This is “Aggregate Output and Keynesian Cross Diagrams”, section 21.1 from the book Finance, Banking, and Money (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

21.1 Aggregate Output and Keynesian Cross Diagrams

Learning Objectives

- What does this equation mean: Y = Yad = C + I + G + NX?

- Why is this equation important?

- What is the equation for C and why is it important?

- What is the Keynesian cross diagram and what does it help us to do?

Developed in 1937 by economist and Keynes disciple John Hicks, the IS-LM model is still used today to model aggregate output (gross domestic product [GDP], gross national product [GNP], etc.) and interest rates in the short run.en.wikipedia.org/wiki/John_Hicks It begins with John Maynard Keynes’s recognition that

where:

Y = aggregate output (supplied)

Yad = aggregate demand

C = consumer expenditure

I = investment (on new physical capital like computers and factories, and planned inventory)

G = government spending

NX = net exports (exports minus imports)

Keynes further explained that C = a + (mpc × Yd)

where:

Yd = disposable income, all that income above a

a = autonomous consumer expenditure (food, clothing, shelter, and other necessaries)

mpc = marginal propensity to consume (change in consumer expenditure from an extra dollar of income or “disposable income;” it is a constant bounded by 0 and 1)

Practice calculating C in Exercise 1.

Exercise

-

Calculate consumer expenditure using the formula C = a + (mpc × Yd).

Autonomous Consumer Expenditure Marginal Propensity to Consume Disposable Income Answer: C 200 0.5 0 200 400 0.5 0 400 200 0.5 200 300 200 0.5 300 350 300 0.5 300 450 300 0.75 300 525 300 0.25 300 375 300 0.01 300 303 300 1 300 600 100 0.5 1000 600 100 0.75 1000 850

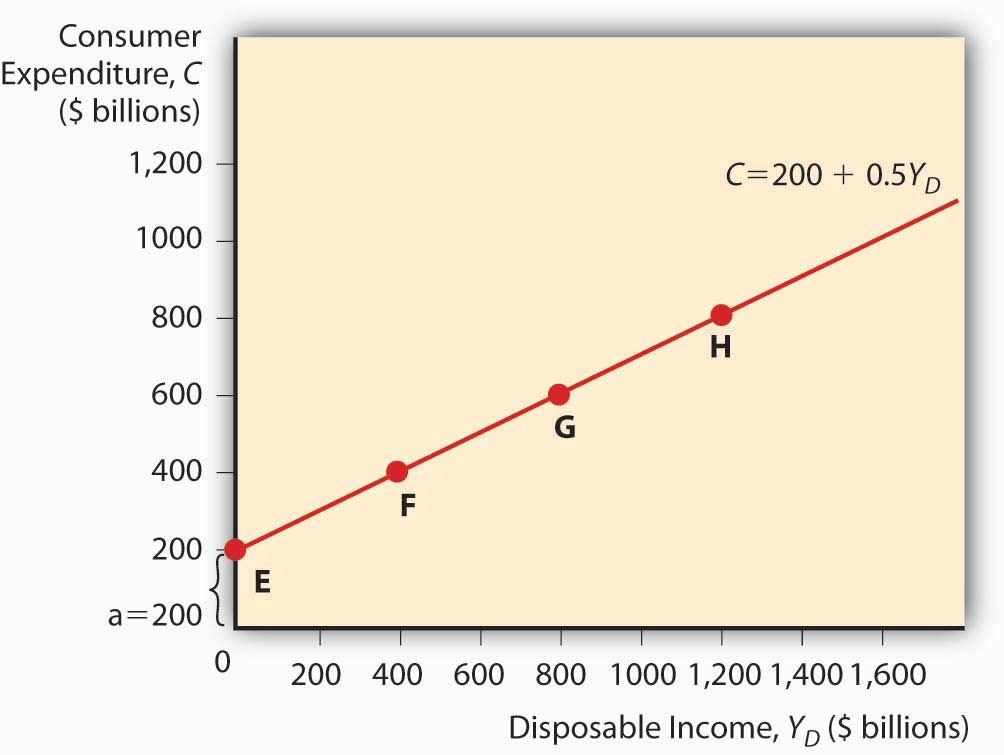

You can plot a consumption functionA mathematical equation thought to express the level of consumer spending. by drawing a graph, as in Figure 21.1 "A consumption function", with consumer expenditure on the vertical axis and disposable income on the horizontal. (Autonomous consumer expenditure a will be the intercept and mpc × Yd will be the slope.)

Figure 21.1 A consumption function

Investment is composed of so-called fixed investment on equipment and structures and planned inventory investment in raw materials, parts, or finished goods.

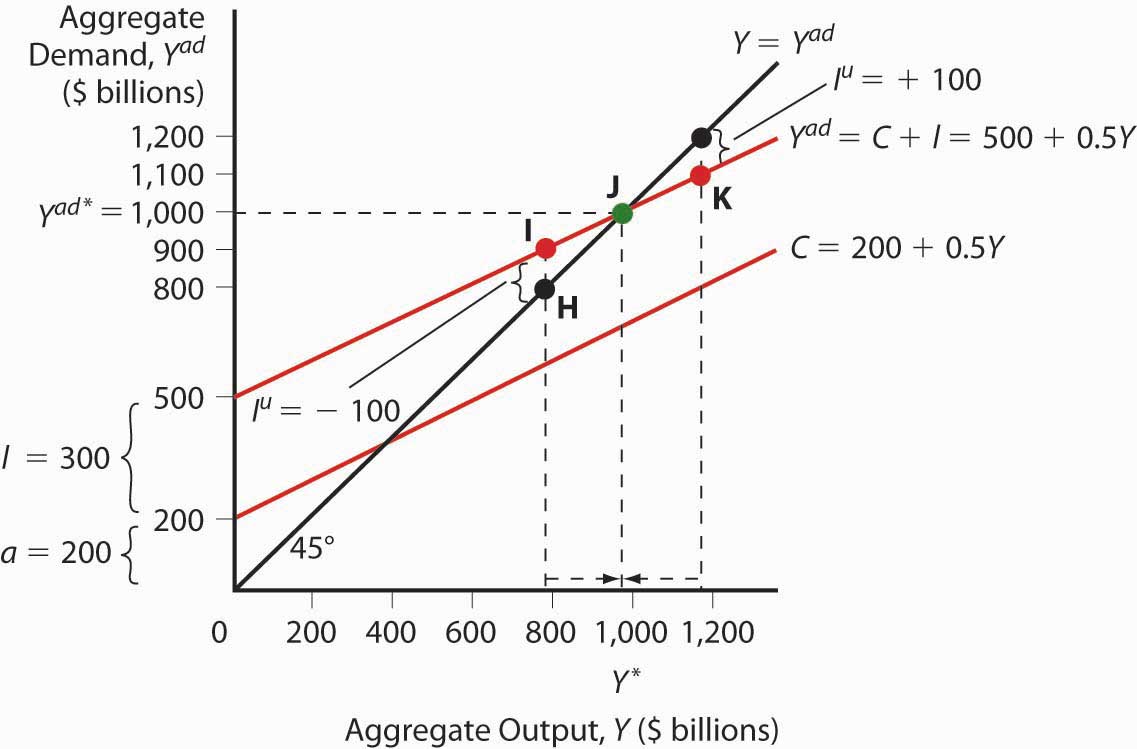

For the present, we will ignore G and NX and, following Keynes, changes in the price level. (Remember, we are talking about the short term here. Remember, too, that Keynes wrote in the context of the gold standard, not an inflationary free floating regime, so he was not concerned with price level changes.) The simple model that results, called a Keynesian cross diagram, looks like the diagram in Figure 21.2 "A Keynesian cross diagram".

Figure 21.2 A Keynesian cross diagram

The 45-degree line simply represents the equilibrium Y = Yad. The other line, the aggregate demand function, is the consumption function line plus planned investment spending I. Equilibrium is reached via inventories (part of I). If Y > Yad, inventory levels will be higher than firms want, so they’ll cut production. If Y < Yad, inventories will shrink below desired levels and firms will increase production. We can now predict changes in aggregate output given changes in the level of I and C and the marginal propensity to consume (the slope of the C component of Yad).

Suppose I increases. Due to the upward slope of Yad, aggregate output will increase more than the increase in I. This is called the expenditure multiplier and it is summed up by the following equation:

So if a is 200 billion, I is 400 billion, and mpc is .5, Y will be

If I increases to 600 billion, Y = 800 × 2 = $1,600 billion.

If the marginal propensity to consume were to increase to .75, Y would increase to

Y = 800 × 1/.25 = 800 × 4 = $3,200 billion because Yad would have a much steeper slope. A decline in mpc to .25, by contrast, would flatten Yad and lead to a lower equilibrium:

Practice calculating aggregate output in Exercise 2.

Exercise

-

Calculate aggregate output with the formula: Y = (a + I) × 1/(1 ? mpc)

Autonomous Spending Marginal Propensity to Consume Investment Answer: Aggregate Output 200 0.5 500 1400 300 0.5 500 1600 400 0.5 500 1800 500 0.5 500 2000 500 0.6 500 2500 200 0.7 500 2333.33 200 0.8 500 3500 200 0.4 500 1166.67 200 0.3 500 1000 200 0.5 600 1600 200 0.5 700 1800 200 0.5 800 2000 200 0.5 400 1200 200 0.5 300 1000 200 0.5 200 800

Stop and Think Box

During the Great Depression, investment (I) fell from $232 billion to $38 billion (in 2000 USD). What happened to aggregate output? How do you know?

Aggregate output fell by more than $232 billion − $38 billion = $194 billion. We know that because investment fell and the marginal propensity to consume was > 0, so the fall was more than $194 billion, as expressed by the equation Y = (a + I) × 1/(1 − mpc).

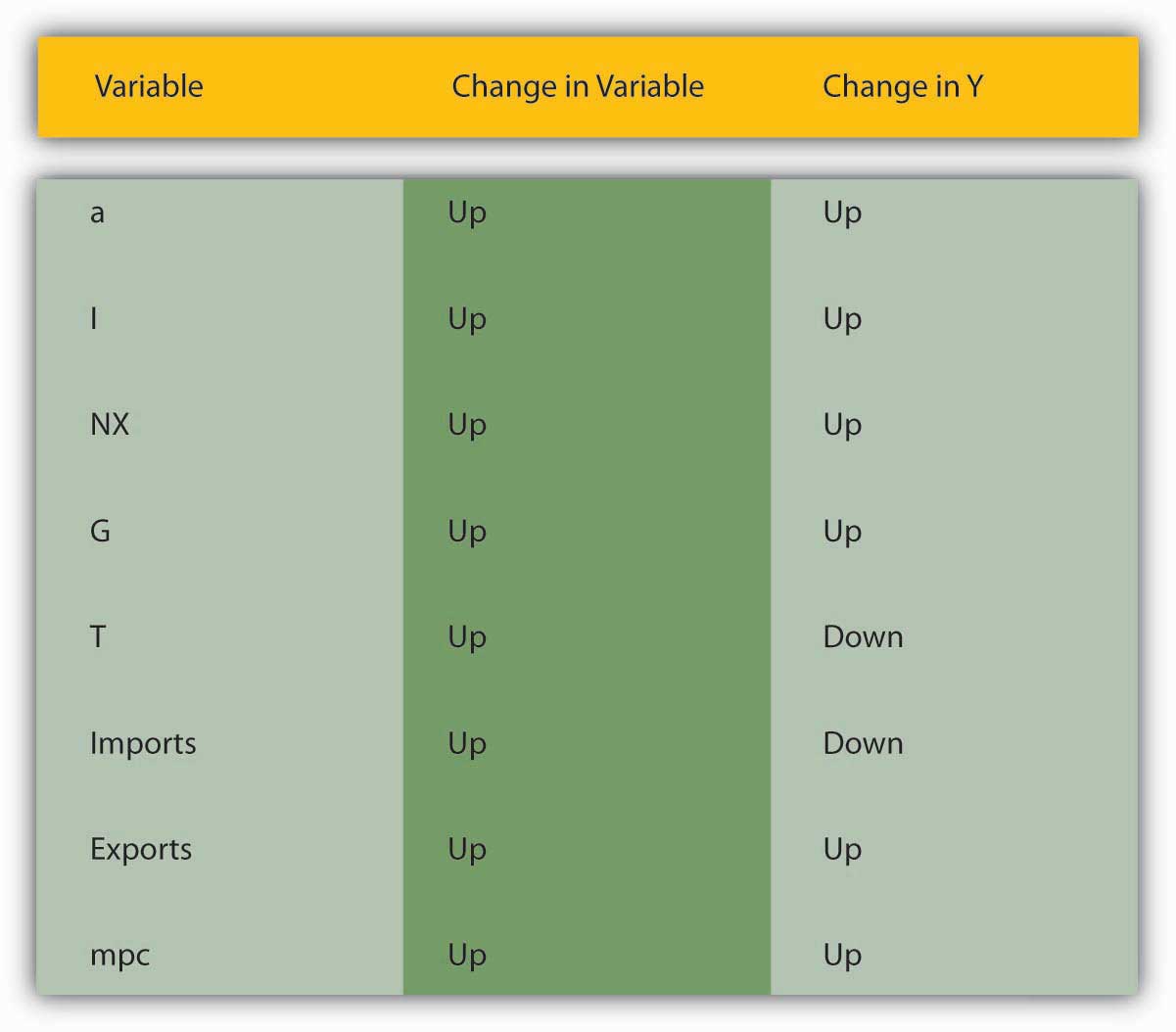

To make the model more realistic, we can easily add NX to the equation. An increase in exports over imports will increase aggregate output Y by the increase in NX times the expenditure multiplier. Likewise, an increase in imports over exports (a decrease in NX) will decrease Y by the decrease in NX times the multiplier.

Government spending (G) also increases Y. We must realize, however, that some government spending comes from taxes, which consumers view as a reduction in income. With taxation, the consumption function becomes the following:

T means taxes. The effect of G is always larger than that of T because G expands by the multiplier, which is always > 1, while T is multiplied by MPC, which never exceeds 1. So increasing G, even if it is totally funded by T, will increase Y. (Remember, this is a short-run analysis.) Nevertheless, Keynes argued that, to help a country out of recession, government should cut taxes because that will cause Yd to rise, ceteris paribus. Or, in more extreme cases, it should borrow and spend (rather than tax and spend) so that it can increase G without increasing T and thus decreasing C.

Stop and Think Box

Many governments, including that of the United States, responded to the Great Depression by increasing tariffs in what was called a beggar-thy-neighbor policy. Today we know that such policies beggared everyone. What were policymakers thinking?

They were thinking that tariffs would decrease imports and thereby increase NX (exports minus imports) and Y. That would make their trading partner’s NX decrease, thus beggaring them by decreasing their Y. It was a simple idea on paper, but in reality it was dead wrong. For starters, other countries retaliated with tariffs of their own. But even if they did not, it was a losing strategy because by making neighbors (trading partners) poorer, the policy limited their ability to import (i.e., decreased the first country’s exports) and thus led to no significant long-term change in NX.

Figure 21.3 "The determinants of aggregate demand" sums up the discussion of aggregate demand.

Figure 21.3 The determinants of aggregate demand

Key Takeaways

- The equation Y = Yad = C + I + G + NX tells us that aggregate output (or aggregate income) is equal to aggregate demand, which in turn is equal to consumer expenditure plus investment (planned, physical stuff) plus government spending plus net exports (exports – imports).

- It is important because it allows economists to model aggregate output (to discern why, for example, GDP changes).

- In a taxless Eden, like the Gulf Cooperation Council countries, consumer expenditure equals autonomous consumer expenditure (spending on necessaries) (a) plus the marginal propensity to consume (mpc) times disposable income (Yd), income above a.

- In the rest of the world, C = a + mpc × (Yd − T), where T = taxes.

- C, particularly the marginal propensity to consume variable, is important because it gives the aggregate demand curve in a Keynesian cross diagram its upward slope.

- A Keynesian cross diagram is a graph with aggregate demand (Yad) on the vertical axis and aggregate output (Y) on the horizontal.

- It consists of a 45-degree line where Y = Yad and a Yad curve, which plots C + I + G + NX with the slope given by the expenditure multiplier, which is the reciprocal of 1 minus the marginal propensity to consume: Y = (a + I + NX + G) × 1/(1 − mpc).

- The diagram helps us to see that aggregate output is directly related to a, I, exports, G, and mpc and indirectly related to T and imports.