This is “Shopping for Homeowners Insurance”, section 13.5 from the book Enterprise and Individual Risk Management (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

13.5 Shopping for Homeowners Insurance

Learning Objective

- In this section we elaborate on strategies for acquiring the most suitable insurance at the lowest relative cost

You can buy insurance for your home from many different sources, and premiums can vary greatly. As with any kind of purchase, price is not the sole consideration, but the possibility of saving 40 or 50 percent a year on your home insurance is worth some effort. The range of prices may not be as great where you live, but there is likely enough variation to justify shopping around. The startling difference between high and low prices clearly demonstrates that it pays to shop for home insurance.

There are three steps to shopping for homeowners coverage:

- Figure out what you have

- Figure out what you want

- Collect your quotes and information about insurers before making your final decision

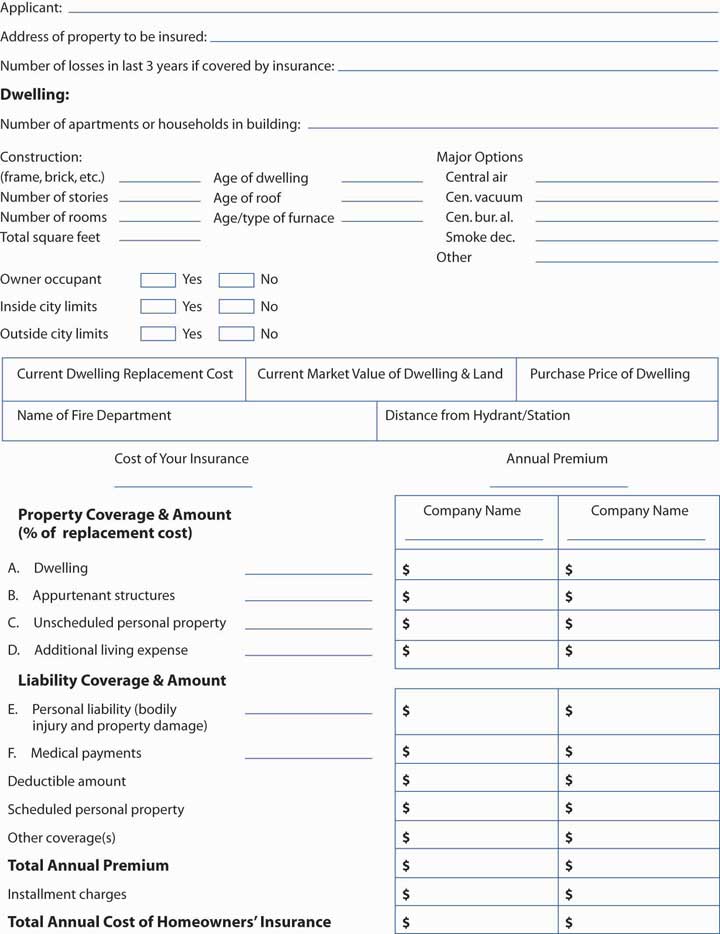

These steps are illustrated in the case of the Smith family mentioned earlier in the chapter. You will need to inventory your possessions and organize all the information the insurer will need. Taking photos of your property and keeping the photos in a safe place away from your home is a good method of maintaining an inventory list. Figure 13.5 "Homeowners Insurance Quotation Worksheet" shows the information about your property that you will need to provide to your insurer, including details such as construction (brick, frame), access to fire hydrants, location, age, and security. The location of the property is important and may cause you to have to pay higher premiums. The issue of redlining—higher premiums for homes in inner cities—is discussed in the box “Redlining: Urban Discrimination Myth or Reality?”

Figure 13.5 Homeowners Insurance Quotation Worksheet

Next, you need to decide what insurance you want and the amounts of coverage, for example:

- Coverage A (dwelling) $100,000

- Coverage E (liability) $25,000

- Coverage F (medical payments) $500 per person

You will also need to choose your deductibles, such as $100, $250, and $500, and limits on coverages E and F, such as $100,000 or $300,000 on coverage E.

Finally, collect quotes from potential insurers. You might choose a couple of online or direct-mail insurers, some independent agents, and some exclusive-agency companies. Taking into account any differences in coverage, compare annual premiums and decide which company will provide what you want at the best price, as is demonstrated in Case 1 of Chapter 23 "Cases in Holistic Risk Management".

Key Takeaways

In this section you studied the general notion of liability and the related legal aspects thereof:

- It is worth shopping around for home insurance because savings can amount to 40 to 50 percent per year.

- The first step in seeking coverage is to perform a thorough inventory of possessions and gather information pertinent to an insurer.

- The second step is deciding on the insurance, the amounts of coverage desired, and the deductibles.

- The final step is to collect quotes from potential insurers.

Discussion Questions

- What might account for cost differentials between policies that offer the same limits of coverage?

- In your experience, is cost the bottom line when it comes to the purchase of insurance? Does service factor into the decision?