This is “Other Important Central Banks”, section 13.3 from the book Finance, Banking, and Money (v. 1.1). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

13.3 Other Important Central Banks

Learning Objective

- How do other central banks compare to the Fed?

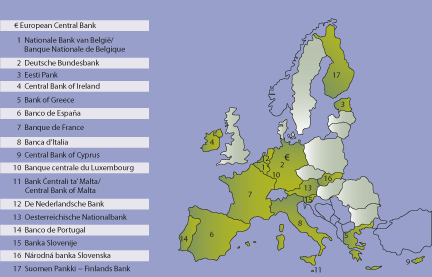

The Fed is the world’s most important central bank because the United States has been the world’s most important economy since at least World War II. But the Maastricht Treaty created a contender:http://www.eurotreaties.com/maastrichtext.html the European Central Bank (ECB),http://www.ecb.int/home/html/index.en.html the central bank of the euro area, the seventeen major countries that have adopted the euro of their unit of account: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia and Spain (see Figure 13.1 "The Eurozone").

Figure 13.1 The Eurozone

The ECB is part of a larger system, the European System of Central Banks (ESCB), some of the countries of which (Bulgaria, Czech Republic, Denmark, Estonia, Cyprus, Latvia, Lithuania, Hungary, Malta, Poland, Romania, Slovakia, Sweden, and the United Kingdom) are part of the European Union but have opted out of the currency union. Other countries in the ESCB, including Bulgaria, Denmark, Latvia, and Lithuania, currently link their national currencies to the euro.

The ECB or Eurosystem was consciously modeled on the Fed, so it is not surprising that their structures are similar. Each nation is like a Federal Reserve district headed by its national central bank (NCB). At its headquarters in Frankfurt sits the ECB’s Executive Board, the structural equivalent of the Fed’s Board of Governors, and the Governing Council, which like the Fed’s FOMC makes monetary policy decisions. The ECB is more decentralized than the Fed, however, because the NCBs control their own budgets and conduct their own open market operations. Also unlike the Fed, the ECB does not regulate financial institutions, a task left to each individual country’s government. The two central banks, of course, also differ in many matters of detail. The ECB’s current head or president is a Frenchman named Jean-Claude Trichet.http://en.wikipedia.org/wiki/President_of_the_European_Central_Bank#Trichet

Three other important central banks, the Bank of England, the Bank of Japan, and the Bank of Canada, look nothing like the Fed or the ECB because they are unitary institutions with no districts. Although they are more independent than in the past, most are not as independent as the Fed or the ECB. Despite their structural differences and relative dearth of independence, unit central banks like the Bank of Japan implement monetary policy in ways very similar to the Fed and ECB.Dieter Gerdesmeier, Francesco Mongelli, and Barbara Roffia, “The Eurosystem, the US Federal Reserve and the Bank of Japan: Similarities and Differences,” ECB Working Paper Series No. 742 (March 2007).

Key Takeaway

- The European Central Bank (ECB), the central bank of the nations that have adopted the euro, and the larger European System of Central Banks (ECSB), of which it is a part, are modeled after the Fed. Nevertheless, numerous differences of detail can be detected. The ECB’s national central banks (NCBs), for example, are much more powerful than the Fed’s district banks because they control their own budgets and conduct open market operations. Most of the world’s other central banks are structured differently than the ECB and the Fed because they are unit banks without districts or branches. Most are less independent than the Fed and ECB but conduct monetary policy in the same ways.