This is “Energy and Climate”, chapter 5 from the book Entrepreneurship and Sustainability (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 5 Energy and Climate

The cases in this chapter offer an opportunity to apply many of the ideas introduced in Chapter 1 "History" through Chapter 4 "Entrepreneurship and Sustainability Innovation Analysis". The key approach that differentiates this collection is the systems perspective used throughout. Thus while “Energy and Climate” is the chapter title, this chapter will discuss materials, building design, community equity implications, and health impacts as well, topics that can also be part of case discussions in later chapters. Typically such conversations are segregated into different courses and even different schools within universities. Appreciation of the interconnections across disciplines and functional areas should be one of the core takeaways from this book.

The chapter begins with a climate change technical note to provide broad background for the reader. Climate science has altered our world as well as the way we think about it. Governments and companies are reacting, with businesses on the leading edge of sustainability innovation often gaining advantages. Interestingly, the recent economic downturn has made environmental and resource use topics (e.g., reducing a firm’s resource footprint) even more salient to financial survival and success. Today it is accepted that cost-cutting measures enabled by viewing operating practices through a sustainability lens can yield significant bottom-line improvements (increased profitability). Companies with sustainability strategic awareness and sufficient resources to invest during a downturn understand that systems and product redesigns can position them for enhanced growth and advantage over less prescient competitors as the economy recovers. State and federal investments currently support a recovery that builds US capacity around “green” economic expansion. While there will be those who deny climate change is happening or reject the role assigned humans, we still need to understand the history and science of climate analysis. Furthermore, governments and companies are actively engaged in carbon market trading, carbon pricing, and reduction of carbon footprints, thus the issues must be discussed and, where opportunities present themselves, any well-managed firm will need to be positioned to respond. Entrepreneurs and innovative companies will seek new opportunities for product and process designs that can reduce climate change effects.

5.1 Climate Change

Learning Objectives

- Understand the basic causes and effects of climate change.

- Know the regulatory frameworks governments have used to address climate change.

- Identify business responses and opportunities related to climate change.

The thickness of the air, compared to the size of the Earth, is something like the thickness of a coat of shellac on a schoolroom globe. Many astronauts have reported seeing that delicate, thin, blue aura at the horizon of the daylit hemisphere and immediately, unbidden, began contemplating its fragility and vulnerability. They have reason to worry.Carl Sagan, Billions and Billions (New York, NY: Random House 1997), 86.

Carl Sagan

Since the beginning of their history, humans have altered their environment. Only recently, however, have we realized how human activities influence earth’s terrestrial, hydrological, and atmospheric systems to the extent that these systems may no longer maintain the stable climate and services we have assumed as the basis of our economies. The science of climate change developed rapidly in the late twentieth century as researchers established a correlation between increasing atmospheric concentrations of certain gases, human activities emitting those gases, and a rapid increase in global temperatures. Many, but by no means all, international policy makers spurred research as it became apparent that impacts ranging from melting polar ice caps to acidified oceans and extreme weather patterns were attributed to anthropogenic (human) influences on climate. Global businesses, many of which initially balked at potential economic disruption from changes in the use of fossil fuel and other business practices, have largely acceded to the need for change. Nonetheless, the overall response to the challenge has been slow and not without resistance, thereby increasing the potential opportunities and urgency.

The Science of Global Climate Change

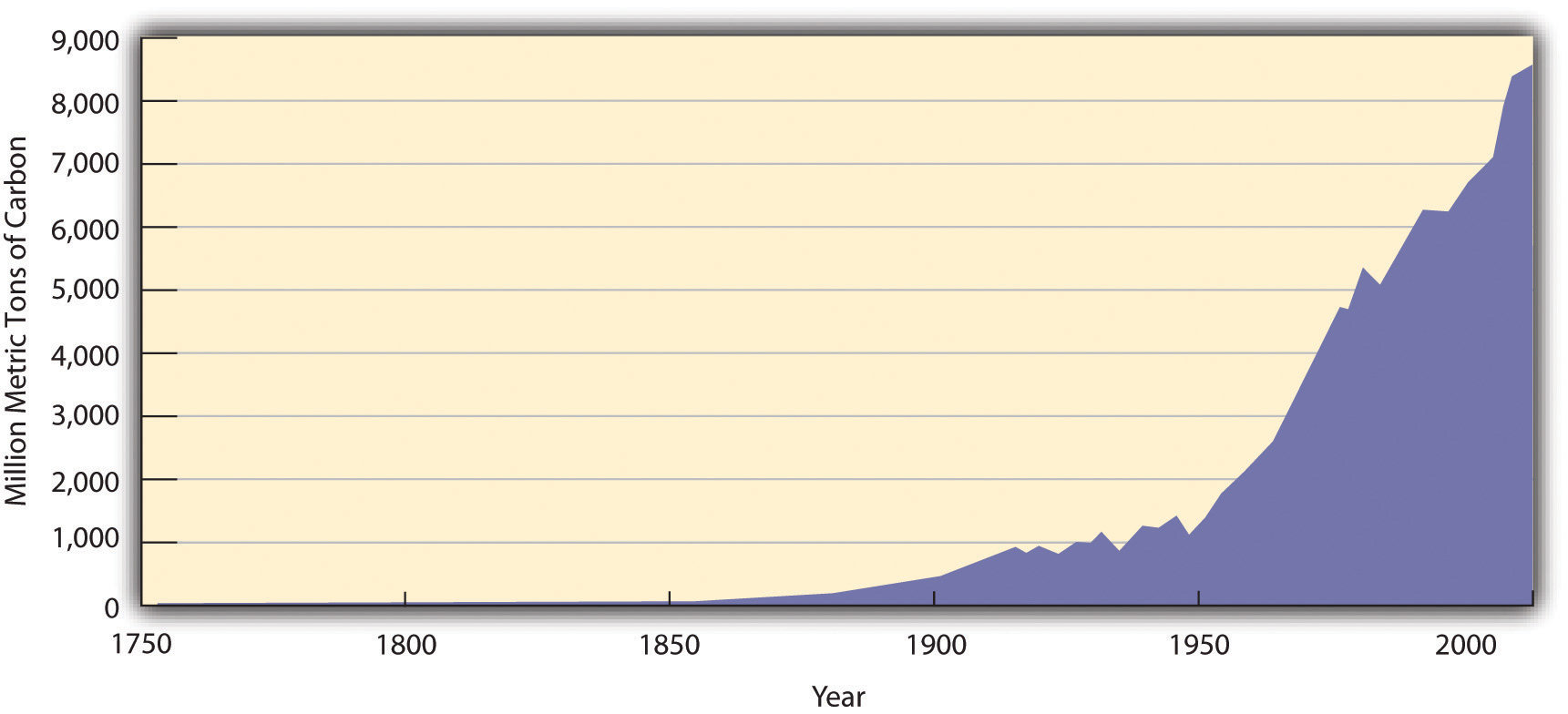

In the early 1820s, Joseph Fourier, the French pioneer in the mathematics of heat diffusion, became interested in why some heat from the sun was retained by the earth and its atmosphere rather than being reflected back into space. Fourier conceived of the atmosphere as a bell jar with the atmospheric gases retaining heat and thereby acting as the containing vessel. In 1896, Swedish Nobel laureate and physicist Svante August Arrhenius published a paper in which he calculated how carbon dioxide (CO2) could affect the temperature of the earth. He and early atmospheric scientists recognized that normal carbon dioxide levels in the atmosphere contributed to making the earth habitable. Scientists also have known for some time that air pollution alters weather. For example, certain industrial air pollutants can significantly increase rainfall downwind of their source. As intensive agriculture and industrial activity have expanded very rapidly around the world since 1850 (Figure 5.1 "Increase in Global Carbon Emissions from Fossil Fuel Combustion, 1750–2006"), a growing body of scientific evidence has accumulated to suggest that humans influence global climate.

Figure 5.1 Increase in Global Carbon Emissions from Fossil Fuel Combustion, 1750–2006

Units of carbon are often used instead of CO2, which can be confusing. One ton of carbon equals 3.67 tons of CO2. Hence emissions of CO2 in 2006 were roughly eight billion tons of carbon, or twenty-nine billion tons of CO2.

Source: Oak Ridge National Laboratory, Carbon Dioxide Information Analysis Center, accessed August 19, 2010, http://cdiac.ornl.gov/trends/emis/graphics/global_ff_1751_2006.jpg.

The earth’s climate has always varied, which initially raised doubts about the significance of human influences on climate or suggested our impact may have been positive. Successive ice ages, after all, likely were triggered by subtle changes in the earth’s orbit or atmosphere and would presumably recur. Indeed, changes in one earth system, such as solar energy reaching the earth’s surface, can alter other systems, such as ocean circulation, through various feedback loops. The dinosaurs are thought to have gone extinct when a meteor struck the earth, causing tsunamis, earthquakes, fires, and palls of ash and dust that would have hindered photosynthesis and lowered oxygen levels and temperatures. Aside from acute catastrophes, however, climate has changed slowly, on the scale of tens of thousands to millions of years. The same paleoclimatological data also suggest a strong correlation between atmospheric CO2 levels and surface temperatures over the past 400,000 years and indicate that the last 20 years have been the warmest of the previous 1,000.National Oceanic and Atmospheric Administration Paleoclimatology, “A Paleo Perspective on Global Warming,” July 13, 2009, accessed August 19, 2010, http://www.ncdc.noaa.gov/paleo/globalwarming/home.html.

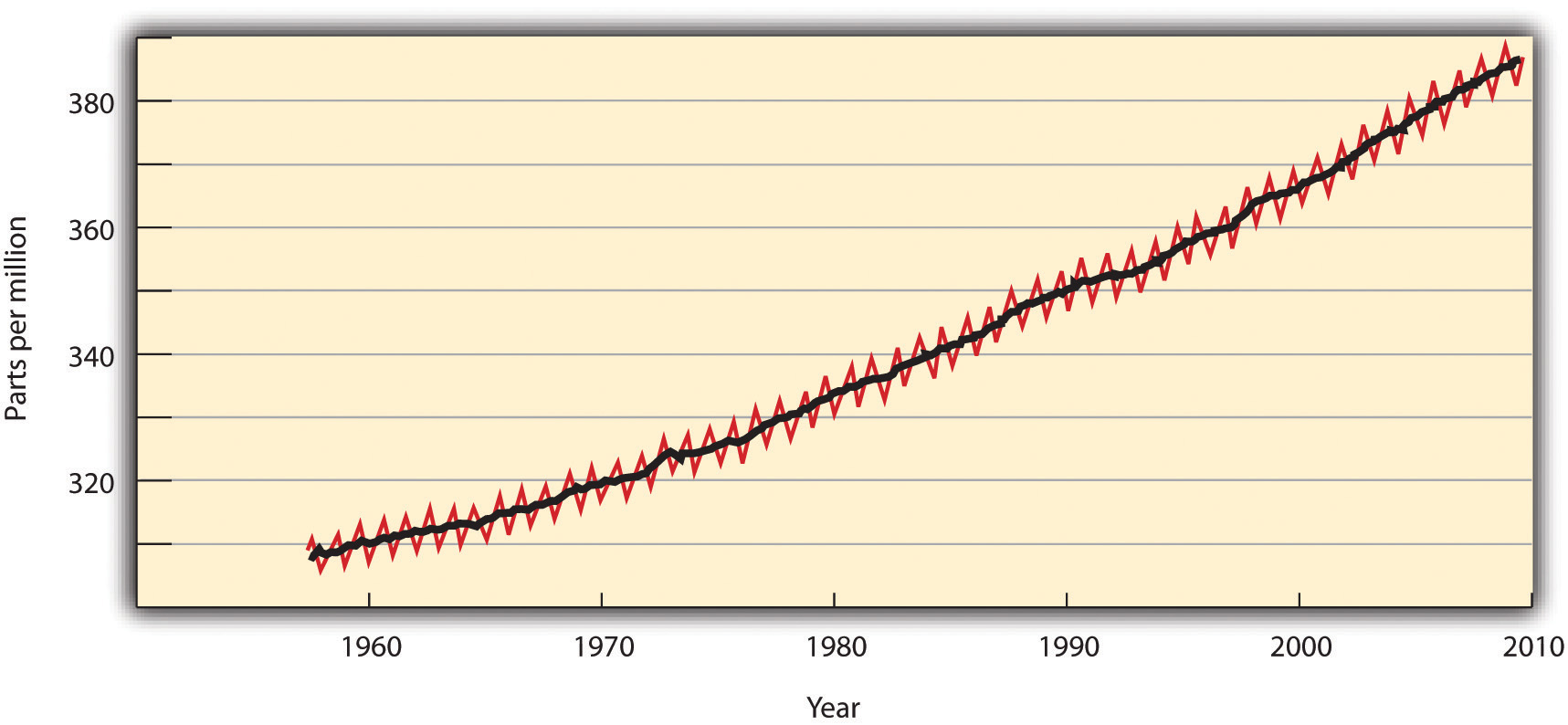

In the last decades of the twentieth century, scientists voiced concern over a rapid increase in “greenhouse gases.” Greenhouse gases (GHGs)Gases that trap heat in the earth’s atmosphere, leading to elevated surface and air temperatures. The GHGs of most concern due to their potency or prevalence are carbon dioxide, nitrous oxide, methane, and chlorofluorocarbons. were named for their role in retaining heat in earth’s atmosphere, causing a greenhouse effect similar to that in Fourier’s bell jar. Increases in the atmospheric concentration of these gases, which could be measured directly in modern times and from ice core samples, were correlated with a significant warming of the earth’s surface, monitored using meteorological stations, satellites, and other means (see Figure 5.2 "Increases in the Concentration of Atmospheric CO").

Figure 5.2 Increases in the Concentration of Atmospheric CO2, 1958–2009

Source: Scripps Institution of Oceanography and NOAA Earth System Research Lab, “Trends in Atmospheric Carbon Dioxide,” accessed August 19, 2010, http://www.esrl.noaa.gov/gmd/ccgg/trends.

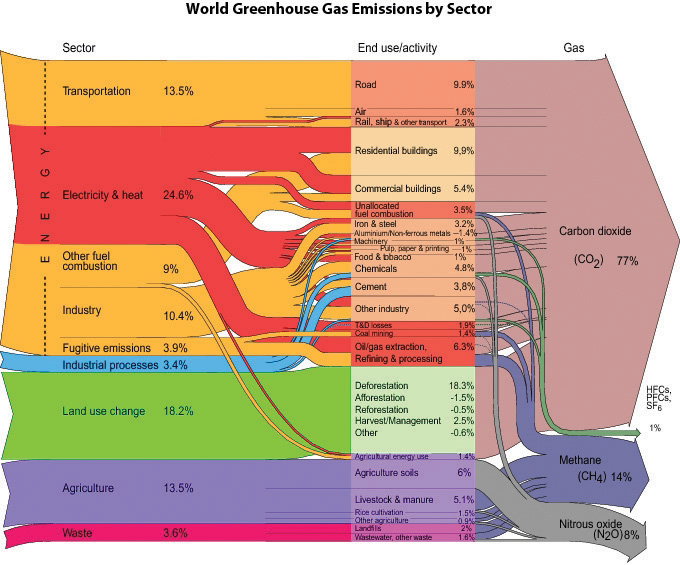

The gases currently of most concern include CO2, nitrous oxide (N2O), methane (CH4), and chlorofluorocarbons (CFCs). CO2, largely a product of burning fossil fuels and deforestation, is by far the most prevalent GHG, albeit not the most potent. Methane, produced by livestock and decomposition in landfills and sewage treatment plants, contributes per unit twelve times as much to global warming than does CO2. N2O, created largely by fertilizers and coal or gasoline combustion, is 120 times as potent. CFCs, wholly synthetic in origin, have largely been phased out by the 1987 Montreal Protocol because they degraded the ozone layer that protected earth from ultraviolet radiation (Figure 5.3 "Sources and Types of GHG Emissions, 2000"). The successor hydrochlorofluorocarbons (HCFCs), however, are GHGs with potencies one to two orders of magnitude greater than CO2.

Figure 5.3 Sources and Types of GHG Emissions, 2000

Source: Riccardo Pravettoni, UNEP/GRID-Arendal and World Resources Institute, Climate Analysis Indicator Tool (CAIT), “Navigating the Numbers: Greenhouse Gas Data and International Climate Policy,” December 2005; Intergovernmental Panel on Climate Change, 1996 (data for 2000), http://maps.grida.no/go/graphic/world-greenhouse-gas-emissions-by-sector2.

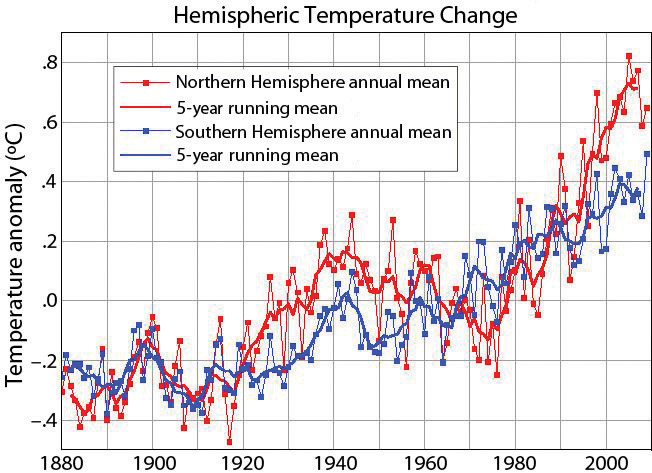

In response to such findings, the United Nations and other international organizations gathered in Geneva to convene the First World Climate Conference in 1979. In 1988, a year after the Brundtland Commission called for sustainable development, the World Meteorological Organization (WMO) and the United Nations Environment Programme (UNEP) created the Intergovernmental Panel on Climate Change (IPCC)An international body of scientific experts who regularly assess the scientific, technical, and socioeconomic aspects of climate change, its risks, and possible mitigation.. The IPCC gathered 2,500 scientific experts from 130 countries to assess the scientific, technical, and socioeconomic aspects of climate change, its risks, and possible mitigation.The IPCC comprises three working groups and a task force. Working Group I assesses the scientific aspects of the climate system and climate change. Working Group II addresses the vulnerability of socioeconomic and natural systems to climate change, negative and positive consequences of climate change, and options for adapting to those consequences. Working Group III assesses options for limiting greenhouse gas emissions and otherwise mitigating climate change. The Task Force on National Greenhouse Gas Inventories implemented the National Greenhouse Gas Inventories Program. Each report has been written by several hundred scientists and other experts from academic, scientific, and other institutions, both private and public, and has been reviewed by hundreds of independent experts. These experts were neither employed nor compensated by the IPCC nor by the United Nations system for this work. The IPCC’s First Assessment Report, published in 1990, concluded that the average global temperature was indeed rising and that human activity was to some degree responsible (Figure 5.4 "Temperature Elevation, 1880–2009"). This report laid the groundwork for negotiation of the Kyoto Protocol, an international treaty to reduce GHG emissions that met with limited success. Subsequent IPCC reports and myriad other studies indicated that climate change was occurring faster and with worse consequences than initially anticipated.

Figure 5.4 Temperature Elevation, 1880–2009

Source: NASA, Goddard Institute for Space Studies, “GISS Surface Temperature Analysis,” accessed August 19, 2010, http://data.giss.nasa.gov/gistemp/graphs.

Charles David Keeling

Modern systematic measurement of CO2 emissions began with the work of scientist Charles David Keeling in the 1950s. The steady upward trajectory of atmospheric CO2 graphed by Dr. Keeling became known as the Keeling curve. This comment is from a front page New York Times article on December 21, 2010: “In later years, as the scientific evidence about climate change grew, Dr. Keeling’s interpretations became bolder, and he began to issue warnings. In an essay in 1998, he replied to claims that global warming was a myth, declaring that the real myth was that ‘natural resources and the ability of the earth’s habitable regions to absorb the impacts of human activities are limitless.’ In an interview in La Jolla, Dr. Keeling’s widow, Louise, said that if her husband had lived to see the hardening of the political battle lines over climate change, he would have been dismayed. “He was a registered Republican,” she said. “He just didn’t think of it as a political issue at all.”Justin Gillis, “Temperature Rising: A Scientist, His Work and a Climate Reckoning,” New York Times, December 21, 2010, http://www.nytimes.com/2010/12/22/science/earth/22carbon.html?_r=1&pagewanted=2.

Effects and Predictions

The IPCC Fourth Assessment Report in 2007 summarized much of the current knowledge about global climate change, which included actual historical measurements as well as predictions based on increasingly detailed models.Rajendra K. Pachauri and Andy Reisinger, eds. (core writing team), Climate Change 2007: Synthesis Report (Geneva, Switzerland: Intergovernmental Panel on Climate Change, 2008). Available from the Intergovernmental Panel on Climate Change, “IPCC Fourth Assessment Report: Climate Change 2007,” accessed August 19, 2010, http://www.ipcc.ch/publications_and_data/ar4/syr/en/contents.html. A fifth assessment report was begun in January 2010 but has yet to be completed. Unless otherwise footnoted, all numbers in this list are from the fourth IPCC assessment. These findings represent general scientific consensus and typically have 90 percent or greater statistical confidence.

The global average surface temperature increased 0.74°C ± 0.18°C (1.3°F ± 0.32°F) from 1906 to 2005, with temperatures in the upper latitudes (nearer the poles) and over land increasing even more. In the same period, natural solar and volcanic activity would have decreased global temperatures in the absence of human activity. Depending on future GHG emissions, the average global temperature is expected to rise an additional 0.5°C to 4°C by 2100, which could put over 30 percent of species at risk for extinction. Eleven of the twelve years from 1995 to 2006 were among the twelve warmest since 1850, when sufficient records were first kept. August 2009 had the hottest ocean temperatures and the second hottest land temperatures ever recorded for that month, and 2010 tied 2005 as the warmest year in the 131-year instrumental record for combined global land and ocean surface temperature.Data more current than the fourth IPCC report are available from NASA and NOAA, among other sources, at NASA, “GISS Surface Temperature Analysis (GISTEMP),” accessed January 27, 2011, http://data.giss.nasa.gov/gistemp; and National Oceanic and Atmospheric Administration, “NOAA: Warmest Global Sea-Surface Temperatures for August and Summer,” September 16, 2009, accessed January 27, 2011, http://www.noaanews.noaa.gov/stories2009/20090916_globalstats.html.

Precipitation patterns have changed since 1900, with certain areas of northern Europe and eastern North and South America becoming significantly wetter, while the Mediterranean, central Africa, and parts of Asia have become significantly drier. Record snowfalls in Washington, DC, in the winter of 2009–10 reflected this trend, as warmer, wetter air dumped nearly one meter of snow on the US capital in two storms.Bryan Walsh, “Another Blizzard,” Time, February 10, 2010, accessed January 7, 2011, http://www.time.com/time/health/article/0,8599,1962294,00.html.

Coral reefs, crucial sources of marine species diversity, are dying, due in part to their sensitivity to increasing ocean temperatures and ocean acidity. Oceans acidify as they absorb additional CO2; lower pH numbers indicate more acidic conditions. Ocean pH decreased 0.1 points between the years 1750 to 2000 and is expected to decrease an additional 0.14 to 0.35 pH by 2100. (A pH difference of one is the difference between lemon juice and battery acid.)

Figure 5.5 Healthy Reefs

© Thinkstock

Figure 5.6 Dead and Dying Reefs

© Thinkstock

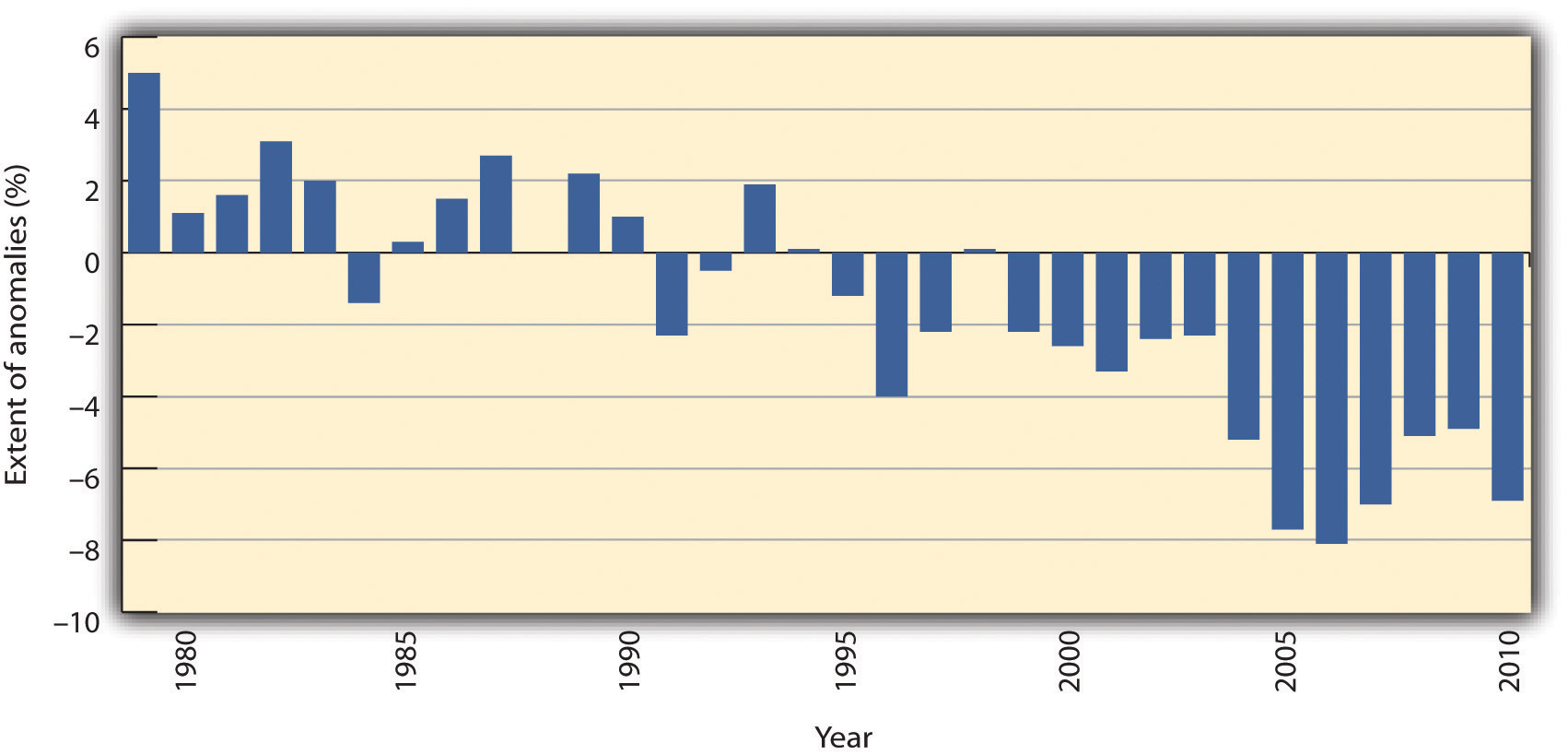

Glaciers and mountain snowpacks, crucial sources of drinking water for many people, have been retreating for the past century. From 1979 to 2006, Arctic ice coverage declined between 6 and 10 percent, with declines in summer coverage of 15–30 percent (Figure 5.7 "Decrease in Arctic Sea Ice, 1979–2009").

Figure 5.7 Decrease in Arctic Sea Ice, 1979–2009

Source: NOAA, National Snow and Ice Data Center, accessed March 5, 2011, ftp://sidads.colorado.edu/DATASETS/NOAA/G02135/Jan/N_01_area.txt.

Seas have risen 20 to 40 centimeters over the past century as glaciers melted and water expanded from elevated temperatures. Sea levels rose at a rate of 1.8 (±0.5) millimeters per year from 1961 to 2003. From 1993 to 2003 alone, that rate was dramatically higher: 3.1 (±0.7) millimeters per year. An additional rise in sea level of 0.4 to 3.7 meters (1.3 to 12.1 feet) is expected by 2100. The former amount would threaten many coastal ecosystems and communities;James G. Titus, K. Eric Anderson, Donald R. Cahoon, Dean B. Gesch, Stephen K. Gill, Benjamin T. Gutierrez, E. Robert Thieler, and S. Jeffress Williams (lead authors), Coastal Elevations and Sensitivity to Sea-Level Rise: A Focus on the Mid-Atlantic Region (Washington, DC: US Climate Change Science Program, 2009), accessed August 19, 2010, http://www.epa.gov/climatechange/effects/coastal/sap4-1.html. the latter would be enough to submerge completely the archipelago nation of the Maldives. If trends continue as predicted, inundation of global coastal areas and island communities may soon present major human migration and resettlement challenges. Many consider this the most critical climate change issue.

Trees are moving northward into the tundra. A thawing permafrost, meanwhile, would release enough methane to catastrophically accelerate global warming.National Science Foundation, “Methane Releases from Arctic Shelf May Be Much Larger and Faster Than Anticipated,” news release, March 4, 2010, accessed January 7, 2011, http://www.nsf.gov/news/news_images.jsp?cntn_id=116532&org=NSF and http://www.nsf.gov/news/news_summ.jsp?cntn_id=116532&org=NSF&from=news. Other species, too, are migrating or threatened, such as the polar bear. The population of polar bears is expected to decline two-thirds by 2050 as their ice pack habitats disintegrate under current trends.US Geological Survey, “USGS Science to Inform U.S. Fish & Wildlife Service Decision Making on Polar Bears, Executive Summary,” accessed January 27, 2011, http://www.usgs.gov/newsroom/special/polar_bears/docs/executive_summary.pdf. Warmer waters will also increase the range of cholera and other diseases and pests.World Health Organization, “Cholera,” June 2010, accessed August 19, 2010, http://www.who.int/mediacentre/factsheets/fs107/en/index.html.

At the same time that humans have increased production of GHGs, they have decreased the ability of the earth’s ecosystems to reabsorb those gases. Deforestation and conversion of land from vegetation to built structures reduces the size of so-called carbon sinks. Moreover, conventional building materials such as pavement contribute to local areas of increased temperature, called heat islands, which in the evenings can be 12°C (22°F) hotter than surrounding areas. These elevated local temperatures further exacerbate the problems of climate change for communities through energy demand, higher air-conditioning costs, and heat-related health problems.US Environmental Protection Agency, “Heat Island Effect,” accessed January 27, 2011, http://www.epa.gov/heatisland.

By impairing natural systems, climate change impairs social systems. A shift in climate would alter distributions of population, natural resources, and political power. Droughts and rising seas that inundate populous coastal areas would force migration on a large scale. Unusually severe weather has already increased costs and death tolls from hurricanes, floods, heat waves, and other natural disasters. Melting Arctic ice packs have also led countries to scramble to discover and dominate possible new shipping routes. When the chairman of the Norwegian Nobel Committee awarded the 2007 Nobel Peace Prize to the IPCC and Al Gore, he said, “A goal in our modern world must be to maintain ‘human security’ in the broadest sense.” Similarly, albeit with different interests in mind, the United States’ 2008 National Intelligence Assessment, which analyzes emerging threats to national security, focused specifically on climate change.Ole Danbolt Mjøs, “Award Ceremony Speech” (presentation speech for the 2007 Nobel Peace Prize, Oslo, Norway, December 10, 2007), accessed January 7, 2011, http://nobelprize.org/nobel_prizes/peace/laureates/2007/presentation-speech.html.

Scientists have tried to define acceptable atmospheric concentrations of CO2 or temperature rises that would still avert the worst consequences of global warming while accepting we will likely not entirely undo our changes. NASA scientists and others have focused on the target of 350 parts per million (ppm) of CO2 in the atmosphere.James Hansen, Makiko Sato, Pushker Kharecha, David Beerling, Valerie Masson-Delmotte, Mark Pagani, Maureen Raymo, Dana L. Royer, and James C. Zachos, “Target Atmospheric CO2: Where Should Humanity Aim?” The Open Atmospheric Science Journal 2 (2008): 217–31. Their paleoclimatological data suggest that a doubling of CO2 in the atmosphere, which is well within some IPCC scenarios for 2100, would likely increase the global temperature by 6°C (11°F). Atmospheric CO2 levels, however, passed 350 ppm in 1990 and reached 388 ppm by early 2010. This concentration will continue to rise rapidly as emissions accumulate in the atmosphere. Worse, even if the CO2 concentration stabilizes, temperatures will continue to rise for some centuries, much the way a pan on a stove keeps absorbing heat even if the flame is lowered. Hence scientists have begun to suggest that anything less than zero net emissions by 2050 will be too little, too late; policy makers have yet to embrace such aggressive action.H. Damon Matthews and Ken Caldeira, “Stabilizing Climate Requires Near-Zero Emissions,” Geophysical Research Letters 35, no. 4: L04705 (2008), 1–5.

International and US Policy Response

The primary international policy response to climate change was the United Nations Framework Convention on Climate Change (UNFCCC)An international convention adopted in 1992 and entered in force in 1994 that became the first binding international legal instrument dealing directly with climate change.. The convention was adopted in May 1992 and became the first binding international legal instrument dealing directly with climate change. It was presented for signature at the Earth Summit in Rio de Janeiro and went into force in March 1994 with signatures from 166 countries. By 2010 the convention had been accepted by 193 countries.United Nations Framework Convention on Climate Change, “Status of Ratification of the Convention,” accessed January 27, 2011, http://unfccc.int/kyoto_protocol/status_of_ratification/items/2613.php. UNFCCC signatories met in 1997 in Kyoto and agreed to a schedule of reduction targets known as the Kyoto Protocol. Industrialized countries committed to reducing emissions of specific GHGs, averaged over 2008–12, to 5 percent below 1990 levels. The European Union (EU) committed to an 8 percent reduction and the United States to 7 percent. Other industrialized countries agreed to lesser reductions or to hold their emissions constant, while developing countries made no commitments but hoped to industrialize more cleanly than their predecessors. Partly to help developing countries, the Kyoto Protocol also created a market for trading GHG emission allowances. If one country developed a carbon sink, such as by planting a forest, another country could buy the amount of carbon sequestered and use it to negate the equivalent amount of its own emissions.

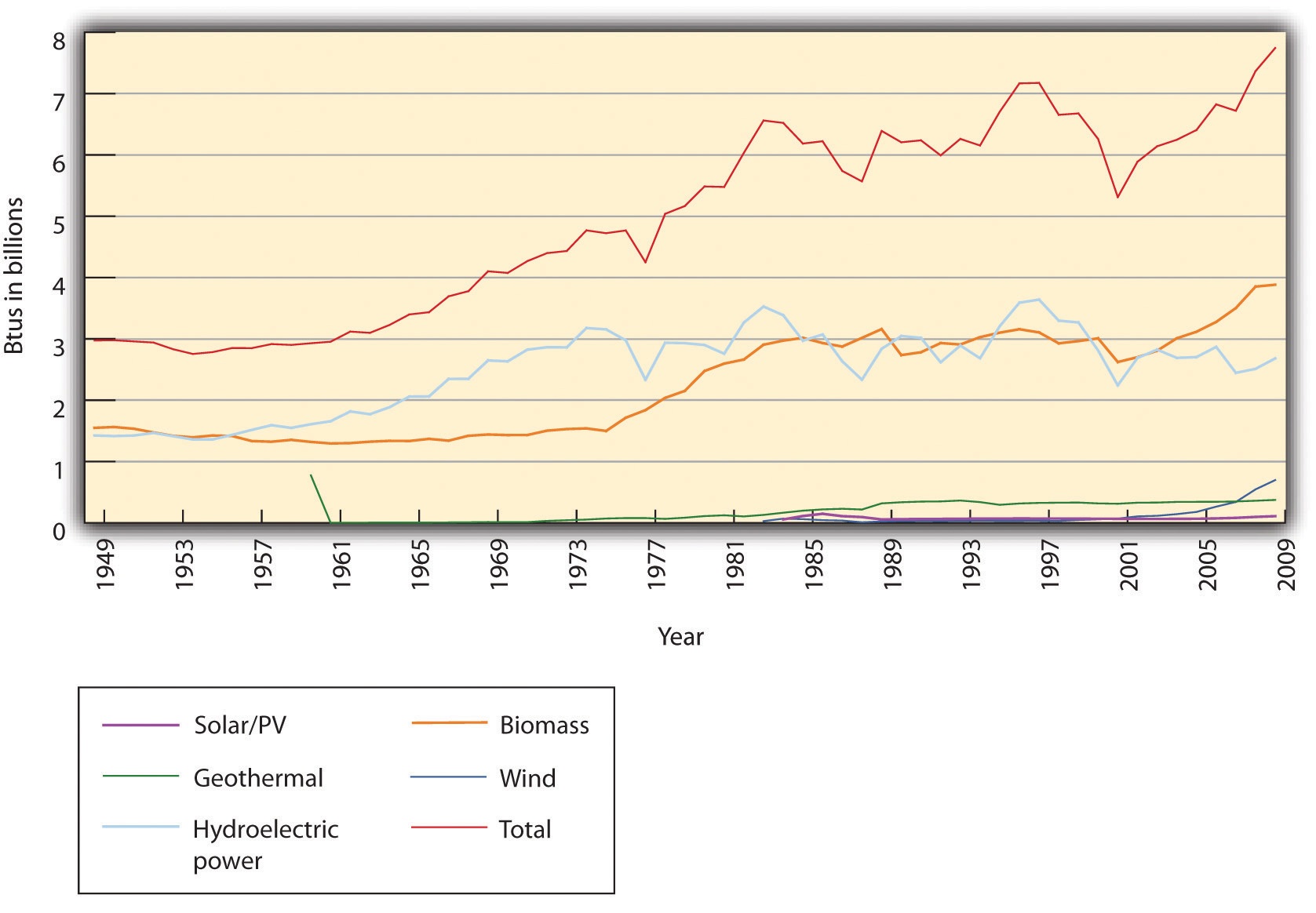

The Kyoto Protocol has ultimately suffered from a lack of political will in the United States and abroad. The United States signed it, but the Senate never ratified it. US President George W. Bush backed away from the emission reduction targets and eventually rejected them entirely. By the time he took office in 2001, a 7 percent reduction from 1990 levels for the United States would have translated into a 30 percent reduction from 2001 levels. US GHG emissions, instead of declining, rose 14 percent from 1990 to 2008 (see Figure 5.8 "Increase in US Energy Consumption, Total and Renewable, in Billions of BTU, 1949–2008" for related energy consumption).US Environmental Protection Agency, 2010 Greenhouse Gas Inventory Report (Washington, DC: US Environmental Protection Agency, 2010), accessed January 29, 2011, http://www.epa.gov/climatechange/emissions/downloads10/US-GHG -Inventory-2010_ExecutiveSummary.pdf. Almost all other Kyoto signatories will also fail to meet their goals. The EU, in contrast, is on track to meet or exceed its Kyoto targets.European Union, “Climate Change: Progress Report Shows EU on Track to Meet or Over-Achieve Kyoto Emissions Target,” news release, November 12, 2009, accessed August 19, 2010, http://europa.eu/rapid/pressReleasesAction.do?reference=IP/09/1703&format=HTML&aged=0&language=EN&guiLanguage=en. GHG pollution allowances for major stationary sources have been traded through the EU Emissions Trading System since 2005. The consensus in Europe is that the Kyoto Protocol is necessary and action is required to reduce GHGs.

Figure 5.8 Increase in US Energy Consumption, Total and Renewable, in Billions of BTU, 1949–2008

Source: Energy Information Administration, “Annual Energy Review, 2008,” accessed March 10, 2011, http://www.eia.doe.gov/aer/txt/ptb1001.html and http://www.eia.doe.gov/aer/txt/ptb0201a.html.

The Kyoto Protocol expires in 2012, so meetings have begun to negotiate new goals. In December 2007, UNFCCC countries met in Bali to discuss a successor treaty. The conference made little headway, and countries met again in December 2009 in Copenhagen. That conference again failed to generate legally binding reduction goals, but the countries confirmed the dangers of climate change and agreed to strive to limit temperature increases to no more than 2°C total. A subsequent meeting was held in Cancun, Mexico, in late 2010.

Individual countries and US states and agencies have acted, nonetheless, in the absence of broader leadership. In 2007, EU countries set their own future emissions reduction goals, the so-called 20-20-20 strategy of reducing emissions 20 percent from 1990 levels by 2020 while reducing energy demand 20 percent through efficiency and generating 20 percent of energy from renewable resources. In January 2008 the European Commission proposed binding legislation to implement the 20-20-20 targets. This “climate and energy package” was approved by the European Parliament and Council in December 2008. It became law in June 2009.European Commission, “The EU Climate and Energy Package,” accessed January 29, 2011, http://ec.europa.eu/clima/policies/brief/eu/package_en.htm and http://ec.europa.eu /environment/climat/climate_action.htm. In the Northeast United States, ten states collaborated to form the Regional Greenhouse Gas Initiative (RGGI), which caps and gradually lowers GHG emissions from power plants by 10 percent from 2009 to 2018. A similar program, the Western Climate Initiative, is being prepared by several western US states and Canadian provinces, and California’s Assembly Bill 32, the Global Warming Solutions Act, set a state GHG emissions limit for 2020.California Environmental Protection Agency Air Resources Board, “Assembly Bill 32: Global Warming Solutions Act,” accessed August 19, 2010, http://www.arb.ca.gov/cc/ab32/ab32.htm. Likewise, the federal government under President Barack Obama committed to reducing its emissions, while the US Environmental Protection Agency (EPA), in response to a 2007 lawsuit led by the state of Massachusetts, prepared to regulate GHGs under the Clean Air Act.

On December 23, 2010, the New York Times reported, “The Environmental Protection Agency announced a timetable on Thursday for issuing rules limiting greenhouse gas emissions from power plants and oil refineries, signaling a resolve to press ahead on such regulation even as it faces stiffening opposition in Congress. The agency said it would propose performance standards for new and refurbished power plants next July, with final rules to be issued in May 2012.”Matthew L. Wald, “E.P.A. Says It Will Press on With Greenhouse Gas Regulation,” New York Times, December 23, 2010, http://www.nytimes.com/2010/12/24/science/earth/24epa.html?_r=1&ref=environmentalprotectionagency.

Members of Congress, however, have threatened to curtail the EPA’s power to do so, either by altering the procedures for New Source Review that would require carbon controls or by legislatively decreeing that global warming does not endanger human health.“Coal State Senators Battle EPA to Control Greenhouse Gases,” Environmental News Service, February 23, 2010, accessed January 7, 2011, http://www.ens-newswire.com/ens/feb2010/2010-02-23-093.html; Juliet Eilperin and David A. Fahrenthold, “Lawmakers Move to Restrain EPA on Climate Change,” Washington Post, March 5, 2010, accessed January 7, 2011, http://www.washingtonpost.com/wp-dyn/content/article/2010/03/04/AR2010030404715.htm. In contrast, one bill to combat climate change would have reduced US emissions by 80 percent from 2005 levels by 2050. It passed the House of Representatives in 2009 but failed to make it to a Senate vote.

Corporate Response and Opportunity

Certain industries are more vulnerable than others to the economic impacts of climate change. Industries that are highly dependent on fossil fuels and high CO2 emitters, such as oil and gas companies, cement producers, automobile manufacturers, airlines, and power plant operators, are closely watching legislation related to GHGs. The reinsurance industry, which over the past several years has taken large financial losses due to extreme weather events, is deeply concerned about global climate change and liabilities for its impacts.

Given the potential costs of ignoring climate change, the costs of addressing it appear rather minimal. In 2006, the UK Treasury released the Stern Review on the Economics of Climate Change. The report estimated that the most immediate effects of global warming would cause damages of “at least 5% of global GDP each year, now and forever. If a wider range of risks and impacts is taken into account, the estimates of damage could rise to 20% of GDP or more.” Actions to mitigate the change, in contrast, would cost only about 1 percent of global GDP between 2010 and 2030.Lord Stern, “Executive Summary,” in Stern Review on the Economics of Climate Change (London: HM Treasury, 2006), 1, accessed January 7, 2011, http://www.hm-treasury.gov.uk/sternreview_index.htm.

Corporate reactions have ranged from taking action now to reduce or eliminate emissions of GHGs and active engagement with carbon trading markets to actively opposing new policies that might require changes in products or processes. Anticipatory firms are developing scenarios for potential threats and opportunities related to those policies, public opinion, and resource constraints. Among those companies actively pursuing a reduction in GHGs, some cite financial gains for their actions. Walmart and General Electric both committed to major sustainability efforts in the first decade of the twenty-first century as have many smaller corporations. Central to their strategies are GHG reduction tactics.

Excessive GHG emissions may reflect inefficient energy use or loss of valuable assets, such as when natural gas escapes during production or use. The Carbon Disclosure Project emerged in 2000 as a private organization to track GHG emissions for companies that volunteered to disclose their data. By 2010, over 1,500 companies belonged to the organization, and institutional investors used these and other data to screen companies for corporate social responsibility. Out of concern for good corporate citizenship and in anticipation of potential future regulation, GHG emissions trading has become a growing market involving many large corporations. The emissions trading process involves credits for renewable energy generation, carbon sequestration, and low-emission agricultural and industrial practices that are bought and sold or optioned in anticipation of variable abilities to reach emissions reduction targets. Some companies have enacted internal, competitive emissions reduction goals and trading schemes as a way to involve all corporate divisions in a search for efficiency, cleaner production methods, and identification of other opportunities for reducing their contribution to climate change.

In parallel to tracking GHG emissions, clean tech or clean commerce has become increasingly prevalent as a concept and a term to describe technologies, such as wind energy, and processes, such as more efficient electrical grids, that do not generate as much or any pollution. New investments in sustainable energy increased between 2002 and 2008, when total investments in sustainable energy projects and companies reached $155 billion, with wind power representing the largest share at $51.8 billion.Rohan Boyle, Chris Greenwood, Alice Hohler, Michael Liebreich, Eric Usher, Alice Tyne, and Virginia Sonntag-O’Brien, Global Trends in Sustainable Energy Investment 2009, United Nations Environment Programme, 2008, accessed January 29, 2011, http://sefi.unep.org/fileadmin/media/sefi/docs/publications/Global_Trends_2008.pdf. Also in 2008, sustainability-focused companies as identified by the Dow Jones Sustainability Index or Goldman Sachs SUSTAIN list outperformed their industries by 15 percent over a six-month period.Daniel Mahler, Jeremy Barker, Louis Belsand, and Otto Schulz, Green Winners (Chicago: A. T. Kearney, 2009), 2, http://www.atkearney.com/images/global/pdf/Green_winners.pdf.

Conclusion

Our climate may always be changing, but humans have changed it dramatically in a short time with potentially dire consequences. GHGs emitted from human activities have increased the global temperature and will continue to increase it, even if we ceased all emissions today. International policy makers have built consensus for the need to curb global climate change but have struggled to take specific, significant actions. In contrast, at a smaller scale, local governments and corporations have attempted to mitigate and adapt to an altered future. Taking a proactive stance on climate change can make good business sense.

At a minimum, strategic planning should be informed by climate change concerns and the inherent liabilities and opportunities therein. Whether operationalized by large firms or smaller companies, one important form of entrepreneurial innovation inspired by climate change challenges today is to apply tools associated with reduced climate and resource footprints that result in systemic reduction of energy and material inputs. When applied within firms and across supply chains, such tools increase profitability by lowering costs. More important, these measures can lead to innovations made visible by the efforts. At minimum, opportunities for product design and process improvements that both reduce climate change impact and increase resource efficiency and consumer loyalty make sense. Companies that chart a course around the most likely set of future conditions with an eye to competitive advantage, good corporate citizenship, and stewardship of natural resources are likely to optimize their profitability and flexibility—and hence their strategic edge—in the future.

Key Takeaways

- Scientific consensus concludes human activity now influences global climate.

- Greenhouse gases (GHGs), of which carbon dioxide (CO2) is predominant, trap heat through their accumulation in the atmosphere.

- Governments at all levels and corporations are designing mechanisms and strategies for addressing climate change by monetizing impacts.

- Companies are well advised to stay current with the science and analyze their liabilities and opportunities as emissions restrictions are increasingly imposed through tax or market means.

Exercises

- Gradual warming of the earth’s temperature is one indication/prediction of climate scientists. What other impacts are being felt today, or are likely to be felt in the future?

- Given the climate change trends, what social and environmental concerns appear most significant?

- What are the implications of climate change, and of regulation of GHG emissions, for companies?

- Under what conditions does a climate change strategy become an opportunity or otherwise make sense for a firm?

5.2 East West Partners: Sustainability Strategy

Learning Objectives

- Understand the conditions under which entrepreneurial leaders can work inside large companies.

- Examine how and why sustainability implementation can require working with multiple stakeholders to increase social, environmental, and business benefits.

- Identify how to translate sustainability thinking into viable corporate strategy.

- Illustrate how to positively pair ecosystems, climate, sustainable development, and community contribution.

The first case looks at how a young entrepreneur, who recently completed his graduate training, successfully built an innovative pilot effort within a large real estate firm that manages real estate and ski resorts.

It might seem unlikely that a real estate developer, much less a project focused on expanding a ski resort, could provide a model of sustainable business practices, but real estate developer East West Partners (EWP) has done just that through its collaboration with a ski resort called Northstar Tahoe. Land conservation, waste reduction, and the adoption of wind energy are all part of EWP’s incorporation of environmental and community considerations into every aspect of the project. At the same time the developer realizes significant cost savings and builds a reputation that enhances its competitive advantage. This was accomplished through top leadership’s creating the opportunity for a young man with a newly minted MBA to innovatively integrate sustainability thinking into strategy.

East West Partners and the Northstar Development

East West Partners was founded in the 1970s by a group of real estate professionals working in the Richmond, Virginia, area. To “protect what we’re here to enjoy” was a founding principle for EWP. In the mid-1980s, two senior EWP partners formed autonomous divisions in North Carolina and Colorado, maintaining a commitment to community and environmental quality and a loose affiliation with the Virginia group.

In 2000, Booth Creek Holdings, Northstar ski resort’s parent company, approached EWP’s Colorado office about a joint venture to develop land owned by the resort. Their subsequent agreement created East West Partners, Tahoe. EWP’s initial decision to partner in the redevelopment of Northstar was based on the project’s positive economic potential and sense of fit between EWP’s and Northstar’s business philosophy. The project was big. Northstar, a popular, family-oriented ski resort, owned hundreds of acres of land that could be developed into residential home sites, each with a market value of hundreds of thousands of dollars. The expansion and redevelopment of Northstar-at-Tahoe, which included a ski village with an ice rink and a massive increase in resort housing, including fractional-ownership condominiums, was expected to cost $2.7 billion over fifteen years. EWP would get zoning approvals, develop land, and build residences and commercial properties, profiting ultimately from property sales and management.

EWP Tahoe’s chief executive, Roger Lessman, and project manager, David Tirman, reasoned that through careful design and the latest green building techniques they could develop new homes with limited environmental impact that would save money on owner operations, particularly energy and water costs. Furthermore, environmentally responsible development and a proactive approach with the local communities would enhance community relations, possibly ease government approvals, and add to the sales appeal of their properties.

By mid-2002, however, the importance of environmental performance and the level of effort necessary to incorporate it into branding and marketing had exceeded initial expectations. Within a year of helping area residents develop a new community plan, EWP discovered that a small but vocal group of citizens was unilaterally antigrowth and opposed to any development, regardless of efforts toward sustainability. It became clear to Lessman and Tirman that they would need help working with the community and establishing EWP as a resort development industry leader sensitive to local social and environmental concerns.

The Ski Resort Industry

In the early 1990s, no single ski company could claim more than 3 percent of the North American market. But industry shifts were under way and by 2002, about 20 percent of US ski resorts captured 80 percent of skier visits. The total for US ski visits in 2001–2 was 54,411,000, with the four largest companies accounting for about 15,000,000. The trends toward acquisitions and larger companies with multiple resorts were accelerating. So too were the industry’s awareness and concern about global warming and its accompanying changing weather patterns influencing snowfalls and spring melts. Because of the industry’s intimate links to well-functioning natural systems, its acute weather dependence, and the protection of aesthetic beauty associated with nature, which customers travel there to enjoy (and pay to surround themselves with), the term sustainability was an increasingly familiar one in ski resort strategy discussions.

During the 1990s the industry emphasized ski villages and on-mountain residences. The affluence of aging baby boom generation skiers and their growing affinity for amenities such as shopping, restaurant dining, and off-season recreation alternatives led to a development surge in ski area villages and mountain communities. Unfortunately, social and environmental issues developed alongside the economic windfall provided by ski area land development. The second homes and high-end shops that attracted wealthy skiers also displaced lower-income residents who lived and worked in or near resort areas. Wildlife that was dependent on the fragile mountain habitat was displaced as well.

Environmental groups issued scathing reports on the damage caused by ski area development and rated ski areas for their impacts on wildlife. In October 1998, environmental activists in Vail, Colorado, protested a ski area expansion into Canada lynx habitat by burning ski resort buildings in a $12 million fire.Hal Clifford, “Downhill Slide,” Sierra, January/February 2003, 35, accessed January 7, 2011, http://www.sierraclub.org/sierra/200301/ski.asp. Elsewhere, local citizen groups pursued less radical and perhaps more effective means of protecting mountain land and communities through actions that blocked, delayed, and limited development plan approvals by local zoning boards. In the California market, land developers faced very difficult government approval processes. Local government agencies and citizens were key players who could block or supply approvals for land development plans.

EWP’s Approach

The proactive approach that EWP adopted—engaging all relevant actors in an open process—had both benefits and drawbacks. It seemed that a small group of citizens would inevitably oppose development of any kind, and keeping that group informed might not have been in a developer’s best interest. On the other hand, a majority of nongovernmental organizations (NGOs) and local residents were likely to see the merit of socially and environmentally sustainable development, which argued for EWP’s full disclosure of its plans with sustainability considerations factored in throughout. The trust of locals, won through an open and transparent planning process, seemed to speed approvals and inform and even attract customers. EWP’s decision was to proceed with the sustainability-infused strategy and accept the risk that construction delays related to its proactive approach could cause added expenses, potentially overwhelming the benefits of goodwill, market acceptance, and premium pricing.

New Leadership Needed

EWP executives knew that environmental concerns were high on the list of factors they should consider in the Northstar development project given the area’s high sensitivity to environmental health and preservation issues. Not only were prospective buyers more environmentally aware, but also, in the California market, land developers faced a very difficult government approval process relative to that in other states.

To address these concerns in the summer of 2002, Lessman hired Aaron Revere as director of environmental initiatives and made him responsible for ensuring that no opportunity for environmental sustainability was overlooked in building and operating the resort consortium. Revere, a recent University of Virginia environmental science and Darden School of Business MBA graduate, made it clear to subcontractors and materials suppliers that any attempt to substitute techniques or materials that circumvented environmental design facets would not be overlooked or tolerated. With complete top management support, Revere’s efforts met with little or no internal resistance. Coworkers wanted to help preserve the natural beauty of the areas they worked in and took a strong interest in new methods for reducing environmental impact.

In the new development model Revere proposed, sustainability would be a defining criterion from the outset. He presented top management with a business plan for making environmental amenities a central platform that differentiated EWP’s project designs. He developed sustainability guidelines and outlined a strategy for making the Tahoe projects’ environmental criteria a model for design and marketing. EWP would streamline government approvals by meeting with community stakeholders and outlining EWP’s program for corporate responsibility before a project began. Contractors, subcontractors, suppliers, and maintenance services interested in working with an EWP project would know as much about a project’s environmental and social criteria as they did about its economics. Marketing and sales personnel would be educated about the sustainability qualities of the project from the start and were expected to use those qualities to help generate sales. As the story unfolded, early tests of EWP’s ability to translate ideals into concrete actions with measurable results came quickly.

A Cornerstone of Sustainable Development: LEED Certification

Revere was pleased to find that other top employees, particularly Northstar project manager David Tirman, had already written of EWP’s intent to make environmental sustainability a key feature. The Leadership in Energy and Environmental Design (LEED) green building certification served as a cornerstone in these efforts. The LEED system was the result of a collaborative panel of respected green building specialists convened by the US Green Building Council (USGBC). The USGBC was formed in 1993 to address the growing US interest in sustainable building technology. The group was associated with the American Institute of Architects (AIA), the leading US architectural design organization. USGBC created the LEED system to provide unambiguous standards that would allow purchasers and end users to determine the validity of environmental claims made by builders and developers. Additionally, LEED provided conscientious industry players with a marketing tool that differentiated their products according to their efforts to minimize adverse health and environmental impacts while maintaining high standards for building quality and livability.

EWP expected to be among the largest builders of LEED-certified projects as that certification system branched into residential buildings. EWP encouraged customers who bought undeveloped lots to use LEED specifications and was offering guidelines and recommended suppliers and architects. By 2006, LEED certification was sought for all Northstar structures.

Successful projects implemented with LEED certification by 2007 included careful dismantling of the clock tower building at Northstar. EWP worked with the nonprofit group Institute for Local Self-Reliance (ILSR) to develop a deconstruction and sales strategy for the assets. Revere, who with three other EWP employees had become a LEED-certified practitioner, documented the percentage of waste diverted from the landfill, energy savings, and CO2 offset credits that would result in tax benefits to EWP.

EWP’s renovation of Sunset’s restaurant on the shore of Lake Tahoe was already under way when Revere was hired. Revere nevertheless wanted to pursue LEED certification for every possible Tahoe Mountain Resorts structure. He soon became a familiar figure at the restaurant, finding design changes, products, and processes that captured environmentally effective building opportunities in the simplest and most efficient ways. His presence on the job enabled Revere to see new opportunities: A system for dispensing nonpolluting cleaning chemicals was installed; and “gray water” from sinks was drained separately, run through a special coagulation and filtration system, and reused for watering landscaping plants outside the restaurant. Sawdust from sanding the recycled redwood decking was captured and prevented from entering Lake Tahoe.

The end result of Revere’s efforts and the enthusiastic participation of the architect, contractors, workers, and even the chefs was the first restaurant renovation to receive LEED certification and a marketing tool that appealed to the resort’s environmentally aware clientele. By the time the renovation was completed, Revere estimated that the expense of seeking superior environmental performance was a negligible part of total renovation cost. Savings on operations—due to low energy-use lighting, maximum use of daylight and air circulation, natural cooling, and superior insulation—were expected to more than pay for the additional cost within the first two to three years.

Conservation and Development: Building Partnerships through an Oxymoron

While the pursuit of LEED certification for buildings was an excellent step toward reducing environmental impact, Revere and EWP management knew that they would have to do more to persuade the local community of their commitment. In 2002, the problem of habitat degradation from ski areas became the topic of considerable negative press. The environmental group Ski Area Citizens’ Coalition (SACC) published claims that ski areas had transitioned from economically marginal winter recreation facilities to year-round resorts with premium real estate developments, mostly without sensitivity to environmental and social issues. The group went on to rate several prominent ski areas on environmental concerns, issuing grades from A to F, on its website.Ski Area Citizens’ Coalition, “Welcome to the 2011 Ski Area Report Card,” accessed January 7, 2011, http://www.skiareacitizens.com.

Since the SACC weighted its ratings heavily on habitat destruction, and new construction necessarily destroyed habitat, Northstar, which planned a 200-acre expansion of its ski area, a 21-acre village and a 345-acre subdivision, fared poorly. While other ski areas with more land and larger residential areas had disturbed more habitats, the SACC viewed past development as “water over the dam.” In the eyes of the group, Northstar’s planned expansion of both ski trails and housing overwhelmed any possible sustainable development efforts. Though the SACC rating would probably have little if any impact on the number of skiers visiting Northstar or the number of new homes sold, EWP executives were nevertheless annoyed. They were working hard to be good stewards of the land, determined to set an example for profitable, socially and environmentally responsible development and operations without giving up their planned projects.

Rather than ignore the SACC rating and environmentalists’ concerns about development of any wilderness area, EWP management, under Aaron Revere’s leadership, began an open and direct dialogue with conservation groups such as Sierra Watch and the Mountain Area Preservation Foundation. In March 2005, the groups reached what many termed as a precedent-setting agreement to limit Northstar’s development of its eight thousand acres of land to fewer than eight hundred acres. In addition, the agreement required a transfer fee on all Northstar real estate sales to be used to purchase and protect sensitive wildlife habitat in the Martis Valley area of Tahoe. The fees were expected to total more than $30 million for the Martis Valley alone. In contrast, the previous two state conservation bonds raised $33 million for the entire Sierra mountain range.

In addition, the agreement called for a “habitat conservation plan” for the more than seven thousand acres of Northstar land not earmarked for residential and commercial development. EWP viewed that agreement as having dual benefits. Through the agreement, environmental and community groups dropped their opposition to the development projects proposed by Northstar, and a large tract of land was protected for the foreseeable future. The additional revenue generated for the purchase of more protected acreage allowed EWP to do more than simply responsibly develop land. Through the strategic intent to develop highly desirable and environmentally sustainable properties, the company had designed a new method of generating funds for the protection of the natural environment that is by definition key to its properties’ success.

Measuring Success and Making a Difference

Aaron Revere’s definition of his job with EWP included proving wherever possible the commercial viability of “doing the right thing.” What preserved and enhanced the natural environmental systems on which the resort depended would serve the longer-term economic interests of the owner. But Revere was interested in the quantitative gains in the short and intermediate terms. He wanted to add to the growing pool of data in the ski industry on the cost differentials between typical construction and development practices and those that strived to incorporate sustainable design elements. Tahoe Mountain Resorts provided an ideal opportunity for tracking improvements and measuring the economic benefits that sustainable practices brought to the company. Metrics included biodiversity/natural capital (ecosystem, flora and fauna, and rare species assessments), air and water quality, and water and energy use. Revere’s strategy included building an environmental initiation team within EWP/Northstar. He also sought early adopters in both Tahoe Mountain Resorts and nearby Booth Creek who would build sustainability into the corporate culture and brand. Sales and marketing people were encouraged to view sustainability features as what he termed “cooler and sexier” selling points that could command a premium price. Revere used weekly e-mail advisories to help keep implementation ideas fresh in the minds of his coworkers. He wanted to put local and organic food items on the menus of Tahoe Mountain Resort restaurants and eliminate the serving of threatened species such as Chilean sea bass and swordfish—the idea was to be consistent and authentic across operations. Advisories sent to colleagues included the following: “Consider permeable paving stones or grass instead of asphalt, stockpiling snow from road-clearing above ‘sinks’ that would replenish aquifers, preformed walls, VOC [volatile organic compound]-free paints, stains, and sealants, water-conserving sensors on faucets and lights, and recyclable carpeting.”Andrea Larson, East West Partners: Sustainable Business Strategy in Real Estate and Ski Resorts, UVA-ENT-0093 (Charlottesville: Darden Business Publishing, University of Virginia, October 21, 2008).

The California Waste Management Board awarded EWP its Waste Reduction Awards Program’s highest honor for eight consecutive years (1997–2004). Describing EWP, the board stated, “To date, East West Partners has achieved successful and unique waste reduction and recycling activities within its Coyote Moon golf course operations, Wild Goose restaurant operations, general office operations, and the planning of Old Greenwood and the Northstar Ski Village. From May 2002 to May 2003, East West Partners successfully diverted an estimated 12.5 tons of material from landfill. These efforts to ‘remove the concept of waste’ from their company vocabulary saved East West Partners thousands of dollars.”Andrea Larson, East West Partners: Sustainable Business Strategy in Real Estate and Ski Resorts, UVA-ENT-0093 (Charlottesville: Darden Business Publishing, University of Virginia, October 21, 2008).

Under Revere’s direction, EWP achieved Audubon International’s Gold Level certification for the Gray’s Crossing Golf Course. Only three other golf courses in the nation had achieved this status for exceptional environmental sensitivity in the design and operations of both the facility and the community that surrounds it. Working with Revere and EWP’s hand-picked contractors, the Audubon sustainable development experts were sufficiently impressed by the company’s sincere efforts on sustainability as a strategic theme that they offered to work with EWP to make the redevelopment of a second course, the Old Greenwood Golf Course, a Gold Level project as well. Sustainable design principles applied to golf courses created significant cost and environmental savings, requiring only 50 percent as much water and fertilizer as conventional courses. Typical of the myriad implementation choices made across Revere’s projects, cost savings, allocation of precious water to better purposes, and a halving of synthetic chemical use merged in what was ultimately seen as just good business.

Additional Reading

- Auden Schendler, Aspen Skiing Company’s Testimony to the US House of Representatives, Committee on Natural Resources, Subcommittee on Energy and Mineral Resources, Oversight Hearing; “Towards a Clean Energy Future: Energy Policy and Climate Change on Public Lands,” March 15, 2007, Aspen Skiing Company, http://www.aspensnowmass.com/environment/images/ASC_House_Climate_Testimony.pdf.

- Don C. Smith, “Greening the Piste,” Refocus (November–December 2004): 28–30. Article is available through the Darden Library search engine Science Direct, http://www.sciencedirect.com/science?_ob=MImg&_imagekey=B73D8-4F26XDH-Y-1&_cdi= 11464&_user=709071&_orig=search&_coverDate=11%2F01%2F2004&_sk= 999949993&view=c&wchp=dGLzVzz-zSkWz&md5=cc88a8caa01db6edb009bbed8bbca727&ie=/sdarticle.pdf.

Key Takeaways

- Climate change is already influencing mountain ice packs and snowfall patterns, shortening ski seasons, and requiring ski resorts to adapt their strategies.

- Sincere efforts with stakeholders can create opportunities and help generate creative solutions.

- A committed, determined, educated entrepreneurial individual can create change within a large firm.

- Well-implemented sustainability concepts deliver concrete business benefits, both operational and strategic.

Exercises

- What factors drove EWP to incorporate sustainability approaches into its strategy?

- What are the roles of climate and climate change in shaping strategy for this company at the Tahoe location?

- What are the changes Aaron Revere instituted? How did they contribute to operations and strategy for the firm? What learning could be transferred to other parts of the parent company’s activities?

- Given the tasks Aaron Revere had when he began his job, identify no less than five of the most significant challenges he faced in this job. Use the case information, your knowledge of business, and your own experience and imagination to anticipate what you believe Aaron would tell you were his major challenges.

- Prepare an analysis of key factors that explain Revere’s success. Come to class ready to present your analysis and defend your argument.

5.3 Frito-Lay North America: The Making of a Net-Zero Snack Chip

Learning Objectives

- Understand how measurable sustainability goals can drive business decisions.

- Explain how projects within a company can contribute to larger changes in corporate culture and sustainability.

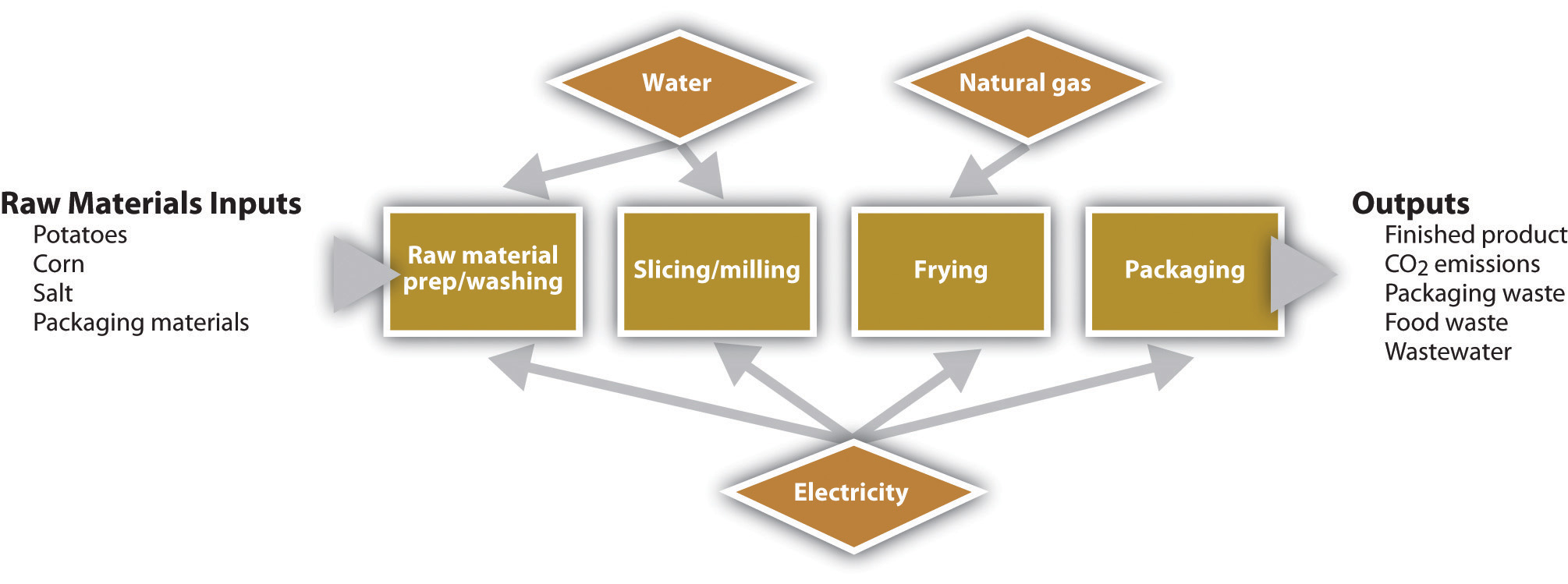

The second case, Frito-Lay (PepsiCo), examines innovative activity that has been ongoing for several years at a manufacturing facility in Arizona. Large firms typically struggle to implement significant change, yet this example shows how established companies can take steps that ultimately create innovative and systemic outcomes guided by sustainability principles that benefit multiple stakeholders.

It was late 2007, and Al Halvorsen had assembled his team of managers from across Frito-Lay North America (FLNA) to make a final decision on an ambitious proposal to take one of its nearly forty manufacturing plants “off the grid”The expression “off the grid” means reducing or eliminating a facility’s reliance on the electricity and natural gas grids and on water utilities for production inputs. through the installation of cutting-edge energy- and water-saving technologies. After a decade of successful initiatives to improve the productivity of operations and to reduce the energy and other resources used in the production of the company’s snack products, senior managers had decided that it was time to take their efforts to the next level.

Frito-Lay’s resource conservation initiatives started in the late 1990s. Company managers recognized potential operating challenges as they faced rising utility rates for water, electricity, and natural gas; increasing resource constraints; and expected government-imposed limits on greenhouse gas (GHG) emissions. These challenges had implications for the company’s ability to deliver sustained growth to its shareholders.

The programs the company put in place resulted in a decade of efficiency improvements, leading to incremental reductions in fuel consumption, water consumption, and GHG emissions. Each project’s implementation helped the operations and engineering teams within the organization grow their institutional knowledge and expertise in a range of emerging technologies.

By 2007, managers were starting to wonder how far they could take efforts to improve the efficiency and environmental impact of operations. Al Halvorsen was several months into a new initiative to evaluate the feasibility of bundling several innovative technologies at one manufacturing facility to maximize the use of renewable energy and dramatically reduce the consumption of water. By leveraging the expertise of the in-house engineering team, and grouping a number of technologies that had been previously piloted in isolation at other facilities, Halvorsen believed that a superefficient facility prototype would emerge that could serve as a learning laboratory for the improvement of the company’s overall manufacturing practices.

Halvorsen had asked the members of his cross-functional team of managers from across the organization to evaluate the broad scope of challenges involved with creating what was dubbed a “net-zero” facility. The project would likely push the boundaries of current financial hurdles for capital expenditure projects but would result in a number of tangible and intangible benefits. After months of evaluation, the time had come to decide whether to go forward with the project.

A Tasty History

Frito-Lay North America is one of the nation’s best-known snack-food companies, with origins in the first half of the twentieth century. In 1932, Elmer Doolin started the Frito Company after purchasing manufacturing equipment, customer accounts, and a recipe from a small corn-chip manufacturer in San Antonio, Texas. That same year, Herman W. Lay of Nashville, Tennessee, started a business distributing potato chips for the Barrett Food Products Company.

The two companies experienced dramatic growth in the ensuing years. Herman Lay expanded his distribution business into new markets and in 1939 bought the manufacturing operations of Barrett Foods to establish the H. W. Lay Corporation. The Frito Company expanded production capacity and broadened its marketing presence by opening a western division in Los Angeles in 1941. Although the war years posed significant challenges, the two companies emerged intact and won the hearts of American GIs with products that provided a tasty reminder of home.

Both companies experienced rapid growth in the postwar boom years, fueled by an ever-expanding product selection and the development of innovative distribution networks. By the mid-1950s, the H. W. Lay Corporation was the largest manufacturer of snack foods in the United States, and the Frito Company had expanded its reach into all forty-eight states. As the two companies expanded nationally, they developed cooperative franchise arrangements. In 1961, after several years of collaboration, the companies merged to form Frito-Lay Inc., the nation’s largest snack-food company.

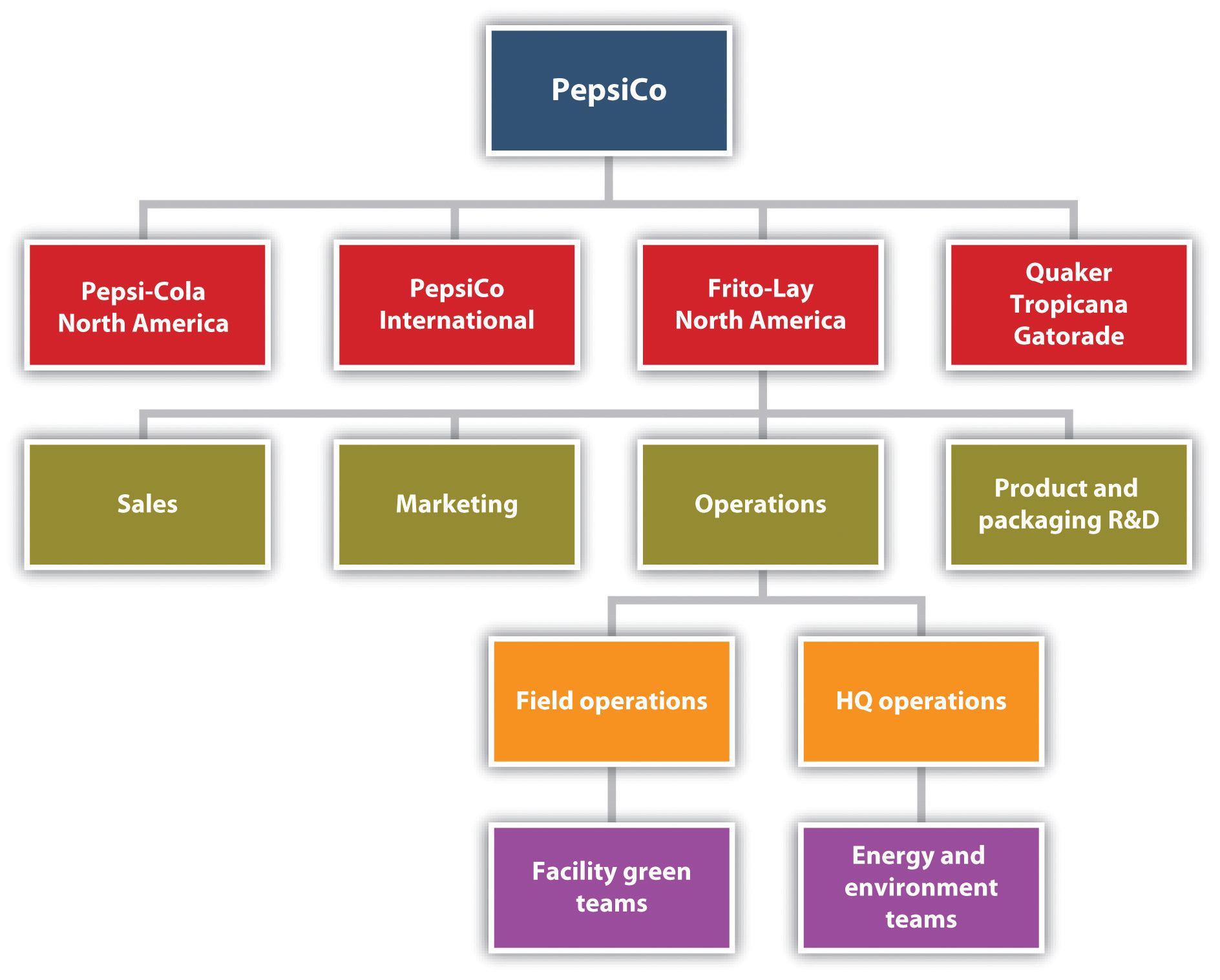

In the years following the creation of Frito-Lay, the company continued to experience rapid growth and changes in its ownership structure. In 1965, a merger with Pepsi-Cola brought together two of the nation’s leading snack and beverage companies under one roof. The resulting parent, PepsiCo Inc., was one of the world’s leading food companies in 2007 and a consistent presence on Fortune’s “America’s Most Admired Companies” list. The company includes a number of other iconic brands such as Tropicana juices, Gatorade sports drinks, and Quaker foods. (See Figure 5.9 "PepsiCo Business Units" for a diagram of PepsiCo’s business units.)

Figure 5.9 PepsiCo Business Units

Source: Andrea Larson, Frito-Lay North America: The Making of a Net Zero Snack Chip, UVA-ENT-0112 (Charlottesville: Darden Business Publishing, University of Virginia, May 4, 2009).

By 2007, the Frito-Lay business unit owned more than fifteen brands that each grossed more than $100 million in annual sales. The most well-known brands included Lay’s potato chips, Fritos corn chips, Cheetos cheese-flavored snacks, Ruffles potato chips, Doritos and Tostitos tortilla chips, Baked Lay’s potato crisps, SunChips multigrain snacks, and Rold Gold pretzels.

The Vision for a More Sustainable Snack Company

By the 1990s, PepsiCo’s Frito-Lay business unit was experiencing healthy growth in earnings and was continuing to expand internationally. In the United States and Canada, Frito-Lay North America was operating more than forty manufacturing facilities, hundreds of distribution centers and sales offices, and a sizeable fleet of delivery vehicles. As the company grew, the costs associated with operating these assets increased as well.

Increasing resource costs, fuel price volatility, and emerging concerns about future resource availability started to worry managers during this time period. Members of the environmental compliance group took the initiative and expanded their traditional regulatory compliance role to also focus proactively on resource conservation as a cost-reduction strategy. Later, a resource conservation and energy team was formed at Frito-Lay’s Plano, Texas, headquarters to coordinate efficiency initiatives across the portfolio of manufacturing and distribution facilities. At the facility level, “Green Teams” and “Energy Teams,” consisting of plant operators and line workers, assembled to closely monitor daily energy and water usage and to identify and implement productivity-boosting resource conservation projects.

Initial results of the resource conservation program were positive, with projects paying back well within the corporate financial benchmark of two to three years and achieving incremental reductions in energy and water use. The company’s senior management, including then CEO Al Bru, took notice of these results and set the stage for a more ambitious program at a time when competitors were only dabbling in the implementation of more efficient business processes.

In 1999, Senior Vice President of Operations Jim Rich challenged the team to expand its efforts into a company-wide effort to reduce resource use and costs. Managers at headquarters defined a set of stretch goals that, if achieved, would take the company’s efforts to the cutting edge of what was feasible on the basis of available technologies while still meeting corporate financial hurdles for the approval of capital expense projects. This set of goals, affectionately known as the BHAGs (“Big Hairy Audacious Goals”),The term “Big Hairy Audacious Goals” is borrowed from James Collins and Jerry Porras’s book Built to Last: Successful Habits of Visionary Companies (New York: HarperCollins, 1997). called for the following efforts:

- A reduction in fuel consumption per pound of product (primarily natural gas) by 30 percent

- A reduction in water consumption per pound of product by 50 percent

- A reduction in electricity consumption per pound of product by 25 percent

Over the next eight years, the Resource Conservation Team and facility Green Teams set about designing, building, and implementing projects across the portfolio of FLNA facilities. Both new and established technologies were piloted, and responsibility was placed on line employees to implement improved operating practices and to monitor variances in resource usage from shift to shift. A growing group of in-house engineering experts—both at headquarters and at manufacturing facilities—oversaw these initiatives, bypassing the need to hire energy service companies (ESCOs), outside consultants often hired for these types of projects, and ensuring that FLNA developed and retained valuable institutional knowledge.

By 2007, the team estimated that it was saving the company $55 million annually in electricity, natural gas, and water expenses, compared with 1999 usage, as a result of the projects implemented to date. Piloted technologies included photovoltaic cells, solar concentrators, landfill gas capture, sky lighting, process steam recapture, and many other energy and water efficiency measures.

In 2006, Indra Nooyi was selected as the new chairman and CEO of the PepsiCo. As a thirteen-year veteran of the company, and the former CFO, she was supportive of the resource conservation initiatives at Frito-Lay and within other operating divisions. Nooyi set forth her vision for PepsiCo of “Performance with Purpose” in a speech on December 18, 2006, in New Delhi. “I am convinced that helping address societal problems is a responsibility of every business, big and small,” she said. “Financial achievement can and must go hand-in-hand with social and environmental performance.”Indra K. Nooyi, “Performance with a Purpose” (speech by PepsiCo President and CEO at the US Chamber of Commerce–India/Confederation of Indian Industry, New Delhi, India, December 18, 2006), accessed January 10, 2011, http://www.wbcsd.org/DocRoot/61wUYBaKS2N35f9b41ua/IKN-IndiaSpeechNum6FINAL.pdf. This statement established her triple-bottom-line vision for growth at the company.The term triple-bottom-line refers to a concept advanced by John Elkington in his book Cannibals with Forks: The Triple Bottom Line of 21st Century Business (Mankato, MN: Capstone Publishers, 1998). Companies that embrace triple-bottom-line thinking believe that to achieve sustained growth in the long term, they must demonstrate good financial, environmental, and social performance, also referred to as “sustainable business.”

In line with this new vision, and with the support of the FLNA finance team, what started as a productivity initiative began to push the boundaries of traditional business thinking about the value of “sustainable” operating practices. By the end of the twenty-first century’s first decade, all PepsiCo business units were adding environmental and resource conservation criteria to the capital expense approval process. With buy-in from the FLNA CFO, the benchmarks for capital expenditure projects were extended if a project could demonstrate additional benefits outside of traditional net present value calculations. This change was justified on the following grounds:

- New technological and manufacturing capabilities are of long-term value to the company and can result in future cost-cutting opportunities.

- Pilot projects that combine multiple technologies serve as a proof of concept for previously undiscovered operational synergies.

- Such projects are a part of overall corporate risk mitigation strategy to reduce dependence on water, energy, and raw materials in the face of resource cost pressures and an increasingly resource-constrained world.

- Sustainably manufactured products will have a place in the marketplace and will contribute to sales dollars, customer loyalty, and increased market share relative to competitors who do not innovate.

- Emerging government regulation, particularly with regard to carbon, could create additional value streams. For example, under a cap-and-trade system, projects that reduce net emissions would potentially generate carbon credits, which could be sold in a market.

- Water, electric, and natural gas inflation rates have been increasing even beyond expectations.

Measuring and Reporting GHG Emissions

A secondary benefit of FLNA’s conservation initiatives was the collection of rich data about operations, productivity, and resource usage. The efforts of each facility Energy Team to implement the corporate resource conservation program resulted in an in-depth understanding of the impact each project had on fuel and electricity consumption in the manufacturing process. Managers at headquarters were able to piece together an aggregate picture of energy consumption across the organization.

Around the same time period, managers within the environmental compliance group started to voice their opinion that the company should be documenting its success in improving the energy efficiency of its operations. During the 1990s, the issue of climate change was receiving increased attention globally—and the Clinton administration was warning that reductions in US emissions of GHGs would be necessary in the future as a part of the solution to this emerging global problem. FLNA managers believed that future climate regulation was likely and were concerned that they might be penalized relative to their competitors in the event that the government limited GHG emissions from manufacturing operations. Future emissions caps were likely to freeze a company’s emissions at their current levels or to mandate a reduction to a lower level. Managers were concerned that all the reductions in emissions made by the company prior to the establishment of a regulatory limit would be ignored. As a result, they sought out potential venues for documenting their successes.

Through dialogues with the US Environmental Protection Agency (EPA), the company learned about a new voluntary industry partnership program aimed at the disclosure and reduction of corporate emissions of GHGs. The Climate Leaders program was the flagship government initiative aimed at working with US companies to reduce GHG emissions, and it provided its partners with a number of benefits. The program, a government-sponsored forum for disclosure of emissions information, offered consulting assistance to companies in the creation of a GHG emissions inventory. In exchange for these benefits, Climate Leaders partners were required to annually disclose emissions and to set a meaningful goal and date by which they would achieve reductions.

In 2004, FLNA signed a partnership agreement with Climate Leaders—publicly disclosing its corporate emissions since 2002.The Climate Leaders program allowed individual business units or parent corporations to sign partnership agreements. In the years since FLNA signed its partnership with Climate Leaders, PepsiCo started reporting the aggregate emissions of all business units via the Carbon Disclosure Project (CDP). The emissions data presented in this case are included in the consolidated emissions reported by PepsiCo through the CDP. By joining the program, FLNA challenged itself to improve the efficiency of its operations even more. A corporate goal of reducing carbon dioxide (CO2) equivalent emissions per ton of manufactured product by 14 percent from 2002 to 2010 was included as a part of the partnership agreement. Public inventory results through 2007 are provided in Table 5.1 "FLNA Public GHG Inventory Results, 2002–7" and include emissions from the following sources:

- Scope 1.The terms Scope 1 and Scope 2 refer to categories of greenhouse gas emissions as defined by the World Business Council for Sustainable Development/World Resource Institute Greenhouse Gas Protocol, which is the accounting standard used by Climate Leaders, the Carbon Disclosure Project, and other organizations. Scope 1 emissions are direct. Scope 2 emissions are indirect. Natural gas, coal, fuel oil, gasoline, diesel, refrigerants (hydrofluorocarbons [HFCs], perfluorocarbons [PFCs]).

- Scope 2. Purchased electricity, purchased steam.

Table 5.1 FLNA Public GHG Inventory Results, 2002–7

| Scope 1 Emissions (Metric Tons CO2 Eq) | Scope 2 Emissions (Metric Tons CO2 Eq) | Total Emissions (Metric Tons CO2 Eq) | Metric Tons of Product Manufactured | Normalized Total | |

|---|---|---|---|---|---|

| 2002 | 1,072,667 | 459,088 | 1,530,755 | 1,287,069 | 1.19 |

| 2003 | 1,081,634 | 452,812 | 1,534,446 | 1,304,939 | 1.18 |

| 2004 | 1,066,906 | 455,122 | 1,522,028 | 1,324,137 | 1.15 |