This is “Liquidity Preference”, section 5.3 from the book Finance, Banking, and Money (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

5.3 Liquidity Preference

Learning Objective

- In Keynes’s liquidity preference framework, what effects do inflation expectations and business expansions and recessions have on interest rates and why?

Elementary price theory and the theory of asset demand go a long way toward helping us to understand why the interest rate bobbles up and down over time. A third aid to our understanding, the liquidity preference framework, strengthens our conviction in the robustness of our analyses and adds nuance to our understanding. In this model there are but two assets, money, which earns no interest, and bonds, which earn some interest greater than zero. (The two-asset assumption needn’t worry you. Economic models deliberately simplify reality to concentrate on what is most important.http://en.wikipedia.org/wiki/Model_(economics)) Furthermore, in the model, the markets for bonds and money are both in equilibrium, so we can study the latter to learn about the former.

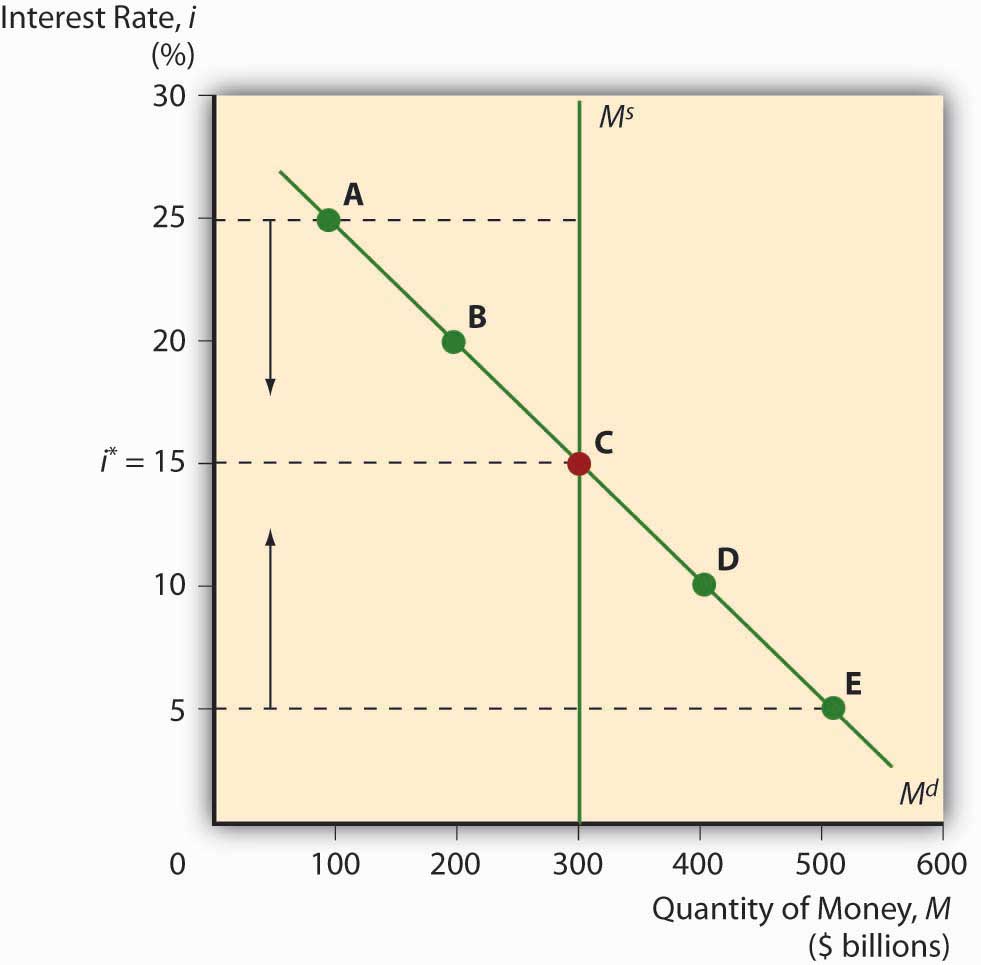

Graphically, the model is most easily represented as shown in Figure 5.8 "Equilibrium in the market for money". It is a little different than what you are used to because the vertical axis is the interest rate, not price. Other than that, the graph works exactly like a traditional supply and demand graph. The money demand curve slopes downward in the usual way because, as the interest rate increases, the quantity of money demanded decreases. Why hoard cash when you can buy bonds with it and make beaucoup bucks? As the interest rate declines, though, the quantity of money demanded will increase as the opportunity cost of holding bonds decreases. Why own bonds, which of course aren’t as liquid as money, if they pay squat? The supply of money in this model is represented by a vertical line. It can slide left and right if the monetary authority (like a government central bank, of which you will learn more in Chapter 13 "Central Bank Form and Function") sees fit to decrease or increase the money supply, respectively, but the quantity supplied does not vary with changes in the interest rate. (In more technical parlance, the supply of money in the model is perfectly inelastic.)

Figure 5.8 Equilibrium in the market for money

The intersection of the money supply and demand curves reveals the market rate of interest. Equilibrium will be reached because, if the interest rate exceeds the equilibrium rate (i*), the quantity of money demanded will be less than the quantity of money supplied. People will use their excess money to buy bonds, which will drive bond prices up and yields down, toward the equilibrium. Conversely, if the interest rate is below the equilibrium rate, the quantity of money demanded exceeds the quantity supplied. People would therefore sell bonds for cash, decreasing bond prices and increasing bond yields until the equilibrium is reached.

The equilibrium interest rate i* changes, of course, with movements of either curve. If the money supply increases (the money supply curve shifts right), the interest rate falls, ceteris paribus. That makes sense because there is more money to lend. If the money supply decreases, by contrast, the interest rate increases because there is less money to lend (and the demand stays the same). The demand for money can also change. If the demand curve shifts right (and the money supply stays constant), higher demand for money will spell a higher interest rate. If it shifts left, lower money demand will cause the interest rate to decrease. Again, this makes great sense intuitively.

The interesting issue here is why the curves move, not what happens when they do. According to the model, the money demand curve shifts for two major reasons, income and price level, both of which are positively related to demand. In other words, as income increases or the price level rises, the demand for money increases (shifting the money demand curve to the right and thus increasing the interest rate). Money demand increases with income for two reasons: because money is an asset and hence demand for it increases with wealth, as described above. Perhaps more important, money demand increases because economic entities transact more as incomes rise, so they need more money to make payments. Inflation increases money demand because people care about real balances, not nominal ones. As the price level rises, the same sum of money cannot buy as much, so people demand more money at any given interest rate (i.e., the money demand curve shifts right) and, in accord with the Fisher Equation, the interest rate rises.

Stop and Think Box

You are a consultant for a company considering issuing bonds when you find the following message in your e-mail inbox:

From: Reuters News Service

Re: “Economists Express Concern Over Inflation”

“Is inflation beginning to awaken from its long slumber? . . . Some economists are beginning to detect signs of strain. They worry that recent inflation reports were pushed down by unusually large price decreases in certain areas, which buck recent trends and are unlikely to recur. Absent those drops, the overall inflation numbers would have edged higher. . . . Other economists argue that many companies are just beginning to feel the bite of skyrocketing energy costs. . . . Businesses are unlikely to watch profit margins continue to shrink without forcing through price increases. Other companies have locked in lower energy costs by skillfully using futures markets, but those options are set to expire, leaving the businesses unprotected.”

What do you advise your clients regarding their bond issue deliberations? Why?

According to Irving Fisher, when expected inflation rises, the interest rate will rise. This well-known Fisher effect, which is confirmed by both the theory of asset demand and Keynes’s liquidity preference framework, suggests that the company will have to pay a higher yield on its bonds than anticipated because the higher expected inflation will reduce the expected return on bonds relative to real assets, shifting the demand curve to the left. Also, the real cost of borrowing will decrease, causing the quantity of bonds supplied to the market to increase and the supply curve to shift to the right. Both reduced demand and increased supply leads to a decrease in bond prices, that is, an increase in bond yields. Or, in Keynes’s framework, the demand for money increases with inflation expectations because people want to maintain real money balances. Any way you slice it, the company is facing the prospect of paying higher yields on its bonds in the near future.

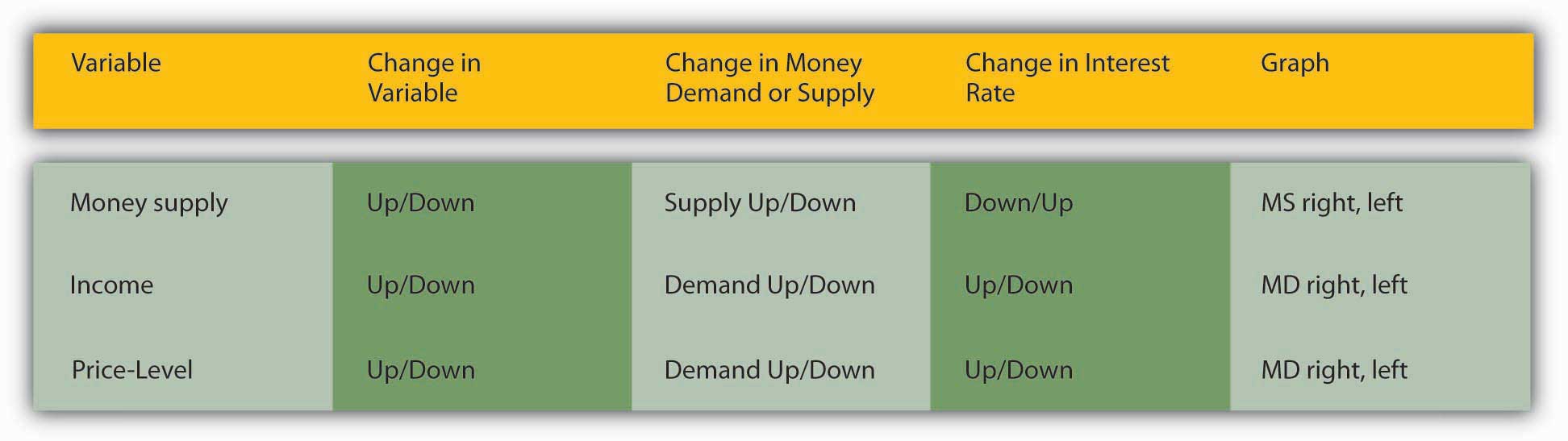

Figure 5.9 "Determinants of the supply and demand for money" summarizes the chapter discussion so far. And it’s time again to complete some problems and make sure you’re following all this.

Figure 5.9 Determinants of the supply and demand for money

Exercises

- What will happen to the interest rate if the monetary authority issues more money (or money at a faster rate than usual)?

- If a steep recession sets in, what will happen to the interest rate?

- The government has decided to drastically slow the rate of money growth. What will happen to the interest rate?

- If war breaks out in the Middle East, thus causing energy prices to soar and the prices of most goods and services to increase steeply, what will happen to the interest rate?

- If the war in number 4 suddenly ceases, causing energy and other prices to actually decline (deflation), what will the interest rate do?

Key Takeaways

- The expectation of higher inflation causes the bond supply curve to shift right and the bond demand curve to shift left, both of which depress bond prices (that is, cause the interest rate to increase). In the liquidity preference framework, expectations of higher prices cause the demand for money to shift to the right, raising the interest rate.

- A business expansion will cause interest rates to increase by increasing the demand for money (causing the money demand curve to shift right).

- A recession will cause interest rates to decrease by decreasing the demand for money (causing the money demand curve to shift left).