This is “Merging Periodic and Perpetual Inventory Systems with a Cost Flow Assumption”, section 9.4 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

9.4 Merging Periodic and Perpetual Inventory Systems with a Cost Flow Assumption

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Merge a cost flow assumption (FIFO, LIFO, and averaging) with a method of monitoring inventory (periodic or perpetual) to arrive at six different systems for determining reported inventory figures.

- Understand that a cost flow assumption is only applied when determining the cost of ending inventory in a periodic system but is used for each reclassification from inventory to cost of goods sold in a perpetual system.

- Calculate ending inventory and cost of goods sold using both a periodic and a perpetual FIFO system.

- Recognize that periodic and perpetual FIFO systems will arrive at identical account balances.

Cost Flow Assumptions and Inventory Systems

Question: In the previous chapter, periodic and perpetual inventory systems were introduced. FIFO, LIFO, and averaging have now been presented. How does all of this material come together for reporting purposes? How does the application of a cost flow assumption impact the operation of a periodic or a perpetual inventory system?

Answer: Each company that holds inventory must develop a mechanism to both (a) monitor the balances and (b) allow for the creation of financial statements. If a periodic system is used, officials simply wait until financial statements are to be produced before taking a physical count. Then, a formula (beginning inventory plus all purchase costs less ending inventory) is applied to derive cost of goods sold.

In contrast, a perpetual system maintains an ongoing record of the goods that remain on hand and those that have been sold. As noted, both of these systems have advantages and disadvantages.

Companies also select a cost flow assumption to specify the cost that is transferred from inventory to cost of goods sold (and, hence, the cost that remains in the inventory T-account). For a periodic system, the cost flow assumption is only applied when the physical inventory count is taken and the cost of the ending inventory is determined. In a perpetual system, the cost flow assumption is used each time a sale is made to identify the cost to be reclassified to cost of goods sold. That can occur thousands of times each day.

Therefore, companies normally choose one of six systems to monitor their merchandise balances and determine the cost assignment between ending inventory and cost of goods sold:

- Periodic FIFO

- Perpetual FIFO

- Periodic LIFO

- Perpetual LIFO

- Periodic averaging (also called weighted averaging)

- Perpetual averaging (also called moving averaging)

Periodic and Perpetual FIFO

Question: To illustrate, assume that the Mayberry Home Improvement Store starts the new year with four bathtubs (Model WET-5) in its inventory, costing $110 each ($440 in total) when bought on December 9 of the previous period. The following events then take place during the current year.

- On February 2, three of these bathtubs are sold for $200 each. (revenue $600)

- On February 6, three new bathtubs of this model are bought for $120 each. (cost $360)

- On June 8, three of these bathtubs are sold for $250 each. (revenue $750)

- On June 13, three new bathtubs of this model are bought for $130 each. (cost $390)

- On September 9, two of these bathtubs are sold for $300 each. (revenue $600)

- On September 22, two new bathtub of this model are bought for $149. (cost $298)

At the end of the year, on December 31, a physical inventory is taken that finds that four bathtubs, Model WET-5, are in stock (4 – 3 + 3 – 3 + 3 – 2 + 2). None were stolen, lost, or damaged during the period. How does a periodic FIFO system differ from a perpetual FIFO system in maintaining accounting records and reporting inventory totals?

Answer: Regardless of the inventory system in use, several pieces of information are established in this example. These figures are factual, not impacted by accounting.

The Facts—Purchase and Sale of WET-5 Bathtubs

- Revenue: Eight units were sold for $1,950 ($600 + $750 + $600)

- Beginning Inventory: Four units costing $110 each or $440 in total

- Purchases: Eight units were bought during the year costing a total of $1,048 ($360 + $390 + $298)

- Ending Inventory: Four units are still held according to the physical inventory

Periodic FIFO. In a periodic system, the cost of all new purchases is the focus of the record keeping. Then, at the end of the period, the accountant must count and also determine the cost of the items held in ending inventory. When using FIFO, the first costs are transferred to cost of goods sold so the cost of the last four bathtubs remain in the inventory T-account. That is the FIFO assumption. The first costs are now in cost of goods sold while the most recent costs remain in the asset account.

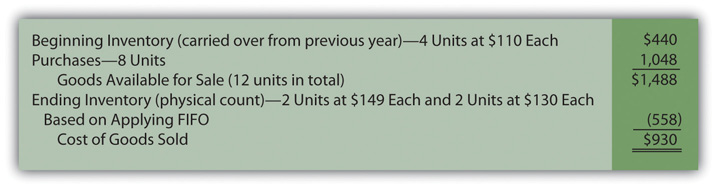

In this illustration, the last four costs (starting at the end of the period and moving forward) are two units at $149 each and two units at $130 each for a total of $558. Only after that cost is assigned to the ending inventory units can cost of goods sold be calculated as shown in Figure 9.6 "Periodic FIFO—Bathtub Model WET-5".

Figure 9.6 Periodic FIFO—Bathtub Model WET-5

Under FIFO, the last costs for the period remain in ending inventory; the first costs have all been transferred to cost of goods sold. Based on the application of FIFO, Mayberry reports gross profit from the sale of bathtubs during this year of $1,020 (revenue of $1,950 minus the cost of goods sold figure of $930 calculated in Figure 9.6 "Periodic FIFO—Bathtub Model WET-5").

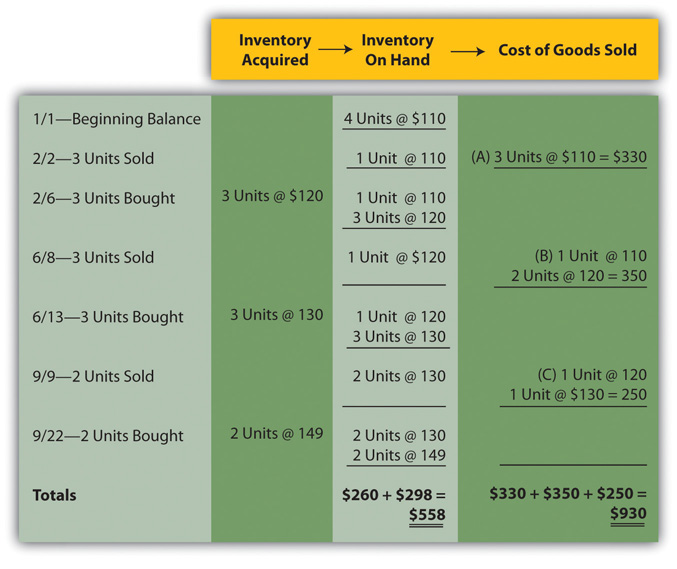

Perpetual FIFO. Perpetual accounting systems are constructed so that costs can be moved from inventory to cost of goods sold at the time of each new sale. With modern computer processing, that is a relatively simple task. In Figure 9.7 "Perpetual FIFO—Bathtub Model WET-5", one format is shown that provides the information needed for this store about the cost and quantity of its inventory of bathtubs. In this figure, at points A, B, and C, costs are moved from inventory on hand to cost of goods sold based on FIFO. The cost of the first goods in the “inventory on hand” is reclassified to cost of goods sold at each of those three points in time.

Figure 9.7 Perpetual FIFO—Bathtub Model WET-5

On this perpetual inventory spreadsheet, the final cell in the “inventory on hand” column ($558 or two units @ $130 and two units at $149) provides the cost of the ending inventory to be reported on the balance sheet. However, it is the summation of the entire “cost of goods sold” column that arrives at the expense for the period ($930 or $330 + $350 + $250).

One important characteristic of FIFO should be noted here. Under both periodic and perpetual FIFO, ending inventory is $558 and cost of goods sold is $930. The reported numbers are identical. The first cost for the period is always the first cost regardless of when the assignment to expense is made. Thus, the resulting amounts are the same when using either FIFO system.

For that reason, many companies that apply FIFO maintain perpetual records to track the units on hand throughout the period but ignore the costs. Later, when financial statements are prepared, a periodic computation is used to determine the cost of ending inventory in order to calculate cost of goods sold. That allows these companies to monitor their inventory quantities every day without the expense and effort of identifying the specific cost associated with each new sale.

Test Yourself

Question:

The Hastings Widget Company starts the year with 27,000 widgets costing $2 each. During the year, the company bought another 450,000 widgets for a total of $1,243,000. Within these figures was the acquisition of 20,000 widgets for $3.10 each on December 26 and 15,000 widgets for $3.00 each on December 18. Those were the last two purchases of the year. On December 31, the company took a physical count and found 22,000 widgets still on hand. If a FIFO cost flow assumption is applied, what is cost of goods sold?

- $1,229,000

- $1,233,200

- $1,243,000

- $1,245,800

Answer:

The correct answer is choice a: $1,229,000.

Explanation:

Beginning inventory is $54,000 (27,000 units at $2 each) while purchases are $1,243,000, a total cost of $1,297,000. With FIFO, the remaining 22,000 units had the cost of the last purchases: 20,000 at $3.10 ($62,000) plus 2,000 bought for $3.00 each ($6,000). Ending inventory cost $68,000 ($62,000 + $6,000). Subtracting this cost from the goods available gives cost of goods sold of $1,229,000 ($1,297,000 less $68,000). The use of periodic or perpetual has no impact since FIFO was used.

Key Takeaway

Companies that sell inventory will choose a cost flow assumption such as FIFO, LIFO, or averaging. In addition, a monitoring system (either periodic or perpetual) must be installed to record inventory balances . Six combinations (periodic FIFO, perpetual FIFO, periodic LIFO, and the like) can result from these two decisions. With any periodic system, the cost flow assumption is only used to determine the cost of ending inventory units so that cost of goods sold for the period can be calculated. For a perpetual inventory system, the reclassification of costs from asset to expense is performed each time that a sale is made and is based on the selected cost flow assumption. Periodic FIFO and perpetual FIFO systems arrive at the same reported balances because the earliest cost is always the first to be transferred regardless of the method applied.