This is “Is Facebook Worth It?”, section 8.9 from the book Getting the Most Out of Information Systems (v. 1.2). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

8.9 Is Facebook Worth It?

Learning Objectives

- Discuss the factors related to Facebook’s valuation.

- Understand why Microsoft might have been willing to offer to invest in Facebook at a higher valuation rate.

It has often been said that the first phase of the Internet was about putting information online and giving people a way to find it. The second phase of the Web is about connecting people with one another. The Web 2.0 movement is big and impactful, but how much money is in it?

While the valuations of private firms are notoriously difficult to pin down due to a lack of financial disclosure, the $15 billion valuation Facebook received after accepting the fall 2007 Microsoft investment was rich, even when made by such a deep-pocketed firm.

But now that investment looks like a steal. The chart of Facebook’s estimated value has risen like a hockey stick. On secondary markets for private shares, such as SharesPost and SecondMarket, Facebook has traded at a value of $70 billion, and a Wall Street Journal report pegged the firm as possibly worth $100 billion or more—a value that would put it ahead of tech giants like Amazon and Cisco.G. Fowler and A. Das, “Facebook Numbers Feed IPO Outlook,” Wall Street Journal, May 1, 2011. Adding fuel to the fire, shares of LinkedIn, one of the first widely anticipated social media IPOs and a firm with a smaller reach than Facebook, nearly doubled in value the first day after it went public.

Facebook faces pressure to go public soon because under U.S. SEC rules, any private company with more than 499 shareholders must disclose its financials, and an early 2011 investment in Facebook by Goldman Sachs, made on behalf of multiple Goldman clients, prompted an investigation as to whether or not Facebook had already crossed that threshold.“Facebook’s Future on the Open Market,” Knowledge@Wharton, May 25, 2011. If a firm needs to make its financials public (exposing details of its business to competitors), then why not go to the public markets and raise money to grow faster? Raising more capital enables Zuckerberg to go on the hunt as well—hiring more people, rewarding existing employees, building more data centers, expanding into new markets, and acquiring firms. Facebook investor Peter Theil confirmed the firm had already made an offer to buy Twitter (a firm that at the time had zero dollars in revenues and no discernible business model) for a cool half billion dollars.S. Ante, “Facebook’s Thiel Explains Failed Twitter Takeover,” BusinessWeek, March 1, 2009.

When considering a firm’s value it’s also important to realize that just because the market is willing to pay a high price for a firm’s stock doesn’t mean the firm is worth it. A firm’s stock price is supposed to reflect the net present value of a firm’s future earnings, and unrealistic expectations can distort value. Shortly after LinkedIn’s IPO, many questioned that firm’s sky-high valuation,S. Zhu, “LinkedIn’s Valuation Is Unjustifiable,” SeekingAlpha, May 30, 2011. and the bubble period before the crash of 2000 was fueled largely by excess euphoria over the prospects of high-technology firms.

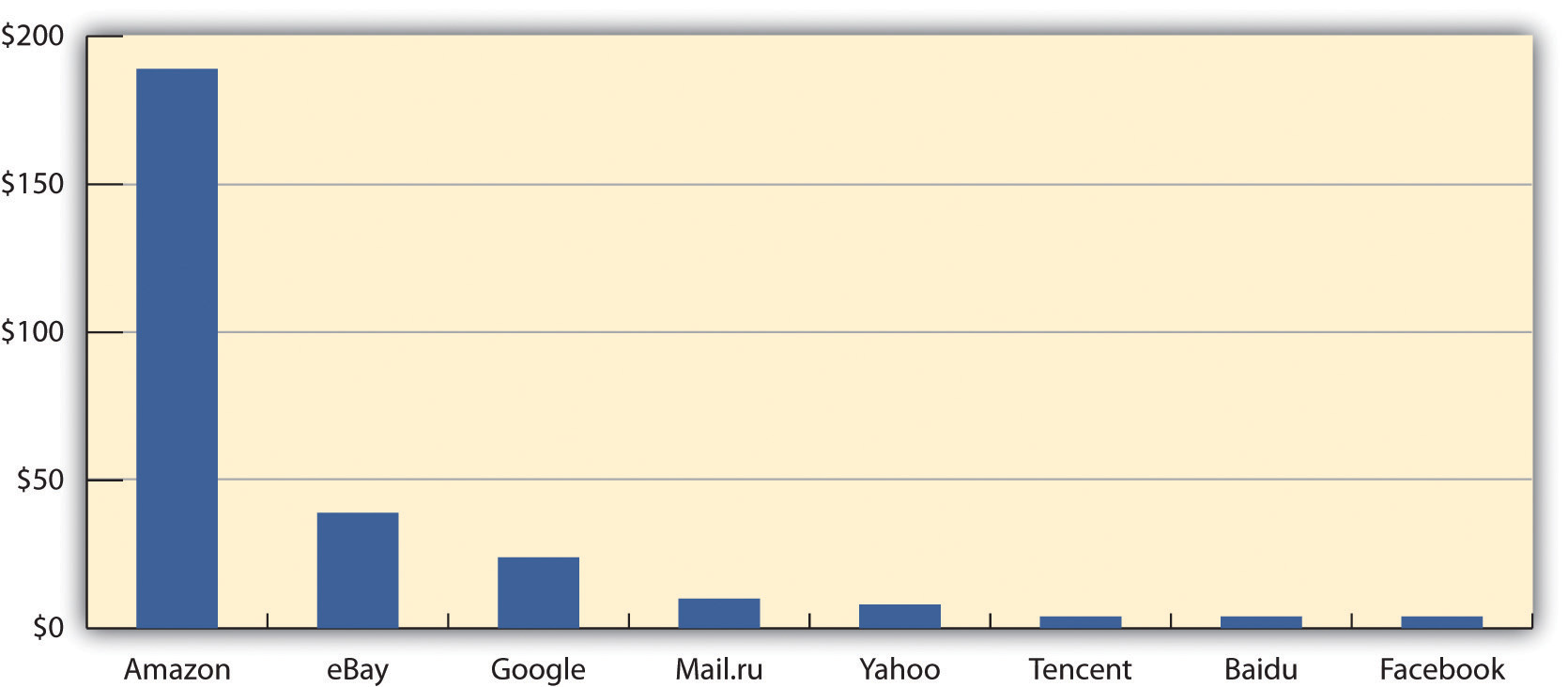

Figure 8.5 Revenue per User (2011)

While Facebook has, at times, been the Web’s most visited destination, its user base generates far less cash on a per-person basis than many rivals do, including only about one-sixth of Google’s per-user figure.J. Yarrow, “Here’s How Much a Unique Visitor Is Worth,” BusinessInsider, January 5, 2011.

Much remains to be demonstrated for any high Facebook valuation to hold over the long term. Facebook is still a relative youngster. Its models are evolving, and it has quite a bit to prove. As the chart in Figure 8.5 "Revenue per User (2011)" shows, Facebook still lags well behind many of its rivals in terms of revenue per user. Also consider the uncertainty as the firm tries to leverage the social graph. According to Facebook’s own research, “an average Facebook user with 500 friends actively follows the news on only forty of them, communicates with twenty, and keeps in close touch with about ten. Those with smaller networks follow even fewer.”S. Baker, “Learning and Profiting from Online Friendships,” BusinessWeek, May 21, 2009. That might not be enough critical mass to offer real, differentiable value to paying advertisers, and interest in deepening connections among users with “value-shallow” social graphs may in part have motivated Facebook’s mishandled attempts to encourage more public data sharing. The advantages of leveraging the friend network hinge on increased sharing and trust, a challenge for a firm that has had so many high-profile privacy stumbles.

Even with uncertainty, though, Facebook’s growth thus far does seem to offer a lot of runway for expansion. Up to this point all of Facebook’s solidly accelerating ad revenue has been derived from serving ads on Facebook.com. But Google earns about 30 percent of its revenue from serving ads on third-party Web sites, splitting the take with site operators (this is referred to as running an ad network). If Facebook takes its targeting technology to the Web and creates its own ad network for other Web sites to join, then that would have the potential to add more rocket fuel to the Facebook revenue moon shot. Where else could Facebook go to seek profits? Zuckerberg has said that music and television are social frontiers as well. Facebook TV, anyone? Facebook Radio?M. Campbell and J. Browning, “Facebook’s Zuckerberg Says Music, TV Are Social Frontiers,” Bloomberg, May 25, 2011.

Steve Rubel wrote the following on his Micro Persuasion blog: “The Internet amber is littered with fossilized communities that once dominated. These former stalwarts include AOL, Angelfire, theGlobe.com, GeoCities, and Tripod.” Network effects and switching cost advantages can be strong, but not necessarily insurmountable if value is seen elsewhere and if an effort becomes more fad than “must have.” Time will tell if Facebook’s competitive assets and constant innovation are enough to help it avoid the fate of those that have gone before them.

Key Takeaways

- Not all investments are created equal, and a simple calculation of investment dollars multiplied by the percentage of firm owned does not tell the whole story.

- Microsoft’s investment entitled the firm to preferred shares; it also came with advertising deal exclusivity.

- Microsoft may also benefit from offering higher valuations that discourage rivals from making acquisition bids for Facebook.

- Facebook has continued to invest capital raised in expansion, particularly in hardware and infrastructure. It has also pursued its own acquisitions, including a failed bid to acquire Twitter.

- The firm’s success will hinge on its ability to create sustainably profitable revenue opportunities. It has yet to prove that data from the friend network will be large enough and can be used in a way that is differentiably attractive to advertisers. However, some experiments in profiling and ad targeting across a friend network have shown very promising results. Firms exploiting these opportunities will need to have a deft hand in offering consumer and firm value while quelling privacy concerns.

Questions and Exercises

- Circumstances change over time. Research the current state of Facebook’s financials—how much is the firm “valued at”? How much revenue does it bring in? How profitable is it? Are these figures easy or difficult to find? Why or why not?

- Who else might want to acquire Facebook? Is it worth it at current valuation rates?

- What motivation does Microsoft have in bidding so much for Facebook?

- Do you think Facebook was wise to take funds from Digital Sky? Why or why not?

- Do you think Facebook’s friend network is large enough to be leveraged as a source of revenue in ways that are notably different than conventional pay-per-click or CPM-based advertising? Would you be excited about certain possibilities? Creeped out by some? Explain possible scenarios that might work or might fail. Justify your interpretation of these scenarios.

- So you’ve had a chance to learn about Facebook, its model, growth, outlook, strategic assets, and competitive environment. How much do you think the firm is worth? Which firms do you think it should compare with in terms of value, influence, and impact? Would you invest in Facebook?

- Which firms might make good merger partners with Facebook? Would these deals ever go through? Why or why not?