This is “Cash Budgets”, section 17.1 from the book Finance for Managers (v. 0.1). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

17.1 Cash Budgets

PLEASE NOTE: This book is currently in draft form; material is not final.

Learning Objectives

- Describe a cash budget and its components.

- Distinguish and explain the difference between cash inflows and outflows.

- Identify the parts of a sales forecast.

Creating a cash budget is a way for a firm to estimate its short-term cash income and expenditure requirements. Typically cash budgets are for a one-year period, usually divided into months to capture the seasonality experienced by many businesses. Just like an individual would want to plan for higher heating bills in the winter, a business would want to plan for seasonal fluctuations, such as lower sales for snowblowers in the summer. A cash budget is very different from the cash flow statement.

Cash Inflows and Outflows

Any cash coming in to the company is a cash inflowA source of cash or an increase in the company’s cash balance.; for the sake of consistency and to avoid errors, we will always use positive numbers to represent inflows. Any cash leaving the company is a cash outflowA use of cash or a decrease in the company’s cash balance., and will be represented by a negative number. Simply put, inflows are sources of cash while outflows are uses of cash.

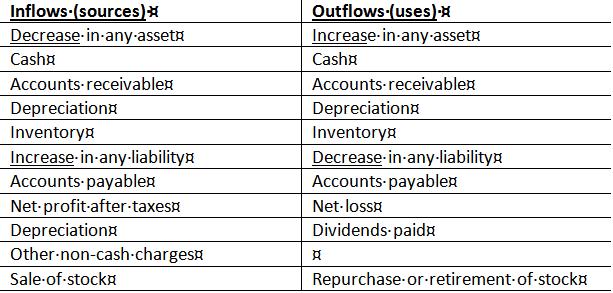

When a company pays its advertising bill, it is a cash outflow. When the company receives payment from a customer, it is a cash inflow. Other accounts are a bit trickier. For example, if a firm’s accounts payable increased by $2,000, it is a cash inflow. If inventory increased over the year by $3,000, the change would be negative and an outflow of cash. Let’s start with the summary below.

Figure 17.1 Examples of Cash Inflows and Outflows

Cash increases occur anytime you have a decrease in any asset or an increase in liabilities. How is this? If any of your assets decrease (for example accounts receivable or inventory) this means that cash has been freed up to be held as cash instead of being tied up as AR or in inventory. In essence we put money in the safe (a cash inflow) and a have a decrease in our asset. Conversely, a company’s cash balance decreases (cash outflow) if there is an increase in any of its assets. If accounts receivable or inventory increases, then that is more money held as that asset and therefore less money held as cash. So the company’s cash balance decreases.

With liabilities the opposite is true. An increase in any liability such as accounts payable results in an inflow of cash. In other words, if accounts payable increases than that means we did not pay as much on our payables and therefore we are holding more cash. If accounts payable decreases, then we have a cash outflow because we used cash to pay our payables. Profit is a bit easier. So easy in fact we can sum it up in one sentence: Any profit is a cash inflow and any loss is a cash outflow.

Key Takeaways

Cash management is vital to the health of any company. A cash budget is an vital tool in cash management as it helps with a company’s financial planning, both short-term and long-term.

- A cash budget is an important tool in financial planning.

- Key in accurate prediction of a cash budget is the sales forecast and any other external or internal variables

- Cash inflows are positive, cash outflows are negative.

Exercises

-

Classify the following cash flows as a cash inflow or cash outflow.

Sales

Electric Supplier invoice

mortgage

payment from biggest customer

-

Create an internal cash budget based on the following information:

Sales = $50,000

Rent = $20,000

Depreciation = $7,500

Accounts Receivable = $20,000

Accounts Payable = $15,000