This is “End-of-Chapter Exercises”, section 10.7 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

10.7 End-of-Chapter Exercises

Questions

- The Ames Corporation reports property and equipment as $19,300,000 on its balance sheet. What does that figure represent?

- What is meant by the term “accumulated depreciation?”

- In determining the historical cost of property and equipment, what amounts are included?

- What is meant by the term “market capitalization?”

- Why is property and equipment not reported on the balance sheet at fair value?

- Why is the recording of depreciation expense necessary?

- Why is the cost of land not subjected to depreciation?

- A company is preparing to determine depreciation expense for a large piece of equipment. What information is needed to determine the amount to report in the current period?

- Assume a machine is bought for $300,000, and depreciation each year is $25,000. What annual adjusting entry is recorded for this depreciation? What is reported as the net book value of the machine at the end of the second year? What expense is reported for the second year?

- How does an asset qualify to be included as property and equipment on a company’s balance sheet?

- How is straight-line depreciation determined?

- Equipment with a five-year expected life is bought during Year One but is later sold on November 8, Year Four. What journal entries are necessary to record the sale?

- What is the half-year convention? Why is the half-year convention considered acceptable in financial accounting?

- What is meant by accelerated depreciation? How is the use of accelerated depreciation methods justified theoretically?

- How does the double-declining balance method determine depreciation expense for each year? What pattern is created by double-declining balance depreciation?

- When is a company most likely to use the units-of-production method to determine depreciation expense? The units-of-production method is often referred to as a straight-line method. Why is that?

- Why is the units-of-production method not more widely used?

- What is meant by MACRS?

- What are some characteristics commonly associated with MACRS? Why does the government allow those characteristics?

- What is depletion? How is depletion different from depreciation?

- A company buys a large building with four acres of land. Why is the allocation of the cost between the building and the land important?

- A company buys a large building with four acres of land. How is the acquisition cost allocated between these two assets?

- A company has been using a building for six years to generate revenues. In the current year, the company spends $900,000 on the building. How would the accountant determine whether this cost should be expensed or capitalized?

- A company pays $6 million for a parcel of land and then spends another $500,000 to install a sewer system. The accountant is not sure whether this $500,000 cost should be reported within the land account or as a land improvement. Why is that decision important?

- A company owns a piece of equipment and its value appears to have been impaired. What two tests should the accountant apply? Under what condition is loss reported on an asset impairment?

- A company constructs a large warehouse. Why is the interest incurred during construction capitalized rather than being expensed? How is the impact of that capitalization reflected in the financial reporting?

- How does a decision maker calculate the fixed asset turnover for a company?

True or False

- ____ A machine is bought, and the price agreed on with the seller is $13,250. The buyer must report this asset on its balance sheet on that date at $13,250.

- ____ The depreciation process is designed to keep the net book value of property and equipment aligned with the asset’s fair value.

- ____ The depreciation for an asset is $10,000 in the first year, $20,000 in the second year, and $12,000 in the third year. On financial statements produced at the end of the third year, depreciation expense is $12,000, whereas accumulated depreciation is $42,000.

- ____ Equipment is bought on October 9, Year One, for $75,000. It has a five -year life and expected residual value of $5,000. The half-year convention is used. If the straight-line method of depreciation is applied, accumulated depreciation at the end of Year Two is $21,000.

- ____ The Osborne Company sells a piece of equipment that it held for several years. The sale results in a reported loss. This information indicates that the company is more likely to have used the double-declining balance method of depreciation rather than the straight-line method.

- ____ On January 1, Year One, a company buys a large machine for $480,000. It has an expected life of eight years and residual value of $40,000. The double-declining balance method is applied but not the half-year convention. The machine is sold on April 1, Year Three, for cash of $280,000. The company should record a gain of $26,875 on the sale.

- ____ Equipment is bought with an expected life of ten years and no residual value. After two years of use, the net book value will be higher if the straight-line method of depreciation is used rather than the double-declining balance method.

- ____ A company buys machinery on October 1, Year One, for $500,000 with a $100,000 estimated residual value and an expected useful life of ten years. The double-declining balance method is applied along with the half-year convention. The machinery is destroyed on May 1, Year Three, in a flood. The insurance company pays $300,000 in cash to the company as settlement for the damages. The company will recognize a loss from the flood of $27,000.

- ____ Equipment is acquired for $140,000 with a $20,000 residual value. The double-declining balance method is used. At the end of its useful life, the asset is sold for $19,000 in cash. A loss of $1,000 should be recognized.

- ____ Equipment is acquired with a cost of $76,000 and an expected residual value of $20,000. In applying MACRS, the residual value is ignored. The primary reason that the government does not take residual value into consideration is to force businesses to pay more money in income taxes.

- ____ Equipment is acquired for $78,000 with an expected residual value of $15,000. After the first year of use, depreciation recognized for financial reporting purposes will be larger than the figure expensed for federal income tax purposes.

- ____ A company buys an oil well costing $8 million under the assumption that the well holds one million barrels of oil. The oil well has no residual value. During the first year of ownership, 220,000 barrels of oil are pumped out of the well. Cost of $1,760,000 must be expensed in that year.

- ____ A piece of equipment with a cost of $40,000 and accumulated depreciation of $28,000 (and a fair value of $15,000) is traded along with $4,000 in cash for a similar piece of equipment valued at $20,000. This new equipment will be reported by the buyer on its financial records at a cost of $16,000.

- ____ A piece of equipment with a cost of $40,000 and accumulated depreciation of $28,000 (and a fair value of $15,000) is traded along with $4,000 in cash for a similar piece of equipment valued at $20,000. This new equipment will be reported by the buyer on its financial records at a cost of $20,000.

- ____ Equipment is bought by the Solomon Corporation for $360,000 on January 1, Year One. It has an expected life of 10 years with a $30,000 residual value. Straight-line depreciation is used, but the half-year convention is not applied. On January 1, Year Three, the equipment is traded for similar equipment with a value of $288,000. However, the value of the equipment surrendered is unknown. The Solomon Corporation should not recognize either a gain or a loss on this exchange.

- ____ Poston Corporation buys equipment for $360,000 on January 1, Year One. It has an expected life of ten years and a residual value of $30,000. Straight-line depreciation is used but not the half-year convention. On January 1, Year Three, the company spends $39,000 on an improvement to this equipment that will enable it to last four years longer than originally expected. The expenditure has no impact on the estimated residual value. Depreciation expense for Year Three should be $28,000.

- ____ On January 1, Year One, the Epstein Corporation buys a plot of land with a four-story office building. The company believes the building is worth $1.9 million and has an estimated life of twenty years (with no anticipated residual value). The straight-line method is used. The land has an assessed value of $100,000. Because the seller was interested in a quick sale, Epstein was able to buy this land and building for $1.7 million. Depreciation expense to be recognized in Year One is $80,750.

- ____ A company buys a machine on October 1, Year One, for $500,000 with a $100,000 estimated residual value and an expected life of 10 years. The straight-line method of depreciation and the half-year convention are both used. On December 31, Year Three, company officials examine the machine and decide that it will only be able to generate $406,000 in future cash flows over its remaining life. It has a fair value at that date of $338,000. From an accounting perspective, the asset’s value is not impaired, and no loss should be recognized.

- ____ A company buys machinery for $320,000 in Year One. It has an expected residual value of $40,000 and a useful life of ten years. After three years, this machinery is sold for $210,000 in cash. Over the three-year period, the double-declining balance method will reduce net income more than the straight-line method will.

- ____ A building is being constructed by a company to use in its operations. Interest of $55,000 is incurred during the construction process. This interest is not expensed but rather added to the capitalized cost of the building.

- ____ A company has net sales in Year One of $10 million. The company starts the year with net property and equipment on its balance sheet of $1 million but ends the year with net property and equipment of $2.4 million. The fixed asset turnover for Year One is 5.9 times.

Multiple Choice

-

On January 1, Year One, the Rhode Island Redbirds organization purchased new workout equipment for its athletes. The equipment had a cost of $15,600, transportation costs of $450, and set-up costs of $290. The Redbirds spent an additional $350 training their athletes on the proper use of this equipment. The expected useful life is five years. No residual value is anticipated. How much accumulated depreciation should the Redbirds report after two years if the straight-line method is used?

- $6,240

- $6,420

- $6,536

- $6,676

-

Refer to the information in number 1. Assume the Redbirds decide to use the double-declining balance depreciation method instead of the straight-line method. What amount of accumulated depreciation is reported on the balance sheet at the end of Year Two?

- $9,890

- $10,214

- $10,682

- $10,918

-

Ace Company buys a machine on April 1, Year One, for $50,000 in cash. It has a residual value of $10,000 and an expected useful life of ten years. The straight-line method and the half-year convention are applied. The asset is sold on September 1, Year Three, for $39,900. What loss should be reported on this sale?

- $100 loss

- $850 loss

- $1,767 loss

- $2,100 loss

-

The Timmons Company buys equipment on August 1, Year One, for a reported total amount of $60,000. It has a residual value of $10,000 and an expected useful life of five years. The straight-line method and the half-year convention are applied. The company reports net income in Year One of $70,000. However, an error was made. When this equipment was bought, a $5,000 cost was capitalized when it should have been expensed. What was the appropriate amount of net income that Timmons should have reported?

- $65,500

- $67,000

- $68,000

- $68,500

-

The Anna Corporation buys equipment on September 1, Year One, for $80,000 with a ten-year expected life and an estimated residual value of $10,000. The asset is depreciated using the double-declining balance method and the half-year convention. What is the net book value for this asset at the end of Year Three?

- $40,320

- $46,080

- $48,840

- $51,220

-

The Larisa Company buys machinery on April 1, Year One, for $50,000 with an expected life of ten years and residual value of $10,000. The double-declining balance method is applied along with the half-year convention. The machinery is sold on September 1, Year Three, for $32,400. What gain should be reported on this sale?

- $0

- $667

- $4,965

- $6,480

-

Which of the following is a characteristic of the MACRS system that is used in computing a company’s taxable income for federal income tax purposes?

- Assets are assigned especially long lives for tax purposes.

- An automatic residual value of 10 percent of cost is always assumed.

- All assets are expensed by means of the straight-line method.

- Especially large amounts of expense are recognized in the first few years of an asset’s life.

-

The Greenville Company starts operations in Year One and buys several pieces of equipment. All of this equipment is expected to last for ten years and have a residual value equal to 25 percent of cost. MACRS is properly used for tax purposes while straight-line depreciation is applied for financial reporting purposes. Based solely on the expensing of this equipment in Year One, which of the following statements is true?

- Reported net income for financial accounting purposes will be higher than taxable income.

- Reported net income for financial accounting purposes will be the same as taxable income.

- Reported net income for financial accounting purposes is likely to be lower than taxable income.

- Reported net income for financial accounting purposes must be lower than taxable income.

-

On January 3, Year One, Jewels Inc. purchases a South American mine (found to be rich in amethyst) for $560,000. After all of the amethyst has been removed, the land is estimated to be worth only $100,000. Experts predict that the mine contains 4,000 pounds of amethyst. Jewels plans on completing the extraction process in four years. In Year One, 400 pounds are dug from the mine. None of it has yet been sold. What should be reported as the net book value for the mine at the end of Year One?

- $420,000

- $445,000

- $514,000

- $560,000

-

Kite Corporation wishes to trade equipment it owns for a vehicle owned by the Runner Corporation. Kite’s equipment has a net book value of $4,000 and a fair value of $4,500. Runner’s vehicle has a net book value and fair value of $5,100. Kite agrees to pay Runner $600 in cash in addition to giving up the equipment. What is Kite’s reported gain or loss on this exchange?

- $100

- $500

- $600

- $1,100

-

A company has equipment with a cost of $50,000 and a net book value at present of $15,000. The equipment is actually worth $18,000. It is traded along with cash of $12,000 for a truck that has a value of $30,400. What is the company’s reported gain or loss on this exchange?

- $3,000 gain

- $3,000 loss

- $3,400 gain

- $3,400 loss

-

The Bristol Corporation buys equipment on January 1, Year One, for $50,000. It has a ten-year life and an expected residual value of $5,000. The double-declining balance method of determining depreciation is applied. The equipment actually loses exactly 10 percent of its initial value every year. On January 1, Year Three, this equipment is traded for some new machinery that has a fair value of $42,000. At what amount should this new machinery be recorded by Bristol?

- $28,800

- $32,000

- $40,000

- $42,000

-

At the beginning of Year Three, the Kelvin Company owned equipment that appeared on its balance sheet with a cost of $7 million and accumulated depreciation of $2 million. The equipment was purchased two years earlier and assigned a useful life of six years. The estimated residual value was $1 million. At the beginning of Year Three, Kelvin made several modifications to the equipment that increased its remaining useful life from four years to five years. No other changes occurred as a result of these modifications. Their cost was $50,000. What is the balance in the accumulated depreciation account on December 31, Year Three?

- $2,000,000

- $2,760,000

- $2,810,000

- $3,000,000

-

The Winslett Company buys a retail store on January 1, Year One, with a ten-year life and a cost of $800,000. No residual value is anticipated. Straight-line depreciation is used. The building was bought because the company believed that it could generate post-cash flows of $98,000 per year. On January 1, Year Four, a new road is opened in the area that takes much of the traffic away from the store. For the remainder of its life, the company only expects to generate a positive cash flow of $82,000 per year. An appraisal is made that indicates the building has a fair value of only $480,000. What recording should be made on that date for this building?

- No change should be made.

- A loss of $77,000 is recognized.

- A loss of $80,000 is recognized.

- A loss of $82,000 is recognized.

-

On January 1, Year One, the Capricorn Corporation borrows money on a loan paying 9 percent interest each year. The money is used to construct a new building, which takes exactly one year to complete. The building has a twenty-year expected life with no residual value. In determining net income for Year One, which of the following statements is true?

- Neither interest expense nor depreciation expense is recognized in Year One.

- Both interest expense and depreciation expense are recognized in Year One.

- Interest expense is recognized in Year One but not depreciation expense.

- Depreciation expense is recognized in Year One but not interest expense.

Video Problems

Professor Joe Hoyle discusses the answers to these two problems at the links that are indicated. After formulating your answers, watch each video to see how Professor Hoyle answers these questions.

-

Your roommate is an English major. The roommate’s parents own a chain of ice cream shops throughout Florida. One day, while packing to go home on spring break, your roommate poses this question: “My parents have always rented their store locations. However, last year, they built their first standalone shop in Orlando. It has been doing great business, but I know they spent a lot of money to build it. They have been talking recently about the depreciation making the first-year results look bad for that shop. I am not sure what they are talking about. The shop looks better than ever. It hasn’t depreciated at all. In fact, the value of that facility has probably gone up. What is this depreciation, and why has it hurt the reported results for the shop in Orlando?” How would you respond?

-

Your uncle and two friends started a small office supply store several years ago. The company has expanded and now has several large locations. Your uncle knows that you are taking a financial accounting class and asks you the following question: “We bought one of our facilities too far from our other stores. We thought it was a good idea at the time. The store does well, but we have trouble managing it and keeping it stocked with merchandise because of the distance. It is a valuable asset, but it does not fit in with our future plans. Another company has come up to us and offered to trade a large warehouse near our headquarters for that store. The warehouse is actually worth slightly more than the store, but the other company would really like to have a store at that location. And, we could use the warehouse space. We are inclined to make the exchange, but we want to have a careful understanding of how this transaction might impact our financial statements. We don’t want to do anything that would make us look bad. We don’t want to scare our creditors. How would we record such a swap?” How would you respond?

Problems

-

Equipment was bought by a company on January 1, Year One, for $40,000. It had an expected useful life of five years and a $5,000 residual value. Unfortunately, at the time of purchase, an error was made. The accountant debited supplies expense for $40,000 and credited cash. No adjusting entry was ever made. At the end of Year One, the company reported net income of $100,000 and total assets of $300,000. What should those reported figures have been under each of the following situations?

- The company uses the straight-line method to depreciate all equipment.

- The company uses the double-declining balance method to depreciate all equipment.

- Company X and Company Y are identical in every way except as follows. On August 1, Year One, both companies buy machinery with a cost of $80,000 and an estimated residual value of $10,000. The equipment has an expected useful life of ten years. Both companies use the half-year convention. Company X reported net income for Year One of $160,000. Company X used the straight-line method of determining depreciation expense. What would have been the reported net income for Company Y if it applied the double-declining balance method?

-

On January 1, Year One, the Sanborn Corporation buys a donut maker for $10,000 that has a ten-year estimated life and an estimated residual value of $1,000. The donut maker is expected to produce a total of 100,000 dozen donuts over its life. In Year One, 13,000 dozen are produced and, in Year Two, 11,000 dozen are produced.

- If the straight-line method of depreciation is applied, what appears in the Year One and in the Year Two financial statements in connection with this donut maker?

- If the double-declining balance method of depreciation is applied, what appears in the Year One and in the Year Two financial statements in connection with this donut maker?

- If the units-of-production method of depreciation is applied, what appears in the Year One and in the Year Two financial statements in connection with this donut maker?

- Based on the answers to the previous questions, what is the fair value of the donut maker at the end of Year Two?

- Which of these depreciation methods provides the fairest representation of the donut maker and its use?

- If the donut maker is sold on October 1, Year Three, depreciation must be recorded for the period from the beginning of the year until the sale. What are the two reasons that this recording is necessary?

- Assume the straight-line method is used, and the donut maker is sold on October 1, Year Three, for $7,100 in cash. What journal entry is recorded for the sale? Assume that the half-year convention is not in use.

- How is the journal entry in problem 3.g. impacted if the half-year convention is being used for any period of time of less than a full year?

- Company A and Company Z both bought buildings on January 1, Year One, for $700,000 in cash. They each spent an additional $60,000 in connection with their buildings. Company A believed the $60,000 expenditure was normal and necessary to get the building into the condition to generate revenue. Company Z did not believe that cost was normal and necessary. Both companies use straight-line depreciation and believe the buildings have a ten-year life with a residual value of $50,000. What will be the difference in the reported net income of these two companies for Year One? What will be the difference in the reported net income of these two companies for Year Two?

-

On April 1, Year One, Chang and Chang Inc. invested in a new machine to manufacture soccer balls. The machine is expected to manufacture 1.4 million soccer balls over its life of three years and then be scrapped. The machine cost $50,000 including the normal and necessary costs of setting it up. The units-of-production method is used to depreciate the machine.

- Record depreciation for Year One and Year Two assuming that 450,000 soccer balls were manufactured and sold in Year One and 600,000 were manufactured and sold in Year Two.

- On January 1, Year Three, Chang and Chang decides to get out of the soccer ball production business and sells the machine for $15,000 in cash. Record this journal entry.

-

Springfield Corporation purchases a new machine on March 3, Year One, for $35,600 in cash. It pays an additional $3,400 to transport and set up the machine. Springfield’s accountant determines that the equipment has no residual value and that the useful life is five years. It is expected to generate 2.4 million units during its life. If applicable, assume that Springfield employs the half-year convention.

- Record the purchase of the machine.

- Assume that Springfield uses the straight-line method of depreciation. Record depreciation expense for the first two years of the machine’s life.

- Assume that Springfield uses the double-declining balance method of depreciation. Record depreciation expense for the first two years of the machine’s life.

- Assume that Springfield uses the units-of-production method of depreciation. During Year One, the machine produces 600,000 units. During Year Two, the machine produces 578,000 units. Record depreciation expense for the first two years of the machine’s life.

-

A company uses the half-year convention and buys equipment for $200,000 on December 1, Year One. The equipment has an expected life of ten years and a $40,000 anticipated residual value. The equipment is sold on March 1, Year Three, for $165,000 in cash.

- Make all the entries from December 1, Year One, to March 1, Year Three, for this equipment assuming that the double-declining balance method is in use.

- Make all the entries from December 1, Year One, to March 1, Year Three, for this equipment assuming that the straight-line method is in use.

-

The Huguenot Corporation buys equipment on October 1, Year One, for $120,000. It has an expected residual value of $30,000. The company expects to make use of it for ten years.The straight-line method of depreciation is applied but not the half-year convention. The equipment is sold on April 1, Year Three, for $107,000.

What would have been the difference in reported net income for Year Three if the double-declining balance method had been used along with the half-year convention?

-

On January 1, Year One, the Oklahoma Corporation buys an oil well for $2 million in cash. The company believes that this well holds 400,000 barrels in crude oil. However, the oil well will have no residual value after the oil has been removed. In Year One, the company pumps out 100,000 barrels and sells 70,000 barrels for $19 per barrel. In Year Two, the company pumps out another 50,000 barrels but sells a total of 60,000 barrels for $20 per barrel.

Make the necessary journal entries.

-

Markov Corporation owns forests that are harvested with the wood sold to papermaking companies. Markov purchases a new tract of forest on January 1, Year One, for $360,000. Company officials estimate that 4,000 tons of wood can be harvested from the forest and sold. After that, the land will be worth about $20,000.

- In Year One, 2,500 tons of wood are harvested, and 2,200 are sold for $120 per ton. Make any necessary journal entries.

- In Year Two, the remaining 1,500 tons of wood are harvested, and then 1,800 tons are sold for $120 per ton. Make any necessary journal entries.

- The Watson Company buys a truck on February 3, Year One, for $53,000 with a six-year life and a $5,000 estimated residual value. The half-year convention is used along with straight-line depreciation. On May 23, Year Three, the truck is traded for a different style of truck. The old truck had a fair value of $40,000 at that time. The new truck had a fair value of $41,000. Because the dealer really wanted to make the trade, the $1,000 difference in the two fair values was ignored. What journal entry does the Watson Company make to record this trade?

- The Ferrum Company acquired a large machine for $360,000 in cash on January 1, Year One. Straight-line depreciation is going to be recorded over an expected life of ten years. The asset has an estimated residual value of $20,000. In reality, this machine lost $60,000 of its value each year. On the first day of Year Three, the asset was traded for another machine with a fair value of $254,000. What journal entry does Ferrum prepare to record this exchange?

-

Gameplay Company operates in mall locations and sells videogame equipment and games. The company purchased furniture and fixtures to use in one of its stores for $440,000 on January 1, Year One. The furniture and fixtures were being depreciated using the straight-line method over ten years with a residual value of $10,000. Near the end of December, Year Five, Gameplay decided to close this location and entered into an exchange agreement with Allero Corporation. Allero agreed to give Gameplay vehicles with a fair value of $200,000 and cash of $50,000 in exchange for the furniture and fixtures from this store. The furniture and fixtures have an estimated fair value of $250,000 on the date of exchange.

- Make the depreciation entry for the furniture and fixtures necessary in December Year Five, assuming that no entries have been made during the year.

- Determine the net book value of the furniture and fixtures on the date of exchange.

- Record the journal entry Gameplay makes to record this exchange.

-

The Milan Corporation owns a building that it has used for a number of years. At the start of the current year, the building has a cost of $1.5 million and accumulated depreciation of $600,000. Straight line depreciation has been used with no expected residual value. The asset was originally assumed to have a thirty-year life, and twelve years have now passed.

Assume that each of the following situations is entirely independent. For each, prepare the appropriate journal entry and determine the amount of depreciation expense that should be reported for the current year.

- The company spends $22,000 in cash to paint the building. When the company bought the building originally, officials had anticipated that it would need to be painted periodically in order to last for thirty years.

- The company spends $80,000 to add a new room at the back of the building.

- The company spends $35,000 to fix a rotten space on the roof which was beginning to leak. Officials had not expected that the roof would rot.

- The company spends $30,000 on a new type of foundation improvement. Officials had not expected to do this but now believe the building will last for an additional five years because of this work.

-

The Monster Cookie Company buys a machine to make cookies on January 1, Year One. It costs $500,000 but has a $100,000 residual value and an expected life of ten years. Straight-line depreciation is to be applied. On January 1, Year Three, the company makes two changes to this machine. First, $30,000 is spent to add an attachment so that the company can make two types of cookies rather than just one. Second, the company spends $40,000 so that the machine will last five years longer than originally anticipated.

In connection with this machine, what figures are reported on the company’s financial statements for Year Three?

- The Romo Corporation buys equipment for $190,000 on January 1, Year One. It has a twelve-year life and an expected residual value of $40,000. Straight-line depreciation is being applied. At the start of Year Three, the company spends $40,000 on this equipment to make it more effective at generating revenue (more widgets can be produced each period, and they will be of a better quality). This added cost did not extend the life of the asset or impact its residual value. Make all journal entries and adjusting entries for Year Three.

-

On June 30, Partyplace, a popular spot for receptions and other events, purchased a used limousine and a used Hummer from a car dealership. The company received a good deal because it was willing to buy both vehicles, paying a total of only $75,000. The market values were $45,000 for the limousine and $40,000 for the Hummer.

- Record the purchase of the vehicles.

- During the year, Partyplace performed maintenance on the vehicles (oil changes and the like) that amounted to $600. Record this expenditure.

- During the year, Partyplace made some modifications to the limo that should make it more appealing to its customers, thus, in effect, increasing its ability to generate revenues. These modifications cost $4,000. Record this expenditure.

- An asset is bought for $360,000 on the first day of Year One. The life of this asset is ten years. There is no expected residual value. Straight-line depreciation is used for this asset but not the half-year convention. Subsequently, on the first day of Year Three, the asset is worth $240,000. On that day, company officials estimate that this asset will generate positive cash flows of $35,000 per year for the rest of its useful life. At what net book value should the asset be reported at that time?

-

The Randolph Corporation owns a building in Waynesboro, Arkansas, that originally cost $2 million. At the current time, this building has a net book value of $900,000 and a remaining useful life of ten years with no expected residual value. However, the company no longer uses the building for manufacturing purposes, so its fair value has fallen to only $576,000. To generate some revenue from the building, several rooms are rented out to other businesses as warehouse space. In each of the following questions, should the company recognize an impairment loss? If so, how much loss should be recognized?

- The cash received from the rental income is $86,000 per year and is expected to last for the remaining life of the building.

- The cash received from the rental income is $93,000 per year and is expected to last for the remaining life of the building.

-

Fairfield Inc. invested in a plant to manufacture “Jphones,” thinking these devices would be the next “big thing.” Unfortunately, things did not work out so well for the Jphone.

- Fairfield purchased the plant on March 1, Year One, for $46,790,000. Additional costs to get the facility up and running amounted to $3,780,000. Fairfield assigned a thirty-year useful life to the asset. The expected residual value is $4 million for the building. Fairfield uses the double-declining balance method. Record the acquisition of the plant and depreciation for the first three years, assuming that Fairfield does not use the half-year convention.

- On December 31, Year Three, Fairfield’s auditors raise concerns that the plant’s market value might be below its net book value due to the failure of the Jphone to gain market share. The auditors believe this decline is permanent and decide to test for impairment. The accountants and auditors agree that the plant will generate net cash flows of approximately $2 million each year but only for the next fifteen years. Perform a test of recoverability on the plant.

- Assume that the auditors determine that the plant’s expected future cash flows are below its net book value. The company must now perform the fair value test. Several appraisers are called in, and the average fair value is $15,600,000. Determine if Fairfield must record an impairment loss and, if so, determine the amount.

-

Company A borrows $4 million on January 1, Year One, and uses the money to buy a retail store in Trenton, New Jersey. The store opens immediately and starts to make sales. The annual interest rate on the debt is 6 percent with payments made every December 31. The building has a twenty-year expected life and no residual value. Straight-line depreciation is used.

Company Z also borrows $4 million on January 1, Year One, but uses the money to construct a store in Reno, Nevada, that is exactly like the store owned by Company A. Construction takes one year, and the store is opened for business on January 1, Year Two. The annual interest rate is 6 percent, and the building is expected to last twenty years with no anticipated residual value. Straight-line depreciation is used.

On Year Two financial statements, how will the balances be different between the reporting by Company A and the reporting by Company Z?

Comprehensive Problem

This problem will carry through over several chapters to enable students to build their accounting skills using knowledge gained in previous chapters.

In Chapter 9 "Why Does a Company Need a Cost Flow Assumption in Reporting Inventory?", financial statements were prepared for Webworks for September 30, and the month then ended. Those financial statements are included here as a starting point for the financial reporting for October.

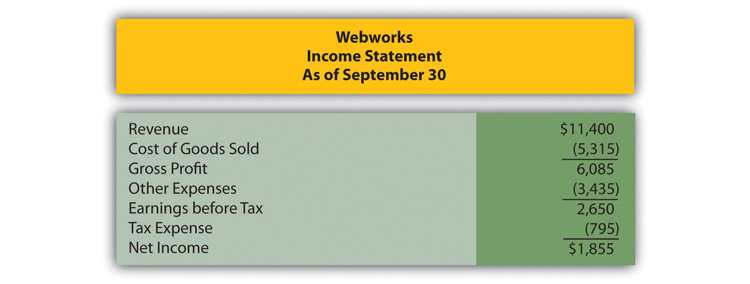

Figure 10.19

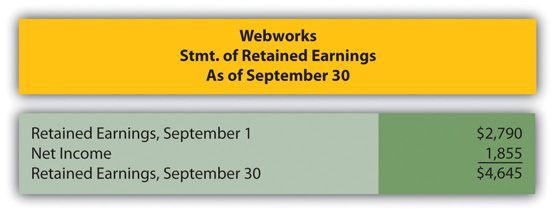

Figure 10.20

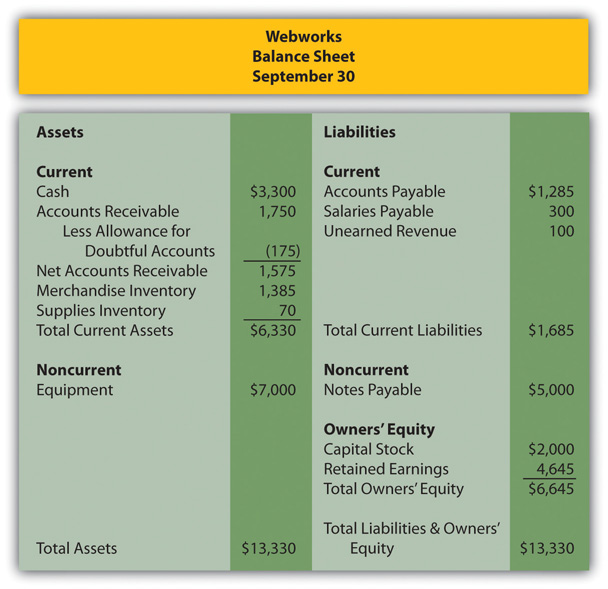

Figure 10.21

The following events occur during October:

- Webworks purchases supplies worth $100 on account.

- Webworks paid $600 in rent for October, November, and December.

- At the beginning of October, Webworks had nine keyboards costing $105 each and forty flash drives costing $11 each. Webworks uses periodic FIFO to cost its inventory.

- On account, Webworks purchases fifty keyboards for $110 each and 100 flash drives for $12 each.

- Webworks starts and completes seven more sites and bills clients for $3,900.

- Webworks pays Nancy Po $700 for her work during the first three weeks of October.

- Webworks sells 50 keyboards for $7,500 and 110 flash drives for $2,200 cash.

- The Web site paid for in August and started in September was completed. The client originally paid the entire $100 in advance.

- Webworks paid off the remainder of its note payable.

- Webworks collects $4,000 in accounts receivable.

- Webworks pays off its salaries payable from September.

- Webworks pays off $6,000 of its accounts payable.

- One Web site client is dissatisfied with the work done and refuses to pay his bill. Rather than incur the expense of taking the client to court, Webworks writes off the $200 account as uncollectible.

- Webworks pays Leon Jackson (the owner of this business) a salary of $2,000.

- Webworks purchased office furniture on account for $1,000, including transportation and setup.

-

Webworks pays taxes of $868 in cash.

Required:

- Prepare journal entries for the previous events.

- Post the journal entries to T-accounts.

- Prepare an unadjusted trial balance for Webworks for October.

- Prepare adjusting entries for the following and post them to your T-accounts.

- Webworks owes Nancy Po $100 for her work during the last week of October.

- Leon’s parents let him know that Webworks owes $300 toward the electricity bill. Webworks will pay them in November.

- Webworks determines that it has $50 worth of supplies remaining at the end of October.

- Prepaid rent should be adjusted for October’s portion.

- Webworks is continuing to accrue bad debts at 10 percent of accounts receivable.

- A CPA tells Leon that Webworks should be depreciating its equipment and furniture. The CPA recommends that Webworks use the straight-line method with a four-year life for the equipment and a five-year life for the furniture. Since Webworks is only generating these monthly statements for internal information, the CPA recommends that Leon just “catch up” the prior month’s depreciation on the equipment this month. So when Webworks records October’s equipment depreciation, it will also record the deprecation that should have been taken in July, August and September. The depreciation on the furniture should just be for one month. Round to the nearest whole number.

-

Record cost of goods sold.

- Prepare an adjusted trial balance.

- Prepare financial statements for October.

Research Assignment

Assume that you take a job as a summer employee for an investment advisory service. One of the partners for that firm is currently looking at the possibility of investing in DuPont (official name is E. I. Du Pont de Nemours and Company). The partner knows that this manufacturing company has been in business for many years and wonders about the age of its property and equipment. The partner asks you to look at the 2011 financial statements for DuPont by following this path:

- Go to investors.dupont.com.

- At the bottom of this screen, click on “SEC Filings.”

- In the “Groupings Filter,” click on “Annual Filings.”

- Scroll through the document tables until you find the 10-K form for 2011 (issued early in 2012).

- Go to page F-5 and find the balance sheet for December 31, 2011.

- Go to page F-9 and read the note to the financial statements titled “Property, Plant and Equipment.”

- Using the amounts reported on the 2011 balance sheet for property, plant, and equipment and accumulated depreciation, divide the net book value by the cost of the asset. What does the resulting percentage tell about the current age and utility of the company’s property, plant, and equipment?

- Using the information disclosed on page F-9, what method of depreciation is being used by DuPont? What is the age used by the company for depreciation purposes?

- Combine the information found in a. and b. to arrive at an estimation of the age of the property, plant, and equipment held by DuPont.