This is “End-of-Chapter Exercises”, section 9.7 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

9.7 End-of-Chapter Exercises

Questions

- In the financial accounting for inventory, what is a cost flow assumption?

- In calculating cost of goods sold for a company, under what condition is a cost flow assumption not needed?

- A hardware store buys a refrigerator for $700. Later, the same store buys another refrigerator for $730 and then a final item for $790. Eventually, one of these refrigerators is sold for $1,200. If specific identification is used, how is cost of goods sold determined?

- A hardware store buys a refrigerator for $700. Later, the same store buys another refrigerator for $730 and then a final item for $790. Eventually, one of these refrigerators is sold for $1,200. If FIFO is used, how is cost of goods sold determined?

- A hardware store buys a refrigerator for $700. Later, the same store buys another refrigerator for $730 and then a final item for $790. Eventually, one of these refrigerators is sold for $1,200. If LIFO is used, how is cost of goods sold determined?

- A hardware store buys a refrigerator for $700. Later, the same store buys another refrigerator for $730 and then a final item for $790. Eventually, one of these refrigerators is sold for $1,200. If averaging is used, how is cost of goods sold determined?

- What characteristics are attributed to FIFO and to LIFO in a period of inflation?

- Tax laws are designed to raise revenues so that a government can afford to operate. What are the other major uses made of income tax laws?

- The Hawkins Company maintains one set of financial records for financial reporting purposes. Separate records are also kept for tax compliance purposes. Why is that necessary?

- What is the LIFO conformity rule? What is the practical impact of the LIFO conformity rule?

- IFRS does not permit the use of LIFO. What are the theoretical problems associated with the application of LIFO?

- A grocery store has been in operation for several decades. One rack contains 100 loaves of bread. Each evening a local bakery restocks this rack so that the store always starts the next day with 100 loaves of bread. If the company uses LIFO, what is reported for this inventory?

- Notes to the financial statements of the KaiKayle Corporation indicate that a LIFO liquidation occurred last year. What does this mean? What is the financial impact of that event?

- The Petrakellon Company reports FIFO inventory of $900,000 but also reports a $300,000 negative figure labeled as a “LIFO reserve.” What information do these balances convey to a decision maker?

- In a periodic inventory system, when is the cost flow assumption applied? In a perpetual inventory system, when is the cost flow assumption applied?

- A company maintains a perpetual FIFO inventory system and determines its cost of goods as $874,400. Why would cost of goods sold be the same if the company had used a periodic FIFO inventory system?

- A company buys two units of inventory for $80 each. It sells one for $200. The company then buys three more units for $90 each. What is cost of goods sold if a periodic LIFO system is in use? What is cost of goods sold if a perpetual LIFO system is in use?

- A company is using averaging to determine cost of goods sold. In a periodic (weighted) averaging system, when is the average cost determined? In a perpetual (moving) averaging system, when is the average cost determined?

- The Pitt Corporation reports cost of goods sold as $300,000 using LIFO. Beginning inventory was $44,000 and ending inventory was $48,000. However, if FIFO had been used, beginning inventory would have been $76,000 and ending inventory would have been $114,000. What would cost of goods sold have been for the Pitt Corporation if FIFO had been used?

- How is the gross profit percentage calculated and what does it tell a user about a company?

- How is the number of days in inventory calculated and why would a decision maker want to know this number? What is the problem if the number begins to increase?

- The Boston Company starts the current year with inventory of $300,000. During the year, purchases of $800,000 are made. A physical count at the end of the year finds that $400,000 is still on hand. What is the inventory turnover for this period?

-

The Ames Company has exactly $60 in cash. The company buys three pieces of inventory which are all exactly the same. Because it is a highly inflationary market, the first one cost $16, the second cost $19, and the third cost $25. Shortly thereafter, one of these three is sold for $40. Answer each of the following questions.

- If FIFO is applied, how many units are now on hand?

- If LIFO is applied, how many units are now on hand?

- If FIFO is applied, how much cash is the company holding?

- If LIFO is applied how much cash is the company holding?

- If FIFO is applied, what appears on the income statement and the balance sheet?

- If LIFO is applied, what appears on the income statement and the balance sheet?

True or False

- ____ Using the LIFO cost flow assumption will always result in a lower net income than using the FIFO cost flow assumption.

- ____ LIFO tends to provide a better matching of expenses with revenues than does FIFO.

- ____ The LIFO conformity rule states that if a company uses LIFO on its financial statements it must also use LIFO on its federal income tax return.

- ____ It is impossible for decision makers to compare a company that uses LIFO with one that uses FIFO.

- ____ A jewelry store or boat dealership would normally be able to use the specific identification method.

- ____ The underlying rationale for FIFO is that the earliest inventory purchased would normally be sold first by a company.

- ____ A company starts Year Two with 3,000 pieces of inventory costing $9 each. In Year Two, 1,000 units are sold and then 2,000 more units are bought for $12 each. Later, another 1,000 units are sold and 2,000 more units are bought for $14 each. On the last day of the year, one final unit is purchased for $16. If a perpetual LIFO system is used, this December 31 transaction has no impact on reported net income.

- ____ A company starts Year Two with 3,000 pieces of inventory costing $9 each. In Year Two, 1,000 units are sold and then 2,000 more units are bought for $12 each. Later, another 1,000 units are sold and 2,000 more units are bought for $14 each. If a FIFO system is in use, the 5,000 units on hand at the end of the year have a reported cost of $58,000.

- ____ A company starts Year Two with 3,000 pieces of inventory costing $9 each. In Year Two, 1,000 units are sold and then 2,000 more units are bought for $12 each. Later, another 1,000 units are sold and 2,000 more units are bought for $14 each. On the last day of the year, one final unit is bought for $16. If a periodic LIFO system is used, this December 31 transaction reduces reported gross profit by $2.

- ____ A decision maker is analyzing a set of financial statements and finds a note about a LIFO liquidation that occurred during a long period of inflation. From this information, the decision maker knows that the company has manipulated its inventory balances to reduce the amount of income taxes to be paid in the current year.

- ____ A company applies a periodic FIFO system and buys and sells inventory all during the year. Early in the year, the company bought some inventory and paid an additional $21,000 in connection with the purchase. The cost was recorded in the inventory account but should have been expensed. Despite this error, reported net income for that year does not require adjustment.

- ____ The gross profit percentage can help decision makers determine how long it takes a company to sell inventory after the purchase date.

- ____ A company starts Year Two with 3,000 pieces of inventory costing $9 each. In Year Two, 1,000 units are sold and then 2,000 more units are bought for $12 each. Later, another 3,000 units are sold and 2,000 more units are bought for $14 each. If a periodic FIFO system is used, the number of days that inventory is held on the average is 285.6.

- ____ A company starts Year Two with 4,000 pieces of inventory costing $8 each. In Year Two, 1,000 units are sold and then 3,000 more units are bought for $10 each. Later, another 5,000 units are sold and 2,000 more units are bought for $14 each. If a periodic LIFO system is used, the number of days that inventory is held on the average is 136.8.

- ____ A company starts Year Two with 10,000 pieces of inventory costing $10 each. During the year, the company buys 40,000 additional pieces of inventory for $15 each. At the end of the year, a physical inventory is taken and 11,000 units are still on hand. If periodic LIFO is used, the inventory turnover for Year Two is 6.44 times.

- ____ A company starts Year Two with 10,000 pieces of inventory costing $10 each. During the year, the company buys 40,000 additional pieces of inventory for $15 each. At the end of the year, a physical inventory is taken and 11,000 units are still on hand. If periodic FIFO is used, the inventory turnover for Year Two is 4.04 times.

Multiple Choice

-

Which of the following provides the best matching of expenses with related revenues?

- Specific Identification

- FIFO

- LIFO

- Averaging

-

Milby Corporation purchased three hats to sell during the year. The first, purchased in February, cost $5. The second, purchased in April, cost $6. The third, purchased in July, cost $8. If Milby sells two hats during the year and uses the FIFO method, what is cost of goods sold for the year?

- $11

- $13

- $14

- $19

-

Which of the following is not a typical reason that a company would choose to use LIFO for financial reporting when prices are rising?

- The company wishes to use LIFO for tax purposes.

- The company wants net income to be as high as possible to impress investors.

- The company would like to match the most current costs with current revenues.

- The company operates in an industry with a high rate of inflation.

-

Traylor Corporation began the year with three items in beginning inventory, each costing $4. During the year Traylor purchased five more items at a cost of $5 each and then two more items at a cost of $6.50 each. Traylor sold eight items for $9 each. If Traylor uses a periodic LIFO system, what would be Traylor’s gross profit for this year?

- $30

- $35

- $42

- $72

-

The Greene Company uses a periodic LIFO system for its inventory and starts off the current year with 10 units costing $8 each. Seven units are sold for $16 each, followed by the purchase of 10 additional units at $10 each. Then, 7 more units are sold for $20 each. Finally, 10 units are bought for $13 each. On December 31 of that year, a customer offers to buy one of the units still in inventory but is only willing to pay $12. If Greene takes that offer, what is the impact of that sale on reported net income?

- Net income will not change.

- Net income will go down by $1.

- Net income will go up by $2.

- Net income will go up by $4.

-

The Bleu Company uses a perpetual LIFO system for its inventory and starts off the current year with 10 units costing $8 each. Seven units are sold for $16 each, followed by the purchase of 10 additional units at $10 each. Then, 7 more units are sold for $20 each. Finally, 10 units are bought for $13 each. On December 31 of that year, a customer offers to buy one of the units still in inventory but is only willing to pay $12. If Bleu takes that offer, what is the impact of that sale on reported net income?

- Net income will not change.

- Net income will go down by $1.

- Net income will go up by $2.

- Net income will go up by $4.

-

The Whyte Company uses a FIFO system for its inventory and starts off the current year with 10 units costing $8 each. Seven units are sold for $16 each, followed by the purchase of 10 additional units at $10 each. Then, 7 more units are sold for $20 each. Finally, 10 units are bought for $13 each. On December 31 of that year, a customer offers to buy one of the units still in inventory but is only willing to pay $12. If Whyte takes that offer, what is the impact of that sale on reported net income?

- Net income will not change.

- Net income will go down by $1.

- Net income will go up by $2.

- Net income will go up by $4.

-

The Osborne Company starts the current year with 30 units of inventory costing $20 each. A few weeks later, 20 of these units are sold for $40 each. Then, 20 units are bought to restock inventory at $24.50 each. Later, 20 more units are sold for $50 each and the company buys 20 new units but again at $24.50 each. Late in the year, 20 final units are sold for $60 each. What is the reported cost of the ending inventory if a moving average (perpetual) system is used?

- $220

- $226

- $230

- $240

-

A decision maker is studying a company that has applied LIFO for over 20 years during a period of inflation. The decision maker is looking at the most recent financial statements and notices a note that indicates that a LIFO liquidation occurred. What information is most likely being conveyed by this note?

- Inventory on the balance sheet is worth more than is reported.

- Inventory on the balance sheet is worth less than is reported.

- The company may be reporting an artificially high net income.

- The company has attempted to reduce its income tax payment by a significant amount this year.

-

Buffalo Inc. buys inventory items for $300 each and sells them for $400 each. During the year, the company bought and sold hundreds of these items. The company uses a perpetual system. One unit was sold near the end of the year. The recording was a debit to cash for $400, a credit to inventory for $300, and a credit to gain on sale of inventory for $100. No other entry or correction was made. Which of the following statements is true about Buffalo’s reported information for the period?

- Gross profit was correct, net income was overstated, and inventory was understated.

- Gross profit was understated, net income was understated, and inventory was correct.

- Gross profit was understated, net income was correct, and inventory was correct.

-

Gross profit was correct, net income was understated, and inventory was overstated.

The following information pertains to multiple-choice questions 11, 12, 13, and 14: A company produces financial statements each year. It is started in Year One and has the following transactions:

- Bought 10 units of inventory for $12 each

- Sold 8 units of inventory

- Bought 10 units of inventory for $13 each

- Sold 8 units of inventory

- Bought 10 units of inventory for $15 each

- Sold 8 units of inventory

- Bought 10 units of inventory for $16 each

-

Based on the previous information, the company holds 16 units at the end of Year Two. What is reported for this inventory if a FIFO system is used?

- $206

- $230

- $240

- $250

-

Based on the previous information, the company holds 16 units at the end of Year Two. What is reported for this inventory if a periodic LIFO system is used?

- $206

- $230

- $240

- $250

-

Based on the previous information, the company holds 16 units at the end of Year Two. What is reported for this inventory if a perpetual LIFO system is used?

- $206

- $230

- $240

- $250

-

Based on the previous information, the company holds 16 units at the end of Year Two. What is reported for this inventory if a weighted average (periodic) system is used?

- $206

- $230

- $240

- $250

-

A company buys and sells inventory and ends each year with approximately 50 units kept in stock at all time. It pays $10 per unit in Year One, $8 per unit in Year Two, and $7 per unit in Year Three. Which of the following statements is true about the Year Three financial statements if LIFO is used rather than FIFO?

- Cost of goods sold will be lower

- Net income will be lower

- Income tax expense will be lower

- Ending inventory will be lower

-

During the year, Hostel Company had net sales of $4,300,000 and cost of goods sold of $2,800,000. Beginning inventory was $230,000 and ending inventory was $390,000. Which of the following would be Hostel’s inventory turnover for the year?

- 4.84 times

- 7.18 times

- 9.03 times

- 13.87 times

-

During the year, the Brighton Corporation had net sales of $4,800,000 and inventory purchases of $3,600,000. Beginning inventory for the year was $280,000 and ending inventory was $320,000. Which of the following would be Brighton’s inventory turnover for the year?

- 10.67 times

- 11.87 times

- 13.33 times

- 14.67 times

-

Ace Company starts the year with 30,000 units costing $8 each. During the year, Ace bought 100,000 more units at $12 each. A count of the ending inventory finds 40,000 units on hand. If the company uses periodic FIFO, what is the inventory turnover for the year?

- 2.67 times

- 3.00 times

- 3.20 times

- 3.67 times

-

During the year, the Trenton Company had net sales of $3,200,000 and cost of goods sold of $2,920,000. Beginning inventory was $250,000 and ending inventory was $390,000. What was the average number of days during the year that Trenton held its inventory items?

- 40 days

- 45 days

- 52 days

- 54 days

-

During the year, the Wyglio Corporation had net sales of $5,100,000 and inventory purchases of $4,340,000. Beginning inventory for the year was $320,000 and ending inventory was $280,000. What was the average number of days during the year that Wyglio held its inventory items?

- 22 days

- 24 days

- 25 days

- 28 days

Video Problems

Professor Joe Hoyle discusses the answers to these two problems at the links that are indicated. After formulating your answers, watch each video to see how Professor Hoyle answers these questions.

-

Your roommate is an English major. The roommate’s parents own a chain of ice cream shops throughout Florida. One day, while walking over to the science building for a general education class, your roommate poses this question: “Dairy prices have been going up over the last couple of years which has caused a steady rise in the price of the ice cream that my parents buy. I was talking with them recently and they were telling me that they use an accounting system called last-in, first-out in recording their inventory. This makes no sense to me. Everyone knows that all stores always sell their oldest ice cream first so it won’t begin to melt and start losing flavor. I don’t understand how they could possibly be using a last-in, first-out system. In this case, the accounting sounds like a work of fiction. What is going on?” How would you respond?

-

Your uncle and two friends started a small office supply store several years ago. The company has expanded and now has several large locations. Your uncle knows that you are taking a financial accounting class and asks you the following question: “When we first got started, our accountant told us to use LIFO for our inventory. We were paying her a lot of money so we followed that advice. One of our biggest customers is owned by a company located in Italy. Recently, the manager for that company was telling me that their accounting is based on IFRS rather than U.S. GAAP and that IFRS apparently believes that LIFO is theoretically flawed. Why are we using a flawed system? I don’t even what impact LIFO has on our financial statements. I know that we started out this year with 100,000 units that cost $5 each and then we bought another 400,000 units for $8.00. At the end of the year, because of our sales during the period, we only had 100,000 units left. What difference did LIFO make?” How would you respond?

Problems

-

SuperDuper Company sells top of the line skateboards. SuperDuper is concerned about maintaining high earnings and has chosen to use the periodic FIFO method of inventory costing. At the beginning of the year, SuperDuper had 5,000 skateboards in inventory, each costing $20. In April, SuperDuper purchased 2,000 skateboards at a cost of $22 and in August, purchased 4,000 more at a cost of $23. During the year, SuperDuper sold 9,000 skateboards for $40 each.

- Record each purchase SuperDuper made.

- Assuming there is no breakage or theft, how many skateboards are on hand at the end of the year?

- Determine SuperDuper’s cost of goods sold using FIFO.

- Assume the same facts as problem 1, except that SuperDuper is more concerned with minimizing taxes and uses periodic LIFO. Determine SuperDuper’s cost of goods sold.

- Assume the same facts as problem 1, except that SuperDuper has decided to use averaging as a compromise between FIFO and LIFO. Determine SuperDuper’s cost of goods sold.

- Ulysses Company uses the LIFO cost flow assumption. This year, the company reported beginning inventory of $20,000,000 and ending inventory of $21,500,000. If FIFO were used to value inventory, beginning inventory would have been $23,000,000 (current cost at that time) and ending inventory would have been $28,700,000 (also current cost). Cost of goods sold using LIFO was $34,900,000. Determine the reported cost of goods sold if Ulysses had used FIFO.

-

A company starts operations on October 1, Year One, holding 400 units of inventory which fills its store. This inventory cost $10 per unit. After that, enough inventory is bought on the last day of each month to bring the quantity on hand back to exactly 400 units. In October, 140 units were sold; in November, 150 units were sold; and in December, 180 units were sold. On October 31, the company bought units for $12 each; on November 30, the company bought units for $13 each; on December 31, the company bought units for $15 each.

- What is the company’s cost of goods sold if a periodic LIFO system is used?

- What is the company’s cost of goods sold if a perpetual LIFO system is used?

-

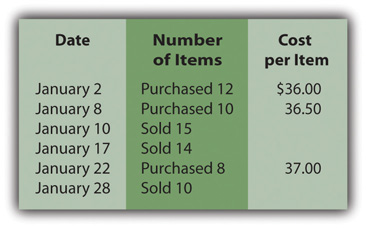

Paula’s Parkas sells NorthPlace jackets. At the beginning of the year, Paula’s had 20 jackets in stock, each costing $35 and selling for $60. The following table details the purchases and sales made during January:

Figure 9.14

Assume that Paula’s Parkas uses the perpetual FIFO method to maintain its inventory records.

- Determine Paula’s Parkas cost of goods sold and ending inventory for January.

- Determine Parka’s gross profit for January.

-

Assume the same facts as in problem 6 except that Paula’s Parkas uses the perpetual LIFO method.

- Determine Paula’s Parkas cost of goods sold and ending inventory for January.

- Determine Parka’s gross profit for January.

-

Assume the same facts as in problem 6 above except that Paula’s Parkas uses the moving average method.

- Determine Paula’s Parkas cost of goods sold and ending inventory for January.

- Determine Parka’s gross profit for January.

-

In Year One, the Major Corporation had the following inventory transactions:

- March 1: Buy 1,000 units at $7 each.

- May 1: Sell 800 units for $12 each.

- August 1: Buy 1,000 units at $8 each.

- October 1: Sell 700 units for $14 each.

- December 1: Buy 1,000 units for $10 each.

In Year Two, the company had the following inventory transactions:

- April 1: Sell 700 units for $17 each.

- June 1: Buy 1,000 units for $11 each.

- September 1: Sell 900 units for $20 each.

- November 1: Buy 1,000 units for $12 each.

-

December 1: Sell 700 units for $22 each.

- What amount of gross profit should this company recognize in Year One and also in Year Two if a periodic LIFO system is in use?

- What amount of gross profit should this company recognize in Year One and also in Year Two if a perpetual LIFO system is in use?

-

A company starts the year with 20 units of inventory costing $20 each. In January, 10 of these units are sold for $40 each. Then, 10 new units are bought for $22 each. Shortly thereafter, 10 units are sold for $50 each. Then, 10 units are bought for $27 each. Finally, near the end of the year, 10 units are sold for $60 each.

- What is reported as the cost of ending inventory if a weighted average (periodic) system is in use?

- What is reported as the cost of ending inventory if a moving average (perpetual) system is in use?

-

The Quiqqley Company is started in Year One and buys 400 pieces of inventory for $4 each on June 1. The company sells 300 of these units on September 1 for $20 each. The company buys another 400 units for $7 each on November 1 and finishes Year One with 500 units in stock.

In Year Two, on February 1, the company sells 300 units for $20 each. On July 1, Year Two, the company buys 200 more units for $9 each. On August 1, Year Two, the company sells 100 units for $25 each. Finally, on December 1, Year Two, the company buys another 100 units for $10 each.

- Assume the company uses a perpetual FIFO system. What is the cost of goods sold figure to be reported for Year Two?

- Assume the company uses a perpetual LIFO system. What is the cost of goods sold figure to be reported for Year Two?

- A company applies LIFO and reports net income for Year Four of $328,000. Reported inventory at January 1 was $32,000 and at December 31 was $35,000. A note to the financial statements indicates that the beginning inventory would have been $52,000 and ending inventory would have been $78,000 if FIFO had been used. What would this company have reported as its net income for Year Four if FIFO has been applied as the cost flow assumption?

- The Montana Company and the Florida Company are identical in every way. They have exactly the same transactions. In Year One, they both started with 10,000 units of inventory costing $6 per unit. During Year One, they both bought 20,000 additional units for $8 per unit and sold 20,000 units. During Year Two, they both bought 30,000 units for $9 per unit and sold 30,000 units. The Montana Company uses a periodic FIFO system and the Florida Company uses a periodic LIFO system. If the Montana Company reports net income in Year Two of $100,000, what will the Florida Company report as its net income?

-

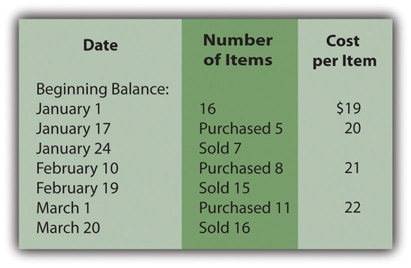

The Furn Store sells home furnishings, including bean bag chairs. Furn currently uses the periodic FIFO method of inventory costing, but is considering implementing a perpetual system. It will cost a good deal of money to start and maintain, so Furn would like to see the difference, if any, between the two and is using its bean bag chair inventory to do so. Here is the first quarter information for bean bag chairs:

Figure 9.15

Each bean bag chair sells for $40.

- Determine Furn’s cost of goods sold and ending inventory under periodic FIFO.

- Determine Furn’s cost of goods sold and ending inventory under perpetual FIFO.

-

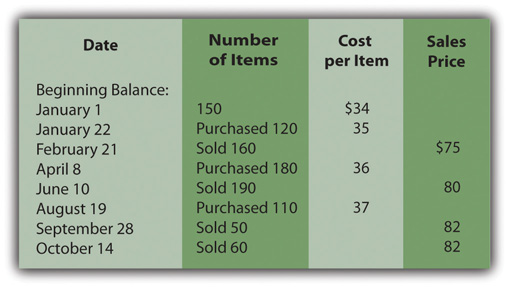

Rollrbladz Inc. is trying to decide between a periodic or perpetual LIFO system. Management would like to see the effect of each on cost of goods sold and ending inventory for the year. The following is information concerning purchases and sales of its specialty line of rollerblades:

Figure 9.16

- Determine Rollrbladz’s cost of goods sold and ending inventory under periodic LIFO.

- Determine Rollrbladz’s cost of goods sold and ending inventory under perpetual LIFO.

-

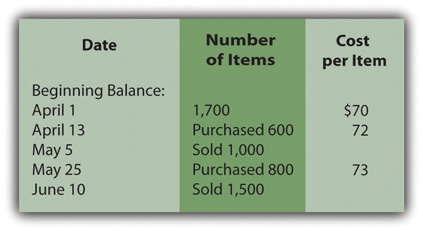

Highlander Corporation sells swords for decorative purposes. It would like to know the difference in cost of goods sold and ending inventory if it uses the weighted average method or the moving average method. Use the following information to help determine these amounts for the second quarter.

Figure 9.17

Swords retail for $120 each.

- Determine Highlander’s cost of goods sold and ending inventory under weighted average.

- Determine Highlander’s cost of goods sold and ending inventory under moving average.

- During the year, the California Corporation had net sales of $11,000,000 and inventory purchases of $7,500,000. Beginning inventory for the year was $1,030,000 but ending inventory was only $500,000 because the company wanted to reduce the amount of money tied up in inventory. What was the average number of days during the year that California held its inventory items before making a sale?

- Deuce Company starts the year with 80,000 units costing $10 each. During the year, Deuce bought 100,000 more units at $12 each and then another 120,000 at $13 each. A count of the ending inventory finds 70,000 units on hand. If the company uses periodic FIFO, what is the inventory turnover for the year?

- During the current year, the Decker Company had net sales of $15,700,000 and cost of goods sold of $9,200,000. Beginning inventory was $420,000 and ending inventory was $500,000. What was the inventory turnover for that year?

-

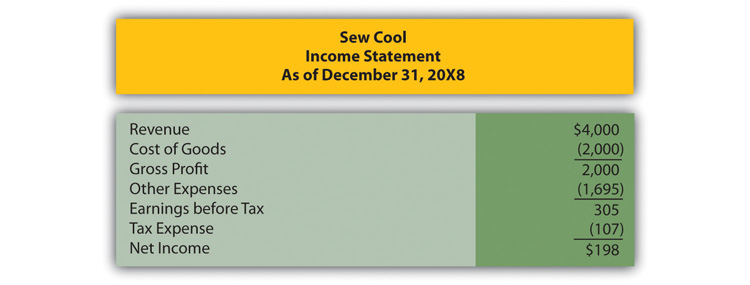

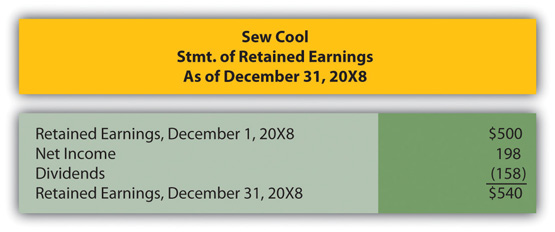

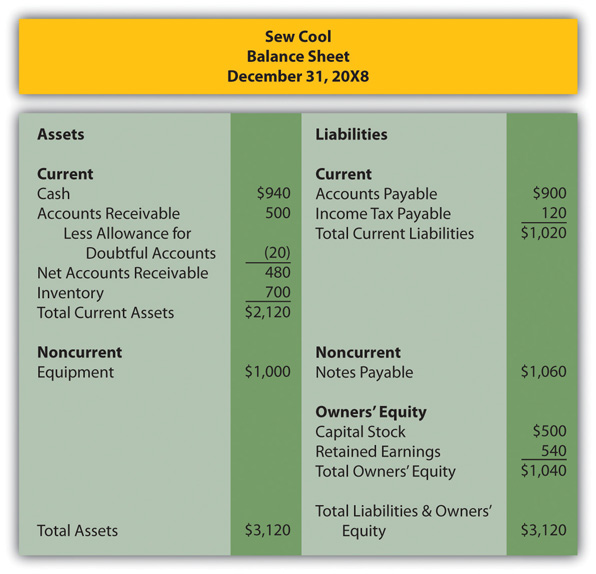

In Chapter 4 "How Does an Organization Accumulate and Organize the Information Necessary to Create Financial Statements?", Heather Miller started her own business, Sew Cool. The financial statements for December were presented in Chapter 7 "In Financial Reporting, What Information Is Conveyed about Receivables?" and are shown again below. For convenience, assume the business was started on January 1, 20X8 with no assets.

Figure 9.18

Figure 9.19

Figure 9.20

Based on the financial statements determine the following:

- Gross profit percentage

- Number of days inventory is held

- Inventory turnover

Comprehensive Problem

This problem will carry through over several chapters to enable students to build their accounting skills using knowledge gained in previous chapters.

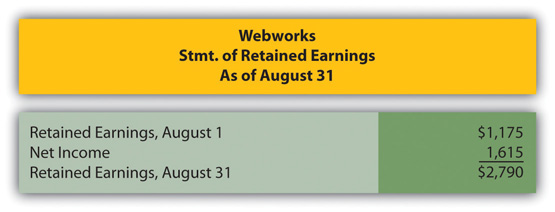

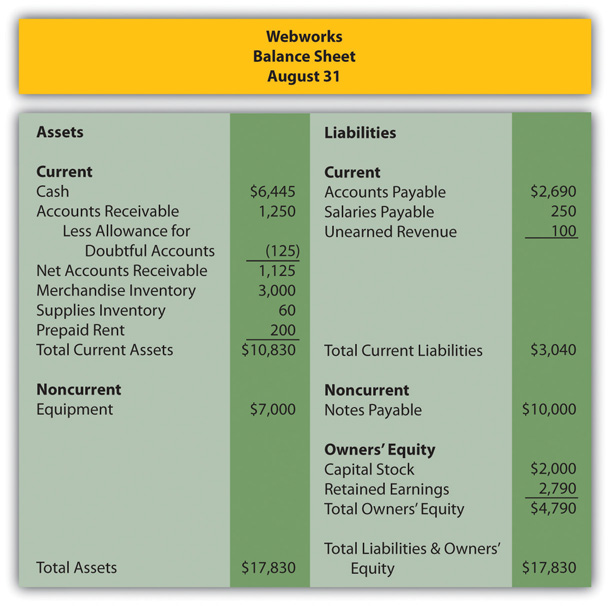

In Chapter 8 "How Does a Company Gather Information about Its Inventory?", financial statements were prepared for Webworks for August 31 and the month then ended. Those financial statements are included here as a starting point for the financial reporting for September.

Figure 9.21

Figure 9.22

The following events occur during September:

- Webworks purchases supplies worth $120 on account.

- At the beginning of September, Webworks held 19 keyboards costing $100 each and 110 flash drives costing $10 each. Webworks has decided to use periodic FIFO to cost its inventory.

- Webworks purchases 30 additional keyboards on account for $105 each and 50 flash drives for $11 each.

- Webworks starts and completes five more Web sites and bills clients for $3,000.

- Webworks pays Nancy Po (the company employee hired in June) $500 for her work during the first three weeks of September.

- Webworks sells 40 keyboards for $6,000 and 120 flash drives for $2,400 cash.

- Webworks collects $2,500 in accounts receivable.

- Webworks pays off its salaries payable from August.

- Webworks pays off $5,500 of its accounts payable.

- Webworks pays off $5,000 of its outstanding note payable.

- Webworks pays Leon Jackson (owner of the company) salary of $2,000.

-

Webworks pays taxes of $795 in cash.

Required:

- Prepare journal entries for the previous events.

- Post the journal entries to T-accounts.

- Prepare an unadjusted trial balance for Webworks for September.

- Prepare adjusting entries for the following and post them to your T-accounts.

- Webworks owes Nancy Po $300 for her work during the last week of September.

- Leon’s parents let him know that Webworks owes $275 toward the electricity bill. Webworks will pay them in October.

- Webworks determines that it has $70 worth of supplies remaining at the end of September.

- Prepaid rent should be adjusted for September’s portion.

- Webworks is continuing to accrue bad debts so that the allowance for doubtful accounts is 10 percent of accounts receivable.

-

Record cost of goods sold.

- Prepare an adjusted trial balance.

- Prepare financial statements for September.

Research Assignment

Assume that you take a job as a summer employee for an investment advisory service. One of the partners for that firm is currently looking at the possibility of investing in Deere & Company. The partner is interested in the impact of the recession on a company that is so closely tied to the agriculture industry. The partner is especially interested in the speed with which the company is able to sell its inventory and also the impact of recording most inventory using LIFO. The partner asks you to look at the 2010 financial statements for Deere & Company by following this path:

- Go to http://www.deere.com.

- At the upper right side of the screen, click on “Our Company” and then on “Investor Relations.” (If you’re using a browser other than Internet Explorer, you may need to select your country before you can click on “Our Company.”)

- On the left side of the next screen, click on “Annual Report.”

- In the middle of the next screen, click on “2010 Annual Report” to download.

- Go to page 24 and find the 2008, 2009, and 2010 income statements.

- Go to page 25 and find the balance sheets for the years ended October 31, 2009 and 2010.

- Go to page 41 and read note 15 titled “Inventories.”

- Using the figures found on the 2010 income statement and the two balance sheets, determine the number of days that inventory was held by Deere & Company during 2010. Does the number seem particularly high or particularly low?

- Using the figures found on the 2010 income statement and the information provided in note 15 of the financial statements, determine the change in cost of sales that would have occurred if the company had applied FIFO to all of its reported inventory. What was the monetary amount of the difference between this figure and the amount actually reported?