This is “Sources of Taxation and Kinds of Taxes”, section 6.1 from the book Individual Finance (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

6.1 Sources of Taxation and Kinds of Taxes

Learning Objectives

- Identify the levels of government that impose taxes.

- Define the different kinds of incomes, assets, and transactions that may be taxed.

- Compare and contrast progressive and regressive taxes.

Any government that needs to raise revenue and has the legal authority to do so may tax. Tax jurisdictions reflect government authorities. In the United States, federal, state, and municipal governments impose taxes. Similarly, in many countries there are national, provincial or state, county, and municipal taxes. Regional economic alliances, such as the European Union, may also levy taxes.

Figure 6.1

© 2010 Jupiterimages Corporation

Jurisdictions may overlap. For example, in the United States, federal, state, and local governments may tax income, which becomes complicated for those earning income in more than one state, or living in one state and working in another. Governments tax income because it is a way to tax broadly based on the ability to pay. Most adults have an income from some source, even if it is a government distribution. Those with higher incomes should be able to pay more taxes, and in theory should be willing to do so, for they have been more successful in or have benefited more from the economy that the government protects.

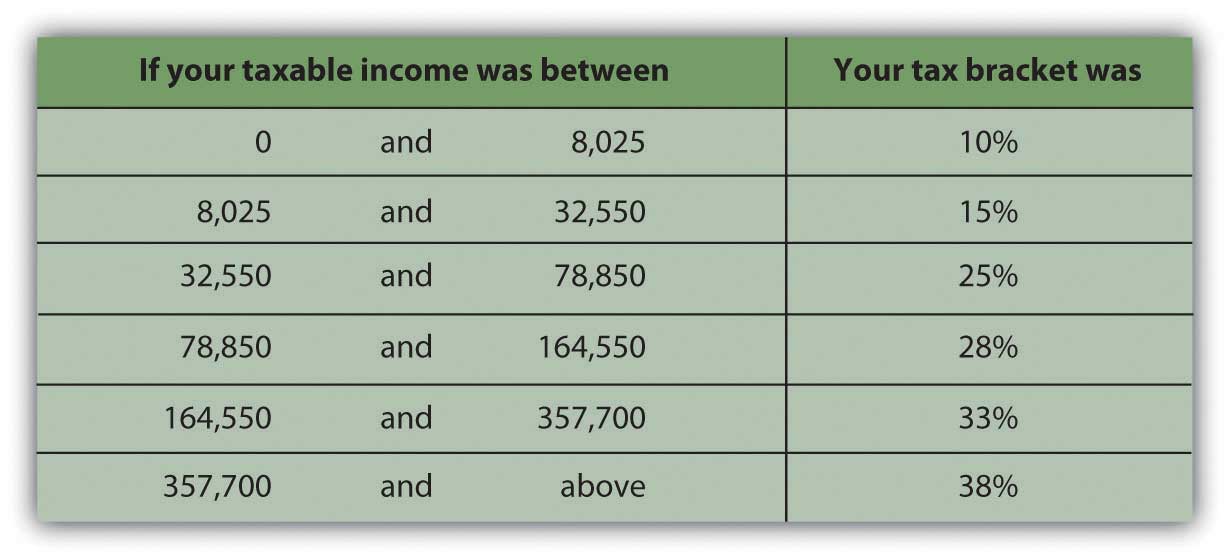

Income tax is usually a progressive taxA tax rate that increases as the amount to be taxed increases, a common design of an income tax.: the higher the income or the more to be taxed, the greater the tax rate. The percentage of income that is paid in tax increases as income rises. Those income categories are called tax bracketsA range of income that defines an income tax rate. (Figure 6.2 "U.S. Income Tax Brackets in 2008 (Single Filing Status)").

Figure 6.2 U.S. Income Tax Brackets in 2008 (Single Filing Status)

Tax is levied on income from many sources:

- Wages (selling labor)

- Interest, dividends, and gains from investment (selling capital)

- Self-employment (operating a business or selling a good or service)

- Property rental

- Royalties (rental of intellectual property)

- “Other” income such as alimony, gambling winnings, or prizes

A sales tax or consumption taxA sales or excise tax that taxes the consumption of discretionary and nondiscretionary goods and services. taxes the consumption financed by income. In the United States, sales taxes are imposed by state or local governments; as yet, there is no national sales tax. Sales taxes are said to be more efficient and fair in that consumption reflects income (income determines ability to consume and therefore level of consumption). Consumption also is hard to hide, making sales tax a good way to collect taxes based on the ability to pay. Consumption taxes typically tax all consumption, including nondiscretionary items such as food, clothing, and housing. Opponents of sales tax argue that it is a regressive taxA tax rate that decreases as the amount to be taxed increases., because those with lower incomes must use a higher percentage of their incomes on nondiscretionary purchases than higher-income people do.

The value-added taxA consumption tax that spreads the tax burden among producers and consumers by taxing the value added to goods at each stage of production and consumption. (VAT) or goods and services tax (GST) is widely used outside the United States. It is a consumption tax, but differs from the sales tax, which is paid only by the consumer as an end user. With a VAT or GST, the value added to the product is taxed at each stage of production. Governments use a VAT or GST instead of a sales tax to spread the tax burden among producers and consumers, and thus to reduce incentive to evade the tax. A consumption tax, like the sales tax, it is a regressive tax. When traveling abroad, you should be aware that a VAT may add substantially to the cost of a purchase (a meal, accommodations, etc.).

Excise taxesA tax on a specific item produced within a country. are taxes on specific consumption items such as alcohol, cigarettes, motor vehicles, fuel, or highway use. In some states, excise taxes are justified by the discretionary nature of the purchases and may be criticized as exercises in social engineering (i.e., using the tax code to dictate social behaviors). For example, people addicted to nicotine or alcohol tend to purchase cigarettes or liquor even if an excise tax increases their cost—and are therefore a reliable source of tax revenue.

Property taxes are used by more local—state, municipal, provincial, and county—governments, and are most commonly imposed on real property (land and buildings) but also on personal assets such as vehicles and boats. Property values theoretically reflect wealth (accrued income) and thus ability to pay taxes. Property values are also a matter of public record (real property is deeded, boats or automobiles are licensed), which allows more efficient tax collection.

Estate taxesA tax on the intergenerational transfer of wealth after death. are taxes on the transfer of wealth from the deceased to the living. Estate taxes are usually imposed on the very wealthiest based on their unusual ability to pay. Because death and the subsequent dispersal of property is legally a matter of public record, estate taxes are generally easy to collect. Estate taxes are controversial because they can be seen as a tax on the very idea of ownership and on incomes that have already been taxed and saved or stored as wealth and properties. Still, estate taxes are a substantial source of revenue for the governments that use them, and so they remain.

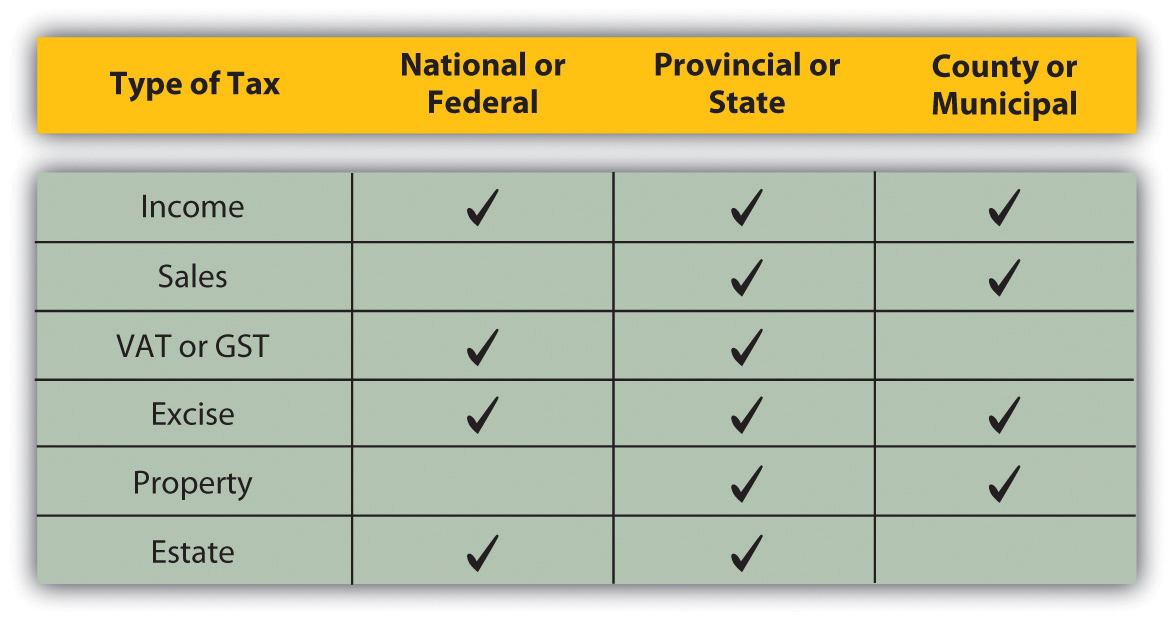

A summary of the kinds of taxes used by the three different jurisdictions is shown in Figure 6.3 "Taxes and Jurisdictions".

Figure 6.3 Taxes and Jurisdictions

Key Takeaways

- Governments at all levels use taxes as a source of financing.

-

Taxes may be imposed on the following:

-

Incomes from

- wages,

- interest, dividends, and gains (losses),

- rental of real or intellectual property.

- Consumption of discretionary and nondiscretionary goods and services.

-

Wealth from

- asset ownership,

- asset transfer after death.

-

-

Taxes may be

- progressive, such as the income tax, in which you pay proportionally more taxes the more income you have;

- regressive, such as a sales tax, in which you pay proportionally more taxes the less income you have.

Exercises

- Examine your state, federal, and other tax returns that you filed last year. Alternatively, estimate based on your present financial situation. On what incomes were you (or would you be) taxed? What tax bracket were you (or would you be) in? How did (or would) your state, federal, and other tax liabilities differ? What other types of taxes did you (or would you) pay and to which government jurisdictions?

-

Match the description to the type of tax. (Write the number of the tax type before its description.)

-

Description:

- ________ tax on the use of vehicles, gasoline, alcohol, cigarettes, highways, and the like.

- ________ tax on the wealth and property of a person upon death.

- ________ tax on purchases of both discretionary and nondiscretionary items.

- ________ tax on wages, earned interest, capital gain, and the like.

- ________ tax on home and land ownership.

- ________ tax on purchases of discretionary items.

- ________ tax on items during their production as well as upon consumption.

-

Type of Tax:

- Property tax

- Consumption tax

- Value-added or goods and services tax

- Income tax

- Excise tax

- Sales tax

- Estate tax

-

- In My Notes or your financial planning journal, record all the types of taxes you will be paying next year and to whom. How will you plan for paying these taxes? How will your tax liabilities affect your budget?

- According to the MSN Money Central article “8 Types of Income the IRS Can’t Touch” (Jeff Schnepper, November 2009, at http://articles.moneycentral.msn.com/Taxes/CutYourTaxes/8typesOfIncomeTheIRScantTouch.aspx), what are eight sources of income that the federal government cannot tax? Poll classmates on the question of whether they think student income can be taxed. According to the companion article “5 Tax Myths That Can Cost You Money” (Jeff Schnepper, November 2009, at http://articles.moneycentral.msn.com/Taxes/AvoidAnAudit/5taxMythsThatCanCostYouMoney.aspx), is it true that students often are exempt from income taxes?