This is “End-of-Chapter Exercises”, section 17.6 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

17.6 End-of-Chapter Exercises

Questions

- James Hartwell is preparing financial statements for the Ashton Corporation. Hartwell wants these statements to conform to U.S. GAAP so they are more credible with decision makers. Only a balance sheet has been prepared so far. Is Hartwell required to prepare a statement of cash flows according to U.S. GAAP?

- As of December 31, Year One, the Midlothian Corporation reports “cash” of $318,455. What might be included in this figure?

- As of December 31, Year One, the Midlothian Corporation reports “cash equivalents” of $74,329. What might be included in this figure?

- Sashya Douglas is analyzing a statement of cash flows reported by a company that has securities traded on the New York Stock Exchange. Is the direct method or the indirect method more likely to be seen? How can Douglas tell whether the direct method or the indirect method has been applied?

- What are the three sections of a statement of cash flows? What types of transactions are included in each of these categories?

- During the current year, the Durham Corporation issued 10,000 shares of $1 par value common stock with a stock market value of $18 per share in exchange for 2 acres of land. How is this transaction reported on a statement of cash flows?

- A company reports rent expense for the current year of $74,000. Why is this figure not the same as the cash paid by the company for rent?

- The Ames Corporation reports salary expense of $875,000. During that period of time, the salary payable balance rose by $39,000. How much cash did the company pay its employees this period?

- The Lewiston Corporation reported cost of goods sold of $376,000 for Year One. During that period, its inventory went up by $72,000 while its accounts payable fell by $19,000. How much cash did the company pay for inventory purchases during Year One?

- The Clarkson Corporation reported depreciation expense of $107,000 in Year One. In a statement of cash flows where the direct method is applied, how is this expense reported? If the indirect method is applied, how is this expense reported?

- For the year ended December 31, Year One, the Maeburry Corporation reports an $85,000 gain on the sale of land. Several acres attached to a warehouse were sold during the year for cash. If cash flows from operating activities are reported by the direct method, how is this gain reported? If the indirect method is applied, how is this gain reported?

- During the current year, the Leftowich Company reported that its accounts receivable had gone down while salary payable went up. If the indirect method is applied to determine cash flows from operating activities, how are these changes shown?

- The Central Western Corporation reports its cash flows from operating activities by means of the indirect method. In the current year, the company’s prepaid rent account increased by $11,000. At the same time, its accounts payable balance fell by $23,000. If the indirect method is used to present cash flows from operating activities, how are these two changes reported?

- The Harbaugh Corporation paid a $39,000 cash dividend this year but also received $11,000 as a dividend from one of the company’s investments. If U.S. GAAP is applied, how are these two transactions reported within a statement of cash flows? If IFRS is applied, how are these two transactions reported within a statement of cash flows?

- The Anna Company sells a building with an original cost of $950,000 and accumulated depreciation of $400,000 to another company at a gain of $18,000. What reporting is necessary on a statement of cash flows?

- During the current year, a company repurchases 10,000 shares of common stock that were originally issued several years ago for $32 per share. The stock is acquired this year for $37 per share. Later, in the year, 3,000 of these shares are reissued to the public for $40 each. How are these transactions reported in the statement of cash flows for this period?

True or False

- ____ A company reports cash equivalents as an asset. The term “cash equivalents” has the same meaning as “cash.”

- ____ If the cash flows from operating activities begins with “cash collected from customers,” the indirect method is being applied.

- ____ When the direct method of reporting cash flows from operating activities is applied, depreciation expense is added to net income.

- ____ When the indirect method of reporting cash flows from operating activities is applied, a loss on the sale of equipment is added to net income.

- ____ The Walsingham Corporation reported rent expense of $75,000 this year. At the same time, prepaid rent increased by $9,000. The company paid $84,000 in rent this period.

- ____ The Trigger Company reported rent expense of $43,000 this year. At the same time, rent payable increases by $9,000. The company paid $52,000 in rent this period.

- ____ A company reports net income for the current year of $200,000. During that year, depreciation expense of $30,000 was reported as well as an $8,000 gain on the cash sale of a building. In addition, accounts receivable increased by $9,000. The net cash flows from operating activities for the period was $213,000.

- ____ A company reports cost of goods sold of $500,000. During that period, inventory fell by $34,000 while accounts payable rose by $9,000. The company paid $475,000 in cash this period for the purchase of merchandise.

- ____ Purchasing treasury stock is an example of a financing activity.

- ____ Significant investing and financing activities not involving cash still need to be disclosed.

- ____ During the current year, the Baxter Corporation paid $100,000 on a long-term note payable and $13,000 in related interest expense. According to U.S. GAAP, these two payments must be shown in separate sections of a statement of cash flows.

- ____ During the current year, the Frances Corporation paid $200,000 on a long-term note payable and $22,000 in related interest expense. According to IFRS, these two payments must be shown in separate sections of a statement of cash flows.

- ____ Equipment costing $320,000 but with accumulated depreciation of $240,000 was sold at a loss of $22,000. The company reports a cash inflow of $58,000 as a financing activity.

Multiple Choice

-

Where does cash that is collected from customers appear on a statement of cash flows?

- Operating activities section

- Investing activities section

- Financing activities section

- Capital activities section

-

Fritz Corporation began the year with $900,000 in accounts receivable. During the year, sales revenue totaled $7,000,000. Fritz ended the year with $750,000 in accounts receivable. How much cash did Fritz collect from its customers during the year?

- $6,850,000

- $7,150,000

- $7,750,000

- $7,900,000

-

The Willson Company pays off one of its bonds before it came due because interest rates have fallen rather significantly. Where does the cash paid to redeem a bond payable appear on a company’s statement of cash flows?

- Operating activities section

- Investing activities section

- Financing activities section

- Capital activities section

-

Which of the following is true about the reporting of cash flows from operating activities?

- Most companies use the indirect method although FASB prefers the direct method.

- Most companies use the indirect method because it is preferred by FASB.

- Most companies use the direct method because it is preferred by FASB.

- Most companies use the direct method, although FASB prefers the indirect method.

-

During the current year, Rafael Corporation distributed dividends of $23,000, received cash by signing a note payable of $105,000, purchased a piece of equipment for $29,000 in cash, and received dividend income of $12,000. What is reported as Rafael’s net cash inflow from financing activities for the year?

- $53,000

- $65,000

- $82,000

- $94,000

-

Happy Toy Company began Year Nine with $1,000 in inventory and $4,500 in accounts payable. During the year, Happy Toy incurred cost of goods sold of $25,000. Happy Toy ended Year Nine with $2,700 in inventory and $3,800 in accounts payable. How much cash did Happy Toy pay for its merchandise purchases during Year Nine?

- $22,600

- $24,000

- $26,000

- $27,400

-

Crystal Bell Company generated $48,900 in net income during the year. Included in this number are depreciation expense of $13,000 and a gain on the sale of equipment of $4,000. In addition, accounts receivable increased by $16,000, inventory decreased by $5,090, accounts payable decreased $4,330, and interest payable increased $1,200. Based on the above information, what is Crystal Bell’s net cash inflow from operating activities?

- $43,860

- $48,900

- $54,120

- $71,940

-

Transportation Inc. incurred rent expense of $98,000 during the year on a large warehouse. During that same period, prepaid rent increased by $34,000. How much cash did Transportation pay for rent during the year?

- $34,000

- $64,000

- $98,000

- $132,000

-

The Robious Company presents cash flows from operating activities by the direct method. On its income statement for the current year, Robious reports rent expense of $60,000. This figure relates to two different buildings in use by the company. For Building One, prepaid rent went up by $9,000 during the year. For Building Two, rent payable went down by $5,000. How much cash did the company pay this year for rent?

- $46,000

- $56,000

- $64,000

- $74,000

-

A building is bought on October 1, Year One, for $500,000 in cash. It is depreciated using the straight-line method over an expected life of twenty years. A residual value of $20,000 is anticipated. The half-year convention is applied. On April 1, Year Four, the building is sold for cash at a loss of $13,000. Which of the following appears on the company’s Year Four statement of cash flows?

- Investing activities cash inflow of $395,000

- Investing activities cash inflow of $415,000

- Investing activities cash inflow of $428,000

- Investing activities cash inflow of $441,000

-

The Hamster Company determines its cash flows from operating activities by the indirect method. Net income is reported for the current period as $400,000, which included depreciation expense of $70,000 and a gain on sale of land of $30,000. In addition, accounts receivable went down $2,000 during the year while accounts payable went up $7,000. What is the amount of cash generated by the Hamster Company’s operating activities this year?

- $431,000

- $435,000

- $445,000

- $449,000

-

In Year One, the Karsenti Company reported net income of $30,000. Among many other accounts, the income statement included sales revenue of $500,000, cost of goods sold of $300,000, depreciation expense−equipment of $50,000, and a gain on sale of equipment of $23,000. Included on the balance sheet were a number of accounts such as bonds payable (increased $23,000), accounts payable, (decreased $6,000), retained earnings (increased $11,000), equipment (decreased $70,000), accumulated depreciation−equipment (increased $29,000), accounts receivable (decreased $17,000), and inventory (increased $3,000). No capital stock was issued or reacquired during the year. How much cash did this company spend on inventory during the year?

- $291,000

- $297,000

- $303,000

- $309,000

-

Use the same information as presented in problem 12. Using the indirect method, how much cash did Karsenti generate this year from its operating activities?

- $57,000

- $65,000

- $69,000

- $71,000

-

Use the same information as presented in problem 12. One piece of equipment was sold by Karsenti this year for cash, and none was bought. Which of the following is true about this sale of equipment?

- It is an investing activity cash inflow of $49,000.

- It is an investing activity cash inflow of $63,000.

- It is an investing activity cash inflow of $72,000.

- It is an investing activity cash inflow of $93,000.

-

Use the same information as presented in problem 12. Karsenti paid a cash dividend to shareholders this year. How should this distribution be shown on a statement of cash flows?

- Operating activity cash outflow of $19,000.

- Investing activity cash outflow of $30,000.

- Operating activity cash outflow of $30,000.

- Financing activity cash outflow of $19,000.

Video Problems

Professor Joe Hoyle discusses the answers to these two problems at the links that are indicated. After formulating your answers, watch each video to see how Professor Hoyle answers these questions.

-

Your roommate is an English major. The roommate’s parents own a chain of ice cream shops located throughout Florida. One day, while the two of you are taking a study break, your roommate asks you the following question: “I was recently looking at the financial statements my parents prepare for their business. I happened to see the statement of cash flows. I studied it more carefully because I was interested in the amount of cash that the business has been making. One of the biggest positive numbers on the entire statement was depreciation expense. It was listed right there under operating activities with a big plus sign. I don’t understand. How are they able to get so much cash from depreciation? I understand how they get cash by selling ice cream, but how does a company get that cash from something called depreciation?” How would you respond?

-

Your uncle and two friends started a small office supply store several years ago. The company has grown and now has several large locations. Your uncle knows that you are taking a financial accounting class and asks you the following question: “We’ve been having cash flow problems recently. We are making roughly the same net income as in the past, but our cash reserves are shrinking. How can we possibly be selling so much merchandise and making a reasonable profit and still see our cash dwindling? This makes no sense to me. I’m mystified.” How would you respond?

Problems

-

For each of the following transactions, indicate whether the cash flows are reported in the operating activities section of the statement of cash flows, the investing activities section, or the financing activities section.

- Issuance of bonds payable

- Cash paid for interest

- Cash collected from customers

- Paid dividends

- Sold equipment for cash

- Issued preferred stock for cash

- Cash paid for inventory purchases

- Purchased a small percentage of the ownership shares of another company

- Cash received from dividend income

-

For each of the following transactions, indicate what is reported on the statement of cash flows and the section in which it is listed. Assume the indirect method is used to present the cash flows from operating activities.

- Equipment costing $33,000 but with accumulated depreciation of $14,000 is sold for cash creating a reported gain of $5,000.

- A note is signed at the bank on a $200,000 loan.

- A building with a cost of $700,000 but a net book value of only $111,000 is destroyed by fire.

- A new truck is acquired for $56,000 by signing a long-term note payable.

- A new owner invests cash of $49,000 into the business in exchange for 10,000 shares of $1 par value common stock.

- The first payment of $11,000 is made on the truck bought in problem 2(d). Of that total, $10,000 is paid on the note with the rest paid as interest.

- A building costing $530,000 with accumulated depreciation of $170,000 is sold for cash at a loss of $15,000.

-

The Starmer Corporation begins the current year with equipment costing $900,000. This figure rises to $1.2 million by the end of the period. Accumulated depreciation was $200,000 on the first of the year but $260,000 at the end. During the year, the following events took place:

- Equipment costing $450,000 was bought by signing a note for $180,000 and paying cash for the remainder.

- Depreciation expense recognized for the year on equipment was $110,000.

- Equipment was sold during the year for cash; a gain of $13,000 was recognized.

In connection with this company’s equipment account, what will be the effects reported on the statement of cash flows?

- Roy Company generated sales during Year Two of $120,000. Roy began the year with $56,000 in accounts receivable and ended the year with $79,000 in accounts receivable. Determine the amount of cash Roy collected from its customers during Year Two.

-

Below are figures found in the beginning and ending trial balances for the DeFaul Company for Year Three.

1/1/3 12/31/3 Equipment $420,000 debit $460,000 debit Accumulated depreciation $350,000 credit $370,000 credit Note payable $320,000 credit $350,000 credit Loss on sale of equipment — $24,000 debit Additional information:

- A $50,000 cash payment was made on the note payable this year as well as a $20,000 payment for interest expense.

- New equipment was bought this year by signing a note payable and making a cash payment.

- Equipment costing $100,000 but with a net book value of $60,000 was sold for cash.

- The company uses the indirect method for presenting its cash flows from operating activities.

- Based on the previous information, this company has two cash flows that need to be reported as investing activities. What are they and what monetary amount should be included?

- Based on the previous information, this company has one cash flow that needs to be reported as a financing activity. What is it and what monetary amount should be included?

-

The Pasley Company prepares an income statement that reports cost of goods sold of $320,000, rent expense of $30,000, and salary expense of $90,000. During the year, prepaid rent went up $5,000, accounts payable went down $4,000, salary payable went up $3,000, and inventory went down $2,000.

- What is the amount of cash the company spent this year to purchase inventory?

- What is the amount of cash the company spent this year on rent?

- What is the amount of cash the company paid this year to its employees as salaries?

-

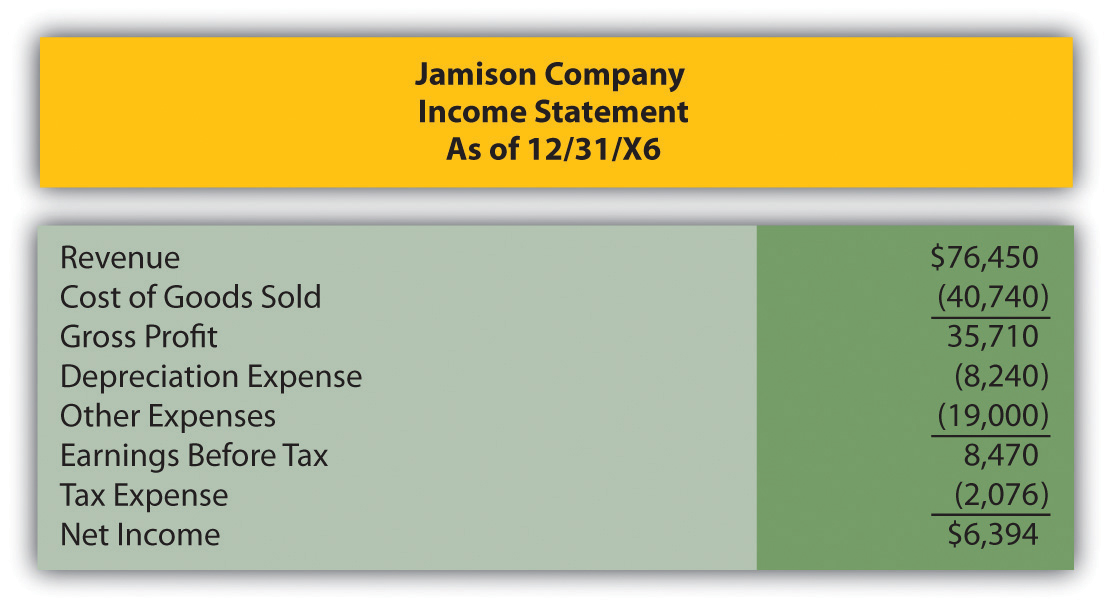

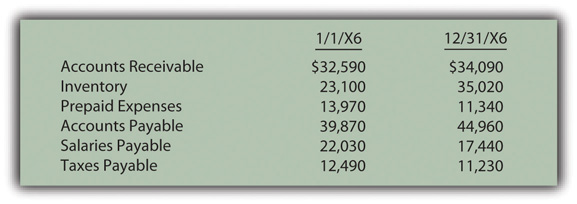

Jamison Company’s income statement for 20X6 is below.

Figure 17.41 Jamison Company Income Statement as of 12/31/X6

Figure 17.42 Selected Balance Sheet Accounts from the Beginning and End of 20X6

Determine Jamison’s net cash inflow or outflow from operating activities for this year using both the direct and indirect methods.

-

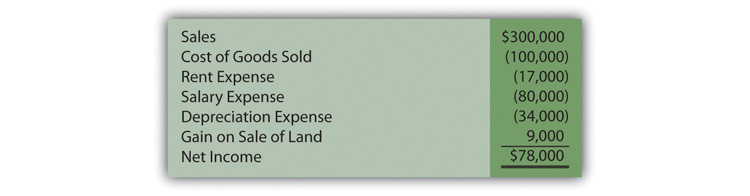

The following information is found in the year-end financial statements reported by Barney Corporation.

Figure 17.43 Income Statement

Figure 17.44 Current Asset and Liability Accounts

Prepare the operating activities section of a statement of cash flows by means of the indirect method.

-

For each of the following transactions, indicate what is shown on a statement of cash flows as either an investing activity, a financing activity, or an operating activity. What kind of activity is it? Is it a cash inflow or outflow? How much cash is reported?

- One thousand shares of $1 per share par value common stock is issued for $19,000.

- A cash dividend of $16,000 is distributed to stockholders.

- A cash dividend of $9,000 is collected from another company because of the ownership of shares of stock.

- A $7,000 payment is made on a long-term note payable with $6,000 reducing the principal and the remaining $1,000 for interest.

- A building is sold with a historical cost of $400,000 and accumulated depreciation of $210,000 for cash at a loss of $17,000.

-

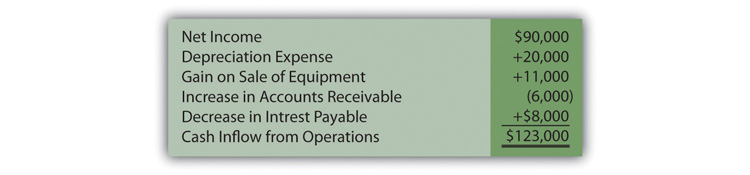

A company creates the following operating activities section of its statement of cash flows.

Figure 17.45 Company Prepared Operating Activities Cash Flows

What was the correct amount of cash that was received during this period from the company’s operating activities?

-

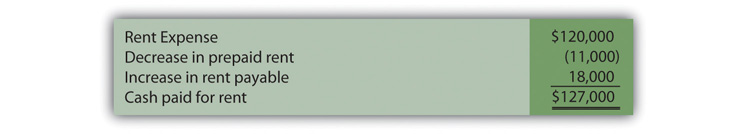

A company computed its cash payments for rent expense for the most recent period as $127,000, as shown next. What was the correct amount of cash the company paid for rent?

Figure 17.46 Company Computed Payments for Rent

-

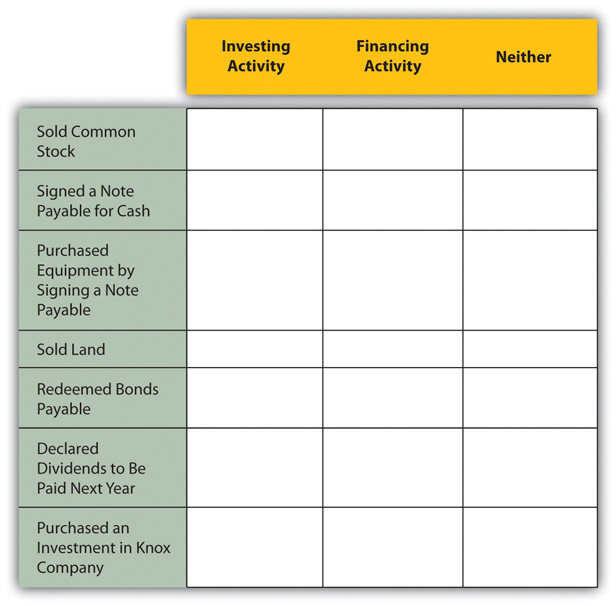

Killian Corporation had several transactions during the year that impacted long-term assets, long-term liabilities, and stockholders’ equity. Determine if the cash amount in each of the following transactions is shown as an investing activity, as a financing activity, or as neither.

Figure 17.47 Determination of Cash Flow Balances

-

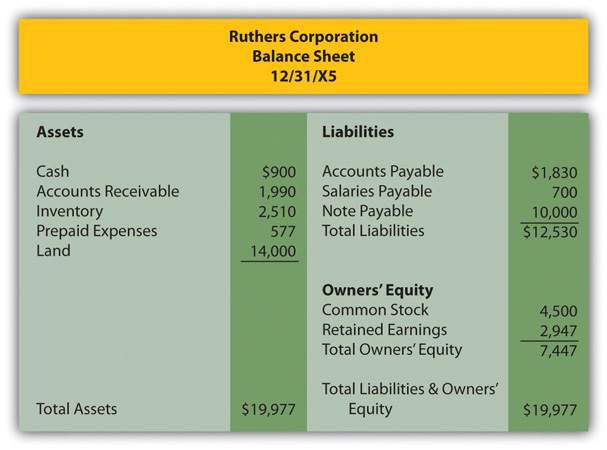

Ruthers Corporation began business on January 1, 20X5. The financial statements for Ruthers’s first year are given here. Because 20X5 is the first year in business, the balance sheet accounts have no beginning balances.

Figure 17.48 Ruthers Corporation Income Statement as of 12/31/X5

Figure 17.49 Ruthers Corporation Balance Sheet 12/31/X5

Additional Information:

- Ruthers purchased land for $14,000 cash.

- Common stock was issued for $4,500 in cash.

- A note payable was signed for $10,000 cash.

Prepare Ruthers’s statement of cash flows for 20X5 using the indirect method of calculating cash flows from operating activities.

-

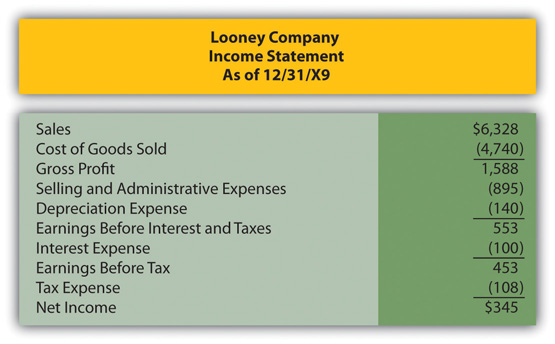

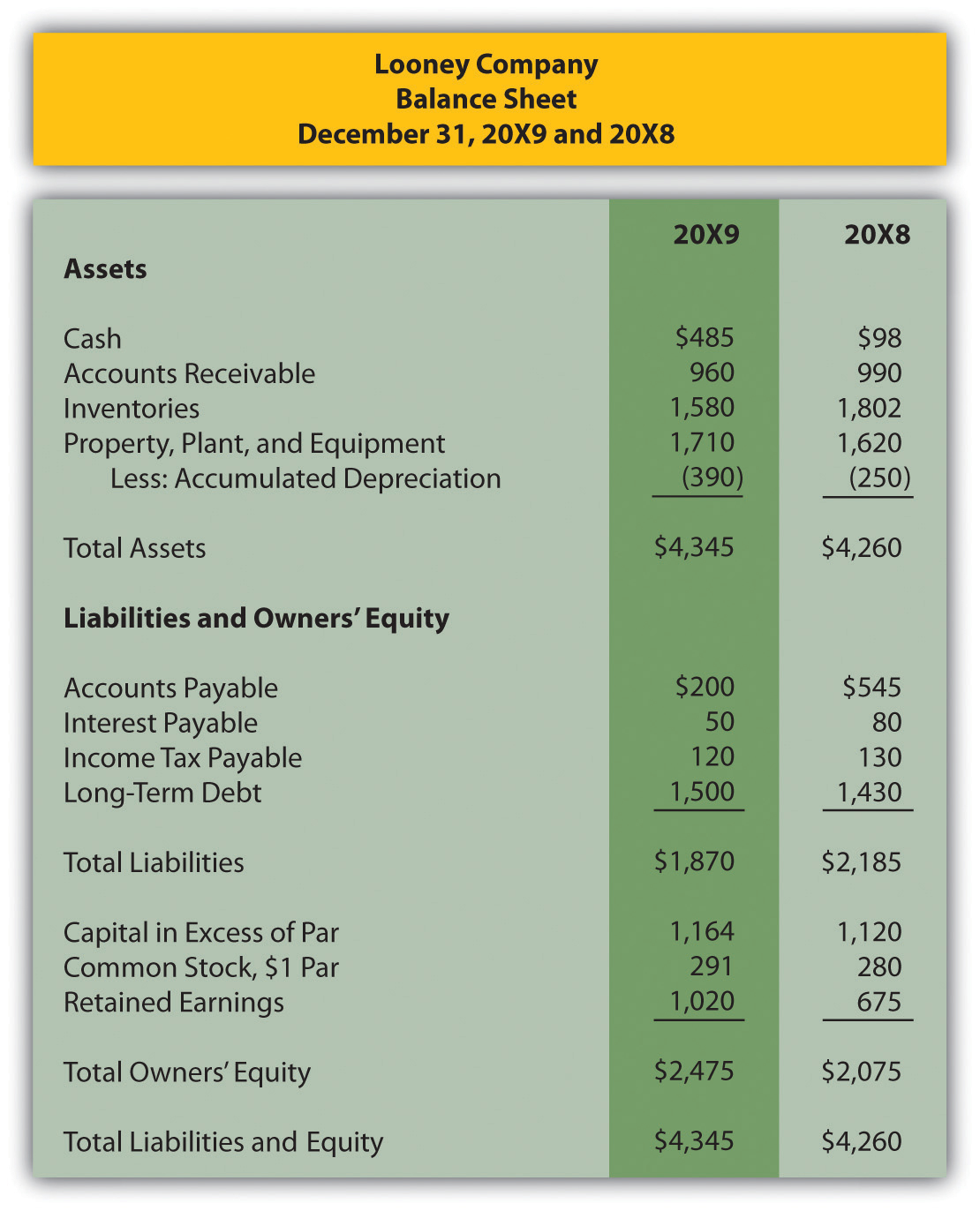

Looney Company is in the process of preparing financial statements for the year ended 12/31/X9. The income statement as of 12/31/X9 and comparative balance sheets are presented here.

Figure 17.50 Looney Company Income Statement as of 12/31/X9

Figure 17.51 Looney Company Balance Sheet December 31, 20X9 and 20X8

The following additional information has been assembled by Looney’s accounting department:

- Equipment was purchased for $90 in cash.

- Long-term debt of $70 was issued for cash.

- Looney issued eleven shares of common stock for cash during 20X9.

Prepare Looney’s statement of cash flows as of 12/31/X9 using the direct method.

-

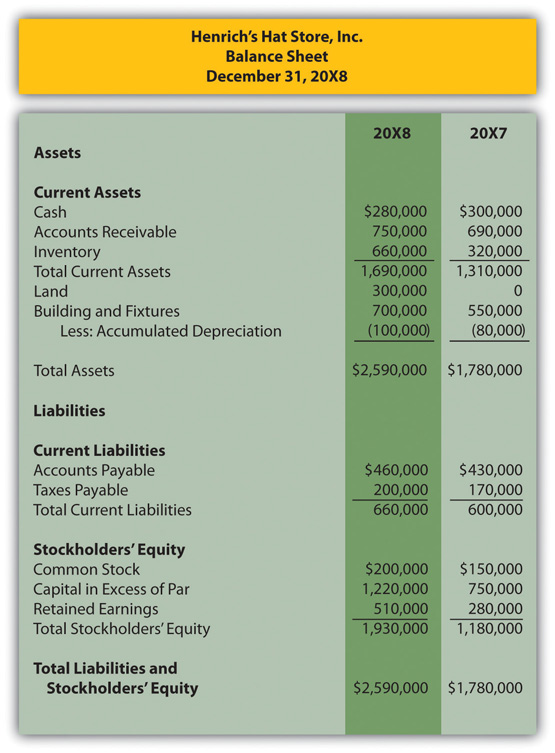

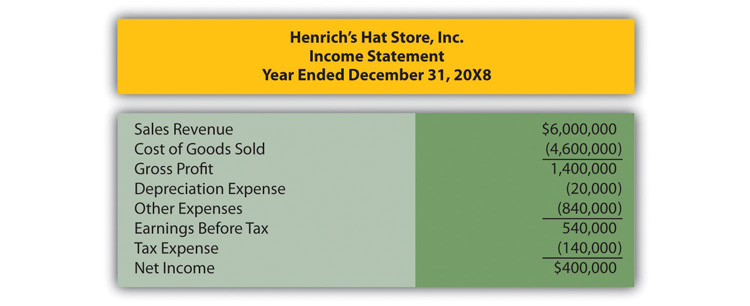

The following information relates to Henrich’s Hat Store Inc. for the year ended December 31, 20X8.

Figure 17.52 Henrich’s Hat Store Inc. Balance Sheet, December 31, 20X8

Figure 17.53 Henrich’s Hat Store Inc. Income Statement for the Year Ended December 31, 20X8

Other information:

- The company purchased a building and fixtures with cash during the year, but none were sold.

- Dividends of $170,000 were declared and paid.

- Cash proceeds from the sale of common stock totaled $520,000.

- Land was purchased for $300,000 cash.

Prepare the statement of cash flows for Henrich’s Hat Store Inc. for the year ended December 31, 20X8 using the indirect method of calculating cash flows from operations.

Comprehensive Problem

This problem has carried through several chapters, building in difficulty. Hopefully, it has allowed students to continually practice skills and knowledge learned in previous chapters.

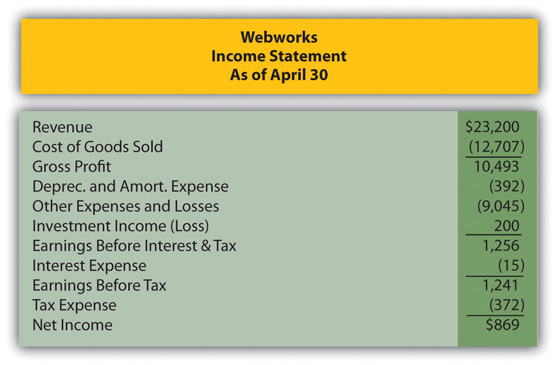

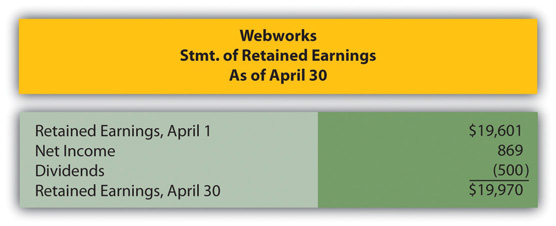

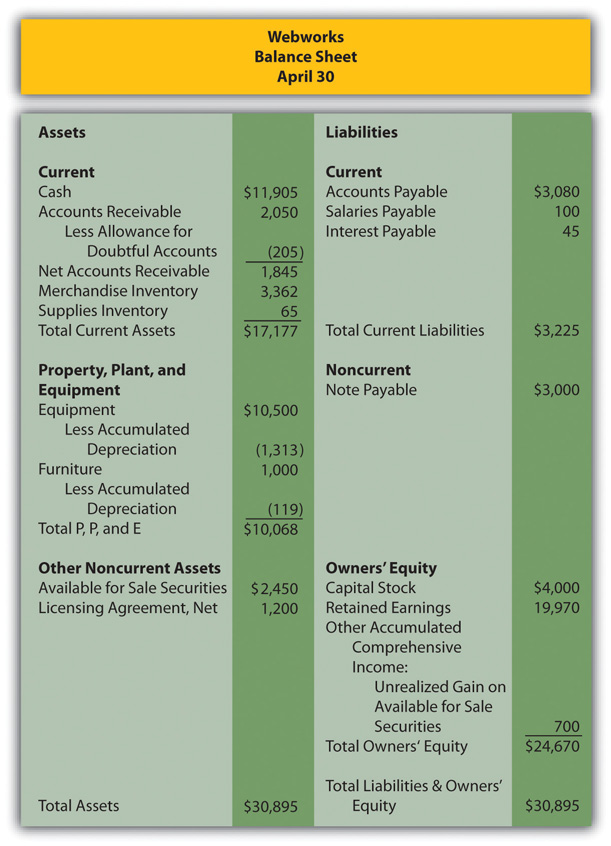

In Chapter 16 "In a Set of Financial Statements, What Information Is Conveyed about Shareholders’ Equity?", financial statements for April were prepared for Webworks. They are included here as a starting point for the required recording for May.

This will be your final month of preparing financial statements for Webworks. This month, the statement of cash flows will be added. To simplify the construction of that statement, fewer transactions than usual are included.

Figure 17.54 Webworks Financial Statements

Figure 17.55

Figure 17.56

The following events occur during May:

- Webworks starts and completes twelve more sites and bills clients for $9,000.

- Webworks purchases supplies worth $140 on account.

- At the beginning of March, Webworks had twenty-two keyboards costing $121 each and twenty-eight flash drives costing $25 each. Webworks uses periodic FIFO to cost its inventory.

- On account, Webworks purchases eighty-three keyboards for $122 each and ninety flash drives for $26 each.

- Webworks sells 98 keyboards for $14,700 and 100 of the flash drives for $3,000 cash.

- Webworks collects $9,000 in accounts receivable.

- Webworks pays its $500 rent.

- Webworks pays off $14,000 of its accounts payable.

- Webworks sells all of its shares of QRS stock for $14 per share.

- Webworks pays Juan $750 for his work during the first three weeks of May.

- Webworks pays off its salaries payable from April.

- Webworks pays the owners (Leon Jackson and Nancy Po) a salary of $4,000 each.

- Webworks’s note payable permits early payment with no penalty. Leon Jackson and Nancy Po decide to use some of their excess cash and pay off the note and interest payable. The note was paid at the beginning of May, so no interest accrued during May.

-

Webworks pays taxes of $740 in cash.

Required:

- Prepare journal entries for the previous events.

- Post the journal entries to T-accounts.

- Prepare an unadjusted trial balance for Webworks for May.

- Prepare adjusting entries for the following, and post them to your T-accounts.

- Webworks owes Juan Marcon (an employee) $200 for his work during the last week of May.

- Webworks receives an electric bill for $450. Webworks will pay the bill in June.

- Webworks determines that it has $70 worth of supplies remaining at the end of May.

- Webworks is continuing to accrue bad debts at 10 percent of accounts receivable.

- Webworks continues to depreciate its equipment over four years and its furniture over five years, using the straight-line method.

- The license agreement should be amortized over its one-year life.

-

Record cost of goods sold.

- Prepare an adjusted trial balance.

- Prepare financial statements, including the statement of cash flows, for May. Prepare the operating section using the indirect method.

Research Assignment

Assume that you take a job as a summer employee for an investment advisory service. One of the partners for that firm is currently looking at the possibility of investing in Caribou Coffee Company Inc. The partner is interested in knowing how much money the company has available for growth. The partner also wants to know how much growth has taken place in recent years. The partner asks you to look at the 2010 financial statements for Caribou Coffee by following this path:

- Go to http://www.cariboucoffee.com.

- At the bottom of this screen, click on “Our Company.”

- In the upper right side of the next screen, click on “Investors.”

- On the left side of the next screen, click on “Financial Reports.”

- On the next screen, click on “2010 Annual Report” to download.

- Scroll to page 26 and find the company’s statement of operations (income statement) for the years ended January 2, 2011, and January 3, 2010. Note the amount of net income reported for each year.

- Scroll down to page 28 and, for each of these two years, note the amount of cash inflow generated by operating activities. Then, look under Investing Activities for the cash outflows labeled as payments for property and equipment.

- What net income is reported for each of these two years? Scan the statements of operation to determine any obvious causes for the difference in these two years.

- What is the net cash inflow from operating activities for each of these two years? How do each of these numbers compare to the net income figures reported for the same periods of time? Scan the statement of cash flows to determine any obvious causes for the difference in these two years.

- In each year, how much cash was spent as payments on property and equipment? What does that say about the growth of the company?