This is “The Insurance Solution and Institutions”, chapter 6 from the book Enterprise and Individual Risk Management (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 6 The Insurance Solution and Institutions

In Part I of this book, we discussed the nature of risk and risk management. We defined risk, measured it, attempted to feel its impact, and learned about risk management tools. We statistically measured risk using the standard deviation and coefficient of variance, for example. We are going to emphasize the fact that risk decreases as the number of exposures increases as the most important foundation of insurance. This is called the law of large numbers. This law is critical to understanding the nature of risk and how it is managed. Once there are large numbers of accidental exposures, the next questions are (1) How does insurance work? and (2) What is insurable risk? This chapter responds to these questions and elaborates on insuring institutions.

The transfer of risk to insurers reduces the level of risk to society as a whole. In the transfer of risk to insurers, the risk of loss or no loss that we face changes. As we learned in Chapter 3 "Risk Attitudes: Expected Utility Theory and Demand for Hedging", we pay premiums to get the security of no loss. When we transfer the risk, insurers take on some risk. To them, however, the risk is much lower; it is the risk of missing the loss prediction. The insurer’s risk is the standard deviation we calculated in Chapter 2 "Risk Measurement and Metrics". The larger the number of exposures, the lower the risk of missing the prediction of future losses. Thus, the transfer of risk to insurers also lowers the risk to society as a whole through the law of large numbers. Even further, insurance is one of the tools that maintains our wealth and keeps the value of firms intact. As we elaborated in Chapter 5 "The Evolution of Risk Management: Enterprise Risk Management", people and firms work to maximize value. One essential element in maximizing the value of our assets is preservation and sustainability. If purchased from a credible and well-rated insurance company, insurance guarantees the preservation of assets and economic value. In this chapter, we will cover the following:

- Links

- Ideal requisites for insurability

- Types of insurance and insurers

6.1 Links

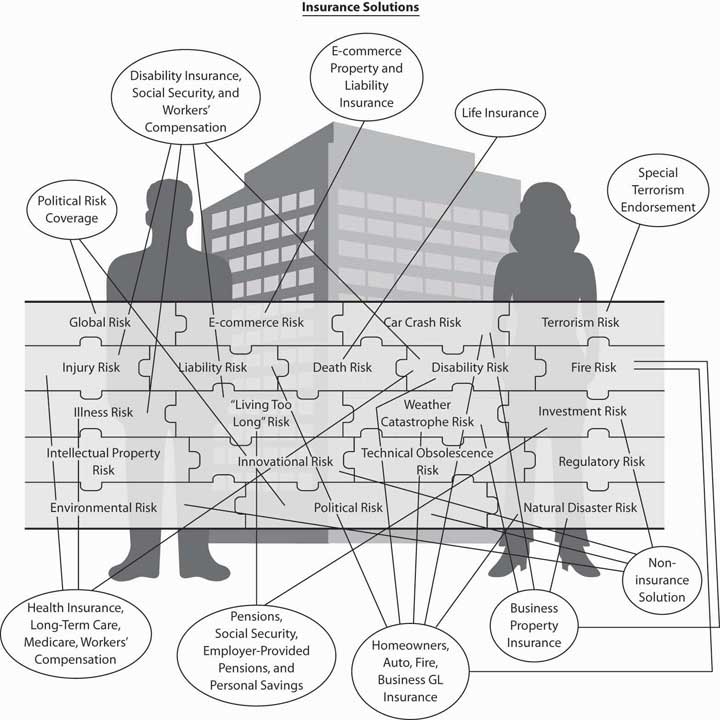

The adverse, or negative, effects of most of the risks can be mitigated by transferring them to insurance companies. The new traveler through the journey of risk mitigation is challenged to ensure that the separate risks receive the appropriate treatment. In Figure 6.1 "Links between the Holistic Risk Puzzle Pieces and Insurance Coverages", each puzzle piece represents a fragment of risk, each with its associated insurance solution or an indication of a noninsurance solution. Despite having all of the risks in one completed puzzle to emulate a notion of holistic risk, the insurance solutions are not holistic. Insurers sell separate policies that cover the separate risks. Each policy specifically excludes the coverage that another policy provides. For example, the auto policy excludes the coverage provided by the homeowners’ policy. These exclusions are designed to prevent double dipping, or double coverage. Every risk has its unique policy or a few layers of coverages from various sources. For the risk of dying prematurely, we can purchase life insurance policies as well as receive coverage from Social Security. For the risk of becoming ill and not being able to pay for medical care, we have health insurance. For the risk of losing our income because of injury, we have disability insurance (or workers’ compensation if the injury occurred on the job). Throughout this text, you will learn about all the policies and how to create an entire portfolio to complete the puzzle of the insurance solution within the risk management activities.

Figure 6.1 Links between the Holistic Risk Puzzle Pieces and Insurance Coverages

6.2 Nature of Insurance

Learning Objectives

In this section you will learn the following:

- The law of large numbers as the essence of insurance

- How insurance is defined

A brief survey of insurance literature reveals differences of opinion among authors concerning how the term insurance should be defined. Regardless, however, the literature agrees that insurance has to contain both of the following elements: (1) risk pooling and (2) risk transfer. The risk pooling creates a large sample of risk exposures and, as the sample gets larger, the possibility of missing future loss predictions gets lower. This is the law of large numbers, discussed further in the box below, “Law of Large Numbers.” The combination of risk pooling and risk transfer (from the owner of the risk to a third, unrelated party) physically reduces the risk, both in number and in the anxiety it causes. As such, we regard insuranceA social device in which a group of individuals transfer risk to another party in such a way that the third party combines or pools all the risk exposures together. as a social device in which a group of individuals transfer risk to another party in such a way that the third party combines or pools all the risk exposures together. Pooling the exposures together permits more accurate statistical prediction of future losses. Individuals who transfer risk to a third-party are known as insuredsIndividuals who transfer risk to a third-party.. The third party that accepts the risks transferred by insureds is known as the insurerThe third party that accepts the risks transferred by insureds..

The Law of Large Numbers

Availability of only small data sources (or sometimes none at all) is troublesome because most estimation techniques rely on numerous observations for accuracy. The benefit of many observations is well stated by the law of large numbers, an important statistical doctrine for the successful management of risk and the basic foundation for the existence of insurance in society.

The law of large numbersAs a sample of observations is increased in size, the relative variation about the mean declines. holds that, as a sample of observations increases in size, the relative variation about the mean declines. An example is given in Section 6.5 "Appendix: More Exposures, Less Risk". The important point is that, with larger samples, we feel more confident in our estimates.

If it were not for the law of large numbers, insurance would not exist. A risk manager (or insurance executive) uses the law of large numbers to estimate future outcomes for planning purposes. The larger the sample size, the lower the relative risk, everything else being equal. The pooling of many exposures gives the insurer a better prediction of future losses. The insurer still has some risk or variability around the average. Nevertheless, the risk of an insurer with more exposures is relatively lower than that of an insurer with fewer exposures under the same expected distribution of losses, as presented in Section 6.5 "Appendix: More Exposures, Less Risk".

The importance of the large number of exposures often prompts the question, What can smaller insurers do to reduce the uncertainty in predicting losses? Smaller insurers use the sharing of data that exists in the insurance industry. One such data collection and statistical analysis organization is the Insurance Services Office (ISO). In addition to being a statistical agent, this organization provides the uniform policy forms for the property/casualty industry (a small sample of these policies are in the appendixes at the end of the text). The ISO is both a data collection agent and an advisory organization to the industry on matters of rates and policy forms.

How Insurance Works

Insurance works through the following steps:

- Risk is transferred from an individual or entity (insured) to a third party (insurer).

- The third party (insurer) pools all the risk exposures together to compute potential future losses with some level of accuracy. The insurer uses various forecasting techniques, depending on the distribution of losses. One of the forecasting techniques was demonstrated in Chapter 4 "Evolving Risk Management: Fundamental Tools".

- The pooling of the risk leads to an overall reduction of risk in society because insurers’ accuracy of prediction improves as the number of exposures increases.

- Insurers pool similar risk exposures together to compute their own risk of missing the prediction.

- Insurers discriminate via underwriting—the process of evaluating a risk and classifying it with similar risks (see the box below, Note 6.10 "Fitting into a Lower Risk-Exposure Pooling Group"). Both the transfer of risk to a third party and the pooling lead to reduced risk in society as a whole and a sense of reduced anxiety.

Risk Transfer

Insurance is created by an insurer that, as a professional risk-bearer, assumes the financial aspect of risks transferred to it by insureds. The insurer assumes riskThe insurer promises to pay whatever loss may occur as long as it fits the description given in the policy and is not larger than the amount of insurance sold. by promising to pay whatever loss may occur as long as it fits the description given in the policy and is not larger than the amount of insurance sold. The loss may be zero, or it may be many thousands of dollars. In return for accepting this variability in outcomes (our definition of risk), the insurer receives a premium. Through the premium, the policyholder has paid a certain expense in order to transfer the risk of a possible large loss. The insurance contract stipulates what types of losses will be paid by the insurer.

Most insurance contracts are expressed in terms of money, although some compensate insureds by providing a service. A life insurance contract obligates the insurer to pay a specified sum of money upon the death of the person whose life is insured. A liability insurance policy requires the insurer not only to pay money on behalf of the insured to a third party but also to provide legal and investigative services needed when the event insured against occurs. The terms of some health insurance policies are fulfilled by providing medical and hospital services (e.g., a semiprivate room and board, plus other hospital services) if the insured is ill or injured. Whether the insurer fulfills its obligations with money or with services, the burden it assumes is financial. The insurer does not guarantee that the event insured against will not happen. Moreover, it cannot replace sentimental value or bear the psychological cost of a loss. A home may be worth only $80,000 for insurance purposes, but it may have many times that value to the owner in terms of sentiment. The death of a loved one can cause almost unbearable mental suffering that is in no way relieved by receiving a sum of money from the insurer. Neither of these aspects of loss can be measured in terms of money; therefore, such risks cannot be transferred to an insurer. Because these noneconomic risks create uncertainty, it is apparent that insurance cannot completely eliminate uncertainty. Yet insurance performs a great service by reducing the financial uncertainty created by risk.

Insurance or Not?

In the real world, a clear definition of what is considered an insurance product does not always exist. The amount of risk that is transferred is usually the key to determining whether a certain accounting transaction is considered insurance or not. A case in point is the product called finite risk. It was used by insurers and reinsurers and became the center of a controversy that led to the resignation of Hank Greenberg, the former chairperson and chief executive officer (CEO) of American International Group (AIG) in 2006. Finite risk programsFinancial methods that can be construed as financing risk assumptions. are financial methods that can be construed as financing risk assumptions. They began as arrangements between insurers and reinsurers, but they can also be arrangements between any business and an insurer. Premiums paid by the corporation to finance potential losses (losses as opposed to risks) are placed in an experience fund, which is held by the insurer. Over time, the insured pays for his or her own losses through a systematic payment plan, and the funds are invested for the client. This arrangement raises the question, Is risk transferred, or is it only an accounting transaction taking place? The issue is whether finite risk should be called insurance without the elements of insurance. The rule is that, if there is no transfer of at least 10 percent of the risk, regulators regard the transaction as a noninsurance transaction that has less favorable accounting treatment for losses and taxes.The interested student should also explore it further. In the case of AIG, the finite risk arrangements were regarded as noninsurance transactions. In early 2006, AIG agreed to pay $1.64 billion to settle investigations by the Securities and Exchange Commission and New York State Attorney General Eliot Spitzer, who brought charges against AIG. This recent real-life example exemplifies how the careful treatment of the definition of insurance is so important to the business and its presentation of its financial condition. For more information on finite risk programs, see “Finite Risk Reinsurance,” Insurance Information Institute (III), May 2005, at http://www.iii.org/media/hottopics/insurance/finite/; Ian McDonald, Theo Francis, and Deborah Solomon, “Rewriting the Books—AIG Admits ‘Improper’ Accounting Broad Range of Problems Could Cut $1.77 Billion Of Insurer’s Net Worth A Widening Criminal Probe,” Wall Street Journal, March 31, 2005, A1; Kara Scannell and Ian McDonald, “AIG Close to Deal to Settle Charges, Pay $1.5 Billion,” Wall Street Journal, February 6, 2006, C1; Steve Tuckey, “AIG Settlement Leaves Out Life Issues,” National Underwriter Online News Service, February 10, 2006. These articles are representative regarding these topics.

Risk Pooling (Loss Sharing)

In general, the bulk of the premium required by the insurer to assume risk is used to compensate those who incur covered losses. Loss sharing is accomplished through premiums collected by the insurer from all insureds—from those who may not suffer any loss to those who have large losses. In this regard, the losses are shared by all the risk exposures who are part of the pool. This is the essence of pooling.

Pooling can be done by any group who wishes to share in each other’s losses. The pooling allows a more accurate prediction of future losses because there are more risk exposures. Being part of pooling is not necessarily an insurance arrangement by itself. As such, it is not part of the transfer of risk to a third party. In a pooling arrangement, members of the group pay each other a share of the loss. Even those with no losses at all pay premiums to be part of the pooling arrangement and enjoy the benefits of such an arrangement. For this purpose, actuaries, charged with determining appropriate rates (prices) for coverage, estimate the frequency and severity of losses and the loss distribution discussed in Chapter 2 "Risk Measurement and Metrics". These estimates are made for a series of categories of insureds, with each category intended to group insureds who are similar with regard to their likelihood. An underwriter then has the job of determining which category is appropriate for each insured (see the discussion in Chapter 7 "Insurance Operations"). Actuaries combine the information to derive expected losses. Estimates generally are based on empirical (in this case, observed) data or theoretical relationships, making them objective estimates. When the actuary must rely on judgment rather than facts, the estimates are termed subjective. In most cases, both objective and subjective estimates are used in setting rates. For example, the actuary may begin with industry—determined rates based on past experience and adjust them to reflect the actuary’s instincts about the insurer’s own expected experience. A life insurer may estimate that 250 of the 100,000 risk exposures of forty-year-old insureds it covers will die in the next year. If each insured carries a $1,000 policy, the insurer will pay out $250,000 in claims (250 × $1,000). To cover these claims, the insurer requires a premium of $2.50 from each insured ($250,000/100,000), which is the average or expected cost per policyholder. (An additional charge to cover expenses, profit, and the risk of actual losses exceeding expected losses would be included in the actual premium. A reduction of the premium would result from the insurer sharing its investment earnings with insureds.) In Chapter 7 "Insurance Operations", we provide the loss development calculations that are performed by the actuary to determine the rates and calculate how much the insurer should keep on reserve to pay future expected claims. Chapter 7 "Insurance Operations" also explains the relationship between rates and investment income of insurers.

Discrimination: The Essence of Pooling

In order for the law of large numbers to work, the pooled exposures must have approximately the same probability of loss (that is, it must follow the same probability distribution, as demonstrated in Chapter 2 "Risk Measurement and Metrics"). In other words, the exposures need to be homogeneous (similar). Insurers, therefore, need to discriminateClassify exposures according to expected loss., or classify exposures according to expected loss. For this reason, twenty-year-old insureds with relatively low rates of mortality are charged lower rates for life insurance than are sixty-year-old insureds, holding factors other than age constant. The rates reflect each insured’s expected loss, which is described in the box “Fitting into a Lower Risk-Exposure Pooling Group.”

If the two groups of dissimilar risk exposures were charged the same rate, problems would arise. As previously stated, rates reflect average loss costs. Thus, a company charging the same rate to both twenty-year-old insureds and sixty-year-old insureds would charge the average of their expected losses. The pooling will be across ages, not by ages. Having a choice between a policy from this company and one from a company that charged different rates based on age, the sixty-year-old insureds would choose this lower-cost, single-rate company, while the young insureds would not. As a result, sixty-year-old policyholders would be overrepresented in the group of insureds, making the average rate insufficient. The sixty-year-old insureds know they represent higher risk, but they want to enjoy lower rates.

Fitting into a Lower Risk-Exposure Pooling Group

Your insurance company relies on the information you provide. Your obligation to the insurance company is not only to provide correct information, but also to provide complete information in order to be placed with your appropriate risk pooling group. The similar exposure in the pooling group is essential for the risk to be insurable, as you saw in this chapter.

Because automobile insurance is an issue of great concern to most students, it is important to know how to handle the process of being placed in the appropriate risk pool group by an insurer. What do you need to tell the insurance agent when you purchase automobile insurance? The agent, usually the first person you talk to, will have routine questions: the make and model of the automobile, the year of manufacture, the location (where the car is parked overnight or garaged), and its usage (e.g., commuting to work). The agent will also ask if you have had any accidents or traffic violations in the past three to five years.

You might be tempted to tell the agent that you keep the automobile at your parents’ home, if rates there are cheaper. You may also be tempted to tell the agent that you have not had any traffic violations, when actually you have had three in the past year. Certainly, your insurance premium will be lower if the agent thinks you have a clean record, but that premium savings will mean very little to you when the insurer notifies you of denial of coverage because of dishonesty. This occurs because you gave information that placed you in the wrong risk pool and you paid the wrong premiums for your characteristics.

Safe driving is the key to maintaining reasonable auto insurance premiums because you will be placed in the less risky pool of drivers. The possibility of being placed in a high-risk pool and paying more premiums can be reduced in other ways, too:

- Avoiding traffic violations and accidents helps reduce the probability of loss to a level that promotes the economic feasibility of premiums.

- Steering clear of sports cars and lavish cars, which place you in a group of similar (homogeneous) insureds. Furthermore, a car that is easily damaged or expensive to repair will increase your physical damage premiums.

- Costs can be reduced further if you use your car for pleasure only instead of driving to and from work. Riding the bus or in a friend’s car will lower the probability of an accident, making you a more desirable policyholder. Living outside the city limits has a similar effect.

- Passing driving courses, maintaining a grade point average of at least B, and not drinking earn discounts on premiums.

This phenomenon of selecting an insurer that charges lower rates for a specific risk exposure is known as adverse selection because the insureds know they represent higher risk, but they want to enjoy lower rates. Adverse selection occurs when insurance is purchased more often by people and/or organizations with higher-than-average expected losses than by people and/or organizations with average or lower-than-average expected losses. That is, insurance is of greater use to insureds whose losses are expected to be high (insureds “select” in a way that is “adverse” to the insurer). On this basis alone, no problem exists because insurers could simply charge higher premiums to insureds with higher expected losses. Often, however, the insurer simply does not have enough information to be able to distinguish completely among insureds, except in cases of life insurance for younger versus older insureds. Furthermore, the insurer wants to aggregate in order to use the law of large numbers. Thus, some tension exists between limiting adverse selection and employing the law of large numbers.

Adverse selection, then, can result in greater losses than expected. Insurers try to prevent this problem by learning enough about applicants for insurance to identify such people so they can either be rejected or put in the appropriate rating class of similar insureds with similar loss probability. Many insurers, for example, require medical examinations for applicants for life insurance.

Some insurance policy provisions are designed to reduce adverse selection. The suicide clause in life insurance contracts, for example, excludes coverage if a policyholder takes his or her own life within a specified period, generally one or two years. The preexisting conditions provision in health insurance policies is designed to avoid paying benefits to people who buy insurance because they are aware, or should be aware, of an ailment that will require medical attention or that will disable them in the near future.Recent health care reforms (HIPAA 1996) have limited the ability of insurers to reduce adverse selection through the use of preexisting-condition limitations.

Key Takeaways

In this section you studied the following:

- The essence of insurance, which is risk transfer and risk pooling

- The necessity of discrimination in order to create pools of insureds

- The fact that insurance provides risk reduction

Discussion Questions

- What is the definition of insurance?

- What is the law of large numbers? Why do insurers rely on the law of large numbers?

- Why is it necessary to discriminate in order to pool?

- Why are finite risk programs not considered insurance?

6.3 Ideal Requisites for Insurability

Learning Objectives

In this section you will learn the following:

- Why so many risks cannot be insured by private insurance companies

- The definition of insurable risks by private insurers

- Why catastrophes such as floods are not insurable risks by private insurers

Soon after the devastation of Hurricane Katrina became known, the Mississippi attorney general filed a lawsuit against insurers claiming that the flood should be covered by homeowner’s insurance policies. The controversy over coverage was explored in the September 8, 2005, New York Times article, “Liability Issue: Wind or Water?” Is this question so open-ended?

Are all pure risks insurable by private (nongovernmental) insurers? No. The private insurance device is not suitable for all risks. Many risks are uninsurable. This section is devoted to a discussion of the requirements that must generally be met if a risk is to be insurable in the private market. As a practical matter, many risks that are insured privately meet these requirements only partially or, with reference to a particular requirement, not at all. Thus, in a sense, the requirements listed describe those that would be met by the ideal risk. Nevertheless, the bulk of the risks insured fulfill—at least approximately—most of the requirements. No private insurer can safely disregard them completely.Governmental insurance programs make greater deviations from the ideal requisites for insurability. They are able to accept greater risks because they often make their insurance compulsory and have it subsidized from tax revenues, while private insurers operate only when a profit potential exists. The nature of government insurance programs will be outlined later in this chapter. A risk that was perfectly suited for insurance would meet the following requirements:

- The number of similar exposure units is large.

- The losses that occur are accidental.

- A catastrophe cannot occur.

- Losses are definite.

- The probability distribution of losses can be determined.

- The cost of coverage is economically feasible.

The sixth requirement in the list above influences the consumer demand for insurance and looks at what is economically feasible from the perspective of potential insureds. The other requirements influence the willingness of insurers to supply insurance.

Many Similar Exposure Units

As noted, an insurance organization prefers to have a large number of similar units when insuring a possible loss exposure. The concepts of mass and similarity are thus considered before an insurer accepts a loss exposure. Some insurance is sold on exposures that do not possess the requirements of mass and similarity, but such coverage is the exception, not the rule. An example is insurance on the fingers of a concert pianist or on prize-winning racehorses. When there are no masses of exposures, the coverage is usually provided by specialty insurers. Lloyd’s of London, for example, is known for insuring nonmass exposures such as Bruce Springsteen’s voice. The types of insurers will be discussed in Chapter 7 "Insurance Operations".

Mass

A major requirement for insurability is mass; that is, there must be large numbers of exposure units involved. For automobile insurance, there must be a large number of automobiles to insure. For life insurance, there must be a large number of persons. An automobile insurance company cannot insure a dozen automobiles, and a life insurance company cannot insure the lives of a dozen persons. How large is a “large group”? For insurance purposes, the number of exposure units needed in a group depends on the extent to which the insurer is willing to bear the risk of deviation from its expectations. Suppose the probability of damage to houses is 1/1,000. An insurer might assume this risk for 1,000 houses, with the expectation that one claim would be made during the year. If no houses were damaged, there would be a 100 percent deviation from expectations, but such a deviation would create no burden for the insurer. On the other hand, if two houses were damaged, the claims to be paid would be twice the expected number. This could be a severe burden for the insurer, assuming average or higher loss severities. By increasing the number of similar houses insured to 10,000, the expected number of losses increases to ten, but the stability of experience is increased. That is, there is a proportionately smaller deviation from expected losses than would exist with a group of 1,000 houses. Similarly, if the group is increased to 100,000 houses, the variation between actual and expected losses would be likely to increase in absolute terms, but it would decline proportionately. One additional loss from 100,000 houses is proportionally less than one additional loss from 10,000 houses and even less than one additional loss from 1,000 houses.

Similarity

The loss exposures to be insured and those observed for calculating the probability distributions must have similarities. The exposures assumed by insurers are not identical, no matter how carefully they may be selected. No two houses are identical, even though physically they may appear to be. They cannot have an identical location and, perhaps more important, they are occupied by different families. Nevertheless, the units in a group must be reasonably similar in characteristics if predictions concerning them are to be accurate. For example, homes with brick sidings are similar for insurance purposes.

Moreover, probability distributions calculated on the basis of observed experience must also involve units similar to one another. Observing the occupational injuries and illnesses of a group of people whose ages, health conditions, and occupations were all different would not provide a basis for calculating workers’ compensation insurance rates. For example, clerical work typically involves much lower probabilities of work-related loss than do occupations such as logging timber or climbing utility poles. Estimates based on experience require that the exposure units observed be similar to one another. Moreover, such estimates are useful only in predicting losses for comparable exposures.

Accidental Losses

The risks assumed by an insurer must involve only the possibility, not the certainty, of loss to the insured. Insurable losses must be accidental or fortuitousA matter of chance.; that is, they must be a matter of chance. Ideally, the insured should have no control or influence over the event to be insured. In fact, this situation prevails only with respect to limited situations. As mentioned in Chapter 1 "The Nature of Risk: Losses and Opportunities", intangible and physical hazards influence the probability of loss. Prediction of potential losses is based on a probability distribution that has been estimated by observing past experience. Presumably, the events observed were, for the most part, fortuitous occurrences. The use of such estimates for predicting future losses is based on the assumption that future losses will also be a matter of chance. If this is not the case, predictions cannot be accurate.

Small Possibility of Catastrophe

The possibility of catastrophic loss may make a loss exposure uninsurable. A catastrophic lossLoss that could imperil the insurer’s solvency. to an insurer is one that could imperil the insurer’s solvency. When an insurer assumes a group of risks, it expects the group as a whole to experience some losses—but only a small percentage of the group members to suffer loss at any one time. Given this assumption, a relatively small contribution by each member of the group will be sufficient to pay for all losses. It is possible for a large percentage of all insureds to suffer a loss simultaneously; however, the relatively small contributions would not provide sufficient funds. Similarly, a single very large loss would also require large contributions. Thus, a requisite for insurability is that there must be no excessive possibility of catastrophe for the group as a whole. Insurers must be reasonably sure that their losses will not exceed certain limits. Insurers build up surpluses (net worth) and contingency reserves (funds for future claims) to take care of deviations of experience from the average, but such deviations must have practical limits. If losses cannot be predicted with reasonable accuracy and confidence, it is impossible to determine insurance premium rates, the size of surpluses, or the net worth required.

Catastrophic losses may occur in two circumstances. In the first, all or many units of the group are exposed to the same loss-causing event, such as war, flood, tornado, mudslide, forest fire, hurricane, earthquake, tsunami, terrorist attack, or unemployment. For example, if one insurer had assumed the risk of damage by wind (hurricane) for all houses in the Miami, Florida, area, it would have suffered a catastrophic loss in 1992 when many structures were damaged simultaneously by Hurricane Andrew (and in fact several insurers were unable to withstand the losses). The 2005 hurricanes, which caused the largest-ever insured losses, are an example of a megacatastrophe that affected many units. These are examples of exposure units that suffer from the same cause of loss because of geographic proximity. Exposure units are susceptible to dependent lossWhen loss to one exposure unit affects the probability of loss to another. when loss to one exposure unit affects the probability of loss to another. Thus, fire at one location increases the probability of fire at other homes in the area: their experience is dependent. In the early days of insurance in the United States, many fire insurance companies concentrated their business in small areas near their headquarters. This worked in New York City, for example, until a major fire devastated large sections of the city in 1835. Because of their concentrated exposures, several insurers suffered losses to a large percentage of their business. The insurers were unable to pay all claims, and several went bankrupt.

A recent example of catastrophe exposure is the case of the risk of mold. Mold created a major availability and affordability issue in the homeowner’s and commercial property insurance markets in the early 2000s. The Wall Street Journal article, “Hit With Big Losses, Insurers Put Squeeze on Homeowner Policies,” reported massive exclusions of mold coverage because of the “avalanche of claims.”Jeff D. Opdyke and Christopher Oster, “Hit With Big Losses, Insurers Put Squeeze on Homeowner Policies,” Wall Street Journal, May 14, 2002.

A second type of catastrophe exposure arises when a single large value may be exposed to loss. September 11, 2001, represents such catastrophic loss. Tremendous value was concentrated in the towers of the World Trade Center. The possibility of a human-made catastrophe of such magnitude was not anticipated. Private insurers stopped short of calling the terrorist attacks “acts of war”—which would have been excluded from coverage—and honored the policies covering the World Trade Center and the lives of the victims. However, one consequence was the industry’s action to immediately exclude terrorism coverage from new policies until the Terrorism Risk Insurance Act (TRIA) of 2002 provided stop-gap coverage from the federal government. When insurers and reinsurers (the insurers of the insurance companies) see the peril as having a far higher probability than previously perceived, they know that they can no longer accurately predict future losses, and their immediate reaction is to exclude the peril. Because of regulation and oversight (see Chapter 8 "Insurance Markets and Regulation"), however, the industry cannot make policy changes instantaneously.Insurance is regulated by the states, a topic that will be covered in more detail in Chapter 7 "Insurance Operations". When private insurers can no longer provide coverage, a solution may be to create pools such as those described in the box below, “Who Should Insure Against Megacatastrophes?” More on this topic and on reinsurance will be explained in Chapter 7 "Insurance Operations".

Definite Losses

Losses must be definite in time, place, and amount because, in many cases, insurers promise to pay in dollar amounts for losses if they occur during a particular time and in a particular geographical area. For example, the contract may cover loss by fire at a specified location. For this contract to be effective, it must be possible to determine when, where, and how much loss occurred. If this cannot be established, it is impossible to determine whether the loss is covered under the terms of the contract. The fact that pain and suffering is hard to measure in dollar terms increases the insurer’s risk when calculating rates for liability insurance. One other reason the requirement of definiteness is essential is that it is necessary to accumulate data for future predictions. Unless such data can be accurate, they cannot provide the basis for useful predictions.

Determinable Probability Distribution

For an exposure to loss to be insurable, the expected loss must be calculable. Ideally, this means that there is a determinable probability distribution for losses within a reasonable degree of accuracy. Insurance premium rates are based on predictions of the future, which are expressed quantitatively as expected losses. Calculation of expected losses requires the use of estimated probability distributions (discussed in detail in Chapter 2 "Risk Measurement and Metrics").

Probability distributions based on experience are useful for prediction; however, only when it is safe to assume that factors shaping events in the future will be similar to those of the past. For this reason, mortality (death) rates during times of peace are inappropriate for estimating the number of insured deaths during times of war. Similarly, the introduction of new technologies such as foam blanketing makes past experience of fire damage a poor indicator of future experience. Yet, because the technology is new and no theory exists as to what the losses ought to be, actuaries have little information on which to base lower rates. The actuary must use subjective estimates as well as engineering information to develop proper rates.

When the probability distribution of losses for the exposure to be insured against cannot be calculated with reasonable accuracy, the risk is uninsurable. An example of purported uninsurability due to inability to predict losses is the nuclear power industry. Insurance experts convinced government officials in 1957 that the risk of loss caused by an incident at a nuclear power site was too uncertain (because of lack of experience and unknown maximum severity) for commercial insurers to accept without some government intervention. As a result, the government limited the liability of owners of nuclear power plants for losses that could arise from such incidents.

Who Should Insure against Megacatastrophes?

The incredible losses from hurricanes Wilma, Rita, and Katrina, including the breached levees in low-lying New Orleans and the subsequent bungled inaction by local, state, and federal authorities, opened a major public debate in the United States. On one level (which is not the focus of this text), the dialogue focused on who should have been first responder and what processes can be put in place to ensure that history does not repeat itself. The second topic of the debate (which we will focus on) was who should pay for such disasters in the future. The economic loss of Katrina and its aftermath was estimated to surpass $100 to $150 billion, large portions of which were not insured. As you will learn in Chapter 1 "The Nature of Risk: Losses and Opportunities", flood is insured only by the federal government through the National Federal Insurance Program, and the coverage limits are low, at $250,000. Many flooded homes and businesses in Louisiana and Mississippi did not carry this insurance. Even if they carried the coverage, the limits prevented recovery of their true property values. Residents had to resort to other assistance programs, some from the Federal Emergency Management Agency (FEMA).

The unprecedented economic loss is at the heart of the debate. Who should insure against such megacatastrophes in the future? The Insurance Information Institute (III) provided a summary of the proposals that were put forward during the public dialogue about how large-scale natural catastrophes should be managed in the post-9/11 era. The following are two main viewpoints:

- Because the private industry cannot insure mega losses that are fundamentally uninsurable, the federal government should be the ultimate insurer. The federal government is already the national flood insurer and has been providing the terrorism stopgap coverage under the Terrorism Risk Insurance Act (TRIA). It makes sense that uninsurable risks be mitigated by the government. The insurance commissioners of Florida, California, and New York proposed a national catastrophe fund. Others suggested amendment to the federal tax code for insurers’ reserves. The idea is that coverage would still be provided by insurers, but states would create pools, and above them, a third layer would be provided for national megacatastrophes by the federal government. Involvement by the federal government in case of large-scale losses has elements of the Terrorism Risk Insurance Act that was extended until the end of 2014.

- Because we are living in a free market economy, the private sector is best suited to handle any disaster, large or small. The idea is to have less government, with relaxed regulation and taxation. The creativity of the private sector should prevail. The government should not compete with private insurance and reinsurance markets. In this scenario, insurers have more capacity and thus more actuarially sound predictions to set appropriate rates. To prove the point, the industry was able to sustain both 9/11 and Katrina (except that the industry has not been responsible for the flood damages). If the private industry takes over all potential mega losses, there does need to be great improvement, however, in catastrophe modeling. The industry will have to diversify and utilize the capital markets (see Chapter 3 "Risk Attitudes: Expected Utility Theory and Demand for Hedging" about CAT bonds). It is predicted that the industry will ensure high-quality loss control in areas with potential disasters through building codes, strengthening of levees, and utilization of all possible disaster management techniques.

Questions for Discussion

- Because large-scale human-made and natural disasters are not controllable by insurers, should the government pay for damages?

- Because insurance is the business of insurers, should they handle their problems without being subsidized by taxpayers? What would be the outcome in terms of safety and loss controls?

Sources: This box relied on information from articles from the National Underwriter, Business Insurance, and the Insurance Information Institute (III) at http://www.iii.org.

Economic Feasibility

For insurance to be economically feasibleWhen the size of the possible loss must be significant to the insured and the cost of insurance must be small compared with the potential loss. for an insured, the size of the possible loss must be significant to the insured, and the cost of insurance must be small compared to the potential loss. Otherwise, the purchase of insurance is not practical. If the possible loss is not significant to those exposed, insurance is inappropriate. Cost-benefit analysis is needed for the insurers to determine if the rates can be feasible to insureds. Also, the analysis in Chapter 3 "Risk Attitudes: Expected Utility Theory and Demand for Hedging" regarding the actuarially fair premiums a risk-averse individual would be willing to pay is important here. For catastrophic coverage, the insurer may determine through capital budgeting methods and cash flow analysis that it cannot provide low enough costs to make the coverage feasible for insureds.

Retention (bearing the financial loss by oneself) of many risks is almost automatic because the loss would not be a burden. If all the people who own automobiles were wealthy, it is doubtful that much automobile collision insurance would be written because such losses would not be significant to the wealthy owners. Insurance is feasible only when the possible loss is large enough to be of concern to the person who may bear the burden.

The possible loss must also be relatively large compared to the size of the premium. If the losses the insurer pays plus the cost of insurer operations are such that the premium must be very large in relation to the potential loss, insurance is not economically feasible. From the viewpoint of the insured, when the expected loss premium is high relative to the maximum possible loss, internal budgeting for the risk is preferable to insurance. The use of deductibles (a form of retention) to eliminate insurance reimbursement for frequent small losses helps make automobile collision premiums economically feasible. The deductible eliminates claims for small losses. Small automobile collision losses have such high probability and the cost of settling them is so great that the premium for covering them would be very large compared to the size of actual losses. For example, if a policy with a $200 deductible costs $85 more than one with a $500 deductible, you may consider $85 too large a premium for $300 of lower deductible. Insurance is best suited for risks involving large potential losses with low probabilities (described in Chapter 3 "Risk Attitudes: Expected Utility Theory and Demand for Hedging"). Large losses are key because insureds cannot pay them, and low probabilities for large losses make premiums relatively small compared with the possible losses. In other situations, insurance may not be economically feasible for the person or business facing risk.

Summary of Insurable Risks

Table 6.1 "Examples of Insurable and Uninsurable Risks" provides an analysis of the insurability characteristics of a few common perils and risks. The first column lists the requirements for insurability that we have just discussed. Note that the risk of flooding is not considered insurable because of its potential for catastrophe: many exposures can suffer losses in the same location. Thus, flooding is covered by the federal government, not by private insurers. Hurricanes, though similar to floods, are covered by private insurers, who obtain reinsurance to limit their exposure. After a catastrophe like Hurricane Andrew, however, many reinsurers became financially strapped or insolvent.

Table 6.1 Examples of Insurable and Uninsurable Risks

| Flood | Fire | Disability | Terrorism | |

|---|---|---|---|---|

| Large number of similar exposure units | Yes | Yes | Yes | No |

| Accidental, uncontrollable | Yes | Yes | Yes | No (man-made, though not by the insured) |

| Potentially catastrophic | Yes | No | No | Yes |

| Definite losses | Yes | Yes | No | Yes |

| Determinable probability distribution of losses | Yes | Yes | Yes | No |

| Economically feasible | Depends | Depends | Depends | No |

| Insurable? | No | Yes | Yes | No |

The second example in Table 6.1 "Examples of Insurable and Uninsurable Risks" is the peril/risk of fire. Fire is an insurable risk because it meets all the required elements. Even this peril can be catastrophic, however, if fires cannot be controlled and a large geographical area is damaged, such as the large fires in Colorado and Arizona in 2002. Disability is another type of peril that is considered insurable in most cases. The last example is the risk of terrorism. As noted above, it is no longer considered an insurable risk due to the catastrophic element associated with this peril since the September 11, 2001, attack.

Insurance companies use cost-benefit analysis to determine whether they should bring a new product to the market. In Chapter 4 "Evolving Risk Management: Fundamental Tools", you learned about the time value of money and computation for such decisions.

Key Takeaways

In this section you studied that a risk perfectly suited for insurance meets the following requirements:

- The number of similar exposure units is large.

- The losses that occur are accidental.

- A catastrophe cannot occur.

- Losses are definite.

- The probability distribution of losses can be determined.

- The cost of coverage is economically feasible.

Discussion Question

Explain whether the following risks and perils are insurable by private insurers:

- A hailstorm that destroys your roof

- The life of an eighty-year-old man

- A flood

- Mold

- Biological warfare

- Dirty bombs

6.4 Types of Insurance and Insurers

Learning Objectives

In this section you will learn the following:

- The types of insurance

- The types of insurance company corporate structures

- Governmental insurance organizations

Many types of insurance policies are available to families and organizations that do not wish to retain their own risks. The following questions may be raised about an insurance policy:

- Is it personal, group, or commercial?

- Is it life/health or property/casualty?

- Is it issued by a private insurer or a government agency?

- Is it purchased voluntarily or involuntarily?

Personal, Group, or Commercial Insurance

Personal insuranceInsurance that is purchased by individuals and families for their risk needs. Such insurance includes life, health, disability, auto, homeowner, and long-term care. is insurance that is purchased by individuals and families for their risk needs. Such insurance includes life, health, disability, auto, homeowner, and long-term care. Group insuranceInsurance provided by the employer for the benefit of employees. is insurance provided by the employer for the benefit of employees. Group insurance coverage includes life, disability, health, and pension plans. Commercial insuranceProperty/casualty insurance for businesses and other organizations. is property/casualty insurance for businesses and other organizations.

An insurance company is likely to have separate divisions within its underwriting department for personal lines, group lines, and commercial business. The criterion to assign insureds into their appropriate risk pool for rating purposes is different for each type of insurance. Staff in the personal lines division are trained to look for risk factors (e.g., driving records and types of home construction) that influence the frequency and severity of claims among individuals and families. Group underwriting looks at the characteristics and demographics, including prior experience, of the employee group. The commercial division has underwriting experts on risks faced by organizations. Personnel in other functional areas such as claims adjustment may also specialize in personal, group, or commercial lines.

Life/Health or Property/Casualty Insurance

Life/health insuranceInsurance that covers exposures to the perils of death, medical expenses, disability, and old age. covers exposures to the perils of death, medical expenses, disability, and old age. Private life insurance companies provide insurance for these perils, and individuals voluntarily decide whether or not to buy their products. Health insurance is provided primarily by life/health insurers but is also sold by some property/casualty insurers. All of these are available on an individual and a group basis. The Social Security program provides substantial amounts of life/health insurance on an involuntary basis.

Property/casualty insuranceInsurance that covers property exposures such as direct and indirect losses of property caused by perils such as fire, windstorm, and theft. covers property exposures such as direct and indirect losses of property caused by perils like fire, windstorm, and theft. It also includes insurance to cover the possibility of being held legally liable to pay damages to another person. Before the passage of multiple-line underwriting laws in the late 1940s and early 1950s, property/casualty insurance had to be written by different insurers. Now they frequently are written in the same contract (e.g., homeowner’s and commercial package policies, which will be discussed in later chapters).

A private insurer can be classified as either a life/health or a property/casualty insurer. Health insurance may be sold by either. Some insurers specialize in a particular type of insurance, such as property insurance. Others are affiliated insurers, in which several insurers (and sometimes noninsurance businesses) are controlled by a holding company; all or almost all types of insurance are offered by some company in the group.

Private or Government Insurance

Insurance is provided both by privately owned organizations and by state and federal agencies. Measured by premium income, the bulk of property/casualty insurance is provided by private insurers. Largely because of the magnitude of the Social Security program, however, government provides about one-third more personal insurance than the private sector. Our society has elected to provide certain levels of death, health, retirement, and unemployment insurance on an involuntary basis through governmental (federal and state) agencies. If we desire to supplement the benefit levels of social insurance or to buy property/casualty insurance, some of which is required, private insurers provide the protection.

Voluntary or Involuntary Insurance

Most private insurance is purchased voluntarily, although some types, such as automobile insurance or insurance on mortgages and car loans, are required by law or contracts. In many states, the purchase of automobile liability insurance is mandatory, and if the car is financed, the lender requires property damage coverage.

Government insurance is involuntary under certain conditions for certain people. Most people are required by law to participate in the Social Security program, which provides life, health, disability, and retirement coverage. Unemployment and workers’ compensation insurance are also forms of involuntary social insurance provided by the government. Some government insurance, such as flood insurance, is available to those who want it, but no one is required to buy it.

Insurers’ Corporate Structure

Stock Insurers

Stock insurersInsurers created for the purpose of making a profit and maximizing the value of the organization for the benefit of the owners. are organized in the same way as other privately owned corporations created for the purpose of making a profit and maximizing the value of the organization for the benefit of the owners. Individuals provide the operating capital for the company. Stock companies can be publicly traded in the stock markets or privately held. Stockholders receive dividends when the company is profitable.

Mutual Insurers

Mutual insurersInsurers owned and controlled, in theory if not in practice, by their policyowners. are owned and controlled, in theory if not in practice, by their policyowners. They have no stockholders and issue no capital stock. People become owners by purchasing an insurance policy from the mutual insurer. Profits are shared with owners as policyowners’ dividendsProfits shared by insurance policyholders.. Company officers are appointed by a board of directors that is, at least theoretically, elected by policyowners. The stated purpose of the organization is to provide low-cost insurance rather than to make a profit for stockholders.

Research shows that mutual and stock insurers are highly competitive in the sense that neither seems to outperform the other. There are high-quality, low-cost insurers of both types. A wise consumer should analyze both before buying insurance.

Many mutual insurers in both the life/health and property/casualty fields are large and operate over large areas of the country. These large mutuals do a general business in the life/health and property/casualty insurance fields, rather than confining their efforts to a small geographic area or a particular type of insured. The largest property/casualty mutual insurer in the United States is State Farm, which was established in 1922 by George J. Mecherle, an Illinois farmer who turned to insurance sales. State Farm grew to be the leading auto and homeowner’s insurer in the United States, with twenty-five regional offices, more than 79,000 employees, and nearly 70 million policies in force. Because of its mutual status, State Farm is overcapitalized (holding relatively more surplus than its peer group or stock companies).

Demutualization

When top managers of a mutual company decide they need to raise capital, they may go through a process called demutualization. In the last decade, there was an increase in the number of companies that decided to demutualize and become stock companies. Policyholders, who were owners of the mutual company, received shares in the stock company. Part of the motive was to provide top management with an additional avenue of income in the form of stock options in the company. The demutualization wave in the life insurance industry reached its peak in December 2001, when the large mutual insurer, Prudential, converted to a stock company. The decade between the mid-1990s and mid-2000s saw the demutualization of twenty-two life insurance companies: Unum, Equitable Life, Guarantee Mutual, State Mutual (First American Financial Life), Farm Family, Mutual of New York, Standard Insurance, Manulife, Mutual Life of Canada (Clarica), Canada Life, Industrial Alliance, John Hancock, Metropolitan Life, Sun Life of Canada, Central Life Assurance (AmerUs), Indianapolis Life, Phoenix Home Life, Principal Mutual, Anthem Life, Provident Mutual, Prudential, and General American Mutual Holding Company (which was sold to MetLife through its liquidation by the Missouri Department of Insurance).Arthur D. Postal, “Decision On Demutualization Cost Basis Sought,” National Underwriter, Life and Health Edition, March 25, 2005. Accessed March 5, 2009. http://www.nationalunderwriter.com/lifeandhealth/nuonline/032805/L12decision.asp.

Lloyd’s of London: A Global Insurance Exchange

Lloyd’s of LondonThe oldest insurance organization in existence. is the oldest insurance organization in existence; it started in a coffeehouse in London in 1688. Lloyds conducts a worldwide business primarily from England, though it is also licensed in Illinois and Kentucky. It maintains a trust fund in the United States for the protection of insureds in this country. In states where Lloyd’s is not licensed, it is considered a nonadmitted insurer. States primarily allow such nonadmitted insurers to sell only coverage that is unavailable from their licensed (admitted) insurers. This generally unavailable coverage is known as excess and surplus lines insurance, and it is Lloyd’s primary U.S. business.

Lloyd’s does not assume risks in the manner of other insurers. Instead, individual members of Lloyd’s, called Names, accept insurance risks by providing capital to an underwriting syndicate. Each syndicate is made up of many Names and accepts risks through one or more brokers. Surplus lines agents—those who sell for excess and surplus lines insurers—direct business to brokers at one or more syndicates. Syndicates, rather than Names, make the underwriting decisions of which risks to accept. Various activities of Lloyd’s are supervised by two governing committees—one for market management and another for regulation of financial matters. The syndicates are known to accept exotic risks and reinsure much of the asbestos and catastrophic risk in the United States. They also insure aviation.

The arrangement of Lloyd’s of London is similar to that of an organized stock exchange in which physical facilities are owned by the exchange, but business is transacted by the members. The personal liability of individual Names has been unlimited; they have been legally liable for their underwriting losses under Lloyd’s policies to the full extent of their personal and business assets. This point is sometimes emphasized by telling new male members that they are liable “down to their cufflinks” and for female members “down to their earrings.” In addition to Names being required to make deposits of capital with the governing committee for financial matters, each Name is required to put premiums into a trust fund that makes them exclusively encumbered to the Name’s underwriting liabilities until the obligations under the policies for which the premiums were paid have been fulfilled. Underwriting accounts are audited annually to ensure that assets and liabilities are correctly valued and that assets are sufficient to meet underwriting liabilities. Normally, profits are distributed annually. Following losses, Names may be asked to make additional contributions. A trust fund covers the losses of bankrupt Names. A supervisory committee has authority to suspend or expel members.

Seldom does one syndicate assume all of one large exposure; it assumes part. Thus, an individual Name typically becomes liable for a small fraction of 1 percent of the total liability assumed in one policy. Historically, syndicates also reinsured with each other to provide more risk sharing. The practice of sharing risk through reinsurance within the Lloyd’s organization magnified the impact of heavy losses incurred by Lloyd’s members for 1988 through 1992. Losses for these five years reached the unprecedented level of $14.2 billion. Reinsurance losses on U.S. business were a major contributor to losses due to asbestos and pollution, hurricanes Hugo and Andrew, the 1989 San Francisco earthquake, the Exxon Valdez oil spill, and other product liabilities.

The massive losses wiped out the fortunes of many Names. In 1953, Lloyd’s consisted of 3,400 Names, most of whom were wealthy citizens of the British Commonwealth. By 1989, many less wealthy, upper-middle-class people had been enticed to become Names with unlimited liability, pushing the total number of Names to an all-time high of 34,000 in 400 syndicates. By mid-1994, only about 17,500 Names and 178 underwriting syndicates (with just ninety-six accepting new business) remained. As a result of the mammoth total losses (and bankruptcy or rehabilitation for many individual members), Lloyd’s had reduced underwriting capacity and was experiencing difficulty in attracting new capital. What started in a coffeehouse was getting close to the inside of the percolator.

Among Lloyd’s reforms was the acceptance of corporate capital. By mid-1994, 15 percent of its capital was from twenty-five corporations that, unlike individual Names, have their liability limited to the amount of invested capital. Another reform consisted of a new system of compulsory stop-loss insurance designed to help members reduce exposure to large losses. Reinsurance among syndicates has ceased.

Other forms of insurance entities that are used infrequently are not featured in this textbook.

Banks and Insurance

For decades, savings banks in Massachusetts, New York, and Connecticut have sold life insurance in one of two ways: by establishing life insurance departments or by acting as agents for other savings banks with insurance departments. Savings banks sell the usual types of individual life insurance policies and annuities, as well as group life insurance. Business is transacted on an over-the-counter basis or by mail. No agents are employed to sell the insurance; however, advertising is used extensively for marketing. Insurance is provided at a relatively low cost.

Many savings and loan associations have been selling personal property/casualty insurance (and some life insurance) through nonbanking subsidiaries. Commercial banks have lobbied hard for permission to both underwrite (issue contracts and accept risks as an insurer) and sell all types of insurance. Approximately two-thirds of the states have granted state-chartered banks this permission. At this time, national banks have not been granted such power.An exception: national commercial banks in communities of less than 5,000 have, for many years, had the right to sell insurance.

In November 1999, State Farm Mutual Automobile Insurance Company opened State Farm Bank. At the time of this writing, State Farm has banking services in eleven states—Alabama, Arizona, Colorado, Illinois, Indiana, Mississippi, Missouri, New Mexico, Nevada, Utah, and Wyoming—and plans to expand to all fifty states. The banking division benefits from State Farm’s 16,000 agents, who can market a full range of banking products.Mark E. Ruquet, “Insurer-Bank Integration Stampede Unlikely,” National Underwriter, Property & Casualty/Risk & Benefits Management Edition, April 23, 2001.

The U.S. Supreme Court approved (with a 9–0 vote) the sale of fixed-dollar and variable annuities by national banks, reasoning that annuities are investments rather than insurance. Banks are strong in annuities sales.

Captives, Risk Retention Groups, and Alternative Markets

Risk retention groups and captives are forms of self-insurance. Broadly defined, a captive insurance companyA company that provides insurance coverage to its parent company and other affiliated organizations. is a company that provides insurance coverage to its parent company and other affiliated organizations. The captive is controlled by its policyholder-parent. Some captives sell coverage to nonaffiliated organizations. Others are comprised of members of industry associations, resulting in captives that closely resemble the early mutual insurers.

Forming a captive insurer is an expensive undertaking. Capital must be contributed in order to develop a net worth sufficient to meet regulatory (and financial stability) requirements. Start-up costs for licensing, chartering, and managing the captive are also incurred. And, of course, the captive needs constant managing, requiring that effort be expended by the firm’s risk management department and/or that a management company be hired.

To justify these costs, the parent company considers various factors. One is the availability of insurance in the commercial insurance market. During the liability insurance crisis of the 1980s, for example, pollution liability coverage became almost nonexistent. Chemical and other firms formed captives to fill the void. Today, there is a big push for captives after the losses of September 11. Another factor considered in deciding on a captive is the opportunity cost of money. If the parent can use funds more productively (that is, can earn a higher after-tax return on investment) than the insurer can, the formation of a captive may be wise. The risk manager must assess the importance of the insurer’s claims adjusting and other services (including underwriting) when evaluating whether to create a captive. Insurers’ services are very important considerations. One reason to create a captive is to have access to the reinsurance market for stop-loss catastrophic coverage for the captive. One currently popular use of captives is to coordinate the insurance programs of a firm’s foreign operations. An added advantage of captives in this setting is the ability to manage exchange rate risks as well as the pure risks more common to traditional risk managers. Perhaps of primary significance is that captives give their parents access to the reinsurance market.

Captive managers in Bermuda received many inquiries after September 11, 2001, as U.S. insurance buyers searched for lower rates. The level of reinsurance capacity is always a concern for captive owners because reinsurers provide the catastrophic layer of protection. In the past, reinsurance was rather inexpensive for captives.Lisa S. Howard, “Tight Re Market Puts Heat On Fronts,” National Underwriter, Property & Casualty/Risk & Benefits Management Edition, March 4, 2002.

A special form of self-insurance is known as a risk retention groupA group that provides risk management and retention to a few players in the same industry who are too small to act on their own..President Reagan signed into law the Liability Risk Retention Act in October 1986 (an amendment to the Product Liability Risk Retention Act of 1981). The act permits formation of retention groups (a special form of captive) with fewer restrictions than existed before. The retention groups are similar to association captives. The act permits formation of such groups in the United States under more favorable conditions than have existed generally for association captives. The act may be particularly helpful to small businesses that could not feasibly self-insure but can do so within a designated group. An interesting example of the risk retention group in practice is the one formed recently by the airline industry, which suffered disproportional losses as a result of September 11, 2001. A risk retention group designed to cover passenger and third-party war risk liability for airlines gained regulatory approval in Vermont.“Vermont Licenses Industry-Backed Airline Insurer,” BestWire, June 11, 2002. The risk retention group for airlines is named Equitime, and it was formed by the Air Transport Association (ATA), a Washington, D.C.-based trade group, and Marsh, Inc. (one of the largest brokerage firms worldwide). Equitime offers as much as $1.5 billion in combined limits for passenger and third-party war risk liability. Equitime’s plan is to retain $300 million of the limit and reinsure the balance with the federal government. The capitalization of this risk retention group is through a private placement of stock from twenty-four airlines belonging to the ATA and about fifty members of the Regional Airline Association.Sue Johnson, “Airline Captive May Be Formed in Second Quarter,” Best’s Review, March 2002. See also the document created by Marsh to explain the program along with other aviation protection programs (as of August 14, 2002) at http://www.marsh.se/files/Third%20Party%20War%20Liability%20Comparison.pdf.

Alternative markets are the markets of all self-insurance programs. Captives and group captives will see steady growth in membership. In addition, governmental risk poolsPools formed for governmental entities to provide group self-insurance coverage. have been formed for governmental entities to provide group self-insurance coverage such as the Texas Association of School Boards (TASB), municipals risk pools, and other taxing-authorities pools. TASB, for example, offers to the Texas school districts a pooling arrangement for workers’ compensation and property, liability, and health insurance. Public risk pools have a large association, the Public Risk Management Association (PRIMA), which provides support and education to public risk pools.For detailed information about PRIMA, search its Web site at http://www.primacentral.org/default.php.

Government Insuring Organizations

Federal and state government agencies account for nearly half of the insurance activity in the United States. Primarily, they fill a gap where private insurers have not provided coverage, in most cases, because the exposure does not adequately meet the ideal requisites for private insurance. However, some governmental programs (examples include the Maryland automobile fund, state workers’ compensation, insurance plans, crop insurance, and a Wisconsin life plan) exist for political reasons. Government insurers created for political goals usually compete with private firms. This section briefly summarizes state and federal government insurance activities.

State Insuring Organizations

- All states administer unemployment compensation insurance programs. All states also have guaranty funds that provide partial or complete coverage in cases of insurance company failure from all insurers in the market. This ensures that the results of insolvencies are not borne solely by certain policyowners. Covered lines of insurance and maximum liability per policyowner vary by state. Financing is provided on a postloss assessment basis (except for preloss assessments in New York) by involuntary contributions from all insurance companies licensed in the state. An insurer’s contributions to a particular state are proportionate to its volume of business in the state. No benefits are paid to stockholders of defunct insurers. The funds are responsible for the obligations of insolvent companies owed to their policyowners.

- Eighteen states have funds to insure worker’s compensation benefits. Some funds are monopolistic, while others compete with private insurers.

- Several states provide temporary nonoccupational disability insurance, title insurance, or medical malpractice insurance. Many states provide medical malpractice insurance (discussed in upcoming chapters) through joint underwriting associations (JUAs), which provide coverage to those who cannot obtain insurance in the regular markets. The JUAs are created by state legislation. If a JUA experiences losses in excess of its expectations, it has the power to assess all insurers that write liability insurance in the state. However, rates are supposed to be set at a level adequate to avoid such assessments. Some states have also created JUAs for lawyers and other groups that have had difficulty finding insurance in the private market.

- Seven states along the Atlantic and Gulf coasts assure the availability of property insurance, and indirect loss insurance in some states, to property owners of coastal areas exposed to hurricanes and other windstorms. Insurance is written through beach and windstorm insurance plans that provide coverage to those who cannot obtain insurance in the regular markets, especially in areas prone to natural catastrophes and hurricanes. Compliance with building codes is encouraged for loss reduction.

- The state of Maryland operates a fund to provide automobile liability insurance to Maryland motorists unable to buy it in the private market. The Wisconsin State Life Fund sells life insurance to residents of Wisconsin on an individual basis similar to that of private life insurers. In recent years, several states have created health insurance pools to give uninsurable individuals access to health insurance. Coverage may be limited and expensive.

Federal Insuring Organizations

- The Social Security Administration, which operates the Social Security program, collects more premiums (in the form of payroll taxes) and pays more claims than any other insurance organization in the United States. The Federal Deposit Insurance Corporation insures depositors against loss caused by the failure of a bank. Credit union accounts are protected by the National Credit Union Administration. The Securities Investor Protection Corporation covers securities held by investment brokers and dealers.

- The Federal Crop Insurance Corporation provides open-perils insurance for farm crops. Policies are sold and serviced by the private market. The federal government provides subsidies and reinsurance.

- The Federal Crime Insurance Program covers losses due to burglary and robbery in both personal and commercial markets.

- Fair Access to Insurance Requirements (FAIR) plans have been established in a number of states under federal legislation. They are operated by private insurers as a pool to make property insurance available to applicants who cannot buy it in the regular market. Federal government reinsurance pays for excessive losses caused by riots and civil disorder.

- The National Flood Insurance Program provides flood insurance through private agents in communities that have met federal requirements designed to reduce flood losses. (See Chapter 1 "The Nature of Risk: Losses and Opportunities" for a description of the federal flood insurance.)

- The Veterans Administration provides several programs for veterans. Several federal agencies insure mortgage loans made by private lenders against losses due to borrowers failing to make payments. The Pension Benefit Guaranty Corporation protects certain retirement plan benefits in the event the plan sponsor fails to fulfill its promises to participants. The Overseas Private Investment Corporation (OPIC) protects against losses suffered by U.S. citizens through political risks in underdeveloped countries.

Key Takeaways

In this section you studied the different types of insurance:

- Personal, group, or commercial

- Life/health or property/casualty

- Private insurer or a government agency?

- Purchased voluntarily or involuntarily?

- Insurers’ Corporate structure: stock insurers; mutual insurers; Lloyd’s of London; Banks and Insurance; Captives, Risk Retention Groups; Alternative Markets

- Government insuring organizations

Discussion Questions

- What types of insurance are available?

- What are the main organizational structures adopted by insurance companies?

- Why is the government involved in insurance, and what are the governmental insuring organizations listed in this section?

- What is demutualization?

6.5 Appendix: More Exposures, Less Risk

Assume that the riskiness of two groups is under consideration by an insurer. One group is comprised of 1,000 units and the other is comprised of 4,000 units. Each group anticipates incurring 10 percent losses within a specified period, such as a year. Therefore, the first group expects to have one hundred losses, and the second group expects 400 losses. This example demonstrates a binomial distribution, one where only two possible outcomes exist: loss or no loss. The average of a binomial equals the sample size times the probability of success. Here, we will define success as a loss claim and use the following symbols:

- n = sample size

- p = probability of “success”

- q = probability of “failure” = 1 – p

- n × p = mean

For Group 1 in our sample, the mean is one hundred:

- (1,000) × (.10) = 100

For Group 2, the mean is 400:

- (4,000) × (.10) = 400

The standard deviation of a distribution is a measure of risk or dispersion. For a binomial distribution, the standard deviation is

In our example, the standard deviations of Group 1 and Group 2 are 9.5 and 19, respectively.