This is “Introduction”, section 2.1 from the book Competitive Strategies for Growth (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

2.1 Introduction

Booklet Binding, Inc., is a Chicago-based provider of finishing services for printers and publishers. The company provides folding, binding, cutting, and gluing services for printers preparing all forms of printed materials, including direct mail pieces. Started in 1976, the company distinguished itself from sleepy competitors by building fast service with the latest technology, making large gains in market share. By the mid-1990s, the competition had caught up. Customers increasingly saw the market as “commoditizedCompetitors believe they are delivering similar products with similar service levels.,” with competitors each believed to be delivering similar products with similar service levels. This led, much more quickly, to conversations about price and pressure to lower prices. In fact, this pressure became so significant that the company’s salespeople began to introduce price into the conversation before customers even began to talk about it!

Commoditization is a real issue in most industries, as markets have become increasingly hypercompetitive and as competitive imitation of new ideas has become fast and furious. In this chapter, we will introduce the concepts in the 3-Circle model by considering customer value and how competitive forces evolve in a market, putting a premium on tools to understand that evolution. Commoditization is one of many strategic problems that is well addressed by the model.

Commoditization

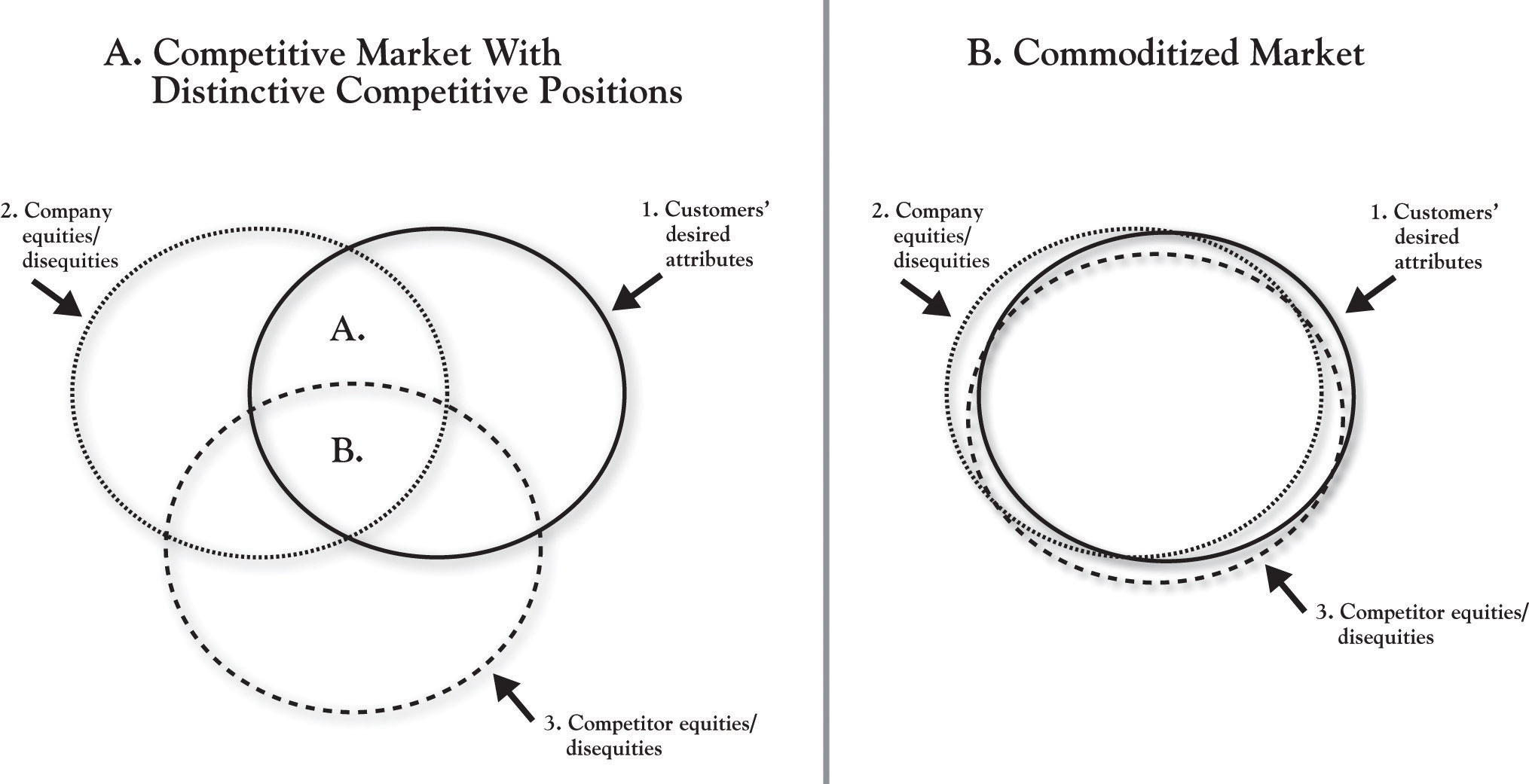

There is a state in an industry in which all competitive products or services have evolved to look the same, that is, to appear undifferentiated. Investopedia defines commoditizationA product becomes indistinguishable from others like it and consumers buy on price alone. as a situation in which “a product becomes indistinguishable from others like it and consumers buy on price alone.”Investopedia, a Forbes digital company. Rangan and Bowman (1992) were among the earliest to explicitly discuss commoditization as signaled by “increasing competition, availability of ‘me-too’ products, the customer’s reluctance to pay for features and services accompanying the product, and pressure on prices and margins in general.” As products or services become more similar in a market, there is an increasing reluctance among buyers to pay high prices. Picking up with our basic diagram from Chapter 1 "The Challenges of Growth", Figure 2.1 "Market With Distinctive Competitive Positions vs. Commoditized Market" (part A) depicts a competitive market in which two different competitors (or competitor groups) show some degree of differentiation. Recall from Figure 1.3 "3-Circle Illustration of Ultimate Ears’ Competitive Advantage" in Chapter 1 "The Challenges of Growth" that Area B represents common value or “points of parity”—this is the value that customers believe both competitors provide. In contrast, Areas A and C capture what is unique about the two competitors. The firm in this example shows a healthy Area A and its competitor shows an equally healthy Area C, indicating that each firm is believed by customers to create unique value in ways the competitor does not. An example might be the market in which Booklet Binding, Inc., initially competed, where it created a distinctive position around service and speed that could not be matched by the smaller, traditional, competitive “craftsmen” in the industry, whose smaller size and longer customer relationships could differentiate them.

Fast-forward 15 years, and what you find is a market with a great deal of overlap in the value being provided by each competitor. Panel B of Figure 2.1 "Market With Distinctive Competitive Positions vs. Commoditized Market" illustrates what happens in a commodity market. The predominant feature of this diagram is the enormous Area B, simply indicating that customers perceive a lot of common value. In other words, over time, the competitors have copied each other’s advantages, and, as a result, they may largely be indistinguishable in the eyes of the customer—hence, the renewed focus on price to seek to gain customers’ favor. Yet this often ends up in lost margin and blood on the income statement rather than competitive advantage.

The goal of this chapter is to introduce the 3-Circle model concepts in more depth, with the aim of illustrating how its primary goal of understanding how—in a market—value is perceived to be “shared” among competitors and how it is actually created. As it turns out, the primary way out of commoditization is through deeply exploring customer value in order to identify and understand needs that have not been well articulated. This is one of the core insights of the 3-Circle growth strategy process.

Figure 2.1 Market With Distinctive Competitive Positions vs. Commoditized Market

Some Fundamentals

The easiest—and, in fact, most powerful—definition of customer valueThe customer’s sense of what benefits they get from a firm relative to the price they pay. is that it is the customer’s sense of what benefits they get from a firm relative to the price they pay. There is a way to quantify this, which we will see. But the fact is that most firms use the term loosely, without much precision—a topic of some consideration in Chapter 4 "The Meaning of Value". It is a term that seems to have intuitive meaning to people, which can be dangerous. One manager might be talking about the quality of a product, while another may be thinking about price. But each is defining this under the rubric “value.” We will provide a more formal definition of customer value shortly, but first consider why the concept of customer value is important in the first place.

Customer Value and Financial Value

The best way to answer the question of why customer value is important is to think about how customer value plays into the bottom line of the firm. Global customer value expert Ray Kordupleski has an excellent chapter in his book Mastering Customer Value Management that goes to great lengths to illustrate very strong relationships among measures of customer value perceptions, market share, and profitability.Kordupleski (2003), chap. 1. The truth is that firms create financial value most effectively by first focusing on the value they create for customers. At the highest level, it is easy to illustrate that profit is a function of revenue and cost:

profit = total revenue – total cost.Further, total revenue can be broken down as a function of volume and price:

total revenue = Q * price,where Q is equal to the sales volume of the product or service (how many units we sell) and price is how much we charge customers for it.

Then, a simple way to think about Q (how much we can sell) is that it is determined by customers’ choices. First, we sell more when more customers choose our brand over competitive brands. Second, the reason customers will tend to choose our brand over competitors is that they believe our brand is a better value for the money.

Frank Perdue

So think of chicken.The Perdue chicken example presented here is a standard case for explaining the basics of customer value, and is sourced from Gale (1994). Twenty years ago, chicken was a commodity product in the grocery store. Different brands were perceived to be very similar and were sold at similar prices. Perdue chicken was one of those brands. Considering the definition of value given previously, we can envision a scenario that defines a commodity market:

where the ratios can be thought of as capturing each brand’s value for the money (“was that product or service worth what I paid for it?”). If the two ratios are equal, you have a commodity market. It is a coin flip to determine which brand a consumer will choose.

In the face of this situation, Frank Perdue did something to change this market. Based on a study of the value that customers sought from chicken, Perdue concluded that consumers wanted meatier, yellower chicken, with no pinfeathers. He then put significant research and investment into breeding and technology that would produce plumper chickens with yellower skin, and processing with turbine engine blow-drying to remove pin feathers on the skin. Essentially, Perdue substantially increased the numerator in his value ratio, greatly enhancing the benefits that consumers received from his chicken. A creative advertising program further enhanced those benefits by communicating the uniqueness of Perdue chicken and conveying Perdue’s no-nonsense personality. At equivalent prices, the Perdue brand became a clear choice for the consumer of the competitive brand Z because it delivers more effectively on important consumer benefits sought.

Considering the relative value ratios, although the denominators are essentially the same, the Perdue numerator is larger, making the overall ratio larger. Interestingly, though, as Perdue’s sales grew as a result of the improved product, competitive brands began to reduce their prices to try to defend their market shares. Yet many consumers still stuck with the higher-priced Perdue brand, meaning they were willing to trade-off higher prices for better chicken. In sum, even at a higher price point, Perdue’s benefits were still considered to be a good value for the money. This was the foundation for Perdue chicken establishing a very profitable niche in the retail grocery market.

So, to this point, a few fundamentals are important:

- Customers choose products or services that they believe provide greater value.

- Commoditization occurs as, over time, firms imitate new ideas and the products and services (and value ratios) become increasingly similar.

- Breaking out of commoditization requires a focus on customer value and the reasons why customers choose certain products. A firm can distinguish its offering by either substantively enhancing the benefits offered or lowering the customer’s costs in a way that is difficult to imitate.

- Greater customer value relative to the competition produces more sales volume, greater revenue, and greater profit (provided it is created within a manageable cost structure).