This is “Software in Flux: Partly Cloudy and Sometimes Free”, chapter 10 from the book Getting the Most Out of Information Systems (v. 1.4). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 10 Software in Flux: Partly Cloudy and Sometimes Free

10.1 Introduction

Learning Objectives

- Understand how low marginal costs, network effects, and switching costs have combined to help create a huge and important industry.

- Recognize that the software industry is undergoing significant and broadly impactful change brought about by several increasingly adopted technologies including open source software, cloud computing, and software as a service.

For many, software has been a magnificent business. It is the two-hundred-billion-dollar-per-year juggernautD. Kirkpatrick, “How the Open Source World Plans to Smack Down Microsoft and Oracle, and…,” Fortune, February 23, 2004. that placed Microsoft’s Bill Gates and Oracle’s Larry Ellison among the wealthiest people in the world. Once a successful software product has been written, the economics for a category-leading offering are among the best you’ll find in any industry. Unlike physical products assembled from raw materials, the marginal costThe cost of producing one more unit of a product. to produce an additional copy of a software product is effectively zero. Just duplicate, no additional input required. That quality leads to businesses that can gush cash. Microsoft generates one and a half billion dollars a month from Windows and Office alone.F. Vogelstein, “Rebuilding Microsoft,” Wired, October 2006. Network effects and switching cost can also offer a leading software firm a degree of customer preference and lock in that can establish a firm as a standard, and in many cases creates winner-take-all (or at least winner-take-most) markets.

But as great as the business has been, the fundamental model powering the software industry is under assault. Open source software (OSS)Software that is free and where anyone can look at and potentially modify the code. offerings—free alternatives where anyone can look at and potentially modify a program’s code—pose a direct challenge to the assets and advantages cultivated by market leaders. Giants shudder—“How can we compete with free,” while others wonder, “How can we make money and fuel innovation on free?” And if free software wasn’t enough of a shock, the way firms and users think about software is also changing. A set of services referred to as cloud computingReplacing computing resources—either an organization’s or individual’s hardware or software—with services provided over the Internet. is making it more common for a firm to move software out of its own IS shop so that it is run on someone else’s hardware. In one variant of this approach known as software as a service (SaaS)A form of cloud computing where a firm subscribes to a third-party software and receives a service that is delivered online., users access a vendor’s software over the Internet, usually by simply starting up a Web browser. With SaaS, you don’t need to own the program or install it on your own computer. Hardware clouds can let firms take their software and run it on someone else’s hardware—freeing them from the burden of buying, managing, and maintaining the physical computing that programs need. Another software technology called virtualizationA type of software that allows a single computer (or cluster of connected computers) to function as if it were several different computers, each running its own operating system and software. Virtualization software underpins most cloud computing efforts, and can make computing more efficient, cost-effective, and scalable. can make a single computer behave like many separate machines. This function helps consolidate computing resources and creates additional savings and efficiencies.

These transitions are important. They mean that smaller firms have access to the kinds of burly, sophisticated computing power than only giants had access to in the past. Start-ups can scale quickly and get up and running with less investment capital. Existing firms can leverage these technologies to reduce costs. Got tech firms in your investment portfolio? Understanding what’s at work here can inform decisions you make on which stocks to buy or sell. If you make tech decisions for your firm or make recommendations for others, these trends may point to which firms have strong growth and sustainability ahead, or which may be facing troubled times.

Key Takeaways

- The software business is attractive due to near-zero marginal costs and an opportunity to establish a standard—creating the competitive advantages of network effects and switching costs.

- New trends in the software industry, including open source software (OSS), hardware clouds, software as a service (SaaS), and virtualization are creating challenges and opportunity across tech markets. Understanding the impact of these developments can help a manager make better technology choices and investment decisions.

Questions and Exercises

- What major trends, outlined in the section above, are reshaping how we think about software? What industries and firms are potentially impacted by these changes? Why do managers, investors, and technology buyers care about these changes?

- Which organizations might benefit from these trends? Which might be threatened? Why?

- What are marginal costs? Are there other industries that have cost economics similar to the software industry?

- Investigate the revenues and net income of major software players: Microsoft, Google, Oracle, Red Hat, and Salesforce.com. Which firms have higher revenues? Net income? Which have better margins? What do the trends in OSS, SaaS, and cloud computing suggest for these and similar firms?

- How might the rise of OSS, SaaS, and cloud computing impact hardware sales? How might it impact entrepreneurship and smaller businesses?

10.2 Open Source

Learning Objectives

- Define open source software and understand how it differs from conventional offerings.

- Provide examples of open source software and how firms might leverage this technology.

Who would have thought a twenty-one-year-old from Finland could start a revolution that continues to threaten the Microsoft Windows empire? But Linus Torvalds did just that. During a marathon six-month coding session, Torvalds created the first version of LinuxD. Diamond, “The Good-Hearted Wizard—Linus Torvalds,” Virtual Finland, January 2008. marshalling open source revolutionaries like no one before him. Instead of selling his operating system, Torvalds gave it away. Now morphed and modified into scores of versions by hundreds of programmers, LinuxAn open source software operating system. can be found just about everywhere, and most folks credit Linux as being the most significant product in the OSS arsenal. Today Linux powers everything from cell phones to stock exchanges, set top boxes to supercomputers. You’ll find the OS on 16 to 30 percent of the servers in corporate America (depending on how you slice the numbers),Sarah Lacy, “Open Warfare in Open Source,” BusinessWeek, August 21, 2006; “Worldwide Server Market Revenues Increase 12.1% in First Quarter as Market Demand Continues to Improve, according to IDC,” IDC, May 24, 2011. on about one in four smartphones,“Gartner Says Worldwide Mobile Phone Sales Grew 35 Percent in Third Quarter 2010; Smartphone Sales Increased 96 Percent,” Gartner, November 10, 2010. and supporting most Web servers (including those at Google, Amazon, and Facebook). Linux forms the core of the TiVo operating system, it underpins Google’s Android and Chrome OS offerings, and it has even gone interplanetary. Linux has been used to power the Phoenix Lander and to control the Spirit and Opportunity Mars rovers.J. Brockmeier, “NASA Using Linux,” Unix Review, March 2004; and S. Barrett, “Linux on Mars,” Science News, Space News, Technology News, June 6, 2008. Yes, Linux is even on Mars!

How Do You Pronounce Linux?

Most English speakers in the know pronounce Linux in a way that rhymes with “cynics.” You can easily search online to hear video and audio clips of Linus (whose name is actually pronounced “Lean-us” in Finish) pronouncing the name of his OS. In deference to Linux, some geeks prefer something that sounds more like “lean-ooks.”For examples, see http://mostlylinux.ca/pronounce/torvalds-says-linux.wav and http://suseroot.com/about-suse-linux/how-do-you-pronounce-linux.php. Just don’t call it “line-ucks,” or the tech-savvy will think you’re an open source n00bWritten with two zeros, pronounced “newb.” Geek-slang (leet speak) derogatory term for an uninformed or unskilled person.! Oh yeah, and while we’re on the topic of operating system pronunciation, the Macintosh operating system OS X is pronounced “oh es ten.”

Figure 10.1 Tux, the Linux Mascot

Open source software (OSS) is often described as free. While most OSS can be downloaded for free over the Internet, it’s also “free” as in liberated (you may even see the acronym FLOSS for free/libre/open source software). The source code for OSS products is openly shared. Anyone can look at the source code, change it, and even redistribute it, provided the modified software continues to remain open and free.A list of criteria defining open source software can be found at the Open Source Initiative at http://opensource.org/osr. This openness is in stark contrast to the practice of conventional software firms, who treat their intellectual property as closely guarded secrets and who almost never provide the source code for their commercial software products. At times, many software industry execs have been downright hostile toward OSS. The former President of SAP once referred to the open source movement as “socialism,” while Microsoft’s Steve Balmer has called Linux a “cancer.”J. Fortt, “Why Larry Loves Linux (and He’s Not Alone),” Fortune, December 19, 2007.

But while execs at some firms see OSS as a threat undermining the lifeblood of their economic model, other big-name technology companies are now solidly behind the open source movement. The old notion of open source being fueled on the contributions of loners tooling away for the glory of contributing to better code is now largely inaccurate. The vast majority of people who work on efforts like Linux are now paid to do so by commercially motivated employers.D. Woods, “The Commercial Bear Hug of Open Source,” Forbes, August 18, 2008. Nearly every major hardware firm has paid staff contributing to open source projects, and most firms also work together to fund foundations that set standards and coordinate the release of product revisions and improvements. Such coordination is critical—helping, for example, to ensure that various versions of Linux work alike. Sun Microsystems claims to have eleven thousand engineers contributing to OSS.C. Preimesberger, “Sun’s ‘Open’-Door Policy,” eWeek, April 21, 2008. Guido van Rossum, the inventor of the open source Python programming language, works for Google where he continues to coordinate development. IBM programmers work on several open source projects, including Linux. The firm has even deeded a commercially developed programming tool (including an IDE) to the Eclipse foundation, where it’s now embraced and supported by dozens of firms.

Turn on the LAMP—It’s Free!

Figure 10.2

Open source is big on the Web. In fact, you’ll often hear Web programmers and open source advocates refer to the LAMP stack. LAMPAn acronym standing for Linux, the Apache Web server software, the MySQL database, and any of several programming languages that start with P (e.g., Perl, Python, or PHP). is an acronym that stands for the Linux operating system, the Apache Web server software, the MySQL database, and any of several programming languages that start with the letter “P”—Perl, Python, and PHP. From Facebook to YouTube, you’ll find LAMP software powering many of the sites you visit each day.

Key Takeaways

- OSS is not only available for free, but also makes source code available for review and modification (for the Open Source Initiatives list of the criteria that define an open source software product, see http://opensource.org/docs/osd).

- While open source alternatives are threatening to conventional software firms, some of the largest technology companies now support OSS initiatives and work to coordinate standards, product improvements, and official releases.

- The flagship OSS product is the Linux operating system, now available on all scales of computing devices from cell phones to supercomputers.

- The LAMP stack of open source products is used to power many of the Internet’s most popular Web sites. Linux can be found on 30 percent of corporate servers, supports most Web servers, and is integral to TiVo and Android-based cell phones.

- The majority of persons who work on open source projects are paid by commercially motivated employers.

Questions and Exercises

- Who developed Linux?

- Who develops it today?

- List the components of the LAMP stack. Which commercial products do these components compete with (investigate online, if necessary)?

- Why do commercial firms contribute to open source consortia and foundations?

- Free doesn’t always win. Why might a firm turn down free software in favor of a commercial alternative?

10.3 Why Open Source?

Learning Objectives

- Know the primary reasons firms choose to use OSS.

- Understand how OSS can beneficially impact industry and government.

There are many reasons why firms choose open source products over commercial alternatives:

Cost—Free alternatives to costly commercial code can be a tremendous motivator, particularly since conventional software often requires customers to pay for every copy used and to pay more for software that runs on increasingly powerful hardware. Big Lots stores lowered costs by as much as $10 million by finding viable OSSM. Castelluccio, “Enterprise Open Source Adoption,” Strategic Finance, November 2008. to serve their system needs. Online broker E*TRADE estimates that its switch to open source helped save over $13 million a year.R. King, “Cost-Conscious Companies Turn to Open-Source Software,” BusinessWeek, December 1, 2008. And Amazon claimed in SEC filings that the switch to open source was a key contributor to nearly $20 million in tech savings.S. Shankland, M. Kane, and R. Lemos, “How Linux Saved Amazon Millions,” CNET, October 30, 2001. Firms like TiVo, which use OSS in their own products, eliminate a cost spent either developing their own operating system or licensing similar software from a vendor like Microsoft.

Reliability—There’s a saying in the open source community, “Given enough eyeballs, all bugs are shallow.”E. Raymond, The Cathedral and the Bazaar: Musings on Linux and Open Source by an Accidental Revolutionary (Sebastopol, CA: O’Reilly, 1999). What this means is that the more people who look at a program’s code, the greater the likelihood that an error will be caught and corrected. The open source community harnesses the power of legions of geeks who are constantly trawling OSS products, looking to squash bugs and improve product quality. And studies have shown that the quality of popular OSS products outperforms proprietary commercial competitors.J. Ljungberg, “Open Source Movements as a Model for Organizing,” European Journal of Information Systems 9, no. 4 (December 2000): 208–16. In one study, Carnegie Mellon University’s Cylab estimated the quality of Linux code to be less buggy than commercial alternatives by a factor of two hundred!M. Castelluccio, “Enterprise Open Source Adoption,” Strategic Finance, November 2008.

Security—OSS advocates also argue that by allowing “many eyes” to examine the code, the security vulnerabilities of open source products come to light more quickly and can be addressed with greater speed and reliability.D. Wheeler, Secure Programming for Linux and Unix, 2003, http://www.dwheeler.com/secure-programs/Secure-Programs-HOWTO/index.html. High profile hacking contests have frequently demonstrated the strength of OSS products. In one well-publicized 2008 event, laptops running Windows and Macintosh were both hacked (the latter in just two minutes), while a laptop running Linux remained uncompromised.R. McMillan, “Gone in Two Minutes,” InfoWorld, March 27, 2008. Government agencies and the military often appreciate the opportunity to scrutinize open source efforts to verify system integrity (a particularly sensitive issue among foreign governments leery of legislation like the USA PATRIOT Act of 2001).S. Lohr, “Microsoft to Give Governments Access to Code,” New York Times, January 15, 2003. Many OSS vendors offer security focusedAlso known as “hardened.” Term used to describe technology products that contain particularly strong security features. (sometimes called hardened) versions of their products. These can include systems that monitor the integrity of an OSS distribution, checking file size and other indicators to be sure that code has not been modified and redistributed by bad guys who’ve added a back door, malicious routines, or other vulnerabilities.

Scalability—Many major OSS efforts can run on everything from cheap commodity hardware to high-end supercomputing. ScalabilityAbility to either handle increasing workloads or to be easily expanded to manage workload increases. In a software context, systems that aren’t scalable often require significant rewrites or the purchase or development of entirely new systems. allows a firm to scale from start-up to blue chip without having to significantly rewrite their code, potentially saving big on software development costs. Not only can many forms of OSS be migrated to more powerful hardware, packages like Linux have also been optimized to balance a server’s workload among a large number of machines working in tandem. Brokerage firm E*TRADE claims that usage spikes following 2008 U.S. Federal Reserve moves flooded the firm’s systems, creating the highest utilization levels in five years. But E*TRADE credits its scalable open source systems for maintaining performance while competitors’ systems struggled.R. King, “Cost-Conscious Companies Turn to Open-Source Software,” BusinessWeek, December 1, 2008.

Agility and Time to Market—Vendors who use OSS as part of product offerings may be able to skip whole segments of the software development process, allowing new products to reach the market faster than if the entire software system had to be developed from scratch, in-house. Motorola has claimed that customizing products built on OSS has helped speed time-to-market for the firm’s mobile phones, while the team behind the Zimbra e-mail and calendar effort built their first product in just a few months by using some forty blocks of free code.R. Guth, “Virtual Piecework: Trolling the Web for Free Labor, Software Upstarts Are a New Force,” Wall Street Journal, November 13, 2006.

Key Takeaways

- The most widely cited benefits of using OSS include low cost; increased reliability; improved security and auditing; system scalability; and helping a firm improve its time to market.

- Free OSS has resulted in cost savings for many large companies in several industries.

- OSS often has fewer bugs than its commercial counterparts due to the large number of persons who have looked at the code.

- The huge exposure to scrutiny by developers and other people helps to strengthen the security of OSS.

- “Hardened” versions of OSS products often include systems that monitor the integrity of an OSS distribution, checking file size and other indicators to be sure that code has not been modified and redistributed by bad guys who have added a back door, malicious routines, or other vulnerabilities.

- OSS can be easily migrated to more powerful computers as circumstances dictate, and also can balance workload by distributing work over a number of machines.

- Vendors who use OSS as part of product offerings may be able to skip whole segments of the software development process, allowing new products to reach the market faster.

Questions and Exercises

- What advantages does OSS offer TiVo? What alternatives to OSS might the firm consider and why do you suppose the firm decided on OSS?

- What’s meant by the phrase, “Given enough eyeballs, all bugs are shallow”? Provide evidence that the insight behind this phrase is an accurate one.

- How has OSS benefited E*TRADE? Amazon? Motorola? Zimbra? What benefits were achieved in each of these examples?

- Describe how OSS provides a firm with scalability. What does this mean, and why does this appeal to a firm? What issues might a firm face if chosen systems aren’t scalable?

- The Web site NetCraft (http://www.netcraft.com) is one of many that provide a tool to see the kind of operating system and Web server software that a given site is running. Visit NetCraft or a similar site and enter the address of some of your favorite Web sites. How many run open source products (e.g., the Linux OS or Apache Web server)? Do some sites show their software as “unknown”? Why might a site be reluctant to broadcast the kind of software that it uses?

10.4 Examples of Open Source Software

Learning Objectives

- Recognize that just about every type of commercial product has an open source equivalent.

- Be able to list commercial products and their open source competitors.

Just about every type of commercial product has an open source equivalent. SourceForge.net lists over two hundred and thirty thousand such products!See http://sourceforge.net. Many of these products come with the installation tools, support utilities, and full documentation that make them difficult to distinguish from traditional commercial efforts.D. Woods, “The Commercial Bear Hug of Open Source,” Forbes, August 18, 2008. In addition to the LAMP products, some major examples include the following:

- Firefox—a Web browser that competes with Internet Explorer

- OpenOffice—a competitor to Microsoft Office

- Gimp—a graphic tool with features found in Photoshop

- Alfresco—collaboration software that competes with Microsoft Sharepoint and EMC’s Documentum

- Marketcetera—an enterprise trading platform for hedge fund managers that competes with FlexTrade and Portware

- Zimbra—open source e-mail software that competes with Outlook server

- MySQL, Ingres, and PostgreSQL—open source relational database software packages that each go head-to-head with commercial products from Oracle, Microsoft, Sybase, and IBM

- HBase and Cassandra—nonrelational distributed databases used to power massive file systems (used to power key features on Facebook, Twitter, LinkedIn, and Amazon)

- SugarCRM—customer relationship management software that competes with Salesforce.com and Siebel

- Asterix—an open source implementation for running a PBX corporate telephony system that competes with offerings from Nortel and Cisco, among others

- Free BSD and Sun’s OpenSolaris—open source versions of the Unix operating system

Key Takeaways

- There are thousands of open source products available, covering nearly every software category. Many have a sophistication that rivals commercial software products.

- Not all open source products are contenders. Less popular open source products are not likely to attract the community of users and contributors necessary to help these products improve over time (again we see network effects are a key to success—this time in determining the quality of an OSS effort).

- Just about every type of commercial product has an open source equivalent.

Questions and Exercises

- Visit http://www.SourceForge.net. Make a brief list of commercial product categories that an individual or enterprise might use. Are there open source alternatives for these categories? Are well-known firms leveraging these OSS offerings? Which commercial firms do they compete with?

- Are the OSS efforts you identified above provided by commercial firms, nonprofit organizations, or private individuals? Does this make a difference in your willingness to adopt a particular product? Why or why not? What other factors influence your adoption decision?

- Download a popular, end-user version of an OSS tool that competes with a desktop application that you own, or that you’ve used (hint: choose something that’s a smaller file or easy to install). What do you think of the OSS offering compared to the commercial product? Will you continue to use the OSS product? Why or why not?

10.5 Why Give It Away? The Business of Open Source

Learning Objectives

- Understand the disproportional impact OSS has on the IT market.

- Understand how vendors make money on open source.

- Know what SQL and MySQL are.

Open source is a sixty-billion-dollar industry,M. Asay, “Open Source Is a $60 Billion Industry,” CNET, May 15, 2008. but it has a disproportionate impact on the trillion-dollar IT market. By lowering the cost of computing, open source efforts make more computing options accessible to smaller firms. More reliable, secure computing also lowers costs for all users. OSS also diverts funds that firms would otherwise spend on fixed costs, like operating systems and databases, so that these funds can be spent on innovation or other more competitive initiatives. Think about Google, a firm that some estimate has over 1.4 million servers. Imagine the costs if it had to license software for each of those boxes!

Commercial interest in OSS has sparked an acquisition binge. Red Hat bought open source application server firm JBoss for $350 million. Novell snapped up SUSE Linux for $210 million (and was later bought by Attachmate for $2.2 billion). And Sun plunked down over $1 billion for open source database provider MySQL.A. Greenberg, “Sun Snaps Up Database Firm, MySQL,” Forbes, January 16, 2008; G. Huang, “Attachmate Buys Novell for $2.2B—The End of an Era,” Xconomy, November 22, 2010. And with Oracle’s acquisition of Sun, one of the world’s largest commercial software firms has zeroed in on one of the deepest portfolios of open source products.

But how do vendors make money on open source? One way is by selling support and consulting services. While not exactly Microsoft money, Red Hat, the largest purely OSS firm, reported nearly a billion dollars in revenue from paying customers subscribing for access to software updates and support services.A. Greenberg, “Sun Snaps Up Database Firm, MySQL,” Forbes, January 16, 2008. Oracle, a firm that sells commercial ERP and database products, provides Linux for free, selling high-margin Linux support contracts for as much as five hundred thousand dollars.J. Fortt, “Why Larry Loves Linux (and He’s Not Alone),” Fortune, December 19, 2007. The added benefit for Oracle? Weaning customers away from Microsoft—a firm that sells many products that compete head-to-head with Oracle’s offerings. Service also represents the most important part of IBM’s business. The firm now makes more from services than from selling hardware and software.J. Robertson, “IBM Sees Better-Than-Expected 2009 Profit, Earns US$4.4 Billion in Q4,” Associated Press, January 20, 2009, http://humantimes.com/finance/business/sanfrancis/54853. And every dollar saved on buying someone else’s software product means more money IBM customers can spend on IBM computers and services. Sun Microsystems was a leader in OSS, even before the Oracle acquisition bid. The firm has used OSS to drive advanced hardware sales, but the firm also sells proprietary products that augment its open source efforts. These products include special optimization, configuration management and performance tools that can tweak OSS code to work its best.C. Preimesberger, “Sun’s ‘Open’-Door Policy,” eWeek, April 21, 2008.

Here’s where we also can relate the industry’s evolution to what we’ve learned about standards competition in our earlier chapters. In the pre-Linux days, nearly every major hardware manufacturer made its own, incompatible version of the Unix operating system. These fractured, incompatible markets were each so small that they had difficulty attracting third-party vendors to write application software. Now, much to Microsoft’s dismay, all major hardware firms run Linux. That means there’s a large, unified market that attracts software developers who might otherwise write for Windows.

To keep standards unified, several Linux-supporting hardware and software firms also back the Linux Foundation, the nonprofit effort where Linus Torvalds serves as a fellow, helping to oversee Linux’s evolution. Sharing development expenses in OSS has been likened to going in on a pizza together. Everyone wants a pizza with the same ingredients. The pizza doesn’t make you smarter or better. So why not share the cost of a bigger pie instead of buying by the slice?S. Cohen, “Open Source: The Model Is Broken,” BusinessWeek, December 1, 2008. With OSS, hardware firms spend less money than they would in the brutal, head-to-head competition where each once offered a “me too” operating system that was incompatible with rivals but offered little differentiation. Hardware firms now find their technical talent can be deployed in other value-added services mentioned above: developing commercial software add-ons, offering consulting services, and enhancing hardware offerings.

Linux on the Desktop?

While Linux is a major player in enterprise software, mobile phones, and consumer electronics, the Linux OS can only be found on a tiny fraction of desktop computers. There are several reasons for this. Some suggest Linux simply isn’t as easy to install and use as Windows or the Mac OS. This complexity can raise the total cost of ownership (TCO)All of the costs associated with the design, development, testing, implementation, documentation, training and maintenance of a software system. of Linux desktops, with additional end-user support offsetting any gains from free software. The small number of desktop users also dissuades third party firms from porting popular desktop applications over to Linux. For consumers in most industrialized nations, the added complexity and limited desktop application availability of desktop Linux just it isn’t worth the one to two hundred dollars saved by giving up Windows.

But in developing nations where incomes are lower, the cost of Windows can be daunting. Consider the OLPC, Nicholas Negroponte’s “one-hundred-dollar” laptop. An additional one hundred dollars for Windows would double the target cost for the nonprofit’s machines. It is not surprising that the first OLPC laptops ran Linux. Microsoft recognizes that if a whole generation of first-time computer users grows up without Windows, they may favor open source alternatives years later when starting their own businesses. As a result, Microsoft has begun offering low-cost versions of Windows (in some cases for as little as seven dollars) in nations where populations have much lower incomes. Microsoft has even offered a version of Windows to the backers of the OLPC. While Microsoft won’t make much money on these efforts, the low cost versions will serve to entrench Microsoft products as standards in emerging markets, staving off open source rivals and positioning the firm to raise prices years later when income levels rise.

MySQL: Turning a Ten-Billion-Dollars-a-Year Business into a One-Billion-Dollar One

Finland is not the only Scandinavian country to spawn an open source powerhouse. Uppsala Sweden’s MySQL (pronounced “my sequel”) is the “M” in the LAMP stack, and is used by organizations as diverse as FedEx, Lufthansa, NASA, Sony, UPS, and YouTube.

The “SQL” in name stands for the structured query languageA language for creating and manipulating databases. SQL is by far the most common database standard in use today, and is supported by many commercial and open source products., a standard method for organizing and accessing data. SQL is also employed by commercial database products from Oracle, Microsoft, and Sybase. Even Linux-loving IBM uses SQL in its own lucrative DB2 commercial database product. Since all of these databases are based on the same standard, switching costs are lower, so migrating from a commercial product to MySQL’s open source alternative is relatively easy. And that spells trouble for commercial firms. Granted, the commercial efforts offer some bells and whistles that MySQL doesn’t yet have, but those extras aren’t necessary in a lot of standard database use. Some organizations, impressed with MySQL’s capabilities, are mandating its use on all new development efforts, attempting to cordon off proprietary products in legacy code that is maintained but not expanded.

Savings from using MySQL can be huge. The Web site PriceGrabber pays less than ten thousand dollars in support for MySQL compared to one hundred thousand to two hundred thousand dollars for a comparable Oracle effort. Lycos Europe switched from Oracle to MySQL and slashed costs from one hundred twenty thousand dollars a year to seven thousand dollars. And the travel reservation firm Sabre used open source products such as MySQL to slash ticket purchase processing costs by 80 percent.D. Lyons, “Cheapware,” Forbes, September 6, 2004.

MySQL does make money, just not as much as its commercial rivals. While you can download a version of MySQL over the Net, the flagship product also sells for four hundred ninety-five dollars per server computer compared to a list price for Oracle that can climb as high as one hundred sixty thousand dollars. Of the roughly eleven million copies of MySQL in use, the company only gets paid for about one in a thousand.A. Ricadela, “The Worth of Open Source? Open Question,” BusinessWeek, June 26, 2007. Firms pay for what’s free for one of two reasons: (1) for MySQL service, and (2) for the right to incorporate MySQL’s code into their own products.D. Kirkpatrick, “How the Open Source World Plans to Smack Down Microsoft and Oracle, and…,” Fortune, February 23, 2004. Amazon, Facebook, Gap, NBC, and Sabre pay MySQL for support; Cisco, Ericsson, HP, and Symantec pay for the rights to the code.A. Ricadela, “The Worth of Open Source? Open Question,” BusinessWeek, June 26, 2007. Top-level round-the-clock support for MySQL for up to fifty servers is fifty thousand dollars a year, still a fraction of the cost for commercial alternatives. Founder Marten Mickos has stated an explicit goal of the firm is “turning the $10-billion-a-year database business into a $1 billion one.”D. Kirkpatrick, “How the Open Source World Plans to Smack Down Microsoft and Oracle, and…,” Fortune, February 23, 2004.

When Sun Microsystems spent over $1 billion to buy Mickos’ MySQL in 2008, Sun CEO Jonathan Schwartz called the purchase the “most important acquisition in the company’s history.”S. Shankland, “Google’s Open-Source Android Now Actually Open,” CNET, October 21, 2008, http://news.cnet.com/8301-1001_3-10071093-92.html. Sun hoped the cheap database software could make the firm’s hardware offerings seem more attractive. And it looked like Sun was good for MySQL, with the product’s revenues growing 55 percent in the year after the acquisition.M. Asay, “Open-Source Database Market Shows Muscles,” CNET, February 3, 2009, http://news.cnet.com/8301-13505_3-10156188-16.html.

But here’s where it gets complicated. Sun also had a lucrative business selling hardware to support commercial ERP and database software from Oracle. That put Sun and partner Oracle in a relationship where they were both competitors and collaborators (the “coopetition” or “frenemies” phenomenon mentioned in Chapter 6 "Understanding Network Effects"). Then in spring 2009, Oracle announced it was buying Sun. Oracle CEO Larry Ellison mentioned acquiring the Java language was the crown jewel of the purchase, but industry watchers have raised several questions. Will the firm continue to nurture MySQL and other open source products, even as this software poses a threat to its bread-and-butter database products? Will the development community continue to back MySQL as the de facto standard for open source SQL databases, or will they migrate to an alternative? Or will Oracle find the right mix of free and fee-based products and services that allow MySQL to thrive while Oracle continues to grow? The implications are serious for investors, as well as firms that have made commitments to Sun, Oracle, and MySQL products. The complexity of this environment further demonstrates why technologists need business savvy and market monitoring skills and why business folks need to understand the implications of technology and tech-industry developments.

Legal Risks and Open Source Software: A Hidden and Complex Challenge

Open source software isn’t without its risks. Competing reports cite certain open source products as being difficult to install and maintain (suggesting potentially higher total cost of ownership, or TCO). Adopters of OSS without support contracts may lament having to rely on an uncertain community of volunteers to support their problems and provide innovative upgrades. Another major concern is legal exposure. Firms adopting OSS may be at risk if they distribute code and aren’t aware of the licensing implications. Some commercial software firms have pressed legal action against the users of open source products when there is a perceived violation of software patents or other unauthorized use of their proprietary code.

For example, in 2007 Microsoft suggested that Linux and other open source software efforts violated some two hundred thirty-five of its patents.A. Ricadela, “Microsoft Wants to ‘Kill’ Open Source,” BusinessWeek, May 15, 2007. The firm then began collecting payments and gaining access to the patent portfolios of companies that use the open source Linux operating system in their products, including Fuji, Samsung, and Xerox. Microsoft also cut a deal with Linux vendor Novell in which both firms pledged not to sue each other’s customers for potential patent infringements.

Also complicating issues are the varying open source license agreements (these go by various names, such as GPL and the Apache License), each with slightly different legal provisions—many of which have evolved over time. Keeping legal with so many licensing standards can be a challenge, especially for firms that want to bundle open source code into their own products.Sarah Lacy, “Open Warfare in Open Source,” BusinessWeek, August 21, 2006. An entire industry has sprouted up to help firms navigate the minefield of open source legal licenses. Chief among these are products, such as those offered by the firm Black Duck, which analyze the composition of software source code and report on any areas of concern so that firms can honor any legal obligations associated with their offerings. Keeping legal requires effort and attention, even in an environment where products are allegedly “free.” This also shows that even corporate lawyers had best geek-up if they want to prove they’re capable of navigating a twenty-first-century legal environment.

Key Takeaways

- Business models for firms in the open source industry are varied, and can include selling services, licensing OSS for incorporation into commercial products, and using OSS to fuel hardware sales.

- Many firms are trying to use OSS markets to drive a wedge between competitors and their customers.

- Linux has been very successful on mobile devices and consumer electronics, as well as on high-end server class and above computers. But it has not been as successful on the desktop. The small user base for desktop Linux makes the platform less attractive for desktop software developers. Incompatibility with Windows applications, switching costs, and other network effects-related issues all suggest that Desktop Linux has an uphill climb in more mature markets.

- MySQL is the dominant open source database software product. Adoption of the SQL standard eases some issues with migrating from commercial products to MySQL.

- OSS also has several drawbacks and challenges that limit its appeal. These include complexity of some products and a higher total cost of ownership for some products, concern about the ability of a product’s development community to provide support or product improvement, and legal and licensing concerns.

Questions and Exercises

- Describe the impact of OSS on the IT market.

- Show your understanding of the commercial OSS market. How do Red Hat, Oracle, Oracle’s Sun division, and IBM make money via open source?

- Visit Mozilla.org. Which open source products does this organization develop? Investigate how development of these efforts is financed. How does this organization differ from the ones mentioned above?

- What is the Linux Foundation? Why is it necessary? Which firms are members, underwriting foundation efforts?

- List the reasons why Linux is installed on only a very small fraction of desktop computers. Are there particular categories of products or users who might see Linux as more appealing than conventional operating systems? Do you think Linux’s share of the desktop market will increase? Why or why not?

- How is Microsoft combating the threat of open source software and other free tools that compete with its commercial products?

- What is the dominant open source database software product? Which firms use this product? Why?

- Which firm developed the leading OSS database product? Do you think it’s more or less likely that a firm would switch to an OSS database instead of an OSS office suite or desktop alternative? Why or why not?

- How has stewardship of the leading OSS database effort changed in recent years? Who oversees the effort today? What questions does this raise for the product’s future? Although this book is updated regularly, current events continue to change after publication of this chapter. Investigate the current status of this effort—reaction of the developer community, continued reception of the product—and be prepared to share your findings with class.

- List some of the risks associated with using OSS. Give examples of firms that might pass on OSS software, and explain why.

10.6 Cloud Computing: Hype or Hope?

Learning Objectives

- Understand the concept of cloud computing.

- Identify the two major categories of cloud computing.

Oracle Chairman Larry Ellison, lamenting the buzzword-chasing character of the tech sector, once complained that the computer industry is more fashion-focused than even the women’s clothing business.D. Farber, “Oracle’s Ellison Nails Cloud Computing,” CNET, September 26, 2008, http://news.cnet.com/8301-13953_3-10052188-80.html?tag=mncol;txt. Ellison has a point: when a technology term becomes fashionable, the industry hype machine shifts into overdrive. The technology attracts press attention, customer interest, and vendor marketing teams scramble to label their products and services as part of that innovation. Recently, few tech trends have been more fashionable than cloud computing.

Like Web 2.0, trying to nail down an exact definition for cloud computing is tough. In fact, it’s been quite a spectacle watching industry execs struggle to clarify the concept. HP’s Chief Strategy Office “politely refused” when asked by BusinessWeek to define the term cloud computing.S. Hamm, “Cloud Computing: Eyes on the Skies,” BusinessWeek, April 24, 2008. Richard Stallman, founder of the Free Software Foundation said about cloud computing, “It’s worse than stupidity. It’s a marketing hype campaign.”L. McKay, “30,000-Foot Views of the Cloud,” Customer Relationship Management, January 2009. And Larry Ellison, always ready with a sound bite, offered up this priceless quip, “Maybe I’m an idiot, but I have no idea what anyone is talking about. What is it? It’s complete gibberish. It’s insane.”D. Lyons, “A Mostly Cloudy Computing Forecast,” Washington Post, November 4, 2008. Insane, maybe, but also big bucks. The various businesses that fall under the rubric of cloud computing had already grown from an estimated $36 billion market in 2008 to $68 billion in 2010, accounting for over 13 percent of global software sales!M. Liedtke, “Cloud Computing: Pie in the Sky Concept or the Next Big Breakthrough on Tech Horizon?” Associated Press Newswires, December 21, 2008; A. Gonsalves, “Cloud Services Top $68 Billion in 2010,” InformationWeek, June 22, 2010.

When folks talk about cloud computing they’re really talking about replacing computing resources—either an organization’s or an individual’s hardware or software—with services provided over the Internet. The name actually comes from the popular industry convention of drawing the Internet or other computer network as a big cloud.

Cloud computing encompasses a bunch of different efforts. We’ll concentrate on describing, providing examples, and analyzing the managerial implications of two separate categories of cloud computing: (1) software as a service (SaaS), where a firm subscribes to a third-party software-replacing service that is delivered online, and (2) models often referred to as utility computingA form of cloud computing where a firm develops its own software, and then runs it over the Internet on a service provider’s computers., which can include variants such as platform as a service (PaaS) and infrastructure as a service (IaaS). Using these latter techniques, an organization develops its own systems, but runs them over the Internet on someone else’s hardware. A later section on virtualization will discuss how some organizations are developing their own private cloudsPools of computing resources that reside inside an organization and that can be served up for specific tasks as need arrives., pools of computing resources that reside inside an organization and that can be served up for specific tasks as need arrives.

The benefits and risks of SaaS and the utility computing-style efforts are very similar, but understanding the nuances of each effort can help you figure out if and when the cloud makes sense for your organization. The evolution of cloud computing also has huge implications across the industry: from the financial future of hardware and software firms, to cost structure and innovativeness of adopting organizations, to the skill sets likely to be most valued by employers.

Key Takeaways

- Cloud computing is difficult to define. Managers and techies use the term cloud computing to describe computing services provided over a network, most often commercial services provided over the Internet by a third party that can replace or offload tasks that would otherwise run on a user or organization’s existing hardware or software.

- Software as a service (SaaS) refers to a third-party software-replacing service that is delivered online.

- Hardware cloud computing services replace hardware that a firm might otherwise purchase.

- Estimated to be a thirty-six-billion-dollar industry, cloud computing is reshaping software, hardware, and service markets, and is impacting competitive dynamics across industries.

Questions and Exercises

- Identify and contrast the two categories of cloud computing.

- Define cloud computing.

10.7 The Software Cloud: Why Buy When You Can Rent?

Learning Objectives

- Know how firms using SaaS products can dramatically lower several costs associated with their information systems.

- Know how SaaS vendors earn their money.

- Be able to list the benefits to users that accrue from using SaaS.

- Be able to list the benefits to vendors from deploying SaaS.

If open source isn’t enough of a threat to firms that sell packaged software, a new generation of products, collectively known as SaaS, claims that you can now get the bulk of your computing done through your Web browser. Don’t install software—let someone else run it for you and deliver the results over the Internet.

Software as a service (SaaS) refers to software that is made available by a third party online. You might also see the terms ASP (application service provider) or HSV (hosted software vendor) used to identify this type of offering, but those are now used less frequently. SaaS is potentially a very big deal. Firms using SaaS products can dramatically lower several costs associated with the care and feeding of their information systems, including software licenses, server hardware, system maintenance, and IT staff. Most SaaS firms earn money via a usage-based pricing model akin to a monthly subscription. Others offer free services that are supported by advertising, while others promote the sale of upgraded or premium versions for additional fees.

Make no mistake, SaaS is yet another direct assault on traditional software firms. The most iconic SaaS firm is Salesforce.com, an enterprise customer relationship management (CRM) provider. This “un-software” company even sports a logo featuring the word “software” crossed out, Ghostbusters-style.J. Hempel, “Salesforce Hits Its Stride,” Fortune, March 2, 2009.

Figure 10.3

The antisoftware message is evident in the logo of SaaS leader Salesforce.com.

Other enterprise-focused SaaS firms compete directly with the biggest names in software. Some of these upstarts are even backed by leading enterprise software executives. Examples include NetSuite (funded in part by Oracle’s Larry Ellison—the guy’s all over this chapter), which offers a comprehensive SaaS ERP suite; Workday (launched by founders of Peoplesoft), which has SaaS offerings for managing human resources; and Aravo, which offers supply chain management software as SaaS. Several traditional software firms have countered start-ups by offering SaaS efforts of their own. IBM offers a SaaS version of its Cognos business intelligence products, Oracle offers CRM On Demand, and SAP’s Business ByDesign includes a full suite of enterprise SaaS offerings. Even Microsoft has gone SaaS, with a variety of Web-based services that include CRM, Web meeting tools, collaboration, e-mail, and calendaring.

SaaS is also taking on desktop applications. Intuit has online versions of its QuickBooks, TurboTax, and Quicken finance software. Adobe has an online version of Photoshop. Google and Zoho offer office suites that compete with desktop alternatives, prompting Microsoft’s own introduction of an online version of Office, with Oracle following as well. And if you use a service like Dropbox or you store photos on Flickr or Picasa, instead of your PC’s hard drive, then you’re using SaaS, too.

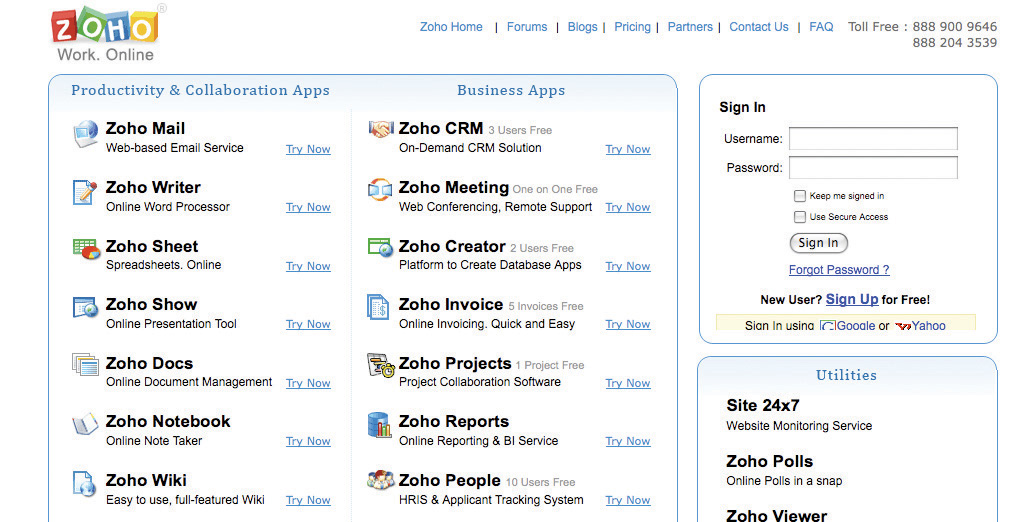

Figure 10.4

A look at Zoho’s home page shows the diversity of both desktop and enterprise offerings from this SaaS upstart. Note that the firm makes it services available through browsers, phones, and even Facebook.

The Benefits of SaaS

Firms can potentially save big using SaaS. Organizations that adopt SaaS forgo the large upfront costs of buying and installing software packages. For large enterprises, the cost to license, install, and configure products like ERP and CRM systems can easily run into the hundreds of thousands or even millions of dollars. And these costs are rarely a one time fee. Additional costs like annual maintenance contracts have also been rising as rivals fail or get bought up. Less competition among traditional firms recently allowed Oracle and SAP to raise maintenance fees to as much as 20 percent.Sarah Lacy, “On-Demand Computing: A Brutal Slog,” BusinessWeek, July 18, 2008.

Firms that adopt SaaS don’t just save on software and hardware, either. There’s also the added cost for the IT staff needed to run these systems. Forrester Research estimates that SaaS can bring cost savings of 25 to 60 percent if all these costs are factored in.J. Quittner, “How SaaS Helps Cut Small Business Costs,” BusinessWeek, December 5, 2008.

There are also accounting and corporate finance implications for SaaS. Firms that adopt software as a service never actually buy a system’s software and hardware, so these systems become a variable operating expense. This flexibility helps mitigate the financial risks associated with making a large capital investment in information systems. For example, if a firm pays Salesforce.com sixty-five dollars per month per user for its CRM software, it can reduce payments during a slow season with a smaller staff, or pay more during heavy months when a firm might employ temporary workers. At these rates, SaaS not only looks good to large firms, it makes very sophisticated technology available to smaller firms that otherwise wouldn’t be able to afford expensive systems, let alone the IT staff and hardware required to run them.

In addition to cost benefits, SaaS offerings also provide the advantage of being highly scalable. This feature is important because many organizations operate in environments prone to wide variance in usage. Some firms might expect systems to be particularly busy during tax time or the period around quarterly financial reporting deadlines, while others might have their heaviest system loads around a holiday season. A music label might see spikes when an artist drops a new album. Using conventional software, an organization would have to buy enough computing capacity to ensure that it could handle its heaviest anticipated workload. But sometimes these loads are difficult to predict, and if the difference between high workloads and average use is great, a lot of that expensive computer hardware will spend most of its time doing nothing. In SaaS, however, the vendor is responsible for ensuring that systems meet demand fluctuation. Vendors frequently sign a service level agreement (SLA)A negotiated agreement between the customer and the vendor. The SLA may specify the levels of availability, serviceability, performance, operation, or other commitment requirements. with their customers to ensure a guaranteed uptime and define their ability to meet demand spikes.

When looking at the benefits of SaaS, also consider the potential for higher quality and service levels. SaaS firms benefit from economies of scale that not only lower software and hardware costs, but also potentially boost quality. The volume of customers and diversity of their experiences means that an established SaaS vendor is most likely an expert in dealing with all sorts of critical computing issues. SaaS firms handle backups, instantly deploy upgrades and bug fixes, and deal with the continual burden of security maintenance—all costly tasks that must be performed regularly and with care, although each offers little strategic value to firms that perform these functions themselves in-house. The breadth of a SaaS vendor’s customer base typically pushes the firm to evaluate and address new technologies as they emerge, like quickly offering accessibility from mobile platforms like the BlackBerry and iPhone. And many contend that cloud computing can actually be greener. SaaS and other cloud firms often have data centers that are better designed to pool and efficiently manage computing resources, and they are often located in warehouse-style buildings designed for computers, not people. Contrast that with corporate data centers that may have wasteful excess capacity to account for service spikes and may be crammed inside inefficiently cooled downtown high-rises. For all but the savviest of IT shops, an established SaaS vendor can likely leverage its scale and experience to provide better, cheaper, more reliable standard information systems than individual companies typically can.

Software developers who choose to operate as SaaS providers also realize benefits. While a packaged software company like SAP must support multiple versions of its software to accommodate operating systems like Windows, Linux, and various flavors of Unix, an SaaS provider develops, tests, deploys, and supports just one version of the software executing on its own servers.

An argument might also be made that SaaS vendors are more attuned to customer needs. Since SaaS firms run a customer’s systems on their own hardware, they have a tighter feedback loop in understanding how products are used (and why they fail)—potentially accelerating their ability to enhance their offerings. And once made, enhancements or fixes are immediately available to customers the next time they log in.

SaaS applications also impact distribution costs and capacity. As much as 30 percent of the price of traditional desktop software is tied to the cost of distribution—pressing CD-ROMs, packaging them in boxes, and shipping them to retail outlets.M. Drummond, “The End of Software as We Know It,” Fortune, November 19, 2001. Going direct to consumers can cut out the middleman, so vendors can charge less or capture profits that they might otherwise share with a store or other distributor. Going direct also means that SaaS applications are available anywhere someone has an Internet connection, making them truly global applications. This feature has allowed many SaaS firms to address highly specialized markets (sometimes called vertical nichesSometimes referred to as vertical markets. Products and services designed to target a specific industry (e.g., pharmaceutical, legal, apparel retail).). For example, the Internet allows a company writing specialized legal software, for example, or a custom package for the pharmaceutical industry, to have a national deployment footprint from day one. Vendors of desktop applications that go SaaS benefit from this kind of distribution, too.

Finally, SaaS allows a vendor to counter the vexing and costly problem of software piracy. It’s just about impossible to make an executable, illegal copy of a subscription service that runs on a SaaS provider’s hardware.

Key Takeaways

-

SaaS firms may offer their clients several benefits including the following:

- lower costs by eliminating or reducing software, hardware, maintenance, and staff expenses

- financial risk mitigation since start-up costs are so low

- potentially faster deployment times compared with installed packaged software or systems developed in-house

- costs that are a variable operating expense rather than a large, fixed capital expense

- scalable systems that make it easier for firms to ramp up during periods of unexpectedly high system use

- higher quality and service levels through instantly available upgrades, vendor scale economies, and expertise gained across its entire client base

- remote access and availability—most SaaS offerings are accessed through any Web browser, and often even by phone or other mobile device

-

Vendors of SaaS products benefit from the following:

- limiting development to a single platform, instead of having to create versions for different operating systems

- tighter feedback loop with clients, helping fuel innovation and responsiveness

- ability to instantly deploy bug fixes and product enhancements to all users

- lower distribution costs

- accessibility to anyone with an Internet connection

- greatly reduced risk of software piracy

- SaaS (and the other forms of cloud computing) are also thought to be better for the environment, since cloud firms more efficiently pool resources and often host their technologies in warehouses designed for cooling and energy efficiency.

Questions and Exercises

- Firms that buy conventional enterprise software spend money buying software and hardware. What additional and ongoing expenses are required as part of the “care and feeding” of enterprise applications?

- In what ways can firms using SaaS products dramatically lower costs associated with their information systems?

- How do SaaS vendors earn their money?

- Give examples of enterprise-focused SaaS vendors and their products. Visit the Web sites of the firms that offer these services. Which firms are listed as clients? Does there appear to be a particular type of firm that uses its services, or are client firms broadly represented?

- Give examples of desktop-focused SaaS vendors and their products. If some of these are free, try them out and compare them to desktop alternatives you may have used. Be prepared to share your experiences with your class.

- List the cost-related benefits to users that accrue from using SaaS.

- List the benefits other than cost-related that accrue to users from using SaaS.

- List the benefits realized by vendors that offer SaaS services instead of conventional software.

- Why might cloud computing be greener than conventional computing alternatives? Research online and share examples suggesting that cloud firms could be less environmentally taxing than if a firm built and ran its own corporate data center.

10.8 SaaS: Not without Risks

Learning Objective

- Be able to list and appreciate the risks associated with SaaS.

Like any technology, we also recognize there is rarely a silver bullet that solves all problems. A successful manager is able to see through industry hype and weigh the benefits of a technology against its weaknesses and limitations. And there are still several major concerns surrounding SaaS.

The largest concerns involve the tremendous dependence a firm develops with its SaaS vendor. While some claim that the subscription-based SaaS model means that you can simply walk away from a vendor if you become dissatisfied, in fact there is quite a bit of lock-in with SaaS vendors, too. And in addition to the switching costs associated with switching on conventional software platforms, switching SaaS vendors may involve the slow and difficult task of transferring very large data files over the Internet. Having all of your eggs in one basket can leave a firm particularly vulnerable. If a traditional software company goes out of business, in most cases its customers can still go on using its products. But if your SaaS vendor goes under, you’re hosed. They’ve got all your data, and even if firms could get their data out, most organizations don’t have the hardware, software, staff, or expertise to quickly absorb an abandoned function.

Beware with whom you partner. Any hot technology is likely to attract a lot of start-ups, and most of these start-ups are unlikely to survive. In just a single year, the leading trade association found the number of SaaS vendors dropped from seven hundred members to four hundred fifty.M. Drummond, “The End of Software as We Know It,” Fortune, November 19, 2001. One of the early efforts to collapse was Pandesic, a joint venture between SAP and Intel—two large firms that might have otherwise instilled confidence among prospective customers. In another example, Danish SaaS firm “IT Factory” was declared “Denmark’s Best IT Company” by Computerworld, only to follow the award one week later with a bankruptcy declaration.R. Wauters, “The Extraordinary Rise and Fall of Denmark’s IT Factory,” TechCrunch, December 2, 2008. Indeed, despite the benefits, the costs of operating as a SaaS vendor can be daunting. NetSuite’s founder claimed it “takes ten years and $100 million to do right”Sarah Lacy, “On-Demand Computing: A Brutal Slog,” BusinessWeek, July 18, 2008.—maybe that’s why the firm still wasn’t profitable, even three and a half years after going public.

Firms that buy and install packaged software usually have the option of sticking with the old stuff as long as it works, but organizations adopting SaaS may find they are forced into adopting new versions. This fact is important because any radical changes in a SaaS system’s user interface or system functionality might result in unforeseen training costs, or increase the chance that a user might make an error.

Keep in mind that SaaS systems are also reliant on a network connection. If a firm’s link to the Internet goes down, its link to its SaaS vendor is also severed. Relying on an Internet connection also means that data is transferred to and from a SaaS firm at Internet speeds, rather than the potentially higher speeds of a firm’s internal network. Solutions to many of these issues are evolving as Internet speeds become faster and Internet service providers become more reliable. There are also several programs that allow for offline use of data that is typically stored in SaaS systems, including Gears and Adobe AIR. With these products a user can download a subset of data to be offline (say on a plane flight or other inaccessible location) and then sync the data when the connection is restored. Ultimately, though, SaaS users have a much higher level of dependence on their Internet connections.

And although a SaaS firm may have more security expertise than your organization, that doesn’t mean that security issues can be ignored. Any time a firm allows employees to access a corporation’s systems and data assets from a remote location, a firm is potentially vulnerable to abuse and infiltration. Some firms may simply be unacceptably uncomfortable with critical data assets existing outside their own network. There may also be contractual or legal issues preventing data from being housed remotely, especially if a SaaS vendor’s systems are in another country operating under different laws and regulations. “We’re very bound by regulators in terms of client data and country-of-origin issues, so it’s very difficult to use the cloud,” says Rupert Brown, a chief architect at Merrill Lynch.G. Gruman, “Early Experiments in Cloud Computing,” InfoWorld, April 7, 2008.

SaaS systems are often accused of being less flexible than their installed software counterparts—mostly due to the more robust configuration and programming options available in traditional software packages. It is true that many SaaS vendors have improved system customization options and integration with standard software packages. And at times a lack of complexity can be a blessing—fewer choices can mean less training, faster start-up time, and lower costs associated with system use. But firms with unique needs may find SaaS restrictive.

SaaS offerings usually work well when the bulk of computing happens at the server end of a distributed system because the kind of user interface you can create in a browser isn’t as sophisticated as what you can do with a separate, custom-developed desktop program. A comparison of the first few iterations of the Web-based Google Docs office suite, which offers word processing, presentation software, and a spreadsheet, reveals a much more limited feature set than Microsoft’s Office desktop software. The bonus, of course, is that an online office suite is accessible anywhere and makes sharing documents a snap. Again, an understanding of trade-offs is key.

Here’s another challenge for a firm and its IT staff: SaaS means a greater consumerization of technology. Employees, at their own initiative, can go to firms such as Socialtext or PBworks and set up a wiki, WordPress to start blogging, or subscribe to a SaaS offering like Salesforce.com, all without corporate oversight and approval. This work can result in employees operating outside established firm guidelines and procedures, potentially introducing operational inconsistencies or even legal and security concerns.

The consumerization of corporate technology isn’t all bad. Employee creativity can blossom with increased access to new technologies, costs might be lower than home grown solutions, and staff could introduce the firm to new tools that might not otherwise be on the radar of the firm’s IS Department. But all this creates an environment that requires a level of engagement between a firm’s technical staff and the groups that it serves that is deeper than that employed by any prior generation of technology workers. Those working in an organization’s information systems group must be sure to conduct regular meetings with representative groups of employees across the firm to understand their pain points and assess their changing technology needs. Non-IT managers should regularly reach out to IT to ensure that their needs are on the tech staff’s agenda. Organizations with internal IT-staff R&D functions that scan new technologies and critically examine their relevance and potential impact on the firm can help guide an organization through the promise and peril of new technologies. Now more than ever, IT managers must be deeply knowledgeable about business areas, broadly aware of new technologies, and able to bridge the tech and business worlds. Similarly, any manager looking to advance his or her organization has to regularly consider the impact of new technologies.

Key Takeaways

The risks associated with SaaS include the following:

- dependence on a single vendor.

- concern about the long-term viability of partner firms.

- users may be forced to migrate to new versions—possibly incurring unforeseen training costs and shifts in operating procedures.

- reliance on a network connection—which may be slower, less stable, and less secure.

- data asset stored off-site—with the potential for security and legal concerns.

- limited configuration, customization, and system integration options compared to packaged software or alternatives developed in-house.

- the user interface of Web-based software is often less sophisticated and lacks the richness of most desktop alternatives.

- ease of adoption may lead to pockets of unauthorized IT being used throughout an organization.

Questions and Exercises

- Consider the following two firms: a consulting start-up, and a defense contractor. Leverage what you know about SaaS and advise whether each might consider SaaS efforts for CRM or other enterprise functions? Why or why not?

- Think of firms you’ve worked for, or firms you would like to work for. Do SaaS offerings make sense for these firms? Make a case for or against using certain categories of SaaS.

- What factors would you consider when evaluating a SaaS vendor? Which firms are more appealing to you and why?

- Discuss problems that may arise because SaaS solutions rely on Internet connections. Discuss the advantages of through-the-browser access.

- Evaluate trial versions of desktop SaaS offerings (offered by Adobe, Google, Microsoft, Zoho, or others). Do you agree that the interfaces of Web-based versions are not as robust as desktop rivals? Are they good enough for you? For most users?

10.9 The Hardware Cloud: Utility Computing and Its Cousins

Learning Objectives

- Distinguish between SaaS and hardware clouds.

- Provide examples of firms and uses of hardware clouds.

- Understand the concepts of cloud computing, cloudbursting, and black swan events.

- Understand the challenges and economics involved in shifting computing hardware to the cloud.

While SaaS provides the software and hardware to replace an internal information system, sometimes a firm develops its own custom software but wants to pay someone else to run it for them. That’s where hardware clouds, utility computing, and related technologies come in. In this model, a firm replaces computing hardware that it might otherwise run on-site with a service provided by a third party online. While the term utility computing was fashionable a few years back (and old timers claim it shares a lineage with terms like hosted computing or even time sharing), now most in the industry have begun referring to this as an aspect of cloud computing, often referred to as hardware cloudsA cloud computing model in which a service provider makes computing resources such as hardware and storage, along with infrastructure management, available to a customer on an as-needed basis. The provider typically charges for specific resource usage rather than a flat rate. In the past, similar efforts have been described as utility computing, hosting, or even time sharing.. Computing hardware used in this scenario exists “in the cloud,” meaning somewhere on the Internet. The costs of systems operated in this manner look more like a utility bill—you only pay for the amount of processing, storage, and telecommunications used. Tech research firm Gartner has estimated that 80 percent of corporate tech spending goes toward data center maintenance.J. Rayport, “Cloud Computing Is No Pipe Dream,” BusinessWeek, December 9, 2008. Hardware-focused cloud computing provides a way for firms to chip away at these costs.

Major players are spending billions building out huge data centers to take all kinds of computing out of the corporate data center and place it in the cloud. While cloud vendors typically host your software on their systems, many of these vendors also offer additional tools to help in creating and hosting apps in the cloud. Salesforce.com offers Force.com, which includes not only a hardware cloud but also several cloud-supporting tools, such as a programming environment (IDE) to write applications specifically tailored for Web-based delivery. Google’s App Engine offers developers several tools, including a database product called Big Table. And Microsoft offers a competing product—Windows Azure that runs the SQL Azure database. These efforts are often described by the phrase platform as a service (PaaS)Where cloud providers offer services that include the hardware, operating system, tools, and hosting (i.e., the platform) that its customers use to build their own applications on the provider’s infrastructure. In this scenario the cloud firm usually manages the platform (hosting, hardware, and supporting software), while the client has control over the creation and deployment of their appliation. since the cloud vendor provides a more complete platform (e.g., hosting hardware, operating system, database, and other software), which clients use to build their own applications.

Another alternative is called infrastructure as a service (IaaS)Where cloud providers offer services that include running the remote hardware and networking (i.e., the infrastructure), but client firms can choose software used (which may include operating systems, programming languages, databases, and other software packages). In this scenario the cloud firm usually manages the infrastructure (keeping the hardware and networking running), while the client has control over most other things (operating systems, storage, deployed applications, and perhaps even security and networking features like firewalls and security systems).. This is a good alternative for firms that want even more control. In IaaS, clients can select their own operating systems, development environments, underlying applications like databases, or other software packages (i.e., clients, and not cloud vendors, get to pick the platform), while the cloud firm usually manages the infrastructure (providing hardware and networking). IaaS services are offered by a wide variety of firms, including Amazon, Rackspace, Oracle, Dell, HP, and IBM.

Still other cloud computing efforts focus on providing a virtual replacement for operational hardware like storage and backup solutions. These include the cloud-based backup efforts like EMC’s Mozy, and corporate storage services like Amazon’s Simple Storage Solution (S3). Even efforts like Apple’s iCloud that sync user data across devices (phone, multiple desktops) are considered part of the cloud craze. The common theme in all of this is leveraging computing delivered over the Internet to satisfy the computing needs of both users and organizations.

Clouds in Action: A Snapshot of Diverse Efforts

Large, established organizations, small firms and start-ups are all embracing the cloud. The examples below illustrate the wide range of these efforts.

Journalists refer to the New York Times as, “The Old Gray Lady,” but it turns out that the venerable paper is a cloud-pioneering whippersnapper. When the Times decided to make roughly one hundred fifty years of newspaper archives (over fifteen million articles) available over the Internet, it realized that the process of converting scans into searchable PDFs would require more computing power than the firm had available.J. Rayport, “Cloud Computing Is No Pipe Dream,” BusinessWeek, December 9, 2008. To solve the challenge, a Times IT staffer simply broke out a credit card and signed up for Amazon’s EC2 cloud computing and S3 cloud storage services. The Times then started uploading terabytes of information to Amazon, along with a chunk of code to execute the conversion. While anyone can sign up for services online without speaking to a rep, someone from Amazon eventually contacted the Times to check in after noticing the massive volume of data coming into its systems. Using one hundred of Amazon’s Linux servers, the Times job took just twenty-four hours to complete. In fact, a coding error in the initial batch forced the paper to rerun the job. Even the blunder was cheap—just two hundred forty dollars in extra processing costs. Says a member of the Times IT group: “It would have taken a month at our facilities, since we only had a few spare PCs.…It was cheap experimentation, and the learning curve isn’t steep.”G. Gruman, “Early Experiments in Cloud Computing,” InfoWorld, April 7, 2008.

NASDAQ also uses Amazon’s cloud as part of its Market Replay system. The exchange uses Amazon to make terabytes of data available on demand, and uploads an additional thirty to eighty gigabytes every day. Market Reply allows access through an Adobe AIR interface to pull together historical market conditions in the ten-minute period surrounding a trade’s execution. This allows NASDAQ to produce a snapshot of information for regulators or customers who question a trade. Says the exchange’s VP of Product Development, “The fact that we’re able to keep so much data online indefinitely means the brokers can quickly answer a question without having to pull data out of old tapes and CD backups.”P. Grossman, “Cloud Computing Begins to Gain Traction on Wall Street,” Wall Street and Technology, January 6, 2009. NASDAQ isn’t the only major financial organization leveraging someone else’s cloud. Others include Merrill Lynch, which uses IBM’s Blue Cloud servers to build and evaluate risk analysis programs; and Morgan Stanley, which relies on Force.com for recruiting applications.