This is “Monetary Policy and the Fed”, chapter 26 from the book Economics Principles (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 26 Monetary Policy and the Fed

Start Up: The Fed’s Extraordinary Challenges in 2008

“The Federal Reserve will employ all available tools to promote the resumption of sustainable economic growth and to preserve price stability. In particular, the Committee anticipates that weak economic conditions are likely to warrant exceptionally low levels of the federal funds rate for some time.” So went the statement issued by the Federal Open Market Committee on December 16, 2008, that went on to say that the new target range for the federal funds rate would be between 0% and 0.25%. For the first time in its history, the Fed was targeting a rate below 1%. It was also acknowledging the difficulty of hitting a specific rate target when the target is so low. And, finally, it was experimenting with extraordinary measures based on a section of the Federal Reserve Act that allows it to take such measures when conditions in financial markets are deemed “unusual and exigent.”

The Fed was responding to the broad-based weakness of the U.S. economy, the strains in financial markets, and the tightness of credit. Unlike some other moments in U.S. economic history, it did not have to worry about inflation, at least not in the short term. On the same day, consumer prices were reported to have fallen by 1.7% for the month of November. Indeed, commentators were beginning to fret over the possibility of deflation and how the Fed could continue to support the economy when it had already used all of its federal funds rate ammunition.

Anticipating this concern, the Fed’s statement went on to discuss other ways it was planning to support the economy over the months to come. These included buying mortgage-backed securities to support the mortgage and housing markets, buying long-term Treasury bills, and creating other new credit facilities to make credit more easily available to households and small businesses. These options recalled a speech that Ben Bernanke had made six years earlier, when he was a member of the Federal Reserve Board of Governors but still nearly four years away from being named its chair, titled “Deflation: Making Sure ‘It’ Doesn’t Happen Here.” In the 2002 speech he laid out how these tools, along with tax cuts, were the equivalent of what Nobel prize winning economist Milton Friedman meant by a “helicopter drop” of money. The speech earned Bernanke the nickname of Helicopter Ben.

The Fed’s decisions of mid-December put it in uncharted territory. Japan had tried a similar strategy, though somewhat less comprehensively and more belatedly, in the 1990s when faced with a situation similar to that of the United States in 2008 with only limited success. In his 2002 speech, Bernanke suggested that Japanese authorities had not gone far enough. Only history will tell us whether the Fed will be more successful and how well these new strategies will work.

This chapter examines in greater detail monetary policy and the roles of central banks in carrying out that policy. Our primary focus will be on the U.S. Federal Reserve System. The basic tools used by central banks in many countries are similar, but their institutional structure and their roles in their respective countries can differ.

26.1 Monetary Policy in the United States

Learning Objectives

- Discuss the Fed’s primary and secondary goals and relate these goals to the legislation that created the Fed as well as to subsequent legislation that affects the Fed.

- State and show graphically how expansionary and contractionary monetary policy can be used to close gaps.

In many respects, the Fed is the most powerful maker of economic policy in the United States. Congress can pass laws, but the president must execute them; the president can propose laws, but only Congress can pass them. The Fed, however, both sets and carries out monetary policy. Deliberations about fiscal policy can drag on for months, even years, but the Federal Open Market Committee (FOMC) can, behind closed doors, set monetary policy in a day—and see that policy implemented within hours. The Board of Governors can change the discount rate or reserve requirements at any time. The impact of the Fed’s policies on the economy can be quite dramatic. The Fed can push interest rates up or down. It can promote a recession or an expansion. It can cause the inflation rate to rise or fall. The Fed wields enormous power.

But to what ends should all this power be directed? With what tools are the Fed’s policies carried out? And what problems exist in trying to achieve the Fed’s goals? This section reviews the goals of monetary policy, the tools available to the Fed in pursuing those goals, and the way in which monetary policy affects macroeconomic variables.

Goals of Monetary Policy

When we think of the goals of monetary policy, we naturally think of standards of macroeconomic performance that seem desirable—a low unemployment rate, a stable price level, and economic growth. It thus seems reasonable to conclude that the goals of monetary policy should include the maintenance of full employment, the avoidance of inflation or deflation, and the promotion of economic growth.

But these goals, each of which is desirable in itself, may conflict with one another. A monetary policy that helps to close a recessionary gap and thus promotes full employment may accelerate inflation. A monetary policy that seeks to reduce inflation may increase unemployment and weaken economic growth. You might expect that in such cases, monetary authorities would receive guidance from legislation spelling out goals for the Fed to pursue and specifying what to do when achieving one goal means not achieving another. But as we shall see, that kind of guidance does not exist.

The Federal Reserve Act

When Congress established the Federal Reserve System in 1913, it said little about the policy goals the Fed should seek. The closest it came to spelling out the goals of monetary policy was in the first paragraph of the Federal Reserve Act, the legislation that created the Fed:

“An Act to provide for the establishment of Federal reserve banks, to furnish an elastic currency, [to make loans to banks], to establish a more effective supervision of banking in the United States, and for other purposes.”

In short, nothing in the legislation creating the Fed anticipates that the institution will act to close recessionary or inflationary gaps, that it will seek to spur economic growth, or that it will strive to keep the price level steady. There is no guidance as to what the Fed should do when these goals conflict with one another.

The Employment Act of 1946

The first U.S. effort to specify macroeconomic goals came after World War II. The Great Depression of the 1930s had instilled in people a deep desire to prevent similar calamities in the future. That desire, coupled with the 1936 publication of John Maynard Keynes’s prescription for avoiding such problems through government policy (The General Theory of Employment, Interest and Money), led to the passage of the Employment Act of 1946, which declared that the federal government should “use all practical means . . . to promote maximum employment, production and purchasing power.” The act also created the Council of Economic Advisers (CEA) to advise the president on economic matters.

The Fed might be expected to be influenced by this specification of federal goals, but because it is an independent agency, it is not required to follow any particular path. Furthermore, the legislation does not suggest what should be done if the goals of achieving full employment and maximum purchasing power conflict.

The Full Employment and Balanced Growth Act of 1978

The clearest, and most specific, statement of federal economic goals came in the Full Employment and Balanced Growth Act of 1978. This act, generally known as the Humphrey–Hawkins Act, specified that by 1983 the federal government should achieve an unemployment rate among adults of 3% or less, a civilian unemployment rate of 4% or less, and an inflation rate of 3% or less. Although these goals have the virtue of specificity, they offer little in terms of practical policy guidance. The last time the civilian unemployment rate in the United States fell below 4% was 1969, and the inflation rate that year was 6.2%. In 2000, the unemployment rate touched 4%, and the inflation rate that year was 3.4%, so the goals were close to being met. Except for 2007 when inflation hit 4.1%, inflation has hovered between 1.6% and 3.4% in all the other years between 1991 and 2008, so the inflation goal was met or nearly met, but unemployment fluctuated between 4.0% and 7.5% during those years.

The Humphrey-Hawkins Act requires that the chairman of the Fed’s Board of Governors report twice each year to Congress about the Fed’s monetary policy. These sessions provide an opportunity for members of the House and Senate to express their views on monetary policy.

Federal Reserve Policy and Goals

Perhaps the clearest way to see the Fed’s goals is to observe the policy choices it makes. Since 1979, following a bout of double-digit inflation, its actions have suggested that the Fed’s primary goal is to keep inflation under control. Provided that the inflation rate falls within acceptable limits, however, the Fed will also use stimulative measures to close recessionary gaps.

In 1979, the Fed, then led by Paul Volcker, launched a deliberate program of reducing the inflation rate. It stuck to that effort through the early 1980s, even in the face of a major recession. That effort achieved its goal: the annual inflation rate fell from 13.3% in 1979 to 3.8% in 1982. The cost, however, was great. Unemployment soared past 9% during the recession. With the inflation rate below 4%, the Fed shifted to a stimulative policy early in 1983.

In 1990, when the economy slipped into a recession, the Fed, with Alan Greenspan at the helm, engaged in aggressive open-market operations to stimulate the economy, despite the fact that the inflation rate had jumped to 6.1%. Much of that increase in the inflation rate, however, resulted from an oil-price boost that came in the wake of Iraq’s invasion of Kuwait that year. A jump in prices that occurs at the same time as real GDP is slumping suggests a leftward shift in short-run aggregate supply, a shift that creates a recessionary gap. Fed officials concluded that the upturn in inflation in 1990 was a temporary phenomenon and that an expansionary policy was an appropriate response to a weak economy. Once the recovery was clearly under way, the Fed shifted to a neutral policy, seeking neither to boost nor to reduce aggregate demand. Early in 1994, the Fed shifted to a contractionary policy, selling bonds to reduce the money supply and raise interest rates. Then Fed Chairman Greenspan indicated that the move was intended to head off any possible increase in inflation from its 1993 rate of 2.7%. Although the economy was still in a recessionary gap when the Fed acted, Greenspan indicated that any acceleration of the inflation rate would be unacceptable.

By March 1997 the inflation rate had fallen to 2.4%. The Fed became concerned that inflationary pressures were increasing and tightened monetary policy, raising the goal for the federal funds interest rate to 5.5%. Inflation remained well below 2.0% throughout the rest of 1997 and 1998. In the fall of 1998, with inflation low, the Fed was concerned that the economic recession in much of Asia and slow growth in Europe would reduce growth in the United States. In quarter-point steps it reduced the goal for the federal funds rate to 4.75%. With real GDP growing briskly in the first half of 1999, the Fed became concerned that inflation would increase, even though the inflation rate at the time was about 2%, and in June 1999, it raised its goal for the federal funds rate to 5% and continued raising the rate until it reached 6.5% in May 2000.

With inflation under control, it then began lowering the federal funds rate to stimulate the economy. It continued lowering through the brief recession of 2001 and beyond. There were 11 rate cuts in 2001, with the rate at the end of that year at 1.75%; in late 2002 the rate was cut to 1.25%, and in mid-2003 it was cut to 1.0%.

Then, with growth picking up and inflation again a concern, the Fed began again in the middle of 2004 to increase rates. By the end of 2006, the rate stood at 5.25% as a result of 17 quarter-point rate increases.

Starting in September 2007, the Fed, since 2006 led by Ben Bernanke, shifted gears and began lowering the federal funds rate, mostly in larger steps or 0.5 to 0.75 percentage points. Though initially somewhat concerned with inflation, it sensed that the economy was beginning to slow down. It moved aggressively to lower rates over the course of the next 15 months, and by the end of 2008, the rate was targeted at between 0% and 0.25%. In late 2008, with inflation running quite low and deflation threatening, the Fed seemed quite willing to use all of its options to try to keep financial markets running smoothly and to moderate the recession.

What can we infer from these episodes in the 1980s, 1990s, and the first years of this century? It seems clear that the Fed is determined not to allow the high inflation rates of the 1970s to occur again. When the inflation rate is within acceptable limits, the Fed will undertake stimulative measures in response to a recessionary gap or even in response to the possibility of a growth slowdown. Those limits seem to have tightened over time. In the late 1990s and early 2000s, it appeared that an inflation rate above 3%—or any indication that inflation might rise above 3%—would lead the Fed to adopt a contractionary policy. While on the Federal Reserve Board in the early 2000s, Ben Bernanke had been an advocate of inflation targeting. Under that system, the central bank announces its inflation target and then adjusts the federal funds rate if the inflation rate moves above or below the central bank’s target. Mr. Bernanke indicated his preferred target to be an expected increase in the price level, as measured by the price index for consumer goods and services excluding food and energy, of between 1% and 2%. Thus, the inflation goal appears to have tightened even more—to a rate of 2% or less. If inflation were expected to remain below 2%, however, the Fed would undertake stimulative measures to close a recessionary gap. Whether the Fed will hold to that goal will not really be tested until further macroeconomic experiences unfold.

Monetary Policy and Macroeconomic Variables

We saw in an earlier chapter that the Fed has three tools at its command to try to change aggregate demand and thus to influence the level of economic activity. It can buy or sell federal government bonds through open-market operations, it can change the discount rate, or it can change reserve requirements. It can also use these tools in combination. In the next section of this chapter, where we discuss the notion of a liquidity trap, we will also introduce more extraordinary measures that the Fed has at its disposal.

Most economists agree that these tools of monetary policy affect the economy, but they sometimes disagree on the precise mechanisms through which this occurs, on the strength of those mechanisms, and on the ways in which monetary policy should be used. Before we address some of these issues, we shall review the ways in which monetary policy affects the economy in the context of the model of aggregate demand and aggregate supply. Our focus will be on open-market operations, the purchase or sale by the Fed of federal bonds.

Expansionary Monetary Policy

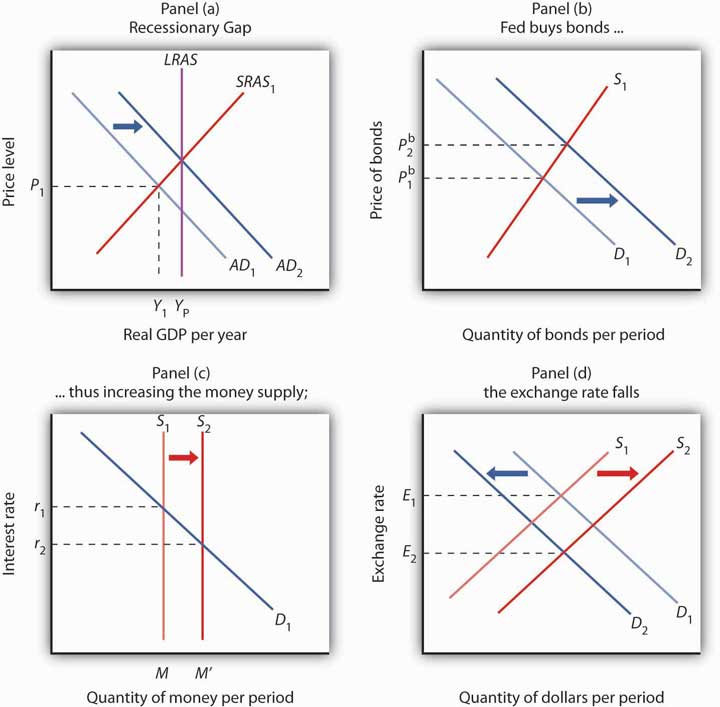

The Fed might pursue an expansionary monetary policy in response to the initial situation shown in Panel (a) of Figure 26.1 "Expansionary Monetary Policy to Close a Recessionary Gap". An economy with a potential output of YP is operating at Y1; there is a recessionary gap. One possible policy response is to allow the economy to correct this gap on its own, waiting for reductions in nominal wages and other prices to shift the short-run aggregate supply curve SRAS1 to the right until it intersects the aggregate demand curve AD1 at YP. An alternative is a stabilization policy that seeks to increase aggregate demand to AD2 to close the gap. An expansionary monetary policy is one way to achieve such a shift.

To carry out an expansionary monetary policy, the Fed will buy bonds, thereby increasing the money supply. That shifts the demand curve for bonds to D2, as illustrated in Panel (b). Bond prices rise to Pb2. The higher price for bonds reduces the interest rate. These changes in the bond market are consistent with the changes in the money market, shown in Panel (c), in which the greater money supply leads to a fall in the interest rate to r2. The lower interest rate stimulates investment. In addition, the lower interest rate reduces the demand for and increases the supply of dollars in the currency market, reducing the exchange rate to E2 in Panel (d). The lower exchange rate will stimulate net exports. The combined impact of greater investment and net exports will shift the aggregate demand curve to the right. The curve shifts by an amount equal to the multiplier times the sum of the initial changes in investment and net exports. In Panel (a), this is shown as a shift to AD2, and the recessionary gap is closed.

Figure 26.1 Expansionary Monetary Policy to Close a Recessionary Gap

In Panel (a), the economy has a recessionary gap YP − Y1. An expansionary monetary policy could seek to close this gap by shifting the aggregate demand curve to AD2. In Panel (b), the Fed buys bonds, shifting the demand curve for bonds to D2 and increasing the price of bonds to Pb2. By buying bonds, the Fed increases the money supply to M′ in Panel (c). The Fed’s action lowers interest rates to r2. The lower interest rate also reduces the demand for and increases the supply of dollars, reducing the exchange rate to E2 in Panel (d). The resulting increases in investment and net exports shift the aggregate demand curve in Panel (a).

Contractionary Monetary Policy

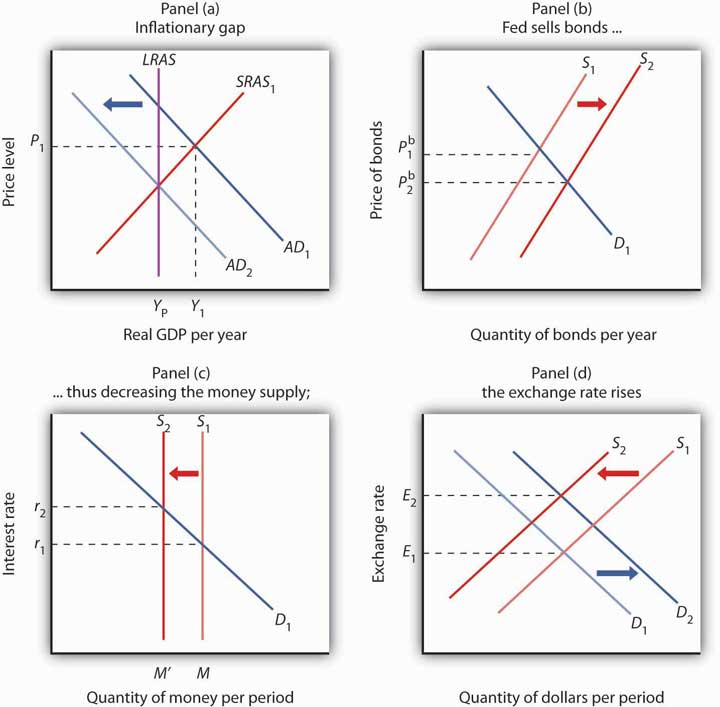

The Fed will generally pursue a contractionary monetary policy when it considers inflation a threat. Suppose, for example, that the economy faces an inflationary gap; the aggregate demand and short-run aggregate supply curves intersect to the right of the long-run aggregate supply curve, as shown in Panel (a) of Figure 26.2 "A Contractionary Monetary Policy to Close an Inflationary Gap".

Figure 26.2 A Contractionary Monetary Policy to Close an Inflationary Gap

In Panel (a), the economy has an inflationary gap Y1 − YP. A contractionary monetary policy could seek to close this gap by shifting the aggregate demand curve to AD2. In Panel (b), the Fed sells bonds, shifting the supply curve for bonds to S2 and lowering the price of bonds to Pb2. The lower price of bonds means a higher interest rate, r2, as shown in Panel (c). The higher interest rate also increases the demand for and decreases the supply of dollars, raising the exchange rate to E2 in Panel (d), which will increase net exports. The decreases in investment and net exports are responsible for decreasing aggregate demand in Panel (a).

To carry out a contractionary policy, the Fed sells bonds. In the bond market, shown in Panel (b) of Figure 26.2 "A Contractionary Monetary Policy to Close an Inflationary Gap", the supply curve shifts to the right, lowering the price of bonds and increasing the interest rate. In the money market, shown in Panel (c), the Fed’s bond sales reduce the money supply and raise the interest rate. The higher interest rate reduces investment. The higher interest rate also induces a greater demand for dollars as foreigners seek to take advantage of higher interest rates in the United States. The supply of dollars falls; people in the United States are less likely to purchase foreign interest-earning assets now that U.S. assets are paying a higher rate. These changes boost the exchange rate, as shown in Panel (d), which reduces exports and increases imports and thus causes net exports to fall. The contractionary monetary policy thus shifts aggregate demand to the left, by an amount equal to the multiplier times the combined initial changes in investment and net exports, as shown in Panel (a).

Key Takeaways

- The Federal Reserve Board and the Federal Open Market Committee are among the most powerful institutions in the United States.

- The Fed’s primary goal appears to be the control of inflation. Providing that inflation is under control, the Fed will act to close recessionary gaps.

- Expansionary policy, such as a purchase of government securities by the Fed, tends to push bond prices up and interest rates down, increasing investment and aggregate demand. Contractionary policy, such as a sale of government securities by the Fed, pushes bond prices down, interest rates up, investment down, and aggregate demand shifts to the left.

Try It!

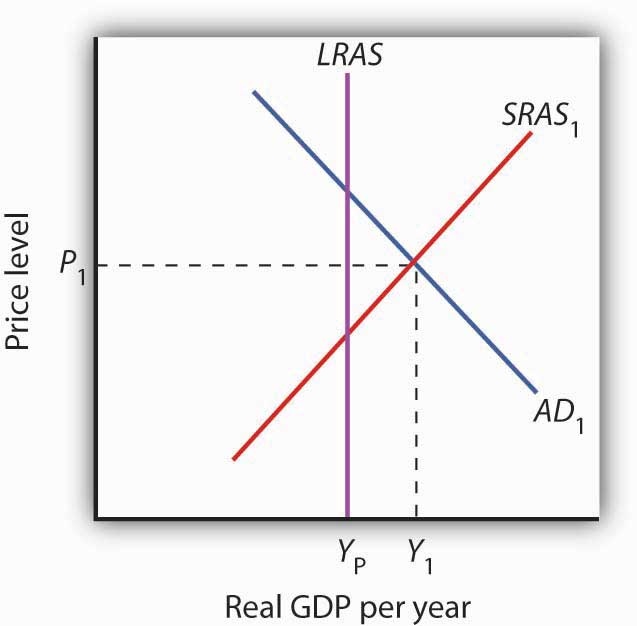

The figure shows an economy operating at a real GDP of Y1 and a price level of P1, at the intersection of AD1 and SRAS1.

Figure 26.3

- What kind of gap is the economy experiencing?

- What type of monetary policy (expansionary or contractionary) would be appropriate for closing the gap?

- If the Fed decided to pursue this policy, what type of open-market operations would it conduct?

- How would bond prices, interest rates, and the exchange rate change?

- How would investment and net exports change?

- How would the aggregate demand curve shift?

Case in Point: A Brief History of the Greenspan Fed

Figure 26.4

With the passage of time and the fact that the fallout on the economy turned out to be relatively minor, it is hard in retrospect to realize how scary a situation Alan Greenspan and the Fed faced just two months after his appointment as Chairman of the Federal Reserve Board. On October 12, 1987, the stock market had its worst day ever. The Dow Jones Industrial Average plunged 508 points, wiping out more than $500 billion in a few hours of feverish trading on Wall Street. That drop represented a loss in value of over 22%. In comparison, the largest daily drop in 2008 of 778 points on September 29, 2008, represented a loss in value of about 7%.

When the Fed faced another huge plunge in stock prices in 1929—also in October—members of the Board of Governors met and decided that no action was necessary. Determined not to repeat the terrible mistake of 1929, one that helped to usher in the Great Depression, Alan Greenspan immediately reassured the country, saying that the Fed would provide adequate liquidity, by buying federal securities, to assure that economic activity would not fall. As it turned out, the damage to the economy was minor and the stock market quickly regained value.

In the fall of 1990, the economy began to slip into recession. The Fed responded with expansionary monetary policy—cutting reserve requirements, lowering the discount rate, and buying Treasury bonds.

Interest rates fell quite quickly in response to the Fed’s actions, but, as is often the case, changes to the components of aggregate demand were slower in coming. Consumption and investment began to rise in 1991, but their growth was weak, and unemployment continued to rise because growth in output was too slow to keep up with growth in the labor force. It was not until the fall of 1992 that the economy started to pick up steam. This episode demonstrates an important difficulty with stabilization policy: attempts to manipulate aggregate demand achieve shifts in the curve, but with a lag.

Throughout the rest of the 1990s, with some tightening when the economy seemed to be moving into an inflationary gap and some loosening when the economy seemed to be possibly moving toward a recessionary gap—especially in 1998 and 1999 when parts of Asia experienced financial turmoil and recession and European growth had slowed down—the Fed helped steer what is now referred to as the Goldilocks (not too hot, not too cold, just right) economy.

The U.S. economy again experienced a mild recession in 2001 under Greenspan. At that time, the Fed systematically conducted expansionary policy. Similar to its response to the 1987 stock market crash, the Fed has been credited with maintaining liquidity following the dot-com stock market crash in early 2001 and the attacks on the World Trade Center and the Pentagon in September 2001.

When Greenspan retired in January 2006, many hailed him as the greatest central banker ever. As the economy faltered in 2008 and as the financial crisis unfolded throughout the year, however, the question of how the policies of Greenspan’s Fed played into the current difficulties took center stage. Testifying before Congress in October 2008, he said that the country faces a “once-in-a-century credit tsunami,” and he admitted, “I made a mistake in presuming that the self-interests of organizations, specifically banks and others, were such as that they were best capable of protecting their own shareholders and their equity in their firms.” The criticisms he has faced are twofold: that the very low interest rates used to fight the 2001 recession and maintained for too long fueled the real estate bubble and that he did not promote appropriate regulations to deal with the new financial instruments that were created in the early 2000s. While supporting some additional regulations when he testified before Congress, he also warned that overreacting could be dangerous: “We have to recognize that this is almost surely a once-in-a-century phenomenon, and, in that regard, to realize the types of regulation that would prevent this from happening in the future are so onerous as to basically suppress the growth rate in the economy and . . . the standards of living of the American people.”

Answers to Try It! Problems

- Inflationary gap

- Contractionary

- Open-market sales of bonds

- The price of bonds would fall. The interest rate and the exchange rate would rise.

- Investment and net exports would fall.

- The aggregate demand curve would shift to the left.

26.2 Problems and Controversies of Monetary Policy

Learning Objectives

- Explain the three kinds of lags that can influence the effectiveness of monetary policy.

- Identify the macroeconomic targets at which the Fed can aim in managing the economy, and discuss the difficulties inherent in using each of them as a target.

- Discuss how each of the following influences a central bank’s ability to achieve its desired macroeconomic outcomes: political pressures, the degree of impact on the economy (including the situation of a liquidity trap), and the rational expectations hypothesis.

The Fed has some obvious advantages in its conduct of monetary policy. The two policy-making bodies, the Board of Governors and the Federal Open Market Committee (FOMC), are small and largely independent from other political institutions. These bodies can thus reach decisions quickly and implement them immediately. Their relative independence from the political process, together with the fact that they meet in secret, allows them to operate outside the glare of publicity that might otherwise be focused on bodies that wield such enormous power.

Despite the apparent ease with which the Fed can conduct monetary policy, it still faces difficulties in its efforts to stabilize the economy. We examine some of the problems and uncertainties associated with monetary policy in this section.

Lags

Perhaps the greatest obstacle facing the Fed, or any other central bank, is the problem of lags. It is easy enough to show a recessionary gap on a graph and then to show how monetary policy can shift aggregate demand and close the gap. In the real world, however, it may take several months before anyone even realizes that a particular macroeconomic problem is occurring. When monetary authorities become aware of a problem, they can act quickly to inject reserves into the system or to withdraw reserves from it. Once that is done, however, it may be a year or more before the action affects aggregate demand.

The delay between the time a macroeconomic problem arises and the time at which policy makers become aware of it is called a recognition lagThe delay between the time a macroeconomic problem arises and the time at which policy makers become aware of it.. The 1990–1991 recession, for example, began in July 1990. It was not until late October that members of the FOMC noticed a slowing in economic activity, which prompted a stimulative monetary policy. In contrast, the most recent recession began in December 2007, and Fed easing began in September 2007.

Recognition lags stem largely from problems in collecting economic data. First, data are available only after the conclusion of a particular period. Preliminary estimates of real GDP, for example, are released about a month after the end of a quarter. Thus, a change that occurs early in a quarter will not be reflected in the data until several months later. Second, estimates of economic indicators are subject to revision. The first estimates of real GDP in the third quarter of 1990, for example, showed it increasing. Not until several months had passed did revised estimates show that a recession had begun. And finally, different indicators can lead to different interpretations. Data on employment and retail sales might be pointing in one direction while data on housing starts and industrial production might be pointing in another. It is one thing to look back after a few years have elapsed and determine whether the economy was expanding or contracting. It is quite another to decipher changes in real GDP when one is right in the middle of events. Even in a world brimming with computer-generated data on the economy, recognition lags can be substantial.

Only after policy makers recognize there is a problem can they take action to deal with it. The delay between the time at which a problem is recognized and the time at which a policy to deal with it is enacted is called the implementation lagThe delay between the time at which a problem is recognized and the time at which a policy to deal with it is enacted.. For monetary policy changes, the implementation lag is quite short. The FOMC meets eight times per year, and its members may confer between meetings through conference calls. Once the FOMC determines that a policy change is in order, the required open-market operations to buy or sell federal bonds can be put into effect immediately.

Policy makers at the Fed still have to contend with the impact lagThe delay between the time a policy is enacted and the time that policy has its impact on the economy., the delay between the time a policy is enacted and the time that policy has its impact on the economy.

The impact lag for monetary policy occurs for several reasons. First, it takes some time for the deposit multiplier process to work itself out. The Fed can inject new reserves into the economy immediately, but the deposit expansion process of bank lending will need time to have its full effect on the money supply. Interest rates are affected immediately, but the money supply grows more slowly. Second, firms need some time to respond to the monetary policy with new investment spending—if they respond at all. Third, a monetary change is likely to affect the exchange rate, but that translates into a change in net exports only after some delay. Thus, the shift in the aggregate demand curve due to initial changes in investment and in net exports occurs after some delay. Finally, the multiplier process of an expenditure change takes time to unfold. It is only as incomes start to rise that consumption spending picks up.

The problem of lags suggests that monetary policy should respond not to statistical reports of economic conditions in the recent past but to conditions expected to exist in the future. In justifying the imposition of a contractionary monetary policy early in 1994, when the economy still had a recessionary gap, Greenspan indicated that the Fed expected a one-year impact lag. The policy initiated in 1994 was a response not to the economic conditions thought to exist at the time but to conditions expected to exist in 1995. When the Fed used contractionary policy in the middle of 1999, it argued that it was doing so to forestall a possible increase in inflation. When the Fed began easing in September 2007, it argued that it was doing so to forestall adverse effects to the economy of falling housing prices. In these examples, the Fed appeared to be looking forward. It must do so with information and forecasts that are far from perfect.

Estimates of the length of time required for the impact lag to work itself out range from six months to two years. Worse, the length of the lag can vary—when they take action, policy makers cannot know whether their choices will affect the economy within a few months or within a few years. Because of the uncertain length of the impact lag, efforts to stabilize the economy through monetary policy could be destabilizing. Suppose, for example, that the Fed responds to a recessionary gap with an expansionary policy but that by the time the policy begins to affect aggregate demand, the economy has already returned to potential GDP. The policy designed to correct a recessionary gap could create an inflationary gap. Similarly, a shift to a contractionary policy in response to an inflationary gap might not affect aggregate demand until after a self-correction process had already closed the gap. In that case, the policy could plunge the economy into a recession.

Choosing Targets

In attempting to manage the economy, on what macroeconomic variables should the Fed base its policies? It must have some target, or set of targets, that it wants to achieve. The failure of the economy to achieve one of the Fed’s targets would then trigger a shift in monetary policy. The choice of a target, or set of targets, is a crucial one for monetary policy. Possible targets include interest rates, money growth rates, and the price level or expected changes in the price level.

Interest Rates

Interest rates, particularly the federal funds rate, played a key role in recent Fed policy. The FOMC does not decide to increase or decrease the money supply. Rather, it engages in operations to nudge the federal funds rate up or down.

Up until August 1997, it had instructed the trading desk at the New York Federal Reserve Bank to conduct open-market operations in a way that would either maintain, increase, or ease the current “degree of pressure” on the reserve positions of banks. That degree of pressure was reflected by the federal funds rate; if existing reserves were less than the amount banks wanted to hold, then the bidding for the available supply would send the federal funds rate up. If reserves were plentiful, then the federal funds rate would tend to decline. When the Fed increased the degree of pressure on reserves, it sold bonds, thus reducing the supply of reserves and increasing the federal funds rate. The Fed decreased the degree of pressure on reserves by buying bonds, thus injecting new reserves into the system and reducing the federal funds rate.

The current operating procedures of the Fed focus explicitly on interest rates. At each of its eight meetings during the year, the FOMC sets a specific target or target range for the federal funds rate. When the Fed lowers the target for the federal funds rate, it buys bonds. When it raises the target for the federal funds rate, it sells bonds.

Money Growth Rates

Until 2000, the Fed was required to announce to Congress at the beginning of each year its target for money growth that year and each report dutifully did so. At the same time, the Fed report would mention that its money growth targets were benchmarks based on historical relationships rather than guides for policy. As soon as the legal requirement to report targets for money growth ended, the Fed stopped doing so. Since in recent years the Fed has placed more importance on the federal funds rate, it must adjust the money supply in order to move the federal funds rate to the level it desires. As a result, the money growth targets tended to fall by the wayside, even over the last decade in which they were being reported. Instead, as data on economic conditions unfolded, the Fed made, and continues to make, adjustments in order to affect the federal funds interest rate.

Price Level or Expected Changes in the Price Level

Some economists argue that the Fed’s primary goal should be price stability. If so, an obvious possible target is the price level itself. The Fed could target a particular price level or a particular rate of change in the price level and adjust its policies accordingly. If, for example, the Fed sought an inflation rate of 2%, then it could shift to a contractionary policy whenever the rate rose above 2%. One difficulty with such a policy, of course, is that the Fed would be responding to past economic conditions with policies that are not likely to affect the economy for a year or more. Another difficulty is that inflation could be rising when the economy is experiencing a recessionary gap. An example of this, mentioned earlier, occurred in 1990 when inflation increased due to the seemingly temporary increase in oil prices following Iraq’s invasion of Kuwait. The Fed was faced with a similar situation in the first half of 2008 when oil prices were again rising. If the Fed undertakes contractionary monetary policy at such times, then its efforts to reduce the inflation rate could worsen the recessionary gap.

The solution proposed by Chairman Bernanke, who is an advocate of inflation rate targeting, is to focus not on the past rate of inflation or even the current rate of inflation, but on the expected rate of inflation, as revealed by various indicators, over the next year. This concept is discussed in the Case in Point essay that follows this section.

Political Pressures

The institutional relationship between the leaders of the Fed and the executive and legislative branches of the federal government is structured to provide for the Fed’s independence. Members of the Board of Governors are appointed by the president, with confirmation by the Senate, but the 14-year terms of office provide a considerable degree of insulation from political pressure. A president exercises greater influence in the choice of the chairman of the Board of Governors; that appointment carries a four-year term. Neither the president nor Congress has any direct say over the selection of the presidents of Federal Reserve district banks. They are chosen by their individual boards of directors with the approval of the Board of Governors.

The degree of independence that central banks around the world have varies. A central bank is considered to be more independent if it is insulated from the government by such factors as longer term appointments of its governors and fewer requirements to finance government budget deficits. Studies in the 1980s and early 1990s showed that, in general, greater central bank independence was associated with lower average inflation and that there was no systematic relationship between central bank independence and other indicators of economic performance, such as real GDP growth or unemployment.See, for example, Alberto Alesina and Lawrence H. Summers, “Central Bank Independence and Macroeconomic Performance: Some Comparative Evidence,” Journal of Money, Credit, and Banking 25, no. 2 (May 1993): 151–62. By the rankings used in those studies, the Fed was considered quite independent, second only to Switzerland and the German Bundesbank at the time. Perhaps as a result of such findings, a number of countries have granted greater independence to their central banks in the last decade. The charter for the European Central Bank, which began operations in 1998, was modeled on that of the German Bundesbank. Its charter states explicitly that its primary objective is to maintain price stability. Also, since 1998, central bank independence has increased in the United Kingdom, Canada, Japan, and New Zealand.

While the Fed is formally insulated from the political process, the men and women who serve on the Board of Governors and the FOMC are human beings. They are not immune to the pressures that can be placed on them by members of Congress and by the president. The chairman of the Board of Governors meets regularly with the president and the executive staff and also reports to and meets with congressional committees that deal with economic matters.

The Fed was created by the Congress; its charter could be altered—or even revoked—by that same body. The Fed is in the somewhat paradoxical situation of having to cooperate with the legislative and executive branches in order to preserve its independence.

The Degree of Impact on the Economy

The problem of lags suggests that the Fed does not know with certainty when its policies will work their way through the financial system to have an impact on macroeconomic performance. The Fed also does not know with certainty to what extent its policy decisions will affect the macroeconomy.

For example, investment can be particularly volatile. An effort by the Fed to reduce aggregate demand in the face of an inflationary gap could be partially offset by rising investment demand. But, generally, contractionary policies do tend to slow down the economy as if the Fed were “pulling on a rope.” That may not be the case with expansionary policies. Since investment depends crucially on expectations about the future, business leaders must be optimistic about economic conditions in order to expand production facilities and buy new equipment. That optimism might not exist in a recession. Instead, the pessimism that might prevail during an economic slump could prevent lower interest rates from stimulating investment. An effort to stimulate the economy through monetary policy could be like “pushing on a string.” The central bank could push with great force by buying bonds and engaging in quantitative easing, but little might happen to the economy at the other end of the string.

What if the Fed cannot bring about a change in interest rates? A liquidity trapSituation that exists when a change in monetary policy has no effect on interest rates. is said to exist when a change in monetary policy has no effect on interest rates. This would be the case if the money demand curve were horizontal at some interest rate, as shown in Figure 26.5 "A Liquidity Trap". If a change in the money supply from M to M′ cannot change interest rates, then, unless there is some other change in the economy, there is no reason for investment or any other component of aggregate demand to change. Hence, traditional monetary policy is rendered totally ineffective; its degree of impact on the economy is nil. At an interest rate of zero, since bonds cease to be an attractive alternative to money, which is at least useful for transactions purposes, there would be a liquidity trap.

Figure 26.5 A Liquidity Trap

When a change in the money supply has no effect on the interest rate, the economy is said to be in a liquidity trap.

With the federal funds rate in the United States close to zero at the end of 2008, the possibility that the country is in or nearly in a liquidity trap cannot be dismissed. As discussed in the introduction to the chapter, at the same time the Fed lowered the federal funds rate to close to zero, it mentioned that it intended to pursue additional, nontraditional measures. What the Fed seeks to do is to make firms and consumers want to spend now by using a tool not aimed at reducing the interest rate, since it cannot reduce the interest rate below zero. It thus shifts its focus to the price level and to avoiding expected deflation. For example, if the public expects the price level to fall by 2% and the interest rate is zero, by holding money, the money is actually earning a positive real interest rate of 2%—the difference between the nominal interest rate and the expected deflation rate. Since the nominal rate of interest cannot fall below zero (Who would, for example, want to lend at an interest rate below zero when lending is risky whereas cash is not? In short, it does not make sense to lend $10 and get less than $10 back.), expected deflation makes holding cash very attractive and discourages spending since people will put off purchases because goods and services are expected to get cheaper.

To combat this “wait-and-see” mentality, the Fed or other central bank, using a strategy referred to as quantitative easingPolicy in which a bank convinces the public that it will keep interest rates very low by providing substantial reserves for as long as is necessary to avoid deflation., must convince the public that it will keep interest rates very low by providing substantial reserves for as long as is necessary to avoid deflation. In other words, it is aimed at creating expected inflation. For example, at the Fed’s October 2003 meeting, it announced that it would keep the federal funds rate at 1% for “a considerable period.” When the Fed lowered the rate to between 0% and 0.25% in December 2008, it added that “the Committee anticipates that weak economic conditions are likely to warrant exceptionally low levels of the federal funds rate for some time.” After working so hard to convince economic players that it will not tolerate inflation above 2%, the Fed must now convince the public that it will, but of course not too much! If it is successful, this extraordinary form of expansionary monetary policy will lead to increased purchases of goods and services, compared to what they would have been with expected deflation. Also, by providing banks with lots of liquidity, it is hoping to encourage them to lend.

The Japanese economy provides an interesting modern example of a country that attempted quantitative easing. With a recessionary gap starting in the early 1990s and deflation in most years from 1995 on, Japan’s central bank, the Bank of Japan, began to lower the call money rate (equivalent to the federal funds rate in the United States), reaching near zero by the late 1990s. With growth still languishing, Japan appeared to be in a traditional liquidity trap. In late 1999, the Bank of Japan announced that it would maintain a zero interest rate policy for the foreseeable future, and in March 2001 it officially began a policy of quantitative easing. In 2006, with the price level rising modestly, Japan ended quantitative easing and began increasing the call rate again. It should be noted that the government simultaneously engaged in expansionary fiscal policy.

How well did these policies work? The economy began to grow modestly in 2003, though deflation between 1% and 2% remained. Some researchers feel that the Bank of Japan ended quantitative easing too early. Also, delays in implementing the policy, as well as delays in restructuring the banking sector, exacerbated Japan’s problems.“Bringing an End to Deflation under the New Monetary Policy Framework,” OECD Economic Surveys: Japan 2008 4 (April 2008): 49–61 and Mark M. Spiegel, “Did Quantitative Easing by the Bank of Japan Work?” FRBSF Economic Letter 2006, no. 28 (October 20, 2006): 1–3.

Fed Chairman Bernanke and other Fed officials have argued that the Fed is also engaged in credit easing.Ben S. Bernanke, “The Crisis and the Policy Response” (Stamp Lecture, London School of Economics, London, England, January 13, 2009) and Janet L. Yellen, “U.S. Monetary Policy Objectives in the Short Run and the Long Run” (speech, Allied Social Sciences Association annual meeting, San Francisco, California, January 4, 2009). Credit easingA strategy that involves the extension of central bank lending to influence more broadly the proper functioning of credit markets and to improve liquidity. is a strategy that involves the extension of central bank lending to influence more broadly the proper functioning of credit markets and to improve liquidity. The specific new credit facilities that the Fed has created were discussed in the Case in Point in the chapter on the nature and creation of money. In general, the Fed is hoping that these new credit facilities will improve liquidity in a variety of credit markets, ranging from those used by money market mutual funds to those involved in student and car loans.

Rational Expectations

One hypothesis suggests that monetary policy may affect the price level but not real GDP. The rational expectations hypothesisIndividuals form expectations about the future based on the information available to them, and they act on those expectations. states that people use all available information to make forecasts about future economic activity and the price level, and they adjust their behavior to these forecasts.

Figure 26.6 "Monetary Policy and Rational Expectations" uses the model of aggregate demand and aggregate supply to show the implications of the rational expectations argument for monetary policy. Suppose the economy is operating at YP, as illustrated by point A. An increase in the money supply boosts aggregate demand to AD2. In the analysis we have explored thus far, the shift in aggregate demand would move the economy to a higher level of real GDP and create an inflationary gap. That, in turn, would put upward pressure on wages and other prices, shifting the short-run aggregate supply curve to SRAS2 and moving the economy to point B, closing the inflationary gap in the long run. The rational expectations hypothesis, however, suggests a quite different interpretation.

Figure 26.6 Monetary Policy and Rational Expectations

Suppose the economy is operating at point A and that individuals have rational expectations. They calculate that an expansionary monetary policy undertaken at price level P1 will raise prices to P2. They adjust their expectations—and wage demands—accordingly, quickly shifting the short-run aggregate supply curve to SRAS2. The result is a movement along the long-run aggregate supply curve LRAS to point B, with no change in real GDP.

Suppose people observe the initial monetary policy change undertaken when the economy is at point A and calculate that the increase in the money supply will ultimately drive the price level up to point B. Anticipating this change in prices, people adjust their behavior. For example, if the increase in the price level from P1 to P2 is a 10% change, workers will anticipate that the prices they pay will rise 10%, and they will demand 10% higher wages. Their employers, anticipating that the prices they will receive will also rise, will agree to pay those higher wages. As nominal wages increase, the short-run aggregate supply curve immediately shifts to SRAS2. The result is an upward movement along the long-run aggregate supply curve, LRAS. There is no change in real GDP. The monetary policy has no effect, other than its impact on the price level. This rational expectations argument relies on wages and prices being sufficiently flexible—not sticky, as described in an earlier chapter—so that the change in expectations will allow the short-run aggregate supply curve to shift quickly to SRAS2.

One important implication of the rational expectations argument is that a contractionary monetary policy could be painless. Suppose the economy is at point B in Figure 26.6 "Monetary Policy and Rational Expectations", and the Fed reduces the money supply in order to shift the aggregate demand curve back to AD1. In the model of aggregate demand and aggregate supply, the result would be a recession. But in a rational expectations world, people’s expectations change, the short-run aggregate supply immediately shifts to the right, and the economy moves painlessly down its long-run aggregate supply curve LRAS to point A. Those who support the rational expectations hypothesis, however, also tend to argue that monetary policy should not be used as a tool of stabilization policy.

For some, the events of the early 1980s weakened support for the rational expectations hypothesis; for others, those same events strengthened support for this hypothesis. As we saw in the introduction to an earlier chapter, in 1979 President Jimmy Carter appointed Paul Volcker as Chairman of the Federal Reserve and pledged his full support for whatever the Fed might do to contain inflation. Mr. Volcker made it clear that the Fed was going to slow money growth and boost interest rates. He acknowledged that this policy would have costs but said that the Fed would stick to it as long as necessary to control inflation. Here was a monetary policy that was clearly announced and carried out as advertised. But the policy brought on the most severe recession since the Great Depression—a result that seems inconsistent with the rational expectations argument that changing expectations would prevent such a policy from having a substantial effect on real GDP.

Others, however, argue that people were aware of the Fed’s pronouncements but were skeptical about whether the anti-inflation effort would persist, since the Fed had not vigorously fought inflation in the late 1960s and the 1970s. Against this history, people adjusted their estimates of inflation downward slowly. In essence, the recession occurred because people were surprised that the Fed was serious about fighting inflation.

Regardless of where one stands on this debate, one message does seem clear: once the Fed has proved it is serious about maintaining price stability, doing so in the future gets easier. To put this in concrete terms, Volcker’s fight made Greenspan’s work easier, and Greenspan’s legacy of low inflation should make Bernanke’s easier.

Key Takeaways

- Macroeconomic policy makers must contend with recognition, implementation, and impact lags.

- Potential targets for macroeconomic policy include interest rates, money growth rates, and the price level or expected rates of change in the price level.

- Even if a central bank is structured to be independent of political pressure, its officers are likely to be affected by such pressure.

- To counteract liquidity traps, central banks have used quantitative-easing and credit-easing strategies.

- No central bank can know in advance how its policies will affect the economy; the rational expectations hypothesis predicts that central bank actions will affect the money supply and the price level but not the real level of economic activity.

Try It!

The scenarios below describe the U.S. recession and recovery in the early 1990s. Identify the lag that may have contributed to the difficulty in using monetary policy as a tool of economic stabilization.

- The U.S. economy entered into a recession in July 1990. The Fed countered with expansionary monetary policy in October 1990, ultimately lowering the federal funds rate from 8% to 3% in 1992.

- Investment began to increase, although slowly, in early 1992, and surged in 1993.

Case in Point: Targeting Monetary Policy

Figure 26.7

Ben Bernanke, the chairman of the Federal Reserve Board, is among a growing group of economists who (at least under normal macroeconomic circumstances!) advocate targeting as an approach to monetary policy. The idea, first proposed in 1993 by Stanford University economist John Taylor, calls for the central bank to set an inflation target and, if the actual rate is above or below it, raise or lower the federal funds rate.

The approach would be a change from the policy carried out under Alan Greenspan, who chaired the board from 1987 to 2006. Mr. Greenspan, who opposed targeting, favors a discretionary approach, one that some critics (and admirers) have called a “seat-of-the-pants” approach to monetary policy.

Targeting would not, according to Mr. Bernanke, be entirely formulaic, replacing the judgment of the Open Market Committee with a rigid rule. Mr. Bernanke has noted, for example, that if the inflation were to increase as a result of a supply side shock (such as an increase in oil prices), then an automatic increase in the federal funds rate would not be appropriate.

One danger of using the current inflation rate as a target is that it might be destabilizing. After all, the current rate is actually the rate for the past month or past several months. Adjusting the federal funds rate to past inflation could, given the inherent recognition and impact lags of monetary policy, easily lead to a worsening of the business cycle. Imagine that past inflation has increased as a result of a much earlier increase in the money supply. That inflation might already be correcting itself by the time a tightening effort takes hold in the economy. It thus could cause a contraction.

Bernanke has said that his preferred target is the expected rate of increase for the next year in the price index for consumer goods and services, excluding food and energy prices. That would avoid the danger of relying on previous inflation rates. He has said that his “comfort zone” for expected inflation is between 1% and 2%.

The central banks of Australia, Brazil, Canada, Great Britain, New Zealand, South Korea, and Sweden adopted targeting. Japan and the United States did not. A study by Goldman Sachs, the investment consulting and management firm, examined the performance of countries that did and did not engage in targeting. It found that countries that used targeting had more stable interest rates and sustained steady growth. Japan and the United States had much more volatile stock and bond markets. In short, the results of the study tended to support the practice of targeting inflation.

Sources: Peter Coy, “What’s the Fuss over Inflation Targeting? Business Week 3958 (November 7, 2005): 34; Justin Fox, “Who Will Replace Greenspan? Who Cares?” Fortune 152, no. 9 (October 31, 2005): 114.

Answers to Try It! Problems

- The recognition lag: the Fed did not seem to “recognize” that the economy was in a recession until several months after the recession began.

- The impact lag: investment did not pick up quickly after interest rates were reduced. Alternatively, it could be attributed to the expansionary monetary policy’s not having its desired effect, at least initially, on investment.

26.3 Monetary Policy and the Equation of Exchange

Learning Objectives

- Explain the meaning of the equation of exchange, MV = PY, and tell why it must hold true.

- Discuss the usefulness of the quantity theory of money in explaining the behavior of nominal GDP and inflation in the long run.

- Discuss why the quantity theory of money is less useful in analyzing the short run.

So far we have focused on how monetary policy affects real GDP and the price level in the short run. That is, we have examined how it can be used—however imprecisely—to close recessionary or inflationary gaps and to stabilize the price level. In this section, we will explore the relationship between money and the economy in the context of an equation that relates the money supply directly to nominal GDP. As we shall see, it also identifies circumstances in which changes in the price level are directly related to changes in the money supply.

The Equation of Exchange

We can relate the money supply to the aggregate economy by using the equation of exchange:

Equation 26.1

The equation of exchangeThe money supply (M) times its velocity (V) equals nominal GDP. shows that the money supply M times its velocity V equals nominal GDP. VelocityThe number of times the money supply is spent to obtain the goods and services that make up GDP during a particular time period. is the number of times the money supply is spent to obtain the goods and services that make up GDP during a particular time period.

To see that nominal GDP is the price level multiplied by real GDP, recall from an earlier chapter that the implicit price deflator P equals nominal GDP divided by real GDP:

Equation 26.2

Multiplying both sides by real GDP, we have

Equation 26.3

Letting Y equal real GDP, we can rewrite the equation of exchange as

Equation 26.4

We shall use the equation of exchange to see how it represents spending in a hypothetical economy that consists of 50 people, each of whom has a car. Each person has $10 in cash and no other money. The money supply of this economy is thus $500. Now suppose that the sole economic activity in this economy is car washing. Each person in the economy washes one other person’s car once a month, and the price of a car wash is $10. In one month, then, a total of 50 car washes are produced at a price of $10 each. During that month, the money supply is spent once.

Applying the equation of exchange to this economy, we have a money supply M of $500 and a velocity V of 1. Because the only good or service produced is car washing, we can measure real GDP as the number of car washes. Thus Y equals 50 car washes. The price level P is the price of a car wash: $10. The equation of exchange for a period of 1 month is

Now suppose that in the second month everyone washes someone else’s car again. Over the full two-month period, the money supply has been spent twice—the velocity over a period of two months is 2. The total output in the economy is $1,000—100 car washes have been produced over a two-month period at a price of $10 each. Inserting these values into the equation of exchange, we have

Suppose this process continues for one more month. For the three-month period, the money supply of $500 has been spent three times, for a velocity of 3. We have

The essential thing to note about the equation of exchange is that it always holds. That should come as no surprise. The left side, MV, gives the money supply times the number of times that money is spent on goods and services during a period. It thus measures total spending. The right side is nominal GDP. But that is a measure of total spending on goods and services as well. Nominal GDP is the value of all final goods and services produced during a particular period. Those goods and services are either sold or added to inventory. If they are sold, then they must be part of total spending. If they are added to inventory, then some firm must have either purchased them or paid for their production; they thus represent a portion of total spending. In effect, the equation of exchange says simply that total spending on goods and services, measured as MV, equals total spending on goods and services, measured as PY (or nominal GDP). The equation of exchange is thus an identity, a mathematical expression that is true by definition.

To apply the equation of exchange to a real economy, we need measures of each of the variables in it. Three of these variables are readily available. The Department of Commerce reports the price level (that is, the implicit price deflator) and real GDP. The Federal Reserve Board reports M2, a measure of the money supply. For the second quarter of 2008, the values of these variables at an annual rate were

M = $7,635.4 billion

P = 1.22

Y = 11,727.4 billion

To solve for the velocity of money, V, we divide both sides of Equation 26.4 by M:

Equation 26.5

Using the data for the second quarter of 2008 to compute velocity, we find that V is equal to 1.87. A velocity of 1.87 means that the money supply was spent 1.87 times in the purchase of goods and services in the second quarter of 2008.

Money, Nominal GDP, and Price-Level Changes

Assume for the moment that velocity is constant, expressed as . Our equation of exchange is now written as

Equation 26.6

A constant value for velocity would have two important implications:

- Nominal GDP could change only if there were a change in the money supply. Other kinds of changes, such as a change in government purchases or a change in investment, could have no effect on nominal GDP.

- A change in the money supply would always change nominal GDP, and by an equal percentage.

In short, if velocity were constant, a course in macroeconomics would be quite simple. The quantity of money would determine nominal GDP; nothing else would matter.

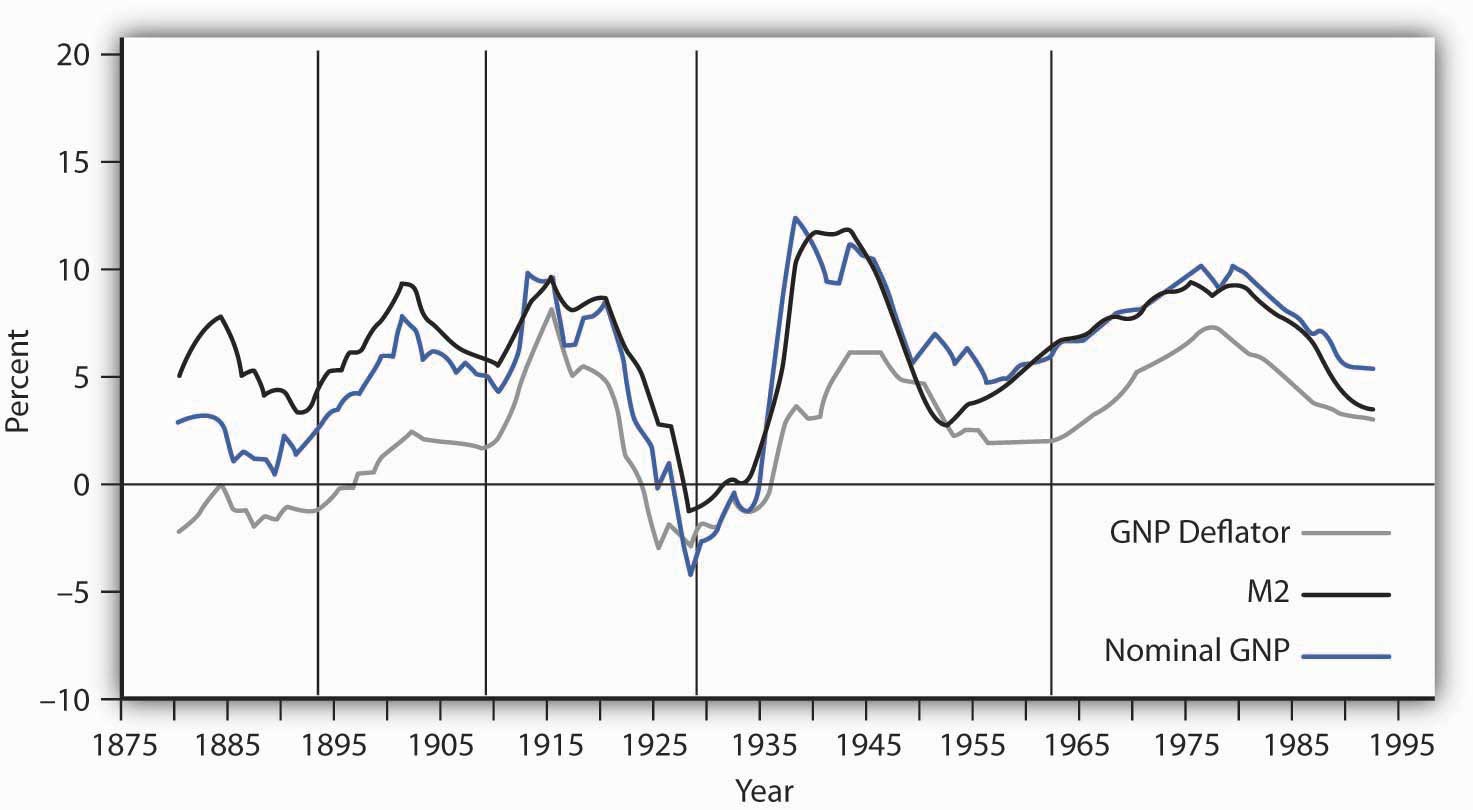

Indeed, when we look at the behavior of economies over long periods of time, the prediction that the quantity of money determines nominal output holds rather well. Figure 26.8 "Inflation, M2 Growth, and GDP Growth" compares long-term averages in the growth rates of M2 and nominal GNP in the United States for more than a century. The lines representing the two variables do seem to move together most of the time, suggesting that velocity is constant when viewed over the long run.

Figure 26.8 Inflation, M2 Growth, and GDP Growth

The chart shows the behavior of price-level changes, the growth of M2, and the growth of nominal GDP using 10-year moving averages. Viewed in this light, the relationship between money growth and nominal GDP seems quite strong.

Source: William G. Dewald, “Historical U.S. Money Growth, Inflation, and Inflation Credibility,” Federal Reserve Bank of St. Louis Review 80:6 (November/December 1998): 13-23.

Moreover, price-level changes also follow the same pattern that changes in M2 and nominal GNP do. Why is this?

We can rewrite the equation of exchange, M = PY, in terms of percentage rates of change. When two products, such as M and PY, are equal, and the variables themselves are changing, then the sums of the percentage rates of change are approximately equal:

Equation 26.7

The Greek letter Δ (delta) means “change in.” Assume that velocity is constant in the long run, so that %ΔV = 0. We also assume that real GDP moves to its potential level, YP, in the long run. With these assumptions, we can rewrite Equation 26.7 as follows:

Equation 26.8

Subtracting %ΔYP from both sides of Equation 26.8, we have the following:

Equation 26.9

Equation 26.9 has enormously important implications for monetary policy. It tells us that, in the long run, the rate of inflation, %ΔP, equals the difference between the rate of money growth and the rate of increase in potential output, %ΔYP, given our assumption of constant velocity. Because potential output is likely to rise by at most a few percentage points per year, the rate of money growth will be close to the rate of inflation in the long run.

Several recent studies that looked at all the countries on which they could get data on inflation and money growth over long periods found a very high correlation between growth rates of the money supply and of the price level for countries with high inflation rates, but the relationship was much weaker for countries with inflation rates of less than 10%.For example, one study examined data on 81 countries using inflation rates averaged for the period 1980 to 1993 (John R. Moroney, “Money Growth, Output Growth, and Inflation: Estimation of a Modern Quantity Theory,” Southern Economic Journal 69, no. 2 [2002]: 398–413) while another examined data on 160 countries over the period 1969–1999 (Paul De Grauwe and Magdalena Polan, “Is Inflation Always and Everywhere a Monetary Phenomenon?” Scandinavian Journal of Economics 107, no. 2 [2005]: 239–59). These findings support the quantity theory of moneyIn the long run, the price level moves in proportion with changes in the money supply, at least for high-inflation countries., which holds that in the long run the price level moves in proportion with changes in the money supply, at least for high-inflation countries.

Why the Quantity Theory of Money Is Less Useful in Analyzing the Short Run

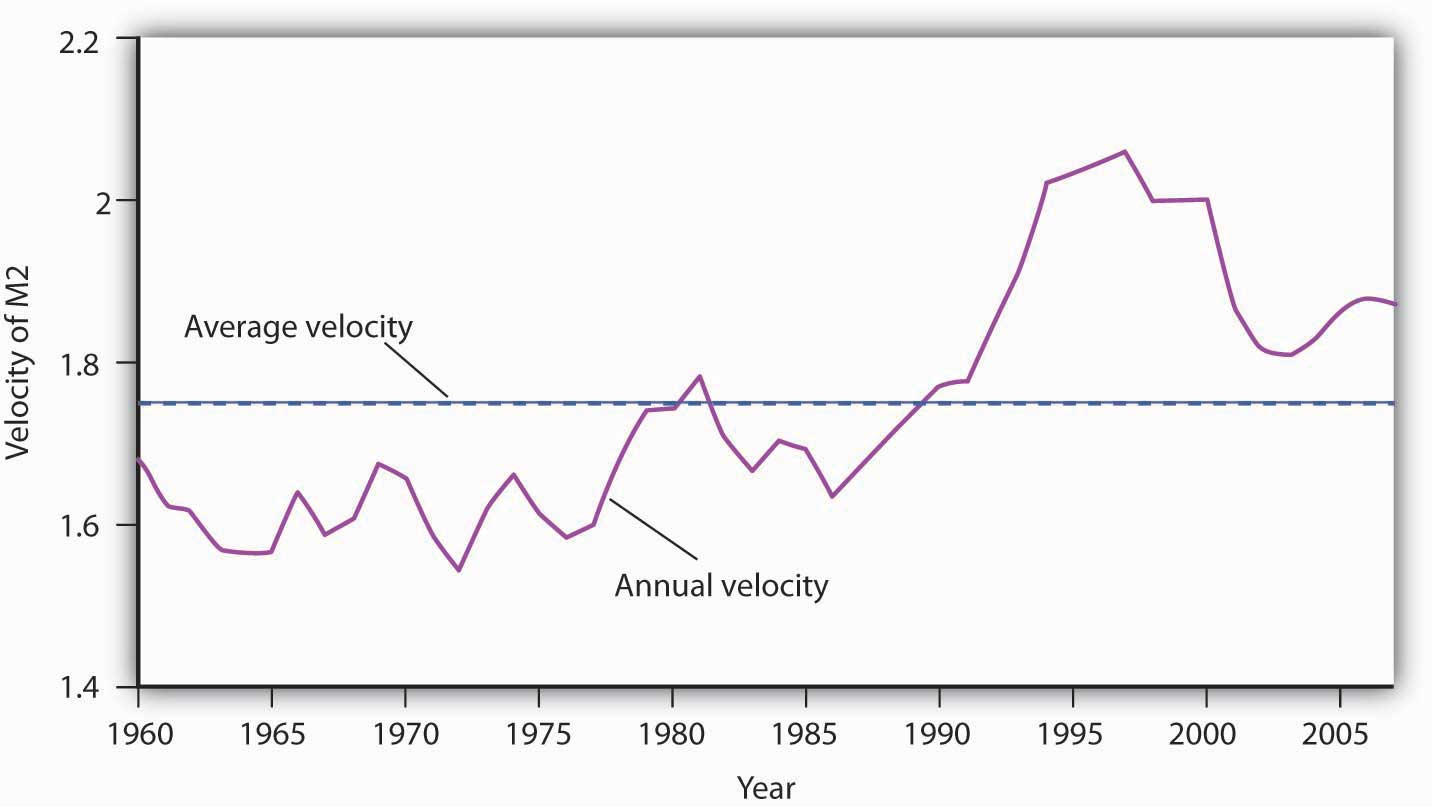

The stability of velocity in the long run underlies the close relationship we have seen between changes in the money supply and changes in the price level. But velocity is not stable in the short run; it varies significantly from one period to the next. Figure 26.9 "The Velocity of M2, 1960–2007" shows annual values of the velocity of M2 from 1960 through 2007. Velocity is quite variable, so other factors must affect economic activity. Any change in velocity implies a change in the demand for money. For analyzing the effects of monetary policy from one period to the next, we apply the framework that emphasizes the impact of changes in the money market on aggregate demand.

Figure 26.9 The Velocity of M2, 1960–2007

The annual velocity of M2 varied about an average of 1.75 between 1960 and 2007.

Source: Survey of Current Business, Oct. 2006; Federal Reserve Statistical Release Nov. 9, 2006, Table H-6; Economic Report of the President, 2009, Tables B-1 and B-69.

The factors that cause velocity to fluctuate are those that influence the demand for money, such as the interest rate and expectations about bond prices and future price levels. We can gain some insight about the demand for money and its significance by rearranging terms in the equation of exchange so that we turn the equation of exchange into an equation for the demand for money. If we multiply both sides of Equation 26.1 by the reciprocal of velocity, 1/V, we have this equation for money demand:

Equation 26.10

The equation of exchange can thus be rewritten as an equation that expresses the demand for money as a percentage, given by 1/V, of nominal GDP. With a velocity of 1.87, for example, people wish to hold a quantity of money equal to 53.4% (1/1.87) of nominal GDP. Other things unchanged, an increase in money demand reduces velocity, and a decrease in money demand increases velocity.

If people wanted to hold a quantity of money equal to a larger percentage of nominal GDP, perhaps because interest rates were low, velocity would be a smaller number. Suppose, for example, that people held a quantity of money equal to 80% of nominal GDP. That would imply a velocity of 1.25. If people held a quantity of money equal to a smaller fraction of nominal GDP, perhaps owing to high interest rates, velocity would be a larger number. If people held a quantity of money equal to 25% of nominal GDP, for example, the velocity would be 4.

As another example, in the chapter on financial markets and the economy, we learned that money demand falls when people expect inflation to increase. In essence, they do not want to hold money that they believe will only lose value, so they turn it over faster, that is, velocity rises. Expectations of deflation lower the velocity of money, as people hold onto money because they expect it will rise in value.

In our first look at the equation of exchange, we noted some remarkable conclusions that would hold if velocity were constant: a given percentage change in the money supply M would produce an equal percentage change in nominal GDP, and no change in nominal GDP could occur without an equal percentage change in M. We have learned, however, that velocity varies in the short run. Thus, the conclusions that would apply if velocity were constant must be changed.

First, we do not expect a given percentage change in the money supply to produce an equal percentage change in nominal GDP. Suppose, for example, that the money supply increases by 10%. Interest rates drop, and the quantity of money demanded goes up. Velocity is likely to decline, though not by as large a percentage as the money supply increases. The result will be a reduction in the degree to which a given percentage increase in the money supply boosts nominal GDP.

Second, nominal GDP could change even when there is no change in the money supply. Suppose government purchases increase. Such an increase shifts the aggregate demand curve to the right, increasing real GDP and the price level. That effect would be impossible if velocity were constant. The fact that velocity varies, and varies positively with the interest rate, suggests that an increase in government purchases could boost aggregate demand and nominal GDP. To finance increased spending, the government borrows money by selling bonds. An increased supply of bonds lowers their price, and that means higher interest rates. The higher interest rates produce the increase in velocity that must occur if increased government purchases are to boost the price level and real GDP.

Just as we cannot assume that velocity is constant when we look at macroeconomic behavior period to period, neither can we assume that output is at potential. With both V and Y in the equation of exchange variable, in the short run, the impact of a change in the money supply on the price level depends on the degree to which velocity and real GDP change.

In the short run, it is not reasonable to assume that velocity and output are constants. Using the model in which interest rates and other factors affect the quantity of money demanded seems more fruitful for understanding the impact of monetary policy on economic activity in that period. However, the empirical evidence on the long-run relationship between changes in money supply and changes in the price level that we presented earlier gives us reason to pause. As Federal Reserve Governor from 1996 to 2002 Laurence H. Meyer put it: “I believe monitoring money growth has value, even for central banks that follow a disciplined strategy of adjusting their policy rate to ongoing economic developments. The value may be particularly important at the extremes: during periods of very high inflation, as in the late 1970s and early 1980s in the United States … and in deflationary episodes.”Laurence H. Meyer, “Does Money Matter?” Federal Reserve Bank of St. Louis Review 83, no. 5 (September/October 2001): 1–15.

It would be a mistake to allow short-term fluctuations in velocity and output to lead policy makers to completely ignore the relationship between money and price level changes in the long run.

Key Takeaways

- The equation of exchange can be written MV = PY.

- When M, V, P, and Y are changing, then %ΔM + %ΔV = %ΔP + %ΔY, where Δ means “change in.”

- In the long run, V is constant, so %ΔV = 0. Furthermore, in the long run Y tends toward YP, so %ΔM = %ΔP.

- In the short run, V is not constant, so changes in the money supply can affect the level of income.

Try It!

The Case in Point on velocity in the Confederacy during the Civil War shows that, assuming real GDP in the South was constant, velocity rose. What happened to money demand? Why did it change?

Case in Point: Velocity and the Confederacy

Figure 26.10

The Union and the Confederacy financed their respective efforts during the Civil War largely through the issue of paper money. The Union roughly doubled its money supply through this process, and the Confederacy printed enough “Confederates” to increase the money supply in the South 20-fold from 1861 to 1865. That huge increase in the money supply boosted the price level in the Confederacy dramatically. It rose from an index of 100 in 1861 to 9,200 in 1865.

Estimates of real GDP in the South during the Civil War are unavailable, but it could hardly have increased very much. Although production undoubtedly rose early in the period, the South lost considerable capital and an appalling number of men killed in battle. Let us suppose that real GDP over the entire period remained constant. For the price level to rise 92-fold with a 20-fold increase in the money supply, there must have been a 4.6-fold increase in velocity. People in the South must have reduced their demand for Confederates.

An account of an exchange for eggs in 1864 from the diary of Mary Chestnut illustrates how eager people in the South were to part with their Confederate money. It also suggests that other commodities had assumed much greater relative value:

“She asked me 20 dollars for five dozen eggs and then said she would take it in “Confederate.” Then I would have given her 100 dollars as easily. But if she had taken my offer of yarn! I haggle in yarn for the millionth part of a thread! … When they ask for Confederate money, I never stop to chafer [bargain or argue]. I give them 20 or 50 dollars cheerfully for anything.”

Sources: C. Vann Woodward, ed., Mary Chestnut’s Civil War (New Haven, CT: Yale University Press, 1981), 749. Money and price data from E. M. Lerner, “Money, Prices, and Wages in the Confederacy, 1861–1865,” Journal of Political Economy 63 (February 1955): 20–40.

Answer to Try It! Problem

People in the South must have reduced their demand for money. The fall in money demand was probably due to the expectation that the price level would continue to rise. In periods of high inflation, people try to get rid of money quickly because it loses value rapidly.

26.4 Review and Practice

Summary

Part of the Fed’s power stems from the fact that it has no legislative mandate to seek particular goals. That leaves the Fed free to set its own goals. In recent years, its primary goal has seemed to be the maintenance of an inflation rate below 2% to 3%. Given success in meeting that goal, the Fed has used its tools to stimulate the economy to close recessionary gaps. Once the Fed has made a choice to undertake an expansionary or contractionary policy, we can trace the impact of that policy on the economy.

There are a number of problems in the use of monetary policy. These include various types of lags, the issue of the choice of targets in conducting monetary policy, political pressures placed on the process of policy setting, and uncertainty as to how great an impact the Fed’s policy decisions have on macroeconomic variables. We highlighted the difficulties for monetary policy if the economy is in or near a liquidity trap and discussed the use of quantitative easing and credit easing in such situations. If people have rational expectations and respond to those expectations in their wage and price choices, then changes in monetary policy may have no effect on real GDP.