This is “Is Facebook Worth It?”, section 8.9 from the book Getting the Most Out of Information Systems (v. 1.4). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

8.9 Is Facebook Worth It?

Learning Objectives

- Discuss the factors related to Facebook’s valuation.

- Compare Facebook’s performance at IPO to that of Google, and offer insightful commentary on Facebook’s future prospects.

- Highlight areas of concern regarding Facebook’s future prospects and areas where Facebook may be able to increase revenues and profits.

It has often been said that the first phase of the Internet was about putting information online and giving people a way to find it. The second phase of the Web is about connecting people with one another. The Web 2.0 movement is big and impactful, but how much money is in it?

Now that Facebook is a publicly traded company, we can get real numbers on revenue, profitability, and growth, and we can use these numbers to compare Facebook against its rivals. In the quarter prior to its IPO, Facebook’s rate of revenue growth was 45 percent, down from 55 percent the prior quarter, which was down again from triple-digit growth the quarter before that.H. Blodget, “Well, Now that Everyone Has Sobered Up, Let’s Figure Out What Facebook is Actually Worth…” Business Insider, May 21, 2012. Usually at IPO time, markets like to see accelerating, not decelerating, growth. Facebook went public at a nosebleed rate of 65 times 2013 EPS (earnings per share). For comparison, still-growing Google traded at 13 times 2013 EPS at the time of Facebook’s IPO. At IPO, Facebook’s market cap was about half of Google’s, but if we compare the business in which Facebook and Google most closely compete, display advertising, both are roughly the same size (Facebook at 14 percent of the US market and Google at 13.8 percent), but Google’s display business is growing faster.C. Boulton, “Google to Pass Facebook in Display Ads in 2013,” eWeek, February 26, 2012. Google also had more cash than Facebook had revenue, and Facebook’s free cash flow is actually negative. This can be blamed on the cost to build data centers to support services users get for free (e.g., storage costs for the upwards of 300 million photos uploaded to Facebook each day).J. Cassidy, “Facebook: The Ultimate Dot-Com,” New Yorker, May 16, 2012. Table 8.1 "Comparing Facebook and Google at Comparable Periods in Time" shows a comparison of Facebook and Google at comparable stages.

Table 8.1 Comparing Facebook and Google at Comparable Periods in Time

| Facebook (5 years) | Pre-IPO Facebook (8 years) | Pre-IPO Google (5 years) | Post-IPO Google (8 years) | |

|---|---|---|---|---|

| Revenue | $272 million | $3.7 billion | $1.5 billion | $10.6 billion |

| Net Income | −$56 million | $1 billion | $106 million | $3.5 billion |

| Market Cap | - | $104 billion | $23 billion | $150 billion+ |

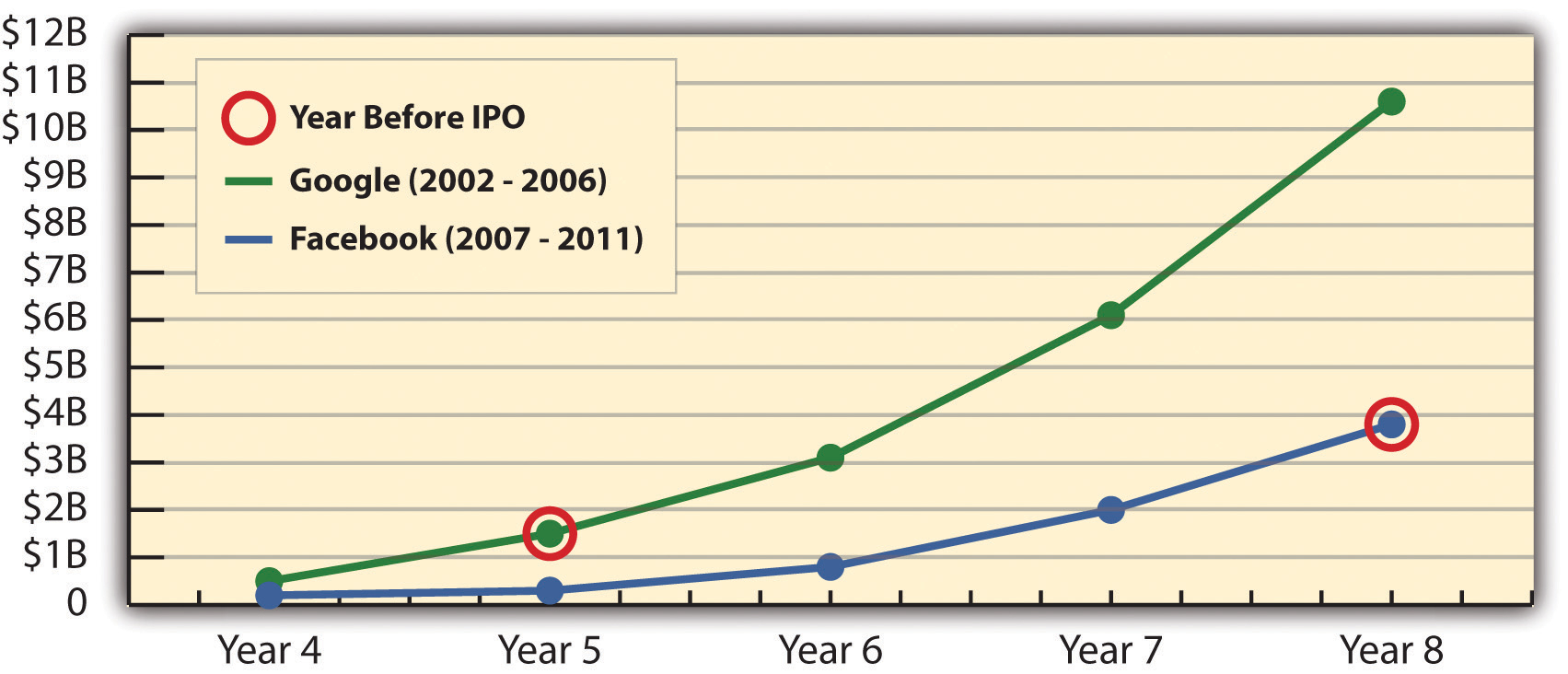

Facebook went public as an 8-year-old, while Google went public after five years. Facebook’s revenues at IPO were $3.7 billion—about 2.5 times Google’s $1.5 billion revenues when it went public. Facebook’s $1 billion in profits the year before it went public equate to about ten times Google’s pre-IPO annual profit of $106 million. And Facebook’s market cap at IPO was about $104 billion, over four times Google’s post-IPO value of $23 billion. But the comparison isn’t Apples-to-Apples (no pun intended). Roll the clock back and 5-year-old Facebook (roughly the age of Google at IPO) actually lost $56 million on revenues of just $272 million. Google as an 8-year-old brought in $10.6 billion in revenue and $3.5 billion in profits, and it sported a market cap of over $150 billion. The 8-year-old comparison also isn’t quite a fair one since capital rose during Google’s IPO (and secondary offering where it sold still more stock), helping to fuel the firm’s growth over those three years. Still, 8-year-old Google made about as much profit as 8-year-old Facebook did in revenue. As TechCrunch points out, the five-year compound annual growth rate for each firm’s revenue during comparable periods (2002–2006 for Google and 2007–2011 for Facebook) was almost exactly the same: 89 percent a year.

Figure 8.4 Revenue of Google and Facebook in Billions of Dollars

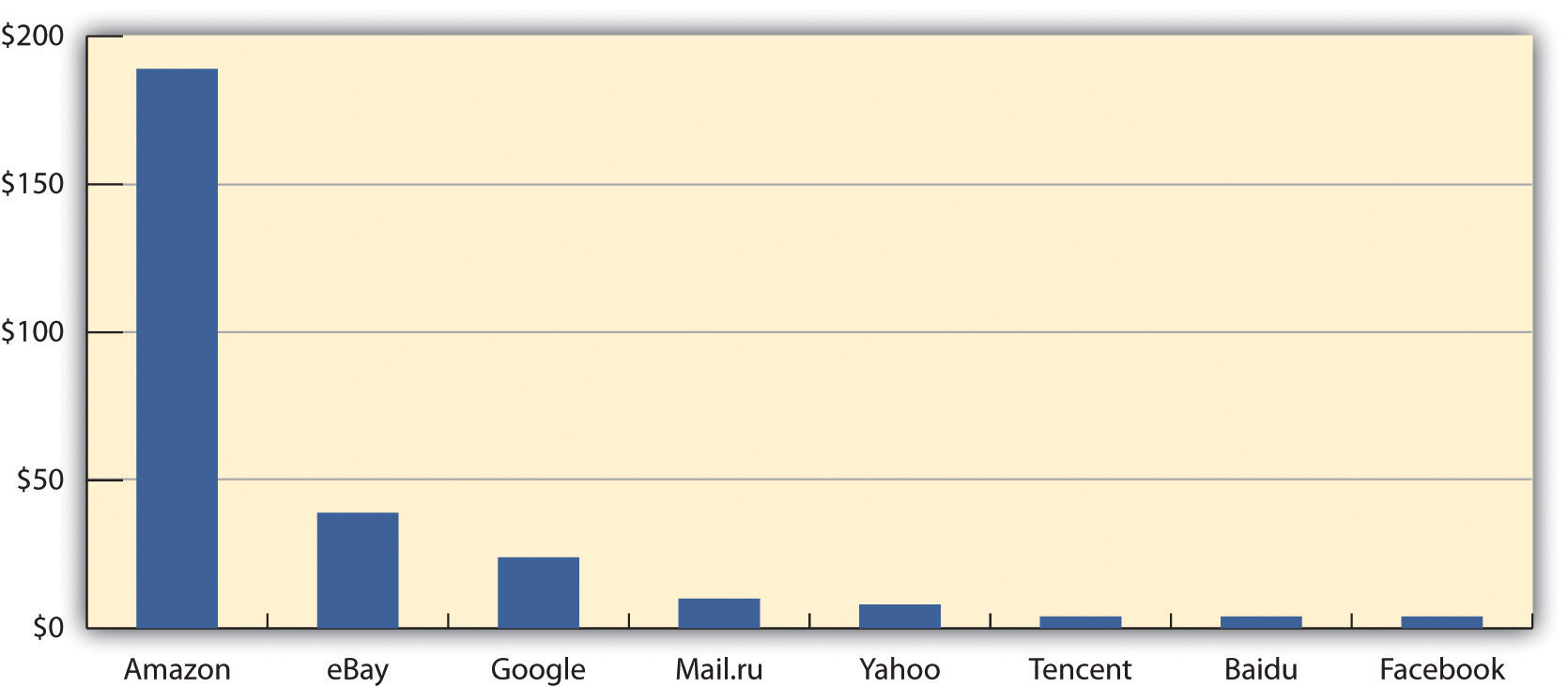

Figure 8.5 Revenue per User (2011)

While Facebook has, at times, been the Web’s most visited destination, its user base generates far less cash on a per-person basis than many rivals do, including only about one-sixth of Google’s per-user figure.J. Yarrow, “Here’s How Much a Unique Visitor Is Worth,” BusinessInsider, January 5, 2011.

When considering a firm’s value, it’s also important to realize that just because the market is willing to pay a high price for a firm’s stock, it doesn’t mean that the firm is actually worth it. A firm’s stock price is supposed to reflect the net present value of a firm’s future earnings, and unrealistic expectations can distort value. Facebook’s stock plummeted following its IPO, losing about a third of its value in a little over two weeks. Much remains to be demonstrated for any high Facebook valuation to hold over the long term. As the chart in Figure 8.5 "Revenue per User (2011)" shows, Facebook still lags well behind many of its rivals in terms of revenue per user; all that time spent on Facebook simply isn’t worth as much on a per-user basis as time spent on Google or many other services. Also consider the uncertainty as the firm tries to leverage the social graph. According to Facebook’s own research, “an average Facebook user with 500 friends actively follows the news on only forty of them, communicates with twenty, and keeps in close touch with about ten. Those with smaller networks follow even fewer.”S. Baker, “Learning and Profiting from Online Friendships,” BusinessWeek, May 21, 2009. That might not be enough critical mass to offer real, differentiable value to paying advertisers, and interest in deepening connections among users with “value-shallow” social graphs may in part have motivated Facebook’s mishandled attempts to encourage more public data sharing. The advantages of leveraging the friend network hinge on increased sharing and trust, a challenge for a firm that has had so many high-profile privacy stumbles.

Facebook does have a lot of potential in terms of upside earnings. First, Facebook ads run only inside Facebook.com, but Google earns about 30 percent of its revenue from ads it runs on third-party sites (referred to as the Google ad network). Next time you search the web, look for advertisements labeled “Ads by Google.” Google serves up these ads and splits the take with Web site operators. If Facebook creates its own ad network, it might be able to offer ad targeting that performs better than Google’s so-called AdSense product. Google targets ads on other Web sites based largely on keywords found on those sites, also using details it can glean from tracking a person’s web browsing history (see Chapter 14 "Google in Three Parts: Search, Online Advertising, and Beyond" for details). Facebook can do all this, but it could also add in all sorts of data from the dark web that Google can’t see: data from a user’s social activity, their highly-accurate personal profile, and more. Turning on such an ad network would be simple from a technical perspective. The tough part, however, would be creating an ad network sales force and rolling it out in a way that doesn’t cause a privacy debacle or lead to a deluge of scare headlines.

Over a longer term, what about Facebook TV? Facebook almost certainly wants to play a starring role in your living room, making the TV a platform for social activity: video chat, serving targeted ads, social entertainment recommendations, games, and all sorts of commerce. It will be tough to navigate the tensions of bandwidth-capping cable guys, channel owners, and hardware firms keen to build their own platform, but Zuckerberg has Reed Hastings on his board—and as much as the Netflix CEO has been derided following the Qwikster debacle, no one has built a further-reaching platform with consumer electronics firms than Hastings.

Steve Rubel wrote the following on his Micro Persuasion blog: “The Internet amber is littered with fossilized communities that once dominated. These former stalwarts include AOL, Angelfire, theGlobe.com, GeoCities, and Tripod.” Network effects and switching cost advantages can be strong, but not necessarily insurmountable if value is seen elsewhere and if an effort becomes more fad than “must have.” Time will tell if Facebook’s competitive assets and constant innovation are enough to help it avoid the fate of those that have gone before them.

Key Takeaways

- Facebook was a profitable and growing company at IPO, and its offering was the largest ever in the technology industry.

- Several metrics suggest that Facebook may have been overvalued at IPO.

- Decelerating growth, lower ARPU than rivals, uncertainty about the ROI of Facebook advertising, and increasing infrastructure costs are all among areas of concern.

- Despite concern, Facebook has significant growth prospects, including the potential to create new products such as a third-party ad network and (longer term) a platform for potentially lucrative social television services.

Questions and Exercises

- Circumstances change over time. Research the current state of Facebook’s financials—what is the firm’s market capitalization? How has the stock performed since IPO? How have revenues performed? What are trends in net income? What are the reasons behind these trends? Do you think that markets are accurate in setting the firm’s value at IPO? Why or why not?

- Do you think Facebook’s social graph data is large enough to be leveraged as a source of revenue in ways that are notably different than conventional pay-per-click or CPM-based advertising? Would you be excited about certain possibilities? Creeped out by some? Explain possible scenarios that might work or might fail. Justify your interpretation of these scenarios.

- So you’ve had a chance to learn about Facebook, its model, growth, outlook, strategic assets, and competitive environment. How much do you think the firm is worth? Which firms do you think it should compare with in terms of value, influence, and impact? Would you invest in Facebook?

- Which firms might make good merger partners with Facebook? Would these deals ever go through? Why or why not?