This is “Strategy and Technology: Concepts and Frameworks for Understanding What Separates Winners from Losers”, chapter 2 from the book Getting the Most Out of Information Systems (v. 1.2). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 2 Strategy and Technology: Concepts and Frameworks for Understanding What Separates Winners from Losers

2.1 Introduction

Learning Objectives

- Define operational effectiveness and understand the limitations of technology-based competition leveraging this principle.

- Define strategic positioning and the importance of grounding competitive advantage in this concept.

- Understand the resource-based view of competitive advantage.

- List the four characteristics of a resource that might possibly yield sustainable competitive advantage.

Managers are confused, and for good reason. Management theorists, consultants, and practitioners often vehemently disagree on how firms should craft tech-enabled strategy, and many widely read articles contradict one another. Headlines such as “Move First or Die” compete with “The First-Mover Disadvantage.” A leading former CEO advises, “destroy your business,” while others suggest firms focus on their “core competency” and “return to basics.” The pages of the Harvard Business Review declare, “IT Doesn’t Matter,” while a New York Times bestseller hails technology as the “steroids” of modern business.

Theorists claiming to have mastered the secrets of strategic management are contentious and confusing. But as a manager, the ability to size up a firm’s strategic position and understand its likelihood of sustainability is one of the most valuable and yet most difficult skills to master. Layer on thinking about technology—a key enabler to nearly every modern business strategy, but also a function often thought of as easily “outsourced”—and it’s no wonder that so many firms struggle at the intersection where strategy and technology meet. The business landscape is littered with the corpses of firms killed by managers who guessed wrong.

Developing strong strategic thinking skills is a career-long pursuit—a subject that can occupy tomes of text, a roster of courses, and a lifetime of seminars. While this chapter can’t address the breadth of strategic thought, it is meant as a primer on developing the skills for strategic thinking about technology. A manager that understands issues presented in this chapter should be able to see through seemingly conflicting assertions about best practices more clearly; be better prepared to recognize opportunities and risks; and be more adept at successfully brainstorming new, tech-centric approaches to markets.

The Danger of Relying on Technology

Firms strive for sustainable competitive advantageFinancial performance that consistently outperforms industry averages., financial performance that consistently outperforms their industry peers. The goal is easy to state, but hard to achieve. The world is so dynamic, with new products and new competitors rising seemingly overnight, that truly sustainable advantage might seem like an impossibility. New competitors and copycat products create a race to cut costs, cut prices, and increase features that may benefit consumers but erode profits industry-wide. Nowhere is this balance more difficult than when competition involves technology. The fundamental strategic question in the Internet era is, “How can I possibly compete when everyone can copy my technology and the competition is just a click away?” Put that way, the pursuit of sustainable competitive advantage seems like a lost cause.

But there are winners—big, consistent winners—empowered through their use of technology. How do they do it? In order to think about how to achieve sustainable advantage, it’s useful to start with two concepts defined by Michael Porter. A professor at the Harvard Business School and father of the value chain and the five forces concepts (see the sections later in this chapter), Porter is justifiably considered one of the leading strategic thinkers of our time.

According to Porter, the reason so many firms suffer aggressive, margin-eroding competition is because they’ve defined themselves according to operational effectiveness rather than strategic positioning. Operational effectivenessPerforming the same tasks better than rivals perform them. refers to performing the same tasks better than rivals perform them. Everyone wants to be better, but the danger in operational effectiveness is “sameness.” This risk is particularly acute in firms that rely on technology for competitiveness. After all, technology can be easily acquired. Buy the same stuff as your rivals, hire students from the same schools, copy the look and feel of competitor Web sites, reverse engineer their products, and you can match them. The fast follower problemExists when savvy rivals watch a pioneer’s efforts, learn from their successes and missteps, then enter the market quickly with a comparable or superior product at a lower cost before the first mover can dominate. exists when savvy rivals watch a pioneer’s efforts, learn from their successes and missteps, then enter the market quickly with a comparable or superior product at a lower cost.

Since tech can be copied so quickly, followers can be fast, indeed. Several years ago while studying the Web portal industry (Yahoo! and its competitors), a colleague and I found that when a firm introduced an innovative feature, at least one of its three major rivals would match that feature in, on average, only one and a half months.J. Gallaugher and C. Downing, “Portal Combat: An Empirical Study of Competition in the Web Portal Industry,” Journal of Information Technology Management 11, no. 1—2 (2000): 13—24. Groupon CEO Andrew Mason claimed the wildly successful daily deal service had spawned 500 imitators within two years of launch.B. Weiss, “Groupon’s $6 Billion Gambler,” The Wall Street Journal, December 20, 2010. When technology can be matched so quickly, it is rarely a source of competitive advantage. And this phenomenon isn’t limited to the Web.

Consider TiVo. At first blush, it looks like this first mover should be a winner since it seems to have established a leading brand; TiVo is now a verb for digitally recording TV broadcasts. But despite this, TiVo has largely been a money loser, going years without posting an annual profit. By the time 1.5 million TiVos had been sold, there were over thirty million digital video recorders (DVRs) in use.N. DiMeo, “TiVo’s Goal with New DVR: Become the Google of TV,” Morning Edition, National Public Radio, April 7, 2010. Rival devices offered by cable and satellite companies appear the same to consumers and are offered along with pay television subscriptions—a critical distribution channel for reaching customers that TiVo doesn’t control.

The Flip video camera is another example of technology alone offering little durable advantage. The pocket-sized video recorders used flash memory instead of magnetic storage. Flip cameras grew so popular that Cisco bought Flip parent Pure Digital, for $590 million. The problem was digital video features were easy to copy, and constantly falling technology costs (see Chapter 5 "Moore’s Law: Fast, Cheap Computing and What It Means for the Manager") allowed rivals to embed video into their products. Later that same year Apple (and other firms) began including video capture as a feature in their music players and phones. Why carry a Flip when one pocket device can do everything? The Flip business barely lasted two years, and by spring 2011 Cisco had killed the division, taking a more than half-billion-dollar spanking in the process.E. Rusli, “Cisco Shutters Flip, Two Years After Acquisition,” New York Times, April 12, 2011.

Operational effectiveness is critical. Firms must invest in techniques to improve quality, lower cost, and generate design-efficient customer experiences. But for the most part, these efforts can be matched. Because of this, operational effectiveness is usually not sufficient enough to yield sustainable dominance over the competition. In contrast to operational effectiveness, strategic positioningPerforming different tasks than rivals, or the same tasks in a different way. refers to performing different activities from those of rivals, or the same activities in a different way. Technology itself is often very easy to replicate, and those assuming advantage lies in technology alone may find themselves in a profit-eroding arms race with rivals able to match their moves step by step. But while technology can be copied, technology can also play a critical role in creating and strengthening strategic differences—advantages that rivals will struggle to match.

Different Is Good: FreshDirect Redefines the NYC Grocery Landscape

For an example of the relationship between technology and strategic positioning, consider FreshDirect. The New York City–based grocery firm focused on the two most pressing problems for Big Apple shoppers: selection is limited and prices are high. Both of these problems are a function of the high cost of real estate in New York. The solution? Use technology to craft an ultraefficient model that makes an end-run around stores.

The firm’s “storefront” is a Web site offering one-click menus, semiprepared specials like “meals in four minutes,” and the ability to pull up prior grocery lists for fast reorders—all features that appeal to the time-strapped Manhattanites who were the firm’s first customers. (The Web’s not the only channel to reach customers—the firm’s iPhone app was responsible for 2.5 percent of sales just weeks after launch.)R. M. Schneiderman, “FreshDirect Goes to Greenwich,” Wall Street Journal, April 6, 2010. Next-day deliveries are from a vast warehouse the size of five football fields located in a lower-rent industrial area of Queens. At that size, the firm can offer a fresh goods selection that’s over five times larger than local supermarkets. Area shoppers—many of whom don’t have cars or are keen to avoid the traffic-snarled streets of the city—were quick to embrace the model. The service is now so popular that apartment buildings in New York have begun to redesign common areas to include secure freezers that can accept FreshDirect deliveries, even when customers aren’t there.L. Croghan, “Food Latest Luxury Lure,” New York Daily News, March 12, 2006.

Figure 2.1 The FreshDirect Web Site and the Firm’s Tech-Enabled Warehouse Operation

Source: Used with permission from FreshDirect. See the photographic tour at the FreshDirect Web site, http://www.freshdirect.com/about/index.jsp?siteAccessPage=c_aboutus.

The FreshDirect model crushes costs that plague traditional grocers. Worker shifts are highly efficient, avoiding the downtime lulls and busy rush hour spikes of storefronts. The result? Labor costs that are 60 percent lower than at traditional grocers. FreshDirect buys and prepares what it sells, leading to less waste, an advantage that the firm claims is “worth 5 percentage points of total revenue in terms of savings.”P. Fox, “Interview with FreshDirect Co-Founder Jason Ackerman,” Bloomberg Television, June 17, 2009. Overall perishable inventory at FreshDirect turns 197 times a year versus 40 times a year at traditional grocers.E. Schonfeld, “The Big Cheese of Online Grocers Joe Fedele’s Inventory-Turning Ideas May Make FreshDirect the First Big Web Supermarket to Find Profits,” Business 2.0, January 1, 2004. Higher inventory turnsSometimes referred to as inventory turnover, stock turns, or stock turnover. It is the number of times inventory is sold or used during the course of a year. A higher figure means that a firm is selling products quickly. mean the firm is selling product faster, so it collects money quicker than its rivals do. And those goods are fresher since they’ve been in stock for less time, too. Consider that while the average grocer may have seven to nine days of seafood inventory, FreshDirect’s seafood stock turns each day. Stock is typically purchased direct from the docks in order to fulfill orders placed less than twenty-four hours earlier.T. Laseter, B. Berg, and M. Turner, “What FreshDirect Learned from Dell,” Strategy+Business, February 12, 2003.

Artificial intelligence software, coupled with some seven miles of fiber-optic cables linking systems and sensors, supports everything from baking the perfect baguette to verifying orders with 99.9 percent accuracy.J. Black, “Can FreshDirect Bring Home the Bacon?” BusinessWeek, September 24, 2002; S. Sieber and J. Mitchell, “FreshDirect: Online Grocery that Actually Delivers!” IESE Insight, 2007. Since it lacks the money-sucking open-air refrigerators of the competition, the firm even saves big on energy (instead, staff bundle up for shifts in climate-controlled cold rooms tailored to the specific needs of dairy, deli, and produce). The firm also uses recycled biodiesel fuel to cut down on delivery costs.

FreshDirect buys directly from suppliers, eliminating middlemen wherever possible. The firm also offers suppliers several benefits beyond traditional grocers, all in exchange for more favorable terms. These include offering to carry a greater selection of supplier products while eliminating the “slotting fees” (payments by suppliers for prime shelf space) common in traditional retail, cobranding products to help establish and strengthen supplier brand, paying partners in days rather than weeks, and sharing data to help improve supplier sales and operations. Add all these advantages together and the firm’s big, fresh selection is offered at prices that can undercut the competition by as much as 35 percent.H. Green, “FreshDirect,” BusinessWeek, November 24, 2003. And FreshDirect does it all with margins in the range of 20 percent (to as high as 45 percent on many semiprepared meals), easily dwarfing the razor-thin 1 percent margins earned by traditional grocers.S. Sieber and J. Mitchell, “FreshDirect: Online Grocery that Actually Delivers!” IESE Insight, 2007; D. Kirkpatrick, “The Online Grocer Version 2.0,” Fortune, November 25, 2002; P. Fox, “Interview with FreshDirect Co-Founder Jason Ackerman,” Bloomberg Television, June 17, 2009.

Today, FreshDirect serves a base of some 600,000 paying customers. That’s a population roughly the size of metro-Boston, serviced by a single grocer with no physical store. The privately held firm has been solidly profitable for several years. Even in recession-plagued 2009, the firm’s CEO described 2009 earnings as “pretty spectacular,”P. Fox, “Interview with FreshDirect Co-Founder Jason Ackerman,” Bloomberg Television, June 17, 2009. while 2010 revenues are estimated to grow to roughly $300 million.R. M. Schneiderman, “FreshDirect Goes to Greenwich,” Wall Street Journal, April 6, 2010.

Technology is critical to the FreshDirect model, but it’s the collective impact of the firm’s differences when compared to rivals, this tech-enabled strategic positioning, that delivers success. Operating for more than half a decade, the firm has also built up a set of strategic assets that not only address specific needs of a market but are now extremely difficult for any upstart to compete against. Traditional grocers can’t fully copy the firm’s delivery business because this would leave them straddlingAttempts to occupy more than one position, while failing to match the benefits of a more efficient, singularly focused rival. two markets (low-margin storefront and high-margin delivery), unable to gain optimal benefits from either. Entry costs for would-be competitors are also high (the firm spent over $75 million building infrastructure before it could serve a single customer), and the firm’s complex and highly customized software, which handles everything from delivery scheduling to orchestrating the preparation of thousands of recipes, continues to be refined and improved each year.C. Valerio, “Interview with FreshDirect Co-Founder Jason Ackerman,” Venture, Bloomberg Television, September 18, 2009. On top of all this comes years of customer data used to further refine processes, speed reorders, and make helpful recommendations. Competing against a firm with such a strong and tough-to-match strategic position can be brutal. Just five years after launch there were one-third fewer supermarkets in New York City than when FreshDirect first opened for business.R. Shulman, “Groceries Grow Elusive for Many in New York City,” Washington Post, February 19, 2008.

But What Kinds of Differences?

The principles of operational effectiveness and strategic positioning are deceptively simple. But while Porter claims strategy is “fundamentally about being different,”M. Porter, “What Is Strategy?” Harvard Business Review 74, no. 6 (November–December 1996): 61–78. how can you recognize whether your firm’s differences are special enough to yield sustainable competitive advantage?

An approach known as the resource-based view of competitive advantageThe strategic thinking approach suggesting that if a firm is to maintain sustainable competitive advantage, it must control an exploitable resource, or set of resources, that have four critical characteristics. These resources must be (1) valuable, (2) rare, (3) imperfectly imitable, and (4) nonsubstitutable. can help. The idea here is that if a firm is to maintain sustainable competitive advantage, it must control a set of exploitable resources that have four critical characteristics. These resources must be (1) valuable, (2) rare, (3) imperfectly imitable (tough to imitate), and (4) nonsubstitutable. Having all four characteristics is key. Miss value and no one cares what you’ve got. Without rareness, you don’t have something unique. If others can copy what you have, or others can replace it with a substitute, then any seemingly advantageous differences will be undercut.

Strategy isn’t just about recognizing opportunity and meeting demand. Resource-based thinking can help you avoid the trap of carelessly entering markets simply because growth is spotted. The telecommunications industry learned this lesson in a very hard and painful way. With the explosion of the Internet it was easy to see that demand to transport Web pages, e-mails, MP3s, video, and everything else you can turn into ones and zeros, was skyrocketing.

Most of what travels over the Internet is transferred over long-haul fiber-optic cables, so telecom firms began digging up the ground and laying webs of fiberglass to meet the growing demand. Problems resulted because firms laying long-haul fiber didn’t fully appreciate that their rivals and new upstart firms were doing the exact same thing. By one estimate there was enough fiber laid to stretch from the Earth to the moon some 280 times!L. Kahney, “Net Speed Ain’t Seen Nothin’ Yet,” Wired News, March 21, 2000. On top of that, a technology called dense wave division multiplexing (DWDM)A technology that increases the transmission capacity (and hence speed) of fiber-optic cable. Transmissions using fiber are accomplished by transmitting light inside “glass” cables. In DWDM, the light inside fiber is split into different wavelengths in a way similar to how a prism splits light into different colors. enabled existing fiber to carry more transmissions than ever before. The end result—these new assets weren’t rare and each day they seemed to be less valuable.

For some firms, the transmission prices they charged on newly laid cable collapsed by over 90 percent. Established firms struggled, upstarts went under, and WorldCom became the biggest bankruptcy in U.S. history. The impact was also felt throughout all industries that supplied the telecom industry. Firms like Sun, Lucent, and Nortel, whose sales growth relied on big sales to telecom carriers, saw their value tumble as orders dried up. Estimates suggest that the telecommunications industry lost nearly $4 trillion in value in just three years,L. Endlich, Optical Illusions: Lucent and the Crash of Telecom (New York: Simon & Schuster, 2004). much of it due to executives that placed big bets on resources that weren’t strategic.

Key Takeaways

- Technology can be easy to copy, and technology alone rarely offers sustainable advantage.

- Firms that leverage technology for strategic positioning use technology to create competitive assets or ways of doing business that are difficult for others to copy.

- True sustainable advantage comes from assets and business models that are simultaneously valuable, rare, difficult to imitate, and for which there are no substitutes.

Questions and Exercises

- What is operational effectiveness?

- What is strategic positioning?

- Is a firm that competes based on the features of technology engaged in operational effectiveness or strategic positioning? Give an example to back up your claim.

- What is the “resource-based” view of competitive advantage? What are the characteristics of resources that may yield sustainable competitive advantage?

- TiVo has a great brand. Why hasn’t it profitably dominated the market for digital video recorders?

- Examine the FreshDirect business model and list reasons for its competitive advantage. Would a similar business work in your neighborhood? Why or why not?

- What effect did FreshDirect have on traditional grocers operating in New York City? Why?

- Choose a technology-based company. Discuss its competitive advantage based on the resources it controls.

- Use the resource-based view of competitive advantage to explain the collapse of many telecommunications firms in the period following the burst of the dot-com bubble.

- Consider the examples of Barnes and Noble competing with Amazon, and Apple offering iTunes. Are either (or both) of these efforts straddling? Why or why not?

2.2 Powerful Resources

Learning Objectives

- Understand that technology is often critical to enabling competitive advantage, and provide examples of firms that have used technology to organize for sustained competitive advantage.

- Understand the value chain concept and be able to examine and compare how various firms organize to bring products and services to market.

- Recognize the role technology can play in crafting an imitation-resistant value chain, as well as when technology choice may render potentially strategic assets less effective.

- Define the following concepts: brand, scale, data and switching cost assets, differentiation, network effects, and distribution channels.

- Understand and provide examples of how technology can be used to create or strengthen the resources mentioned above.

Management has no magic bullets. There is no exhaustive list of key resources that firms can look to in order to build a sustainable business. And recognizing a resource doesn’t mean a firm will be able to acquire it or exploit it forever. But being aware of major sources of competitive advantage can help managers recognize an organization’s opportunities and vulnerabilities, and can help them brainstorm winning strategies. And these assets rarely exist in isolation. Oftentimes, a firm with an effective strategic position can create an arsenal of assets that reinforce one another, creating advantages that are particualrly difficult for rivals to successfully challenge.

Imitation-Resistant Value Chains

While many of the resources below are considered in isolation, the strength of any advantage can be far more significant if firms are able to leverage several of these resources in a way that makes each stronger and makes the firm’s way of doing business more difficult for rivals to match. Firms that craft an imitation-resistant value chainA way of doing business that competitors struggle to replicate and that frequently involves technology in a key enabling role. have developed a way of doing business that others will struggle to replicate, and in nearly every successful effort of this kind, technology plays a key enabling role. The value chain is the set of interrelated activities that bring products or services to market (see below). When we compare FreshDirect’s value chain to traditional rivals, there are differences across every element. But most importantly, the elements in FreshDirect’s value chain work together to create and reinforce competitive advantages that others cannot easily copy. Incumbents trying to copy the firm would be straddled across two business models, unable to reap the full advantages of either. And late-moving pure-play rivals will struggle, as FreshDirect’s lead time allows the firm to develop brand, scale, data, and other advantages that newcomers lack (see below for more on these resources).

Key Framework: The Value Chain

The value chainThe “set of activities through which a product or service is created and delivered to customers.” is the “set of activities through which a product or service is created and delivered to customers.”M. Porter, “Strategy and the Internet,” Harvard Business Review 79, no. 3 (March 2001): 62–78. There are five primary components of the value chain and four supporting components. The primary components are as follows:

- Inbound logistics—getting needed materials and other inputs into the firm from suppliers

- Operations—turning inputs into products or services

- Outbound logistics—delivering products or services to consumers, distribution centers, retailers, or other partners

- Marketing and sales—customer engagement, pricing, promotion, and transaction

- Support—service, maintenance, and customer support

The secondary components are the following:

- Firm infrastructure—functions that support the whole firm, including general management, planning, IS, and finance

- Human resource management—recruiting, hiring, training, and development

- Technology / research and development—new product and process design

- Procurement—sourcing and purchasing functions

While the value chain is typically depicted as it’s displayed in the figure below, goods and information don’t necessarily flow in a line from one function to another. For example, an order taken by the marketing function can trigger an inbound logistics function to get components from a supplier, operations functions (to build a product if it’s not available), or outbound logistics functions (to ship a product when it’s available). Similarly, information from service support can be fed back to advise research and development (R&D) in the design of future products.

Figure 2.2 The Value Chain

When a firm has an imitation-resistant value chain—one that’s tough for rivals to copy in a way that yields similar benefits—then a firm may have a critical competitive asset. From a strategic perspective, managers can use the value chain framework to consider a firm’s differences and distinctiveness compared to rivals. If a firm’s value chain can’t be copied by competitors without engaging in painful trade-offs, or if the firm’s value chain helps to create and strengthen other strategic assets over time, it can be a key source for competitive advantage. Many of the examples used in this book, including FreshDirect, Amazon, Zara, Netflix, and eBay, illustrate this point.

An analysis of a firm’s value chain can also reveal operational weaknesses, and technology is often of great benefit to improving the speed and quality of execution. Firms can often buy software to improve things, and tools such as supply chain management (SCM; linking inbound and outbound logistics with operations), customer relationship management (CRM; supporting sales, marketing, and in some cases R&D), and enterprise resource planning software (ERP; software implemented in modules to automate the entire value chain), can have a big impact on more efficiently integrating the activities within the firm, as well as with its suppliers and customers. But remember, these software tools can be purchased by competitors, too. While valuable, such software may not yield lasting competitive advantage if it can be easily matched by competitors as well.

There’s potential danger here. If a firm adopts software that changes a unique process into a generic one, it may have co-opted a key source of competitive advantage particularly if other firms can buy the same stuff. This isn’t a problem with something like accounting software. Accounting processes are standardized and accounting isn’t a source of competitive advantage, so most firms buy rather than build their own accounting software. But using packaged, third-party SCM, CRM, and ERP software typically requires adopting a very specific way of doing things, using software and methods that can be purchased and adopted by others. During its period of PC-industry dominance, Dell stopped deployment of the logistics and manufacturing modules of a packaged ERP implementation when it realized that the software would require the firm to make changes to its unique and highly successful operating model and that many of the firm’s unique supply chain advantages would change to the point where the firm was doing the same thing using the same software as its competitors. By contrast, Apple had no problem adopting third-party ERP software because the firm competes on product uniqueness rather than operational differences.

Dell’s Struggles: Nothing Lasts Forever

Michael Dell enjoyed an extended run that took him from assembling PCs in his dorm room as an undergraduate at the University of Texas at Austin to heading the largest PC firm on the planet. For years Dell’s superefficient, vertically integrated manufacturing and direct-to-consumer model combined to help the firm earn seven times more profit on its own systems when compared with comparably configured rival PCs.B. Breen, “Living in Dell Time,” Fast Company, December 19, 2007, http://www.fastcompany.com/magazine/88/dell.html. And since Dell PCs were usually cheaper, too, the firm could often start a price war and still have better overall margins than rivals.

It was a brilliant model that for years proved resistant to imitation. While Dell sold direct to consumers, rivals had to share a cut of sales with the less efficient retail chains responsible for the majority of their sales. Dell’s rivals struggled in moving toward direct sales because any retailer sensing its suppliers were competing with it through a direct-sales effort could easily chose another supplier that sold a nearly identical product. It wasn’t that HP, IBM, Sony, and so many others didn’t see the advantage of Dell’s model—these firms were wedded to models that made it difficult for them to imitate their rival.

But then Dell’s killer model, one that had become a staple case study in business schools worldwide, began to lose steam. Nearly two decades of observing Dell had allowed the contract manufacturers serving Dell’s rivals to improve manufacturing efficiency.T. Friscia, K. O’Marah, D. Hofman, and J. Souza, “The AMR Research Supply Chain Top 25 for 2009,” AMR Research, May 28, 2009, http://www.amrresearch.com/Content/View.aspx?compURI=tcm:7-43469. Component suppliers located near contract manufacturers, and assembly times fell dramatically. And as the cost of computing fell, the price advantage Dell enjoyed over rivals also shrank in absolute terms. That meant savings from buying a Dell weren’t as big as they once were. On top of that, the direct-to-consumer model also suffered when sales of notebook PCs outpaced the more commoditized desktop market. Notebooks can be considered to be more differentiated than desktops, and customers often want to compare products in person—lift them, type on keyboards, and view screens—before making a purchase decision.

In time, these shifts created an opportunity for rivals to knock Dell from its ranking as the world’s number one PC manufacturer. Dell has even abandoned its direct-only business model and now also sells products through third-party brick-and-mortar retailers. Dell’s struggles as computers, customers, and the product mix changed all underscore the importance of continually assessing a firm’s strategic position among changing market conditions. There is no guarantee that today’s winning strategy will dominate forever.

Brand

A firm’s brandThe symbolic embodiment of all the information connected with a product or service. is the symbolic embodiment of all the information connected with a product or service, and a strong brand can also be an exceptionally powerful resource for competitive advantage. Consumers use brands to lower search costs, so having a strong brand is particularly vital for firms hoping to be the first online stop for consumers. Want to buy a book online? Auction a product? Search for information? Which firm would you visit first? Almost certainly Amazon, eBay, or Google. But how do you build a strong brand? It’s not just about advertising and promotion. First and foremost, customer experience counts. A strong brand proxies quality and inspires trust, so if consumers can’t rely on a firm to deliver as promised, they’ll go elsewhere. As an upside, tech can play a critical role in rapidly and cost-effectively strengthening a brand. If a firm performs well, consumers can often be enlisted to promote a product or service (so-called viral marketingLeveraging consumers to promote a product or service.). Consider that while scores of dot-coms burned through money on Super Bowl ads and other costly promotional efforts, Google, Hotmail, Skype, eBay, Facebook, LinkedIn, Twitter, YouTube, and so many other dominant online properties built multimillion member followings before committing any significant spending to advertising.

Figure 2.3

Icons accompanying stories on the New York Times Web site enlist customers to spread the word about products and services, user to user, like a virus.

Early customer accolades for a novel service often mean that positive press (a kind of free advertising) will also likely follow.

But show up late and you may end up paying much more to counter an incumbent’s place in the consumer psyche. In recent years, Amazon has spent no money on television advertising, while rivals Buy.com and Overstock.com spent millions. Google, another strong brand, has become a verb, and the cost to challenge it is astonishingly high. Yahoo! and Microsoft’s Bing each spent $100 million on Google-challenging branding campaigns, but the early results of these efforts seemed to do little to grow share at Google’s expense.J. Edwards, “JWT’s $100 Million Campaign for Microsoft’s Bing Is Failing,” BNET, July 16, 2009. Branding is difficult, but if done well, even complex tech products can establish themselves as killer brands. Consider that Intel has taken an ingredient product that most people don’t understand, the microprocessor, and built a quality-conveying name recognized by computer users worldwide.

Scale

Many firms gain advantages as they grow in size. Advantages related to a firm’s size are referred to as scale advantagesAdvantages related to size.. Businesses benefit from economies of scaleWhen costs can be spread across increasing units of production or in serving multiple customers. Businesses that have favorable economies of scale (like many Internet firms) are sometimes referred to as being highly scalable. when the cost of an investment can be spread across increasing units of production or in serving a growing customer base. Firms that benefit from scale economies as they grow are sometimes referred to as being scalable. Many Internet and tech-leveraging businesses are highly scalable since, as firms grow to serve more customers with their existing infrastructure investment, profit margins improve dramatically.

Consider that in just one year, the Internet firm BlueNile sold as many diamond rings with just 115 employees and one Web site as a traditional jewelry retailer would sell through 116 stores.T. Mullaney, “Jewelry Heist,” BusinessWeek, May 10, 2004. And with lower operating costs, BlueNile can sell at prices that brick-and-mortar stores can’t match, thereby attracting more customers and further fueling its scale advantages. Profit margins improve as the cost to run the firm’s single Web site and operate its one warehouse is spread across increasing jewelry sales.

A growing firm may also gain bargaining power with its suppliers or buyers. Apple’s dominance of smartphone and tablet markets has allowed the firm to lock up 60 percent of the world’s supply of advanced touch-screen displays, and to do so with better pricing than would be available to smaller rivals.S. Yin, “Report: Apple Controls 60% of Touchscreen Supply,” PCMag.com, February 17, 2011. Similarly, for years eBay could raise auction fees because of the firm’s market dominance. Auction sellers who left eBay lost pricing power since fewer bidders on smaller, rival services meant lower prices.

The scale of technology investment required to run a business can also act as a barrier to entry, discouraging new, smaller competitors. Intel’s size allows the firm to pioneer cutting-edge manufacturing techniques and invest $7 billion on next-generation plants.J. Flatley, “Intel Invests $7 Billion in Stateside 32nm Manufacturing,” Engadget, February 10, 2009. And although Google was started by two Stanford students with borrowed computer equipment running in a dorm room, the firm today runs on an estimated 1.4 million servers.R. Katz, “Tech Titans Building Boom,” IEEE Spectrum 46, no. 2 (February 1, 2009): 40–43. The investments being made by Intel and Google would be cost-prohibitive for almost any newcomer to justify.

Switching Costs and Data

Switching costsThe cost a consumer incurs when moving from one product to another. It can involve actual money spent (e.g., buying a new product) as well as investments in time, any data loss, and so forth. exist when consumers incur an expense to move from one product or service to another. Tech firms often benefit from strong switching costs that cement customers to their firms. Users invest their time learning a product, entering data into a system, creating files, and buying supporting programs or manuals. These investments may make them reluctant to switch to a rival’s effort.

Similarly, firms that seem dominant but that don’t have high switching costs can be rapidly trumped by strong rivals. Netscape once controlled more than 80 percent of the market share in Web browsers, but when Microsoft began bundling Internet Explorer with the Windows operating system and (through an alliance) with America Online (AOL), Netscape’s market share plummeted. Customers migrated with a mouse click as part of an upgrade or installation. Learning a new browser was a breeze, and with the Web’s open standards, most customers noticed no difference when visiting their favorite Web sites with their new browser.

Sources of Switching Costs

- Learning costs: Switching technologies may require an investment in learning a new interface and commands.

- Information and data: Users may have to reenter data, convert files or databases, or may even lose earlier contributions on incompatible systems.

- Financial commitment: Can include investments in new equipment, the cost to acquire any new software, consulting, or expertise, and the devaluation of any investment in prior technologies no longer used.

- Contractual commitments: Breaking contracts can lead to compensatory damages and harm an organization’s reputation as a reliable partner.

- Search costs: Finding and evaluating a new alternative costs time and money.

- Loyalty programs: Switching can cause customers to lose out on program benefits. Think frequent purchaser programs that offer “miles” or “points” (all enabled and driven by software).Adapted from C. Shapiro and H. Varian, “Locked In, Not Locked Out,” Industry Standard, November 2–9, 1998.

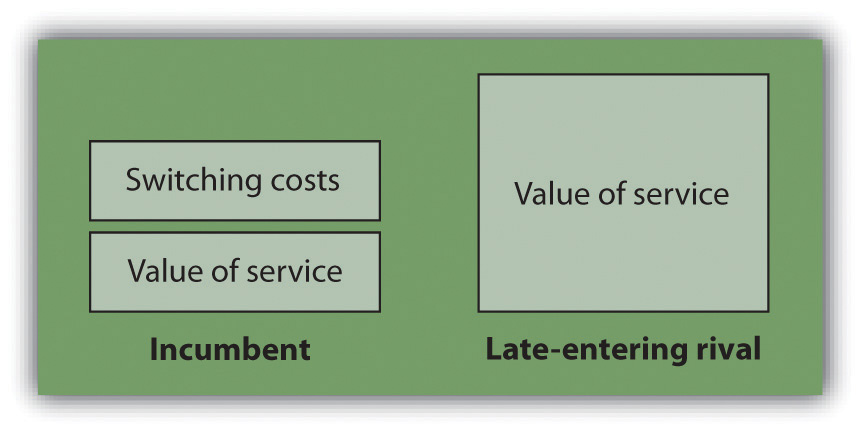

It is critical for challengers to realize that in order to win customers away from a rival, a new entrant must not only demonstrate to consumers that an offering provides more value than the incumbent, they have to ensure that their value added exceeds the incumbent’s value plus any perceived customer switching costs (see Figure 2.4). If it’s going to cost you and be inconvenient, there’s no way you’re going to leave unless the benefits are overwhelming.

Data can be a particularly strong switching cost for firms leveraging technology. A customer who enters her profile into Facebook, movie preferences into Netflix, or grocery list into FreshDirect may be unwilling to try rivals—even if these firms are cheaper—if moving to the new firm means she’ll lose information feeds, recommendations, and time savings provided by the firms that already know her well. Fueled by scale over time, firms that have more customers and have been in business longer can gather more data, and many can use this data to improve their value chain by offering more accurate demand forecasting or product recommendations.

Figure 2.4

In order to win customers from an established incumbent, a late-entering rival must offer a product or service that not only exceeds the value offered by the incumbent but also exceeds the incumbent’s value and any customer switching costs.

Competing on Tech Alone Is Tough: Gmail versus Rivals

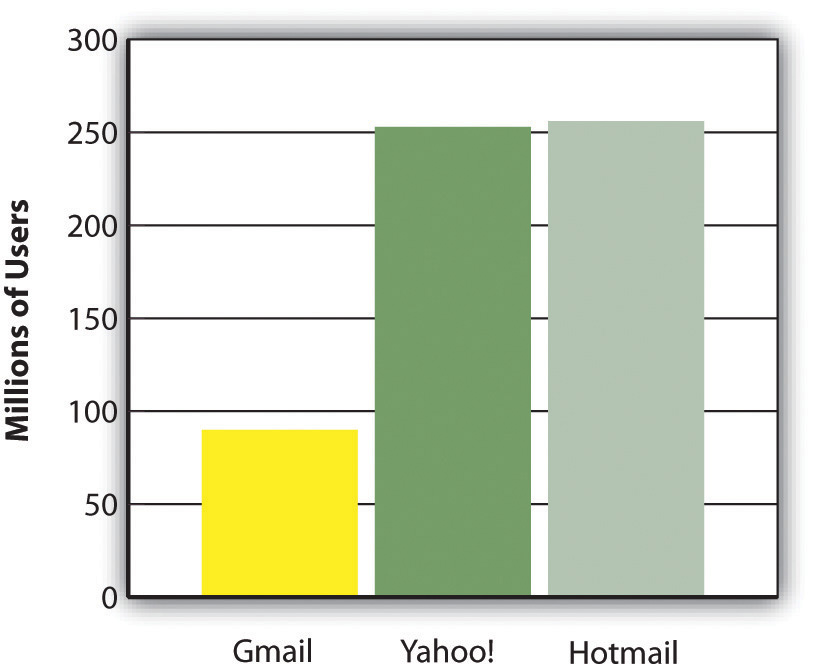

Switching e-mail services can be a real a pain. You’ve got to convince your contacts to update their address books, hope that any message-forwarding from your old service to your new one remains active and works properly, and regularly check the old service to be sure nothing is caught in junk folder purgatory. Not fun. So when Google entered the market for free e-mail, challenging established rivals Yahoo! and Microsoft Hotmail, it knew it needed to offer an overwhelming advantage to lure away customers who had used these other services for years. Google’s offering? A mailbox with vastly more storage than its competitors. With 250 to 500 times the capacity of rivals, Gmail users were liberated from the infamous “mailbox full” error, and could send photos, songs, slideshows, and other rich media files as attachments.

A neat innovation, but one based on technology that incumbents could easily copy. Once Yahoo! and Microsoft saw that customers valued the increased capacity, they quickly increased their own mailbox size, holding on to customers who might otherwise have fled to Google. Four years after Gmail was introduced, the service still had less than half the users of each of its two biggest rivals.

Figure 2.5 E-mail Market Share in Millions of UsersJ. Graham, “E-mail Carriers Deliver Gifts of Nifty Features to Lure, Keep Users,” USA Today, April 16, 2008.

Differentiation

Commodities are products or services that are nearly identically offered from multiple vendors. Consumers buying commodities are highly price-focused since they have so many similar choices. In order to break the commodity trap, many firms leverage technology to differentiate their goods and services. Dell gained attention from customers not only because of its low prices, but also because it was one of the first PC vendors to build computers based on customer choice. Want a bigger hard drive? Don’t need the fast graphics card? Dell will oblige.

Data is not only a switching cost, it also plays a critical role in differentiation. Each time a visitor returns to Amazon, the firm uses browsing records, purchase patterns, and product ratings to present a custom home page featuring products that the firm hopes the visitor will like. Customers value the experience they receive at Amazon so much that the firm received the highest score ever recorded on the University of Michigan’s American Customer Satisfaction Index (ACSI). The score was not just the highest performance of any online firm, it was the highest ranking that any service firm in any industry had ever received.

Capital One has also used data to differentiate its offerings. The firm mines data and runs experiments to create risk models on potential customers. Because of this, the credit card firm aggressively pursued a set of customers that other lenders considered too risky based on simplistic credit scoring. Technology determined that a subset of underserved customers was not properly identified by conventional techniques and was actually a good bet. Finding profitable new markets that others ignored allowed Capital One to grow its EPS (earnings per share) 20 percent a year for seven years, a feat matched by less than 1 percent of public firms.T. Davenport and J. Harris, Competing on Analytics: The New Science of Winning (Boston: Harvard Business School Press, 2007).

Network Effects

Facebook is by far the most dominant social network worldwide. Microsoft Windows has a 90 percent market share in operating systems. EBay has an 80 percent share of online auctions. Why are these firms so dominant? Largely due to the concept of network effectsAlso known as Metcalfe’s Law, or network externalities. When the value of a product or service increases as its number of users expands. (see Chapter 6 "Understanding Network Effects"). Network effects (sometimes called network externalities or Metcalfe’s Law) exist when a product or service becomes more valuable as more people use it. If you’re the first person with a Facebook account, then Facebook isn’t very valuable. But with each additional user, there’s one more person to communicate with. A firm with a big network of users might also see value added by third parties. Apple’s iOS devices (the iPhone, iPod touch, and iPad) and Google’s Android dominate rivals from Microsoft and HP in part because Apple and Google have tens of thousands more apps that run on and enhance these devices, and most of these apps are provided by firms other than Apple and Google. Third-party add-on products, books, magazines, or even skilled labor are all attracted to networks of the largest number of users, making dominant products even more valuable.

Switching costs also play a role in determining the strength of network effects. Tech user investments often go far beyond simply the cost of acquiring a technology. Users spend time learning a product; they buy add-ons, create files, and enter preferences. Because no one wants to be stranded with an abandoned product and lose this additional investment, users may choose a technically inferior product simply because the product has a larger user base and is perceived as having a greater chance of being offered in the future. The virtuous cycle of network effectsA virtuous adoption cycle occurs when network effects exist that make a product or service more attractive (increases benefits, reduces costs) as the adopter base grows. doesn’t apply to all tech products, and it can be a particularly strong asset for firms that can control and leverage a leading standard (think Apple’s iPhone and iPad with their closed systems versus the once-dominant but now rarely used Netscape browser, which was almost entirely based on open standards), but in some cases where network effects are significant, they can create winners so dominant that firms with these advantages enjoy a near-monopoly hold on a market.

Distribution Channels

If no one sees your product, then it won’t even get considered by consumers. So distribution channelsThe path through which products or services get to customers.—the path through which products or services get to customers—can be critical to a firm’s success. Again, technology opens up opportunities for new ways to reach customers.

Users can be recruited to create new distribution channels for your products and services (usually for a cut of the take). You may have visited Web sites that promote books sold on Amazon.com. Web site operators do this because Amazon gives them a percentage of all purchases that come in through these links. Amazon now has over 1 million of these “associates” (the term the firm uses for its affiliatesThird parties that promote a product or service, typically in exchange for a cut of any sales.), yet it only pays them if a promotion gains a sale. Google similarly receives some 30 percent of its ad revenue not from search ads, but from advertisements distributed within third-party sites ranging from lowly blogs to the New York Times.Google Fourth Quarter 2008 Earnings Summary, http://investor.google.com/earnings.html.

In recent years, Google and Microsoft have engaged in bidding wars, trying to lock up distribution deals that would bundle software tools, advertising, or search capabilities with key partner offerings. Deals with partners such as Dell, Nokia, and Verizon Wireless have been valued at up to $1 billion each.N. Wingfield, “Microsoft Wins Key Search Deals,” Wall Street Journal, January 8, 2009; P. Clarke, “Report: Microsoft to Pay Nokia $1 Billion for Support,” EETimes, March 8, 2011.

The ability to distribute products by bundling them with existing offerings is a key Microsoft advantage. But beware—sometimes these distribution channels can provide firms with such an edge that international regulators have stepped in to try to provide a more level playing field. Microsoft was forced by European regulators to unbundle the Windows Media Player, for fear that it provided the firm with too great an advantage when competing with the likes of RealPlayer and Apple’s QuickTime (see Chapter 6 "Understanding Network Effects").

What about Patents?

Intellectual property protection can be granted in the form of a patent for those innovations deemed to be useful, novel, and nonobvious. In the United States, technology and (more controversially) even business models can be patented, typically for periods of twenty years from the date of patent application. Firms that receive patents have some degree of protection from copycats that try to identically mimic their products and methods.

The patent system is often considered to be unfairly stacked against start-ups. U.S. litigation costs in a single patent case average about $5 million,B. Feld, “Why the Decks Are Stacked against Software Startups in Patent Litigation,” Technology Review, April 12, 2009. and a few months of patent litigation can be enough to sink an early stage firm. Large firms can also be victims. So-called patent trolls hold intellectual property not with the goal of bringing novel innovations to market but instead in hopes that they can sue or extort large settlements from others. BlackBerry maker Research in Motion’s $612 million settlement with the little-known holding company NTP is often highlighted as an example of the pain trolls can inflict.T. Wu, “Weapons of Business Destruction,” Slate, February 6, 2006; R. Kelley, “BlackBerry Maker, NTP Ink $612 Million Settlement,” CNN Money, March 3, 2006.

Even if an innovation is patentable, that doesn’t mean that a firm has bulletproof protection. Some patents have been nullified by the courts upon later review (usually because of a successful challenge to the uniqueness of the innovation). Software patents are also widely granted, but notoriously difficult to defend. In many cases, coders at competing firms can write substitute algorithms that aren’t the same, but accomplish similar tasks. For example, although Google’s PageRank search algorithms are fast and efficient, Microsoft, Yahoo! and others now offer their own noninfringing search that presents results with an accuracy that many would consider on par with PageRank. Patents do protect tech-enabled operations innovations at firms like Netflix and Caesars Entertainment Corporation (formerly known as Harrah’s), and design innovations like the iPod click wheel. But in a study of the factors that were critical in enabling firms to profit from their innovations, Carnegie Mellon professor Wes Cohen found that patents were only the fifth most important factor. Secrecy, lead time, sales skills, and manufacturing all ranked higher.T. Mullaney and S. Ante, “InfoWars,” BusinessWeek, June 5, 2000.

Key Takeaways

- Technology can play a key role in creating and reinforcing assets for sustainable advantage by enabling an imitation-resistant value chain; strengthening a firm’s brand; collecting useful data and establishing switching costs; creating a network effect; creating or enhancing a firm’s scale advantage; enabling product or service differentiation; and offering an opportunity to leverage unique distribution channels.

- The value chain can be used to map a firm’s efficiency and to benchmark it against rivals, revealing opportunities to use technology to improve processes and procedures. When a firm is resistant to imitation, a superior value chain may yield sustainable competitive advantage.

- Firms may consider adopting packaged software or outsourcing value chain tasks that are not critical to a firm’s competitive advantage. A firm should be wary of adopting software packages or outsourcing portions of its value chain that are proprietary and a source of competitive advantage.

- Patents are not necessarily a sure-fire path to exploiting an innovation. Many technologies and business methods can be copied, so managers should think about creating assets like the ones previously discussed if they wish to create truly sustainable advantage.

- Nothing lasts forever, and shifting technologies and market conditions can render once strong assets as obsolete.

Questions and Exercises

- Define and diagram the value chain.

- Discuss the elements of FreshDirect’s value chain and the technologies that FreshDirect uses to give the firm a competitive advantage. Why is FreshDirect resistant to imitation from incumbent firms? What advantages does FreshDirect have that insulate the firm from serious competition from start-ups copying its model?

- Which firm should adopt third-party software to automate its supply chain—Dell or Apple? Why? Identify another firm that might be at risk if it adopted generic enterprise software. Why do you think this is risky and what would you recommend as an alternative?

- Identify two firms in the same industry that have different value chains. Why do you think these firms have different value chains? What role do you think technology plays in the way that each firm competes? Do these differences enable strategic positioning? Why or why not?

- How can information technology help a firm build a brand inexpensively?

- Describe BlueNile’s advantages over a traditional jewelry chain. Can conventional jewelers successfully copy BlueNile? Why or why not?

- What are switching costs? What role does technology play in strengthening a firm’s switching costs?

- In most markets worldwide, Google dominates search. Why hasn’t Google shown similar dominance in e-mail, as well?

- Should Lands’ End fear losing customers to rivals that copy its custom clothing initiative? Why or why not?

- How can technology be a distribution channel? Name a firm that has tried to leverage its technology as a distribution channel.

- Do you think it is possible to use information technology to achieve competitive advantage? If so, how? If not, why not?

- What are network effects? Name a product or service that has been able to leverage network effects to its advantage.

- For well over a decade, Dell earned above average industry profits. But lately the firm has begun to struggle. What changed?

- What are the potential sources of switching costs if you decide to switch cell phone service providers? Cell phones? Operating systems? PayTV service?

- Why is an innovation based on technology alone often subjected to intense competition?

- Can you think of firms that have successfully created competitive advantage even though other firms provide essentially the same thing? What factors enable this success?

- What role did network effects play in your choice of an instant messaging client? Of an operating system? Of a social network? Of a word processor? Why do so many firms choose to standardize on Microsoft Windows?

- What can a firm do to prepare for the inevitable expiration of a patent (patents typically expire after twenty years)? Think in terms of the utilization of other assets and the development of advantages through employment of technology.

2.3 Barriers to Entry, Technology, and Timing

Learning Objectives

- Understand the relationship between timing, technology, and the creation of resources for competitive advantage.

- Argue effectively when faced with broad generalizations about the importance (or lack of importance) of technology and timing to competitive advantage.

- Recognize the difference between low barriers to entry and the prospects for the sustainability of new entrant’s efforts.

Some have correctly argued that the barriers to entry for many tech-centric businesses are low. This argument is particularly true for the Internet where rivals can put up a competing Web site or deploy a rival app seemingly overnight. But it’s absolutely critical to understand that market entry is not the same as building a sustainable business and just showing up doesn’t guarantee survival.

Platitudes like “follow, don’t lead”N. Carr, “IT Doesn’t Matter,” Harvard Business Review 81, no. 5 (May 2003): 41—49. can put firms dangerously at risk, and statements about low entry barriers ignore the difficulty many firms will have in matching the competitive advantages of successful tech pioneers. Should Blockbuster have waited while Netflix pioneered? In a year where Netflix profits were up seven-fold, Blockbuster lost more than $1 billion, and today Blockbuster is bankrupt.“Movies to Go,” Economist, July 9, 2005. Should Sotheby’s have dismissed seemingly inferior eBay? Sotheby’s made $96 million in 2010, but eBay earned over $1.8 billion. Barnes & Noble waited seventeen months to respond to Amazon.com. Amazon now has 32 times the profits of its offline rival, and its market cap is roughly 140 times greater.FY 2010 net income and March 26, 2011, market cap figures for both firms. Rival Borders has already declared bankruptcy. Today’s Internet giants are winners because in most cases, they were the first to move with a profitable model and they were able to quickly establish resources for competitive advantage. With few exceptions, established offline firms have failed to catch up to today’s Internet leaders.

Table 2.1 A Tale of Two Firms

| 2007 | 2008 | 2009 | 2010 | |

|---|---|---|---|---|

| Amazon | $476 million | $645 million | $902 million | $1,152 million |

| Barnes & Noble | $150 million | $135 million | $75 million | $36 million |

Barnes & Noble saw net income cut in half from 2007 to 2009 then fall half again in 2010. Over the same period Amazon’s profits are up nearly threefold—in a recession.

Timing and technology alone will not yield sustainable competitive advantage. Yet both of these can be enablers for competitive advantage. Put simply, it’s not the time lead or the technology; it’s what a firm does with its time lead and technology. True strategic positioning means that a firm has created differences that cannot be easily matched by rivals. Moving first pays off when the time lead is used to create critical resources that are valuable, rare, tough to imitate, and lack substitutes. Anything less risks the arms race of operational effectiveness. Build resources like brand, scale, network effects, switching costs, or other key assets and your firm may have a shot. But guess wrong about the market or screw up execution and failure or direct competition awaits. It is true that most tech can be copied—there’s little magic in eBay’s servers, Intel’s processors, Oracle’s databases, or Microsoft’s operating systems that past rivals have not at one point improved upon. But the lead that each of these tech-enabled firms had was leveraged to create network effects, switching costs, data assets, and helped build solid and well-respected brands.

But Google Arrived Late! Why Incumbents Must Constantly Consider Rivals

Although its share is slowly eroding, Yahoo! has been able to hold onto its lead in e-mail for so long because the firm quickly matched and nullified Gmail’s most significant tech-based innovations before Google could inflict real damage. Perhaps Yahoo! had learned from prior errors. The firm’s earlier failure to respond to Google’s emergence as a credible threat in search advertising gave Sergey Brin and Larry Page the time they needed to build the planet’s most profitable Internet firm.

Yahoo! (and many Wall Street analysts) saw search as a commodity—a service the firm had subcontracted out to other firms including Alta Vista and Inktomi. Yahoo! saw no conflict in taking an early investment stake in Google or in using the firm for its search results. But Yahoo! failed to pay attention to Google’s advance. As Google’s innovations in technology and interface remained unmatched over time, this allowed the firm to build its brand, scale, and advertising network (distribution channel) that grew from network effects because content providers and advertisers attract one another. These are all competitive resources that rivals have never been able to match.

Now Google (and Apple, too) are once again running from this playbook—turning the smartphone software market into what increasingly looks like a two-horse race. Many rivals, including Microsoft, had been trying to create a mobile standard for years, but their technical innovations offered little durable strategic value. It wasn’t until app stores flourished, offered with a high-quality user experience, that dominant smartphone platforms emerged. Yes, Google and Apple arrived late, but nothing before them had created defensible strategic assets, and that left an opening.

Google’s ability to succeed after being late to the search and mobile party isn’t a sign of the power of the late mover; it’s a story about the failure of incumbents to monitor their competitive landscape, recognize new rivals, and react to challenging offerings. That doesn’t mean that incumbents need to respond to every potential threat. Indeed, figuring out which threats are worthy of response is the real skill here. Video rental chain Hollywood Video wasted over $300 million in an Internet streaming business years before high-speed broadband was available to make the effort work.N. Wingfield, “Netflix vs. the Naysayers,” Wall Street Journal, March 21, 2007. But while Blockbuster avoided the balance sheet—cratering gaffes of Hollywood Video, the firm also failed to respond to Netflix—a new threat that had timed market entry perfectly (see Chapter 4 "Netflix in Two Acts: The Making of an E-commerce Giant and the Uncertain Future of Atoms to Bits").

Firms that quickly get to market with the “right” model can dominate, but it’s equally critical for leading firms to pay close attention to competition and innovate in ways that customers value. Take your eye off the ball and rivals may use time and technology to create strategic resources. Just look at Friendster—a firm that was once known as the largest social network in the United States but has fallen so far behind rivals that it has become virtually irrelevant today.

Key Takeaways

- It doesn’t matter if it’s easy for new firms to enter a market if these newcomers can’t create and leverage the assets needed to challenge incumbents.

- Beware of those who say, “IT doesn’t matter” or refer to the “myth” of the first mover. This thinking is overly simplistic. It’s not a time or technology lead that provides sustainable competitive advantage; it’s what a firm does with its time and technology lead. If a firm can use a time and technology lead to create valuable assets that others cannot match, it may be able to sustain its advantage. But if the work done in this time and technology lead can be easily matched, then no advantage can be achieved, and a firm may be threatened by new entrants

Questions and Exercises

- Does technology lower barriers to entry or raise them? Do low entry barriers necessarily mean that a firm is threatened?

- Is there such a thing as the first-mover advantage? Why or why not?

- Why did Google beat Yahoo! in search?

- A former editor of the Harvard Business Review, Nick Carr, once published an article in that same magazine with the title “IT Doesn’t Matter.” In the article he also offered firms the advice: “Follow, Don’t Lead.” What would you tell Carr to help him improve the way he thinks about the relationship between time, technology, and competitive advantage?

- Name an early mover that has successfully defended its position. Name another that had been superseded by the competition. What factors contributed to its success or failure?

- You have just written a word processing package far superior in features to Microsoft Word. You now wish to form a company to market it. List and discuss the barriers your start-up faces.

- What kinds of strategic assets are Google’s Android and Apple’s iOS seeking to create and exploit? Do you think these firms will be more successful than rivals? Why or why not?

2.4 Key Framework: The Five Forces of Industry Competitive Advantage

Learning Objectives

- Diagram the five forces of competitive advantage.

- Apply the framework to an industry, assessing the competitive landscape and the role of technology in influencing the relative power of buyers, suppliers, competitors, and alternatives.

Professor and strategy consultant Gary Hamel once wrote in a Fortune cover story that “the dirty little secret of the strategy industry is that it doesn’t have any theory of strategy creation.”G. Hamel, “Killer Strategies that Make Shareholders Rich,” Fortune, June 23, 1997. While there is no silver bullet for strategy creation, strategic frameworks help managers describe the competitive environment a firm is facing. Frameworks can also be used as brainstorming tools to generate new ideas for responding to industry competition. If you have a model for thinking about competition, it’s easier to understand what’s happening and to think creatively about possible solutions.

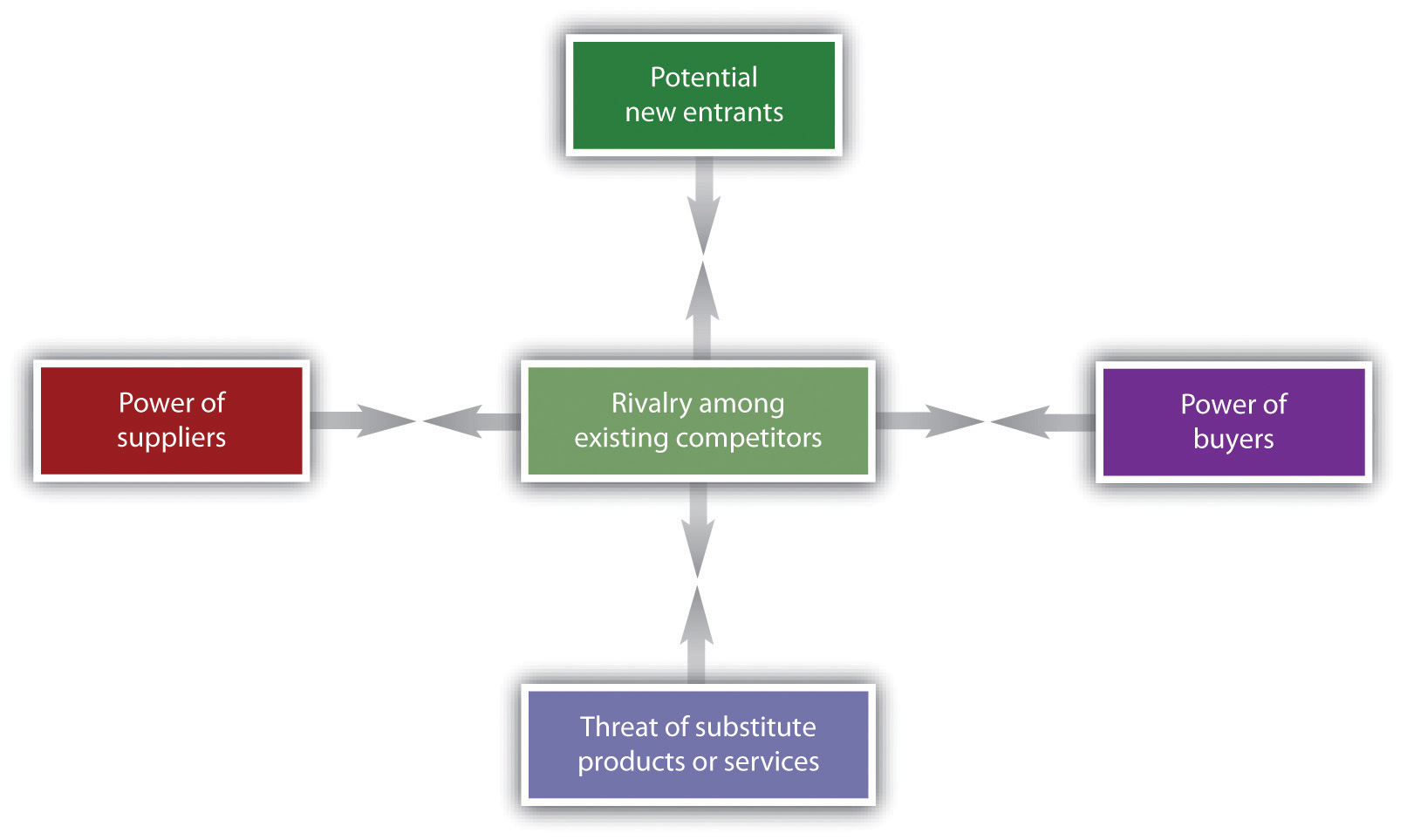

One of the most popular frameworks for examining a firm’s competitive environment is Porter’s five forcesAlso known as Industry and Competitive Analysis. A framework considering the interplay between (1) the intensity of rivalry among existing competitors, (2) the threat of new entrants, (3) the threat of substitute goods or services, (4) the bargaining power of buyers, and (5) the bargaining power of suppliers., also known as the Industry and Competitive Analysis. As Porter puts it, “analyzing [these] forces illuminates an industry’s fundamental attractiveness, exposes the underlying drivers of average industry profitability, and provides insight into how profitability will evolve in the future.” The five forces this framework considers are (1) the intensity of rivalry among existing competitors, (2) the threat of new entrants, (3) the threat of substitute goods or services, (4) the bargaining power of buyers, and (5) the bargaining power of suppliers (see Figure 2.6 "The Five Forces of Industry and Competitive Analysis").

Figure 2.6 The Five Forces of Industry and Competitive Analysis

New technologies can create jarring shocks in an industry. Consider how the rise of the Internet has impacted the five forces for music retailers. Traditional music retailers like Tower and Virgin found that customers were seeking music online. These firms scrambled to invest in the new channel out of what is perceived to be a necessity. Their intensity of rivalry increases because they not only compete based on the geography of where brick-and-mortar stores are physically located, they now compete online as well. Investments online are expensive and uncertain, prompting some firms to partner with new entrants such as Amazon. Free from brick-and-mortar stores, Amazon, the dominant new entrant, has a highly scalable cost structure. And in many ways the online buying experience is superior to what customers saw in stores. Customers can hear samples of almost all tracks, selection is seemingly limitless (the long tail phenomenon—see this concept illuminated in Chapter 4 "Netflix in Two Acts: The Making of an E-commerce Giant and the Uncertain Future of Atoms to Bits"), and data is leveraged using collaborative filtering software to make product recommendations and assist in music discovery.For more on the long tail and collaborative filtering, see Chapter 4 "Netflix in Two Acts: The Making of an E-commerce Giant and the Uncertain Future of Atoms to Bits". Tough competition, but it gets worse because CD sales aren’t the only way to consume music. The process of buying a plastic disc now faces substitutes as digital music files become available on commercial music sites. Who needs the physical atoms of a CD filled with ones and zeros when you can buy the bits one song at a time? Or don’t buy anything and subscribe to a limitless library instead.

From a sound quality perspective, the substitute good of digital tracks purchased online is almost always inferior to their CD counterparts. To transfer songs quickly and hold more songs on a digital music player, tracks are encoded in a smaller file size than what you’d get on a CD, and this smaller file contains lower playback fidelity. But the additional tech-based market shock brought on by digital music players (particularly the iPod) has changed listening habits. The convenience of carrying thousands of songs trumps what most consider just a slight quality degradation. ITunes is now responsible for selling more music than any other firm, online or off. Most alarming to the industry is the other widely adopted substitute for CD purchases—theft. Illegal music “sharing” services abound, even after years of record industry crackdowns. And while exact figures on real losses from online piracy are in dispute, the music industry has seen album sales drop by 45 percent in less than a decade.K. Barnes, “Music Sales Boom, but Album Sales Fizzle for ’08,” USA Today, January 4, 2009. All this choice gives consumers (buyers) bargaining power. They demand cheaper prices and greater convenience. The bargaining power of suppliers—the music labels and artists—also increases. At the start of the Internet revolution, retailers could pressure labels to limit sales through competing channels. Now, with many of the major music retail chains in bankruptcy, labels have a freer hand to experiment, while bands large and small have new ways to reach fans, sometimes in ways that entirely bypass the traditional music labels.

While it can be useful to look at changes in one industry as a model for potential change in another, it’s important to realize that the changes that impact one industry do not necessarily impact other industries in the same way. For example, it is often suggested that the Internet increases bargaining power of buyers and lowers the bargaining power of suppliers. This suggestion is true for some industries like auto sales and jewelry where the products are commodities and the price transparencyThe degree to which complete information is available. of the Internet counteracts a previous information asymmetryA decision situation where one party has more or better information than its counterparty. where customers often didn’t know enough information about a product to bargain effectively. But it’s not true across the board.

In cases where network effects are strong or a seller’s goods are highly differentiated, the Internet can strengthen supplier bargaining power. The customer base of an antique dealer used to be limited by how many likely purchasers lived within driving distance of a store. Now with eBay, the dealer can take a rare good to a global audience and have a much larger customer base bid up the price. Switching costs also weaken buyer bargaining power. Wells Fargo has found that customers who use online bill pay (where switching costs are high) are 70 percent less likely to leave the bank than those who don’t, suggesting that these switching costs help cement customers to the company even when rivals offer more compelling rates or services.

Tech plays a significant role in shaping and reshaping these five forces, but it’s not the only significant force that can create an industry shock. Government deregulation or intervention, political shock, and social and demographic changes can all play a role in altering the competitive landscape. Because we live in an age of constant and relentless change, mangers need to continually visit strategic frameworks to consider any market-impacting shifts. Predicting the future is difficult, but ignoring change can be catastrophic.

Key Takeaways

- Industry competition and attractiveness can be described by considering the following five forces: (1) the intensity of rivalry among existing competitors, (2) the potential for new entrants to challenge incumbents, (3) the threat posed by substitute products or services, (4) the power of buyers, and (5) the power of suppliers.

- In markets where commodity products are sold, the Internet can increase buyer power by increasing price transparency.

- The more differentiated and valuable an offering, the more the Internet shifts bargaining power to sellers. Highly differentiated sellers that can advertise their products to a wider customer base can demand higher prices.

- A strategist must constantly refer to models that describe events impacting their industry, particularly as new technologies emerge.

Questions and Exercises

- What are Porter’s “five forces”?

- Use the five forces model to illustrate competition in the newspaper industry. Are some competitors better positioned to withstand this environment than others? Why or why not? What role do technology and resources for competitive advantage play in shaping industry competition?

- What is price transparency? What is information asymmetry? How does the Internet relate to these two concepts? How does the Internet shift bargaining power among the five forces?

- How has the rise of the Internet impacted each of the five forces for music retailers?

- In what ways is the online music buying experience superior to that of buying in stores?

- What is the substitute for music CDs? What is the comparative sound quality of the substitute? Why would a listener accept an inferior product?

- Based on Porter’s five forces, is this a good time to enter the retail music industry? Why or why not?

- What is the cost to the music industry of music theft? Cite your source.

- Discuss the concepts of price transparency and information asymmetry as they apply to the diamond industry as a result of the entry of BlueNile. Name another industry where the Internet has had a similar impact.

- Under what conditions can the Internet strengthen supplier bargaining power? Give an example.

- What is the effect of switching costs on buyer bargaining power? Give an example.

- How does the Internet impact bargaining power for providers of rare or highly differentiated goods? Why?