This is “Recording Depreciation Expense for a Partial Year”, section 10.3 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

10.3 Recording Depreciation Expense for a Partial Year

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Understand the need to record depreciation for each period of use even when property and equipment are disposed of prior to the end of the year.

- Construct the journal entry to record the disposal of property or equipment and the recognition of a gain or loss.

- Explain the half-year convention and the reason that it is frequently used by companies for reporting purposes.

Recording the Disposal of Property or Equipment

Question: Property and equipment are occasionally sold before the end of their estimated lives. A company’s operational needs might change or officials could want to gain the benefit of a newer or more efficient model. What accounting is necessary in the event that a piece of property or equipment is sold prior to the conclusion of its useful life? In the example illustrated in Figure 10.2 "Building Acquisition and Straight-Line Depreciation", assume that after the adjusting entry for depreciation is made on December 31, Year Two, the building is sold for $290,000 cash. How is that transaction recorded?

Answer: Accounting for the disposal of property and equipment is relatively straightforward.

First, to establish account balances that are appropriate as of the date of sale, depreciation is recorded for the period of use during the current year. In this way, the expense is matched with the revenues earned in the current period.

Second, the amount received from the sale is recorded while the net book value of the asset (both its cost and accumulated depreciation) is removed. If the owner receives less for the asset than net book value, a loss is recognized for the difference. If more is received than net book value, the excess is recorded as a gain so that net income increases.

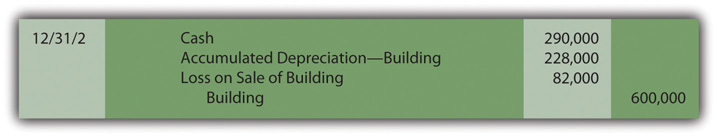

Because the building is sold for $290,000 on December 31, Year Two, when the net book value is $372,000 (cost of $600,000 less accumulated depreciation of $228,000), a loss of $82,000 is reported by the seller ($372,000 net book value less $290,000 proceeds). The journal entry shown in Figure 10.3 "Sale of Building at a Loss" is recorded after the depreciation adjustment for the period is made.

Figure 10.3 Sale of Building at a Loss

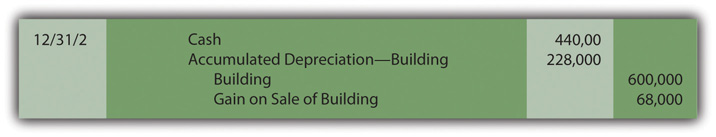

Conversely, if this building is sold on that same date for $440,000 rather than $290,000, the company receives $68,000 more than net book value ($440,000 less $372,000) so that a gain of that amount is recognized. The entry under this second possibility is presented in Figure 10.4 "Sale of Building at a Gain".

Figure 10.4 Sale of Building at a Gain

Although gains and losses such as these appear on the income statement, they are often shown separately from revenues and expenses. In that way, a decision maker can determine both the income derived from primary operations (revenues less expenses) and the amount that resulted from tangential activities such as the sale of a building or other property (gains less losses).

Test Yourself

Question:

The Lombardi Company buys equipment on January 1, Year One, for $2 million with an expected twenty-year life and a residual value of $100,000. Company officials apply the straight-line method to determine depreciation expense. On December 31, Year Three, this equipment is sold for $1.8 million. What gain is recognized on this sale?

- $10,000

- $85,000

- $100,000

- $185,000

Answer:

The correct answer is choice b: $85,000.

Explanation:

The depreciable basis for this asset is $1.9 million ($2 million cost less $100,000 estimated residual value). This amount is to be expensed over twenty years at a rate of $95,000 per year ($1.9 million/20 years). After three years, accumulated depreciation is $285,000 ($95,000 × 3) so net book value is $1,715,000 ($2 million cost less $285,000 accumulated depreciation). The sale was for $1.8 million. The company reports a gain of $85,000 ($1.8 million received less $1,715,000 book value).

Recognizing Depreciation When Asset Is Used for a Partial Year

Question: In the previous reporting, the building was bought on January 1 and later sold on December 31 so that depreciation was always determined and recorded for a full year. However, in reality, virtually all such assets are bought and sold at some point within the year so that a partial period of use is more likely. What amount of depreciation is appropriate if property or equipment is held for less than twelve months during a year?

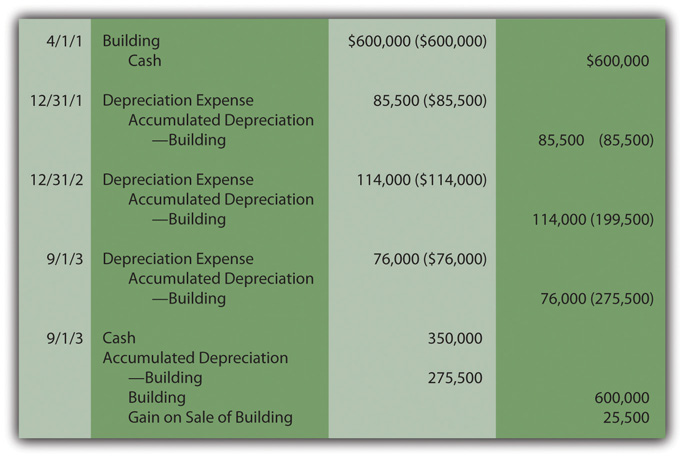

Answer: The recording of depreciation follows the matching principle. If an asset is owned for less than a full year, it does not help generate revenues for all twelve months. The amount of expense should be reduced accordingly. For example, if the building from the previous reporting is purchased on April 1, Year One, depreciation expense of only $85,500 (9/12 of the full-year amount of $114,000) is recognized on December 31, Year One. Similarly, if the asset is sold on a day other than December 31, less than a full year’s depreciation is assigned to expense in the year of sale. Revenue is not generated for the entire period; therefore, depreciation must also be recognized proportionally.

To illustrate, assume the building was purchased on April 1 of Year One for $600,000 and then sold for $350,000 on September 1 of Year Three. As just calculated, depreciation for Year One is $85,500 or 9/12 of the annual amount. In Year Three, depreciation for the final eight months that the property was used is $76,000 (8/12 of $114,000). The journal entries shown in Figure 10.5 "Acquisition, Depreciation, and Sale of Building" reduce the asset’s net book value to $324,500 (cost of $600,000 less accumulated depreciation of $275,500). Because cash of $350,000 is collected from the sale, a gain of $25,500 is recognized ($350,000 less $324,500).

Figure 10.5 Acquisition, Depreciation, and Sale of Building

The Half-Year Convention

Question: Monitoring the specific days on which depreciable assets are bought and sold seems like a tedious process. For example, what happens when equipment is bought on August 8 or when a building is sold on April 24? In practice, how do companies assign depreciation to expense when a piece of property or equipment is held for less than a full year?

Answer: Most companies hold a great many depreciable assets, often thousands. Depreciation is nothing more than a mechanical cost allocation process. It is not an attempt to mirror current value. Cost is mathematically assigned to expense in a systematic and rational manner. Consequently, company officials often prefer not to invest the time and effort needed to keep track of the specific number of days or weeks of an asset’s use during the years of purchase and sale.

As a result, depreciation can be calculated to the nearest month when one of these transactions is made. A full month of expense is recorded if an asset is held for fifteen days or more whereas no depreciation is recognized in a month where usage is less than fifteen days. No genuine informational value comes from calculating the depreciation of assets down to days, hours, and minutes. An automobile acquired on March 19, for example, is depreciated as if bought on April 1. A computer sold on November 11 is assumed to have been used until October 31.

As another accepted alternative, many companies apply the half-year conventionMethod of calculating depreciation for assets that are held for any period of time less than a year; automatically records one-half year of depreciation; it makes the maintenance of exact records as to the period of use unnecessary. (or some variation). When property or equipment is owned for any period less than a full year, a half year of depreciation is automatically assumed. The costly maintenance of exact records is not necessary. Long-lived assets are typically bought and sold at various times throughout each period so that, on the average, one-half year is a reasonable assumption. As long as such approaches are applied consistently, reported figures are viewed as fairly presented. Property and equipment bought on February 3 or sold on November 27 is depreciated for exactly one-half year in both situations.

Test Yourself

Question:

On August 12, Year One, the O’Connell Company buys a warehouse for $1.2 million with a ten-year expected life and an estimated residual value of $200,000. This building is eventually sold on March 18, Year Three, for $1,080,000 in cash. The straight-line method of depreciation is used for allocation purposes along with the half-year convention. What gain should O’Connell recognize on the sale of the warehouse?

- $80,000

- $84,000

- $108,000

- $120,000

Answer:

The correct answer is choice a: $80,000.

Explanation:

Annual depreciation is $100,000: the depreciable basis of $1 million ($1.2 million less $200,000) allocated over ten years. Because the half-year convention is used, $50,000 is recorded in Years One and Three. The asset was used less than twelve months in each of these periods. When sold, accumulated depreciation is $200,000 ($50,000 + $100,000 + $50,000) and net book value is $1 million (cost was $1.2 million). Cash of $1,080,000 was received so that a gain of $80,000 must be recognized.

Key Takeaway

Depreciation expense is recorded for property and equipment at the end of each fiscal year and also at the time of an asset’s disposal. To record a disposal, cost and the accumulated depreciation as of that date are removed. Any proceeds are recorded and the difference between the amount received and the net book value surrendered is recognized as a gain (if more than net book value is collected) or a loss (if less is collected). Many companies automatically record depreciation for one-half year for any period of use of less than a full year. The process is much simpler and, as a mechanical allocation process, no need for absolute precision is warranted.