This is “Financial Structure, Transaction Costs, and Asymmetric Information”, chapter 8 from the book Finance, Banking, and Money (v. 1.1). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 8 Financial Structure, Transaction Costs, and Asymmetric Information

Chapter Objectives

By the end of this chapter, students should be able to:

- Describe how nonfinancial companies meet their external financing needs.

- Explain why bonds play a relatively large role in the external financing of U.S. companies.

- Explain why most external finance is channeled through financial intermediaries.

- Define transaction costs and explain their importance.

- Define and describe asymmetric information and its importance.

- Define and explain adverse selection, moral hazard, and agency problems.

- Explain why the financial system is heavily regulated.

8.1 The Sources of External Finance

Learning Objective

- How can companies meet their external financing needs?

Thus far, we have spent a lot of time discussing financial markets and learning how to calculate the prices of various types of financial securities, including stocks and bonds. Securities markets are important, especially in the U.S. economy. But you may recall from Chapter 2 "The Financial System" that the financial system connects savers to spenders or investors to entrepreneurs in two ways, via markets and via financial intermediaries. It turns out that the latter channel is larger than the former. That’s right, in dollar terms, banks, insurance companies, and other intermediaries are more important than the stock and bond markets. The markets tend to garner more media attention because they are relatively transparent. Most of the real action, however, takes place behind closed doors in banks and other institutional lenders.

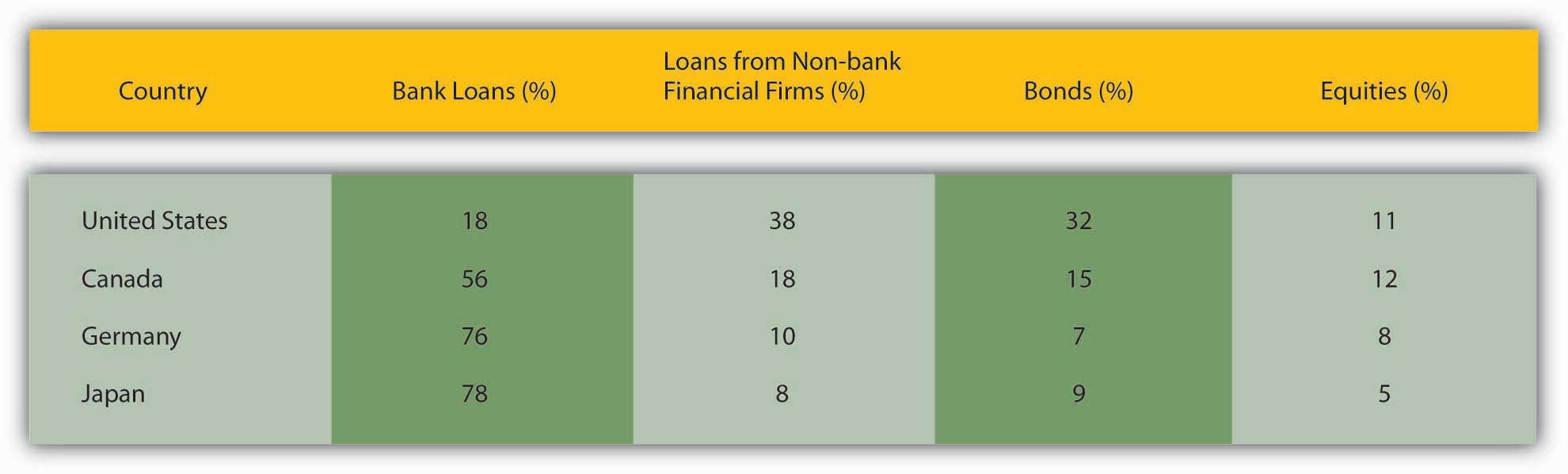

Not convinced? Check out Figure 8.1 "Sources of external finance for nonfinancial companies in four financially and economically developed countries", which shows the sources of external funds for nonfinancial businesses in four of the world’s most advanced economies: the United States, Germany, Japan, and Canada. In none of those countries does the stock market (i.e., equities) supply more than 12 percent of external finance. Loans, from banks and nonbank financial companies, supply the vast bulk of external finance in three of those countries and a majority in the fourth, the United States. The bond market supplies the rest, around 10 percent or so of total external finance (excluding trade creditCredit granted in the course of trade, as when suppliers ship their wares, then bill net 15 or 30, or when customers, like libraries for academic journals, pay for goods or services before they are provided.), except in the United States, where bonds supply about a third of the external finance of nonfinancial businesses. (As we’ll learn later, U.S. banking has been relatively weak historically, which helps to explain why the bond market and loans from nonbank financial companies are relatively important in the United States. In short, more companies found it worthwhile to borrow from life insurance companies or to sell bonds than to obtain bank loans.)

Figure 8.1 Sources of external finance for nonfinancial companies in four financially and economically developed countries

As noted above, the numbers in Figure 8.1 "Sources of external finance for nonfinancial companies in four financially and economically developed countries" do not include trade credit. Most companies are small and most small companies finance most of their activities by borrowing from their suppliers or, sometimes, their customers. Most such financing, however, ultimately comes from loans, bonds, or stock. In other words, companies that extend trade credit act, in a sense, as nonbank intermediaries, channeling equity, bonds, and loans to small companies. This makes sense because suppliers usually know more about small companies than banks or individual investors do. And information, we’ll see, is key.

Also note that the equity figures are somewhat misleading given that, once sold, a share provides financing forever, or at least until the company folds or buys it back. The figures above do not account for that, so a $1,000 year-long bank loan renewed each year for 20 years would count as $20,000 of bank loans, while the sale of $1,000 of equities would count only as $1,000. Despite that bias in the methodology, it is clear that most external finance does not, in fact, come from the sale of stocks or bonds. Moreover, in less economically and financially developed countries, an even higher percentage of external financing comes to nonfinancial companies via intermediaries rather than markets.

What explains the facts highlighted in Figure 8.1 "Sources of external finance for nonfinancial companies in four financially and economically developed countries"? Why are bank and other loans more important sources of external finance than stocks and bonds? Why does indirect finance, via intermediaries, trump direct finance, via markets? For that matter, why are most of those loans collateralizedPledge some asset, like land or financial securities, for the repayment of a loan.? Why are loan contracts so complex? Why are only the largest companies able to raise funds directly by selling stocks and bonds? Finally, why are financial systems worldwide one of the most heavily regulated economic sectors?

Those questions can be answered in three ways: transaction costs, asymmetric information, and the free-rider problem. Explaining what those three terms mean, however, will take a little doing.

Key Takeaways

- To meet their external financing needs, companies can sell equity (stock) and commercial paper and longer-term bonds and they can obtain loans from banks and nonbank financial institutions.

- They can also obtain trade credit from suppliers and customers, but most of those funds ultimately come from loans, bonds, or equity.

- Most external financing comes from loans, with bonds and equities a distant second, except in the United States, where bonds provide about a third of external financing for nonfinancial companies.

- Bonds play a relatively larger role in the external financing of U.S. companies because the U.S. banking system has been weak historically. That weakness induced companies to obtain more loans from nonbank financial institutions like life insurance companies and also to issue more bonds.

8.2 Transaction Costs, Asymmetric Information, and the Free-Rider Problem

Learning Objective

- Why is most external finance channeled through financial intermediaries?

Minimum efficient scaleThe smallest a business can be and still remain efficient and/or profitable. in finance is larger than most individuals can invest. Somebody with $100, $1,000, $10,000, even $100,000 to invest would have a hard time making any profit at all, let alone the going risk-adjusted return. That is because most of his or her profits would be eaten up in transaction costs, brokerage fees, the opportunity cost of his or her time, and liquidity and diversification losses. Many types of bonds come in $10,000 increments and so are out of the question for many small investors. A single share of some companies, like Berkshire Hathaway, costs thousands or tens of thousands of dollars and so is also out of reach.http://www.berkshirehathaway.com/ Most shares cost far less, but transaction fees, even after the online trading revolution of the early 2000s, are still quite high, especially if an investor were to try to diversify by buying only a few shares of many companies. As discussed in Chapter 7 "Rational Expectations, Efficient Markets, and the Valuation of Corporate Equities", financial markets are so efficient that arbitrage opportunities are rare and fleeting. Those who make a living engaging in arbitrage, like hedge fund D. E. Shaw, do so only through scale economies. They need superfast (read “expensive”) computers and nerdy (read “expensive”) employees to operate custom (read “expensive”) programs on them. They also need to engage in large-scale transactions. You can’t profit making .001 percent on a $1,000 trade, but you can on a $1,000,000,000 one.

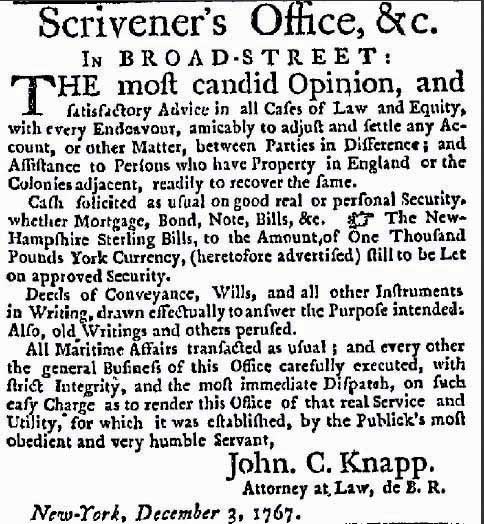

What about making loans directly to entrepreneurs or other borrowers? Fuggeddaboutit! The time, trouble, and cash (e.g., for advertisements like that in Figure 8.2 "Need a loan?") it would take to find a suitable borrower would likely wipe out any profits from interest. The legal fees alone would swamp you! (It helps if you can be your own lawyer, like John C. Knapp.) And, as we’ll learn below, making loans isn’t all that easy. You’ll still occasionally see advertisements like those that used to appear in the eighteenth century, but they are rare and might in fact be placed by predators, people who are more interested in robbing you (or worse) than lending to you. A small investor might be able to find a relative, co-religionist, colleague, or other acquaintance to lend to relatively cheaply. But how could the investor know if the borrower was the best one, given the interest rate charged? What is the best rate, anyway? To answer those questions even haphazardly would cost relatively big bucks. And here is another hint: friends and relatives often think that a “loan” is actually a “gift,” if you catch my “drift.”

Figure 8.2 Need a loan?

From Early American Newspapers, an Archive of Americana Collection, published by Readex (Readex.com), a division of NewsBank, Inc.

A new type of banking, called peer-to-peer bankingIn this new type of banking, a facilitator links lenders to borrowers, acting more like a securities broker than a bank., might reduce some of those transaction costs. In peer-to-peer banking, a financial facilitator, like Zopa.com or Prosper.com, reduces transaction costs by electronically matching individual borrowers and lenders. Most peer-to-peer facilitators screen loan applicants in at least a rudimentary fashion and also provide diversification services, distributing lenders’ funds to numerous borrowers to reduce the negative impact of any defaults.For details, see “Options Grow for Investors to Lend Online,” Wall Street Journal, July 18, 2007. Although the infant industry is currently growing, the peer-to-peer concept is still unproven and there are powerful reasons to doubt its success. Even if the concept succeeds (and it might given its Thomas Friedman–The World Is Flatishnesshttp://en.wikipedia.org/wiki/The_World_is_Flat), it will only reinforce the point made here about the inability of most individuals to invest profitably without help.

Financial intermediaries clearly can provide such help. They have been doing so for at least a millennium (yep, a thousand years, maybe more). One key to their success is their ability to achieve minimum efficient scale. Banks, insurers, and other intermediaries pool the resources of many investors. That allows them to diversify cheaply because instead of buying 10 shares of XYZ’s $10 stock and paying $7 for the privilege (7/100 = .07) they can buy 1,000,000 shares for a brokerage fee of maybe $1,000 ($1,000/1,000,000 = .001). In addition, financial intermediaries do not have to sell assets as frequently as individuals (ceteris paribus, of course) because they can usually make payments out of inflows like deposits or premium payments. Their cash flow, in other words, reduces their liquidity costs. Individual investors, on the other hand, often find it necessary to sell assets (and incur the costs associated therewith) to pay their bills.

As specialists, financial intermediaries are also experts at what they do. That does not mean that they are perfect—far from it, as we learned during the financial crisis that began in 2007—but they are certainly more efficient at accepting deposits, making loans, or insuring risks than you or I will ever be (unless we work for a financial intermediary, in which case we’ll likely become incredibly efficient in one or at most a handful of functions). That expertise covers many areas, from database management to telecommunications. But it is most important in the reduction of asymmetric information.

You may recall from Chapter 2 "The Financial System" that we called asymmetric information the devil incarnate, a scourge of humanity second only to scarcity. That’s no exaggeration. Asymmetric information makes our markets, financial and otherwise, less efficient than they otherwise would be by allowing the party with superior information to take advantage of the party with inferior information. Where asymmetric information is high, resources are not put to their most highly valued uses, and it is possible to make outsized profits by cheating others. Asymmetric information, we believe, is what primarily gives markets, including financial markets, the bad rep they have acquired in some circles.

Figure 8.3 Adverse selection, moral hazard, and agency problems incarnate

© 2010 Jupiterimages Corporation

Financial intermediaries and markets can reduce or mitigate asymmetric information, but they can no more eliminate it than they can end scarcity. Financial markets are more transparent than ever before, yet dark corners remain.http://www.investopedia.com/articles/00/100900.asp The government and market participants can, and have, forced companies to reveal important information about their revenues, expenses, and the like, and even follow certain accounting standards.http://www.fasb.org/ As a CEO in a famous Wall Street Journal cartoon once put it, “All these regulations take the fun out of capitalism.” But at the edges of every rule and regulation there is ample room for shysters to play.http://knowledge.wharton.upenn.edu/article.cfm?articleid=585&CFID=4138806&CFTOKEN=88010645 When managers found that they could not easily manipulate earnings forecasts (and hence stock prices, as we learned in Chapter 7 "Rational Expectations, Efficient Markets, and the Valuation of Corporate Equities"), for example, they began to backdate stock optionsIn this context, a form of compensation given to executives, managers, and sometimes other employees to reward them for increasing their company’s stock price. By backdating the options, managers were able to profit from their stock options, although stock prices declined (or did not rise very much). to enrich themselves at the expense of stockholders and other corporate stakeholders.

What is the precise nature of this great asymmetric evil? Turns out this devil, this Cerberus, has three heads: adverse selection, moral hazard, and the principal-agent problem. Let’s lop off each head in turn.

Key Takeaways

- Transaction costs, asymmetric information, and the free-rider problem explain why most external finance is channeled through intermediaries.

- Most individuals do not control enough funds to invest profitably given the fact that fixed costs are high and variable costs are low in most areas of finance. In other words, it costs almost as much to buy 10 shares as it does to buy 10,000.

- Also, individuals do not engage in enough transactions to be proficient or expert at it.

- Financial intermediaries, by contrast, achieve minimum efficient scale and become quite expert at what they do, though they remain far from perfect.

- Transaction costs are any and all costs associated with completing an exchange.

- Transaction costs include, but are not limited to, broker commissions; dealer spreads; bank fees; legal fees; search, selection, and monitoring costs; and the opportunity cost of time devoted to investment-related activities.

- They are important because they detract from bottom-line profits, eliminating or greatly reducing them in the case of individuals and firms that have not achieved minimum efficient scale.

- Transaction costs are one reason why institutional intermediaries dominate external finance.

8.3 Adverse Selection

Learning Objective

- What problems do asymmetric information and, more specifically, adverse selection cause and how can they be mitigated?

The classic case of adverse selection, the one that brought the phenomenon backClassical economists like Adam Smith recognized adverse selection and asymmetric information more generally, but they did not label or stress the concepts.to the attention of economists in 1970, is the market for “lemons,” which is to say, breakdown-prone automobiles. The lemons story, with appropriate changes, applies to everything from horses to bonds, to lemons (the fruit), to construction services. That is because the lemons story is a simple but powerful one. People who offer lemons for sale know that their cars stink. Most people looking to buy cars, though, can’t tell that a car is prone to breakdown. They might kick the tires, take it for a short spin, look under the hood, etc., all without discovering the truth. The seller has superior information and indeed has an incentive to increase the asymmetry by putting a Band-Aid over any obvious problems. (He might, for example, warm the car up thoroughly before showing it, put top-quality gasoline in the tank, clean up the oil spots in the driveway, and so forth.) He may even explain that the car was owned by his poor deceased grandmother, who used it only to drive to church on Sundays (for services) and Wednesdays (for bingo), and that she took meticulous care of it. The hapless buyer, the story goes, offers the average price for used cars of the particular make, model, year, and mileage for sale. The seller happily (and greedily if you want to be moralistic about it) accepts. A day, week, month, or year later, the buyers learns that he has overpaid, that the automobile he purchased is a lemon. He complains to his relatives, friends, and neighbors, many of whom tell similar horror stories. A consensus emerges that all used cars are lemons.

Of course, some used cars are actually “peaches,” very reliable means of personal transportation. The problem is that owners of peaches can’t credibly inform buyers of the car’s quality. Oh, she can say, truthfully, that the car was owned by her poor deceased grandmother who used it only to drive to church on Sundays (for services) and Wednesdays (for bingo) and that she took meticulous care of it. But that sounds a lot like what the owner of the lemon says too. (In fact, we just copied and pasted it from above!) So the asymmetric information remains and the hapless buyer offers the average price for used cars of the particular make, model, year, and mileage for sale. (Another copy and paste job!) But this time the seller, instead of accepting the offer, gets offended and storms off (or at least declines). So the buyer’s relatives, friends, and neighbors are half right—not all the used cars for sale are lemons, but those that are bought are!

Now appears our hero, the used car dealer, who is literally a dealer in the same sense a securities dealer is: he buys from sellers at one (bid) price and then sells to buyers at a higher (ask) price. He earns his profits or spread by facilitating the market process by reducing asymmetric information. Relative to the common person, he is an expert at assessing the true value of used automobiles. (Or his operation is large enough that he can hire such people and afford to pay them. See the transaction costs section above.) So he pays more for peaches than lemons (ceteris paribus, of course) and the used car market begins to function at a much higher level of efficiency. Why is it, then, that the stereotype of the used car salesman is not very complimentary? That the guy in Figure 8.4 "Shady used car salesman." seems more typical than the guy in Figure 8.5 "Not-so-shady used car salesman."?

Figure 8.4 Shady used car salesman.

© 2010 Jupiterimages Corporation

Figure 8.5 Not-so-shady used car salesman.

© 2010 Jupiterimages Corporation

Several explanations come to mind. The market for used car dealers may be too competitive, leading to many failures, which gives dealers incentives to engage in rent seeking (ripping off customers) and disincentives to establish long-term relationships. Or the market may not be competitive enough, perhaps due to high barriers to entry. Because sellers and buyers have few choices, dealers find that they can engage in sharp business practiceshttp://www.m-w.com/dictionary/sharp and still attract customers as long as they remain better than the alternative, the nonfacilitated market. I think the latter more likely because in recent years, many used car salesmen have cleaned up their acts in the face of national competition from the likes of AutoNation and similar companies.http://en.wikipedia.org/wiki/AutoNation Moreover, CarFax.com and similar companies have reduced asymmetric information by tracking vehicle damage using each car’s unique vehicle identification number (VIN), making it easier for buyers to reduce asymmetric information without the aid of a dealer.

What does this have to do with the financial system? Plenty, as it turns out. As noted above, adverse selection applies to a wide variety of markets and products, including financial ones. Let’s suppose that, like our friend Mr. Knapp above, you have some money to lend and the response to your advertisement is overwhelming. Many borrowers are in the market. Information is asymmetric—you can’t really tell who the safest borrowers are. So you decide to ration the credit as if it were apples, by lowering the price you are willing to give for their bonds (raising the interest rate on the loan). Big mistake! As the interest rate increases (the sum that the borrower/securities seller will accept for his IOU decreases), the best borrowers drop out of the bidding. After all, they know that their projects are safe, that they are the equivalent of an automotive peach. People with riskier business projects continue bidding until they too find the cost of borrowing too high and bow out, leaving you to lend to some knave, to some human lemon, at a very high rate of interest. That, our friend, is adverse selection.

Adverse selection also afflicts the market for insurance. Safe risks are not willing to pay much for insurance because they know that the likelihood that they will suffer a loss and make a claim is low. Risky firms, by contrast, will pay very high rates for insurance because they know that they will probably suffer a loss. Anyone offering insurance on the basis of premium alone will end up with the stinky end of the stick, just as the lender who rations on price alone will.

Like used car dealers, financial facilitators and intermediaries seek to profit by reducing adverse selection. They do so by specializing in discerning good from bad credit and insurance risks. Their main weapon here is called screening and it’s what all those forms and questions are about when you apply for a loan or insurance policy. Potential lenders want to know if you pay your bills on time, if your income minus expenses is large and stable enough to service the loan, if you have any collateral that might protect them from loss, and the like. Potential insurers want to know if you have filed many insurance claims in the past because that may indicate that you are clumsy; not very careful with your possessions; or worse, a shyster who makes a living filing insurance claims. They also want to know more about the insured property so they don’t insure it for too much, a sure inducement to start a fire or cause an accident. They also need to figure out how much risk is involved, how likely a certain type of car is to be totaled if involved in an accident,http://www.edmunds.com/ownership/safety/articles/43804/article.html the probability of a wood-frame house burning to the ground in a given area,http://www.usfa.dhs.gov/statistics/estimates/index.shtm the chance of a Rolex watch being stolen, and so forth.

Stop and Think Box

Credit-protection insurance policies promise to make payments to people who find themselves unemployed or incapacitated. Whenever solicited to buy such insurance, I (Wright) always ask how the insurer overcomes adverse selection because there are never any applications or premium schedules, just one fixed rate. Why do I care?

I care because I’m a peach of a person. I know that if I lived a more dangerous lifestyle or was employed in a more volatile industry that I’d snap the policy right up. Given my current situation, however, I don’t think it very likely that I will become unemployed or incapacitated, so I don’t feel much urgency to buy such a policy at the same rate as some guy or gal who’s about to go skydiving instead of going to work. I don’t want to subsidize them or to deal with a company that doesn’t know the first thing about insurance.

Financial intermediaries are not perfect screeners. They often make mistakes. Insurers like State Farm, for example, underestimated the likelihood of a massive storm like Katrina striking the Gulf Coast. And subprime mortgage lenders, companies that lend to risky borrowers on the collateral of their homes, grossly miscalculated the likelihood that their borrowers would default. Competition between lenders and insurers induces them to lower their screening standards to make the sale. (In a famous cartoon in the Wall Street Journal, a clearly nonplussed father asks a concerned mom how their son’s imaginary friend got preapproved for a credit card.) At some point, though, adverse selection always rears its ugly head, forcing lenders and insurance providers to improve their screening procedures and tighten their standards once again. And, on average, they do much better than you or I acting alone could do.

Another way of reducing adverse selection is the private production and sale of information. Companies like Standard and Poor’s, Bests, Duff and Phelps, Fitch’s, and Moody’s used to compile and analyze data on companies, rate the riskiness of their bonds, and then sell that information to investors in huge books. The free-rider problemTrying to hop a ride without paying for it. More technically, it is any behavior where a party takes more than his or her fair share of the benefits, or does not pay his or her fair share of the costs, of some activity., though, killed off that business model. Specifically, the advent of cheap photocopying induced people to buy the books, photocopy them, and sell them at a fraction of the price that the bond-rating agencies could charge. (The free riders had to pay only the variable costs of publication; the rating agencies had to pay the large fixed costs of compiling and analyzing the data.) So in the mid-1970s, the bond-rating agencies began to give their ratings away to investors and instead charged bond issuers for the privilege of being rated. The new model greatly decreased the effectiveness of the ratings because the new arrangement quickly led to rating inflation similar to grade inflation. (Pleasure flows with the cash. Instead of pleasing investors, the agencies started to please the issuers.) After every major financial crisis, including the subprime mortgage mess of 2007, academics and former government regulators lambaste credit-rating agencies for their poor performance relative to markets and point out the incentive flaws built into their business model. Thus far, little has changed, but encrypted databases might allow a return to the investor-pay model. But then another form of free riding would arise as investors who did not subscribe to the database would observe and mimic the trades of those investors known to have subscriptions. Due to the free-rider problem inherent in markets, banks and other financial intermediaries have incentives to create private information about borrowers and people who are insured. This helps to explain why they trump bond and stock markets.

Governments can no more legislate away adverse selection than they can end scarcity by decree. They can, however, give markets and intermediaries a helping hand. In the United States, for example, the Securities and Exchange Commission (SEC) tries to ensure that corporations provide market participants with accurate and timely information about themselves, reducing the information asymmetry between themselves and potential bond- and stockholders.http://www.sec.gov/ Like sellers of lemons, however, bad companies often outfox the SEC (and similar regulators in other countries) and investors, especially when said investors place too much confidence in government regulators. In 2001, for example, a high-flying energy trading company named Enron suddenly encountered insurmountable financial difficulties and was forced to file for bankruptcy, the largest in American history at that time. Few saw Enron’s implosion coming because the company hid its debt and losses in a maze of offshore shell companies and other accounting smokescreens. Some dumbfounded investors hadn’t bothered watching the energy giant because they believed the government was doing it for them. It wasn’t.

Key Takeaways

- Asymmetric information decreases the efficiency of financial markets, thereby reducing the flow of funds to entrepreneurs and injuring the real economy.

- Adverse selection is precontractual asymmetric information.

- It can be mitigated by screening out high-risk members of the applicant pool.

- Financial market facilitators can also become expert specialists and attain minimum efficient scale, but financial markets are hampered by the free-rider problem.

- In short, few firms find it profitable to produce information because it is easy for others to copy and profit from it. Banks and other intermediaries, by contrast, create proprietary information about their borrowers and people they insure.

8.4 Moral Hazard

Learning Objective

- What is moral hazard and how can it be mitigated?

Adverse selection is precontractual asymmetric information. Moral hazard is postcontractual asymmetric information. It occurs whenever a borrower or insured entity (an approved borrower or policyholder, not a mere applicant) engages in behaviors that are not in the best interest of the lender or insurer. If a borrower uses a bank loan to buy lottery tickets instead of Treasuries, as agreed upon with the lender, that’s moral hazard. If an insured person leaves the door of his or her home or car unlocked or lets candles burn all night unattended, that’s moral hazard. It’s also moral hazard if a borrower fails to repay a loan when he has the wherewithal to do so, or if an insured driver fakes an accident.

We call such behavior moral hazard because it was long thought to indicate a lack of morals or character and in a sense it does. But thinking about the problem in those terms does not help to mitigate it. We all have a price. How high that price is can’t be easily determined and may indeed change, but offered enough money, every human being (except maybe Gandhi, prophets, and saints) will engage in immoral activities for personal gain if given the chance. It’s tempting indeed to put other people’s money at risk. As we’ve learned, the more risk, the more reward. Why not borrow money to put to risk? If the rewards come, the principal and interest are easily repaid. If the rewards don’t come, the borrower defaults and suffers but little. Back in the day, as they say, borrowers who didn’t repay their loans were thrown into jail until they paid up. Three problems eventually ended that practice. First, it is difficult to earn money to repay the loan when you’re imprisoned! (The original assumption was that the borrower had the money but wouldn’t cough it up.) Second, not everyone defaults on a loan due to moral hazard. Bad luck, a soft economy, and/or poor execution can turn the best business plan to mush. Third, lenders are almost as culpable as the borrowers for moral hazard if they don’t take steps to try to mitigate it. A locked door, an old adage goes, keeps an honest man honest. Don’t tempt people, in other words, and most won’t rob you. There are locks against moral hazard. They are not foolproof but they get the job done most of the time.

Stop and Think Box

Investment banks engage in many activities, two of which, research and underwriting, have created conflicts of interest. The customers of ibanks’ research activities, investors, want unbiased information. The customers of ibanks’ underwriting activities, bond issuers, want optimistic reports. A few years back, problems arose when the interests of bond issuers, who provided ibanks with most of their profits, began to supersede the interests of investors. Specifically, ibank managers forced their research departments to avoid making negative or controversial comments about clients. The situation grew worse during the Internet stock mania of the late 1990s, when ibank research analysts like Jack Grubman (a Dickensian name but true!) of Citigroup (then Salomon Smith Barney) made outrageous claims about the value of high-tech companies. That in itself wasn’t evil because everyone makes mistakes. What raised hackles was that the private e-mails of those same analysts indicated that they thought the companies they were hyping were extremely weak. And most were. What sort of problem does this particular conflict of interest represent? How does it injure the economy? What can be done to rectify the problem?

This is an example of asymmetric information and, more specifically, moral hazard. Investors contracted with the ibanks for unbiased investment research but instead received extremely biased advice that induced them to pay too much for securities, particularly the equities of weak tech companies. As a result, the efficiency of our financial markets decreased as resources went to firms that did not deserve them and could not put them to their most highly valued use. That, of course, injured economic growth. One way to solve this problem would be to allow ibanks to engage in securities underwriting or research, but not both. That would make ibanks less profitable, though, as doing both creates economies of scope. (That’s why ibanks got into the business of selling research in the first place.) Another solution is to create a “Chinese wall” within each ibank between their research and underwriting departments. This apparent reference to the Great Wall of China, which despite its grandeur was repeatedly breached by “barbarian” invaders with help from insiders, also belies that strategy’s weakness.http://en.wikipedia.org/wiki/Great_Wall_of_China If the wall is so high that it is impenetrable, then the economies of scope are diminished to the vanishing point. If the wall is low or porous, then the conflict of interest can again arise. Rational expectations and transparency could help here. Investors now know (or at least could/should know) that ibanks can provide biased research reports and hence should remain wary. Government regulations could help here by mandating that ibanks completely and accurately disclose their interests in the companies that they research and evaluate. That extra transparency would then allow investors to discount rosy prognostications that appear to be driven by ibanks’ underwriting interests. The Global Legal Settlement of 2002, which was brokered by Eliot Spitzer (then New York State Attorney General and New York’s governor until he ran into a little moral hazard problem himself!), bans spinning, requires investment banks to sever the links between underwriting and research, and slapped a $1.4 billion fine on the ten largest ibanks.

The main weapon against moral hazard is monitoring, which is just a fancy term for paying attention! No matter how well they have screened (reduced adverse selection), lenders and insurers cannot contract and forget. They have to make sure that their customers do not use the superior information inherent in their situation to take advantage. Banks have a particularly easy and powerful way of doing this: watching checking accounts. Banks rarely provide cash loans because the temptation of running off with the money, the moral hazard, would be too high. Instead, they credit the amount of the loan to a checking account upon which the borrower can draw funds. (This procedure has a second positive feature for banks called compensatory balances. A loan for, say, $1 million does not leave the bank at once but does so only gradually. That raises the effective interest rate because the borrower pays interest on the total sum, not just that drawn out of the bank.) The bank can then watch to ensure that the borrower is using the funds appropriately. Most loans contain restrictive covenantsClauses in loan contracts that restrict the uses to which borrowed funds can be put and otherwise direct borrower behavior., clauses that specify in great detail how the loan is to be used and how the borrower is to behave. If the borrower breaks one or more covenants, the entire loan may fall due immediately. Covenants may require that the borrower obtain life insurance, that he or she keep collateral in good condition, or that various business ratios be kept within certain parameters.http://www.toolkit.cch.com/text/P06_7100.asp Often, loans will contain covenants requiring borrowers to provide lenders with various types of information, including audited financial reports, thus minimizing the lender’s monitoring costs.

Another powerful way of reducing moral hazard is to align incentives. That can be done by making sure the borrower or insured has some skin in the game,http://www.answers.com/topic/skin-in-the-game that he, she, or it will suffer if a loan goes bad or a loss is incurred. That will induce the borrower or insured to behave in the lender’s or insurer’s best interest. Collateral, property pledged for the repayment of a loan, is a good way to reduce moral hazard. Borrowers don’t take kindly to losing, say, their homes. Also, the more equity they have—in their home or business or investment portfolio—the harder they will fight to keep from losing it. Some will still default, but not purposely. In other words, the higher one’s net worth (market value of assets minus market value of liabilities), the less likely one is to default, which could trigger bankruptcy proceedings that would reduce or even wipe out the borrower’s net worth. This is why, by the way, it is sometimes alleged that you have to have money to borrow money. That isn’t literally true, of course. What is true is that owning assets free and clear of debt makes it much easier to borrow.

Similarly, insurers long ago learned that they should insure only a part of the value of a ship, car, home, or life. That is why they insist on deductibles or co-insurance. If you will lose nothing if you total your car, you might attempt that late-night trip on icy roads or sign up for a demolition derby. If an accident will cost you $500 (deductible) or 20 percent of the costs of the damage (co-insurance), you will think twice or thrice before doing something risky with your car.

When it comes to reducing moral hazard, financial intermediaries have advantages over individuals. Monitoring is not cheap. Indeed, economists sometimes refer to it as “costly state verification.” Economies of scale give intermediaries an upper hand. Monitoring is also not easy, so specialization and expertise also render financial intermediaries more efficient than individuals at reducing moral hazard. If nothing else, financial intermediaries can afford to hire the best legal talent to frighten the devil out of would-be scammers. Borrowers can no longer be imprisoned for defaulting, but they can go to prison for fraud. Statutes against fraud are one way that the government helps to chop at the second head of the asymmetric information Cerberus.

Financial intermediaries also have monitoring advantages over markets. Bondholder A will try to free-ride on Bondholder B, who will gladly let Bondholder C suffer the costs of state verification, and all of them hope that the government will do the dirty work. In the end, nobody may monitor the bond issuer.

Key Takeaways

- Moral hazard is postcontractual asymmetric information.

- Moral hazard can be mitigated by monitoring counterparties after contracting.

8.5 Agency Problems

Learning Objective

- What are agency problems and how can they be mitigated?

The principal-agent problem is an important subcategory of moral hazard that involves postcontractual asymmetric information of a specific type. In many, nay, most instances, principals (owners) must appoint agents (employees) to conduct some or all of their business affairs on their behalf. Stockholders in joint-stock corporations, for example, hire professional managers to run their businesses. Those managers in turn hire other managers, who in turn hire supervisors, who then hire employees (depending on how hierarchical the company is). The principal-agent problem arises when any of those agents does not act in the best interest of the principal, for example, when employees and/or managers steal, slack off, act rudely toward customers, or otherwise cheat the company’s owners. If you’ve ever held a job, you’ve probably been guilty of such activities yourself. (We admit we have, but it’s best not to get into the details!) If you’ve ever been a boss, or better yet an owner, you’ve probably been the victim of agency problems. (Wright has been on this end too, like when he was eight years old and his brother told him their lemonade stand had revenues of only $1.50 when in fact it brought in $10.75. Hey, that was a lot of money back then!)

Stop and Think Box

As one of the authors of this textbookhttp://ideas.repec.org/a/taf/acbsfi/v12y2002i3p419-437.html and many others have pointed out, investment banks often underprice stock initial public offerings (IPOs). In other words, they offer the shares of early-stage companies that decide to go public for too little money, as evidenced by the large first day “pops” or “bumps” in the stock price in the aftermarket (the secondary market). Pricing the shares of a new company is tricky business, but the underpricing was too prevalent to have been honest errors, which one would think would be too high about half of the time and too low the other half. All sorts of reasons were proffered for the systematic underpricing, including the fact that many shares could not be “flipped” or resold for some weeks or months after the IPO. Upon investigation, however, a major cause of underpricing turned out to be a conflict of interest called spinning: ibanks often purposely underpriced IPOs so that there would be excess demand, so that investors would demand a larger quantity of shares than were being offered. Whenever that occurs, shares must be rationed by nonprice mechanisms. The ibanks could then dole out the hot shares to friends or family, and, in return for future business, the executives of other companies! Who does spinning hurt? Help? Be as specific as possible.

Spinning hurts the owners of the company going public because they do not receive as much from the IPO as they could have if the shares were priced closer to the market rate. It may also hurt investors in the companies whose executives received the underpriced shares who, in reciprocation for the hot shares, might not use the best ibank when their companies later issue bonds or stock or attempt a merger or acquisition. Spinning helps the ibank by giving it a tool to acquire more business. It also aids whoever gets the underpriced shares.

Monitoring helps to mitigate the principal-agent problem. That’s what supervisors, cameras, and corporate snitches are for. Another, often more powerful way of reducing agency problems is to try to align the incentives of employees with those of owners by paying efficiency wagesWages higher than the equilibrium or market clearing rate. Employers offer them to reduce agency problems, hoping employees will value their jobs so much they will try to please owners by behaving in the owners’ interest., commissions, bonuses, stock options, and the like. Caution is the watchword here, though, because people will do precisely what they have incentive to do. Failure to recognize that apparently universal human trait has had adverse consequences for some organizations, a point made in business schools through easily understood case stories. In one story, a major ice cream retailer decided to help out its employees by allowing them to consume, free of charge, any mistakes they might make in the course of serving customers. What was meant to be an environmentally sensitive (no waste) little perk turned into a major problem as employee waistlines bulged and profits shrank because hungry employees found it easy to make delicious frozen mistakes. (“Oh, you said chocolate. I thought you said my favorite flavor, mint chocolate chip. Excuse me because I am now on break.”)

In another story, a debt collection agency reduced its efficiency and profitability by agreeing to a change in the way that it compensated its collectors. Initially, collectors received bonuses based on the dollars collected divided by the dollars assigned to be collected. So, for example, a collector who brought in $250,000 of the $1 million due on his accounts would receive a bigger bonus than a collector who collected only $100,000 of the same denominator (250/1,000 = .25 > 100/1,000 = .10). Collectors complained, however, that it was not fair to them if one or more of their accounts went bankrupt, rendering collection impossible. The managers of the collection agency agreed and began to deduct the value of bankrupt accounts from the collectors’ denominators. Under the new incentive scheme, a collector who brought in $100,000 would receive a bigger bonus than his colleague if, say, $800,000 of his accounts claimed bankruptcy (100/[1,000 – 800 = 200] = .5, which is > 250/1,000 = .25). Soon, the collectors transformed themselves into bankruptcy counselors! The new scheme inadvertently created a perverse incentive, that is, one diametrically opposed to the collection agency’s interest, which was to collect as many dollars as possible, not to help debtors file for bankruptcy.

In a competitive market, pressure from competitors and the incentives of managers would soon rectify such mishaps. But when the incentive structure of management is out of kilter, bigger and deeper problems often appear. When managers are paid with stock options, for instance, they are given an incentive to increase stock prices, which they almost invariably do, sometimes by making their companies’ more efficient but sometimes, as investors in the U.S. stock market in the late 1990s learned, through accounting legerdemain. Therefore, corporate governance looms large and requires constant attention from shareholders, business consulting firms, and government regulators.

A free-rider problem, however, makes it difficult to coordinate the monitoring activities that keep agents in line. If Stockholder A watches management, then Stockholder B doesn’t have to but he will still reap the benefits of the monitoring. Ditto with Stockholder A, who sits around hoping Stockholder B will do the dirty and costly work of monitoring executive pay and perks, and the like. Often, nobody ends up monitoring managers, who raise their salaries to obscene levels, slack off work, go empire-building, or all three!http://www.investopedia.com/terms/e/empirebuilding.asp This governance conundrum helps to explain why the sale of stocks is such a relatively unimportant form of external finance worldwide.

Governance becomes less problematic when the equity owner is actively involved in management. That is why investment banker J. P. Morgan used to put “his people” (principals in J.P. Morgan and Company) on the boards of companies in which Morgan had large stakes. A similar approach has long been used by Warren Buffett’s Berkshire Hathaway. Venture capital firms also insist on taking some management control and have the added advantage that the equity of startup firms does not, indeed cannot, trade. (It does only after it holds an IPOOffering of stock to investors with the aid of an investment bank. or direct public offering [DPOOffering of stock to investors without the aid of an investment bank.]). So other investors cannot free-ride on its costly state verification. The recent interest in private equity, funds invested in privately owned (versus publicly traded) companies, stems from this dynamic as well as the desire to avoid costly regulations like Sarbanes-Oxley.http://www.sec.gov/info/smallbus/pnealis.pdf

Stop and Think Box

Investment banks are not the only financial services firms that have recently suffered from conflicts of interest. Accounting firms that both audit (confirm the accuracy and appropriateness of) corporate financial statements and provide tax, business strategy, and other consulting services found it difficult to reconcile the conflicts inherent in being both the creator and the inspector of businesses. Auditors were too soft in the hopes of winning or keeping consulting business because they could not very well criticize the plans put in place by their own consultants. One of the big five accounting firms, Arthur Andersen, actually collapsed after the market and the SEC discovered that its auditing procedures had been compromised. How could this type of conflict of interest be reduced?

In this case, simply informing investors of the problem would probably not work. Financial statements have to be correct; the free-rider problem ensures that no investor would have an incentive to verify them him- or herself. The traditional solution to this problem was the auditor and no better one has yet been found. But the question is, How to ensure that auditors do their jobs? One answer, enacted in the Sarbanes-Oxley Act of 2002 (aka SOX and Sarbox), is to establish a new regulator, the Public Company Accounting Oversight Board (PCAOB) to oversee the activities of auditors.http://www.pcaobus.org/ The law also increased the SEC’s budget (but it’s still tiny compared to the grand scheme of things), made it illegal for accounting firms to offer audit and nonaudit services simultaneously, and increased criminal charges for white-collar crimes. The most controversial provision in SOX requires corporate executive officers (CEOs) and corporate financial officers (CFOs) to certify the accuracy of corporate financial statements and requires corporate boards to establish unpaid audit committees composed of outside directors, that is, directors who are not members of management. The jury is still out on SOX. The consensus so far appears to be that it is overkill: that it costs too much given the benefits it provides.

Government regulators try to reduce asymmetric information. Sometimes they succeed. Often, however, they do not. Asymmetric information is such a major problem, however, that their efforts will likely continue, whether all businesses like it or not.

Key Takeaways

- Agency problems are a special form of moral hazard involving employers and employees or other principal-agent relationships.

- Agency problems can be mitigated by closely aligning the incentives of the agents (employees) with those of the principal (employer).

- Regulations are essentially attempts by the government to subdue the Cerberus of asymmetric information.

- Some government regulations, like laws against fraud, are clearly necessary and highly effective.

- Others, though, like parts of Sarbanes-Oxley, may add to the costs of doing business without much corresponding gain.

8.6 Suggested Reading

Allen, Franklin, and Douglas Gale. Comparing Financial Systems. Cambridge, MA: MIT Press, 2001.

Demirguc-Kunt, Asli, and Ross Levine. Financial Structure and Economic Growth: A Cross-Country Comparison of Banks, Markets, and Development. Cambridge, MA: MIT Press, 2004.

Laffont, Jean-Jacques, and David Martimort. The Theory of Incentives: The Principal-Agent Model. Princeton, NJ: Princeton University Press, 2001.