This is “Review and Practice”, section 15.4 from the book Macroeconomics Principles (v. 1.1). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

15.4 Review and Practice

Summary

In this chapter we examined the role of net exports in the economy. We found that export and import demand are influenced by many different factors, the most important being domestic and foreign income levels, changes in relative prices, the exchange rate, and preferences and technology. An increase in net exports shifts the aggregate demand curve to the right; a reduction shifts it to the left.

In the foreign exchange market, the equilibrium exchange rate is determined by the intersection of the demand and supply curves for a currency. Given the ease with which most currencies can be traded, we can assume this equilibrium is achieved, so that the quantity of a currency demanded equals the quantity supplied. An economy can experience current account surpluses or deficits. The balance on current account equals the negative of the balance on capital account. We saw that one reason for the current account deficit in the United States is the U.S. capital account surplus; the United States has attracted a great deal of foreign financial investment.

The chapter closed with an examination of floating and fixed exchange rate systems. Fixed exchange rate systems include commodity-based systems and fixed rates that are maintained through intervention. Exchange rate systems have moved from a gold standard, to a system of fixed rates with intervention, to a mixed set of arrangements of floating and fixed exchange rates.

Concept Problems

- David Ricardo, a famous English economist of the 19th century, stressed that a nation has a comparative advantage in those products for which its efficiency relative to other nations is the highest. He argued in favor of specialization and trade based on comparative, not absolute, advantage. From a global perspective, what would be the “advantage” of such a system?

- For several months prior to your vacation trip to Naples, Italy, you note that the exchange rate for the dollar has been increasing relative to the euro (that is, it takes more euro to buy a dollar). Are you pleased or sad? Explain.

- Who might respond in a way different from your own to the falling value of the euro in Question 2?

- Suppose a nation has a deficit on capital account. What does this mean? What can you conclude about its balance on current account?

- Suppose a nation has a surplus on capital account. What does this mean? What can you conclude about its balance on current account?

-

The following analysis appeared in a newspaper editorial:

“If foreigners own our businesses and land, that’s one thing, but when they own billions in U.S. bonds, that’s another. We don’t care who owns the businesses, but our grandchildren will have to put up with a lower standard of living because of the interest payments sent overseas. Therefore, we must reduce our trade deficit.”

Critically analyze this editorial view. Are the basic premises correct? The conclusion?

- In the years prior to the abandonment of the gold standard, foreigners cashed in their dollars and the U.S. Treasury “lost gold” at unprecedented rates. Today, the dollar is no longer tied to gold and is free to float. What are the fundamental differences between a currency based on the gold standard and one that is allowed to float? What would the U.S. “lose” if foreigners decided to “cash in” their dollars today?

- Can there be a deficit on current account and a deficit on capital account at the same time? Explain.

- Suppose the people of a certain economy increase their spending on foreign-produced goods and services. What will be the effect on real GDP and the price level in the short run? In the long run?

- Now suppose the people of a certain economy reduce their spending on foreign-produced goods and services. What will be the effect on real GDP and the price level in the short run? In the long run?

- Canada, Mexico, and the United States have a free trade zone. What would be some of the advantages of having a common currency as well? The disadvantages? Do you think it would be a good idea? Why or why not?

- The text says that the U.S. capital account surplus necessarily implies a current account deficit. Suppose that the United States were to undertake measures to eliminate its capital account surplus. What sorts of measures might it take? Do you think such measures would be a good idea? Why or why not?

Numerical Problems

-

For each of the following scenarios, determine whether the aggregate demand curve will shift. If so, in which direction will it shift and by how much?

- A change in consumer preferences leads to an initial $25-billion decrease in net exports. The multiplier is 1.5.

- A change in trade policies leads to an initial $25-billion increase in net exports. The multiplier is 1.

- There is an increase in the domestic price level from 1 to 1.05, while the price level of the country’s major trading partner does not change. The multiplier is 2.

- Recession in a country’s trading partner lowers exports by $20 billion. The multiplier is 2.

-

Fill in the missing items in the table below. All figures are in U.S. billions of dollars.

U.S. exports U.S. imports Domestic purchases of foreign assets Rest-of-world purchases of U.S. assets a. 100 100 400 b. 100 200 200 c. 300 400 600 d. 800 800 1,100 -

Suppose the market for a country’s currency is in equilibrium and that its exports equal $700 billion, its purchases of rest-of-world assets equal $1,000 billion, and foreign purchases of its assets equal $1,200 billion. Assuming it has no international transfer payments and that output is measured as GNP:

- What are the country’s imports?

- What is the country’s balance on current account?

- What is the country’s balance on capital account?

-

Suppose that the market for a country’s currency is in equilibrium and that its exports equal $400, its imports equal $500 billion, and rest-of-world purchases of the country’s assets equal $100. Assuming it has no international transfer payments and that output is measured as GNP:

- What is the country’s balance on current account?

- What is the country’s balance on capital account?

- What is the value of the country’s purchases of rest-of-world assets?

-

The information below describes the trade-weighted exchange rate for the dollar (standardized at a value of 100) and net exports (in billions of dollars) for an eight-month period.

Month Trade-weighted exchange rate Net exports January 100.5 −9.8 February 99.9 −11.6 March 100.5 −13.5 April 100.3 −14.0 May 99.6 −15.6 June 100.9 −14.2 July 101.4 −14.9 August 101.8 −16.7 - Plot the data on a graph.

- Do the data support the expected relationship between the trade-weighted exchange rate and net exports? Explain.

-

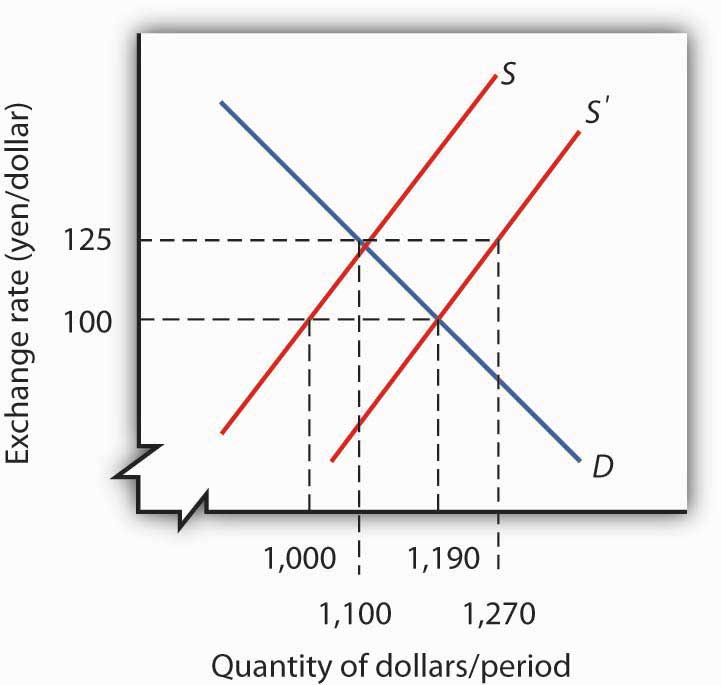

The graph below shows the foreign exchange market between the United States and Japan before and after an increase in the demand for Japanese goods by U.S. consumers.

- If the exchange rate was free-floating prior to the change in demand for Japanese goods, what was its likely value?

- After the change in demand, the free-floating exchange rate would be how many yen per dollar?

- If the Japanese central bank wanted to keep the exchange rate fixed at its initial value, how many dollars would it have to buy?

Figure 15.12

- Suppose Japan relaxes its restrictions on imports of foreign goods and services and begins importing more from the United States. Illustrate graphically how this will affect the U.S. exchange rate, price level, and level of real GDP in the short run and in the long run. How will it affect these same variables in Japan? (Assume both economies are initially operating at their potential levels of output.)

- Suppose U.S. investors begin purchasing assets in Mexico. Illustrate graphically how this will affect the U.S. exchange rate, price level, and level of real GDP in the short run and in the long run. How will it affect these same variables in Mexico? (Assume both economies are initially operating at their potential levels of output.)

- Suppose foreigners begin buying more assets in the United States. Illustrate graphically how this will affect the U.S. exchange rate, price level, and level of real GDP in the short run and in the long run. (Assume the economy is initially operating at its potential output.)