This is “Other People’s Money: An Introduction to Debt”, section 7.4 from the book Individual Finance (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

7.4 Other People’s Money: An Introduction to Debt

Learning Objectives

- Define debt and identify its uses.

- Explain how default risk and interest rate risk determine the cost of debt.

- Analyze the appropriate uses of debt.

Debt is long-term credit, or the ability to delay payment over several periods. Credit is used for short-term, recurring expenses, whereas debt is used to finance the purchase of long-term assets. Credit is a cash management tool used to create security and convenience, whereas debt is an asset management tool used to create wealth. Debt also creates risk.

Two most common uses of debt by consumers are car loans and mortgages. They are discussed much more thoroughly in Chapter 8 "Consumer Strategies" and Chapter 9 "Buying a Home". Before you get into the specifics, however, it is good to know some general ideas about debt.

Figure 7.11

© 2010 Jupiterimages Corporation

Usually, the asset financed by the debt can serve as collateral for the debt, lowering the default risk for the lender. However, that security is often outweighed by the amount and maturity of the loan, so default risk remains a serious concern for lenders. Whatever concerns lenders will be included in the cost of debt, and so these things should also concern borrowers.

Lenders face two kinds of risk: default risk, or the risk of not being paid, and interest rate riskThe risk that a bond’s market value will be affected by a change in interest rates., or the risk of not being paid enough to outweigh their opportunity cost and make a profit from lending. Your costs of debt will be higher than the lender’s cost of risk. When you lower the lender’s risk, you lower your cost of debt.

Costs of Debt

Default Risk

Lenders are protected against default risk by screening applicants to try to determine their probability of defaulting. Along with the scores provided by credit rating agencies, lenders evaluate loan applicants on “the five C’s”: character, capacity, capital, collateral, and conditions.

Character is an assessment of the borrower’s attitude toward debt and its obligations, which is a critical factor in predicting timely repayment. To deduce “character,” lenders can look at your financial stability, employment history, residential history, and repayment history on prior loans.

Capacity represents your ability to repay by comparing the size of your proposed debt obligations to the size of your income, expenses, and current obligations. The larger your income is in relation to your obligations, the more likely it is that you are able to meet those obligations.

Capital is your wealth or asset base. You use your income to meet your debt payments, but you could use your asset base or accumulated wealth as well if your income falls short. Also, you can use your asset base as collateral.

Collateral insures the lender against default risk by claiming a valuable asset in case you default. Loans to finance the purchase of assets, such as a mortgage or car loan, commonly include the asset as collateral—the house or the car. Other loans, such as a student loan, may not specify collateral but instead are guaranteed by your general wealth.

Conditions refer to the lender’s assessment of the current and expected economic conditions that are the context for this loan. If the economy is contracting and unemployment is expected to rise, that may affect your ability to earn income and repay the loan. Also, if inflation is expected, the lender can expect that (1) interest rates will rise and (2) the value of the currency will fall. In this case, lenders will want to use a higher interest rate to protect against interest rate risk and the devaluation of repayments.

Interest Rate Risk

Because debt is long term, the lender is exposed to interest rate risk, or the risk that interest rates will fluctuate over the maturity of the loan. A loan is issued at the current interest rate, which is “the going rate” or current equilibrium market price for liquidity. If the interest rate on the loan is fixed, then that is the lender’s compensation for the opportunity cost or time value of money over the maturity of the loan.

If interest rates increase before the loan matures, lenders suffer an opportunity cost because they miss out on the extra earnings that their cash could have earned had it not been tied up in a fixed-rate loan. If interest rates fall, borrowers will try to refinance or borrow at lower rates to pay off this now higher-rate loan. Then the lender will have its liquidity back, but it can only be re-lent at a newer, lower price and create earnings at this new, lower rate. So the lender suffers the opportunity cost of the interest that could have been earned.

Why should you, the borrower, care? Because lenders will have you cover their costs and create a loan structured to protect them from these sorts of risks. Understanding their risks (looking at the loan agreement from their point of view) helps you to understand your debt choices and to use them to your advantage.

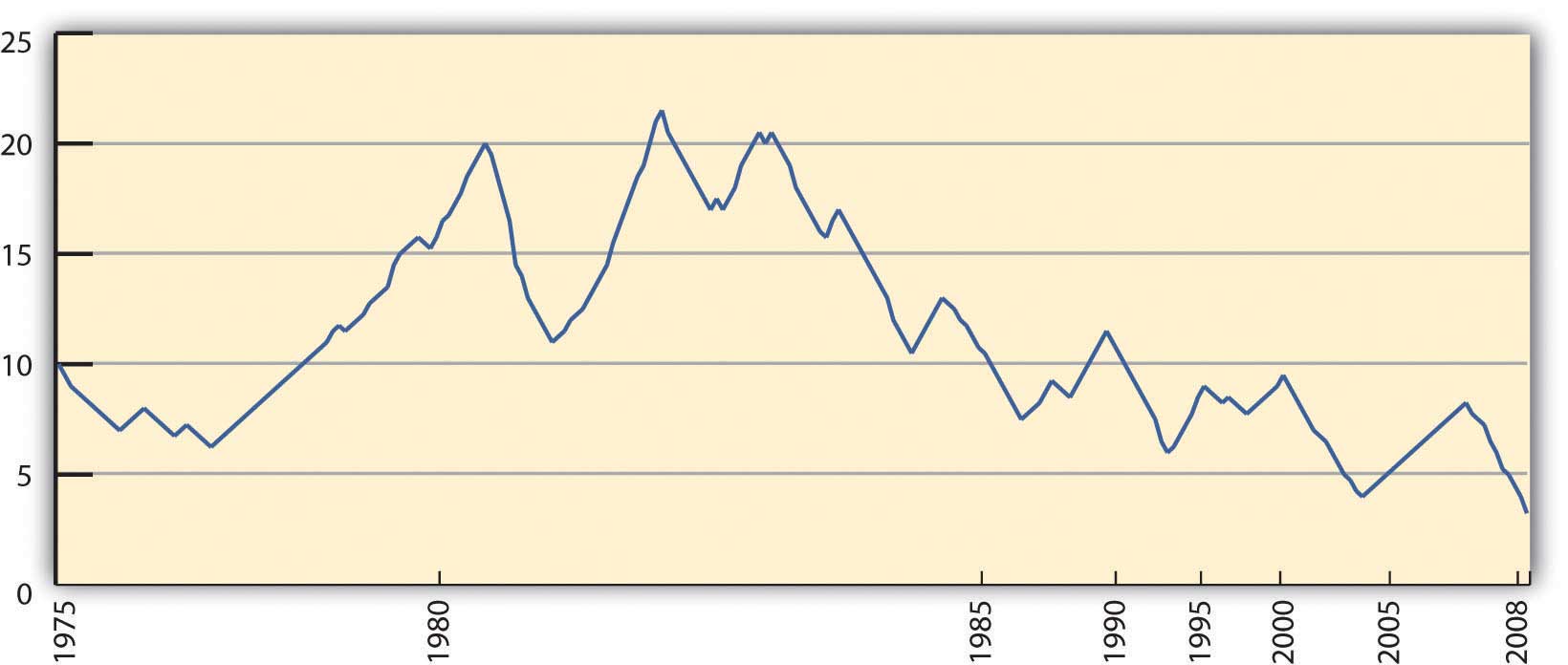

Lenders can protect themselves against interest rate risk by structuring loans with a penalty for early repayment to discourage refinancing or by offering a floating-rate loanA loan for which the interest rate can change, usually periodically and relative to a benchmark rate such as the prime rate. instead of a fixed rate-loanA loan for which the interest rate remains constant over the maturity of the loan.. With a floating-rate loan, the interest rate “floats” or changes, usually relative to a benchmark such as the prime rateA benchmark interest rate understood to be the rate that major banks charge corporate borrowers with the least default risk., which is the rate that banks charge their very best (least risky) borrowers. The floating-rate loan shifts some interest rate risk onto the borrower, for whom the cost of debt would rise as interest rates rise. The borrower would still benefit, and the lender would still suffer from a fall in interest rates, but there is less probability of early payoff should interest rates fall. Mainly, the floating-rate loan is used to give the lender some benefit should interest rates rise. Figure 7.12 "U.S. Prime Rate 1975–2008" shows the extent and frequency of fluctuations in the prime rate from 1975–2008.

Figure 7.12 U.S. Prime Rate 1975–2008Data from the U.S. Federal Reserve, http://federalreserve.gov/releases/h15/data/Monthly/H15_PRIME_NA.txt (accessed February 11, 2009).

Borrowers may be better off having a fixed-rate loan and having stable and predictable payments over the life of the loan. The better or more creditworthy a borrower you are, the better the terms and structure of the loan you may negotiate.

Uses of Debt

Debt should be used to finance assets rather than recurring expenses, which are better managed with a combination of cash and credit. The maturity of the financing (credit or debt) should match the useful life of the purchase. In other words, you should use shorter-term credit for consumption and longer-term debt for assets.

Figure 7.13

© 2010 Jupiterimages Corporation

If you finance consumption with longer-term debt, then your debt will outlive your expenses; you will be continuing to pay for something long after it is gone. If you finance assets with short-term debt, you will be making very high payments, both because you will be repaying over a shorter time and so will have fewer periods in which to repay and because your cost of credit is usually higher than your cost of debt, for example, annual credit card rates are typically higher than mortgage rates.

Borrowers may be tempted to finance asset purchases with credit, however, to avoid the more difficult screening process of debt. Given the more significant investment of time and money in debt, lenders screen potential borrowers more rigorously for debt than they do for credit. The transaction costs for borrowing with debt are therefore higher than they are for borrowing with credit. Still, the higher costs of credit should be a caution to borrowers.

The main reason not to finance expenses with debt is that expenses are expected to recur, and therefore the best way to pay for them is with a recurring source of financing, such as income. The cost of credit can be minimized if it is used merely as a cash management tool, but if it is used as debt, if interest costs are allowed to accrue, then it becomes a very costly form of financing, because it creates new expense (interest) and further obligates future income. In turn, that limits future choices, creating even more opportunity cost.

Credit is more widely available than debt and therefore is a tempting source of financing. It is a more costly financing alternative, however, in terms of both interest and opportunity costs.

Key Takeaways

- Debt is an asset management tool used to create wealth.

- Costs of debt are determined by the lender’s costs and risks, such as default risk and interest rate risk.

- Default risk is defined by the borrower’s ability to repay the interest and principal.

- Interest rate risk is the risk of a change in interest rates that affects the value of the loan and the borrower’s behavior.

- Debt should be used to purchase assets, not to finance recurring expenses.

Exercises

- Identify and analyze your debts. What assets secure your debts? What assets do your debts finance? What is the cost of your debts? What determined those costs? What risks do you undertake by being in debt? How can being in debt help you build wealth?

- Are you considered a default risk? How would a lender evaluate you based on “the five C’s” of character, capacity, capital, collateral, and conditions? Write your evaluations in your personal finance journal or My Notes. How could you plan to make yourself more attractive to a lender in the future?

- Discuss with classmates the Tim Clue video on debt at http://karenblundell.com/funny/funny-video-debt. What makes this comedy spot funny? What makes it not funny? What does it highlight about the appropriate uses of debt?