This is “End-of-Chapter Exercises”, section 12.5 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

12.5 End-of-Chapter Exercises

Questions

- On January 1, Year One, the Lawrence Company acquires 10,000 shares of the Memphis Company for $39 per share. What are possible reasons why Lawrence chose to use its cash to make this acquisition?

- Wilson Company buys 200 shares of Pepitone Corporation for $17 per share, an asset that is classified as an investment in trading securities. Why is an investment classified in this manner?

- An investor owns equity shares of a number of companies. Some of these investments are reported as trading securities while others are shown as available-for-sale securities. The investor receives a cash dividend of $1,000. How is that receipt reported by the investor?

- The Amos Corporation bought 1,000 shares of Jones Company during Year One for $18 per share. The investment is labeled as a trading security. Amos plans to sell these shares on the stock market for $27 each and is trying to decide whether to make the sell on December 30, Year One, or January 2, Year Two. How will reported net income differ in Year One and in Year Two based on the timing of this sale?

- Unless value is impaired, equipment and inventory are reported based on historical cost. Why is the financial accounting of an investment in trading securities handled differently from these other assets?

- StampCo Corporation bought 1,000 shares of Bates Corporation on December 1, Year One. Company officials are trying to decide whether to report this asset as an investment in trading securities or as an investment in available-for-sale securities. How is this decision made?

- Company A bought 1,000 shares of Company Y for $13 per share and 2,000 shares of Company Z for $18 per share. At the end of the year, the stock of Company Y is worth $15 per share and the stock of Company Z is worth $14 per share. What is reported at year-end if these investments are both classified as investments in trading securities? What is reported at year-end if these investments are both classified as investments in available-for-sale securities?

- An investment is bought during Year One for a total of $9,000. At the end of Year One, these shares are worth $10,000. However, they are sold on February 11, Year Two, for only $6,000. What is the income effect for these two years if this stock is viewed by company officials as a trading security? What is the income effect for these two years if this stock is viewed by company officials as available-for-sale?

- A company acquires an investment in available-for-sale securities during Year one for $23,000. At the end of the year, this investment was worth $19,000. Reported net income was $200,000. What should the company report as its comprehensive income?

- The Lincoln Corporation bought 1,000 shares of Illinois Company during Year One for $21 per share. The investment is labeled as available-for-sale. Lincoln plans to sell these shares on the stock market for $26 each and is trying to decide whether to make the sell on December 30, Year One, or January 2, Year Two. How will reported net income differ in Year One and in Year Two based on the timing of this sale?

- Big Company acquired enough shares of Little Company so that it has gained the ability to exert significant influence over its operating and financing decisions. How should Big report this investment?

- Mama Corporation acquired a rather large block of the capital shares of Child Corporation. Currently, company officials for Mama are trying to decide whether application of the equity method is appropriate. In theory, how is that decision made? In practice, how is that decision made?

- Archibald Corporation owns 30 percent of Saratoga Corporation and will apply the equity method to this investment. During the current year, Saratoga reported net income of $150,000 and paid a total cash dividend of $60,000. What reporting is required of Archibald in connection with this investment?

- Why are dividends that are received from an investment that is being accounted for by means of the equity method not reported as revenue?

- The Walters Company acquired 40 percent of the Ameston Company on January 1, Year One, for $388,000. Ameston reported net income of $100,000 for Year One and paid a total cash dividend of $40,000. At the end of Year One, this investment was worth $460,000. What is reported on the owner’s balance sheet for this investment, and what does that figure represent?

- Giant Corporation buys 54 percent of the outstanding stock of Small Corporation. Under normal conditions, how will this investment be reported?

- Lauderdale Corporation has two assets. The land cost $100,000 and is worth $220,000. A building has a net book value of $650,000 and a fair value of $730,000. Yarrow Corporation buys 100 percent of the outstanding stock of Lauderdale for cash of $1 million. What journal entry does Yarrow make to consolidate Lauderdale’s assets within its own financial records?

- Donnelly Corporation generated revenues of $900,000 during Year One while Nelson Company generated revenues of $600,000 during the same period. On the last day of the year, Donnelly buys all of the ownership shares of Nelson. In consolidated financial statements for December 31, Year One, and the year then ended, what is the reported amount of revenues?

- Financial analysts determine the total asset turnover for the Paquet Corporation as 2.3. How did these decision makers arrive at this figure?

- Financial analysts study the financial statements reported by Williamston Corporation and calculate a return on assets of 11.3 percent. How did they arrive at that figure?

True or False

- ____ To keep the information relatively simple for financial statement users, all investments in the ownership shares of other companies are accounted for in the same way according to U.S. GAAP.

- ____ If the owner of trading securities receives a cash dividend, it should be recorded as revenue at that time and shown on the income statement.

- ____ All investments in other companies should be reported at the historical cost of the investment.

- ____ A company buys trading securities in Year One for $11,000. They increase in value by $2,000 in Year One and are then sold in Year Two for $14,000. A gain of $3,000 is recognized on the company’s income statement in Year Two.

- ____ The Argentina Company buys shares of another company and is currently attempting to determine whether this ownership qualifies as an investment in trading securities or available-for-sale securities. The total amount of assets reported by Argentina will vary depending on which approach is selected.

- ____ Changes in the value of available-for-sale securities do not affect the reported net income of the investor until the securities are sold.

- ____ The Nile Company buys 100 shares of a company for $7,000 in cash in Year One. The shares increase in value by $1,000 in Year One and then by $2,000 in Year Two and are then sold. In addition, a dividend is received from this investment of $300. In Year Two, the Nile Company will increase its net income by $3,300 if this investment is judged to be a trading security.

- ____ At the beginning of Year One, the Barksdale Corporation buys shares of another company for $7,000. The stock goes up in value during Year One by $5,000. Dividends of $1,000 are also collected. Company officials view this as an investment in available-for-sale securities. If net income is reported as $40,000, then comprehensive income will be $45,000.

- ____ Accumulated other comprehensive income is included by a company on its income statement within the computation of net income.

- ____ If one company owns 25 percent of another company, it must use the equity method to account for this investment.

- ____ Equity method investments are reported at current fair value on the owner’s balance sheet.

- ____ On January 1, Year One, Ajax Company spends $200,000 on an investment. In this purchase, the company gains 30 percent ownership of another company and the ability to apply significant influence. During Year One, the other company reports net income of $50,000 and distributes a cash dividend of $10,000. Ajax should report dividend revenue of $3,000.

- ____ On January 1, Year One, Dylan Company spends $300,000 on an investment. The company buys 30 percent of another company and gains the ability to apply significant influence. During Year One, the other company reports net income of $70,000 and distributes a cash dividend of $20,000. At the end of the year, these shares have a fair value of $400,000. Ajax should report the investment on its balance sheet at $315,000.

- ____ Big Company has held 30 percent of Little Company’s ownership for several years and uses the equity method for financial reporting. Little reports net income in the current year of $40,000 while paying no dividends. Big reports its share of Little’s net income in the current year.

- ____ Consolidated financial statements are only created when one company acquires 100 percent ownership over another company.

- ____ Bismarck Company buys control over another company late in Year One. One of the likely reasons for this acquisition is so that the revenues earned throughout the year can be added to those of Bismarck on consolidated statements to make that company’s financial situation look better.

- ____ Reinstein Company has net assets with a net book value of $600,000 but a fair value of $740,000. If a company buys control over Reinstein for $740,000, no goodwill is recognized.

- ____ The NYork Company has only one asset and no liabilities. It owns a building that it rents out. The building has a net book value of $800,000 but is worth $960,000. Another company paid exactly $1 million to gain all of the outstanding stock of NYork. The building will be added to consolidated financial statements on that date at $960,000.

- ____ The higher a company’s ROA, the more efficiently the company is using its assets.

Multiple Choice

-

On November 5, Year One, Maxwell Corporation purchased seventy shares of Tyrone Company for $30 per share, planning to hold the investment for a short time and then sell these shares. At the end of Year One, Tyrone is selling for $32 per share on a stock exchange. What unrealized gain will Maxwell report for Year One, and where should that balance be reported?

- $140 unrealized gain, stockholders’ equity section of balance sheet

- $140 unrealized gain, income statement

- $2,240 unrealized gain, income statement

- $2,240 unrealized gain, stockholders’ equity section of balance sheet

-

Which of the following is not a reason investments in trading securities are shown at fair value on the balance sheet?

- The fair values of publicly-traded securities are readily available.

- Fair value is considered relevant information to financial statement users.

- The fair value is an objective amount determined by the stock market.

- Fair value is easier to determine than historical cost.

-

Hope Corporation buys shares of Lonesome Corporation for $14,000 during Year One. By year-end, the stock has a total market value of $18,000. Which of the following is not true?

- If viewed as a trading security, the asset is reported on the balance sheet at $18,000.

- If viewed as a trading security, Hope’s net income will increase in Year One by $4,000.

- If viewed as an available-for-sale security, the asset is reported on the balance sheet at $18,000.

- If viewed as an available-for-sale security, Hope’s net income will increase in Year One by $4,000.

-

An investor spends $23,000 for shares of another company late in Year One. The shares are worth $24,000 at the end of that year. Early in Year Two, a $1,200 dividend is received from this investment. Shortly thereafter, the shares are sold for $26,000. If this asset is an investment in trading securities, what is the impact on net income in Year Two?

- Increase by $1,200.

- Increase by $2,000.

- Increase by $3,200.

- Increase by $4,200.

-

The Andre Corporation spends $35,000 for shares of another company late in Year One. The shares are worth $34,000 at the end of that year. Early in Year Two, a $900 dividend is received from this investment. Shortly thereafter, the shares are sold for $38,000. If this asset is viewed as an investment in trading securities, what is the impact on net income in Year Two?

- Increase by $3,000

- Increase by $3,900

- Increase by $4,000

- Increase by $4,900

-

Early in Year One, Jackson Corporation purchased 150 shares of Riley Corporation for $46 per share. The investment is classified as available-for-sale. At the end of Year One, Riley’s stock is selling on a stock exchange for $43 per share. Jackson’s reported net income for the year was $235,000. What should Jackson report as its comprehensive income for Year One?

- $228,100

- $228,550

- $234,550

- $235,000

-

In Year One, Jeremiah Corporation purchased shares of Lauren Corporation for $9,000. The investment is classified as a trading security. At the end of Year One, Lauren’s stock has a value on a stock exchange equal to $13,000. Jeremiah’s reported net income for the year was $180,000. What should Jeremiah report as its comprehensive income for Year One?

- $180,000

- $184,000

- $189,000

- $193,000

-

The Monroe Corporation owns the capital stock of several corporations and receives a cash dividend of $7,000 this year. Which of the following statements is true?

- For both trading securities and available-for-sale securities, the dividend is a reduction in the investment account.

- For trading securities, the dividend is included in net income; for available-for-sale securities, the dividend is a reduction in the investment account.

- For trading securities, the dividend is a reduction in the investment account; for available-for-sale securities, the dividend is included in net income.

- For both trading securities and available-for-sale securities, the dividend is included in net income.

-

Wisconsin Corporation makes an investment in Badger Corporation for $38,000 at the beginning of Year One. At the end of the year, the shares are selling at an amount equal to $34,000. The drop in value is viewed as temporary. During the period, Badger earned $30,000 in income and Wisconsin received a dividend of $1,800. Which of the following is not true?

- If this investment is viewed as a trading security, it should be reported on a year-end balance sheet at $34,000.

- If this this investment is viewed as available-for-sale, dividend revenue is recognized for $1,800.

- If this investment is viewed as a trading security, dividend revenue is recognized for $1,800.

- If this investment is accounted for by means of the equity method, it should be reported on a year-end balance sheet at $34,000.

-

Anton Company owns shares of Charlotte Corporation. Which of the following is true about the reporting for this investment?

- If Anton owns 15 percent of Charlotte and has significant influence, the investment must be reported by the equity method.

- If Anton owns 25 percent of Charlotte and does not have significant influence, the investment must be reported by the equity method.

- If Anton owns 4 percent of Charlotte and does not have significant influence, the investment must be reported as a trading security.

- If Anton owns 56 percent of Charlotte and has control, the investment must be reported by the equity method.

-

Rocko Corporation acquires 40 percent of Hailey Corporation on January 1, Year One, for $400,000. By this purchase, Rocko has gained the ability to exert significant influence over Hailey. Hailey reports net income of $80,000 in Year One and $100,000 in Year Two. Hailey pays a total dividend of $30,000 each year. These shares have a value of $460,000 at the end of Year One and $500,000 at the end of Year Two. On a December 31, Year Two, balance sheet, what does Rocko report for this investment?

- $448,000

- $472,000

- $500,000

- $520,000

-

Lancaster Inc. purchases all the outstanding stock of Lucy Company for $4,500,000. The net assets of Lucy have a total fair value of $2,900,000. These assets include a patent with a net book value of $4,700 and a fair value of $159,000. At what amount should the patent and any goodwill from this purchase be shown on consolidated financial statements produced on the date of purchase?

- Patent—$4,700; Goodwill—$0

- Patent—$159,000; Goodwill—$0

- Patent—$159,000; Goodwill—$1,600,000

- Patent—$4,700; Goodwill—$1,600,000

-

On December 31, Year One, Brenda Corporation purchased 100 percent of Kyle Inc. for $3,400,000. The net assets of Kyle had a net book value of $3 million. Kyle had a trademark with a fair value ($45,000) that exceeded its book value ($15,000) by $30,000. For all other assets and liabilities reported by Kyle, net book value was the same as fair value. At what amounts should the trademark and goodwill be shown on Brenda’s consolidated balance sheet on December 31, Year One?

- Trademark—$15,000; Goodwill—$370,000

- Trademark—$15,000; Goodwill—$400,000

- Trademark—$45,000; Goodwill—$370,000

- Trademark—$45,000; Goodwill—$400,000

-

On December 31, Year One, the Bolger Corporation purchases all of the capital stock of Osbourne Corporation for $200,000 more than the fair value of the subsidiary’s identifiable assets and liability. During Year One, Bolger reported revenues of $900,000 and expenses of $600,000. In the same period, Osbourne reported revenues of $700,000 and expenses of $500,000. On a consolidated income statement for Year One, what is reported for revenues and expenses?

- Revenues—$900,000; Expenses—$600,000

- Revenues—$1.6 million; Expenses—$600,000

- Revenues—$900,000; Expenses—$1.1 million

- Revenues—$1.6 million, Expenses—$1.1 million

-

Hydro Company and Aqua Corporation are in the same industry. During Year One, Hydro had average total assets of $35,000 and sales of $47,800. Aqua had average total assets of $49,000 and sales of $56,900. Which of the following is true?

- Aqua Corporation has a total asset turnover of 0.86 times.

- Hydro Company is not using its assets as efficiently as Aqua Corporation.

- Aqua Corporation has a higher ROA than Hydro Company.

- Hydro Corporation has a total asset turnover of 1.37 times.

-

Tried Company began the year with $450,000 in total assets and ended the year with $530,000 in total assets. Sales for the year were $560,000 while net income for the year was $46,000. What was Tried Company’s return on assets (ROA) for the year?

- 8.2%

- 9.4%

- 10.2%

- 14.0%

Video Problems

Professor Joe Hoyle discusses the answers to these two problems at the links that are indicated. After formulating your answers, watch each video to see how Professor Hoyle answers these questions.

-

Your roommate is an English major. The roommate’s parents own a chain of ice cream shops located throughout Florida. One day, while waiting for a bus to go across campus, your roommate poses this question: “As you can imagine, my parent’s business is very seasonal. They do great during the summer but not nearly as well in the winter. So, the business has to save up enough cash by the end of summer to support operations over the colder months. This year the business bought shares of several well-known companies in September that will be sold in February when cash reserves begin to run low. Unfortunately, the stock market went down, and now my parents are telling me that they have to report a loss at the end of December. I don’t understand. If they are not going to sell this stock until February, why do they have to report a loss in December? The stock market price may well go way up by the time they sell those shares in February. They have plenty of time to recoup the lost value.” How would you respond?

-

Your uncle and two friends started a small office supply store several years ago. The company has expanded and now has several large locations. Your uncle knows that you are taking a financial accounting class and asks you the following question: “We have some friends who own an office supply service in the next state. They had been having some trouble, so at the beginning of the current year, our company bought 35 percent of their company for a considerable amount of money. We have plans to help them get their operations turned around. We believe, in the long run, that this investment will be very profitable as they begin to make the changes we suggest. This year, that other company only made a profit of $40,000 and paid a total cash dividend of $10,000. However, in the future, we believe that they will do much better. We’ve never owned a portion of a business like this before. How do we go about accounting for our ownership interest in this other company?” How would you respond?

Problems

-

The Kansas Company buys 1,000 shares of Topeka Inc. on August 1, Year One, for $19 per share. Topeka paid a $1 per share cash dividend on December 12, Year One. The shares are worth $23 per share on December 31, Year One. Kansas sells this entire investment on April 7, Year Two, for $25 per share.

- If this asset is viewed as an investment in trading securities, what is reported in the Year One financial statements for Kansas?

- If this asset is viewed as an investment in trading securities, what is reported in the Year Two financial statements for Kansas?

- If this asset is viewed as an investment in available-for-sale securities, what is reported in the Year One financial statements for Kansas?

- If this asset is viewed as an investment in available-for-sale securities, what is reported in the Year Two financial statements for Kansas?

-

Record Investor Corporation’s journal entry for each of the following events.

- Investor Corporation purchases 600 shares of stock in Company A for $60 per share on December 6, Year One. This investment is considered a trading security.

- At the end of Year One, Company A shares are selling for $63 each.

- On January 31, Year Two, Company A pays a cash dividend of $2 per share.

- At the end of Year Two, Company A shares are selling for $59 each.

- On January 22, Year Three, Investor sells all of the shares of Company A for $62 each.

-

On September 9, Year One, Johnson Inc. purchased 500 shares of Thomas Company stock when this stock was selling for $20 per share. Johnson plans to hold these shares for a short time and hopefully sell the investment for a gain. Shortly thereafter, Thomas paid a cash dividend of $0.32 per share.

On December 31, Year One, Johnson prepares its financial statements. At that time, this stock is selling for $18 per share.

- Determine all balances that Johnson will report on its Year One income statement in connection with this investment.

- Determine all balances that Johnson will report on its December 31, Year One, balance sheet in connection with this investment.

- If Johnson reports net income of $79,000 for Year One, what should be disclosed as comprehensive income?

-

In Year One, Waterloo Corporation makes an investment in the equity securities of another company for $53,000. The company then collects a cash dividend of $2,000. At the end of Year One, this investment is valued at $58,000. In March of Year Two, the entire investment is sold for cash of $54,000.

Waterloo reported this investment as being in available-for-sale securities. How would Waterloo’s reported net income have been different in each of these two years if the investment had been reported as a trading security?

-

Record Christopher Corporation’s journal entry for each of the following events. After each entry, indicate the balances that will be reported on Christopher Corporation’s balance sheet at that date.

- Christopher Corporation purchases 1,000 shares of stock in Alpha Company for $30 per share on July 7, Year Two. This investment is considered an available-for-sale security.

- At the end of Year Two, Alpha Company’s stock is selling for $25 per share.

- At the end of Year Three, Alpha Company’s stock is selling for $28 per share.

- On February 16, Year Four, Alpha Company pays a $0.60 per share cash dividend to its stockholders.

- On March 27, Year Four, Christopher sells all of these shares for $36 per share in cash.

-

On April 16, Youngstown Inc. purchased 900 shares of Cool Company stock when Cool’s stock was selling for $15 per share. Youngstown plans to hold this stock indefinitely until the company has a need for cash.

- On December 31, Cool’s stock is selling for $20 per share. What appears on the financial statements for Youngstown?

- If Youngstown reports net income of $190,000, what should the company report as its comprehensive income?

- Assume that Youngstown sells this investment three months later when Cool’s shares are selling for $24 per share. Make the journal entry to record the sale.

-

Ordello Company buys 20 percent of the capital stock of Pottsboro Corporation on January 1, Year One, for $370,000. Ordello plans to hold these shares for an indefinite period of time. Pottsboro reports net income of $80,000 in Year One and $100,000 in Year Two. The company pays a total cash dividend of $30,000 in each year. Ordello’s investment is worth $420,000 at the end of Year One and $470,000 at the end of Year Two. Ordello sells this investment on the first day of Year Three for $470,000 in cash.

- Assume that the ownership of these shares does not give Ordello the ability to apply significant influence over Pottsboro. Make all journal entries for Ordello for Years One, Two, and Three.

- Assume that the ownership of these shares does give Ordello the ability to apply significant influence over Pottsboro. Make all journal entries for Ordello for Years One, Two, and Three.

-

Oregon Company, a paper products manufacturer, wishes to enter the Canadian market. The company purchased 30 percent of the outstanding stock of Canadian Paper Inc. on January 1, Year One, for $6,000,000. The CEO of Oregon will sit on the board of directors of Canadian, and other evidence of significant influence does exist.

- Canadian reported net income of $760,000 for the year. Record the journal entry (if any) to be prepared by Oregon.

- Canadian paid a cash dividend of $80,000. Record the journal entry for Oregon.

- What amount would Oregon report on its balance sheet as its investment in Canadian as of the end of Year One?

-

At the beginning of Year One, Current Properties paid $1,000,000 for 25 percent of the shares of Nealy Enterprises. Current immediately begins to exert significant influence over the operating decisions of Nealy.

- Nealy reported earnings of $400,000 during Year One. Record the appropriate journal entry for Current.

- Nealy paid a total cash dividend of $50,000 during October of Year One. Record the appropriate journal entry for Current when the company receives this dividend.

- At the end of Year One, what amount does Current report on its balance sheet as its investment in Nealy? What does Current report on its income statement as its investment income from Nealy?

- Nealy reported earnings of $440,000 during Year Two. Nealy paid dividends of $60,000 during Year Two. What is the balance of the Investment in Nealy at the end of Year Two?

- At the end of Year Two, Current sells its entire investment in Nealy for $1,200,000 in cash. Record the appropriate journal entry for Current.

-

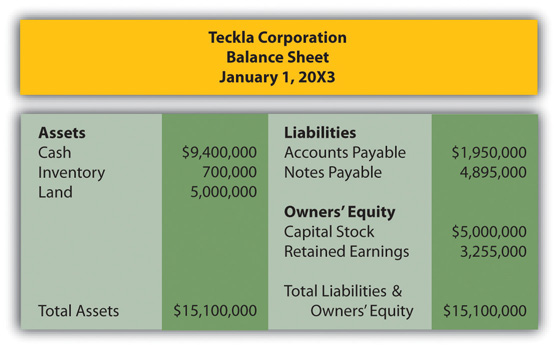

Teckla Corporation purchases all the outstanding stock of Feather Company on January 1, 20X3 for $5,000,000. Teckla’s balance sheet on that date before the purchase is shown in the following:

Figure 12.18 Assets and Liabilities of Teckla

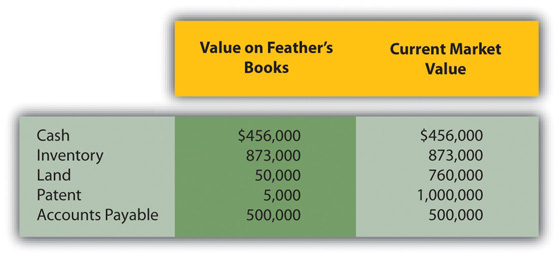

On January 1, 20X3, Feather has assets and liabilities as shown in the following:

Figure 12.19 Assets and Liabilities of Feather

- Determine the amount of goodwill (if any) that Teckla will show on its consolidated balance sheet at January 1, 20X3.

- Prepare a consolidated balance sheet for Teckla after it purchases Feather on January 1, 20X3.

-

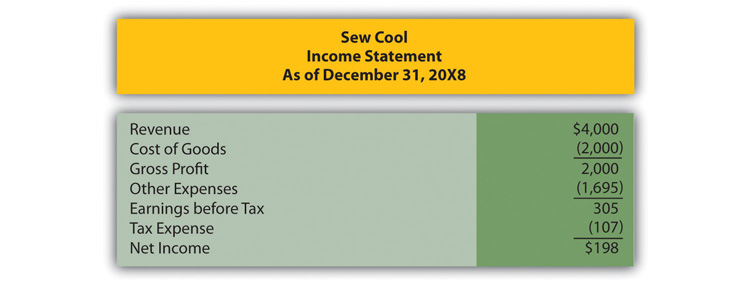

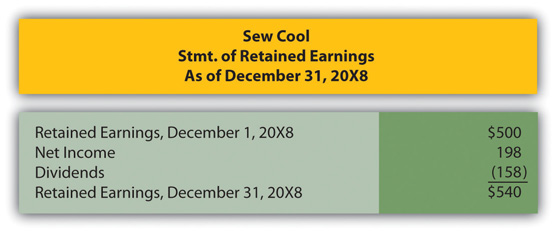

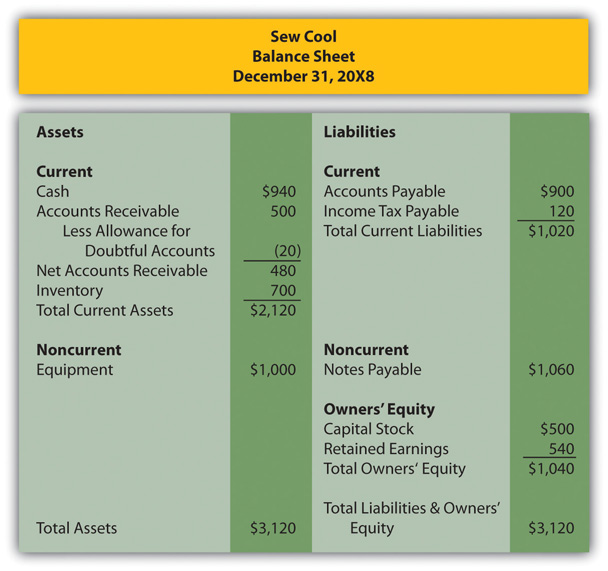

In several past chapters, we have met Heather Miller, who started her own business, Sew Cool. The following are the financial statements for December. To calculate average total assets, assume that total assets on June 1, 20X8, when Sew Cool first started in business, were zero.

Figure 12.20 Sew Cool Financial Statements

Figure 12.21

Figure 12.22

Based on the financial statements determine the following:

- Total asset turnover

- Return on assets

Comprehensive Problem

This problem will carry through several chapters, building in difficulty. It allows students to continually practice skills and knowledge learned in previous chapters.

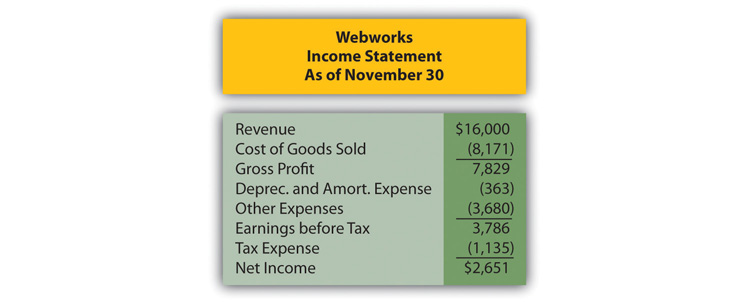

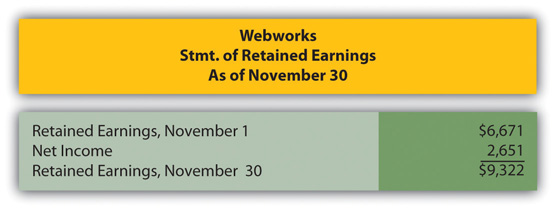

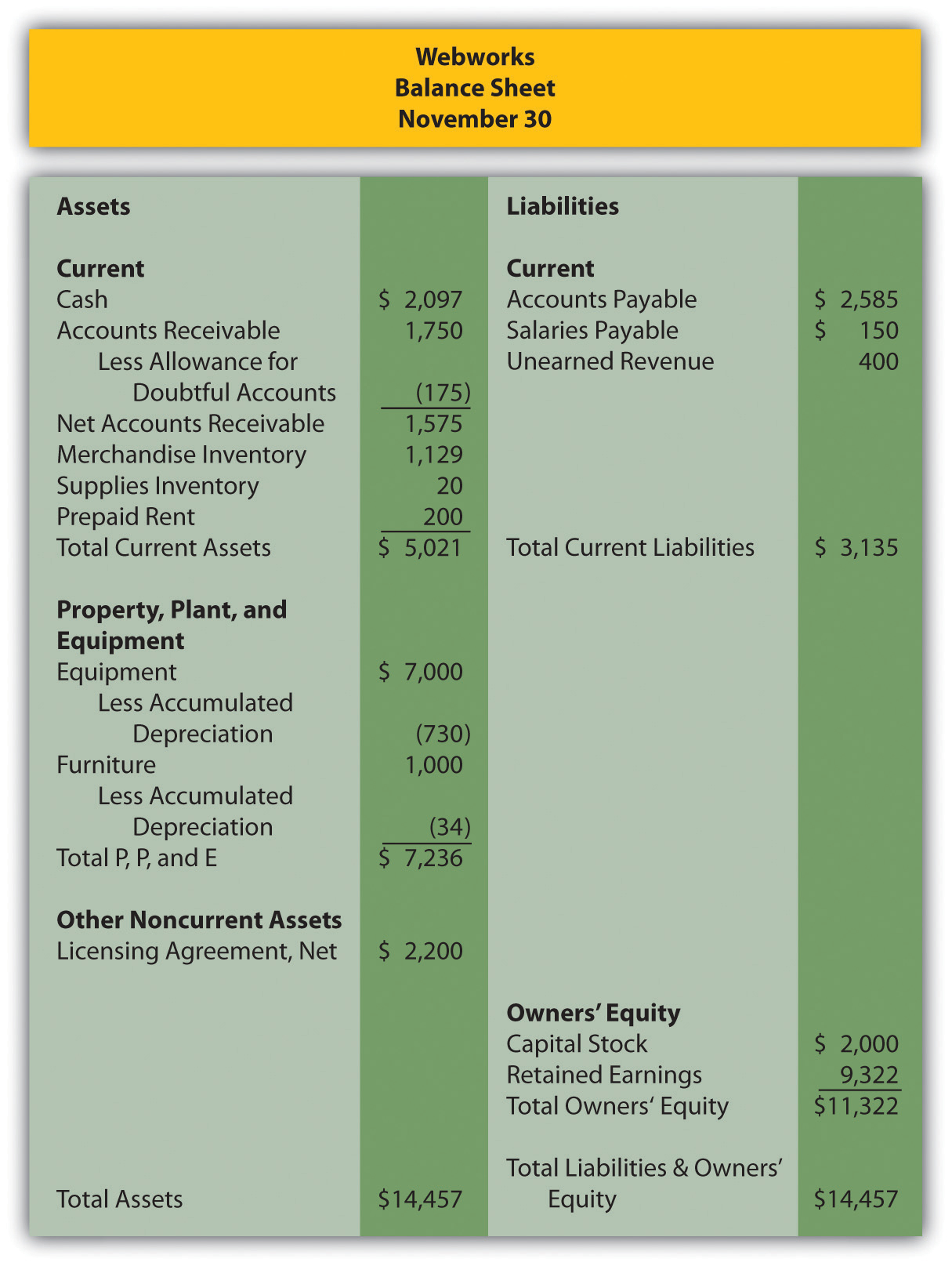

In Chapter 11 "In a Set of Financial Statements, What Information Is Conveyed about Intangible Assets?", financial statements for November were prepared for Webworks. They are included here as a starting point for the required recording for December.

Figure 12.23 Webworks Financial Statements

Figure 12.24

Figure 12.25

The following events occur during December:

- Webworks starts and completes nine more Web sites and bills clients for $5,000.

- Webworks purchases supplies worth $130 on account.

- At the beginning of December, Webworks had nine keyboards costing $111 each and ten flash drives costing $13 each. Webworks uses periodic FIFO to cost its inventory.

- Webworks purchases seventy keyboards for $113 each and one hundred flash drives for $15 each, all on account.

- Webworks decides to invest a small amount of its excess cash in the stock market in the hopes of making a quick gain. Webworks purchases sixty shares of stock in XYZ Corporation for $5 per share in cash.

- Webworks pays Nancy Po $750 for her work during the first three weeks of December.

- Webworks sells sixty-five keyboards for $9,750 and ninety flash drives for $1,800 cash.

- The Web site for the realtor started in November is completed.

- Webworks collects $4,500 in accounts receivable.

- Webworks pays off its salaries payable from November.

- Webworks pays off $10,500 of its accounts payable.

- XYZ Corporation pays Webworks a dividend of $40.

- Webworks pays Leon Jackson (the owner of the business) a salary of $2,000.

-

Webworks pays taxes of $1,272 in cash.

Required:

- Prepare journal entries for the previous events.

- Post the journal entries to T-accounts.

- Prepare an unadjusted trial balance for Webworks for December.

- Prepare adjusting entries for the following and post them to your T-accounts.

- Webworks owes Nancy Po $200 for her work during the last week of December.

- Leon’s parents let him know that Webworks owes $300 toward the electricity bill. Webworks will pay them in January.

- Webworks determines that it has $60 worth of supplies remaining at the end of December.

- Prepaid rent should be adjusted for December’s portion.

- Webworks is continuing to accrue bad debts at 10 percent of accounts receivable.

- Webworks continues to depreciate its equipment over four years and its furniture over five years, using the straight-line method.

- The license agreement should continue to be amortized over its one-year life.

- On December 31, XYZ stock is selling for $6 per share.

- Record cost of goods sold.

-

Near the end of December, a new flash drive appears on the market that makes the ones Webworks has been selling virtually obsolete. Leon believes that it might be able to sell the rest of its inventory (twenty flash drives) for $5 each.

- Prepare an adjusted trial balance.

- Prepare financial statements for December.

Research Assignment

Assume that you take a job as a summer employee for an investment advisory service. One of the partners for that firm is currently looking at the possibility of investing in Google. The partner is aware that Google holds an enormous amount of marketable securities. The partner is curious as to the actual size of that balance. The partner is also interested in knowing whether these marketable securities are reported as trading securities or as available-for-sale securities. The partner asks you to look at the 2010 financial statements for Google by following this path:

- Go to http://www.google.com.

- At the very bottom of this screen, click on “About Google.”

- Near the top of the next screen, click on “Investor Relations.”

- On the next screen, scroll to the bottom and click on “View 2011 Proxy Materials.”

- On the next screen, in the center, click on “December 31, 2010 Annual Report” to download.

- Go to page 49 and find the balance sheet for December 31, 2010.

- Go to page 56 and read the second paragraph under “Cash, Cash Equivalents, and Marketable Securities” shown within Note One.

- Using the balance sheet information located on Google’s website, what is the dollar amount reported by Google as of December 31, 2010, for its “marketable securities?” What percentage does this asset comprise of the company’s total assets?

- Using the information found in the section of Note One describing “Cash, Cash Equivalents, and Marketable Securities,” determine whether these marketable securities are reported as trading securities or available-for-sale securities.