This is “The Economics of Interest-Rate Spreads and Yield Curves”, chapter 6 from the book Finance, Banking, and Money (v. 1.1). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 6 The Economics of Interest-Rate Spreads and Yield Curves

Chapter Objectives

By the end of this chapter, students should be able to:

- Define the risk structure of interest rates and explain its importance.

- Explain the term flight to quality.

- Define the term structure of interest rates and explain its importance.

- Describe a yield curve and explain its economic meaning.

6.1 A Short History of Interest Rates

Learning Objective

- How and why has the interest rate changed in the United States over time?

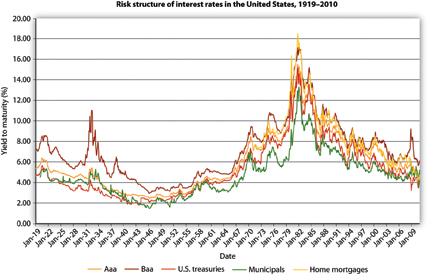

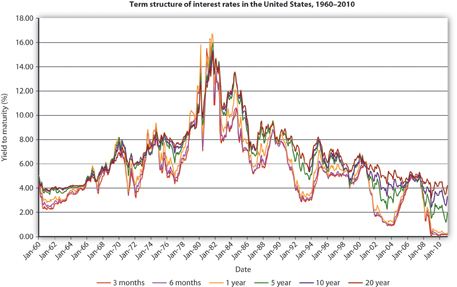

In Chapter 5 "The Economics of Interest-Rate Fluctuations" you learned about the factors that influence “the” interest rate, or in other words the general level of interest rates. For the sake of clarity, we ignored the fact that different types of financial instruments have different interest rates. We were able to do so because interest rate movements are highly correlated. In other words, they track each other closely, as Figure 6.1 "The risk structure of interest rates in the United States, 1919–2010" and Figure 6.2 "The term structure of interest rates in the United States, 1960–2010" show.

Figure 6.1 The risk structure of interest rates in the United States, 1919–2010

Figure 6.2 The term structure of interest rates in the United States, 1960–2010

The graphs reveal that interest rates generally trended downward from 1920 to 1945, then generally rose until the early 1980s, when they began trending downward again through 2010. Given what you learned in Chapter 5 "The Economics of Interest-Rate Fluctuations", you should be able to understand the basic causes underlying those general trends. During the 1920s, general business conditions were favorable (President Calvin Coolidge summed this up when he said, “The business of America is business”), so the demand for bonds increased (the demand curve shifted right), pushing prices higher and yields lower. The 1930s witnessed the Great Depression, an economic recession of unprecedented magnitude that dried up profit opportunities for businesses and hence shifted the supply curve of bonds hard left, further increasing bond prices and depressing yields. (If the federal government had not run budget deficits some years during the depression, the interest rate would have dropped even further.) During World War II, the government used monetary policy to keep interest rates low (as we’ll see in Chapter 16 "Monetary Policy Tools"). After the war, that policy came home to roost as inflation began, for the first time in American history, to become a perennial fact of life. Contemporaries called it creeping inflation. A higher price level, of course, put upward pressure on the interest rate (think Fisher Equation and Keynes’s real nominal balances). The unprecedented increase in prices during the 1970s (what some have called creepy inflation and others the Great Inflation) drove nominal interest rates higher still. Only in the early 1980s, after the Federal Reserve mended its ways (a topic to which we will return) and brought inflation under control, did the interest rate begin to fall. Positive geopolitical events in the late 1980s and early 1990s, namely, the end of the cold war and the birth of what we today call globalization, also helped to reduce interest rates by rendering the general business climate more favorable (thus pushing the demand curve for bonds to the right, bond prices upward, and yields downward). Pretty darn neat, eh?

Key Takeaways

- When general business conditions were favorable, demand for bonds increased (the demand curve shifted right), pushing prices higher and yields lower.

- When general business conditions were unfavorable, profit opportunities for businesses dried up, shifting the supply curve of bonds left, further increasing bond prices and depressing yields.

- During inflationary periods, interest rates rose per the Fisher Equation and Keynes’s real nominal balances.

- The end of the cold war and the birth of globalization helped to reduce interest rates by rendering the general business climate more favorable (thus pushing the demand curve for bonds to the right, bond prices upward, and yields downward).

6.2 Interest-Rate Determinants I: The Risk Structure

Learning Objective

- What is the risk structure of interest rates and flight to quality, and what do they explain?

In this chapter, we’re going to figure out, as best we can, why yields on different types of bonds differ. The analysis will help us to understand a couple of interesting features of Figure 6.1 "The risk structure of interest rates in the United States, 1919–2010" and Figure 6.2 "The term structure of interest rates in the United States, 1960–2010":

- Why the yields on Baa corporate bonds are always higher than the yields on Aaa corporate bonds, which in turn are higher than those on Treasury bonds (issued by the federal government), which for a long time have been higher still than those on munis (bonds issued by municipalities, like state and local governments)

- Why the yields on corporate Baa bonds bucked the trend of lower rates in the early 1930s and why, at one time, municipal bonds yielded more than Treasuries

- Why bonds issued by the same economic entity (the U.S. government) with different maturities generally, but not always, have different yields and why the rank ordering changes over time

Figure 6.1 "The risk structure of interest rates in the United States, 1919–2010", which holds maturity constant, is the easiest to understand because we’ve already discussed the major concepts. We’ll tackle it, and what economists call the risk structure of interest rates, first. Remember from Chapter 5 "The Economics of Interest-Rate Fluctuations" that investors care mostly about three things: risk, return, and liquidity. Because the bonds in Figure 6.1 "The risk structure of interest rates in the United States, 1919–2010" are all long-term bonds, their expected relative returns might appear at first glance to be identical. Investors know, however, that bonds issued by different economic entities have very different probabilities of defaulting. Specifically, they know the following:

- The U.S. government has never defaulted on its bonds and is extremely unlikely to do so because even if its much-vaunted political stability were to be shattered and its efficient tax administration (that wonderful institution, the Internal Revenue Service [IRS]) were to stumble, it could always meet its nominal obligations by creating money. (That might create inflation, as it has at times in the past. Nevertheless, except for a special type of bond called TIPS, the government and other bond issuers promise to pay a nominal value, not a real [inflation-adjusted] sum, so the government does not technically default when it pays its obligations by printing money.)

- Municipalities have defaulted on their bonds in the past and could do so again in the future because, although they have the power to tax, they do not have the power to create money at will. (Although in the past, most recently during the Great Depression, some issued money-like—let’s call them extralegal—bills of credit, or chits.) Nevertheless, the risk of default on municipal bonds (aka munis) is often quite low, especially for revenue bonds, upon which specific taxes and fees are pledged for interest payments.

- Munis are exempt from most forms of income taxation.

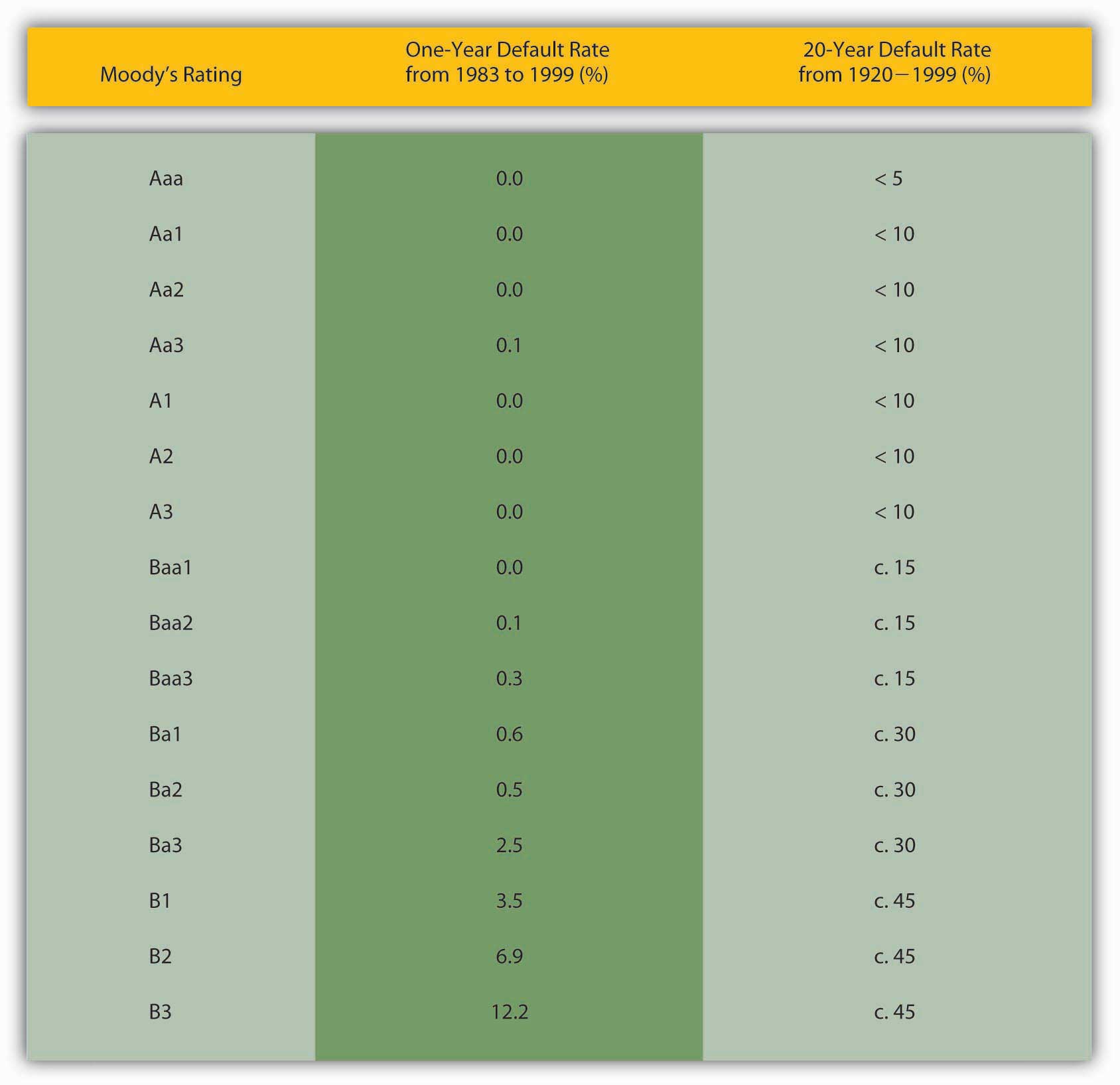

- Corporations are more likely to default on their bonds than governments are because they must rely on business conditions and management acumen. They have no power to tax and only a limited ability to create the less-liquid formsof money, a power that decreases in proportion to their need! (I’m thinking of gift cards, declining balance debit cards, trade credit, and so forth.) Some corporations are more likely to default on their bonds than others. Several credit-rating agencies, including Moody’s and Standard and Poor’s, assess the probability of default and assign grades to each bond. There is quite a bit of grade inflation built in (the highest grade being not A or even A+ but Aaa), the agencies are rife with conflicts of interest, and the market usually senses problems before the agencies do. Nevertheless, bond ratings are a standard proxy for default risk because, as Figure 6.3 "Default rates on bonds rated by Moody’s from 1983 to 1999" shows, lower-rated bonds are indeed more likely to default than higher-rated ones. Like Treasuries, corporate bonds are fully taxable.

- The most liquid bond markets are usually those for Treasuries. The liquidity of corporate and municipal bonds is usually a function of the size of the issuer and the amount of bonds outstanding. So the bonds of the state of New Jersey might be more liquid than those of a small corporation, but less liquid than the bonds of, say, General Electric.

Figure 6.3 Default rates on bonds rated by Moody’s from 1983 to 1999

Equipped with this knowledge, we can easily understand the reasons for the rank ordering in Figure 6.1 "The risk structure of interest rates in the United States, 1919–2010". Corporate Baa bonds have the highest yields because they have the highest default risk (of those graphed), and the markets for their bonds are generally not very liquid. Corporate Aaa bonds are next because they are relatively safer (less default risk) than Baa bonds and they may be relatively liquid, too. U.S. Treasuries are extremely safe and the markets for them are extremely liquid, so their yields are lower than those of corporate bonds. In other words, investors do not need as high a yield to own Treasuries as they need to own corporates. Another way to put this is that investors place a positive risk premium (to be more precise, a credit or default risk, liquidity, and tax premium) on corporate bonds.

Stop and Think Box

Corporate bond ratings go all the way down to C (Moody’s) or D (Standard and Poor’s). (These used to be called high-yield or junk bonds but are now generally referred to as B.I.G. or below investment grade bonds.) If plotted on Figure 6.1 "The risk structure of interest rates in the United States, 1919–2010", where would the yields of such bonds land? How do you know?

They would have higher yields and hence would be above the Baa line because they would have a higher default risk, the same tax treatment, and perhaps less liquidity.

The low yield on munis is best explained by their tax exemptions. Before income taxes became important, the yield on munis was higher than that of Treasuries, as we would expect given that Treasuries are more liquid and less likely to default. During World War II, investors, especially wealthy individuals, eager for tax-exempt income and convinced that the fiscal problems faced by many municipalities during the depression were over, purchased large quantities of municipal bonds, driving their prices up (and their yields down). Almost all the time since, tax considerations, which are considerable given our highest income brackets exceed 30 percent, have overcome the relatively high default risk and illiquidity of municipal bonds, rendering them more valuable than Treasuries, ceteris paribus.

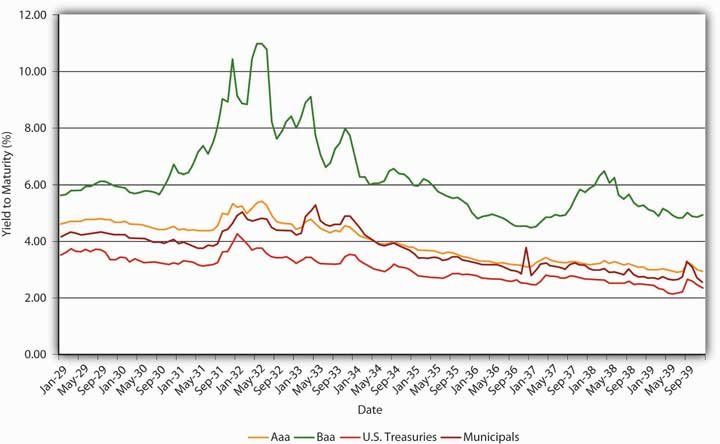

Figure 6.4 Risk premiums and bond spreads during the Great Depression, 1929–1939

Risk, after-tax returns, and liquidity also help to explain changes in spreads, the difference between yields of bonds of different types (the distance between the lines in Figure 6.1 "The risk structure of interest rates in the United States, 1919–2010" and Figure 6.4 "Risk premiums and bond spreads during the Great Depression, 1929–1939"). The big spike in Baa bond yields in the early 1930s, the darkest days of the Great Depression, was due to one simple cause: companies with Baa bond ratings were going belly-up left and right, leaving bondholders hanging. As Figure 6.4 "Risk premiums and bond spreads during the Great Depression, 1929–1939" shows, companies that issued Aaa bonds, municipalities, and possibly even the federal government were also more likely to default in that desperate period, but they were not nearly as likely to as weaker companies. Yields on their bonds therefore increased, but only a little, so the spread between Baa corporates and other bonds increased considerably in those troubled years. In better times, the spreads narrowed, only to widen again during the so-called Roosevelt Recession of 1937–1938.

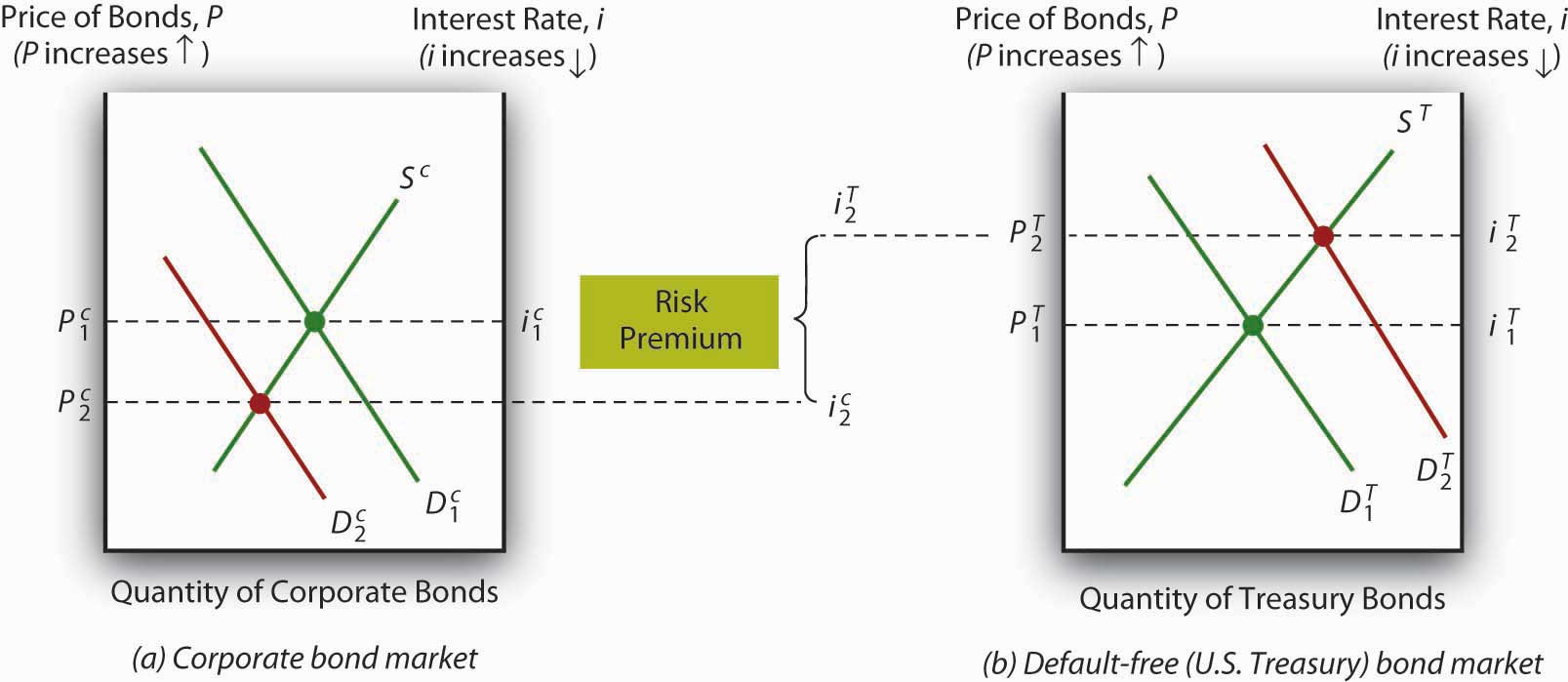

Figure 6.5 The flight to quality (Treasuries) and from risk (corporate securities)

During crises, spreads can quickly soar because investors sell riskier assets, like Baa bonds, driving their prices down, and simultaneously buy safe ones, like Treasuries, driving their prices up. This so-called flight to quality is represented in Figure 6.5 "The flight to quality (Treasuries) and from risk (corporate securities)".

Stop and Think Box

In the confusion following the terrorist attacks on New York City and Washington, DC, in September 2001, some claimed that people who had prior knowledge of the attacks made huge profits in the financial markets. How would that have been possible?

The most obvious way, given the analyses provided in this chapter, would have been to sell riskier corporate bonds and buy U.S. Treasuries on the eve of the attack in expectation of a flight to quality, the mass exchange of risky assets (and subsequent price decline) for safe ones (and subsequent price increase).

Time for a check of your knowledge.

Exercises

- What would happen to the spreads between different types of bonds if the federal government made Treasuries tax-exempt and at the same time raised income taxes considerably?

- If the Supreme Court unexpectedly declared a major source of municipal government tax revenue illegal, what would happen to municipal bond yields?

- If several important bond brokers reduced the brokerage fee they charge for trading Baa corporate bonds (while keeping their fees for other bonds the same), what would happen to bond spreads?

- What happened to bond spreads when Enron, a major corporation, collapsed in December 2001?

Key Takeaways

- The risk structure of interest rates explains why bonds of the same maturity but issued by different economic entities have different yields (interest rates).

- The three major risks are default, liquidity, and after-tax return.

- By concentrating on the three major risks, you can ascertain why some bonds are more (less) valuable than others, holding their term (repayment date) constant.

- You can also post-dict, if not outright predict, the changes in rank order as well as the spread (or difference in yield) between different types of bonds.

- A flight to quality occurs during a crisis when investors sell risky assets (like below-investment-grade bonds) and buy safe ones (like Treasury bonds or gold).

6.3 The Determinants of Interest Rates II: The Term Structure

Learning Objective

- What is the term structure of interest rates and the yield curve, and what do they explain?

Now we are going to hold the risk structure of interest rates—default risk, liquidity, and taxes—constant and concentrate on what economists call the term structure of interest rates, the variability of returns due to differing maturities. As Figure 6.4 "Risk premiums and bond spreads during the Great Depression, 1929–1939" reveals, even bonds from the same issuer, in this case, the U.S. government, can have yields that vary according to the length of time they have to run before their principals are repaid. Note that the general postwar trend is the same as that in Figure 6.1 "The risk structure of interest rates in the United States, 1919–2010", a trend upward followed by an equally dramatic slide. Unlike Figure 6.1 "The risk structure of interest rates in the United States, 1919–2010", however, the ranking of the series here is much less stable. Sometimes short-term Treasuries have lower yields than long-term ones, sometimes they have about the same yield, and sometimes they have higher yields.

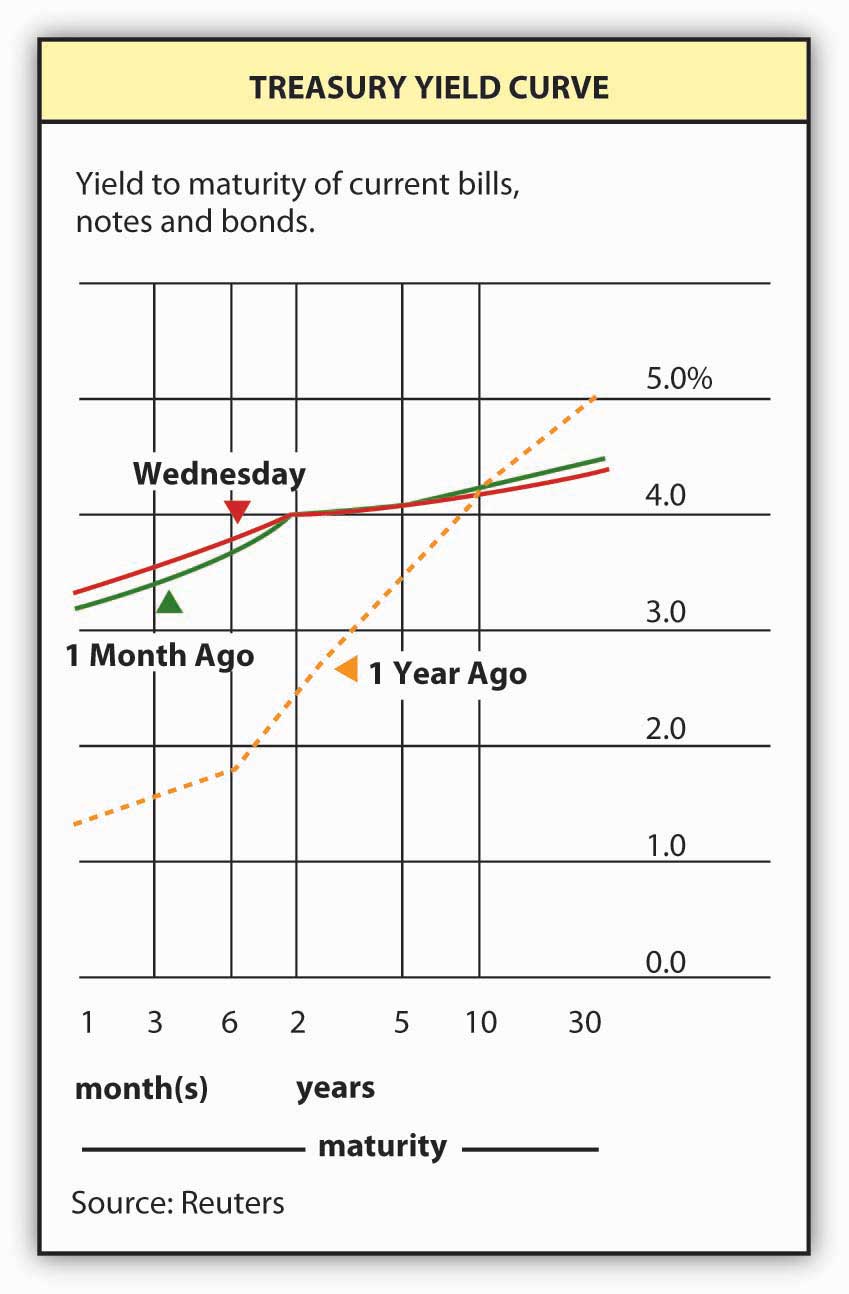

To study this phenomenon more closely, economists and market watchers use a tool called a yield curve, which is basically a snapshot of yields of bonds of different maturities at a given moment. Figure 6.1 "The risk structure of interest rates in the United States, 1919–2010" is what the Treasury yield curve looks like as reported in the Wall Street Journal, which publishes it daily. The current yield curve can also be viewed many places online, including Bloomberg and the U.S. Treasury itself.www.bloomberg.com/markets/rates/index.html;http://www.ustreas.gov/offices/domestic-finance/debt-management/interest-rate/yield.shtml What observers have discovered is that the yields of bonds of different maturities (but identical risk structures) tend to move in tandem. They also note that yield curves usually slope upward. In other words, short-term rates are usually lower than long-term rates. Sometimes, however, the yield “curve” is actually flat—yields for bonds of different maturities are identical, or nearly so. Sometimes, particularly when short-term rates are higher than normal, the curve inverts or slopes downward, indicating that the yield on short-term bonds is higher than that on long-term bonds. And sometimes the curve goes up and down, resembling a sideways S (sometimes tilted on its face and sometimes its back) or Z. What explains this? (Remember, it can’t be tax, default, or liquidity risk because those variables are all the same for Treasuries.)

Figure 6.6 Treasury yield curve

Theory and empirical evidence both point to the same conclusion: bonds of different maturities are partial substitutes for each other, not perfect substitutes, but not completely segmented either. Generally, investors prefer short-term bonds to long-term ones, but they reverse their preference if the interest rate goes unusually high. Investors are willing to pay more for short-term bonds, other factors (like “the” interest rate and the risk structure) held constant, because longer-term bonds are more subject to interest rate risk, as we learned in Chapter 3 "Money". Or, to put it another way, investors need a premium (in the form of a lower price or higher yield) to hold long-term bonds. Ergo, the yield curve usually slopes upward, as it does in Figure 6.6 "Treasury yield curve".

But what about those times when the curve is flat or inverted? Well, there is one thing that can induce investors to give up their liquidity preferenceThe name of one of the theories that economists use to explain the yield curve., their preferred habitatThe name of one of the theories that economists use to explain the yield curve. of short-term bonds: the expectation of a high interest rate for a short term. Investors think of a long-term bond yield as the average of the yields on shorter-term obligations, so when the interest rate is high by historical norms but expected after a year or so to revert to some long-term mean, they will actually begin to prefer long-term bonds and will buy them at much higher prices (lower yields) than short-term bonds. More formally, investors believe that

where:

in = interest rate today on a bond that matures in n years

iex = expected interest rate at time x (0, 1, 2, 3, . . . through n)

ρ = the liquidity or term premium for an n-period bond (it is always positive and increases with n)

So the yield today of a bond with 5 years to maturity, if the liquidity premium is .5 percent and the expected interest rate each year is 4, is 4.5:

i5 = (4 + 4 + 4 + 4 + 4)/5 + .5 = 20/5 + .5 = 4.5, implying an upward sloping yield curve because 4 < 4.5.

If the interest rate is expected to rise over the next 5 years, the yield curve slopes upward yet more steeply:

i5 = (4 + 5 + 6 + 7 + 8)/5 + .5 = 30/5 + .5 = 6.5, again implying an upward sloping curve because 4 < 6.5.

If, on the other hand, interest rates are expected to fall over the next 5 years, the yield curve will slope downward, as in this example:

i5 = (12 + 10 + 8 + 5 + 5)/5 + .5 = 40/5 + .5 = 8.5, implying an inverted yield curve because 12 > 8.5.

Investors may also realize that long-term bonds will increase in price when interest rates fall (as they are expected to do in this example and as we learned in Chapter 3 "Money"), so they are willing to pay more for them now.

Stop and Think Box

In the nineteenth century, the yield curve was usually flat under normal conditions. (It inverted during financial panics.) In other words, short-term and long-term bonds issued by the same economic entity did not often differ much in price. Why might that have been?

One possibility is that there was no liquidity premium then. Then, as now, short-term bonds suffered less interest rate risk than long-term bonds, but investors often complained of extremely high levels of reinvestment risk, of their inability to easily and cheaply reinvest the principal of bonds and mortgages when they were repaid. Often, lenders urged good borrowers not to repay (but to continue to service their obligations, of course). Another not mutually exclusive possibility is that the long-term price level stability engendered by the specie standard made the interest rate less volatile. The expectation was that the interest rate would not long stray from its long-term tendency.

The neat thing about this theory is that it reveals the yield curve as the market’s prediction of future short-term interest rates, making it, by extension, an economic forecasting tool. Where the curve slopes sharply upward, the market expects future short-term interest rates to rise. Where it slopes slightly upward, the market expects future short-term rates to remain the same. Where the curve is flat, rates, it is thought, will fall moderately in the future. Inversion of the curve means short-term interest rates should fall sharply, as in the numerical example above. The simplest way to remember this is to realize that the prediction equals the yield curve minus ρn, the term premium.

Empirical research suggests that the yield curve is a good predictor of future interest rates in the very short term, the next few months, and the long term, but not in between. Part of the difficulty is that ρn is not well understood nor is it easily observable. It may change over time and/or not increase much from one maturity to the next on the short end of the curve. Nevertheless, economic forecasters use the yield curve to make predictions about inflation and the business cycle. A flat or inverted curve, for instance, portends lower short-term interest rates in the future, which is consistent with a recession but also with lower inflation rates, as we learned in Chapter 5 "The Economics of Interest-Rate Fluctuations". A curve sloped steeply upward, by contrast, portends higher future interest rates, which might be brought about by an increase in inflation rates or an economic boom.

Time once again to ensure that we’re on the same page, er, Web site.

Exercises

-

What does the following yield curve tell us?

Treasury yield curve for January 20, 2006.

Maturity Yield (%) 1 month 3.95 3 months 4.35 6 months 4.48 1 year 4.44 2 years 4.37 3 years 4.32 5 years 4.31 7 years 4.32 10 years 4.37 20 years 4.59 -

What does the following yield curve predict?

Treasury yield curve for July 31, 2000.

Maturity Yield (%) 1 month 3 months 6.20 6 months 6.35 1 year 2 years 6.30 3 years 6.30 5 years 6.15 7 years 10 years 6.03 30 years 5.78

Key Takeaways

- The term structure of interest rates explains why bonds issued by the same economic entity but of different maturities sometimes have different yields.

- Plotting yield against maturity produces an important analytical tool called the yield curve.

- The yield curve is a snapshot of the term structure of interest rates created by plotting yield against maturity for a single class of bonds, like Treasuries or munis, which reveals the market’s prediction of future short-term interest rates, and thus, by extension, can be used to make inferences about inflation and business cycle expectations.

6.4 Suggested Reading

Choudry, Moorad. Analysing and Interpreting the Yield Curve. Hoboken, NJ: John Wiley and Sons, 2004.

Fabozzi, Frank. Interest Rate, Term Structure, and Valuation Modeling. Hoboken, NJ: John Wiley and Sons, 2002.

Fabozzi, Frank, Steven Mann, and Moorad Choudry. Measuring and Controlling Interest Rate and Credit Risk. Hoboken, NJ: John Wiley and Sons, 2003.

Homer, Sidney, and Richard E. Sylla. A History of Interest Rates, 4th ed. Hoboken, NJ: John Wiley and Sons, 2005.