This is “Netflix in Two Acts: The Making of an E-commerce Giant and the Uncertain Future of Atoms to Bits”, chapter 4 from the book Getting the Most Out of Information Systems (v. 1.2). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 4 Netflix in Two Acts: The Making of an E-commerce Giant and the Uncertain Future of Atoms to Bits

4.1 Introduction

Learning Objectives

- Understand the basics of the Netflix business model.

- Recognize the downside the firm may have experienced from an early IPO.

- Appreciate why other firms found Netflix’s market attractive, and why many analysts incorrectly suspected Netflix was doomed.

Entrepreneurs are supposed to want to go public. When a firm sells stock for the first time, the company gains a ton of cash to fuel expansion and its founders get rich. Going public is the dream in the back of the mind of every tech entrepreneur. But in 2007, Netflix founder and CEO Reed Hastings told Fortune that if he could change one strategic decision, it would have been to delay the firm’s initial public stock offering (IPO)Also known as “going public.” The first time a firm sells stock to the public.: “If we had stayed private for another two to four years, not as many people would have understood how big a business this could be.”M. Boyle, “Questions for…Reed Hastings,” Fortune, May 23, 2007. Once Netflix was a public company, financial disclosure rules forced the firm to reveal that it was on a money-minting growth tear. Once the secret was out, rivals showed up.

Hollywood’s best couldn’t have scripted a more menacing group of rivals for Hastings to face. First in line with its own DVD-by-mail offering was Blockbuster, a name synonymous with video rental. Some 40 million U.S. families were already card-carrying Blockbuster customers, and the firm’s efforts promised to link DVD-by-mail with the nation’s largest network of video stores. Following close behind was Wal-Mart—not just a big Fortune 500 company but the largest firm in the United States ranked by sales. In Netflix, Hastings had built a great firm, but let’s face it, his was a dot-com, an Internet pure playA firm that focuses on a specific product, service, or business model. An Internet pure play is a firm that only operates through the Internet channel (i.e., with no physical stores or catalogs). without a storefront and with an overall customer base that seemed microscopic compared to these behemoths.

Before all this, Netflix was feeling so confident that it had actually raised prices. Customers loved the service, the company was dominating its niche, and it seemed like the firm could take advantage of a modest price hike, pull in more revenue, and use this to improve and expand the business. But the firm was surprised by how quickly the newcomers mimicked Netflix with cheaper rival efforts. This new competition forced Netflix to cut prices even lower than where they had been before the price increase. To keep pace, Netflix also upped advertising at a time when online ad rates were increasing. Big competitors, a price war, spending on the rise—how could Netflix possibly withstand this onslaught? Some Wall Street analysts had even taken to referring to Netflix’s survival prospects as “The Last Picture Show.”M. Conlin, “Netflix: Flex to the Max,” BusinessWeek, September 24, 2007.

Fast-forward a year later and Wal-Mart had cut and run, dumping their experiment in DVD-by-mail. Blockbuster had been mortally wounded, hemorrhaging billions of dollars in a string of quarterly losses. And Netflix? Not only had the firm held customers, it grew bigger, recording record profits. The dot-com did it. Hastings, a man who prior to Netflix had already built and sold one of the fifty largest public software firms in the United States, had clearly established himself as one of America’s most capable and innovative technology leaders. In fact, at roughly the same time that Blockbuster CEO John Antioco resigned, Reed Hastings accepted an appointment to the board of directors of none other than the world’s largest software firm, Microsoft. Like the final scene in so many movies where the hero’s face is splashed across the news, Time named Hastings one of the “100 most influential global citizens,” while Fortune magazine named him “Businessperson of the Year.”M. Copeland, “Businessperson of the Year,” Fortune, December 6, 2010.

Why Study Netflix?

Studying Netflix gives us a chance to examine how technology helps firms craft and reinforce a competitive advantage. We’ll pick apart the components of the firm’s DVD-by-mail strategy and learn how technology played a starring role in placing the firm atop its industry. In the second part of this case, we recognize that while Netflix emerged the victorious underdog at the end of the first show, there will be at least one sequel, with the final scene yet to be determined. Act II looks at the very significant challenges the firm faces as its primary business shifts from competing in shipping the atoms of DVDs to one focused on sending bits over the Internet. We’ll see that a highly successful firm can still be challenged by technical shifts, giving us an oportunity to examine issues that include digital goods, licensing, platform competition, and supplier power.

How Netflix Works

Reed Hastings, a former Peace Corps volunteer with a master’s in computer science, got the idea for Netflix when he was late in returning the movie Apollo 13 to his local video store. The forty-dollar late fee was enough to have bought the video outright with money left over. Hastings felt ripped off, and out of this initial outrage, Netflix was born. The model the firm eventually settled on was a DVD-by-mail service that charged a flat-rate monthly subscription rather than a per-disc rental fee. Under this model, customers don’t pay a cent in mailing expenses, and there are no late fees. Videos arrive in red Mylar envelopes that are addressed and postage-paid for reuse in disc returns. When done watching videos, consumers just slip the DVD back into the envelope, reseal it with a peel-back sticky strip, and drop the disc in the mail. Users make their video choices in their “request queue” at Netflix.com. If a title isn’t available, Netflix simply moves to the next title in the queue. Consumers use the Web site to rate videos they’ve seen, specify their viewing preferences, get video recommendations, check out title details, and even share their viewing habits and reviews.

This model helped Netflix grow into a giant, but technology continues to radically change the firm. Hastings knew that if his firm was successful it would one day transition from reliance on mailed DVDs and introduce streaming video. Says Hastings, “We named the company Netflix for a reason; we didn’t name it DVDs-by-mail.”M. Boyle, “Questions for…Reed Hastings,” Fortune, May 23, 2007. In 2007, the firm added a “Watch Now” button next to those videos that could be automatically streamed over the Internet. By 2011, the firm was so focused on streaming that the first page at Netflix.com didn’t even mention DVDs or discs (although disc plans remain quite popular).

Key Takeaways

- Analysts and managers have struggled to realize that dot-com start-up Netflix could actually create sustainable competitive advantage, beating back challenges from Wal-Mart and Blockbuster, among others.

- Data disclosure required by public companies may have attracted these larger rivals to the firm’s market.

- Netflix operates via a DVD subscription and video streaming model. Although sometimes referred to as “rental,” the model is really a substitute good for conventional use-based media rental.

Questions and Exercises

- How does the Netflix business model work?

- Which firms are or have been Netflix’s most significant competitors? How do their financial results or performance of their efforts compare to Netflix’s efforts?

- What recent appointment did Reed Hastings accept in addition to his job as Netflix CEO? Why is this appointment potentially important for Netflix?

- Why did Wal-Mart and Blockbuster managers, as well as Wall Street analysts, underestimate Netflix? What issues might you advise analysts and managers to consider so that they avoid making these sorts of mistakes in the future?

4.2 Act I: Netflix Leverages Tech and Timing to Create Killer Assets in DVD-by-Mail

Learning Objectives

- Understand how many firms have confused brand and advertising, why branding is particularly important for online firms, and the factors behind Netflix’s exceptional brand strength.

- Understand the long tail concept, and how it relates to Netflix’s ability to offer the customer a huge (the industry’s largest) selection of movies.

- Know what collaborative filtering is, how Netflix uses collaborative filtering software to match movie titles with the customer’s taste, and in what ways this software helps Netflix garner sustainable competitive advantage.

- List and discuss the several technologies Netflix uses in its operations to reduce costs and deliver customer satisfaction and enhance brand value.

- Understand the role that scale economies play in Netflix’s strategies, and how these scale economies pose an entry barrier to potential competitors.

- Understand the role that market entry timing has played in the firm’s success.

To understand Netflix’s strengths, it’s important to view the firm as its customers see it. And for the most part, what they see they like—a lot! Netflix customers are rabidly loyal and rave about the service. The firm repeatedly ranks at the top of customer satisfaction surveys. Ratings agency ForeSee has named Netflix the number one e-commerce site in terms of customer satisfaction in eleven out of twelve surveys conducted since 2005 (placing it ahead of Apple and Amazon, among others). Netflix has also been cited as the best at satisfying customers by the American Customer Satisfaction Index (ACSI), Nielsen, and Fast Company and was also named the Retail Innovator of the Year by the National Retail Federation.

Building a great brand, especially one online, starts with offering exceptional value to the customer. Don’t confuse branding with advertising. During the dot-com era, firms thought brands could be built through Super Bowl ads and expensive television promotion. Advertising can build awareness, but brands are built through customer experience. This is a particularly important lesson for online firms. Have a bad experience at a burger joint and you might avoid that location but try another of the firm’s outlets a few blocks away. Have a bad experience online and you’re turned off by the firm’s one and only virtual storefront. If you click over to an online rival, the offending firm may have lost you forever. But if a firm can get you to stay through quality experience, switching costs and data-driven value might keep you there for a long, long time, even when new entrants try to court you away.

If brand is built through customer experience, consider what this means for the Netflix subscriber. They expect the firm to offer a huge selection, to be able to find what they want, for it to arrive on time, for all of this to occur with no-brainer ease of use and convenience, and at a fair price. Technology drives all of these capabilities, so tech is at the very center of the firm’s brand building efforts. Let’s look at how the firm does it.

Selection: The Long Tail in Action

Customers have flocked to Netflix in part because of the firm’s staggering selection. A traditional video store (and Blockbuster had some 7,800 of them) stocks roughly three thousand DVD titles on its shelves. For comparison, Netflix is able to offer its customers a selection of over 125,000 DVD titles, and rising! At traditional brick-and-mortar retailers, shelf space is the biggest constraint limiting a firm’s ability to offer customers what they want when they want it. Just which films, documentaries, concerts, cartoons, TV shows, and other fare make it inside the four walls of a Blockbuster store is dictated by what the average consumer is most likely to be interested in. To put it simply, Blockbuster stocks blockbusters.

Finding the right product mix and store size can be tricky. Offer too many titles in a bigger storefront and there may not be enough paying customers to justify stocking less popular titles (remember, it’s not just the cost of the DVD—firms also pay for the real estate of a larger store, the workers, the energy to power the facility, etc.). You get the picture—there’s a breakeven point that is arrived at by considering the geographic constraint of the number of customers that can reach a location, factored in with store size, store inventory, the payback from that inventory, and the cost to own and operate the store. Anyone who has visited a video store only to find a title out of stock has run up against the limits of the physical store model.

But many online businesses are able to run around these limits of geography and shelf space. Internet firms that ship products can get away with having just a few highly automated warehouses, each stocking just about all the products in a particular category. And for firms that distribute products digitally (think songs on iTunes), the efficiencies are even greater because there’s no warehouse or physical product at all (more on that later).

Offer a nearly limitless selection and something interesting happens: there’s actually more money to be made selling the obscure stuff than the hits. Music service Rhapsody makes more from songs outside of the top ten thousand than it does from songs ranked above ten thousand. At Amazon.com, roughly 60 percent of books sold are titles that aren’t available in even the biggest Borders or Barnes & Noble Superstores.C. Anderson, “The Long Tail,” Wired 12, no. 10 (October 2004), http://www.wired.com/wired/archive/12.10/tail.html. And at Netflix, roughly 75 percent of DVD titles shipped are from back-catalog titles, not new releases (at Blockbuster outlets the equation is nearly flipped, with some 70 percent of business coming from new releases).B. McCarthy, “Netflix, Inc.” (remarks, J. P. Morgan Global Technology, Media, and Telecom Conference, Boston, May 18, 2009). Consider that Netflix sends out forty-five thousand different titles each day. That’s fifteen times the selection available at your average video store! Each quarter, roughly 95 percent of titles are viewed—that means that every few weeks Netflix is able to find a customer for nearly every DVD title that has ever been commercially released.

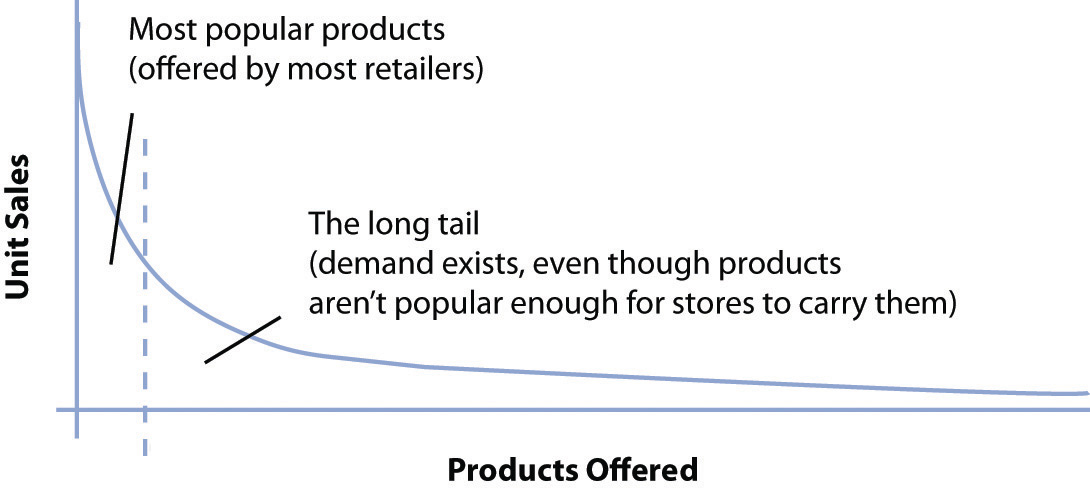

This phenomenon whereby firms can make money by selling a near-limitless selection of less-popular products is known as the long tailIn this context, refers to an extremely large selection of content or products. The long tail is a phenomenon whereby firms can make money by offering a near-limitless selection.. The term was coined by Chris Anderson, an editor at Wired magazine, who also wrote a best-selling business book by the same name. The “tail” (see Figure 4.1 "The Long Tail") refers to the demand for less popular items that aren’t offered by traditional brick-and-mortar shops. While most stores make money from the area under the curve from the vertical axis to the dotted line, long tail firms can also sell the less popular stuff. Each item under the right part of the curve may experience less demand than the most popular products, but someone somewhere likely wants it. And as demonstrated from the examples above, the total demand for the obscure stuff is often much larger than what can be profitably sold through traditional stores alone. While some debate the size of the tail (e.g., whether obscure titles collectively are more profitable for most firms), two facts are critical to keep above this debate: (1) selection attracts customers, and (2) the Internet allows large-selection inventory efficiencies that offline firms can’t match.

Figure 4.1 The Long Tail

The long tail works because the cost of production and distribution drop to a point where it becomes economically viable to offer a huge selection. For Netflix, the cost to stock and ship an obscure foreign film is the same as sending out the latest Will Smith blockbuster. The long tail gives the firm a selection advantage (or one based on scale) that traditional stores simply cannot match.

For more evidence that there is demand for the obscure stuff, consider Bollywood cinema—a term referring to films produced in India. When ranked by the number of movies produced each year, Bollywood is actually bigger than Hollywood, but in terms of U.S. demand, even the top-grossing Hindi film might open in only one or two American theaters, and few video stores carry many Bollywood DVDs. Again, we see the limits that geography and shelf space impose on traditional stores. As Anderson puts it, when it comes to traditional methods of distribution, “an audience too thinly spread is the same as no audience at all.”C. Anderson, “The Long Tail,” Wired 12, no. 10 (October 2004), http://www.wired.com/wired/archive/12.10/tail.html. While there are roughly 1.7 million South Asians living in the United States, Bollywood fans are geographically disbursed, making it difficult to offer content at a physical storefront. Fans of foreign films would often find the biggest selection at an ethnic grocery store, but even then, that wouldn’t be much. Enter Netflix. The firm has found the U.S. fans of South Asian cinema, sending out roughly one hundred thousand Bollywood DVDs a month. As geographic constraints go away, untapped markets open up!

For evidence on Netflix’s power to make lucrative markets from nonblockbusters, visit the firm’s “Top 100 page.”http://www.netflix.com/Top100. You’ll see a list loaded with films that were notable for their lack of box office success. During a six-year period of the firm’s megagrowth, the top spot was held not by a first-run megahit but by the independent film Crash (an Oscar winner, but box office weakling).R. Elder, “‘Crash’ Remains Top DVD Rental,” Chicago Tribune, April 14, 2009.

Netflix has used the long tail to its advantage, crafting a business model that creates close ties with film studios. In most cases, studios earn a percentage of the subscription revenue for every disk sent out to a Netflix customer. In exchange, Netflix gets DVDs at a very low cost. The movie business is characterized by large fixed costsA cost that does not vary according to production volume. up front. Studio marketing budgets are concentrated on films when they first appear in theaters and when they’re first offered on DVD. After that, studios are done promoting a film, focusing instead on their most current titles. But Netflix is able to find an audience for a film without the studios spending a dime on additional marketing. Since so many of the titles viewed on Netflix are in the long tail, revenue sharing is all gravy for the studios—additional income they would otherwise be unlikely to get. It’s a win-win for both ends of the supply chain. These supplier partnerships grant Netflix a sort of soft bargaining power that’s distinctly opposite the strong-arm price bullying that giants like Wal-Mart are often accused of.

The VCR, the Real “Killer App”?

Netflix’s coziness with movie studios grateful to generate revenue from back-catalog movie titles is particularly noteworthy, given that the film industry has often viewed new technologies with a suspicion bordering on paranoia. In one of the most notorious incidents, Jack Valenti, the former head of the Motion Picture Association of America (MPAA) once lobbied the U.S. Congress to limit the sale of home video recorders, claiming, “the VCR is to the American film producer and the American public as the Boston strangler is to the woman home alone.”J. Bates, “Formidable Force for Hollywood,” Los Angeles Times, April 27, 2007.

Not only was the statement over the top, Jack couldn’t have been more wrong. Revenue from the sale of VCR tapes would eventually surpass the take from theater box offices, and today, home video brings in about two times box office earnings.

Cinematch: Technology Creates a Data Asset That Delivers Profits

Netflix proves there’s both demand and money to be made from the vast back catalog of film and TV show content. But for the model to work best, the firm needed to address the biggest inefficiency in the movie industry—“audience finding,” that is, matching content with customers. To do this, Netflix leverages some of the industry’s most sophisticated technology, a proprietary recommendation system that the firm calls Cinematch.

Each time a customer visits Netflix after sending back a DVD, the service essentially asks “So, how did you like the movie?” With a single click, each film can be rated on a scale of one to five stars. If you’re new to Netflix, the service can prompt you with a list of movies (or you can search out and rate titles on your own). Love Rushmore but hate The Life Aquatic? Netflix wants to know.

The magic of Cinematch happens not by offering a gross average user rating—user tastes are too varied and that data’s too coarse to be of significant value. Instead, Cinematch develops a map of user ratings and steers you toward titles preferred by people with tastes that are most like yours. Techies and marketers call this trick collaborative filteringA classification of software that monitors trends among customers and uses this data to personalize an individual customer’s experience.. The term refers to a classification of software that monitors trends among customers and uses this data to personalize an individual customer’s experience. Input from collaborative filtering software can be used to customize the display of a Web page for each user so that an individual is greeted only with those items the software predicts they’ll most likely be interested in. The kind of data mining done by collaborative filtering isn’t just used by Netflix; other sites use similar systems to recommend music, books, even news stories. While other firms also employ collaborative filtering, Netflix has been at this game for years, and is constantly tweaking its efforts. The results are considered the industry gold standard.

Figure 4.2 Netflix Community Features

Source: Netflix Investor Day presentation, May 2008. Reproduced by permission of Netflix, Inc. Copyright © 2009, Netflix, Inc. All rights reserved.

Collaborative filtering software is powerful stuff, but is it a source of competitive advantage? Ultimately it’s just math. Difficult math, to be sure, but nothing prevents other firms from working hard in the lab, running and refining tests, and coming up with software that’s as good, or perhaps one day even better than Netflix’s offering. But what the software has created for the early-moving Netflix is an enormous data advantage that is valuable, results yielding, and impossible for rivals to match. Even if Netflix gave Cinematch to its competitors, they’d be without the over five billion ratings that the firm has amassed (according to the firm, users add about a million new ratings to the system each day). More ratings make the system seem smarter, and with more info to go on, Cinematch can make more accurate recommendations than rivals.

Evidence suggests that users trust and value Cinematch. Recommended titles make up over 60 percent of the content users place in their queues—an astonishing penetration rate. Compare that to how often you’ve received a great recommendation from the sullen teen behind the video store counter. While data and algorithms improve the service and further strengthen the firm’s brand, this data is also a switching cost. Drop Netflix for Blockbuster and the average user abandons the two hundred or more films they’ve rated. Even if one is willing to invest the time in recreating their ratings on Blockbuster’s site, the rival will still make less accurate recommendations because there are fewer users and less data to narrow in on similarities across customers.

One way to see how strong these switching costs are is to examine the Netflix churn rateThe rate at which customers leave a product or service.. Churn is a marketing term referring to the rate at which customers leave a product or service. A low churn is usually key to profitability because it costs more to acquire a customer than to keep one. And the longer a customer stays with the firm, the more profitable they become and the less likely they are to leave. If customers weren’t completely satisfied with the Netflix experience, many would be willing to churn out and experiment with rivals offering cheaper service. However, the year after Blockbuster and Wal-Mart launched with copycat efforts, the rate at which customers left Netflix actually fell below 4 percent. Churn rates have remained stable over time, an indication that customer loyalty remained strong despite a challenging recession.“Final Transcript: NFLX—Q1 2011 Netflix Inc. Earnings Conference Call,” Thompson StreetEvents, April 25, 2011.

All of this impacts marketing costs, too. Happy customers refer friends (free marketing from a source consumers trust more than a TV commercial). Ninety-four percent of Netflix subscribers say they have recommended the service to someone else, and 71 percent of new subscribers say an existing subscriber has encouraged them to sign up. It’s no wonder subscriber acquisition costs have been steadily falling, further contributing to the firm’s overall profitability.

The Netflix Prize

Netflix isn’t content to stand still with its recommendation engine. Recognizing that there may be useful expertise outside its Los Gatos, California headquarters, the firm launched a crowdsourcingThe act of taking a job traditionally performed by a designated agent (usually an employee) and outsourcing it to an undefined generally large group of people in the form of an open call. effort known as The Netflix Prize (for more on crowdsourcing, see Chapter 7 "Social Media, Peer Production, and Web 2.0").

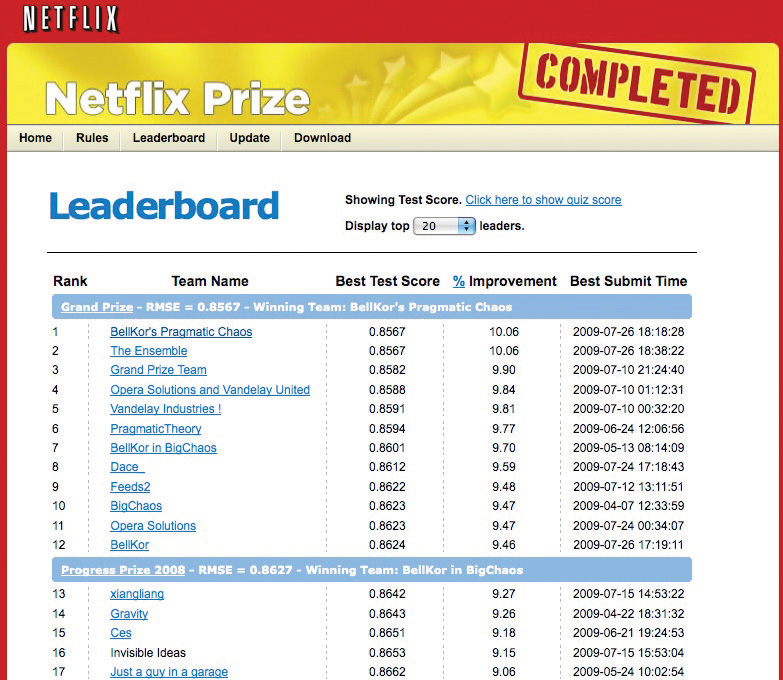

Figure 4.3 The Netflix Prize Leader Board

Source: Reproduced by permission of Netflix, Inc. Copyright © 2009, Netflix, Inc. All rights reserved.

The goal was simple: Offer $1 million to the first group or individual who can improve Cinematch’s ratings accuracy by 10 percent. In order to give developers something to work with, the firm turned over a large ratings database (with customer-identifying information masked, of course). The effort attracted over 30,000 teams from 170 countries. Not bad when you consider that $1 million would otherwise fund just four senior Silicon Valley engineers for about a year. And the effort earned Netflix a huge amount of PR, as newspapers, magazines, and bloggers chatted up the effort.

While Netflix gains access to any of the code submitted as part of the prize, it isn’t exclusive access. The Prize underscores the value of the data asset. Even if others incorporate the same technology as Netflix, the firm still has user data (and attendant customer switching costs) that prevent rivals with equal technology from posing any real threat. Results incorporating many innovations offered by contest participants were incorporated into Cinematch, even before the prize was won.

As the contest dragged on, many participants wondered if the 10 percent threshold could ever be reached. While many teams grew within striking distance, a handful of particularly vexing titles thwarted all algorithms. Perhaps the most notorious title was Napoleon Dynamite. The film is so quirky, and Netflix customers so polarized, that there’s little prior indicator to suggest if you’re in the “love it” or “hate it” camp. One contestant claimed that single film was responsible for 15 percent of the gap between his team’s effort and the million dollars.C. Thompson, “If You Liked This, You’re Sure to Love That,” New York Times, November 21, 2008.

The eventual winner turned out to be a coalition of four teams from four countries—prior rivals who sought to pool their noggins and grab fame and glory (even if their individual prize split was less). BellKor’s Pragmatic Chaos, the first team to cross the 10 percent threshold, included a pair of coders from Montreal; two U.S. researchers from AT&T Labs; a scientist from Yahoo! Research, Israel; and a couple of Austrian consultants.B. Patterson, “Netflix Prize Competitors Join Forces, Cross Magic 10-Percent Mark,” Yahoo! Tech, June 29, 2009. It’s safe to say that without the Netflix Prize, these folks would likely never have met, let alone collaborated.

Patron Saint of the Independent Film Crowd

Many critically acclaimed films that failed to be box office hits have gained a second life on Netflix, netting significant revenue for the studios, with no additional studio marketing. Babel, The Queen, and The Last King of Scotland are among the films that failed to crack the top twenty in the box office, but ranked among the most requested titles on Netflix during the year after their release. Netflix actually delivered more revenue to Fox from The Last King of Scotland than it did from the final X-Men film.Netflix Investor Day presentation, May 2008, accessed via http://ir.netflix.com/events.cfm.

In the true spirit of the long tail, Netflix has occasionally acquired small market titles for exclusive distribution. One of its first efforts involved the Oscar-nominated PBS documentary, Daughters from Danang. PBS hadn’t planned to distribute the disc after the Academy Awards; it was simply too costly to justify producing a run of DVDs that almost no retailer would carry. But in a deal with PBS, Netflix assumed all production costs in exchange for exclusive distribution rights. For months after, the film repeatedly ranked in the Top 15 most requested titles in the documentary category. Cost to PBS—nothing.C. Anderson, “The Long Tail,” Wired 12, no. 10 (October 2004), http://www.wired.com/wired/archive/12.10/tail.html.

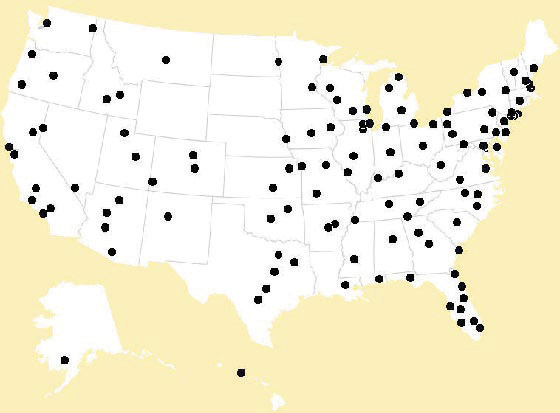

A Look at Operations

Tech also lies at the heart of the warehouse operations that deliver customer satisfaction and enhance brand value. As mentioned earlier, brand is built through customer experience, and a critical component of customer experience is for subscribers to get their DVDs as quickly as possible. In order to do this, Netflix has blanketed the country with a network of fifty-six ultrahigh-tech distribution centers that collectively handle in excess of 1.8 million DVDs a day. These distribution centers are purposely located within driving distance of 119 U.S. Postal Service (USPS) processing and distribution facilities.

By 4:00 a.m. each weekday, Netflix trucks collect the day’s DVD shipments from these USPS hubs and returns the DVDs to the nearest Netflix center. DVDs are fed into custom-built sorters that handle disc volume on the way in and the way out. That same machine fires off an e-mail as soon as it detects your DVD was safely returned (now rate it via Cinematch). Most DVDs never hit the restocking shelves. Scanners pick out incoming titles that are destined for other users and place these titles into a sorted outbound pile with a new, appropriately addressed red envelope. Netflix not only helps out the postal service by picking up and dropping off the DVDs at its hubs, it presorts all outgoing mail for faster delivery. This extra effort has a payoff—Netflix gets the lowest possible postal rates for first-class mail delivery. And despite the high level of automation, 100 percent of all discs are inspected by hand so that cracked ones can be replaced, and dirty ones can be given a wipe down.B. McCarthy, “Netflix, Inc.” (remarks, J. P. Morgan Global Technology, Media, and Telecom Conference, Boston, May 18, 2009). Total in and out turnaround time for a typical Netflix DVD is just eight hours!N. Kenny, “Special Report: Inside Netflix,” WMC TV, July 7, 2009.

First-class mail takes only one day to be delivered within a fifty-mile radius, so the warehouse network allows Netflix to service over 97 percent of its customer base within a two-day window—one day is allotted for receipt; early the next morning the next item in their queue is processed; and the new title arrives at the customer’s address by that afternoon. All this means a customer with the firm’s most popular “three disc at a time” plan could watch a movie a day and never be without a fresh title.

Figure 4.4 A Proprietary Netflix Sorting Machine

Source: Netflix Investor Day presentation, May 2008. Reproduced by permission of Netflix, Inc. Copyright © 2009, Netflix, Inc. All rights reserved.

Figure 4.5 USPS Hubs Serviced by the Netflix Distribution Center Network

Source: Netflix Investor Day presentation, May 2008. Reproduced by permission of Netflix, Inc. Copyright © 2009, Netflix, Inc. All rights reserved.

Warehouse processes don’t exist in a vacuum; they are linked to Cinematch to offer the firm additional operational advantages. The software recommends movies that are likely to be in stock so users aren’t frustrated by a wait.

Everyone on staff is expected to have an eye on improving the firm’s processes. Every warehouse worker gets a Netflix subscription so that they understand the service from the customer’s perspective and can provide suggestions for improvement. Quality management features are built into systems supporting nearly every process at the firm, allowing Netflix to monitor and record the circumstances surrounding any failures. When an error occurs, a tiger team of quality improvement personnel swoops in to figure out how to prevent any problems from recurring. Each phone call is a cost, not a revenue enhancement, and each error increases the chance that a dissatisfied customer will bolt for a rival.

By paying attention to process improvements and designing technology to smooth operations, Netflix has slashed the number of customer representatives even as subscriptions ballooned. In the early days, when the firm had one hundred and fifteen thousand customers, Netflix had one-hundred phone support reps. By the time the customer base had grown thirtyfold, errors had been reduced to the point where only forty-three reps were needed.J. McGregor, “High Tech Achiever,” Fast Company, October 2005. Even more impressive, because of the firm’s effective use of technology to drive the firm’s operations, fulfillment costs as a percentage of revenue have actually dropped even though postal rates have increased and Netflix has cut prices.

Killer Asset Recap: Understanding Scale

Netflix executives are quite frank that the technology and procedures that make up their model can be copied, but they also realize the challenges that any copycat rival faces. Says the firm’s VP of Operations Andy Rendich, “Anyone can replicate the Netflix operations if they wish. It’s not going to be easy. It’s going to take a lot of time and a lot of money.”Netflix Investor Day presentation, 2008, accessed via http://ir.netflix.com/events.cfm.

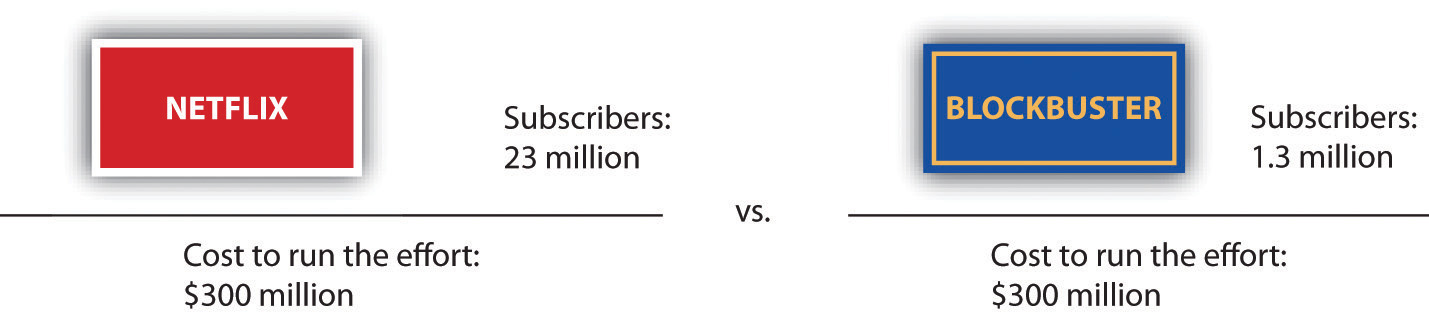

While we referred to Netflix as David to the Goliaths of Wal-Mart and Blockbuster, within the DVD-by-mail segment Netflix is now the biggest player by far, and this size gives the firm significant scale advantages. The yearly cost to run a Netflix-comparable nationwide delivery infrastructure is about $300 million.S. Reda and D. Schulz, “Concepts that Clicked,” Stores, May 2008. Think about how this relates to economies of scale. In Chapter 2 "Strategy and Technology: Concepts and Frameworks for Understanding What Separates Winners from Losers", we said that firms enjoy scale economies when they are able to leverage the cost of an investment across increasing units of production. Even if rivals have identical infrastructures, the more profitable firm will be the one with more customers (see Figure 4.6). And the firm with better scale economies is in a position to lower prices, as well as to spend more on customer acquisition, new features, or other efforts. Smaller rivals have an uphill fight, while established firms that try to challenge Netflix with a copycat effort are in a position where they’re straddling markets, unable to gain full efficiencies from their efforts.

Figure 4.6

Running a nationwide sales network costs an estimated $300 million a year. But Netflix has several times more subscribers than Blockbuster. Which firm has economies of scale?M. Hoffman, “Netflix Tops 23 Million Subscribers,” Inc., April 25, 2011; T. Hals and L. Baker, “Dish Expands Scope with Blockbuster Win,” Reuters, April 6, 2011; infrastructure cost estimates from S. Reda and D. Schulz, “Concepts That Clicked,” Stores, May 2008.

For Blockbuster, the arrival of Netflix plays out like a horror film where it is the victim. For several years now, the in-store rental business has been a money loser. Things got worse in 2005 when Netflix pressure forced Blockbuster to drop late fees, costing it about $400 million.T. Mullaney, “Netflix: The Mail-Order House That Clobbered Blockbuster,” BusinessWeek, May 25, 2006. The Blockbuster store network once had the advantage of scale, but eventually its many locations were seen as an inefficient and bloated liability. Between 2006 and 2007, the firm shuttered over 570 stores.A. Farrell, “Blockbuster’s CEO Ousted,” Forbes, July 2, 2007. By 2008, Blockbuster had been in the red for ten of the prior eleven years. During a three-year period that included the launch of its Total Access DVD-by-mail effort, Blockbuster lost over $4 billion.N. MacDonald, “Blockbuster Proves It’s Not Dead Yet,” Maclean’s, March 12, 2008. The firm tried to outspend Netflix on advertising, even running Super Bowl ads for Total Access in 2007, but a money loser can’t outspend its more profitable rival for long, and it was eventually forced to significantly cut back on promotion. Blockbuster also couldn’t sustain subscription rates below Netflix’s, so it has given up its price advantage. A Viacom executive said about the firm, “Blockbuster will certainly not survive and it will not be missed.”E. Epstein, “Hollywood’s New Zombie: The Last Days of Blockbuster,” Slate, January 9, 2006, http://www.slate.com/id/2133995. This assessment had to sting, given that Viacom was once Blockbuster’s parent (the firm was spun off in 2004). In early 2008, Blockbuster even briefly pursued a merger with another struggling giant, Circuit City, a strategy that has left industry experts scratching their heads. In September 2010, Blockbuster declared bankruptcy, and in April 2011, the firm was purchased by Dish Network at a bankruptcy auction.T. Hals and L. Baker, “Dish Expands Scope with Blockbuster Win,” Reuters, April 6, 2011.

For Netflix, what delivered the triple scale advantage of the largest selection, the largest network of distribution centers, and the largest customer base and the firm’s industry-leading strength in brand and data assets? Moving first. Timing and technology don’t always yield sustainable competitive advantage, but in this case, Netflix leveraged both to craft what seems to be an extraordinarily valuable pool of assets that continue to grow and strengthen over time.

And as we’ll see in the next section, while technology shifts helped Netflix attack Blockbuster’s once-dominant position, even newer technology shifts may threaten Netflix. As they like to say in the mutual fund industry “Past results aren’t a guarantee of future returns.”

Key Takeaways

- Durable brands are built through customer experience, and technology lies at the center of the Netflix top satisfaction ratings and hence the firm’s best-in-class brand strength.

- Physical retailers are limited by shelf space and geography. This limitation means that expansion requires building, stocking, and staffing operations in a new location.

- Internet retailers serve a larger geographic area with comparably smaller infrastructure and staff. This fact suggests that Internet businesses are more scalable. Firms providing digital products and services are potentially far more scalable, since physical inventory costs go away.

- The ability to serve large geographic areas through lower-cost inventory means Internet firms can provide access to the long tail of products, potentially earning profits from less popular titles that are unprofitable for physical retailers to offer.

- Netflix technology revitalizes latent studio assets. Revenue sharing allows Netflix to provide studios with a costless opportunity to earn money from back catalog titles: content that would otherwise not justify further marketing expense or retailer shelf space.

- The strategically aligned use of technology by this early mover has allowed Netflix to gain competitive advantage through the powerful resources of brand, data and switching costs, and scale.

- Collaborative filtering technology has been continually refined, but even if this technology is copied, the true exploitable resource created and leveraged through this technology is the data asset.

- Technology leveraged across the firm’s extensive distribution network offers an operational advantage that allows the firm to reach nearly all of its customers with one-day turnaround.

Questions and Exercises

- What are Netflix’s sources of competitive advantage?

- Does Netflix have a strong brand? Offer evidence demonstrating why the firm’s brand is or isn’t strong. How is a strong brand built?

- Scale advantages are advantages related to size. In what key ways is Netflix “bigger” than the two major competitors who tried to enter the DVD-by-mail market?

- What is the long tail? How “long” is the Netflix tail compared to traditional video stores?

- What “class” of software does Netflix use to make movie recommendations? Think about Chapter 2 "Strategy and Technology: Concepts and Frameworks for Understanding What Separates Winners from Losers": Which key competitive resource does this software “create”? What kinds of benefits does this provide to the firm? What benefits does it provide to Netflix’s suppliers?

- Could a new competitor match Netflix’s recommendation software? If it did, would this create a threat to Netflix? Why or why not?

- What is the Netflix churn rate and what are the reasons behind this rate?

- Netflix uses technology to coordinate the process of sorting and dropping off DVDs for the U.S. Postal Service. This application of technology speeds delivery. What other advantage does it give the firm?

- How has Netflix improved its customer service operation? Describe the results and impact of this improvement.

4.3 Act II: Netflix and the Shift from Mailing Atoms to Streaming Bits

Learning Objectives

- Understand the shift from atoms to bits, and how this is impacting a wide range of industries.

- Recognize the various key issues holding back streaming video models.

- Know the methods that Netflix is using to attempt to counteract these challenges.

Nicholas Negroponte, the former head of MIT’s Media Lab and founder of the One Laptop per Child effort, wrote a now-classic essay on the shift from atoms to bitsThe idea that many media products are sold in containers (physical products, or atoms) for bits (the ones and zeros that make up a video file, song, or layout of a book). As the Internet offers fast wireless delivery to TVs, music players, book readers, and other devices, the “atoms” of the container aren’t necessary. Physical inventory is eliminated, offering great cost savings.. Negroponte pointed out that most media products are created as bits—digital files of ones and zeros that begin their life on a computer. Music, movies, books, and newspapers are all created using digital technology. When we buy a CD, DVD, or even a “dead tree” book or newspaper, we’re buying physical atoms that are simply a container for the bits that were created in software—a sound mixer, a video editor, or a word processor.

The shift from atoms to bits is realigning nearly every media industry. Newspapers struggle as readership migrates online and once-lucrative classified ads and job listings shift to the bits-based businesses of Craigslist, Monster.com, and LinkedIn. Apple dominates music sales, selling not a single “atom” of physical CDs, while most of the atom-selling “record store” chains of a decade ago are bankrupt. Amazon jumped into the atoms-to-bits shift when it developed the Kindle digital reader. Who needs to kill a tree, spill ink, fill a warehouse, and roll a gas-guzzling truck to get you a book? Kindle can slurp your purchases through the air and display them on a device lighter than any college textbook. When the Kindle was released, many thought it to be an expensive, niche product for gadget lovers, but in less than four years, the firm was selling more electronic books than print titles,M. Hamblen, “Amazon: E-Books Now Outsell Print Books,” ComputerWorld, May 19, 2011. and in both unit sales and total revenue, the Kindle had become the best-selling product ever sold on Amazon.com.A. Golsalves, “Amazon Says Kindle Best Selling Product Ever,” InformationWeek, December 27, 2010.

There’s a clear potential upside to the Netflix model as it shifts from mailing atoms to streaming bits: it will eliminate a huge chunk of costs associated with shipping and handling. Postage represents one-third of the firm’s expenses. A round-trip DVD mailing, even at the deep discounts Netflix receives from the U.S. Postal Service, runs about eighty cents, while the bandwidth and handling costs to send bits to a TV set are around a nickel.B. McCarthy, “Netflix, Inc.” (remarks, J. P. Morgan Global Technology, Media, and Telecom Conference, Boston, MA, May 18, 2009). At some point, if postage goes away, Netflix may be in a position to offer even greater profits to its studio suppliers and to make more money itself, too. But Netflix became a profitable business by handling the atoms of DVDs, and the streaming space is crowded with a host of rivals offering consumers a dizzying array of options. Victory is far from certain.

Video is already going digital, but Netflix became a profitable business by handling the atoms of DVDs. The question is, will the atoms to bits shift crush Netflix and render it as irrelevant as Hastings did Blockbuster? Or can Reed pull off yet another victory and recast his firm for the day that DVDs disappear?

Concerns over the death of the DVD and the relentless arrival of new competitors are probably the main cause for Netflix’s stock volatility these past few years. Through the first half of 2011, the firm’s growth, revenue, and profit graphs all go up and to the right, but the stock has experienced wild swings as pundits have mostly guessed wrong about the firm’s imminent demise (one well-known Silicon Valley venture capitalist even referred to the firm as “an ice cube in the sun,”M. Copeland, “Netflix Lives! Video Downloads Haven’t Made the DVD-by-Mail Business Obsolete,” Fortune, April 21, 2008. a statement Netflix countered with six years of record-breaking growth and profits). The troughs on the Netflix stock graph have proven great investment opportunities for the savvy. Netflix broke all previous growth and earnings records and posted its lowest customer churn ever, even as a deep recession and the subprime crisis hammered many other firms. But even the most bullish investor can see that there’s no stopping the inevitable shift from atoms to bits, and the firm’s share price swings continue. When the DVD dies, the high-tech shipping and handling infrastructure that Netflix has relentlessly built will be rendered worthless. The question is, can Hastings pull off yet another victory and recast Netflix for the day that DVDs disappear, or will the atoms-to-bits shift decimate his firm’s hard-earned competitive advantage and render his firm as irrelevant as Blockbuster?

Reed Hastings has always expected the firm would migrate from atoms to bits. He also prepared the public for a first-cut service that was something less than we’d expect from the long tail poster child. When speaking about the launch of the firm’s Internet video streaming offering in January 2007, Hastings said it would be “underwhelming.” The two biggest limitations of this initial service? As we’ll see below, not enough content, and figuring out how to squirt the bits to a television.

Access to Content

First the content. Three years after the launch of Netflix streaming option (enabled via a “Watch Now” button next to movies that can be viewed online), only 17,000 videos were offered, just 17 percent of the firm’s long tail. And not the best 17 percent. While the number of titles available for streaming by Netflix has steadily increased, acquiring content has been a significant challenge. Netflix is able to send out physical DVDs in the United States due to a Supreme Court ruling known as the “First Sale Doctrine.” Even if studios charge Netflix full price for their discs, they can’t prevent the firm from sending purchased discs to subscribers. But “First Sale Doctrine” applies to the disc, not the media, so Netflix can’t offer unlimited streaming without separate licenses.D. Roth, “Netflix Everywhere: Sorry Cable, You’re History,” Wired, September 21, 2009. It’s not just studio reluctance or fear of piracy. There are often complicated legal issues involved in securing the digital distribution rights for all of the content that makes up a movie. Music, archival footage, and performer rights may all hold up a title from being available under “Watch Now.” The 2007 Writers Guild strike occurred largely due to negotiations over digital distribution, showing just how troublesome these issues can be.

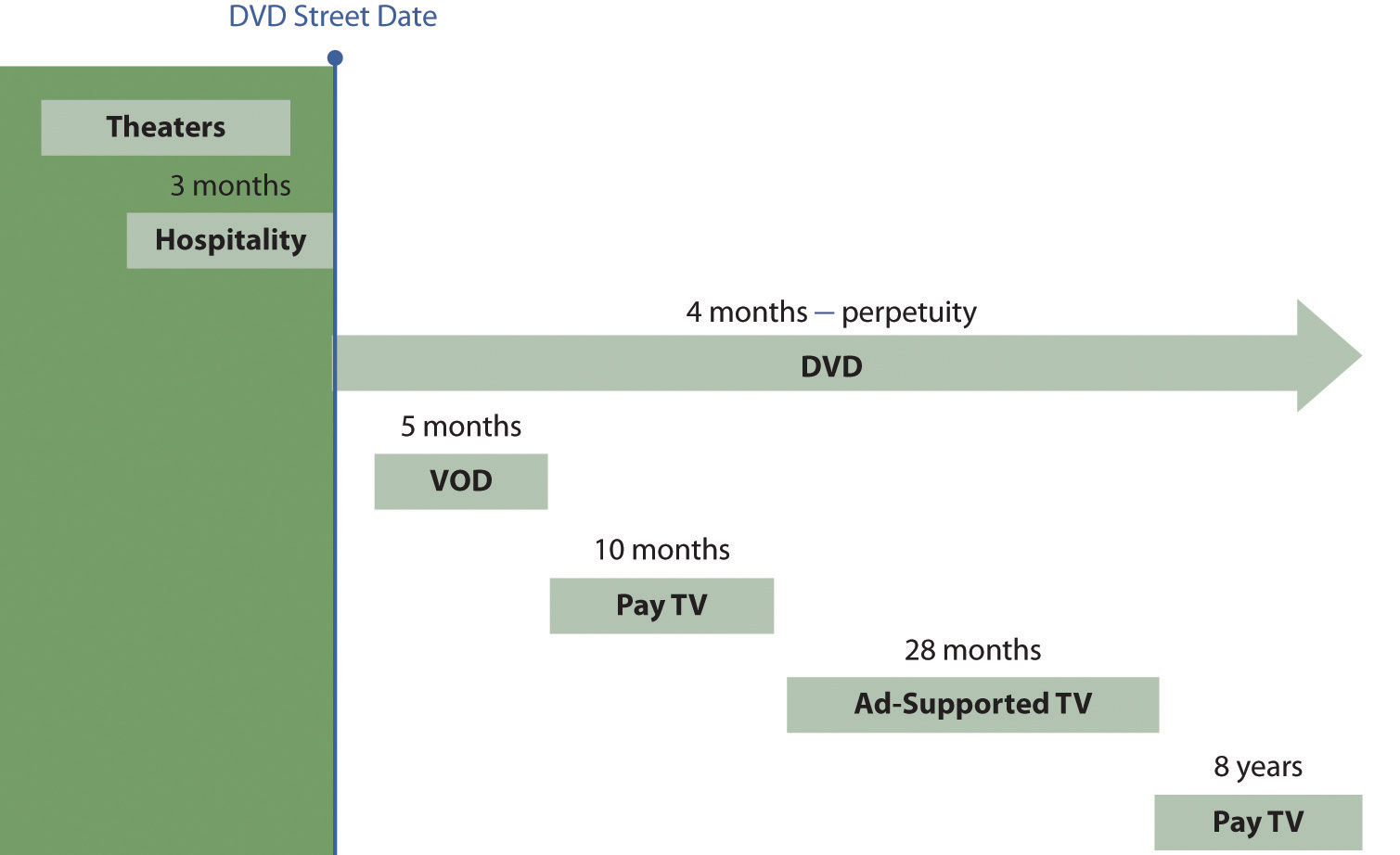

Add to that the exclusivity contracts negotiated by key channels, in particular the so-called premium television networks. Film studios release their work in a system called windowingIndustry practice whereby content (usually a motion picture) is available to a given distribution channel for a specified time period or “window,” usually under a different revenue model (e.g., ticket sale, purchase, license fee).. Content is available to a given distribution channel (in theaters, through hospitality channels like hotels and airlines, on DVD, via pay-per-view, via pay cable, then broadcast commercial TV) for a specified time window, usually under a different revenue model (ticket sales, disc sales, license fees for broadcast). Windows controlled by pay television channels can be particularly challenging, since many have negotiated exclusive access to content as they strive to differentiate themselves from one another. This exclusivity means that even when a title becomes available for streaming by Netflix, it may disappear when a pay TV window opens up. If HBO or Showtime has an exclusive for a film, it’s pulled from the Netflix streaming service until the exclusive pay TV time window closes. A 2008 partnership with the Starz network helped provide access to some content locked up inside pay television windows, and deals with individual networks and studios allow for streaming of current-season shows.S. Portnoy, “Netflix News: Starz Catalog Added to Online Service, Streaming to PS3, Xbox 360 through PlayOn Beta Software,” ZDNet, October 2, 2008, http://blogs.zdnet.com/home-theater/?p=120. But the firm still has a long way to go before the streaming tail seems comparably long when compared against its disc inventory.

Figure 4.7 Film Release Windows

Source: Reproduced by permission of Netflix, Inc. Copyright © 2009, Netflix, Inc. All rights reserved.

Even those studios that embrace the audience-finding and revenue-sharing advantages of Netflix don’t want to undercut higher-revenue early windows. Fox, Universal, and Warner have all demanded that Netflix delay sending DVDs to customers until twenty-eight days after titles go on sale. In exchange, Netflix has received guarantees that these studios will offer more content for digital streaming.

There’s also the influence of the king of DVD sales: Wal-Mart. The firm accounts for about 40 percent of DVD sales—a scale that delivers a lot of the bargaining power it has used to “encourage” studios to hold content from competing windows or to limit offering digital titles at competitive pricing during the peak new release period.R. Grover, “Wal-Mart and Apple Battle for Turf,” BusinessWeek, August 31, 2006. Apparently, Wal-Mart isn’t ready to yield ground in the shifts from atoms to bits, either. In February 2010, the retail giant spent an estimated $100 million to buy the little-known video streaming outfit VUDU.B. Stone, “Wal-Mart Adds Clout to Streaming,” New York Times, February 22, 2010. Wal-Mart’s negotiating power with studios may help it gain special treatment for VUDU. As an example, VUDU was granted exclusive high-definition streaming rights for the hit movie Avatar, offering the title online the same day the DVD appeared for sale.J. Jacobson, “VUDU/Wal-Mart Gets Avatar HD Streaming Exclusive,” Electronic House, April 22, 2010.

Studios may also be wary of the increasing power Netflix has over product distribution, and as such, they may be motivated to keep rivals around. Studios have granted Blockbuster more favorable distribution terms than Netflix. While the bankrupt firm was bought out by Dish Network and remains a shadow of its former self, in many cases, Blockbuster can now distribute DVDs the day of release instead of waiting nearly a month, as Netflix does.J. Birchall, “Blockbuster Strikes Deal to Ensure DVD Supply,” Financial Times, April 8, 2010. Studios are likely concerned that Netflix may be getting so big that it will one day have Wal-Mart-like negotiating leverage.

Controlling rising licensing costs presents a further challenge. Streaming costs are growing rapidly, with Netflix financials indicating the firm’s cost of acquiring streaming content has steadily risen, from $48 million in 2008 to $64 million in 2009, then to a whopping $406 million in 2010. The Starz deal cost the firm about $30 million, but some estimates suggest that renewal might require ten times that amount.G. Szala, “Analysts Opine on Possible Netflix-Starz Deal Renewal,” Hollywood Reporter, May 10, 2011. Streaming licensing deals are tricky because rates vary widely even when titles are available. Titles might be offered via a flat rate for unlimited streams, a per-stream rate, a rate for a given number of streams, a premium for exclusive content, and various permutations in between. Some vendors have been asking as much as four dollars per stream for more valuable contentD. Rayburn, “Netflix Streaming Costs,” Streaming Media, June/July 2009.—a fee that would quickly erase subscriber profits, making any such titles too costly to add to the firm’s library. Remember, Netflix doesn’t charge more for streaming—it’s built into the price of its flat-rate subscriptions, so these marginal costsThe cost associated with each additional unit produced. could crater earnings.

The Netflix track record for securing streaming deals has also been mixed, with some firms steadfastly refusing to offer Netflix streaming rights. Time Warner’s HBO has thus far tried to keep streaming a perk limited to its own paying subscribers. It offers video-on-demand and HBO Go app access for its cable customers, but refuses to offer current content for streaming via Netflix. Many fear that a Netflix with broad content offerings might prompt cable subscribers to become cord cutters, paying only for Internet access and not cable TV.

One way Netflix can counter rivals with exclusive content is to offer exclusive content of its own. It’s first big-name deal involved paying $100 million for the initial twenty-six-episode exclusive for the series House of Cards, beating out HBO and AMC in a bidding war for the yet-to-be produced show that features Oscar-winner Kevin Spacey and which will be produced by David Fincher (director of The Social Network). It’s a risky move—unlike most of Netflix’s other content, House of Cards hasn’t been produced, so no one knows if it’ll be a hit. And it’s unknown if the prospect of exclusive content bidding wars will prompt more firms to share their content instead of fighting over it. But Netflix’s growing audience size is now comparable to that of the largest cable firms, with some suggesting Netflix is a quasi-network (Netflix now has more subscribers than Showtime and Comcast and is closing in on HBOB. Evangelista, “Netflix Growth Moves It into No. 2 behind HBO,” San Francisco Chronicle, April 26, 2011.). Hastings says he anticipates that Netflix will do more exclusive deals for new content, stating, “We’re willing to do that if we have to, but we think it makes more economic sense for us and pay television [providers like HBO] to share windows.”L. Rose, “Netflix Will Distribute David Fincher’s ‘House of Cards’—It’s Official,” Hollywood Reporter, March 18, 2011.

Supplier Power and Atoms to Bits

The winner-take-all, winner-take-most dynamics of digital distribution can put suppliers at a disadvantage. If firms rely on one channel partner for a large portion of sales, that partner has an upper hand in negotiations. For years, record labels and movie studios complained that Apple’s dominance of iTunes allowed them little negotiating room in price setting. A boycott where NBC temporarily lifted TV shows from iTunes is credited with loosening Apple’s pricing policies. Similarly, when Amazon’s Kindle dominated the e-book reader market, Amazon enforced a $9.99 price on electronic editions, even as publishers lobbied for higher rates. It wasn’t until Apple arrived with a creditable e-book rival in the iPad that Amazon’s leverage was weakened to the point where publishers were allowed to set their own e-book prices.M. Rich and B. Stone, “Publisher Wins Fight with Amazon over E-Books,” New York Times, January 31, 2010.

Taken together, all these content acquisition factors make it clear that shifting the long tail from atoms to bits will be significantly more difficult than buying DVDs and stacking them in a remote warehouse.

But How Does It Get to the TV?

The other major problem lies in getting content to the place where most consumers want to watch it: the living room TV. Netflix’s “Watch Now” button first worked only on Windows PCs. Although the service was introduced in January 2007, the months before were fueled with speculation that the firm would partner with TiVo. Just one month later, TiVo announced its first streaming partner—Amazon.com. At that point Netflix found itself up against a host of rivals that all had a path to the television: Apple had its own hardware solution in Apple TV (not to mention the iPod and iPhone for portable viewing), the cable companies delivered OnDemand through their set-top boxes, and now Amazon had TiVo.

An internal team at Netflix developed a prototype set-top box that Hastings himself supported offering. But most customers aren’t enthusiastic about purchasing yet another box for their set top, the consumer electronics business is brutally competitive, and selling hardware would introduce an entirely new set of inventory, engineering, marketing, distribution, and competitive complexities.

The solution Netflix eventually settled on was to think beyond one hardware alternative and instead recruit others to provide a wealth of choice. The firm developed a software platform and makes this available to manufacturers seeking to build Netflix access into their devices. Today, Netflix streaming is baked into over two hundred consumer electronics products, including televisions and DVD players from LG, Panasonic, Samsung, Sony, Toshiba, and Vizio. The migration to Blu-ray has also helped the firm piggyback its way into the living room. Buy one of the increasing number of Blu-ray players that has partnered with Hastings’s firm and for just eight bucks a month you can get a ticket to the all-you-can-eat Netflix buffet. Netflix streaming is also available on all major video game consoles. A Netflix app for Apple’s iPad was available the day the device shipped, and Android users can get in on the action, too. Even TiVo now streams Netflix. And that internally developed Netflix set-top box? The group was spun out to form Roku, an independent firm that launched their own $99 Netflix streamer.

By working with consumer electronics firms, offering Netflix streaming as a feature or an app, Hastings’s firm has ended up with more television access than either Amazon or Apple, despite the fact that both of these firms got their digital content to the TV set first. Partnerships have helped create distribution breadth, giving Hastings an enviable base through which to grow the video streaming business.

Disintermediation and Digital Distribution

The purchase of NBC/Universal by Comcast, the largest cable television provider in the United States, has consolidated content and distribution in a single firm. The move can be described as both vertical integration (when an organization owns more than one layer of its value chain) and disintermediationRemoving an organization from a firm’s distribution channel. Disintermediation collapses the path between supplier and customer. (removing an organization from a firm’s distribution channel).J. Gallaugher, “E-Commerce and the Undulating Distribution Channel,” Communications of the ACM, July 2002. Disintermediation in the video industry offers two potentially big benefits. First, studios don’t need to share revenue with third parties; they can keep all the money generated through new windows. Also critically important, studios keep the interface with their customers. Remember, in the digital age data is valuable; if another firm sits between a supplier and its customers, the supplier loses out on a key resource for competitive advantage. For more on the value of the data asset in maintaining and strengthening customer relationships, see Chapter 11 "The Data Asset: Databases, Business Intelligence, and Competitive Advantage".

Who’s going to win the race for delivering bits to the television is still very much an uncertain bet. The models all vary significantly. Netflix pioneered unlimited subscription streaming, but Blockbuster and VUDU also offer Netflix-like subscriptions and have copied Hastings’s lead, partnering with consumer electronics makers to bring their services to TV sets. Apple’s iTunes offers video purchases and “rentals” that can also play across PCs and Macs, as well as the firm’s iPod, iPhone, iPad, and Apple TV products. Microsoft also offers an online rental and purchase service via Xbox (yes, this makes Microsoft both a Netflix partner as well as a sort of competitor, a phenomenon often referred to as coopetition, or frenemiesA. Brandenberger and B. Nalebuff, Co-opetition: A Revolution Mindset that Combines Competition and Cooperation: The Game Theory Strategy That’s Changing the Game of Business (New York: Broadway Business, 1997); and S. Johnson, “The Frenemy Business Relationship,” Fast Company, November 25, 2008.). Amazon has expanded its Internet video purchase and rental business with the addition of free streaming for thousands of titles as a perk to those customers paying for its Amazon Prime shipping service. Amazon’s consumer electronics partnerships have also expanded (yes, those vendors are quite promiscuous) and many of the same firms partnering with Netflix also stream Amazon content. And Amazon is getting into the disc-by-mail act, too, acquiring LoveFilm (often described as the “Netflix of Europe”), for some $200 million in early 2011.C. Byrne, “Amazon Acquires LoveFilm, Europe’s Netflix, for Approximately $200 Million,” VentureBeat, January 20, 2011. YouTube now offers thousands of television shows and movies via both ad-supported and rental models, and the firm’s parent has launched Google TV to make television access easier. Facebook has begun to experiment with video streaming, working with Warner Brothers to stream The Dark Knight for a fee of thirty Facebook credits. And the networks and content providers also have their own offerings: many stream content on their own Web sites; Comcast and Verizon have apps that stream content to phones, PCs, and tablets; and Hulu is a joint venture backed by NBC, Fox, and other networks. Hulu offers a basic ad-supported PC streaming service as well as Hulu Plus, a subscription service that offers more content as well as streaming to certain consumer electronics devices. Whether all these efforts are individually sustainable remains to be seen. Many are efforts offered by deep-pocketed rivals that can subsidize experimentation through profits from their primary businesses, so even if efforts are slow to gain traction, a shakeout may take time.

Then there’s the issue of unhappy consumer Internet service providers. Netflix streaming has become so successful that by May 2011, the service had become the largest single source of Internet traffic, displacing the prior leader, BitTorrent. That makes many in Hollywood happy since Netflix streams are legally licensed, while BitTorrent is a platform that many see as supporting piracy. But many Internet service providers aren’t pleased by the growth of streaming, viewing Netflix as a rapidly-expanding, network-clogging traffic hog. Netflix pays its own Internet service providers to connect the firm to the Internet and to support its heavy volume of outbound traffic. But Netflix offers no such payment to the ISPs used by consumers (e.g., your local cable and telephone companies). By spring 2011, Netflix streaming made up nearly 30 percent of all U.S. Internet traffic—a 44 percent increase from just six months earlier.R. Lawler, “Netflix Traffic Now Bigger Than BitTorrent. Has Hollywood Won?,” GigaOM, May 17, 2011. Several ISPs, including Comcast (which also owns content through its purchase of NBC/Universal), AT&T, and Charter, have imposed bandwidth capsA limit, imposed by the Internet service provider (e.g., a cable or telephone company) on the total amount of traffic that a given subscriber can consume (usually per each billing period). that place a ceiling on a customer’s total monthly consumption (users can usually bump up the ceiling, but they have to pay to do it). Today few U.S. users are running into the ceiling, but that may change as more family members sport tablets, smartphones, and other streaming devices and as new, traffic-heavy technologies like Apple’s FaceTime and Microsoft’s Skype become more widely used. In Canada, Netflix has already lowered stream quality to deal with that nation’s more restrictive traffic consumption limits. Netflix hasn’t been shy about sharing its concern on bandwidth caps with the FCC, arguing that caps are really a much higher markup than the incremental cost of Internet transmission and claiming that if caps restrict users then this could stifle innovation.R. Lawler, “Netflix Traffic Now Bigger Than BitTorrent. Has Hollywood Won?,” GigaOM, May 17, 2011. If U.S. bandwidth caps start to limit consumer access to streaming, Netflix could suffer.

No Turning Back

While one day the firm will lose the investment in its warehouse infrastructure, nearly all assets have a limited lifespan. That’s why corporations depreciate assets, writing their value down over time. The reality is that the shift from atoms to bits isn’t flicking on like a light switch; it is a hybrid transition taking place over several years. However, the shift is well under way. Says Hastings, “Streaming is much bigger than DVD for us in terms of hours of viewing, growth, and focus.”E. Schonfeld, “Reed Hastings: Netflix DVD Shipments ‘May Go Down the First Time Ever’ This Quarter,” TechCrunch, May 6, 2011. If the firm can grab long-tail content, broaden distribution options, grow its customer base, and lock them in with the switching costs created by Cinematch (all big “ifs”), it just might cement its position as a key player in a bits-only world.

Is the hybrid strategy a dangerous straddling gambit or a clever expansion that will keep the firm dominant? Netflix really doesn’t have a choice but to try. Hastings already has a long history as one of the savviest strategic thinkers in tech. As the networks say, stay tuned!

Key Takeaways

- The shift from atoms to bits is impacting all media industries, particularly those relying on print, video, and music content. Content creators, middlemen, retailers, consumers, and consumer electronics firms are all impacted.

- Netflix’s shift to a streaming model (from atoms to bits) is limited by access to content and in methods to get this content to televisions.

- Windowing and other licensing issues limit available content, and inconsistencies in licensing rates make profitable content acquisitions a challenge.

Questions and Exercises

- What do you believe are the most significant long-term threats to Netflix? How is Netflix trying to address these threats? What obstacles does the firm face in dealing with these threats?

- Who are the rivals to Netflix’s “Watch Now” effort? Do any of these firms have advantages that Netflix lacks? What are these advantages?

- Why would a manufacturer of DVD players be motivated to offer the Netflix “Watch Now” feature in its products?

- Describe various revenue models available as video content shifts from atoms to bits. What are the advantages and disadvantages to each—for consumers, for studios, for middlemen like television networks and Netflix?

- Wal-Mart backed out of the DVD-by-mail industry. Why does the firm continue to have so much influence with the major film studios? What strategic asset is Wal-Mart leveraging?

- Investigate the firm Red Box. Do you think they are a legitimate threat to Netflix? Why or why not?

- Is Netflix a friend or foe to the studios? Make a list of reasons why they would “like” Netflix, and why studios might be fearful of the firm. What is disintermediation, and what incentives do studios have to try to disintermediate Netflix?

- Why didn’t Netflix vertically integrate and offer its own set top box for content distribution?

- Make a chart of the various firms offering video streaming services. List the pros and cons of each, along with its revenue model. Which efforts do you think will survive a shakeout? Why?

- How big is Facebook compared to Netflix? Do you think that Facebook presents a credible threat to Netflix? Why or why not?

- Investigate the current status of bandwidth caps. Do you think bandwidth caps are fair? Why or why not?

- Investigate Netflix stock price. One of the measures of whether a stock is “expensive” or not is the price-earnings ratio (share price divided by earnings per share). P/Es vary widely, but historic P/Es are about fifteen. What is the current P/E of Netflix? Do you think the stock is fairly valued based on prospects for future growth, earnings, and market dominance? Why or why not? How does the P/E of Netflix compare with that of other well-known firms, both in and out of the technology sector? Arrive in class with examples you are ready to discuss.