Or worse yet, what if the competition launches a much better offering? The key to a successful ongoing marketing strategy is twofold: understanding causality and good execution of the marketing plan. Next we discuss each of these aspects.

Audio Clip

Katie Scallan-Sarantakes

http://app.wistia.com/embed/medias/b1db0efe17Katie Scallan-Sarantakes knows firsthand the difficulty of tracking the success of marketing activity. She describes some of those challenges here.

Causality

CausalityThe relationship between two variables whereby one variable is a direct consequence of the other. is the relationship between two variables whereby one variable is a direct consequence of the other. For a scientist in a lab, identifying causality is fairly easy because the causal variable can be controlled and the consequences observed. For marketers, such control is a dream, not a reality. Identifying causality, then, can be a real challenge.

Why is causality so important? Assume you’ve observed a drop in sales that you think is caused by a competitor’s lower price. If you reduce your price to combat the competitor’s when, in reality, the poor sales are due simply to seasonal factors, lower prices might give consumers the impression that your product is cheap or low quality. This could send your sales even further downward. Drawing the wrong conclusions about causality can lead to disastrous results.

Control is an important related concept. Control(a) The degree to which you can manipulate an outcome; (b) the degree to which you can separate the effects of a variable on a consequence., in this context, means not the degree to which you can manipulate an outcome but rather the degree to which you can separate the effects of a variable on a consequence. For example, you have complete control over what the customer pays for the offering. You are able to manipulate that outcome. However, you have no control over seasonal effects. Nonetheless, you can identify what those effects are and account for their influence.

The first type of control is managerial controlThe ability to manipulate variables, such as how a marketing plan is implemented., whereby you have control over how variables in a marketing plan are implemented. You decide, for example, how many stores will carry your product. You can vary that number and have an effect on sales. The second type of control is statistical controlMathematically removing the influence of a variable on an outcome so as to isolate the cause of a problem., whereby you can remove the influence of the variable on the outcome mathematically. For example, you have no control over seasonality. If you are selling a product for babies and more babies are born in August than any other month, then your sales will go up in September. Statistical control allows you to smooth out the seasonal variance on sales so you can then determine how much of the change in sales is due to other factors, especially those you have control over. Statistical control is something you learned in a regression class. However, the numbers in a statistical analysis can be as easily approximated. You don’t necessarily need to utilize complicated equations. Consider the following scenario:

- Over the past five years, you have observed an average decline of 20 percent in sales for the months of June, July, and August, which also happen to be months in which many salespeople and buyers vacation.

- This year, the decline was 28 percent.

- You can therefore safely assume that about 20 percent of the decline this year was due to people taking vacations, as they have in years past; you can further assume that the amount of the decline due to factors other than vacations was about 8 percent.

Doing a simple analysis such as this at least gives you some idea that something new is going on that is lowering your sales. You can then explore the problem more completely.

So how do you figure out exactly what is the cause of such a decline? In some instances, marketing executives speculate about the potential causes of problems and then research them. For example, if the product’s price is perceived to be the problem, conversing with a number of former customers who switched to competing products could either verify this hunch or dispel it. In a B2B environment, salespeople who are aware of a competitor’s new lower prices might be the first to identify the problem, rather than marketing executives. Nonetheless, the firm’s marketing executives can then try to verify that lower prices led to the sales decline. In consumer-goods markets, there are often many segments of consumers. Rather than asking a few of them what they think, formal market research tools such as surveys and focus groups are used.

The Marketing Audit

Another investigative tool that can be used to research a drop in a company’s sales performance is a marketing audit. A marketing auditA snapshot of the state of the company’s marketing strategies as they are actually implemented; an examination of the implementation of a marketing plan to determine if it was implemented properly and if it was successful. is an examination or snapshot of the state of a company’s marketing strategies as they are actually implemented. Here, managerial control becomes important. Was the strategy implemented as intended? Is the strategy working?

Figure 16.12

A marketing audit is an examination of all of the company’s marketing activities. Here, an auditor is looking at actual product displays in a retail store to make sure the product is being displayed and priced properly.

© 2010 Jupiterimages Corporation

For example, when Xerox launched a new workstation, the company ran a promotion giving a customer who bought a workstation a discount on a copier. Despite the promotion, the overall sales of the workstation failed to meet Xerox’s expectations. There were, however, geographical areas in which the sales of the product were quite good. What was up?

Upon closer examination, Xerox’s managers learned that the firm’s salespeople in these areas had actually developed a much more effective selling strategy: they sold the copiers first and then offered the workstation for free by applying the amount of the discount to the workstation, not the copier. Xerox’s marketing quickly revamped the promotion and communicated it effectively to the rest of the sales staff.

FidelityThe degree to which a plan is implemented as intended. is the degree to which the plan is being implemented as it is supposed to be. In the example of the Xerox workstation, there was substantial fidelity—the plan was being implemented right—but the plan was poor. Usually, though, the problem is that the plan is not executed properly.

More serious issues require more in-depth study. When Mark Hurd took over as Hewlett-Packard’s CEO in 2005, he ordered an immediate audit of HP’s sales and marketing activities. Metrics such as the win/loss ratios of business deals, the length of time it took to get a proposal approved and presented to a customer, and other factors exposed numerous problems Hurd needed to fix. The audit identified the causes, many of which Hurd and his team were able to deal with quickly. As a result, HP increased market share and captured the lead in the PC market in the first year following Hurd’s appointment.

According to the marketing consulting company Copernicus, a marketing audit should assess many factors, but especially those listed below. Does any of the information surprise you?

Top Ten Factors a Marketing Audit Should Assess

- Key factors that impacted the business for good or for bad during the past year.

- Customer satisfaction scores and the number and type of customer complaints.

- The satisfaction levels of distributors, retailers, and other value chain members.

- The marketing knowledge, attitudes, and satisfaction of all executives involved in the marketing function.

- The extent to which the marketing program was marketed internally and “bought into” by top managers and nonmarketing executives.

- The offering: Did it meet the customer’s needs as expected, and was the offering’s competitive advantage defensible?

- The performance of the organization’s advertising, promotion, sales, marketing, and research programs with an emphasis on their return on the money invested in them.

- Whether the marketing plan achieved its stated financial and nonfinancial goals.

- Whether the individual elements of the marketing plan achieved their stated financial and nonfinancial goals.

- The current value of the brand and customer equity for each brand in the product portfolio.“Marketing Audit: 10 Critical Components,” Copernicus Marketing Consulting, http://www.copernicusmarketing.com/our-thinking/blog/2011/07/20/10-critical-components-of-a-marketing-audit/ (accessed April 13, 2012).

You were probably surprised by a few items on the list. For example, did your marketing plan include a plan to market the marketing program to important internal parties, such as the company’s managers and employees? We discussed earlier that the marketing plan should persuade others to invest in the plan’s success. Part of that persuasion process could actually include a plan to communicate the plan! A marketing audit should assess the extent to which the plan was successful in achieving the goal of getting important people and departments within an organization to buy into the plan.

Do you think the “top ten” list above is prioritized correctly? Some people would argue that the first four or five factors that need to be examined are the most important. Other people would argue that only the financial factors (factors 7–10) matter. Which group is right?

The answer really depends on what’s important at the time to a company. Because HP hired Hurd to improve the company’s poor financial performance, financial issues were likely his top priority. He knew, however, that the causes of the poor financial performance probably lay elsewhere, so he had his team look deeper. Financial problems are usually the first to prompt a marketing audit.

Many firms don’t wait for problems before conducting an audit. Either they hire consultants like Copernicus Marketing Consulting to conduct the audit, or they do the audits themselves. If a firm’s budget doesn’t allow for a complete audit annually, the company will often focus on one particular area at a time, such as levels of satisfaction among its customers and channel partners. The following year it might audit the company’s communications strategy. Rotating the focus ensures that every aspect is audited regularly, if not annually.

Audio Clip

Katie Scallan-Sarantakes

http://app.wistia.com/embed/medias/f33fa6fb78Marketing is a fun job, but it is more than that. Marketing professionals have to deliver business results with all of the work they do. As Katie Scallan-Sarantakes describes, you have to prove your ability to deliver value.

Key Takeaway

The key to a successful ongoing marketing strategy is twofold: understanding causality and good marketing plan execution. Drawing the wrong conclusions about causality, or what actually causes a change in a company’s sales performance, can lead to disastrous results. That’s why companies investigate the causes by gathering market feedback and conducting market research. Another tool that can be used to research a change in a company’s sales performance is a marketing audit. A marketing audit is an examination or a snapshot of the state of a company’s marketing strategies as they are actually implemented. Complete and partial audits can be done internally or by a consulting firm in order to find areas for improvement.

Review Questions

- What is the difference between managerial control and statistical control? How is statistical control used?

- What should a marketing audit accomplish?

16.5 Discussion Questions and Activities

Discussion Questions

- In addition to CMOs, why do you believe so many other employees participate in marketing planning?

- What is the most important part of a marketing plan? Why? What is the least important? Why?

- Why doesn’t the execution of a marketing plan necessarily follow the same order as the plan itself?

- What is the most important part of a marketing audit? Why? What is the least important part? Why?

Activities

- Pick a product with which you are very familiar and create a simple marketing plan for it. Focus on one market segment.

- Conduct an audit of a company’s marketing plan as if you were a consultant. Selecting a relatively new consumer product may be easier because it is likely to have more press available that you can use for data.