This is “End-of-Chapter Exercises”, section 16.6 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

16.6 End-of-Chapter Exercises

Questions

- What are the three legal forms of business found in the United States?

- Art Heyman and Jeff Mullins create a new business that they form as a partnership. Why might they have decided not to incorporate their business?

- Hans Iverson forms a business that earns income of $600,000 in the current year. He paid himself $400,000 purely as a reward for ownership (not a salary). How are this income and this distribution taxed if the business is formed as a sole proprietorship? How are this income and this distribution taxed if the business is formed as a corporation?

- Jack and Jill form a business by each contributing $30,000 in cash. Jack then borrows $1 million for the business from the local bank. Unfortunately, the money is lost through a series of bad investments. If this business is formed as a corporation, what is the impact of this loss on Jill? If this business is formed as a partnership, what is the impact of this loss on Jill?

- Arthur C. Clarke bought one share of common stock in HAL Computing on the New York Stock Exchange. What rights does Clarke gain as a result of this ownership?

- Wilson Beckett buys a share of common stock directly from Anston Corporation for $13 in cash. Several weeks later, Beckett sells this share to Buddy O’Coron for $22 in cash. What is the impact on Anston of each of these transactions?

- The Amskan Corporation issues common stock to several investors. On the stock certificate, a par value of $1.00 per share is listed. What is the significance of this par value figure?

- Hogsdon Corporation was incorporated in the state of Delaware although its operations are carried out entirely in the state of Vermont. On its balance sheet, the company indicates that it has 300 million shares of common stock authorized, 188 million issued, and 174 million outstanding. What do each of these terms mean?

- Company PR issues 1,000 shares of common stock with a $2.00 per share par value to investors for cash of $9.00 per share. What journal entry does the company record for this transaction?

- Company PR issues 1,000 shares of common stock with a $2.00 per share par value and a $9.00 per share fair value to investors for a tract of land that has a fair value of $10,000. What journal entry does the company record?

- Over the years, the Boyer Corporation has issued thousands of shares of its common stock. It has also bought back some of these shares as treasury stock and then reissued them later. Under what conditions do these transactions affect the company’s reported net income?

- Mike Lewis and Warren Chapman each own 50 percent of the common stock of MlWc Corporation. Ron Wyskowski wants to become an owner, so he contributes $50,000 in cash to the business for 1,000 shares of preferred stock. How might these preferred shares be different from the company’s common stock? Why might the original owners have wanted to issue preferred shares rather than common shares to Wyskowski? Why might Wyskowski have wanted to acquire preferred shares rather than common shares?

- The Vylon Corporation wants to buy enough shares of the Bitsey Corporation to gain control of its operations. Upon hearing this news, the board of directors of Bitsey immediately authorizes the purchase of 3 million shares of its common stock. Why is the company acquiring its own treasury stock?

- The common stock of Orlent Corporation has been selling for approximately $14 per share for the past year. Stockholders are upset that the stock price has not risen for such an extended period of time. On January 19 of the current year, the board of directors authorizes the purchase of 11 million share of the company’s own stock. Why was this action most likely taken?

- A press release issued by Mason-Williams Corporation provides the following information: “On March 17, the company’s Board of Directors declared a $0.60 per share cash dividend on the company’s common stock to be paid to all owners on record as of March 29 with distribution on April 11.” The company has 20 million shares authorized, 6 million shares issued, and 5 million shares outstanding. Make all journal entries for this cash dividend including the dates.

- The CarlB Corporation has 30,000 shares of common stock issued and outstanding. It also has 2,000 shares of $100 par value preferred stock issued and outstanding that pays an annual 4 percent cash dividend. The dividend is neither declared nor paid in Year One. What reporting is necessary on the Year One financial statements if this preferred stock dividend is cumulative? What reporting is necessary on the Year One financial statements if this preferred stock dividend is noncumulative?

- The MWF Corporation has 40,000 shares of common stock issued and outstanding. It also has 5,000 shares of $100 par value preferred stock issued and outstanding that pays an annual 6 percent cumulative cash dividend. No cash dividends are declared or paid in Year One but an $80,000 cash dividend is declared and paid in Year Two. How much of this cash will each share of common stock receive in Year Two?

- A company has 100,000 shares outstanding at January 2, Year One. The company reports assets of $1.4 million and liabilities of $500,000. The company’s stock is selling for $20 per share just before it issues a 20 percent dividend. Susan Marie Fonseca owns 8,000 shares of the company’s stock before the dividend. What journal entry does she make when she receives the additional 1,600 shares? Why is this reporting necessary?

- What benefit does an owner hope to receive when a corporation issues a stock dividend or a stock split?

- The Lion Corporation has shares of $2 par value common stock outstanding that are currently selling for $29 per share. The company issues 35,000 new shares as a stock dividend. What is the reduction to be recorded in retained earnings if this issuance is a 10 percent stock dividend? What is the reduction to be recorded in retained earnings if the issuance is a 40 percent stock dividend?

- In Year One, the Marstale Corporation reports a return on equity (ROE) of 14.7 percent. In Year Two, the ROE is 18.2 percent. How is ROE computed? What information is provided by a company’s ROE?

- A company has both common stock and preferred stock outstanding. Each of these stocks paid a cash dividend in the current year. How is basic earnings per share (EPS) computed?

- A company reports net income of $300,000 for Year One. It started this year with 120,000 shares of common stock outstanding. However, on April 1, another 20,000 shares were issued to the public for cash. What should be reported as basic EPS?

- A company reports a price-earnings ratio (P/E ratio) of 14.6. How is that figure determined? How might investors make use of this number?

- The Jacston Corporation reports basic EPS of $3.80 but diluted EPS of $2.90. In general, how is diluted EPS computed? What is the significance of diluted EPS to investors?

True or False

- ____ Sole proprietorships are easier to form than corporations.

- ____ Most businesses of any significant size are formed as corporations.

- ____ Limited liability is a concept that applies to a corporation but not to a partnership.

- ____ Mutual agency is a concept that applies to a corporation but not to a partnership.

- ____ All corporations in the United States have both common stock and preferred stock.

- ____ Par value is a term used to indicate the market value of a share of capital stock.

- ____ The management of a corporation appoints the board of directors.

- ____ If a company has 80,000 shares of common stock issued but only 70,000 shares outstanding, the company holds 10,000 shares of its own treasury stock.

- ____ If a company has 80,000 shares of common stock issued but only 70,000 shares outstanding and a $1.00 per share dividend is declared, retained earnings is reduced on that date by $80,000.

- ____ A company is going to pay a cash dividend. The liability for that dividend is first reported on the date of record.

- ____ The Yelson Company has 20,000 shares of $50 par value preferred stock authorized but only 9,000 shares issued and outstanding. This preferred stock pays a 4 percent annual cash dividend that is cumulative. The dividend is missed in both Year One and Year Two. A liability for $36,000 should be reported on the December 31, Year Two, balance sheet.

- ____ Jayne Wellsfield owns 10,000 shares of Hartlan Corporation that she bought for $16 per share. She sells this entire investment to Robert Cranston for $23 per share. This transaction has no financial impact on Hartlan.

- ____ The Robertsen Corporation issues 4,000 shares of $3 par value common stock (with a fair value of $9 per share) in exchange for eight acres of land worth $5,000 per acre. Robertsen should report a gain as a result of this transaction.

- ____ The Cordol Corporation issues 10,000 shares of its $2 par value common stock for $9 cash per share. Later, the company reacquires 2,000 shares of this stock for $10 per share. The cost method is used to record these shares. Cordol records this acquisition as an asset with a reported value of $20,000.

- ____ The Lodroc Corporation issues 30,000 shares of its $1 par value common stock for $13 cash per share. Later, the company reacquires 4,000 shares of this stock for $15 per share. The cost method is used to record these shares. The treasury stock is reissued at $16 per share. Net income is not affected by either the reacquisition or the reissuance of these shares.

- ____ On the ex-dividend date, the price of a company’s stock on a stock exchange will have a tendency to fall.

- ____ A company declares a cash dividend on December 18, Year One to be paid on January 22, Year Two. Working capital decreases in Year One but is not affected in Year Two.

- ____ A cumulative dividend on preferred stock must be paid each year or a company can be forced into bankruptcy.

- ____ An investor receives 1,000 shares of stock valued at $7 per share as a stock dividend. Dividend revenue of $7,000 should be recognized.

- ____ The Westling Corporation is trying to decide whether to issue a 15 percent stock dividend (15,000 new shares) or a 30 percent stock dividend (30,000 new shares). The 30 percent stock dividend automatically reduces retained earnings by twice as much as the 15 percent stock dividend.

- ____ Return on equity (ROE) is found by dividing net income for a period by the average amount of retained earnings.

- ____ Basic earnings per share is required to be reported for all publicly-traded corporations.

- ____ Earnings per share is found by taking the net income for the year divided by the number of common shares outstanding at the end of the year.

- ____ The P/E ratio relates a company’s reported earnings per share to the market price of its common stock.

- ____ A company reports net income of $500,000 but pays cash dividends to preferred stock ($100,000) and common stock ($50,000). The company has 100,000 shares of common stock outstanding all year as well as 20,000 shares of preferred stock. Basic EPS is $3.50 per share.

- ____ Diluted EPS includes the potential negative impact of convertibles on the computation of earnings per share.

Multiple Choice

-

Bob Wills, Susan Oglethorpe, and Billie Elkins form a business and decide to have it formally recognized as a corporation. Which of the following is the most likely reason for that decision?

- The limited liability that is available to the owners of a corporation.

- The advantages of mutual agency which are only available to the owners of a corporation.

- The double taxation faced by partnerships and sole proprietorships.

- The ease of forming a corporation.

-

Which of the following rights is most typical for the owners of a corporation’s common stock?

- The right to vote for the members of the board of directors

- The right to an annual dividend

- The right to be involved in policy making decisions

- The right to decide on the issuance of a cash dividend

-

Landon Corporation sold 16,000 shares of $0.50 par value common stock for $17 per share. Which of the following is the journal entry Landon should make?

-

Figure 16.16

-

Figure 16.17

-

Figure 16.18

-

Figure 16.19

-

-

Jackson Company is authorized to issue 20,000 shares of $1 par value stock. On February 1, Year One, it issues 4,000 shares for $9 per share. On July 1, Year One, the company pays a $1 per share cash dividend. On December 1, Year One, the company buys back 1,000 shares of its own stock at $11 per share. Treasury stock is reported at its cost. On a December 31, Year One, balance sheet, what is reported as Capital in Excess of Par Value?

- $17,000

- $28,000

- $30,000

- $32,000

-

Paul Mitchell purchased a licensing agreement for $40,000 from a well-known restaurant chain. Subsequently, Traylor Corporation agreed to issue 2,000 shares of its common stock to Mitchell in exchange for this licensing agreement, which now has a value of $30,000. At the time of the exchange, Traylor’s $2 par value stock was selling for $14 per share. For what amount should Traylor report the licensing agreement?

- $4,000

- $28,000

- $30,000

- $40,000

-

Kramer Company is authorized by the state to issue 10,000 shares of 8 percent, $100 par value preferred stock. On January 1, Year One, Kramer issues 5,000 shares for $125 per share. On December 13, Year One, Kramer’s board of directors declares the annual dividend to owners on record as of January 3, Year Two. The dividend will be distributed January 18, Year Two. What liability should Kramer Company report on its December 31, Year One, balance sheet as a result of this dividend?

- Zero

- $40,000

- $50,000

- $80,000

-

Barbara Waterman bought 10,000 shares of $2 par value common stock directly from the Towsend Corporation for $13 per share. Later she sold these shares to Benjamin Duke for $17 per share. Subsequently, he sold 2,000 of these shares back to Towsend for cash of $19 per share. The cost method is in use for the treasury stock. Just based on these transactions, what is the total amount reported by the company as its stockholders’ equity.

- $92,000

- $112,000

- $132,000

- $152,000

-

The Kansas-Kentucky Corporation is started on January 1, Year One. The company issues 100,000 shares of its $1 par value common stock for $8 per share. Subsequently, the company reports net income of $40,000 each year and pays an annual cash dividend of $10,000. In Year Three, the company reacquires 10,000 of these shares for $15 each. The cost method is to be applied to the treasury stock. Several weeks later, the company reissues 1,000 shares of this stock for $17 per share. A few days later, another 2,000 shares are reissued for $12 per share. At the end of Year Three, what should the company report as its retained earnings?

- $84,000

- $86,000

- $88,000

- $90,000

-

The Gewrty Corporation issues a 50 percent stock dividend. Which of the following is true about this event?

- The owners are happy because they own a larger percentage of the company.

- The owners are happy because the stock price will be lower, which might well create an increase in the demand for the company’s stock on the stock market.

- The owners are unhappy because the net assets have been reduced by the company’s action.

- The owners are unhappy because some owners benefit more than others from a stock dividend.

-

The Anglewood Corporation has 200,000 shares of its $1 par value common stock outstanding. These shares currently have a market price of $15 each. The company decides to issue a 10 percent (20,000 shares) stock dividend. At the last moment, the board of directors decides to increase this stock dividend to 30 percent (60,000 shares). Which of the following is true about the impact of the change in this decision?

- Retained earnings will be $60,000 lower than it would have been.

- Retained earnings will be $90,000 lower than it would have been.

- Retained earnings will be $220,000 higher than it would have been.

- Retained earnings will be $240,000 higher than it would have been.

-

The Kearsey Corporation issues 10,000 shares of its own common stock (with a $10 per share par value) for cash of $12 per share. Several months later, the company reacquires 1,000 shares of its own stock for $15 per share. This treasury stock is to be reported using the cost method. Which of the following statements is true?

- If these treasury shares are later reissued for $17,000, the $2,000 gain cannot be reported on the company’s income statement.

- The $15,000 cash outflow will be reported like a dividend as a reduction in retained earnings.

- The $15,000 cost of these treasury shares will be reported by the company as a noncurrent asset.

- When these shares are reacquired, the company’s contributed capital will increase by $15,000.

-

Portor Corporation is authorized to issue 150,000 shares of its $0.25 par value common stock. It currently has 90,000 shares issued and outstanding. Portor plans to declare a stock dividend and is curious about the effect this will have on retained earnings. Portor’s stock has a current market value per share of $26. Portor is trying to decide between a 5 percent stock dividend and a 40 percent stock dividend. Which of the following shows the reduction caused by each on retained earnings?

5% Stock Dividend 40% Stock Dividend a. $117,000 $936,000 b. $117,000 $9,000 c. $1,125 $9,000 d. $1,125 $936,000 -

Falls Church Corporation ended Year Four with revenues of $98,000 and expenses of $86,000. The company distributed a cash dividend of $8,000 during the year. No stock transactions occurred. On the year-end balance sheet, the stockholders’ equity accounts total $492,000. Which of the following is Falls Church’s return on equity (ROE) for the year?

- 2.45%

- 6.73%

- 9.18%

- 9.75%

-

Fleming Corporation began and ended the current year with 50,000 outstanding shares of common stock. These shares were paid a $0.20 per share cash dividend. Net income for the year totaled $480,000. The company also had 10,000 shares of preferred stock outstanding throughout the year that paid dividends of $30,000. Which of the following figures is reported as Fleming’s basic earnings per share?

- $6.00 per share

- $9.00 per share

- $9.60 per share

- $10.60 per share

-

The Houston Corporation started the year with 190,000 shares of common stock but issued 40,000 more shares on April 1 of the current year. The company also has 30,000 shares of preferred stock outstanding for the entire year. During the year, net income of $710,000 was reported. Cash dividends were paid during the year; $50,000 was distributed to the owners of the preferred stock and $30,000 to the owners of the common stock. What should be reported as basic earnings per share for this year (rounded)?

- $2.86

- $2.87

- $3.00

- $3.09

-

The Zerton Corporation ends Year One with net income of $400,000 and 100,000 shares of common stock issued and outstanding. The company also has 30,000 shares of $50 par value preferred stock issued and outstanding. During the year, the company distributed a $1 per share cash dividend on its common stock and a $2 per share cash dividend on its preferred stock. Each share of preferred stock is convertible into two shares of common stock. What should the company report as its basic earnings per share (rounded)?

- $2.13

- $2.50

- $3.40

- $4.00

-

Friar Inc. reported net income for Year Five of $1,870,000. It had 600,000 shares of common stock outstanding on January 1, Year Five, and repurchased 150,000 of those shares on September 1, Year Five, as treasury stock. The company has no preferred stock. At the end of Year Five, Friar’s stock was selling for $26 per share. Which of the following is Friar’s price-earnings ratio on that date?

- 6.25

- 7.00

- 7.65

- 8.33

Video Problems

Professor Joe Hoyle discusses the answers to these two problems at the links that are indicated. After formulating your answers, watch each video to see how Professor Hoyle answers these questions.

-

Your roommate is an English major. The roommate’s parents own a chain of ice cream shops located throughout Florida. One day, while waiting for an appointment with an academic advisor, your roommate asks you the following question: “My parents started their business originally as a partnership. However, after a year or two, they switched over and had the business incorporated. Since then, they complain every year about double taxation. What does that mean? And, if double taxation is so bad, why didn’t they just continue to function as a partnership? They seemed happier before they made this switch.” How would you respond?

-

Your uncle and two friends started a small office supply store several years ago. The company has grown and now has several large locations. Your uncle knows that you are taking a financial accounting class and asks you the following question: “We are planning to build a new store in a town that is 50 miles from our headquarters. For us, this is a major expansion. We are going to need several million dollars in cash. We have looked at several options for raising this money. Our financial advisor has recommended that we issue preferred stock. I’m not totally sure what this means. And, I’m not sure why we wouldn’t just be better off to issue additional shares of the corporation’s common stock. Why is our financial advisor giving us this advice?” How would you respond?

Problems

- Cutlass Corporation is authorized by the state government to issue 40,000 shares of $1 par value common stock. On March 15, the company issues 1,000 shares for $6 cash per share. On April 19, the company issues another 800 shares for $7 per share. Record these transactions.

-

McNair Corporation is authorized to issue 150,000 shares of 5 percent, $200 par value preferred stock. On January 22, McNair issues 32,000 shares of this preferred stock for $225 per share. The board of directors for McNair declares the annual preferred dividend on September 1, payable to owners on record as of September 17, with the money to be distributed on October 1.

- Record the issuance of the preferred stock.

- Record the declaration and payment of the dividend and provide the date for each entry.

-

Several years ago, Douglas Company issued 33,000 shares of its $1 par value common stock for $18 per share. In the current year, Douglas’s board of directors approves a plan to buy back a portion of these common stock shares. Prepare journal entries for each of the following transactions and events.

- On Monday, Douglas buys back 2,500 shares for $35 per share.

- On Tuesday, Douglas reissues 1,000 shares of treasury stock for $37 per share.

- On Wednesday, Douglas reissues 500 shares of treasury stock for $34 per share.

- On Thursday, Douglas reissues 600 shares of treasury stock for $28.

- On Friday, the board of directors declares a cash dividend of $1.00 per share.

-

The following are a number of transactions and events for the Nielsen Corporation. For each, prepare the necessary journal entry. If no entry is required, please indicate that.

- The state of Delaware approves the application for incorporation made by Nielsen and authorizes 100,000 shares of common stock with a $10 per share par value.

- Nielsen issues the first 1,000 shares of its common stock for $12 per share in cash.

- On the same day as (b), Nielsen issues another 500 shares of common stock for equipment that is valued at $6,200.

- Nielsen’s board of directors declares a $2 per share cash dividend.

- On the date of record for the previous dividend, Nielsen prepares a list of all owners.

- The date of payment arrives and Nielsen mails out all dividend distributions.

- A 10 percent stock dividend is declared and immediately issued after the market price of the common stock has risen to $19 per share.

- The company reacquires 300 shares of common stock for $16 per share in cash. Treasury stock is reported by means of the cost method.

- The company reissues 200 shares of its treasury stock for $17 per share in cash.

- The company reissues the remaining shares of treasury stock for $11 per share in cash.

- A 40 percent stock dividend is declared and immediately issued on a day when the fair value of the stock is $20 per share.

-

At the beginning of Year One, a company issues 40,000 shares of $2 par value common stock for $23 per share in cash. The company also issues 10,000 shares of $40 par value preferred stock that pays an annual dividend of 10 percent. No dividend is paid in Year One but a total dividend of $100,000 is distributed in Year Two.

- If the preferred stock dividend is not cumulative, what is reported on the financial statements about the dividend at the end of Year One?

- If the preferred stock dividend is not cumulative, what amount of cash dividend does each share of common stock receive in Year Two?

- If the preferred stock dividend is cumulative, what is reported on the financial statements about the dividend at the end of Year One?

- If the preferred stock dividend is cumulative, what amount of cash dividend does each share of common stock receive in Year Two?

-

The Rostinaja Company is incorporated at the beginning of Year One. For convenience, assume that the company earns a reported net income of $130,000 each year and pays an annual cash dividend of $50,000. The company is authorized to issue 200,000 shares of $3 par value common stock. At the start of Year One, the company issues 40,000 shares of this common stock for $8 per share. At the end of Year Two, the company buys back 5,000 shares of its own stock for $12 per share. The cost method is used to record these shares. At the start of Year Three, the company reissues 1,000 of these shares for $14 per share. At the start of Year Four, the company reissues the remainder of the treasury stock for $9 per share.

- Prepare the stockholders’ equity section of this company’s balance sheet as of December 31, Year One.

- Prepare the stockholders’ equity section of this company’s balance sheet as of December 31, Year Two.

- Prepare the stockholders’ equity section of this company’s balance sheet as of December 31, Year Three.

- Prepare the stockholders’ equity section of this company’s balance sheet as of December 31, Year Four.

-

Grayson Corporation is authorized by the state to sell 2 million shares of its $1 par value common stock to the public. Before Year Seven, the company had issued 60,000 shares for cash of $12 per share. During Year Seven, Grayson issued another 14,000 shares at the market value of $24 per share.

On January 1, Year Seven, Grayson reported retained earnings of $1,950,000. During that year, Grayson earned net income of $80,000 and paid cash dividends to common stockholders of $19,000. Also, during December of Year Seven, Grayson repurchased 11,000 shares of its own stock when the market price was $22 per share.

- Record the issuance of the common stock in Year Seven.

- Determine retained earnings as of the end of Year Seven.

- Record the purchase of the treasury stock.

- Prepare the stockholders’ equity section of the balance sheet as of December 31, Year Seven.

- Compute the company’s return on equity (ROE) for Year Seven.

-

On December 28, Year One, the Pickins Corporation was formed. The articles of incorporation authorize 5 million shares of common stock carrying a $1 par value, and 1 million shares of $5 par value preferred stock. On January 1, Year Two, 2 million shares of common stock are issued for $15 per share. Also on January 1, 500,000 shares of preferred stock are issued at $30 per share.

- Prepare journal entries to record these transactions on January 1.

- On March 9, Year Two, the Pickins Corporation repurchases 100,000 common shares as treasury stock paying a price of $13 per share. During August of that year, all 100,000 treasury shares are reissued at $16 per share. Prepare journal entries to record these transactions.

- On November 3, Year Two, Pickins issues a 30 percent stock dividend on all outstanding shares of common stock when the market price is $50 per share. On December 1, Year Two, Pickens declares a $0.75 per share cash dividend on common stock and a $2.00 per share cash dividend on preferred stock. Payment is scheduled for December 20, Year Two, to shareholders of record on December 10, Year Two. Prepare journal entries to record the declaration and distribution of these stock and cash dividends.

-

On March 1, St. George Company declares a stock dividend on its $1 par value stock. The company had 1,000 shares outstanding on that date with a market value of $13 per share.

- What reduction is recorded in retained earnings if a 10 percent stock dividend is issued?

- What reduction is recorded in retained earnings if a 30 percent stock dividend is issued?

-

Rawlings Company has the following equity accounts at the beginning and end of Year Three:

January 1, Year Three December 31, Year Three Preferred Stock, 6%, $100 par value $2,000,000 $2,000,000 Common Stock, $1 Par Value $160,000 $200,000 Capital in Excess of Par, Common $12,000,000 $16,000,000 Retained Earnings $1,100,000 $1,800,000 The common stock account increased because 40,000 shares of common stock were issued to the public on September 1, Year Three. Preferred stock was paid its dividend during the year. A cash dividend was also distributed on the common stock. Net income for the year was $1,200,000.

- How much cash was received when the common stock was issued during Year Three?

- What was the total cash dividend paid on the common stock shares during the year?

- What was the company’s basic earnings per share for Year Three?

-

Information on Massaff Corporation’s stock accounts follows:

December 31, Year 7 December 31, Year 8 Outstanding shares of Common stock 300,000 330,000 Nonconvertible preferred stock 10,000 10,000 The following additional information is available about this company:

- On July 1, Year 8, Massaff issued 30,000 additional shares of common stock for cash.

- Net income for the year ended December 31, Year 8, was $750,000.

- During Year 8, Massaff paid dividends of $3.00 per share on its preferred stock. The company also paid a total cash dividend of $220,000 on its outstanding shares of common stock.

Required:

Compute Massaff’s basic earnings per common share for the year ended December 31, Year 8.

-

Yesterday, the Neumann Corporation had 100,000 shares of common stock authorized, 60,000 shares issued, and 40,000 shares outstanding. The stock has a par value of $10 per share but was issued originally for $24 per share. The stock is currently selling on a stock exchange for $30 per share. Treasury stock was acquired for $25 per share. None of that stock has been reissued. It is recorded using the cost method.

Today, a stock dividend was issued. After that dividend was distributed, the Neumann Corporation reported a total for its Capital in Excess of Par Value account of $960,000. How many shares were issued in the stock dividend?

-

A company has 20,000 shares of common stock issued and outstanding. These shares have a par value of $10 per share but were issued for $17 per share. When the fair value of the shares hits $21 per share, the company declares and issues a 50 percent stock dividend. The company accidentally recorded these new shares as a small stock dividend (20 percent or less) when the issuance should have been reported as a large stock dividend. At the end of the year, the company reported total assets of $300,000, total retained earnings of $80,000, and total stockholders’ equity of $220,000.

- What was the proper amount of total assets that should have been reported?

- What was the proper amount of total retained earnings that should have been reported?

- What was the proper amount of total stockholders’ equity that should have been reported?

-

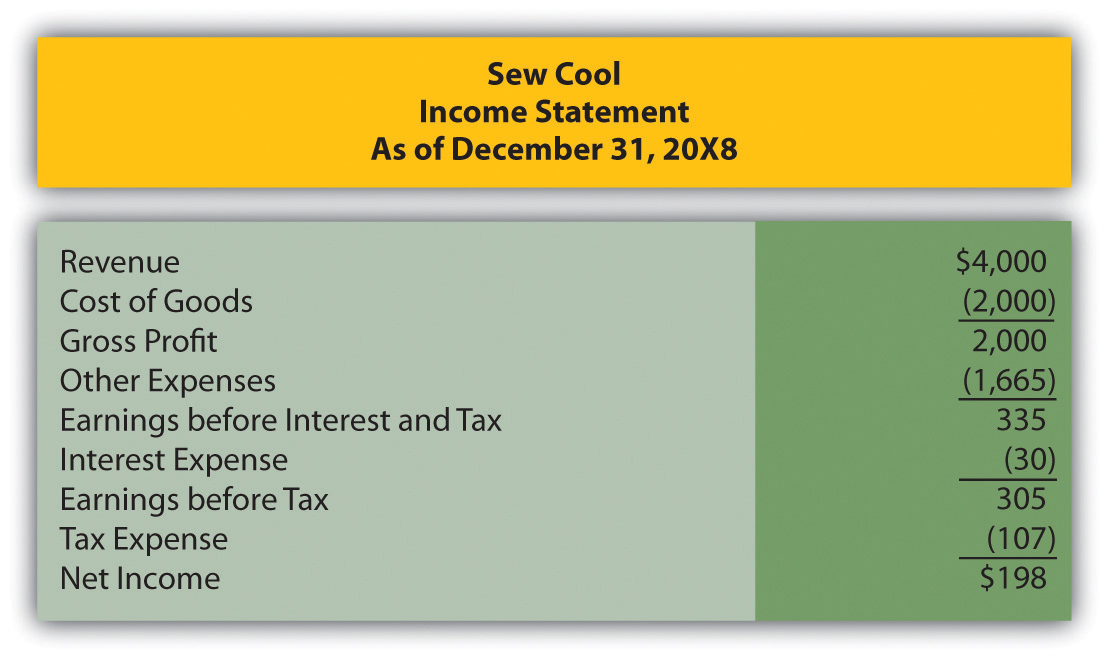

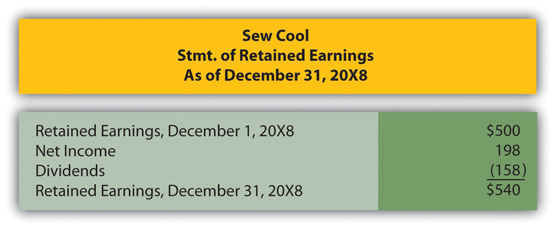

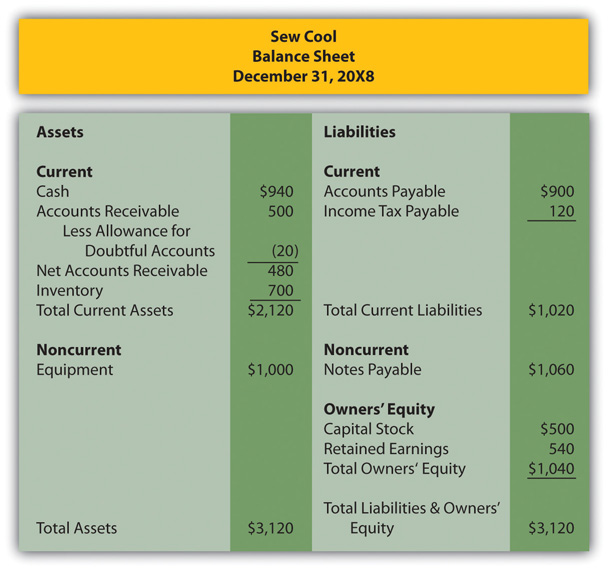

In several past chapters, we have met Heather Miller, who started her own business, Sew Cool. The following are the financial statements for December.

Figure 16.20 Sew Cool Financial Statements

Figure 16.21

Figure 16.22

Based on the financial statements determine Sew Cool’s return on equity (ROE).

Comprehensive Problem

This problem will carry through several chapters, building in difficulty. It allows students to continually practice skills and knowledge learned in previous chapters.

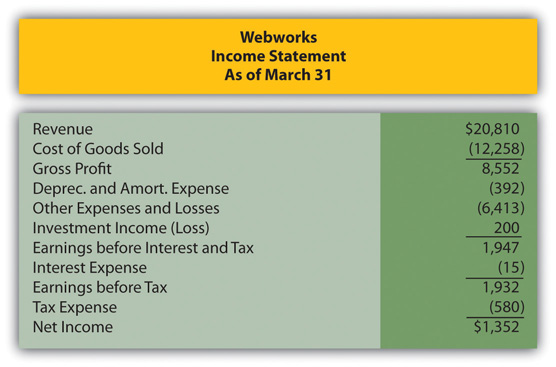

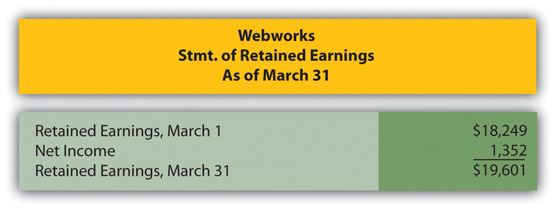

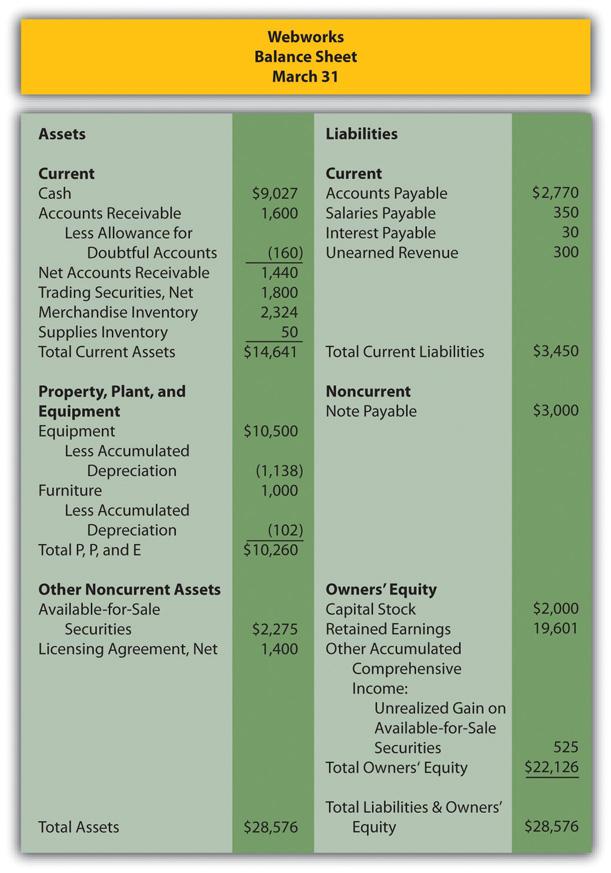

In Chapter 15 "In a Set of Financial Statements, What Information Is Conveyed about Other Noncurrent Liabilities?", financial statements for March were prepared for Webworks. They are included here as a starting point for the required recording for April.

Here are Webworks financial statements as of March 31.

Figure 16.23 Webworks Financial Statements

Figure 16.24

Figure 16.25

The following events occur during April:

- Webworks starts and completes ten more sites and bills clients for $7,000.

- Leon invites Nancy Po (an employee) to invest money in the business. She contributes $2,000 and becomes an equal owner with Leon.

- Webworks purchases supplies worth $125 on account.

- At the beginning of March, Webworks had fourteen keyboards costing $120 each and twenty-eight flash drives costing $23 each. Webworks uses periodic FIFO to cost its inventory.

- Webworks purchases ninety-five keyboards for $121 each and ninety flash drives for $25 each. All purchases are on account.

- Webworks sells eighty-seven keyboards for $13,050 and ninety of the flash drives for $2,850 cash.

- Webworks collects $6,400 in accounts receivable.

- Webworks pays its $500 rent.

- Webworks pays off $14,000 of its accounts payable.

- Webworks sells all of its shares of RST stock for $20 per share.

- Webworks pays Juan Marcon (another employee) $700 for his work during the first three weeks of April.

- Webworks writes off an account receivable from December in the amount of $150 because collection appears unlikely.

- Webworks pays off its salaries payable from March.

- Webworks pays Leon Jackson and Nancy Po a salary of $3,500 each.

- Webworks completes the design for the photographer for which it was paid in February. The $300 of unearned revenue has now been earned.

- Webworks pays Leon Jackson and Nancy Po a dividend of $250 each.

-

Webworks pays taxes of $372 in cash.

Required:

- Prepare journal entries for the previous events.

- Post the journal entries to T-accounts.

- Prepare an unadjusted trial balance for Webworks for April.

- Prepare adjusting entries at the end of February for the following and post them to your T-accounts.

- Webworks owes Juan Marcon $100 for his work during the last week of April.

- Webworks receives an electric bill for $440. Webworks will pay the bill in May.

- Webworks determines that it has $65 worth of supplies remaining at the end of April.

- Webworks is continuing to accrue bad debts at 10 percent of accounts receivable.

- Webworks continues to depreciate its equipment over four years and its furniture over five years, using the straight-line method.

- The license agreement should be amortized over its one-year life.

- QRS Company is selling for $14 per share on April 30.

- Interest should be accrued for April.

-

Record cost of goods sold.

- Prepare an adjusted trial balance.

- Prepare financial statements for April.

Research Assignment

Assume that you take a job as a summer employee for an investment advisory service. One of the partners for that firm is currently looking at the possibility of investing in Advanced Micro Devices Inc. The partner is aware that technology companies like AMD often issue a lot of stock options and other items that can be converted into shares of common stock. The partner is curious as to the potential impact such conversions might have on the company and the price of its stock. The partner asks you to look at the 2010 financial statements for AMD by following this path:

- Go to http://www.amd.com.

- At the top of this screen, click on “About AMD.”

- In the center of the next screen, click on “Investor Relations.”

- On the left side of the next screen, click on “Annual Report & Proxy.”

- On the next screen, click on “2010 Annual Report” to download.

- Scroll to page 73 and find the company’s statement of operations (income statement) for the year ended December 25, 2010. At the bottom of that statement, determine the basic earnings per share reported by AMD as well as the diluted earnings per share. In addition, note the number of common stock shares used in the computation of basic earnings per share and the number of common stock shares used in the computation of diluted earnings per share.

- Scroll down to page 81 and read the last paragraph on that page which is part of “Note 2: Summary of Significant Accounting Policies.” This paragraph mentions that AMD has three types of instruments outstanding that can be converted into common stock.

- For the year ended December 25, 2010, what is the amount reported for basic earnings per share and for diluted earnings per share? What is the amount of the difference in those two figures?

- Assume that the common stock of AMD was selling on the New York Stock Exchange on December 25, 2010, at $8.05. What was the P/E Ratio?

- What were the three types of convertible items that AMD had outstanding at this time?

- How many shares of common stock were used in computing basic earnings per share and how many shares of common stock were used in computing diluted earnings per share? How many shares were added to arrive at diluted earnings per share as a result of the possible conversion of the items listed in the answer to (c)?